Attached files

| file | filename |

|---|---|

| 8-K - CurrencyWorks Inc. | form8-k.htm |

APPCOIN

INNOVATIONS INC.(1)

(the “Issuer”)

PRIVATE

PLACEMENT SUBSCRIPTION AGREEMENT

(SUBSCRIPTION RECEIPTS)

INSTRUCTIONS TO SUBSCRIBER

| 1. | You must complete all the information in the boxes on page 2 and sign where indicated with an “X”. |

| 2 | You must complete Exhibit A, “Acknowledgement and Direction” that is on page 16. |

| 3. | You must complete and sign Exhibit B “Canadian Investor Questionnaire” that starts on page 17. The purpose of this form is to determine whether you meet the standards for participation in a private placement under applicable Canadian securities laws. In order for the Issuer to satisfy its obligations under applicable Canadian securities laws, you may be required to provide additional evidence to verify the information you have provided in Exhibit B. |

| 4. | If you are a “U.S. Purchaser”, as defined in Exhibit C, you must complete and sign BOTH Exhibit B “Canadian Investor Questionnaire” that starts on page 17 AND Exhibit C “United States Accredited Investor Questionnaire” that starts on page 35. |

| 5. | Unless you are subscribing through a person registered as a registered firm, registered individual or an exempt market dealer (each as defined in National Instrument 31-103 – Registration Requirements and Exemptions), or you are subscribing directly from the Issuer without the involvement of a finder, you must complete and sign Exhibit D “Risk Acknowledgement Form”, that starts on page 40. |

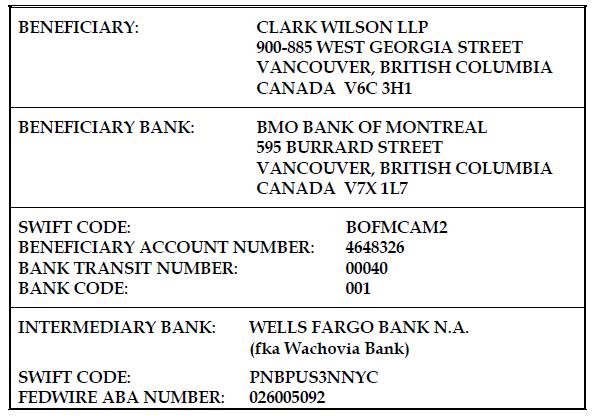

| 6. | All subscription funds must be in U.S. Dollars. If you are paying for your subscription with funds drawn from a Canadian bank, you may pay by certified cheque or bank draft drawn on a Canadian chartered bank or by wire transfer to Clark Wilson LLP, legal counsel for the Issuer, pursuant to the wiring instructions set out in Exhibit E that is on page 41. |

| 7. | All subscription funds must be in U.S. Dollars. If you are paying for your subscription with funds drawn on any source other than a Canadian chartered bank, you may only pay by wire transfer to Clark Wilson LLP pursuant to the wiring instructions set out in Exhibit E that is on page 41. |

| (1) | The Issuer has approved a change of name to “ICOX Innovations Inc.” which will be completed on or before February 28, 2018. |

| - 2 - |

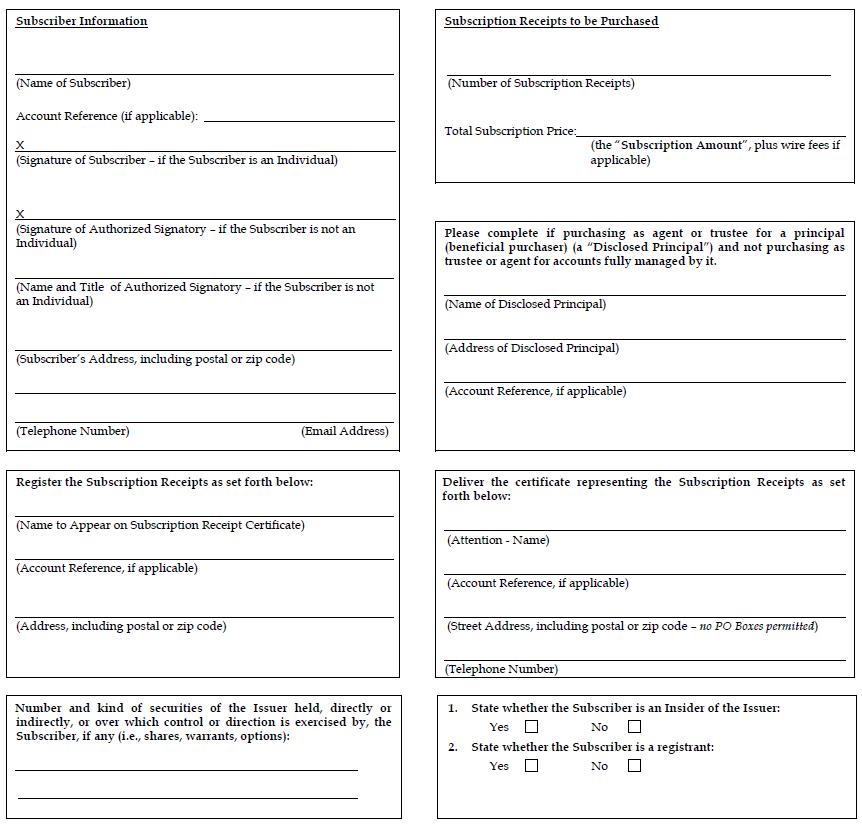

APPCOIN INNOVATIONS INC.

PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT

The undersigned (the “Subscriber”) hereby irrevocably subscribes for and agrees to purchase from AppCoin Innovations Inc.(1) (the “Issuer”) that number of subscription receipts of the Issuer (each, a “Subscription Receipt”) set out below at a price of $0.60 per Subscription Receipt. Each Subscription Receipt will automatically convert into one common share in the capital of the Issuer (each, a “Share”) in the event of the occurrence of the Escrow Release Condition (as defined herein). The Subscriber agrees to be bound by the terms and conditions set forth in the attached “Terms and Conditions of Subscription for Subscription Receipts”.

| (1) | The Issuer has approved a change of name to “ICOX Innovations Inc.” which will be completed on or before February 28, 2018. |

| - 3 - |

ACCEPTANCE

The Issuer hereby accepts the Subscription (as defined herein) on the terms and conditions contained in this private placement subscription agreement (this “Agreement”) as of the _____ day of ___________, 2018 (the “Closing Date”).

| APPCOIN INNOVATIONS INC.(1) | ||

| Per: | ||

| Authorized Signatory | ||

| Address: | 561 Indiana Court | |

| Venice Beach, CA 90291 | ||

| Email: | Michael.blum@appcoininnovations.com | |

| Attention: | Michael Blum |

| (1) | The Issuer has approved a change of name to “ICOX Innovations Inc.” which will be completed on or before February 28, 2018. |

| - 4 - |

TERMS AND CONDITIONS OF SUBSCRIPTION FOR SUBSCRIPTION RECEIPTS

1. Subscription

1.1 On the basis of the representations and warranties, and subject to the terms and conditions, set forth in this Agreement, the Subscriber hereby irrevocably subscribes for and agrees to purchase such number of Subscription Receipts as is set forth on page 2 of this Agreement at a price of $0.60 per Subscription Receipt for the Subscription Amount shown on page 2 of this Agreement, which is tendered herewith (such subscription and agreement to purchase being the “Subscription”), and the Issuer agrees to sell the Subscription Receipts to the Subscriber, effective upon the Issuer’s acceptance of this Agreement.

1.2 In the event of the occurrence of the Escrow Release Condition (as defined herein), each Subscription Receipt will automatically convert into one common share in the capital of the Issuer (each, a “Share”), for no additional consideration. The Subscription Receipts and the Shares are collectively referred to herein as the “Securities”.

1.3 The Subscriber acknowledges that the Subscription Receipts have been offered to the Subscriber as part of an offering by the Issuer of additional Subscription Receipts to other subscribers for gross proceeds of up to $5,000,000 (or any such greater or lesser amount as may be determined by the Issuer in its sole discretion) (the “Offering”).

1.4 All dollar amounts referred to in this Agreement are in lawful money of United States, unless otherwise indicated.

1.5 The Subscriber acknowledges and agrees that this Agreement, the Subscription Amount and any other documents delivered in connection herewith will be held by Clark Wilson LLP (the “Escrow Agent”), legal counsel to the Issuer, by or on behalf of the Issuer. In the event that this Agreement is not accepted by the Issuer for whatever reason, which the Issuer expressly reserves the right to do, the Issuer will cause the Escrow Agent to return the Subscription Amount (without interest thereon) to the Subscriber at the address of the Subscriber as set forth on page 2 of this Agreement.

2. Payment and Escrow Provisions

2.1 On or before the closing of the Offering (the “Closing”), the Subscriber will deliver to the Escrow Agent payment for the Subscription Amount (the “Escrowed Funds”), as follows:

| (a) | if the Subscriber is drawing funds from a Canadian bank to pay for this Subscription, by a certified cheque or bank draft drawn on a Canadian chartered bank, or by wire transfer to the Escrow Agent pursuant to the wiring instructions set out in Exhibit E that is on page 41 of this Agreement; or | |

| (b) | if the Subscriber is drawing funds from any source other than a Canadian chartered bank to pay for this Subscription, then ONLY by wire transfer to the Escrow Agent pursuant to the wiring instructions set out in Exhibit E that is on page 41 of this Agreement, |

which Escrowed Funds will be held in escrow, on behalf of the Issuer, by the Escrow Agent, in accordance with the terms and conditions of an escrow agreement to be entered into between the Issuer and the Escrow Agent (the “Escrow Agreement”) at or prior to the Closing.

| - 5 - |

2.2 The Escrowed Funds will be held by the Escrow Agent until the receipt by the Issuer of conditional approval for the listing of the Shares on a Canadian stock exchange (the “Escrow Release Condition”).

2.3 In the event that the Escrow Release Condition is satisfied prior to 5:00 p.m. (Vancouver time) on May 31, 2018 (the “Escrow Deadline”), the Issuer will deliver a notice to the Escrow Agent confirming the Escrow Release Condition has been satisfied (the “Release Notice”). Upon receipt of the Release Notice: (a) the Escrow Agent will, as soon as practicable thereafter, release the Escrowed Funds to the Issuer, and (b) each Subscription Receipt will automatically convert, without any further action on the part of the Subscriber, into one Share, without payment of any additional consideration by the Subscriber.

2.4 If the Escrow Release Condition is not satisfied by the Escrow Deadline, or if the Issuer delivers written notice to the Escrow Agent that the Escrow Release Condition will not be satisfied before the Escrow Deadline (the “Default Notice”), the Subscription Receipts will expire and be of no further force and effect, effective as of the earlier of: (a) the Escrow Deadline and (b) the date of the receipt of the Default Notice by the Escrow Agent, and the Subscriber will be entitled to receive from the Escrow Agent a refund of the Escrowed Funds, without interest thereon and less applicable expenses required to return the Escrowed Funds, to be refunded in the same format and, if applicable, to the same account, as the Escrowed Funds were initially delivered by, or from, the Subscriber to the Escrow Agent, unless otherwise mutually agreed by the Subscriber and the Escrow Agent.

2.5 For greater certainty, the Subscription Receipts will be issued at the Closing by the Issuer and the Subscriber acknowledges and agrees that it will be acquiring Subscription Receipts, and not Shares, pursuant to this Subscription Agreement. The Subscriber further acknowledges and agrees that, if the Escrow Release Condition is satisfied by the Escrow Deadline, the Subscription Receipts will convert automatically, with no further action on the part of the Subscriber, into Shares. In the event that the Issuer fails to satisfy the Escrow Release Condition by the Escrow Deadline, or the Issuer delivers the Default Notice to the Escrow Agent, the Escrowed Funds will be refunded to the Subscriber, in accordance with the terms of the certificate representing the Subscription Receipts (the “Certificate”), which will be substantially in the form as attached hereto as Exhibit F.

2.6 Prior to the time that the Escrow Release Condition is satisfied and the Release Notice is provided, the Subscriber will not be a shareholder of the Issuer with respect to the Subscription Receipts (or the Shares issuable on the conversion thereof) and will not be entitled to vote on or in respect of any event which forms part of the Escrow Release Condition. The Subscriber will only be entitled to receive the Shares if the Release Notice is provided to the Escrow Agent by the Issuer prior to the Escrow Deadline. If the Release Notice is not provided to the Escrow Agent prior to the Escrow Deadline, the Subscriber will only be entitled to a return of the Escrowed Funds and will not be entitled to acquire any Shares.

2.7 The Subscriber hereby acknowledges and agrees that upon conversion of the Subscription Receipts into Shares as provided in this Agreement and the Certificate, the Issuer shall cause the Issuer’s Transfer Agent to issue the Shares by way of book entry on the register maintained by the Issuer’s Transfer Argent for the appropriate number of Shares issuable upon deemed exercise of the Subscription Receipts. The Issuer will not issue and deliver any certificates representing the Shares.

3. Documents Required from Subscriber

3.1 Prior to the Closing, the Subscriber must complete, sign and return to the Issuer the following documents:

| (a) | this Agreement; |

| - 6 - |

| (b) | the Acknowledgement and Direction attached as Exhibit A, which is on page 16; | |

| (c) | the Canadian Investor Questionnaire (the “Canadian Questionnaire”) attached as Exhibit B that starts on page 17, along with any additional evidence that may be requested by the Issuer to verify the information provided in the Canadian Questionnaire; | |

| (d) | if the Subscriber is a U.S. Purchaser (as defined in Exhibit C), the United States Accredited Investor Questionnaire (the “U.S. Questionnaire” and, together with the Canadian Questionnaire, the “Questionnaires”) attached as Exhibit C that starts on page 35 along with any additional evidence that may be requested by the Issuer to verify the information provided in the U.S. Questionnaire; | |

| (e) | if the Subscriber is not subscribing through a person registered as a registered firm, registered individual or an exempt market dealer (each as defined in National Instrument 31-103 – Registration Requirements and Exemptions), or the Subscriber is acquiring the Subscription Receipts directly from the Issuer without involvement of a finder, the “Risk Acknowledgement Form” attached hereto as Exhibit D, which is on page 40; and | |

| (f) | such other supporting documentation that the Issuer or the Escrow Agent may request to establish the Subscriber’s qualification as a qualified investor, |

and the Subscriber acknowledges and agrees that the Issuer will not consider the Subscription for acceptance unless the Subscriber has provided all of such documents to the Issuer.

3.2 As soon as practicable upon any request by the Issuer, the Subscriber will complete, sign and return to the Issuer any additional documents, questionnaires, notices and undertakings as may be required by any regulatory authorities or applicable laws.

3.3 The Issuer and the Subscriber acknowledge and agree that the Escrow Agent has acted as legal counsel only to the Issuer and, notwithstanding its requirements as escrow agent, is not protecting the rights and interests of the Subscriber. The Subscriber acknowledges and agrees that the Issuer and the Escrow Agent have given the Subscriber the opportunity to seek, and are hereby recommending that the Subscriber obtain, independent legal advice with respect to the subject matter of this Agreement, and the Subscriber hereby represents and warrants to the Issuer and the Escrow Agent that the Subscriber has sought such independent legal advice or waives such advice.

4. Conditions and Closing

4.1 The Closing Date will occur on such date as may be determined by the Issuer in its sole discretion. The Issuer may, at its discretion, elect to close the Offering in one or more closings.

4.2 The Closing is conditional upon and subject to:

| (a) | the Issuer having obtained all necessary approvals and consents, including applicable regulatory approvals, for the Offering; | |

| (b) | the issue and sale of the Subscription Receipts being exempt from the requirement to file a prospectus and the requirement to deliver an offering memorandum under applicable securities laws relating to the sale of the Subscription Receipts, or the Issuer having received such orders, consents or approvals as may be required to permit such sale without the requirement to file a prospectus or deliver an offering memorandum; and |

| - 7 - |

| (c) | the Issuer having obtained the approval of any stock exchange upon which the Shares are then listed and trading, if applicable, for the Offering. |

4.3 The Subscriber acknowledges that the certificates representing the Subscription Receipts will be available for delivery within five business days of the Closing Date, provided that the Subscriber has satisfied the requirements of Section 3 hereof and the Issuer has accepted this Agreement.

5. Acknowledgements and Agreements of the Subscriber

5.1 The Subscriber acknowledges and agrees that:

| (a) | except as provided in this Agreement, none of the Securities have been or will be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or under any securities or “blue sky” laws of any state of the United States, and, unless so registered, may not be offered or sold in the United States or, directly or indirectly, to any U.S. Person (as defined in Section 6.2), except in accordance with the provisions of Regulation S under the 1933 Act (“Regulation S”), pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act, and in each case only in accordance with applicable state, provincial and foreign securities laws; | |

| (b) | hedging transactions involving the Securities may not be conducted unless such transactions are in compliance with the provisions of the 1933 Act and in each case only in accordance with applicable securities laws; | |

| (c) | other than as set out herein, the Issuer has not undertaken, and will have no obligation, to register any of the Securities under the 1933 Act or any other applicable securities laws; | |

| (d) | the Issuer will refuse to register the transfer of any of the Securities to a U.S. Person not made pursuant to an effective registration statement under the 1933 Act or pursuant to an available exemption from the registration requirements of the 1933 Act, and in each case in accordance with applicable laws; | |

| (e) | the decision to execute this Agreement and to acquire the Securities has not been based upon any oral or written representation as to fact or otherwise made by or on behalf of the Issuer and such decision is based entirely upon a review of any public information which has been filed by the Issuer with the United States Securities and Exchange Commission (the “SEC”) (collectively, the “Public Record”); | |

| (f) | the Issuer and others will rely upon the truth and accuracy of the acknowledgements, representations, warranties, covenants and agreements of the Subscriber contained in this Agreement and the Questionnaires, as applicable, and the Subscriber agrees that if any of such acknowledgements, representations and agreements are no longer accurate or have been breached, the Subscriber will promptly notify the Issuer; | |

| (g) | there are risks associated with the purchase of the Securities, as more fully described in the Issuer’s periodic disclosure forming part of the Public Record; | |

| (h) | the Subscriber and the Subscriber’s advisor(s) have had a reasonable opportunity to ask questions of and receive answers from the Issuer in connection with the distribution of the Securities hereunder, and to obtain additional information, to the extent possessed or obtainable without unreasonable effort or expense, necessary to verify the accuracy of the information about the Issuer; |

| - 8 - |

| (i) | a portion of this Offering may be sold pursuant to an agreement between the Issuer and one or more agents registered in accordance with applicable securities laws, in which case the Issuer will pay a fee and/or compensation securities on terms as set out in such agency agreement; | |

| (j) | finder’s fees or broker’s commissions may be payable by the Issuer to finders who introduce subscribers to the Issuer; | |

| (k) | the books and records of the Issuer were available upon reasonable notice for inspection, subject to certain confidentiality restrictions, by the Subscriber during reasonable business hours at its principal place of business, and all documents, records and books in connection with the distribution of the Securities hereunder have been made available for inspection by the Subscriber, the Subscriber’s legal counsel and/or the Subscriber’s advisor(s); | |

| (l) | all of the information which the Subscriber has provided to the Issuer is correct and complete, and if there should be any change in such information prior to the Closing, the Subscriber will immediately notify the Issuer, in writing, of the details of any such change; | |

| (m) | the Issuer is entitled to rely on the representations and warranties of the Subscriber contained in this Agreement and the Questionnaires, as applicable; | |

| (n) | any resale of the Securities by the Subscriber will be subject to resale restrictions contained in the securities laws applicable to the Issuer, the Subscriber and any proposed transferee, and it is the responsibility of the Subscriber to find out what those restrictions are and to comply with such restrictions before selling any of the Securities; | |

| (o) | the Subscriber has been advised to consult the Subscriber’s own legal, tax and other advisors with respect to the merits and risks of an investment in the Securities and with respect to applicable resale restrictions, and the Subscriber is solely responsible (and the Issuer is not in any way responsible) for compliance with any applicable: |

| (i) | laws of the jurisdiction in which the Subscriber is resident in connection with the distribution of the Securities hereunder, and | |

| (ii) | resale restrictions; |

| (p) | there may be material tax consequences to the Subscriber for any acquisition or disposition of the Securities and the Issuer gives no opinion and makes no representation to the Subscriber with respect to the tax consequences to the Subscriber under federal, state, provincial, local or foreign tax laws that may apply to the Subscriber’s acquisition or disposition of the Securities; | |

| (q) | the Subscriber consents to the placement of a legend or legends on any certificate or other document evidencing any of the Securities setting forth or referring to the restrictions on transferability and sale thereof contained in this Agreement, with such legend(s) to be substantially as follows: |

| - 9 - |

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE THE DATE THAT IS 4 MONTHS AND A DAY AFTER THE LATER OF (i) [INSERT THE DISTRIBUTION DATE], AND (ii) THE DATE THE ISSUER BECAME A REPORTING ISSUER IN ANY PROVINCE OR TERRITORY;

| (r) | the Issuer has advised the Subscriber that the Issuer is relying on an exemption from the requirements to provide the Subscriber with a prospectus and to sell the Securities through a person registered to sell securities under Canadian securities laws, and, as a consequence of acquiring the Securities pursuant to such exemption, certain protections, rights and remedies provided by applicable securities laws (including the various provincial securities acts), including statutory rights of rescission or damages, will not be available to the Subscriber; | |

| (s) | no securities commission or similar regulatory authority has reviewed or passed on the merits of any of the Securities; | |

| (t) | there is no government or other insurance covering any of the Securities; and | |

| (u) | this Agreement is not enforceable by the Subscriber unless it has been accepted by the Issuer and the Issuer reserves the right to reject this Subscription for any reason. |

6. Representations and Warranties of the Subscriber

6.1 The Subscriber hereby represents and warrants to the Issuer (which representations and warranties will survive the Closing) that:

| (a) | unless the Subscriber has completed Exhibit C, the Subscriber is not a U.S. Person; | |

| (b) | the Subscriber is resident in the jurisdiction set out on page 2 of this Agreement; | |

| (c) | if the Subscriber is resident outside of Canada: |

| (i) | the Subscriber is knowledgeable of, or has been independently advised as to, the applicable securities laws having application in the jurisdiction in which the Subscriber is resident (the “International Jurisdiction”) which would apply to the offer and sale of the Securities, | |

| (ii) | the Subscriber is purchasing the Securities pursuant to exemptions from prospectus or equivalent requirements under applicable laws or, if such is not applicable, the Subscriber is permitted to purchase the Securities under applicable securities laws of the International Jurisdiction without the need to rely on any exemptions, | |

| (iii) | the applicable securities laws of the International Jurisdiction do not require the Issuer to make any filings or seek any approvals of any kind from any securities regulator of any kind in the International Jurisdiction in connection with the offer, issue, sale or resale of any of the Securities, |

| - 10 - |

| (iv) | the purchase of the Securities by the Subscriber does not trigger: |

| A. | any obligation to prepare and file a prospectus or similar document, or any other report with respect to such purchase in the International Jurisdiction, or | |

| B. | any continuous disclosure reporting obligation of the Issuer in the International Jurisdiction, and |

| (v) | the Subscriber will, if requested by the Issuer, deliver to the Issuer a certificate or opinion of local counsel from the International Jurisdiction which will confirm the matters referred to in subparagraphs (ii), (iii) and (iv) above to the satisfaction of the Issuer, acting reasonably; |

| (d) | the Subscriber has the legal capacity and competence to enter into and execute this Agreement and to take all actions required pursuant hereto and, if the Subscriber is a corporate entity, it is duly incorporated and validly subsisting under the laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to authorize execution and performance of this Agreement on behalf of the Subscriber; | |

| (e) | the entering into of this Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or, if applicable, the constating documents of, the Subscriber or of any agreement, written or oral, to which the Subscriber may be a party or by which the Subscriber is or may be bound; | |

| (f) | the Subscriber has duly executed and delivered this Agreement and it constitutes a valid and binding agreement of the Subscriber enforceable against the Subscriber in accordance with its terms; | |

| (g) | the Subscriber has received and carefully read this Agreement; | |

| (h) | the Subscriber is aware that an investment in the Issuer is speculative and involves certain risks, including those risks disclosed in the Public Record and the possible loss of the entire Subscription Amount; | |

| (i) | the Subscriber has made an independent examination and investigation of an investment in the Securities and the Issuer and agrees that the Issuer will not be responsible in any way for the Subscriber’s decision to invest in the Securities and the Issuer; | |

| (j) | the Subscriber is not an underwriter of, or dealer in, any of the Securities, nor is the Subscriber participating, pursuant to a contractual agreement or otherwise, in the distribution of the Securities; | |

| (k) | the Subscriber is not aware of any advertisement of any of the Securities and is not acquiring the Securities as a result of any form of general solicitation or general advertising, including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media, or broadcast over radio or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising; and |

| - 11 - |

| (l) | no person has made to the Subscriber any written or oral representations: |

| (i) | that any person will resell or repurchase any of the Securities, | |

| (ii) | that any person will refund the purchase price of any of the Securities, or | |

| (iii) | as to the future price or value of any of the Securities. |

6.2 In this Agreement, the term “U.S. Person” will have the meaning ascribed thereto in Regulation S, and for the purpose of this Agreement includes, but is not limited to: (a) any person in the United States; (b) any natural person resident in the United States; (c) any partnership or corporation organized or incorporated under the laws of the United States; (d) any partnership or corporation organized outside the United States by a U.S. Person principally for the purpose of investing in securities not registered under the 1933 Act, unless it is organized or incorporated, and owned, by accredited investors who are not natural persons, estates or trusts; or (e) any estate or trust of which any executor or administrator or trustee is a U.S. Person.

7. Representations and Warranties of the Issuer

7.1 By executing this Subscription Agreement, the Issuer represents, warrants and covenants to the Subscriber, which representations, warranties and covenants will be true and correct as of the Closing with the same force and effect as if made at and as of the Closing (and acknowledges that the Subscriber is relying thereon) that:

| (a) | the Issuer has been duly incorporated and organized and is a valid and subsisting company under the laws of the State of Nevada, and is duly qualified to carry on business in each jurisdiction wherein the carrying out of the activities contemplated makes such qualifications necessary; | |

| (b) | the Subscription Receipts will, upon issue and delivery, be validly issued upon receipt by the Issuer of full payment therefor, and upon conversion of the Subscription Receipts in accordance with their terms, the Shares will be validly issued, as fully paid and non-assessable; | |

| (c) | the Issuer has the full corporate right, power and authority to execute this Subscription Agreement, and to issue the Subscription Receipts (and the Shares upon conversion of the Subscription Receipts) to the Subscriber pursuant to the terms of this Agreement; and | |

| (d) | this Agreement constitutes a binding and enforceable obligation of the Issuer, enforceable in accordance with its terms. |

8. Registration Rights

8.1 The Issuer will prepare and file a registration statement with respect to 50% of the Shares issuable upon conversion of the Subscription Receipts (the “Registration Statement”) with the SEC within 90 days following the Closing and will use commercially reasonable efforts to have the Registration Statement declared effective by the SEC as soon as possible after filing. The Registration Statement shall state, to the extent permitted by Rule 416 under the 1933 Act, that it also covers such indeterminate number of additional Shares as may become issuable upon exercise of the Subscription Receipts in order to (i) prevent dilution resulting from stock splits, stock dividends or similar events and (ii) effect any required anti-dilution adjustments pursuant to the terms of the Subscription Receipts. Notwithstanding any other provision in this Section 8, if the Issuer receives a comment from the staff of the SEC that effectively results in the Issuer having to reduce the number of Shares included in such Registration Statement, then the Issuer, after having first used commercially reasonable efforts to persuade the staff of the SEC to withdraw such comment, may in its sole discretion reduce on a pro rata basis (among all subscribers in the Offering) the number of Shares to be included in the Registration Statement.

| - 12 - |

8.2 In connection with the preparation and filing of the Registration Statement, the Subscriber will furnish to the Issuer, in writing, such information and representations with respect to itself and the proposed distribution by it as are reasonably necessary in order to assure compliance with applicable federal and state securities laws. The Issuer will require the Subscriber to furnish to the Issuer, among other things as may be determined by the Issuer in its sole discretion, a certified statement as to the number of securities of the Issuer beneficially owned by the Subscriber and the name of the natural person that has voting and dispositive control over such Shares. The Subscriber will be responsible for payment of any legal fees it incurs in connection with the Registration Statement.

8.3 The Subscriber shall indemnify and hold harmless the Issuer, its directors, officers, agents and employees, each person who controls the Issuer (within the meaning of Section 15 of the 1933 Act and Section 20 of the Securities Exchange Act of 1934), and the directors, officers, agents or employees of such controlling persons, to the fullest extent permitted by applicable law, from and against all losses, as incurred, to the extent arising out of or based solely upon: (a) the Subscriber’s failure to comply with the prospectus delivery requirements of the 1933 Act; (b) any untrue or alleged untrue statement of a material fact contained in the Registration Statement, or in any amendment or supplement thereto or in any preliminary prospectus, or arising out of or relating to any omission or alleged omission of a material fact required to be stated therein or necessary to make the statements therein not misleading to the extent that: (i) such untrue statement or omission is contained in any information so furnished in writing by the Subscriber to the Issuer specifically for inclusion in the Registration Statement, (ii) such untrue statements or omissions are based solely upon information regarding the Subscriber furnished in writing to the Issuer by the Subscriber expressly for use therein, or (iii) such information relates to the Subscriber or the Subscriber’s proposed method of distribution of the Shares and was reviewed and expressly approved in writing by the Subscriber expressly for use in the Registration Statement or in any amendment or supplement thereto; or (c) the use by the Subscriber of an outdated or defective Registration Statement after the Issuer has notified the Subscriber in writing that the Registration Statement is outdated or defective.

8.4 If a claim for indemnification hereunder is unavailable to the Issuer (by reason of public policy or otherwise), then the Subscriber, in lieu of indemnifying the Issuer, shall contribute to the amount paid or payable by the Issuer as a result of such losses, in such proportion as is appropriate to reflect the relative fault of the Subscriber and the Issuer in connection with the actions, statements or omissions that resulted in such losses, as well as any other relevant equitable considerations. The relative fault of the Subscriber and the Issuer shall be determined by reference to, among other things, whether any action in question, including any untrue or alleged untrue statement of a material fact or omission or alleged omission of a material fact, has been taken or made by, or relates to information supplied by, the Subscriber or the Issuer, and the parties’ relative intent, knowledge, access to information and opportunity to correct or prevent such action, statement or omission. The amount paid or payable by a party as a result of any losses shall be deemed to include, subject to the limitations set forth in this Agreement, any reasonable attorneys’ or other reasonable fees or expenses incurred by such party in connection with any proceeding to the extent such party would have been indemnified for such fees or expenses if the indemnification provided for in this section was available to such party in accordance with its terms.

| - 13 - |

9. Representations and Warranties will be Relied Upon by the Issuer

9.1 The Subscriber acknowledges and agrees that the representations and warranties contained in this Agreement are made by it with the intention that such representations and warranties may be relied upon by the Issuer and the Escrow Agent in determining the Subscriber’s eligibility to purchase the Securities under applicable laws, or, if applicable, the eligibility of others on whose behalf the Subscriber is contracting hereunder to purchase the Securities under applicable laws. The Subscriber further agrees that, upon issuance of the Securities, it will be representing and warranting that the representations and warranties contained herein are true and correct as at the Closing Date, and as at the date of any issuance of Shares hereunder, with the same force and effect as if they had been made by the Subscriber at such date and that they will survive the purchase by the Subscriber of the Securities and will continue in full force and effect notwithstanding any subsequent disposition by the Subscriber of any of the Securities.

10. Acknowledgement and Waiver

10.1 The Subscriber has acknowledged that the decision to acquire the Securities was solely made on the basis of the Public Record.

11. Collection of Personal Information

11.1 The Subscriber acknowledges and consents to the fact that the Issuer is collecting the Subscriber’s personal information for the purpose of fulfilling this Agreement and completing the Offering. The Subscriber acknowledges that its personal information (and, if applicable, the personal information of those on whose behalf the Subscriber is contracting hereunder) may be included in record books in connection with the Offering and may be disclosed by the Issuer to: (a) stock exchanges or securities regulatory authorities, (b) the Issuer’s registrar and transfer agent, (c) Canadian or international tax authorities, (d) authorities pursuant to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada) or similar legislation of other countries, and (e) any of the other parties involved in the Offering, including the Escrow Agent. By executing this Agreement, the Subscriber is deemed to be consenting to the foregoing collection, use and disclosure of the Subscriber’s personal information (and, if applicable, the personal information of those on whose behalf the Subscriber is contracting hereunder) for the foregoing purposes, and such other purposes as may be determined by the Issuer in order to comply with applicable laws, and to the retention of such personal information for as long as permitted or required by applicable laws. Notwithstanding that the Subscriber may be purchasing the Securities as agent on behalf of an undisclosed principal, the Subscriber agrees to provide, on request, particulars as to the nature and identity of such undisclosed principal, and any interest that such undisclosed principal has in the Issuer, all as may be required by the Issuer in order to comply with the foregoing.

11.2 The Subscriber is hereby notified that:

| (a) | the Issuer may deliver to any securities commission or other governmental authority having jurisdiction over the Issuer, the Subscriber or this Subscription, including any Canadian securities commissions, the SEC and/or any state securities commissions (collectively, the “Commissions”), certain personal information pertaining to the Subscriber, including the Subscriber’s full name, residential address and telephone number, the number of Shares or other securities of the Issuer owned by the Subscriber, the number of Subscription Receipts purchased by the Subscriber, the total Subscription Amount, the prospectus exemption relied on by the Issuer and the date of distribution of the Subscription Receipts; | |

| (b) | such information is being collected indirectly by the Commissions under the authority granted to them by applicable securities laws; and | |

| (c) | such information is being collected for the purposes of the administration and enforcement of applicable securities laws. |

| - 14 - |

12. Costs

12.1 The Subscriber acknowledges and agrees that all costs and expenses incurred by the Subscriber (including any fees and disbursements of any legal counsel or other advisor retained by the Subscriber) relating to the purchase of the Subscription Receipts will be borne by the Subscriber.

13. Governing Law

13.1 This Agreement, and all matters related hereto or arising herefrom, are and will be, governed by the laws of the State of Nevada and the federal laws of the United States applicable therein.

14. Survival

14.1 This Agreement, including, without limitation, the representations, warranties and covenants contained herein, will survive and continue in full force and effect and be binding upon the Issuer and the Subscriber, notwithstanding the completion of the acquisition of the Securities by the Subscriber.

15. Assignment

15.1 This Agreement is not transferable or assignable.

16. Severability

16.1 The invalidity or unenforceability of any particular provision of this Agreement will not affect or limit the validity or enforceability of the remaining provisions of this Agreement.

17. Entire Agreement

17.1 Except as expressly provided in this Agreement and in the exhibits, agreements, instruments and other documents attached hereto or contemplated or provided for herein, this Agreement contains the entire agreement between the parties with respect to the sale of the Subscription Receipts and there are no other terms, conditions, representations or warranties, whether expressed, implied, oral or written, by statute or common law, by or of the Issuer, the Subscriber or anyone else.

18. Notices

18.1 All notices and other communications hereunder will be in writing and will be deemed to have been duly given if mailed or transmitted by any standard form of telecommunication, including email or other means of electronic communication capable of producing a printed copy. Notices to the Subscriber will be directed to it at the address or email address of the Subscriber set forth on page 2 of this Agreement and notices to the Issuer will be directed to it at the address of the Issuer set forth on page 3 of this Agreement.

19. Beneficial Subscribers

19.1 Whether or not explicitly stated in this Agreement, any acknowledgement, representation, warranty, covenant or agreement made by the Subscriber in this Agreement, including the exhibits hereto, will be treated as if made by the Disclosed Principal, if any.

| - 15 - |

20. Execution of Subscription Agreement

20.1 The Issuer and the Escrow Agent will be entitled to rely on delivery by facsimile machine or other means of electronic communication capable of producing a printed copy of an executed copy of this Agreement, and acceptance by the Issuer of such facsimile or electronic copy will be equally effective to create a valid and binding agreement between the Subscriber and the Issuer in accordance with the terms hereof. If less than a complete copy of this Agreement is delivered to the Issuer or the Escrow Agent prior to or at Closing, the Issuer and the Issuer’s Counsel are entitled to assume that the Subscriber accepts and agrees to all of the terms and conditions of the pages not delivered prior to or at Closing unaltered.

21. Counterparts and Electronic Means

21.1 This Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, will constitute an original and all of which together will constitute one instrument. Delivery of an executed copy of this Agreement by email or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery of this Agreement as of the Closing.

22. Exhibits

22.1 The exhibits attached hereto form part of this Agreement.

| - 16 - |

EXHIBIT A

ACKNOWLEDGMENT AND DIRECTION

| TO: | Clark Wilson LLP |

| RE: | AppCoin Innovations Inc. (the “Issuer”) |

| Private Placement of Subscription Receipts | |

The undersigned (the “Subscriber”) hereby confirms that, subject to the written confirmation of receipt of funds by Clark Wilson LLP (the “Escrow Agent”), it has deposited $________________ (the “Escrowed Funds”) in trust with the Escrow Agent for the purchase of the number of Subscription Receipts of the Issuer (the “Subscription Receipts”) as set out on page 2 of the Subscription Agreement between the Subscriber and the Issuer to which this Exhibit A is attached. Capitalized terms used but not otherwise defined herein have the meanings ascribed thereto in the Subscription Agreement.

The Subscriber acknowledges and agrees that the Escrow Agent acts as legal counsel only to the Issuer. For greater certainty, the Escrow Agent in no way represents the interests of the Subscriber in any manner or for any purpose whatsoever. The Subscriber confirms that it has had the opportunity to consult with its own legal counsel with respect to the purchase, and any potential resale, of the Subscription Receipts and the Shares issuable on conversion of the Subscription Receipts or hereby waives such opportunity.

In the event that the Escrow Release Condition is satisfied prior to the Escrow Deadline, the Subscriber hereby expressly and irrevocably authorizes and directs the Escrow Agent to immediately release and deliver the Escrowed Funds to the Issuer, without any further notice to the Subscriber.

EXECUTED by the Subscriber this __________ day of January, 2018.

| If the Subscriber is not an individual: | If the Subscriber is an individual: | |

| Signature of Authorized Signatory | Signature of Subscriber | |

| Name of Subscriber | Name of Subscriber | |

| Name and Title of Authorized Signatory |

| - 17 - |

EXHIBIT B

CANADIAN INVESTOR QUESTIONNAIRE

Capitalized terms used in this Canadian Investor Questionnaire (this “Questionnaire”) and not specifically defined have the meaning ascribed to them in the Private Placement Subscription Agreement between the Subscriber (as defined herein) and AppCoin Innovations Inc. (the “Issuer”) to which this Exhibit B is attached with respect to the purchase of subscription receipts of the Issuer (the “Subscription Receipts”).

In connection with the purchase by the Subscriber (being the undersigned, or if the undersigned is purchasing the Subscription Receipts as agent on behalf of a disclosed beneficial Subscriber, such beneficial Subscriber, will be referred herein as the “Subscriber”) of the Subscription Receipts, the Subscriber hereby represents, warrants and certifies to the Issuer that the Subscriber:

| (i) | is purchasing the Subscription Receipts as principal (or deemed principal under the terms of National Instrument 45-106 – Prospectus Exemptions adopted by the Canadian Securities Administrators (“NI 45-106”)); | |

| (ii) | (A) is resident in or is subject to the laws of one of the following (check one): |

| [ ] Alberta | [ ] New Brunswick | [ ] Prince Edward Island | |

| [ ] British Columbia | [ ] Nova Scotia | [ ] Quebec | |

| [ ] Manitoba | [ ] Ontario | [ ] Saskatchewan | |

| [ ] Newfoundland and Labrador | [ ] Yukon | ||

| [ ] Northwest Territories | |||

| [ ] United States: _________________________ (List State of Residence) | |||

or

| (B) | [ ] is resident in a country other than Canada or the United States; and |

| (iii) | has not been provided with any offering memorandum in connection with the purchase of the Subscription Receipts. | ||

In connection with the purchase of the Subscription Receipts, the Subscriber hereby represents, warrants, covenants and certifies that the Subscriber meets one or more of the following criteria:

| I. SUBSCRIBERS PURCHASING UNDER THE “ACCREDITED INVESTOR” EXEMPTION | |

| (a) | the Subscriber is not a trust company or trust company registered under the laws of Prince Edward Island that is not registered or authorized under the Trust and Loan Companies Act (Canada) or under comparable legislation in another jurisdiction of Canada, |

| (b) | _________ the Subscriber is an “accredited investor” within the meaning of NI 45-106, by virtue of satisfying the indicated criterion below (YOU MUST INITIAL OR PLACE A CHECK-MARK ON THE APPROPRIATE LINE(S)) (see certain guidance with respect to accredited investors that starts on page 23 below) |

| - 18 - |

| [ ] | (i) | except in Ontario, a person registered under the securities legislation of a jurisdiction of Canada as an adviser or dealer, | |

| [ ] | (ii) | an individual registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (i), | |

| [ ] | (iii) | an individual formerly registered under the securities legislation of a jurisdiction of Canada, other than an individual formerly registered solely as a representative of a limited market dealer under one or both of the Securities Act (Ontario) or the Securities Act (Newfoundland and Labrador), | |

| [ ] | (iv) | an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that, before taxes but net of any related liabilities, exceeds $1,000,000 (YOU MUST ALSO COMPLETE AND SIGN APPENDIX “A” TO THIS QUESTIONNAIRE THAT STARTS ON PAGE 28), | |

| [ ] | (v) | an individual who beneficially owns financial assets having an aggregate realizable value that, before taxes but net of any related liabilities, exceeds $5,000,000, | |

| [ ] | (vi) | an individual whose net income before taxes exceeded $200,000 in each of the 2 most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the 2 most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year (YOU MUST ALSO COMPLETE AND SIGN APPENDIX “A” TO THIS QUESTIONNAIRE THAT STARTS ON PAGE 28), | |

| [ ] | (vii) | an individual who, either alone or with a spouse, has net assets of at least $5,000,000 (YOU MUST ALSO COMPLETE AND SIGN APPENDIX “A” TO THIS QUESTIONNAIRE THAT STARTS ON PAGE 28), | |

| [ ] | (viii) | a person, other than an individual or investment fund, that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements and that has not been created or used solely to purchase or hold securities as an accredited investor as defined in this paragraph (viii), |

| [ ] | (ix) | an investment fund that distributes or has distributed its securities only to |

| (i) | a person that is or was an accredited investor at the time of the distribution, | |

| (ii) | a person that acquires or acquired securities in the circumstances referred to in Sections 2.10 [Minimum amount investment] of NI 45-106, or 2.19 [Additional investment in investment funds] of NI 45-106, or | |

| (iii) | a person described in paragraph (i) or (ii) that acquires or acquired securities under Section 2.18 [Investment fund reinvestment] of NI 45-106, |

| [ ] | (x) | an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Québec, the securities regulatory authority, has issued a receipt, | |

| [ ] | (xi) | a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be, |

| - 19 - |

| [ ] | (xii) | a person acting on behalf of a fully managed account managed by that person, if that person is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction, | |

| [ ] | (xiii) | a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility adviser or an adviser registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded, | |

| [ ] | (xiv) | an entity organized in a foreign jurisdiction that is analogous to the entity referred to in paragraph (i) in form and function, or | |

| [ ] | (xv) | a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors, and | |

| (c) | if the Subscriber is an “accredited investor” within the meaning of NI 45-106 by virtue of satisfying the indicated criterion as set out in paragraphs (iv), (vi) or (vii) above, the Subscriber has provided the Issuer with the signed risk acknowledgment form set out in Appendix “A” to this Questionnaire; | ||

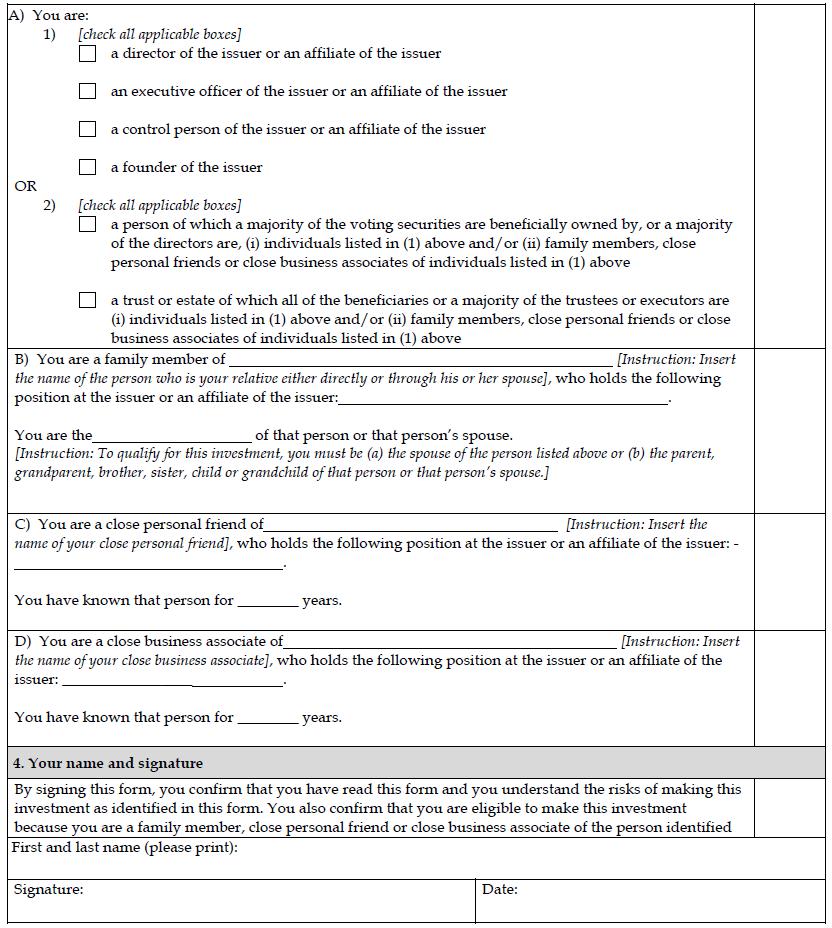

| II. | SUBSCRIBERS PURCHASING UNDER THE “FAMILY, FRIENDS AND BUSINESS ASSOCIATES” EXEMPTION |

| (a) | the Subscriber is (YOU MUST PLACE A CHECK-MARK ON THE APPROPRIATE LINE AND PROVIDE THE REQUESTED INFORMATION, AS APPLICABLE): |

| [ ] | (i) | a director, executive officer or control person of the Issuer, or of an affiliate of the Issuer, | |

| [ ] | (ii) | a spouse, parent, grandparent, brother, sister, child or grandchild of _________________________________ (print name of person), who is a director, executive officer or control person of the Issuer or of an affiliate of the Issuer, | |

| [ ] | (iii) | a parent, grandparent, brother, sister, child or grandchild of the spouse of ___________________________________ (print name of person), who is a director, executive officer or control person of the Issuer or of an affiliate of the Issuer, | |

| [ ] | (iv) | _________ a close personal friend (see guidance on making this determination that starts on page 25 below) of ___________________________________ (print name of person), who is a director, executive officer, founder or control person of the Issuer, or of an affiliate of the Issuer, and has been for __________________________ years based on the following factors:

______________________________________________________________________(explain the nature of the close personal friendship), | |

| [ ] | (v) | a close business associate (see guidance on making this determination that starts on page 25 below) of ___________________________________ (print name of person), who is a director, executive officer, founder or control person of the Issuer, or of an affiliate of the Issuer, and has been for __________________________ years based on the following factors

_________________________________________________________________________(explain the nature of the close business association), |

| - 20 - |

| [ ] | (vi) | a founder of the Issuer or a spouse, parent, grandparent, brother, sister, child, grandchild, close personal friend or close business associate (see guidance on making these determinations that starts on page 25 below) of ________________________________ (print name of person), who is a founder of the Issuer, and, if a close personal friend or close business associate of such person, has been for __________________________ years based on the following factors:

______________________________________________________________________(explain the nature of the close personal friendship or business association), | |

| [ ] | (vii) | a parent, grandparent, brother, sister, child or grandchild of the spouse of ______________________________ (print name of person), who is a founder of the Issuer, | |

| [ ] | (viii) | a company of which a majority of the voting securities are beneficially owned by, or a majority of the directors are, persons or companies described in subsections II(a)(i) to II(a)(vii) above, or | |

| [ ] | (ix) | a trust or estate of which all of the beneficiaries or a majority of the trustees or executors are persons or companies described in subsections II(a)(i) to II(a)(viii) above; |

| (b) | if the Subscriber is resident in the Province of Ontario or is subject to the securities laws of the Province of Ontario, the Subscriber has provided the Issuer with a signed risk acknowledgement form in the form attached as Appendix “B” to this Questionnaire (YOU MUST ALSO COMPLETE AND SIGN APPENDIX “B” TO THIS QUESTIONNAIRE THAT STARTS ON PAGE 30), or |

| (c) | if the Subscriber is resident in the Province of Saskatchewan or is subject to the securities laws of the Province of Saskatchewan, and the Subscriber is relying on the indicated criterion as set out in subsections II(a)(iv), II(a)(v) or II(a)(viii) or II(a)(ix) if the distribution is based in whole or in part on a close personal friendship or a close business association, the Subscriber has provided the Issuer with a signed risk acknowledgement form in the form attached as Appendix “C” to this Questionnaire (YOU MUST ALSO COMPLETE AND SIGN APPENDIX “C” TO THIS QUESTIONNAIRE THAT STARTS ON PAGE 33); or |

| - 21 - |

| III. | SUBSCRIBERS PURCHASING UNDER THE MINIMUM AMOUNT INVESTMENT |

| (a) | the Subscriber is not an individual as that term is defined in applicable Canadian securities laws, |

| (b) | the Subscriber is purchasing the Subscription Receipts as principal for its own account and not for the benefit of any other person, |

| (c) | the Subscription Receipts have an acquisition cost to the Subscriber of not less than $150,000, payable in cash at the Closing, and |

| (d) | the Subscriber was not created and is not being used solely to purchase or hold securities in reliance on the prospectus exemption provided under Section 2.10 of NI 45-106, it pre-existed the Offering and has a bona fide purpose other than investment in the Subscription Receipts. |

For the purposes of this Questionnaire and the appendices attached hereto:

| (a) | an issuer is “affiliated” with another issuer if |

| (i) | one of them is the subsidiary of the other, or | |

| (ii) | each of them is controlled by the same person; |

| (b) | “control person” means |

| (i) | a person who holds a sufficient number of the voting rights attached to all outstanding voting securities of an issuer to affect materially the control of the issuer, or | |

| (ii) | each person in a combination of persons, acting in concert by virtue of an agreement, arrangement, commitment or understanding, which holds in total a sufficient number of the voting rights attached to all outstanding voting securities of an issuer to affect materially the control of the issuer, |

and, if a person or combination of persons holds more than 20% of the voting rights attached to all outstanding voting securities of an issuer, the person or combination of persons is deemed, in the absence of evidence to the contrary, to hold a sufficient number of the voting rights to affect materially the control of the issuer;

| (c) | “director” means |

| (i) | a member of the board of directors of a company or an individual who performs similar functions for a company, and | |

| (ii) | with respect to a person that is not a company, an individual who performs functions similar to those of a director of a company; |

| (d) | “eligibility adviser” means |

| (i) | a person that is registered as an investment dealer and authorized to give advice with respect to the type of security being distributed; and | |

| (ii) | in Saskatchewan or Manitoba, also means a lawyer who is a practicing member in good standing with a law society of a jurisdiction of Canada or a public accountant who is a member in good standing of an institute or association of chartered accountants, certified general accountants or certified management accountants in a jurisdiction of Canada provided that the lawyer or public accountant must not: |

| - 22 - |

| (A) | have a professional, business or personal relationship with the issuer, or any of its directors, executive officers, founders or control persons, and | |

| (B) | have acted for or been retained personally or otherwise as an employee, executive officer, director, associate or partner of a person that has acted for or been retained by the issuer or any of its directors, executive officers, founders or control persons within the previous 12 months; |

| (e) | “executive officer” means, for an issuer, an individual who is |

| (i) | a chair, vice-chair or president, | |

| (ii) | a vice-president in charge of a principal business unit, division or function including sales, finance or production, or | |

| (iii) | performing a policy-making function in respect of the issuer; |

| (f) | “financial assets” means |

| (i) | cash, | |

| (ii) | securities, or | |

| (iii) | a contract of insurance, a deposit or an evidence of a deposit that is not a security for the purposes of securities legislation; |

| (g) | “foreign jurisdiction” means a country other than Canada or a political subdivision of a country other than Canada; | |

| (h) | “founder” means, in respect of an issuer, a person who, |

| (i) | acting alone, in conjunction, or in concert with one or more persons, directly or indirectly, takes the initiative in founding, organizing or substantially reorganizing the business of the issuer, and | |

| (ii) | at the time of the distribution or trade is actively involved in the business of the issuer; |

| (i) | “fully managed account” means an account of a client for which a person makes the investment decisions if that person has full discretion to trade in securities for the account without requiring the client’s express consent to a transaction; | |

| (j) | “individual” means a natural person, but does not include |

| (i) | a partnership, unincorporated association, unincorporated syndicate, unincorporated organization or trust, or | |

| (ii) | a natural person in the person's capacity as a trustee, executor, administrator or personal or other legal representative; |

| (k) | “investment fund” means a mutual fund or a non-redeemable investment fund, and, for great certainty in British Columbia, includes an employee venture capital corporation and a venture capital corporation as such terms are defined in National Instrument 81-106 Investment Fund Continuous Disclosure; | |

| (l) | “jurisdiction” or “jurisdiction of Canada” means a province or territory of Canada except when used in the term foreign jurisdiction; | |

| (m) | “non-redeemable investment fund” means an issuer: |

| (i) | whose primary purpose is to invest money provided by its securityholders; | |

| (ii) | that does not invest |

| (A) | for the purpose of exercising or seeking to exercise control of an issuer, other than an issuer that is a mutual fund or a non-redeemable investment fund, or |

| - 23 - |

| (B) | for the purpose of being actively involved in the management of any issuer in which it invests, other than an issuer that is a mutual fund or a non-redeemable investment fund, and |

| (iii) | that is not a mutual fund; |

| (n) | “person” includes |

| (i) | an individual; | |

| (ii) | a corporation; | |

| (iii) | a partnership, trust, fund and an association, syndicate, organization or other organized group of persons, whether incorporated or not; and | |

| (iv) | an individual or other person in that person’s capacity as a trustee, executor, administrator or personal or other legal representative; |

| (o) | “related liabilities” means |

| (i) | liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets, or | |

| (ii) | liabilities that are secured by financial assets; and |

| (p) | “spouse” means, an individual who, |

| (i) | is married to another individual and is not living separate and apart within the meaning of the Divorce Act (Canada), from the other individual, | |

| (ii) | is living with another individual in a marriage-like relationship, including a marriage-like relationship between individuals of the same gender, or | |

| (iii) | in Alberta, is an individual referred to in paragraph (i) or (ii), or is an adult interdependent partner within the meaning of the Adult Interdependent Relationships Act (Alberta). |

Guidance On Accredited Investor Exemptions for Individuals

An individual accredited investor is an individual:

| (a) | who, either alone or with a spouse, beneficially owns financial assets (please see the guidance below regarding what financial assets are) having an aggregate realizable value that. before taxes but net of any related liabilities (please see the guidance below regarding what related liabilities are), exceeds $1,000,000; | |

| (b) | whose net income before taxes exceeded $200,000 in each of the 2 most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the 2 most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year; | |

| (c) | who, either alone or with a spouse, has net assets (please see the guidance below regarding calculating net assets) of at least $5,000,000; and | |

| (d) | who beneficially owns financial assets (please see the guidance below regarding what financial assets are) having an aggregate realizable value that, before taxes but net of any related liabilities (please see the guidance below regarding what related liabilities are), exceeds $5,000,000. |

| - 24 - |

The monetary thresholds above are intended to create bright-line standards. Subscribers who do not satisfy these monetary thresholds do not qualify as accredited investors.

Spouses

Sections (a), (b) and (c) above are designed to treat spouses as a single investing unit, so that either spouse qualifies as an accredited investor if the combined financial assets of both spouses exceed $1,000,000, the combined net income of both spouses exceeds $300,000, or the combined net assets of both spouses exceed $5,000,000. Section (d) above does not treat spouses as a single investing unit.

If the combined net income of both spouses does not exceed $300,000, but the net income of one of the spouses exceeds $200,000, only the spouse whose net income exceeds $200,000 qualifies as an accredited investor.

Financial Assets and Related Liabilities

For the purposes of Sections (a) and (d) above, “financial assets” means: (1) cash, (2) securities, or (3) a contract of insurance, a deposit or an evidence of a deposit that is not a security for the purposes of securities legislation. These financial assets are generally liquid or relatively easy to liquidate. The value of a subscriber’s personal residence is not included in a calculation of financial assets.

The calculation of financial assets must exclude “related liabilities”, meaning: (1) liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets, or (2) liabilities that are secured by financial assets.

As a general matter, it should not be difficult to determine whether financial assets are beneficially owned by an individual, an individual’s spouse, or both, in any particular instance. However, in the case where financial assets are held in a trust or in another type of investment vehicle for the benefit of an individual, there may be questions as to whether the individual beneficially owns the financial assets. The following factors are indicative of beneficial ownership of financial assets:

| ● | physical or constructive possession of evidence of ownership of the financial asset; | |

| ● | entitlement to receipt of any income generated by the financial asset; | |

| ● | risk of loss of the value of the financial asset; and | |

| ● | the ability to dispose of the financial asset or otherwise deal with it as the individual sees fit. |

For example, securities held in a self-directed RRSP for the sole benefit of an individual are beneficially owned by that individual.

In general, financial assets in a spousal RRSP can be included for the purposes of the $1,000,000 financial asset test in Section (a) above because Section (a) takes into account financial assets owned beneficially by a spouse. However, financial assets in a spousal RRSP cannot be included for purposes of the $5,000,000 financial asset test in Section (d) above.

Financial assets held in a group RRSP under which the individual does not have the ability to acquire the financial assets and deal with them directly do not meet the beneficial ownership requirements in either Sections (a) or (d) above.

Net Assets

For the purposes of Section (c) above, “net assets” means all of a subscriber’s total assets minus all of the subscriber’s total liabilities. Accordingly, for the purposes of the net asset test, the calculation of total assets includes the value of a subscriber’s personal residence, and the calculation of total liabilities includes the amount of any liability (such as a mortgage) in respect of the subscriber’s personal residence.

| - 25 - |

To calculate a subscriber’s net assets under the net asset test, subtract the subscriber’s total liabilities from the subscriber’s total assets. The value attributed to assets should reasonably reflect their estimated fair value. Income tax is considered a liability if the obligation to pay it is outstanding at the time of the distribution of the security to the subscriber by the Company.

Guidance On Accredited Investor Exemptions for Corporations, Trusts and Other Entities

Accredited investors that are corporations, trusts or other entities include:

| (a) | a corporation, trust or other entity, other than an investment fund, that has net assets (please see the guidance below regarding calculating net assets) of at least $5,000,000 as shown on its most recently prepared financial statements in accordance with applicable generally accepted accounting principles and that has not been created or used solely to purchase or hold securities as an accredited investor; | |

| (b) | a corporation, trust or other entity in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law to be owned by directors, are persons that are accredited investors; and | |

| (c) | a trust established by an accredited investor for the benefit of the accredited investor’s family members of which a majority of the trustees are accredited investors and all of the beneficiaries are the accredited investor’s spouse, a former spouse of the accredited investor or a parent, grandparent, brother, sister, child or grandchild of that accredited investor, of that accredited investor’s spouse or of that accredited investor’s former spouse. |

Net Assets

For the purposes of Section (a) above, “net assets” means all of the subscriber’s total assets minus all of the subscriber’s total liabilities. The minimum net asset threshold of $5,000,000 specified in Section (a) above must be shown on the entity’s most recently prepared financial statements. The financial statements must be prepared in accordance with applicable generally accepted accounting principles.

Guidance on Close Personal Friend and Close Business Associate Determination

A “close personal friend” of a director, executive officer, founder or control person of an issuer is an individual who knows the director, executive officer, founder or control person well enough and has known them for a sufficient period of time to be in a position to assess their capabilities and trustworthiness and to obtain information from them with respect to the investment.

The following factors are relevant to this determination:

| (a) | the length of time the individual has known the director, executive officer, founder or control person, | |

| (b) | the nature of the relationship between the individual and the director, executive officer, founder or control person including such matters as the frequency of contacts between them and the level of trust and reliance in the other circumstances, and | |

| (c) | the number of “close personal friends” of the director, executive officer, founder or control person to whom securities have been distributed in reliance on the private issuer exemption or the family, friends and business associates exemption. |

| - 26 - |

An individual is not a close personal friend solely because the individual is:

| (a) | a relative, | |

| (b) | a member of the same club, organization, association or religious group, | |

| (c) | a co-worker, colleague or associate at the same workplace, | |

| (d) | a client, customer, former client or former customer, | |

| (e) | a mere acquaintance, or | |

| (f) | connected through some form of social media, such as Facebook, Twitter or LinkedIn. |

The relationship between the individual and the director, executive officer, founder or control person must be direct. For example, the exemption is not available to a close personal friend of a close personal friend of a director of the issuer. Further, a relationship that is primarily founded on participation in an internet forum is not considered to be that of a close personal friend.

A “close business associate” is an individual who has had sufficient prior business dealings with a director, executive officer, founder or control person of the issuer to be in a position to assess their capabilities and trustworthiness and to obtain information from them with respect to the investment.

The following factors are relevant to this determination:

| (a) | the length of time the individual has known the director, executive officer, founder or control person, | |

| (b) | the nature of any specific business relationships between the individual and the director, executive officer, founder or control person, including, for each relationship, when it began, the frequency of contact between them and when it terminated if it is not ongoing, and the level of trust and reliance in the other circumstances, | |

| (c) | the nature and number of any business dealings between the individual and the director, executive officer, founder or control person, the length of the period during which they occurred, and the nature and date of the most recent business dealing, and | |

| (d) | the number of “close business associates” of the director, executive officer, founder or control person to whom securities have been distributed in reliance on the private issuer exemption or the family, friends and business associates exemption. |

An individual is not a close business associate solely because the individual is:

| (a) | a member of the same club, organization, association or religious group, | |

| (b) | a co-worker, colleague or associate at the same workplace, | |

| (c) | a client, customer, former client or former customer, | |

| (d) | a mere acquaintance, or | |

| (e) | connected through some form of social media, such as Facebook, Twitter or LinkedIn. |

The relationship between the individual and the director, executive officer, founder or control person must be direct. For example, the exemptions are not available for a close business associate of a close business associate of a director of the issuer. Further, a relationship that is primarily founded on participation in an internet forum is not considered to be that of a close business associate.

| - 27 - |

The Subscriber agrees that the above representations and warranties will be true and correct both as of the execution of this Questionnaire and as of the Closing and acknowledges that they will survive the completion of the issue of the Subscription Receipts.

The Subscriber acknowledges that the foregoing representations and warranties are made by the Subscriber with the intent that they be relied upon in determining the suitability of the Subscriber to acquire the Subscription Receipts and that this Questionnaire is incorporated into and forms part of the Agreement and the undersigned undertakes to immediately notify the Issuer of any change in any statement or other information relating to the Subscriber set forth herein which takes place prior to the closing time of the purchase and sale of the Subscription Receipts.

The Subscriber undertakes to immediately notify the Issuer of any change in any statement or other information relating to the Subscriber set forth in the Agreement or in this Questionnaire which takes place prior to the Closing.

By completing this Questionnaire, the Subscriber authorizes the indirect collection of this information by each applicable regulatory authority or regulator and acknowledges that such information is made available to the public under applicable laws.

DATED as of _________ day of January, 2018.

| Print Name of Subscriber (or person signing as agent of the Subscriber) | ||

| By: | ||

| Signature | ||

| Print Name and Title of Authorized | ||

| Signatory (if Subscriber is not an individual) | ||

| - 28 - |

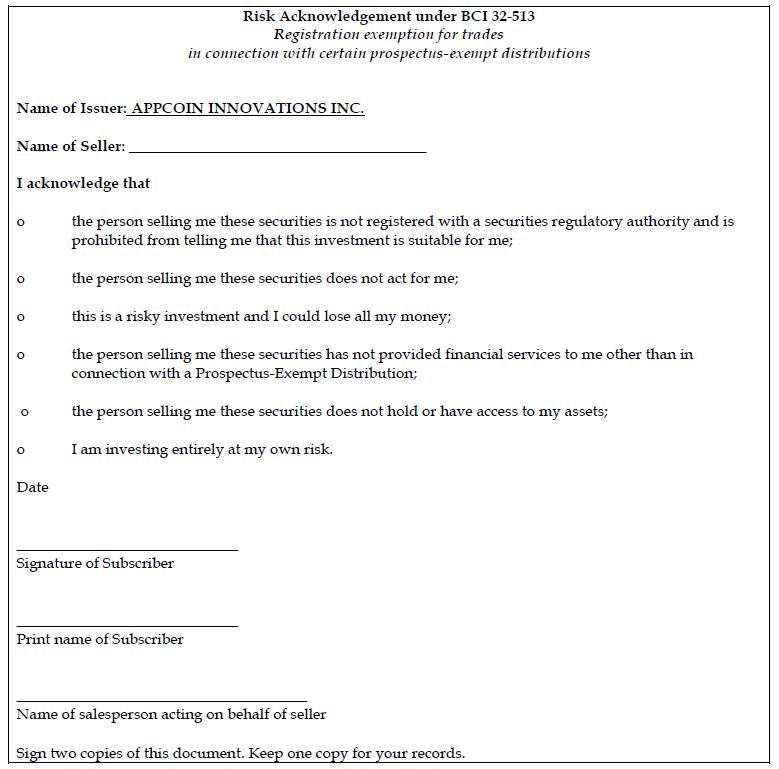

APPENDIX

“A”

TO CANADIAN INVESTOR QUESTIONNAIRE

Form

45-106F9

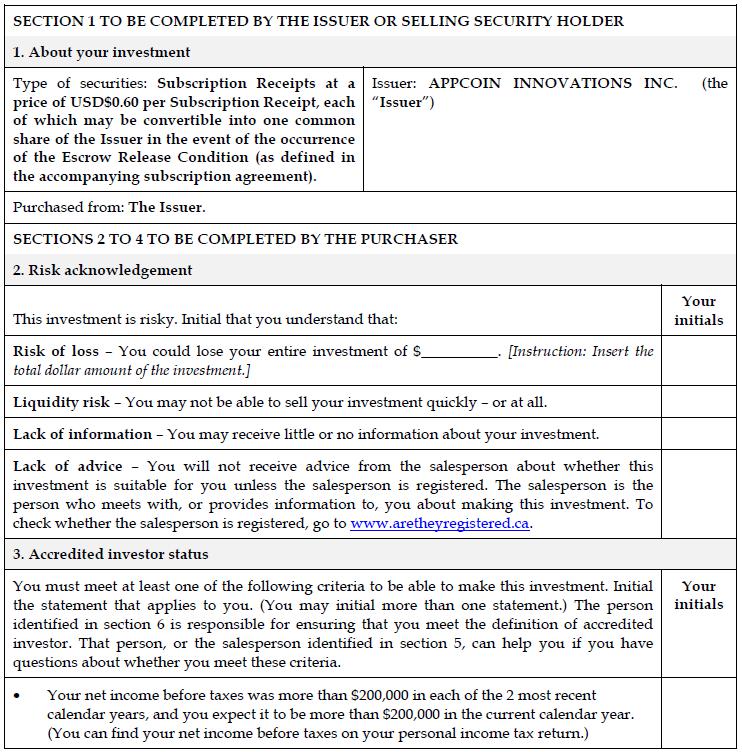

WARNING! This investment is risky. Don’t invest unless you can afford to lose all the money you pay for this investment. |

| - 29 - |

Form instructions:

| 1. | This form does not mandate the use of a specific font size or style but the font must be legible |

| 2. | The information in sections 1, 5 and 6 must be completed before the purchaser completes and signs the form. |

| 3. | The purchaser must sign this form. Each of the purchaser and the issuer or selling security holder must receive a copy of this form signed by the purchaser. The issuer or selling security holder is required to keep a copy of this form for 8 years after the distribution. |

| - 30 - |

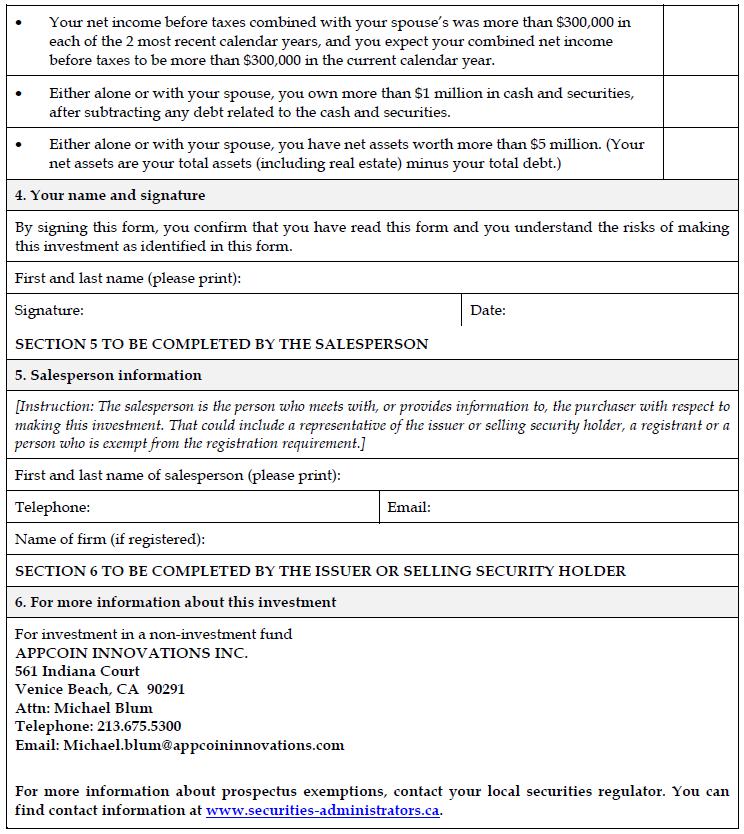

APPENDIX

“B” TO CANADIAN INVESTOR QUESTIONNAIRE

Form 45-106F12

RISK

ACKNOWLEDGEMENT FORM FOR FAMILY, FRIEND AND

BUSINESS ASSOCIATE INVESTORS

WARNING! This investment is risky. Don’t invest unless you can afford to lose all the money you pay for this investment. |

| - 31 - |

| - 32 - |

Form instructions:

| 1. | This form does not mandate the use of a specific font size or style but the font must be legible. |

| 2. | The information in sections 1, 5 and 6 must be completed before the purchaser completes and signs the form . |

| 3. | The purchaser, an executive officer who is not the purchaser and, if applicable, the person who claims the close personal relationship to the purchaser must sign this form. Each of the purchaser, contact person at the issuer and the issuer must receive a copy of this form signed by the purchaser. The issuer is required to keep a copy of this form for 8 years after the distribution. |

| 4. | The detailed relationships required to purchase securities under this exemption are set out in section 2.5 of National Instrument 45-106 Prospectus and Registration Exemptions. For guidance on the meaning of “close personal friend” and “close business associate”, please refer to sections 2.7 and 2.8, respectively, of Companion Policy 45-106CP Prospectus and Registration Exemptions. |

| - 33 - |

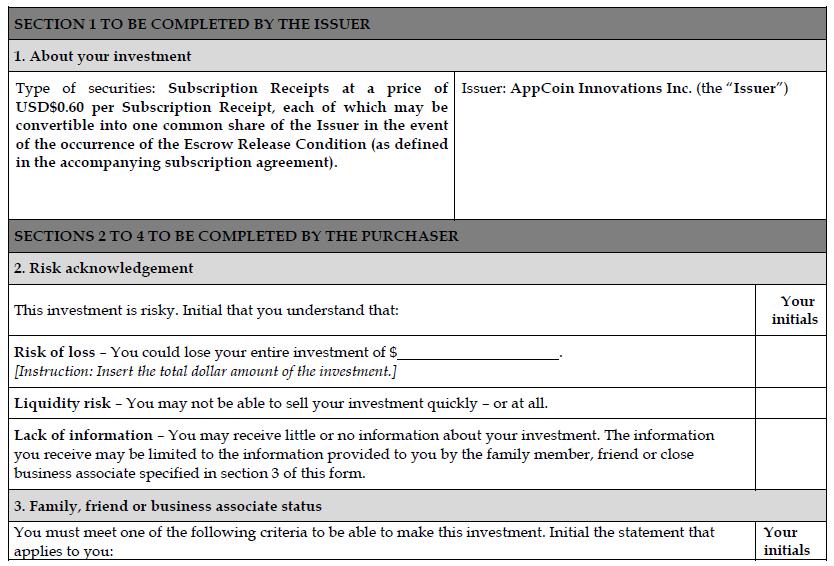

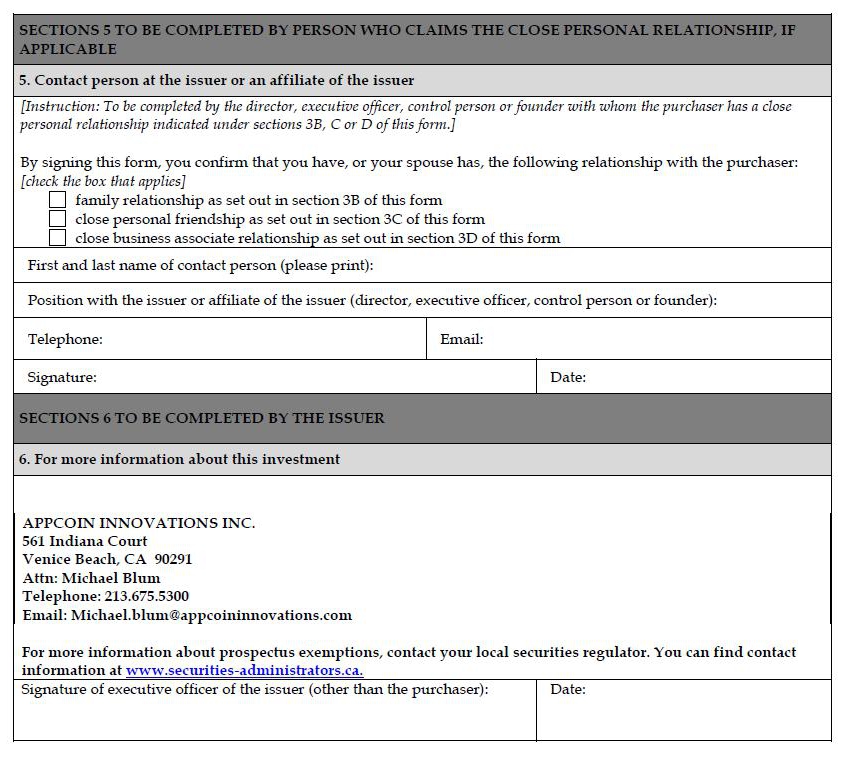

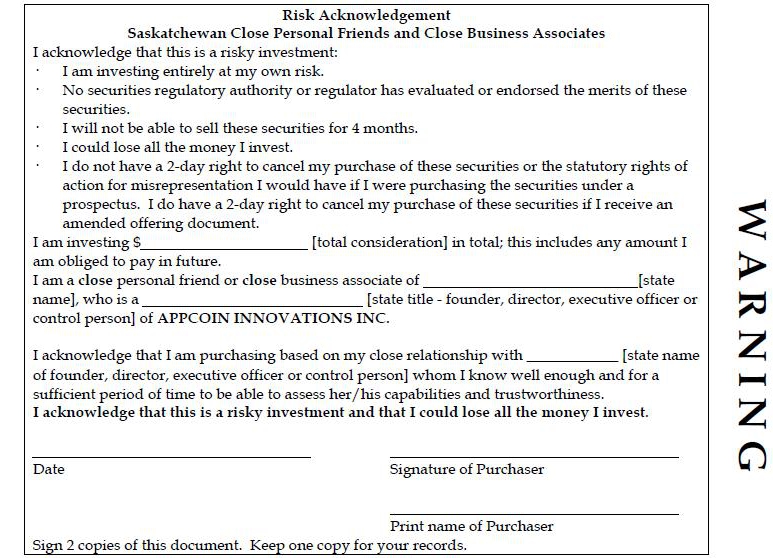

APPENDIX “C” TO CANADIAN INVESTOR QUESTIONNAIRE

Form 45-106F5

RISK

ACKNOWLEDGEMENT

SASKATCHEWAN CLOSE PERSONAL FRIENDS AND CLOSE BUSINESS ASSOCIATES

You are buying Exempt Market Securities. They are called exempt market securities because two parts of securities law do not apply to them. If an issuer wants to sell exempt market securities to you:

| ● | the issuer does not have to give you a prospectus (a document that describes the investment in detail and gives you some legal protections), and | |