Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - CatchMark Timber Trust, Inc. | d518084dex992.htm |

| 8-K - 8-K - CatchMark Timber Trust, Inc. | d518084d8k.htm |

Exhibit 99.1

|

Exhibit 99.1

Follow-On Equity Offering

M ar c h 2 0 1 8

|

F O R WA R D—L OOK I N G S TAT E M E N T S

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,”

“estimate,” “believe,” “continue,” or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are not

guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such

statements include, among others, that we believe that we are well positioned given expected increases in sawtimber pricing, housing starts and lumber consumption and our evolving harvest mix to an increased share of sawtimber; that we will continue

to concentrate on disciplined execution of our operating plan while strategically expanding our timberlands holdings and capital relationships; that we believe that we are on target for executing our business plan; that we remain focused on

providing a superior and sustainable rate of return to stockholders through disciplined acquisitions, sustainable harvests, increased cash flow and revenue growth, well-timed sales, our joint venture strategy, recurring dividends and opportunistic

share repurchases; and that we believe that our new growth opportunities, operational execution, and capital allocation strategy are building long-term value. Forward-looking statements involve risks and uncertainties that could cause actual results

to differ materially from those contemplated by our forward-looking statements including, but not limited to: (i) we may not generate the harvest volumes from our timberlands that we currently anticipate; (ii) the demand for our timber may

not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iii) the cyclical nature of the real estate market generally,

including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties;

(iv) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of timberlands available for acquisition that meet our investment criteria may be less

than we currently anticipate; (vi) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at attractive rates or at all;

(viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase program may not be successful in improving stockholder value over the long-term; (x) our joint venture strategy may

not enable us to access non-dilutive capital and enhance our ability to make acquisitions; and (xi) the factors described in Item 1A. Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this presentation. We undertake no obligation to update our forward-looking statements, except as required by law.

|

DI S CLA I M E R

The Company has filed a registration statement (including a prospectus and a related preliminary prospectus supplement) with the SEC for the offering to which this presentation

relates. Before you invest, you should read the preliminary prospectus supplement and the accompanying prospectus in that registration statement and the other documents that the Company has filed with the SEC for more complete information about the

Company and such offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in such offering will arrange to send you the prospectus and

preliminary prospectus supplement if you request it by calling toll-free (800) 248-8863. This communication shall not constitute an offer to sell or the solicitation of any offer to buy, nor shall there be any

sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification of such securities under the securities law of any such jurisdiction.

|

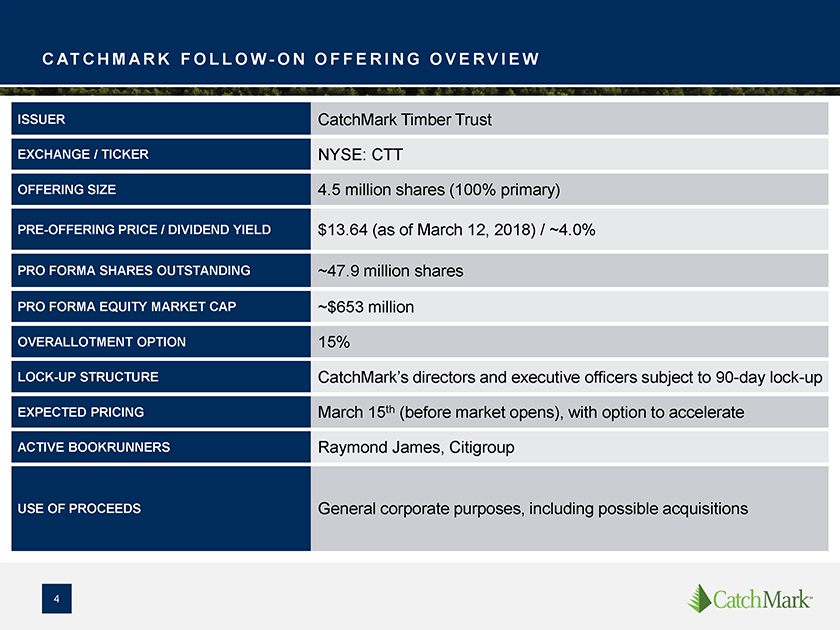

CATCHM A RK F O L L O W—O N O F F E R I N G O V

E R V I E W

ISSUER CatchMark Timber Trust

EXCHANGE / TICKER NYSE: CTT

OFFERING SIZE 4.5 million shares (100% primary)

PRE-OFFERING PRICE / DIVIDEND YIELD $13.64 (as of March 12, 2018) / ~4.0%

PRO FORMA SHARES OUTSTANDING ~47.9 million

shares

PRO FORMA EQUITY MARKET CAP ~$653 million

OVERALL OTMENT OPTION

15%

LOCK-UP STRUCTURE CatchMark’s directors and executive officers subject to

90-day lock-up

EXPECTED PRICING March 15th (before market opens), with option to

accelerate

ACTIVE BOOKRUNNERS Raymond James, Citigroup

USE OF PROCEEDS

General corporate purposes, including possible acquisitions

|

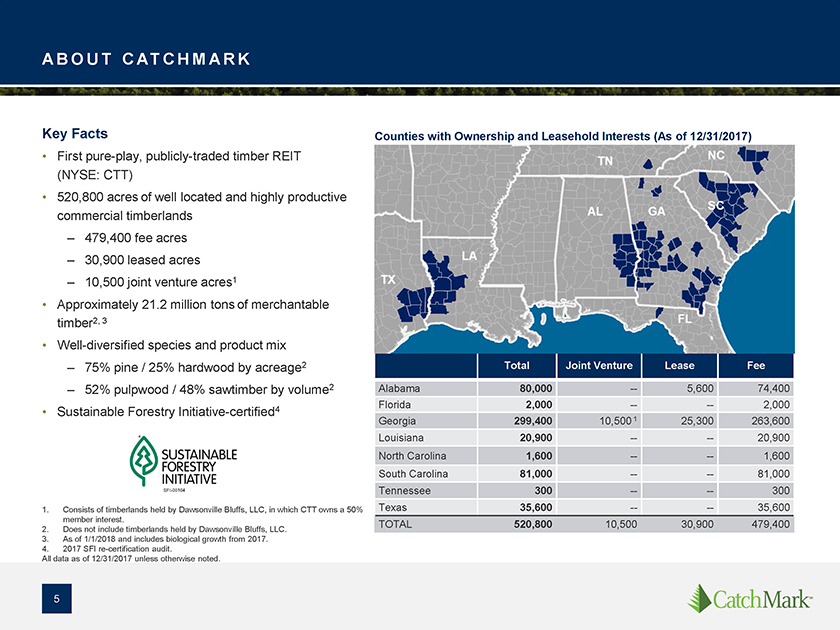

A B O U T C AT C H M A R K

Key Facts

• First pure-play, publicly-traded timber REIT (NYSE: CTT)

• 520,800 acres of well located and highly productive commercial timberlands

–

479,400 fee acres

– 30,900 leased acres

– 10,500 joint venture

acres1

• Approximately 21.2 million tons of merchantable timber2, 3

• Well-diversified species and product mix

– 75% pine / 25%

hardwood by acreage2

– 52% pulpwood / 48% sawtimber by volume2

•

Sustainable Forestry Initiative-certified4

1. Consists of timberlands held by Dawsonville Bluffs, LLC, in which CTT owns a 50% member interest.

2. Does not include timberlands held by Dawsonville Bluffs, LLC. 3. As of 1/1/2018 and includes biological growth from 2017. 4. 2017 SFI

re-certification audit.

All data as of 12/31/2017 unless otherwise noted.

Counties with Ownership and Leasehold Interests (As of 12/31/2017)

Total Joint Venture

LeaseFee

Alabama 80,000 —5,60074,400

Florida 2,000 ——2,000

Georgia 299,400 10,500 125,300263,600

Louisiana 20,900 ——20,900

North Carolina 1,600 ——1,600

South Carolina 81,000

——81,000

Tennessee 300 ——300

Texas 35,600

——35,600

TOTAL 520,800 10,50030,900479,400

|

EXPER I EN C ED M A N A G E M E N T T E A M

CatchMark’s seasoned leadership provides significant industry experience and capability to help realize company objectives and growth plan.

Jerry Barag, President and CEO (31 years of industry experience)

• Managing Director and

Founder TimberStar Advisors and TimberStar

• Chief Investment Officer at Lend Lease Real Estate Investments

• Executive Vice President, Equitable Real Estate

John Rasor, Chief Operating Officer (46

years of industry experience)

• Managing Director and Founder TimberStar Advisors and TimberStar

• Executive Vice President of Georgia Pacific, responsible for timber and timberlands, building product businesses, and wood and fiber procurement for wood products, pulp and

paper

Brian Davis, Chief Financial Officer (26 years of industry experience)

• Senior Vice President and Chief Financial Officer of Wells Timberland

• Various executive finance roles with SunTrust Bank and CoBank, delivering capital market solutions – advisory, capital raising, and financial risk

management to public and private companies.

Todd Reitz, Senior Vice President, Forestry Operations (23 years of industry experience)

• Atlantic South Regional Marketing Manager for Weyerhaeuser with operational oversite for all log and pulpwood production from East Alabama to Virginia

• Previous roles with Weyerhaeuser, Plum Creek and Stone Container Corporation – extensive marketing, harvesting, silviculture and business development experience across

the U.S. South from East Texas to Virginia.

|

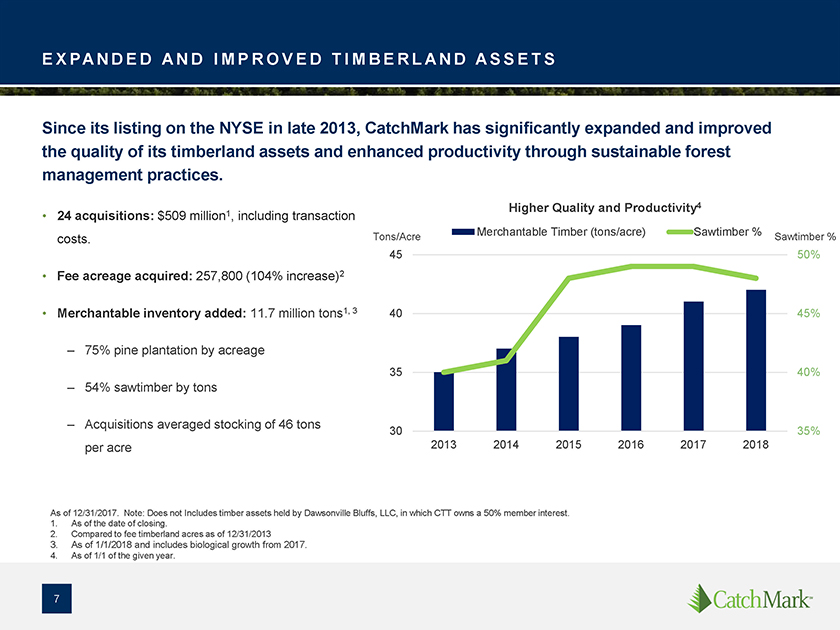

E X PA NDE D A N D I M P R O V E D T I M B E R L A N

D A S S E T S

Since its listing on the NYSE in late 2013, CatchMark has significantly expanded and improved the quality of its timberland assets and enhanced

productivity through sustainable forest management practices.

• 24 acquisitions: $509 million1, including transaction costs.

• Fee acreage acquired: 257,800 (104% increase)2

• Merchantable inventory added:

11.7 million tons1, 3

– 75% pine plantation by acreage

– 54%

sawtimber by tons

– Acquisitions averaged stocking of 46 tons per acre

Higher Quality and Productivity4

Tons/Acre Merchantable Timber (tons/acre)

Sawtimber % Sawtimber %

45 50%

40 45%

35 40%

30 35% 2013 2014 2015 2016 2017 2018

As of 12/31/2017. Note: Does not Includes timber assets held by Dawsonville Bluffs, LLC, in which CTT owns a 50% member interest. 1. As of the date of closing.

2. Compared to fee timberland acres as of 12/31/2013

3. As of 1/1/2018 and includes biological

growth from 2017.

4. As of 1/1 of the given year.

|

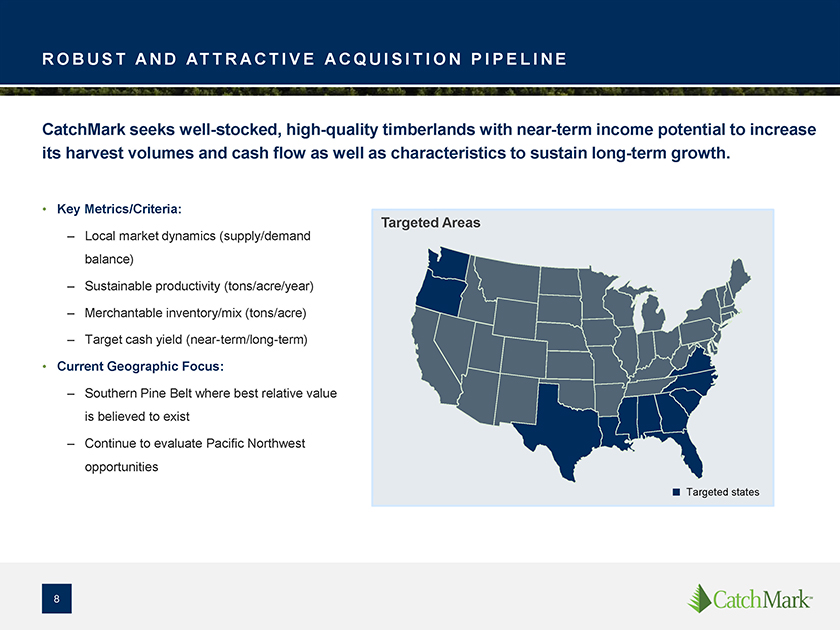

RO BUS T A N D AT T R A C T I V E A C Q U I S I T I

O N P I P E L I N E

CatchMark seeks well-stocked, high-quality timberlands with near-term income potential to increase its harvest volumes and cash flow as well as

characteristics to sustain long-term growth.

• Key Metrics/Criteria:

– Local market dynamics (supply/demand balance)

– Sustainable

productivity (tons/acre/year)

– Merchantable inventory/mix (tons/acre)

– Target cash yield (near-term/long-term)

• Current Geographic

Focus:

– Southern Pine Belt where best relative value is believed to exist

– Continue to evaluate Pacific Northwest opportunities

Targeted Areas

Targeted states

|

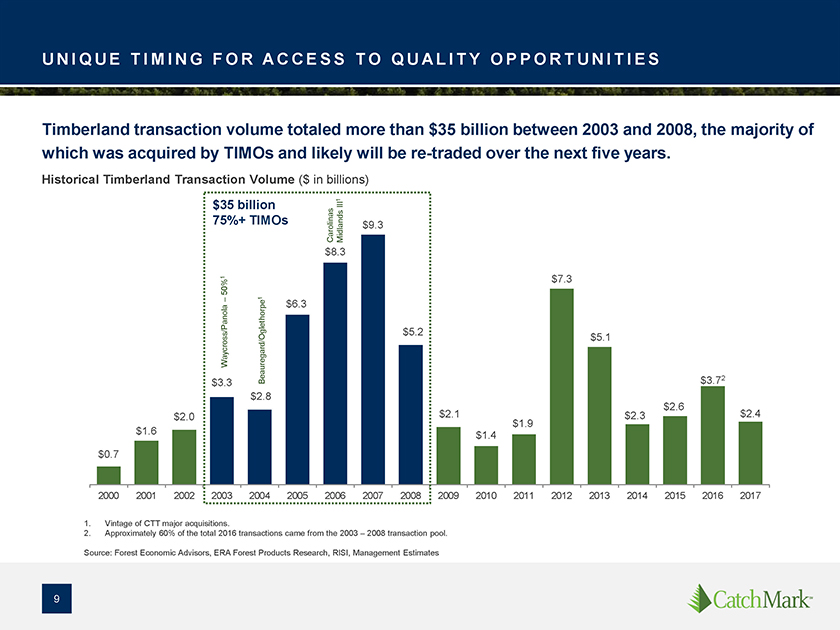

U N I QU E T I M I N G F O R A C C E S S T O Q U A L

I T Y O P P O R T U N I T I E S

Timberland transaction volume totaled more than $35 billion between 2003 and 2008, the majority of which was acquired by TIMOs

and likely will be re-traded over the next five years.

Historical Timberland Transaction Volume ($ in billions)

1

$35 billion III 75%+ TIMOs $9.3

Carolinas Midlands

$8.3

1 $7.3

50%

1

– $6.3

$5.2

Waycross/Panola $5.1 $3.3 Beauregard/Oglethorpe $3.72

$2.8 $2.6 $2.0 $2.1 $2.3 $2.4 $1.9 $1.6 $1.4 $0.7

2000 2001 2002 2003 2004 2005 2006 2007 2008

2009 2010 2011 2012 2013 2014 2015 2016 2017

1. Vintage of CTT major acquisitions.

2. Approximately 60% of the total 2016 transactions came from the 2003 – 2008 transaction pool.

Source: Forest Economic Advisors, ERA Forest Products Research, RISI, Management Estimates

|

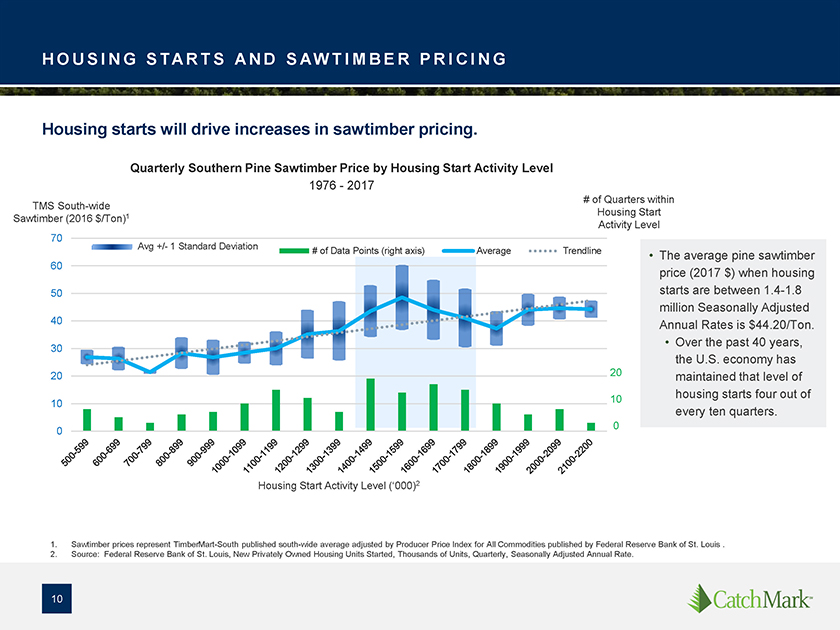

H O U S I N G S TA R T S A N D S AW T I M B E R P R

I C I N G

Housing starts will drive increases in sawtimber pricing.

Quarterly

Southern Pine Sawtimber Price by Housing Start Activity Level

1976—2017

TMS South-wide Sawtimber (2016 $/Ton)1

# of Quarters within Housing Start

Activity Level

The average pine sawtimber price (2017 $) when housing starts are between 1.4-1.8 million Seasonally

Adjusted Annual Rates is $44.20/Ton.

Over the past 40 years, the U.S. economy has maintained that level of housing starts four out of every ten quarters.

70 60 50 40 30 20 10 0

Avg +/- 1 Standard Deviation # of Data Points (right

axis) Average Trendline

Housing Start Activity Level (‘000)2

20 10 0

1. Sawtimber prices represent TimberMart-South published south-wide average adjusted by Producer Price Index for All Commodities published by Federal Reserve Bank

of St. Louis .

2. Source: Federal Reserve Bank of St. Louis, New Privately Owned Housing Units Started, Thousands of Units, Quarterly, Seasonally Adjusted Annual

Rate.

|

S U M M A RY

CatchMark’s focus on quality—timberland assets, operational excellence, and sustainable earnings—helps the company grow cash flow, dividends and shareholder value.

S t ra t e g y

• Expand holdings of prime, well-stocked timberlands;

manage for durable earnings and increase value through sustainable environmental practices; grow cash flow and increase dividends per share.

P e rf o rm a n ce

• Double–digit timber sales and revenue growth year-over-year since IPO in 2013.

• Increased Adjusted EBITDA by 14% to $42.0 million, compared to $36.8 million for full-year 2016.1

• Expanded fee ownership by 104% since IPO.

• Highest dividend yield in sector with

superior risk-adjusted coverage.

Op p o rt u n i t y

• Invest in a

company well-positioned to take advantage of an improving housing market with an experienced and proven management team implementing a clear strategy, buoyed by a strong balance sheet.

1. Net loss for 2017 and 2016 was $13.5 million and $11.1 million, respectively. Our net income or losses fluctuate with timber prices, harvest volume and mix, depletion

rates, timberland sales, and interest expenses.

|

Appendix

|

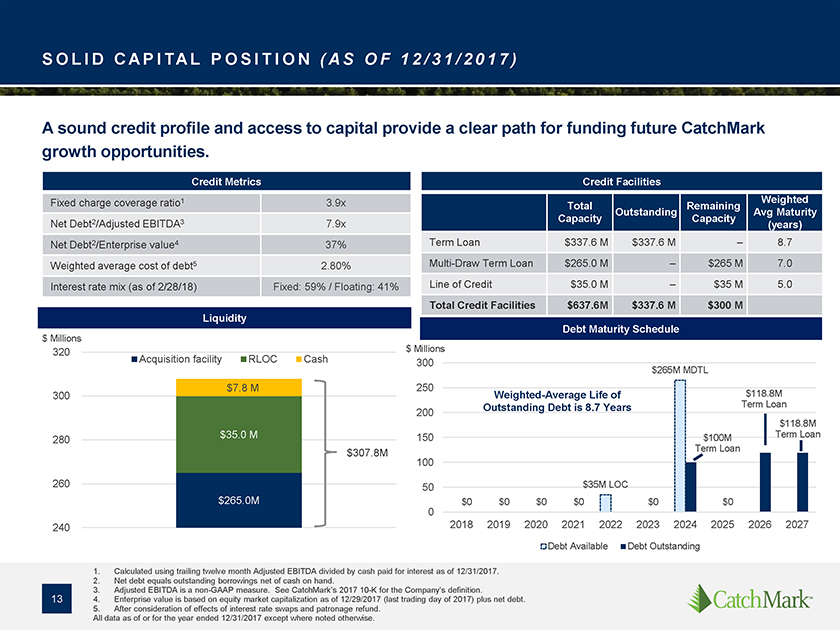

SOL I D C A P I TA L P O S I T I O N ( A S O F 1 2 /

3 1 / 2 0 1 7 )

A sound credit profile and access to capital provide a clear path for funding future CatchMark growth opportunities.

Credit Metrics

Fixed charge coverage ratio1 3.9x

Net Debt2/Adjusted EBITDA3 7.9x

Net Debt2/Enterprise value4 37%

Weighted average cost of debt5 2.80%

Interest rate mix (as of 2/28/18) Fixed: 59% / Floating:

41%

Credit Facilities

Total RemainingWeighted

Outstanding Avg Maturity

Capacity Capacity (years)

Term Loan $337.6 M $337.6 M–8.7

Multi-Draw Term Loan $265.0 M –$265 M7.0

Line of Credit $35.0 M –$35 M5.0

Total Credit Facilities $637.6M $337.6 M$300 M

Liquidity

$ Millions

320 300 280 260 240

Acquisition facility RLOC Cash

$7.8 M

$35.0 M

$265.0M

$307.8M

$ Millions

300 250 200 150 100 50 0

Debt Maturity Schedule

$265M MDTL

Weighted-Average Life of Outstanding Debt is 8.7 Years

$118.8M Term Loan

$118.8M Term Loan

$100M Term Loan

$35M LOC

$0 $0 $0 $0 $0 $0

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

Debt Available Debt Outstanding

1. Calculated using trailing twelve month Adjusted EBITDA divided by cash paid for interest as of 12/31/2017. 2. Net debt equals outstanding borrowings net of cash on hand.

3. Adjusted EBITDA is a non-GAAP measure. See CatchMark’s 2017 10-K for the

Company’s definition.

4. Enterprise value is based on equity market capitalization as of 12/29/2017 (last trading day of 2017) plus net debt. 5. After

consideration of effects of interest rate swaps and patronage refund.

All data as of or for the year ended 12/31/2017 except where noted otherwise.

|

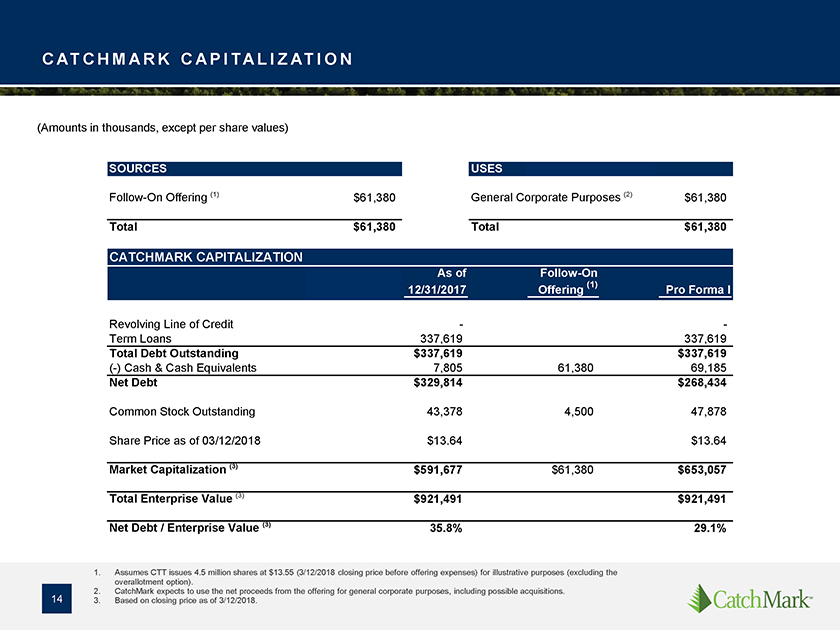

CATCHM A RK C A P I TA L I Z AT I O N

(Amounts in thousands, except per share values)

Follow-On Offering (1) $61,380

Total

$61,380

USES

General Corporate Purposes (2) $61,380

Total $61,380

CATCHMARK CAPITALIZATION

As of Follow-On

12/31/2017 Offering (1) Pro Forma

I

Revolving Line of Credit - -

Term Loans 337,619 337,619

Total Debt Outstanding $337,619 $337,619

(-) Cash & Cash Equivalents 7,805

61,38069,185

Net Debt $329,814 $268,434

Common Stock Outstanding 43,378

4,50047,878

Share Price as of 03/12/2018 $13.64 $13.64

Market Capitalization

(3) $591,677 $61,380$653,057

Total Enterprise Value (3) $921,491 $921,491

Net

Debt / Enterprise Value (3) 35.8% 29.1%

1. Assumes CTT issues 4.5 million shares at $13.55 (3/12/2018 closing price before offering expenses) for illustrative

purposes (excluding the overallotment option).

2. CatchMark expects to use the net proceeds from the offering for general corporate purposes, including possible

acquisitions.

3. Based on closing price as of 3/12/2018.