Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - DANA INC | d547685dex993.htm |

| EX-99.1 - EX-99.1 - DANA INC | d547685dex991.htm |

| 8-K - FORM 8-K - DANA INC | d547685d8k.htm |

Important Information for Investors and Stockholders This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction between Dana and GKN, an entity to be formed for this proposed transaction (“SpinCo”) will file with the Securities and Exchange Commission (“SEC”) a registration statement containing a joint proxy statement/prospectus, which will constitute a preliminary prospectus of SpinCo and a preliminary proxy statement of Dana, and Dana will file with the SEC a proxy statement on Schedule 14A. The materials to be filed by Dana and SpinCo will be made available to Dana’s investors and stockholders at no expense to them and, once available, copies may be obtained free of charge on Dana’s website at www.dana.com. In addition, all of those materials will be available at no charge on the SEC’s website at www.sec.gov. Investors and stockholders of Dana are urged to read the registration statement, the proxy statement and other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction because they contain important information about the proposed transaction and the parties to the proposed transaction. Dana and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies of Dana stockholders in connection with the proposed transaction. Investors and stockholders may obtain more detailed information regarding the names, affiliations and interests of certain of Dana’s executive officers and directors in the solicitation by reading Dana’s preliminary proxy statement for its 2018 annual meeting of stockholders, Annual Report on Form 10-K for the fiscal year ended December 31, 2017, and proxy statement and other relevant materials which will be filed with the SEC in connection with the proposed transaction when they become available. Information concerning the interests of Dana’s participants in the solicitation, which may, in some cases, be different than those of Dana’s stockholders generally, will be set forth in the proxy statement relating to the proposed transaction when it becomes available. Forward-Looking Statements Certain statements and projections contained in this presentation are, by their nature, forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. Forward-looking statements include, among other things, statements about the potential benefits of the proposed transaction; the prospective performance and outlook of the combined company’s business, performance and opportunities, including cost synergies and projections; the ability of the parties to complete the proposed transaction and the expected timing of completion of the proposed transaction; as well as any assumptions underlying any of the foregoing. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. Such risks and uncertainties, include, without limitation, risks related to Dana’s ability to complete the proposed transaction on the proposed terms and schedule, including obtaining shareholder and regulatory approvals; unforeseen liabilities; future capital expenditures; risks associated with business combination transactions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the proposed transaction will not occur; risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making it more difficult to conduct business as usual or maintain relationships with customers, employers or suppliers; and the possibility that if the combined company does not achieve the perceived benefits of the proposed transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of the combined company’s shares could decline, as well as other risks related to Dana’s business. Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings discuss important risk factors that could affect our business, results of operations and financial condition. The forward-looking statements in this communication speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason Safe Harbor Statement Exhibit 99.2 Filed by Dana Incorporated Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Dana Incorporated (Commission File No. 001-01063)

2 © Dana 2018 Revised Dana Outlook

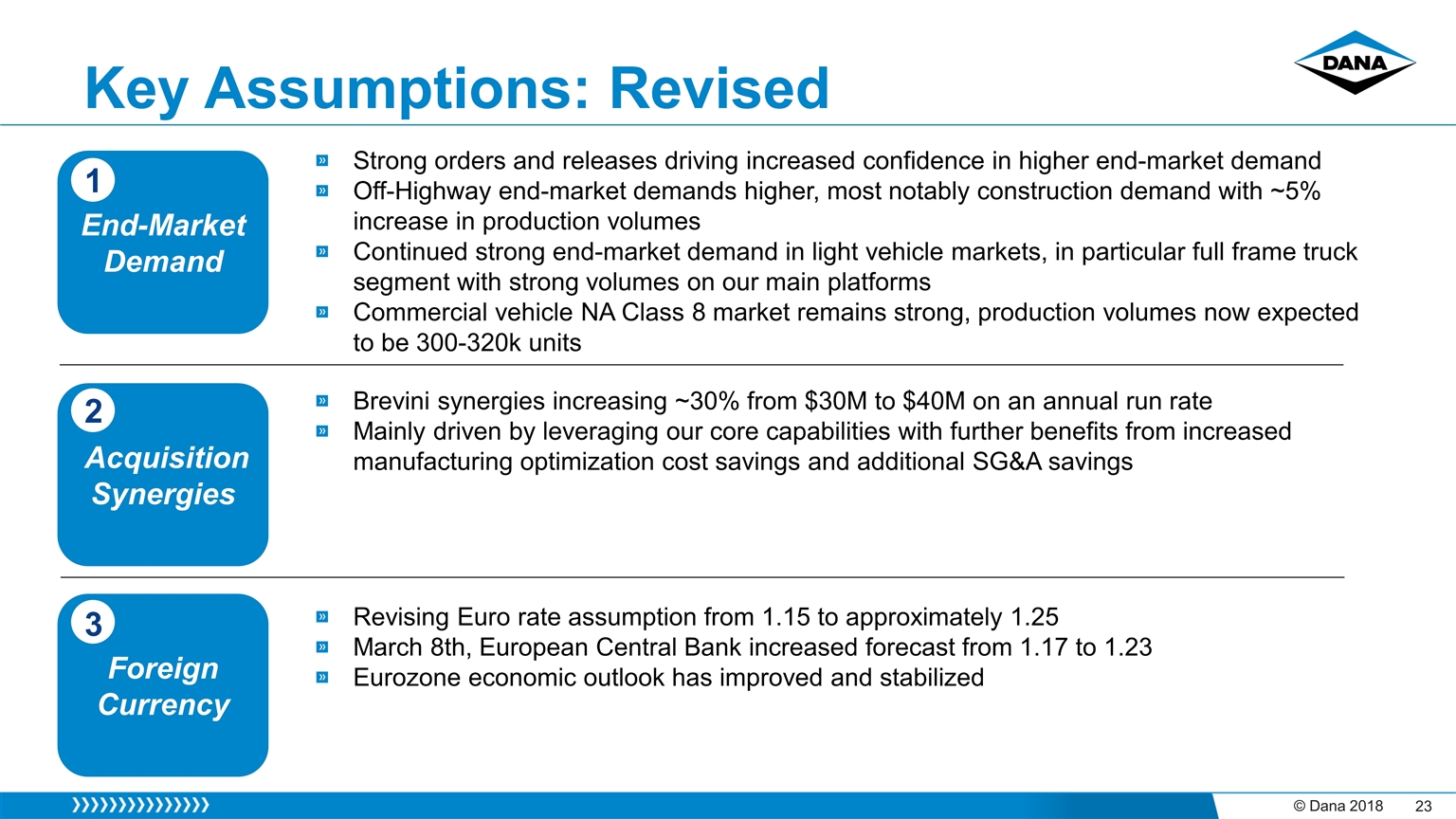

Acquisition Synergies Key Assumptions: Revised Foreign Currency End-Market Demand 1 2 3 Revising Euro rate assumption from 1.15 to approximately 1.25 March 8th, European Central Bank increased forecast from 1.17 to 1.23 Eurozone economic outlook has improved and stabilized Strong orders and releases driving increased confidence in higher end-market demand Off-Highway end-market demands higher, most notably construction demand with ~5% increase in production volumes Continued strong end-market demand in light vehicle markets, in particular full frame truck segment with strong volumes on our main platforms Commercial vehicle NA Class 8 market remains strong, production volumes now expected to be 300-320k units Brevini synergies increasing ~30% from $30M to $40M on an annual run rate Mainly driven by leveraging our core capabilities with further benefits from increased manufacturing optimization cost savings and additional SG&A savings

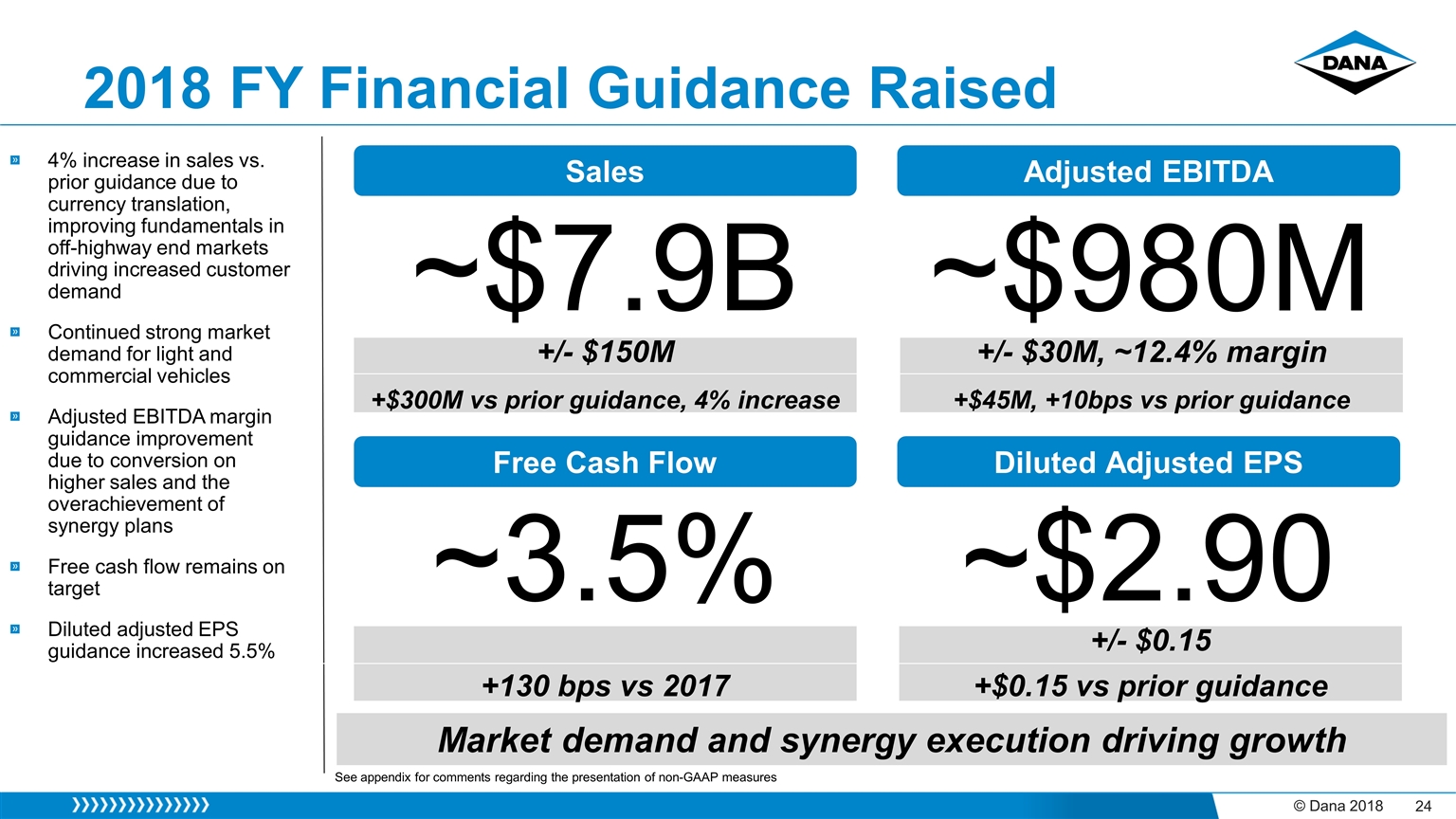

Market demand and synergy execution driving growth 4% increase in sales vs. prior guidance due to currency translation, improving fundamentals in off-highway end markets driving increased customer demand Continued strong market demand for light and commercial vehicles Adjusted EBITDA margin guidance improvement due to conversion on higher sales and the overachievement of synergy plans Free cash flow remains on target Diluted adjusted EPS guidance increased 5.5% See appendix for comments regarding the presentation of non-GAAP measures Sales Adjusted EBITDA Free Cash Flow Diluted Adjusted EPS ~$7.9B ~3.5% ~$2.90 +/- $150M +$300M vs prior guidance, 4% increase +/- $30M, ~12.4% margin +$45M, +10bps vs prior guidance +130 bps vs 2017 +/- $0.15 +$0.15 vs prior guidance 2018 FY Financial Guidance Raised ~$980M

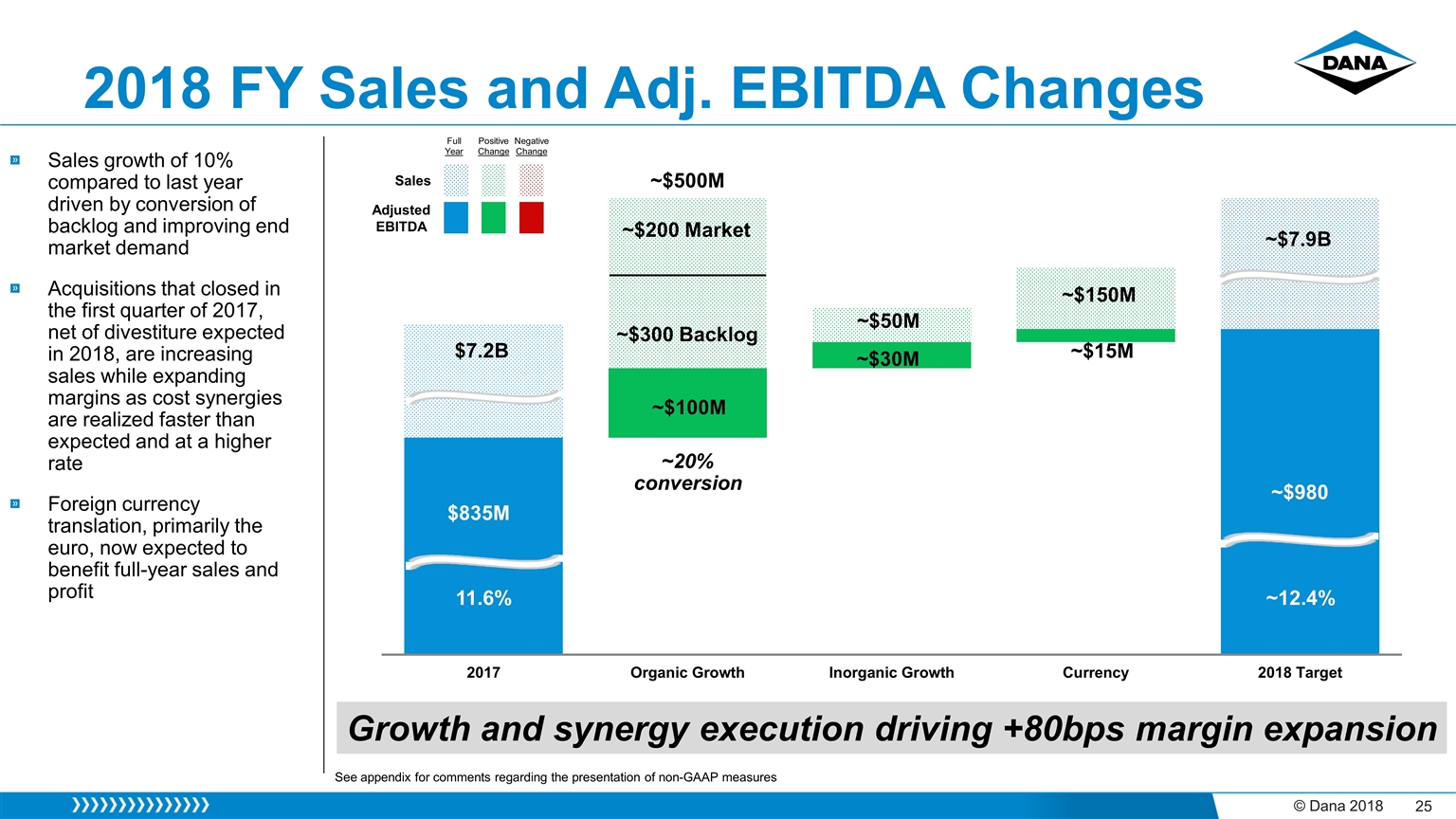

11.6% ~12.4% ~$200 Market ~$300 Backlog 2018 FY Sales and Adj. EBITDA Changes ~20% conversion Sales growth of 10% compared to last year driven by conversion of backlog and improving end market demand Acquisitions that closed in the first quarter of 2017, net of divestiture expected in 2018, are increasing sales while expanding margins as cost synergies are realized faster than expected and at a higher rate Foreign currency translation, primarily the euro, now expected to benefit full-year sales and profit Growth and synergy execution driving +80bps margin expansion Positive Change Negative Change Adjusted EBITDA Sales Full Year See appendix for comments regarding the presentation of non-GAAP measures

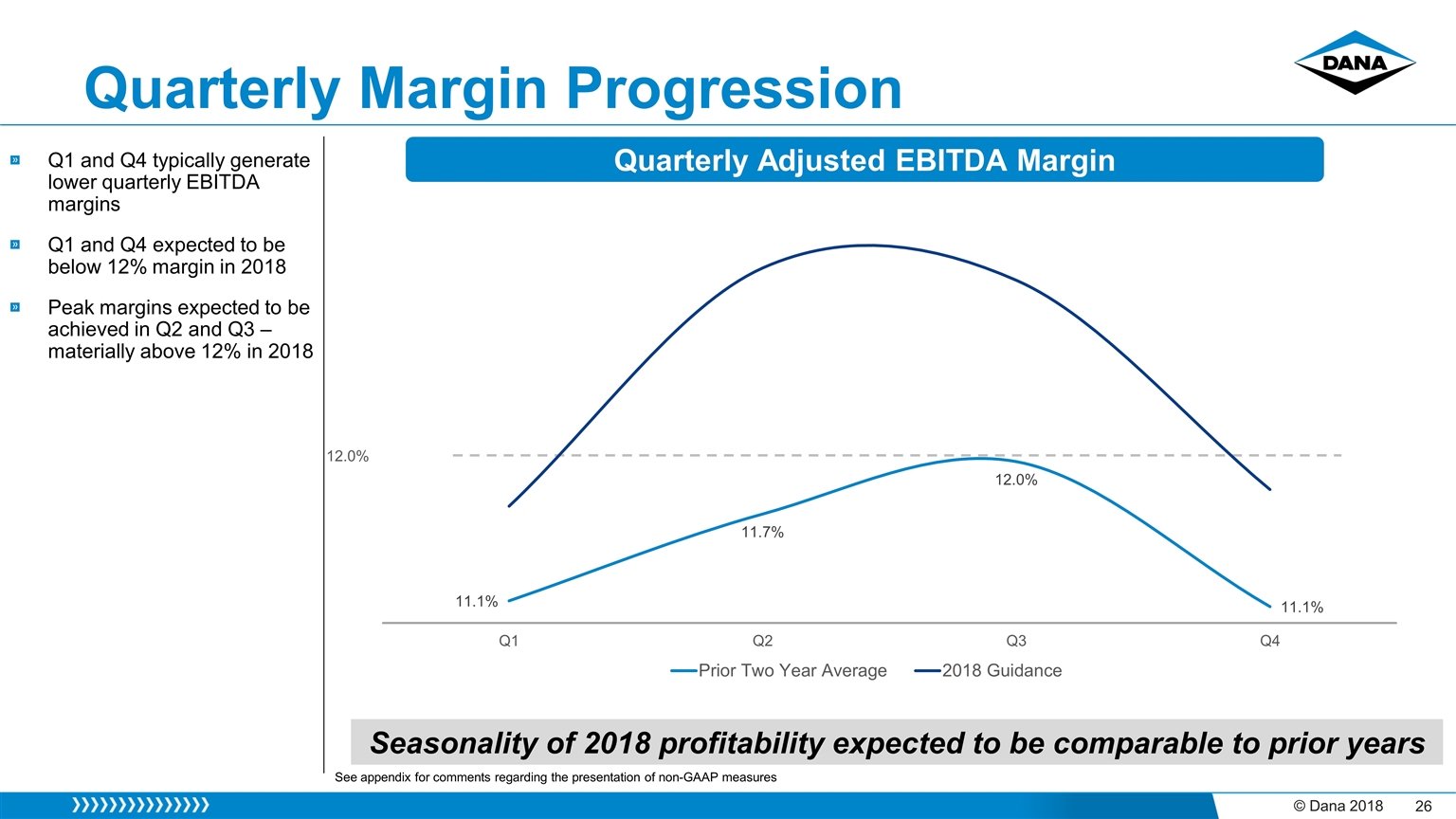

Quarterly Margin Progression Quarterly Adjusted EBITDA Margin Seasonality of 2018 profitability expected to be comparable to prior years Q1 and Q4 typically generate lower quarterly EBITDA margins Q1 and Q4 expected to be below 12% margin in 2018 Peak margins expected to be achieved in Q2 and Q3 – materially above 12% in 2018 See appendix for comments regarding the presentation of non-GAAP measures

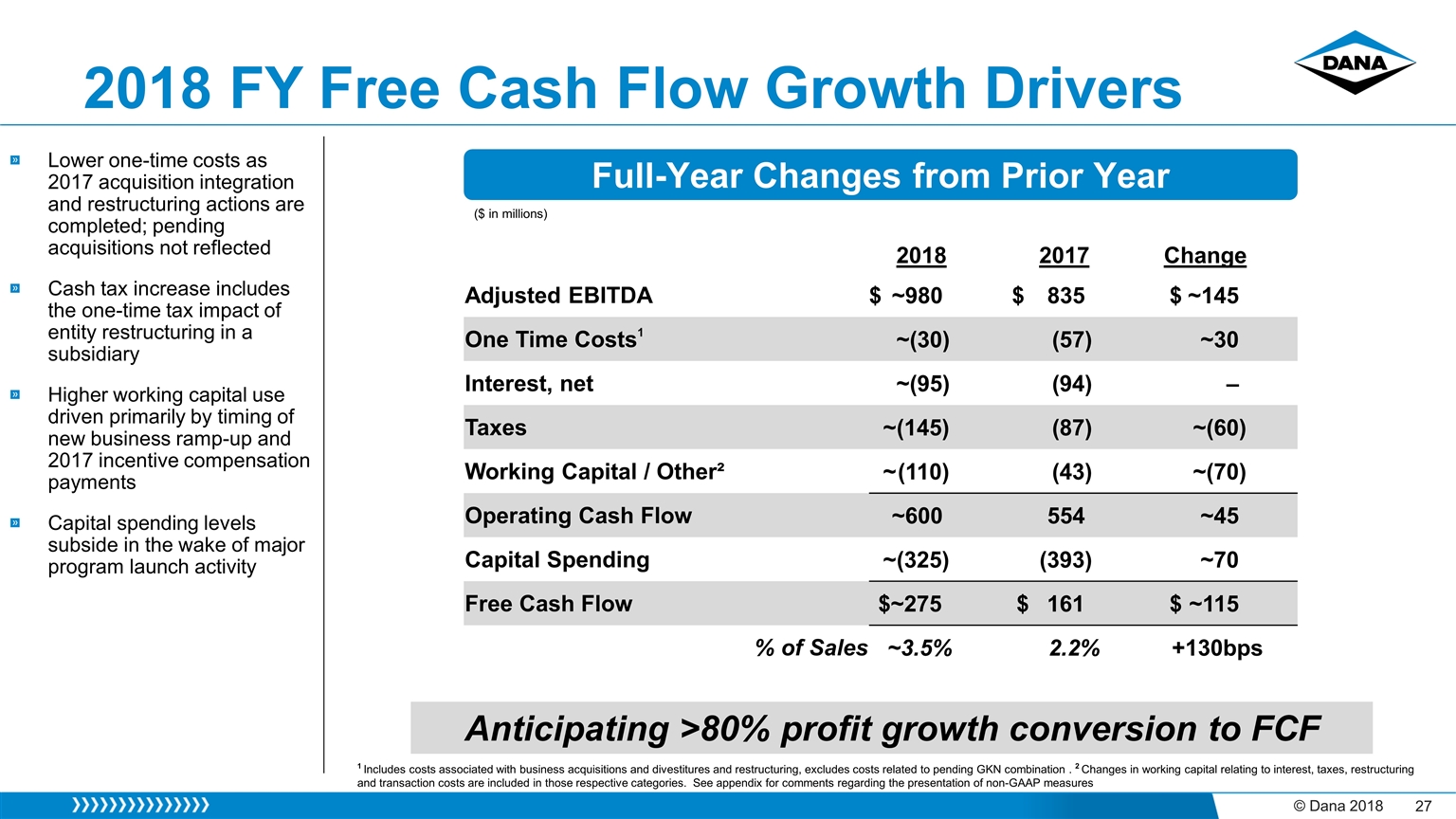

2018 FY Free Cash Flow Growth Drivers Full-Year Changes from Prior Year Lower one-time costs as 2017 acquisition integration and restructuring actions are completed; pending acquisitions not reflected Cash tax increase includes the one-time tax impact of entity restructuring in a subsidiary Higher working capital use driven primarily by timing of new business ramp-up and 2017 incentive compensation payments Capital spending levels subside in the wake of major program launch activity 2018 2017 Change Adjusted EBITDA $~980 $ 835 $~145 One Time Costs1 ~(30) (57) ~30 Interest, net ~(95) (94) – Taxes ~(145) (87) ~(60) Working Capital / Other² ~(110) (43) ~(70) Operating Cash Flow ~600 554 ~45 Capital Spending ~(325) (393) ~70 Free Cash Flow $~275 $161 $~115 % of Sales ~3.5% 2.2% +130bps ($ in millions) 1 Includes costs associated with business acquisitions and divestitures and restructuring, excludes costs related to pending GKN combination . 2 Changes in working capital relating to interest, taxes, restructuring and transaction costs are included in those respective categories. See appendix for comments regarding the presentation of non-GAAP measures Anticipating >80% profit growth conversion to FCF

The preceding slides refer to Adjusted EBITDA, a non-GAAP financial measure which we have defined as net income before interest, taxes, depreciation, amortization, equity grant expense, restructuring expense and other adjustments not related to our core operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations and provide shareholder returns. We use adjusted EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be considered a substitute for income before income taxes, net income or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Diluted adjusted EPS is a non-GAAP financial measure which we have defined as adjusted net income divided by adjusted diluted shares. We define adjusted net income as net income attributable to the parent company, excluding any nonrecurring income tax items, restructuring charges, amortization expense and other adjustments not related to our core operations (as used in adjusted EBITDA), net of any associated income tax effects. We define adjusted diluted shares as diluted shares as determined in accordance with GAAP based on adjusted net income. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an indicator of ongoing financial performance that provides enhanced comparability to EPS reported by other companies. Diluted adjusted EPS is neither intended to represent nor be an alternative measure to diluted EPS reported under GAAP. Free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in) operating activities less purchases of property, plant and equipment. We believe this measure is useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Free cash flow is neither intended to represent nor be an alternative to the measure of net cash provided by (used in) operating activities reported under GAAP. Free cash flow may not be comparable to similarly titled measures reported by other companies. Please reference the “Non-GAAP financial information” accompanying our quarterly earnings conference call presentations on our website at www.dana.com/investors for reconciliations of adjusted EBITDA, diluted adjusted EPS and free cash flow to the most directly comparable financial measures calculated and presented in accordance with GAAP. We have not provided a reconciliation of our adjusted EBITDA and diluted adjusted EPS outlook to the most comparable GAAP measures of net income and diluted EPS. Providing net income and diluted EPS guidance is potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items that are included in net income and diluted EPS, including restructuring actions, asset impairments and income tax valuation adjustments. The reconciliations of these non-GAAP measures with the most comparable GAAP measures for the historical periods presented on our website are indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance. Non-GAAP Financial Information