Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - GEX MANAGEMENT, INC. | ex32.htm |

| EX-31 - CERTIFICATION - GEX MANAGEMENT, INC. | ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2017

| □ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ________ to ________

GEX MANAGEMENT, INC.

(Exact name of registrant as specified in its charter)

| Texas | 333-213470 | 56-2428818 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

12001 N. Central Expressway Suite 825 Dallas, Texas 75243 |

||||

| (Address of Principal Executive Offices) |

Registrant’s telephone number, including area code: 877-210-4396

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par value $0.001

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes□ No ☑

Indicate by a check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Securities Exchange Act. Yes □ No ☑

| 1 |

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports) (2) has been subject to such filing requirement for the past 90 days. Yes ☑ No□

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No□

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | □ | Accelerated Filer | □ |

| Non-Accelerated Filer | □ | Smaller Reporting Company | ☑ |

| Emerging growth company ☑ | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes □ No ☑

Aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2017: $14,595,868.

Indicate the number of Shares of outstanding of each of the Registrant's classes of common stock, as of the latest practicable date: As of April 2, 2018, the Registrant had 11,797,231 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

| 2 |

TABLE OF CONTENTS

| PART I | |||

| Item 1. | Business | 4 | |

| Item 1A. | Risk Factors | 6 | |

| Item 1B. | Unresolved Staff Comments | 6 | |

| Item 2. | Description of Properties | 6 | |

| Item 3. | Legal Proceedings | 6 | |

| Item 4. | Mine Safety Disclosures | 6 | |

| PART II | |||

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | 7 | |

| Item 6. | Selected Financial Data | 7 | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 | |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 9 | |

| Item 8. | Financial Statements and Supplementary Data | 10 | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 10 | |

| Item 9A. | Controls and Procedures | 10 | |

| Item 9B. | Other Information | 11 | |

| PART III | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 11 | |

| Item 11. | Executive Compensation | 13 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 15 | |

| Item 13. | Certain Relationship and Related Transactions and Director Independence | 15 | |

| Item 14. | Principal Accounting Fees and Services | 16 | |

| PART IV | |||

| Item 15. | Exhibits and Financial Statement Schedules | 15 | |

| 3 |

FORWARD-LOOKING STATEMENTS

For purposes of this Annual Report, the terms “GEX,” “GEX Management,” “the Company,” “we,” “us,” and “our,” refer to GEX Management, Inc., a Texas Corporation, and its consolidated subsidiaries unless the context clearly indicates otherwise. Included in this Annual Report are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases, regarding, among other things, all statements other than statements of historical facts contained in this report, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. In addition, our past results of operations do not necessarily indicate our future results.

From time to time, we also provide forward-looking statements in other materials we release to the public, as well as oral forward-looking statements. Such statements relate to our current expectations, projections and assumptions about our business, the economy and future events or conditions. They do not relate strictly to historical or current facts.

Forward-looking statements are not guarantees and involve risks, uncertainties and assumptions that are difficult to predict. Actual results may differ materially from past results and from those indicated by such forward-looking statements if known or unknown risks or uncertainties materialize, or if underlying assumptions prove inaccurate. These risks and uncertainties include, among other things:

| § | our ability to execute our business plans or growth strategy; |

| § | the nature of investment and acquisition opportunities we are pursuing, and the successful execution of such investments and acquisitions; |

| § | our ability to successfully integrate acquired businesses and realize synergies; |

| § | variations in our results of operations; |

| § | our ability to accurately forecast the revenue under our contracts; |

| § | competition for our services; |

| § | our failure to maintain a high level of client retention or the unexpected reduction in scope or termination of key contracts with major clients; |

| § | client dissatisfaction, our non-compliance with contractual provisions or regulatory requirements; |

| § | our inability to manage our relationships with our clients; |

| § | pending or threatened litigation; |

| § | unfavorable outcomes in legal proceedings; |

| § | our ability to generate sufficient cash to cover our interest and principal payments under our note payable, or to borrow or use credit; |

| § | unexpected changes in tax laws, regulations or guidance and unexpected changes in our effective tax rate; and |

| § | the market price of our common stock. |

Other sections of this report may include additional factors which could adversely affect our business and financial performance. New risk factors emerge from time to time and it is not possible for us to anticipate all the relevant risks to our business, and we cannot assess the impact of all such risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. Those factors include, among others, those matters disclosed in this Annual Report on Form 10-K.

| 4 |

Except as otherwise required by applicable laws and regulations, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in this report, whether as a result of new information, future events, changed circumstances or any other reason after the date of this report. Neither the Private Securities Litigation Reform Act of 1995 nor Section 27A of the Securities Act of 1933 provides any protection to us for statements made in this report. You should not rely upon forward-looking statements as predictions of future events or performance. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

PART I

ITEM 1. BUSINESS

History and Development of Business

GEX Management, Inc. was originally formed in 2004 as Group Excellence Management, LLC. d/b/a MyEasyHQ. In March of 2016, it was converted from a limited liability company into a C corporation and changed its name to GEX Management, Inc. in April of 2016. GEX Management obtained its license to operate as a Professional Employer Organization (PEO), and established GEX Staffing, LLC, a wholly owned subsidiary of GEX Management, in March 2017 in order to begin distinguishing its staffing and PEO operations.

Carl Dorvil founded Group Excellence, LLC, a tutoring and mentoring company, from his dorm room at Southern Methodist University in 2004. Group Excellence provided tutoring and mentoring services to students with the goal of inspiring young persons to pursue high personal and academic achievement. The company quickly grew to more than six hundred employees. In 2011, Group Excellence was on Inc. 500’s annual list of the 500 fastest growing private companies in the United States.

In response to rapid growth, Mr. Dorvil developed GEX Management to facilitate the back-office functions of his company. GEX Management provided Group Excellence, LLC with human resources, IT, accounting/bookkeeping, social media, payroll, and conducted a majority of the overall operations of the company. Mr. Dorvil sold Group Excellence, LLC in 2011 but maintained ownership of GEX Management, which continued as a Professional Services Company providing back office support to the tutoring company, as well as third-party clients. In 2016 GEX Management revised its business model to provide staffing and back-office services to a wide variety of industries in order to expand the Company’s footprint, thereby building on the previous 12-year history of exceptional client service. On February 23, 2018, the US Secretary of Commerce, Wilbur Ross, mentioned at the “African American Leaders in the White House: Education, Business and Policy” that Dorvil was “the youngest African American CEO ever to take a company public in U.S. history.”

| 5 |

Business Operations

GEX Management is a progressive and growing provider of business management and human resources (“HR”) solutions for small to midsize businesses. By means of our value-driven co-employment model, we reduce employer stress and increase employee capacity by performing many of the skill-specific and time-intensive office functions that typically distract managers from growing their businesses. We likewise minimize employer-related risks and ensure that our clients are consistently in proper governmental compliance. Our service offerings include a robust HR technology platform with online and mobile tools that allow our clients and their employees alike to manage their HR-related information and conduct a variety of HR-related functions 24-7. GEX Management also provides both long and short-term staffing solution services, including interview vetting, background checks, drug screening, employee onboarding, and more. The Company became licensed as a Professional Employer Organization (“PEO”) in 2017.

GEX Management is strategically purposed to provide tailored HR products and services to our clients; thereby allowing them to concentrate of the larger goal of growing their businesses. Our client-responsive approach is a key differentiator in the industry.

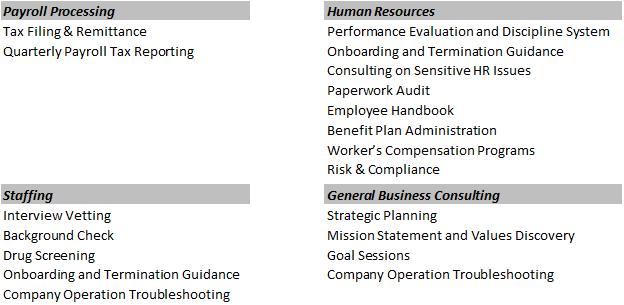

Specific services are described below:

| 6 |

Business Strategy

Our objective is to become a leading business management and HR company, and to continuously expand our client base. We seek to achieve this objective by continuing to implement our business strategy, which includes the primary elements enumerated below.

Marketing and Sales

Our comprehensive marketing efforts are fluid, adaptive, and results-driven. They comprise both traditional and non-traditional channels including print collateral, website, video, PowerPoint presentations, digital ads, social media posts and press releases. We likewise employ a small sales team. We strategically target small and mid-sized businesses that require the services we provide. Previously, a significant amount of corporate revenue has been derived through client referrals and management’s personal relationships. Our 2018 plan is to continue to leverage these important relationships while expanding our brand reach by means of integrated marketing campaigns, more timely, informative, and effectual messaging, and greater collaboration between marketing and sales in order to increase both client and sales growth.

Dependence on Major Customers

We rely heavily on the service contract renewals of our clients. Our management and client facing team members are responsible for developing and maintaining successful long-term relationships with key clients. In 2017 we had 2 significant clients that comprised approximately 84% of our revenues and in 2016 we had 4 or 5 significant clients that made up approximately 80% of our revenues.

Our Qualifications

Our qualifications include our reputation as a professional services company with specific experience in back office services business consulting since 2004. In addition, we have been minority certified since 2016 and a licensed Professional Employer Organization (“PEO”) since the beginning of 2017. Our current team has over 40 years of experience in the PEO industry.

Industry and Competitors

The HR industry is highly fragmented, resulting in robust competition. Competition affects our success in both the market segments we currently serve, as well as the new market segments we may enter in the future. We compete with several large HR companies, as well as PEOs and Administrative Service Organizations (“ASO”) that provide identical services to those GEX Management provides; some offer additional services. The financial and marketing resources of some of our competitors exceed those of GEX Management. Businesses primarily select a service provider based on price point/value, innovative/flexible product offerings, and quality of customer service.

Environmental Concerns

As a professional services company, federal, state or local laws that regulate the discharge of materials into the environment do not impact us.

| 7 |

Number of Employees

As of December 31, 2017 we had 23 employees.

ITEM 1A. RISK FACTORS

As a Smaller Reporting Company we are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Corporate Office

GEX's corporate offices are located at 12001 N. Central Expressway Suite 825, Dallas, Texas. GEX entered into a 38-month lease agreement on September 28, 2016.

Satellite Location

GEX Management has a satellite office located at 4285 N. Shiloh Dr., Fayetteville, Arkansas. GEX entered into a 12-month lease agreement on October 30, 2017.

Other Property

On December 29, 2017 the Company acquired a 12,223 square foot, multi-use office building in Lowell, Arkansas. The purchase of this building was for its strategic location in Northwest Arkansas in anticipation of establishing a larger satellite office in the region. The building had a 100% occupancy at the time of purchase, and included lease agreements with three tenants.

ITEM 3. LEGAL PROCEEDINGS

GEX is not subject to any pending legal proceedings, nor is the Company aware of any material threatened claims against it.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 8 |

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is included in the Nasdaq Global Select Market, under the symbol GXXM. The table below summarizes the high and low closing sales prices per share for our common stock for the periods indicated, as reported on the Nasdaq Global Select Market. These amounts have been adjusted to reflect the 4 for 3 stock split of our common stock effected on December 12, 2017. The Company began trading on June 13, 2017 and therefore has no activity prior to the Quarter ended June 30, 2017.

| Quarter Ended | March 31, | June 30, | September 30, | December 31, | ||||||||||||

| Fiscal Year 2017 | ||||||||||||||||

| High | $ | — | $ | 8.60 | $ | 10.50 | $ | 8.25 | ||||||||

| Low | $ | — | $ | 1.40 | $ | 6.02 | $ | 3.41 | ||||||||

| Fiscal Year 2016 | ||||||||||||||||

| High | $ | — | $ | — | $ | — | $ | — | ||||||||

| Low | $ | — | $ | — | $ | — | $ | — | ||||||||

Shareholders

As of December 31, 2017, there were approximately 58 holders of record of our common stock. This number does not include shareholders for whom shares were held in “nominee” or “street name.”

Dividends

On November 22, 2017, the Board of Directors of GEX, unanimously resolved that the Company declare a dividend on its outstanding common stock on the basis of four for three (4 for 3), with all fractional shares to be rounded up to the nearest whole share, with any shares needed for such rounding to be authorized and issued by the Company, and such dividend to be subject to a mandatory exchange of certificates, so that the net effect of the dividend is a four for three (4 for 3) forward split of the outstanding common stock. The FINRA effective date for this transaction was December 12, 2017.

The payment of dividends is made at the discretion of our Board of Directors and depends upon our operating results, financial condition, capital requirements, general business conditions and such other factors as our Board of Directors deems relevant.

Recent Sales of Unregistered Securities

On December 29, 2017, the Company sold 75,000 shares of its common stock, restricted pursuant to Rule 144 of the Securities Act of 1934, as amended, for $300,000.

On December 29, 2017 GEX purchased 100% of the membership interest in AMAST Consulting, LLC (“AMAST”), which owned a multi-use office building in Lowell, Arkansas, for 200,000 shares of the Company’s common stock, restricted pursuant to Rule 144 of the Securities Act of 1934, as amended.

ITEM 6. SELECTED FINANCIAL DATA

As a Smaller Reporting Company, we are not required to report selected financial data.

| 9 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Business

GEX Management is a business management company providing client employers and their employees with a broad portfolio of HR-related products and services. Our HR technology platform, complete with online and mobile tools, allows our clients and their employees to digitally manage HR functions which as payroll processing, tax administration, employee onboarding and termination, compensation reporting, expense management, and benefits enrollment and administration.

Business Operations

GEX Management works continuously to expand its service offerings to its clients in order to assist them to achieve their respective business goals. Our unique and tailored approach, coupled with an ever-expanding array of services, has significantly differentiated the Company from competitors. GEX likewise distinguished itself in the market via accessible and exceptional client support ensuring that we will not only gain new clients but will retain those we currently have, resulting in long-term sustainability. Clients typically initiate service by means of a three-month agreement with the Company. The contract thereby automatically renews until terminated with a 30-day notice by either party.

Critical Accounting Policies

The Company’s financial statements were prepared in conformity with U.S. generally accepted accounting principles. As such, management is required to make certain estimates, judgments and assumptions that they believe are reasonable based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expense during the periods presented.

Revenue Recognition

PEO Services

Professional Employment Organization (“PEO”) service revenues represent the fees charged to clients for administering payroll and payroll tax transactions for our clients’ Co-Employed Employees (“CEEs”), access to our HR and benefits administration services, consulting related to employment and benefit law compliance and general employment consulting related fees. PEO service revenues are recognized in the period the PEO services are performed as stipulated in the Client Service Agreement (“CSA”), where these fees are fixed or determinable, when the PEO client is invoiced and collectability is reasonably assured.

GEX is not considered the primary obligor with respect to CEE’s payroll and payroll tax payments and therefore, these payments are not reflected as either revenue or expense in our statements of operations.

| 10 |

PEO-related revenues also include revenues generated from insurance administration for our PEO clients. These insurance-related revenues include insurance-related billings, as well as administrative fees that GEX collects from PEO clients and withholds from CEEs for health benefit insurance plans provided by third-party insurance carriers. Insurance-related revenues are recognized over the period the insurance coverage is provided and where collectability is reasonably assured.

Staffing Services and Professional Services

Staffing services revenue is derived from supplying temporary staff to clients. Temporary staff generally consists of temporary workers working under a contract for a fixed period of time, or on a specific client project. The temporary staff includes both GEX employees and third-parties contracted by GEX.

Temporary staff are provided to clients through a Staffing Service Agreement (‘SSA’) involving a specified service that the temporary staff will provide to the client. When GEX is the principal or primary obligor for the temporary staff, GEX records the gross amount of the revenue and expense from the SSA.

GEX is generally the primary obligor when GEX is responsible for the fulfillment of services under the SSA, even if the temporary staff are not employees of GEX. This typically occurs when GEX contracts third-parties to fulfill all or part of the SSA with the client, but GEX remains the holder of the credit risk associated with the SSA, and GEX has total discretion in establishing the pricing under the SSA.

All other Professional Services revenues are recognized in the period the services are performed as stipulated in the client’s Outsourcing Agreement, when the client is invoiced, and collectability is reasonably assured. Revenue recognition for arrangements with multiple deliverables constituting a single unit of accounting is recognized generally over the greater of the term of the arrangement or the expected period of performance.

Income Taxes

On December 22, 2017, the 2017 Tax Cuts and Jobs Act (the “Tax Act”) was enacted into law including a one-time mandatory transition tax on accumulated foreign earnings and a reduction of the corporate income tax rate to 21% effective January 1, 2018, among others. We are required to recognize the effect of the tax law changes in the period of enactment, such as determining the transition tax, remeasuring our U.S. deferred tax assets and liabilities as well as reassessing the net realizability of our deferred tax assets and liabilities. The Company does not have any foreign earnings and therefore, we do not anticipate the impact of a transition tax. We have remeasured our U.S. deferred tax assets at a statutory income tax rate of 21%. Since the Tax Act was passed late in the fourth quarter of 2017, and ongoing guidance and accounting interpretation are expected over the next 12 months, we consider the accounting of any transition tax, deferred tax re-measurements, and other items to be incomplete due to the forthcoming guidance and our ongoing analysis of final year-end data and tax positions. We expect to complete our analysis within the measurement period in accordance with SAB 118, and no later than fiscal year end December 31, 2018.

Results of Operations for the Year Ended December 31, 2017 Compared to the Year Ended December 31, 2016

Revenues

| 11 |

Revenues for the year ended December 31, 2017 and 2016 were $8,407,088 and $508,221, respectively. Of that amount, related party revenues were $104,000 and $305,885 for the years ended December 31, 2017 and 2016 respectively. The increase is due to the focusing our efforts on growing our business and laying the foundation for expansion in the future. Over the same period, we reduced our reliance on related party revenues. In addition, revenue for our PEO clients is recorded net of payroll expense, in accordance with current revenue recognition standards.

Cost of Services and Gross Profit

The Company’s gross margin was $145,167 or 2% in 2017 compared to $122,995 or 24% in 2016. The increase was due to the Company engaging more PEO clients which have a lower margin than staffing clients, as well as building the Company’s talent infrastructure for future growth.

Operating Expense

Total operating expense in the years ended December 31, 2017 and 2016 were $1,171,035 and $382,097 respectively. The increase reflects the increase in personnel and infrastructure costs, as well as costs related to reporting as a publicly traded company. Depreciation expense increased from $577 to $1,262 from the year ended December 31, 2016 to December 31, 2017. Amortization expense was $56,740 and $0 for the years ended December 31, 2017 and 2016 respectively. The amortization related to contracts and intangible assets of $74,750 that the Company acquired in 2017. At December 31, 2017, the unamortized amount was $4,167.

Other income and expense for the years ended December 31, 2017 and 2016 was made up of interest income, interest expense and a non-cash gain of extinguishment of debt of $172,872. Interest income was $0 and $72 for the years ended December 31, 2017 and 2016 respectively. Interest expense, which related solely to the interest on our notes payable, was $14,039 and $39,809 for the years ended December 31, 2017 and 2016 respectively.

Net Loss

Net loss for the years ended December 31, 2017 and 2016 was $867,035 and $298,839, respectively.

Liquidity and Capital Resources

The Company has sufficient cash reserves and liquidity to operate at current levels for the next twelve months.

Cash increased by $102,701 from $307,395 at December 31, 2016 to $410,096 at December 31, 2017. The increase was due to the funds we raised in the Company’s S-1 offering, as well as additional sales of common stock subsequent to the closing of the S-1 offering, and net loan proceeds of $306,100.

| 12 |

A summary of our cash flows was as follows:

| 2017 | 2016 | |||

| Net cash used in operating activities | $ (990,374) | $ (236,852) | ||

| Net cash used in investing activities | (40,113) | - | ||

| Net cash provided by financing activities | 1,133,188 | 541,410 | ||

| Net increase in cash and cash equivalents | $ 102,701 | $ 304,558 |

Net cash used by operating activities was $990,374 for the year ended December 31, 2017, compared to net cash used by operating activities of $236,852 for the year ended December 31, 2016. The increase in the net cash used by operating activities was due to an increase in non-cash items such as depreciation, amortization and stock issued for services and expenses, increased working capital requirements to support the Company’s infrastructure growth, offset by a gain on extinguishment of debt.

Net cash used in investing activities for fixed assets was $40,113 and $0 in the years ended December 31, 2017 and 2016 respectively. Additionally, the Company purchased a building valued at $2,459,420 by issuing 200,000 shares of common stock and assuming the $1,310,920 real estate loan.

Net cash from financing activities in the year ended December 31, 2017 came from two sources (a) net proceeds of $306,100 in advances from lines of credit – related party and (b) the sale of common stock of $827,088.

As of December 31, 2017, the Company had $410,096 of cash on hand. The Company had $1,147,900 available on its lines of credit.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company’s financial statements as of December 31, 2017 and 2016, included in this Form 10-K have been audited by Pinnacle Accountancy Group of Utah (a d/b/a of Heaton & Company, PLLC) independent registered public accountants, as set forth in their report. The financial statements have been included in reliance upon the authority of them as experts in accounting and auditing.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

None.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

In accordance with Exchange Act Rules 13a-15 and 15a-15, we carried out an evaluation, under the supervision and with the participation of management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective as of December 31, 2017.

| 13 |

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act. Our internal control system was designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes, in accordance with generally accepted accounting principles in the United States of America. Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements. Because of inherent limitations, a system of internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate due to change in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management conducted an evaluation of the effectiveness of our internal control over financial reporting using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control—Integrated Framework (2013) at December 31, 2017. Based on its evaluation, our management concluded that, as of December 31, 2017, our internal control over financial reporting was effective.

Changes in Internal Control over Financial Reporting

Management previously identified that our internal control over financial reporting was not effective due to our dependence on upon independent financial reporting consultants for review of critical accounting areas and disclosures material non-standard transactions, and the lack of sufficient accounting staff to increase the Company’s ability to segregate duties.

The following steps were taken by the Company in 2017 to remediate the material weakness:

- Hired more payroll and accounting personnel to segregate critical duties and processes of the Company.

- Expanded the dual authority requirements for major banking transactions.

- Implemented enhanced user log in for individuals that have access to accounting and payroll systems.

- Automated interfaces between our payroll and accounting system that is stored electronically and reviewed regularly by the accounting and payroll staff.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to the attestation by the Company’s registered public accounting firm pursuant to the rules of the SEC that permit the Company, as a Smaller Reporting Company, to provide only management’s report in this annual report.

| 14 |

Inherent Limitations

Control systems, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control systems' objectives are being met. Further, the design of any control systems must reflect the fact that there are resource constraints, and the benefits of all controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision making can be faulty and that breakdowns can occur because of simple errors or mistakes. Control systems can also be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls. The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or procedures.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The Company has a code of business conduct and ethics that applies to all of its employees, officers and directors. The code of business conduct and ethics is available on our website at www.gexmanagement.com and we will post any amendments to, or waivers from, the code of ethics on that website.

The following table lists the names and ages of the executive officers and directors a of the Company as of December 31, 2017. The directors will continue to serve until the next annual shareholders meeting, or until their successors are elected and qualified. All Directors have been elected to serve through the 2018 annual meeting. All officers serve at the discretion of the Chairman of the Board of Directors, and members of the Board of Directors.

| 15 |

| Name | Age | Position | Held Since | |||

| Carl Dorvil | 34 | Chairman of The Board | October 2004 | |||

| 12001 N. Central Expy. Suite 825 | CEO/President* | |||||

| Dallas, Texas 75243 | ||||||

| Clayton Carter | 32 | Director | April 2016 | |||

| 12001 N. Central Expy. Suite 825 | Chief Financial Officer | |||||

| Dallas, TX 75243 | ||||||

| Chelsea Christopherson | 29 | Director | April 2016 | |||

| 12001 N. Central Expy. Suite 825 | Chief Operating Officer* | |||||

| Dallas, TX 75243 |

*On March 9, 2018, which is subsequent to the end of the period covered by this Report, the Board of Directors of the Company voted to amend its Bylaws to separate the positions of President and Chief Executive Officer and also appointed Chelsea Christopherson as the Company’s President. Ms. Christopherson continues to serve as the Company’s Chief Operating Officer and on the Company’s Board.

Carl Dorvil:

Carl Dorvil, age 34, grew up in Garland, Texas and is the son of Haitian immigrants. Mr. Dorvil graduated from Southern Methodist University (“SMU”) in 2005 with three majors -- Public Policy, Economics, and Psychology, all with Distinction. Mr. Dorvil continued his education post undergraduate studies at SMU and received his MBA from the Cox School of Business. In 2004, he founded Group Excellence, a mentoring and tutoring company, out of his dorm room at SMU. The company started with a $20,000 grant from Texas Instrument Foundation. Since its inception, Group Excellence provided over 800,000 hours of tutoring to students around the country and created over 2,000 jobs. In 2011, Mr. Dorvil sold the company to a Dallas-based investor group. Two years later, he bought it back for 10% of the original sale price. After stabilizing the business, Mr. Dorvil converted it into a nonprofit.

In 2010, Mr. Dorvil received the Minority Business Leader Award from the Dallas Business Journal (“DBJ”) and Group Excellence was included in the “Top 100 on SMU's Dallas 100 Fastest-Growing Businesses” list. In 2011, Mr. Dorvil was the youngest-ever honoree on the DBJ’s 40 Under Forty, and Group Excellence was the fifth on the Inc. 500 list of fastest-growing companies in the United States. Mr. Dorvil is a regular contributor to Forbes, with his most recent article being “Challenges and Opportunities When Doing Business with the Government”.

Mr. Dorvil has served as the Chief Executive Officer and Chairman of the Board of GEX from 2004 until present. Mr. Dorvil has also served as a managing partner at P413 Management, LLC, a strategy and consulting firm that focuses on non-profit entities and consulting related to the expansion of corporate community outreach programs, from 2011 to present, and serves as Managing Partner at Vicar Capital Partners, LLC, a licensed capital advisory firm, from 2013 to present.

Clayton Carter:

Clayton Carter, age 32, received his Bachelor of Arts in Integrated Marketing and Communications from Pepperdine University. With his extensive knowledge of the public markets and investment-based finance, Mr. Carter served as Chief Executive Officer and Chairman of the Board at Freestone Resources, Inc., an oil and gas technology company, from 2010 to 2015. Mr. Carter’s responsibilities as the CEO of Freestone Resources included the preparation of the quarterly and annual reports, as well as the day-to-day operation of a fully reporting, publicly traded company. In March 2016, Mr. Carter became the Chief Financial Officer and Director for GEX Management, Inc., and currently serves in these roles. In November 2017 Mr. Carter became an officer and director of Vicar Financial, Inc.

| 16 |

Chelsea Christopherson:

Chelsea Christopherson, age 29, received her Business Management degree from Dallas Baptist University. Ms. Christopherson has several years of experience executing operational processes for small cap, growing businesses across a variety of industries. Ms. Christopherson joined Group Excellence in 2010, was appointed Human Resources Director in 2012 and became Vice President of Group Excellence in 2013. While serving as Vice President of Group Excellence, Ms. Christopherson managed a staff of 600 employees, helped build and implement processes to manage a geographically diverse workforce in the midst of unpredictable staffing patterns. Ms. Christopherson has served as Chief Operating Officer for GEX Management, Inc. from 2014 to present where she oversees all operations of the company and its clients.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors, and persons who beneficially own more than ten percent of our common stock, to file initial reports of ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater than ten percent beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. We believe that as of the date of this report they were all current in their 16(a) reports.

Board of Directors

Our Board of Directors currently consists of three members. Our directors serve one-year terms. Our Board of Directors has affirmatively determined that there are currently no independent directors serving on our board.

Committees of the Board of Directors

Audit Committee

We do not have a standing audit committee of the Board of Directors. Management has determined not to establish an audit committee at present because of our limited resources and limited operating activities do not warrant the formation of an audit committee or the expense of doing so. We do not have a financial expert serving on the Board of Directors or employed as an officer based on management’s belief that the cost of obtaining the services of a person who meets the criteria for a financial expert under Item 401(e) of Regulation S is beyond its limited financial resources and the financial skills of such an expert are simply not required or necessary for us to maintain effective internal controls and procedures for financial reporting in light of the limited scope and simplicity of accounting issues raised in its financial statements at this stage of its development.

| 17 |

Governance, Compensation and Nominating Committee

We do not have a standing governance, compensation and nominating committee of the Board of Directors. Management has determined not to establish governance, compensation and nominating committee at present because of our limited resources and limited operations do not warrant such a committee or the expense of doing so.

Code of Ethics

The Company has adopted the following code of ethics for officers, directors and employees:

- Show respect towards others in the workplace

- Conduct all business activities in a fair and ethical manner

- Work dutifully and responsibly for the Company’s shareholders and stakeholders

The Company has provided its code of ethics on its website, of which a copy can be obtained by visiting http://www.gexmanagement.com or by calling the Company at 877.210.4396.

Limitation of Liability of Directors

Pursuant to the Texas Business Organizations Code, our Amended and Restated Articles of Incorporation exclude personal liability for our Directors for monetary damages based upon any violation of their fiduciary duties as Directors, except as to liability for any breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, or any transaction from which a Director receives an improper personal benefit. This exclusion of liability does not limit any right which a Director may have to be indemnified and does not affect any Director’s liability under federal or applicable state securities laws.

Legal Proceedings

During the past ten years, none of our present or former directors, executive officers or persons nominated to become directors or executive officers:

(1) A petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

(2) Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3) Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

| 18 |

(i) Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) Engaging in any type of business practice; or

(iii) Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

(4) Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

(5) Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

(6) Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

(7) Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

(i) Any Federal or State securities or commodities law or regulation; or

(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(8) Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

| 19 |

Material Changes to the Procedures by which Security Holders May Recommend Nominees

There have been no material changes to the procedures by which security holders may recommend nominees to the registrants Board of Directors.

ITEM 11. EXECUTIVE COMPENSATION

Compensation of Executive Officers

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to the named executive officers paid by us during the fiscal years ended December 31, 2017 and 2016 in all capacities for the accounts of our executives, including the Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), and Chief Operating Officer (“COO”):

The following officers received the following compensation for the years ended December 31, 2017 and 2016. These officers have employment contracts with the Company.

| Name and principal position | Year | Salary | Bonus | Stock Awards |

Option Awards |

Non-equity incentive plan compensation | Nonqualified deferred compensation | All other compensation |

| Carl Dorvil, | 2017 | $102,170 | None | None | None | None | None | None |

| CEO/President | 2016 | $29,231 | None | None | None | None | None | None |

| Clayton Carter, | 2017 | $80,739 | None | None | None | None | None | None |

| Chief Financial Officer | 2016 | $17,370 | None | None | None | None | None | None |

| Chelsea Christopherson, | 2017 | $80,700 | None | None | None | None | None | None |

| Chief Operating Officer | 2016 | $30,376 | None | None | None | None | None | None |

| Option Awards | Stock Awards | |||||||

| Name and principal position | Number of Securities Underlying Unexercised options (#) exercisable | Number of Securities Underlying Unexercised options (#) unexercisable | Equity incentive plan awards | Option exercise price | Option expiration date | Number of share awards that have not vested | ||

| Carl Dorvil, CEO/President | None | None | None | N/A | N/A | None | ||

| Clayton Carter, Chief Financial Officer | None | None | None | N/A | N/A | None | ||

| Chelsea Christopherson, Chief Operating Officer | None | None | None | N/A | N/A | None | ||

Employment Agreements

We have employment agreements in place with each of the above referenced officers of the Company.

| 20 |

Compensation of Directors

Directors do not receive any compensation for their services as directors. The Board of Directors has the authority to establish the compensation of directors. No amounts have been paid to, or accrued to, directors in such capacity.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED SHAREHOLDER MATTERS

As of December 31, 2017, the following persons are known to own 5% or more of GEX Management's Common Stock, as well as the Company’s officers and directors.

| Name and Address of Beneficial Owner, Officer or Director |

Amount Beneficially Owned |

Percent of Class | ||

| Carl Dorvil, President, CEO and Director | 6,438,788 | 55.88% | ||

| Clayton Carter, Chief Financial Officer and Director | 1,333,394 | 11.57% | ||

| Chelsea Christopherson, Chief Operating Officer and Director | 1,335,200 | (1) | 11.58% | |

| Directors and Officers as a Group | 9,107,382 | 79.03% |

Directors and Officers as a Group

12001 N. Central Expy., Suite 825

Dallas, Texas 75243

1 Based on Form 3 filed on November 11, 2017, and accounts for the 4:3 forward split with the FINRA effective date of December 12, 2017, this amount includes 1,333,334 shares owned by Ms. Christopherson and 1,866 owned by the spouse of Ms. Christopherson.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS AND

DIRECTOR INDEPENDENCE

On March 1, 2015, the Company entered into a Revolving Line of Credit (“LOC”) with its CEO, Carl Dorvil. Mr. Dorvil agreed to loan the Company up to $1,000,000 at a rate of 6%. This LOC has a balance of $0 and $317,187 at December 31, 2017 and 2016, respectively. The outstanding balance of $318,187 and related accrued interest of $28,557 was converted into 115,248 shares of common stock in the year ended December 31, 2017 and the LOC was cancelled after the conversion.

On March 1, 2015, the Company entered into a Loan Agreement with P413 Management, LLC (“P413”). P413 agreed to loan the Company up to $500,000 at a rate of 6%. On November 1, 2017, this line of credit was increased to $1,000,000. Additionally, P413 extended a $500,000 line of credit to GEX Staffing, Inc. under the same terms. GEX’s CEO, Carl Dorvil, is a majority member interest owner in P413. These lines of credit have a balance of $352,100 and $46,000 at December 31, 2017 and 2016, respectively. The LOCs are due and payable on March 31, 2019.

The Company had revenues from related parties of $104,000 and $305,885 for the years ended December 31, 2017 and 2016, respectively.

On March 1, 2015, the Company entered into an Outsourcing Agreement with P413 Management, LLC (“P413”) to provide back office services to P413. GEX’s CEO, Carl Dorvil, is a majority member interest owner in P413. The Company reported revenues under this Agreement of $0 and $38,513 for the years ended December 31, 2017 and 2016 respectively.

| 21 |

On September 1, 2015 the Company entered into an Outsourcing Agreement with Vicar Capital Advisors, LLC (“Vicar”) to provide back office services to Vicar. GEX’s CEO, Carl Dorvil, is a majority member interest owner in Vicar. The Company reported revenues under this Agreement of $104,000 and $101,992 for the years ended December 31, 2017 and 2016 respectively. As of December 31, 2017 and 2016, Vicar had outstanding balances owed to the Company of $30,771 and $23,500, respectively.

On August 1, 2014 the Company entered into an Outsourcing Agreement with Renaissance Global Marketing, LLC (“Renaissance”) to provide back office services to Renaissance. GEX’s CEO, Carl Dorvil was formerly a minority member interest owner in Renaissance. The Company reported revenues under this Agreement of $0 and $165,380 for the years ended December 31, 2017 and 2016. As of December 31, 2017 and 2016 Renaissance had an outstanding balance owed to the Company of $0 and $0, respectively.

The Company entered into a Consulting Agreement with Capital Financial Consultants, Inc. for $45,000 for the year ended December 31, 2016. A GEX officer’s family member owns Capital Financial Consultants, Inc. As of December 31, 2017 and 2016 the balance payable under the two agreements to CFC was $0 and $45,000, respectively.

The Company had revenue from related parties of $104,000 and $305,885 for the years ended December 31, 2017 and 2016, respectively.

The Company does not have any independent directors serving on the Board of Directors.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit Fees

The aggregate fees billed for professional services rendered by our auditors, for the audit of our annual financial statements and review of the financial statements included in our Form S-1, Form 10-K and Form 10-Q or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the year ended December 31, 2017 and 2016 was $17,000 and $21,000.

Audit Related Fees

None.

Tax Fees

None.

All Other Fees

None.

| 22 |

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

Exhibits

| 31.1 | Certification of the Company’s Principal Executive Officer and Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of the Company’s Principal Executive Officer and Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| XBRL |

| 23 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on April 9, 2018.

| GEX Management, Inc. | |||

| By: | /s/ Clayton Carter, | ||

| Clayton Carter, | |||

| Chief Financial Officer | |||

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned hereunto duly authorized.

| Name | Title | Date | ||

|

By: /s/ Carl Dorvil |

Chief Executive Officer and Chairman of the Board | April 9, 2018 | ||

| Carl Dorvil | ||||

| By: /s/ Clayton Carter | Chief Financial Officer, Director | April 9, 2018 | ||

| Clayton Carter | ||||

| By: /s/ Chelsea Christopherson | President, Chief Operations Officer, Director | April 9, 2018 | ||

| Chelsea Christopherson |

| 24 |

GEX MANAGEMENT, INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets as of December 31, 2017 and 2016

Consolidated Statements of Operations for the Years Ended December 31, 2017 and 2016

Consolidated Statement of Changes in Shareholders’ Equity (Deficit) for the Years Ended December 31, 2017 and 2016

Consolidated Statements of Cash Flows for the Years Ended December 31, 2017 and 2016

Notes to the Consolidated Financial Statements for the Years Ended December 31, 2017 and 2016

| 25 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors and Stockholders of

GEX Management, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of GEX Management, Inc. (the “Company”) as of December 31, 2017 and 2016, and the related statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in the two-year period ended December 31, 2017 and the related notes (collectively referred to as the financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2017 and 2016, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/Pinnacle Accountancy Group of Utah

We have served as the Company’s auditor since 2016

Farmington, Utah

April 6, 2018

| 26 |

GEX Management, Inc.

Consolidated Balance Sheets

December 31, 2017 and 2016

| 2017 | 2016 | |||||||

| Assets | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 410,096 | $ | 307,395 | ||||

| Accounts Receivable, net | 91,532 | 100,820 | ||||||

| Accounts Receivable - Related Party | 30,771 | 23,500 | ||||||

| Other Current Assets and Prepaid | 88,749 | 959 | ||||||

| Total Current Assets | $ | 621,148 | $ | 432,674 | ||||

| Property and Equipment, net | 2,463,377 | 1,106 | ||||||

| Other Assets | 4,471 | — | ||||||

| Total Assets | $ | 3,088,996 | $ | 433,780 | ||||

| Liabilities and Shareholders' Equity (Deficit) | ||||||||

| Current Liabilities: | ||||||||

| Accounts Payable | $ | 48,280 | $ | 3,832 | ||||

| Accrued Expenses | 20,514 | 60,615 | ||||||

| Accrued Expenses - Related Party | — | 45,000 | ||||||

| Accrued Interest Payable | 7,433 | 21,952 | ||||||

| Notes Payable - Current Portion | 56,649 | — | ||||||

| Total Current Liabilities | 132,876 | 131,399 | ||||||

| Long-term liabilities: | ||||||||

| Notes Payable | 1,254,271 | — | ||||||

| Lines of Credit - Related Party | 352,100 | 363,187 | ||||||

| Total Long-Term Liabilities | 1,606,371 | 363,187 | ||||||

| Total Liabilities | 1,739,247 | 494,586 | ||||||

| Commitments and contingencies (Note 10) | ||||||||

| Shareholders' Equity (Deficit) | ||||||||

| Preferred Stock, $0.001 par value, 20,000,000 shares authorized, | ||||||||

| 0 shares issued and outstanding | — | — | ||||||

| Common Stock, $0.001 par value, 200,000,000 shares authorized, and | ||||||||

| 11,797,231 and 10,988,036 shares issued and outstanding | 11,797 | 10,988 | ||||||

| Additional Paid-In-Capital | 2,651,178 | 374,397 | ||||||

| Accumulated Deficit | (1,313,226 | ) | (446,191 | ) | ||||

| Total Shareholders' Equity (Deficit) | 1,349,749 | (60,806 | ) | |||||

| Total Liabilities and Shareholders' Equity (Deficit) | $ | 3,088,996 | $ | 433,780 | ||||

See accompanying notes to the consolidated financial statements.

| 27 |

GEX Management, Inc.

Consolidated Statements of Operations

Years Ended December 31, 2017 and 2016

| 2017 | 2016 | |||||||

| Revenues | $ | 8,303,088 | $ | 202,336 | ||||

| Revenues - Related Party | 104,000 | 305,885 | ||||||

| Total Revenues (1) | 8,407,088 | 508,221 | ||||||

| Cost of Revenues | 8,261,921 | 385,226 | ||||||

| Gross Profit | 145,167 | 122,995 | ||||||

| Operating Expenses: | ||||||||

| Depreciation and Amortization | 58,002 | 577 | ||||||

| Selling and Advertising | 139,938 | 36,226 | ||||||

| General and Administrative | 973,095 | 345,294 | ||||||

| Total Operating Expenses | 1,171,035 | 382,097 | ||||||

| Total Operating Loss | (1,025,868 | ) | (259,102 | ) | ||||

| Other Income (Expense) | ||||||||

| Gain on Extinguishment of Debt | 172,872 | — | ||||||

| Interest Income | — | 72 | ||||||

| Interest Expense | (14,039 | ) | (39,809 | ) | ||||

| Total Other Income (Expense) | 158,833 | (39,737 | ) | |||||

| Net Loss Before Income Taxes | (867,035 | ) | (298,839 | ) | ||||

| Provision for Income Taxes | — | — | ||||||

| Net Loss | $ | (867,035 | ) | $ | (298,839 | ) | ||

| Income per common share: | ||||||||

| Net loss per common share - basic | $ | (0.08 | ) | $ | (0.03 | ) | ||

| Net loss per common share - diluted | $ | (0.08 | ) | $ | (0.03 | ) | ||

| Weighted Average Shares: | ||||||||

| Basic | 11,362,120 | 10,687,015 | ||||||

| Diluted | 11,362,120 | 10,687,015 | ||||||

(1) Gross billings were $10,318,584 and $508,221 for the years ended December 31, 2017 and 2016 as the Company excludes payroll and payroll tax cost related to PEO clients. These amounts totaled $2,215,314 and $0 for the years ended 2017 and 2016, respectively.

See accompanying notes to the consolidated financial statements.

| 28 |

GEX Management, Inc.

Consolidated Statement of Changes in Shareholders’ Equity (Deficit)

Years Ended December 31, 2017 and 2016

| Preferred | Common | Additional | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Paid-In-Capital | Deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2015 | — | $ | — | 10,666,669 | $ | 10,667 | $ | 13,195 | $ | (147,352 | ) | $ | (123,490 | ) | ||||||||||||||

| Issuance of Common Shares for Cash | 321,367 | 321 | 361,202 | 361,523 | ||||||||||||||||||||||||

| Net Loss | (298,839 | ) | (298,839 | ) | ||||||||||||||||||||||||

| Balance at December 31, 2016 | — | $ | — | 10,988,036 | 10,988 | 374,397 | (446,191 | ) | (60,806 | ) | ||||||||||||||||||

| Issuance of Common Shares for Cash | 366,684 | 367 | 826,721 | 827,088 | ||||||||||||||||||||||||

| Issuance of Common Shares for Services | 47,780 | 48 | 74,702 | 74,750 | ||||||||||||||||||||||||

| Issuance of Common Shares for Assets | 200,000 | 200 | 1,149,800 | 1,150,000 | ||||||||||||||||||||||||

| Issuance of Common Shares for Expenses | 1,067 | 1 | 7,879 | 7,880 | ||||||||||||||||||||||||

| Issuance of Common Shares for Debt and Interest | 153,664 | 153 | 172,719 | 172,872 | ||||||||||||||||||||||||

| Issuance of Common Shares for Accrued Liabilities | 40,000 | 40 | 44,960 | 45,000 | ||||||||||||||||||||||||

| Net Loss | (867,035 | ) | (867,035 | ) | ||||||||||||||||||||||||

| Balance at December 31, 2017 | — | $ | — | 11,797,231 | $ | 11,797 | $ | 2,651,178 | $ | (1,313,226 | ) | $ | 1,349,749 | |||||||||||||||

See accompanying notes to the consolidated financial statements.

| 29 |

GEX Management, Inc.

Consolidated Statements of Cash Flow

Years Ended December 31, 2017 and 2016

| 2017 | 2016 | |||||||

| Operating Activities: | ||||||||

| Net Loss | $ | (867,035 | ) | (298,839 | ) | |||

| Adjustments to reconcile net loss to net cash used by operating activities: | ||||||||

| Depreciation and Amortization | 58,002 | 577 | ||||||

| Common Stock Issued for Services | 74,750 | — | ||||||

| Common Stock Issued for Expenses | 7,880 | — | ||||||

| Write Off Balance of Contract Paid with Shares | 11,343 | |||||||

| Gain on Extinguishment of Debt | (172,872 | ) | — | |||||

| Bad Debt Expense | — | 29,918 | ||||||

| Change in Assets and Liabilities: | ||||||||

| Accounts Receivable | 9,288 | (56,954 | ) | |||||

| Accounts Receivable - Related Party | (7,271 | ) | (21,471 | ) | ||||

| Other Current Assets | (118,373 | ) | (959 | ) | ||||

| Notes Receivable - Related Party | — | 15,500 | ||||||

| Other Assets | (4,471 | ) | — | |||||

| Accounts Payable | 44,448 | 2,291 | ||||||

| Accounts Payable - Related Party | — | (137 | ) | |||||

| Accrued Expenses | (40,101 | ) | 30,674 | |||||

| Accrued Expenses - Related Party | — | 45,000 | ||||||

| Accrued Interest Payable | 14,038 | 17,548 | ||||||

| Net Cash Used by Operating Activities | $ | (990,374 | ) | (236,852 | ) | |||

| Investing Activities: | ||||||||

| Purchase of Contracts | (37,500 | ) | — | |||||

| Purchase of Fixed Assets | (2,613 | ) | — | |||||

| Net Cash Used in Investing Activities | $ | (40,113 | ) | $ | — | |||

| Financing Activities: | ||||||||

| Proceeds from Sale of Common Stock | 827,088 | 361,523 | ||||||

| Proceeds from Line of Credit - Related Party | 756,100 | 268,527 | ||||||

| Payments on Line of Credit - Related Party | (450,000 | ) | (13,196 | ) | ||||

| Payments on Working Capital Loan | — | (75,444 | ) | |||||

| Net Cash Provided by Financing Activities | $ | 1,133,188 | $ | 541,410 | ||||

| Net increase in cash and cash equivalents | $ | 102,095 | $ | 304,558 | ||||

| Cash and cash equivalents | ||||||||

| Cash and cash equivalents at beginning of year | 307,395 | 2,837 | ||||||

| Cash and cash equivalents at end of year | $ | 410,096 | $ | 307,395 | ||||

| Supplemental Disclosures: | ||||||||

| Income Taxes Paid | $ | — | $ | — | ||||

| Interest Paid | $ | 14,039 | $ | 22,261 | ||||

| Non-Cash Investing and Financing Activities: | ||||||||

| Common Shares Issued for Debt and Interest | $ | 172,872 | $ | — | ||||

| Common Shares Issued for Building | $ | 1,150,000 | $ | — | ||||

| Common Shares Issued for Accrued Expenses – Related Party | $ | 45,000 | $ | — | ||||

| Debt Assumed as Part of Real Estate Purchase | $ | 1,310,920 | $ | — | ||||

See accompanying notes to the consolidated financial statements.

| 30 |

GEX Management, Inc.

Notes to the Consolidated Financial Statements

December 31, 2017

NOTE 1. DESCRIPTION OF BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

Organization and Description of Business

GEX Management, Inc. (“GEX”, the “Company”, “we”, “our”, “us”) is a professional services company that was originally formed in 2004 as Group Excellence Management, LLC d/b/a MyEasyHQ. The Company converted from a limited liability company to a C corporation in March of 2016, and changed its name to GEX Management, Inc. in April of 2016.

On January 25, 2017, GEX obtained its license to operate as a Professional Employer Organization (“PEO”), and we began offering PEO services in April 2017. The Company formed GEX Staffing, LLC (“GEX Staffing”) in March 2017. The initial funding and first transactions occurred in GEX Staffing in September 2017. The consolidated financials include the accounts of GEX Staffing, LLC. Staffing and PEO services make up a majority of our revenue.

On December 29, 2017 GEX purchased 100% of the membership interest in AMAST Consulting, LLC (“AMAST”), which owned a multi-use office building in Lowell, Arkansas, which had an occupancy rate of 100% at the time of the acquisition. The terms of the Agreement to purchase AMAST include the fulfillment of the lease obligations of the current tenants, as well as the assumption of the debt that is collateralized by the building and associated property. The consolidated financials include the asset and debt of AMAST.

Basis of Presentation

Our financial statements have been prepared in conformity with accounting principles generally accepted in the United States (“GAAP”), as well as the applicable regulations and rules of the Securities and Exchange Commission. This requires management to make estimates and assumptions that affect the amounts reported in the financial statements and their accompanying notes. The actual results could differ from those estimates.

Principles of Consolidation

The consolidated financial statements include the accounts of GEX Management, Inc. and its wholly owned subsidiaries. Intercompany accounts and transactions have been eliminated in consolidation.

There have been no significant changes to our accounting policies that have a material impact on our financial statements and accompanying notes.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

| 31 |

Revenue Recognition

PEO Services

Professional Employment Organization (“PEO”) service revenues represent the fees charged to clients for administering payroll and payroll tax transactions for our clients’ Co-Employed Employees (“CEEs”), access to our HR and benefits administration services, consulting related to employment and benefit law compliance and general employment consulting related fees. PEO service revenues are recognized in the period the PEO services are performed as stipulated in the Client Service Agreement (“CSA”), where these fees are fixed or determinable, when the PEO client is invoiced and collectability is reasonably assured.

GEX is not considered the primary obligor with respect to CEE’s payroll and payroll tax payments and therefore, these payments are not reflected as either revenue or expense in our statements of operations.

PEO-related revenues also include revenues generated from insurance administration for our PEO clients. These insurance-related revenues include insurance-related billings, as well as administrative fees that GEX collects from PEO clients and withholds from CEEs for health benefit insurance plans provided by third-party insurance carriers. Insurance-related revenues are recognized over the period the insurance coverage is provided and where collectability is reasonably assured.

Staffing Services and Professional Services

Staffing services revenue is derived from supplying temporary staff to clients. Temporary staff generally consists of temporary workers working under a contract for a fixed period of time, or on a specific client project. The temporary staff includes both GEX employees and third-parties contracted by GEX.

Temporary staff are provided to clients through a Staffing Service Agreement (‘SSA’) involving a specified service that the temporary staff will provide to the client. When GEX is the principal or primary obligor for the temporary staff, GEX records the gross amount of the revenue and expense from the SSA.

GEX is generally the primary obligor when GEX is responsible for the fulfillment of services under the SSA, even if the temporary staff are not employees of GEX. This typically occurs when GEX contracts third-parties to fulfill all or part of the SSA with the client, but GEX remains the holder of the credit risk associated with the SSA, and GEX has total discretion in establishing the pricing under the SSA.

All other Professional Services revenues are recognized in the period the services are performed as stipulated in the client’s Outsourcing Agreement, when the client is invoiced, and collectability is reasonably assured. Revenue recognition for arrangements with multiple deliverables constituting a single unit of accounting is recognized generally over the greater of the term of the arrangement or the expected period of performance.

Income Taxes

The Company has adopted ASC 740-10, which requires the use of the liability method in the computation of income tax expense and the current and deferred income taxes payable. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

Fair Value Measurements

ASC Topic 820, defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and requires certain disclosures about fair value measurements. In general, fair value of financial instruments is based upon quoted market prices, where available. If such quoted market prices are not available, fair value is based upon internally developed models that primarily use, as inputs, observable market based parameters. Valuation adjustments may be made to ensure that financial instruments are recorded at fair value. These adjustments may include amounts to reflect counterparty credit quality and the Company’s credit worthiness, among other things, as well as unobservable parameters.

| 32 |

Cash, accounts receivable, accounts payable and other accrued expenses and other current assets and liabilities are carried at amounts which reasonably approximate their fair values because of the relatively short maturity of those instruments.

Earnings Per Share