Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KNOLL INC | exh991proformafinancialsta.htm |

| 8-K/A - 8-K/A - KNOLL INC | a8-ka.htm |

1

MUUTO Holdings ApS

Financial Statements as of and for the year ended December 31, 2017

Exhibit 99.2

2

TABLE OF CONTENTS

Independent Auditor's Report

Consolidated Financial Statements

Consolidated Balance Sheet as of December 31, 2017

Consolidated Statement of Operations and Comprehensive Income for the year ended December 31, 2017

Consolidated Statement of Stockholders' Equity as of and for the year ended December 31, 2017

Consolidated Statement of Cash Flows for the years ended December 31, 2017

Notes to the Consolidated Financial Statements

1. Description of the Business

2. Summary of Significant Accounting Policies

3. Inventories

4. Property, Plant and Equipment

5. Intangible Assets, net

6. Other Current Liabilities

7. Leases

8. Indebtedness

9. Contingent Liabilities and Commitments

10. Stockholders' Equity

11. Income Taxes

12. Other Expense, net

13. Subsequent Events

3

4

5

6

7

8

8

12

12

13

13

13

14

14

14

15

16

16

3

INDEPENDENT AUDITORS' REPORT

To the shareholders and the Board of Directors of Muuto Holdings ApS

We have audited the accompanying financial statements of Muuto Holdings ApS (the "Company"), which comprise the balance sheet

as of December 31, 2017, and the related statements of operations and comprehensive income, stockholders' equity, and cash flows

for the year then ended, and the related notes to the financial statements.

Management's Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting

principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal

control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due

to fraud or error.

Auditors' Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance

with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the

audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The

procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial

statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the

Company's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly,

we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness

of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Muuto

Holdings ApS as of December 31, 2017, and the results of its operations and its cash flows for the year then ended in accordance

with accounting principles generally accepted in the United States of America.

Copenhagen, Denmark

April 12, 2018

/s/ Deloitte,

Statsautoriseret Revisionspartnerselskab

CVR no: 33963556

/s/ Henrik Hjort Kjelgaard

State Authorised Public Accountant

MUUTO HOLDINGS ApS

CONSOLIDATED BALANCE SHEET

(Amounts in Danish Kroner)

4

December 31, 2017

ASSETS

Current assets:

Cash and cash equivalents 32,458,475

Customer receivables, net of allowance for doubtful accounts of 987,844 62,391,941

Inventories 54,233,399

Deferred income taxes 595,000

Prepaid expenses 4,273,494

Other current assets 1,936,626

Total current assets 155,888,935

Property, plant, and equipment, net 7,779,486

Goodwill 283,831,473

Intangible assets, net 5,237,297

Advances to suppliers 1,915,541

Total Assets 454,652,732

LIABILITIES AND EQUITY

Current liabilities:

Current maturities of long-term debt 15,000,000

Accounts payable 40,868,748

Income taxes payable 25,096,050

Customer deposits 3,218,081

Employee related liabilities 5,970,601

Other current liabilities 36,646,265

Total current liabilities 126,799,745

Long-term debt 75,000,000

Total liabilities 201,799,745

Commitments and contingent liabilities

Equity:

Common stock 25,000,000

Additional paid-in capital 80,520,936

Retained earnings 147,088,398

Accumulated other comprehensive income 243,653

Total equity 252,852,987

Total Liabilities and Equity 454,652,732

See accompanying notes to the consolidated financial statements.

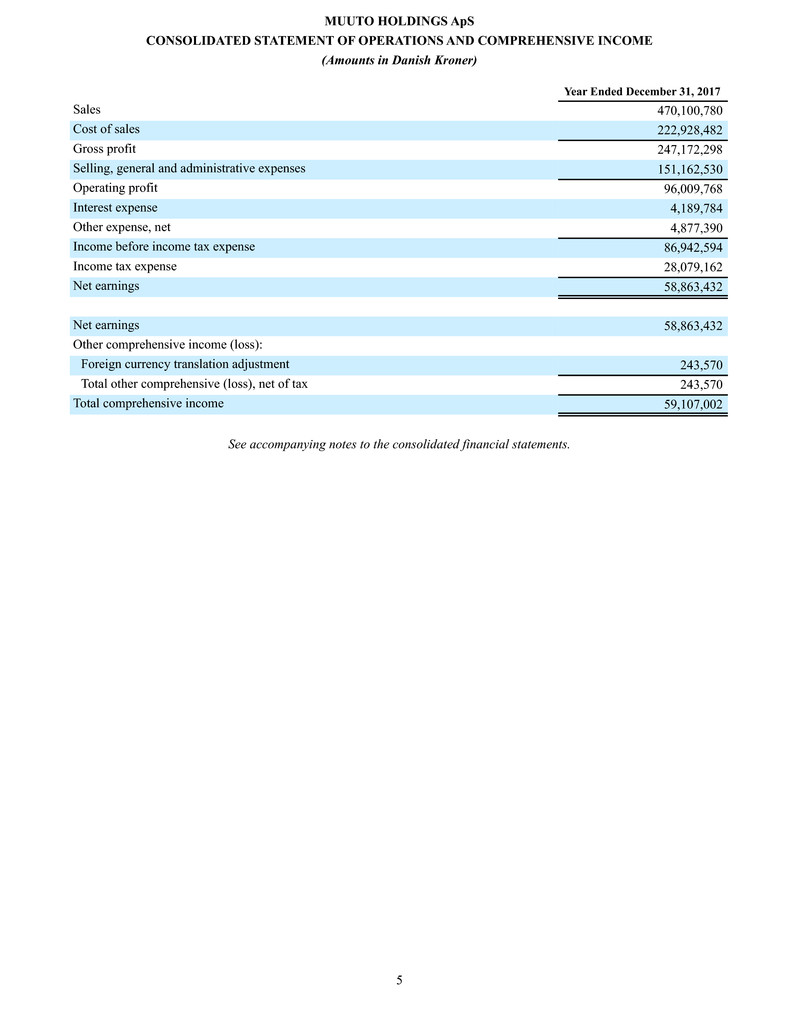

MUUTO HOLDINGS ApS

CONSOLIDATED STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME

(Amounts in Danish Kroner)

5

Year Ended December 31, 2017

Sales 470,100,780

Cost of sales 222,928,482

Gross profit 247,172,298

Selling, general and administrative expenses 151,162,530

Operating profit 96,009,768

Interest expense 4,189,784

Other expense, net 4,877,390

Income before income tax expense 86,942,594

Income tax expense 28,079,162

Net earnings 58,863,432

Net earnings 58,863,432

Other comprehensive income (loss):

Foreign currency translation adjustment 243,570

Total other comprehensive (loss), net of tax 243,570

Total comprehensive income 59,107,002

See accompanying notes to the consolidated financial statements.

MUUTO HOLDINGS ApS

CONSOLIDATED STATEMENT OF EQUITY

(Amounts in Danish Kroner)

6

Common

Stock

Additional

Paid-In

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Total

Stockholders'

Equity

Balance at January 1, 2017 25,000,000 80,520,936 88,224,966 83 193,745,985

Net earnings — — 58,863,432 — 58,863,432

Other comprehensive income — — — 243,570 243,570

Balance at December 31, 2017 25,000,000 80,520,936 147,088,398 243,653 252,852,987

See accompanying notes to the consolidated financial statements.

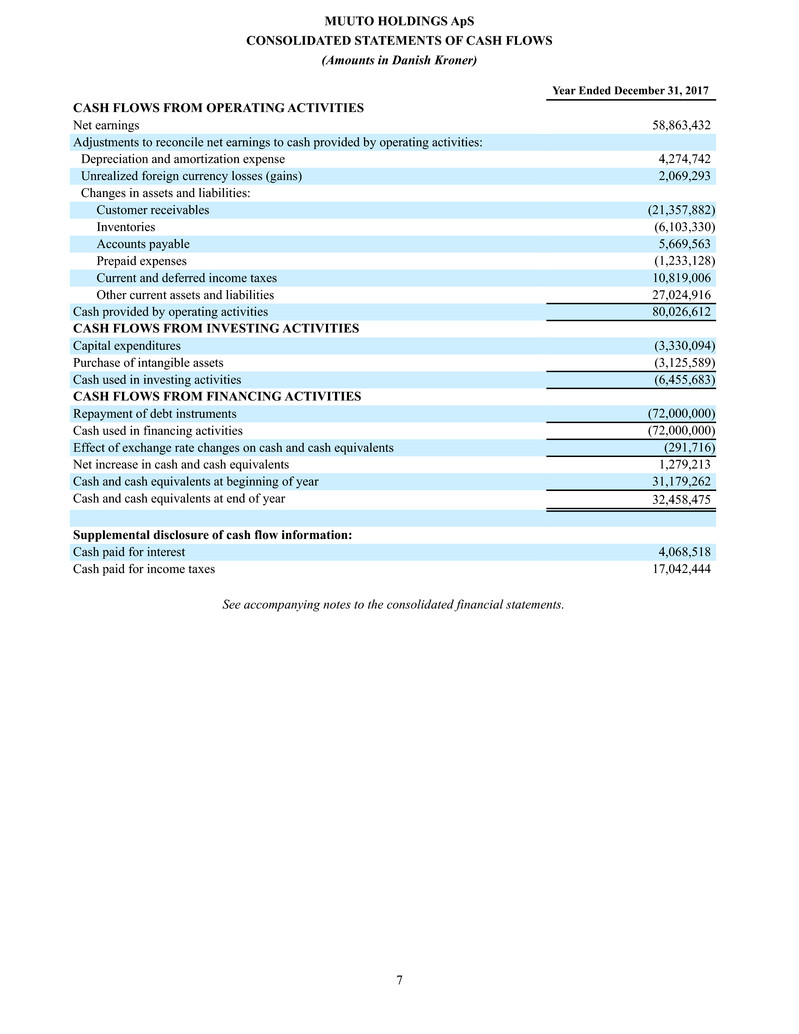

MUUTO HOLDINGS ApS

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in Danish Kroner)

7

Year Ended December 31, 2017

CASH FLOWS FROM OPERATING ACTIVITIES

Net earnings 58,863,432

Adjustments to reconcile net earnings to cash provided by operating activities:

Depreciation and amortization expense 4,274,742

Unrealized foreign currency losses (gains) 2,069,293

Changes in assets and liabilities:

Customer receivables (21,357,882)

Inventories (6,103,330)

Accounts payable 5,669,563

Prepaid expenses (1,233,128)

Current and deferred income taxes 10,819,006

Other current assets and liabilities 27,024,916

Cash provided by operating activities 80,026,612

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditures (3,330,094)

Purchase of intangible assets (3,125,589)

Cash used in investing activities (6,455,683)

CASH FLOWS FROM FINANCING ACTIVITIES

Repayment of debt instruments (72,000,000)

Cash used in financing activities (72,000,000)

Effect of exchange rate changes on cash and cash equivalents (291,716)

Net increase in cash and cash equivalents 1,279,213

Cash and cash equivalents at beginning of year 31,179,262

Cash and cash equivalents at end of year 32,458,475

Supplemental disclosure of cash flow information:

Cash paid for interest 4,068,518

Cash paid for income taxes 17,042,444

See accompanying notes to the consolidated financial statements.

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

8

1. DESCRIPTION OF THE BUSINESS AND BASIS OF PRESENTATION

Description of the Business

Muuto Holdings ApS. and its subsidiaries (the “Company”) are engaged in the design, manufacture, market and sale of

furniture products and accessories. The Company primarily operates in Denmark, the United States (“U.S.”) and Europe, and

sells its products primarily through a broad network of contract dealers and distribution partners, through a direct sales force,

and through its showrooms, as well as online.

Basis of Presentation

These financial statements have been prepared solely for the purpose of meeting the requirements of U.S. Securities and

Exchange Commission (“SEC”) Rule 3-05 of Regulation S-X. These financial statements are not the statutory financial statements

of the Company. No comparative information has been presented in these financial statements as no comparatives are required

for the Company's circumstances under SEC Rule 3-05 of Regulation S-X. The financial statements have been prepared in

accordance with the accounting standards set by the Financial Accounting Standards Board (“FASB”). The FASB establishes

accounting principles generally accepted in the United States (“GAAP”). References to GAAP issued by the FASB in these

footnotes are to the FASB Accounting Standards Codification (“ASC”), which serves as a single source of authoritative non-

Securities and Exchange Commission accounting and reporting standards to be applied by non-governmental entities. All amounts

are presented in Danish kroner (“DKK”), unless otherwise noted.

Entry into a Material Definitive Agreement

On December 10, 2017, Knoll Denmark ApS (“Buyer”), a wholly owned subsidiary of Knoll, Inc., entered into a share

purchase agreement (the “Agreement”) pursuant to which Buyer will acquire one hundred percent (100%) of the shares of Muuto

Holding ApS and MIE4 Holding 5 ApS, which collectively hold substantially all the business operations of Muuto. Pursuant to

the Agreement, the purchase price for the shares will be approximately $300.0 million USD, less certain customary adjustments.

Consummation of the transaction is subject to limited closing conditions. See Note 13 for additional information.

For the year ended December 31, 2017, the Company incurred 30,590,466 of costs related to the Agreement, which are

currently included in “Selling, general and administrative expenses” line on the Consolidated Statement of Operations.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The consolidated financial statements of the Company include the accounts of the Company and its wholly owned

subsidiaries and any partially owned subsidiaries that the Company has the ability to control through direct or indirect majority

interest in such entity. Significant intercompany transactions and balances have been eliminated in consolidation. The subsidiaries

of the Company include Muuto A/S and Muuto Inc.

Use of Estimates

The preparation of the consolidated financial statements in conformity with United States GAAP requires management

to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and accompanying

notes. Actual results may differ from such estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and highly liquid investments with original maturities of three months

or less at the date of purchase.

Revenue Recognition

The Company recognizes revenue when performance obligations under the terms of a contract with our customer are

satisfied. This occurs when the control of the goods have been transferred to the customer. Accordingly, revenue for sale of

goods is typically recognized upon shipment or delivery depending on the shipping terms of the underlying contract. Revenue

is measured as the amount of consideration the Company expects to receive in exchange for transferring goods. The Company

occasionally receives deposits from customers before revenue is recognized, thus resulting in the recognition of a contract

liability (customer deposits). Revenue is recognized net of value added tax, duties and sales discounts.

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

9

Allowance for Doubtful Accounts

The Company maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers

to make required payments. The allowance is determined through an analysis of the aging of accounts receivable and assessments

of risk that are based on historical trends. The Company evaluates the past-due status of its customer receivables based on the

contractual terms of sale. If the financial condition of the Company's customers were to deteriorate, additional allowances may

be required. Accounts receivable are charged against the allowance for doubtful accounts when the Company determines that

the likelihood of recovery is remote, and the Company no longer intends to expend resources to attempt collection.

Inventories

Inventories are stated at the lower of cost or net realizable value. Cost is determined using the first-in, first-out method.

The Company adjusts for inventory that it believes is impaired or obsolete. Obsolescence occurs as the result of several factors,

including the discontinuance of a product line, changes in product material specifications, replacement products in the marketplace

and other competitive influences.

Property, Plant, and Equipment

Property, plant, and equipment are stated at cost, less accumulated depreciation and impairments. Depreciation is computed

using the straight-line method over the estimated useful lives of the assets. The useful lives are as follows:

Category Useful Life (in years)

Leasehold improvements (1) Various

Other fixtures and fittings, tools and equipment 3-5

(1) Useful lives for leasehold improvements are amortized over the shorter of the economic lives or the term of the lease.

The Company reviews the carrying values of its property and equipment for possible impairment whenever events or

changes in circumstances indicate that the carrying value of an asset may not be recoverable based on undiscounted estimated

cash flows expected to result from its use and eventual disposition. The factors considered by the Company in performing this

assessment include current operating results, business trends affecting the use of certain assets and other economic factors. In

assessing the recoverability of the carrying value of property and equipment, the Company must make assumptions regarding

future cash flows and other factors. If these estimates or the related assumptions change in the future, the Company may be

required to record an impairment loss for these assets.

Goodwill and Intangible Assets

The Company records the excess of purchase price over the fair value of the tangible and identifiable intangible assets

acquired as goodwill. Intangible assets with finite lives are amortized over their useful lives.

Finite-lived assets are amortized over their estimated useful lives. The Company reviews the carrying values of these

assets for possible impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not

be recoverable based on undiscounted estimated cash flows expected to result from its use and eventual disposition. The Company

continually evaluates the reasonableness of the useful lives of these assets.

The Company assesses whether goodwill impairment exists using both the qualitative and quantitative assessments. The

qualitative assessment involves determining whether events or circumstances exist that indicate it is more likely than not that

the fair value of a reporting unit is less than its carrying amount, including goodwill. If based on this qualitative assessment the

Company determines it is more likely than not that the fair value of a reporting unit is less than its carrying amount, or if the

Company elects not to perform a qualitative assessment, a quantitative assessment is performed to determine whether a goodwill

impairment exists at the reporting unit.

As at December 31, 2017, the company had completed its annual qualitative impairment assessment and had not identified

any indicators of impairment which would require it to perform a quantitative assessment.

There have been no additions or impairment of the goodwill amount stated in the Consolidated Balance Sheet since initial

recognition.

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

10

Business Combinations

The purchase price of an acquired company is allocated between tangible and intangible assets acquired and liabilities

assumed from the acquired business based on their estimated fair values, with the residual of the purchase price recorded as

goodwill. The results of operations of the acquired business are included in the Company's operating results from the date of

acquisition.

Shipping and Handling

Amounts billed to clients for shipping and handling of products are classified as sales. Costs incurred by the Company

for shipping and handling are classified as cost of sales.

Research and Development Costs

Research and development expenses are expensed as incurred, and are included as a component of selling, general and

administrative expenses. Research and development expenses, were 1,583,966 for 2017.

Income Taxes

The Company accounts for income taxes using the asset and liability approach, which requires deferred tax assets and

liabilities be recognized using enacted tax rates to measure the effect of temporary differences between book and tax bases on

recorded assets and liabilities. Valuation allowances are recorded to reduce deferred tax assets, if it is more likely than not some

portion or all of the deferred tax assets will not be recognized. The need to establish valuation allowances against deferred tax

assets is assessed quarterly.

The Company evaluates tax positions to determine whether the benefits of tax positions are more likely than not to be

sustained upon audit based on the technical merits of the tax position. For tax positions that are more likely than not to be

sustained upon audit, the Company recognizes the largest amount of the benefit that is greater than 50% likely of being realized

upon ultimate settlement. For tax positions that are not more likely than not to be sustained upon audit, the Company does not

recognize any portion of the benefit. If the more likely than not threshold is not met in the period for which a tax position is

taken, the Company may subsequently recognize the benefit of that tax position if the tax matter is effectively settled, the statute

of limitations expires, or if the more likely than not threshold is met in a subsequent period.

The Company recognizes tax-related interest and penalties in income tax expense and accrues for interest and penalties

in other noncurrent liabilities.

Fair Value of Financial Instruments

The Company uses the following valuation techniques to measure fair value for its financial assets and financial liabilities:

Level 1 Inputs are unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 Inputs are quoted prices for similar assets or liabilities in an active market, quoted prices for identical or similar

assets or liabilities in markets that are not active, inputs other than quoted prices that are observable and market-

corroborated inputs which are derived principally from or corroborated by observable market data.

Level 3 Inputs are derived from valuation techniques in which one or more significant inputs or value drivers are

unobservable.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. The Company and its subsidiaries use, as appropriate, a market approach (generally,

data from market transactions), an income approach (generally, present value techniques and option-pricing models), and/or a

cost approach (generally, replacement cost) to measure the fair value of an asset or liability. These valuation approaches

incorporate inputs such as observable, independent market data and/or unobservable data that management believes are predicated

on the assumptions market participants would use to price an asset or liability. These inputs may incorporate, as applicable,

certain risks such as nonperformance risk, which includes credit risk.

Financial Instruments

The fair values of the Company’s cash and cash equivalents approximate carrying value due to their short maturities and

are classified as Level 1.

The fair value of the Company’s long-term debt approximates its carrying value, as it is variable rate debt and the terms

are comparable to market terms as of the balance sheet dates, and are classified as Level 2.

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

11

Assets and Liabilities Recorded at Fair Value on a Recurring Basis

The Company utilizes derivative instruments to hedge specific financial risks including foreign exchange risk. The

Company does not engage in speculative hedging activity. In order to account for a derivative instrument as a hedge, specific

criteria must be met, including: (i) ensuring at the inception of the hedge that formal documentation exists for both the hedging

relationship and the entity’s risk management objective and strategy for undertaking the hedge and (ii) at the inception of the

hedge and on an ongoing basis, the hedging relationship is expected to be highly effective in achieving offsetting changes in

fair value attributed to the hedged risk during the period that the hedge is designated. Further, an assessment of effectiveness is

required whenever financial statements or earnings are reported. Absent meeting these criteria, changes in fair value are

recognized in other income, net, in the consolidated statements of income. Once the underlying forecasted transaction is realized,

the gain or loss from the derivative designated as a hedge of the transaction is reclassified from accumulated other comprehensive

income (loss) to the statement of income, in cost of goods sold. Any ineffective portion of the derivatives designated as cash

flow hedges is recognized in current earnings.

Assets and Liabilities Recorded at Fair Value on a Nonrecurring Basis

There were no additional assets and/or liabilities remeasured to fair value on a nonrecurring basis as of December 31,

2017 and for the year then ended.

Guarantees

All shares in the subsidiary Muuto A/S have been charged as security for balances with banks.

Warranty

The Company generally offers an assurance-type warranty for its products. The specific terms and conditions of those

warranties vary depending upon the product sold. The Company estimates the costs that may be incurred under its warranties

and records a liability for the amount of such costs at the time the product revenue is recognized. Factors that affect the Company's

warranty liability include historical product-failure experience and estimated repair costs for identified matters. The Company

regularly assesses the adequacy of its recorded warranty liabilities and adjusts the amounts as necessary.

Concentration of Credit Risk

The Company's accounts receivables are comprised primarily of amounts due from customers. The Company monitors

and manages the credit risk associated with the customers.

Foreign Currency Translation

Results of foreign operations are translated into Danish kroner using average exchange rates during the year, while assets

and liabilities are translated into Danish kroner using the exchange rates as of the balance sheet dates. The resulting translation

adjustments are recorded in accumulated other comprehensive income (loss).

Transaction gains and losses resulting from exchange rate changes on transactions denominated in currencies other than

the functional currency of the applicable subsidiary are included in the consolidated statements of operations, within other

expense, net, in the year in which the change occurs.

Stock-Based Compensation

The Company measures the cost of employee services received in exchange for an award of equity instruments based on

the grant-date fair value of the award. Forfeitures are recognized when they occur.

Stock options

The fair value of stock options is estimated at the date of grant using the Black-Scholes option pricing model, which

requires management to make certain assumptions of future expectations based on historical and current data. The assumptions

include the expected term of the options, risk-free interest rate, expected volatility, and dividend yield. The expected term

represents the expected amount of time that options granted are expected to be outstanding, based on historical and forecasted

exercise behavior. The risk-free rate is based on the rate at grant date of Danish government bonds with a term equal to the

expected term of the option. Expected volatility is estimated based on volatility for comparable peers and industry practice. The

Company's dividend yield is based on historical data. The Company recognizes compensation expense using the straight-line

method over the vesting period.

As of December 31, 2017, there were 773,196 fully vested options outstanding and exercisable at an exercise price of

8.00. The remaining contractual life of these options is 4.5 years. In addition, the options have accelerated vesting provisions

upon a change of control of the Company.

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

12

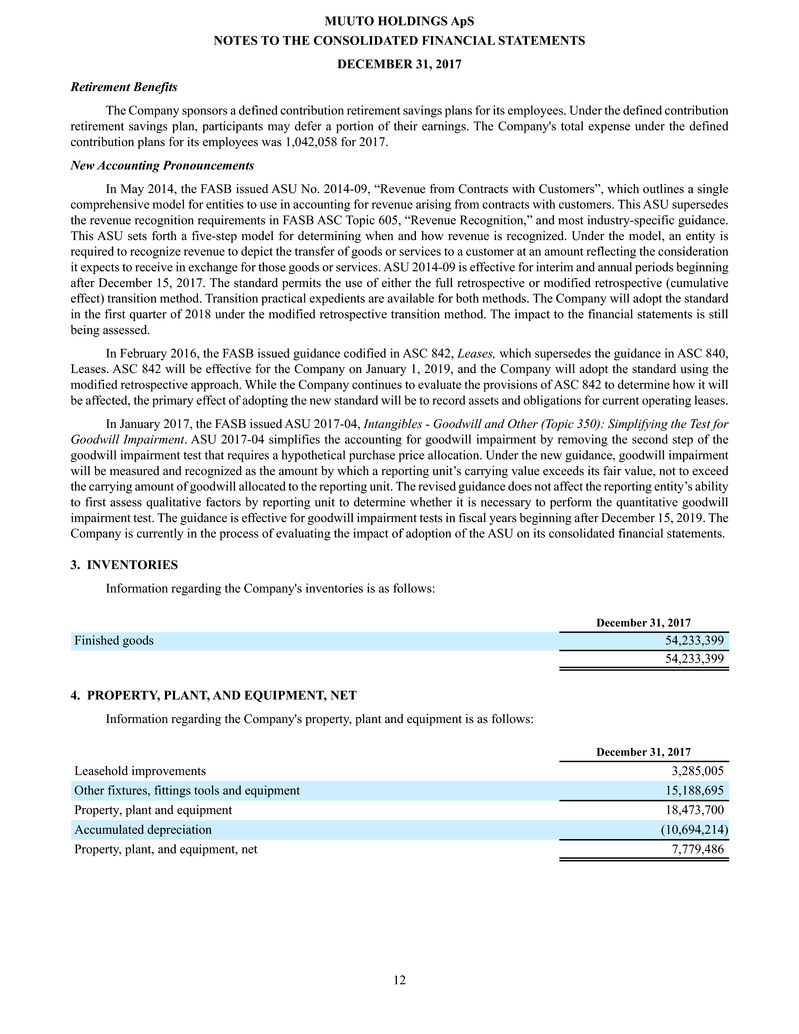

Retirement Benefits

The Company sponsors a defined contribution retirement savings plans for its employees. Under the defined contribution

retirement savings plan, participants may defer a portion of their earnings. The Company's total expense under the defined

contribution plans for its employees was 1,042,058 for 2017.

New Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers”, which outlines a single

comprehensive model for entities to use in accounting for revenue arising from contracts with customers. This ASU supersedes

the revenue recognition requirements in FASB ASC Topic 605, “Revenue Recognition,” and most industry-specific guidance.

This ASU sets forth a five-step model for determining when and how revenue is recognized. Under the model, an entity is

required to recognize revenue to depict the transfer of goods or services to a customer at an amount reflecting the consideration

it expects to receive in exchange for those goods or services. ASU 2014-09 is effective for interim and annual periods beginning

after December 15, 2017. The standard permits the use of either the full retrospective or modified retrospective (cumulative

effect) transition method. Transition practical expedients are available for both methods. The Company will adopt the standard

in the first quarter of 2018 under the modified retrospective transition method. The impact to the financial statements is still

being assessed.

In February 2016, the FASB issued guidance codified in ASC 842, Leases, which supersedes the guidance in ASC 840,

Leases. ASC 842 will be effective for the Company on January 1, 2019, and the Company will adopt the standard using the

modified retrospective approach. While the Company continues to evaluate the provisions of ASC 842 to determine how it will

be affected, the primary effect of adopting the new standard will be to record assets and obligations for current operating leases.

In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for

Goodwill Impairment. ASU 2017-04 simplifies the accounting for goodwill impairment by removing the second step of the

goodwill impairment test that requires a hypothetical purchase price allocation. Under the new guidance, goodwill impairment

will be measured and recognized as the amount by which a reporting unit’s carrying value exceeds its fair value, not to exceed

the carrying amount of goodwill allocated to the reporting unit. The revised guidance does not affect the reporting entity’s ability

to first assess qualitative factors by reporting unit to determine whether it is necessary to perform the quantitative goodwill

impairment test. The guidance is effective for goodwill impairment tests in fiscal years beginning after December 15, 2019. The

Company is currently in the process of evaluating the impact of adoption of the ASU on its consolidated financial statements.

3. INVENTORIES

Information regarding the Company's inventories is as follows:

December 31, 2017

Finished goods 54,233,399

54,233,399

4. PROPERTY, PLANT, AND EQUIPMENT, NET

Information regarding the Company's property, plant and equipment is as follows:

December 31, 2017

Leasehold improvements 3,285,005

Other fixtures, fittings tools and equipment 15,188,695

Property, plant and equipment 18,473,700

Accumulated depreciation (10,694,214)

Property, plant, and equipment, net 7,779,486

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

13

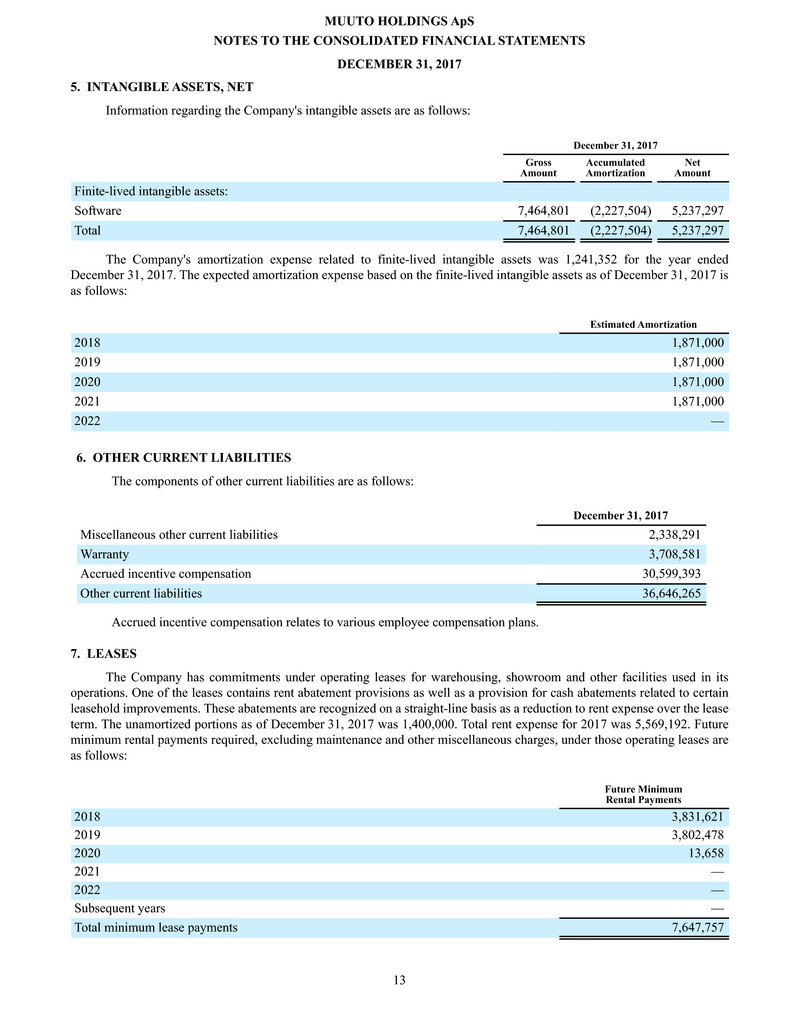

5. INTANGIBLE ASSETS, NET

Information regarding the Company's intangible assets are as follows:

December 31, 2017

Gross

Amount

Accumulated

Amortization

Net

Amount

Finite-lived intangible assets:

Software 7,464,801 (2,227,504) 5,237,297

Total 7,464,801 (2,227,504) 5,237,297

The Company's amortization expense related to finite-lived intangible assets was 1,241,352 for the year ended

December 31, 2017. The expected amortization expense based on the finite-lived intangible assets as of December 31, 2017 is

as follows:

Estimated Amortization

2018 1,871,000

2019 1,871,000

2020 1,871,000

2021 1,871,000

2022 —

6. OTHER CURRENT LIABILITIES

The components of other current liabilities are as follows:

December 31, 2017

Miscellaneous other current liabilities 2,338,291

Warranty 3,708,581

Accrued incentive compensation 30,599,393

Other current liabilities 36,646,265

Accrued incentive compensation relates to various employee compensation plans.

7. LEASES

The Company has commitments under operating leases for warehousing, showroom and other facilities used in its

operations. One of the leases contains rent abatement provisions as well as a provision for cash abatements related to certain

leasehold improvements. These abatements are recognized on a straight-line basis as a reduction to rent expense over the lease

term. The unamortized portions as of December 31, 2017 was 1,400,000. Total rent expense for 2017 was 5,569,192. Future

minimum rental payments required, excluding maintenance and other miscellaneous charges, under those operating leases are

as follows:

Future Minimum

Rental Payments

2018 3,831,621

2019 3,802,478

2020 13,658

2021 —

2022 —

Subsequent years —

Total minimum lease payments 7,647,757

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

14

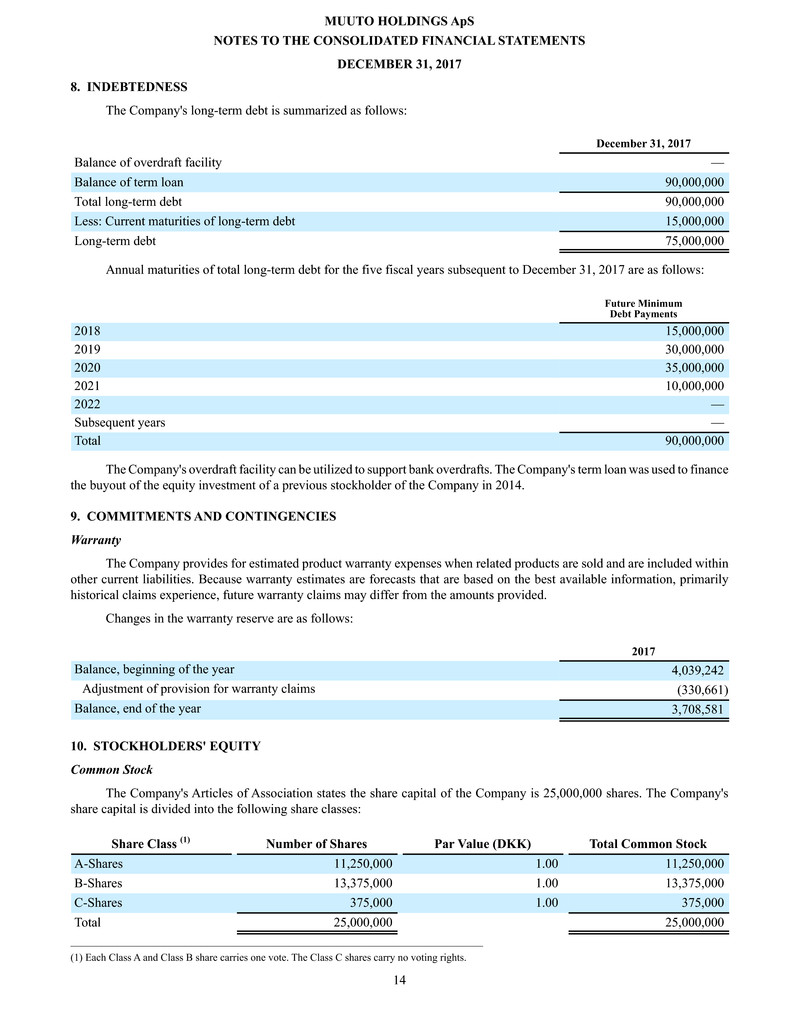

8. INDEBTEDNESS

The Company's long-term debt is summarized as follows:

December 31, 2017

Balance of overdraft facility —

Balance of term loan 90,000,000

Total long-term debt 90,000,000

Less: Current maturities of long-term debt 15,000,000

Long-term debt 75,000,000

Annual maturities of total long-term debt for the five fiscal years subsequent to December 31, 2017 are as follows:

Future Minimum

Debt Payments

2018 15,000,000

2019 30,000,000

2020 35,000,000

2021 10,000,000

2022 —

Subsequent years —

Total 90,000,000

The Company's overdraft facility can be utilized to support bank overdrafts. The Company's term loan was used to finance

the buyout of the equity investment of a previous stockholder of the Company in 2014.

9. COMMITMENTS AND CONTINGENCIES

Warranty

The Company provides for estimated product warranty expenses when related products are sold and are included within

other current liabilities. Because warranty estimates are forecasts that are based on the best available information, primarily

historical claims experience, future warranty claims may differ from the amounts provided.

Changes in the warranty reserve are as follows:

2017

Balance, beginning of the year 4,039,242

Adjustment of provision for warranty claims (330,661)

Balance, end of the year 3,708,581

10. STOCKHOLDERS' EQUITY

Common Stock

The Company's Articles of Association states the share capital of the Company is 25,000,000 shares. The Company's

share capital is divided into the following share classes:

Share Class (1) Number of Shares Par Value (DKK) Total Common Stock

A-Shares 11,250,000 1.00 11,250,000

B-Shares 13,375,000 1.00 13,375,000

C-Shares 375,000 1.00 375,000

Total 25,000,000 25,000,000

_______________________________________________________________________________

(1) Each Class A and Class B share carries one vote. The Class C shares carry no voting rights.

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

15

The shares are non-negotiable instruments, but must be registered in the name of the shareholder in the Company's register

of shareholders. Any lost certificate may be cancelled without prior court order pursuant to relevant statutory provisions. Any

sale or transfer of shares shall only take place upon prior approval from the board of directors.

Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) are as follows (in thousands):

Beginning

Balance

Before-Tax

Amount

Tax Benefit

(Expense)

Net-of-Tax

Amount

Ending

Balance

December 31, 2017

Foreign currency translation adjustment 83 243,570 — 243,570 243,653

Accumulated other comprehensive income (loss) 83 243,570 — 243,570 243,653

11. INCOME TAXES

Income before income tax expense consists of the following:

2017

U.S. operations 4,402,837

Non-U.S. operations 82,539,757

Total 86,942,594

Income tax expense is comprised of the following:

2017

Current:

Federal 1,572,469

State 458,087

Foreign (non-U.S.) 26,201,811

Total current 28,232,367

Deferred:

Foreign (non-U.S.) (153,205)

Total deferred (153,205)

Income tax expense 28,079,162

The following table sets forth the tax effects of temporary differences that give rise to the deferred tax assets and liabilities:

December 31, 2017

Deferred tax assets

Inventories 243,000

Deferred rent 308,000

Plant and equipment 64,000

Gross deferred tax assets 615,000

Valuation allowance —

Net deferred tax assets 615,000

Deferred tax liabilities:

Intangibles 20,000

Gross deferred tax liabilities 20,000

Net deferred tax assets 595,000

MUUTO HOLDINGS ApS

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2017

16

The following table sets forth a reconciliation of the statutory federal income tax rate to the effective income tax rate:

2017

Federal statutory tax rate 34.0 %

Increase (decrease) in the tax rate resulting from:

State taxes, net of federal effect 0.3 %

Foreign rate differential (11.4)%

Nondeductible expense 8.7 %

Other 0.7 %

Effective tax rate 32.3 %

As of December 31, 2017, the Company is subject to U.S. Federal Income Tax examination for the tax years 2014 through

2016, and to non-U.S. income tax examination for the tax years 2013 to 2016. In addition, the Company is subject to state and

local income tax examinations for the tax years 2014 through 2016.

12. OTHER EXPENSE, NET

The components of other expense, net are as follows:

Year Ended December 31, 2017

Unrealized foreign exchange losses 1,776,909

Realized foreign exchange losses 2,159,448

Other, net 941,033

Other expense, net 4,877,390

13. SUBSEQUENT EVENTS

On January 25, 2018, Knoll Denmark ApS (“Knoll Denmark”), a wholly owned subsidiary of Knoll, Inc., completed

the acquisition of one hundred percent (100%) of the shares of the Company, pursuant to a share purchase agreement,

dated as of December 10, 2017, among Knoll Denmark and the owners of the Company. The purchase price for the

acquisition was $311.3 million USD, subject to certain customary adjustments.