Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CHOICE HOTELS INTERNATIONAL INC /DE | exhibit992whfsfinancials.htm |

| EX-99.1 - EXHIBIT 99.1 - CHOICE HOTELS INTERNATIONAL INC /DE | exhibit991proforma.htm |

| EX-23.1 - EXHIBIT 23.1 - CHOICE HOTELS INTERNATIONAL INC /DE | exhibit231.htm |

| 8-K - 8-K - CHOICE HOTELS INTERNATIONAL INC /DE | chh330188-k.htm |

Exhibit 99.3

CONDENSED INTERIM OPERATING UNIT

FINANCIAL STATEMENTS

WOODSPRING HOTELS FRANCHISE

SERVICES

September 30, 2017 and 2016

Contents

Page

CONDENSED INTERIM OPERATING UNIT FINANCIAL STATEMENTS

BALANCE SHEETS 1

STATEMENTS OF EARNINGS 3

STATEMENT OF OPERATING UNIT’S EQUITY (DEFICIT) 4

STATEMENTS OF CASH FLOWS 5

NOTES TO FINANCIAL STATEMENTS 6

1

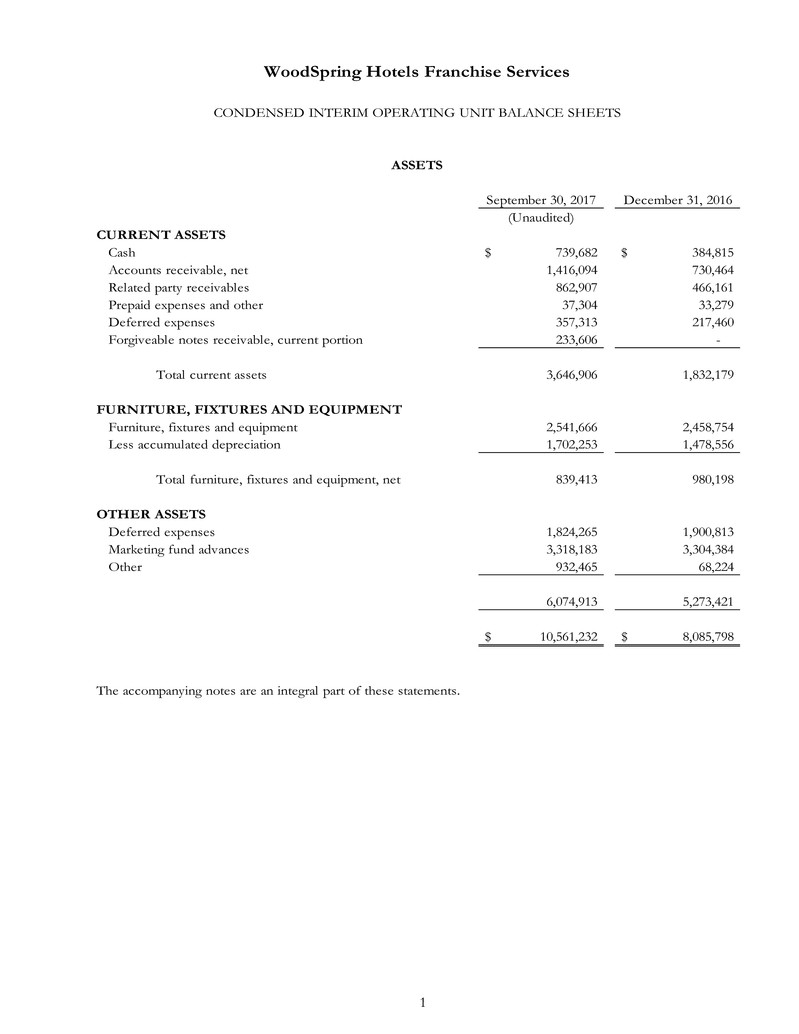

September 30, 2017 December 31, 2016

(Unaudited)

CURRENT ASSETS

Cash 739,682$ 384,815$

Accounts receivable, net 1,416,094 730,464

Related party receivables 862,907 466,161

Prepaid expenses and other 37,304 33,279

Deferred expenses 357,313 217,460

Forgiveable notes receivable, current portion 233,606 -

Total current assets 3,646,906 1,832,179

FURNITURE, FIXTURES AND EQUIPMENT

Furniture, fixtures and equipment 2,541,666 2,458,754

Less accumulated depreciation 1,702,253 1,478,556

Total furniture, fixtures and equipment, net 839,413 980,198

OTHER ASSETS

Deferred expenses 1,824,265 1,900,813

Marketing fund advances 3,318,183 3,304,384

Other 932,465 68,224

6,074,913 5,273,421

10,561,232$ 8,085,798$

The accompanying notes are an integral part of these statements.

WoodSpring Hotels Franchise Services

CONDENSED INTERIM OPERATING UNIT BALANCE SHEETS

ASSETS

2

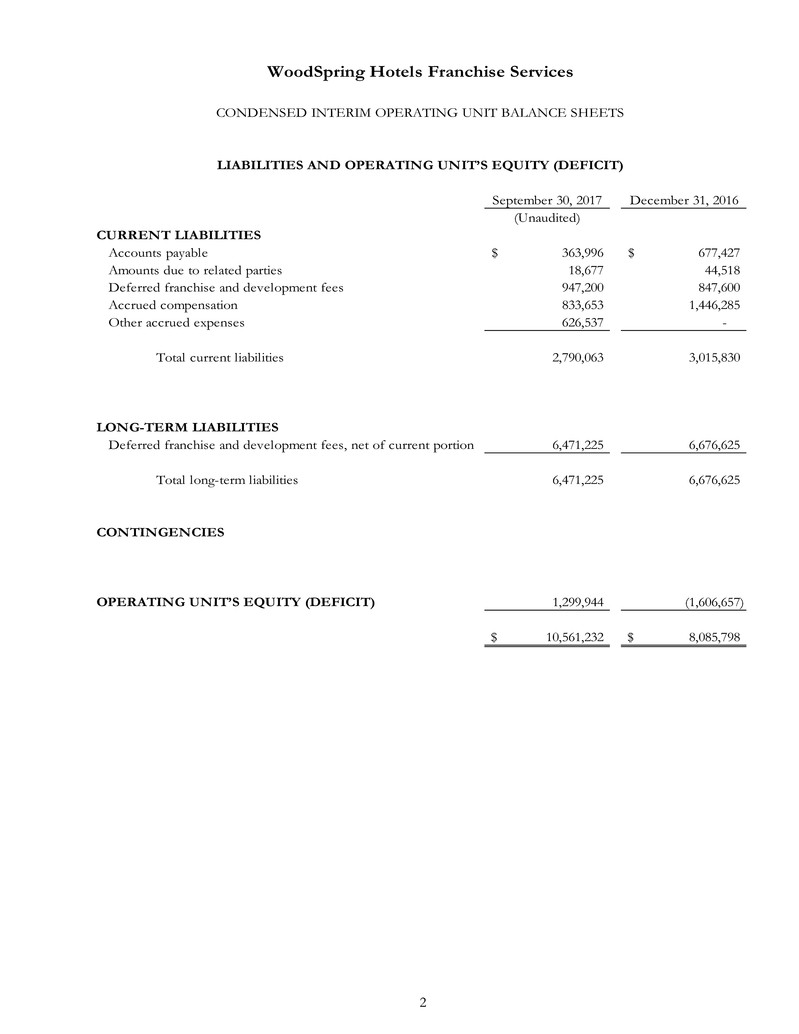

September 30, 2017 December 31, 2016

(Unaudited)

CURRENT LIABILITIES

Accounts payable 363,996$ 677,427$

Amounts due to related parties 18,677 44,518

Deferred franchise and development fees 947,200 847,600

Accrued compensation 833,653 1,446,285

Other accrued expenses 626,537 -

Total current liabilities 2,790,063 3,015,830

LONG-TERM LIABILITIES

Deferred franchise and development fees, net of current portion 6,471,225 6,676,625

Total long-term liabilities 6,471,225 6,676,625

CONTINGENCIES

OPERATING UNIT’S EQUITY (DEFICIT) 1,299,944 (1,606,657)

10,561,232$ 8,085,798$

LIABILITIES AND OPERATING UNIT’S EQUITY (DEFICIT)

WoodSpring Hotels Franchise Services

CONDENSED INTERIM OPERATING UNIT BALANCE SHEETS

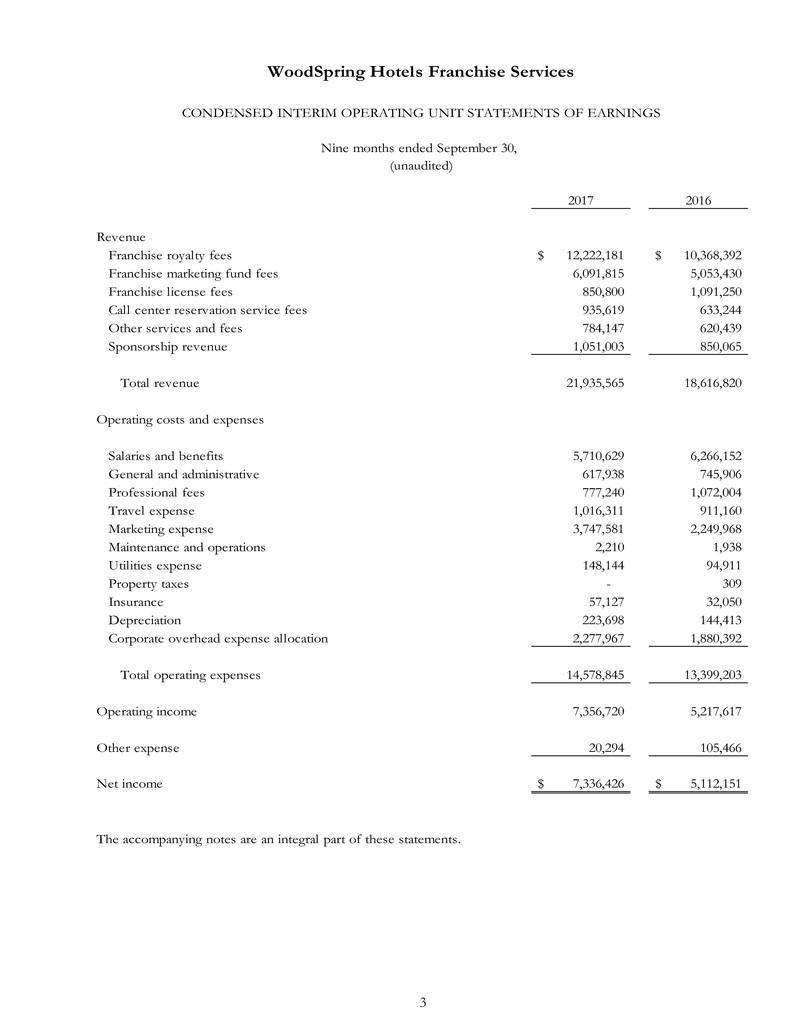

3

2017 2016

Revenue

Franchise royalty fees 12,222,181$ 10,368,392$

Franchise marketing fund fees 6,091,815 5,053,430

Franchise license fees 850,800 1,091,250

Call center reservation service fees 935,619 633,244

Other services and fees 784,147 620,439

Sponsorship revenue 1,051,003 850,065

Total revenue 21,935,565 18,616,820

Operating costs and expenses

Salaries and benefits 5,710,629 6,266,152

General and administrative 617,938 745,906

Professional fees 777,240 1,072,004

Travel expense 1,016,311 911,160

Marketing expense 3,747,581 2,249,968

Maintenance and operations 2,210 1,938

Utilities expense 148,144 94,911

Property taxes - 309

Insurance 57,127 32,050

Depreciation 223,698 144,413

Corporate overhead expense allocation 2,277,967 1,880,392

Total operating expenses 14,578,845 13,399,203

Operating income 7,356,720 5,217,617

Other expense 20,294 105,466

Net income 7,336,426$ 5,112,151$

The accompanying notes are an integral part of these statements.

(unaudited)

Nine months ended September 30,

WoodSpring Hotels Franchise Services

CONDENSED INTERIM OPERATING UNIT STATEMENTS OF EARNINGS

4

Balance January 1, 2017 (1,606,657)$

Contributions 990,000

Distributions (6,000,000)

Corporate overhead expense allocation settled via deemed contribution 2,277,967

Royalty fees from related parties settled via deemed distribution (1,697,792)

Net income for the period 7,336,426

Balance September 30, 2017 1,299,944$

The accompanying notes are an integral part of this statement.

(unaudited)

WoodSpring Hotels Franchise Services

CONDENSED INTERIM STATEMENT OF OPERATING UNIT’S EQUITY (DEFICIT)

Nine months ended September 30, 2017

5

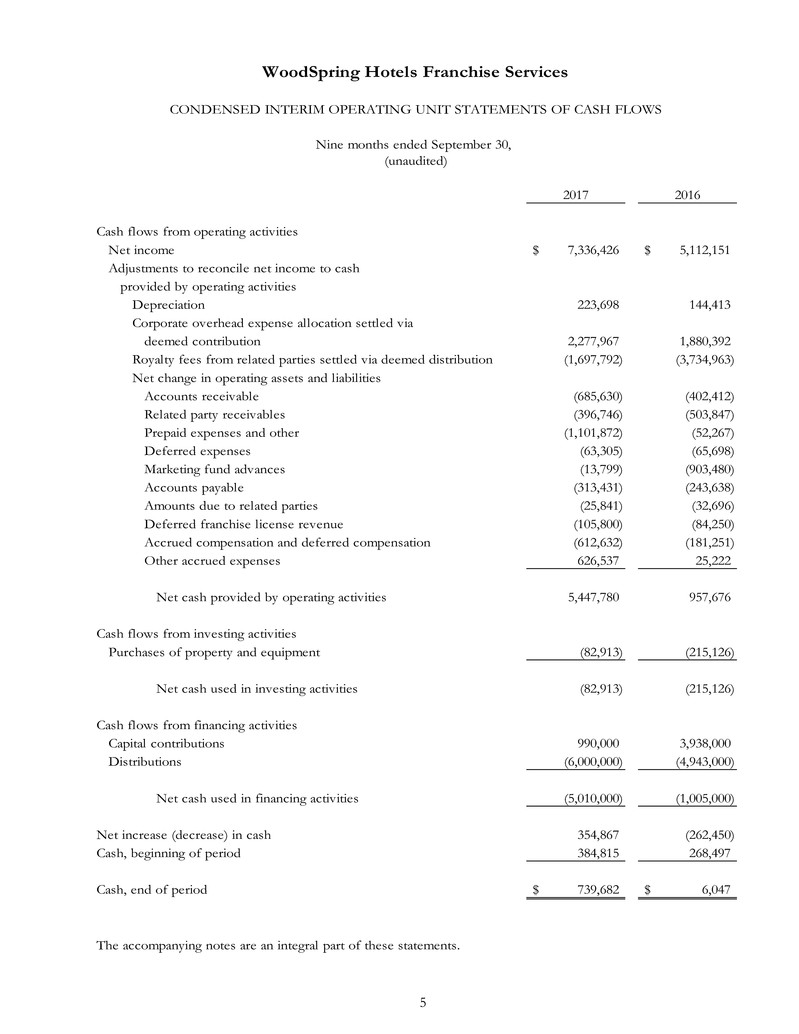

2017 2016

Cash flows from operating activities

Net income 7,336,426$ 5,112,151$

Adjustments to reconcile net income to cash

provided by operating activities

Depreciation 223,698 144,413

Corporate overhead expense allocation settled via

deemed contribution 2,277,967 1,880,392

Royalty fees from related parties settled via deemed distribution (1,697,792) (3,734,963)

Net change in operating assets and liabilities

Accounts receivable (685,630) (402,412)

Related party receivables (396,746) (503,847)

Prepaid expenses and other (1,101,872) (52,267)

Deferred expenses (63,305) (65,698)

Marketing fund advances (13,799) (903,480)

Accounts payable (313,431) (243,638)

Amounts due to related parties (25,841) (32,696)

Deferred franchise license revenue (105,800) (84,250)

Accrued compensation and deferred compensation (612,632) (181,251)

Other accrued expenses 626,537 25,222

Net cash provided by operating activities 5,447,780 957,676

Cash flows from investing activities

Purchases of property and equipment (82,913) (215,126)

Net cash used in investing activities (82,913) (215,126)

Cash flows from financing activities

Capital contributions 990,000 3,938,000

Distributions (6,000,000) (4,943,000)

Net cash used in financing activities (5,010,000) (1,005,000)

Net increase (decrease) in cash 354,867 (262,450)

Cash, beginning of period 384,815 268,497

Cash, end of period 739,682$ 6,047$

The accompanying notes are an integral part of these statements.

(unaudited)

WoodSpring Hotels Franchise Services

CONDENSED INTERIM OPERATING UNIT STATEMENTS OF CASH FLOWS

Nine months ended September 30,

WoodSpring Hotels Franchise Services

NOTES TO CONDENSED INTERIM OPERATING UNIT FINANCIAL STATEMENTS

September 30, 2017 and 2016

(Unaudited)

6

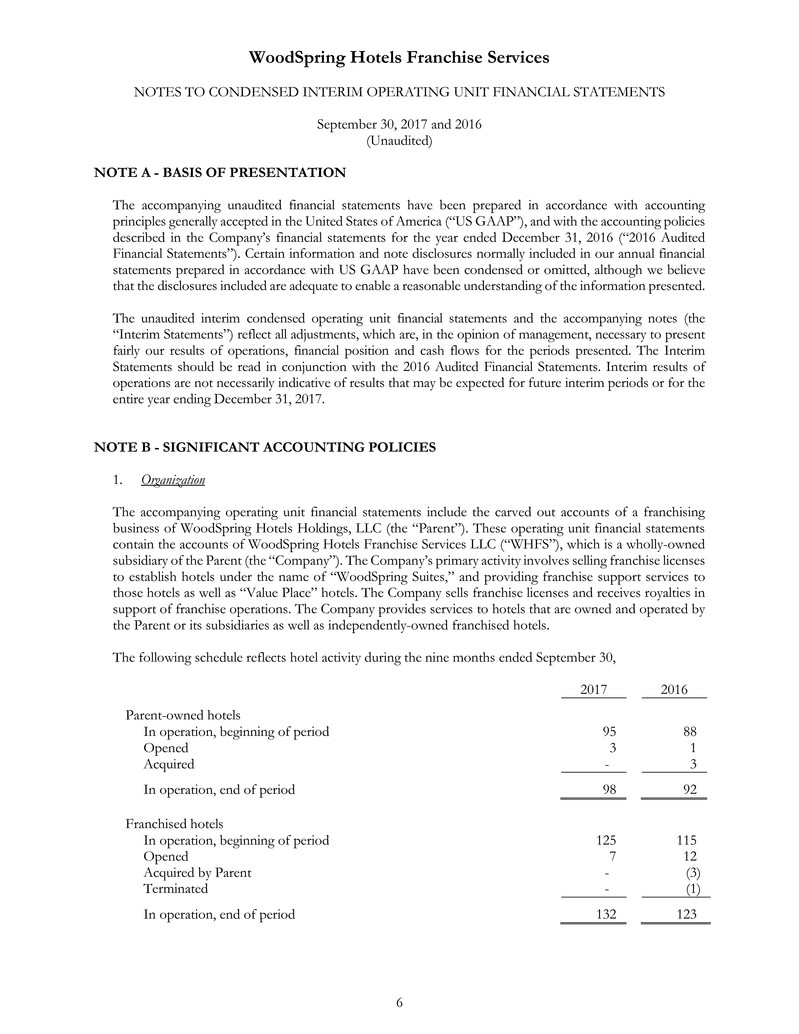

NOTE A - BASIS OF PRESENTATION

The accompanying unaudited financial statements have been prepared in accordance with accounting

principles generally accepted in the United States of America (“US GAAP”), and with the accounting policies

described in the Company’s financial statements for the year ended December 31, 2016 (“2016 Audited

Financial Statements”). Certain information and note disclosures normally included in our annual financial

statements prepared in accordance with US GAAP have been condensed or omitted, although we believe

that the disclosures included are adequate to enable a reasonable understanding of the information presented.

The unaudited interim condensed operating unit financial statements and the accompanying notes (the

“Interim Statements”) reflect all adjustments, which are, in the opinion of management, necessary to present

fairly our results of operations, financial position and cash flows for the periods presented. The Interim

Statements should be read in conjunction with the 2016 Audited Financial Statements. Interim results of

operations are not necessarily indicative of results that may be expected for future interim periods or for the

entire year ending December 31, 2017.

NOTE B - SIGNIFICANT ACCOUNTING POLICIES

1. Organization

The accompanying operating unit financial statements include the carved out accounts of a franchising

business of WoodSpring Hotels Holdings, LLC (the “Parent”). These operating unit financial statements

contain the accounts of WoodSpring Hotels Franchise Services LLC (“WHFS”), which is a wholly-owned

subsidiary of the Parent (the “Company”). The Company’s primary activity involves selling franchise licenses

to establish hotels under the name of “WoodSpring Suites,” and providing franchise support services to

those hotels as well as “Value Place” hotels. The Company sells franchise licenses and receives royalties in

support of franchise operations. The Company provides services to hotels that are owned and operated by

the Parent or its subsidiaries as well as independently-owned franchised hotels.

The following schedule reflects hotel activity during the nine months ended September 30,

2017 2016

Parent-owned hotels

In operation, beginning of period 95 88

Opened 3 1

Acquired - 3

In operation, end of period 98 92

Franchised hotels

In operation, beginning of period 125 115

Opened 7 12

Acquired by Parent - (3)

Terminated - (1)

In operation, end of period 132 123

WoodSpring Hotels Franchise Services

NOTES TO CONDENSED INTERIM OPERATING UNIT FINANCIAL STATEMENTS - CONTINUED

September 30, 2017 and 2016

(Unaudited)

7

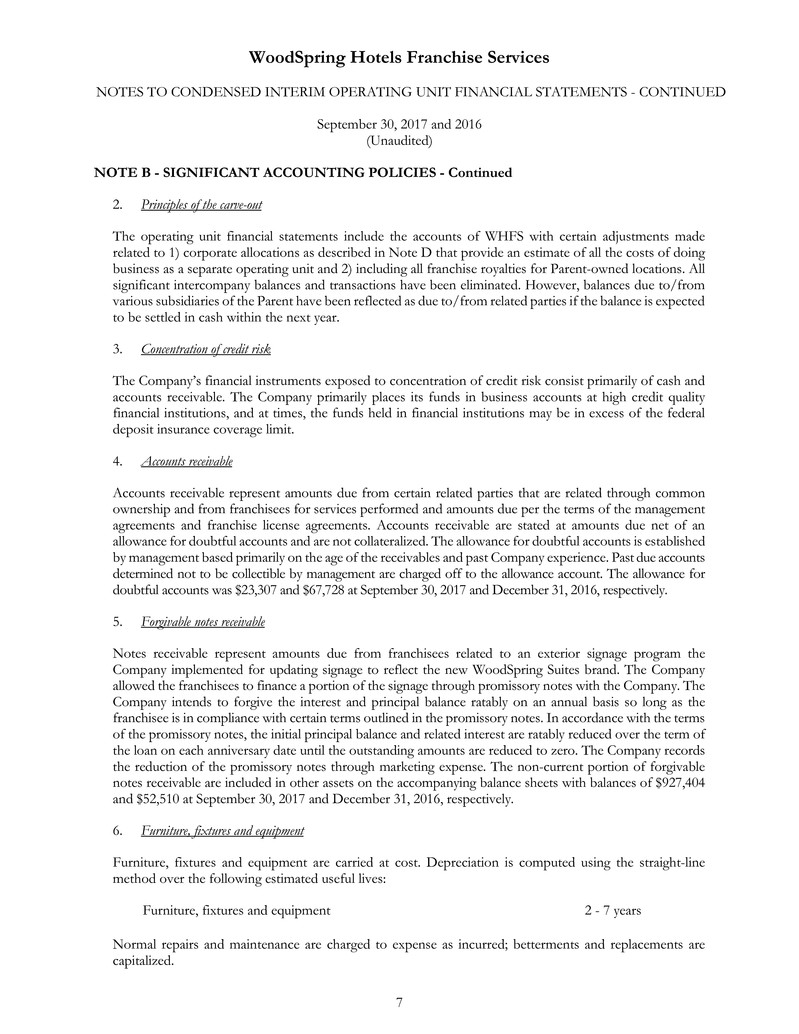

NOTE B - SIGNIFICANT ACCOUNTING POLICIES - Continued

2. Principles of the carve-out

The operating unit financial statements include the accounts of WHFS with certain adjustments made

related to 1) corporate allocations as described in Note D that provide an estimate of all the costs of doing

business as a separate operating unit and 2) including all franchise royalties for Parent-owned locations. All

significant intercompany balances and transactions have been eliminated. However, balances due to/from

various subsidiaries of the Parent have been reflected as due to/from related parties if the balance is expected

to be settled in cash within the next year.

3. Concentration of credit risk

The Company’s financial instruments exposed to concentration of credit risk consist primarily of cash and

accounts receivable. The Company primarily places its funds in business accounts at high credit quality

financial institutions, and at times, the funds held in financial institutions may be in excess of the federal

deposit insurance coverage limit.

4. Accounts receivable

Accounts receivable represent amounts due from certain related parties that are related through common

ownership and from franchisees for services performed and amounts due per the terms of the management

agreements and franchise license agreements. Accounts receivable are stated at amounts due net of an

allowance for doubtful accounts and are not collateralized. The allowance for doubtful accounts is established

by management based primarily on the age of the receivables and past Company experience. Past due accounts

determined not to be collectible by management are charged off to the allowance account. The allowance for

doubtful accounts was $23,307 and $67,728 at September 30, 2017 and December 31, 2016, respectively.

5. Forgivable notes receivable

Notes receivable represent amounts due from franchisees related to an exterior signage program the

Company implemented for updating signage to reflect the new WoodSpring Suites brand. The Company

allowed the franchisees to finance a portion of the signage through promissory notes with the Company. The

Company intends to forgive the interest and principal balance ratably on an annual basis so long as the

franchisee is in compliance with certain terms outlined in the promissory notes. In accordance with the terms

of the promissory notes, the initial principal balance and related interest are ratably reduced over the term of

the loan on each anniversary date until the outstanding amounts are reduced to zero. The Company records

the reduction of the promissory notes through marketing expense. The non-current portion of forgivable

notes receivable are included in other assets on the accompanying balance sheets with balances of $927,404

and $52,510 at September 30, 2017 and December 31, 2016, respectively.

6. Furniture, fixtures and equipment

Furniture, fixtures and equipment are carried at cost. Depreciation is computed using the straight-line

method over the following estimated useful lives:

Furniture, fixtures and equipment 2 - 7 years

Normal repairs and maintenance are charged to expense as incurred; betterments and replacements are

capitalized.

WoodSpring Hotels Franchise Services

NOTES TO CONDENSED INTERIM OPERATING UNIT FINANCIAL STATEMENTS - CONTINUED

September 30, 2017 and 2016

(Unaudited)

8

NOTE B - SIGNIFICANT ACCOUNTING POLICIES - Continued

7. Deferred expenses

Direct and incremental expenses incurred in the sale of initial franchise licenses are deferred along with the

related franchise license fees (see Note B8). The deferred expenses consist of commissions paid at the time

a franchise license is sold. Deferred expenses are recognized as an expense at the time the related fees are

recognized as income.

8. Revenue recognition

Initial franchise license fees received for sales of licenses to establish WoodSpring Suites hotels for

independently-owned operations are deferred and recognized as income when either (1) substantially all initial

services required by the license agreement have been performed which is considered to be the date the hotel

opens or (2) the licensee agreement is terminated as a result of the failure to open a new hotel in the time allowed

per the agreement. Continuing franchise royalty fees for hotels operated by both the Parent and independently-

owned operations are calculated based on 5% of room revenue and reported in operations when earned.

Franchise marketing fund fees for hotels operated by both the Parent and independently-owned operations are

calculated based on 2.5% of room revenue with a maximum fee per hotel of $40,000 and $30,000 for the nine

month periods ended September 30, 2017 and 2016, respectively. The franchise marketing fund fees are

reported in operations when earned. Other services such as call center reservation fees are recognized monthly

as services are provided. Sponsorship revenue is related to sponsor fees received from various vendors related

to the annual franchise conference. These fees are deferred until the conference occurs and recognized in

operations when the conference is held.

9. Advertising costs

Advertising costs are expensed as incurred. Advertising costs for the nine month periods ending September

30, 2017 and 2016 were $271,635 and $222,885, respectively.

10. Marketing fund

The Company maintains a marketing fund which is used by the Company for expenses associated with

providing marketing, advertising, central reservation systems and technology services for Parent owned and

independently franchised hotels. The Company is contractually obligated under its license agreements to spend

the marketing fund fees it collects, recorded as revenues in the statement of earnings, in accordance with the

franchise agreements. Marketing fund expenses incurred in excess of revenues related to independently-owned

franchised hotels are recorded as an asset, marketing fund advances, in the balance sheet with a corresponding

reduction in costs, and are expected to be recovered in subsequent years. Marketing fund fees not expended

in the current year are recorded as a liability in the Company’s balance sheet and carried over to the next fiscal

year or utilized to repay previous advances.

11. Income taxes

The accompanying financial statements do not include a provision for income taxes, with the exception of

certain state income taxes, because the Company is not a taxpaying entity. Each member includes their

proportionate share of the Company’s taxable income or loss in their individual tax returns.

WoodSpring Hotels Franchise Services

NOTES TO CONDENSED INTERIM OPERATING UNIT FINANCIAL STATEMENTS - CONTINUED

September 30, 2017 and 2016

(Unaudited)

9

NOTE B - SIGNIFICANT ACCOUNTING POLICIES - Continued

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not

that the tax position will be sustained on examination by the taxing authorities, based on the technical merits

of the position. The Company is generally no longer subject to examinations by income taxing authorities

before 2013. The Company records interest and penalties on tax assessments as other expense. As of

September 30, 2017, the Company does not have a liability for unrecognized tax benefits.

12. Fair value of financial instruments

The carrying amounts of the Company’s financial instruments, including cash, accounts receivable, accounts

payable, and accrued liabilities, approximate fair value due to the short-term nature of these instruments.

13. Use of estimates

In preparing the financial statements in conformity with accounting principles generally accepted in the United

States of America, management is required to make estimates and assumptions that affect the reported

amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ from those estimates.

14. New accounting standards

Accounting Standards Update No. 2014-09 – Revenue from Contracts with Customers (ASU No. 2014-09)

becomes effective January 1, 2019 for the Company. The Company is still evaluating the potential impact

of ASU No. 2014-09 on the financial statements and disclosures, but believes there will be significant impact

to the Company’s reported revenue relating primarily to initial franchise license fees.

NOTE C - RELATED PARTY TRANSACTIONS

The Company provides services to entities that are related through common ownership. These services

primarily relate to the Parent’s ownership of hotels that are licensed and managed by the Company.

Related party revenue for the nine month periods ended September 30, 2017 and 2016 follows:

2017 2016

Franchise royalty fees $ 5,194,809 $ 4,434,825

Franchise marketing fund fees 2,591,327 2,156,773

Call center reservation service fees 519,789 462,959

Other revenue and fees 245,581 160,099

The Company also has related party receivables that primarily relate to the December fees that are paid the

following month.

The Parent and its subsidiaries (including the Company) guarantee certain debt obligations related to

mortgages payable and construction notes payable, totaling $107,349,507 as of September 30, 2017. The

guarantees cover debt with maturity dates ranging from December 2017 to April 2038. The Parent is in

compliance with its debt covenants at September 30, 2017 (after obtaining a waiver from one lender), or the

bank has allowed for self-cure of any technical defaults.

WoodSpring Hotels Franchise Services

NOTES TO CONDENSED INTERIM OPERATING UNIT FINANCIAL STATEMENTS - CONTINUED

September 30, 2017 and 2016

(Unaudited)

10

NOTE D - CORPORATE ALLOCATIONS

While many of the Company’s expenses, including employee salaries, are directly recorded in the accounts

of the Company, the Parent provides certain corporate services and functions that are recorded by the

Parent with no allocation of the expense to the various subsidiaries that benefit from the services.

Management performed an allocation of these corporate overhead costs and the Company has reflected

that allocation in the accompanying financial statements. The corporate overhead allocation includes such

costs as executive compensation and benefits, support staff compensation and benefits, deferred

compensation costs, travel expense and professional fees. Management estimated the appropriate amount

to allocate based on their knowledge of how the Parent company executives and employees spent their time

supporting the Parent company and its subsidiaries in relation to their time spent supporting the business

needs related to the Company. The other allocated expenses were reviewed by management with judgement

to determine the appropriate amount to allocate to the Company based on their assessment of how much

the Company benefited from or utilized the associated service or function.

NOTE E - CONTINGENCIES

The Company is involved in claims and suits arising in the ordinary course of business. The Company is

vigorously defending its position related to the claims and suits against it and management believes the

litigation will not have a material effect on the financial statement of the Company. No accrual has been

recorded in the accompanying financial statements, as no amount of loss is considered more likely. The

Company is generally covered for the outstanding litigation with an insurance deductible of $100,000 per

claim.

NOTE F - SUBSEQUENT EVENTS

Effective December 15, 2017, WoodSpring Hotels Franchise Services LLC and the Parent signed a Unit

Purchase Agreement to sell the units of WoodSpring Hotels Franchise Services LLC for approximately

$231,250,000. The transaction is expected to close in early 2018.

The Company evaluated and disclosed subsequent events through December 15, 2017, which represents

the date the financial statements were available to be issued.