Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hudson Pacific Properties, Inc. | a8-k.htm |

Investor Presentation December 31, 2017

This document is not an offer to sell or solicitation of an offer to buy any securities. Any offers to sell or solicitations to buy securities shall be made by means

of a prospectus approved for that purpose.

2

Forward-Looking Statements and Non-GAAP Financial Measures

% of ABR

21

% of ABR

6

% of ABR

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Such forward-looking statements relate to, without limitation, our future economic performance, plans and objectives for future

operations, and projections of revenue, net operating income, funds from operations, discounts to net asset values and other selected financial information. Forward-

looking statements can be identified by the use of words such as "may," "will," "plan," “could,” "should," "expect,” "anticipate," “outlook,” "estimate," “projected,”

“target,” "continue" “intend,” “believe,” “seek,” or “assume,” and variations of such words and similar expressions are intended to identify such forward-looking

statements. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. You should not

rely on forward-looking statements as predictions of future events. Forward-looking statements involve numerous risks and uncertainties that could significantly affect

anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statement made by us. These risks and

uncertainties include, but are not limited to: adverse economic and real estate developments in Northern and Southern California and the Pacific Northwest; decreased

rental rates or increased tenant incentives and vacancy rates; defaults on, early terminations of, or non-renewal of leases by tenants; increased interest rates and

operating costs; failure to generate sufficient cash flows to service our outstanding indebtedness; difficulties in identifying properties to acquire and completing

acquisitions; failure to successfully integrate pending and recent acquisitions; failure to successfully operate acquired properties and operations; failure to maintain our

status as a REIT under the Internal Revenue Code of 1986, as amended; possible adverse changes in laws and regulations; environmental uncertainties; risks related to

natural disasters; lack or insufficient amount of insurance; inability to successfully expand into new markets or submarkets; risks associated with property development;

conflicts of interest with our officers; changes in real estate and zoning laws and increases in real property tax rates; and the consequences of any possible future

terrorist attacks. You are cautioned that the information contained herein speaks only as of the date hereof and we assume no obligation to update any forward-looking

information, whether as a result of new information, future events or otherwise. The risks described above are not exhaustive, and additional factors could adversely

affect our business and financial performance, including those discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December

31, 2017 filed with the Securities and Exchange Commission on February 16, 2018. In this presentation, we rely on and refer to information and statistical data regarding

the industry and the sectors in which we operate. This information and statistical data is based on information obtained from various third-party sources, and, in some

cases, on our own internal estimates. We believe that these sources and estimates are reliable, but have not independently verified them and cannot guarantee their

accuracy or completeness.

USE OF NON-GAAP FINANCIAL MEASURES AND OTHER DEFINITIONS

This presentation contains certain non-GAAP financial measures within the meaning Regulation G and other terms that have particular definitions when used by us. The definitions of

these non-GAAP financial measures and other terms may differ from those used by other REITs and, accordingly, may not be comparable. The definitions of these terms, the reasons for

their use, and reconciliations to the most directly comparable GAAP measure are either included in the Appendix hereto or in our Supplemental Operating and Financial Data report for the

quarter ended December 31, 2017.

ABR: ANNUALIZED BASE RENT

Annualized cash rents before abatements under commenced leases, excludes tenant reimbursements

RENT SPREADS

Initial rents on new and renewal leases compared to expiring rents for same space

NOI: NET OPERATING INCOME

Rental income less rental expenses1

STABILIZED YIELD

Quotient of NOI and property investment once project has reached stabilization

FFO: FUNDS FROM OPERATIONS

Typical measurement used to assess REIT performance, similar to EPS with adjustments for depreciation and other items1

FFO MULTIPLE

Share price divided by FFO per share

TOTAL CAPITALIZATION

Sum of total debt, Series A preferred units, Series B preferred stock and aggregate market value of outstanding common equity1

GROSS REAL ESTATE ASSETS

Book value of real estate assets, excluding depreciation and amortization, plus deferred leasing costs and acquired lease intangibles, net

NET DEBT

Total debt excluding unamortized loan premiums and deferred financing costs, less cash and cash equivalents

SECURED DEBT

Debt secured by first-priority deed of trust liens on properties

STABILIZED PROPERTIES

Office properties that have reached 92% occupancy since the date acquired or place under (re)development, excludes (re)development, held-for-sale and land assets

LEASE-UP PROPERTIES

Office properties that have not reached stabilization, excludes (re)development, held-for-sale and land assets

IN-SERVICE PROPERTIES

Stabilized and lease-up office properties

3

Glossary of Terms

1) See Appendix (p.37) for expanded definitions.

We Specialize in Owning and Enhancing High-Quality Office

and Studio Properties in Select West Coast Markets

+ We focus on unlocking value through leasing, redevelopment of operating assets and

development of ancillary sites

+ We invest in high-barrier office markets poised for outsized growth

+ Our portfolio largely consists of blue-chip and growth tenants, many in technology,

media and entertainment

+ Our strong balance sheet provides exceptional flexibility and access to capital sources

+ We offer investors an attractive valuation with a significant opportunity for growth

4

5

17.6M

SQUARE FEET2

83%

5-YEAR TOTAL

SHAREHOLDER RETURN3

1) As of 12/31/17. 2) Square footage includes office, studio and land assets. Land square footage represents management’s estimate of

developable square feet, which may be subject to entitlement approvals not yet been obtained. 3) Data provided by FactSet and as of 12/31/17 and

based on closing price of $34.25. 4) Market cap based on closing price of $34.25 and includes common stock and operating partnership units. 5)

Represents Q4 ‘17 total revenue annualized. 6) Debt includes pro-rata share of indebtedness for joint venture assets. 7) Dividend yield calculated

as Q4 ‘17 dividend of $0.25 annualized divided by the12/31/17 closing price of $34.25.

2010

INITIAL PUBLIC OFFERING

2006

FOUNDED IN

OFFICE PROPERTIES

51

STUDI0 PROPERTIES

3

INVESTMENT GRADE COMPANY

NYSE:HPP

$7.8B

TOTAL MARKET CAP3,4

$757M

ANNUALIZED REVENUE5

30.7%

DEBT6 / TOTAL MARKET CAP4

2.9%

DIVIDEND YIELD7

Hudson Pacific

at a Glance

Our Business Model

Pg. 7: Section 1

Our Portfolio

Pg. 19: Section 2

Our Opportunity

Pg. 28: Section 3

Contents

Section 1:

Our Business Model

8

Our Portfolio Spans the Most Dynamic West Coast Office Markets

8.6

MILLION S.F. % of ABR

52

SILICON VALLEY

3.9

MILLION S.F. % of ABR

15

L O S A N G E L E S

3

STUDIOS

7

H O L L Y W O O D

1.5

MILLION S.F. % of ABR

7

S E A T T L E

2.3

MILLION S.F.

19

SAN FRANCISCO

WASHINGTON

OREGON

CALIFORNIA

% of ABR

% of ABR

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions. Square footage includes office (both in-service and development and redevelopment

properties), studio and land assets.

9

Capital Discipline Facilitates Our Strategic Growth

+ $1.9 billion of public equity raised exclusively to fund transactions

+ 31% average Net Debt / Gross Assets, while growing Gross Assets 11x

+ Investment grade credit rated: Moody’s (Baa3), S&P (BBB-), Fitch (BBB-)

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions and Appendix (p.36) for information and reconciliations of non-GAAP financial

measures.

$0.6

$1.2

$1.6

$2.2 $2.5

$6.5

$7.1 $7.2

1%

32% 34%

40% 38%

34% 37% 33%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

Q2 '10 (IPO) Q4 '11 Q4 '12 Q4 '13 Q4 '14 Q4 '15 Q4 '16 Q4 '17

Gross RE Assets

($ in Billions)

Consolidated Net Debt /

Gross Assets

10

Our Balance Sheet Enables Excellent Capital Access and Liquidity

69%

31%

Total Equity Market Cap Total Debt

Low Leverage—31% Debt / Equity Market Cap2

92%

8%

Fixed Rate Debt Floating Rate Debt

Minimal Exposure to Interest Rate Volatility3 4

$300

$79

$220

Undrawn Cash Revolver Cash Sunset Gower/Bronson Loan

Nearly $600 Million of Untapped Liquidity

83%

17%

Unsecured Debt Secured Debt

Few Real Estate Assets Collateralize Debt3

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions and Appendix (p.36) for information and reconciliations of non-GAAP financial

measures. 2) Market cap based on closing price of $34.25 and includes common stock and operating partnership units. 3) Debt includes pro-rata

share of indebtedness for joint venture assets. 4) Certain indebtedness is subject to interest rate contracts to swap floating rate interest to fixed

rate interest.

11

Our Leasing Expertise Drives Office Occupancy and Rents

+ 9.8 million square feet leased at 52% GAAP and 38% Cash Rent Spreads since 2010 IPO

+ Stabilized and In-Service Office Portfolios 96.7% and 92.1% leased, respectively

LOS ANGELES

SAN FRANCISCO

SILICON VALL

EY

SEATTLE

% LEASED AT CHANGE (BPS) ANNUALIZED BASE RENT AT CHANGE (%)

Acquisition

Date (Various)

53% 95% 4,221

81% 98% 1,725

86% 88% 187

88% 98% 936

$34 $47 36%

$23 $47 108%

$40 $46 15%

$24 $28 19%

12/31/17 Acquisition

Date (Various)

12/31/17

1) As of 12/31/17 for in-service office properties only. Leased percentage and ABR at acquisition calculated as the weighted average as of the last

day of the first quarter following acquisition. Excludes assets held for sales as of 12/31/17, including Peninsula Office Park Building 6, 2180 Sand

Hill, Embarcadero Place, and 9300 Wilshire. See Glossary of Terms (p.3) for definitions.

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

12

Studio Same-Store Cash NOI Growth 2010-2017

56%

Our Operating Expertise Improves Studio Occupancy and Cash Flow

2010 2017

1) As of 12/31/17. Based on Same-Store Studios only—Sunset Gower and Sunset Bronson. See Glossary of Terms (p.3) for definitions and

Appendix (p.36) for information and reconciliations of non-GAAP financial measures. 2) Year-over-year growth compares Studio Same-Store Cash

NOI for the twelve months ended 12/31/17 to Studio Same-Store Cash NOI for the twelve months ended 12/31/16.

$14.3M

$22.4M

+ Full-year Studio Same-Store Cash NOI increased 56% from 2010 to 2017—13% growth year-over-year2

+ 36% of stage/production office square footage now under long-term lease (3 or more years)

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17

Est. Project Costs Total Market Cap

Project Costs as % of

Total Market Cap

Pre-Leasing S.F. as % of

Construction S.F.

13

We Take a Conservative Approach to (Re)Development

7% 7% 7% 5% 5% 4% 7%

1) As of 12/31/17. Estimated project costs based on management estimates as of the last day of the respective period and exclude capitalized

interest, personnel costs and operating expenses. Total market cap based on the closing stock price as of the last day of the respective period.

+ Focus on creating value through leasing, less capital intensive repositionings and redevelopment

+ Project costs consistently less than 10% of total market cap

+ Pipeline typically 50% pre-leased before new construction starts

4%

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17 Q4 '17

S.F. Pre-Leased Est. S.F. Under Construction

60% 60% 60% 67% 72%

38% 23%

6%

S.F.

(Millions)

Market Cap

($ Billions)

$300+ Million Invested

8.2% Weighted Avg. Stabilized Yield

$198 Million of Estimated Value Creation

14

We Invest Strategically to Transform Underperforming Assets

Vacant warehouse redeveloped as Class A office;

100% leased to Github

Vacant warehouses redeveloped as Class A LEED

Gold office; 100% leased to Riot Games

Vacant warehouse redeveloped as Class A office;

100% leased to Deluxe Media

BRANNAN

S A N F R A N C I S C O275 ELEMENT W E S T L . ALA 3401EXPOSITIONS A N T A M O N I C A

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions. 2) Calculations are a weighted average for 275 Brannan, Element LA, 3401 Exposition

and 12655 Jefferson (sold). Value creation calculated by applying a 5% cap rate to stabilized cash NOI less total project cost as of stabilization.

Project costs exclude capitalized interest costs, capitalized personnel costs and capitalized operating expenses capitalized. Actual value creation

may differ materially from estimates. See Appendix (p.36) for additional calculation details.

15

We Develop Best-In-Class Office Environments for Leading Companies

Focus on Ancillary Sites Adjacent to Operating Assets Allows

for Lower Basis and Outsized Returns

10.2% Stabilized Yield

$152 Million of Estimated Value Creation

9.2% Stabilized Yield

$44 Million of Estimated Value Creation

115,000 S.F. of Class A office replaced dated, low-rise buildings

at Sunset Gower; 100% leased to Technicolor as North American HQ

327,000 S.F. pf Class A, LEED Gold office replaced former

parking lot at Sunset Bronson; 100% leased to Netflix as L.A. HQ

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions. 2) Value creation calculated by applying a 5% cap rate to stabilized cash NOI less

total project cost as of stabilization (Technicolor includes land). Project costs exclude capitalized interest costs, capitalized personnel costs and

capitalized operating expenses. Actual value creation may differ materially from estimates. See Appendix (p.36) for additional calculation details.

16

We Are Committed to Sustainable Building Design and Operations

53 Energy Star-Labeled Buildings

90 Average Energy Star Rating (Top 10% for Energy Efficiency)

17% Energy Star Improvement from 2015 to 2017

100% of Office Portfolio Benchmarked in Energy Star’s Portfolio Manager

23% of Office S.F. LEED Certified (Gold, Silver, or Platinum)

100% of New Developments Obtained/Pursuing LEED Certification

$-

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

$2.00

$2.20

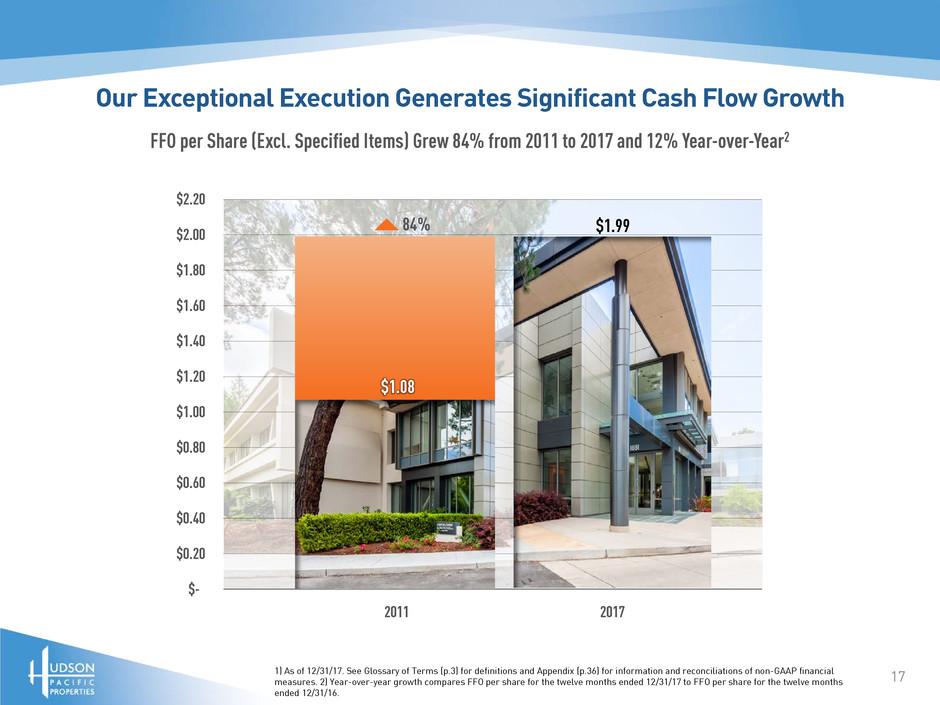

Our Exceptional Execution Generates Significant Cash Flow Growth

FFO per Share (Excl. Specified Items) Grew 84% from 2011 to 2017 and 12% Year-over-Year2

17

84%

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions and Appendix (p.36) for information and reconciliations of non-GAAP financial

measures. 2) Year-over-year growth compares FFO per share for the twelve months ended 12/31/17 to FFO per share for the twelve months

ended 12/31/16.

2011 2017

$1.99

$1.08

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

100.0%

18

Our 5-Year Total Shareholder Return Outperforms Most Office REITs

83% Total Return from December 2012 to December 2017

S&P 500

86%

RMZ USA

28%

HPP

83%

1) As of 12/31/17. Data provided by FactSet and as of 12/31/17 and based on closing price of $34.25.

Section 2:

Our Portfolio

Los Angeles Market Snapshot

Unique Office and Studio Holdings in Leading Creative Markets

20

O F F I C E M A R K E T D R I V E R S

+ Streaming networks: Netflix, Amazon, Google establishing significant foothold to access talent

+ Production increase: Networks spent over $15 billion on content in 20171

+ Maturing tech sector: ‘Silicon Beach’ expands to Hollywood, Downtown; $21 billion (#5) of VC investment since 20102

+ Limited new supply: Only 4.8 million S.F. (6% of supply) of new office construction delivered since 20103

1) Based on current management estimates. 2) Pitchbook, Venture Ecosystem Factbook, 2017. 3) Provided by CBRE data as of 12/31/17. Data

included for Hollywood, Downtown L.A. and West L.A. submarkets. 4) 9300 Wilshire is under contract to sell as of 12/31/17.

4

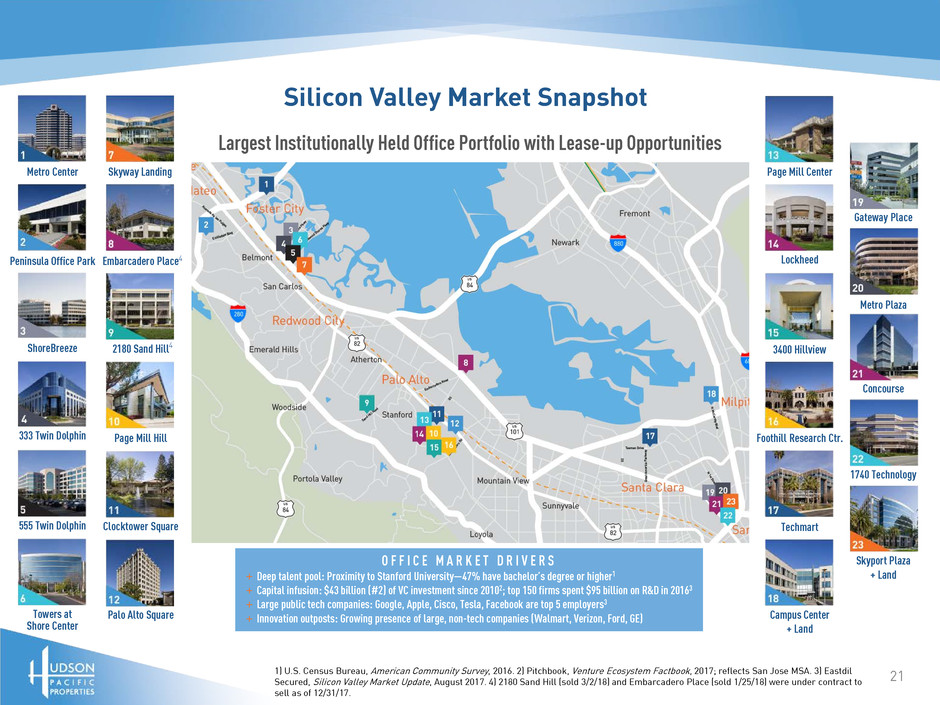

Silicon Valley Market Snapshot

Largest Institutionally Held Office Portfolio with Lease-up Opportunities

21

O F F I C E M A R K E T D R I V E R S

+ Deep talent pool: Proximity to Stanford University—47% have bachelor’s degree or higher1

+ Capital infusion: $43 billion (#2) of VC investment since 20102; top 150 firms spent $95 billion on R&D in 20163

+ Large public tech companies: Google, Apple, Cisco, Tesla, Facebook are top 5 employers3

+ Innovation outposts: Growing presence of large, non-tech companies (Walmart, Verizon, Ford, GE)

Metro Center

Peninsula Office Park

ShoreBreeze

333 Twin Dolphin

555 Twin Dolphin

Towers at

Shore Center

Skyway Landing

Embarcadero Place

2180 Sand Hill

Page Mill Hill

Clocktower Square

Palo Alto Square

Page Mill Center

Lockheed

3400 Hillview

Foothill Research Ctr.

Techmart

Campus Center

+ Land

Gateway Place

Metro Plaza

Concourse

1740 Technology

Skyport Plaza

+ Land

1) U.S. Census Bureau, American Community Survey, 2016. 2) Pitchbook, Venture Ecosystem Factbook, 2017; reflects San Jose MSA. 3) Eastdil

Secured, Silicon Valley Market Update, August 2017. 4) 2180 Sand Hill (sold 3/2/18) and Embarcadero Place (sold 1/25/18) were under contract to

sell as of 12/31/17.

4

4

San Francisco Market Snapshot

7-8

Fully Leased, Iconic Office Assets in Prime Locations

22

O F F I C E M A R K E T D R I V E R S

+ Deep talent pool: 57% bachelor’s degree or higher1

+ Capital infusion: $101 billion (#1) of VC investment since 20102;

+ Urban sensibility: Tech companies expanding into the city to

augment Silicon Valley HQ (Google, Yahoo, Cisco)

+ Limited new supply: Prop M caps annual office construction

project completions at 950,000 S.F.

Rincon Center I & II

901 Market

875 Howard

275 Brannan

625 Second

1455 Market

1) U.S. Census Bureau, American Community Survey, 2016. 2) Pitchbook, Venture Ecosystem Factbook, 2017; reflects San Francisco MSA.

Seattle Market Snapshot

Growing Office Foothold in Transforming Urban Markets

23

411 First

83 King

505 First

Met Park North

Hill 7

O F F I C E M A R K E T D R I V E R S

+ Deep talent pool: 63% bachelor’s degree or higher; 1,000 people moving to

Seattle each week1

+ Capital infusion: $8+ billion (#7) of VC investment since 2010; U. of

Washington spends $1+ billion (#4) on R&D annually2

+ Blue-chip growth companies: Global HQ for Starbucks, Microsoft, Amazon

(footprint increased nearly 7X since 2007)3

+ Company in-migration: Facebook, Google, HBO, Staples opened hubs to

access talent

450 Alaskan

Northview Center

1) U.S. Census Bureau, American Community Survey, 2016, U.S. Department of Education; Colliers International, Seattle Office Update, 12/31/18.

2) Pitchbook, Venture Ecosystem Factbook, 2017; BestColleges.com, 2016. 3) Colliers International, Seattle Office Update, 12/31/17.

24

Tenancy Comprised of Leading Blue-Chip and Growth Companies

% A B R

3.1%6.3% 3.5% 3.1% 3.1% 2.9% 2.6% 2.6% 2.3% 2.1% 1.8% 1.6% 1.6% 1.4% 1.3% 1.1%

37.3% TOTAL

NASDAQ : $744B

(Tencent : HKG)

NASDAQ : $126B

NASDAQ : $211B

NASDAQ : $96B

NASDAQ : $86B

$68B Post-$

Valuation

NASDAQ : $18B

$80B + Valuation

(Dell)

(Oracle : ORCL)

U.S. Government

$22B Endowment

15 Largest Tenants

1) As of 12/31/17. Public company market cap data as of 3/1/18. Uber, Stanford University and NFL valuations based on current management

estimates. See Glossary of Terms (p.3) for definitions.

NASDAQ : $6B

Int’l. Law Firm

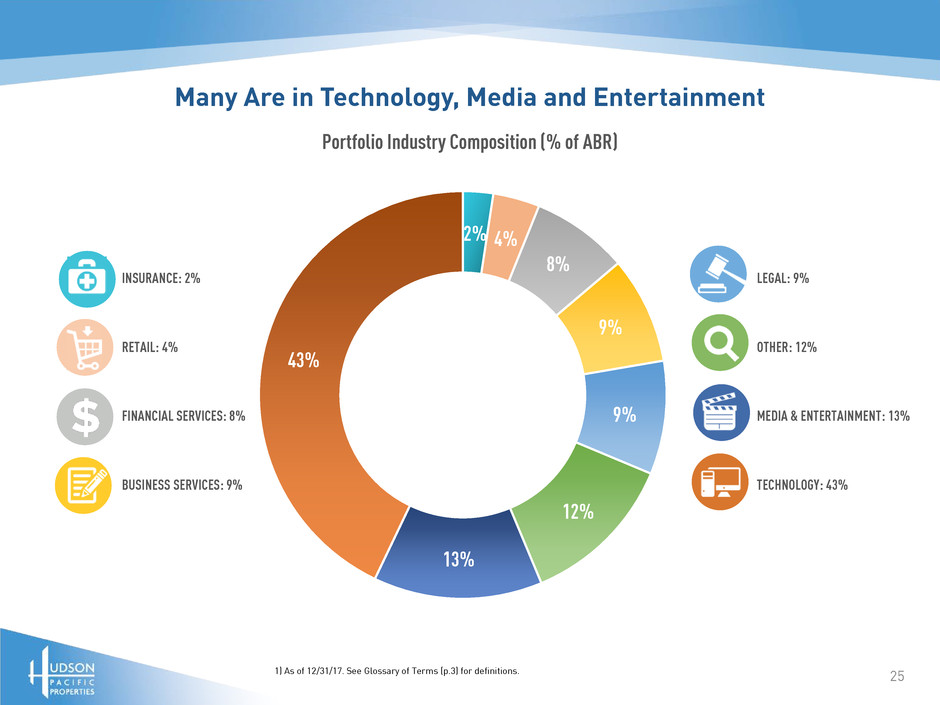

2% 4%

8%

9%

9%

12%

13%

43%

Many Are in Technology, Media and Entertainment

INSURANCE: 2%

RETAIL: 4%

FINANCIAL SERVICES: 8%

BUSINESS SERVICES: 9%

LEGAL: 9%

OTHER: 12%

MEDIA & ENTERTAINMENT: 13%

TECHNOLOGY: 43%

Portfolio Industry Composition (% of ABR)

251) As of 12/31/17. See Glossary of Terms (p.3) for definitions.

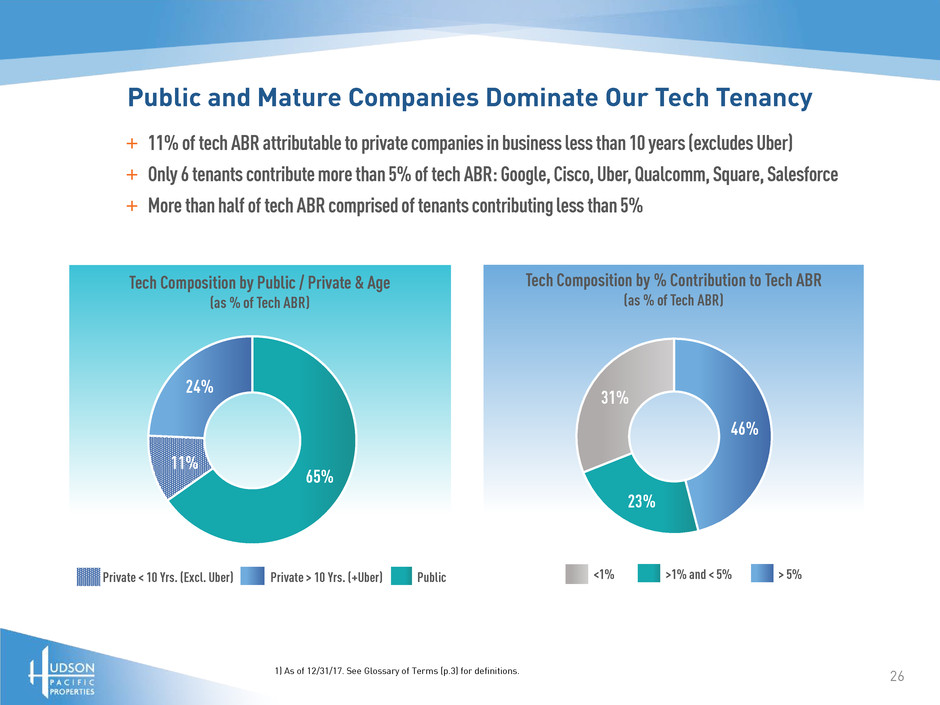

Tech Composition by Public / Private & Age

(as % of Tech ABR)

65%

11%

24%

Private < 10 Yrs. (Excl. Uber) Private > 10 Yrs. (+Uber) Public

46%

23%

31%

Public and Mature Companies Dominate Our Tech Tenancy

26

Tech Composition by % Contribution to Tech ABR

(as % of Tech ABR)

<1% >1% and < 5% > 5%

+ 11% of tech ABR attributable to private companies in business less than 10 years (excludes Uber)

+ Only 6 tenants contribute more than 5% of tech ABR: Google, Cisco, Uber, Qualcomm, Square, Salesforce

+ More than half of tech ABR comprised of tenants contributing less than 5%

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions.

27

Our Facilities and Expertise Draw Media & Entertainment Users

10 Stages 308,000 S.F.

Clients: Netflix HQ,

KTLA, CBS, Showtime

12 Stages 572,000 S.F.

Clients: Technicolor HQ,

ABC, Netflix, Amazon, HBO

13 Stages 377,000 S.F.

Clients: MTV, Disney,

Comedy Central, Netflix

1) As of 12/31/17. Clients representative of both historical and current tenancy.

+ Own/operate Sunset Studios—largest collection of independent studios in Hollywood and U.S.

+ 1.2 million S.F. of existing/under construction Class A office space adjacent to stages

+ Deep relationships with traditional and streaming networks (e.g., Netflix, ABC/Disney, CBS, Amazon, HBO)

Section 3:

Our Opportunity

Net Operating Income Growth Driver

Leasing Up Our Below-Market-Occupancy Office Acquisitions

29

Region Properties Square Feet % Leased Submarket %

Occupancy2

Los Angeles 1 500,475 88.1% 91.9%

Silicon Valley 8 3,338,433 78.9% 87.0%

Total 9 3,838,908 80.1% 87.3%

Existing In-Service Lease-Up Portfolio

New Leasing Strategies Strategic Upgrades Substantial Repositioning

1) As of 12/31/17, excluding Hill7, which was 100% leased. See Glossary of Terms (p.3) for definitions. 2) Occupancy data provided by CBRE as of

12/31/17 and calculated based on a weighted average of applicable submarkets by region.

$40.39

$29.46

$55.56

$47.78

$45.92

$36.23

$66.10

$55.55

$-

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

$70.00

Los Angeles Seattle San Francisco Silicon Valley

Expiring Rent Market Rent

196,499 Exp. S.F. 265,628 Exp. S.F. 2,034,615 Exp. S.F.308,591 Exp. S.F.

Mark-To-Market Rent Growth: 2018 & 2019 Expirations

Net Operating Income Growth Driver

Re-Leasing Our Office Space at Substantially Higher Rents

30

17% Mark-To-Market on 2018 and 2019 Expirations

14%

23%

19%

16%

1) As of 12/31/17. Market rent statistics provided by CoStar and REIS. See Glossary of Terms (p.3) for definitions.

Net Operating Income Growth Driver

Building Our Pipeline of (Re)Development Projects

31

Under Construction Projects To Produce Estimated Weighted Avg. 6.9% Stabilized Yield3

Under Construction

430,748 S.F. in Los Angeles and Seattle

Potential Future Projects

2.7 million S.F.—53% in Los Angeles, 47% in Silicon Valley

Nearly 1 million S.F. of studio-adjacent opportunities2

95 Jackson

(Pioneer Square)

Maxwell

(L.A. Arts District)

1) As of 12/31/17. See Glossary of Terms (p.3) for definitions. 2) Land square footage represents management’s estimate of developable square

feet, which may be subject to entitlement approvals not yet been obtained. 3) Calculated as the weighted average of the stabilized yield for each

under construction project. Initial stabilized yield calculated as the quotient of estimated NOI and total project cost upon stabilization.

EPIC

(Hollywood)

Net Operating Income Growth Driver

Enhancing Facilities and Operations at Sunset Las Palmas Studios

32

+ Investing $3 million to improve facilities and optimize stage and support space mix

+ Increasing stage occupancy from 78% to 95% by closing multi-year, multi-stage production deals

+ Increasing below-market production office rates by 10% coincident with improved client experience

Our Valuation is Favorable Relative to Other West Coast Office REITs

33

HPP Pure Peers

Current FFO Multiple 17.4x 21.7x

Forward FFO Multiple 16.6x 20.3x

HPP Pure Peers

NAV Premium (Discount) (18.4%) (5.2%)

Analyst Coverage Reinforces HPP’s

Unrealized Value

HPP Trades at a Significant Discount

1) As of 12/31/17, including closing stock price of $34.25. Pure peers include other pure-play West Coast Office REITS Kilroy Realty Corporation

and Douglas Emmett. Current and forward FFO multiples based on 2017 and 2018 FFO consensus estimates, respectively. NAV consensus

premium (discount) represents the delta between closing stock price and consensus NAV. See Glossary of Terms (p.3) for definitions.

34

HPP Offers a Compelling Investment Opportunity

Exceptional track record of unlocking value through leasing, redevelopment

and development of ancillary sites

Blue-chip tenants in high-growth West Coast markets and industries, like

technology, media and entertainment

Strong balance sheet with excellent capital access

Attractive valuation with a significant opportunity for growth

Our Executive Team Has Deep Real Estate and Public Company Experience

Alexander Vouvalides

35

Dale Shimoda

Victor J. Coleman

Chairman & CEO

Founded Hudson Capital in

2006 and served as

Managing Partner.

Formerly Co-Founder,

President, COO and Director

at Arden Realty. Sold to GE.

Mark T. Lammas

COO & CFO

Joined in 2009 as CFO.

Formerly EVP, SVP and

General Counsel at Maguire

Properties, Inc.

Christopher Barton

EVP, Development & Capital

Investments

Joined in 2006. Prior roles as

SVP and VP, Construction &

Development.

Formerly with Arden Realty and

Beers-Skanska Construction.

CIO

Joined in 2009, Prior roles as

SVP, Acquisitions and VP, Asset

Management.

Formerly with Credit Suisse.

Arthur Suazo

EVP, Leasing

Joined in 2010, Prior roles as

SVP, VP and Director of

Leasing.

Formerly with Cushman &

Wakefield and Savills

Studley.

Josh Hatfield

EVP, Operations

Joined in 2014. Prior roles as

SVP, Operations and SVP,

Northern California.

Formerly held senior

positions at GE Capital Real

Estate.

Gary Hansel

SVP, Southern California

Joined in 2014.

Formerly SVP, Operations at

GE/Arden Realty.

Drew Gordon

SVP, Northern California

Joined in 2011 as SVP,

Northern California. Prior

role as SVP, Pacific

Northwest.

Formerly EVP and CIO at

Venture Corporation.

Andrew Wattula

SVP, Pacific Northwest

Joined in 2017.

Formerly Managing Director

with Beacon Partners.

Bill Humphrey

SVP, Sunset Studios

Joined in 2014.

Formerly SVP at Point 360 and

Principal and Founder at Water

Clock Media.

Kay Tidwell

EVP, General Counsel

Joined in 2010.

Formerly an attorney with

Latham & Watkins LLP.

EVP, Finance

Joined in 2010.

Formerly with Arden Realty, the

Yarmouth Group and Ernst &

Young.

Appendix:

Definitions, Calculations &

Reconciliations

37

Expanded Definitions

NOI: NET OPERATING INCOME

NOI is not a measure of operating results or cash flows from operating activities as measured by GAAP and should not be considered an alternative to income from continuing operations,

as an indication of our performance, or as an alternative to cash flows as a measure of liquidity, or our ability to make distributions. All companies may not calculate NOI in the same

manner. We consider NOI to be a useful performance measure to investors and management because, when compared across periods, NOI reflects the revenues and expenses directly

associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective not

immediately apparent from income from continuing operations. We define NOI as operating revenues (including rental revenues, other property-related revenue, tenant recoveries and

other operating revenues), less property-level operating expenses (which includes external management fees, if any, and property-level general and administrative expenses). NOI

excludes corporate general and administrative expenses, depreciation and amortization, impairments, gain/loss on sale of real estate, interest expense, acquisition-related expenses

and other non-operating items. NOI on a cash basis is NOI on a GAAP basis, adjusted to exclude the effect of straight-line rent and adjustments required by GAAP. We believe that NOI on

a cash basis is helpful to investors as an additional measure of operating performance because it eliminates straight-line rent and other non-cash adjustments to revenue and expenses.

FFO: FUNDS FROM OPERATIONS

Total Funds From Operations (“FFO”): Funds From Operations before non-controlling interest (“FFO”) is a non-GAAP financial measure we believe is a useful supplemental measure of

our performance. We calculate FFO in accordance with the White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts. The

White Paper defines FFO as net income or loss calculated in accordance with generally accepted accounting principles in the United States (“GAAP”), excluding extraordinary items, as

defined by GAAP, gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus real estate-related depreciation and

amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets) and after adjustment for unconsolidated partnerships and joint ventures. The

calculation of FFO includes the amortization of deferred revenue related to tenant-funded tenant improvements and excludes the depreciation of the related tenant improvement assets.

We believe that FFO is a useful supplemental measure of our operating performance. The exclusion from FFO of gains and losses from the sale of operating real estate assets allows

investors and analysts to readily identify the operating results of the assets that form the core of our activity and assists in comparing those operating results between periods. Also,

because FFO is generally recognized as the industry standard for reporting the operations of REITs, it facilitates comparisons of operating performance to other REITs. However, other

REITs may use different methodologies to calculate FFO, and accordingly, our FFO may not be comparable to all other REITs. Implicit in historical cost accounting for real estate assets in

accordance with GAAP is the assumption that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market

conditions, many industry investors and analysts have considered presentations of operating results for real estate companies using historical cost accounting alone to be insufficient.

Because FFO excludes depreciation and amortization of real estate assets, we believe that FFO along with the required GAAP presentations provides a more complete measurement of our

performance relative to our competitors and a more appropriate basis on which to make decisions involving operating, financing and investing activities than the required GAAP

presentations alone would provide. We use FFO per share to calculate annual cost bonuses for certain employees. However, FFO should not be viewed as an alternative measure of our

operating performance because it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating

performance of our properties, which are significant economic costs and could materially impact our results from operations.

TOTAL CAPITALIZATION

Total capitalization represents the sum of total debt, Series A preferred units, Series B preferred stock and the aggregate market value of outstanding common equity as of the

applicable date assuming that each partnership unit owned by a third party has a market value equal to one share of common stock (including unvested restricted shares).

38

Value Creation Calculations

1) Square footage for office properties as determined by management based on estimated leasable square feet, which may be less or more than

the Building Owners and Managers Association (BOMA) rentable area. Square footage may change over time due to re-measurement or re-

leasing. Square footage for land assets represents management’s estimate of developable square feet, which may be subject to entitlement

approvals not yet been obtained. 2) Project costs exclude interest costs capitalized in accordance with Accounting Standards Codification (“ASC”)

835-20-50-1, personnel costs capitalized in accordance with ASC 970-360-25 and operating expenses capitalized in accordance with ASC 970-340.

(3) Estimated stabilized yield on project costs is calculated as the quotient of the estimated amounts of NOI and our investment in the property

once the project has reached stabilization and initial rental concessions, if any, have elapsed. Our estimated initial stabilized yield excludes the

impact of leverage. Our cash rents related to our value-creation projects are expected to increase over time and our average cash yields are

expected, in general, to be greater than our estimated stabilized yields on a cash basis.

Total Project Stabilized Value

S.F.1 Costs2 Cap Rate NOI Value Creation Yield3

3401 Exposition 63,376 37.4$ 5% 2.6$ 52.1$ 14.7$ 7.0%

Element LA 284,037 190.6 5% 15.6 311.6 120.9 8.2%

12655 Jefferson 100,756 60.1 5% 4.4 88.0 27.9 7.3%

275 Brannan 54,673 16.7 5% 2.5 50.9 34.2 15.3%

Total 502,842 304.8$ 25.1$ 502.6$ 197.8$ 8.2%

Total Project Stabilized Value

S.F.1 Costs2 Cap Rate NOI Value Creation Yield3

Technicolor 114,958 52.6$ 5% 4.8$ 96.4$ 43.8$ 9.2%

ICON 325,757 145.9$ 5% 14.9$ 298.0$ 152.1$ 10.2%

DEVELOPMENT PROJECT ESTIMATED VALUE CREATION ($ in Millions)

REDEVELOPMENT PROJECT ESTIMATED VALUE CREATION ($ in Millions)

39

Cash / GAAP Reconciliations

NET & TOTAL DEBT

Q210 Q411 Q412 Q413 Q414 Q415 Q416 Q417

Notes payable $94,020 $399,871 $582,085 $931,308 $960,508 $2,279,755 $2,707,839 $2,439,311

less : Unamortized loan premium, net 280 (1,965) (1,201) (5,320) (3,056) (1,310) - -

less : Cash and cash equivalents (84,509) (13,705) (18,904) (30,356) (17,753) (53,551) (83,015) (78,922)

Net Debt $9,791 $384,201 $561,980 $895,632 $939,699 $2,224,894 $2,624,824 $2,360,389

Secured debt $94,300 $397,906 $580,884 $770,988 $677,452 $723,445 $682,839 $464,311

Unsecured debt $- $- $- $155,000 $280,000 $1,555,000 $2,025,000 $1,975,000

Total debt $94,300 $397,906 $580,884 $925,988 $957,452 $2,278,445 $2,707,839 $2,439,311

UNDEPRECIATED REAL ESTATE ASSETS

Q210 Q411 Q412 Q413 Q414 Q415 Q416 Q417

Investment in real estate, at cost $509,378 $1,060,504 $1,475,955 $2,035,330 $2,171,295 $5,769,536 $6,470,301 $6,423,441

plus : Real estate held for sale - - - - 70,777 208,438 39,101 224,776

plus: Investment in unconsolidated entities - - - - - 37,228 14,240

plus : Deferred leasing costs and lease intangibles, net 22,288 84,131 83,498 112,204 102,023 318,031 310,062 244,554

less : Lease intangible liabilities, net (12,259) (22,861) (31,560) (45,441) (40,969) (95,208) (80,130) (49,930)

plus : Notes receivable - - 4,000 - 28,268 28,684 - -

Undepreciated real estate assets $519,407 $1,121,774 $1,531,893 $2,102,093 $2,331,394 $6,229,481 $6,776,562 $6,857,081

40

Cash / GAAP Reconciliations (Cont.)

STUDIO SAME-STORE CASH NET OPERATING INCOME

Twelve Months Ended

12/31/10 12/31/16 12/31/17

Net (loss) income $(2,682) $43,758 $94,561

Adjustments:

Interest expense 8,831 76,044 90,037

Interest income (59) (260) (97)

Unrealized (gain) loss on ineffective portion of derivative instruments (347) 1,436 70

Transaction-related expenses 4,273 376 598

Other expense (income) 192 (1,558) (2,992)

Gains on sale of real estate - (30,389) (45,574)

Income from operations $10,208 $89,407 $136,603

Adjustments:

General and administrative 4,493 52,400 54,459

Depreciation and amortization 15,912 269,087 283,570

Office GAAP net operating income (16,291) (390,301) (448,237)

Non-same-store studio NOI - - (4,283)

Same-store studio GAAP NOI adjustments - (822) 247

Studio same-store cash net operating income $14,322 $19,771 $22,359

41

Cash / GAAP Reconciliations (Cont.)

FUNDS FROM OPERATIONS (FFO)

Twelve Months Ended

12/31/12 12/31/16 12/31/17

Net (loss) income $(5,006) $43,758 $94,561

Adjustments:

Depreciation and amortization of real estate assets 57,024 267,245 281,773

Gains on sale of real estate - (30,389) (45,574)

FFO attributable to non-controlling interests (17) (18,817) (24,068)

Net income attributable to preferred stock and units (12,924) (636) (636)

FFO to common shareholders and unit holders 39,077 261,161 306,056

Specified items impacting FFO:

Transaction-related expenses 1,051 376 598

One-time property tax expenses 918 - -

One-time debt extinguishment costs - - 1,114

FFO (excluding specified items) per common stock/unit - diluted $41,046 $261,537 $307,768

42

Contact:

Laura Campbell

VP, Head of Investor Relations

(310) 622-1702

lcampbell@hudsonppi.com