Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Solid Biosciences Inc. | d530438dex311.htm |

| EX-32.2 - EX-32.2 - Solid Biosciences Inc. | d530438dex322.htm |

| EX-32.1 - EX-32.1 - Solid Biosciences Inc. | d530438dex321.htm |

| EX-31.2 - EX-31.2 - Solid Biosciences Inc. | d530438dex312.htm |

| EX-23.1 - EX-23.1 - Solid Biosciences Inc. | d530438dex231.htm |

| EX-10.21 - EX-10.21 - Solid Biosciences Inc. | d530438dex1021.htm |

| EX-10.7 - EX-10.7 - Solid Biosciences Inc. | d530438dex107.htm |

| EX-2.3 - EX-2.3 - Solid Biosciences Inc. | d530438dex23.htm |

| EX-2.2 - EX-2.2 - Solid Biosciences Inc. | d530438dex22.htm |

| 10-K - 10-K - Solid Biosciences Inc. | d530438d10k.htm |

Exhibit 10.20

SUBLEASE

BETWEEN

TWITTER, INC.

AND

SOLID BIOSCIENCES, LLC

141 Portland Street, Cambridge, Massachusetts

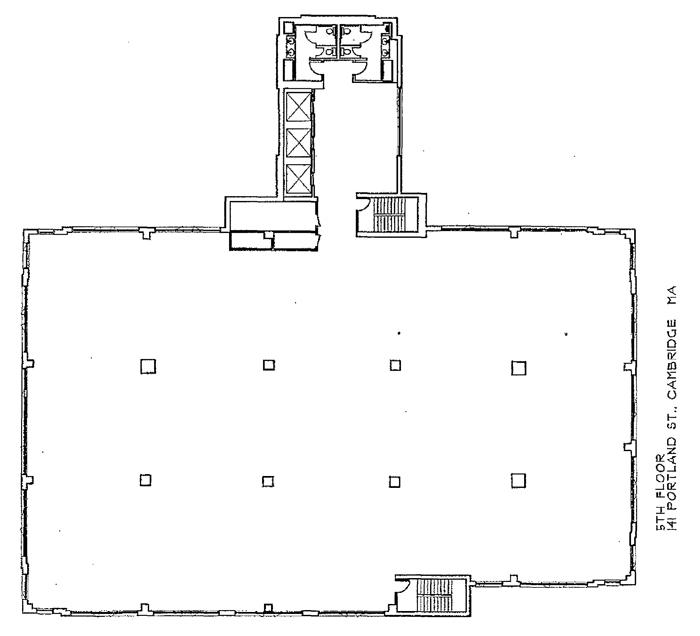

Fifth (5th) Floor

SUBLEASE

THIS SUBLEASE (“Sublease”) is entered into as of January 30, 2018 (the “Effective Date”), by and between TWITTER, INC., a Delaware corporation (“Sublandlord”) and SOLID BIOSCIENCES, LLC, a Delaware limited liability company (“Subtenant”), with reference to the following facts:

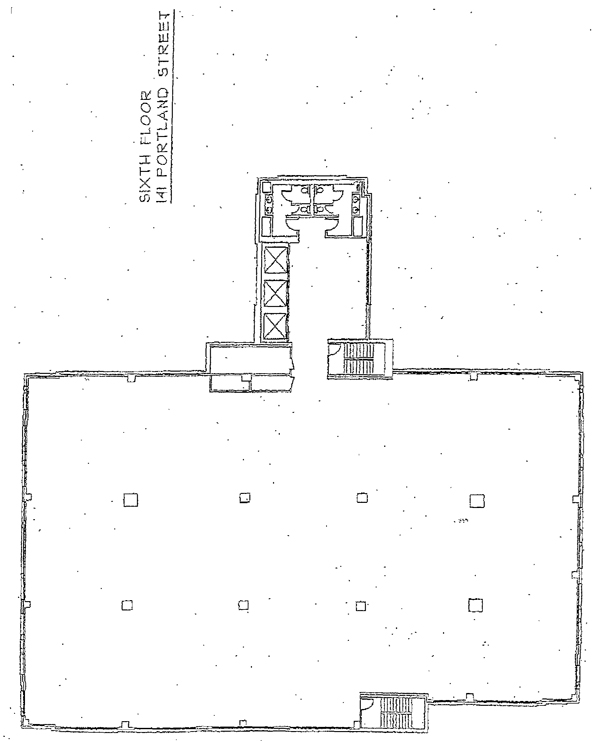

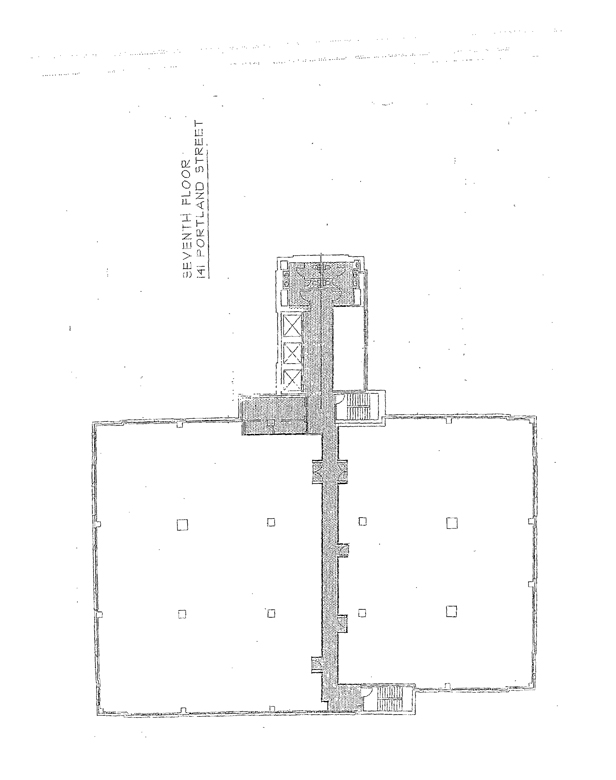

A. Pursuant to that certain Lease dated as of September 10, 2013 (the “Original Master Lease”), as amended by that certain First Amendment to Lease Agreement dated as of January 24, 2018 (the “First Amendment”) (as amended, the “Master Lease”),Kendall Square Entity, Inc. (“Landlord”), as Landlord, leases to Sublandlord, as Subtenant, certain space (the “Master Lease Premises”) consisting of 47,631 rentable square feet (“RSF”) and consisting of 15,877 RSF on the fifth (5th) floor of the Building (defined below) (the “5th Floor Premises”), 15,877 RSF on the sixth (6th) floor of the Building (the “6th Floor Premises”) and 15,877 RSF on the seventh (7th) floor of the Building (the “7th Floor Premises”); as used herein, the “Building” shall mean the building located at 141 Portland Street, Cambridge, Massachusetts.

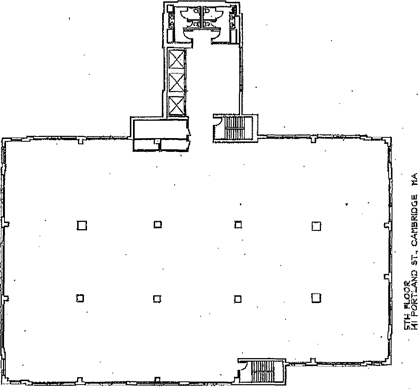

B. Subtenant wishes to sublease from Sublandlord, and Sublandlord wishes to sublease to Subtenant, the 5th Floor Premises, said space being more particularly identified and described on the floor plan attached hereto as Exhibit A and incorporated herein by reference (and hereafter referred to as the “Subleased Premises”).

NOW, THEREFORE, in consideration of the foregoing, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged by the parties, Sublandlord and Subtenant hereby agree as follows:

1. Sublease. Sublandlord hereby subleases to Subtenant and Subtenant hereby subleases from Sublandlord for the term, at the rental, and upon all of the conditions set forth herein, the Subleased Premises, together with rights of ingress and egress thereto, and with the right in common with others to use, to the extent applicable, the elevators and common passageways, stairways and vestibules, and to pass over and park on that portion of land owned by Landlord and designated by Landlord for Sublandlord’s parking.

2. Term.

(a) Generally. The term of this Sublease (the “Term”) shall commence on the date (the “Commencement Date”) that is the later to occur of (i) the date that Sublandlord delivers possession of the Subleased Premises to Subtenant with Sublandlord’s Pre-Delivery Work (defined in Section 14(a) below) completed (the “Delivery Date” and such delivery, “Delivery”) and (ii) the date upon which Sublandlord or Landlord delivers Landlord’s fully executed Consent (as defined in Section 26 of this Sublease) to Subtenant; the parties anticipate that the Commencement Date will be January 15, 2018 (the “Anticipated Commencement Date”). Unless sooner terminated pursuant to any provision hereto, the Term will end on the later of either (x) February 28, 2019 or, (y) if Sublandlord and Landlord mutually execute and deliver an amendment to the Master Lease pursuant to which the term of the Master Lease is extended to at least February 28, 2022, then, subject to Landlord’s consent, the Term will expire February 28, 2022 (the “Expiration Date”). Upon the determination of the Commencement

1

Date and the Expiration Date, Sublandlord and Subtenant will enter into a letter agreement in the form of Exhibit B attached hereto. If Sublandlord and Landlord fail by March 31, 2018 to mutually execute and deliver an amendment to the Master Lease, pursuant to which the term of the Master Lease is extended to at least February 28, 2022, then Subtenant shall have the right to negotiate directly with Landlord for the extension of the Expiration Date beyond February 28, 2019.

(b) Delivery Conditions. If, as of the date that Sublandlord would otherwise achieve Delivery as described in clause (i) of Section 2(a) above, Subtenant has not delivered to Sublandlord (x) the prepaid Base Rent pursuant to the provisions of Section 3(a) below, (y) the Security Deposit pursuant to the provisions of Section 4 below and (z) evidence of Subtenant’s procurement of all insurance coverage required hereunder (the “Delivery Conditions”), then Sublandlord will have no obligation to Deliver the Subleased Premises to Subtenant, but the failure on the part of Sublandlord to so Deliver possession of the Subleased Premises to Subtenant in such event will not serve to delay the occurrence of the Commencement Date and the commencement of Subtenant’s obligations to pay Rent (defined below) hereunder.

(c) Late Delivery. If the Commencement Date does not occur as of the Anticipated Commencement Date for any reason other than due to Subtenant’s failure to fulfill the Delivery Conditions, or to execute the Consent, Subtenant shall be entitled to a day-for-day delay in the Rent Commencement Date (defined in Section 3(a) below).

(d) First Right to Negotiate Extension. If both (y) the term of the Master Lease expires more than one (1) month after the Expiration Date and (z) Sublandlord determines in good faith that Sublandlord will not reoccupy the Subleased Premises for the conduct of Sublandlord’s business following the Expiration Date, Sublandlord will provide written notice to Subtenant of such determination (a “Non-Occupancy Notice”) no later than three (3) months prior to the Expiration Date; thereafter, Subtenant shall have the right to provide written notice to Sublandlord within fifteen (15) days of Subtenant’s receipt of such notice if it desires to negotiate to extend the Term. If Subtenant fails to timely notify Sublandlord of Subtenant’s desire to extend the Term, Sublandlord shall be free to negotiate with third parties regarding the sublease of the Subleased Premises on such terms and conditions as Sublandlord in its good faith discretion may determine to be acceptable. If, however, Subtenant timely notifies Sublandlord of Subtenant’s desire to extend the Term, Subtenant shall have the exclusive right to negotiate with Sublandlord for a period of two (2) weeks (the “Negotiation Period”) following Subtenant’s notice to Sublandlord, regarding the terms upon which the Term may be so extended, with Subtenant paying the same rental rate payable by Sublandlord under the Master Lease, for a term to be mutually agreed upon by Sublandlord and Subtenant. During the Negotiation Period, the parties will attempt in good faith to reach agreement on such extension and any corresponding change to the Security Deposit; if, at the expiration of the Negotiation Period, the parties have not reached an agreement, Sublandlord shall be free to negotiate with third parties regarding the sublease of the Subleased Premises on such terms and conditions as Sublandlord in its good faith discretion may determine to be acceptable. For avoidance of doubt, if Sublandlord fails to timely deliver a Non-Occupancy Notice but, in fact, has determined that Sublandlord will not reoccupy the Subleased Premises as described above, Sublandlord will not enter into any sublease for the period following the Expiration Date with any third party for the Subleased Premises without initially providing Subtenant the right to engage in the negotiation of a potential extension of this Sublease during a Negotiation Period.

2

3. Rent.

(a) Rent Payments. From and after April 1, 2018 (the “Rent Commencement Date”) Subtenant shall pay to Sublandlord as base rent for the Subleased Premises during the Term (“Base Rent”) the following:

| Period |

Rate Per RSF Per Annum |

Monthly Base Rent |

||||||

| Rent Commencement Date - February 28, 2019 |

$ | 60.00 | $ | 79,385.00 | ||||

Base Rent shall be paid in advance on the first day of each month of the Term from and after the Rent Commencement Date, except that Subtenant shall pay one (1) month’s Base Rent to Sublandlord (i.e., $79,385.00) upon execution of this Sublease and delivery of this Sublease to Sublandlord; said pre-paid Base Rent will be applied to the first (1st) month’s Base Rent due and payable hereunder. If the Term is extended pursuant to the provisions of clause (y) of Section 2(a) above, then, during such extended portion of the Term, Subtenant will pay the same Base Rent rate per RSF per annum that Sublandlord is obligated to pay pursuant to the provisions of the Master Lease during such extended Term, but in no event will such amounts exceed the following:

| Period |

Maximum Base Rent Per RSF Per Annum |

|||

| March 1, 2019 - February 29, 2020 |

$ | 78.00 | ||

| March 1, 2020 - February 28, 2021 |

$ | 79.00 | ||

| March 1, 2021 - February 28, 2022 |

$ | 80.00 | ||

Rent for any partial month shall be prorated as necessary based upon the actual number of days in such month which fall within the Term. All Rent shall be payable in lawful money of the United States by electronic funds transfer, ACH or wire transfer to an account designated by Sublandlord, or by regular bank check of Subtenant, to Sublandlord at the following address:

Twitter, Inc.

c/o SRS - Cresa Lease Administration, LLC

Inwood National Bank

P.O. Box 852724

Richardson, Texas 75085

or to such other persons or at such other places as Sublandlord may designate in writing.

(b) Operating Costs.

(i) Definitions. For purposes of this Sublease and in addition to the terms defined elsewhere in this Sublease, the following terms shall have the meanings set forth below:

(1) “Additional Rent” shall mean the sums payable pursuant to Section 3(b)(ii) below.

3

(2) “Base Operating Costs” shall mean Operating Costs payable by Sublandlord to Landlord for the Master Lease Premises during the Base Year.

(3) “Base Year” shall mean the calendar year 2018, however, if the Term is extended as described in clause (y) of Section 2(a) above, then, during such extended portion of the Term, the Base Year hereunder shall be the same Base Year as is applicable under the Master Lease, as the Master Lease is modified to effect such extension.

(4) “Operating Costs” shall mean the aggregate of Operating Expenses and Taxes (as such terms are defined in the Original Master Lease) charged by Landlord to Sublandlord pursuant to the Master Lease.

(5) “Rent” shall mean, collectively, Base Rent, Additional Rent, and all other sums payable by Subtenant to Sublandlord under this Sublease, whether or not expressly designated as “rent”, all of which are deemed and designated as rent pursuant to the terms of this Sublease.

(6) “Subtenant’s Percentage Share” shall mean 33.33% (i.e., 15,877/47,631); provided, however, that if at any time the RSF of the Master Lease Premises or the Subleased Premises shall change as a consequence to the change in the physical dimensions of either the Master Lease Premises or the Subleased Premises, then Subtenant’s Percentage Share shall be recalculated to reflect the ratio, expressed as a percentage, that the RSF of the Subleased Premises then bears to the RSF of the Master Lease Premises.

(ii) Payment of Additional Rent. In addition to the Base Rent payable hereunder, from and after the expiration of the Base Year, Subtenant shall pay, as Additional Rent, Subtenant’s Percentage Share of the amount by which Operating Costs payable by Sublandlord for the then current calendar year exceed Base Operating Costs. Sublandlord shall provide Subtenant with written notice of Sublandlord’s estimate of the amount of Additional Rent per month payable for each calendar year after the Base Year promptly following the Sublandlord’s receipt of Landlord’s estimate of the Operating Costs payable under the Master Lease. Thereafter, the Additional Rent payable shall be determined and adjusted in accordance with the provisions below.

(iii) Procedure. The determination and adjustment of Additional Rent payable hereunder shall be made in accordance with the following procedures:

(1) Delivery of Estimate; Payment. Upon receipt of a statement from Landlord specifying the estimated Operating Costs to be charged to Sublandlord under the Master Lease with respect to each calendar year, or as soon after receipt of such statement as practicable, Sublandlord shall give Subtenant written notice of its estimate of Additional Rent for the ensuing calendar year, which estimate shall be prepared based on the estimate received from Landlord (as Landlord’s estimate may change from time to time), together with a copy of the statement received from Landlord. On or before the first day of each month during each calendar year, Subtenant shall pay to Sublandlord as Additional Rent one-twelfth (l/12th) of such estimated amount together with the Base Rent.

4

(2) Sublandlord’s Failure to Deliver Estimate. In the event Sublandlord’s notice is not given on or before December 1 of the calendar year preceding the calendar year for which Sublandlord’s notice is applicable, as the case may be, then until the calendar month after such notice is delivered by Sublandlord, Subtenant shall continue to pay to Sublandlord monthly, during the ensuing calendar year, estimated payments equal to the amounts payable hereunder during the calendar year just ended. Upon receipt of any such post-December 1 notice Subtenant shall (i) commence as of the immediately following calendar month, and continue for the remainder of the calendar year, to pay to Sublandlord monthly such new estimated payments and (ii) if the monthly installment of the new estimate of such Additional Rent is greater than the monthly installment of the estimate for the previous calendar year, pay to Sublandlord within thirty (30) days of the receipt of such notice an amount equal to the difference of such monthly installment multiplied by the number of full and partial calendar months of such year preceding the delivery of such notice.

(iv) Year End Reconciliation. Following the receipt by Sublandlord of a final statement of Operating Costs from Landlord with respect to each calendar year, Sublandlord shall deliver to Subtenant a statement of any adjustment to be made for the calendar year just ended (“Sublandlord’s Annual Statement”), together with a copy of any corresponding Landlord’s statement of actual Operating Expense and Taxes received by Sublandlord (“Landlord’s Statement”). If on the basis of Sublandlord’s Annual Statement,Subtenant owes an amount that is less than the estimated payments actually made by Subtenant for the calendar year just ended, Sublandlord shall credit such excess to the next payments of Rent coming due or, if the Sublease Term will expire before such credit offsets the full excess, refund any remaining excess to Subtenant within thirty (30) days after the expiration of the Sublease Term. If on the basis of such Sublandlord’s Annual Statement Subtenant owes an amount that is more than the estimated payments for the calendar year just ended previously made by Subtenant, Subtenant shall pay the deficiency to Sublandlord within thirty (30) days after delivery of the Sublandlord’s Annual Statement from Sublandlord to Subtenant.

(v) Reliance on Landlord’s Calculations.

(1) Generally. In calculating Operating Costs payable hereunder by Subtenant, Sublandlord shall have the right to rely upon the calculations of Landlord made in determining Operating Expenses and Taxes pursuant to the provisions of the Master Lease and Subtenant shall have no direct right to audit or review Landlord’s calculation of Operating Expenses and Taxes.

(2) Subtenant’s Right to Request Audit.

a. Notwithstanding the provisions of Section 3(b)(v)(l) above, provided Subtenant is not in Default hereunder and no notice of Default from Sublandlord to Subtenant is then currently outstanding and uncured, and further provided that Subtenant delivers Subtenant’s Audit Request Notice (defined below) at least thirty (30) days prior to the date of expiration of Sublandlord’s right to request a review of Landlord’s books and records pursuant to the provisions of Section 5 of Exhibit C to the Original Master Lease, if in

5

any year Sublandlord’s Annual Statement reflects an increase in Operating Costs in excess of five percent (5%) over the Operating Costs for the immediately preceding year, Subtenant shall have the right, to be exercised by written notice delivered to Sublandlord (“Subtenant’s Audit Request Notice”) to request that Sublandlord exercise its rights to review Landlord’s books and records regarding Operating Expenses and Taxes as set forth in Section 5 of Exhibit C to the Original Master Lease. In such event, Sublandlord will promptly exercise Sublandlord’s rights set forth in Section 5 of Exhibit C to the Original Master Lease. In the event of any such exercise by Sublandlord pursuant to the provisions of this Section 3(b)(v)(2) the following provisions will apply:

b. Sublandlord will select a certified public accountant selected by Sublandlord to review Landlord’s books and records in accordance with the provisions of Section 5 of Exhibit C to the Original Master Lease, following which Sublandlord and Subtenant will confer in good faith regarding the results of such review; thereafter, if the parties deem it necessary, then Sublandlord, will endeavor in good faith to resolve with Landlord any necessary clarification or dispute raised by Subtenant in Subtenant’s Audit Request Notice. All costs of any such review shall be borne solely by Subtenant as additional Rent hereunder, unless Landlord is liable for the costs of the audit pursuant to Section 5 of Exhibit C to the Original Master Lease. Any additional amounts will be due within thirty (30) days after Sublandlord’s delivery of an invoice to Subtenant. If, following the completion of any such audit, it is determined that Sublandlord is entitled to the reimbursement of Operating Expenses and Taxes under the Master Lease, any such reimbursement shall be applied, first, to the audit costs previously paid by Subtenant, and second, to any such reasonable out of pocket cost incurred by Sublandlord which have not then been reimbursed by Subtenant or Landlord to Sublandlord, and, thereafter, the remaining refund will be equitably allocated between Sublandlord and Subtenant in accordance with the ratio that their respective overpayments of Operating Expenses and Taxes (in the case of Sublandlord) and Operating Costs (in the case of Subtenant) compare to each other. For avoidance of doubt, if, as of the date that Subtenant delivers a Subtenant’s Audit Request, Sublandlord has already notified Landlord of Sublandlord’s exercise of the review rights described in Section 5 of Exhibit C to the Original Master Lease, then Subtenant shall have no independent right to require any such review of Landlord’s books and records, but Sublandlord agrees to: (A) promptly provide Subtenant with any report prepared by Sublandlord’s accounting firm or accountant on the basis of any such review of Landlord’s books and records (subject to Landlord’s consent to such disclosure) and, (B) allocate to Subtenant any net refund of Operating Expenses and Taxes attributable to an overpayment by Sublandlord following Sublandlord’s recovery from any aggregate refund of all costs associated with such review, as may then be equitable given any corresponding overpayment of Operating Costs by Subtenant and in such event, Subtenant shall have no obligation to reimburse Sublandlord for the costs of the review initiated solely by Sublandlord.

(vi) Survival. The expiration or earlier termination of this Sublease shall not affect the obligations of Sublandlord and Subtenant pursuant to this Section 3(b), and such obligations shall survive, remain to be performed after, any expiration or earlier termination of this Sublease.

6

(c) Electricity. Pursuant to the Master Lease, the cost of all electrical consumption in the Master Lease Premises is borne by Sublandlord. During the Term, Subtenant shall be obligated to pay for the cost of electrical consumption in the Subleased Premises (i.e., such cost will not be included in Operating Costs). Sublandlord will invoice Subtenant, on a monthly basis, for the cost of the electrical consumption as shown on an existing submeter measuring electrical consumption in the Subleased Premises. Subtenant shall pay such costs as additional Rent hereunder within thirty (30) days following Sublandlord’s delivery of an invoice therefor to Subtenant.

(d) Janitorial. As of the Effective Date, Sublandlord (as opposed to Landlord), at Sublandlord’s sole cost and expense, provides janitorial services to the Subleased Premises. During the Sublease Term, Subtenant will provide janitorial services to the Subleased Premises using a janitorial contractor approved in advance by Sublandlord (not to be unreasonably withheld) and Landlord pursuant to a separate contract between Subtenant and such janitorial contractor. Subtenant will be responsible for the cost of such janitorial service. Such services will be provided in a manner reasonably commensurate in scope, level of service and frequency of services as, and not less than the scope, level of service and frequency of services than, the services provided by Landlord elsewhere in the Building.

4. Security Deposit. Concurrently with Subtenant’s execution of this Sublease, Subtenant shall deposit with Sublandlord the sum of $79,385.00 (the “Security Deposit”); however, if the Term is extended pursuant to the provisions of clause (y) of Section 2(a) above, the Security Deposit will be increased to the sum of $209,047.00, and Subtenant will deliver to Sublandlord the sum of $129,662.17 within ten (10) calendar days following Sublandlord’s request. The Security Deposit shall be held by Sublandlord as security for the faithful performance by Subtenant of all the provisions of this Sublease to be performed or observed by Subtenant. If a Default exists hereunder, Sublandlord may use, apply or retain all or any portion of the Security Deposit for the payment of any past-due sum or for the payment of any other sum to which Sublandlord may become obligated by reason of Subtenant’s Default, or to compensate Sublandlord for any loss or damage which Sublandlord may suffer thereby. If Sublandlord so uses or applies all or any portion of the Security Deposit, Subtenant shall within ten (10) days after demand therefor deposit cash with Sublandlord in an amount sufficient to restore the Security Deposit to the full amount thereof and Subtenant’s failure to do so shall be a Default without the necessity of the passage of any additional cure period. The Security Deposit, or so much thereof as has not theretofore been applied by Sublandlord, shall be returned, without interest, to Subtenant (or, at Sublandlord’s option, to the last assignee, if any, of Subtenant’s interest hereunder) within thirty (30) days following the later to occur of (a) the expiration of the Term, and (b) Subtenant’s vacation from the Subleased Premises and completion of all removal,repair and restoration obligations that may be required by this Sublease. No trust relationship is created herein between Sublandlord and Subtenant with respect to the Security Deposit.

5. Use and Occupancy.

(a) Use. The Subleased Premises shall be used and occupied only for general office use purposes and other uses provided under the Master Lease.

7

(b) Compliance with Master Lease. Subtenant will occupy the Subleased Premises in accordance with the terms of the Master Lease and will not suffer to be done, or omit to do, any act which may result in a violation of or an Event of Default (as defined in the Original Master Lease) under the Master Lease, or render Sublandlord liable for any damage, charge or expense thereunder. Subtenant will indemnify, defend protect and hold Sublandlord harmless from and against any loss, cost, damage or liability (including reasonable attorneys’ fees) of any kind or nature arising out of, by reason of, or resulting from, Subtenant’s failure to perform or observe any of the terms and conditions of the Master Lease (unless such failure is due to Sublandlord’s breach of this Sublease or the Master Lease) or this Sublease. Sublandlord will indemnify, defend protect and hold Subtenant harmless from and against any loss, cost, damage or liability (including reasonable attorneys’ fees) of any kind or nature arising out of, by reason of, or resulting from, Sublandlord’s failure to perform or observe any of the terms and conditions of the Master Lease or this Sublease (unless such failure is due to Subtenant’s breach of this Sublease or the Master Lease). Any other provision in this Sublease to the contrary notwithstanding, Subtenant shall pay to Sublandlord as Rent hereunder any and all sums which Sublandlord may be required to pay the Landlord in accordance with the Master Lease arising out of a request by Subtenant for, or the use by Subtenant of, additional or over-standard Building services from Landlord to the extent attributable to the Subleased Premises (for example, but not by way of limitation, charges associated with after-hour HVAC usage and overstandard electrical charges).

(c) Landlord’s Obligations. Subtenant agrees that Sublandlord shall not be required to perform any of the covenants, agreements and/or obligations of Landlord under the Master Lease, including, without limitation, the provision of services provided in the Master Lease, and, insofar as any of the covenants, agreements and obligations of Sublandlord hereunder are required to be performed under the Master Lease by Landlord thereunder, Subtenant acknowledges and agrees that Sublandlord shall be entitled to look to Landlord for such performance; provided that Sublandlord shall reasonably cooperate with Subtenant to coordinate any request for services or enforcing any other covenant of Landlord under the Master Lease. In addition, Sublandlord shall have no obligation to perform any repairs or any other obligation of Landlord under the Master Lease, nor shall any representations or warranties made by Landlord under the Master Lease be deemed to have been made by Sublandlord. Sublandlord shall not be responsible for any failure or interruption, for any reason whatsoever, of the services or facilities that may be appurtenant to or supplied at the Building by Landlord or otherwise, including, without limitation, heat, air conditioning, ventilation, life-safety, water, electricity, elevator service and cleaning service, if any; and no failure to furnish, or interruption of, any such services or facilities shall give rise to any (i) abatement, diminution or reduction of Subtenant’s obligations under this Sublease (provided that if Sublandlord is entitled to an abatement of Rent payable under the Master Lease with respect to the Subleased Premises as a result of an interruption in services to the Subleased Premises, then Subtenant will be entitled to a parallel abatement of Rent payable hereunder) or (ii) liability on the part of Sublandlord. Notwithstanding the foregoing, Sublandlord shall use good faith efforts, under the circumstances, to secure such performance upon Subtenant’s request to Sublandlord to do so and shall thereafter diligently prosecute such performance on the part of Landlord; provided, however, that this sentence will not be interpreted to require Sublandlord to commence any legal proceeding, arbitration or any other similar form of process unless Sublandlord, in Sublandlord’s sole discretion, determines that commencement of such action is necessary and appropriate.

8

(d) Access. Access to the Building is provided through the use of a key fob that is provided by Landlord (Sublandlord shall, at no cost to Sublandlord, coordinate Subtenant’s procurement of such key fobs from Landlord); the charge for each Landlord-issued key fob is, as of the Effective Date, $25.00, and Subtenant will be responsible for the costs of any such key fobs. Landlord-issued key fobs are also used to access the Building’s parking garage. Subtenant acknowledges that elevator access to the fifth (5th) floor of the Building is, as of the Effective Date, controlled by Sublandlord’s card reader system; (i.e., an individual cannot cause the elevator to stop at the fifth (5th) floor without using a Sublandlord-issued access badge). Prior to Delivery, Sublandlord, at Sublandlord’s sole cost and expense, shall terminate Sublandlord’s elevator access controls with respect to the fifth (5th) floor such that the fifth (5th) floor will have open access. Additionally, the Subleased Premises currently has several card readers and cameras installed; Sublandlord will leave these devices and the associated cabling in the Subleased Premises upon delivery to Subtenant. Sublandlord’s card reader system cannot be reprogrammed to differentiate Subtenant access cards from the access cards of Sublandlord and other occupants of the Building, but Subtenant will be entitled to install, and Sublandlord hereby approves in concept, its own “head end” security system (subject to any necessary approval of plans and specifications therefor to be obtained from Sublandlord to the extent required under Section 14(b) below and from Landlord to the extent required under the Master Lease) which Subtenant will be required to remove at the end of the Term. Sublandlord will respond to any request from Subtenant for approval of Subtenant’s proposed security system within five (5) business days and will use reasonable efforts to obtain Landlord’s agreement to expedite its review of such security system (Subtenant acknowledges that Landlord is not required to respond in five (5) business days).

6. Master Lease and Sublease Terms.

(a) Subject to Master Lease. This Sublease is and shall be at all times subject and subordinate to the Master Lease. Subtenant acknowledges that Subtenant has reviewed and is familiar with all of the terms, agreements, covenants and conditions of the Master Lease. During the Term and for all periods subsequent thereto with respect to obligations which have arisen prior to the termination of this Sublease, Subtenant agrees to perform and comply with, for the benefit of Sublandlord and Landlord, the obligations of Sublandlord under the Master Lease which pertain to the Subleased Premises and/or this Sublease, except for those provisions of the Master Lease which are directly contradicted by this Sublease, in which event the terms of this Sublease shall control over the Master Lease.

(b) Incorporation of Terms of Master Lease. The terms, conditions and respective obligations of Sublandlord and Subtenant to each other under this Sublease shall be the terms and conditions of the Master Lease, except for those provisions of the Master Lease which are directly contradicted by this Sublease, in which event the terms of this Sublease shall control over the Master Lease. Therefore, for the purposes of this Sublease, wherever in the Master Lease the word “Landlord” is used it shall be deemed to mean Sublandlord and wherever in the Master Lease the word “Tenant” is used it shall be deemed to mean Subtenant. Additionally, wherever in the Master Lease the word “Premises” is used it shall be deemed to mean the Subleased Premises. Any non-liability, release, indemnity or hold harmless provision in the Master Lease for the benefit of Landlord that is incorporated herein by reference, shall be deemed to inure to the benefit of Sublandlord, Landlord, and any other person intended to be benefited by said provision, for the purpose of incorporation by reference in this Sublease. Any right of Landlord under the Master Lease (a) of access or inspection, (b) to do work in the Master

9

Lease Premises or in the Building, (c) in respect of rules and regulations, and construction standards, as updated from time to time, which are incorporated herein by reference, shall be deemed to inure to the benefit of Sublandlord, Landlord, and any other person intended to be benefited by said provision, for the purpose of incorporation by reference in this Sublease.

(c) Modifications. For the purposes of incorporation herein, the terms of the Master Lease are subject to the following additional modifications:

(i) Approvals. In all provisions of the Master Lease (under the terms thereof and without regard to modifications thereof for purposes of incorporation into this Sublease) requiring the approval or consent of Landlord, Subtenant shall be required to obtain the approval or consent of both Sublandlord and Landlord.

(ii) Deliveries. In all provisions of the Master Lease requiring Tenant to submit, exhibit to, supply or provide Landlord with evidence, certificates, or any other matter or thing, Subtenant shall be required to submit, exhibit to, supply or provide, as the case may be,the same to both Landlord and Sublandlord.

(iii) Damage; Condemnation. Sublandlord shall have no obligation to restore or rebuild any portion of the Subleased Premises after any destruction or taking by eminent domain. Any rights of Subtenant to abatement of rent shall be conditioned upon Sublandlord’s ability to abate rent for the Subleased Premises under the terms of the Master Lease.

(iv) Insurance. In all provisions of the Master Lease requiring Tenant to designate Landlord as an additional or named insured on its insurance policy, Subtenant shall be required to so designate Landlord and Sublandlord on its insurance policy. Sublandlord shall have no obligation to maintain the insurance to be maintained by Landlord under the Master Lease.

(d) Exclusions. Notwithstanding the terms of Section 6(b) above, Subtenant shall have no rights nor obligations under the following parts, Sections and Exhibits of the Master Lease:

(i) Original Master Lease: Articles 1, 2, 3 (except Section 3.2), 4 (except to the extent necessary to implement Section 3(b)(ii) above), 5, Sections 7.1 (reference to “Delivery Condition” only), 7.2, 10.1 (references to “Second Request” and deemed approval of Alterations only), 10.4 (superceded by Section 14.1 below), 10.5, 10.6, 11.2 (provided that Sublandlord will request Building passes for Subtenant’s employees from Landlord and will use reasonable efforts to assist Subtenant in obtaining such Building passes from Landlord), 12.2, 13.1 (references to deemed approval only), 16.4, 17.5 (provided that if Sublandlord is entitled to an abatement of rent payable under the Master Lease pursuant to Section 17.5 as a consequence of an Abatement Event [defined in the Original Master Lease] which affects the Subleased Premises, Subtenant will be entitled to a parallel abatement of Rent payable hereunder), Articles 18 (clauses (a) and (b) only, which are superceded by Section 8 below), 22, 24, 27, 28, Section 29.5, Articles 30 (except to the extent necessary to implement Section 16 below), 31 and 32, Exhibit A, Exhibit B, Exhibit C (except to the extent necessary to implement Section 3(b) above), Exhibit E, Exhibit F, Exhibit G, Exhibit H, Exhibit I; and

10

(ii) First Amendment: Section 3, Section 4 (except to the extent necessary to implement Section 3(b)(ii) above), Sections 5, 8, 9, 10, 11 and 12 and Exhibit A.

(e) Sublandlord’s Representations. Sublandlord represents to Subtenant that (i) attached hereto as Exhibit D is a true, accurate and complete (subject to redaction of certain financial terms) copy of the Master Lease and all amendments thereto and the same have not been further modified, (ii) Sublandlord is the “Tenant” under the Master Lease, (iii) as of the Effective Date, the Master Lease is in full force and effect, (iv) as of the Effective Date, Sublandlord is not in default in the payment of any rent or other sums due under the Master Lease, (A) Sublandlord has not received any notice of default under the Master Lease which remains uncured as of the Effective Date, (B) to the best of Sublandlord’s knowledge, Landlord is not in default thereunder, and (C) to the best of Sublandlord’s knowledge, no Hazardous Materials are present in the Subleased Premises in violation of any of the provisions of the Master Lease, and (v) subject to the consent of Landlord, Sublandlord has full right and authority to sublease the Subleased Premises to Subtenant on the terms and conditions set forth herein.

(f) Sublandlord’s Compliance with Master Lease. Sublandlord shall perform all covenants and obligations required to be performed by Sublandlord under the Master Lease in accordance with the terms and provisions thereof and, so long as Subtenant is not in Default hereunder, shall not cause the Master Lease to terminate or expire before the scheduled date of expiration of this Sublease. Upon Sublandlord’s knowledge thereof, Sublandlord shall promptly provide Subtenant with written notice of any violation or default of any of the terms of the Master Lease and provide Subtenant with a copy of any default notices received by Sublandlord from Landlord.

7. Assignment and Subletting. Subtenant shall not assign Subtenant’s interest in this Sublease or further sublet all or any part of the Subleased Premises except subject to and in compliance with all of the terms and conditions of the Master Lease, and Sublandlord (in addition to Landlord) shall have the same rights with respect to assignment and subleasing as Landlord has under the Master Lease; provided, however that Sublandlord shall not unreasonably withhold, condition or delay its consent to any such proposed assignment or sublease. Subtenant shall pay all fees and costs payable to Landlord pursuant to the Master Lease in connection with any proposed assignment, sublease or transfer of the Subleased Premises (or any portion), together with all of Sublandlord’s reasonable out-of-pocket costs relating to any proposed assignment, sublease or transfer of the Subleased Premises (or any portion) regardless of whether consent is granted (or is required), and the effectiveness of any assignment, sublease or transfer by Subtenant will be conditioned upon Landlord’s and Sublandlord’s receipt of all such fees and costs. Subtenant agrees that it would be reasonable for Sublandlord to refuse to consent to any assignment of this Sublease or a sub-subletting of the Subleased Premises to a Competitor (defined below) of Sublandlord or an Affiliate of any such Competitor. If, at any time, Subtenant desires to sublease all or any portion of the Subleased Premises or assign its interest in this Sublease to a particular entity and desires to have Sublandlord determine whether such entity is a Competitor, Subtenant may deliver notice to Sublandlord stating the identity of the proposed assignee or subtenant and Sublandlord will notify Subtenant whether such entity is a Competitor within ten (10) business days of Sublandlord’s receipt of such request. As used herein, a “Competitor” is an entity (or an affiliate of an entity) which Sublandlord deems to be a business competitor of Sublandlord or any of Sublandlord’s affiliates.

11

8. Default. Except as expressly set forth herein, Subtenant shall perform all obligations in respect of the Subleased Premises that Sublandlord would be required to perform pursuant to the Master Lease. It shall constitute a “Default” hereunder if Subtenant fails to perform any obligation hereunder (including, without limitation, the obligation to pay Rent), or any obligation under the Master Lease which has been incorporated herein by reference, and, in each instance, Subtenant has not remedied such failure (i) in the case of any monetary Default, three (3) business days after delivery of written notice and (ii) in the case of any other Default, ten (10) business days after delivery of written notice; provided, however, that if the Default is incapable of cure within ten (10) business days, then for so long as Sublandlord has not received notice from Landlord stating that Landlord will treat such Default as an “Event of Default” under the Master Lease, Subtenant shall not be in Default hereunder if Subtenant commences the cure within the ten (10) business day period and thereafter diligently prosecutes the cure to completion; however, if at any time Sublandlord receives notice from Landlord that the Default will be treated as an “Event of Default” under the Master Lease, Subtenant’s cure period will immediately be deemed to expire ten (10) days before the date of expiration of Sublandlord’s cure period as set forth in Landlord’s notice of default to Sublandlord.

9. Remedies. In the event of any Default hereunder by Subtenant, Sublandlord shall have all remedies provided to the “Landlord” in the Master Lease as if a default had occurred thereunder and all other rights and remedies otherwise available at law and in equity. Sublandlord may resort to its remedies cumulatively or in the alternative.

10. Right to Cure Defaults. If Subtenant fails to perform any of its obligations under this Sublease. after expiration of applicable grace or cure periods, then Sublandlord may, but shall not be obligated to, perform any such obligations for Subtenant’s account. All reasonable costs and expenses incurred by Sublandlord in performing any such act for the account of Subtenant shall be deemed Rent payable by Subtenant to Sublandlord upon demand, together with interest thereon at the lesser of (i) the Default Rate (as defined in the Original Master Lease) per annum or (ii) the maximum rate allowable under law from the date of the expenditure until repaid. If Sublandlord undertakes to perform any of Subtenant’s obligations for the account of Subtenant pursuant hereto, the taking of such action shall not constitute a waiver of any of Sublandlord’s remedies.

11. Consents and Approvals. In any instance when Sublandlord’s consent or approval is required under this Sublease, Sublandlord’s refusal to consent to or approve any matter or thing shall be deemed reasonable if, among other matters, such consent or approval is required under the provisions of the Master Lease incorporated herein by reference but has not been obtained from Landlord. Except as otherwise provided herein, Sublandlord shall not unreasonably withhold, condition or delay its consent to or approval of a matter if such consent or approval is required under the provisions of the Master Lease and Landlord has consented to or approved of such matter.

12

12. Liability.

(a) Limitation of Liability. Notwithstanding any other term or provision of this Sublease, the liability of Sublandlord to Subtenant for any default in Sublandlord’s obligations under this Sublease shall be limited to actual, direct damages, and under no circumstances shall Subtenant, its partners, members, shareholders, directors, agents, officers, employees, contractors, sublessees, successors and/or assigns be entitled to recover from Sublandlord (or otherwise be indemnified by Sublandlord) for (i) any losses, costs, claims, causes of action, damages or other liability incurred in connection with a failure of Landlord, its partners, members, shareholders, directors, agents, officers, employees, contractors, successors and /or assigns to perform or cause to be performed Landlord’s obligations under the Master Lease, (ii) lost revenues, lost profit or other consequential, special or punitive damages arising in connection with this Sublease for any reason, or (iii) any damages or other liability arising from or incurred in connection with the condition of the Subleased Premises or suitability of the Subleased Premises for Subtenant’s intended uses. Subtenant shall, however, have the right to seek any injunctive or other equitable remedies as may be available to Subtenant under applicable law. Notwithstanding any other term or provision of this Sublease, except as set forth below, the liability of Subtenant to Sublandlord for any default in Subtenant’s obligations under this Sublease shall be limited to actual, direct damages, and under no circumstances shall Sublandlord, its partners, members, shareholders, directors, agents, officers, employees, contractors, sublessees, successors and/or assigns be entitled to recover from Subtenant (or otherwise be indemnified by Subtenant) for lost revenues, lost profit or other consequential, special or punitive damages arising in connection with this Sublease for any reason; the foregoing limitation will not, however, apply to the liability of Subtenant with respect to any holding over in the Subleased Premises by Subtenant beyond the expiration or sooner termination of this Sublease or the use by Subtenant of Hazardous Material (defined in Article 8 of the Original Master Lease) in violation of the provisions of the Master Lease. Notwithstanding any other term or provision of this Sublease, no personal liability shall at any time be asserted or enforceable against Sublandlord’s shareholders, directors, officers, or partners on account of any of Sublandlord’s obligations or actions under this Sublease. Notwithstanding any other term or provision of this Sublease, no personal liability shall at any time be asserted or enforceable against Subtenant’s shareholders, directors, officers, or partners on account of any of Subtenant’s obligations or actions under this Sublease. In the event of any assignment or transfer of the Sublandlord’s interest under this Sublease, Sublandlord shall be and hereby is entirely relieved of all covenants and obligations of Sublandlord hereunder accruing subsequent to the date of the transfer and it shall be deemed and construed, without further agreement between the parties hereto, that any transferee has assumed and shall carry out all covenants and obligations thereafter to be performed by Sublandlord hereunder. Sublandlord may transfer and deliver any then existing Security Deposit or Letter of Credit, as applicable, to the transferee of Sublandlord’s interest under this Sublease, and thereupon Sublandlord shall be discharged from any further liability with respect thereto.

(b) Sublandlord Default. Sublandlord shall be in default hereunder only if Sublandlord has not commenced and pursued with reasonable diligence the cure of any failure of Sublandlord to meet its obligations hereunder within thirty (30) days after the receipt by Sublandlord of written notice from Subtenant. In no event shall Subtenant have the right to terminate or rescind this Sublease as a result of Sublandlord’s default as to any covenant or agreement contained in this Sublease. Subtenant hereby waives such remedies of termination and rescission.

13

13. Attorneys’ Fees. If Sublandlord or Subtenant brings an action to enforce the terms hereof or to declare rights hereunder, the prevailing party who recovers substantially all of the damages, equitable relief or other remedy sought in any such action on trial and appeal shall be entitled to receive from the other party its costs associated therewith, including, without limitation, reasonable attorney’s fees and costs from the other party. Without limiting the generality of the foregoing, if Sublandlord utilizes the services of an attorney for the purpose of collecting any Rent hereunder which is, in fact, past due and unpaid by Subtenant, Subtenant will be obligated to pay Sublandlord reasonable actual attorneys’ fees incurred in connection therewith, irrespective of whether any legal action may be commenced or filed by Sublandlord.

14. Delivery of Possession.

(a) Generally. Sublandlord shall deliver, and Subtenant shall accept, possession of the Subleased Premises in their “AS IS” condition as the Subleased Premises exists on the Effective Date, but broom clean, free of all occupants; provided however, that prior to Delivery, Sublandlord will (i) relocate the MDF room equipment currently located in the Subleased Premises, (ii) install a barrier enclosing the interconnecting stairwell between the fifth (5th) floor and the sixth (6th) floor, (iii) leave all cabling located within the Subleased Premises but will remove all network equipment (i.e., WAPS, network gear in IDF’s, etc.) (collectively, “Sublandlord’s Pre-Delivery Work”). To Sublandlord’s knowledge, the Building Systems (defined in the Original Master Lease) serving the Subleased Premises, as well as the existing lighting fixtures therein, will be in good working order and condition as of the date of Sublandlord’s delivery of the Subleased Premises to Subtenant. All of Sublandlord’s Pre-Delivery Work shall be done (1) at Sublandlord’s sole cost and expense, (2) in a workmanlike manner, and (3) in accordance with all applicable laws. Except for Sublandlord’s Pre-Delivery Work, Sublandlord shall have no obligation to furnish, render or supply any work, labor, services, materials, furniture, other than the Furniture (defined below), fixtures, equipment, decorations or other items to make the Subleased Premises ready or suitable for Subtenant’s occupancy. Sublandlord does not represent or warrant that any cabling located in the Subleased Premises is suitable for Subtenant’s use. Subtenant acknowledges that Landlord may require that Sublandlord, on or about the expiration of the Master Lease and at no cost to Subtenant, perform restoration work related to the stairwell between the fifth (5th) floor and sixth (6th) floor, and in such event, Sublandlord will provide notice to Subtenant and use reasonable efforts to minimize any disruption to Subtenant’s business operations; Subtenant will reasonably cooperate with Sublandlord’s stairway work. Additionally, Sublandlord and Subtenant will mutually cooperate during the performance of any such work to limit access from the sixth (6th) floor to the fifth (5th) floor, including cooperating to establish access procedures to be followed by Sublandlord’s vendors who need access to the fifth (5th) floor in order to perform such work. Access from the sixth (6th) floor to the fifth (5th) floor shall be limited to only that which is necessary to conduct the stairway work and such access shall be completely prohibited upon completion of the stairway work, and all work and procedures that may reasonably be required to effectuate such limitation on access shall be at Sublandlord’s sole cost and expense. In making and executing this Sublease, Subtenant has relied solely on such investigations, examinations and inspections as Subtenant has chosen to make or has made and has not relied on any representation or warranty

14

concerning the Subleased Premises or the Building, except as expressly set forth in this Sublease. Subtenant acknowledges that Sublandlord has afforded Subtenant the opportunity for full and complete investigations, examinations and inspections of the Subleased Premises and the common areas of the Building. Subtenant acknowledges that it is not authorized to make or do any alterations or improvements in or to the Subleased Premises except as permitted by the provisions of this Sublease and the Master Lease and that upon termination of this Sublease, Subtenant shall deliver the Subleased Premises to Sublandlord in the same condition as the Subleased Premises were at the commencement of the Term, reasonable wear and tear, casualty and condemnation excepted; Subtenant acknowledges that Subtenant shall, at either Sublandlord’s election (to be made, if at all, concurrently with Sublandlord’s approval of any applicable Subtenant Improvements (defined below) or Landlord’s election), remove from the Subleased Premises some or all of the Subtenant Improvements constructed therein by Subtenant. Additionally, at Subtenant’s cost, Subtenant will remove all telecommunications and data cabling installed by or for the benefit of Subtenant. Sublandlord acknowledges that Subtenant intends to construct or install eight (8) modular, demountable private offices in the Subleased Premises (the “Modular Offices”); Sublandlord’s consent to the installation of Modular Offices will not be unreasonably withheld.

(b) Subtenant’s Improvements.

(i) Generally. If Subtenant desires to construct improvements within the Subleased Premises (“Subtenant Improvements”), all Subtenant Improvements will be carried out in accordance with the applicable provisions of the Master Lease and Landlord’s then-current construction guidelines. Sublandlord will have the right to reasonably approve the plans, specifications and contractor submittals for any proposed Subtenant Improvements, as well as any architects/designers and contractors whom Subtenant proposes to retain to perform such work. Subtenant will submit all such information for Sublandlord’s review and written approval prior to commencement of any such work; Sublandlord will similarly submit such information to Landlord for review and approval. Subtenant will bear all costs imposed by Landlord under the Master Lease, as well as all reasonable costs incurred by Sublandlord, in connection with any Subtenant Improvements. Promptly following the completion of any Subtenant Improvements or subsequent alterations or additions by or on behalf of Subtenant, Subtenant will deliver to Sublandlord two (2) sets of reproducible “as built” drawings of such work, together with a CAD file of the “as-built” drawings meeting Sublandlord’s (CAD Format Requirements (defined below). Subtenant acknowledges that it is not authorized to make or perform any alterations or improvements in or to the Subleased Premises except as permitted by the provisions of this Sublease and the Master Lease and that upon termination of this Sublease, Subtenant may be obligated to remove from the Subleased Premises any Alterations. Subtenant expressly acknowledges that, in addition to Landlord’s rights under the Master Lease, Sublandlord will have the right to require that Subtenant remove any Subtenant Improvement constructed by or on behalf of Subtenant on or before the date of expiration or sooner termination of this Sublease; for the purposes of this sentence, the provisions of Section 10.4 of the Original Master Lease restricting removal obligations to “Specialty Alterations” (as defined in the Original Master Lease) constructed therein by Subtenant will not be deemed to limit Sublandlord’s right to require removal of any Subtenant Improvements, in being acknowledged that Subtenant will be required to remove any Subtenant Improvements (and restore the applicable area(s) to its (their) condition existing prior to the installation of such Subtenant

15

Improvements) if so elected (a) by Landlord pursuant to the terms of the Master Lease or (b) by Sublandlord. Notwithstanding the foregoing, (x) Sublandlord agrees that if Subtenant expressly requests Sublandlord’s determination as to whether any Subtenant Improvement(s) will be required to be removed at the expiration or sooner termination of this Sublease (specifically referencing this Section 14(b)(i)), at Subtenant’s written request for the consent to such Subtenant Improvement(s), Sublandlord will make its determination concurrently with Sublandlord’s approval of such Subtenant Improvement(s) (assuming that such Subtenant Improvement(s) is approved by Sublandlord) and (y) in no event will Subtenant be obligated to remove any improvements existing in the Subleased Premises as of the date that Sublandlord delivers the Subleased Premises to Subtenant. As used herein, “Sublandlord’s CAD Format Requirements” shall mean, as of the Effective Date (but subject to subsequent adjustment) (a) the version is no later than current Autodesk version of AutoCAD plus the most recent release version, (b) files must be unlocked and fully accessible (no “cad-lock”, read-only, password protected or “signature” files), (c) files must be in “dwg” format, and (d) if the data was electronically in a non-Autodesk product, then files must be converted into “dwg” files when given to Sublandlord.

(ii) Code-Required Work. If the performance of any Subtenant Improvements or other work by Subtenant within the Subleased Premises “triggers” a requirement for code-related upgrades to or improvements of any portion of the Building, Subtenant shall be responsible for the cost of such code-required upgrade or improvements.

15. Holding Over. If Subtenant fails to surrender the Subleased Premises at the expiration or earlier termination of this Sublease, occupancy of the Subleased Premises after the termination or expiration shall be that of a tenancy at sufferance. Subtenant’s occupancy of the Subleased Premises during the holdover shall be subject to all the terms and provisions of this Sublease and Subtenant shall pay an amount equal to 150% of the sum of the Base Rent due for the period immediately preceding the holdover. No holdover by Subtenant or payment by Subtenant after the expiration or early termination of this Sublease shall be construed to extend the Term or prevent Sublandlord from immediate recovery of possession of the Subleased Premises by summary proceedings or otherwise. In addition to the payment of the amounts provided above, if Sublandlord is unable to deliver possession of the Subleased Premises to a new subtenant or to Landlord, as the case may be, or to perform improvements for a new subtenant, as a result of Subtenant’s holdover, Subtenant shall be liable to Sublandlord for all damages, including, without limitation, consequential damages, that Sublandlord suffers from the holdover; Subtenant expressly acknowledges that such damages may include all of the holdover rent charged by Landlord under the Master Lease as a result of Subtenant’s holdover, which Master Lease holdover rent may apply to the entire Master Lease Premises.

16. Parking. During the Term, Subtenant shall have the right, but not the obligation, to initially use up to sixteen (16) of the parking spaces allocated to Sublandlord pursuant to the Master Lease and Subtenant will be responsible for the current monthly rate charged by Landlord or Landlord’s parking garage operator (without any mark-up by Sublandlord) for such spaces that Subtenant elects to lease, as additional Rent. If and to the extent that Subtenant does not initially use any of said sixteen (16) spaces, but subsequently desires to use some or all of those spaces which Subtenant did not initially use, Sublandlord will use reasonable efforts, at Subtenant’s sole cost, to assist Subtenant in obtaining the rights to such spaces, but Sublandlord

16

does not guaranty that such spaces will be available, and Sublandlord will have no liability for any lack of availability of such spaces, Subtenant expressly acknowledges that Subtenant will be required to pay Landlord or Landlord’s parking garage operator for any such spaces which Subtenant initially elects to use prior to the commencement of Subtenant’s obligation to pay Base Rent hereunder.

17. Notices: Any notice by either party to the other required, permitted or provided for herein shall be valid only if in writing and shall be deemed to be duly given only if (a) delivered personally, or (b) sent by means of Federal Express, UPS Next Day Air or another reputable express mail delivery service guaranteeing next day delivery, or (c) sent by United States certified or registered mail, return receipt requested, addressed: (i) if to Sublandlord, at the following addresses:

| Twitter, Inc. | ||

| 1355 Market Street, Suite 900 | ||

| San Francisco, California 94103 | ||

| Attn: Legal Department | ||

| with a copy to: | ||

| Twitter, Inc. | ||

| 1355 Market Street, Suite 900 | ||

| San Francisco, California 94103 | ||

| Attn: Head of Real Estate Workplace | ||

| and with a copy to: | ||

| Shartsis Friese LLP | ||

| One Maritime Plaza, 18th Floor | ||

| San Francisco, California 94111 | ||

| Attn: Jonathan M. Kennedy and | ||

| Kathleen K. Bryski | ||

| and (ii) if to Subtenant, at the following addresses: | ||

| Prior to the Commencement Date: | 161 First Street, Suite 3A | |

| Cambridge, MA 02142 | ||

| Attn: General Counsel | ||

| From and after the Commencement Date: | 141 Portland Street, 5th Fl. | |

| Cambridge, MA 02139 | ||

| Attn: General Counsel | ||

or at such other address for either party as that party may designate by notice to the other. A notice shall be deemed given and effective, if delivered personally, upon hand delivery thereof (unless such delivery takes place after hours or on a holiday or weekend, in which event the notice shall be deemed given on the next succeeding business day), if sent via overnight courier, on the business day next succeeding delivery to the courier, and if mailed by United States certified or registered mail, three (3) business days following such mailing in accordance with this Section.

17

18. Furniture. During the Term, at no charge to Subtenant, Subtenant shall be permitted to use the existing furniture located in the Subleased Premises and described in more particular detail in Exhibit C attached hereto, as well as all equipment and data cabling associated therewith (the “Furniture”). Subtenant shall accept the Furniture in its current condition without any warranty of fitness from Sublandlord (Subtenant expressly acknowledges that no warranty is made by Sublandlord with respect to the condition of any cabling currently located in or serving the Subleased Premises). For purposes of documenting the current condition of the Furniture, Subtenant and Sublandlord shall, prior to the Commencement Date, conduct a joint walk-through of the Subleased Premises in order to inventory items of damage or disrepair. Subtenant shall use the Furniture only for the purposes for which such Furniture is intended and shall be responsible for the proper maintenance, insurance, care and repair of the Furniture, at Subtenant’s sole cost and expense, using maintenance contractors specified by Sublandlord. Subtenant shall not modify, reconfigure or relocate any of the Furniture except with the advance written permission of Sublandlord, and any work of modifying any Furniture (including, without limitation, changing the configuration of, “breaking down” or reassembly of cubicles or other modular furniture) shall be performed at Subtenant’s sole cost using Sublandlord’s specified vendors or an alternate vendor approved in writing by Sublandlord (such approval to be granted or withheld on Sublandlord’s good faith discretion, based upon Sublandlord’s assessment of factors which include, without limitation, whether the performance by such vendor will void applicable warranties for such Furniture and whether such vendor is sufficiently experienced in the design of such Furniture). No item of Furniture shall be removed from the Subleased Premises without Sublandlord’s prior written consent. Prior to or promptly following the expiration or earlier termination of the Sublease, Sublandlord and Subtenant shall conduct a joint walk-through of the Subleased Premises to catalog any items of damage, disrepair, misuse or loss among the Furniture (reasonable wear and tear excepted), and Subtenant shall be responsible, at Subtenant’s sole cost and expense, for curing any such items (including, with respect to loss, replacing any lost item with a substantially similar new item reasonably acceptable to Sublandlord).

19. Signage. Subtenant shall be entitled to Building-standard lobby directory signage (to be initially installed at Sublandlord’s sole cost and expense, provided that any changes requested by Subtenant shall be at Subtenant’s sole cost and expense consistent with Landlord’s signage program). Any Subtenant installed signage will be removed at the end of the Term at Subtenant’s sole cost.

20. Brokers. Subtenant represents that it has dealt directly with and only with Newmark Knight Frank (“Subtenant’s Broker”), as a broker in connection with this Sublease. Sublandlord represents that it has dealt directly with and only with CRESA (“Sublandlord’s Broker”), as a broker in connection with this Sublease. Sublandlord and Subtenant shall indemnify and hold each other harmless from all claims of any brokers other than Subtenant’s Broker and Sublandlord’s Broker claiming to have represented Sublandlord or Subtenant in connection with this Sublease. Subtenant and Sublandlord agree that Subtenant’s Broker and Sublandlord’s Broker shall be paid commissions by Sublandlord in connection with this Sublease pursuant to a separate agreement.

18

21. Complete Agreement. There are no representations, warranties, agreements, arrangements or understandings, oral or written, between the parties or their representatives relating to the subject matter of this Sublease which are not fully expressed in this Sublease. This Sublease cannot be changed or terminated nor may any of its provisions be waived orally or in any manner other than by a written agreement executed by both parties.

22. Confidentiality. Sublandlord and Subtenant acknowledge that the content of this Sublease and any related documents (including, without limitation, the terms and conditions of the Master Lease) are confidential information. Sublandlord and Subtenant shall keep such confidential information strictly confidential and shall not disclose such confidential information to any person or entity other than their respective financial, legal and space planning consultants, or their respective directors, officers, employees, attorneys, or accountants, to potential sub-subtenants (in the case of Subtenant), to Landlord and Landlord’s lenders (in the case of Sublandlord) and to potential assignees of the Master Lease or this Sublease, or to the extent that disclosure is mandated by applicable laws. Notwithstanding the foregoing, the restriction on disclosure described in this Section 21 will not apply with respect to (i) information which is or becomes generally available to the public other than as a result of a disclosure by a party hereto, or (ii) the inclusion by either party of a reference to this Sublease and/or information regarding the rent payable hereunder in such party’s financial statement(s) which are compiled in a normal course of such party’s business (and the subsequent submission of such financial statements to governmental authorities as required by applicable law and/or potential investors).

23. Interpretation. Irrespective of the place of execution or performance, this Sublease shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts. If any provision of this Sublease or the application thereof to any person or circumstance shall, for any reason and to any extent, be invalid or unenforceable, the remainder of this Sublease and the application of that provision to other persons or circumstances shall not be affected but rather shall be enforced to the extent permitted by law. The table of contents, captions, headings and titles, if any, in this Sublease are solely for convenience of reference and shall not affect its interpretation. This Sublease shall be construed without regard to any presumption or other rule requiring construction against the party causing this Sublease or any part thereof to be drafted. If any words or phrases in this Sublease shall have been stricken out or otherwise eliminated, whether or not any other words or phrases have been added, this Sublease shall be construed as if the words or phrases so stricken out or otherwise eliminated were never included in this Sublease and no implication or inference shall be drawn from the fact that said words or phrases were so stricken out or otherwise eliminated. Each covenant, agreement, obligation or other provision of this Sublease shall be deemed and construed as a separate and independent covenant of the party bound by, undertaking or making same, not dependent on any other provision of this Sublease unless otherwise expressly provided. All terms and words used in this Sublease, regardless of the number or gender in which they are used, shall be deemed to include any other number and any other gender as the context may require. The word “person” as used in this Sublease shall mean a natural person or persons, a partnership, a corporation or any other form of business or legal association or entity.

24. USA Patriot Act Disclosures. Subtenant is currently in compliance with and shall at all times during the Term remain in compliance with the regulations of the Office of Foreign Asset Control (“OFAC”) of the Department of the Treasury (including those named on OFAC’s Specially Designated and Blocked Persons List) and any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action relating thereto.

19

25. Counterparts. This Sublease may be executed in multiple counterparts, each of which is deemed an original but which together constitute one and the same instrument. This Sublease shall be fully executed when each party whose signature is required has signed and delivered to each of the parties at least one counterpart, even though no single counterpart contains the signatures of all of the parties hereto. This Sublease may be executed in so-called “pdf” format and each party has the right to rely upon a pdf counterpart of this Sublease signed by the other party to the same extent as if such party had received an original counterpart.

26. Landlord Consent, Notwithstanding anything to the contrary contained in this Sublease, this Sublease is subject to and contingent upon Landlord’s written consent to this Sublease in accordance with the Master Lease (the “Consent”), which Sublandlord shall attempt to obtain with commercially reasonable diligence, at its sole cost and expense, by no later than January 22, 2018. Sublandlord acknowledges that Subtenant may decline to execute any proposed Consent, and at Subtenant’s option, the Consent shall be deemed not to have been delivered, in which Landlord does not (1) conceptually consent (subject to final review and approval of the specific plans therefor) to the installation by Subtenant of (x) Subtenant’s proposed security system as described in Section 5(d) above and (y) the Modular Offices in accordance with Section 14(b)(i) (2) approve of the Term of this Sublease as it may be extended in accordance with Section 2(a) above and (3) inform Subtenant if the Modular Offices will need to be removed at the end of the Term of this Sublease. If a fully executed Consent is not delivered by Landlord, or is deemed not to have been delivered in accordance with this Section 26 above (a “Deemed Consent Failure”), by January 31, 2018, then either party hereto will have the right to terminate this Sublease by providing written notice to the other any time prior to the delivery by Landlord to Sublandlord and Subtenant of a fully executed Consent (provided, however, that Sublandlord’s ability to terminate this Sublease pursuant to the provisions of this sentence shall be conditioned upon Sublandlord having used diligent good faith efforts to obtain the Consent from Landlord) and, upon such termination, this Sublease shall automatically become null and void and of no further force and effect and Sublandlord and Subtenant shall have no further obligations or liabilities hereunder. Notwithstanding anything to the contrary contained herein, Sublandlord shall not have the right to terminate this Sublease in accordance with this Section 26 in the event of a Deemed Consent Failure.

[Remainder of Page Intentionally Left Blank.]

20

IN WITNESS WHEREOF, the parties hereto hereby execute this Sublease as of the Effective Date.

| SUBLANDLORD: | TWITTER, INC., | |

| a Delaware corporation |

| By: | /s/ Ned Segal | |

| Print Name: | Ned Segal | |

| Title: | CFO | |

| SUBTENANT: | SOLID BIOSCIENCES, LLC, | |

| a Delaware limited liability company |

| By: | /s/ Ilan Ganot | |

| Print Name: | Ilan Ganot | |

| Title: | CEO | |

21

EXHIBIT A

Subleased Premises

This plan represents a depiction of the location of the subject space but not a representation of the size or location of specific improvements or features of such space (such as, by way of example, furniture doors and interior walls).

1

EXHIBIT B

Commencement Date Agreement

| Date | ||||

| Subtenant | Solid Biosciences, LLC |

|||

| Address | ||||

| Re: | Commencement Date Letter Agreement with respect to that certain Sublease dated as of , 2018, by and between TWITTER, INC., a Delaware corporation, as Sublandlord, and SOLID BIOSCIENCES, LLC, a Delaware limited liability company, as Subtenant, for 15,877 rentable square feet on the 5th floor of the Building located at 141 Portland Street, Cambridge, Massachusetts. |

Dear :

In accordance with the terms and conditions of the above referenced Sublease, Subtenant accepts possession of the Subleased Premises and agrees:

| 1. | The Commencement Date is , 2018; |

| 2. | The Rent Commencement Date is , 2018; and |

| 3. | The Expiration Date is , 20 . |

Please acknowledge your acceptance of possession and agreement to the terms set forth above by signing this Commencement Letter in the space provided and returning a fully executed counterpart (a scanned signature sent in PDF or similar format to @twitter.com will suffice) to my attention.

| Sincerely, |

|

|

| Sublandlord Authorized Signatory |

| Agreed and Accepted: |

| Subtenant: | SOLID BIOSCIENCES, LLC | |

| By: | [EXHIBIT — DO NOT SIGN] | |

| Name: | ||

| Title: | ||

| Date: | ||

1

EXHIBIT C

Furniture

1

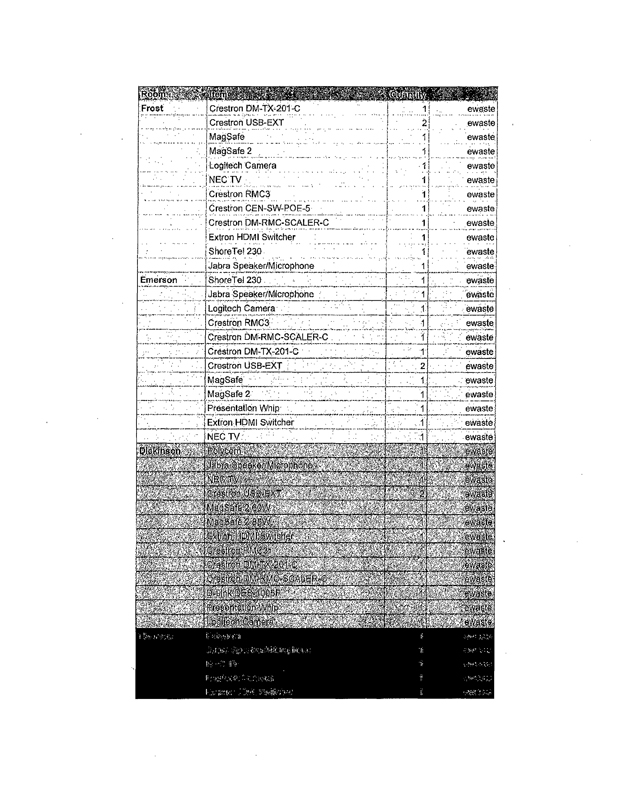

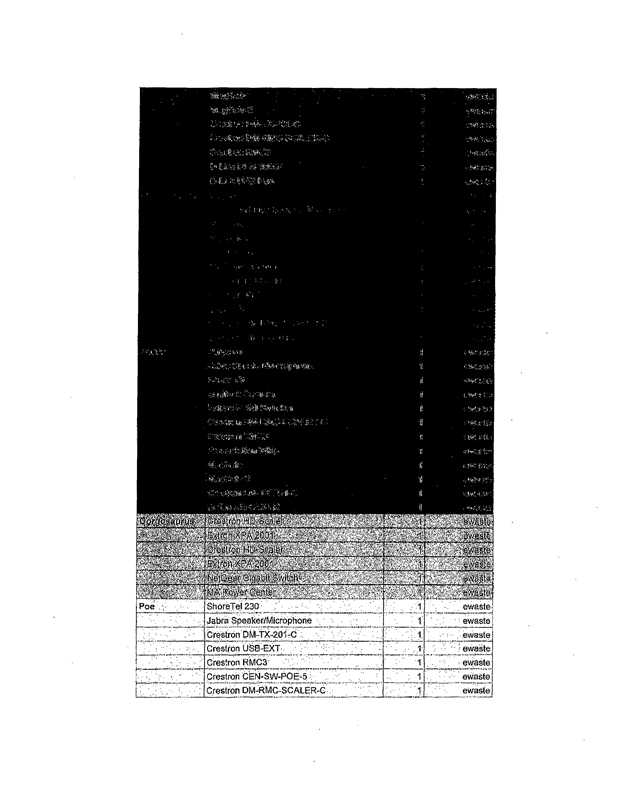

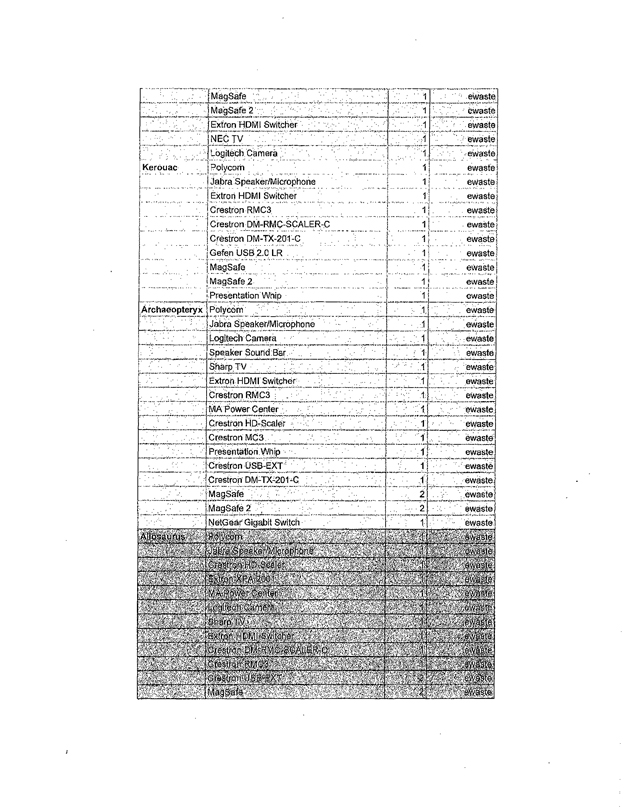

| Furniture |

Quantity | |||

| OVERALL |

||||

| Desk Chair |

130 | |||

| Pedestal Filing Cabinet |

102 | |||

| Credenza |

13 | |||

| Grey Upholstered Chair |

26 | |||

| Wood Cube Side Table |

2 | |||

| High Top Table |

2 | |||

| High Top Stool |

8 | |||

| Height Adjustable Desk |

22 | |||

| Metal Stool |

2 | |||

| Mobile White Board (A) |

7 | |||

| Wood Octagon Side Table |

4 | |||

| Coat Rack |

3 | |||

| Micro Kitchen Stool |

5 | |||

| Puzzle Wood Cube |

2 | |||

| Rectangle Wood Side Table |

2 | |||

| Book Shelf |

1 | |||

| Filing Cabinet |

1 | |||

| Ping Pong Table |

1 | |||

| Mobile White Board (B) |

1 | |||

| Conference Room Side Table |

2 | |||

| Round Conference Table (A) |

3 | |||

| Conference Chair |

30 | |||

| Round Conference Table (B) |

2 | |||

| Board Room Table |

1 | |||

| Board Room Chair |

12 | |||

| Wood Credenza |

1 | |||

| Upholstered Sofa |

1 | |||

| Grey Conference Chair |

20 | |||

| Long White table (A) |

1 | |||

| Long White Table (B) |

1 | |||

| Merchandiser Refrigerator |

1 | |||

| Standard Refrigerator |

1 | |||

| Kegerator |

1 | |||

| Dishwasher |

1 | |||

| Water/Ice Machine |

1 | |||

| Microwave |

2 | |||

| Shelving Wall Unit |

2 | |||

| Free Standing Table |

1 | |||

| TV Rack |

1 | |||

| AV Rack |

2 | |||

| Conf Large Credenza |

1 | |||

| ITEMIZED |

||||

| Conference Room 509 |

||||

| Wood Side Table |

1 | |||

| Conference Room 506 |

||||

| Round Conference Table (A) |

1 | |||

| Conference Chairs |

7 | |||

| Conference Room 505 |

||||

| Round Conference Table (A) |

1 | |||

| Conference Chairs |

7 | |||

| Conference Room 522 |

||||

| Round Conference Table (B) |

1 | |||

| Conference Chairs |

5 | |||

| Conference Room 524 |

||||

| Board Room Table |

1 | |||

| Board Room Chairs |

12 | |||

| Wood Credenza |

1 | |||

| Conference Room 527 |

||||

| Round Conference Table (A) |

1 | |||

| Conference Chairs |

7 | |||

| Conference Room 525 |

||||

| Conference Room 520 |

||||

| Wood Side Table |

1 | |||

| Upholstered Sofa |

1 | |||

| Conference Room 519 |

||||

| Round Conference Table (B) |

1 | |||

| Conference Chairs |

4 | |||

| Conference Room 518 |

||||

| Long White Table (A) |

1 | |||

| Grey Conference Chairs |

10 | |||

| Conference Room 514 |

||||

| Long White Table (B) |

1 | |||

| Grey Conference Chairs |

10 |

| Women’s Restroom |

||

| Shelving Wall Unit |

1 | |

| Men’s Restroom |

||

| Shelving Wall Unit |

1 | |

| Micro Kitchen |

||

| Merchandiser Refrigerator |

1 | |

| Standard Refrigerator |

1 | |

| Kegerator |

1 | |

| Dishwasher |

1 | |

| Water/Ice Machine |

1 | |

| Microwave |

2 | |

| Micro Kitchen Stool |

5 | |

| IT Help Desk |

||

| IDF/Lab Room |

Item Quantity Description Desk Chair 130 Pedestal Filing Cabinet 102 Credenza 15 Grey Upholstered Chair 26

Wood Cube Side Table 2 High Top Table 2 High Top Stool 8 Height adjustable Desk 22 AV Rack 2

Mobile White Board (A) 7 Wood Octagon Side Table 4 Coat Rack 4 Micro Kitchen Stool 5 Puzzle Wood Cube 2 Rectangle Wood Side Table 2

Book Shelf 1 Filing Cabinet 1 Ping Pong Table 1 Mobile White Board (B) 1 Conference Room Side Table 2

Round Conference Table Conference (A) 3 Conference Chair 30 Round Conference Table(B) 2 Board Room Table 1 Board Room Chairs 12

Wood Credenza 1 Upholstered Sofa 1 Grey Conference Chairs 20 Long White Table (A) 1 Long White Table (B) 1 Shelving Wall Unit 2

Merchandiser Refrigerator 1 Standard Refrigerator 1 Kegerator 1 Dishwasher 1 Water/Ice Machine 1

Microwave 2 Free Standing Table 1 TV Stand 1 Conf. Rm Large Credenza 1

EXHIBIT D

Master Lease