Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark

One)

|

☒

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

For the

Fiscal Year Ended December

31, 2017

|

☐

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

For the

transition period from __________________ to

__________________

Commission

file number: 001-37969

|

ENDRA Life Sciences Inc.

|

||

|

(Exact Name of

Registrant as Specified in Its Charter)

|

||

|

Delaware

|

|

26-0579295

|

|

(State or Other

Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

3600 Green Court, Suite 350, Ann

Arbor, MI

|

|

48105-1570

|

|

(Address of

Principal Executive Offices)

|

|

(Zip

Code)

|

(734) 335-0468

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common

Stock, par value $0.0001 per share

|

The

NASDAQ Stock Market LLC

|

|

Warrants,

each to purchase one share of Common Stock

|

The

NASDAQ Stock Market LLC

|

Securities

registered pursuant to Section 12 (g) of the Act: None

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined

in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate by check

mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate by check

mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes

☒ No ☐

Indicate by check

mark whether the registrant has submitted electronically and posted

on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of

Regulation S-T during the preceding 12 months (or for

such shorter period that the registrant was required to submit and

post such files). Yes ☒ No ☐

Indicate by check

mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained,

to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check

mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definitions of "large

accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☐ (Do not check if a smaller reporting

company)

|

Smaller

reporting company ☒

|

|

Emerging

growth company ☒

|

|

If

an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check

mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act): Yes ☐ No ☒

The

aggregate market value of voting and non-voting common equity held

by non-affiliates of the registrant, as of June 30, 2017, was

approximately $14,831,809 based on the closing sales price of the

common stock on such date as reported on the NASDAQ Capital

Market.

As of

March 20, 2018, there were 3,923,027 shares of the

registrant’s common stock outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

ENDRA LIFE SCIENCES INC.

TABLE OF CONTENTS

|

PART

I

|

|

|

Item 1. Business

|

3

|

|

Item

1A. Risk Factors

|

18

|

|

Item

1B. Unresolved Staff Comments

|

39

|

|

Item

2. Properties

|

39

|

|

Item 3. Legal

Proceedings

|

39

|

|

Item

4. Mine Safety Disclosures

|

39

|

|

PART

II

|

|

|

Item

5. Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity

Securities

|

40

|

|

Item

6. Selected Financial Data

|

40

|

|

Item

7. Management's Discussion and Analysis of Financial

Condition and Results of Operations

|

41

|

|

Item

7A. Quantitative and Qualitative Disclosures About

Market Risk.

|

45

|

|

Item 8. Financial

Statements and Supplementary Data.

|

46

|

|

Item 9. Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

47

|

|

Item 9A. Controls

and Procedures.

|

48

|

|

Item 9B. Other

Information.

|

48

|

|

PART

III

|

48

|

|

Item 10. Directors,

Executive Officers and Corporate Governance.

|

49

|

|

Item

11. Executive Compensation

|

53

|

|

Item 12. Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholders Matters.

|

56

|

|

Item

13. Certain Relationships and Related Transactions, and

Director Independence

|

57

|

|

Item 14. Principal

Accountant Fees and Services

|

58

|

|

PART

IV

|

|

|

Item 15. Exhibits,

Financial Statements and Schedules

|

59

|

|

Item

16. Form 10-K Summary

|

60

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K (this “Annual Report”)

contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

that are intended to be covered by the “safe harbor”

created by those sections. Forward-looking statements, which are

based on certain assumptions and describe our future plans,

strategies and expectations, can generally be identified by the use

of forward-looking terms such as “believe,”

“expect,” “may,” “will,”

“should,” “would,” “could,”

“seek,” “intend,” “plan,”

“goal,” “project,” “estimate,”

“anticipate,” “strategy”,

“future”, “likely” or other comparable

terms and references to future periods. All statements other than

statements of historical facts included in this Annual Report

regarding our strategies, prospects, financial condition,

operations, costs, plans and objectives are forward-looking

statements. Examples of forward-looking statements include, among

others, statements we make regarding: expectations for revenues,

cash flows and financial performance, the anticipated results of

our development efforts and the timing for receipt of required

regulatory approvals and product launches.

Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, the

following:

●

our limited

commercial experience, limited cash and history of

losses;

●

our ability to

obtain adequate financing to fund our business operations in the

future;

●

our ability to

achieve profitability;

●

our ability to

develop a commercially feasible application based on our

Thermo-Acoustic Enhanced Ultrasound (“TAEUS”)

technology;

●

market acceptance

of our technology;

●

results of our

human studies, which may be negative or inconclusive;

●

our ability to find

and maintain development partners;

●

our reliance on

collaborations and strategic alliances and licensing

arrangements;

●

the amount and

nature of competition in our industry;

●

our ability to

protect our intellectual property;

●

potential changes

in the healthcare industry or third-party reimbursement

practices;

●

delays and changes

in regulatory requirements, policy and guidelines including

potential delays in submitting required regulatory applications for

CE mark certification or FDA approval;

●

our ability to

obtain CE mark certification and secure required Food and Drug

Administration (“FDA”) and other governmental approvals

for our TAEUS applications;

●

our ability to

comply with regulation by various federal, state, local and foreign

governmental agencies and to maintain necessary regulatory

clearances or approvals; and

●

the other risks and

uncertainties described in the Risk Factors and in

Management’s Discussion and Analysis of Financial Condition

and Results of Operations sections of this Annual

Report.

Any

forward-looking statement made by us in this report is based only

on information currently available to us and speaks only as of the

date on which it is made. We undertake no obligation to publicly

update any forward-looking statement, whether written or oral, that

may be made from time to time, whether as a result of new

information, future developments or otherwise.

2

PART I

As used

in this Annual Report, unless the context otherwise requires, the

terms “ENDRA,” “we,” “us,”

“our,” and the “Company” refer to ENDRA

Life Sciences Inc., a Delaware corporation.

Item 1. Business

Overview

We have

commercialized an enhanced ultrasound technology for the

pre-clinical research market and are leveraging that expertise to

develop technology for increasing the capabilities of clinical

diagnostic ultrasound to broaden patient access to the safe

diagnosis and treatment of a number of significant medical

conditions in circumstances where expensive X-ray computed

tomography, or CT, and magnetic resonance imaging, or MRI,

technology is unavailable or impractical.

Since

2010, we have marketed and sold our Nexus 128 system, which

combines light-based thermoacoustics and ultrasound, to address the

imaging needs of researchers studying disease models in

pre-clinical applications. Building on our expertise in

thermoacoustics, we have developed a next-generation technology

platform — Thermo Acoustic Enhanced Ultrasound, or TAEUS,

which is intended to enhance the capability of clinical ultrasound

technology and support the diagnosis and treatment of a number of

significant medical conditions that require the use of expensive CT

or MRI imaging or where imaging is not practical using existing

technology. We believe that our TAEUS technology, which can be used

with existing ultrasound equipment and incorporated into

next-generation ultrasound systems, has the potential to make

advanced imaging available in certain applications to a wider range

of patients on a more cost-effective basis than is possible using

existing CT and MRI technology. We expect to continue to sell our

Nexus 128 system to maintain a base level of revenue, but believe

the market potential for our clinical systems is much

higher.

Diagnostic Imaging Technologies

Diagnostic

imaging technologies such as CT, MRI and ultrasound allow

physicians to look inside a person’s body to guide treatment

or gather information about medical conditions such as broken

bones, cancers, signs of heart disease or internal

bleeding. The type of imaging technology a physician uses

depends on a patient’s symptoms and the part of the body

being examined. CT technology is well suited for viewing bone

injuries, diagnosing lung and chest problems, and detecting

cancers. MRI technology excels at examining soft tissue in ligament

and tendon injuries, spinal cord injuries, and brain tumors. CT

scans can take as little as 5 minutes, while an MRI scan can take

up to 30 minutes.

Unfortunately,

while CT and MRI systems are versatile and create high quality

images, they are also expensive and not always accessible to

patients. A CT system costs approximately $1 million and an MRI

system can cost up to $3 million. CT and MRI systems are large and

can weigh several tons, typically requiring significant

modifications to existing healthcare facilities to safely handle

the load. Because of their size and weight, CT and MRI systems are

usually fixed-in-place at major medical facilities. As a result,

they are less accessible to primary care and rural clinics,

economically developing markets, and patient bedsides. As of 2013,

there were only approximately 64,000 CT systems and 32,000 MRI

systems in the world, approximately 50% of which were located in

the U.S. and Japan.

While

CT and MRI systems create high quality images, their use is not

always practical. For example, the diagnosis and treatment of the

estimated 1.4 billion patients suffering from Non-Alcoholic Fatty

Liver Disease, or NAFLD, requires ongoing surveillance of the

patients’ livers to assess the progression of the disease and

the efficacy of treatment. However, the use of CT and MRI systems

to perform that surveillance is impractical for a number of

reasons, including the high cost of the scan, the limited

availability of CT and MRI systems and the required use of contrast

agents, including those containing radioactive substances that can

cause allergic reactions and reduced kidney functions. Patient

exposure to the ionizing radiation generated by a CT system must be

limited for safety reasons. Similarly, because of the strong

magnetic field created by an MRI machine, patients with metal joint

replacements or cardiac pacemakers cannot be imaged with an MRI

system.

3

Because

of CT and MRI’s limited availability and practical

limitations, a patient who would otherwise be a candidate for CT or

MRI scanning must often rely on less effective or less practical

methods. For example, MRI scans are not typically used to measure

tissue temperature during thermoablative (temperature based)

surgery. Instead, physicians use printed manufacturer guidelines to

time the thermal surgery or insert surgical temperature probes in

an attempt to guide treatment. As a result, the treatment is often

imprecise or comes with additional risks, such as

infection.

These

limitations have led to a decrease in the number of CT scans.

According to the American College of Radiology, the overall number

of CT scans performed in the United States under Medicare Part B

fell approximately 8% from 2009 to 2014. The decline in CT scans

has been accompanied by increased use of alternative scanning

technologies. The American College of Radiology reported that the

overall number of ultrasound scans performed in the United States

under Medicare Part B increased approximately 6% from 2009 to 2014.

During the same period MRI usage increased by 5%, but remains

significantly below the use of ultrasound technology, even in the

United States.

Ultrasound Technology

An

ultrasound machine transmits sound waves, which bounce off tissues,

organs and blood in the body. The ultrasound machine captures these

echoes and uses them to create an image. Ultrasound technology

excels at imaging the structure of internal organs, muscles and

bone surfaces. Due to its utility, cost-effectiveness and safety

profile, ultrasound imaging is frequently used in a

physician’s examination room or at a patient’s bedside

as a first-line diagnostic tool, which has resulted in an overall

increase in the number of ultrasound scans performed.

Ultrasound

systems are more broadly available to patients than either CT or

MRI systems. There are an estimated 925,000 ultrasound systems

globally in use today. Ultrasound systems are relatively

inexpensive compared to CT and MRI systems, with smaller portable

ultrasound systems costing as little as $10,000 and

new cart-based ultrasound systems costing between $75,000 and

$200,000. Ultrasound systems are also more mobile than CT and MRI

systems and many are designed to be moved by an operator from room

to room, or closer to patients. Ultrasound technology does not

present the same safety concerns as CT and MRI technology, since

ultrasound does not emit ionizing radiation and ultrasound contrast

agents are considered to be generally safe.

However,

ultrasound’s imaging capabilities are more limited compared

to CT and MRI technology. For example, ultrasound systems cannot

measure tissue temperature during thermal ablation surgery, or

quantify fat to diagnose early stage liver disease -- instances

where CT and MRI systems are used.

Ultrasound Market

Sales

of ultrasound diagnostic equipment were approximately $4.4 billion

globally in 2017 and are expected to grow at approximately 4.4%

annually. There are an estimated 925,000 installed systems

generating over 400 million annual diagnostic ultrasound procedures

globally. Additionally, an estimated 30,000 to 50,000 new and

replacement systems are sold into the market each year. These

numbers include both portable and cart-based ultrasound systems,

and cover all types of diagnostic ultrasound procedures, including

systems intended for cardiology, prenatal and abdominal use. We do

not intend to address low-cost, portable ultrasound systems and

systems focused on applications, such as prenatal care, where we

believe our TAEUS technology will not substantially impact patient

care. Accordingly, we define our addressable market for one or more

of our TAEUS applications at approximately 338,000 cart-based

ultrasound systems currently in use throughout the

world.

We

believe that demand for ultrasound systems is driven primarily by

the following factors:

●

Population

growth and age demographics that increase the demand for diagnostic

screening for cancer, cardiology, and prenatal

applications.

●

Economic

development broadening investment in healthcare in previously

underserved markets such as China and Latin America, where

ultrasound technology has significant appeal due to its price point

and flexibility at point-of-care.

●

Expanding

ultrasound applications and improving image quality that drive

demand for new ultrasound technologies, such as software

enhancements, bi-axial probes, and dedicated single application

systems.

●

Positive

insurance reimbursement rate trends for ultrasound diagnostics due

to the technology’s safety and

cost-effectiveness.

Unmet Need

We

believe that the limited availability of high-utility and

cost-effective imaging technology represents a significant unmet

medical need. We believe that expanding the capability of

ultrasound technology to perform more of the imaging tasks

presently available only on expensive CT and MRI systems will

satisfy this unmet need.

Our Solutions

Our

Thermo-Acoustic Enhanced Ultrasound, or TAEUS, technology, as well

as our commercially available Nexus 128 system, use a pulsed energy

source – near-infrared light and radio-frequency, or RF,

respectively – to generate ultrasonic waves in tissue. These

waves are then detected with ultrasound equipment and used to

create high-contrast images using our proprietary algorithms.

Unlike conventional ultrasound, which creates images based on the

scattering properties of tissue, thermoacoustic imaging provides

tissue absorption maps of the pulsed energy, similar to those

generated by CT scans. Ultrasound is only utilized to transmit the

absorption signal to the imaging system outside of the

body.

4

Our TAEUS Technology Platform for Clinical

Applications

To

increase the utility of our thermoacoustic technology, in 2013 we

began to develop our TAEUS technology platform. Unlike the

near-infrared light pulses used in our Nexus 128 system (discussed

below), our TAEUS technology uses RF pulses to stimulate tissues,

using a small fraction of the energy transmitted into the body

during an MRI scan. Using RF energy enables our TAEUS technology to

penetrate deep into tissue, enabling the imaging of human anatomy

at depths equivalent to those of conventional ultrasound. The RF

pulses are absorbed by tissue and converted into ultrasound

signals, which are detected by an external ultrasound receiver and

a digital acquisition system that is part of the TAEUS system. The

detected ultrasound is processed into images using our proprietary

algorithms and displayed to complement conventional gray-scale

ultrasound images. The TAEUS imaging process is illustrated

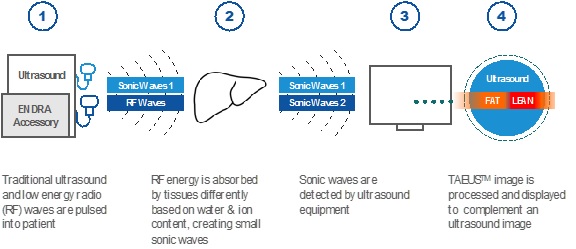

below:

Our

RF-based thermoacoustics are not adversely affected by blood-filled

organs, enabling our TAEUS technology to be used in clinical liver

applications, among others.

After

approval, our TAEUS technology can be added as an accessory to

existing ultrasound systems, helping to improve clinical

decision-making on the front lines of patient care, without

requiring new clinical workflows or large capital investments. We

are also developing TAEUS for incorporation into new ultrasound

systems, primarily through our collaboration with GE Healthcare,

described more fully below.

We

believe that our TAEUS technology has the potential to add a number

of new capabilities to conventional ultrasound and thereby enhance

the utility of both existing and new ultrasound systems and extend

the use of ultrasound technology to circumstances that either

require the use of expensive CT or MRI imaging systems or where

imaging is not practical using existing technology. To

demonstrate the capabilities of our TAEUS platform, we have

conducted various internal ex-vivo laboratory experiments and have

also conducted limited internal in-vivo large animal studies. In

our ex-vivo and in-vivo testing, we have demonstrated that the

TAEUS platform has the following capabilities and potential

clinical applications:

5

●

Tissue Composition:

Our TAEUS technology enables ultrasound to distinguish fat from

lean tissue. This capability would enable the use of TAEUS-enhanced

ultrasound for the early identification, staging and monitoring of

NAFLD, a precursor to non-alcoholic steatohepatitis

(“NASH”), liver fibrosis, cirrhosis and liver

cancer.

●

Temperature

Monitoring: Our TAEUS technology enables traditional ultrasound to

visualize changes in tissue temperature, in real time. This

capability would enable the use of TAEUS-enhanced ultrasound to

guide thermoablative therapy, which uses heat or cold to remove

tissue, such as in the treatment of cardiac atrial fibrillation, or

removal of cancerous liver and kidney lesions, with greater

accuracy.

●

Vascular Imaging:

Our TAEUS technology enables ultrasound to view blood vessels from

any angle, using only a saline solution contrasting agent, unlike

Doppler ultrasound, which requires precise viewing angles. This

capability would enable the use of TAEUS-enhanced ultrasound to

easily identify arterial plaque or malformed vessels.

●

Tissue Perfusion:

Our TAEUS technology enables ultrasound to image blood flow at the

capillary level in a region, organ or tissue. This capability could

be used to assist physicians in characterizing microvasculature

fluid flows symptomatic of damaged tissue, such as internal

bleeding from trauma, or diseased tissue, such as certain

cancers.

In

addition, to further test the capability of our TAEUS platform to

distinguish tissue composition in conjunction with an NAFLD

application, we have engaged the Centre for Imaging Technology

Commercialization (“CIMTEC”), a contract research

organization, to initiate human studies.

Because

of the large number of traditional ultrasound systems currently in

global use, we are first developing our TAEUS technology for sale

as an aftermarket accessory that works with existing ultrasound

systems. Because our TAEUS technology is designed to enhance the

utility of, not replace, conventional ultrasound, we believe

healthcare providers will be able to increase the utilization of,

and generate new revenue from, their existing ultrasound systems

once we obtain required regulatory approval for specific

applications. Based on our design work and our understanding

of the ultrasound accessory market, we intend to price

our initial NAFLD TAEUS application at a price

point approximating $40,000 to $50,000, which should enable

purchasers to recoup their investment in less than one year by

performing a relatively small number of additional ultrasound

procedures. We further believe that clinicians will be attracted to

our technology because it will enable them to perform more

procedures with existing ultrasound equipment, thereby retaining

more imaging patients in their clinics rather than referring

patients out to a regional medical center for a CT or MRI

scan.

ENDRA’s

first clinical product will be designed to interface with a

conventional ultrasound scanner, utilizing the scanner’s

B-mode imaging to guide the selected region for assessment of liver

fat content. The following sub-systems will comprise ENDRA’s

first generation product.

Radio Frequency (RF) Source and Computer:

The RF

source consists of a low power waveform generator and an amplifier.

Together, these components provide the characteristic pulses

required to excite thermoacoustic signals in tissue. The computer

provides processing capability to both utilize the conventional

ultrasound data for navigation to the measurement site of interest,

and the calculations required to convert digitized thermoacoustic

signals to measurements of fat in liver tissue. The entire

sub-system will reside in a single enclosure, on wheels, and sit

adjacent to the ultrasound imaging system.

Specialized Transducer:

A

single channel ‘receive only’ ultrasound transducer is

specifically designed and optimized for thermoacoustic imaging. The

transducer sub-system will detect thermoacoustic signals excited by

the RF source within the liver. The transducer assembly includes

electronics for signal amplification, digitization, and signal

processing. The specialized transducer will attach to the

conventional ultrasound probe used for liver imaging.

6

RF Applicator:

The RF

applicator transmits pulses of energy, provided by the RF source,

into tissue. The applicator is positioned in proximity to the

target region for measurement.

A

second generation product is expected to provide two dimensional

imaging with a transducer composed of multiple receive elements.

The RF source and applicator will be similar to those in the first

generation product but the multi-element transducer will allow for

multiple applications including: reading tissue composition,

temperature, vascular flow, tissue perfusion, and other potential

applications. Ultimately, we expect our technology will be

incorporated into conventional ultrasound systems and our business

model will transition from producing stand-alone systems to

licensing our technology, IP and specialized components to

ultrasound OEMs. Existing ultrasound equipment already includes

power supplies, computation, high speed electronics, and ultrasound

transducers, which may be leveraged by our thermoacoustic imaging

applications. The RF source and applicator are the principal

hardware components that will be added to OEM ultrasound systems

for the OEM fully integrated form of our product.

We are

following a model that mirrors the approach used by companies in

the past to introduce new ultrasound imaging capabilities to

existing conventional ultrasound scanners. Color Doppler,

elastography, 3-D imaging, and high channel count systems were all

introduced by new companies (not already involved in conventional

ultrasound imaging). Historically, ultrasound imaging has grown

through the introduction of unique technology and capabilities that

expanded the applications and use of clinical ultrasound in a form

that often added separate hardware to existing ultrasound systems.

Ultimately, as these new technologies gained acceptance in the

marketplace they were incorporated into OEM-designed and built

systems that were sold by the leading ultrasound imaging

vendors.

Sales

of ultrasound diagnostic equipment were approximately $4.4 billion

globally in 2017 and are expected to grow at approximately 4.4%

annually. There are an estimated 925,000 installed systems

generating over 400 million annual diagnostic ultrasound procedures

globally. Additionally, an estimated 30,000 to 50,000 new and

replacement systems are sold into the market each year. These

numbers include both portable and cart-based ultrasound systems,

and cover all types of diagnostic ultrasound procedures, including

systems intended for cardiology, prenatal and abdominal use. We do

not intend to address low-cost, portable ultrasound systems and

systems focused on applications, such as prenatal care, where we

believe our TAEUS technology will not substantially impact patient

care. Accordingly, we define our addressable market for one or more

of our TAEUS applications at approximately 338,000 cart-based

ultrasound systems currently in use throughout the

world.

7

Potential Clinical Applications for our TAEUS

Technology

Early Diagnosis and Monitoring of Non-Alcoholic Fatty Liver

Disease, or NAFLD

Our

first TAEUS platform application will focus on quantifying fat in

the liver and stage progression of NAFLD which, untreated, can

progress to Non-Alcoholic Steato-Hepatitis, or NASH, cirrhosis and

liver cancer. In 2011, over 1.4 billion people were affected by

NAFLD/NASH. The World Gastroenterology Organisation considers

NAFLD/NASH a global pandemic affecting rich and poor countries

alike. Obesity, hepatitis, and diabetes are leading contributors to

the development of NAFLD.

Untreated,

an estimated 30% of NAFLD cases progress to NASH, a condition in

which liver fat causes inflammation and decreased liver function,

resulting in fatigue, weight loss, muscle pain and abdominal

pain.

Approximately

25% of NASH cases progress to liver fibrosis, in which liver

inflammation causes scar tissue which eventually prevents the liver

from functioning properly. The scar tissue blocks the flow of blood

through the liver and slows the processing of nutrients, hormones,

drugs, and naturally produced toxins. It also slows the production

of proteins and other substances made by the liver. Once a patient

develops cirrhosis of the liver, the only life-saving therapy is a

liver transplant. Additionally, cirrhosis patients may develop

liver cancer. In 2015, the World Health Organization estimated that

liver cancer kills 745,000 people annually. Because of the

increased incidence of obesity, hepatitis and diabetes throughout

the world, NAFLD has become the most common chronic liver disease

and an important cause of cirrhosis and liver cancer

worldwide.

Despite

the increased incidence of NAFLD and its role in the development of

NASH, cirrhosis and liver cancer, we believe that no low-cost,

accurate and safe method exists for measuring fat in the liver.

Current liver enzyme blood tests are indicative, but cannot

reliably confirm early stage NAFLD or NASH, and liver enzyme levels

are normal in a large percentage of patients with NAFLD. Existing

ultrasound technology can only measure fat qualitatively in the

liver at moderate to severe levels, typically greater than 30%

liver fat, and ultrasound has low accuracy when used on obese

patients. While early stage NAFLD and NASH can be confirmed by an

MRI scan, an MRI scan is expensive, and MRI systems are not widely

available or practical for many patients. A surgical biopsy can be

used to confirm NAFLD and NASH, but is also expensive, involves a

painful procedure and exposes patients to the risk of infection.

Furthermore, MRIs and surgical biopsies are impractical for

repeated screening and monitoring of liver disease. We believe

these limitations negatively impact the diagnosis and treatment of

patients with NAFLD.

Patients

diagnosed with NAFLD and related liver diseases are typically

treated with therapies such as statins, insulin sensitizers and

other compounds and are encouraged to adopt lifestyle changes to

improve their overall health.

A

significant number of pharmaceutical compounds targeting liver

disease are in development by companies such as Bristol-Myers

Squibb Company, Intercept Pharmaceuticals, Inc., Gilead Sciences,

Inc., Genfit SA, Conatus Pharmaceuticals Inc., Allergan plc and

Immuron Limited.

8

Billions

of dollars are spent annually on the diagnosis and treatment of

NAFLD and related liver diseases. In the United States alone, the

median Medicare inpatient charge per NAFLD patient is estimated to

be $36,000 and the total

annual direct medical costs for NAFLD are estimated to be $103

billion. Identification and staging of NAFLD is central to

determining the course of treatment.

In

addition, patients receiving treatment for NAFLD-spectrum liver

diseases must continue to be monitored to assess disease

progression and the efficacy of treatment. Because of the high cost

and limited global availability, CT and MRI technology is not

typically used for this function.

We

believe our TAEUS technology will enable primary care physicians,

radiologists and hepatologists to diagnose NAFLD earlier and

monitor patients with NAFLD-spectrum liver diseases more accurately

and cost-effectively than is possible with existing

technology.

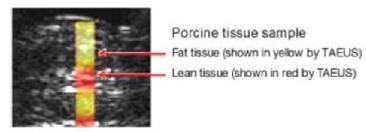

Image below: Depiction of ex-vivo TAEUS tissue composition analysis

overlaid on traditional ultrasound image. First version of TAEUS is

expected to assess fat in liver only.

Temperature Monitoring of Thermoablative Surgery

We also

intend to develop a TAEUS platform application to guide thermal

ablation surgery, such as in the treatment of cardiac atrial

fibrillation, chronic pain and lesions of the liver, thyroid,

kidneys and other soft tissues. We plan to target clinical users of

thermoablative technology, including interventional radiologists,

cardiologists, gynecologists and surgical oncologists.

Thermoablation

involves the use of heat or cold to remove malfunctioning or

diseased tissue in surgical oncology, cardiology, neurology,

gynecology, and urology applications. Thermoablative technologies

include RF, microwave, laser and cryogenic ablation. The worldwide

market for RF surgical ablation procedures alone was estimated in

2015 to be $3.7 billion per annum, generating over 5 million annual

RF ablation procedures and growing at approximately 18% annually.

We believe that the growth of this market is driven primarily by

the aging global population requiring more cardiac and cancer

procedures, as well as the relative ease-of-use and low cost of

thermoablative technologies when compared to open

surgery.

However,

RF and other thermoablative surgery technologies pose risks,

including under-treatment of diseased tissue and unintended thermal

damage to areas outside the treatment area. For example, it has

been reported that patients receiving RF ablation of liver tumors

have experienced thermal injury to the diaphragm, gallbladder, bile

ducts and gastrointestinal tract, some of which have resulted in

patient deaths.

Clinicians

must rely on printed manufacturer guidelines to

plan procedures using thermal ablation technologies or,

when available, monitor tissue temperature changes in real-time

with MRI imaging or surgical temperature probes. We believe these

existing methods either lack real-time precision or are impractical

due to cost, poor availability and other factors.

9

We

believe that the ability to visualize changes in tissue temperature

in real time could potentially enhance the effectiveness and safety

of thermoablation therapies and that our TAEUS technology platform

combined with traditional ultrasound has the potential to guide

thermoablation surgery more cost-effectively and more accurately

than existing methods.

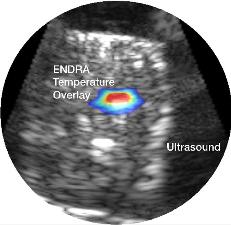

Image below: Depiction of ex-vivo TAEUS tissue temperature analysis

overlaid on traditional ultrasound image.

Vascular Imaging

We

believe that our TAEUS technology can be used to image blood

vessels and distinguish them from the surrounding tissue. In

addition to our NAFLD and thermoablation applications, we intend to

develop a cardiovascular application based on our TAEUS technology

that, with the use of a standard saline contrast agent, can enable

existing ultrasound systems to perform a number of cardiovascular

diagnostic functions, such as identifying arterial plaque or

blocked or malformed vessels, as well as safely guiding biopsies

away from vital vasculature.

Conventional

ultrasound imaging systems use Doppler imaging in a variety of

vascular applications. Doppler ultrasound, which images the

velocity of blood, is effective in larger vessels and regions where

blood velocity is high. However, Doppler ultrasound is not

sufficiently sensitive for use in very small vessels or in vascular

imaging applications where blood velocities are very low. For these

applications, contrast enhanced CT and MRI angiography is used

which requires the patient to be injected with a contrast agent,

iodinated compounds and gadolinium, respectively. Contrast-enhanced

CT and MRI scans both require referral for examination after

initial screening with ultrasound and carry risks associated with

their respective contrast agents. We believe that our TAEUS

platform application has the potential to offer the advantages of

CT and MR contrast enhanced imaging at the point of care using only

a safe electrolyte solution as the contrast agent.

Tissue Perfusion or “Leakiness”

We

believe that our TAEUS technology can be used to image tissue

perfusion, or the absorption of fluids into an organ or tissue. We

intend to develop an application for our TAEUS platform that would

enable ultrasound detection of microvasculature fluid flows

symptomatic of tissue compromised by trauma or

disease.

When a

person’s body is affected by disease or trauma, blood and

other fluids may leak from damaged tissues in subtle ways.

Traditional ultrasound cannot effectively image these disruptions

in microvascular permeability, but we believe ultrasound combined

with our TAEUS technology can.

10

We

believe that using our TAEUS technology physicians will be able to

quickly and clearly see tissue compromised by disease, such as

cancer, or trauma, especially with the use of a standard saline

contrast agent, when CT or MRI is not readily

available.

Collaboration

with GE Healthcare

On

April 22, 2016, we entered into a Collaborative Research Agreement

with General Electric Company, acting through its GE Healthcare

business unit and the GE Global Research Center, or GE Healthcare.

Under the terms of the agreement, GE Healthcare has agreed to

assist us in our efforts to commercialize our TAEUS technology for

use in a fatty liver application by, among other things, providing

equipment and technical advice, and facilitating introductions to

GE Healthcare clinical ultrasound customers. In return for this

assistance, we have agreed to afford GE Healthcare certain rights

of first offer with respect to manufacturing and licensing rights

for the target application. More specifically, we have agreed that,

prior to commercially releasing our TAEUS technology for a fatty

liver application, we will offer to negotiate an exclusive

ultrasound manufacturer relationship with GE Healthcare for a

period of at least one year of commercial sales. The commercial

sales would involve, within our sole discretion, either our company

commercially selling GE Healthcare ultrasound systems as the

exclusive ultrasound system with their TAEUS fatty liver

application embedded, or GE Healthcare being the exclusive

ultrasound manufacturer to sell ultrasound systems with the TAEUS

fatty liver application technology embedded.

The

agreement with GE Healthcare does not prevent us from selling our

TAEUS fatty liver application technology to distributors or

directly to non-manufacturer purchasers.

Additionally,

the agreement provides that prior to offering to license any of our

TAEUS fatty liver application intellectual property to a third

party, we will first offer to negotiate to license our TAEUS fatty

liver application intellectual property to GE

Healthcare.

Finally,

we agreed that prior to selling any equity interests in our company

to a healthcare device manufacturer, we will first offer to

negotiate in good faith to sell such equity interests to GE

Healthcare.

The

term of the agreement has been extended to January 2020, but the

agreement is subject to termination by either party upon not less

than 60 days’ notice.

Our Nexus 128 System for Laboratory

Research

Since

2010 we have marketed our Nexus 128 system to address the imaging

needs of researchers studying disease models in pre-clinical

applications. The Nexus 128 uses near-infrared light combined

with ultrasound to generate 3D images of tumors in laboratory mice.

We believe the Nexus 128 is the only commercially available fully

3D thermoacoustic imaging system.

Sales

of the Nexus 128 system were approximately $500,000 in 2016 and

$287,000 in 2017. Our Nexus 128 system is used in a number of

leading global academic research centers, including Stanford

University, The University of Michigan, Shanghai Jiao Tong

University, and Purdue University.

While

our Nexus 128 system is suited for small animal research, the

near-infrared light energy used in our Nexus 128 system only

penetrates tissues up to 3cm, limiting its utility beyond

shallow-depth human dermatological or breast applications.

Additionally, blood-filled organs, such as the liver, absorb most

of the near-infrared light, making it difficult to generate an

accurate image.

11

Intellectual

Property

We rely

on a combination of patent, copyright, trademark and trade secret

laws and other agreements with employees and third parties to

establish and protect our proprietary intellectual property rights.

We require our officers, employees and consultants to enter into

standard agreements containing provisions requiring confidentiality

of proprietary information and assignment to us of all inventions

made during the course of their employment or consulting

relationship. We also enter into nondisclosure agreements with our

commercial counterparties and limit access to, and distribution of,

our proprietary information.

We are

committed to developing and protecting our intellectual property

and, where appropriate, filing patent applications to protect our

technology. Our issued and pending patents claims are directed at

the following areas related to our technology:

●

Methods to induce

and enhance thermoacoustic signal generation;

●

System

configurations, devices and novel hardware for transmission of RF

pulses into tissue and detection of acoustic signals;

●

Methods for

integrating our devices with existing conventional ultrasound

systems; and

●

Methods and

algorithms for signal processing, image formation and

analysis.

We

currently maintain a patent portfolio consisting of two US and two

foreign issued patents, nine patent applications pending in the

United States and ten patent applications pending in foreign

jurisdictions. These patents and patent applications cover

certain innovations relating to contrast-enhanced imaging as well

as several aspects of fat imaging and fat quantitation in the liver

and other tissues.

In

addition, we have in-licensed four U.S. patents, three foreign

patents. These patents protect a number of key design

attributes that are specific to our Nexus 128 product.

Each of

our patents generally has a term of 20 years from its respective

priority filing date. Among our issued patents, the first

patents are set to expire in 2018 and the last patents expire in

2031.

Sales

and Marketing

We

currently do not have a sales and marketing team dedicated to our

TAEUS clinical applications. In parallel to securing all necessary

government marketing approvals, we intend to hire a small internal

marketing team to engage and support channel partners and clinical

customers. As we have done with our Nexus 128 system, we intend to

partner with several geographically-focused independent clinical

ultrasound equipment distributors to market and sell our TAEUS

applications. We believe that these distributors have existing

customer relationships, a strong knowledge of diagnostic imaging

technology and the capabilities to support the installation,

customer training and post-sale service of capital equipment and

software.

We also

intend to work with original equipment manufacturers, or OEMs, of

ultrasound and thermal ablation equipment to sell our TAEUS

applications alongside their own new systems and into their

existing installed base systems. We believe that these OEMs will

find our applications attractive as they will enable them to

generate additional revenue from their installed systems – as

they currently do with aftermarket accessory portfolios. We believe

our relationship with GE Healthcare will facilitate this

strategy.

Based

on our design work and our understanding of the ultrasound

accessory market, we intend to price our initial NAFLD TAEUS

application at a price point approximating one-half of the price of

a new cart-based ultrasound system, which should enable purchasers

to recoup their investment in less than one year by performing a

relatively small number of additional ultrasound

procedures.

12

Some of

our TAEUS offerings are expected to be implemented via a hardware

platform that can run multiple individual software applications

that we will offer TAEUS users for a one-time licensing fee,

enabling users to perform more procedures with their existing

ultrasound equipment and retaining more patients in their clinics

rather than referring them out to a regional imaging medical center

for a CT or MRI scan.

We also

intend to license our TAEUS technology to OEMs, such as GE

Healthcare, for incorporation in their new ultrasound

systems.

We

currently market our Nexus 128 pre-clinical system domestically in

North America through a small internal marketing team and a network

of distributors in the United Kingdom, the European Union,

Australia, China and Korea. We use our corporate website, sales

materials and key industry meetings to drive customer awareness,

interest and trial of our products.

Engineering, Design and Manufacturing

Development of TAEUS Device

We have

contracted with StarFish Product Engineering, Inc.

(“StarFish”), a medical device contract manufacturing

company, to commence the productization of our NAFLD TAEUS

application. In particular, we have retained StarFish to develop

ENDRA’s current prototype TAEUS device into a clinical

product meeting CE regulatory requirements required for commercial

launch. We expect to further engage StarFish to support our

application for a CE mark that will enable us to sell the

application in the European Union as a Class IIa medical device

once a final design for our TAEUS device has been developed and

tested, and to lead the preparation of documentation for regulatory

approval submission both in the European Union and in the United

States. In order to foster collaboration, our Chief Technology

Officer regularly visits StarFish’s facilities to monitor the

TAEUS application manufacturing process.

Additionally,

we have also engaged CriTech Research, Inc.

(“CriTech”), a firm specializing in medical device

software, to develop the software that will support the operation

of our TAEUS device.

We

believe that our contract manufacturers will either supply

necessary components internally or obtain them from third-party

sources. At this time, we do not know whether any components are or

will be single sourced.

Regulatory Approval Pathway

Each of

our TAEUS platform applications will require regulatory approvals

before we are able to sell or license the application. Based on

certain factors, such as the installed base of ultrasound systems,

availability of other imaging technologies, such as CT and MRI,

economic strength and applicable regulatory requirements, we intend

to seek initial approval of our applications for sale in the

European Union, followed by the United States and

China.

The

first TAEUS application we intend to commercialize is our NAFLD

TAEUS application. Our initial target market for this application

is the European Union. We believe that our NAFLD TAEUS application

will qualify for sale in the European Union as a Class IIa medical

device. As a result, we will be required to obtain a CE mark for

our NAFLD TAEUS application before we can sell the application in

the European Union. To this end, we have contracted with medical

device contract engineering firms to perform the commercial product

engineering for our NAFLD TAEUS application. Existing regulations

would not require us to conduct a clinical trial to obtain a CE

mark for this application. Nonetheless, for commercial reasons and

to support our CE mark application we have contracted the Centre

for Imaging Technology Commercialization, a medical imaging

research group, to conduct human studies to demonstrate our NAFLD

TAEUS application’s ability to distinguish fat from lean

tissue.

13

In

2012, the European Commission proposed a new regulatory scheme

that, if implemented, will impose significant additional

obligations on medical device companies. Expected changes include

stricter requirements for clinical evidence and pre-market

assessment of safety and performance, new classifications to

indicate risk levels, requirements for third party testing by

government accredited groups for some types of medical devices, and

tightened and streamlined quality management system assessment

procedures. It is anticipated that this new regulatory scheme may

be implemented prior to receipt of the CE mark for our NAFLD TAEUS

application, but we believe that applicable transition rules should

allow us to avoid their application in that case. However, such new

rules could impose additional requirements, such as a requirement

to conduct clinical trials, on future CE mark applications we

make.

After

the process of obtaining a CE mark for our NAFLD TAEUS application

is complete and if we are able to raise additional capital, we

intend to prepare for submission to the U.S. Food and Drug

Administration, or the FDA, an application under the Food, Drug and

Cosmetic Act, or the FD&C Act, to sell our NAFLD TAEUS

application in the U.S. We anticipate that the application, as well

as those for our other TAEUS applications, will be submitted for

approval under Section 510(k) of the FD&C Act. We expect that

our initial FDA clearance will allow us to sell the NAFLD TAEUS

application in the U.S. with general imaging claims. However, we

will need to obtain additional FDA clearances to be able to make

diagnostic claims for fatty tissue content determination.

Accordingly, to support our commercialization efforts we expect

that, following receipt of our initial FDA clearance, we will

submit one or more additional applications to the FDA, each of

which will need to include additional clinical trial data, so that

following receipt of the necessary clearances we may make those

diagnostic claims.

Nexus 128 Product

We

assemble our Nexus 128 products from components provided to us by

third-party component suppliers and manufacturers. While many of

the components are off-the-shelf

components available from multiple suppliers, our

proprietary receiver array is specially manufactured to our

specifications by one manufacturer. To date, we have not

experienced any component shortages. We do not have any long-term

supply or manufacturing agreements related to our Nexus 128

products and components are obtained on a purchase order basis when

required.

Regulation

European Union

The

primary regulatory environment in Europe is the European Union,

which consists of 28 member states encompassing most of the major

countries in Europe. We believe that in the European Union

applications incorporating our TAEUS technology will be regulated

as Class IIa medical devices by the European Medicines Agency, or

EMA, and the European Union Commission. As described above, we

expect our applications will receive a CE mark from an appropriate

Competent Authority as a result of successful review of one or more

submissions prepared by our contract engineering and

manufacturer(s), so that such applications can be marketed and

distributed within the European Economic Area. Each of our

applications will be required to be recertified each year for CE

marking, which recertification may require an annual audit. The

audit procedure, which will include on-site visits at our facility,

and the contract manufacturer’s(s’) facility(ies), will

require us to provide the contract manufacturer(s) with information

and documentation concerning our quality management system and all

applicable documents, policies, procedures, manuals, and other

information.

In the

European Union, the manufacturer of medical devices is subject to

current Good Manufacturing Practice, or cGMP, as set forth in the

relevant laws and guidelines of the European Union and its member

states. Compliance with cGMP is generally assessed by a Notified

Body accredited by a Competent Authority. For a Class IIa device,

typically, quality system evaluation is performed by the Notified

Body, which also recommends to the relevant Competent Authority for

the European community whether a device will receive a CE mark. The

Notified Body may conduct inspections of relevant facilities, and

review manufacturing procedures, operating systems and personnel

qualifications. In addition to obtaining approval for each

application, in many cases each device manufacturing facility must

be audited on a periodic basis by the Notified Body. Further

inspections may occur over the life of the

application.

14

FDA Regulation

Each of

our products must be approved or cleared by the FDA before it is

marketed in the United States. Before and after approval or

clearance in the United States, our applications are subject to

extensive regulation by the FDA under the FD&C Act

and/or the Public Health Service Act, as well as by other

regulatory bodies. The FDA regulations govern, among other things,

the development, testing, manufacturing, labeling, safety, storage,

record-keeping, market clearance or approval, advertising and

promotion, import and export, marketing and sales, and distribution

of medical devices and pharmaceutical products.

FDA Approval or Clearance of Medical Devices

In the

United States, medical devices are subject to varying degrees of

regulatory control and are classified in one of three classes

depending on the extent of controls the FDA determines are

necessary to reasonably ensure their safety and

efficacy:

●

Class I: general

controls, such as labeling and adherence to quality system

regulations;

●

Class II: special

controls, premarket notification (510(k)), specific controls such

as performance standards, patient registries and post-market

surveillance and additional controls such as labeling and adherence

to quality system regulations; and

●

Class III: special

controls and approval of a premarket approval, or PMA,

application.

We

expect all of our products to be classified as Class II medical

devices and require FDA authorization prior to marketing by means

of a 510(k) clearance.

To

request marketing authorization by means of a 510(k) clearance, we

must submit a premarket notification demonstrating that the

proposed device is substantially equivalent to another legally

marketed medical device, has the same intended use, and is as safe

and effective as a legally marketed device and does not raise

different questions of safety and effectiveness than a legally

marketed device. 510(k) submissions generally include, among other

things, a description of the device and its manufacturing, device

labeling, medical devices to which the device is substantially

equivalent, safety and biocompatibility information and the results

of performance testing. In some cases, a 510(k) submission must

include data from human clinical studies. Marketing may commence

only when the FDA issues a clearance letter finding substantial

equivalence. The typical duration to receive a 510(k) approval is

approximately nine to twelve months from the date of the initial

510(k) submission, although there is no guarantee that the timing

will not be longer.

In the

past, the 510(k) pathway for product marketing has required only

proof of substantial equivalence in technology for a given

indication with a previously cleared device. Recently, there has

been a trend of the FDA requiring additional clinical work to prove

efficacy in addition to technological equivalence and basic safety.

Whether clinical data is provided or not, the FDA may decide to

reject the substantial equivalence argument we present. If that

happens, the device is automatically designated as a Class III

device. The device sponsor must then fulfill more rigorous PMA

requirements, or can request a risk-based classification

determination for the device in accordance with the “de

novo” process, which may determine that the new device is of

low to moderate risk and that it can be appropriately be regulated

as a Class I or II device. If a de novo request is granted, the

device may be legally marketed and a new classification is

established. If the device is classified as Class II, the device

may serve as a predicate for future 510(k) submissions. If the

device is not approved through de novo review, then it must go

through the standard PMA process for Class III

devices.

15

After a

device receives 510(k) clearance, any product modification that

could significantly affect the safety or effectiveness of the

product, or that would constitute a significant change in intended

use, requires a new 510(k) clearance or, if the device would no

longer be substantially equivalent, a PMA. If the FDA determines

that the product does not qualify for 510(k) clearance, then a

company must submit, and the FDA must approve, a PMA before

marketing can begin.

A PMA

application must provide a demonstration of safety and

effectiveness, which generally requires extensive pre-clinical and

clinical trial data. Information about the device and its

components, device design, manufacturing and labeling, among other

information, must also be included in the PMA. As part of the PMA

review, the FDA will inspect the manufacturer’s facilities

for compliance with quality system regulation requirements, which

govern testing, control, documentation and other aspects of quality

assurance with respect to manufacturing. If the FDA determines the

application or manufacturing facilities are not acceptable, the FDA

may outline the deficiencies in the submission and often will

request additional testing or information. Notwithstanding the

submission of any requested additional information, the FDA

ultimately may decide that the application does not satisfy the

regulatory criteria for approval. During the review period, a FDA

advisory committee, typically a panel of clinicians and

statisticians, is likely to be convened to review the application

and recommend to the FDA whether, or upon what conditions, the

device should be approved. The FDA is not bound by the advisory

panel decision. While the FDA often follows the panel’s

recommendation, there have been instances in which the FDA has not.

The FDA must find the information to be satisfactory in order to

approve the PMA. The PMA approval can include post-approval

conditions, including, among other things, restrictions on

labeling, promotion, sale and distribution, or requirements to do

additional clinical studies after approval. Even after approval of

a PMA, a new PMA or PMA supplement is required to authorize certain

modifications to the device, its labeling or its manufacturing

process. Supplements to a PMA often require the submission of the

same type of information required for an original PMA, except that

the supplement is generally limited to that information needed to

support the proposed change from the product covered by the

original PMA. The typical duration to receive PMA approval is

approximately two years from the date of submission of the initial

PMA application, although there is no guarantee that the timing

will not be longer.

Clinical Trials of Medical Devices

One or

more clinical trials are generally required to support a PMA

application and more recently are becoming necessary to support a

510(k) submission. Clinical studies of unapproved or uncleared

medical devices or devices being studied for uses for which they

are not approved or cleared (investigational devices) must be

conducted in compliance with FDA requirements. If an

investigational device could pose a significant risk to patients,

the sponsor company must submit an investigational device exemption

application to the FDA prior to initiation of the clinical study.

An investigational device exemption application must be supported

by appropriate data, such as animal and laboratory test results,

showing that it is safe to test the device on humans and that the

testing protocol is scientifically sound. The investigational

device exemption will automatically become effective 30 days after

receipt by the FDA unless the FDA notifies the company that the

investigation may not begin. Clinical studies of investigational

devices may not begin until an institutional review board has

approved the study.

During

the study, the sponsor must comply with the FDA’s

investigational device exemption requirements. These requirements

include investigator selection, trial monitoring, adverse event

reporting, and record keeping. The investigators must obtain

patient informed consent, rigorously follow the investigational

plan and study protocol, control the disposition of investigational

devices, and comply with reporting and record keeping requirements.

The sponsor, the FDA, or the institutional review board at each

institution at which a clinical trial is being conducted may

suspend a clinical trial at any time for various reasons, including

a belief that the subjects are being exposed to an unacceptable

risk. During the approval or clearance process, the FDA typically

inspects the records relating to the conduct of one or more

investigational sites participating in the study supporting the

application.

16

Post-Approval Regulation of Medical Devices

After a

device is cleared or approved for marketing, numerous and pervasive

regulatory requirements continue to apply. These

include:

●

the FDA quality

systems regulation, which governs, among other things, how

manufacturers design, test, manufacture, exercise quality control

over, and document manufacturing of their products;

●

labeling and claims

regulations, which prohibit the promotion of products for

unapproved or “off-label” uses and impose other

restrictions on labeling; and

●

the Medical Device

Reporting regulation, which requires reporting to the FDA of

certain adverse experiences associated with use of the

product.

Good Manufacturing Practices Requirements

Manufacturers

of medical devices are required to comply with the good

manufacturing practices set forth in the quality system regulation

promulgated under Section 520 of the FD&C Act.

Current good manufacturing practices regulations require, among

other things, quality control and quality assurance as well as the

corresponding maintenance of records and documentation. The

manufacturing facility for an approved product must be registered

with the FDA and meet current good manufacturing practices

requirements to the satisfaction of the FDA pursuant to a pre-PMA

approval inspection before the facility can be used. Manufacturers,

including third party contract manufacturers, are also subject to

periodic inspections by the FDA and other authorities to assess

compliance with applicable regulations. Failure to comply with

statutory and regulatory requirements subjects a manufacturer to

possible legal or regulatory action, including the seizure or

recall of products, injunctions, consent decrees placing

significant restrictions on or suspending manufacturing operations,

and civil and criminal penalties. Adverse experiences with the

product must be reported to the FDA and could result in the

imposition of marketing restrictions through labeling changes or in

product withdrawal. Product approvals may be withdrawn if

compliance with regulatory requirements is not maintained or if

problems concerning safety or efficacy of the product occur

following the approval.

China Regulation

China’s

regulatory approval framework includes nationwide approval based on

a showing that the device for which approval is sought has been

previously approved in the country of origin. Alternatively, we

understand it is also possible to receive approval at the

provincial level or to work exclusively with hospitals that do not

require such nationwide or provincial approval. We intend to

explore these potential paths to regulatory compliance in

China.

Other Regulations

We will

become subject to regulations and product registration requirements

in many foreign countries in which we may sell our products,

including in the areas of product standards, packaging

requirements, labeling requirements, import and export restrictions

and tariff regulations, duties and tax requirements. The time

required to obtain clearance required by foreign countries may be

longer or shorter than that required for EMA or FDA clearance, and

requirements for licensing a product in a foreign country may

differ significantly from EMA and FDA requirements.

Competition

While

we believe that we are the only company developing RF-based

thermoacoustic ultrasound products, we will face direct and

indirect competition from a number of competitors, many of whom

have greater financial, sales and marketing and other resources

than we do.

Manufacturers

of CT and MRI systems include multi-national corporations such as

Royal Philips, Siemens AG and Hitachi, Ltd., many of whom also

manufacture and sell ultrasound equipment. In the NAFLD diagnosis

market we will compete with makers of surgical biopsy tools, such

as Cook Medical and Sterylab S.r.l. In the thermal ablation market,

we will compete with manufacturers of surgical temperature probes,

such as Medtronic plc and St. Jude Medical, Inc.

17

Research and

Development

Our

research and development expenses were $1,931,075 and $495,377 for

the years ended December 31, 2017 and 2016,

respectively.

Employees

As of

December 31, 2017, we had 13 employees, all of whom are employed on

a full-time basis. 6 full-time employees were engaged in research

and development activities, 3 full-time employees were engaged in

administrative activities, 2 full-time employees were engaged in

product assembly and 2 employees were engaged in marketing

activities. None of our employees are covered by a collective

bargaining agreement, and we believe our relationship with our

employees is good.

We also

employ technical advisors, on an as-needed basis, to supplement

existing staff. We believe that these technical advisors provide us

with necessary expertise in clinical ultrasound applications,

ultrasound technology, and intellectual property.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You

should carefully consider the following risks and all other

information contained in this Annual Report, including our

financial statements and the related notes, before investing in our

common stock. The risks and uncertainties described below are not

the only ones we face, but include the most significant factors

currently known by us that make investing in our securities

speculative or risky. Additional risks and uncertainties that we

are unaware of, or that we currently believe are not material, also

may become important factors that affect us. If any of the

following risks materialize, our business, financial condition and

results of operations could be materially harmed. In that case, the

trading price of our common stock could decline, and you may lose

some or all of your investment.

Risks Related to Our Business

We have a history of operating losses, we may never achieve or

maintain profitability, and we will need to raise significant

additional capital if we are going to continue as a going

concern.

We have limited commercial experience upon which investors may

evaluate our prospects. We have only generated limited revenues to

date and have a history of losses from operations. As of December

31, 2017, we had an accumulated deficit of approximately $17.9

million. Our independent registered public accounting firm, in its

report on our financial statements for the year ended

December 31, 2017, has raised substantial doubt about our

ability to continue as a going concern.

We will require additional capital in the near term to continue as

a going concern to proceed with the commercialization of our

planned TAEUS applications and to meet our growth and profitability

targets. We believe that cash on hand at December 31, 2017 and

other potential sources of cash, including revenues we may generate

from sales of our Nexus 128 system, will be sufficient to fund our

current operations into the third quarter of 2018. If we do not

raise additional capital in the next several months we will need to

significantly slow or pause our development activities until we

raise additional funds.

We have expended and expect to continue to expend significant

resources on hiring of personnel, payroll and benefits, continued

scientific and potential product research and development,

potential product testing and pre-clinical and clinical

investigations, expenses associated with the development of

relationships with strategic partners, intellectual property

development and prosecution, marketing and promotion, capital

expenditures, working capital, and general and administrative

expenses. We also expect to incur costs and expenses related to