Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - AutoWeb, Inc. | ex99-1.htm |

| 8-K - CURRENT REPORT - AutoWeb, Inc. | auto8k_mar082018.htm |

Exhibit 99.2

AUTOWEB, INC

Moderator: Sean Mansouri

March 8th, 2018

5:00 p.m. ET

OPERATOR:

This is conference

# 1396037

Operator:

Good afternoon,

everyone, and thank you for participating in today’s

conference call to discuss AutoWeb’s Financial Results for

the Fourth Quarter and Full Year Ended December 31,

2017.

Joining

us today are AutoWeb’s President and CEO, Jeff Coates; the

company’s CFO, Kimberly Boren; and the company’s

outside Investor Relations Adviser, Sean Mansouri, with Liolios

Group.

Following their

remarks, we will open up the call for your questions.

I would

now like to turn the call over to Mr. Mansouri for some

introductory comments.

Sean

Mansouri:

Thank you. Before I

introduce Jeff, I’ll remind you that during today’s

call, including the question-and-answer session, any projections

and forward-looking statements made regarding future events or

AutoWeb’s future financial performance are covered by the

safe harbor statements contained in today’s press release,

the slides accompanying this presentation and the company’s

public filings with the SEC.

Actual

events may differ materially from those forward-looking statements.

Specifically, please refer to the company’s Form 10-K for the

full year ended December 31, 2017, which we anticipate filing on or

before March 15, 2018, as well as other filings made by AutoWeb

with the SEC from time to time. These filings identify factors that

could cause results to differ materially from those forward-looking

statements.

There

are slides included with today’s presentation to help

illustrate some of the points being made and discussed during the

call. The slides can be accessed by visiting AutoWeb’s

website at autoweb.com. When there, go to Investor Relations and

then click on Events and Presentations.

Please

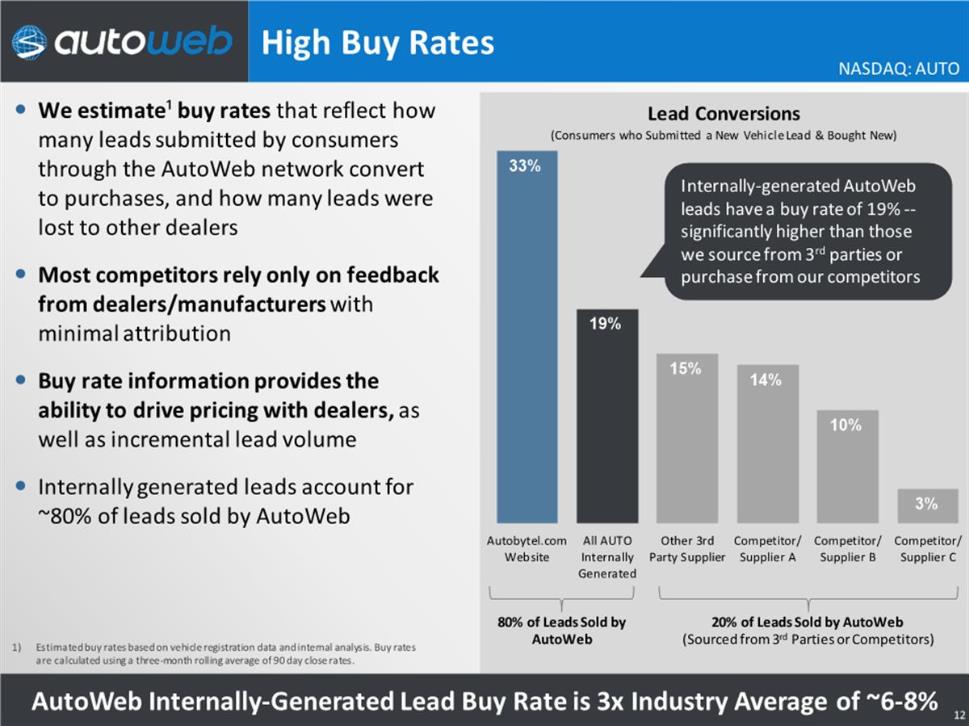

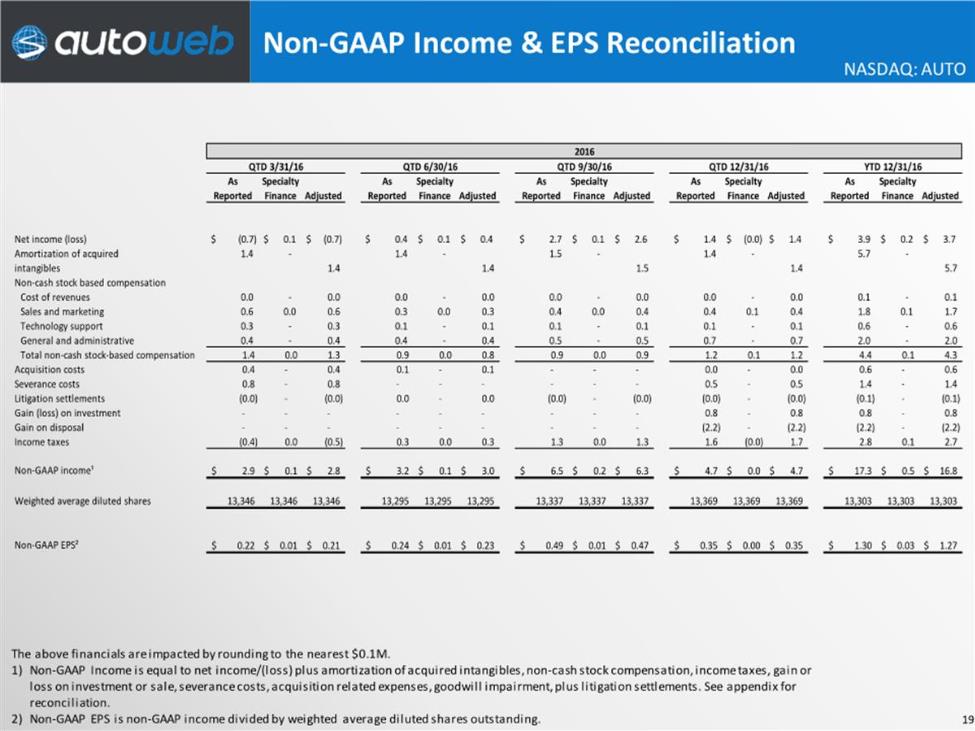

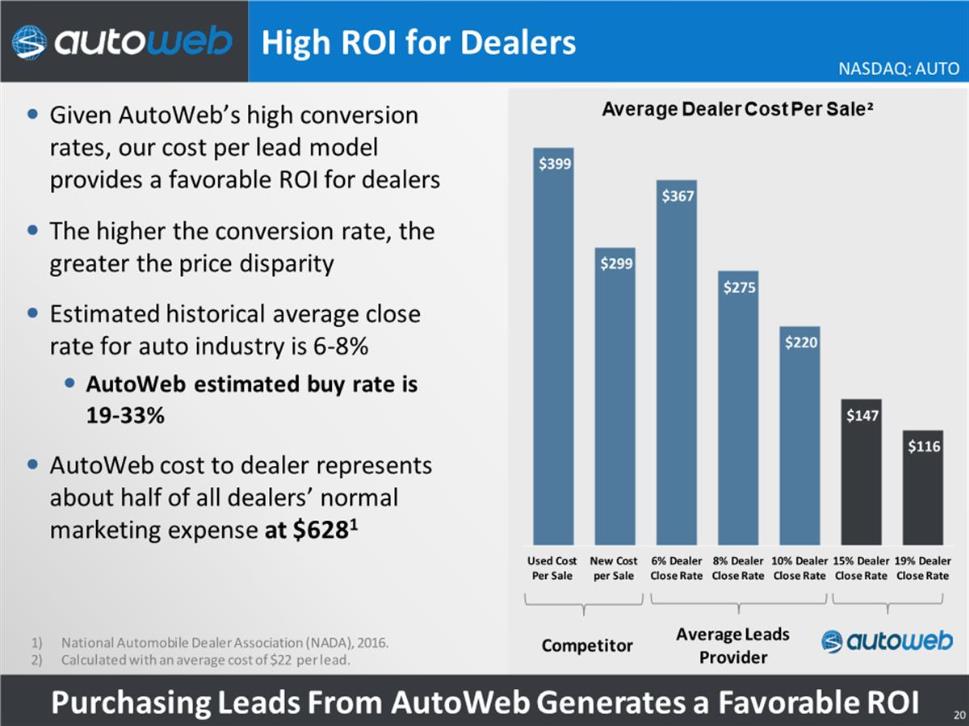

also note that during this call and/or in the accompanying slides,

management will be disclosing non-GAAP income and non-GAAP EPS, and

for year-over-year comparisons, prior year results with the

exception of cash flow from operations for all periods presented

are adjusted to exclude the company’s specialty finance leads

product, which was divested on December 31, 2016. These are

non-GAAP financial measures as defined by SEC Regulation

G.

Reconciliations of

these non-GAAP financial measures to the most directly comparable

GAAP measures are included in today’s press release and/or in

the slides, which are posted on the company’s

website.

And

with that, I’ll turn the call over to Jeff.

Jeffrey

Coats:

Thank you, Sean.

Good afternoon, everyone. As announced earlier today, the Board of

Directors and I have been discussing a succession plan for several

months. After more than a decade of leading AutoWeb and 20 years on

its Board of Directors, and after the board completes this process

and a new CEO is named during the coming month, I will be stepping

down to begin the next phase of my life.

Also

announced earlier today, Kimberly Boren will be stepping down as

Chief Financial Officer to pursue another opportunity. The company

will initiate a search for a new permanent CFO, but is in very good

hands with Senior Vice President and Controller, Wesley Ozima, as

Interim Chief Financial Officer, as he has served in

AutoWeb’s finance and accounting organization for nearly 14

years. We thank him (sic) [her] for her many years of service and

wish her all the best in her future endeavors.

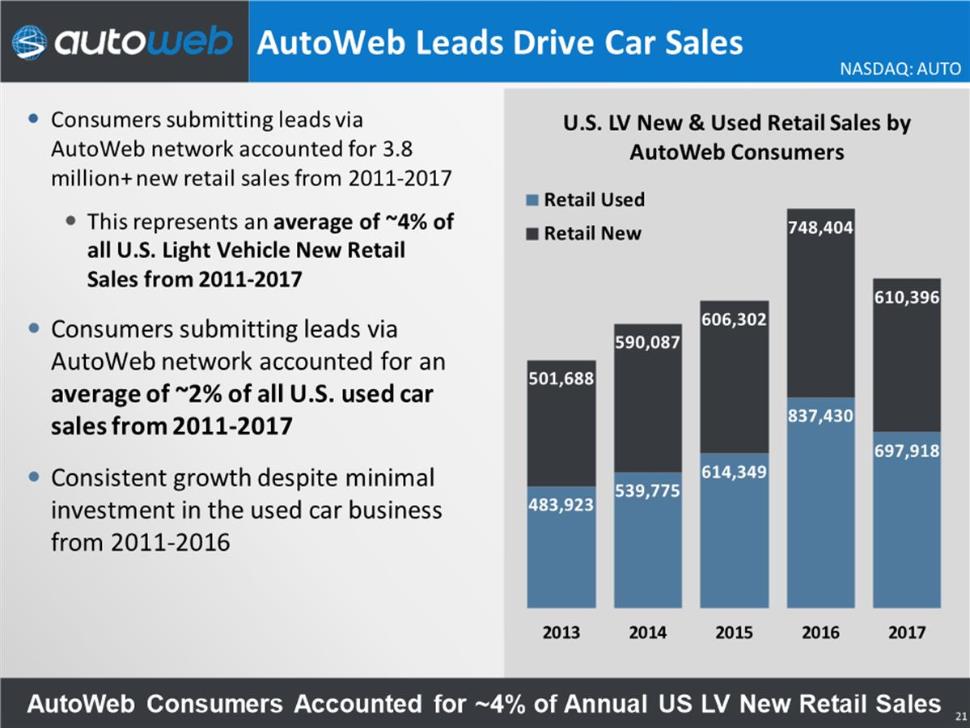

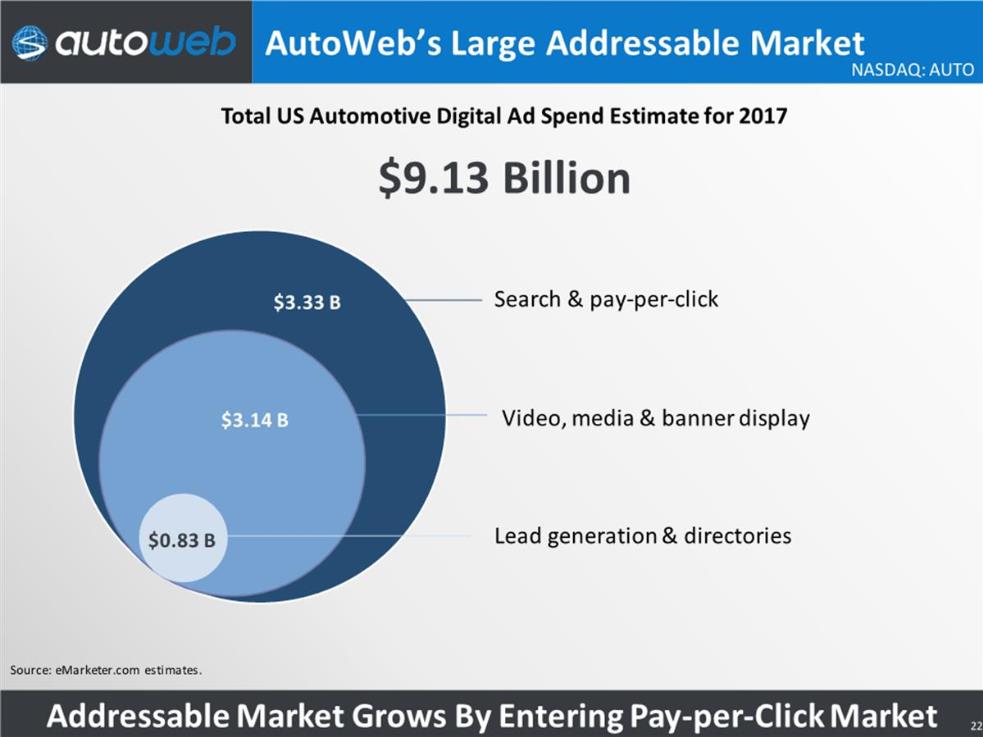

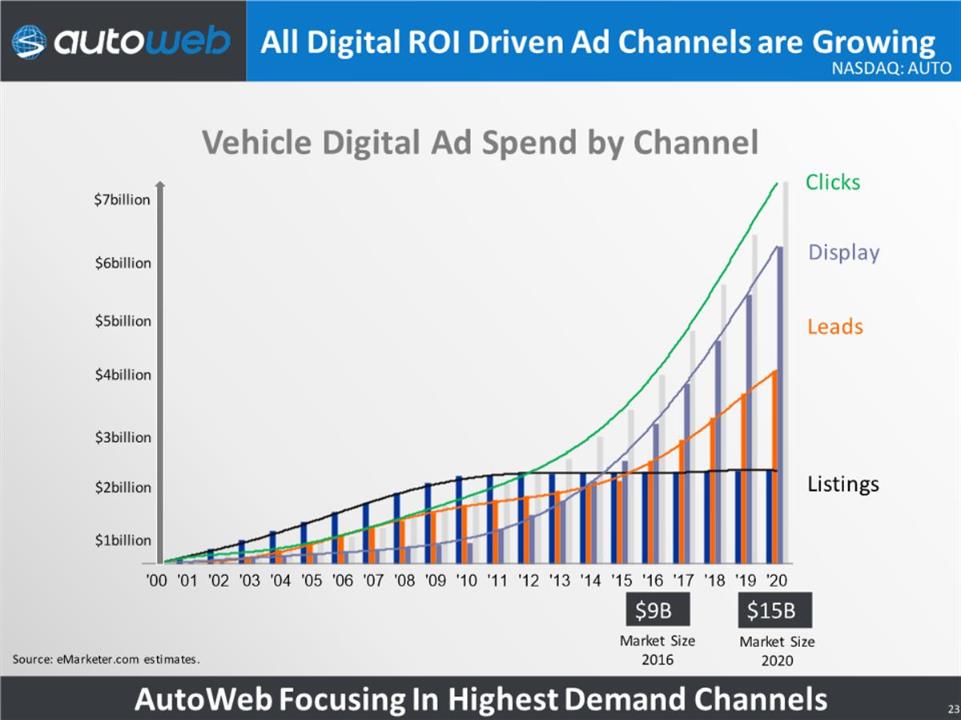

Despite

recent struggles with our traffic acquisition, we’ve

dramatically increased the company’s addressable market over

the last several years through targeted acquisitions while

establishing AutoWeb as the largest supplier of online leads to

every major OEM in the country.

During

the fourth quarter, demand for leads and clicks from our customers

remain strong, however, we were unable to fully meet this demand

due to higher traffic acquisition costs. This led to lower revenue

and profitability than we had previously anticipated. While our Q4

results certainly were not acceptable, we believe we’ve been

taking the appropriate actions to address these traffic issues and

mitigate the impact to profitability. Just last month, we realigned

our headcount and expect to reduce operating expenses by $2 million

on an annual basis.

Before

commenting any further, I’d like to turn the call over to

Kim, and have her take us through the important details of our Q4

financial results. Kim?

Kimberly

Boren:

Thanks, Jeff, and

good afternoon, everyone. As noted in our press release today, for

year-over-year comparative purposes, the results for all periods

presented and discussed on our call today exclude our specialty

finance leads product, which was divested on December 31,

2016.

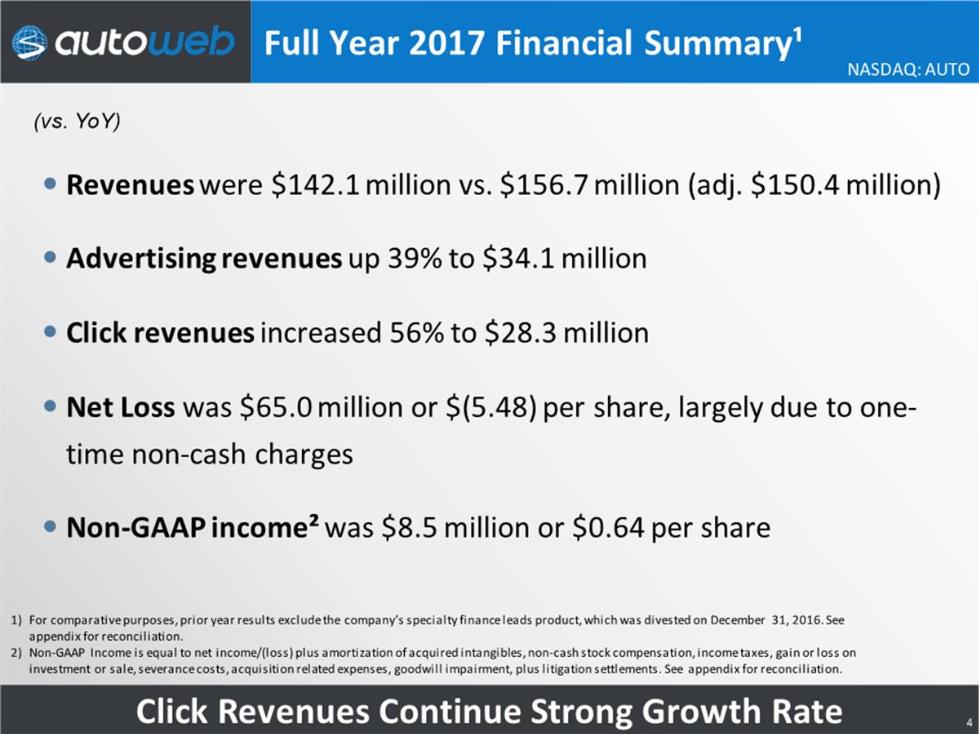

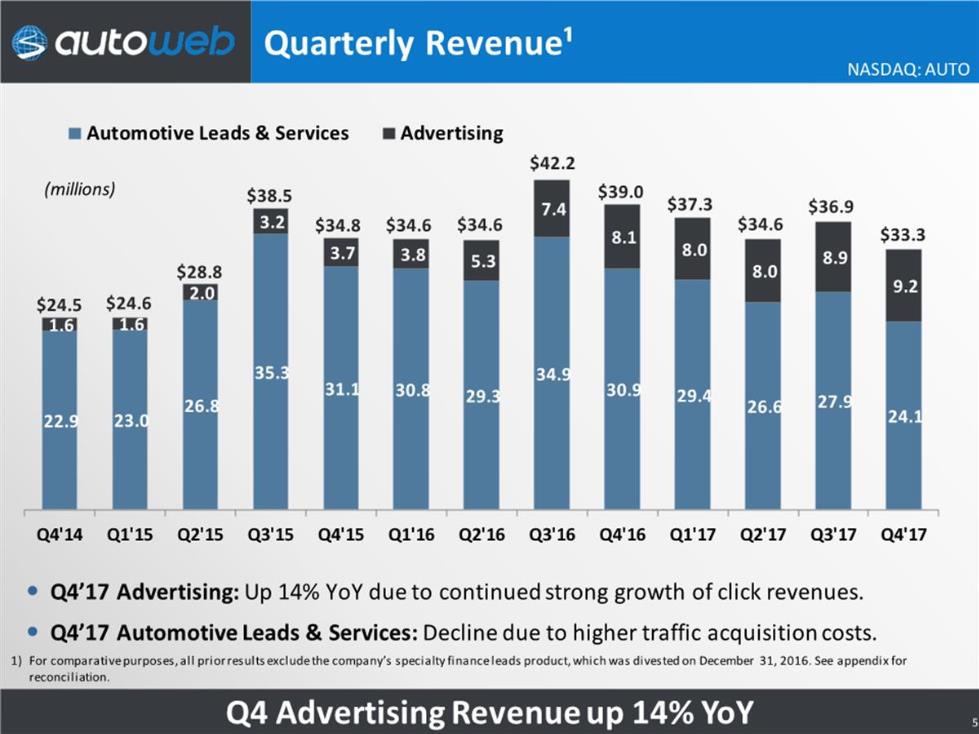

For

those of you following along with our earnings presentation, on

Slide 3, you can see that our fourth quarter revenue came in at

$33.3 million, down from $39 million in the adjusted year-ago

quarter. The decline in revenue was due to unfulfilled demand for

our leads as a result of higher traffic acquisition costs as well

as channel mix issues resulting from a lower retail dealer count,

partially offset by continued strong growth of advertising click

revenues, which increased 23% to $7.9 million.

Moving

to Slide 6. You’ll see that we delivered approximately $1.8

million automotive leads during the fourth quarter compared to $2.3

million last year, a reduction resulting primarily from the traffic

issues discussed earlier. Note that this lead volume reflects all

leads sold to both the retail and wholesale channels. As a

reminder, the retail channel comprises leads sold directly to

dealers whereas our wholesale channel, primarily reflects leads

sold to OEMs that are then distributed to dealers and their

corporate leads program at the OEM’s discretion.

And on

Slide 7, you’ll see that dealer count stood at 24,242 at

December 31, up from 24,191 at the end of Q3. Note that the

increase was largely driven by increased dealers on our OEM

wholesale program, partially offset by a decline in retail

dealers.

Similar

to our leads breakout, this dealer count reflects all of the

dealers we sell leads to, including both the wholesale and retail

channels for new cars.

Moving

on to advertising. As mentioned earlier, our advertising revenues

increased 14% to $9.2 million compared to $8.1 million in the

year-ago quarter. The increase was due to continued strong growth

in input revenues.

On

Slide 8, you’ll see click revenues increased 23% to a record

$7.9 million compared to $6.4 million in the same period last year.

The increase was driven by higher foot volumes into our wholesale

channel.

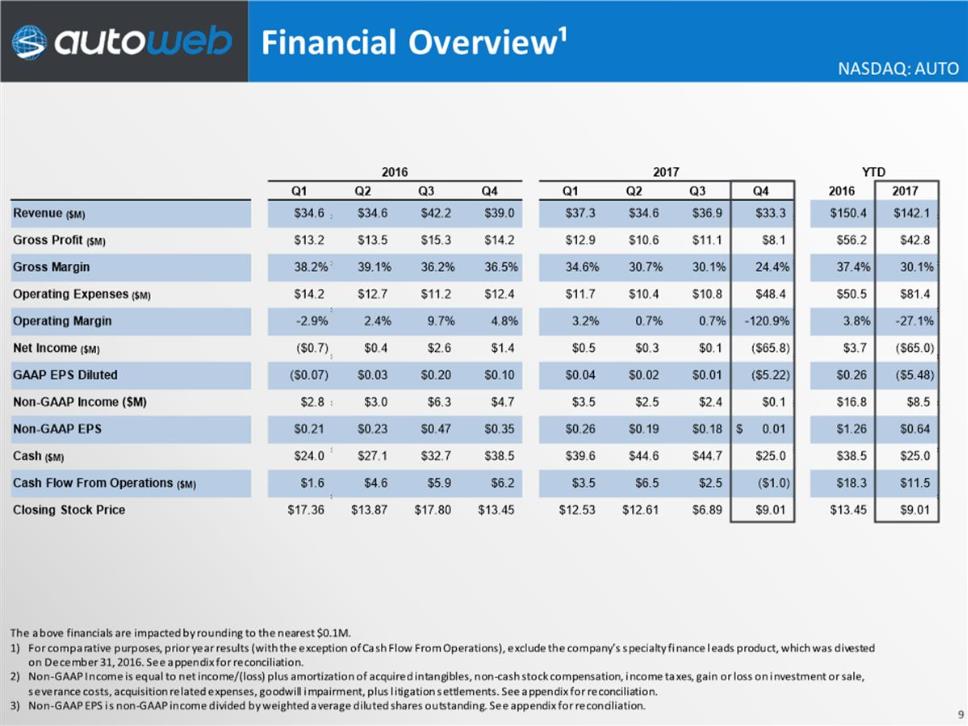

Now

moving to Slide 9. Gross profit during the fourth quarter was $8.1

million compared to an adjusted $14.2 million in the year-ago

quarter, with gross margin coming in at 24.4% compared to an

adjusted 36.5%.The decline was driven by higher consumer

acquisition costs as well as amortization costs associated with

DealerX. Total operating expenses in the fourth quarter were $48.4

million compared to an adjusted $12.4 million last

year.

The

increase was largely driven by a onetime noncash goodwill

impairment charge of $37.7 million. We evaluate the carrying value

of enterprise goodwill for impairment at a minimum on an annual

basis. During 2017, we performed our annual impairment tax,

effective October 1, by comparing the carrying value of AutoWeb to

its fair value based on market capitalization at that date. This

resulted in the $37.7 million charge.

On a

GAAP basis, net loss in the fourth quarter was $65.8 million or

$5.22 per share on 12.6 million shares compared to adjusted net

income of $1.4 million or $0.10 per share on 13.4 million shares in

the year-ago quarter. The decrease was driven by the aforementioned

goodwill charge as well as the $25.4 million noncash tax charge,

primarily related to the Tax Cuts and Jobs Act and a valuation

allowance on our remaining balance.

For the

fourth quarter, non-GAAP income, which adds back amortization on

acquired intangibles, noncash stock-based compensation, acquisition

costs, severance costs, gain or loss on investment or sale,

litigation settlements, goodwill impairment and income taxes, was

$0.1 million or $0.01 per share compared to an adjusted $4.7

million or $0.35 per share in the fourth quarter of 2016. The

decline was primarily driven by lower revenue in gross margins,

resulting from the aforementioned challenges with traffic

supply.

Cash

used in operations in the fourth quarter was $1 million compared to

cash provided by operations of $6.2 million unadjusted in the prior

year quarter. We also repurchased $0.7 million of stock during the

fourth quarter and have an additional $2.3 million authorized for

future purchases.

On

Slide 10, you’ll see that our cash balance remains strong,

with cash and cash equivalents of $25 million at December 31, 2017,

compared to $38.5 million at December 31, 2016. The decrease was

driven by debt paydowns, stock repurchases, the DealerX licensing

agreements and the usedtrucks.com URL purchased in 2017. Total debt

at December 31, 2017, was reduced to $9 million compared to $23.1

million at the end of 2016.

In

closing, it has been a pleasure being part of AutoWeb and leading

its finance and accounting organization over the last 10 years. And

I will do everything I can to ensure a successful transition of the

role to Wes and the team.

With

that, I’ll now turn the call back over to Jeff. It’s

been a pleasure.

Jeffrey

Coats:

Thank you, Kim. As

I mentioned earlier, we experienced significant challenges with

traffic acquisition during the fourth quarter. We were click

trending quite positively at the end of the third quarter before

hitting somewhat of a wall in October. We believe this was in large

part due to dramatically greater SEM spend from several of our

competitors, which ultimately drove up our prices to acquire

traffic. For context, we spend approximately $6 million to $7

million per month with our largest traffic suppliers, while

it’s our understanding that some of our competitors have each

been spending upwards of $25 million per month to acquire traffic

during Q4.

As

I’ve stated in the past, we remain committed to profitability

over growth and will not spend excessive amounts on traffic

acquisition to satisfy growth objectives. Ultimately, we do not

believe this estimated level of spending from our competition is

sustainable. So while our near-term results are being impacted, we

do expect market conditions to normalize over the course of the

year, which should then enable us to acquire traffic at a more

reasonable cost. Despite the rising cost, we will continue to work

with our traffic partners to optimize our SEM methodologies and

rebuild our high-quality traffic streams so that the company can be

prepared to return to growth as market conditions

normalize.

Due to

the competitive dynamics discussed and the anticipated management

transition, we cannot provide an exact timeframe to this

resolution. However, note that the company will prudently manage

its cost structure to maintain profitability as reflected by the

headcount realignment discussed earlier. A few weeks ago, Billy

Ferriolo resigned due to personal reasons. He was one of the

founders of the Tampa-based company we acquired in 2010, which was

instrumental in AutoWeb’s successful growth over the past

several years. Our strong team in Tampa remains in place and has

received increased support from Google to assist in the continued

recovery of our consumer acquisition efforts. We also wish Billy

all the best in his future endeavors as well.

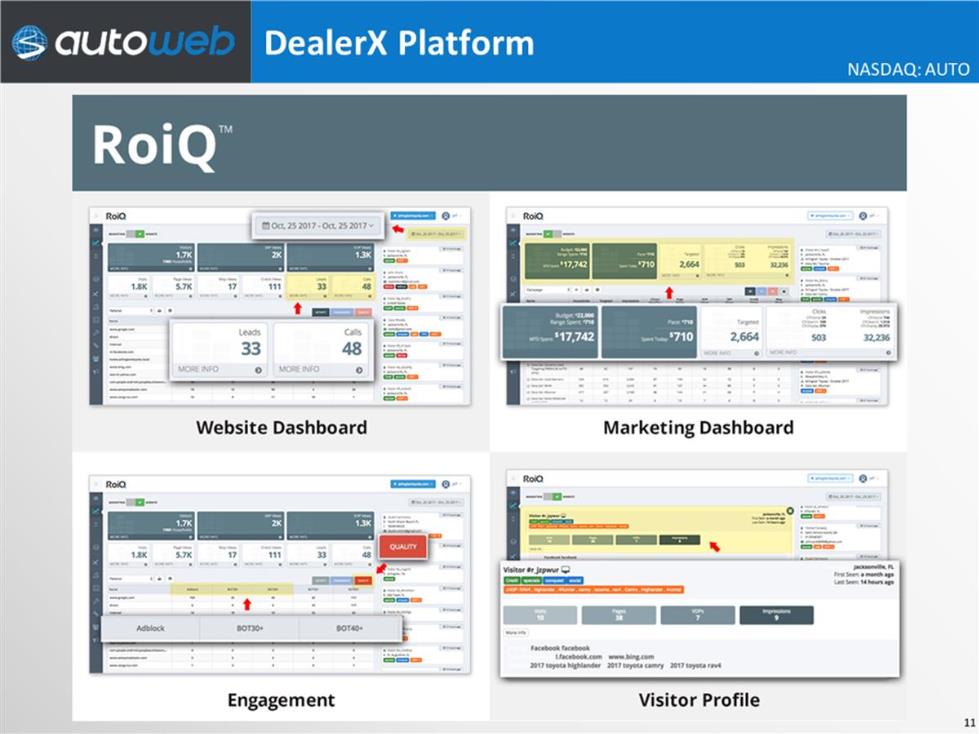

We also

remain in the early stages of implementing the new DealerX ROiQ

platform. As you may recall, we licensed the ROiQ technology from

DealerX in October of last year. This technology records countless

consumer-driven behavioral events online and scores them in real

time to determine what content to show a consumer across multiple

devices. We plan to utilize this technologies to support both our

clicks and leads products as we can target the right consumer and

monetize the event in multiple ways.

In

addition to the monetary benefits, the DealerX platform provides us

with an entirely new source of traffic which builds upon our

strategy to diversify our consumer acquisition partners, especially

given the competitive dynamics mentioned earlier. It’s

important to note that we have the exclusive rights as to other

third-party service providers like ourselves to use the DealerX

technology to generate leads, traffic and other results and output

for the auto industry.

In our

clicks business, we continue to increase click volumes with

existing clients and have added new dealers, OEMs and advertising

customers. As I’ve mentioned in the past, our strong growth

in clicks up to this point has only come from a small number of

customers, so there’s plenty of room for ongoing growth. It

should also be noted that even though we have seen strong growth in

click revenue, this growth has been limited by the elimination of

lower quality traffic campaigns beginning in Q2 2017.

On

Slide 14, you’ll see that J.D. Power LMC Automotive is

forecasting 2018 total light vehicle sales to be just under 17

million units, a decrease of 1.4% from 2017. And retail light

vehicle sales are forecasted at 13.7 million units, which is a 1.7%

decrease from last year. As noted in our press release today, given

the anticipated management changes at this time, we will not be

issuing a 2018 business outlook.

Though

we find ourselves in a challenging period as we work to restore our

retail dealer footprint and traffic acquisition methodologies, we

continue to have robust relationships with our OEM partners and

they continue to have strong demand for our core leads and traffic

products. We are still in the early stages of expanding and

optimizing our proprietary AutoWeb traffic solutions and demand for

high-quality website traffic in the automotive industry continues

to grow.

Also,

while we’re committed to prudently managing our expenses

during this management transition, we are actively enhancing the

experience and capabilities of our strong portfolio of

consumer-facing automotive research sites, which includes

usedcars.com, car.com, autoweb.com, usedtrucks.com and

autobytel.com.

As we

continue to optimize our consumer acquisition practice, we are

embracing new platforms and strategies as we look to accelerate the

diversification of our revenue and traffic streams.

Operator, at this

time, we will open the call for questions.

Operator:

Thank you, sir.

Ladies and gentlemen, if you have a question at this time, pleas

press star then one on your touchtone telephone. If your question

has been answered or you wish to remove yourself from the queue,

please press the pound key. To prevent any background noise, we ask

that you please place your line on mute once your question has been

stated. Our first question comes from Sameet Sinha of B. Riley

FBR.

Sameet

Sinha:

A couple of

questions here. So one thing about traffic. So how -- I agree

you’re not giving guidance, but how are the trends been so

far in Q1? Are you seeing the same pressures you saw in Q4, and

that’s how we should be thinking about for the next -- for

the foreseeable future until a resolution is reached there? Or is

this -- are the trends worsening at this point? Secondly, can you

talk about -- you spoke about some cost-cutting initiatives. And

it’s -- where exactly are you taking those cuts? Some details

will be helpful.

Kimberly

Boren:

Sameet, the trends

have been choppy in the first quarter. So in January and February,

it was consistent with what we’re seeing in the fourth

quarter. March is improving significantly. And so it’s too

early to tell, but for your assumptions and modeling, I would

probably assume the same trends for the balance of the year. In

regards to the headcount that came out, it was really across all

functions.

It was

focused a little bit heavier on our operations in Los Angeles,

which was some of the consumer-facing and data operations,

we’ve gone ahead and consolidated those functions into

Irvine. But again, overall, it was across multiple

functions.

Operator:

Our next question

comes from Ed Woo of Ascendiant Capital.

Ed

Woo:

I had a question in

terms of the industry. 1% decline doesn’t seem like

(inaudible). Is there anything that we should be aware of

that’s going to affect on how dealer and OEM spends for leads

next year?

Jeffrey

Coats:

I don’t think

it will have a negative impact on the way dealers or OEMs spend for

leads next year. If anything, it may help. I mean what we normally

see is when foot traffic and the dealership starts slowing down,

they turn to their other traffic sources, lead providers, leads of

their own websites, some things like that. So I think we’re

in a period right now that is probably reasonably positive for

those of us in the digital marketing business.

Ed

Woo:

Great. And then

another question I have is -- last year, you guys were talking,

talked, about wrapping up your used car business. Is that -- how is

that going?

Jeffrey

Coats:

We are still

investing behind the used car business. It has been impacted

somewhat by our ongoing traffic issues, but it is still a priority

for us and it is still something that we’re expanding

resources on. And we do still believe it is a very big opportunity

for us as we continue to grow towards it.

Ed

Woo:

Great. And then my

last question is, obviously, you guys have made some changes to

kind of offset the traffic issues. But what do you think are some

of the biggest risks that could possibly change that? And how much

of it is you can get competitors spend versus any type of algorithm

changes by Google?

Jeffrey

Coats:

I would say, based

on our pretty extensive conversations with our friends at Google,

this is not algorithm changes. It’s just broad dollars coming

into the market. I think if you look back at what happened in the

-- probably beginning in the second quarter, but really

pronouncedly picking up in the third and fourth quarters,

particularly as some of the folks that we compete against came into

the market, other new models like (inaudible), which we do not

really compete against, but which is also spending heavily in the

SCM markets.

There’s just

massive amounts of traffic coming into the markets. Our

understanding is CarGurus, Cars.com, Autotrader. I mean we can see

some level of that in the search markets themselves, but you can

also read about it just by reading what their commentaries are and

their quarterly results and/or in the original S-1s.They certainly

want to come out of the gates with some strong growth rates, and a

really great way to do that is to spend a lot of

money.

And by

traffic, I think most of us in the industry, most of the people

that we talk to don’t believe, however, those spending levels

are sustainable. So it should settle down as we move into 2018, but

that does remain to be seen.

Operator:

Our next question

comes from Gary Prestopino of Barrington Research.

Gary

Prestopino:

I was going to ask

that you mentioned competitors that were spending, but fully aware

of what some of these other online platforms are doing. But I guess

the question that I would have is, is this a permanent kind of

secular shift change, Jeff? I mean you say that you don’t

think they can keep spending money like this, but

Autotrader’s not public. I know they’re having their

own internal problems, but Cars.com and CarGurus are, and

they’re basically meeting or exceeding their numbers, so at

least in this latest quarter when there was some heightened

spending. So any commentary you could share, your thoughts on that,

would be very helpful.

Jeffrey

Coats:

Gary, I certainly

don’t have a crystal ball, and I certainly don’t have

any inside knowledge. But from talking to people in the search

business and around the automotive industry that have seen things

like this happened in the past, the expectation is that they just

cannot continue to spend at these really extremely high levels for

extended periods of time. Now, right now, neither one of them, as I

understand it is -- or certainly one of them is not being measured

based upon on their bottom line margins at all, they’re only

being measured on growth.

And it

will maybe a little easier for them to continue to spend some of

those dollars, but again, we just don’t think it’s

sustainable over an extended period of time. We could be wrong. It

could be a secular shift. But from talking to experts and our

partners on the search side, they, at least, at this point,

don’t think that, that’s the case. We are expanding our

search partners. We are doing more with Facebook and Credio and

Instagram. We have also done this new license with DealerX that

we’re still in a very, very, very early phases of

implementing.

So we

remain hopeful that we can, in fact, get our traffic generation

back at the levels that we needed to be at in the margin profiles

that we needed to be. But obviously, we have some work cut out for

us to do that.

Gary

Prestopino:

Yes, okay,

that’s fine. And then could you -- Kim, could you maybe just

into -- with this goodwill impairment, with $38 million, which is

more than 30% of your preannounced equity value in the market. So

is this really pertaining to valuations that were assigned to the

acquisitions? And that the acquisitions are not delivering returns

that you expected? Or is it something else that’s closing

this write-down?

Kimberly

Boren:

That’s a good

question, Gary. I wouldn’t say that the acquisitions are not

delivering the returns that were expected since the goodwill is not

an asset that you amortize. I would say that because of the

performance in the lead side of the business, that impacted the

stock, which is the primary factor in the valuation. So

that’s what the driving factor is, less from a cash flow and

a business perspective and more so from a market

perspective.

Jeffrey

Coats:

And for what

it’s worth what the measurement date of October 1, which is

the measurement date we’ve been using every year for several

years, was very close to our 52-week low trading price. It’s

not right on it, but certainly very close to it. And so it’s

one of those “perfect storm” kind of situations. And

then you know the tax law changes which affected the write-downs we

had to take in our tax assets also exacerbated this, because it

puts us in a negative 3-year EBITDA position as part of doing all

that.

Operator:

Thank you. And

again, ladies and gentlemen, if you do have a questions at this

time, please press star then one on your touchtone telephone. Our

next question comes from Bruce Goldfarb of Lakestreet

Capital.

Bruce

Goldfarb:

Jeff, Kim, just a

few questions. The lead business, given the contraction of

‘17, when do you guys think -- when do you expect it to start

to stabilize?

Jeffrey

Coats:

We are still in the

midst of working to stabilize it. I think that it’s not a

demand problem that we have, it’s a supply problem. If we

equally had a demand problem, we’d be a whole lot more

worried about it. But it’s really almost entirely a supply

problem. So as we continue to rebuild our traffic supplies, as we

continue to improve the margin coming out of our traffic supply, we

should be able to rebuild leads.

I mean,

leads are pretty standard, they’re pretty basic. It’s

somebody’s name and telephone number and e-mail address and

maybe their address and no matter what a dealer does, no matter

what social methodology they use, no matter what a salesman does,

they need to capture that information to have an ongoing dialogue

with the consumer. And we’re kind of the front line of that.

So it’s not that leads are out-of-favor, it’s simply

right now, we’re just having a real supply

issue.

And we

do expect to work through that. We do expect to make progress on

that during the course of this year. Our new DealerX license, we

think will help, but we also think we’ll see some help coming

out of our own direct relationships with Facebook and Credio and

other players like that, as we began to generate more traffic from

them as well.

Bruce

Goldfarb:

Okay. And then, do

you expect any material contribution from used car leads in

‘18? And when do you think those -- so when do you think --

what part of the year do you think that’ll start to show or

start to have an impact?

Jeffrey

Coats:

I would say,

honestly, we will start seeing some benefits from used car leads

during the course of the year, but it’s not going to be as

robust as we would have initially expected, again, in part because

of the ongoing traffic issues. The traffic issues that use just the

way they do knew and so we definitely are still feeling that

impact, unfortunately.

Bruce

Goldfarb:

And then PTC has

performed well. And I know you’re not really projecting it in

‘18, but what -- I don’t know, could you guesstimate a

growth rate for ‘18 for that segment?

Jeffrey

Coats:

We would probably

still expect it to grow nicely during the course of this year. It

has impacted somewhat by our ongoing traffic issues, but we would

still expect it to grow at a double-digit rate this

year.

Operator:

Thank you. And

ladies and gentlemen, this does conclude our question-and-answer

session. I would now like to turn the call back over to Mr. Coats

for closing remarks.

Jeffrey

Coats:

Thank you all for

joining today. I know the conversation was not the most

heartwarming or what you wanted to hear. 2017 was a tough year for

us. But certainly, we made a lot of progress in identifying where

our issues are. We are working hard to address those during

2018.

I want

to thank everybody for joining us today. I also sincerely want to

thank our team of extremely dedicated employees for all of the hard

work and all of the extra hours that they’ve been putting in

over the many, many months we’ve been working through

this.

And in

closing, I’d also like to personally thank Kim Boren for her

insights and hard work and dedication to the company over the years

she’s been here. It has been a true pleasure to work with

you, Kim. So thank you very much.

Kimberly

Boren:

Thank you, Jeff.

Likewise.

Jeffrey

Coats:

Thank you,

operator.

Operator:

Ladies and

gentlemen, this does conclude today’s teleconference. You may

disconnect your lines at this time. Thank you for your

participation.

END