Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - II-VI INC | d553573dex991.htm |

| 8-K - FORM 8-K - II-VI INC | d553573d8k.htm |

INVESTOR PRESENTATION MARCH 2018 Exhibit 99.2

Safe Harbor Statement Matters discussed in this presentation may contain forward-looking statements that are subject to risks and uncertainties. These risks and uncertainties could cause the forward-looking statements and II-VI Incorporated’s (the “Company’s”) actual results to differ materially. In evaluating these forward-looking statements, you should specifically consider the “Risk Factors” in the Company’s most recent Form 10-K and Form 10-Q. Forward-looking statements are only estimates and actual events or results may differ materially. II-VI Incorporated disclaims any obligation to update information contained in any forward-looking statement. This presentation contains certain non-GAAP financial measures. Reconciliations of non-GAAP financial measures to their most comparable GAAP financial measures are presented at the end of this presentation.

Origins of Our Company Name Refers to groups II and VI of the Periodic Table of Elements. “TWO SIX” S Sulfur Se Selenium Zn Zinc Te Tellurium Cd Cadmium

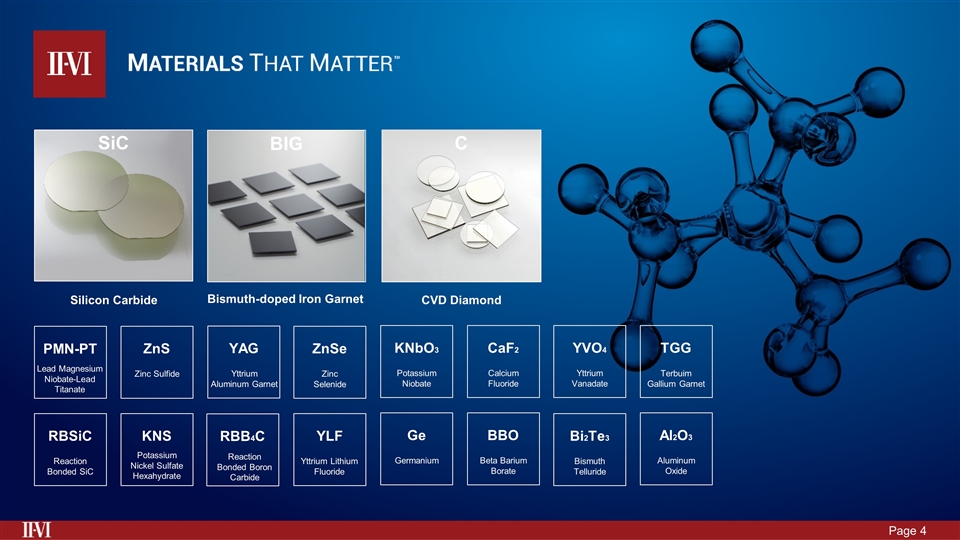

PMN-PT Lead Magnesium Niobate-Lead Titanate ZnS Zinc Sulfide ZnSe Zinc Selenide KNbO3 Potassium Niobate CaF2 Calcium Fluoride YVO4 Yttrium Vanadate TGG Terbuim Gallium Garnet YAG Yttrium Aluminum Garnet Bi2Te3 Bismuth Telluride RBSiC Reaction Bonded SiC KNS Potassium Nickel Sulfate Hexahydrate YLF Yttrium Lithium Fluoride Ge Germanium BBO Beta Barium Borate RBB4C Reaction Bonded Boron Carbide Al2O3 Aluminum Oxide SiC Silicon Carbide BIG Bismuth-doped Iron Garnet CVD Diamond C

Our Footprint 14 Countries 45 Worldwide Locations 10,000+ Worldwide employee World Headquarters Manufacturing and R&D Facilities Global Sales Offices North America Europe Asia 2,000+ 500+ 7,500+

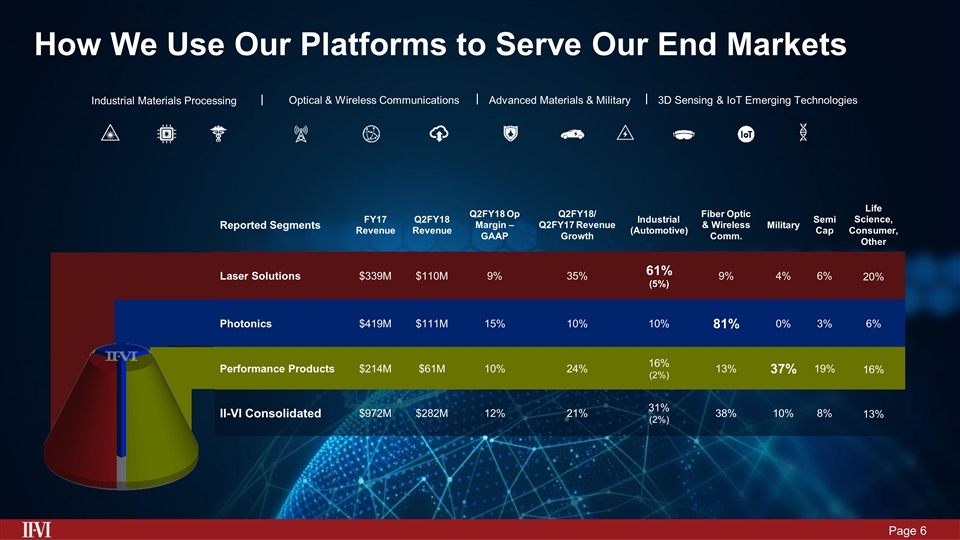

How We Use Our Platforms to Serve Our End Markets Industrial Materials Processing Optical & Wireless Communications Advanced Materials & Military 3D Sensing & IoT Emerging Technologies Reported Segments FY17 Revenue Q2FY18 Revenue Q2FY18 Op Margin – GAAP Q2FY18/ Q2FY17 Revenue Growth Industrial (Automotive) Fiber Optic & Wireless Comm. Military Semi Cap Life Science, Consumer, Other Laser Solutions $339M $110M 9% 35% 61% (5%) 9% 4% 6% 20% Photonics $419M $111M 15% 10% 10% 81% 0% 3% 6% Performance Products $214M $61M 10% 24% 16% (2%) 13% 37% 19% 16% II-VI Consolidated $972M $282M 12% 21% 31% (2%) 38% 10% 8% 13%

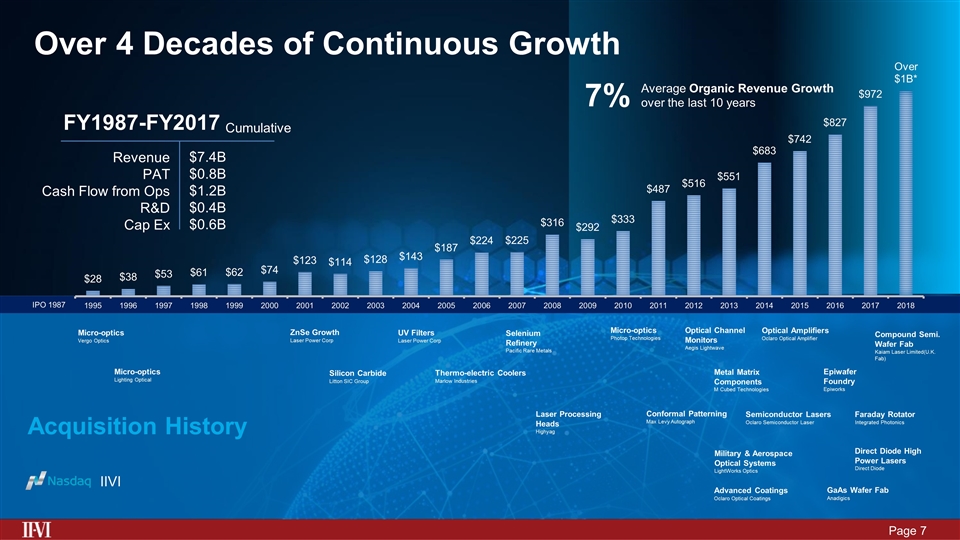

Over 4 Decades of Continuous Growth Micro-optics Vergo Optics Micro-optics Lighting Optical ZnSe Growth Laser Power Corp Silicon Carbide Litton SIC Group UV Filters Laser Power Corp Thermo-electric Coolers Marlow Industries Selenium Refinery Pacific Rare Metals Laser Processing Heads Highyag Micro-optics Photop Technologies Conformal Patterning Max Levy Autograph Optical Channel Monitors Aegis Lightwave Metal Matrix Components M Cubed Technologies Military & Aerospace Optical Systems LightWorks Optics Advanced Coatings Oclaro Optical Coatings Optical Amplifiers Oclaro Optical Amplifier Semiconductor Lasers Oclaro Semiconductor Laser Epiwafer Foundry Epiworks GaAs Wafer Fab Anadigics Compound Semi. Wafer Fab Kaiam Laser Limited(U.K. Fab) Faraday Rotator Integrated Photonics Direct Diode High Power Lasers Direct Diode IIVI IPO 1987 Acquisition History Average Organic Revenue Growth over the last 10 years 7% FY1987-FY2017 Revenue PAT Cash Flow from Ops R&D Cap Ex $7.4B $0.8B $1.2B $0.4B $0.6B Cumulative

Recent Platform Acquisitions COMPOUND SEMICONDUCTOR LASERS COMPOUND SEMICONDUCTOR DEVICES: AIMING BEYOND LASERS VERTICAL INTEGRATION & SCALE OPTICAL COMMUNICATIONS & ACCESS TO CHINA MARKET 2010 2013 2016 2017

Markets Differentiation Performance Infrastructure Business Model Products Diversified per Platforms Engineered Materials Valued By Customers Process Intensive Capital Intensive Vertical Integration Innovation Strategy

Sources of Growth New or Emerging Markets: Applications using Silicon Carbide (SiC) 3D Sensing EUV Core Markets: Industrial Materials Processing and increasing use of lasers Optical Communications Military especially in Intelligence and Surveillance

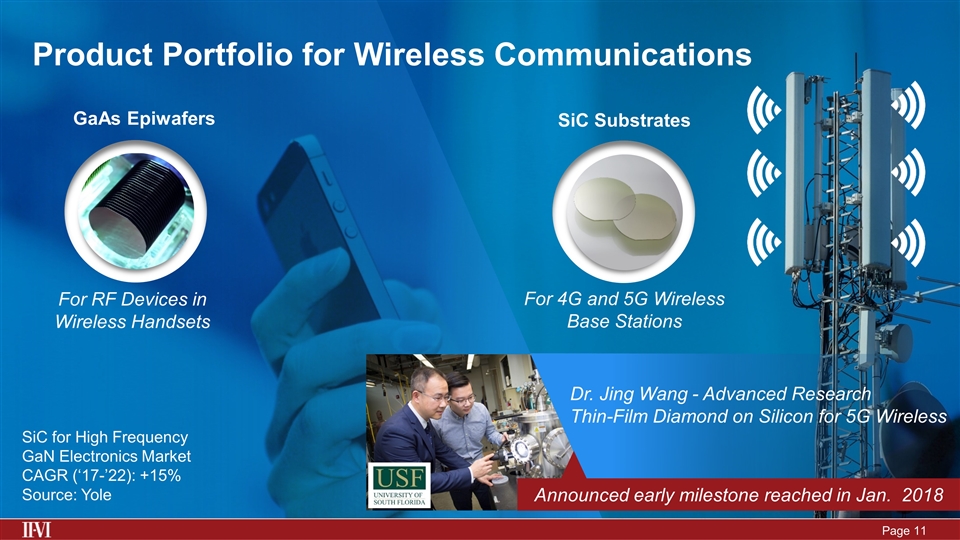

Product Portfolio for Wireless Communications SiC for High Frequency GaN Electronics Market CAGR (‘17-’22): +15% Source: Yole SiC Substrates GaAs Epiwafers For 4G and 5G Wireless Base Stations For RF Devices in Wireless Handsets Dr. Jing Wang - Advanced Research Thin-Film Diamond on Silicon for 5G Wireless Announced early milestone reached in Jan. 2018

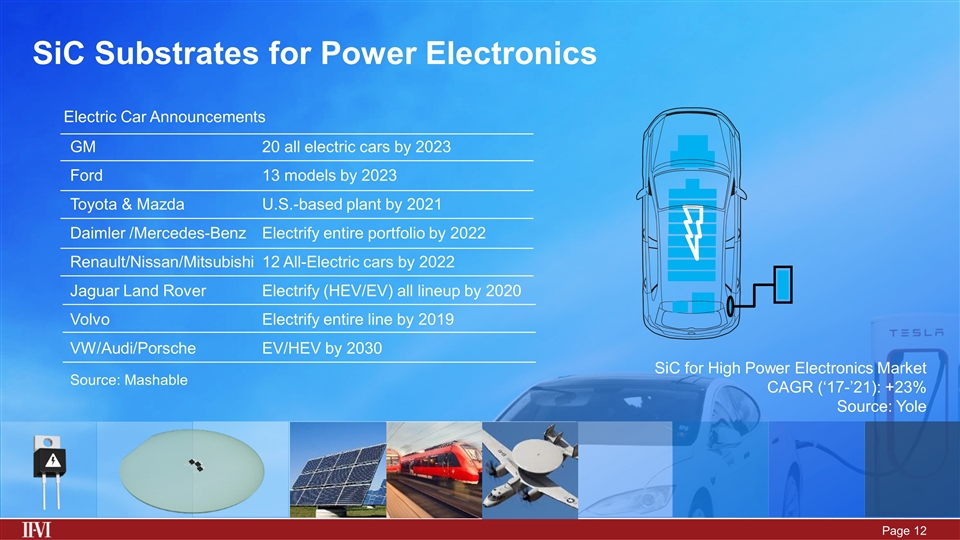

SiC Substrates for Power Electronics Electric Car Announcements GM20 all electric cars by 2023 Ford13 models by 2023 Toyota & MazdaU.S.-based plant by 2021 Daimler /Mercedes-BenzElectrify entire portfolio by 2022 Renault/Nissan/Mitsubishi12 All-Electric cars by 2022 Jaguar Land Rover Electrify (HEV/EV) all lineup by 2020 VolvoElectrify entire line by 2019 VW/Audi/PorscheEV/HEV by 2030 SiC for High Power Electronics Market CAGR (‘17-’21): +23% Source: Yole Source: Mashable

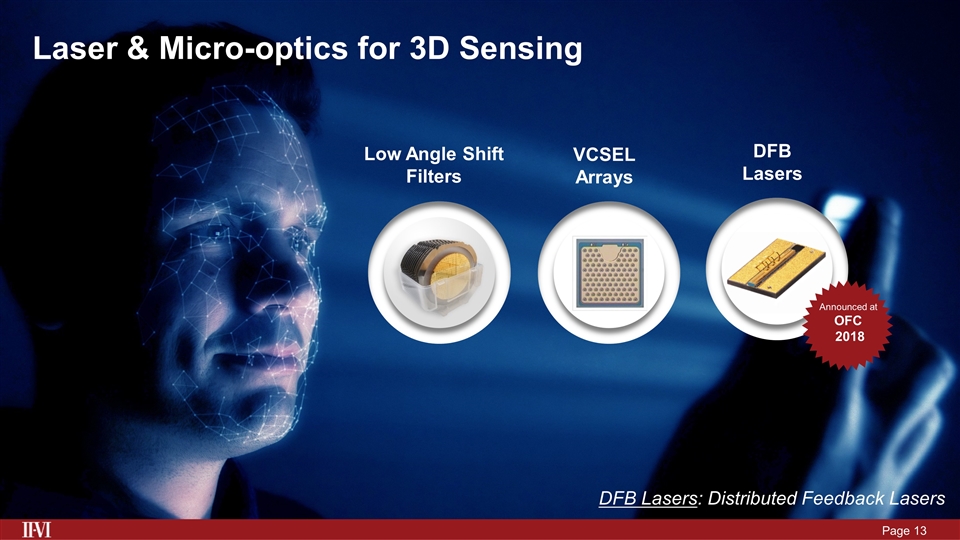

Laser & Micro-optics for 3D Sensing DFB Lasers: Distributed Feedback Lasers Low Angle Shift Filters VCSEL Arrays DFB Lasers Announced at OFC 2018

Tesla 2017 GM 2018 Hyundai 2020 Renault-Nissan 2020 Toyota 2020 Opto-Electronics for LiDAR Laser Diodes for LiDAR Market (’17-’22): +20% Source: Strategies Unlimited Self-driving car availability by car manufacturer Volvo 2020 Daimler 2020 BMW 2021 Ford 2021 Honda 2025 Source: AXIOS

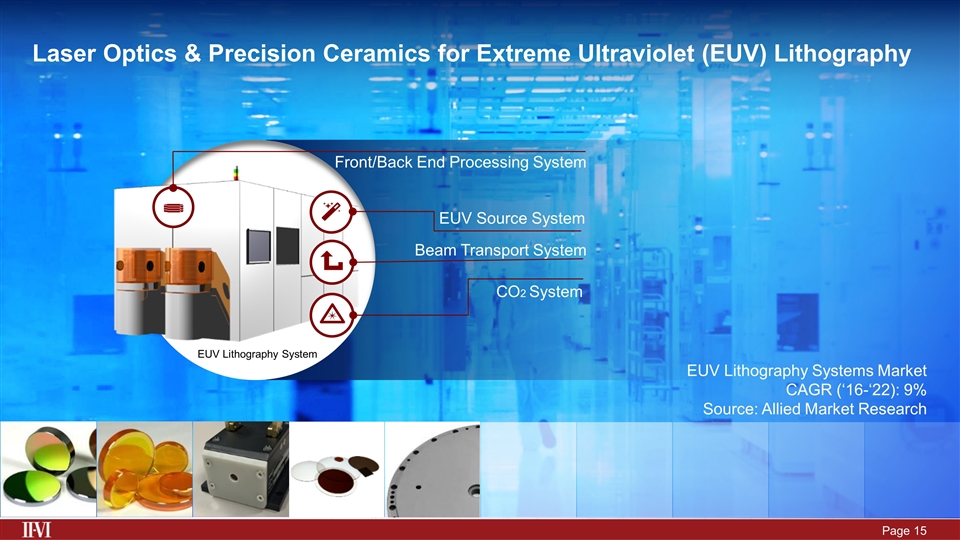

EUV Lithography System EUV Source System CO2 System Front/Back End Processing System Beam Transport System Laser Optics & Precision Ceramics for Extreme Ultraviolet (EUV) Lithography EUV Lithography Systems Market CAGR (‘16-‘22): 9% Source: Allied Market Research

Differentiated Product Portfolio for Industrial Lasers Fiber Lasers Direct diode Lasers Fiber Lasers Market CAGR (‘17-‘22): +8% Direct Diode Market CAGR (‘17-‘22): +7% Source: Strategies Unlimited Laser Remote Welding Head Direct Diode Laser Engine Broad portfolio of components including: pump lasers, high power combiners, acousto-optic modulators, high power isolators, gratings and micro-optics.

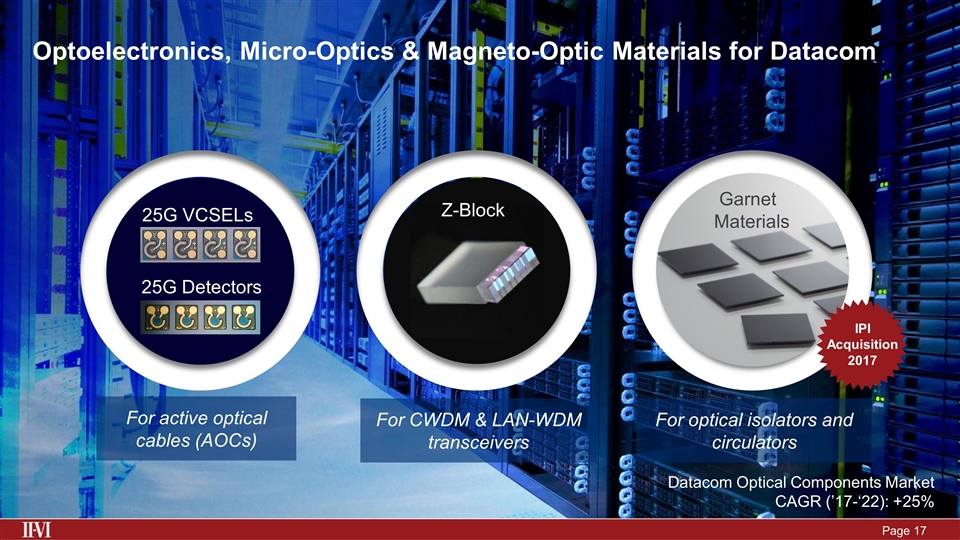

Optoelectronics, Micro-Optics & Magneto-Optic Materials for Datacom Datacom Optical Components Market CAGR (’17-‘22): +25% Z-Block BIG 25G VCSELs 25G Detectors Garnet Materials For active optical cables (AOCs) For CWDM & LAN-WDM transceivers For optical isolators and circulators IPI Acquisition 2017

Vertically Integrated Products for ROADMs Optics OTDR Micro optics Optical Communications Market CAGR (’15-’21): +12% Source: Ovum Tunable thin film filter technology High Resolution Optical Channel Monitor (OCM) In-house 4 inch amorphous silicon technology platform II-VI product content is 20-40% of ROADM Line Card BOM value Announced at OFC 2018 Optical Amplifier Laser Chip-on-Carrier Assembly Thermoelectric Cooler Sharper tunable filters and enhanced spectral processing algorithms

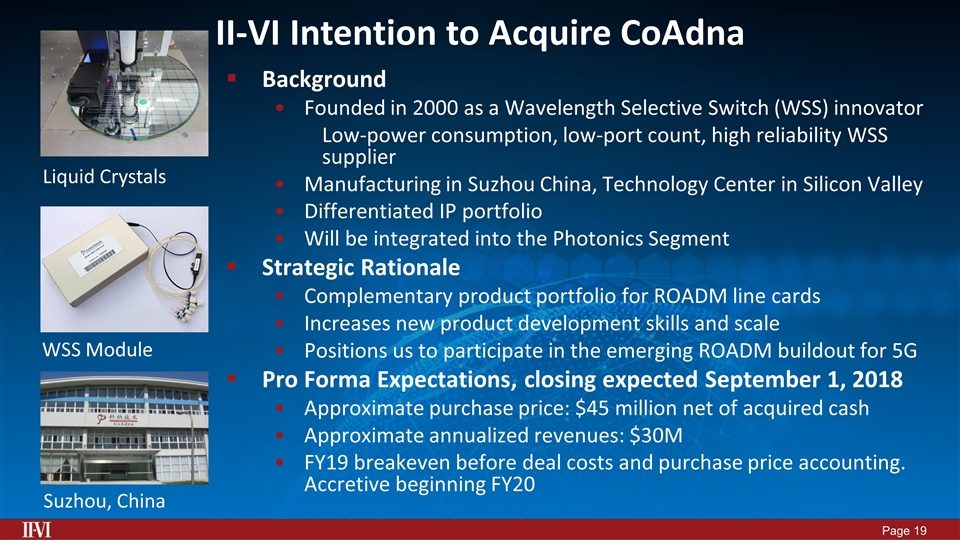

II-VI Intention to Acquire CoAdna Background Founded in 2000 as a Wavelength Selective Switch (WSS) innovator Low-power consumption, low-port count, high reliability WSS supplier Manufacturing in Suzhou China, Technology Center in Silicon Valley Differentiated IP portfolio Will be integrated into the Photonics Segment Strategic Rationale Complementary product portfolio for ROADM line cards Increases new product development skills and scale Positions us to participate in the emerging ROADM buildout for 5G Pro Forma Expectations, closing expected September 1, 2018 Approximate purchase price: $45 million net of acquired cash Approximate annualized revenues: $30M FY19 breakeven before deal costs and purchase price accounting. Accretive beginning FY20 Liquid Crystals Suzhou, China WSS Module

Engineered Materials, High Energy Laser and Optics for Military & Aerospace World leader in large sapphire panel output 24,000 sf dedicated facility F-35 Electro-Optical Targeting System (EOTS) Infrared Countermeasure Systems Market CAGR (’17-’22): +8% Source: Strategies Unlimited

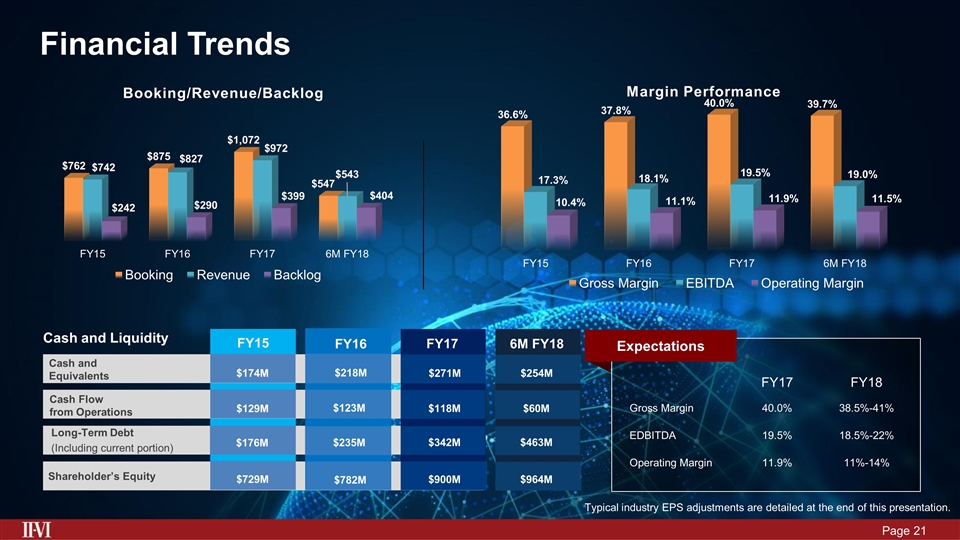

Expectations Cash and Equivalents Cash Flow from Operations Long-Term Debt (Including current portion) FY17 FY15 FY16 Shareholder’s Equity $271M $174M $218M $118M $129M $123M $342M $176M $235M $900M $729M $782M Cash and Liquidity 6M FY18 $254M $60M $463M $964M Typical industry EPS adjustments are detailed at the end of this presentation. Financial Trends FY17 FY18 Gross Margin 40.0% 38.5%-41% EDBITDA 19.5% 18.5%-22% Operating Margin 11.9% 11%-14%

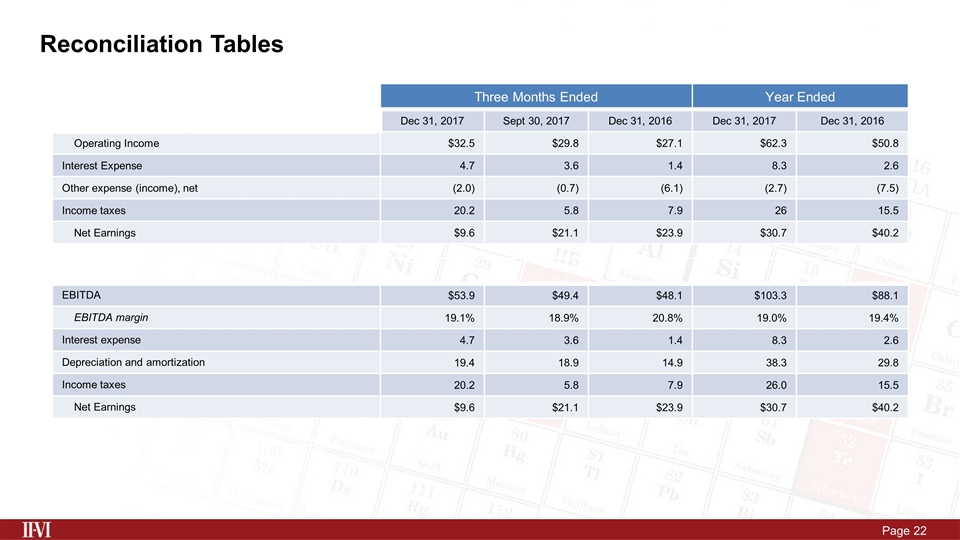

Reconciliation Tables Three Months Ended Year Ended Dec 31, 2017 Sept 30, 2017 Dec 31, 2016 Dec 31, 2017 Dec 31, 2016 Operating Income $32.5 $29.8 $27.1 $62.3 $50.8 Interest Expense 4.7 3.6 1.4 8.3 2.6 Other expense (income), net (2.0) (0.7) (6.1) (2.7) (7.5) Income taxes 20.2 5.8 7.9 26 15.5 Net Earnings $9.6 $21.1 $23.9 $30.7 $40.2 EBITDA $53.9 $49.4 $48.1 $103.3 $88.1 EBITDA margin 19.1% 18.9% 20.8% 19.0% 19.4% Interest expense 4.7 3.6 1.4 8.3 2.6 Depreciation and amortization 19.4 18.9 14.9 38.3 29.8 Income taxes 20.2 5.8 7.9 26.0 15.5 Net Earnings $9.6 $21.1 $23.9 $30.7 $40.2

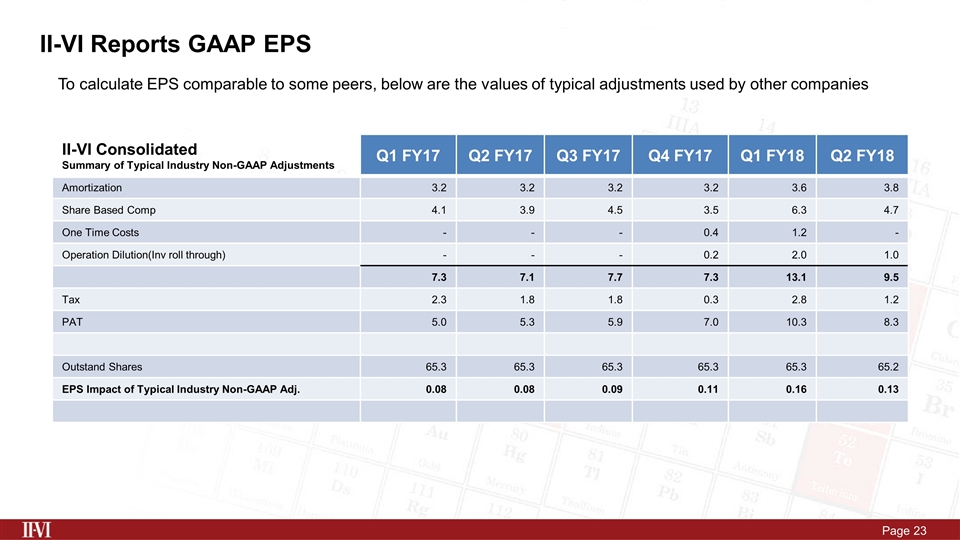

II-VI Reports GAAP EPS II-VI Consolidated Summary of Typical Industry Non-GAAP Adjustments Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 Q1 FY18 Q2 FY18 Amortization 3.2 3.2 3.2 3.2 3.6 3.8 Share Based Comp 4.1 3.9 4.5 3.5 6.3 4.7 One Time Costs - - - 0.4 1.2 - Operation Dilution(Inv roll through) - - - 0.2 2.0 1.0 7.3 7.1 7.7 7.3 13.1 9.5 Tax 2.3 1.8 1.8 0.3 2.8 1.2 PAT 5.0 5.3 5.9 7.0 10.3 8.3 Outstand Shares 65.3 65.3 65.3 65.3 65.3 65.2 EPS Impact of Typical Industry Non-GAAP Adj. 0.08 0.08 0.09 0.11 0.16 0.13 To calculate EPS comparable to some peers, below are the values of typical adjustments used by other companies