Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - APX Group Holdings, Inc. | d532110d8k.htm |

Exhibit 99.1

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

CORPORATE PARTICIPANTS

Dale Gerard, Senior Vice President, Finance and Treasurer

Todd Pedersen, Chief Executive Officer

Mark Davies, Chief Financial Officer

Alex Dunn, President

CONFERENCE CALL PARTICIPANTS

Jeffrey Kessler, Imperial Capital

Ashish Nair, Citigroup

Rich Gross (phon)

Geoffrey McKinney, Deutsche Bank AG

PRESENTATION

Operator:

Good afternoon. My name is Jesse, and I will be your conference Operator today. At this time, I would like to welcome everyone to Vivint’s 2017 Fourth Quarter and Full Year Earnings Call. All lines have been placed on mute to prevent any background noise. After the speakers’ remarks, there will be a question-and-answer session. If you would like to ask a question during this time, please press star, then the number one on your telephone keypad. If you would like to withdraw your question, press the pound key. Thank you.

Dale Gerard, Senior Vice President of Finance and Treasurer, you may begin your conference.

Dale Gerard:

Thanks, Jesse. Good afternoon, everyone. Thank you for joining us this afternoon to discuss the results for the three-month and twelve-month period ended December 31, 2017. Joining me on the conference call this afternoon are Todd Pedersen, APX Group’s Chief Executive Officer; Alex Dunn, APX Group’s President; and Mark Davies, APX Group’s Chief Financial Officer.

I would like to begin by reminding everyone that the discussion today may contain forward-looking statements, including with regard to the Company’s future performance and prospects. Forward-looking statements are inherently subject to risks, uncertainties and assumptions and are not guarantees of performance. You should not put undue reliance on these statements. You should understand that a number of important factors, including the items discussed under the Risk Factors in our most recent filing

1

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

with the SEC and such factors may be updated from time to time in our filings with the SEC, which are available on our Investor Relations section of our website, could cause actual results to differ materially from those expressed or implied in our forward-looking statements. The Company takes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

In today’s remarks, we will also refer to certain non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most comparable measures calculated and presented in accordance with GAAP are available in the earnings release and the accompanying presentation or in the Financial Information page of the Investor Relations portion of our website.

Now I’ll turn the call over to Alex.

Alex Dunn:

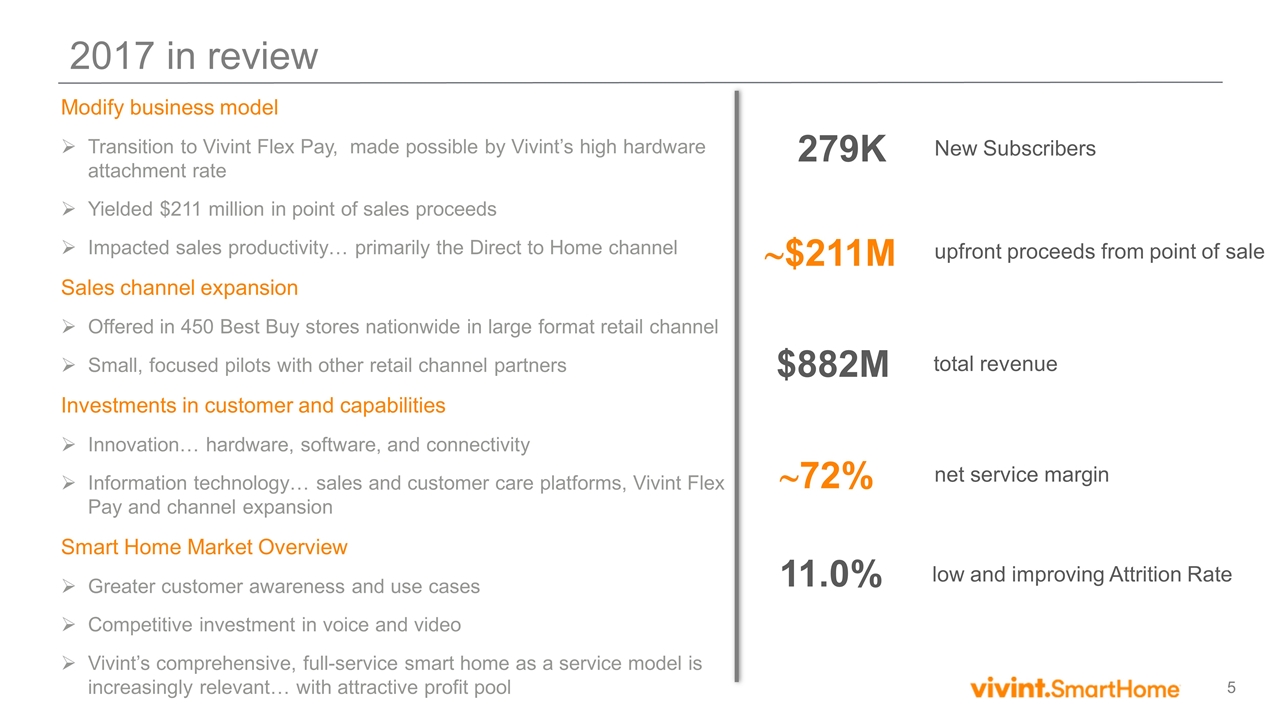

Thanks, Dale. Thanks for getting on the call today. Twenty seventeen was a really exciting and transformational year for Vivint. The first thing that was very transformational for us was Flex Pay, as we’ve talked about before. Now that we have a full year of the Flex Pay transformation under our belt, we wanted to talk a little bit about it.

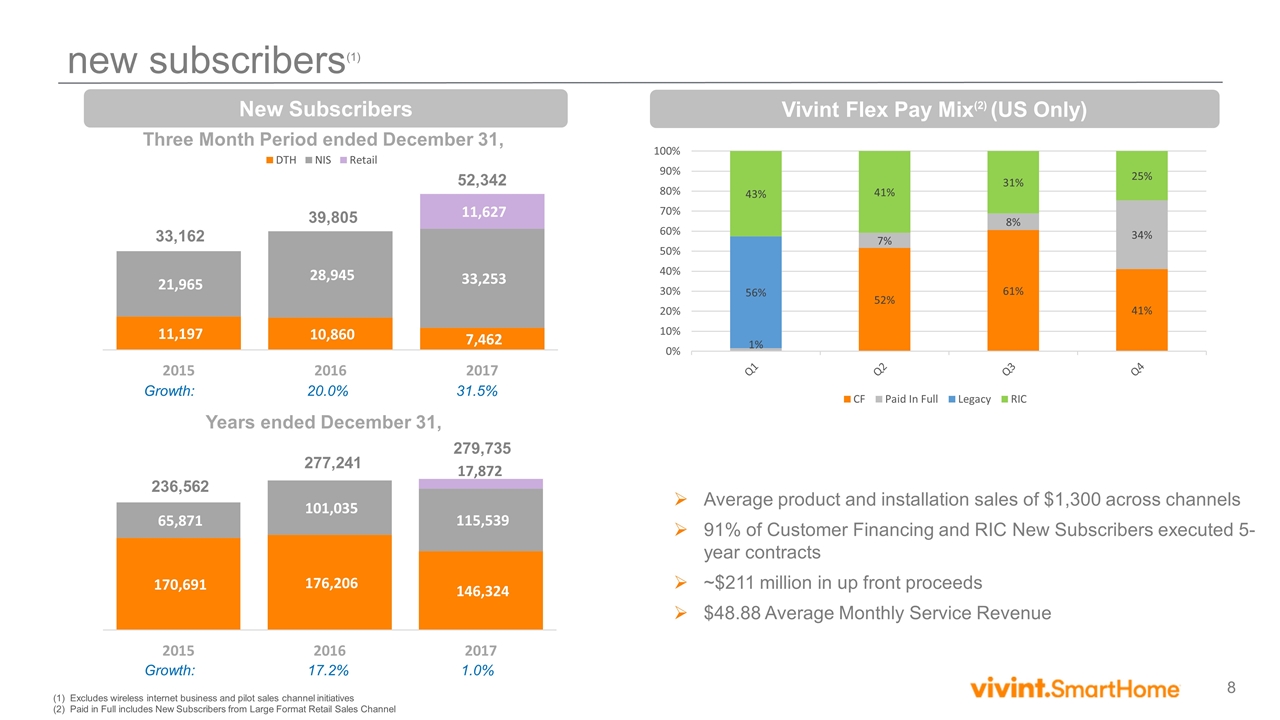

The first thing is is it yielded $211 million in point-of-sale proceeds, which is from a balance sheet perspective real transformational for our business. One of the negative aspects to it, and this was one that we anticipated, is that it would take a while for our sales channels to make the change from the old model to the new Flex Pay model, and so because of that we saw a little bit of decrease in volume specifically in our direct-to-home channel.

Sales channel expansion was another thing that was transformational for our business. Really in the fourth quarter we were able to spinout 450 Best Buy stores nationwide in large format retail channel. In addition to that, we had and have some small focus pilots with other retail channel partners. The other thing that we really focused on this last year was some investments, both in the customer and our capabilities. We have specifically invested some money into innovation center around hardware, software and specifically connectivity.

As we’ve seen over the last five years our ARPU has increased by 19% on new customers, and our service costs has essentially remained flat. The reason ARPU has increased is specifically around the adoption of new services, Smart Home services. And something that is really driving a lot of the growth in the last couple of years are cameras - outdoor cameras, doorbell cameras and indoor cameras all are seeing explosive growth in terms of adoption.

One of the challenges associated with cameras is they are a WiFi device that is high bandwidth and always need to be connected. So one of the things that we’re seeing is some pressure on servicing cost around supporting kind of this proliferation of cameras in the system, and so one of the investments we’ve made in innovation is around shoring up the reliability and our ability to diagnose kind of WiFi and connectivity and camera problems.

The other area that we’ve invested in is information technology around sales and customer care platforms, Vivint Flex Pay and channel expansion. So you’ll see that we have increased some investment both in IT and the innovation center, and specifically in IT around the initiatives that we rolled out this year. So Flex Pay was a heavy lift for the IT department. In addition, Best Buy. We are integrated with their platform and their point-of-sale and so offering kind of the seamless experience to the consumer was done through the use of technology. So you’ll see kind of an extra investment there.

The other thing that’s exciting is all the developments in the smart home space. There’s really a greater customer awareness of use cases. We’re seeing when we started selling Smart Home in 2010 we had to take a lot of time to explain to consumers what it was and why they might want it. Now we’re seeing pull

2

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

through specifically in cameras and voice assistance. So really the two areas that there is a lot of growth and investment from other players in the space. The good thing is is that we are integrated with most of the companies that are making big investments in the space, both Nest and Google and in Amazon. So these services really are an opportunity for us to continue to grow our business.

Then just finally I would say one of the things that I think we had a thesis early on around is is that providing Smart Home services, technology-enabled Smart Home services, was really the winning business model, both for consumers and for businesses that employed that strategy and we’re seeing more and more that that is the winning strategy to allow a business to create a lot of value in a sustainable business model.

Just some quick stats around 2017. So we had 279,000 new subscribers. I mentioned the $211 million in cash proceeds from Flex Pay, $882 million in total revenue, the 72% net service margin and our attrition is down to 11%.

I’ll now turn the time over to Mark Davies.

Mark Davies:

Thanks, Alex. So we’ll walk through a number of the standard slides and then we’ll have Todd Pedersen close this out and we’ll get to Q&A.

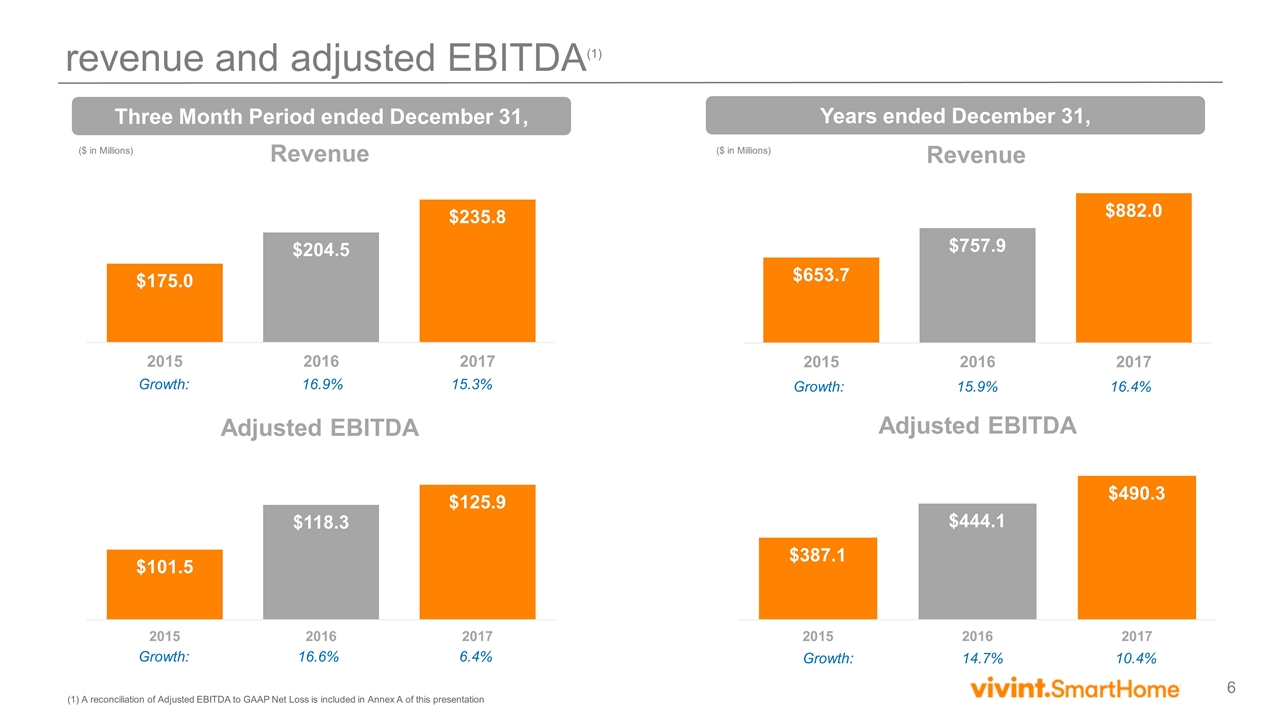

On Slide number 6, in the quarter, we drove $235 million in revenue, which was a 15% growth year-over-year, which pushed our year-over-year growth to 16.4% on that $882 million that Alex just mentioned. On the Adjusted EBITDA perspective, for the quarter, Adjusted EBITDA grew 6.4%. There were two impacts to the quarter that again Alex just mentioned. One is the service costs. Service costs increased about $0.97 year-over-year from Q4 ‘16 to Q4 ‘17.

Two primary drivers. One, we see a uptick in service cost due to the increased penetration of Smart Home devices, primarily cameras, and we’re attaching just about two cameras per install. That was one driver. The second driver in service, and it represents about $5 million, was our decision to ensure that the field service professionals would have appropriate time to service, i.e., the more service professionals we have in the field the quicker we can get to a customer where there is a problem, and we also increased a bit of investment in our tech support personnel and our call centers to make sure that time to answer the phones was at a level that we thought was appropriate.

The second piece in Q4 in terms of an EBITDA impact is the G&A expenses around IT and innovation and those were—it’s primarily investment to scale for the future. We saw this once before at the very beginning of this ownership with Blackstone. We invested in innovation and engineering that was about four years ago and we’re just topping that off right now to make sure that we have the assets and the capabilities to move forward as we grow revenue, grow service platforms and channel platforms. For the year, EBITDA grew 10.4% to $490 million.

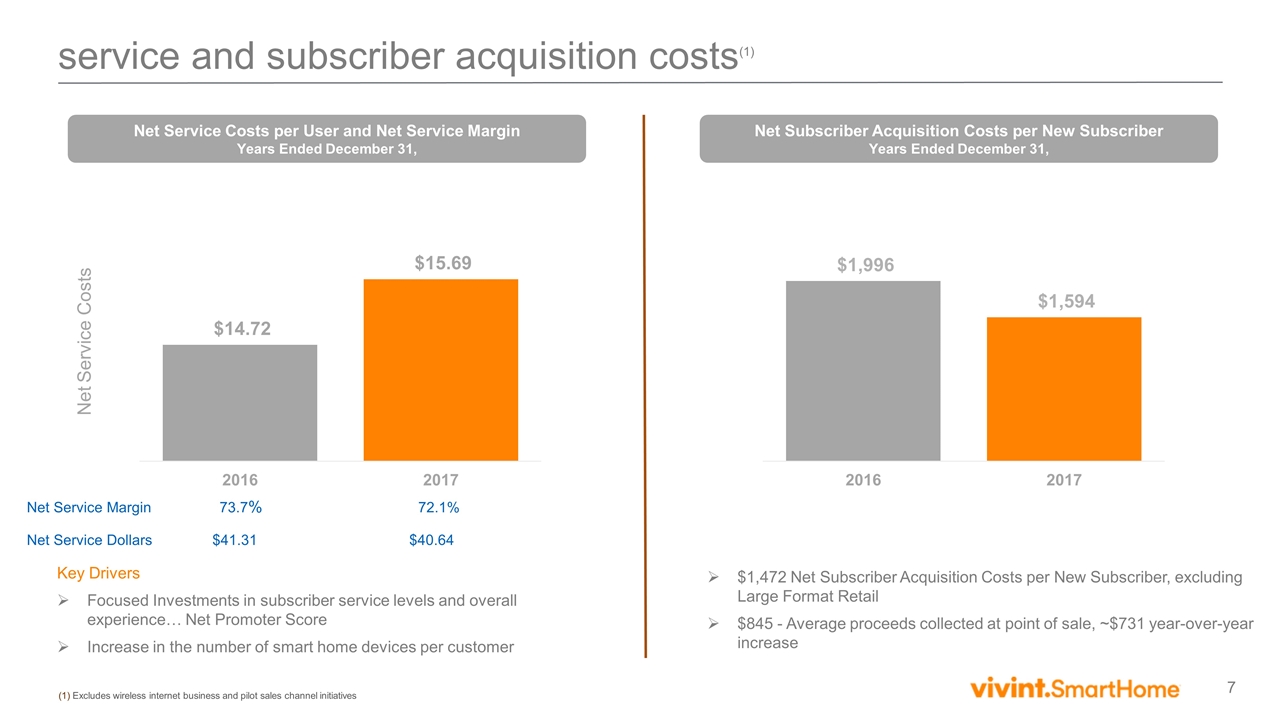

On Page 7, a bit of detail on service cost and creation costs. This shows the $0.97 on the left-hand side; service cost increasing about 6.5%. It’s probably worth noting, it’s something we spend a lot of time, is looking at the service margin contribution per month per customer. In 2013, we generated about on a new subscriber $58 of ARPU, with a cost of about $16 per month. So we generated about $42 of margin. In 2017, a like-for-like comparison would be about $69 of revenue on $16 of cost, and that generated 53%. So the margin is up almost 18%. There is—we expect the service margins, as you’ll notice we’re at 72% for the year, to stay relatively stable to that, but as we continue to grow content and devices we expect service cost to somewhat track with that.

On the creation cost, really good improvement there. A lot of it based on Flex Pay. Our creation cost in aggregate across all three channels, including retail, went from $19.96 to $15.94 on a net creation basis. So that drop of $400 is due to about eight months of Flex Pay or eight months of the Citizens’ portion of

3

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Flex Pay. If we normalize out the Best Buy—and the investment in Best Buy primarily went into creation cost. And that’s the start-up cost associated with building out and staffing the 450 stores and a level of kind of low productivity as people came up to speed on sales and install, new hires. Our creation cost without Best Buy in our core channel was $14.72. So a reduction of $5.24. So really good progress on that. Average proceeds collected at point-of-sale were $845, up $722 year-over-year.

Just for a point of reference for anyone who’s modeling this. Our creation cost—I’m sorry, our point-of-sale proceeds on a consumer finance Citizen program is about $1,600, and our paid in full, which is just people paying us for the hardware at point-of-sale, is about $1,200. And that’s the generation of the creation cost reduction.

On Slide number 8 is a breakout of new subscribers. As Alex mentioned, as you see on the bottom left-hand quadrant of this—it’s not a quadrant, there’s three elements here—is our year-over-year sales. We did 270,000—almost 280,000 new subscribers. We had a 30,000 drop—30,000 new subscriber drop in direct-to-home, which was 17%, which was then offset by a 15% increase in NIS to $115,000. Both of those were muted by this transition of Flex Pay where we’re unbundling hardware and service. We expect that those productivity numbers in our direct-to-home and NIS will come back to a more natural growth level, but that’s what it was in 2017. And then we drove about 18,000 sales through our retail format in—across 2017 and about two thirds of those came in Q4.

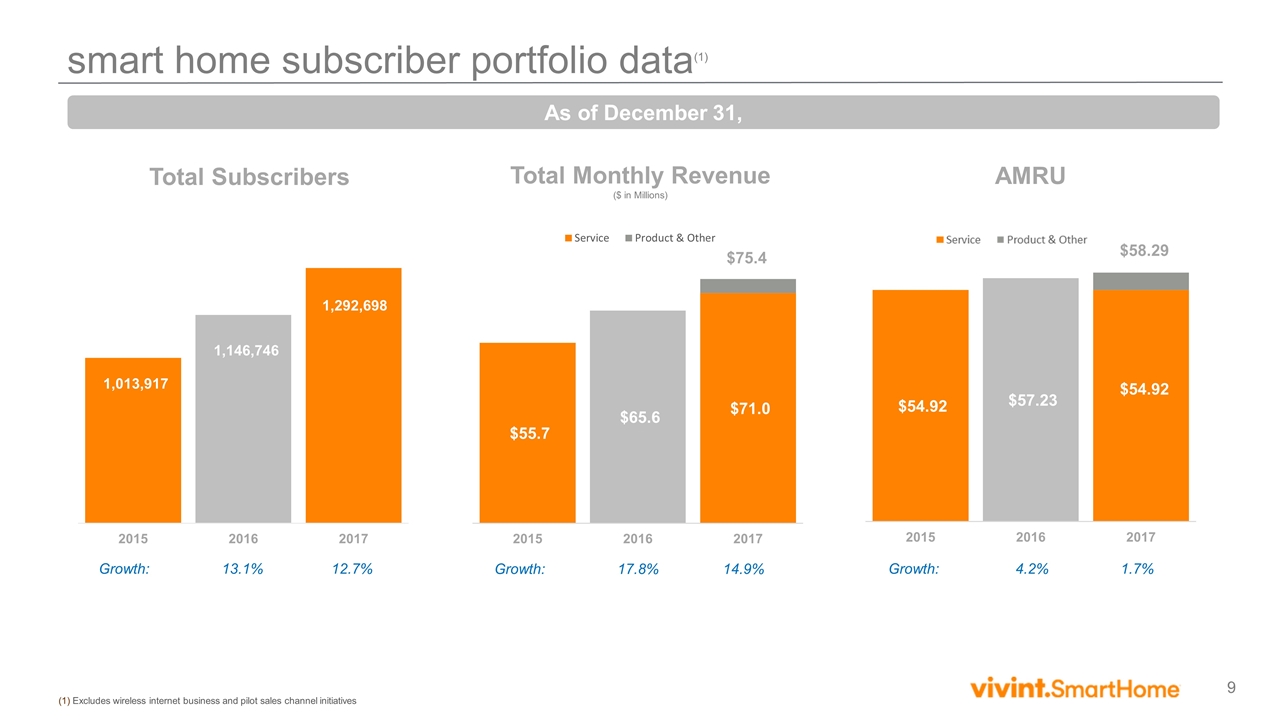

If you look at Slide number 9, this just breaks out our install base. We exited the year about 1.3 million customers, up 12.7% for the year. If you look at our total monthly recurring revenue, $75.4 million. There’s $71 million in service and $4.4 million in the imputed interest off of RICs and the hardware amortization. So about $75 million of recurring revenue, and that represents about 85% of the $882 million of total revenue. And then our average revenue per user is up slightly year-over-year to $58.29 from the $57.23.

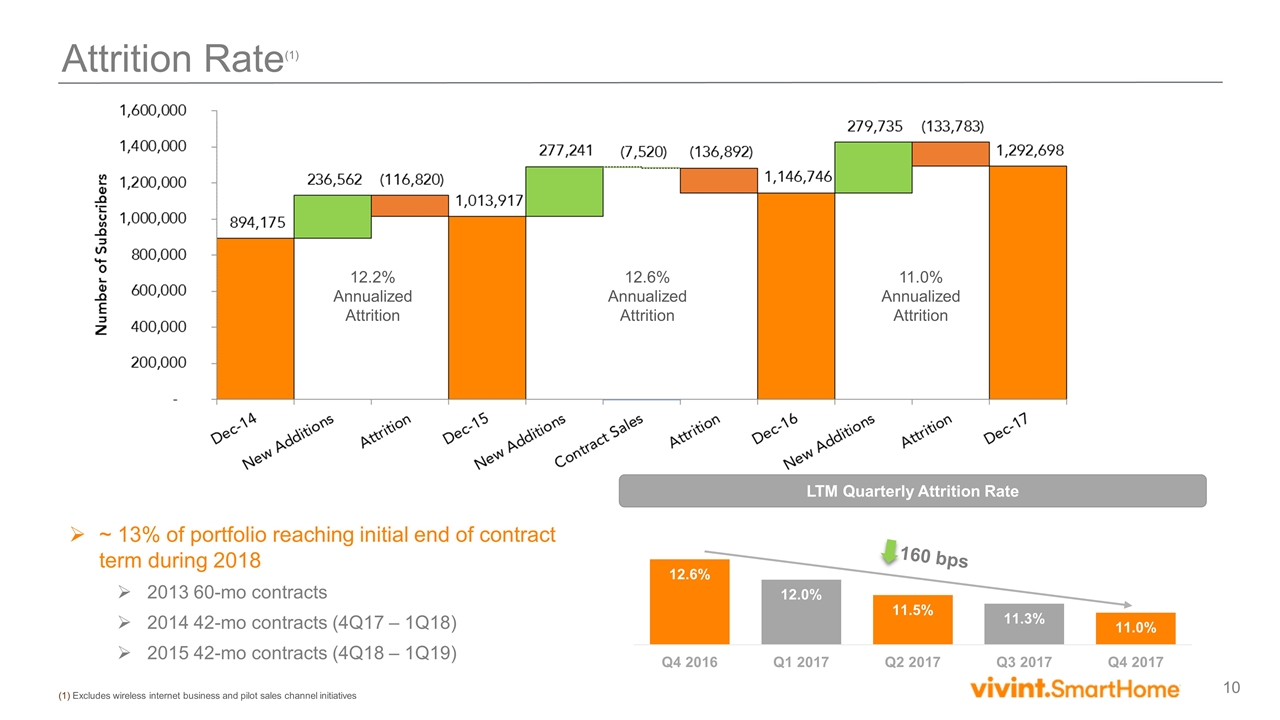

And then finally, in terms of the operational metrics, Slide number 10 just goes through our normal walk on attrition and customer growth. We added the 280,000 units, 11% annualized attrition. The best that we’ve seen in quite some time. We still believe that we have stable cohort attrition. Some of the 11%, as you’ve seen it come down, is due to the way that our cohorts are coming out of contract and coming up for renewal. We expect for 2018 for those numbers to be roughly 11.5% to 12%. So we’ll continue to see really good performance on our attrition.

With that, I’ll turn it over to Todd for a wrap up and a bit of discussion around 2018.

Todd Pedersen:

Thanks, Mark. So from a financial and operational objective for the year, Alex mentioned that Flex Pay was critical and important to the Company; obviously utilizing the customers’ balance sheet instead of our own balance sheet to put accounts on lowers our overall creation dollars spent. We’re going to look for gains to push more—a higher percentage of our accounts that we on-board into the Flex Pay program. We’ve got some ideas around that. Not really ready to give numbers or projections around that percentage but just know that we’re focused on that because it’s a great use of proceeds.

The other thing, and again Alex mentioned this, that we’ve made investment in both IT, IT systems and then around innovation in the Company, and right now it’s our job to make sure that we’re driving scale to make sure that we make those worth our while for spending the money on those and we think we’ve got the plans in place to do that. Some of them, you know, they’re necessary. You get to a certain scale of customer size and number of phone calls and you’ve got to make sure that your IT systems are up to par. When things go down for an hour anywhere and some of it can be internal issues and sometimes external software issues, it’s never a great experience. So we’re always making sure that we have backups and great IT systems. But we’ll scale into those.

And then the other—and this one is—well, there’s none that are most important, but this one is. For the business to win and succeed in smart home we believe the customer experience is absolutely critical.

4

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

This, and again, back to the investments we are making, we need to deliver something that’s magical to the consumer. Things need to work, they need to work all the time, they’ve got to feel like they have confidence that the cameras—and again, the cameras, the number of cameras in the home, outside the home is growing—they’ve got to have confidence that they work, that we can do things like detect packages and distinguish between a human and a dog and things are happening inside their home or outside of their home, in the neighborhood with some of the new technologies we’re launching. So we’re going to be there for the consumer to make sure that they feel peace of mind.

So, that’s a huge focus of ours. And if we do deliver on that, by the way, the net effect for the Company is subscriber growth, but more importantly consumers want to be with us and stay with us and attrition goes down. Theoretically, even service cost should go down with that. So that’s a huge focus of the Company.

And then the other is our—would be a sales-side focus. We think we’re going to get the gains back that we lost in launching the Flex Pay program. We’ve been through a full season of that. In every given season we do change slight things in the program, how we underwrite, how customers are onboarded. There are going to be some minor adjustments but no I don’t think any major hiccups or anything that will go on. So we do believe we’re going to get the gains back on the productivity perspective.

And then we do have this new retail project. The thing I would say is retail’s new. It’s very new. We had some successes. We found out things that were difficult—we knew going into it it was going to be difficult, but it’s a new format. We believe long term that we will have success in retail. We’ve spent the money and we think we’ll get the benefit of that over the upcoming quarters and years. The one thing that we’re certain on, and we’ve said this many times, is that this smart home industry, although it’s on the very forefront, is gaining momentum and it’s going to be big and with the assets of the Company and our capabilities and the technologies that we’ve invested and built, the structure we have, the go-to-market operational capabilities, we think we’re going to absolutely be one of the wonders in the space.

One thing that we have done some but are going to probably do more of, are strategic partnerships. So looking to ways to leverage what we have and what we do with other people’s assets and we think there’s quite a few opportunities out there that are low risk, smart to do and can expand the breadth of the Company and the types of services that are delivered to the consumer.

So with that, we’ll end that we are excited about what we’re doing, what we’re working on. We have a lot of big ideas that take a lot of people doing their jobs right and correctly and we have a lot of smart people on board but we’re excited.

Thank you for your time and let’s go ahead to Q&A, Dale.

Dale Gerard:

Yes. Jesse, we’re ready to start accepting questions.

Operator:

At this time, I would like to remind everyone in order to ask a question, please press star, then the number one on your telephone keypad. We will pause for a brief moment to compile the Q&A roster.

Your first question comes from Jeffrey Kessler. Your line is open.

Jeffrey Kessler:

Thank you. Now that you’ve had obviously a number of years to put the package together, but now that you’ve gotten yourselves into a place where you have a combination of being able to finance the system and the customer begins to expect something, what do you see as the minimal, the gaiting factor what you must have in place to create a customer experience that makes it worthwhile for that customer to stay with you for seven, eight, ten years? What do you have to have in place now that perhaps two years ago you were building on but now you have to have it otherwise the model is not there?

5

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Alex Dunn:

Yes, I think that’s a good question, Jeff. So I think the way we think about first, smart home, is that it’s not just one or two connected devices. So I think it’s probably easier to, if you have, let’s say, a doorbell cam and that’s kind of it, then that is not a smart home experience. It certainly is a smart doorbell experience but we are big believers in kind of having the key functionality in the home connected into the smart home.

So what are those things? The front door is a really important part of that experience—so that includes doorbell cams and locks and door shutters. We actually think protection or security is a big part of it. So there’s a whole set of sensors around security that are important to deliver that experience in the home. You have sensors, you have cameras, then you look at energy. You have—and we have integrated into the platform both the management of energy through the thermostat and then the production of energy through solar. So we have both of those offerings for the consumer that’s interested in those. And then you have things that would be a little bit of a longer tail—garage door openers. Lights is actually really an important part of that.

So there’s really these key systems in your home that we have been focused for a long time on tying together and making work seamlessly together. So the other thesis is is that you don’t change those things out very often. So when we ask consumers, you know, how often do you change your door lock or how often do you change the thermostat or how often—that actually doesn’t happen very often. So we believe that as you can provide that experience for the consumer and then the service on top of that, you will have really a consumer for—a pretty long-lived consumer.

The one other thing that I would point out here is that on average we’re installing about 15 devices for every new home that we’re installing. So we’re certainly not there yet. We’re not to a place where we feel like we’re fully connecting every home, but I think from a—in terms of kind of competitive differentiation, we are way ahead I think of anybody else in terms of actual connected devices that we install into the home at the beginning.

Jeffrey Kessler:

Okay. If I can ask just one more question. I ask this of every single company in this business. What are you doing to harden your systems from a IT security standpoint, both inside the home and from the home to the monitoring station?

Alex Dunn:

Yes, so this is actually a really important topic that we are focused on everyday. One of the advantages of the architecture of our system is that we actually—we set up really private networks in the home. So like the networks that—like, for instance, the WiFi network that’s used that have the cameras communicate with our hub, is a private WiFi network that you can’t—none of the consumers or really anybody else can get onto and that’s protected, it’s encrypted. So we do that with all of the wireless radios in the home is provide kind of a encrypted, safe way for all those devices to communicate with the hub.

And then from the hub back to the cloud, we have multiple ways that we communicate. We have mobile or cellular and we have the customers’ internet. We use things like VPN and encryption to really make sure that that’s as safe and as secure as possible. Obviously, no system is 100% protected, but one of the real advantages I think again that we bring to the table is we’re providing a more comprehensive solution to the consumer, which allows us to actually control more of the environment which allows us to actually offer a higher level of security. If you’re just connecting a device to someone’s WiFi and their WiFi network is not protected, then you’ve got some pretty big security holes that truthfully would be almost

6

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

impossible for a company that does that to control. The consumer’s kind of in control of that. In our case, when we go and install these things we’re setting up our own networks in the home and we require that on every install so that we can provide that security.

Jeffrey Kessler:

Okay, great. And thank you very much. Appreciate it.

Alex Dunn:

Thanks, Jeff.

Operator:

Your next question comes from Ashish Nair. Your line is open.

Ashish Nair:

Hi guys. Thank you for taking my question. On your point about investments in product and technology in 2018, I just wanted to ask a few questions around that. Do you—I know AI was something you had talked about in the past. Is that something you expect to invest in significantly? Is that going to be internal or do you think you might need to go out and maybe look at some other companies that might be better at that technology? What sort of investments do you think you’d need to make to stay ahead of some of the new entrants that are coming into the market?

Alex Dunn:

Yes. So AI is a big part of the investment thesis in our innovation center and really specifically things around video and video analytics. So our approach on any of these investments is we’re fairly agnostic to whether or not we build it or we buy it and in fact we have lots of partners that we work with to deliver on different aspects of the technology that we’re looking to incorporate. But I think the level of investment that you see now takes into account the fact that we are in the process of developing and working with partners to leverage their technology around AI and video analytics.

Ashish Nair:

Got it.

Alex Dunn:

And I guess the thing I would say, when you take a look at AI and you take a look at video analytics, a big part of the thesis there is that you have to have good data to kind of drive that artificial intelligence and learning, and that’s another, again, big advantage. When you have 15 sensors that have been professionally installed in the home, the amount of data that we are driving or getting out of the home is exponentially higher than what it would be if we had one thermostat or a doorbell cam.

Ashish Nair:

Right. And I assume that’s probably a software upgrade that you can just push out to your existing users or does that require some sort of installation from your end?

Alex Dunn:

No. So actually it’s all software driven, and we are actually—all of our consumers have really what we would call the first level of our artificial intelligence or Smart Home Assistant that is taking the data and helping the consumer understand how they can better manage their home and use the features of the system. So that actually is rolled out right now and that’s just getting smarter and smarter everyday.

7

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Ashish Nair:

Got it. And moving on to Best Buy, the subscriber add was a little lighter than I’d expected and it sounds like you guys were also—you know, maybe had expected slightly higher. I just wanted to understand how the channel’s doing with the expectation now. Are you still expecting to open as many stores as you had previously indicated and what sort of ramp can we expect in that channel?

Alex Dunn:

Yes. So, I think in terms of subscribers, it was a little lighter than what we had kind of projected. With that said, we were projecting to make sure that we didn’t, like, under staff and under inventory that channel, and so we wanted to make sure that we probably were over and not under in guessing there. The other thing I would say about retail is is that there’s been some really positive results there and what we’re finding is is that when we have an opportunity to engage with the customer our sales to—our conversation to sell rates is actually very high, maybe even a little bit higher than what it is on our other channels. So that’s a real, real positive for us. We’re very focused now. And there’s stores where we have lots of engagement with customers for various reasons and there’s stores where we have less engagement. Mostly it’s tactical. It’s things like the actual store manager or a region or how we’re working with the employees in the store.

So there’s a lot of really positive aspects to that channel that we’re just working on continuing to optimize. This is—look, this is the same—when we started inside sales, it was the same way, and many—well, five years ago inside sales was not very much of our volume, and today it’s starting to push 40% to 50% of the volume that’s generated in the business. So, we are patient and we know that it takes time to develop these channels and we’ve seen lots of—we’ve seen enough positive kind of results there that right now we’re committed to continuing to develop the channel.

Ashish Nair:

Right. And have you seen significant improvement since the fourth quarter? And also I was curious if you expect this to be more of a lumpy business with maybe most of the subscriber adds that (inaudible) the holiday season or just through the year you expect...

Alex Dunn:

Yes. So I think you should expect that at least with Best Buy - and there’s different—there’s also different kind of retail partners that have different cycles - but with Best Buy I think you should expect that you would see the same cycle as Best Buy has in terms of sales that we would expect a similar cycle. But are we seeing improvement in that channel the way we measure it where it is in the cycle? Yes, we are.

Ashish Nair:

Got it. I just had one last question. You guys because of the new channels and the Flex Pay obviously throwing a lot of—generating a lot of free cash flow, any thoughts around the capital structure? Do you want to refi some of your high coupon (inaudible) debt in the next few quarters? And just what are your plans for the free cash flow generation? Do you want to reduce that or do you have any significant investments that you see upfront for growth that you think you will invest that cash in?

8

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Mark Davies:

Yes. So we are always looking at the best way to optimize the capital structure as any other company would. I think a couple of things that we have on the top of mind right now. We do have notes coming due over the next few years that we’ll need to go deal with. We can deal with that in a number of ways. We could reissue bonds, we could think about more of a loan situation, we could bring on equity, or we could use some of this internally and generate cash for that.

One of the things that we do strongly believe in is growth. If we took the growth and went to steady state we’re generating a good amount of cash with Citizens. It would even optimize our creation costs. What we would like to do is add sales at an accretive acquisition cost to what we’re doing right now. And that’s what Todd had mentioned upfront that it’s not just Citizens and this new Flex Pay but there are other things that we’re thinking about. If we can get large format retail in these other channels up to scale, they’re very, very cost beneficial at point of sale. So kind of on a long-term basis we’d like to continue to grow and utilize internally generated funds for that and then we need to in the next year or so deal with more of the longer-term debt structure. We’ll do that in partnership with Blackstone as they have not only a lot of experience in this but they own a good chunk of the equity here.

In terms of 2018, I think you mentioned, we don’t expect to be in the market in the next little while but we’ll kind of assess that in Q3, think about the 2019 growth plan and see what comes out of some of these initiatives in 2018.

Ashish Nair:

Understood. Thank you so much and good luck for the rest of the year.

Mark Davies:

Thank you. Thanks for the time.

Operator:

Your next question comes from Rich Gross (phon). Your line is open.

Rich Gross:

Sorry, I should take it off of mute. So just a follow-up to that last response. Did you say you guys would look at it in the third quarter on the financing?

Mark Davies:

Yes, I mean, I think if you look at the numbers that came out in the earnings release - and we’ll release the K here in the next hour or two - we actually did the year with a lot of room on our revolver and plenty of kind of cash to move through the selling season. Post the selling season, we’ll look at some of these initiatives that we’ve just talked about scaling, any other kind of accretive activities that we do, look at 2019 plans and then decide kind of what we want to do for the tactical—if we need tactical cash as we move into 2019. We typically at the end of a fiscal year will top off our—pay off our revolver and get ready for the following year.

Rich Gross:

Mm-hmm.

Mark Davies:

With Flex Pay, it’s changed that dynamic. It hasn’t changed the dynamic in terms of the cycle. We usually will spend more money towards the end of the year and we’ll kind of have the 2019 plan in place. So yes, we should be looking at that in Q3.

9

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Rich Gross:

And to make sure I didn’t miss it, you are addressing this separately—this is a separate comment to the earlier comment on the upcoming maturities and that could happen whenever you guys kind of decide to move on that.

Mark Davies:

Yes, that’s right. And yes, we’ve already swapped out some short-term debt with longer-term maturities and there was—was it $800 million? We did $400 million swap last year and so we’re thinking about that and dealing with it on a real-time basis.

Rich Gross:

So I’m slightly surprised that you guys didn’t come back to the market and swapped the rest of it given how well that bond performed. Any thoughts you’re willing to share on why you chose not to do that?

Mark Davies:

Not really.

Rich Gross:

Okay. Question on Best Buy. Did you guys have 400 stores set up at the start of the fourth quarter?

Mark Davies:

We did—we had 450 stores up and running—in November is when we hit the 450. So we had 450 through the quarter, we did not have 450 at the start of the quarter.

Alex Dunn:

It was a massive ramp-up—about over 90 days that we ramped about 400 stores. So it was quite the effort.

Rich Gross:

Okay. So if I were to allocate all of the customer adds just in those six weeks, it looks like you’re probably running maybe one every other day or so, a little better than that. And then I think about 2019, I mean, I guess, the first question would be, would you expect fourth—first quarter normally seasonally I would expect to be down just because it’s a non-holiday season. Given that you’re ramping productivity, is that a good assumption for me to be thinking about for the first quarter or should I think that productivity should ramp quarter-over-quarter just as people get better at doing the job?

Alex Dunn:

Yes. So there’s—I mean, I think, we’ll give some broad guidance on this but not specific. So, I think you need to think that—about productivity increasing but in relative to where we are in the cycle. So, Best Buy specifically, I think is a fairly cyclical retailer and has a lot of the revenue that’s generated in the fourth quarter.

10

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Mark Davies:

So the seasonality will remain heavy towards Q4 or around buying season. Productivity within that seasonality we expect to improve as we move through just the natural maturity. We did 11,000, almost 12,000 accounts in Q4. We had those stores up and running for about, all of them, for about six weeks. Most of the people selling were very, very new to the role, to the product, to the whole industry. So we expect that to improve as we go through the year.

Rich Gross:

Okay. No, that’s a fair statement. When I think about the investments that you’re going to be making with staff, should I think about these first two quarters of that potentially going back a little bit and then ramping back up as we get into the holiday season?

Alex Dunn:

Yes, I think, again, generally, you should think about it kind of matching as best we can the costs with the production in that channel.

Mark Davies:

So the fixed cost that we have in Best Buy - we’ve talked about this a bit in the past - is really people to a large degree. When you have a lot of foot traffic you have to put more than one person in there, and we did during the holiday. You could only go down to one because you really want somebody in that store and in that branded kiosk at all times. So we can ramp cost down to suit the foot traffic, which is the Q1, Q2, Q3, to a level that is kind of the minimum, and then we look for productivity on those resources, but you would see the cost pool come down.

Rich Gross:

Okay. And that’s exactly kind of what I was thinking about was kind of reduced hours a person is in the store, something like that.

Mark Davies:

That’s right.

Rich Gross:

Okay. No, great. And then the other one I had on the retail side is, there’s some reports out there that you guys were also exploring and had done some work on some of the Sprint stores. Is that something you guys are willing to address or talk about or is that something we potentially could see in the future?

Mark Davies:

Say that—repeat that real quick one more time?

Rich Gross:

Yes. So you guys have this partnership with Best Buy and I’m sure you explored other ones. You talked about strategic partnerships earlier in the commentary. There’s some reports out there, probably customers that were at stores that there was some Vivint products at some of the Sprint stores. Is something like that, you know, these other potential retail avenues that we could see you explore?

Mark Davies:

Yes.

11

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Rich Gross:

Any thoughts on if a environment like that would have better or worse productivity?

Alex Dunn:

We have thoughts around it. We’re probably not prepared to say that yet. You saw things in Sprint. We’re still in kind of test mode there but it’s going well.

Rich Gross:

Okay. All right, thank you very much for your time guys.

Mark Davies:

Yes. Thank you.

Operator:

The last question today comes from Geoffrey McKinney. Your line is open.

Geoffrey McKinney:

Hi, good afternoon. Thanks for the question. Most have been answered but I guess just to make sure I’m squared away. You exited the quarter with liquidity of about $238 million including cash. I think you commented that you’re in a position and you don’t think going into the selling season you necessarily need liquidity. If I just kind of look ait where you’ve been historically we’re at a relatively low point for the end of the year. I guess, what gives you confidence that you don’t need incremental capital given the rate of growth that’s been significant and the rate of growth that you’re likely going to be attaching to the retail segment or the retail business in the first half of the year?

Mark Davies:

Yes, I think in short answer to that there’s two drivers. One is - and Alex mentioned this a minute ago - that we actually had staffed (phon) up an inventory level in Best Buy that was more than we actually used. So when you look at our numbers you’ll see that our current assets are high, inventory is high. The good thing is that inventory is all relevant inventory, there’s no excess, there’s no obsolescence. We’ll burn that off in 2018 and the funds have already been applied to that in ‘17.

So that’s number one. Number two, we think that Citizens—Citizens as I mentioned is about—we had that program up for about eight months of the year, so the $211 million that we mentioned is really two thirds of what we think it would be on a run rate basis. So that’s kind of number two. And then we continue to look at scaling creation cost. Probably the biggest creation cost improvement that we’ll see is in retail. So the cost that you see in our cash flow in Q4 around that Best Buy start-up is not what we’ll see going through the year.

So when we look at our volumes that we expect for the year by channel, creation cost by channel, we look at kind of cash from point-of-sale proceeds, we’ll make that decision. We’ll have plenty of time to do that in Q3 to kind of balance the year of where we are and how we want to deal with the revolver. Number two, how we want to set up for 2019. And then number three, to how we would look at the overall capital structure that we have to start thinking about in late ‘19.

12

APX Group Holdings, Inc. - 2017 Fourth Quarter and Full Year Earnings Conference Call, March 6, 2018

Geoffrey McKinney:

Okay. Thank you, that’s helpful. And then I might have missed any comments on this or in the Q&A, so apologies. But the obvious question and risk asking the dumb question potentially, but in light of the reports around Amazon’s acquisition of Ring - and that’s certainly being a hardware and not a service provider which you guys are, I guess - how do you view any potential partnership of those products and with Vivint or how do you perceive any competitive threat over the long term there, if at all? Just kind of curious to get your thoughts.

Alex Dunn:

Yes. Look, I think, you know, we actually know Jamie at Ring and I think it was great that he was able to sell his company to Amazon. So congratulations to him. I think we’ve been through this before. Certainly when Nest sold to Google that was another kind of big thing that happened in the industry that was a big player committing to smart home. We feel, at least right now, that both of those things are accretive to our business. We are integrated with the Echo and we’re integrated with Nest and customers that have those single point solutions are great leads for us to bring the kind of whole smart home services around whatever that single point solution is.

So I think we feel that—we feel pretty good about overall where the industry is going and that this is a space that you’re going to see at some point in the future every home will be a smart home and that we are pretty excited to be a leader—one of the leaders in an industry that is going to be very big and pervasive.

Geoffrey McKinney:

Okay, that’s helpful. Thank you guys very much.

Todd Pedersen:

So again, as always, we appreciate the time. For those of you who are invested in our bonds, we appreciate the support, and for those of you are looking (phon), and we appreciate you listening to our comments and we look forward to talking to you next quarter. Thank you.

Operator:

This concludes today’s conference call. You may now disconnect.

13

APX Group Holdings, Inc. 4th Quarter and Full Year 2017 Results March 6, 2018

This presentation includes forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995, including but not limited to, statements of APX Group Holdings, Inc. (the “Company”, “Vivint”, “we”, “our”, or “us” related to the performance of our business, our financial results, our liquidity and capital resources, our plans, strategies and prospects, both business and financial and other non-historical statements. Forward-looking statements convey the Company’s current expectations or forecasts of future events. All statements contained in this presentation other than statements of historical fact are forward-looking statements. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of this date hereof. You should understand that the following important factors, in addition to those discussed in “Risk Factors” in our most recent annual report on Form 10-K and other reports filed with the Securities Exchange Commission (“SEC”), could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements: (1) risks of the smart home and security industry, including risks of and publicity surrounding the sales, subscriber origination and retention process; (2) the highly competitive nature of the smart home and security industry and product introductions and promotional activity by our competitors; (3) litigation, complaints or adverse publicity; (4) the impact of changes in consumer spending patterns, consumer preferences, local, regional, and national economic conditions, crime, weather, demographic trends and employee availability; (5) adverse publicity and product liability claims; (6) increases and/or decreases in utility and other energy costs, increased costs related to utility or governmental requirements; (7) cost increases or shortages in smart home and security technology products or components; (8) the introduction of unsuccessful new products and services; (9) privacy and data protection laws, privacy or data breaches, or the loss of data; and (10) the impact to our business, results of operations, financial condition, regulatory compliance and customer experience of the Vivint Flex Pay plan and the Best Buy Smart Home powered by Vivint Program. In addition, the origination and retention of new subscribers will depend on various factors, including, but not limited to, market availability, subscriber interest, the availability of suitable components, the negotiation of acceptable contract terms with subscribers, local permitting, licensing and regulatory compliance, and our ability to manage anticipated expansion and to hire, train and retain personnel, the financial viability of subscribers and general economic conditions. These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this presentation are more fully described in the “Risk Factors” section of our most recent annual report on Form 10-K, as such factors may be updated from time to time in our periodic filings with the SEC. These risk factors should not be construed as exhaustive. We disclaim any obligations to and do not intend to update the above list or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligations to update or revise publicly any forward-looking statements, whether a result of new information, future events, or otherwise. forward-looking statements

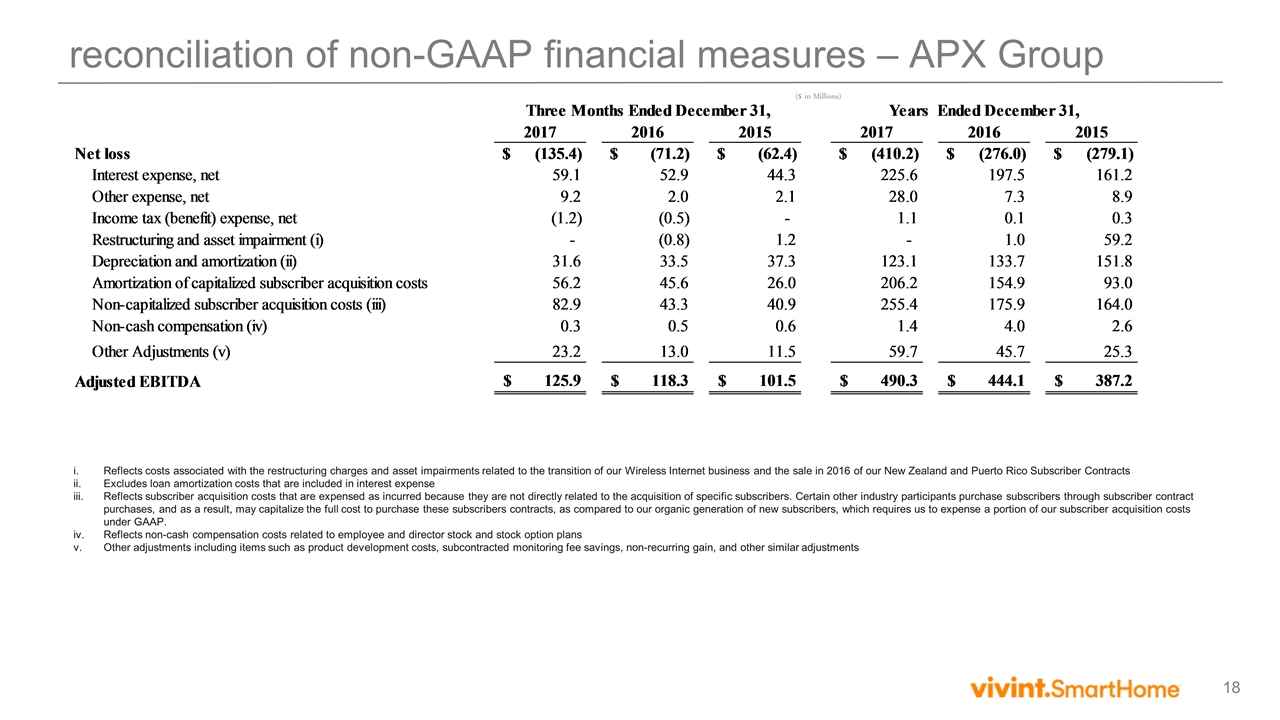

non-GAAP financial measures This presentation includes Adjusted EBITDA, which is a supplemental measure that is not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). “Adjusted EBITDA” is defined as net income (loss) before interest expense (net of interest income), income and franchise taxes and depreciation and amortization (including amortization of capitalized subscriber acquisition costs), further adjusted to exclude the effects of certain contract sales to third parties, non-capitalized subscriber acquisition costs, stock based compensation, the historical results of Solar and certain unusual, non-cash, non-recurring and other items permitted in certain covenant calculations under the indentures and other agreements governing our notes and the credit agreement governing our revolving credit facility. We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about the calculation of, and compliance with, certain covenants in the indentures and other agreements governing our notes and the credit agreement governing our revolving credit facility. We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA may not be comparable to similar measures disclosed by other issuers, because not all issuers and analysts calculate Adjusted EBITDA in the same manner. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income (loss) or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. See Annex A of this presentation for a reconciliation of Adjusted EBITDA to net loss for the Company, which we believe is the most closely comparable financial measure calculated in accordance with GAAP. Adjusted EBITDA should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with GAAP.

participants Todd Pedersen Chief Executive Officer Alex Dunn President Mark Davies Chief Financial Officer Dale R. Gerard SVP, Finance & Treasurer

Modify business model Transition to Vivint Flex Pay, made possible by Vivint’s high hardware attachment rate Yielded $211 million in point of sales proceeds Impacted sales productivity… primarily the Direct to Home channel Sales channel expansion Offered in 450 Best Buy stores nationwide in large format retail channel Small, focused pilots with other retail channel partners Investments in customer and capabilities Innovation… hardware, software, and connectivity Information technology… sales and customer care platforms, Vivint Flex Pay and channel expansion Smart Home Market Overview Greater customer awareness and use cases Competitive investment in voice and video Vivint’s comprehensive, full-service smart home as a service model is increasingly relevant… with attractive profit pool 2017 in review net service margin ~72% ~$211M upfront proceeds from point of sale 11.0% low and improving Attrition Rate $882M total revenue 279K New Subscribers

revenue and adjusted EBITDA(1) (1) A reconciliation of Adjusted EBITDA to GAAP Net Loss is included in Annex A of this presentation Adjusted EBITDA Three Month Period ended December 31, Revenue ($ in Millions) Revenue Adjusted EBITDA Years ended December 31, ($ in Millions) Growth: 16.9% 15.3% Growth: 15.9% 16.4% Growth: 16.6% 6.4% Growth: 14.7% 10.4%

service and subscriber acquisition costs(1) Net Subscriber Acquisition Costs per New Subscriber Years Ended December 31, Net Service Costs per User and Net Service Margin Years Ended December 31, (1) Excludes wireless internet business and pilot sales channel initiatives Net Service Costs $1,472 Net Subscriber Acquisition Costs per New Subscriber, excluding Large Format Retail $845 - Average proceeds collected at point of sale, ~$731 year-over-year increase Key Drivers Focused Investments in subscriber service levels and overall experience… Net Promoter Score Increase in the number of smart home devices per customer Net Service Margin 73.7% 72.1% Net Service Dollars $41.31 $40.64

Vivint Flex Pay Mix(2) (US Only) New Subscribers new subscribers(1) Three Month Period ended December 31, 33,162 39,805 52,342 236,562 277,241 279,735 Years ended December 31, Average product and installation sales of $1,300 across channels 91% of Customer Financing and RIC New Subscribers executed 5-year contracts ~$211 million in up front proceeds $48.88 Average Monthly Service Revenue (1) Excludes wireless internet business and pilot sales channel initiatives (2) Paid in Full includes New Subscribers from Large Format Retail Sales Channel Growth: 20.0% 31.5% Growth: 17.2% 1.0%

smart home subscriber portfolio data(1) As of December 31, Total Subscribers ($ in Millions) Total Monthly Revenue AMRU (1) Excludes wireless internet business and pilot sales channel initiatives Growth: 13.1% 12.7% Growth: 17.8% 14.9% Growth: 4.2% 1.7% $75.4 $58.29

11.0% Annualized Attrition 12.2% Annualized Attrition 12.6% Annualized Attrition Attrition Rate(1) ~ 13% of portfolio reaching initial end of contract term during 2018 2013 60-mo contracts 2014 42-mo contracts (4Q17 – 1Q18) 2015 42-mo contracts (4Q18 – 1Q19) LTM Quarterly Attrition Rate 160 bps (1) Excludes wireless internet business and pilot sales channel initiatives

2018 objectives Financial and Operational Continue the momentum of Vivint Flex Pay in identifying opportunities to lower subscriber acquisition cost and dependence on external funding Drive scale from the investments in engineering and information technology Focus on quality and customer experience… NPS and service margin Sales and Growth Direct to home sales rep productivity Large format efficiencies and tuning of model and offerings Accretive partnerships and alliances… product, services, customers Strategic Focus Continuation of the Vivint platform as an enabler for knitting together a comprehensive, consumer-friendly, true smart home offering

Q&A

APX Group Holdings, Inc. Full Years and 4th Quarters Ended December 31, 2017 and 2016 Consolidated Financial Statements

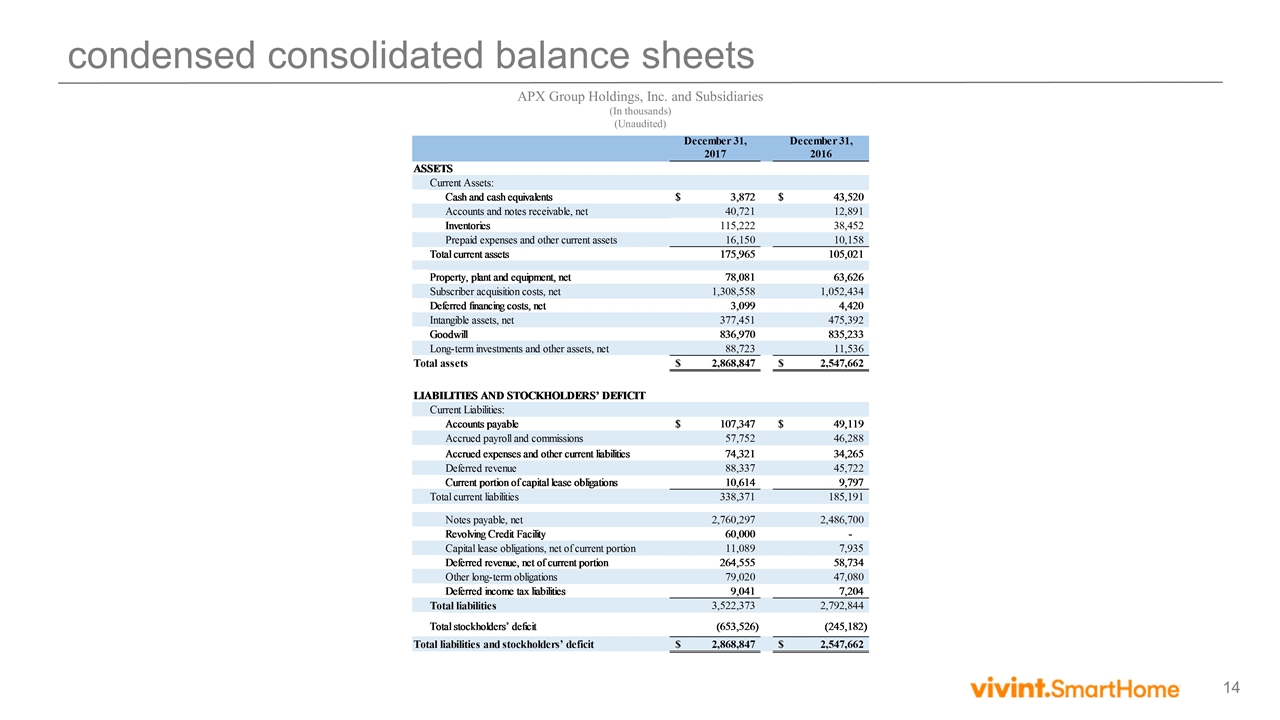

condensed consolidated balance sheets APX Group Holdings, Inc. and Subsidiaries (In thousands) (Unaudited)

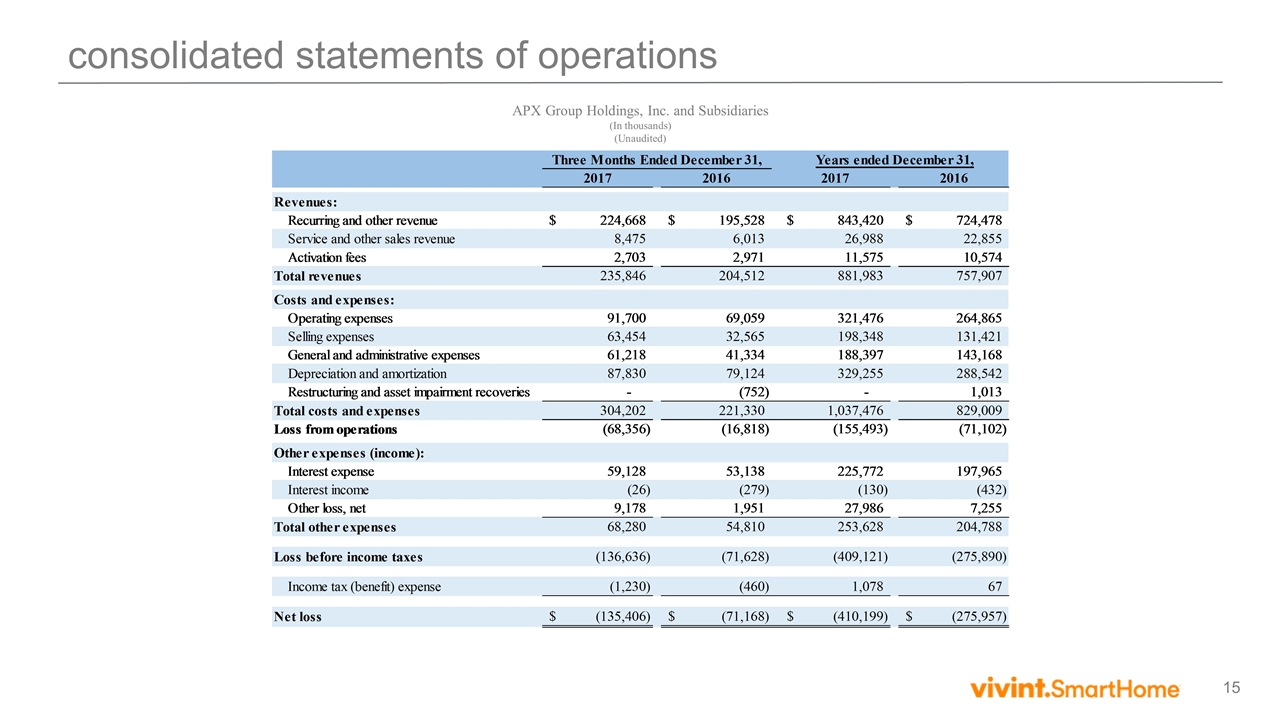

consolidated statements of operations APX Group Holdings, Inc. and Subsidiaries (In thousands) (Unaudited)

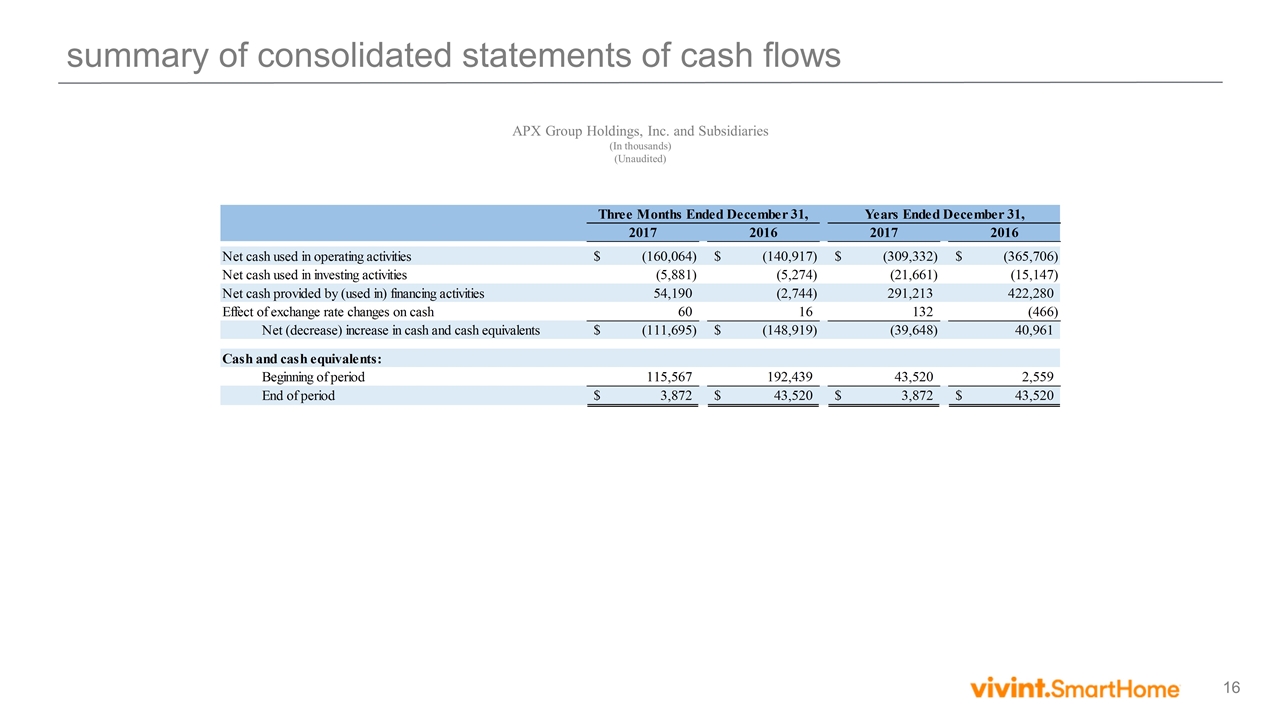

summary of consolidated statements of cash flows APX Group Holdings, Inc. and Subsidiaries (In thousands) (Unaudited)

APX Group Holdings, Inc. Annex A

reconciliation of non-GAAP financial measures – APX Group ($ in Millions) Reflects costs associated with the restructuring charges and asset impairments related to the transition of our Wireless Internet business and the sale in 2016 of our New Zealand and Puerto Rico Subscriber Contracts Excludes loan amortization costs that are included in interest expense Reflects subscriber acquisition costs that are expensed as incurred because they are not directly related to the acquisition of specific subscribers. Certain other industry participants purchase subscribers through subscriber contract purchases, and as a result, may capitalize the full cost to purchase these subscribers contracts, as compared to our organic generation of new subscribers, which requires us to expense a portion of our subscriber acquisition costs under GAAP. Reflects non-cash compensation costs related to employee and director stock and stock option plans Other adjustments including items such as product development costs, subcontracted monitoring fee savings, non-recurring gain, and other similar adjustments

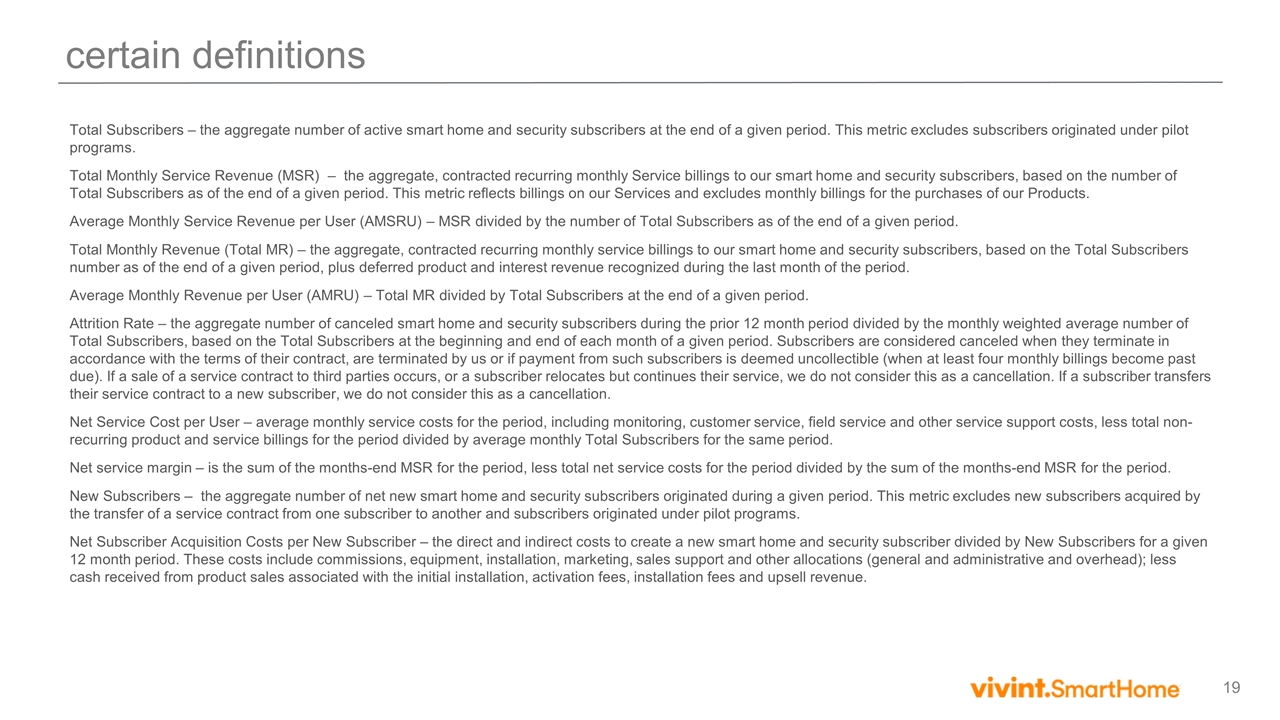

certain definitions Total Subscribers – the aggregate number of active smart home and security subscribers at the end of a given period. This metric excludes subscribers originated under pilot programs. Total Monthly Service Revenue (MSR) – the aggregate, contracted recurring monthly Service billings to our smart home and security subscribers, based on the number of Total Subscribers as of the end of a given period. This metric reflects billings on our Services and excludes monthly billings for the purchases of our Products. Average Monthly Service Revenue per User (AMSRU) – MSR divided by the number of Total Subscribers as of the end of a given period. Total Monthly Revenue (Total MR) – the aggregate, contracted recurring monthly service billings to our smart home and security subscribers, based on the Total Subscribers number as of the end of a given period, plus deferred product and interest revenue recognized during the last month of the period. Average Monthly Revenue per User (AMRU) – Total MR divided by Total Subscribers at the end of a given period. Attrition Rate – the aggregate number of canceled smart home and security subscribers during the prior 12 month period divided by the monthly weighted average number of Total Subscribers, based on the Total Subscribers at the beginning and end of each month of a given period. Subscribers are considered canceled when they terminate in accordance with the terms of their contract, are terminated by us or if payment from such subscribers is deemed uncollectible (when at least four monthly billings become past due). If a sale of a service contract to third parties occurs, or a subscriber relocates but continues their service, we do not consider this as a cancellation. If a subscriber transfers their service contract to a new subscriber, we do not consider this as a cancellation. Net Service Cost per User – average monthly service costs for the period, including monitoring, customer service, field service and other service support costs, less total non-recurring product and service billings for the period divided by average monthly Total Subscribers for the same period. Net service margin – is the sum of the months-end MSR for the period, less total net service costs for the period divided by the sum of the months-end MSR for the period. New Subscribers – the aggregate number of net new smart home and security subscribers originated during a given period. This metric excludes new subscribers acquired by the transfer of a service contract from one subscriber to another and subscribers originated under pilot programs. Net Subscriber Acquisition Costs per New Subscriber – the direct and indirect costs to create a new smart home and security subscriber divided by New Subscribers for a given 12 month period. These costs include commissions, equipment, installation, marketing, sales support and other allocations (general and administrative and overhead); less cash received from product sales associated with the initial installation, activation fees, installation fees and upsell revenue.