Attached files

| file | filename |

|---|---|

| 8-K - 8-K - XpresSpa Group, Inc. | tv488282_8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION 30 th Annual ROTH Conference NASDAQ: XSPA

Safe Harbor Statement This presentation includes forward - looking statements, which may be identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “should,” “seeks,” ”future,” “continue,” or the negative of such terms, or other comparable terminology. Forward - looking statements relating to expectations about future results or events are based upon information available to XpresSpa Group as of today's date, and are not guarantees of the future performance of the company, and actual results may vary materially from the results and expectations discussed. Additional information concerning these and other risks is contained in XpresSpa Group’s most recently filed Annual Report on Form 10 - K, Quarterly Report on Form 10 - Q, recent Current Reports on Form 8 - K and other SEC filings. All subsequent written and oral forward - looking statements concerning XpresSpa Group, or other matters and attributable to XpresSpa Group or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. XpresSpa Group does not undertake any obligation to publicly update any of these forward - looking statements to reflect events or circumstances that may arise after the date hereof. Trademark Usage XpresSpa Group the XpresSpa Group logo , and other XpresSpa Group trademarks , service marks, and designs are registered or unregistered trademarks of XpresSpa Group Inc . and itssubsidiaries in the United States and in foreign countries. This presentation contains trade names, trademarks and service marks of other companies. All such trade names, trademarksand service marks of other companies are property of their respective owners . XpresSpa Group Inc . does not intend its use or display of other parties’ trade names, trademarks andservice marks to imply a relationship with, or endorsement or sponsorship of or by, such other parties. Use of Non - GAAP Financial Measures XpresSpa uses GAAP and non - GAAP measurements to assess the trends in its business. Items XpresSpa reviews on an ongoing basis are revenues, Comp Store Sales (which it defines assales from stores opened longer than a year compared to the same period sales of those stores a year ago), store contribution margins, and number of transactions (which is a way tomeasure traffic in spas). In addition, XpresSpa monitors stores’ performance compared to its model store metrics to ensure that it is consistently opening spas that have the same orsimilar return dynamics as historical stores. XpresSpa believes the trends exhibited by its business are strong and substantiate its continued investment in additional locations andinfrastructure. Please note that XpresSpa Group’ s consolidated Statement of Operations includes XpresSpa results from December 23, 2016 onwards. During the full year of 2016, XpresSpa generated $43.4million of revenue. Disclaimers 2

Wellness On The Go We are the leader in fast - spa services, providing premier wellness solutions in 30 minutes or less . Dedicated to keeping people looking and feeling their best on the go . Our cutting - edge services and products are designed to move with you . We ar e 3

Investment Considerations • Large and Growing wellness marketplace supported by favorable demographics and spending trends • Dominant Branded position in growing c ategory • Transition to Pure Play Health and Wellness company nearly complete • Partnerships with health and experience economy leaders Elevating Awareness • Vast Expansion Potential in both airport and off - airport locations • Approaching Inflection Point to Adjusted EBITDA Profitability • Attractive Unit Economics with compelling ROI • Technology - based process improvements expanding operating leverage • Existing net operating loss carryforwards 4

The Experience Economy & Wellness Industry • Nearly 1 million XpresSpa customers in 2017 • XpresSpa services are " not - Amazonable ” • Consumer Spending patterns are shifting to experience - based spending . 72 % of millennials would rather spend money on experiences than on material goods . 3 • Millennials Spend Nearly 25% of Disposable Income on Health and Wellness. 2 3 Forbes, 2017 1 Global Wellness Institute , 201 6 2 Market Wired , 2017 5 • The global wellness industry is a $3.7 trillion market. 1

In 2018 , air travel is projected to g r o w b y 6% . 1 Average wait time is 137 minutes . 2 ¹ IATA, 2017 2 Aviation Pros, 2017 6

11 Xp r esSpa is the answer to growing traveler demands Increased travelers, security and wait times have driven innovation and growth in airport retail Travelers at large hub airports typically spend ~137 minutes in the airport after going through security. 1 • Nearly 20% of flights were delayed in 2017. 2 Premium concepts like XpresSpa are suited for typical traveler demographic • Frequent fliers (18% of travelers) have a HHI > $100,000. 3 • 70 % of purchases occur on impulse because these affluent customers are bored, rushed, and stressed. 4 Airport infrastructure spending is increasing • $ 1.2 - 1.5 trillion is expected to be spent on global airport infrastructure development up to 2030. 5 1 Aviation Pros, 2017 2 TRANSTATS, 2017 4 Airport Revenue News 7 3 Airport World Magazine, 2016 5 New Market Research & Micro Market Monitor

We offer busy people a moment to relax and renew on the go Brand Guidelines 8

Logo Alternate Lockups The leading airport spa company in the world Over 50% market sha r e in the U.S . • P erfected the fast - spa format • W in approximately 80% of RFPs we participate in • 57 locations in 23 airports globally 9

1 based on company websites as of 3 /8/18 Dominant Market Share Position ` TOTAL DOMESTIC TOTAL DOMESTIC TOTAL DOMESTIC TOTAL DOMESTIC STORES STORES STORES STORES STORES STORES STORES STORES BE RELAX 1 MASSAGEBAR 1 TERMINAL GETAWAY 1 57 52 36 14 7 7 5 5 10

11

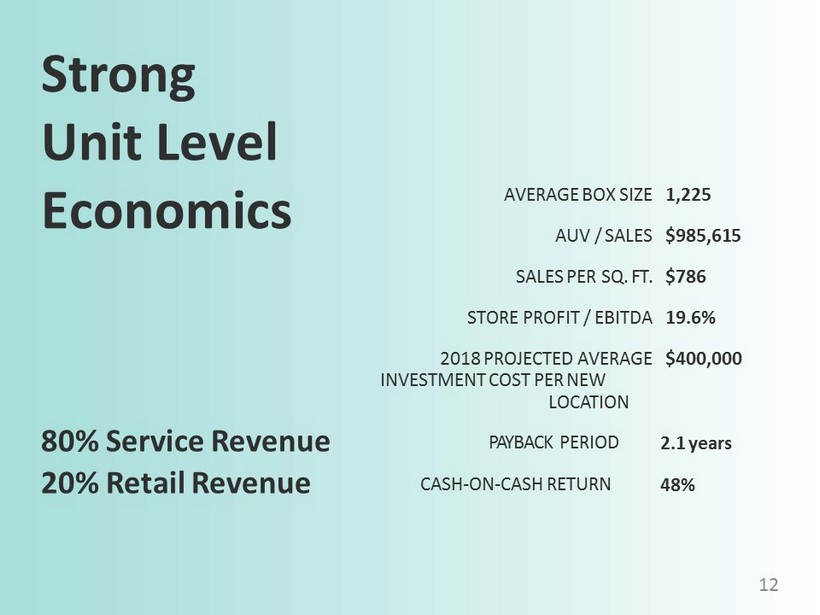

1 1 St r ong Unit Level Economics 80% Service Revenue 20% Retail Revenue AVERAGE BOX SIZE 1,225 AUV / SALES $ 985,615 SALES PER SQ. FT. $786 STORE PROFIT / EBITDA 19.6% 2018 PROJECTED AVERAGE $400,000 INVESTMENT COST PER NEW LOCATION PAYBACK PERIOD 2.1 years CASH - ON - CASH RETURN 48% 12

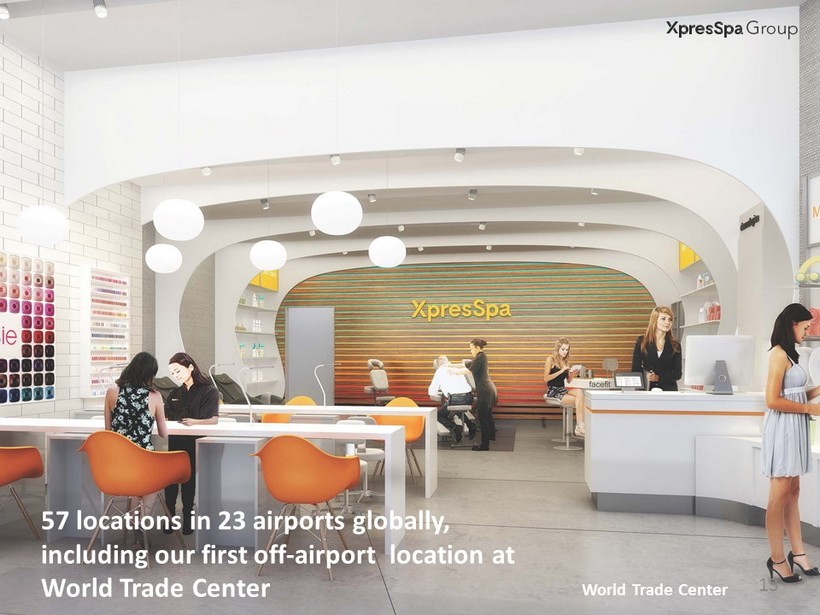

World Trade Center 5 7 locations in 23 airports globally, including our first off - airport location at W orld Trade Center 13

1 7 JFK Terminal 8 14

Accelerating Growth Under New Management 2017 Accomplishments • Opened Net 9 Locations • Same store sales growth • Recruited top talent for corporate and field teams • Improved technology in stores • Major rebrand completed • Introduced retail partnerships with Dermalogica and Essie • Created innovate partnership for XpresSpa branded product with Capelli 15

Las Vegas Salt Lake City 2 3 Phoenix 2 Santa Ana 1 Los Angeles 2 San Francisco 4 Denver 2 Minneapolis 3 Chicago 1 Pittsbu r gh 2 Amsterdam 3 Dubai 2 Dallas 3 Houston 1 New York 1 0 Philadelphia Washington, DC 3 1 Raleigh 1 Charlotte 3 Atlanta Orlando 2 4 Miami 2 Established Airport P r esence XpresSpa Airport Market Opportunity 1 st tier airports: 170 2 nd tier airports: 100 Int’l airports: 170 - 200 Over 10 new locations already scheduled to open in 2018 5 7 locations globally 16 *subject to New York State approval of Franchise Disclosure Document

Brand Extension XpresRecover launch ed first location in first half of 2018. Featuring: • cryotherapy • compression therapy • salt chambers • healthy grab & go 17

Off - Airport - Major property/mall owners courting EXPERIENCE retailers - XpresSpa in high demand - First location: WTC “Oculus” - Carefully evaluating opportunity 18 XpresSpa Franchise - Franchise disclosure documents approved January 2018 - Built pipeline of 800 interested franchisees since XpresSpa inception - Marketing to potential partners at airport conferences - Initial focus: tier 2 airports Additional Growth Opportunities

1 based on 26.5 million shares of common stock outstanding on September 30 , 2017 and closing price of $1.52 on January 5, 2018 2 as of January 5, 2018 L everaging and scaling XpresSpa to build a preeminent pure play health and wellness services company . 19 Fixed Stores, Culture 2017 • Team in place • Branded focus on Health and Wellness • New POS Efficiency and Growth 2018 • POS and CRM technology / Airport traffic analysis • Leverage unique airport EXPERIENCE offering with partners • Launch Franchising • New XpresSpa openings, including XpresRecover Acceleration 2019 • Extensions of Health and Wellness branding • International partnership • New XpresSpa openings Dominance 2020 • Potential M&A • Expand globally • Become dominant player in on - the - go wellness experience

ANDREW PERLMAN CEO & Director XpresSpa Group ŕ Former CEO of FORM Holdings ŕ Former Head of Digital, Classic Media ŕ Former Vice President of Global Digital Business Development, EMI Music ŕ George Washington University, B.A. ED JANKOWSKI President of XpresSpa ŕ Former Vice President, Luxottica ŕ Former Senior Vice President, Godiva ŕ Former Chief Operating Officer, Safilo Group ŕ Former President, World Duty Free Group ŕ Former Vice President, Liz Claiborne ANASTASIA NYRKOVSKAYA CPA, CFO & Treasurer ŕ Former Vice President and Assistant Global Controller, NBC Universal Media, LLC ŕ Former Auditor, KPMG LLP ŕ Moscow State University of Publishing and Printing Arts Team in Place to Execute Growth Strategy KERRY DUCHI Visual, Merchandising and Marketing Manager ŕ Former Retail Merchandising & Analytics Manager, Godiva ŕ Former Merchandise Planner, Calvin Klein Jeans ŕ Former Merchandiser, Polo Ralph Lauren ŕ Northwood University, B.A. IGA WYRZYKOWSKI Construction Project Manager ŕ Former Project Architect, Gensler ŕ Former Project Manager for Drybar, Heitler Houstoun Architects ŕ Wentworth Institute of Technology, BSA & M.Arch ANGELIA YAUN Senior Director of Spas XpresSpa, North America ŕ Former Senior Director of Stores, Luxottica Luxury ŕ Former Regional Director, Godiva ŕ Former Regional Manager Safilo/Solstice 20

Capitalization Table 1 ¹ as of September 18, 2017 3 W arrants convertible into 343,377 shares of common stock with a strike price of $17.60 expired on July 19, 2017 FULLY DILUTED SHARES 38,324,415 COMMON STOCK 26,540,689 PREFERRED STOCK (AS CONVERTED BASIS AT $6.00 PER SHARE) 3,364,429 WARRANTS OUTSTANDING 3 $5.00 STRIKE, EXPIRE APRIL 2021 50,000 $3.00 STRIKE, EXPIRE MAY 2020 537,500 $3.00 STRIKE, EXPIRE OCTOBER 2021 2,500,000 EMPLOYEE INCENTIVE PLAN OUTSTANDING 5,331,797 21 2 $20 million face value, matures December 2023, payable at maturity in either cash or stock at then - current market price

2 Opportunity 22 • G rowth of wellness market • Powerful brand • Store operating model • Expansion of existing model • E xtensive ways to leverage the brand experience to partner and expand

26 780 3rd Avenue, 12th Floor New York, NY 10017 212 - 309 - 7549 IR@XpresSpaGroup.com