Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2017

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

For the transition period

from to

Commission file number: 333-207095

Eco Energy Tech Asia, Ltd.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

47-3444723

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

Unit 503, 5/F, Silvercord Tower 2,

30 Canton Road, TST,

Kowloon, Hong Kong.

(Address of Principal Executive Offices and Zip Code)

(852) 91235575

Registrant’s telephone number, including area

code)

Securities registered pursuant

to Section 12(b) of the Act:

|

(Title of Each Class)

|

(Name of Each Exchange on Which Registered)

|

|

Common Stock, par value $0.001 per share

|

Over the Counter Electronic Bulletin Board

|

Securities registered pursuant to Section 12(g) of the

Act:

None

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing

requirements for the past 90

days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such

files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant

to Item 405 of Regulation S-K (§229.405) is not contained

herein, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer,

or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

|

|

|

|

|

Non-accelerated

filer

|

☐ (Do not check if a smaller reporting

company)

|

Smaller reporting company

|

☒

|

|

|

|

|

|

|

|

|

Emerging

Growth Company

|

☐

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the

Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting

common equity held by non-affiliates computed by reference to the

price at which the common equity was last sold, or the average bid

and asked price of such common equity, as of the last business day

of the registrant’s most recently completed second fiscal

quarter: Approximately $22,760,887.

As of March 31, 2018, there were outstanding 24,458,757 shares of

the registrant’s common stock, par value $0.001 per

share.

DOCUMENTS INCORPORATED BY REFERENCE

Certain documents contained in our Registration Statement on Form

S-1, as amended, SEC File No. 333-207095, and declared effective on

November 12, 2015, are hereby incorporated by

reference.

TABLE

OF CONTENTS

|

|

|

|

|

|

|

|

Page

|

|

PART

I

|

1

|

|

|

|

|

Item 1.

Business

|

1

|

|

|

|

|

Item

1A. Risk Factors

|

8

|

|

|

|

|

Item

1B. Unresolved Staff Comments

|

8

|

|

|

|

|

Item 2.

Properties

|

8

|

|

|

|

|

Item 3. Legal

Proceedings

|

9

|

|

|

|

|

Item 4. Mine

Safety Disclosures

|

9

|

|

|

|

|

PART

II

|

9

|

|

|

|

|

Item 5. Market

for Registrant’s Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities

|

9

|

|

|

|

|

Item 6.

Selected Financial Data

|

10

|

|

|

|

|

Item 7.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

|

11

|

|

|

|

|

Item 7A.

Quantitative and Qualitative Disclosures About Market

Risk

|

18

|

|

|

|

|

Item 8.

Financial Statements and Supplementary Data

|

18

|

|

|

|

|

Item 9.

Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure

|

18

|

|

|

|

|

Item 9A.

Controls and Procedures

|

18

|

|

|

|

|

Item 9B. Other

Information

|

19

|

|

|

|

|

PART

III

|

19

|

|

|

|

|

Item 10.

Directors, Executive Officers and Corporate Governance

|

19

|

|

|

|

|

Item 11.

Executive Compensation

|

21

|

|

|

|

|

Item 12.

Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

|

22

|

|

|

|

|

Item

13. Certain Relationships and Related Transactions, and Director

Independence

|

22

|

|

|

|

|

Item 14.

Principal Accountant Fees and Services

|

22

|

|

|

|

|

PART

IV

|

23

|

|

|

|

|

Item 15.

Exhibits and Financial Statement Schedules

|

23

|

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking

statements” that involve substantial risks and uncertainties.

The statements contained in this Annual Report on Form 10-K that

are not purely historical are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as

amended, or the Securities Act, and Section 21E of the

Securities Exchange Act of 1934, as amended, or the Exchange Act,

including, but not limited to, statements regarding our

expectations, beliefs, intentions, strategies, future operations,

future financial position, future revenue, projected expenses, and

plans and objectives of management. In some cases, you can identify

forward-looking statements by terms such as

“anticipate,” “believe,”

“estimate,” “expect,” “intend,”

“may,” “might,” “plan,”

“project,” “will,” “would,”

“should,” “could,” “can,”

“predict,” “potential,”

“continue,” “objective,” or the negative of

these terms, and similar expressions intended to identify

forward-looking statements. However, not all forward-looking

statements contain these identifying words. These forward-looking

statements reflect our current views about future events and

involve known risks, uncertainties, and other factors that may

cause our actual results, levels of activity, performance, or

achievement to be materially different from those expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to such differences include, but are not limited to,

those identified below, and those discussed in the section entitled

“Risk Factors” included in this Annual Report on Form

10-K. Furthermore, such forward-looking statements speak only as of

the date of this Annual Report on Form 10-K. Except as required by

law, we undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

such statements. We qualify all of our forward-looking statements

by these cautionary statements. In addition, the industry in which

we operate is subject to a high degree of uncertainty and risk due

to a variety of factors, including those described in the section

entitled “Risk Factors.” These and other factors could

cause our results to differ materially from those expressed in this

Annual Report on Form 10-K.

Unless otherwise indicated, information contained in this Annual

Report on Form 10-K concerning our industry and the markets in

which we operate, including our general expectations and market

position, market opportunity, and market size, is based on

information from various sources, on assumptions that we have made

that are based on those data and other similar sources, and on our

knowledge of the markets for our services. This data involves a

number of assumptions and limitations, and you are cautioned not to

give undue weight to such estimates. In addition, projections,

assumptions, and estimates of our future performance and the future

performance of the industry in which we operate are necessarily

subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in the section entitled

“Risk Factors” and elsewhere in this Annual Report on

Form 10-K. These and other factors could cause results to differ

materially from those expressed in the estimates made by third

parties and by us.

Unless the context otherwise requires, references in this Annual

Report on Form 10-K to the “company,” “our

company,” “we,” “us,” and

“our” refer to Eco Energy Tech Asia, Ltd. and, when

appropriate, its subsidiaries.

ii

PART I

|

ITEM 1.

|

BUSINESS

|

Overview

Eco Energy Tech Asia, Ltd. ( the “Company”

“we” or “us”) is a development stage

company. We were incorporated under the laws of the state of Nevada

on January 20, 2015. To date we have not generated any revenues. We

have developed a proprietary growing system that designs and builds

custom biodomes ranging in size appropriate for global commercial

agricultural concerns as well as small local producers; delivering

greater yields per meter than traditional single level greenhouse

operations resulting from our multi-tier/multi-level growing system

which permits us to grow a greater number of plants. Our fiscal

year end is December 31.

On February 27, 2015, we entered into a Share Exchange Agreement to

acquire 100% of the outstanding capital stock of Eco Energy Tech

Asia, Ltd. (“EETA”), a Hong Kong corporation formed on

December 27, 2012. Pursuant to the Share Exchange Agreement, we

issued 20,000,000 shares of our common stock to the sole

shareholder of EETA in exchange for 1,000,000 ordinary shares of

EETA. The sole shareholder of EETA, Yuen May Cheung, is also our

Chief Executive Officer, President and sole

Director. EETA is also the owner of 82.4% of the common

stock of 7582919 Canada, Inc., a corporation originally formed

pursuant to the laws of British Columbia, Canada on June 21, 2010,

as Renergy Foods Canada, Inc. On March 6, 2012, Renergy Foods

Canada, Inc. changed its name to NuAgri, Inc. On October 1, 2013,

NuAgri, Inc. changed its name to 7582919 Canada, Inc.

We have developed a proprietary growing system that designs and

builds custom biodomes ranging in size appropriate for global

commercial agricultural concerns as well as small local producers;

delivering greater yields per meterthan traditional

single level greenhouse operations as a result of our

multi-tie/multi-level system which permits us to grow a greater

number of plants. By avoiding a traditional, low-profit

commoditized monoculture environment, we can increase profitability

by selling a higher yielding and diversified range of high-profit

niche produce.

Our proprietary biodomes are environmentally friendly and can be

located anywhere, including in the most climatically inhospitable

areas. The Company’s technologies provide the ability to grow

high margin produce for twelve (12) months of the year, with faster

growing times and cost-effective energy management. As a result,

clients will experience faster capital payback, enhanced

profitability and compelling, consistent revenue

growth.

Marketing Overview

We are in the process of building a sales organization to penetrate

established markets with multiple product lines to sell Biodomes to

property developers, and commercial growers; sell propagation

services to commercial growers; sell produce to restaurants,

hotels, supermarkets, and greengrocers as well as direct to

consumers.

We will establish partnerships with local (supermarket) food

retailers, which can locate directly below a Biodome’s

production area. In such an arrangement, local retailers will make

product purchase commitments with the dome operators.

Product Overview

● Turnkey

Biodomes

We design and build climate-controlled Biodomes with Vertical

Aeroponic Growing Cabinets that markedly increase yields and

mitigates the risks associated with growing vegetables, herbs,

microgreens, and fruits.

● Micropropagation

Services

We intend to provide commercial growers worldwide with the highest

quality, certified disease free, high-yielding plantlets grown in a

closed-controlled environment from both seeds and cuttings obtained

by micropropagation.

● Karma Verdi Brand: Local.

Everywhere.

We intend to develop a global network of small commercial growers

interested in contract growing for the Karma Verdi Brand. This

brand will differentiate itself by growing produce locally so it is

fresh, and where possible, alive to increase shelf life for both

retailers and consumers year-round.

Background

The following few key global issues shape our business model for

the foreseeable future.

1

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

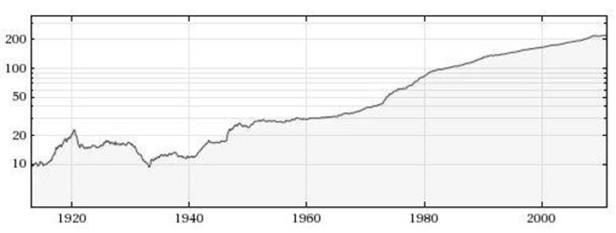

Increasing Populations

With no change to the 1.14%1 annual growth rate, the current

world population of 6.79 billion people will double over the next

61 years to 13.6 billion. Realistically, and according to

projections, the world population will continue to grow until at

least 2050, with the population reaching 9 billion in

2040.2 Most of this growth will take place in developing

nations.

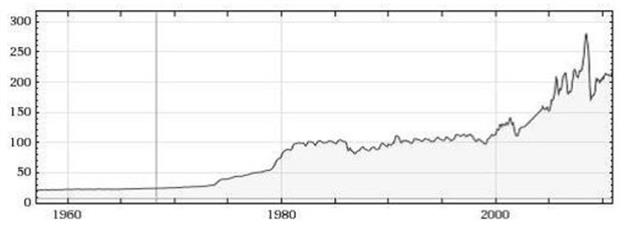

Energy Inflation

For the developed world, conventional food production and

distribution requires a tremendous amount of energy. Besides

fueling farm machinery and transporting food, significant energy

goes towards the production of artificial fertilizers and

pesticides, and to the processing, packaging, and storing of food.

Because commercial growers have evolved to depend upon the use of

low-cost rural land, inefficient greenhouses, and low-cost fossil

fuels to supply food to urban centers, they have not been designed

to deal with the potential problems associated to energy inflation.

Over time, and with an annual rate of 7.33% energy inflation,

this inherent inefficiency in food production and distribution has

resulted in increased food prices. Extrapolating the 7.33% rate of

inflation, energy costs are likely to double in the next ten

years.

__________________________

1 Wolfram Alpha data worldwide

2 International Data Base (IDB) — World Population, and

World Population Clock — Worldometers.

3 Wolfram Alpha data for the United States

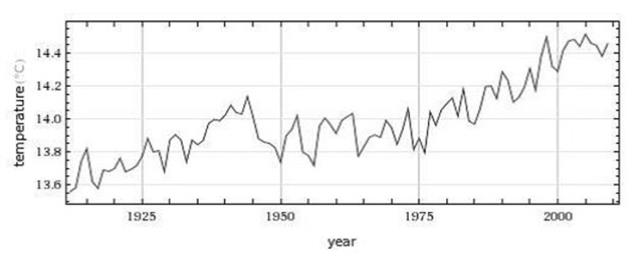

Global Warming / Climate Change

With global warming and climate change, predictions4 call for

the frequency of warm spells or heat waves to increase over most

land areas. Other likely changes include an increase in the number

of areas that will be affected by drought, floods, and tropical

storm activity, all of which will have a negative impact on

agricultural activities and result in increased food

prices.

2

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

Food Inflation

With increasing populations, energy costs, and climate change, the

current annual rate of 1.84%5 per year is likely to increase

significantly: In all likelihood, this rate of inflation will

likely increase to match the higher rate of energy

inflation.

Consumer Food Choice Trends

Four primary food choice trends exist in today’s

market:

|

|

●

|

Health and wellness – an aging population

increasingly focused on health awareness is creating a demand for

chemical-free foods, functional foods, nutraceuticals, and treating

food as medicine.

|

|

|

●

|

Convenience – with a faster pace of lifestyle,

smaller households, a higher rate of women working, and time

becoming a more valuable resource, there is a growing demand for

smaller portions of prepared foods.

|

|

|

●

|

Value – with an increasingly educated and

sophisticated consumer, there is a growing demand for premium

private label products. With increasing income distribution and

gaps, and declining food expenditure share, there is growing price

consciousness of lower income consumers.

|

|

|

●

|

Pleasure - As populations in developing countries

increase, new immigrants are replenishing the declining populations

in developed countries. This trend is creating an increasing demand

for ethnic and exotic foods. In addition, consumers are

increasingly looking for more variety in the taste of their food.

Due to the fact that they want to be indulgent and guilt-free, they

are seeking more healthy foods

|

______________________________________________________________________

4 Intergovernmental Panel on Climate Change. "Summary for

Policymakers". In Solomon 2007.

5 Wolfram Alpha data for the United States

Our Products

EcoEnergy provides sustainable horticultural solutions that will

allow commercial growers to achieve higher yields, stable

year-round production and significantly improve their operational

performance. Productivity and cost-efficiency are enhanced through

a marked reduction of inputs, energy consumption, waste and

pollution. These solutions include the following proprietary

products and services:

Turnkey Biodomes

We design and build climate-controlled Biodomes with Vertical

Aeroponic Growing Cabinets that mitigate the risks associated with

growing vegetables, herbs, microgreens, and fruits. Biodomes can be

designed to incorporate retail areas and be situated at ground

level, on rooftops in urban areas, or in virtually any geographic

location. Revenues will be generated from the sale of Biodomes,

vertical aeroponic growing cabinets, nutrient solutions, and

support media.

Micropropagation

Services

We intend to provide commercial growers worldwide with the highest

quality, certified disease free, high-yielding plantlets grown in a

closed-controlled environment from both seeds and cuttings obtained

by micropropagation. EcoEnergy intends to incorporate a

state-of-the-art plant biotechnology/ micropropagation laboratory

into a warehouse and its second demonstration Biodome; and by

applying the latest in modern plant tissue culture methods.

Revenues will be generated from the sale of plantlets.

3

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

Karma Verdi Brand: Local. Everywhere

We intend to develop a global network of small commercial growers

interested in contract growing for the Karma Verdi Brand. This

brand will differentiate itself by growing produce locally so it is

fresh, and where possible, alive to increase shelf life for both

retailers and consumers year-round. The revenues of growers and

retailers benefit from higher out-of-season prices. The Company is

also developing the KarmaVerdi.com website to process orders for

this international network of growers and to promote the Brand,

consisting of a diversified range of fruits, herbs, microgreens,

and vegetables. Social media assets, the website, and

print-on-demand eBooks will be used to promote recipes, chefs, and

restaurants that use Karma Verdi produce. Revenues will be

generated from the sale of Karma Verdi – branded material as

well as distribution and processing fees.

Technologies

EcoEnergy Biodome

One of our principal objectives is to provide food producers with

the opportunity of growing high-quality food crops year-round

– even in heavily populated urban environments. For this

purpose, we have developed several design versions of an insulated,

efficient hi-tech plant sheltering structures called

“EcoEnergy Biodomes”. These custom Biodomes may be

configured as single-level or as two-story structures, depending on

the requirements of the end user and the necessary technical degree

of sophistication. A two-story version can, for instance,

incorporate a retail floor and a crop cultivation floor. Our

initial demonstration Biodome consists of a growing level, a

laboratory floor, and a test retail area.

There are a number of architectural and environmental features,

which set EcoEnergy Biodomes apart from most conventional

(monoculture-type, petrochemically-intensive) greenhouses. In the

paragraphs below, we discuss a number of environmental and

biological aspects as they relate specifically to the creation of

ideal crop growing conditions in EcoEnergy Biodomes.

First, a discussion of some of the architectural benefits of the

EcoEnergy Biodomes that pertain largely to the extensive use of a

cladding material called ETFE (Ethylene tetrafluoroethylene). This

product is a lightweight, high-strength, low-cost, transparent

non-petroleum based plastic with a number of remarkable

properties:

ETFE has a significantly longer lifespan of up to fifty (50) years

than the frequently used poly sheets, which need to be replaced

every three (3) to four (4) years. At the same time, among a wide

range of common cladding materials used in greenhouses, ETFE film

ranks highest in terms of plant growth enhancing light

transmittance (both for direct and for diffuse light), allowing

transmission of up to 95% all light frequencies. ETFE weighs only

1% as much as glass, making for considerable material savings from

a structural perspective. The non-stick characteristics of ETFE

make it low maintenance and virtually self-cleaning. With a wide

service temperature range of between -200° to +150° C,

ETFE is extremely resistant to tearing, weathering, solvents and

chemicals. It is also extremely flexible and can stretch up to 200%

before breaking. Furthermore, ETFE is low flammable and

self-extinguishing. In contrast to many other plastics,

specifically those used to cover non-glass greenhouses, ETFE is not

a petrochemical derivative (i.e. no solvents or additives are used

in the water-based manufacturing process) and can be fully

recycled. When fashioned into so-called “pneumatic

pillows” (which may consist of three layers of 100 micron

sheets of ETFE welded together with specialized welding equipment),

a significant solar gain can be achieved inside EcoEnergy Biodomes:

ETFE in a triple-layered pillow configuration achieves a U-value of

approximately 1.95 W/m2K, considerably better than triple glazing.

Pneumatic ETFE pillows can be filled with air and kept inflated at

pressures of 200 and 600 Pascal’s. Gauges and electronic

switches are used to monitor and automatically activate low-power

electrical fans connected to the pillows to maintain air pressure.

Maintaining air pressure (rather than creating air flow) markedly

lowers energy consumption. As well, the air pressure in the pillows

pre-stresses them to withstand external loads, such as snow and

wind. EcoEnergy will use ETFE pillows as cladding for its Biodomes

with the pillows held in place by aluminum keder tracks and

compression plates. Structural movement is absorbed within each

panel.

A significant architectural feature of EcoEnergy Biodomes is that

they are largely sealed and equipped with air-lock doors. These

features limit the venting of carbon dioxide (which is added as a

plant growth accelerant) and keep insects and pathogens

out.

Plant Lighting

For optimal photosynthesis, plants require specific types and

amounts of light. Inadequate lighting may stunt growth and

compromise the taste of produce. EcoEnergy Biodomes are designed to

use full spectrum diffused light in order to optimize plant

yields.

When natural light is not sufficiently available, EcoEnergy

Biodomes will supplement with artificial light. Amongst other

technologies, sulphur plasma lights will be used. Researchers at

Wageningen University in the Netherlands reported that sulphur

plasma lights produced young cucumber plants that are 64% heavier

than those grown under a SON-T-light, a light source traditionally

used in the horticultural industry.

Sulphur plasma lamps provide a true, full spectrum light similar to

that of sunlight. Sulphur plasma light is low in infrared energy;

less than 1% of the spectrum is ultraviolet light. As much as 75%

of the emitted radiation is in the visible spectrum, far more than

with other types of lamps. Sulphur plasma lamps are between 25% and

100% more efficient than any other artificial source of high

quality white light.

4

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

Together with a leading Dutch plant lighting scientist, we will be

testing a range of lighting options including LED lights to gain

first-hand experience in this crucial field.

Plant Biotechnology and Micropropagation Laboratory

Our demonstration Biodome will house a state-of-the-art plant

biotechnology / micropropagation laboratory to be located on the

lower floors of the structure. This well-equipped lab will serve

numerous purposes, including the study of seed physiology and

germination patterns, the assessment of crop growth performance

(physiology, biochemistry), the quality and health control of foods

grown (microbiology), the formulation and testing of dry blend and

liquid solution fertilizers, and the optimization of aeroponics

nutrient delivery mechanisms. Further, the laboratory will also

serve to address, test, and resolve post-harvest and packaging

issues, and finally to assess the potential of new crops, such as

micro-greens. A significant section of the laboratory will be

devoted to the micropropagation of plants. The result will be large

quantities of disease-free crops of superior quality for ensuing

cultivation in EcoEnergy Biodomes, as well as for sale to the wider

market. The most promising crops currently under consideration for

in vitro micropropagation include strawberry, raspberry,

blackberry, potato, culinary herbs (e.g., oregano, thyme, French

tarragon), spices (Wasabi, Horseradish), and medicinal plants (such

as Goldenseal and Seabucktorn). Specific protocols for the

micropropagation of such crops will be developed and refined.

Plants with nutraceutical potential (e.g., the sugar replacement

plant “Stevia”) will also be addressed.

A key design objective of the laboratory is that it allows

micropropagation to be scaled up rapidly. We will be able to

respond quickly and efficiently to an anticipated increase in

market demand for its high quality propagated juvenile

plants.

Growing Cabinets

We have developed a proprietary aeroponics growing cabinet in which

crops of various sizes can be cultivated vertically in multiple

layers. This growing arrangement increases plant density. Based on

a variety of plant sizes, a EcoEnergy Biodome will hold between

200,000 and 600,000 plants, all in a footprint comprising less than

a third of an acre (which is roughly equivalent to 1/10 ha). At a

very basic level, we can differentiate two main types of roots: (1)

Burrowing roots that serve to anchor the plant; and (2) Fine root

hairs through which plants absorb most of the water and nutrients

they require.

When growing in the soil, plant root systems need to seek out

nutrients and water in what is typically a very hostile,

competitive environment characterized by limited, local, and highly

variable nutrient availability. In contrast, in a soilless

environment, plants do not need to develop an extensive system of

burrowing roots to access nutrients. EcoEnergy's growing cabinets

optimize plant growth by providing ideal conditions – a dark,

oxygenated environment where nutrients are delivered in a spray

with the perfect droplet size consisting of less than 5 microns. In

such an environment, plants can put all of their energies directly

into the development of healthy fine root hairs, which optimize

nutrient uptake and accelerated plant growth.

Furthermore, our growing cabinet design addresses a problem that

has limited the commercial use of aeroponics nutrient systems:

blocked nozzles. We intend to file a patent that bypasses the

problem of blocked nozzles, paving the way for widespread

commercial adoption of our solution.

Nutrient Solution

Conventional soil-based agriculture may use anywhere from 200 to

400 liters of water to produce a single kilogram of tomatoes. In a

hydroponic horticulture in a typical greenhouse, the same quantity

of tomatoes would require 70 liters of water. However, with our

aeroponic system, less than 20 liters of water will be required to

produce a kilogram of tomatoes.

We will market a naturally derived nutrient solution to grow

healthy and tasty produce rich in nutrients. The basic nutrients

required for plant growth are divided into two main

categories:

|

|

●

|

Macronutrients: Nitrogen, calcium, potassium,

magnesium, phosphorus, and sulphur; and;

|

|

|

●

|

Micronutrients: Iron, zinc, molybdenum, selenium,

manganese, boron, copper, cobalt, and chlorine.

|

We have developed and market a nutrient solutions formulated

specifically for each Biodome crop.

Biodome Control Systems

EcoEnergy Biodomes use sophisticated control technologies, which

automatically monitor and adjust plant growth parameters

twenty-four hours a day, seven days a week.

In alphabetical order, control systems include:

|

|

●

|

Artificial Light Control System: Measures available

light conditions and automatically switches supplemental lighting

on/off, when necessary;

|

|

|

●

|

Carbon Dioxide Control System: Monitors and

automatically adjusts carbon dioxide levels for optimal plant

growth when the Biodome is sealed;

|

5

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

|

|

●

|

Climate Control System: Monitors a variety of climate

control parameters, automatically activating the appropriate HVAC

equipment in order to heat, cool, or dehumidify the

Biodome;

|

|

|

●

|

Energy Control System: Monitors both the availability

and energy requirements in the Biodome;

|

|

|

●

|

ETFE Control System: Measures parameters such as

interior and exterior temperatures, wind velocity, and snow loads

and automatically inflate or deflate the Biodomes pneumatic ETFE

pillows in order to maintain structural integrity and interior

climate conditions.

|

|

|

●

|

Nutrient Control System: Monitors, activates and

maintain the release of plant nutrients and oxygen;

|

|

|

●

|

Plant Productivity System: Monitors, manages, and

forecasts crop growing / harvest parameters;

|

|

|

●

|

Video Monitoring System: Monitors and activates video

cameras in and around the Biodome.

|

The Opportunity

We have identified a number of needs that if addressed

cost-effectively, provide a significant opportunity to support a

commercially viable business.

Growing Environment to Supply Local Markets

With transportation and food distribution costs expected to rise in

the foreseeable future and with consumers increasingly interested

in buying locally, there is an opportunity to supply growing

environments such as the EcoEnergy Biodome to commercial growers

within or close to urban markets. As costs associated to food

distribution increase over time, more consumers will become

interested in supporting local growers.

Growing Environment with a Smaller Footprint

With increasing populations and migration to urban areas, land

costs in and around urban areas are expected to continue to rise

over the coming decades. Because energy and food costs and demand

are expected to rise in the foreseeable future, there is an

opportunity to supply commercially viable growing environments that

occupy a smaller footprint that is located in or around urban

areas.

More Productive Year-Round Growing Environment

With climate change the increased risk of draughts, floods, and

cold and hot temperatures will continue to impact the availability

of food year-round. As a result, there is a significant opportunity

to supply a growing system such as the EcoEnergy Biodome that can

grow produce year-round, provide more crops per year, and enjoy the

profits associated with out-of-season production. In addition,

there is an opportunity to supply Biodomes to areas not

traditionally used to grow fresh produce because of inhospitable

climate.

Healthier Growing Environment

With climate change and the consequential adverse weather

conditions expected to compromise food security, there is an

opportunity to supply Biodomes that can be controlled to provide a

healthier growing environment that limits exposure to pathogens,

root rot, humidity, fungi, algae, and excessive cold or

heat.

Improved Growing System

With the increased cost of land and need to generate profits, there

is an opportunity to supply growing systems to commercial farmers

that will achieve higher plant densities than currently available,

allow the development of healthier roots, and that use less water

and nutrient solution.

Healthier and Diversified Range of Niche Products

Because commercial growers are continuously seeking ways to

maximize yields, and because healthy plants require healthy

seedlings, there is an opportunity to supply commercial growers

with seedlings that are warranted to be disease-free and

pathogen-free. In addition, there is an opportunity to supply a

diversified range of seedlings that are simply not commercially

available.

Lower Cost Branding Solution for Local Suppliers

Smaller commercial growers cannot afford to brand their produce in

the same way as larger commercial growers that have sophisticated

websites that incorporate social media, professional packaging

designs, and access to shelf space in supermarkets. As a result,

there is an opportunity to allow smaller commercial growers to

market their produce under a shared brand. This eventuality is

accomplished by allowing smaller commercial growers to grow under

contract for EcoEnergy Foods and to market produce directly under

the Karma Verdi Brand.

6

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

Target Markets

Today, an increasing number of (urban) food consumers want to know

where their food is produced and are thus concerned about aspects

such as the environmental impacts of food production, carbon

footprints, and sustainability. Our turnkey urban agriculture

system will appeal to a growing number of entities that wish to tap

into this consumer market trend:

Commercial

Growers

Commercial growers represent our largest target market; all of our

products and services should appeal to segments of this large,

diverse market.

|

Eco Business Opportunities

|

Potential Opportunities for Eco to Market:

|

|

Turn-Key

Biodomes

|

Yes

|

|

Soilless Growing

Systems & Supplies

|

Yes

|

|

Greenhouse

Retrofits

|

Yes

|

|

Micropropagation

Services

|

Yes

|

|

Production &

Sale of Biodome-Grown Produce/Herbs/Specialty Crops

|

Yes

|

|

Karma Verdi

Brand

|

Yes

|

Competition

Our competitive research shows that few players are developing

integrative, interdisciplinary approaches that match challenging

goals of plant science with hands-on, commercial growing methods

specifically for the urban agriculture context.

A handful of direct competitors address indoor vertical farming

methods (mostly hydroponics), growing produce on city rooftops, or

bringing plant life to abandoned industrial buildings. While

vertical soilless growing systems are being developed in various

configurations, work is often limited to low-margin leafy greens

rather than tackling more challenging and profitable

crops.

Many of our competitors are well established, have longer-standing

relationships with customers and suppliers, greater name

recognition and greater financial, technical and marketing

resources. As a result, these competitors may be able to respond

more quickly and effectively than we can to new or changing

opportunities or customer requirements. Existing or

future competitors may develop or offer products that provide

price, service, number or other advantages over those we intend to

offer. If we fail to compete successfully against

current or future competitors with respect to these or other

factors, our business, financial condition, and results of

operations may be materially and adversely affected.

Our Competitive Advantage

Biodomes versus Traditional Greenhouses

Most suppliers provide a single floor greenhouse design that has

benefitted from small incremental design improvements over the last

forty years. However, these design changes have not addressed

fundamental design flaws that impact on the viability and

profitability of commercial growing operations.

Greenhouses invariably use glass that requires shade cloths to

diffuse light and minimize heat buildup in summer, and are

extremely expensive to heat in winter. In some areas, greenhouse

operations cannot operate in winter months because the cost of

heating is too high. When heat levels rise, hot air along with

carbon dioxide used to optimize plant growth is vented out of the

greenhouse. Because they are not sealed, greenhouses are

susceptible to pest and pathogen invasion. When using a positive

pressure to minimize the presence of pathogens and pests, higher

energy costs ensue.

In creating a microclimate around the plants, a few patented

designs achieve the benefit of delivering optimum air quality to

plants. However, because these systems use traditional greenhouse

designs, pathogens and pests are not guaranteed to be kept

out.

EcoEnergy Biodomes are sealed, grow areas do not require venting, are

extremely well insulated, filtered and designed to diffuse

light.

Growing

Systems

Most traditional greenhouse operations grow plants on horizontal

surfaces; train plants to grow upwards, and may suspend plants to

form multiple layers. Because artificial lighting solutions are so

costly, lights are placed high above the plants to maximize

coverage. This characteristic compromises the taste of produce.

Growing horizontally is not an efficient use of space.

7

|

ITEM 1.

|

BUSINESS (CONTINUED)

|

An emerging and increasing number of companies are commercializing

their vertical growing systems.

Our Aeroponic Growing System allows plants to grow on multiple layers,

positions lights closer to the plants, creates an ideal micro

climate for plants, and delivers light directly to leaves. In

addition, the aeroponic nutrient delivery system oxygenates plant

roots, delivers optimum droplet size for nutrient uptake, and only

uses 20% of water and nutrients used by hydroponic

systems.

Property and Facilities

Our Hong Kong business office is located at Unit 503, 5F Silvercord

Tower 2, 30 Canton Road, TST, Kowloon, Hong Kong. This

office is provided to us by our Chief Executive Officer, President

and Director, Yuen May Cheung, at no cost to our Company. Through

our Canadian subsidiary, 7582919 Canada Inc., we own a parcel of

land at 4174 184th Street, Surrey, British Columbia, Canada (the

“Land”). On July 5, 2017, 7582919 Canada, Inc.

(“7582919”), a subsidiary of the Company, consummated

the sale of a parcel of real property located at 4174

184th St., Surrey, British Columbia V3Z 1B7, Canada. The

purchase price was $1,650,000 (CN). 7582919 received $1,000,868.70

(CN) after deduction for payment of the outstanding mortgage, real

estate commissions and other related closing expenses.

Dependence on One or a Few Major Customers

We do not anticipate dependence on one or a few major customers for

at least the next twelve (12) months or the foreseeable

future.

Environmental Regulations

Environmental regulations have had no materially adverse effect on

our operations to date, but no assurance can be given that

environmental regulations will not, in the future, result in a

curtailment of service or otherwise have a materially adverse

effect on our business, financial condition or results of

operation. Public interest in the protection of the environment has

increased dramatically in recent years. The trend of more expansive

and stricter environmental legislation and regulations could

continue. To the extent that laws are enacted or other governmental

action is taken that imposes environmental protection requirements

that result in increased costs, our business and prospects could be

adversely affected.

Patents, Trademarks and Licenses

We currently do not have any patents or trademarks; and we are not

party to any license, franchise, concession, or royalty agreements

or any labor contracts.

Employees

In addition to our three (3) executive officers, we currently have

five (5) part time employees.

We file reports with the SEC, including Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K, and any other filings required by the SEC. The public may

read and copy any materials we file with, or furnish to, the SEC at

the SEC’s Public Reference Room at 100 F Street, NE,

Washington, DC 20549. The public may obtain information on the

operation of the Public Reference Room by calling the SEC at

1-800-SEC-0330. The SEC maintains an Internet site

at www.sec.gov that contains reports, proxy and information

statements, and other information regarding issuers that file

electronically with the SEC.

|

ITEM 1A.

|

RISK FACTORS

|

This information is not required as a result of our status as a

“small business issuer.”

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

We have no unresolved staff comments.

|

ITEM 2.

|

PROPERTIES

|

Our Hong Kong business office is located at Unit 503, 5F Silvercord

Tower 2, 30 Canton Road, TST, Kowloon, Hong Kong. This

office is provided to us by our Chief Executive Officer, President

and Director, Yuen May Cheung, at no cost to our Company. On July

5, 2017, 7582919 Canada, Inc. (“7582919”), a subsidiary

of the Company, consummated the sale of a parcel of real property

located at 4174 184th St., Surrey, British Columbia V3Z 1B7,

Canada. The purchase price was $1,650,000 (CN). 7582919 received

$1,000,868.70 (CN) after deduction for payment of the outstanding

mortgage, real estate commissions and other related closing

expenses

8

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

As of the date of this report, we know of no material pending legal

proceedings to which we are a party or of which any of our property

is the subject. There are no proceedings in which any of our

directors, executive officers or affiliates, or any registered or

beneficial stockholder, is an adverse party or has a material

interest adverse to our interest.

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

Not applicable.

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Information

Our common stock has been quoted on the OTCQB under the symbol

"EYTH. Prior to July 5, 2016, there was no active market for our

common stock.

The market for our common stock is limited and can be volatile. The

following table sets forth the high and low bid prices relating to

our common stock on the OTCQB on a quarterly basis for the periods

indicated, as reported by OTC Markets Group. The quotations reflect

interdealer prices, without retail markup, markdown or commission,

and may not represent actual transactions.

|

Year Ended December

31, 2016

|

High

|

Low

|

|

Quarter ended

September 30, 2016

|

$7.50

|

$3.00

|

|

Quarter ended

December 31, 2016

|

$8.00

|

$4.00

|

|

Year Ended December

31, 2017

|

|

|

|

Quarter ended March

31, 2017

|

$8.00

|

$8.00

|

|

Quarter ended June

30, 2017

|

$8.00

|

$1.70

|

|

Quarter ended

September 30, 2017

|

$2.80

|

$0.38

|

|

Quarter ended

December 31, 2017

|

$0.60

|

$0.06

|

Dividend Policy

We have never declared or paid, and do not anticipate declaring or

paying in the foreseeable future, any cash dividends on our capital

stock. Any future determination as to the declaration and payment

of dividends, if any, will be at the discretion of our board of

directors and will depend on then existing conditions, including

our operating results, financial condition, contractual

restrictions, capital requirements, business prospects, and other

factors our board of directors may deem relevant.

Equity Compensation Plan Information

None

Recent Sales of Unregistered Securities

We issued 20,000,000 shares of common stock pursuant to the Share

Exchange Agreement on February 27, 2015, and issued a total of

650,000 shares to 41 separate foreign shareholders on April 24,

2015, pursuant to a private placement of common stock exempt from

registration under Regulation S of the Securities Act of 1933, for

total proceeds of approximately $6,500.

On May 20, 2016, we issued 1,021,600 shares of common stock to five

foreign (5) shareholders, pursuant to a private placement of common

stock exempt from registration under Regulation S of the Securities

Act of 1933, at a price of $0.10 per share, for an aggregate value

of $102,160.

On May 31, 2017, we issued 6,930 shares of common stock to ten

foreign (10) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$6,930.

9

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

(CONTINUED)

|

On July 5, 2017, we issued 21,110 shares of common stock to five

foreign (5) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$21,110.

On July 18, 2017, we issued 60,250 shares of common stock to ten

foreign (10) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$60,250.

On August 1, 2017, we issued 50,700 shares of common stock to five

foreign (5) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $0.10 per share, value of

$5,070.

On August 1, 2017, we issued 212,551 shares of common stock to

twelve foreign (12) shareholders, pursuant to a private placement

of our common stock exempt from registration under Regulation S of

the Securities Act of 1933, at a price of $0.05 per share, value of

$106,276.

On August 1, 2017, we issued 47,500 shares of common stock to four

foreign (4) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$47,500.

On August 10, 2017, we issued 2,000 shares of common stock to one

foreign (1) shareholder, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$2,000.

On September 1, 2017, we issued 70,440 shares of common stock to

four foreign (4) shareholders, pursuant to a private placement of

our common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$70,440.

On October 1, 2017, we issued 492,369 shares of common stock to

twenty-seven foreign (27) shareholders, pursuant to a private

placement of our common stock exempt from registration under

Regulation S of the Securities Act of 1933, at a price of $0.10 per

share, value of $49,237.

On October 1, 2017, we issued 371,433 shares of common stock to

sixteen foreign (16) shareholders, pursuant to a private placement

of our common stock exempt from registration under Regulation S of

the Securities Act of 1933, at a price of $0.20 per share, value of

$74,286.

On October 1, 2017, we issued 183,352 shares of common stock to

thirteen foreign (13) shareholders, pursuant to a private placement

of our common stock exempt from registration under Regulation S of

the Securities Act of 1933, at a price of $0.50 per share, value of

$91,676.

On October 1, 2017, we issued 614,034 shares of common stock to

fifty foreign (50) shareholders, pursuant to a private placement of

our common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$614,034.

On November 1, 2017, we issued 654,488 shares of common stock to

twenty-five foreign (25) shareholders, pursuant to a private

placement of our common stock exempt from registration under

Regulation S of the Securities Act of 1933, at a price of $0.10 per

share, value of $65,449.

As of December 31, 2017, there were 24,458,757 shares of common

stock issued and outstanding.

Issuer Purchases of Equity Securities

None

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

Not Applicable

10

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

|

The following discussion and analysis of our financial condition

and results of operations should be read together with our

consolidated financial statements and accompanying notes appearing

elsewhere in this Annual Report on Form 10-K. This discussion

contains forward-looking statements, based upon our current

expectations and related to future events and our future financial

performance, that involve risks and uncertainties. Our actual

results may differ materially from those anticipated in these

forward-looking statements as a result of various factors,

including those set forth elsewhere in this Annual Report on

Form 10-K.

Plan of Operations

Company Summary

Eco Energy Tech Asia, Ltd. is a development stage company. We were

incorporated under the laws of the state of Nevada on January 20,

2015. We have developed a proprietary growing system that designs

and builds custom biodomes ranging in size appropriate for global

commercial agricultural concerns as well as small local producers;

delivering greater yields per meter than traditional single level

greenhouse operations resulting from our multi-tier/multi-level

growing system which permits us to grow a greater number of plants.

Our fiscal year end is December 31.

On February 27, 2015, we entered into a Share Exchange Agreement to

acquire 100% of the outstanding capital stock of Eco Energy Tech

Asia, Ltd. (“EETA”), a Hong Kong corporation formed on

December 27, 2012. Pursuant to the Share Exchange Agreement, we

issued 20,000,000 shares of our common stock to the sole

shareholder of EETA in exchange for 1,000,000 ordinary shares of

EETA. The sole shareholder of EETA, Yuen May Cheung, is also our

Chief Executive Officer, President and sole

Director. EETA is also the owner of 92.40% of the common

stock of 7582919 Canada, Inc., a corporation originally formed

pursuant to the laws of British Columbia, Canada on June 21, 2010

as Renergy Foods Canada, Inc. On March 6, 2012, Renergy Foods

Canada, Inc. changed its name to NuAgri, Inc. On October 1, 2013,

NuAgri, Inc. changed its name to 7582919 Canada, Inc.

Our business offices are currently located at Unit 503, 5/F

Silvercord Tower 2, 30 Canton Road TST, Kowloon, Hong Kong. Our

telephone number is (852) 91235575.

We have three (3) executive officers, Yuen May Cheung, our Chief

Executive Officer and President, Philip K.H. Chan, our Chief

Financial Officer, and Thomas Colclough, our Chief Operating

Officer. Yuen May Cheung is our sole Director.

We are a development stage company that has generated no revenues

and has had limited operations to date. From January 20, 2015 (date

of inception) to December 31, 2017, we have incurred accumulated

net losses of $5,511,151. As of December 31, 2017, we had $583,950

in current assets and current liabilities of $5,713,508. Through

December 31, 2017, we have issued an aggregate of 24,458,757 shares

of our common stock since our inception.

We issued 20,000,000 shares of common stock pursuant to the Share

Exchange Agreement on February 27, 2015, and issued a total of

650,000 shares to 41 separate foreign shareholders on April 24,

2015, pursuant to a private placement of common stock exempt from

registration under Regulation S of the Securities Act of 1933, for

total proceeds of approximately $6,500.

On May 20, 2016, we issued 1,021,600 shares of common stock to five

foreign (5) shareholders, pursuant to a private placement of common

stock exempt from registration under Regulation S of the Securities

Act of 1933, at a price of $0.10 per share, for an aggregate value

of $102,160.

On May 31, 2017, we issued 6,930 shares of common stock to ten

foreign (10) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$6,930.

On July 5, 2017, we issued 21,110 shares of common stock to five

foreign (5) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$21,110.

On July 18, 2017, we issued 60,250 shares of common stock to ten

foreign (10) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$60,250.

On August 1, 2017, we issued 50,700 shares of common stock to five

foreign (5) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $0.10 per share, value of

$5,070.

On August 1, 2017, we issued 212,551 shares of common stock to

twelve foreign (12) shareholders, pursuant to a private placement

of our common stock exempt from registration under Regulation S of

the Securities Act of 1933, at a price of $0.05 per share, value of

$106,276.

On August 1, 2017, we issued 47,500 shares of common stock to four

foreign (4) shareholders, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$47,500.

On August 10, 2017, we issued 2,000 shares of common stock to one

foreign (1) shareholder, pursuant to a private placement of our

common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$2,000.

11

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS (CONTINUED)

|

On September 1, 2017, we issued 70,440 shares of common stock to

four foreign (4) shareholders, pursuant to a private placement of

our common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$70,440.

On October 1, 2017, we issued 492,369 shares of common stock to

twenty-seven foreign (27) shareholders, pursuant to a private

placement of our common stock exempt from registration under

Regulation S of the Securities Act of 1933, at a price of $0.10 per

share, value of $49,237.

On October 1, 2017, we issued 371,433 shares of common stock to

sixteen foreign (16) shareholders, pursuant to a private placement

of our common stock exempt from registration under Regulation S of

the Securities Act of 1933, at a price of $0.20 per share, value of

$74,286.

On October 1, 2017, we issued 183,352 shares of common stock to

thirteen foreign (13) shareholders, pursuant to a private placement

of our common stock exempt from registration under Regulation S of

the Securities Act of 1933, at a price of $0.50 per share, value of

$91,676.

On October 1, 2017, we issued 614,034 shares of common stock to

fifty foreign (50) shareholders, pursuant to a private placement of

our common stock exempt from registration under Regulation S of the

Securities Act of 1933, at a price of $1.00 per share, value of

$614,034.

On November 1, 2017, we issued 654,488 shares of common stock to

twenty-five foreign (25) shareholders, pursuant to a private

placement of our common stock exempt from registration under

Regulation S of the Securities Act of 1933, at a price of $0.10 per

share, value of $65,449.

As of December 31, 2017, there were 24,458,757 shares of common

stock issued and outstanding.

On July 5, 2017, 7582919 Canada, Inc. (“7582919”), a

subsidiary of the Company, consummated the sale of a parcel of real

property located at 4174 184th St., Surrey, British Columbia

V3Z 1B7, Canada. The purchase price was $1,650,000 (CN). 7582919

received $1,000,868.70 (CN) equivalent to $1,275,372, and

got a gain on disposal of $678,032 after deduction for payment of the outstanding

mortgage, real estate commissions and other related closing

expenses.

Our Business

Eco Energy Tech Asia, Ltd. is and end-to-end vertical farming

provider that manufactures the highest quality Biodomes for

vertical commercial growing solutions. The solutions include the

following proprietary goods and services: Biodomes: We develop

proprietary growing systems using original designs and also install

different sizes of custom built Biodomes. These microgreen Biodomes

enable diverse crops, vegetables and other high-end plants to be

cultivated within smaller spaces than traditional greenhouses and

agricultural buildings. The Biodomes for vertical farming and

microgreen practice enables large and small producers to produce

crops that would typically require more space, costs, and time. Our

Biodomes and growing systems can deliver yields per meter of at

most five times the production point of a conventional greenhouse

operation. The products comprise of two systems: the containers and

Biodome.

Expenditures

The following chart provides an overview of our budgeted

expenditures by significant area of activity over the next twelve

(12) months, assuming we are able to attract sufficient debt or

equity financing. There can be no assurance that we will be able to

attract financing and we may be required to scale back operations

accordingly.

The following table outlines the planned use of working capital and

does not take Inventory expenses into account. If we are able to

attract sufficient debt or equity financing and are successful in

securing manufacturing facilities for BioDomes and are able to

secure orders, we will need to secure inventory financing. There

can be no assurance that such financing will be available to us,

and our inability to obtain such financing would materially impact

our ability to execute our business plan as outlined in this

Report.

12

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS (CONTINUED)

|

|

|

Months 1-3

|

Months 4 - 6

|

Months

7-9

|

Months 10-12

|

Total 12 months

|

|

Rental

|

$30,000

|

$30,000

|

$30,000

|

$30,000

|

$120,000

|

|

Payroll

|

$80,000

|

$80,000

|

$100,000

|

$120,000

|

$380,000

|

|

Loans

|

$5,000

|

$5,000

|

$5,000

|

$5,000

|

$20,000

|

|

Supplies

|

$50,000

|

$45,000

|

$40,000

|

$40,000

|

$175,000

|

|

Utilities

|

$12,000

|

$15,000

|

$18,000

|

$25,000

|

$70,000

|

|

Accounting

|

$10,000

|

$10,000

|

$10,000

|

$10,000

|

$40,000

|

|

Legal

|

$15,000

|

$9,000

|

$9,000

|

$9,000

|

$42,000

|

|

Auditing

|

$6,000

|

$6,000

|

$6,000

|

$6,000

|

$24,000

|

|

CFO

|

$15,000

|

$15,000

|

$15,000

|

$15,000

|

$60,000

|

|

VP

Sales

|

$18,000

|

$21,000

|

$21,000

|

$21,000

|

$81,000

|

|

Consulting

|

$5,000

|

$5,000

|

$5,000

|

$5,000

|

$20,000

|

|

Project

Management

|

$12,000

|

$12,000

|

$12,000

|

$12,000

|

$48,000

|

|

Product

Development

|

$50,000

|

$40,000

|

$40,000

|

$40,000

|

$170,000

|

|

Engineering

|

$30,000

|

$30,000

|

$15,000

|

$15,000

|

$90,000

|

|

Mechanical

|

$50,000

|

$50,000

|

$30,000

|

$30,000

|

$160,000

|

|

Electrical

|

$30,000

|

$40,000

|

$40,000

|

$50,000

|

$160,000

|

|

Software

|

$30,000

|

$20,000

|

$20,000

|

$20,000

|

$90,000

|

|

Marketing

|

$15,000

|

$20,000

|

$30,000

|

$50,000

|

$115,000

|

|

Advertising

|

$50,000

|

$100,000

|

$150,000

|

$200,000

|

$500,000

|

|

Promotion

|

$50,000

|

$60,000

|

$80,000

|

$120,000

|

$310,000

|

|

Investor

Relations

|

$60,000

|

$80,000

|

$100,000

|

$150,000

|

$390,000

|

|

Total Expenditures

|

$623,000

|

$693,000

|

$776,000

|

$973,000

|

$3,065,000

|

Milestones

Months 1 through 3

During the first three (3) months we plan to:

|

|

o

|

Development

on the New Solar Biodome and Bio

Container with solar energy factories in China

|

|

|

o

|

Apply

the application of the trademark of the Biodome mobile

App

|

|

|

o

|

Complete

for Trademark registration in China and process the application of

patent in

|

|

|

o

|

Enter

into contract with a factory and the contractor for the first Solar

Biodome development in China

|

|

|

o

|

Setting

up the sale team for the Canada Office

|

|

|

o

|

Hire

three engineering staff in China

|

Biodome II

We design and build climate-controlled Biodomes with Vertical

Aeroponic Growing Cabinets that mitigate the risks associated with

growing vegetables, herbs, microgreens, and fruits. Biodome can be

designed to incorporate retail areas and be situated at ground

level, on rooftops in urban areas, or in virtually any geographic

location. Revenues will be generated from the sale of Biodome,

Vertical Aeroponic Growing Cabinets, nutrient solutions, and

support media. It is our intention to make the necessary

modifications to the system, namely the development of a BioDome

II, to make the system work faster and control better, but we will

need to source components, make engineering refinements, and have

molds for mass production made.

Testing of Nutrition Solution

We have developed a naturally derived nutrient solution to grow

healthy and good tasting produce rich in nutrients. The basic

nutrients required for plant growth are divided into two main

categories:

● Macronutrients: Nitrogen,

calcium, potassium, magnesium, phosphorus, and Sulphur;

and;

13

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS (CONTINUED)

|

And we added up a New Pi-water system into the Nutrients for

plants

We have engaged China Agricultural Labs to test the fluid and

develop the system to produce the nutrition

fluid.

Complete Trademark (神农殿)

(means ‘God of Vega Palace’) Registration in China

, we just finished three departments, still working on other

two.—We successfully applied the tradename but not included

the IT marketing for our APP( we can use the tradename for

Agriculture useful but not for internet marketing), so we applying

another tradename for digital marketing usage, it will take 8-12

months to finish.

File for trademark protection in China to protect our business

name, product names, domain names, logos and slogans still in

process. We anticipate the completion of this process within three

months.

Contract to build the first Biodome in Southern China

We are currently negotiating a contract with a company in Southern

China for a 200 acres of agriculture land foot where we can build a

100,000 sq. ft. Green House building that can producing 400 tons of

vegetables per month. We have developed a proprietary,

patent-pending aeroponic growing cabinet in which crops of various

sizes can be cultivated vertically in multiple layers. This growing

arrangement increases plant density. Based on a variety of plant

sizes, an Eco Energy Biodome will hold between 100,000 and 300,000

plants, all in a footprint comprising less than a third of an

acre.

Development the third Generation of the Biodome III

We developed more than 20 Multi-layers Vertical Hydroponics system,

greatly improved space utilization and go to patent in China also

we starting developing Artificial light-type House and Flat

Type.

Software Development

We plan on hiring IT company for software, and one for mechanical.

Realize online management and remote monitoring to control the

vegetables growth everywhere, with mobile phones, laptops, PDAs and

other terminals, through the network transmission

system.

In addition, we expect that during months one (1) through three (3)

that we will hire a VP of sales to handle product sales to

distributors and retailers for the vegetable markets.

Months 4 through 6

During the following three (3) months, we expect to achieve the

following:

|

|

o

|

Working

on the New design of the software for mobile phones.

Laptops

|

|

|

o

|

Seek

more suppliers for the materials for lighting and nutrition

fluids

|

|

|

o

|

Compete

the Agreement with a china land developer for fist

agreement

|

|

|

o

|

Finish

the agriculture drawing for New Eco container working with

microgreen china

|

|

|

|

.

|

Hiring the Architecture Company for the new design for Eco

Container in China Project

Eco Energy intends to develop a fully controlled plant factory

system in which utilization of multistage (2-8 stage) bench and

space-efficient indoor space. Fluorescent lamp is the main light

source and the combination with LED is also provide. Hydroponics

and organic soil culture can be used in this system

Developing the mobile end user

system social media platforms in china.

The new App will allow Chinese customers to contact ECO Energy Asia

directly and find out about the variety of goods available and

produced in the Biodome. The customer can then choose any item and

quantity for his personal needs and have it sent to their home

address. With this procedure, Chinese customers can easily pick

fresh and organic foods in a comfortable way. China today counts

1.3 Bio. mobile subscribers using Android or Apple's iPhone

technology.

Engage the engineering company to design the Controlled Atmosphere

Storages

The ideal oxygen level for storing pears must be between 1 and 3%;

for some varieties of apples, however, it must be lower than 1%.

Storage under such O2 conditions is referred to as Ultra Low Oxygen

(ULO) storage. ULO storage takes place in gas-tight cells and is

used for the long-term storage of apples, pears, blue berries and

kiwis. We shall be engaging a European engineering company to

develop storage system to protect the fast-growing

products.

14

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS (CONTINUED)

|

The partners will now buy agricultural technology system developed

and successfully invented by Eco Energy. An engineering and

construction team has been established and the first contacts to

potential clients have been made. Over many years Eco Energy

developed and tested different technologies which are applied in

the operation of vertical farming. These technologies are used to

save energy and water in an isolated mini-climate as it is provided

in a Biodome. The use of these systems facilitates the operation of

a Biodome and allows to increase profitability by decreasing costs

for water and energy used.

Months 7 through 9

During the following three (3) months, we expect to achieve the

following:

|

|

o

|

Complete

the agreement with Mathias Stecher GmbH from Swiss

|

|

|

o

|

Finish

the design in China project and start to order the

materials

|

|

|

o

|

Finish

the third level of Biodome and Solar system design