Attached files

| file | filename |

|---|---|

| 8-K - 8-K - John Bean Technologies CORP | a8-kinvestorpresentation.htm |

JBT Investor Presentation

March 2018

Exhibit 99.1

These slides and the accompanying presentation contain “forward-looking”

statements, including statements about management’s expectations

regarding trends in the food markets, strategic initiatives, acquisition

strategies and long-term goals, which represent management’s best

judgment as of the date hereof, based on currently available information.

Actual results may differ materially from those contained in such forward-

looking statements.

JBT Corporation’s (the “Company”) most recent filings with the Securities

and Exchange Commission include information concerning factors, including

the factors set forth under “Item 1A. Risk Factors” in the Company’s Annual

Report on Form 10-K filed with the Securities and Exchange Commission on

February 28, 2018 that may cause actual results to differ from those

anticipated by these forward-looking statements. The Company undertakes

no obligation to update or revise these forward-looking statements to reflect

new events or uncertainties.

Forward-Looking Statements

2

JBT Snapshot

3

One Purpose & Set of Values

Across the Entire Organization

Leading Global Technology Solutions

Provider to High-value Segments of the

Food & Beverage Industry

72%

28%

Total Revenue

$1.6 billion

Segment Operating Profit

$190 million

73%

27%

2017 at a Glance

AeroTech

FoodTech

Founded

Listed

Market Cap

Employees

Customers

Countries

Locations

1884

JBT (NYSE)

$3.5 billion1

5,800

500+

25+

20+

1As of February 28, 2018

Enjoy Lunch

Day

Ends

Drive to Airport

Day

Begins

Enjoy Dinner… …& Dessert

Fly to Meeting

Feed Pet

Grocery Shop Attend Meeting

Enjoy Breakfast

4

If you ate or drank something today, there’s a

good chance JBT equipment played a critical

role in its preparation

ConsumerDistribution

Leading Technology Solutions Provider to

High-Value Segments of the Market

5

Delivering innovative solutions we believe offer best-in-class yield and productivity,

with a goal of maximizing customer profitability

Clear Value Proposition

for JBT Customers

Yield

Food Safety

Reduced Operating Costs

Uptime

Full-Line Solutions

Global Food and Beverage ProducersFarm / Ranch

Restaurants

Entire Market Value Chain

Grocery / C-Store

Foodservice

Commissary

Automation

Global Service and Support

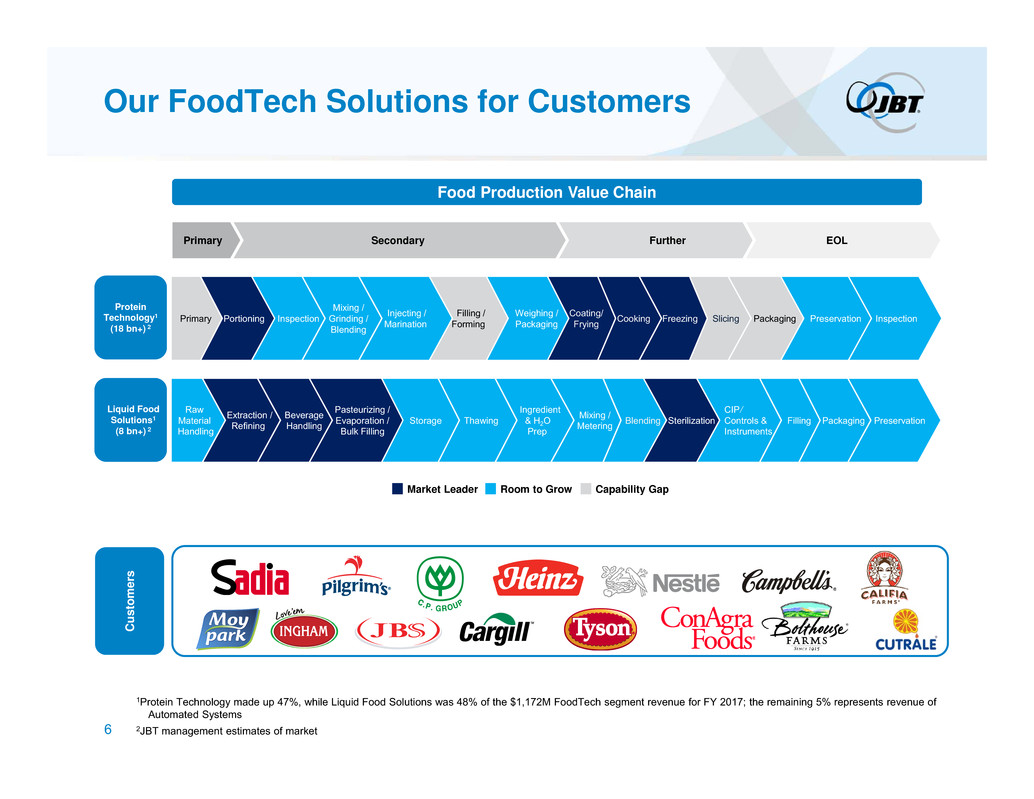

Our FoodTech Solutions for Customers

6

C

u

s

t

o

m

e

r

s

1Protein Technology made up 47%, while Liquid Food Solutions was 48% of the $1,172M FoodTech segment revenue for FY 2017; the remaining 5% represents revenue of

Automated Systems

2JBT management estimates of market

Market Leader Room to Grow Capability Gap

EOLFurtherSecondaryPrimary

Primary Portioning Weighing / Packaging

Coating/

Frying Cooking Freezing

Filling /

Forming SlicingInspection Packaging Preservation

Mixing /

Grinding /

Blending

InspectionInjecting / Marination

Raw

Material

Handling

Extraction /

Refining

Ingredient

& H2O

Prep

Mixing /

Metering Blending SterilizationThawing

CIP/

Controls &

Instruments

Beverage

Handling Filling Packaging

Pasteurizing /

Evaporation /

Bulk Filling

PreservationStorage

Protein

Technology1

(18 bn+) 2

Liquid Food

Solutions1

(8 bn+) 2

Food Production Value Chain

Returns

Durable Shareholder Value Creation

“Value creation is a virtuous

circle, starting with margin

expansion initiatives

generating results that are

reinvested to drive organic

growth, creating customer

value and returns that

support further growth – and

the cycle continues…”

7

Serving Large, Growing Food Markets with

Low Cyclicality

1 Source: Technavio, “Global Food Processing Machinery Market, 2016-2020”

2 Euromonitor International

3 Technavio, “Global Functional Drinks Market 2016-2020”, April 2016

Global Food Machinery Market1

Size: $53 billion as of 2016

Global Packaged Food Market1

Size: $3.2 trillion by 2020

Growth: 5% CAGR Global

Packaged Meat

$145 billion2

Functional Fruit &

Vegetable Juices

5%

2016-2020 CAGR3

Supportive Key Global Trends in Global Consumption4

(in millions of metric tons)

Functional Fruit &

Vegetable Juices

$58 billion3

25

70

90

Per Capita Meat Consumption

APAC Europe North America

Growing Global Income

5.8%

Global Disposable Income CAGR

2017-20302

JBT FoodTech Market

~$26 billion5

100

200

300

400

Global Meat Production, 1995 - 2025

Innovation Driving Equipment

Investment

11-15%

Medium and Small Food

Companies’ Revenue CAGR

2012-20156

8

(kg/person/year)

4 OECD-FAO Agricultural Outlook 2016-2025, WATTAgNet.com

5 JBT management estimate

6 AT Kearney, “Is Big Food in Big Trouble”

JBT is Positioned to Benefit From Positive

Macro Trends…

9

Accelerating TrendsPositive Macro Drivers

Consolidating Food Industry

Industry increasingly served by fewer global producers

Growing Middle Class

2x growth by 20301; Asia a significant contributor

…unique and supportive trends in both developed and

developing markets

Emergence of Clean Labels & Organic Foods

10%+ annual growth2

Consumer Focus on Health, Safety & Convenience

Increasingly selective consumers seeking ‘on-demand’ food

Increasing Customer Adoption of Automation

Shrinking labor pool coupled with rising wages

Protein & Value-Added Food & Bev Consumption

Positively correlates to GDP per capita

JBT Positioning

Global Footprint

International & local

customers

Strong Asia

Presence

Mfg, engineering,

Innovation center

Wolf-tec and

C.A.T.

protein injection

technology

SF&DS solutions &

ReadyGo Veggie

skid

Largest Selection

of Preservation

Solutions

iOPS

Development

Internet of Things

initiative

Avure

HPP solutions

JBT Positioning

DSI

waterjet portioners,

iOPS capabilities

Source:

1https://www.ota.com/news/press-releases/19031

2http://www.reuters.com/middle-class-infographic

Canada

U.S.

Mexico

Brazil

Chile

Argentina

U.K.

Belgium

Spain

Sweden

Germany

South Africa

Saudi Arabia

Russia

India

Malaysia

Philippines

Australia

New Zealand

Netherlands

China

Vietnam

Thailand

Indonesia

Global Footprint and Comprehensive

Offerings

Global Reach Strengthens Competitive Advantage

10

FoodTech Production

AeroTech Production

Personnel Location

Corporate HQ

Italy

2017 Sales

NA 63%

EMEA 21%

APAC 11%

LatAm 5%

$413 $438 $455

$518

$653

2013 2014 2015 2016 2017

Significant Recurring Revenue

Recurring Revenue % of Total Revenue

Significant Recurring Revenue…

11

…through aftermarket parts, service, and emerging iOPS

offering with further penetration opportunities

• Developing economies driving demand

• New equipment designed to meet

evolving customer preferences

− Organic foods

− Clean labels

− Functional beverages

− Convenience foods

• Real-time data allows for

predictive maintenance

• Enables ability to improve

equipment performance,

resulting in higher customer

profitability

• 130 years delivering equipment and systems

• Solutions are highly customized

• Equipment operates in challenging

environment for extended periods of

time

• Significant downtime expense

for customers results in

planned rebuild opportunities

• Food safety requirements

driving need for regular

servicing

• Improve customer profitability with higher yield

and efficiency, while reducing labor costs

• Equipment can preemptively notify

of service need

Aftermarket

Share of

Customer

Wallet:

30 – 35%

40%

ONE JBT

Continued Growth and Margin Expansion

Opportunities

12

Multi-pronged approach continues to deliver value to all stakeholders

Key Initiative Focus Long-Term Benefits

Integrity, accountability, relentless

improvement and teamwork

Unlocks benefits of common ownership, e.g.

coordinated supply chain, and shared service

centers and production facilities

Increase customers’ profitability with higher

levels of engagement and thorough

understanding of their business

Enables above market growth rates and

margin expansion

Deliver continuous improvement in Safety,

Quality, Delivery, and Cost metrics and

become a lean enterprise

Boosts competitive advantage, drives organic

growth and lowers cost of goods sold

Focus on opportunities that add

complementary solutions across portfolio

Continuous value creation coupled with

stronger global customer opportunities

Customer First

Relentless

Continuous

Improvement (RCI)

Disciplined

Acquisitions

…supported by specific JEM and RCI initiatives

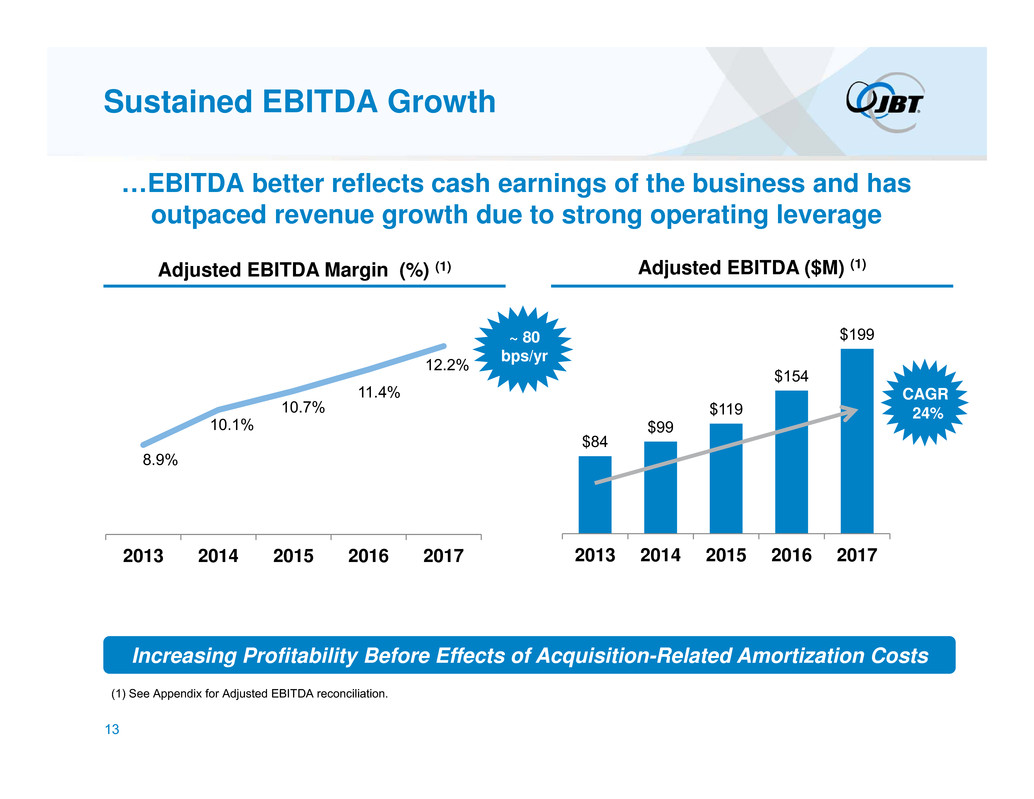

$84

$99

$119

$154

$199

2013 2014 2015 2016 2017

8.9%

10.1%

10.7%

11.4%

12.2%

2013 2014 2015 2016 2017

13

Sustained EBITDA Growth

CAGR

24%

Increasing Profitability Before Effects of Acquisition-Related Amortization Costs

…EBITDA better reflects cash earnings of the business and has

outpaced revenue growth due to strong operating leverage

Adjusted EBITDA Margin (%) (1) Adjusted EBITDA ($M) (1)

~ 80

bps/yr

(1) See Appendix for Adjusted EBITDA reconciliation.

Delivering Sustainable Growth Through

Organic Initiatives & Disciplined Acquisitions

14

• Accelerate new product & service

development

• Grow recurring revenue

• Build Asia-Pacific business

• Execute JBT Excellence ModelTotal

CAGR

15%

• Strategic capital allocation focused on

FoodTech

• Disciplined and standardized always-on

acquisition program

Attractive Revenue Growth Profile Focus on Core Organic Growth Initiative

Along with Disciplined Acquisition Growth

Organic Growth Inorganic Growth

1.8%

4.5%

10.8%

9.0% 8.0%0.9%

1.7%

13.0%

13.0%

2013 2014 2015 2016 2017

1.8%

5.4%

12.5%

22.0%

21.0%

A Leader in the Consolidation of Our Large,

Highly Fragmented Food Equipment Industry

15

Repeatable,

disciplined,

metrics-driven

approach

Protein:

$18bn+

Liquid Foods:

$8bn+

Opportunity1

Technology strength

Lack access to global entrants

and customers

Require additional R&D and

consistent capital

Opportunity to augment

aftermarket capabilities

Generational ownership

transition

Plus 3 acquisitions in 2014

Total Capital Deployed across 10

acquisitions: ~$600M

…using a disciplined, focused, strategic approach to consolidate pipeline of high quality, attractive targets

1 JBT management estimates

Target Business Purchase Price

Schröder Protein Undisclosed

PLF

International Liquid Foods ~$37M

Avure Protein & Liquid Foods $57M

Tipper Tie Protein $160M

C.A.T. Protein $90M

Novus X-Ray Protein &

Liquid Foods $3M

A&B Process

Systems Liquid Foods $102M

Stork Food &

Dairy Systems Liquid Foods ~$61M

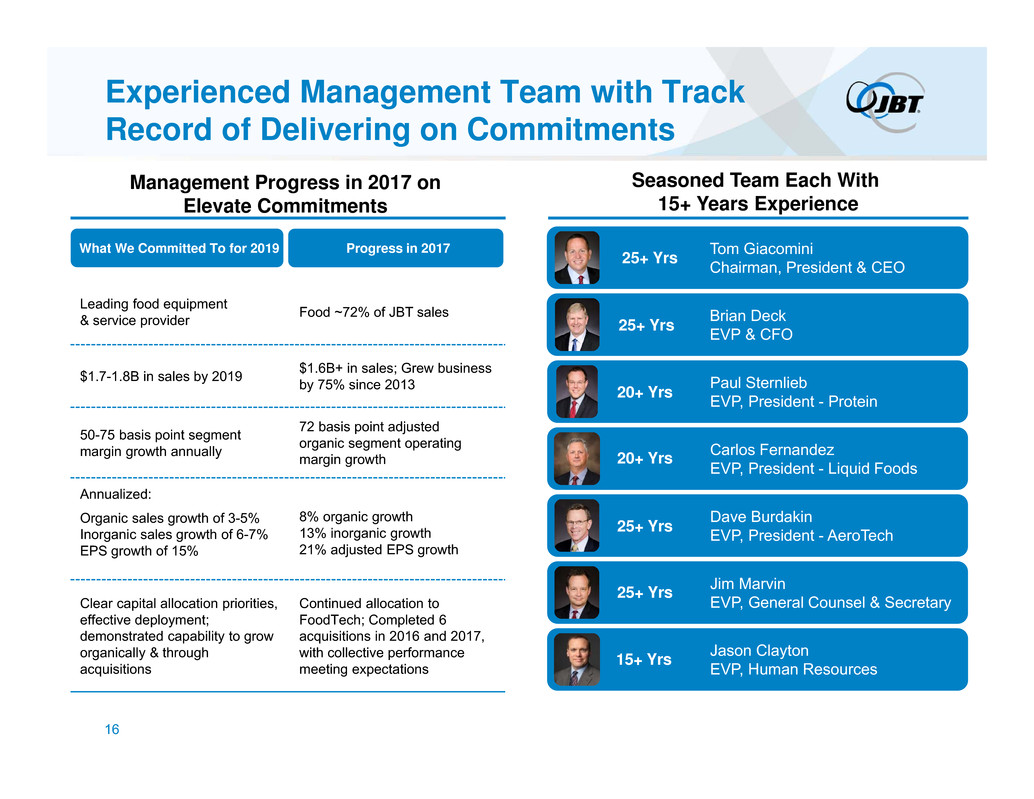

Leading food equipment

& service provider Food ~72% of JBT sales

$1.7-1.8B in sales by 2019 $1.6B+ in sales; Grew business by 75% since 2013

50-75 basis point segment

margin growth annually

72 basis point adjusted

organic segment operating

margin growth

Annualized:

Organic sales growth of 3-5%

Inorganic sales growth of 6-7%

EPS growth of 15%

8% organic growth

13% inorganic growth

21% adjusted EPS growth

Clear capital allocation priorities,

effective deployment;

demonstrated capability to grow

organically & through

acquisitions

Continued allocation to

FoodTech; Completed 6

acquisitions in 2016 and 2017,

with collective performance

meeting expectations

Experienced Management Team with Track

Record of Delivering on Commitments

16

Tom Giacomini

Chairman, President & CEO25+ Yrs

Jim Marvin

EVP, General Counsel & Secretary

25+ Yrs

Brian Deck

EVP & CFO25+ Yrs

Dave Burdakin

EVP, President - AeroTech25+ Yrs

Paul Sternlieb

EVP, President - Protein20+ Yrs

Jason Clayton

EVP, Human Resources

15+ Yrs

Management Progress in 2017 on

Elevate Commitments

Seasoned Team Each With

15+ Years Experience

Progress in 2017What We Committed To for 2019

Carlos Fernandez

EVP, President - Liquid Foods

20+ Yrs

Appendix

Non-GAAP Adjusted EBITDA

18

Twelve Months Ended December 31,

($M) 2017 2016 2015 2014 2013

Revenue 1,635.1$ 1,350.5$ 1,107.3$ 984.2$ 934.2$

Net income 80.5$ 67.6$ 55.9$ 30.8$ 33.1$

Loss from discontinued operations, net of tax 1.6 0.4 0.1 - 0.9

Income from continuing operations as reported 82.1$ 68.0$ 56.0$ 30.8$ 34.0$

Provision for income tax 50.1 26.0 26.2 13.9 13.8

Net interest expense 13.6 9.4 6.8 6.0 5.4

Depreciation and amortization 51.7 38.5 29.6 25.3 25.0

EBITDA 197.5$ 141.9$ 118.6$ 76.0$ 78.2$

EBITDA Margin % 12.1% 10.5% 10.7% 7.7% 8.4%

Restructuring expense 1.7 12.3 - 14.5 1.6

Other non-recurring expense - - - 8.8 3.7

Adjusted EBITDA 199.2$ 154.2$ 118.6$ 99.3$ 83.5$

Adjusted EBITDA Margin % 12.2% 11.4% 10.7% 10.1% 8.9%

Non-GAAP Segment Operating Profit

19

Twelve months

ended

December 31,

($M) 2017

Total revenue 1,635.1$

Total segment operating profit 189.8$

Segment operating profit margin 11.6%

Total Revenue 1,635.1$

Incremental revenue from acquisitions (175.2)

Adjusted organic total revenue 1,459.9$

Total segment operating profit 189.8$

Incremental segment operating profit from acquisitions (8.2)

Adjusted organic total segment operating profit 181.6$

Adjusted 2017 organic segment operating profit margin 12.4%

Full-year 2016 segment operating profit margin 11.7%

Margin Growth 72 bps

Non-GAAP Adjusted Earnings per Share

20

Twelve Months Ended

December 31,

($M, except per share data) 2017 2016

Income from continuing operations as reported 82.1$ 68.0$

Non-GAAP adjustments:

Restructuring expense 1.7 12.3

Impact on tax provision from restructuring expense (0.5) (3.9)

Impact on tax provision from mandatory repatriation tax 7.7 -

Impact on tax provision from rate change on deferred tax position 7.8 -

Adjusted income from continuing operations 98.8$ 76.4$

Income from continuing operations as reported 82.1$ 68.0$

Total shares and dilutive securities 31.9 29.8

Diluted earnings per share from continuing operations 2.58$ 2.28$

Adjusted income from continuing operations 98.8$ 76.4$

Total shares and dilutive securities 31.9 29.8

Adjusted diluted earnings per share from continuing operations 3.10$ 2.56$

JBT Investor Presentation

March 2018