Attached files

| file | filename |

|---|---|

| EX-32.2 - SECTION 906 CFO CERTIFICATION - Papa Murphy's Holdings, Inc. | ex32220180101section906cfo.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - Papa Murphy's Holdings, Inc. | ex32120180101section906ceo.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - Papa Murphy's Holdings, Inc. | ex31220180101section302cfo.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - Papa Murphy's Holdings, Inc. | ex31120180101section302ceo.htm |

| EX-24.1 - POWER OF ATTORNEY - Papa Murphy's Holdings, Inc. | ex24120180101directorspowe.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Papa Murphy's Holdings, Inc. | mossadamsconsent20180101.htm |

| EX-21.1 - SUBSIDIARIES - Papa Murphy's Holdings, Inc. | ex21120180101listofsubsidi.htm |

| EX-10.26 - EXHIBIT 10.26 - Papa Murphy's Holdings, Inc. | ex102620180101hutchensprom.htm |

| EX-10.8 - EXHIBIT 10.8 - Papa Murphy's Holdings, Inc. | ex10820180101spangleremplo.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

––––––––––––––––––––––––––––––––––––––––––––––––––––––––

FORM 10-K

––––––––––––––––––––––––––––––––––––––––––––––––––––––––

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended January 1, 2018

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-36432

––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Papa Murphy’s Holdings, Inc.

(Exact name of registrant as specified in its charter)

––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Delaware | 27-2349094 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

8000 NE Parkway Drive, Suite 350, Vancouver, WA | 98662 | |

(Address of principal executive offices) | (Zip Code) | |

(360) 260-7272 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Common Stock, $0.01 par value | NASDAQ Global Select Market | |

(Title of Each Class) | (Name of Each Exchange on Which Registered) | |

Securities registered pursuant to Section 12(g) of the Act: | ||

NONE | ||

––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [X] | |

Non-accelerated filer [ ] | Smaller reporting company [ ] | |

Emerging growth company [X] | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ]. No [X].

At July 3, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the shares of voting and non-voting common stock of the Registrant held by non-affiliates was $52,178,979 based on the last sales price of the Registrant’s common stock as reported by the NASDAQ Global Select Market on that day.

At March 2, 2018, there were 16,971,461 shares of the Registrant’s common stock, $0.01 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates certain information by reference from the registrant’s definitive proxy statement for the 2018 annual meeting of shareholders, which will be filed no later than 120 days after the close of the registrant’s fiscal year ended January 1, 2018.

TABLE OF CONTENTS

PART I | ||

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

PART II | ||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

PART III | ||

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

PART IV | ||

Item 15. | Exhibits and Financial Statement Schedules | |

SIGNATURES | ||

2

PART I

ITEM 1. Business

General |

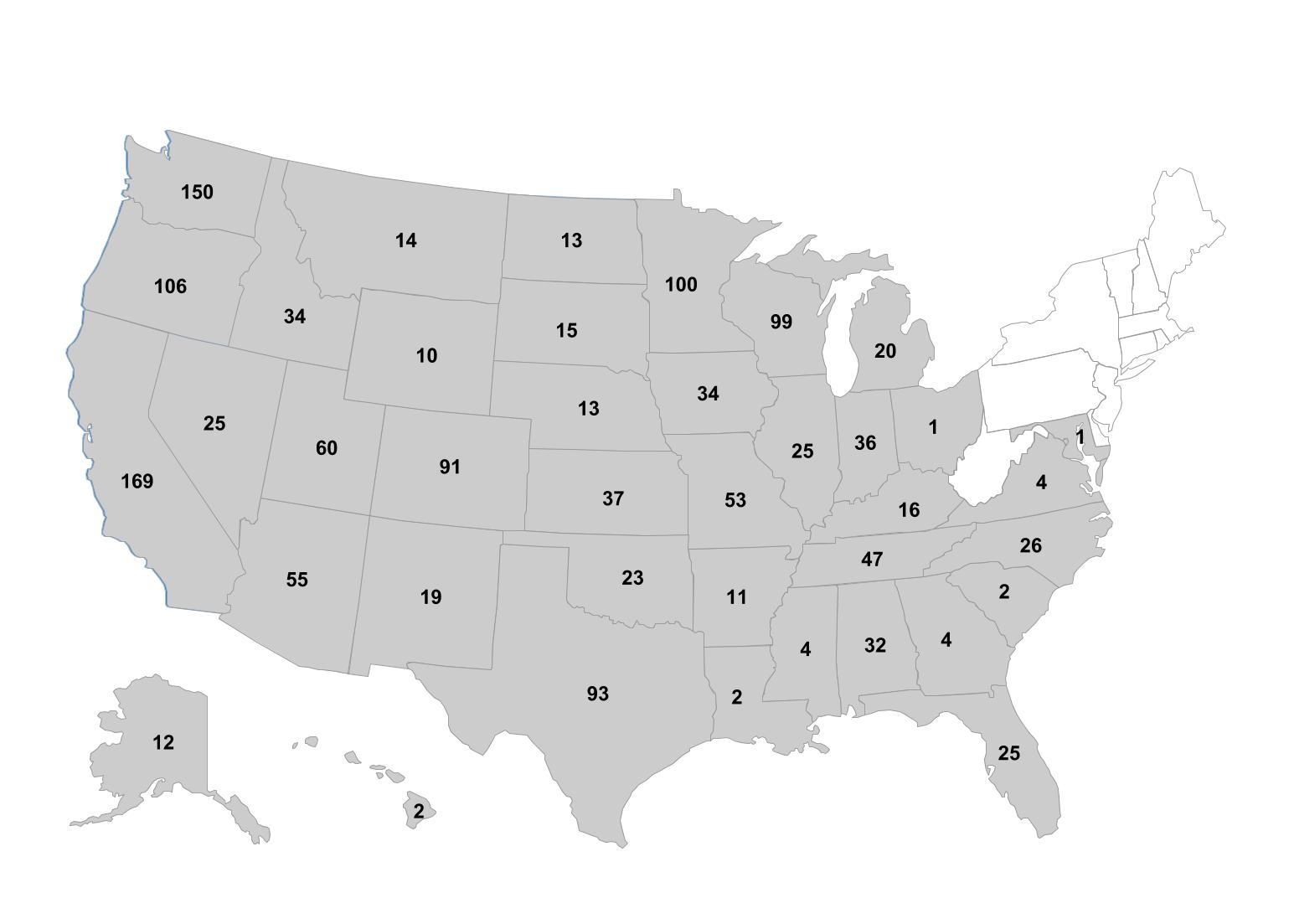

Papa Murphy’s Holdings, Inc. is a franchisor and operator of the largest Take ‘N’ Bake pizza chain in the United States. We were founded in 1981 and have grown our footprint to a total of 1,523 system-wide stores as of January 1, 2018.

We have defined three reportable segments for the Company: Domestic Company Stores, Domestic Franchise and International. Financial information about segment operations appears in Selected Financial Data, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Financial Statements and Supplementary Data in Note 18—Segment Information of the accompanying Notes to Consolidated Financial Statements.

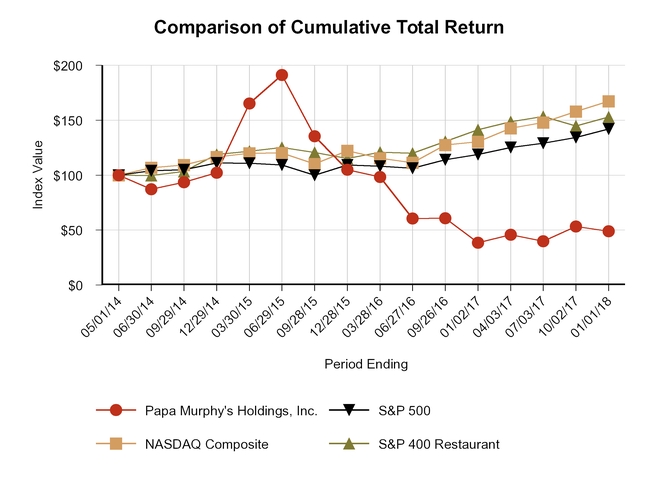

We are a Delaware corporation that was organized and acquired a majority of the capital stock of PMI Holdings, Inc., our predecessor, in 2010. In May 2014, we completed our initial public offering (the “IPO”) and now our common stock trades on the NASDAQ Global Select Market under the “FRSH” ticker symbol. Papa Murphy’s Holdings, Inc. and its subsidiaries are sometimes referred to as the “Company,” “Papa Murphy’s,” or in the first person as “we,” “us,” and “our” in this report.

We make available, free of charge, the following filings on our corporate website located at www.papamurphys.com as soon as reasonably practicable after such filings are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”): our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, any amendments to such reports, and our annual proxy statement. Information contained on our corporate website located at www.papamurphys.com is not part of this annual report on Form 10-K.

Our Concept |

The Papa Murphy’s experience is different from traditional pizza restaurants. Our customers:

• | CREATE their fresh, personally customized pizza with high-quality ingredients; |

• | TAKE their fresh pizza home; and |

• | BAKE their pizza fresh in their ovens, at their convenience, for a home-cooked meal served hot. |

We were founded on the following core values—Great Quality, Great Value, Great Customer Service—and we strive to deliver on these values every day.

• | Great Quality: We have continually focused on quality since our founding and we believe customers can taste the difference. Unlike some of our competitors, we do not use pre-shredded, pre-packaged, or frozen cheese and our dough is made from scratch daily, never frozen. |

• | Great Value: We offer a high-quality pizza at a value price point. |

• | Great Customer Service: We train our store crews to greet each customer, to promote the latest new products and to assist each customer in choosing the combination of fresh made pizzas and side items to complete the customer’s meal. |

We actively target solving the “dinnertime dilemma” by providing a scratch-made, customized, home-baked meal. Our concept has broad appeal and is focused on freshness, quality, and convenience.

• | We make our dough fresh in each store daily, starting with flour, water, and yeast; |

• | We grate our cheese daily from blocks of 100% whole-milk mozzarella cheese; |

• | We slice fresh, never-frozen vegetables by hand; |

• | We feature specialty, premium ingredients; |

• | We use only high-quality meats with no added fillers; and |

• | We provide a convenient, easy, meal-time solution. |

3

Our stores feature a food-forward design with a store layout that highlights our high-quality, scratch-made pizzas. Pizzas are made fresh to order and our customers can follow their pizza as it is created.

Our menu offers customers the ability to create a customized pizza from a broad selection of crusts, sauces, and topping combinations. Our core menu offerings include the following:

▪ | Signature pizzas: classic combinations with broad appeal; |

▪ | Gourmet Delite pizzas: our artisan thin crust with premium, specialty toppings; |

▪ | Stuffed pizzas: two-layer, four-pound pizzas with meats and vegetables stuffed between two layers of dough; |

▪ | Fresh Pan pizzas: signature recipes with a thick, buttery crust; and |

▪ | “C.Y.O.” or Create Your Own pizzas: customer choice of crust, sauce, and any combination of our cheese, meat, and vegetable toppings. |

We have developed a loyal and diverse customer base. We attribute our success across a national footprint to the broad appeal of our concept. Our business model resonates across all ages, demographics, and income levels. Finally, we believe our model encourages a stronger emotional connection. The active role of ordering and watching the pizza being built gives customers a feeling of ownership: “a pizza” becomes “my pizza.”

Efficient, Simple Operating Model

Our stores average just 1,400 square feet in size and do not require ovens, venting hoods, freezers, or dining areas. Our store model offers franchise owners operating advantages that differentiate us from other restaurant concepts. Our domestic stores:

• | Focus on creating fresh pizzas for carry out reducing operational complexity for franchise owners and their employees; |

• | Maintain shorter operating hours (typically 11:00 a.m. to 9:00 p.m.) that are attractive to franchise owners and their employees; |

• | Require fewer employees each shift compared to other restaurant concepts, resulting in lower labor costs; |

• | Accept electronic benefit transfer (“EBT”) payment systems (food stamps); |

• | Benefit from local cooperative marketing and consistent creative marketing assets for use in a variety of media channels; |

• | Utilize a centrally-managed, locally customizable, integrated e-commerce platform; and |

• | Receive strong franchisor support through training, operating standards, supply-chain management, and development assistance. |

Our Strategy |

Our strategy has four key components: (i) convenience; (ii) relevance; (iii) people; and (iv) process. We believe that successfully implementing these strategic components will enable us to achieve our growth and profitability targets and leverage our current infrastructure.

Convenience

We believe convenience is our differentiating attribute because our customers have control over when they order, receive, bake, and serve our fresh, hot, made to order pizza. Customers decide exactly when their pizza goes into and comes out of their oven for maximum convenience and freshness. We believe customers want a product that is easy to order, easy to pay for, and easy to obtain.

• | E-commerce and Online Ordering. We continue to improve our e-commerce platform to provide a consistent and convenient online ordering experience to consumers. To remain relevant, we must design systems that have the flexibility to advertise and promote special products or promotions as well as provide convenience to the consumer through ease of ordering and payment. We believe our e-commerce platform will enable owners to realize greater efficiencies in store labor costs and provide an easy consumer experience through multiple ordering platforms and integration with third party delivery services. |

• | Expansion of Delivery. Online ordering addresses only half of the convenience cycle. In 2018, we plan to continue expansion of delivery through the use of various third party delivery options as they become available in the |

4

markets we serve. Our research indicates a strong demand for delivery from our customers, with more than half indicating they would order more often if delivery was available. We have a unique opportunity with delivery because our pizzas are not baked and customers receive the same high-quality fresh food when delivered as when they pick up their order in-store.

Relevance

As we strive to provide fresh, hot, and convenient options for the “dinnertime dilemma,” we must ensure that our messaging and brand strategy resonate with consumers in a competitive marketplace. We intend to broaden our marketing messaging and focus on telling the right story to the right audience.

• | Increased Digital Marketing. We continue to learn which value offers drive traffic by testing a broad range of messages through a variety of media channels including social media, text, and email. Through this dynamic, strategic shift in media mix, we have begun to capture consumer ordering and shopping trends in a rapidly changing marketplace. The insights gained from this data enable us to rapidly adapt to changes in consumer preferences and develop increasingly effective digital marketing campaigns. |

• | Loyalty Program. We are in the early stages of developing a loyalty program on a digital platform intended to increase the frequency of purchases. |

• | Improved Messaging. To better communicate the brand’s benefits and differentiation, we are refining our consumer messaging to reach a broader audience across all communication points. Emphasis will be placed on empowering the consumer and providing them with control over ingredients, quality, and timing. |

• | Targeted Communication. In order to increase the effectiveness of our messaging, we will focus on reaching customers through targeted communications and offers. |

People

By cultivating a culture of teamwork, continuous learning, and development, we expect to improve productivity and performance throughout our organization.

• | Franchisee Relations. Developing and maintaining strong relations with franchise owners are crucial components to our business strategy. With 1,483 stores across the United States and 489 domestic franchise owners as of January 1, 2018, we have a diverse base of owners who can help cultivate ingenuity, entrepreneurship, and community connections that are key to successful store-level operations. Engaging with franchise owners from a perspective of cooperation will allow the brand to learn best practices for ensuring quality, value, and service, as well as help all franchise owners execute our strategy locally on a consistent basis. |

• | Field Support. To help our franchise owners operate a profitable business and to protect our brand standards, we deploy teams located across the country to provide support in operations, store technology, and marketing. These teams assist franchise owners by coaching them on strategies for reaching new audiences, operating their stores with maximum efficiency, and building brand awareness and community engagement locally through offering employment opportunities, providing a high quality convenient meal, and partnering with local organizations to give back to the community. |

Process

In order to achieve optimal results, we are focusing efforts on creating an efficient, consistent execution process.

• | Spending Optimization. We intend to optimize and prioritize our spending to deliver improved store-level financial results. We are prioritizing initiatives that focus on the areas of store operations, growth channels, business reviews, advertising relevance, and real-time sales analytics with the intended result of stabilizing comparable store sales figures and improving profitability. |

• | Consumer Experience. We believe a consistent, high-quality consumer experience in product, service, and advertising is key to building a strong brand. In addition, providing franchise owners with access to real-time store performance metrics will allow them to quickly optimize their store operations, identify trends in customer patterns, and improve overall store economics. |

5

Our Industry and Competition |

With system-wide sales of $847 million in fiscal year 2017, we are the fifth largest pizza chain in the United States as measured by system-wide sales and total number of stores. We generally compete on the basis of product quality, variety, price, location, image, convenience, and service with regional and local pizza restaurants as well as national chains such as Domino’s Pizza®, Pizza Hut®, Papa John’s®, and Little Caesars Pizza®. According to NPD Crest, the quick service restaurant (“QSR”) pizza market, a subset of the overall pizza category, was about $36 billion in 2017. The top five pizza chains accounted for approximately 50.4% of QSR pizza restaurant sales in 2017 compared to 49.4% in 2016 and 47.8% in 2015. We believe the pizza restaurant market continues to be an attractive category due to its size and growth, as well as its fragmented competitive landscape.

On a broader scale, we compete with other limited service restaurants (“LSRs”), the overall food service industry, grocery and convenience stores, and online meal kit delivery services. The food service industry, particularly LSRs, are competitive with respect to product quality, price, location, service, and convenience. Many of our competitors have been in existence for longer periods of time and have developed stronger brand awareness in markets where we compete. In these markets, we compete for customers, employees, management personnel, franchisees, and real estate sites suitable for our stores.

Suppliers and Distribution |

We enter into national supply or pricing agreements with certain key third-party suppliers. We negotiate pricing for our franchised and Company-owned stores with national pricing agreements covering a term of three months to one year. We do not realize any profits from the sale of these supplies to franchise owners.

We rely on multiple third-party distributors as our primary distributors of cheese, refrigerated items, meat, canned and dry goods, paper and disposables, and janitorial supplies. Pursuant to our distribution service agreements, we have the right to designate the brands and products supplied. Supplies are delivered to each store one to two times each week.

For our beverage products, we rely on Pepsi-Cola Advertising and Marketing, Inc. (“Pepsi”) as our primary provider of packaged beverage products. We have maintained a national distribution relationship with Pepsi since 2004.

Intellectual Property and Trademarks |

We regard the Papa Murphy’s brand name and associated trademarks as valuable assets. We have a portfolio of 32 trademarks registered with the United States Patent and Trademark Office. We have also secured trademark registrations for our brand name in multiple countries outside of the United States in which we currently conduct business or may consider conducting business in the future. All of the marks we own cover store-related services and/or food products.

Management Information/Technology Systems |

Our point-of-sale system (“POS system”) has been customized specifically for Papa Murphy’s stores, and we use this integrated restaurant-level technology for inventory, labor management and cash handling in our domestic stores. Our POS system allows us to track sales data and evaluate store efficiency. Through our POS system we are able to collect, utilize, and disseminate data and information collected by each store to generate reports and evaluate sales performance in real-time. In addition, we collect monthly store-level profit and loss statements for analysis.

We continue to make substantial investments to further develop our e-commerce capabilities and platform, including a new Papa Murphy’s website and mobile application ordering system. This ordering channel, fully integrated with our in-store POS system, enables us to gather more information about customer ordering habits, which will enable us to further develop attractive offers and increase sales with digital marketing.

6

Franchising Overview |

Our store base was 90.5% franchised as of January 1, 2018, with our franchise owners operating a total of 1,378 Papa Murphy’s stores in 39 states, Canada, and the Middle East. Through our franchise support, development infrastructure, and screening process, we have successfully built a base of 501 franchise owners with an average store ownership of approximately 2.7 stores per franchise owner. A majority of our franchise owners owned one store, approximately 73% owned one or two stores, and 21% of all franchised stores were owned by our 10 largest franchise owners. We believe this highly diversified owner base demonstrates the viability of our store concept across numerous types of owners and operators, and provides an attractive base of owners with capacity to grow with our brand. We believe the relationships we have with our franchise system provide a solid platform for growth.

We are dedicated to providing the tools our franchise owners need to succeed before, during, and after a store opening, including assistance with site selection and development, training, operations, and marketing. We set forth qualification criteria and provide training programs for franchise owners to ensure that every Papa Murphy’s store meets the same quality and customer service standards to preserve the consistency and reliability of the Papa Murphy’s brand.

Our asset-light franchised business model offers us strategic and financial benefits. It enables us to focus Company resources on menu innovation, marketing, franchise owner training, and operations support to drive the overall success of our brand. Our franchised business model also allows us to grow our store base and brand awareness with limited corporate capital investment. Further, our predominantly franchised business model reduces our exposure to changes in commodity and other operating costs. As a result, our business model is designed to provide high operating margins and cash flows with low capital expenditures and working capital.

Employees |

As of March 1, 2018, we had 1,753 employees, including 290 salaried employees and 1,463 hourly employees. None of our employees are unionized or covered by a collective bargaining agreement and we consider our current employee relations to be good.

Seasonality | ||||

Seasonal factors and the timing of holidays cause our revenues to fluctuate from quarter to quarter. We typically follow family eating patterns at home, with our strongest sales levels occurring in the months of September through May and our lowest sales levels occurring in the months of June, July, and August. Therefore, our revenues per store are typically higher in the first and fourth quarters and lower in the second and third quarters. Additionally, our new store openings have historically been most heavily concentrated in the fourth quarter and we anticipate that new store openings will continue to be weighted towards the third and fourth quarters. As a result of these factors, our quarterly and annual results of operations and comparable store sales may fluctuate significantly. Accordingly, results for any one quarter are not necessarily indicative of results to be expected for any other quarter or for any year, and comparable store sales for any particular future period may decrease and materially and adversely affect our business, financial condition, or results of operations.

Government Regulation |

We, along with our franchise owners, are subject to various federal, state, local, and foreign laws affecting the operation of our respective businesses. Each store is subject to licensing and regulation by a number of governmental authorities, which include zoning, health, safety, sanitation, building, and fire agencies in the jurisdiction in which the store operates. In order to maintain our stores, we may be required to expend funds to meet certain federal, state, local, and foreign regulations, including regulations that require remodeled stores to be accessible to persons with disabilities. Difficulties in obtaining, or the failure to obtain, required licenses or approvals could delay or prevent the opening of a new store. Our domestic store operations are subject to various federal and state laws governing such matters as minimum wage requirements, benefits, working conditions, citizenship requirements, and overtime. We are also subject to federal and state environmental regulations.

7

We are subject to Federal Trade Commission (“FTC”) rules and to various state and foreign laws that govern the offer and sale of franchises. The FTC requires us to furnish to prospective franchise owners a franchise disclosure document containing prescribed information. Some states and foreign countries also have disclosure requirements and other laws regulating franchising and the franchisor-franchisee relationship. These laws regulate various aspects of the franchise relationship, including terminations and the refusal to renew franchises. The failure to comply with these laws and regulations in any jurisdiction or to obtain required government approvals could result in a ban or temporary suspension of future franchise sales, fines, or other penalties or require us to make offers of rescission or restitution, any of which could materially and adversely affect our business, financial condition, and results of operations.

8

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the following risk factors, as well as the other information in this Annual Report on Form 10-K, in evaluating our business. If any of these risks, as well as other risks and uncertainties that are not yet identified or that we currently think are immaterial, actually occur, our business, results of operations or financial condition could be materially and adversely affected. In such an event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Relating to Our Business and Industry |

The limited service restaurant pizza category and restaurant sector overall are highly competitive and such competition could adversely affect our business, financial condition and results of operations.

The restaurant industry in general, and the limited service restaurant pizza category in particular, are highly competitive with respect to price, value, food quality, ambience, convenience, concept, service, and location. A substantial number of restaurant operations compete with us for customer traffic, both in store and online. We compete against other major national limited service restaurant pizza chains and regional and local businesses, including other chains offering pizza products. We also compete on a broader scale with other international, national, regional, and local limited-service restaurants. In addition, we face increasing competition from pizza product and other offerings available at grocery stores and convenience stores and through home delivery, including from online meal kit delivery services, which offer pre-made ready-to-bake frozen and carry-out pizzas and other foods that customers may prepare at home. Many of our competitors have significantly greater financial, marketing, personnel, and other resources as well as greater brand recognition than we do and may have lower operating costs, more restaurants, better locations, broader delivery options, and more effective marketing than we do. Many of our competitors are well established in markets in which we and our franchise owners operate stores or intend to locate new stores. In addition, many of our competitors emphasize lower-cost value options or meal packages, home delivery, or have loyalty programs, which provide discounts on certain menu offerings, and they may continue to do so in the future.

We also compete for employees, suitable real estate sites, and qualified franchise owners. If we are unable to compete successfully and maintain or enhance our competitive position, or if customers have a poor experience at a Papa Murphy’s store, whether Company-owned or franchise-owned, we could experience decreased customer traffic, downward pressure on prices, lower demand for our products, reduced margins, diminished ability to take advantage of new business opportunities, and the loss of market share, all of which could have a material and adverse effect on our business, financial condition, and results of operations.

The food service market is affected by consumer preferences and perceptions. Changes in these preferences and perceptions may lessen the demand for our products, which would reduce sales and harm our business.

Food service businesses are affected by changes in consumer tastes, international, national, regional, and local economic conditions, and demographic trends. For instance, if prevailing health or dietary preferences cause consumers to avoid pizza and other products we offer in favor of foods that are perceived as more healthy, our business, financial condition, and results of operations would be materially and adversely affected. In addition, if consumers no longer seek pizza that they can bake at home in favor of pizza that is already baked or can be delivered, our business, financial condition, and results of operations would be materially and adversely affected. Moreover, because we are primarily dependent on a single product, if consumer demand for pizza in general, and take and bake pizza in particular, should decrease, our business would be adversely affected more than if we had a more diversified menu, as many other food service businesses do.

Our business and results of operations depend significantly upon the success of our and our franchise owners’ existing and new stores.

Our business and results of operations are significantly dependent upon the success of our franchised and Company-owned stores. We and our franchise owners may be adversely affected by:

▪ | declining economic conditions, including downturns in the housing market, increases in unemployment rates, reductions in consumer disposable income, adverse credit market conditions, increases in fuel prices, drops in consumer confidence, and other events or factors that adversely affect consumer spending in the markets that we serve; |

9

▪ | increased competition in the restaurant industry, particularly in the pizza, casual, and fast-casual dining segments, and from grocery stores, convenience stores, and online meal kit delivery services; |

▪ | changes in consumer tastes and preferences; |

▪ | demographic trends; |

▪ | customers’ budgeting constraints; |

▪ | customers’ willingness to accept menu price increases; |

▪ | adverse weather conditions; |

▪ | our reputation and consumer perception of our concepts’ offerings in terms of quality, price, value, ambiance, and service; and |

▪ | customers’ experiences in our stores. |

In addition, the adverse effects of any of the preceding factors may reduce the attractiveness of new franchise stores to prospective franchise owners, which could make it more difficult to recruit the qualified franchise owners needed to implement our refranchising initiative. Our Company-owned stores and our franchise owners are also susceptible to increases in certain key operating expenses that are either wholly or partially beyond our control, including:

▪ | food costs, particularly for mozzarella cheese and other raw materials, many of which we do not or cannot effectively hedge; |

▪ | labor costs, including wages, which are affected by minimum wage requirements, workers’ compensation, health care, and other benefits expenses; |

▪ | rent expenses and construction, remodeling, maintenance, and other costs under leases for our new and existing stores; |

▪ | compliance costs as a result of changes in legal, regulatory, or industry standards; |

▪ | energy, water, and other utility costs; |

▪ | insurance costs; |

▪ | information technology and other logistics costs; and |

▪ | litigation expenses. |

Furthermore, the success of our and our franchise owners’ stores in markets in which we have historically not had a significant number of stores may be adversely affected by a lack of awareness or acceptance of our brand and the take and bake concept as well as by a lack of existing marketing efforts and operational execution in these new markets. Stores in new markets may also face challenges related to being new to a market and having less marketing funds than competitors, which may be due in part to lower store density than competitors. To the extent that we are unable to foster name recognition and affinity for our brand and concept in new markets and implement effective advertising and promotional programs, our franchise owners’ and our new stores may not perform as expected and our results of operations could be adversely affected.

Our strategic initiatives may not be successful, which may have an adverse effect on our business and results of operations.

Our business depends upon our ability to execute on our strategic initiatives in order to stabilize our sales and maintain profitability. These strategic initiatives include improving and expanding our online ordering platform, deploying third-party delivery services and increasing the scope and effectiveness of our digital marketing. These initiatives may not increase our sales and margins to the degree we expect, or at all. Online ordering and delivery also introduce new operating procedures to our stores, which, if not implemented properly, could adversely affect the experience of our customers and be burdensome to our store operators. Our digital marketing strategy relies, in part, on our customers using our online ordering platform, which provides us with contact and other information about our customers. If we are not successful in improving and expanding our online ordering platform, our digital marketing efforts may suffer. In further of our strategic initiatives, we are devoting additional resources to digital marketing. If our digital marketing efforts are not as effective as traditional forms of marketing, such as television or print, our results of operations could be adversely affected.

The planned refranchising of a portion of our Company-owned stores could adversely affect our results of operations.

We have announced plans to refranchise a significant number of our 145 Company-owned stores (total as of March 1, 2018) by selling the stores and entering into franchise agreements with the buyers. We are targeting to own about 50 Company-owned stores by 2020. Company-owned store sales accounted for 65% of our total revenues in 2017. We expect the proposed refranchising to result in a decrease in our total revenues because once the stores are refranchised we will derive revenue from the collection of a royalty equal to a percentage of net sales rather than from the total net sales of food

10

and beverages to customers. In addition, refranchising Company-owned stores, and particularly Company-owned stores that have historically enjoyed high profit margins, may reduce our operating income.

We face many challenges associated with refranchising Company-owned stores, including identifying, recruiting, and contracting with a sufficient number of qualified franchise owners, retaining employees during the transition to franchise owner management, and obtaining necessary consents from landlords and other third parties. These challenges may delay, limit, or prevent our planned refranchising, which could materially and adversely affect our ability to improve operating margins, reduce our exposure to changes in commodity and other operating costs, and generate cash to be used to repay debt. In addition, if we fail to manage our refranchising initiative effectively, the initiative could be time-consuming and distracting for management.

If we fail to identify, recruit, and contract with a sufficient number of qualified franchise owners, our ability to refranchise Company-owned stores and open new franchise stores could be materially and adversely affected.

The refranchising of Company-owned stores and the opening of additional franchise stores depends, in part, upon the attractiveness of our franchise stores to prospective franchise owners and the availability of prospective franchise owners who meet our criteria. Because most of our franchise owners open and operate one or two stores, our refranchising initiative requires us to identify, recruit, and contract with a significant number of new franchise owners each year. Decreases in system-wide average store sales or comparable store sales in select markets may reduce the attractiveness of new franchise stores to prospective franchise owners, making it more difficult for us to recruit qualified franchise owners. We may not be able to identify, recruit, or contract with suitable franchise owners in our target markets on a timely basis or at all. In addition, our franchise owners may not have access to the financial or management resources that they need to open the stores contemplated by their agreements with us, or they may elect to cease store development for other reasons. If we are unable to recruit suitable franchise owners or if franchise owners are unable or unwilling to acquire existing Company-owned stores or open new stores, our business, financial condition, and results of operations could be materially and adversely affected.

We may be unable to refinance or generate sufficient cash flow to satisfy our outstanding debt, which would adversely affect our financial condition and results of operations.

As of January 1, 2018, we had $95.9 million of outstanding indebtedness, including $92.9 million outstanding under our senior secured credit facilities, and $20.0 million of availability under a revolving credit facility, and we may, from time to time, incur additional indebtedness. Our obligations under our senior secured credit facility will mature in August 2019.

Our ability to meet our payment obligations under our debt depends on our ability to generate significant cash flows in the future. Interest rates on our senior secured credit facility are based on LIBOR and so increases in LIBOR would increase our payment obligations. If we are unable to generate sufficient cash flows to service our debt payment obligations, we may need to refinance or restructure our debt, sell assets, reduce or delay investments in our business, or seek to raise additional capital through the sale of equity securities. Such measures might not be successful, and additional debt or equity capital may not be available on acceptable terms or at all. If we are unable to implement one or more of these alternatives, we may be unable to meet our debt payment obligations, which would have a material adverse effect on our business, results of operations, or financial condition.

Our indebtedness may limit our ability to invest in the ongoing needs of our business and if we are unable to comply with our financial covenants, our liquidity and results of operations could be adversely affected.

The agreement governing our senior secured credit facilities places certain conditions on us, including that it:

▪ | requires us to utilize a substantial portion of our cash flow from operations to make payments on our indebtedness, reducing the availability of our cash flow to fund working capital, capital expenditures, development activity, and other general corporate purposes; |

▪ | increases our vulnerability to adverse general economic or industry conditions; |

▪ | limits our flexibility in planning for, or reacting to, changes in our business or the industries in which we operate; |

▪ | makes us more vulnerable to increases in interest rates, as borrowings under our new senior secured credit facilities are made at variable rates; |

▪ | limits our ability to obtain additional financing in the future for working capital or other purposes; and |

▪ | places us at a competitive disadvantage compared to our competitors that have less indebtedness. |

Our senior secured credit facilities place certain limitations on our ability to incur additional indebtedness. However, subject to the qualifications and exceptions in our senior secured credit facilities, we may be permitted to incur substantial additional indebtedness and may incur obligations that do not constitute indebtedness under the terms of the new senior secured credit facilities. The senior secured credit facilities also place certain limitations on, among other things, our ability to enter

11

into certain types of transactions, financing arrangements and investments, to make certain changes to our capital structure, and to guarantee certain indebtedness and pay. These restrictions limit or prohibit, among other things, our ability to:

▪ | pay dividends on, redeem or repurchase our stock, or make other distributions; |

▪ | incur or guarantee additional indebtedness; |

▪ | sell stock in our subsidiaries; |

▪ | create or incur liens; |

▪ | make acquisitions or investments; |

▪ | transfer or sell certain assets or merge or consolidate with or into other companies; |

▪ | make certain payments or prepayments of indebtedness subordinated to our obligations under our new senior secured credit facilities; and |

▪ | enter into certain transactions with our affiliates. |

Failure to comply with certain covenants or the occurrence of a change of control under our senior secured credit facilities could result in the acceleration of our obligations under the senior secured credit facilities, which would have an adverse effect on our liquidity, capital resources, and results of operations.

Our senior secured credit facilities also require us to comply with certain financial covenants regarding our leverage ratio, our interest coverage ratio, and our fixed charge coverage ratio. Changes with respect to these financial covenants may increase our interest rate and failure to comply with these covenants could result in a default and an acceleration of our obligations under the new senior secured credit facilities, which would have an adverse effect on our liquidity, capital resources, and results of operations.

The success of our business continues to depend, to a significant degree, upon the continued contributions of our senior officers and key employees, both individually and as a group, and the hiring of qualified executives to join our management team.

The composition of our senior management team has changed and we anticipate more change in the future as we seek to hire a new Chief Financial Officer in 2018, allowing our existing Chief Financial Officer, Mark Hutchens, to focus solely on his new role as Executive Vice President and Chief Operations Officer.

The changes in our senior management team have resulted in reallocations of duties and may increase employee uncertainty and cause unintended attrition. If we are not able to successfully manage these changes, it may be more difficult for us to attract and recruit highly skilled employees and our Company culture may suffer. The loss of any additional senior officers and key employees could have negative effects on our business and operations.

Although we have employment agreements in place with certain senior officers and key employees, we cannot prevent them from terminating their employment with us. The loss of the services of our Chief Executive Officer, Chief Operating Officer and Chief Financial Officer, other senior officers or key employees could have negative effects on our business and operations and could materially and adversely affect our business and plans for future development. We do not believe that we will lose the services of any of our current senior officers and key employees in the foreseeable future; however, we currently have no effective replacement for any of these individuals due to their experience, reputation in the industry, and special role in our operations. We do not maintain any key man life insurance policies for any of our employees.

New information or attitudes regarding diet and health could result in changes in regulations and consumer consumption habits that could adversely affect our results of operations.

Government regulation and consumer eating habits may affect our business as a result of changes in attitudes regarding diet and health or new information regarding the adverse health effects of consuming certain menu offerings. These changes have resulted in, and may continue to result in, laws and regulations requiring us to disclose the nutritional content of our food offerings, and they have resulted, and may continue to result in, laws and regulations affecting permissible ingredients and menu offerings. For example, to implement the nutrition labeling provisions of the Patient Protection and Affordable Care Act of 2010 (the “PPACA”), the United States Food and Drug Administration (the “FDA”) finalized Food Labeling; Nutrition Labeling of Standard Menu Items in Restaurants and Similar Retail Food Establishments (“the Menu Labeling Final Rule”), which requires covered restaurants, including our stores, to post nutritional information, including calorie disclosures, on their menus and/or menu boards and to provide additional nutrition information upon request. The Menu Labeling Final Rule is scheduled to take effect in May 2018. While some states had previously passed state menu labeling laws, the Menu Labeling Final Rule is intended to preempt inconsistent state laws. An unfavorable report on, or reaction to, our menu ingredients, the size of our portions, or the nutritional content of our menu items could negatively influence the demand for our products and materially and adversely affect our business, financial condition, and results of operations.

12

Compliance with current and future laws and regulations regarding the ingredients and nutritional content of our menu items may be costly and time-consuming. Additionally, if consumer health regulations or consumer eating habits change significantly, we may be required to modify or discontinue certain menu items, and we may experience higher costs associated with the implementation of those changes. We cannot predict the effect of the new nutrition labeling requirements under the Menu Labeling Final Rule until it takes effect. The risks and costs associated with nutritional disclosures on our menus could also affect our operations, particularly given differences among applicable legal requirements and practices within the restaurant industry with respect to testing and disclosure, ordinary variations in food preparation among our own restaurants, and the need to rely on the accuracy and completeness of nutritional information obtained from third-party suppliers.

We may also become subject to legislation or regulation seeking to tax and/or regulate high-fat foods, foods with high sugar and salt content, or foods otherwise deemed “unhealthy”. If we fail to comply with existing or future laws and regulations, we may be subject to governmental or judicial fines or sanctions.

Our results of operations and strategy depend in significant part on the success of our franchise owners, and we are subject to a variety of additional risks associated with our franchise owners, including litigation that has been brought against us by certain franchise owners.

A substantial portion of our revenues comes from royalties generated by our franchise stores. We anticipate that franchise royalties will represent a substantial and growing part of our revenues in the future. Accordingly, we are reliant on the performance of our franchise owners in successfully opening and operating their stores and paying royalties to us on a timely basis, and our reliance on the performance of our franchise owners increases as we franchise Company-owned stores. Our franchise system subjects us to a number of risks, any one of which may affect our ability to collect royalty payments from our franchise owners, may harm the goodwill associated with our brands, and may materially and adversely affect our business and results of operations.

• | Franchise owner independence. Franchise owners are independent operators, and their employees are not our employees. Accordingly, their actions are outside of our control. Although we have developed criteria to evaluate and screen prospective franchise owners, we cannot be certain that our franchise owners will have the business acumen or financial resources necessary to operate successful franchises in their locations and state franchise laws may limit our ability to terminate or modify these franchise agreements. Moreover, despite our training, support, and monitoring, franchise owners may not successfully operate stores in a manner consistent with our standards and requirements, or may not hire and adequately train qualified managers and other store personnel. The failure of our franchise owners to operate their franchises successfully, and actions taken by their employees, could each have a material and adverse effect on our reputation, brand, ability to attract prospective franchise owners, business, financial condition, or results of operations. |

• | Franchise agreement termination or non-renewal. Each franchise agreement is subject to termination by us as the franchisor in the event of a default, generally after expiration of applicable cure periods, although in certain circumstances a franchise agreement may be terminated by us upon notice without an opportunity to cure. The default provisions under the franchise agreements are drafted broadly and include, among other things, any failure to meet operating standards and actions that may threaten our licensed intellectual property. |

In addition, each franchise agreement has an expiration date. Upon the expiration of the franchise agreement, we or the franchise owner may not elect to renew the franchise agreement. If the franchise agreement is renewed, the franchise owner will receive a successive franchise agreement for an additional term. Such option, however, is contingent on the franchise owner’s execution of the then-current form of franchise agreement (which may include new obligations, as well as increased franchise fees, royalty payments, advertising fees, and other fees and costs), the satisfaction of certain conditions (including modernization of the restaurant and related operations) and the payment of a renewal fee. If a franchise owner is unable or unwilling to satisfy any of the foregoing conditions, we may elect not to renew the expiring franchise agreement, in which event the franchise agreement will terminate upon expiration of the term.

• | Franchise owner insurance. The franchise agreements require each franchise owner to maintain certain insurance types and levels. Certain extraordinary hazards, however, may not be covered, and insurance may not be available (or may be available only at prohibitively expensive rates) with respect to many other risks. Moreover, any loss incurred could exceed policy limits and any policy payments made to franchise owners may not be made on a timely basis. Any such loss or delay in payment could have a material and adverse effect on a franchise owner’s ability to satisfy obligations under the franchise agreement, including the ability to make royalty payments and perform indemnity obligations. Further, the franchise owner may fail to obtain or maintain the required insurance types and levels, and we may not be aware of that failure until a loss is incurred. |

13

• | Product liability exposure. We require franchise owners to maintain general liability insurance coverage to protect against the risk of product liability and other risks and demand strict franchise owner compliance with health and safety regulations. However, franchise owners may receive or produce defective food or beverage products, which may materially and adversely affect our brand’s goodwill and our business. Further, a franchise owner’s failure to comply with health and safety regulations, including requirements relating to food quality or preparation and the sourcing of food from vendors, could subject the franchise owner, and possibly us, to litigation. Any litigation, including the imposition of fines or damage awards, could adversely affect the ability of a franchise owner to make royalty payments, or could generate negative publicity, or otherwise adversely affect us. |

• | Franchise owners’ participation in our strategy. Our franchise owners are an integral part of our business. We may be unable to successfully implement our strategy if our franchise owners do not actively participate in such implementation. From time to time, franchise owners have disagreed with or resisted elements of our strategy, including new product initiatives and investments in their stores such as remodeling, migrating to a new e-commerce platform, and adopting third party delivery. Franchise owners may also fail to participate in our marketing initiatives, with respect to financial contributions, time spent on initiatives and the content of marketing messaging, and implementation of recommended promotions, which could materially and adversely affect their sales trends, average weekly sales (“AWS”), and results of operations. In addition, the failure of our franchise owners to focus on the fundamentals of restaurant operations, such as quality, service, and cleanliness, would have a negative effect on our business. It also may be difficult for us to monitor our international franchise owners’ implementation of our strategy due to our lack of personnel in the markets served by such franchise owners. |

• | Franchise owner litigation and conflicts with franchise owners. Franchise owners are subject to a variety of litigation risks, including customer claims, personal-injury claims, environmental claims, employee claims, intellectual property claims, and claims related to violations of the Americans with Disabilities Act, religious freedom, the Fair Labor Standards Act (“FLSA”), the Employee Retirement Income Security Act of 1974, as amended, and advertising laws. Each of these claims may increase costs and limit the funds available to make royalty payments and reduce entries into new franchise agreements. We also may be named in lawsuits against our franchise owners. |

In addition, the nature of the franchisor-franchise owner relationship may give rise to conflict. For example, franchise owners have expressed a number of concerns and disagreements with our Company, including concern over a lack of franchise owner involvement in strategic decision-making, inadequate assistance in increasing and difficulty maintaining franchise store profitability in a higher cost environment, disagreement with marketing strategy and initiatives and product launches, concern over the implementation of the Company’s marketing programs, disagreement with the Company’s expansion strategy and the availability of development incentives, dissatisfaction with food safety measures implemented by the Company, including required purchases and new protocols, and dissatisfaction with costs associated with, and the functionality of, the Company’s online ordering platform. Our senior management team engages with franchise owner leadership to address these concerns and resolve specific issues raised by the franchise owners. Such engagement may not result in a satisfactory resolution of the issues, which could materially and adversely affect our ability to strengthen our franchise system and maintain relationships with our franchise owners, damage our reputation and our brand, and materially and adversely affect our results of operations.

We currently are subject to litigation with a group of our franchise owners as described in Part I, Item 3. Legal Proceedings. We also may become subject to additional litigation with franchise owners in the future. In addition to these and other claims that may be brought against us by franchise owners, we also may engage in future litigation with franchise owners to enforce the terms of our franchise agreements and compliance with our brand standards as determined necessary to protect our brand, the consistency of our products, and the customer experience. Any negative outcome of these or any other claims could materially and adversely affect our results of operations as well as our ability to expand our franchise system and may damage our reputation and our brand.

• | Access to credit. Our franchise owners typically finance new operations and new store openings with loans or other forms of credit. If our franchise owners are unable to access credit or obtain sufficient credit, if interest rates on loans that our franchise owners use to finance operations of current stores or to open new stores increase or if franchise owners are unable to service their debt, our franchise owners may have difficulty operating their stores or opening new stores, which could materially and adversely affect our results of operations as well as our ability to expand our franchise system. |

• | Franchise owner bankruptcy. The bankruptcy of a multi-unit franchise owner could negatively affect our ability to collect payments due under such franchise owner’s franchise agreement. In a franchise owner bankruptcy, the |

14

bankruptcy trustee may reject its franchise agreements pursuant to Section 365 under the United States Bankruptcy Code, in which case there would be no further royalty payments from such franchise owner.

Termination of area development agreements (“ADAs”) or master franchise agreements with certain franchise owners could adversely affect our revenues.

We enter into ADAs with certain domestic franchise owners that plan to open multiple Papa Murphy’s stores in a designated market area and we have entered into master franchise agreements with third parties to develop and operate stores in Canada and in the Middle East. These franchise owners are granted certain rights with respect to specified territories, and, at their discretion, these franchise owners may open more stores than specified in their agreements. The termination of ADAs or other arrangements with a master franchise owner or a lack of expansion by these franchise owners could result in the delay of the development of franchised restaurants or discontinuation or an interruption in the operation of our brands in a particular market or markets. We may not be able to find another operator to resume development activities in such market or markets. Any such delay, discontinuation or interruption would result in a delay in, or loss of, royalty income to us by way of reduced sales and could materially and adversely affect our business, financial condition, or results of operations.

We are subject to all of the risks associated with leasing space subject to long-term non-cancelable leases.

We do not own any of the real property where our Company-owned stores operate. Payments under our operating leases account for a portion of our operating expenses. Our leases generally have an initial term of five years and generally can be extended only in five-year increments (at increased rates). All of our leases require a fixed annual rent, although some require the payment of additional rent if store sales exceed a negotiated amount. Generally, our leases are net leases, which require us to pay all of the cost of insurance, taxes, maintenance, and utilities. We generally cannot cancel these leases. Additional sites that we lease are likely to be subject to similar long-term non-cancelable leases. We also sublease or assign some of our leases to our franchisees, and will continue to do so in the future, either before or after we have developed a store at the leased location. When we assign or sublease our leases to franchisees, such as assignments or subleases made in connection with refranchising Company-owned stores, we are in most instances required to retain ultimate liability to the landlord. If an existing or future store is not profitable, resulting in its closure (or, in the case of a lease that we have subleased or assigned to a franchisee, the franchisee defaults on the subleased or assigned lease), we could lose some or all of our development investment as well as be committed to perform our obligations under the applicable lease. This could include, among other things, paying the base rent for the balance of the lease term. We may also be subject to a claim by a franchise owner who defaults on a lease that we knew or should have known that the leased location would be unprofitable.

In addition, we may fail to negotiate renewals as each of our leases expires, either on commercially acceptable terms or at all, which could cause us to pay increased occupancy costs or to close stores in desirable locations. These potential increased occupancy costs and closed stores could materially and adversely affect our business, financial condition, or results of operations.

The effect of negative economic factors, including the availability of credit, on our franchise owners’ and our landlords could negatively affect our results of operations.

Negative effects on our and our franchise owners’ existing and potential landlords due to the inaccessibility of credit and other unfavorable economic factors may adversely affect our business and results of operations. If our or our franchise owners’ landlords are unable to obtain financing or remain in good standing under their existing financing arrangements, they may be unable to provide construction funding to us or satisfy other lease covenants. In addition, if our franchise owners or our landlords are unable to obtain sufficient credit to continue to properly manage their retail sites, we may experience a drop in the level of quality of such retail locations.

Damage to our reputation and the Papa Murphy’s brand and negative publicity relating to our stores, including our franchise stores, could reduce sales at some or all of our other stores and could negatively affect our business, financial condition, and results of operations.

Our success is dependent in part upon our ability to maintain and enhance the value of the Papa Murphy’s brand, consumers’ connection to our brand and positive relationships with our franchise owners. We may, from time to time, be faced with negative publicity relating to food quality, food safety, store facilities, customer complaints or litigation alleging illness or injury, health inspection scores, integrity of our or our suppliers’ food processing, employee and franchise owner relationships, franchise owner litigation, or other matters, regardless of whether the allegations are valid or whether we are held to be responsible. The risks associated with such negative publicity cannot be completely eliminated or mitigated and may materially and adversely affect our business, financial condition, and results of operations and result in damage to our brand. For multi-location food service businesses such as ours, the negative effect of adverse publicity relating to one store or a limited number of stores may extend far beyond the stores or franchise owners involved to affect some or all of our other stores. The risk of negative publicity is particularly great with respect to our franchise stores because we are limited in

15

the manner in which we can regulate them, especially on a real-time basis. A similar risk exists with respect to unrelated food service businesses, if consumers associate those businesses with our own operations.

The use of social media platforms and similar devices, including blogs, social media websites, and other forms of Internet-based communications that allow individuals to access a broad audience of consumers and other interested persons has increased markedly. Consumers value readily available information concerning goods and services that they purchase and may act on such information without further investigation or authentication. The availability of information on social media platforms is virtually immediate, as is its effect. Many social media platforms immediately publish the content their subscribers and participants’ post, often without filters or checks on the accuracy of the content posted. The opportunity for dissemination of information, including inaccurate information, is seemingly limitless and readily available. Information concerning our Company may be posted on such platforms at any time. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects, or business. The harm may be immediate without affording us an opportunity for redress or correction. Such platforms also could be used for dissemination of trade secret information, compromising valuable Company assets.

Food safety and foodborne illness concerns could have an adverse effect on our business.

We cannot guarantee that our supply chain and food safety controls and training will be fully effective in preventing all food safety issues at our stores, including any occurrences of foodborne illnesses such as salmonella, E. coli, and hepatitis A. In addition, we do not assure you that our franchise locations will maintain the high levels of internal controls and training we require at our Company-owned stores. Furthermore, our franchise owners and we rely on third-party vendors, making it difficult to monitor food safety compliance and increasing the risk that foodborne illness would affect multiple locations rather than a single store. Some foodborne illness incidents could be caused by third-party vendors and transporters outside of our control. New illnesses resistant to our current precautions may develop in the future, or diseases with long incubation periods could arise, that could give rise to claims or allegations on a retroactive basis. One or more instances of foodborne illness in any of our stores or markets or related to types of food products we sell, if publicized on national media outlets or through social media, could negatively affect our store sales nationwide. This risk exists even if it were later determined that the illness was wrongly attributed to us or one of our stores. A number of other restaurant chains have experienced incidents related to foodborne illnesses that have had a material and adverse effect on their operations. The occurrence of a similar incident at one or more of our stores, or negative publicity or public speculation about an incident, could materially and adversely affect our business, financial condition, or results of operations.

Our success depends in part upon effective advertising and marketing campaigns, which may not be successful, and franchise owner support of such advertising and marketing campaigns, as well as compliance with the restrictions and obligations imposed by laws regulating certain marketing practices.

We believe the Papa Murphy’s brand is critical to our business. We expend resources in our marketing efforts using a variety of media, including television advertising, digital and social media, email, and opt-in text messaging. We expect to continue to conduct brand awareness programs and customer initiatives to attract and retain customers. Additionally, some of our competitors have greater financial resources than we do, which enables them to spend significantly more on marketing and advertising than us. Should our competitors increase spending on marketing and advertising, or should our advertising and promotions be less effective than our competitors, our business, financial condition, and results of operations could be materially and adversely affected.

The support of our franchise owners is critical for the success of our advertising and the marketing campaigns we seek to undertake, and the successful execution of these campaigns will depend on our ability to maintain alignment with our franchise owners. Our franchise owners are required to spend a minimum of five percent of net sales directly on local advertising or contribute to a local fund managed by franchise owners in certain market areas to fund the purchase of advertising media. Our franchise owners are also required to contribute two percent of their net sales to a fund to support the development of new products, brand development, and national marketing programs. Consequently, a decline in net sales at franchise stores may result in reduced spending on advertising and the development of new products, brand development, and national marketing programs, or may require us, our franchise owners, or other third-parties to contribute additional advertising funds, which we, our franchise owners, and other third-parties have done at various times. Although we maintain control over advertising and marketing materials and can mandate certain strategic initiatives pursuant to our franchise agreements, we need the active support of our franchise owners if the implementation of these initiatives is to be successful. Additional advertising funds are not contractually required, and we, our franchise owners and other third-parties may choose to discontinue contributing additional funds in the future. Any significant decreases in our advertising and marketing funds or financial support for advertising activities could significantly curtail our marketing efforts, which may materially and adversely affect our business, financial condition, and results of operations.

Further, some of our marketing campaigns involve emails and opt-in text messages. In the United States, the Telephone Consumer Protection Act regulates making phone calls and sending text messages to consumers. The Federal Controlling

16

the Assault of Non-Solicited Pornography and Marketing Act of 2003 (the “CAN-SPAM Act”) regulates commercial email messages and specifies penalties for the transmission of commercial email messages that do not comply with the law‘s requirements, such as providing an opt-out mechanism for stopping future emails from senders. States and other countries have similar laws related to telemarketing and commercial emails. Failure to comply with obligations and restrictions related to text message and email marketing could subject us to lawsuits, fines, statutory damages, consent decrees, injunctions, adverse publicity, and other losses that could harm our business. We are currently subject to one such lawsuit, which is described in Part I, Item 3, Legal Proceedings.

We experience the effects of seasonality.

Seasonal factors and the timing of holidays cause our revenues to fluctuate from quarter to quarter. We typically follow family eating patterns at home, with our strongest sales levels occurring in the months of September through May, and our lowest sales levels occurring in the months of June, July, and August. Therefore, our revenues per store have typically been higher in the first and fourth quarters and lower in the second and third quarters. Additionally, our new store openings have historically been concentrated in the fourth and first quarters because new franchise owners may seek to benefit from historically stronger sales levels occurring in these periods. We believe that new store openings will continue to be weighted towards the fourth quarter. As a result of these factors, our quarterly and annual results of operations and comparable store sales may fluctuate significantly. Accordingly, results for any one quarter are not necessarily indicative of results to be expected for any other quarter or for any year and comparable store sales for any particular future period may decrease and materially and adversely affect our business, financial condition, or results of operations.

Changes in economic conditions, including effects from recession, adverse weather, and other unforeseen conditions, could materially and adversely affect our business, financial condition, and results of operations.

The restaurant industry depends on consumer discretionary spending. Volatile economic conditions now or in the future may depress consumer confidence and discretionary spending. If the economy fails to fully recover for a prolonged period of time or worsens and if our customers have less discretionary income or reduce the amount they spend on quick service meals, customer traffic could be adversely affected. We believe that if negative economic conditions persist for a long period of time or become pervasive, consumers might make long-lasting changes to their discretionary spending behavior, including dining out less frequently. Declines in food commodity prices may accelerate these changes in consumer spending by inducing consumers to purchase more of their meals from grocery and convenience stores. In addition, given our geographic concentrations in the West and Midwest, economic conditions in these particular areas of the country could have a disproportionate effect on our overall results of operations, and regional occurrences such as local strikes, terrorist attacks, increases in energy prices, adverse weather conditions, tornadoes, earthquakes, floods, droughts, fires, or other natural or man-made disasters could materially and adversely affect our business, financial condition, and results of operations. Adverse weather conditions may also affect customer traffic at our stores, and, in more severe cases, cause temporary store closures, sometimes for prolonged periods. If store sales decrease, our profitability could decline as we spread fixed costs across a lower level of sales. Reductions in staff levels, asset impairment charges, and potential store closures could result from prolonged negative store sales.

Changes in food availability and costs could adversely affect our results of operations.

Our profitability and operating margins are dependent in part on our ability to anticipate and react to changes in food costs, particularly the costs of mozzarella cheese and flour. We are party to national supply agreements for core ingredients with certain key third party suppliers, including Saputo Cheese Inc. and Davisco Foods, for cheese; Pizza Blends, Inc., for flour and dough mix; Neil Jones Foods Company, for tomatoes used in sauce; and several suppliers for meat, pursuant to which we lock in pricing for our franchise owners and Company-owned stores. We rely on Sysco Corporation as the primary distributor of food and other products to our franchise owners and Company-owned stores. Our pricing arrangements with national suppliers typically have terms from three months to a year, after which the pricing may be renegotiated. Each store purchases food supplies directly from our approved distributors and produce locally through an approved produce supplier.

The type, variety, quality, availability, and price of produce, meat, and cheese are volatile and are subject to factors beyond our control, including weather, governmental regulation, availability, and seasonality, each of which may affect our and our franchise owners’ food costs or cause a disruption in our supply. For example, cheese pricing is higher in the summer months due to a drop off in milk production in higher temperatures. Our food distributors and suppliers also may be affected by higher costs to produce and transport commodities used in our stores, higher minimum wage and benefit costs, and other expenses that they pass through to their customers, which could result in higher costs for goods and services supplied to us. We may not be able to anticipate and react to changing food costs through our purchasing practices and menu price adjustments in the future. As a result, any increase in the prices charged by suppliers would increase the food costs for our Company-owned stores and for our franchise owners and could adversely affect our and their profitability. In addition, because we provide moderately priced food, we may choose not to, or may be unable to, pass along commodity price increases to consumers, and any price increases that are passed along to consumers may materially and adversely affect

17