Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CytoDyn Inc. | d560026d8k.htm |

® www.cytodyn.com First self-administered antibody therapy for HIV in late-stage clinical development March 2018 PRO 140 Exhibit 99.1

www.cytodyn.com This presentation includes forward-looking statements and forward-looking information within the meaning of United States securities laws. These statements and information represent CytoDyn’s intentions, plans, expectations and beliefs, and are subject to numerous known and unknown risks, uncertainties and other factors, many of which are beyond CytoDyn’s control and could cause actual results or outcomes to differ materially from such forward-looking statements or information. The words “believe,” “estimate,” “expect,” “intend,” “attempt,” “anticipate,” “foresee,” “plan,” and similar expressions and variations thereof, identify certain of such forward-looking statements or forward-looking information, which speak only as of the date on which they are made. Readers are cautioned not to place undue reliance on these forward-looking statements or forward-looking information. While it is impossible to identify or predict all such matters, these differences may result from, among other things, the inherent uncertainty of the timing and success of and expense associated with research, development, regulatory approval, and commercialization of CytoDyn’s products and product candidates, including the risks that clinical trials will not commence or proceed as planned; products appearing promising in early trials will not demonstrate efficacy or safety in larger-scale trials; future clinical trial data on CytoDyn’s products and product candidates will be unfavorable; funding for additional clinical trials may not be available; CytoDyn’s products may not receive marketing approval from regulators or, if approved, may fail to gain sufficient market acceptance to justify development and commercialization costs; competing products currently on the market or in development may reduce the commercial potential of CytoDyn’s products; CytoDyn, its collaborators or others may identify side effects after the product is on the market; or efficacy or safety concerns regarding marketed products, whether or not scientifically justified, may lead to product recalls, withdrawals of marketing approval, reformulation of the product, additional pre-clinical testing or clinical trials, changes in labeling of the product, the need for additional marketing applications, or other adverse events. CytoDyn is also subject to additional risks and uncertainties, including risks associated with the actions of its corporate, academic, and other collaborators and government regulatory agencies; risks from market forces and trends; potential product liability; intellectual property litigation; environmental and other risks; and risks that current and pending patent protection for its products may be invalid, unenforceable, or challenged or fail to provide adequate market exclusivity. In addition, there are also substantial risks arising out of CytoDyn’s need to raise additional capital to develop its products and satisfy its financial obligations; the highly regulated nature of its business, including government cost-containment initiatives and restrictions on third-party payments for its products; the highly competitive nature of its industry; and other factors set forth under the caption “Risk Factors” in CytoDyn’s Annual Report on Form 10-K and other reports filed with the U.S. Securities and Exchange Commission. CytoDyn disclaims any intention or obligation to publicly update or revise any forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law. Forward-Looking Statements

Large U.S. market ($20 billion) for HIV therapies PRO 140 is currently under development for two different HIV indications: Combination with HAART – primary endpoint achieved in February 2018 BLA filing in 2018, expected approval in 2019 with BTD Potential market size is estimated at $1 billion Monotherapy switch trial – from HAART to single-drug therapy Potential market size is estimated at $4 billion Pipeline: Multiple opportunities in immunologic indications: Transplantation, GvHD – Phase 2 clinical trial underway Autoimmune disease & oncology – Positive data from preclinical studies Other immunologic indications being explored www.cytodyn.com Investment Highlights for PRO 140 (leronlimab) *HAART - Highly Active Antiretroviral Therapy

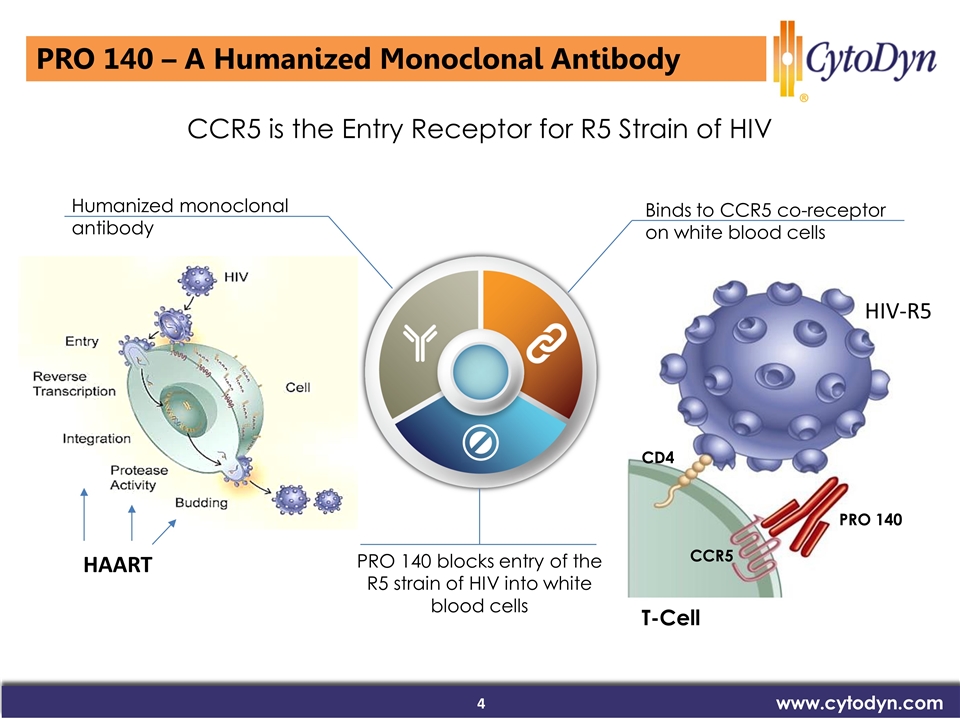

www.cytodyn.com CCR5 is the Entry Receptor for R5 Strain of HIV Binds to CCR5 co-receptor on white blood cells PRO 140 blocks entry of the R5 strain of HIV into white blood cells PRO 140 CCR5 CD4 T-Cell HIV-R5 Humanized monoclonal antibody PRO 140 – A Humanized Monoclonal Antibody HAART

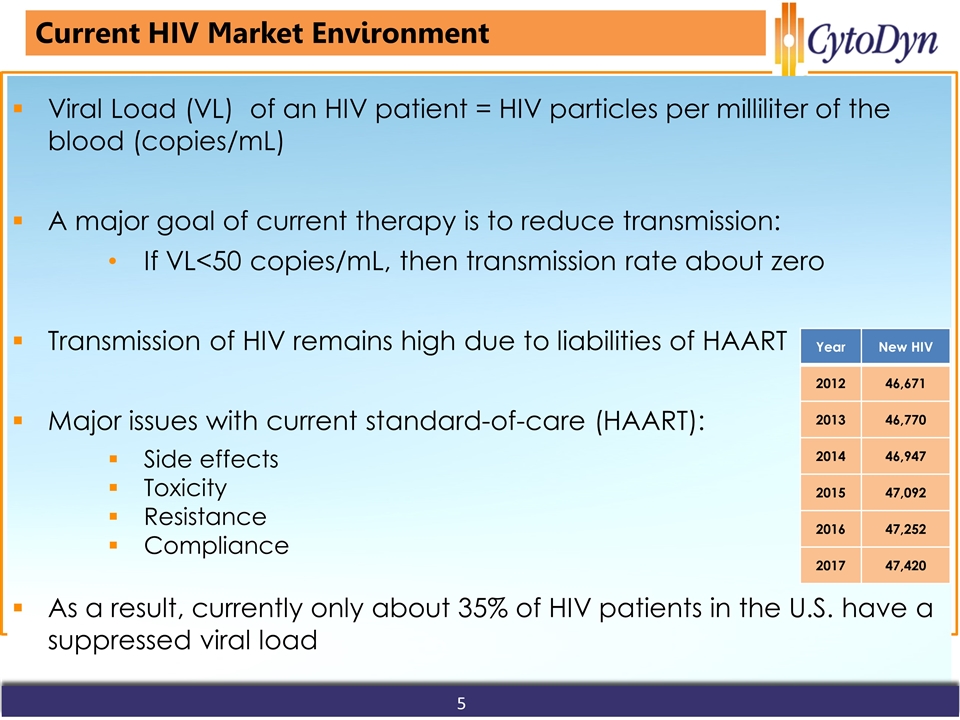

www.cytodyn.com Current HIV Market Environment Viral Load (VL) of an HIV patient = HIV particles per milliliter of the blood (copies/mL) A major goal of current therapy is to reduce transmission: If VL<50 copies/mL, then transmission rate about zero Transmission of HIV remains high due to liabilities of HAART Major issues with current standard-of-care (HAART): Side effects Toxicity Resistance Compliance As a result, currently only about 35% of HIV patients in the U.S. have a suppressed viral load Year New HIV 2012 46,671 2013 46,770 2014 46,947 2015 47,092 2016 47,252 2017 47,420 5

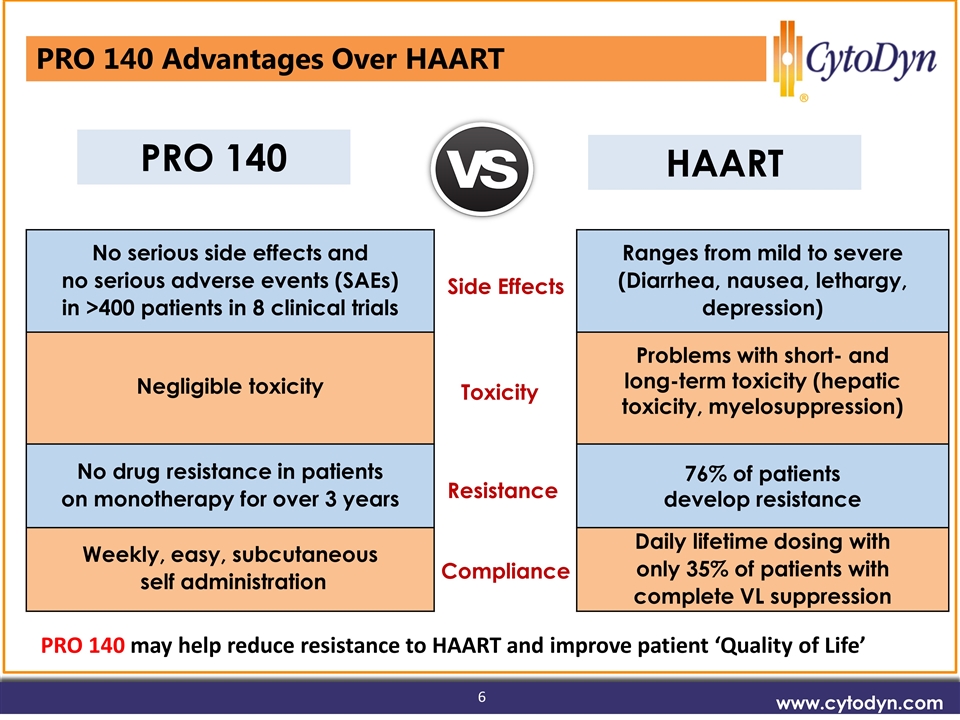

Vision www.cytodyn.com PRO 140 No serious side effects and no serious adverse events (SAEs) in >400 patients in 8 clinical trials Ranges from mild to severe (Diarrhea, nausea, lethargy, depression) Negligible toxicity Problems with short- and long-term toxicity (hepatic toxicity, myelosuppression) No drug resistance in patients on monotherapy for over 3 years 76% of patients develop resistance Weekly, easy, subcutaneous self administration Daily lifetime dosing with only 35% of patients with complete VL suppression PRO 140 Advantages Over HAART Side Effects Toxicity Resistance Compliance HAART PRO 140 may help reduce resistance to HAART and improve patient ‘Quality of Life’

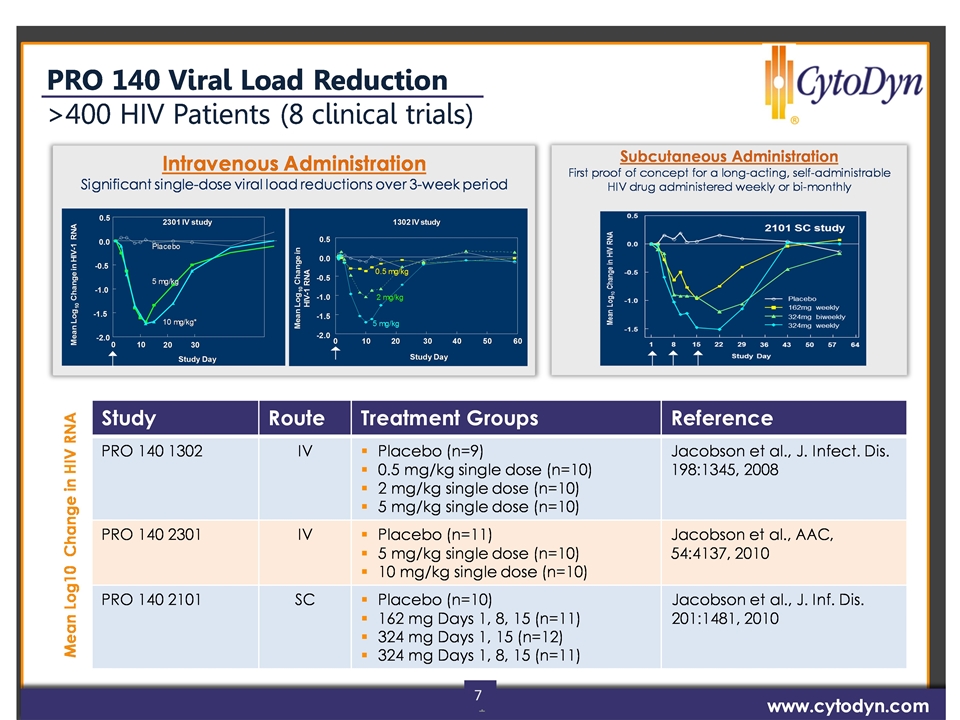

7

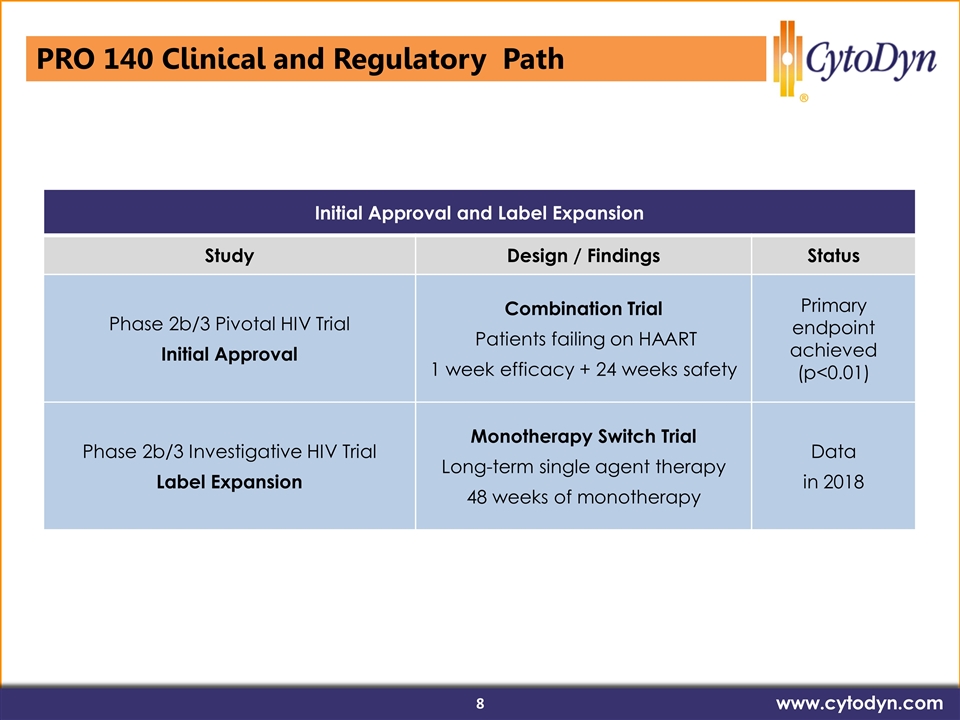

Initial Approval and Label Expansion Study Design / Findings Status Phase 2b/3 Pivotal HIV Trial Initial Approval Combination Trial Patients failing on HAART 1 week efficacy + 24 weeks safety Primary endpoint achieved (p<0.01) Phase 2b/3 Investigative HIV Trial Label Expansion Monotherapy Switch Trial Long-term single agent therapy 48 weeks of monotherapy Data in 2018 PRO 140 Clinical and Regulatory Path www.cytodyn.com

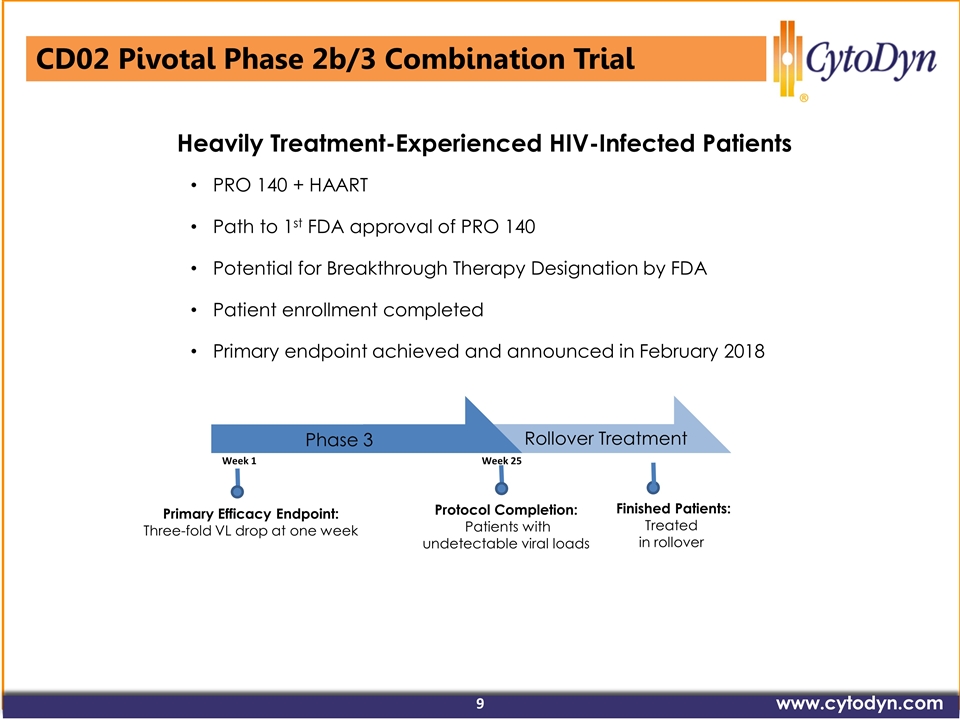

Primary Efficacy Endpoint: Three-fold VL drop at one week Phase 3 Rollover Treatment Protocol Completion: Patients with undetectable viral loads Week 1 Week 25 PRO 140 + HAART Path to 1st FDA approval of PRO 140 Potential for Breakthrough Therapy Designation by FDA Patient enrollment completed Primary endpoint achieved and announced in February 2018 Finished Patients: Treated in rollover Heavily Treatment-Experienced HIV-Infected Patients CD02 Pivotal Phase 2b/3 Combination Trial www.cytodyn.com

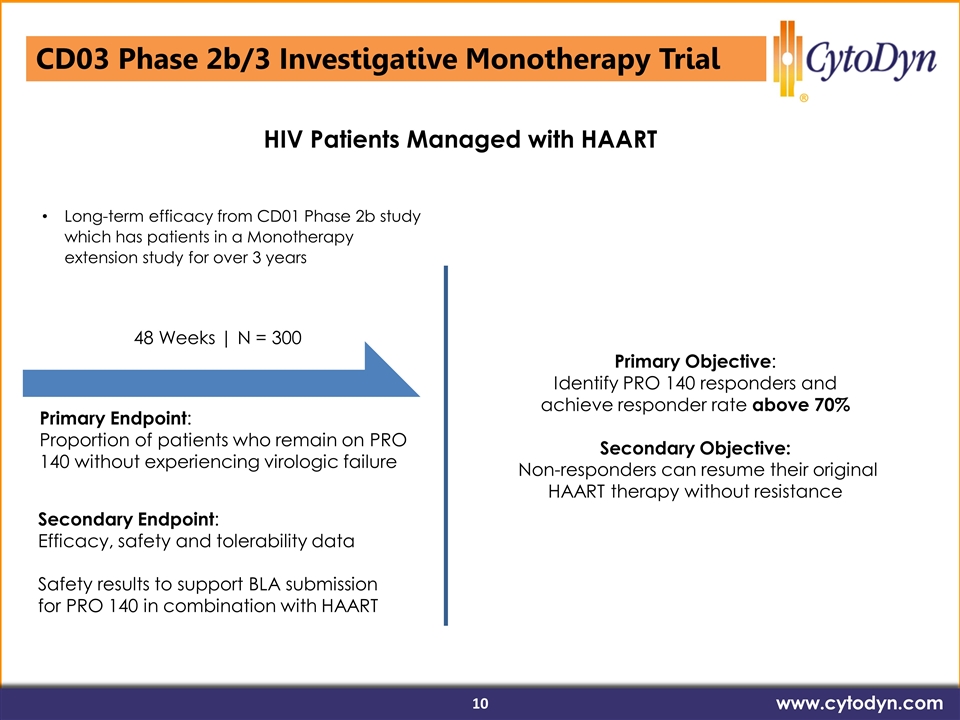

HI Long-term efficacy from CD01 Phase 2b study which has patients in a Monotherapy extension study for over 3 years 48 Weeks | N = 300 Primary Endpoint: Proportion of patients who remain on PRO 140 without experiencing virologic failure Secondary Endpoint: Efficacy, safety and tolerability data Safety results to support BLA submission for PRO 140 in combination with HAART Primary Objective: Identify PRO 140 responders and achieve responder rate above 70% Secondary Objective: Non-responders can resume their original HAART therapy without resistance HIV Patients Managed with HAART CD03 Phase 2b/3 Investigative Monotherapy Trial www.cytodyn.com

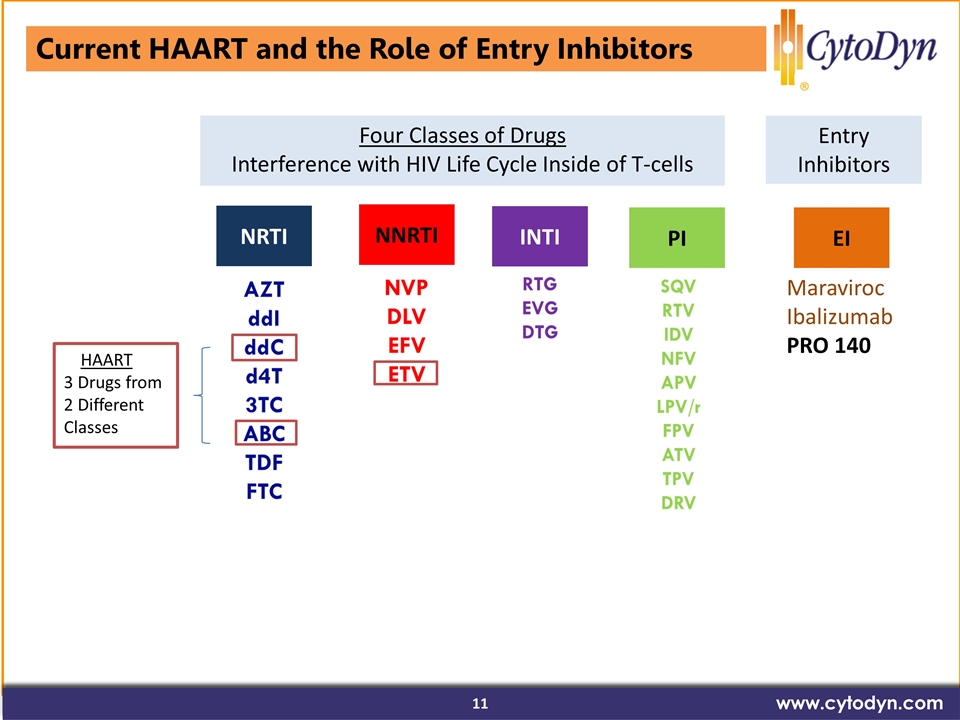

Current HAART and the Role of Entry Inhibitors www.cytodyn.com NRTI NNRTI INTI PI HAART 3 Drugs from 2 Different Classes EI Maraviroc Ibalizumab PRO 140 Four Classes of Drugs Interference with HIV Life Cycle Inside of T-cells Entry Inhibitors

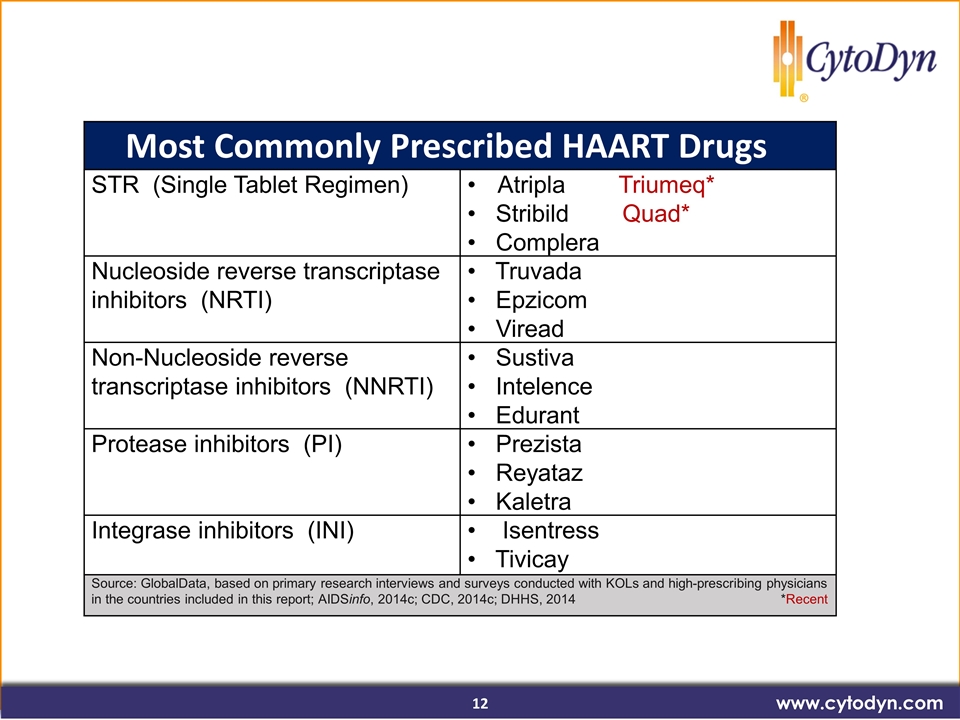

www.cytodyn.com Most Commonly Prescribed HAART Drugs STR (Single Tablet Regimen) Atripla Triumeq* • Stribild Quad* • Complera Nucleoside reverse transcriptase inhibitors (NRTI) • Truvada • Epzicom • Viread Non-Nucleoside reverse transcriptase inhibitors (NNRTI) • Sustiva • Intelence • Edurant Protease inhibitors (PI) • Prezista • Reyataz • Kaletra Integrase inhibitors (INI) • Isentress • Tivicay Source: GlobalData, based on primary research interviews and surveys conducted with KOLs and high-prescribing physicians in the countries included in this report; AIDSinfo, 2014c; CDC, 2014c; DHHS, 2014 *Recent

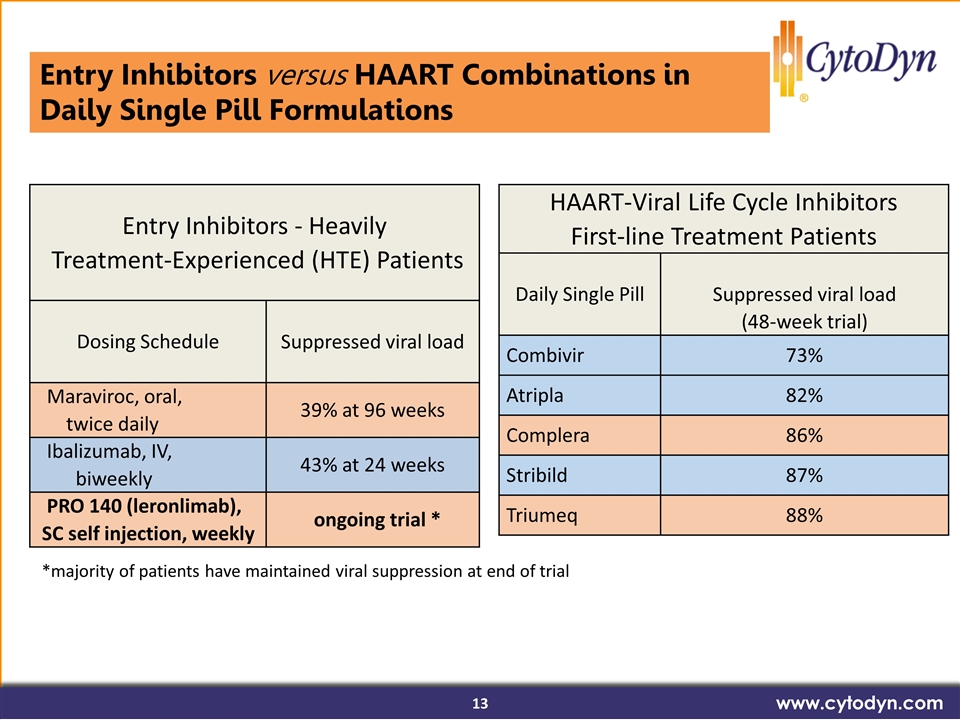

(33/37 patients in ongoing trail) Entry Inhibitors versus HAART Combinations in Daily Single Pill Formulations www.cytodyn.com HAART-Viral Life Cycle Inhibitors First-line Treatment Patients Daily Single Pill Suppressed viral load (48-week trial) Combivir 73% Atripla 82% Complera 86% Stribild 87% Triumeq 88% Entry Inhibitors - Heavily Treatment-Experienced (HTE) Patients Dosing Schedule Suppressed viral load Maraviroc, oral, twice daily 39% at 96 weeks Ibalizumab, IV, biweekly 43% at 24 weeks PRO 140 (leronlimab), SC self injection, weekly ongoing trial * *majority of patients have maintained viral suppression at end of trial

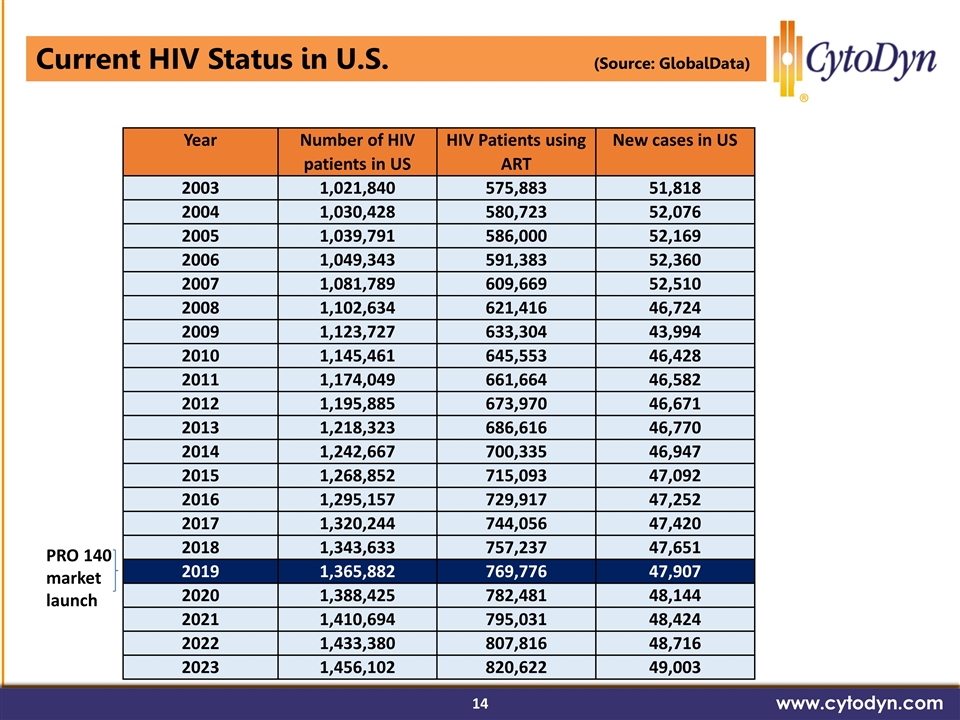

Current HIV Status in U.S. (Source: GlobalData) www.cytodyn.com Year Number of HIV patients in US HIV Patients using ART New cases in US 2003 1,021,840 575,883 51,818 2004 1,030,428 580,723 52,076 2005 1,039,791 586,000 52,169 2006 1,049,343 591,383 52,360 2007 1,081,789 609,669 52,510 2008 1,102,634 621,416 46,724 2009 1,123,727 633,304 43,994 2010 1,145,461 645,553 46,428 2011 1,174,049 661,664 46,582 2012 1,195,885 673,970 46,671 2013 1,218,323 686,616 46,770 2014 1,242,667 700,335 46,947 2015 1,268,852 715,093 47,092 2016 1,295,157 729,917 47,252 2017 1,320,244 744,056 47,420 2018 1,343,633 757,237 47,651 2019 1,365,882 769,776 47,907 2020 1,388,425 782,481 48,144 2021 1,410,694 795,031 48,424 2022 1,433,380 807,816 48,716 2023 1,456,102 820,622 49,003 PRO 140 market launch

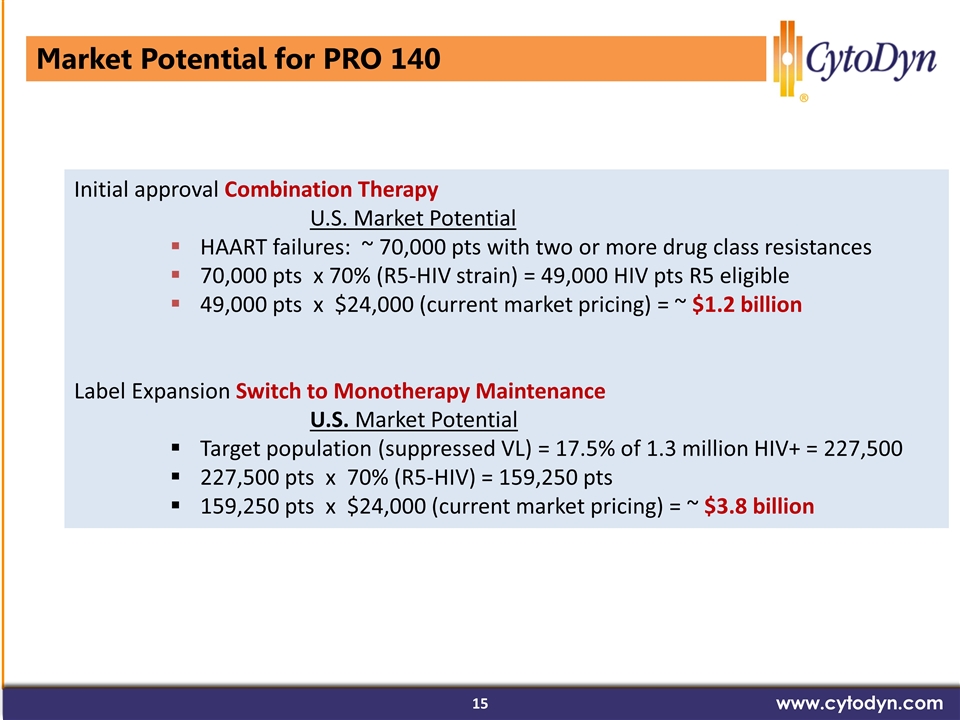

Market Potential for PRO 140 www.cytodyn.com Initial approval Combination Therapy U.S. Market Potential HAART failures: ~ 70,000 pts with two or more drug class resistances 70,000 pts x 70% (R5-HIV strain) = 49,000 HIV pts R5 eligible 49,000 pts x $24,000 (current market pricing) = ~ $1.2 billion Label Expansion Switch to Monotherapy Maintenance U.S. Market Potential Target population (suppressed VL) = 17.5% of 1.3 million HIV+ = 227,500 227,500 pts x 70% (R5-HIV) = 159,250 pts 159,250 pts x $24,000 (current market pricing) = ~ $3.8 billion

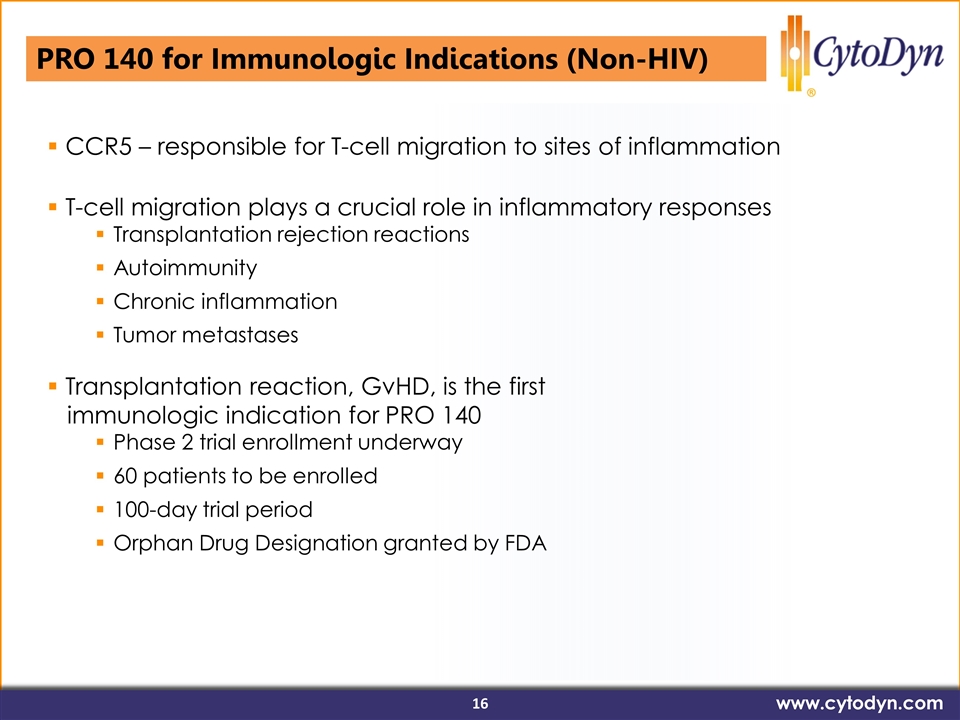

www.cytodyn.com CCR5 – responsible for T-cell migration to sites of inflammation T-cell migration plays a crucial role in inflammatory responses Transplantation rejection reactions Autoimmunity Chronic inflammation Tumor metastases Transplantation reaction, GvHD, is the first immunologic indication for PRO 140 Phase 2 trial enrollment underway 60 patients to be enrolled 100-day trial period Orphan Drug Designation granted by FDA PRO 140 for Immunologic Indications (Non-HIV)

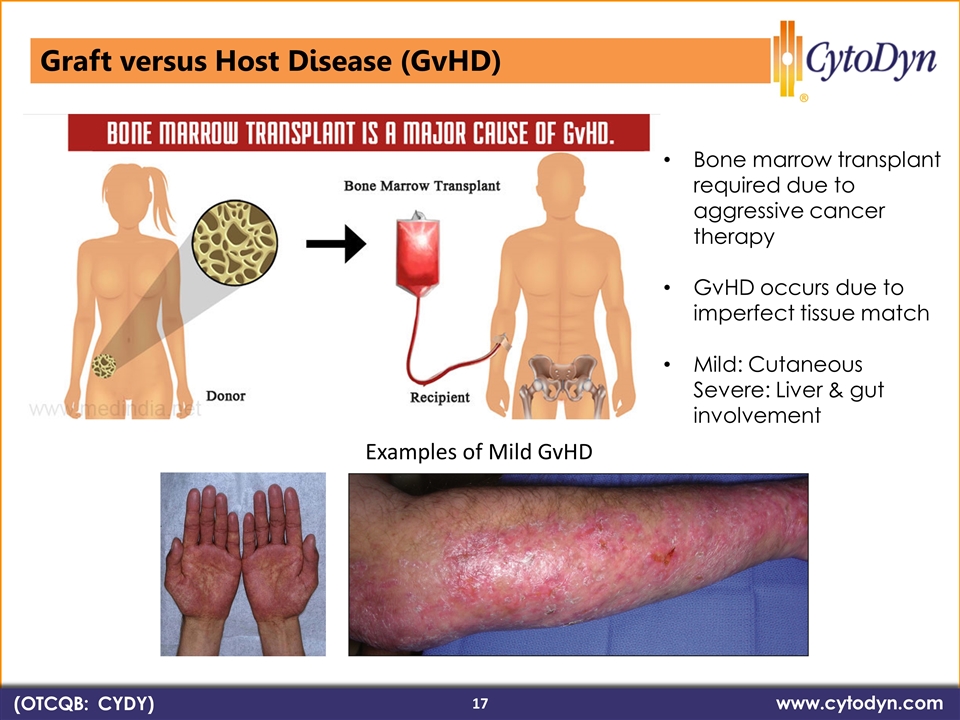

www.cytodyn.com (OTCQB: CYDY) Bone marrow transplant required due to aggressive cancer therapy GvHD occurs due to imperfect tissue match Mild: Cutaneous Severe: Liver & gut involvement Examples of Mild GvHD (OTCQB: CYDY) www.cytodyn.com 17 Graft versus Host Disease (GvHD)

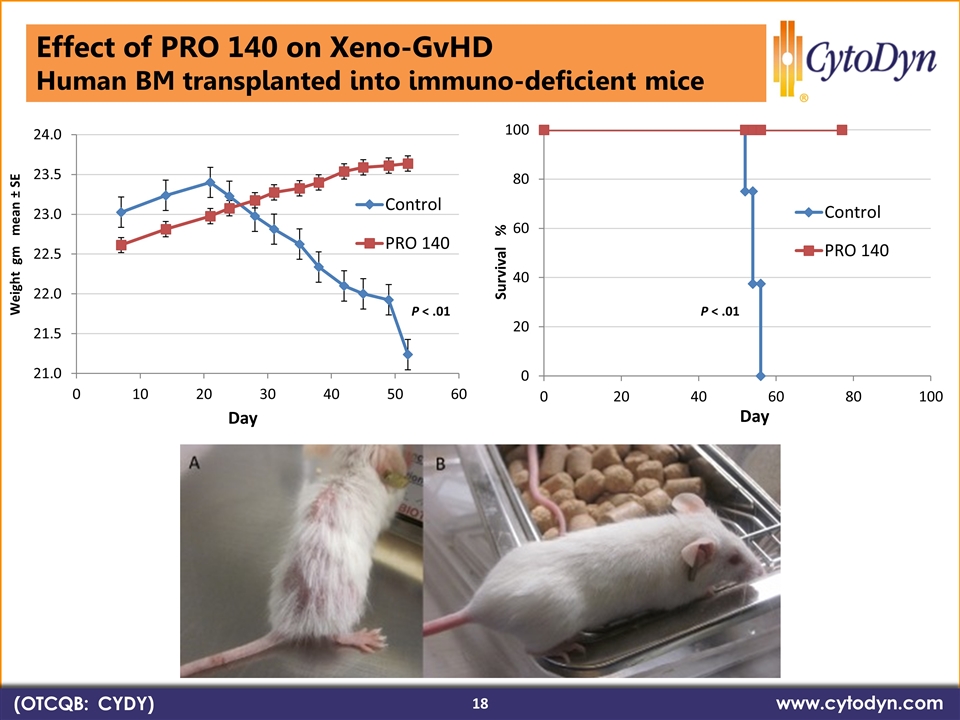

P < .01 P < .01 (OTCQB: CYDY) www.cytodyn.com 18 Effect of PRO 140 on Xeno-GvHD Human BM transplanted into immuno-deficient mice

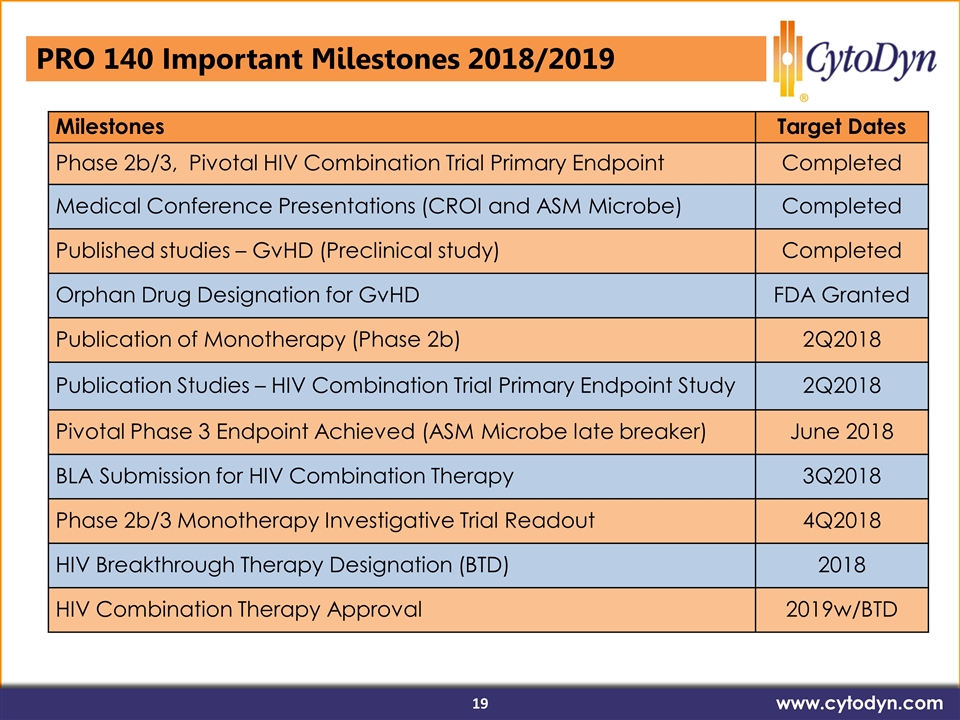

HIV Breakthrough Therapy Designation (BTD) www.cytodyn.com Milestones Target Dates Phase 2b/3, Pivotal HIV Combination Trial Primary Endpoint Completed Medical Conference Presentations (CROI and ASM Microbe) Completed Published studies – GvHD (Preclinical study) Completed Orphan Drug Designation for GvHD FDA Granted Publication of Monotherapy (Phase 2b) 2Q2018 Publication Studies – HIV Combination Trial Primary Endpoint Study 2Q2018 Pivotal Phase 3 Endpoint Achieved (ASM Microbe late breaker) June 2018 BLA Submission for HIV Combination Therapy 3Q2018 Phase 2b/3 Monotherapy Investigative Trial Readout 4Q2018 HIV Breakthrough Therapy Designation (BTD) 2018 HIV Combination Therapy Approval 2019w/BTD PRO 140 Important Milestones 2018/2019