Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Gates Industrial Corp plc | d547886dex322.htm |

| EX-32.1 - EX-32.1 - Gates Industrial Corp plc | d547886dex321.htm |

| EX-31.2 - EX-31.2 - Gates Industrial Corp plc | d547886dex312.htm |

| EX-31.1 - EX-31.1 - Gates Industrial Corp plc | d547886dex311.htm |

| EX-23.1 - EX-23.1 - Gates Industrial Corp plc | d547886dex231.htm |

| EX-21.1 - EX-21.1 - Gates Industrial Corp plc | d547886dex211.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2017

Commission file number 001-38366

Gates Industrial Corporation plc

(Exact Name of Registrant as Specified in its Charter)

| England and Wales | 98-1395184 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

| 1551 Wewatta Street, Denver, Colorado | 80202 | |

| (Address of principal executive offices) | (Zip Code) |

(303) 744-1911

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Ordinary Shares, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 1, 2017, the last day of the registrant’s most recently completed second quarter, the registrant’s common stock was not publicly traded. The registrant’s ordinary shares, $0.01 par value per share, began trading on the New York Stock Exchange on January 25, 2018. As of March 8, 2018 the aggregate market value of the registrant’s ordinary shares held by non-affiliates of the registrant was $783.7 million (based upon the closing sale price of the common stock on that date on the New York Stock Exchange). As of March 8, 2018, there were 289,745,605 million ordinary shares outstanding.

Table of Contents

| Part I |

||||

| 1 | ||||

| 10 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| Part II |

||||

| 35 | ||||

| 36 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | |||

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk |

64 | |||

| 67 | ||||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

67 | |||

| 67 | ||||

| 68 | ||||

| Part III |

||||

| Item 10. Directors, Executive Officers and Corporate Governance |

68 | |||

| 74 | ||||

| 99 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

102 | |||

| 106 | ||||

| Part IV |

||||

| 106 | ||||

| 108 | ||||

| 109 | ||||

Table of Contents

Forward-looking statements

This Annual Report on Form 10-K (this “annual report” or “report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that reflect our current views with respect to, among other things, our operations and financial performance. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,” “intends,” “trends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors include but are not limited to those described under “Part I—Item 1A. Risk Factors.” These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this annual report. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Social Media

We use our website (www.gates.com), our corporate Facebook page @GatesCorporation and our corporate Twitter account @GatesAuto as channels of distribution of company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, Securities and Exchange Commission filings and public conference calls and webcasts. The contents of our website and social media channels are not, however, a part of this report.

ABOUT THIS ANNUAL REPORT

Financial Statement Presentation

This annual report includes certain historical consolidated financial and other data for Omaha Topco Limited, an exempted company incorporated in the Cayman Islands with limited liability (“Omaha Topco”). Omaha Topco was formed by Blackstone (as defined below) primarily as a vehicle to finance the acquisition in July 2014 of the entire equity interest in Pinafore Holdings B.V. for $5.4 billion (the “Acquisition”) by investment funds managed by Blackstone. Following the Acquisition, Pinafore Holdings B.V. and its subsidiaries (the “Pre-Acquisition Predecessor”) is the predecessor to the group comprised of Omaha Topco and its subsidiaries (the “Post-Acquisition Predecessor”).

The last day of the fiscal year for the Post-Acquisition Predecessor’s annual consolidated financial statements is the Saturday nearest December 31. Accordingly, the Post-Acquisition Predecessor’s consolidated financial statements are presented for the periods from January 1, 2017 to December 30, 2017 (“Fiscal 2017”), January 3, 2016 to December 31, 2016 (“Fiscal 2016”) and January 4, 2015 to January 2, 2016 (“Fiscal 2015”).

Gates Industrial Corporation plc is a public limited company that was organized under the laws of England and Wales on September 25, 2017. It is the financial reporting entity following the completion of its initial public offering (the “IPO”) in January 2018. Prior to the completion of the IPO, we undertook certain reorganization transactions (the “pre-IPO reorganization transactions”) so that Gates Industrial Corporation plc now indirectly owns all equity interests in Omaha Topco and is the holding company of our business. In connection with the pre-IPO reorganization transactions, the equity owners of Omaha Topco received depositary receipts representing ordinary shares in Gates Industrial Corporation plc in consideration for their equity in Omaha Topco, at a ratio of 0.76293 of our ordinary shares for each outstanding ordinary share of Omaha Topco. The reorganization was accounted for as a transaction between entities under common control in a manner similar to pooling-of-interest and the net assets were recorded at the historical cost basis when the entities were contributed into Gates Industrial Corporation plc.

Gates Industrial Corporation plc is a newly organized entity and had no significant business transactions or activities prior to the pre-IPO reorganization transactions, and, as a result, the historical financial information reflects that of Omaha Topco.

Certain monetary amounts, percentages and other figures included elsewhere in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Table of Contents

Certain Definitions

As used in this annual report, unless otherwise noted or the context requires otherwise:

| • | “Gates,” the “Company,” “we,” “us” and “our” refer (1) prior to the consummation of the IPO and the pre-IPO reorganization transactions, to Omaha Topco and its consolidated subsidiaries and (2) after the consummation of the IPO and the pre-IPO reorganization transactions, to Gates Industrial Corporation plc and its consolidated subsidiaries, as the case may be; |

| • | “Blackstone” or “our Sponsor” refer to investment funds affiliated with The Blackstone Group L.P., our current majority owners; |

| • | “car parc” refers to the number of light vehicles in a region, it is typically used to gauge the size of replacement markets within a region; |

| • | “notes issuers” refers to Gates Global LLC, a Delaware limited liability company and indirect subsidiary of the Company, and Gates Global Co., a Delaware corporation and subsidiary of Gates Global LLC, which co-issued our senior notes; and |

| • | “pre-IPO owners” refer to our Sponsor together with the other owners of Omaha Topco, prior to the IPO. |

Table of Contents

Part I

We are a global manufacturer of innovative, highly engineered power transmission and fluid power solutions. We offer a broad portfolio of products to diverse replacement channel customers, and to original equipment (“first-fit”) manufacturers as specified components, with the majority of our revenue coming from replacement channels. Our products are used in applications across numerous end markets, which include construction, agriculture, energy, automotive, transportation, general industrial, consumer products and many others. Our revenue has historically been highly correlated with industrial activity and utilization, and not with any single end market given the diversification of our business and high exposure to replacement markets. Key indicators of our performance include industrial production, industrial sales and manufacturer shipments. We sell our products globally under the Gates brand, which is recognized by distributors, equipment manufacturers, installers and end users as a premium brand for quality and technological innovation; this reputation has been built for over a century since Gates’ founding in 1911.

Within the diverse end markets we serve, our highly engineered products are critical components in applications for which the cost of downtime is high relative to the cost of our products, resulting in the willingness of end users to pay a premium for superior performance and availability. These applications subject our products to normal wear and tear, resulting in a natural replacement cycle that drives high-margin, recurring revenue. Our product portfolio represents one of the broadest ranges of power transmission and fluid power products in the markets we serve, and we maintain long-standing relationships with a diversified group of blue-chip customers throughout the world. As a leading designer, manufacturer and marketer of highly engineered, mission-critical products, we have become an industry leader across most of the regions and end markets in which we operate.

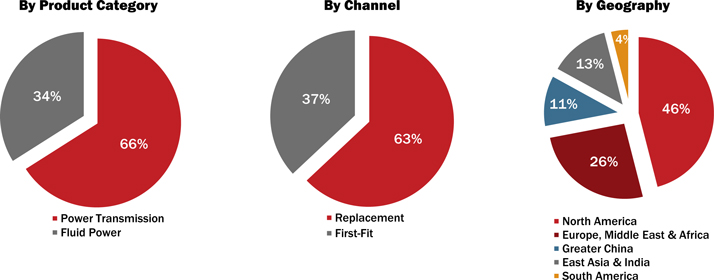

Gates’ business is well-balanced and diversified across products, channels and geographies, as highlighted in the following charts showing breakdowns of our Fiscal 2017 net sales of $3,042 million.

Our History and Recent Developments

On October 1, 1911, Charles Gates, Sr. purchased the Colorado Tire and Leather Company, a manufacturer of steel-studded bands of leather that attached to tires to extend their mileage. In 1917, the Company commercialized the V-belt, which used rubber and woven threading instead of rope belts, which were more commonly used at that time. In 1963, we built the first of many international facilities in Erembodegem, Belgium, followed by Jacarei, Brazil, in 1973. In 1986 Gates acquired the Uniroyal Power Transmission Company, which included an interest in the Unitta joint venture that lay the groundwork for Gates’ growth in the Asia-Pacific region. We have full operational control over the joint venture, and as such consolidate it in our financial statements.

In 1996, the Gates was acquired by a publicly held engineering firm based in the United Kingdom, Tomkins plc, which was itself acquired by Onex Partners and the Canada Pension Plan Investment Board, who proceeded to divest certain of Tomkins plc’s businesses under a new parent entity, Pinafore Holdings B.V. Gates was acquired by funds affiliated with The Blackstone Group L.P. in July 2014.

1

Table of Contents

Gates has developed an active acquisition pipeline and the organizational capability to integrate acquired companies. In 2017, we closed two transactions, Techflow Flexibles in the United Kingdom and Atlas Hydraulics in North America, both focused on expanding our presence in industrial markets with new products, capabilities, capacity and geographic reach.

Our Solutions

We operate our business on a product-line basis through our two reporting segments – Power Transmission and Fluid Power. See note 5 of our audited consolidated financial statements included elsewhere in this report for additional information.

We sell our products under the Gates brand in all geographies and end markets. Our power transmission segment includes elastomer drive belts and related components used to efficiently transfer motion in a broad range of applications. Power transmission products represented approximately 66% of our total net sales for Fiscal 2017. Our fluid power segment includes hoses, tubing and fittings designed to convey hydraulic fluid at high pressures in both mobile and stationary applications, and other high-pressure and fluid transfer hoses used to convey various fluids. Our fluid power products represented approximately 34% of our net sales for Fiscal 2017.

Our power transmission and fluid power products are often critical to the functioning of the equipment, process or system in which they are components, such that the cost of downtime or potential equipment damage is high relative to the cost of our products. Our products are therefore replaced not only as a result of normal wear and tear, but also preemptively as part of ongoing maintenance to the broader system.

We believe that we provide industry-leading delivery times for our products and have a broad portfolio of both power transmission and fluid power products in the end markets we serve. We have a long history of focusing on customer engagement and training, driving product innovation and providing best-in-class order fulfilment services. This allows us to maintain a consistently high level of customer satisfaction, driving continued loyalty among our customer base.

Power Transmission. Our Power Transmission solutions enable and control motion. They are used in applications in which belts, chains, cables, geared transmissions or direct drives transfer power from an engine or motor to another part or system. Belt-based power transmission drives typically consist of either a synchronous belt or an asynchronous belt (V-belt, CVT belt or Micro-V® belt) and related components (sprockets, pulleys, water pumps, tensioners or other accessories). Within our Power Transmission segment, we offer solutions across the following key application platforms:

| • | Stationary drives: fixed drive systems such as those used in a factory driving a machine or pump, or on a grain elevator driving the lift auger. |

| • | Mobile drives: drives on a piece of mobile machinery such as a combine harvester or a road compactor, or in applications such as the brush head of a vacuum cleaner. |

| • | Engine systems: synchronous drives and related components for cam shafts and auxiliary drives and asynchronous accessory drives for A/C compressors, power steering, alternators and starter/generator systems. |

2

Table of Contents

| • | Personal mobility: drives on motorcycles, scooters, bicycles, snowmobiles and other power sports vehicles that are used to transfer power between the power source and the drive wheel(s) or track. |

| • | Vertical lift: elevators, cargo lifts and other applications in which a belt, cable, chain or other lifting mechanism is used to carry load. |

Customers choose power transmission solutions based on a number of factors, including application requirements such as load, speed, gear ratio, temperature, operating environment, ease of maintenance, noise, efficiency and reliability, as well as the support they receive from their suppliers, including application-specific engineering. Belt-based drive systems have many advantages over other alternatives, as they are typically clean, low-maintenance, lubrication-free, quiet with low-vibration, light-weight, compact, energy-efficient, durable and reliable. In applications where these advantages are valued, customers typically choose belts over other forms of power transmission solutions.

Our belts are classified by their general design into asynchronous and synchronous belts; in addition, we also manufacture metal drive products and assemble automotive replacement kits.

Asynchronous Belts. Asynchronous belts are our highest-volume products and are used in a broad range of applications. Asynchronous belts are made of proprietary rubber formulations, textiles and embedded cords for reinforcement. We were a pioneer in the design and manufacturing of V-belts, which draw their name from the shape of their profile. We also manufacture “ribbed” V-belts, which are belts with lengthwise V-shaped grooves, which we market under the Micro-V® name. This design results in a thinner belt for the same drive surface, making it more flexible and offering improved efficiency through lower friction losses. Belt starter/generator (“BSG”) belts are used in start/stop accessory drive systems on automobiles and other engine applications used to improve fuel economy. The demanding BSG system functionality, including engine starting, torque boosting and energy recuperation, requires a high-performance belt construction. Continuously-variable transmission (“CVT”) systems found in scooters, power sports vehicles and other applications use a specialized V-belt knows as a CVT belt.

In industrial end markets, asynchronous belts have a wide variety of applications, including use in pump drives, manufacturing lines, HVAC systems, industrial engines, truck, bus and marine engines, forestry and mining equipment and many other applications. In automotive applications, our asynchronous belts perform functions that include transferring power from the crankshaft to accessory drive components such as the alternator, A/C compressor, power steering system, water pump and, in some vehicles, a BSG system.

Synchronous Belts. Synchronous belts, also known as timing belts, are non-slipping mechanical drive belts. They have teeth molded onto the inner surface and they run over matching toothed pulleys or sprockets. Synchronous belts experience no slippage and are often used to transfer motion for indexing or timing purposes, as well as for linear positioning and positive drive conveying. They are typically used instead of chains or gears and we believe have a number of advantages over these alternatives, including less noise, no need for lubrication, improved durability and performance and a more compact design. Our synchronous belts are made of a flexible polymer over fabric reinforcement and are often built with Kevlar, aramid and carbon fibers.

3

Table of Contents

Examples of industrial applications include use in HVAC systems, food processing and bottling plants, mining and agricultural equipment, automatic doors and robotics. In automotive applications, our synchronous belts are used to synchronize the rotation of the engine crankshaft with the camshaft due to engine combustion in a valve train system, as well as in electric power steering and parking brake systems which are present in gasoline-powered, hybrid and electric vehicles.

Metal Drive Components. We manufacture and sell the tensioners and idlers used in belt drive systems. These products are designed and engineered to work efficiently with our belts. Tensioners are devices that maintain a constant tension in the belt drive system, thereby ensuring proper function and preventing loss of power or system failure. Tensioners typically employ a spring that places pressure along the belt for an intricate hold, while still allowing enough movement for vibration and to prevent stretching. Idlers, which sometimes also perform as tensioners, are used to take up extra belt length.

Kits. Our kits for the automotive replacement market include all of the parts needed by an automotive service shop to perform a replacement of one of our products. Kits are created for specific makes and models and typically include belts, tensioners and idlers, and will sometimes also include water pumps as they are often replaced when a timing belt is replaced. Our kits are convenient for service technicians as they eliminate the need for more complicated product sourcing. On a comparable quantity basis, kits typically sell at a premium to a loose belt and single tensioner.

Our power transmission products are used in a broad range of applications in end markets including construction, agriculture, transportation, automotive, energy, general industrial and consumer products. The majority of our Fiscal 2017 net sales came from the replacement markets, which provide high-margin, recurring revenue streams and are driven by attractive market trends. The bulk of our power transmission replacement business resides in developed regions, in which a large, aging installed base of equipment follows a natural maintenance cycle and is served by well-developed distribution channels. For example, a combine harvester in North America has over 25 high-performance belts that are typically replaced at regular intervals, depending on wear and tear, with end users having access to replacement parts through an established channel. Similarly, in the North American automotive replacement market, maintenance intervals are well defined and miles driven per vehicle are increasing, leading to more wear and tear on vehicles. A smaller portion of our power transmission replacement business is generated in emerging markets, which generally have a smaller base of installed equipment and relatively immature distribution channels. As they continue to develop, these replacement markets represent a significant long-term opportunity for growth.

4

Table of Contents

In addition to our power transmission replacement business, we also serve a wide variety of blue-chip first-fit customers across all of our end markets. The majority of our automotive first-fit revenues in power transmission tend to come from emerging markets. These markets generally are higher-growth and result in higher-margin business than our developed regions. Our first-fit presence in these markets serves to further strengthen our brand, strongly positioning us to serve the growing base of installed equipment as the nascent replacement channels continue to develop.

Fluid Power. Our Fluid Power solutions are used in applications in which hoses and rigid tubing assemblies either transfer power hydraulically or convey fluids, gases or granular materials from one location to another. Within our Fluid Power segment, we offer solutions across the following key application platforms:

| • | Stationary hydraulics: applications within stationary machinery, such as an injection molding machine or a manufacturing press. |

| • | Mobile hydraulics: applications used to power various implements in mobile equipment used in construction, agriculture, mining and other heavy industries. |

| • | Engine systems: applications for engine systems such as coolant, fuel, A/C, turbocharger, air intake and SCR for diesel emissions. |

| • | Other industrial: applications in which hoses are used to convey fluids, gases or granular material across several industries such as oil and gas drilling and refining, food and beverage and other process industries. |

Customers choose fluid power solutions based on a number of factors including application-specific product performance parameters such as pressure and temperature ratings, corrosion and leak resistance, weight, flexibility, abrasion resistance and cleanliness, as well as compliance with standards and product availability. Attributes associated with the supplier, including brand, global footprint and reputation for reliability and quality, are also considered.

Hydraulics. Our hydraulics product line is comprised of hoses, tubing and fittings, as well as assemblies consisting of these products. Our hydraulic products are key components of hydraulic systems in both stationary and mobile equipment applications. We provide a full selection of hose sizes and construction types for use in a wide variety of working requirements and conditions. Hydraulic hoses are made of synthetic rubber and reinforced with steel wire or a textile-based yarn, and typically operate at very high pressures, often in extreme environmental conditions. Hoses are designed for use in specific mechanical applications and require high levels of quality and durability.

Our hydraulic fittings and tubing are engineered to match the product performance of our hydraulic hoses. The high-pressure nature of hydraulic systems requires these products have high levels of performance similar to those found in our hydraulic hoses. The ultimate performance of a hydraulic assembly, in which our products function as part of a hydraulic circuit, depends not only on how well the components are made, but also on how well they complement each other. In order to ensure compatibility with numerous applications, our hydraulic fittings are manufactured in a wide assortment of sizes, crimping systems and materials, and are protected by a range of patents.

5

Table of Contents

Our hydraulic products and assemblies are used in construction, agricultural and forestry equipment, as well as in food and other processing lines and stationary machinery.

Engine Hose. Our engine hose products perform a variety of conveyance functions in engine applications in gasoline-powered, hybrid and electric vehicles. Engine system applications for which Gates provides solutions include coolant (radiator, heater), air system (turbocharger, intake, vacuum, crankcase ventilation), fuel, oil (transmission oil cooling, power steering) and emissions/Diesel Exhaust Filtration (DEF) systems.

Industrial Hose. Our industrial hoses are capable of transferring a wide range of substances—chemicals, food and beverages, petroleum, fuels, bulk materials, water, steam and air—to meet the requirements of diverse applications, including manufacturing, mining, oil and gas drilling, marine, agriculture, industrial cleaning and construction. Our application engineering teams work with customers to assist them in selecting the appropriate hose solution to safely meet their operational needs. We leverage our materials science expertise to enable hose performance at varying pressures and levels of resistance to chemicals, oil, abrasion, ozone, flame and both hot and cold temperatures. For performance in extreme environments, many of our industrial hoses feature both crush-resistant and flexible designs. Gates industrial hoses are highly engineered to meet or exceed a multitude of industry standards and certifications, and are offered in a range of diameters, lengths and colors to allow customers to differentiate the hoses in applications. We also offer a wide range of couplings to provide complete assembly solutions to our customers.

Our fluid power products are used in numerous applications, including construction, agriculture, transportation, automotive, energy and general industrial. The largest portion of our Fiscal 2017 fluid power revenue came from replacement markets. Within these replacement markets, the majority of our revenue comes from industrial applications. Approximately 17% of our Fiscal 2017 fluid power revenue came from products sold into the automotive end market, almost all of which was served through the higher-margin replacement channel.

Our Diverse Markets

We participate in many sectors of the industrial and consumer markets. Our products play essential roles in a diverse range of applications across a wide variety of end markets ranging from harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners. Virtually every form of transportation, ranging from trucks, buses and automobiles to personal mobility vehicles such as motorcycles, bicycles and snowmobiles uses our products.

6

Table of Contents

Our revenue has historically been highly correlated with industrial activity and utilization, and not with any single end market given the diversification of our business and high exposure to replacement markets. Key indicators include industrial production, industrial sales and manufacturer shipments.

Our products are sold in over 120 countries across our four commercial regions: (1) the Americas; (2) Europe, Middle East & Africa; (3) Greater China; and (4) East Asia & India. We have a long-standing presence in each of these regions. See note 5E “Selected geographic information” in our audited consolidated financial statements included elsewhere in this report for information regarding our net sales by geographic origin and property, plant and equipment by geographic origin.

Our commercial capabilities are complemented by our global manufacturing footprint, which frequently allows us to manufacture products in close proximity to our customers. We have power transmission and fluid power operations in each commercial region and typically manufacture products for both first-fit customers and replacement customers in the same factory, which provides improved factory loading and demand leveling, as well as optimization of capital expenditures.

Our Channels

We sell our power transmission and fluid power products both as replacement components and as specified components on original equipment to customers worldwide. For Fiscal 2017, approximately 63% of our net sales were generated from replacement markets and 37% from first-fit markets globally. Our mix of replacement sales to first-fit sales varies by region based on our market strategy and the maturity of the equipment fleet and replacement channel. For example, in emerging markets such as China, our business is characterized by a higher first-fit presence, given the relatively underdeveloped replacement channels and newer average age of cars. We believe that ultimately our first-fit presence in these emerging markets will allow us to better develop the replacement channels as they mature over time. By contrast, in North America and Europe, where there are long-established replacement markets, approximately 71% and 67% of our Fiscal 2017 net sales, respectively, were derived from these higher-margin replacement channels. In the vast majority of the applications we service, we do not need to have been the first-fit provider to service these applications in the replacement markets.

Replacement. The majority of our sales are generated from customers in replacement channels, who primarily serve a large base of installed equipment that follows a natural maintenance cycle. Our ability to help replacement channel partners maximize revenue is an important part of our value proposition. These customers miss sales opportunities if a required product cannot be obtained quickly, either from a catalog or on-hand inventory.

In addition to our products, we provide a complementary suite of services, digital tools and other content to distributors, installers and end users of equipment containing our products. We offer customer training on product installation and early identification of wear-and-tear on components, which helps drive sales for our channel customers while mitigating the risk of equipment failure for end users.

First-Fit. We work closely with our customers by providing application engineering expertise to assist them in selecting the right products for their applications. In engine systems, we are one of the only suppliers providing application engineering for cam drive and accessory drive applications, and completing all design and manufacturing of the system components in-house. Close interactions between our R&D organization and customer technical teams provide input into our innovation and product development processes. We selectively participate in first-fit projects, focusing on opportunities where we are able to differentiate with technology and innovative solutions.

7

Table of Contents

Customers

We maintain long-standing relationships with many customers, who range from local distributors with one location to large, global manufacturers of equipment. No single customer accounted for more than 10% of our Fiscal 2017 net sales.

Sales and Marketing and Distribution Organization

Our sales and distribution operations are structured to serve our customers efficiently across the globe. We have field representatives who possess local knowledge of product and application requirements, allowing us to meet our customers’ product availability requirements with short lead times. Our global sales and service support team helps reinforce customer and distributor relationships by focusing on end markets and customers.

Manufacturing

We have a global, “in region, for region” manufacturing footprint and regional service model that enable us to operate efficiently and effectively in proximity to our customers. We operate 64 manufacturing facilities and service centers as well as several major technical centers giving us a presence in 30 countries throughout the world. Our in-country deployment of manufacturing and technical resources enables us to meet customer needs rapidly and satisfy regional variations in product preference, while our scale allows us to service global customers on a world-wide basis.

Competition

We operate in competitive markets and industries that are also very fragmented. We offer our products and solutions across numerous and varied end markets and geographies through over 120 locations in 30 countries. Consequently, we have many competitors across our various markets and product offerings. These competitors and the degree of competition vary by product line, geographic scope, end market and channel. Although each of our markets and product offerings has many competitors, no single competitor competes with us with respect to all of our products, solutions, channels and end markets. Our global presence makes it difficult for smaller regional and low-cost country manufacturers to penetrate our markets. We differentiate ourselves on the basis of product performance and quality, breadth of portfolio, customer support and training, service level, fill rates and product availability.

Research, Development and Intellectual Property

Applied R&D is important to our businesses and integral to our leading market positions. We have engineering teams in the United States, Canada, the United Kingdom, Germany, Spain, Poland, Turkey, Japan, China, Brazil, India, Mexico, Korea and Thailand that focus on the introduction of new and improved products with a particular emphasis on energy efficiency and safety, the application of technology to reduce unit and operating costs and improving services to our customers.

As of December 30, 2017, we owned more than 2,000 issued patents and pending patent applications, and over 3,000 registered trademarks in various jurisdictions. While no individual patent or group of patents, taken alone, is considered critical to our business, collectively our patents and trademarks provide meaningful protection for our products and technical innovations.

Materials and Suppliers

We use a wide variety of materials, resulting in a highly diversified mix of inputs, which are sourced from a variety of suppliers around the world. Generally, we seek to obtain materials in the regions where our products are manufactured to minimize transportation and other costs. As of December 30, 2017, we had not experienced any significant shortages of raw materials and normally do not carry inventories of raw materials in excess of those required to meet our production schedules.

8

Table of Contents

We are continually seeking to manage commodity and raw material costs using various strategies, including working with our suppliers to mitigate costs, exploring material substitution opportunities, combining purchase requirements across regions and changing suppliers when appropriate.

Environmental

Our operations, products and properties are subject to extensive U.S. and foreign federal, state, local, and provincial laws and regulations relating to environmental, health and safety (“EHS”) protection, including laws and regulations governing air emissions, wastewater discharges, waste management and disposal, substances in products, and workplace health and safety, as well as the investigation and clean-up of contaminated sites. Under certain environmental laws, the obligation to investigate and remediate contamination at a facility may be imposed on current and former owners, lessees or operators or on persons who may have sent waste to that facility for disposal. We are currently performing environmental investigations and/or remediation at a number of former and current facilities in the United States and Canada and are incurring costs in relation to a number of offsite waste disposal sites.

Employees

As of December 30, 2017, we employed approximately 14,200 employees worldwide. Approximately 6,600 of our employees were located in North America, 3,200 in EMEA, 3,700 in China and East Asia and 700 in South America. Some of our employees are members of labor unions and over many years we have been able to maintain successful relationships with the unions and employment organizations. To date, employee relations have been flexible and constructive as we continue to pursue lean manufacturing improvements in our plants.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the internet at the SEC’s website at http://www.sec.gov. Our SEC filings are also available on our website, free of charge, at http://www.gates.com as soon as reasonably practicable after they are filed with or furnished to the SEC. You may also read and copy any filed document at the SEC’s public reference room in Washington, D.C. at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about public reference rooms.

We maintain an internet site at http://www.gates.com. Our website and the information contained on or connected to that site are not incorporated into this report.

9

Table of Contents

The risk factors noted in this section and other factors noted throughout this annual report, describe certain risks and uncertainties that could cause our actual results to differ materially from those contained in any forward-looking statement and should be considered carefully in evaluating our company and our business.

Risks Related to Our Business and Industry

Conditions in the global and regional economy and the major end markets we serve may materially and adversely affect the business and results of operations of our businesses should they deteriorate.

Our business and operating results have been, and will continue to be, affected by worldwide and regional economic conditions, including conditions in the end markets we serve. The level of demand for our products depends, in part, on the general economic conditions that exist in our served end markets. A substantial portion of our revenues are derived from customers in cyclical industries that typically are adversely affected by downward economic cycles. Our customers may experience deterioration of their businesses, cash flow shortages or difficulty obtaining financing as a result of the effects of contraction or low levels of economic growth, disruptions in the financial markets, weak consumer and business confidence, high levels of unemployment, reduced levels of capital expenditures, fluctuating commodity prices, bankruptcies and other challenges affecting the global economy, as happened following the global recession in 2008. For example, our historical results have been highly correlated to global industrial activity and utilization and decreases in such activity or utilization may impact our business, financial condition and results of operations. As a result, existing or potential customers may delay or cancel plans to purchase our products and services and may not be able to fulfill their obligations to us in a timely fashion. Further, our suppliers, distributors and vendors may experience similar conditions, which may impact their ability to fulfill their obligations to us. If conditions in the global economy or in the regions and major end markets that we serve deteriorate, demand for our products and services may be decline and our results of operations, financial position and cash flows could be materially adversely affected.

We are subject to economic, political and other risks associated with international operations, and this could adversely affect our business and our strategy to capitalize on our global reach.

One of our key strategies is to capitalize on our global commercial reach, and a substantial portion of our operations are conducted and located outside the United States. For Fiscal 2017, approximately 62% of our net sales originated from outside of the United States. We have manufacturing, sales and service facilities spanning five continents and sell to customers in over 120 countries. Moreover, a significant amount of our manufacturing functions and sources of our raw materials and components are from emerging markets such as China, India and Eastern Europe. Accordingly, our business and results of operations, as well as the business and results of operations of our vendors, suppliers and customers, are subject to risks associated with doing business internationally, including:

| • | instability in a specific country’s or region’s political, economic or social conditions, including inflation, recession, interest rate fluctuations and actual or anticipated military or political conflicts; |

| • | changes in foreign currency exchange rates or currency restructurings and hyperinflation or deflation in the countries in which we operate; |

| • | imposition of restrictions on currency conversion or the transfer of funds or limitations on our ability to repatriate income or capital in a tax efficient manner; |

| • | trade protection measures, such as tariff increases and embargoes, and import and export licensing and control requirements; |

| • | the complexities of operating within multiple tax jurisdictions, including potentially negative consequences from changes in tax laws or from tax examinations, which may, in addition, require an extended period of time to resolve; |

| • | partial or total expropriation by local, state or national governments; |

| • | uncertainties as to local laws regarding, and enforcement of, contract and intellectual property rights; |

10

Table of Contents

| • | the ability to comply with or effect of complying with complex and changing laws, regulations and policies of foreign governments, including differing and, in some cases, more stringent labor and environmental regulations; |

| • | differing local product preferences and product requirements; and |

| • | difficulties involved in staffing and managing widespread operations, including challenges in administering and enforcing corporate policies, which may be different than the normal business practices of local cultures. |

The likelihood of such occurrences and their potential effect on us vary from country to country and are unpredictable. Certain regions, including Latin America, Asia, the Middle East and Africa, are generally more economically and politically volatile and as a result, our operations in these regions could be subject to significant fluctuations in sales and operating income from quarter to quarter. Because a significant percentage of our operating income in recent years has come from these regions, adverse fluctuations in the operating results in these regions could have a disproportionate impact on our results of operations in future periods.

The new U.S. administration has publicly supported certain potential tax and trade proposals, modifications to international trade policy and other changes which may affect U.S. trade relations with other countries. In addition, economic and political uncertainty arose out of the June 23, 2016 vote in the United Kingdom that resulted in the decision to leave the European Union (the “E.U.”). It is possible that these or other changes, if enacted, may impact or require us to modify our current business practices. At the present time, it is unclear as to the ultimate impact of these changes, policies or proposals and, as such, we are unable to determine the effect, if any, that such changes, policies or proposals would have on our business.

Additionally, concerns persist regarding the debt burden of certain European countries and the ability of these countries to meet future financial obligations, as well as concerns regarding the overall stability of the euro and the suitability of the euro as a single currency given the diverse economic and political circumstances of individual euro-area countries. If a country within the euro area were to default on its debt or withdraw from the euro currency, or if the euro were to be dissolved entirely, the impact on markets around the world, and on our global business, could be immediate and material. Such a development could cause financial and capital markets within and outside Europe to constrict, thereby negatively impacting our ability to finance our business, and also could cause a substantial reduction in consumer confidence and spending that could negatively impact sales. Any one of these impacts could have a material adverse effect on our financial condition and results of operations.

If we are unable to obtain raw materials at favorable prices in sufficient quantities, or at the time we require them, our operating margins and results of operations may be materially adversely affected.

We purchase our energy, steel, aluminum, rubber and rubber-based materials, chemicals, polymers and other key manufacturing inputs from outside sources. We do not traditionally have long-term pricing contracts with raw material suppliers. The costs of these raw materials have been volatile historically and are influenced by factors that are outside our control. In recent years, the prices for energy, metal alloys, polymers and certain other of our raw materials have fluctuated significantly. While we strive to avoid this risk by using price escalation mechanisms with respect to our raw materials in certain of our customer contracts and we also seek to offset our increased costs with gains achieved through operational efficiencies, if we are unable to pass increases in the costs of our raw materials on to our customers, we experience a lag in our ability to pass increases to our customers, or operational efficiencies are not achieved, our operating margins and results of operations may be materially adversely.

Additionally, our businesses compete globally for key production inputs. The availability of qualified suppliers and of key inputs may be disrupted by market disturbances or any number of geopolitical factors, including political unrest and significant weather events. Such disruptions may require additional capital or operating expenditure by us or force reductions in our production volumes. In the event of an industry-wide general shortage of certain raw materials or key inputs, or a shortage or discontinuation of certain raw materials or key inputs from one or more of our suppliers, we may not be able to arrange for alternative sources of certain raw materials or key inputs. Any such shortage may materially adversely affect our competitive position versus companies that are able to better or more cheaply source such raw materials or key inputs.

11

Table of Contents

Adverse changes in our relationships with, or the financial condition, performance, purchasing patterns or inventory levels of, key channel partners could adversely affect our business, financial condition and results of operations.

Certain of our businesses sell a significant amount of their products to key channel partners, including distributors, that have valuable relationships with end users. Some of these channel partners may also sell our competitors’ products, and if they favor competing products for any reason they may fail to market our products effectively. Adverse changes in our relationships with these channel partners, or adverse developments in their financial condition, performance or purchasing patterns, could adversely affect our business, financial condition and results of operations. The levels of inventory maintained by our distributors and other channel partners, and changes in those levels, can also significantly impact our results of operations in any given period. In addition, the consolidation of channel partners and customers in certain of our end markets could adversely impact our profitability.

We face competition in all areas of our business and may not be able to successfully compete with our competitors, which could adversely affect our revenues and profitability.

We are subject to competition from other producers of products that are similar to ours. We compete on a number of factors, including product performance, quality, value, product availability, brand recognition, customer service and innovation and technology. Our customers often demand delivery of our products on a tight time schedule and in a number of geographic markets. If our quality of service declines or we cannot meet the demands of our customers, they may utilize the services or products of our competitors. Our competitors include manufacturers that may be better capitalized, may have a more extensive low-cost sourcing strategy and presence in low-cost regions or may receive significant governmental support and as a result, may be able to offer more aggressive pricing. Our competitors also may develop products that are superior to our products, or may develop more efficient or effective methods of providing products and services or may adapt more quickly than we do to new technologies or evolving customer requirements. If we are unable to continue to provide technologically superior or better quality products or to price our products competitively, our ability to compete could be harmed and we could lose customers or market share.

Pricing pressures from our customers may materially adversely affect our business.

We generate strong margins by selling premium products at premium prices. Accordingly, our margins could suffer if our customers are no longer willing to pay a premium for our product and service offerings. We face the greatest pricing pressure from our customers in the automotive first-fit end market. Virtually all vehicle manufacturers seek price reductions in both the initial bidding process and during the term of the award. We are also, from time to time, subject to pricing pressures from customers in our other end markets. If we are not able to offset price reductions through improved operating efficiencies and reduced expenditures or new product introduction, those price reductions may have a material adverse effect on our results of operations.

We are dependent on the continued operation of our manufacturing facilities and we may need to make investments in new or existing facilities.

While we are not heavily dependent on any single manufacturing facility, major disruptions at a number of our manufacturing facilities, due to labor unrest, adverse weather, natural disasters, terrorist attacks, significant mechanical failure of our facilities, or other catastrophic event, could result in significant interruption of our business and a potential loss of customers and sales or could significantly increase our operating costs.

In addition, we may need to make investments in new or existing manufacturing facilities to adapt our production capacity to changing market conditions and to align with our growth strategies. The costs of such investments may be significant and we may not realize the expected benefits on our anticipated timeframe or at all, which may have a material adverse effect on our business, financial condition and results of operations.

12

Table of Contents

We may not be able to accurately forecast demand or meet significant increases in demand for our products.

Certain of our businesses operate with short lead times and we order raw materials and supplies and plan production based on discussions with our customers and internal forecasts of demand. If we are unable to accurately forecast demand for our products, in terms of both volume and specific products, or react appropriately to abrupt changes in demand, we may experience delayed product shipments and customer dissatisfaction. If demand increases significantly from current levels, both we and our suppliers may have difficulty meeting such demand, particularly if such demand increases occur rapidly. Additionally, we may carry excess inventory if demand for our products decreases below projected levels. Failure to accurately forecast demand or meet significant increases in demand could have a material adverse impact on our business, financial condition and operating results.

We are exposed to exchange rate fluctuations in the international markets in which we operate.

We conduct operations in many areas of the world involving transactions denominated in a variety of functional currencies. We are subject to currency exchange rate risk to the extent that our costs may be denominated in currencies other than those in which we earn and report revenues and vice versa. In addition, a decrease in the value of any of these currencies relative to the U.S. dollar could reduce our profits from non-U.S. operations and the translated value of the net assets of our non-U.S. operations when reported in U.S. dollars in our consolidated financial statements. Ongoing movements in average currency translation rates in the future could continue to have a negative impact on our business, financial condition or results of operations as reported in U.S. dollars. Fluctuations in currencies may also make it more difficult to perform period-to-period comparisons of our reported results of operations.

We anticipate that there will be instances in which costs and revenues will not be exactly matched with respect to currency denomination. As a result, to the extent we continue to expand geographically, we expect that increasing portions of our revenues, costs, assets and liabilities will be subject to fluctuations in foreign currency valuations. We may experience economic loss and a negative impact on earnings or net assets solely as a result of foreign currency exchange rate fluctuations. Further, the markets in which we operate could restrict the removal or conversion of the local or foreign currency, resulting in our inability to hedge against these risks.

We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into U.S. dollars or to remit dividends and other payments by our foreign subsidiaries or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation. Actions of this nature, if they occur or continue for significant periods of time, could have an adverse effect on our results of operations and financial condition in any given period.

We are dependent on market acceptance of new product introductions and product innovations for continued revenue growth.

The markets in which we operate are subject to technological change. Our long-term operating results depend substantially upon our ability to continually develop, introduce, and market new and innovative products, to modify existing products, to respond to technological change, and to customize certain products to meet customer requirements and evolving industry standards. The development of new product introductions and product innovations may require significant investment by us. There are numerous risks inherent in this process, including the risks that we will be unable to anticipate the direction of technological change or that we will be unable to develop and market new products and applications in a timely fashion to satisfy customer demands. For example, the increased adoption of electric vehicles may affect certain of the end markets that we serve and could alter the application platforms in which we offer solutions.

If we are unable to adapt to technological changes, including by developing and marketing new products, our business and results of operations may be adversely affected.

13

Table of Contents

We have taken, and continue to take, cost-reduction actions, which may expose us to additional risk and we may not be able to maintain the level of cost reductions that we have achieved.

We have been reducing costs in all of our businesses and have discontinued product lines, divested non-core businesses, consolidated manufacturing operations and reduced our employee population. The impact of these cost-reduction actions on our sales and profitability may be influenced by many factors and we may not be able to maintain the level of cost savings that we have achieved depending on our ability to successfully complete these efforts. In connection with the implementation and maintenance of our cost reduction measures, we may face delays in anticipated workforce reductions, a decline in employee morale and a potential inability to meet operational targets due to an inability to retain or recruit key employees.

We are subject to risks from litigation, legal and regulatory proceedings and obligations that may materially impact our operations.

We face an inherent business risk of exposure to various types of claims, lawsuits and proceedings. We are involved in various tax, intellectual property, product liability, product warranty and environmental claims and lawsuits, and other legal, antitrust and regulatory proceedings arising in the ordinary course of our business. Although it is not possible to predict with certainty the outcome of every claim, lawsuit or proceeding and the range of probable loss, we believe these claims, lawsuits and proceedings will not individually or in the aggregate have a material impact on our results. However, we could, in the future, be subject to various claims, lawsuits and proceedings, including, amongst others, tax, intellectual property, product liability, product warranty, environmental claims and antitrust claims, and we may incur judgments or enter into settlements of lawsuits and proceedings that could have a material adverse effect on our results of operations in any particular period.

Our products could infringe on the intellectual property of others, which may cause us to engage in costly litigation and, if we are not successful, could cause us to pay substantial damages and/or prohibit us from selling our products.

Third parties may assert infringement or other intellectual property claims against us based on their patents or other intellectual property rights. Any claim relating to intellectual property infringement that is successfully asserted against us may require us to pay substantial damages, including treble damages, if we are found to be willfully infringing another party’s patents, for past use of the asserted intellectual property and royalties and other consideration going forward if we are forced to take a license. In addition, if any such claim were successfully asserted against us, we may be forced to stop or delay developing, manufacturing, selling or otherwise commercializing our products, product candidates or other technology, or those we develop with our R&D partners. Even if infringement claims against us are without merit, defending these types of lawsuits takes significant time, may be expensive and may divert management attention from other business concerns.

In addition, first-fit and other manufacturers have attempted to use claims of intellectual property infringement against manufacturers and distributors of aftermarket products to restrict or eliminate the sale of aftermarket products that are the subject of the claims. First-fit manufacturers have brought such claims in federal court and with the U.S. International Trade Commission and with various foreign government agencies.

To the extent first-fit and other manufacturers are seeking and obtaining more utility and design patents than they have in the past and are successful in asserting infringement of these patents and defending their validity, if any of our products are found to infringe someone’s patent, we could be restricted or prohibited from selling such products, which could have an adverse effect on our business. If we are sued for intellectual property infringement, we will likely incur significant expenses investigating and defending such claims, even if we prevail.

In addition, certification by independent organizations of certain of our aftermarket products may be revoked or adversely affected by first-fit manufacturer claims. Lack of certification may negatively impact us because many major insurance companies recommend or require the use of aftermarket products only if they have been certified by an independent certifying organization.

14

Table of Contents

Failure to adequately protect or enforce our intellectual property rights against counterfeiting activities could adversely affect our business.

Although we routinely conduct anti-counterfeiting activities in multiple jurisdictions, we have encountered counterfeit reproductions of our products or products that otherwise infringe on our intellectual property rights. The actions we take to establish and protect trademarks and other intellectual property rights may not be adequate to prevent such counterfeiting activities by others. If we are unsuccessful in challenging such products on the basis of trademark or other intellectual property infringement, continued sales of such imitating products may adversely affect market share and impact customer perceptions and demand, leading to the shift of consumer preference away from our products and loss of market share.

We will not seek to protect our intellectual property rights in all jurisdictions throughout the world and we may not be able to adequately enforce our intellectual property rights even in the jurisdictions where we seek protection.

Filing, prosecuting and defending patents on our products in all countries and jurisdictions throughout the world would be prohibitively expensive, and the laws of certain foreign countries may not protect or allow enforcement of intellectual property rights to the same extent as the laws of the United States.

Competitors may use our technologies in jurisdictions where we do not pursue and obtain patent protection to develop their own products and further, may export otherwise infringing products to territories where we have patent protection, but where the ability to enforce our patent rights is not as strong as in the United States. These products may compete with our products, and our intellectual property rights may not be effective or sufficient to prevent such competition. In addition, we may face significant expenses in connection with the protection of our intellectual property rights outside the United States. If we are unable to successfully protect our rights or resolve intellectual property conflicts with others, our business, financial condition and results of operations may be adversely affected.

Failure to develop, obtain, enforce and protect intellectual property rights or liability for intellectual property infringement could adversely affect our business.

Our success depends on our ability to develop technologies and inventions used in our products and to brand such products, to obtain intellectual property rights in such technologies, inventions, and brands, and to protect and enforce such intellectual property rights. In this regard, we rely on U.S. and foreign trademark, patent, copyright, and trade secret laws, as well as license agreements, nondisclosure agreements, and confidentiality and other contractual provisions. Nevertheless, the technologies and inventions developed by our engineers in the future may not prove to be as valuable as those of competitors, or competitors may develop similar or identical technologies and inventions independently of us and before we do.

We may not be able to obtain patents or other intellectual property rights in our new technologies and inventions or, if we do, the scope of such rights may not be sufficiently broad to afford us any significant commercial advantage over our competitors. Owners of patents or other intellectual property rights that we need to conduct our business as it evolves may be unwilling to license such intellectual property rights to us on terms we consider reasonable. Competitors and other third parties may challenge the ownership, validity, and/or enforceability of our patents or other intellectual property rights. Further, we expect pirates to continue to counterfeit certain of our products using our trademarks, which has led to, and will likely continue to cause loss of sales. It is difficult to police such counterfeiting, particularly on a worldwide basis, and the efforts we take to stop such counterfeiting may not be effective.

Our other efforts to enforce our intellectual property rights against infringers may not prove successful and will likely be time consuming and expensive and may divert management’s attention from the day-to-day operation of our business. Adequate remedies may not be available in the event of an infringement or unauthorized use or disclosure of our trade secrets and manufacturing expertise. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our business, financial condition, results of operations and cash flows. Further, successful assertion of our intellectual property rights depends on the judicial strength and willingness of the issuing jurisdictions to enact and enforce sufficient intellectual property laws. Creation and enforcement of intellectual property rights is a relatively recent development in much of the world, and so some time may be necessary to realize reliable intellectual property systems across all markets and jurisdictions, if this occurs at all.

15

Table of Contents

We operate in industries with respect to which there are many third-party patents. Owners of patents or other intellectual property rights that we need to conduct our business as it evolves may be unwilling to license such intellectual property rights to us on terms we consider reasonable. We cannot assure you that our business operations, products and methods do not or will not infringe, misappropriate or otherwise violate the patents or other intellectual property rights of third parties. Any claim relating to intellectual property infringement that is successfully asserted against us may require us to pay substantial damages, including treble damages, if we are found to be willfully infringing another party’s patents, for past use of the asserted intellectual property and royalties and other consideration going forward if we are forced to take a license. In addition, if any such claim were successfully asserted against us, we may be forced to stop or delay developing, manufacturing, selling or otherwise commercializing our products, product candidates or other technology, or those we develop with our R&D partners. If we are sued for intellectual property infringement, we will likely incur significant expenses investigating and defending such claims, even if we prevail. Any of these risks coming to fruition could have a material adverse effect on our business, results of operations, financial condition and prospects.

We may be subject to recalls, product liability claims or may incur costs related to product warranties that may materially and adversely affect our business.

Meeting or exceeding many government-mandated safety standards is costly and requires manufacturers to remedy defects related to product safety through recall campaigns if the products do not comply with safety, health or environmental standards. If we, customers or government regulators determine that a product is defective or does not comply with such standards prior to the start of production, the launch of a product could be delayed until such defect is remedied. The costs associated with any protracted delay of a product launch or a recall campaign to remedy defects in products that have been sold could be substantial.

We face an inherent risk of product liability claims if product failure results in any claim for injury or loss. Supplier consolidation and the increase in low-cost country sourcing may increase the likelihood of receiving defective materials, thereby increasing the risk of product failure and resulting liability claims. Litigation is inherently unpredictable and these claims, regardless of their outcome, may be costly, divert management attention and adversely affect our reputation. Although we have liability insurance, we cannot be certain that this insurance coverage will continue to be available to us at a reasonable cost or will be adequate. In addition, even if we are successful in defending against a claim relating to our products, claims of this nature could cause our customers to lose confidence in our products and us.

From time to time, we receive product warranty claims from our customers, pursuant to which we may be required to bear costs of repair or replacement of certain of our products. Vehicle manufacturers are increasingly requiring their outside suppliers to participate in the warranty of their products and to be responsible for the operation of these component products in new vehicles sold to consumers. Warranty claims may range from individual customer claims to full recalls of all products in the field. It cannot be assured that costs associated with providing product warranties will not be material.

We are subject to anti-corruption laws in various jurisdictions, as well as other laws governing our international operations. If we fail to comply with these laws we could be subject to civil or criminal penalties, other remedial measures, and legal expenses, which could materially adversely affect our business, financial condition and results of operations.

Our international operations are subject to one or more anti-corruption laws in various jurisdictions, such as the U.S. Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”), the U.K. Bribery Act of 2010 and other anti-corruption laws. The FCPA and these other laws generally prohibit employees and intermediaries from bribing or making other prohibited payments to foreign officials or other persons to obtain or retain business or gain some other business advantage. We operate in a number of jurisdictions that pose a high risk of potential FCPA or other anti-corruption violations, and we participate in joint ventures and relationships with third parties whose actions could potentially subject us to liability under the FCPA or other anti-corruption laws. In addition, we cannot predict the nature, scope or effect of future regulatory requirements to which our international operations might be subject or the manner in which existing laws might be administered or interpreted.

16

Table of Contents

We are also subject to other laws and regulations governing our international operations, including regulations administered by the U.S. Department of Commerce’s Bureau of Industry and Security, the U.S. Department of Treasury’s Office of Foreign Assets Control, and various non-U.S. government entities, including applicable export control regulations, economic sanctions on countries and persons, customs requirements, currency exchange regulations, and transfer pricing regulations (collectively, “Trade Control laws”).

We are also subject to new U.K. corporate criminal offences for failure to prevent the facilitation of tax evasion pursuant to the Criminal Finances Act 2017 (“FTP offences”). The FTP offences impose criminal liability on a company where it has failed to prevent the criminal facilitation of tax evasion by a person associated with the company.

We have instituted policies, procedures and ongoing training of certain employees with regard to business ethics, designed to ensure that we and our employees comply with the FCPA, other anticorruption laws, Trade Control laws and the Criminal Finances Act 2017. However, there is no assurance that our efforts have been and will be completely effective in ensuring our compliance with all applicable anti-corruption laws, including the FCPA, or other legal requirements. If we are not in compliance with the FCPA, other anti-corruption laws, Trade Control laws or the Criminal Finances Act 2017, we may be subject to criminal and civil penalties, disgorgement and other sanctions and remedial measures, and legal expenses, which could have a material adverse impact on our business, financial condition, results of operations and liquidity. Likewise, any investigation of any potential violations of the FCPA, other anti-corruption laws or the Criminal Finances Act 2017 by U.S. or foreign authorities could also have a material adverse impact on our reputation, business, financial condition and results of operations.

Existing or new laws and regulations may prohibit, restrict or burden the sale of aftermarket products.

Most states have passed laws that regulate or limit the use of aftermarket products in certain types of repair work. These laws include requirements relating to consumer disclosure, owner’s consent regarding the use of aftermarket products in the repair process, and the requirement to have aftermarket products certified by an independent testing organization. Additional legislation of this kind may be introduced in the future. If additional laws prohibiting or restricting the use of aftermarket products are passed, it could have an adverse impact on our aftermarket products business.

Certain organizations test the quality and safety of vehicle replacement products. If these organizations decide not to test a particular vehicle product, or in the event that such organizations decide that a particular vehicle product does not meet applicable quality or safety standards, we may decide to discontinue sales of such product or insurance companies may decide to discontinue authorization of repairs using such product. Such events could adversely affect our business.

Our information technology systems are decentralized, which may lead to certain security risks and make access to our applications cumbersome.

In general, our information technology (“IT”) systems are decentralized. This decentralization may lead to security risks and makes access to common applications cumbersome. We are in the midst of several large-scale information technology projects, including with respect to Enterprise Resource Planning systems and consolidation of applications and servers. The costs of such projects may exceed the amounts we have budgeted for them, and any material failures in the execution of such projects may hinder our day-to-day operations.

Our business could be materially adversely affected by interruptions to our computer and IT systems.