Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Highpower International, Inc. | tv488361_8k.htm |

Exhibit 99.1

Highpower International (NASDAQ: HPJ) Investor Presentation March 2018

Safe Harbor This presentation may contain "forward - looking statements" within the meaning of the “safe - harbor” provisions of the Private Securities Litigation Reform Act of 1995 , including statements regarding the Company’s expected production and sales . Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of Highpower International (“HPJ” or the “Company”) to differ materially from the results expressed or implied by such statements . These risks and uncertainties include, without limitation, that estimated 4 Q 17 results are preliminary and unaudited, have not been reviewed by external auditors and are subject to completion and may be revised as a result of management’s further review of the Company’s results, that any changes could be material, the Company may identify items that may require it to make material adjustments to the preliminary financial information, an economic downturn adversely affecting demand for the Company’s products, fluctuations in the cost of raw materials, the Company's dependence on, or inability to attract additional, major customers for a significant portion of its net sales, the Company’s ability to increase manufacturing capabilities to satisfy orders from new customers, changes in the laws of the PRC that affect the Company's operations, the devaluation of the U . S . Dollar relative to the Renminbi, the Company's dependence on the growth in demand for portable electronic devices and the success of manufacturers of the end applications that use its battery products, the Company’s ability to expand sales in the EV and Solar ESS markets, responsiveness to competitive market conditions, the Company’s ability to successfully manufacture Li - ion batteries in the time frame and amounts expected, the market acceptance of the Company’s Li - ion products, and changes in foreign, political, social, business and economic conditions that affect the Company’s production capabilities or demand for its products . For a discussion of these and other risks and uncertainties see "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the Company's public filings with the SEC . Although the Company believes that the expectations reflected in such forward - looking statements are reasonable, there can be no assurance that such expectations will prove to be correct . The Company has no obligation to update the forward - looking information contained in this presentation . 2

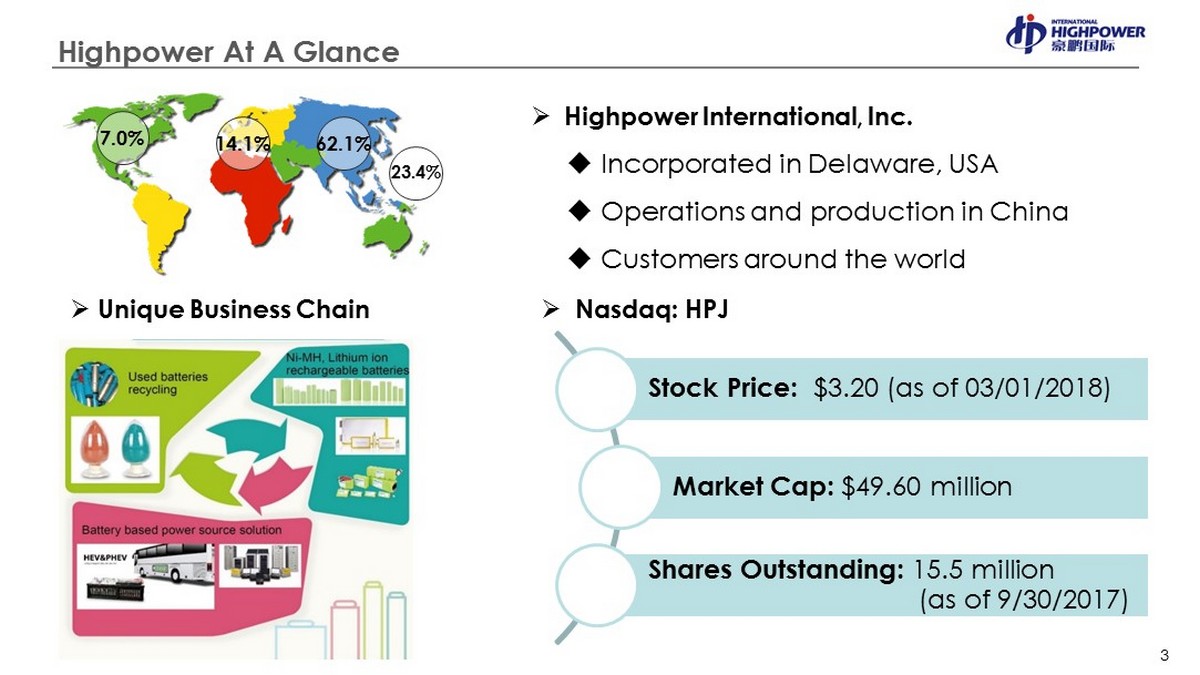

7.0% 14.1% 62.1% 23.4% » Highpower International, Inc. ; Incorporated in Delaware, USA ; Operations and production in China ; Customers around the world Highpower At A Glance » Unique Business Chain Stock Price: $3.20 (as of 03/01/2018) Market Cap: $49.60 million Shares Outstanding: 15. 5 million (as of 9/30/2017) » Nasdaq: HPJ 3

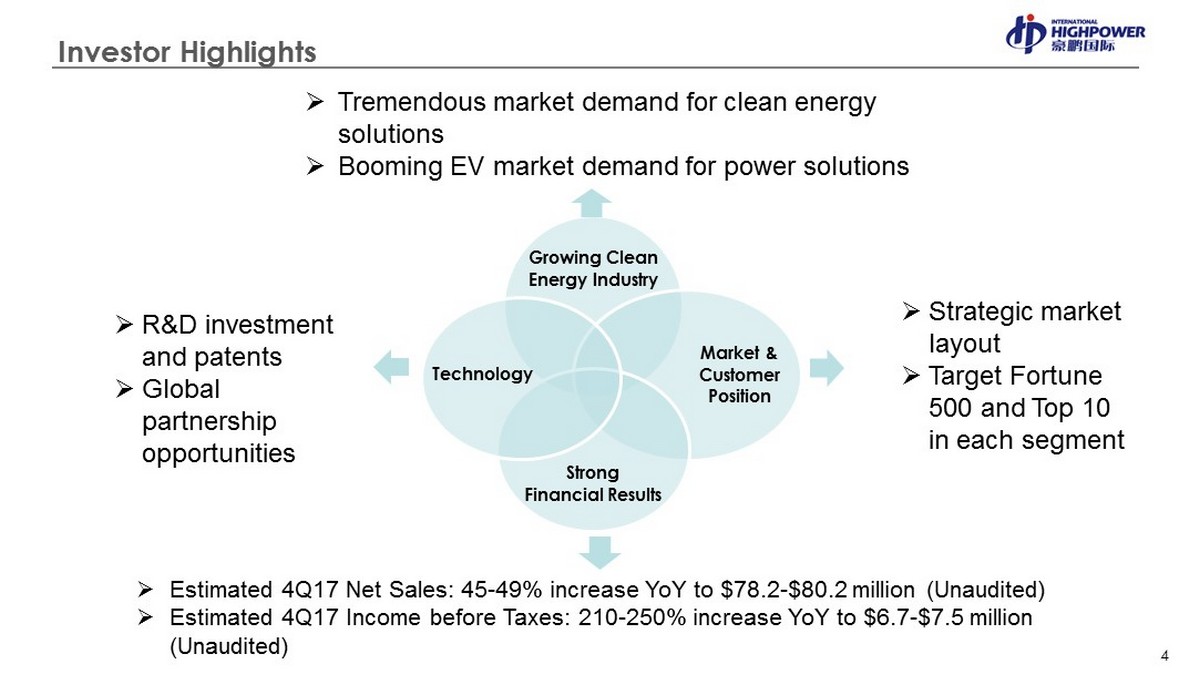

Growing Clean Energy Industry Market & Customer Position Strong Financial Results » Tremendous market demand for clean energy solutions » Booming EV market demand for power solutions » R&D investment and patents » Global partnership opportunities » Strategic market layout » Target Fortune 500 and Top 10 in each segment » Estimated 4Q17 Net Sales: 45 - 49% increase YoY to $78.2 - $80.2 million (Unaudited) » Estimated 4Q17 Income before Taxes: 210 - 250% increase YoY to $6.7 - $7.5 million (Unaudited) Investor Highlights 4 Technology

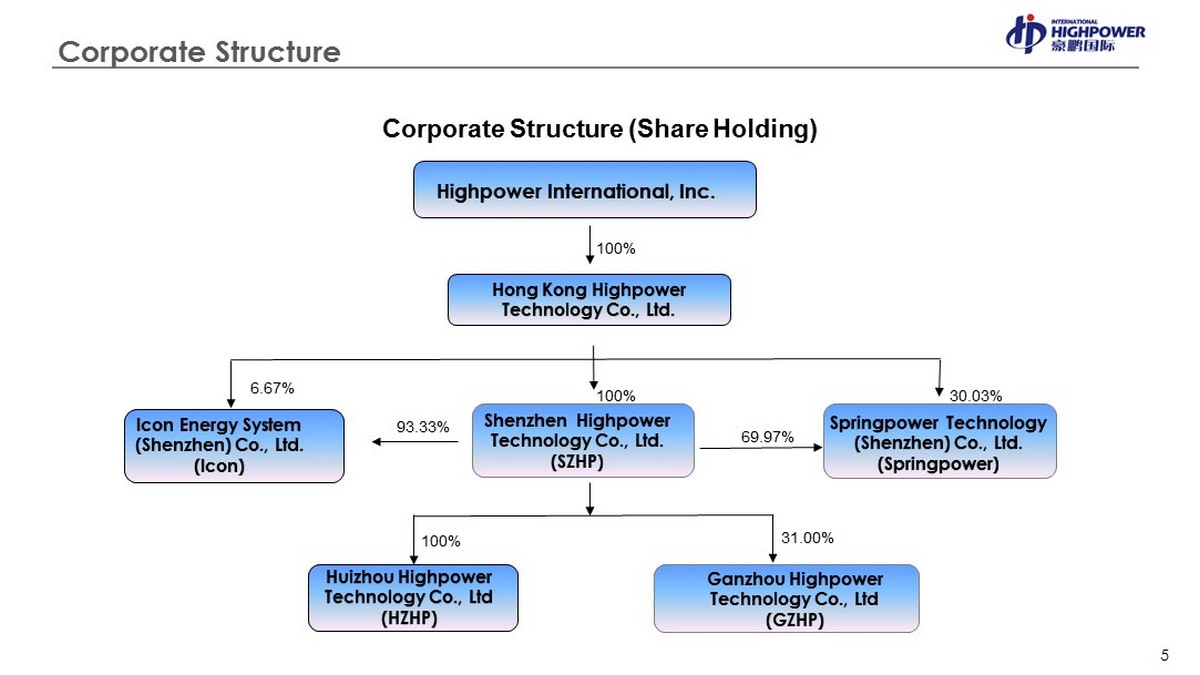

Corporate Structure (Share Holding) Springpower Technology (Shenzhen) Co., Ltd. ( Springpower ) Icon Energy System (Shenzhen) Co., Ltd. (Icon) Shenzhen Highpower Technology Co., Ltd. (SZHP) Huizhou Highpower Technology Co., Ltd (HZHP) Ganzhou Highpower Technology Co., Ltd (GZHP) Hong Kong Highpower Technology Co., Ltd. Highpower International, Inc. Corporate Structure 5 100% 6.67% 100% 100% 69.97% 30.03% 31.00% 93.33%

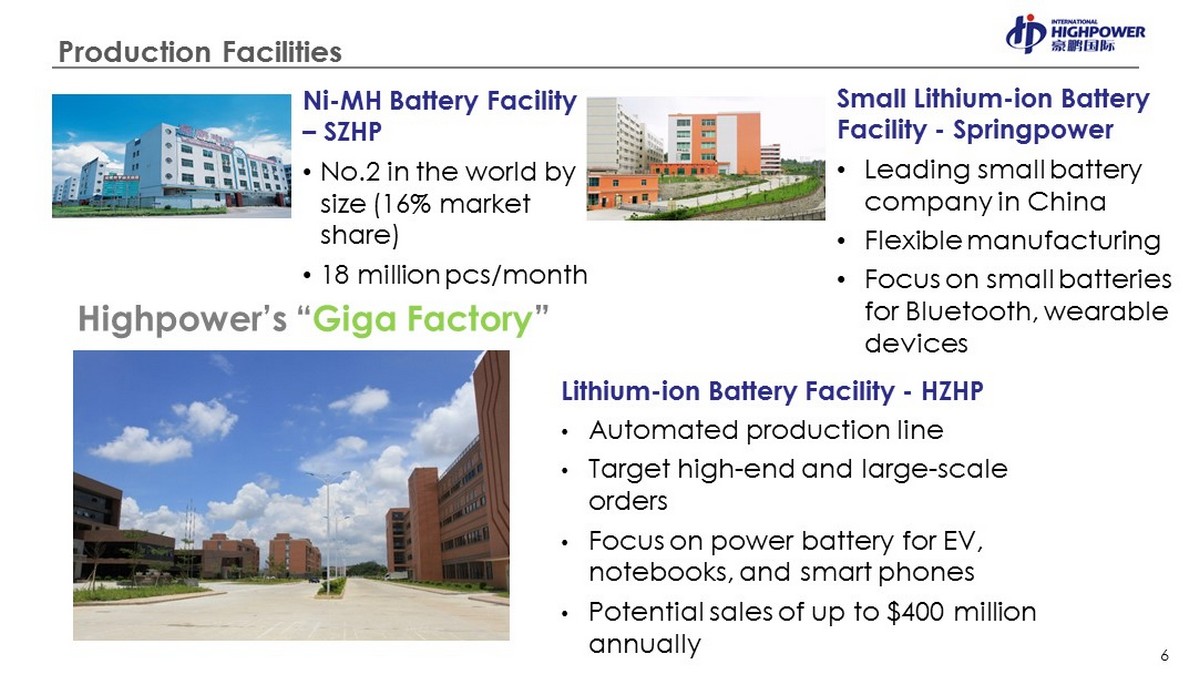

Production Facilities Small Lithium - ion Battery Facility - Springpower • Leading small battery company in China • Flexible manufacturing • Focus on small batteries for Bluetooth, wearable devices Ni - MH Battery Facility – SZHP • No.2 in the world by size (16% market share) • 18 million pcs/month Lithium - ion Battery Facility - HZHP • Automated production line • Target high - end and large - scale orders • Focus on power battery for EV, notebooks, and smart phones • Potential sales of up to $400 million annually 6 Highpower’s “ Giga Factory ”

7 Battery Solution and Energy Storage Facility - Icon • Battery Management System (BMS) • Total battery solution • Portable power station and stationary energy storage Used Battery Recycling Facility – GZHP • Used battery recycling • Pollution free processing • Battery stagger utilization Production Facilities Continued

Experienced Management Team Name & Title Years of Experience Past Experience George Pan Chairman and CEO >23 Highpower International HuangPu Aluminum Co. Guangzhou Aluminum Products Co. Sunny Pan CFO >20 Finance controller for Philips Luminaire Manufacturing Co. LTD. General Manager ACCA and CICPA certified Leo Liao CTO, President of Research Institute >20 General Manager of Shenzhen Highpower Technology Co. Ltd. Chief Engineer, R&D manager of Shenzhen Highpower Technology Co. Ltd 8

Lighting Blue Tooth Electric Tools Tablets & NB Toys Portable Solar Energy Storage Cordless Phones Medical Devices Personal Care Electric Mowers Handheld Devices Wearable Products Smart Phones Stable Market Consumer/ Household/ Industrial Exploding Market Mobile/ Portable/ Wearable EV Growing Market Vacuum Cleaners Electric Buses Mobile Payment Electric Wheelchair Stationary Solar Energy Storage Solar ESS Strategic Market Electric Race Car Market Positioning 9

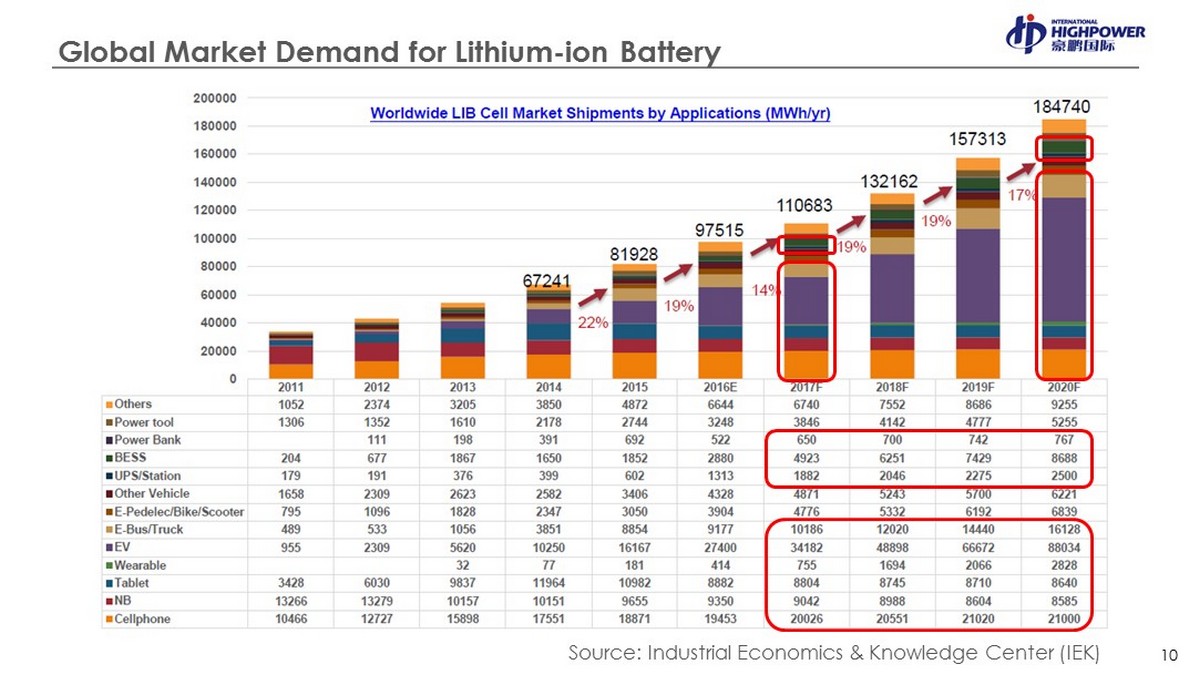

Global Market Demand for Lithium - ion Battery 10 Source: Industrial Economics & Knowledge Center (IEK)

>5% of revenues invested in R&D 185 patents granted >200 engineers in primary materials, battery materials, and battery systems research Certifications in Quality, Safety, Technical, Environmental, Regional , and Social Responsibility UL Approval MH 21283 --- NiMH (90% of models approved) MH 46844 --- Li - ion / Li - polymer (60% of models approved) Commitment to Technology 12

Five Year Overview of Financial Results $112.6 $132.8 $147.1 $146.2 $173.9 100.0 120.0 140.0 160.0 180.0 200.0 2012 2013 2014 2015 2016 Annual Revenues $1.7 $1.5 $2.8 $3.9 $6.1 1.5% 1.1% 1.9% 2.6% 3.5% 0.0% 1.0% 2.0% 3.0% 4.0% 0.0 2.0 4.0 6.0 8.0 2012 2013 2014 2015 2016 Net Income Attributable to the Company Net Income Net Margin » CAGR of revenue in the past 5 years is 11.5%. » CAGR of net income in the past 5 years is 37.6%. » Strong net margin expansion In USD million 12

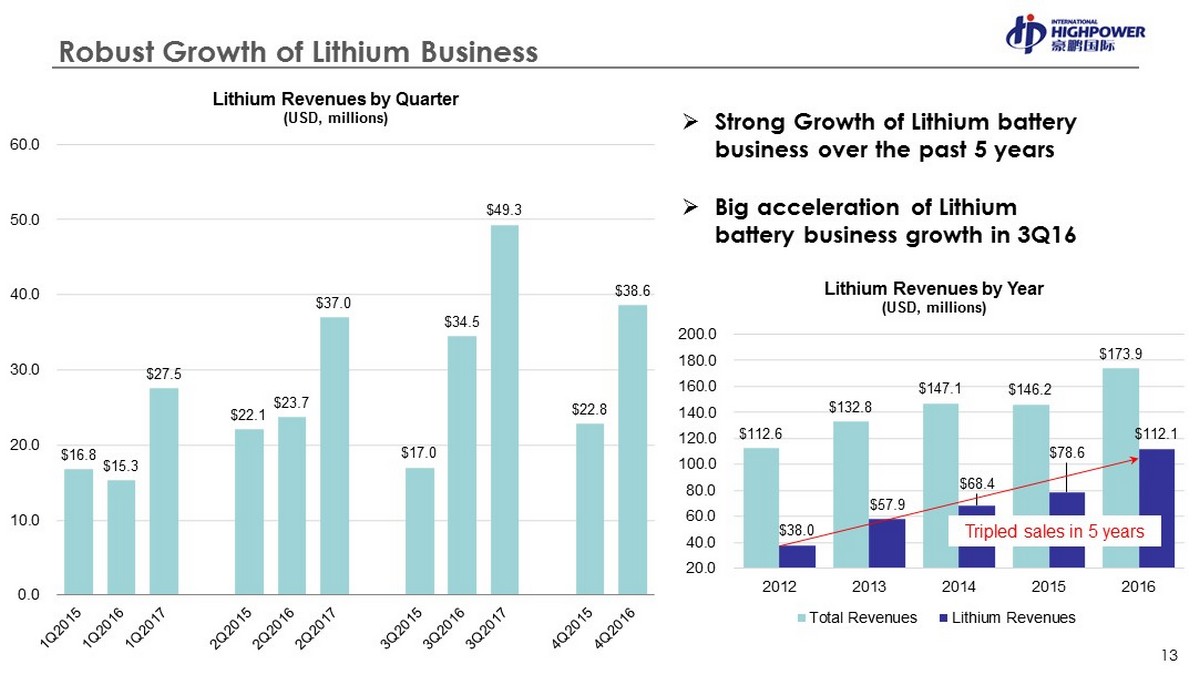

Robust Growth of Lithium Business $16.8 $15.3 $27.5 $22.1 $23.7 $37.0 $17.0 $34.5 $49.3 $22.8 $38.6 0.0 10.0 20.0 30.0 40.0 50.0 60.0 Lithium Revenues by Quarter (USD, millions) $112.6 $132.8 $147.1 $146.2 $173.9 $38.0 $57.9 $68.4 $78.6 $112.1 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0 180.0 200.0 2012 2013 2014 2015 2016 Lithium Revenues by Year (USD, millions) Total Revenues Lithium Revenues » Strong Growth of Lithium battery business over the past 5 years » Big acceleration of Lithium battery business growth in 3Q16 Tripled sales in 5 years 13

Highpower’s Future Prospects x Accelerate revenue growth given the increased demand for lithium - ion batteries x Continue to maximize the efficiency of existing production capacity x Reinvest capital to support future growth 14

Advisors Investor Relations: ICR, Inc. 685 Third Avenue, 2 nd Floor New York, NY 10017 646 - 931 - 0303 Legal Counsel: Manatt , Phelps & Phillips, LLP 11355 W. Olympic Blvd . Los Angeles, CA 90064 310 - 312 - 4252 Auditor Marcum Bernstein & Pinchuk 750 Third Avenue, 11th Floor New York, NY 10017 212 - 485 - 5500 Transfer Agent Computershare Trust Company, N.A. 462 South 4 th Street, Suite 1600 Louisville, KY 40202 781 - 575 - 4247 15