Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CIVISTA BANCSHARES, INC. | d548613d8k.htm |

2017 Shareholder Presentation James O. MillerChairman Dennis G. ShafferChief Executive Officer & President NASDQ: CIVB Exhibit 99.1

This material and any oral presentation that may accompany it contain, and future oral and written statements of the Company and its management may contain, forward-looking statements, within the meaning of such term in the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of the Company’s management and on information available to management at the time the statements are made, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “bode,” “predict,” “suggest,” “project,” “appear,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should,” “likely,” or other similar expressions. Additionally, all statements in this material including forward-looking statements speak only as of the date they are made, and we undertake no obligation to update any statement in light of new information or future events except as may be required by law. Forward-looking statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements. Factors that could cause actual results, performance or achievements to differ from results discussed in the forward-looking statements include, but are not limited to, changes in financial markets or national or local economic conditions; sustained weakness or deterioration in the real estate market; volatility and direction of market interest rates; credit risks of lending activities; changes in the allowance for loan losses; legislation or regulatory changes or actions; increases in Federal Deposit Insurance Corporation insurance premiums and assessments; changes in tax laws; failure of or breach in our information and data processing systems; unforeseen litigation; and other risks identified from time-to-time in the Company’s other public documents on file with the SEC, including those risks identified in “Item 1A. Risk Factors” of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. FORWARD-LOOKING STATEMENTS 2

CONTACT INFORMATION Civista Bancshares, Inc.’s common shares are traded on the NASDAQ Capital Market under the symbol ‘CIVB.’ The Company’s depository shares, each representing 1/40th ownership interest in a Series B Preferred Share, are traded on the NASDAQ Capital Market under the symbol ‘CIVBP.’ Additional information can be found at www.civb.com Dennis G. Shaffer CEO & President dgshaffer@civistabank.com 888.645.4121 3

OVERVIEW CORPORATE OVERVIEW 2017 STRATEGIC & FINANCIAL PERFORMANCE HIGHLIGHTS STOCK PERFORMANCE STRATEGIC PRIORITIES TECHNOLOGY & INNOVATION COMMUNITY & EMPLOYEE INVESTMENT UNITED COMMUNITY BANCORP ACQUISITION 4

CORPORATE OVERVIEW Bank founded in 1884 10th largest publicly traded commercial bank headquartered in Ohio Full-service banking organization with diversified revenue streams Commercial Banking Retail Banking Wealth Management Private Banking Mortgage Banking Tax Refund Processing Community Banking Focused 5

CORPORATE OVERVIEW Operations in 12 Ohio counties 27 Branches & 2 Loan Production Offices Approximately 370 employees In 4 of the 5 largest Ohio MSAs Experienced executive management team average 26 years each in banking Franchise poised for acquisitions and organic growth 6

2017 STRATEGIC HIGHLIGHTS Opened a second loan production office Completed a $32.8 million capital offering Originated several innovation initiatives to enhance the customer experience Commercial Lending Team – Mayfield & Westlake February 2017 7

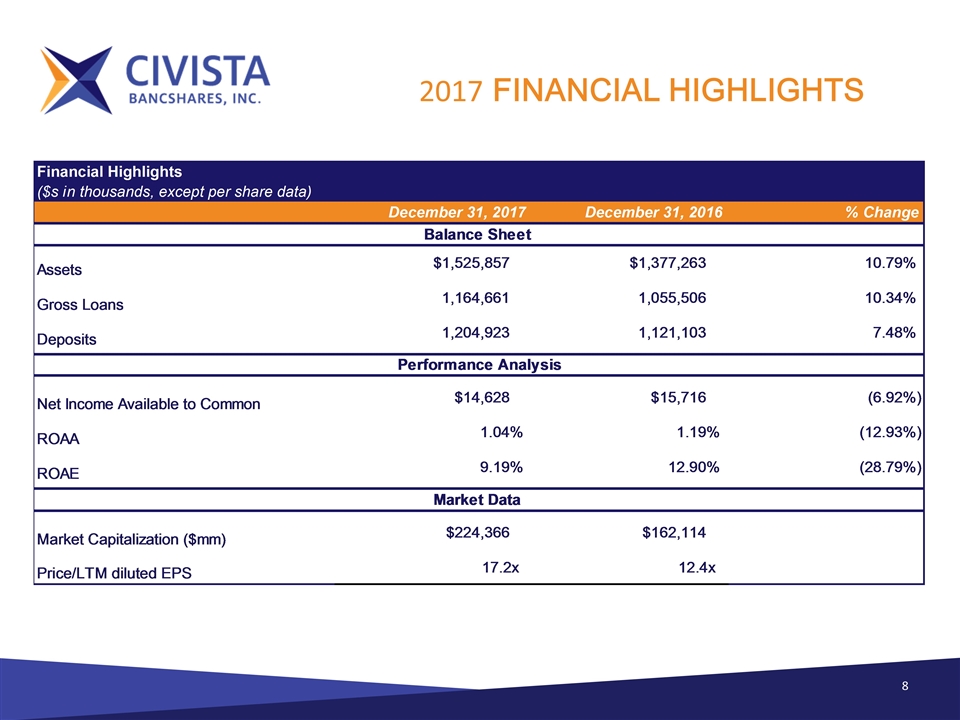

2017 FINANCIAL HIGHLIGHTS 8

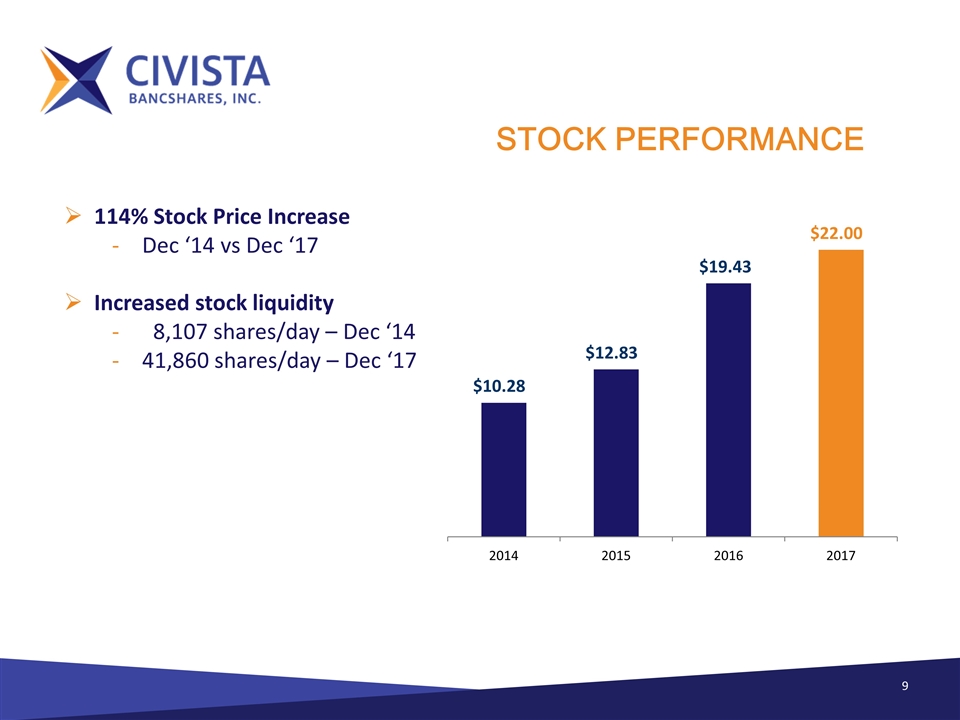

STOCK PERFORMANCE 114% Stock Price Increase Dec ‘14 vs Dec ‘17 Increased stock liquidity 8,107 shares/day – Dec ‘14 41,860 shares/day – Dec ‘17 9

STRATEGIC PRIORITIES Grow the Bank Infrastructure in place to support larger company Increased scalability leads to diversified revenue stream Larger lending limits allows opportunity to expand relationships Total Assets $ in 000s 10

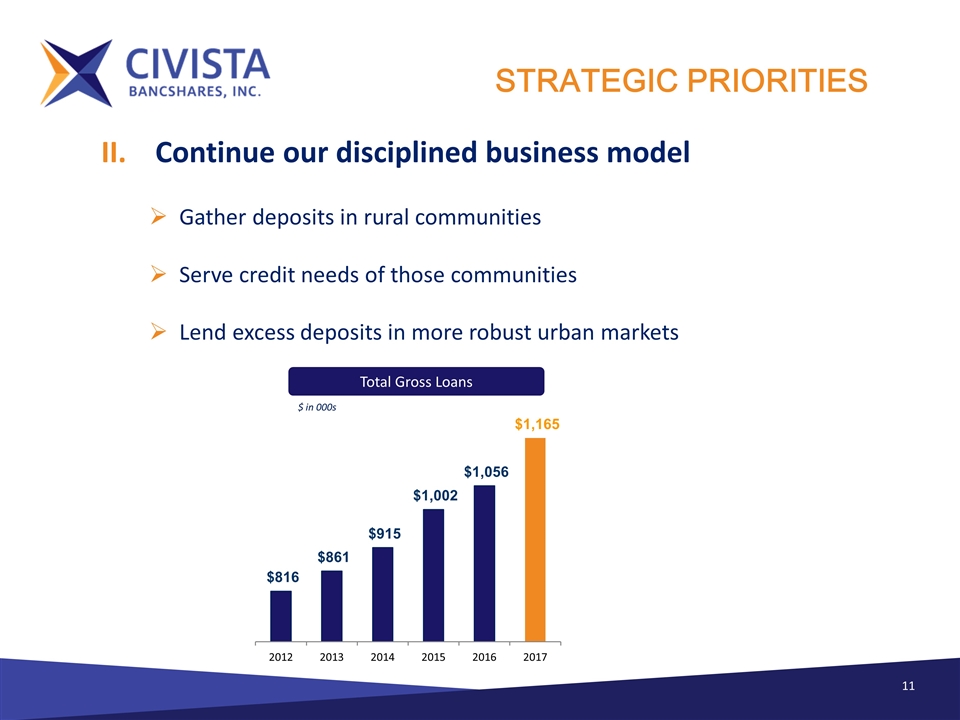

STRATEGIC PRIORITIES Continue our disciplined business model Gather deposits in rural communities Serve credit needs of those communities Lend excess deposits in more robust urban markets Total Gross Loans $ in 000s 11

STRATEGIC PRIORITIES Differentiate by the Civista Customer Experience Easy to do business; reduced ‘red tape’ Offer valued solutions and convenience tailored to each customer Genuinely interested in customer’s financial well-being Empowered and relationship-driven employees experienced and well-connected front line strong, service-oriented support team cross-trained for seamless sales & service delivery 12

MISSION STATEMENT To be the community’s trusted financial advisor and to serve all their financial needs by developing generations of life-long relationships built on trust, expertise and exceptional service. 13

COMMITMENT TO SHAREHOLDERS To provide long term value through growth and profitability. 14

TECHNOLOGY & INNOVATION Convenience and Security Initiatives Ongoing Mobile App Updates Mobile Deposit Biometric Login – both fingerprint and Face ID Ability to suspend and activate your debit card instantly from your phone Bill Pay and Pay a Person 15

TECHNOLOGY & INNOVATION Convenience and Security Initiatives Debit Card Payment Enhancements EMV Chip Cards Civista FraudEYE: suspicious activity alerts Instant Issue of cards in branches Digital Wallet compatibility for mobile payments 16

TECHNOLOGY & INNOVATION Convenience and Security Initiatives Branch Anywhere eSign civista.bank Xperience Commercial Loan Documentation 17

OUR PEOPLE AND OUR COMMUNITITES Investing in the communities we serve School Supply Collections Food Drives 18

OUR PEOPLE AND OUR COMMUNITITES Community Volunteers 19

Volunteer Day 2017 20

United Way Tricycle Race $127,000 23 Community Funds United Way of Erie County Pacesetter OUR PEOPLE AND OUR COMMUNITITES 2017 Annual Community Campaign 21

OUR PEOPLE AND OUR COMMUNITITES Our employees are our greatest asset 22

UCB Profile Lawrenceburg, IN $546 million total assets – 12/31/17 9 Locations 8 Branches 1 LPO Walnut Street Lawrenceburg 23

UCB Profile Stateline Rd Lawrenceburg West Eads Parkway Lawrenceburg 24

UCB Profile Aurora Milan 25

UCB Profile St. Leon Osgood 26

UCB Profile Northern Kentucky LPO Versailles 27

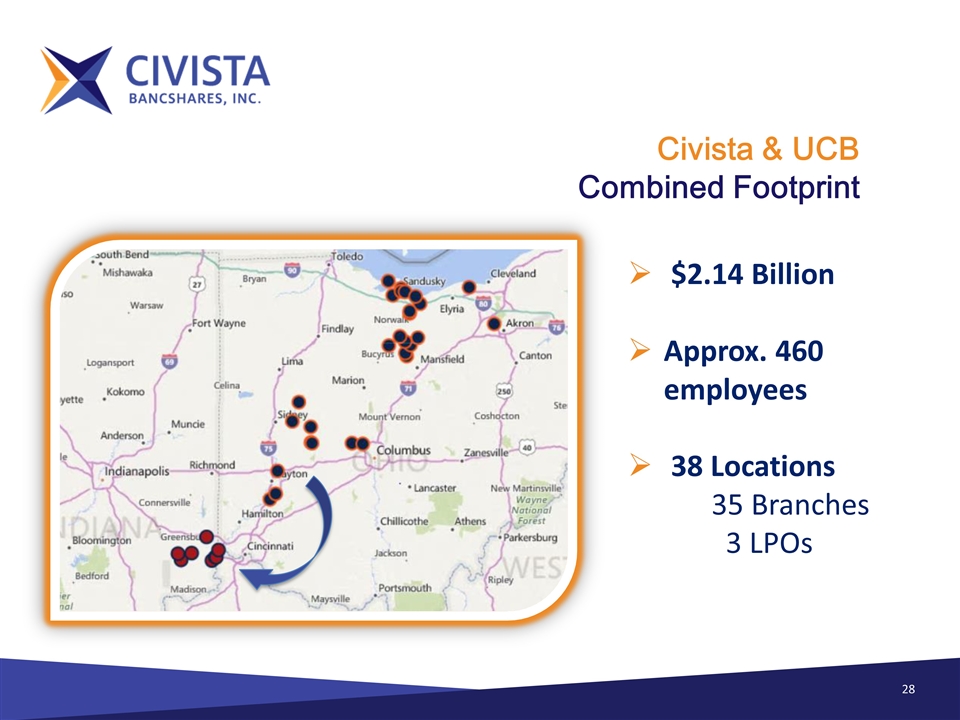

Civista & UCB Combined Footprint $2.14 Billion Approx. 460 employees 38 Locations 35 Branches 3 LPOs 28

Deposit Profile 40% transactional, low-cost Loan to deposit ratio Pro forma loan to deposit ratio moves from 97% to 87% post acquisition Preserve strong net interest margin CRE/RBC ratio Resets ratio from 324% to 223% Cincinnati MSA Now operate in the 5 largest MSAs in the State Like-minded Culture Community Banking focus UCB Advantages 29

THANK YOU