Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Altra Industrial Motion Corp. | d545256dex993.htm |

| EX-99.1 - EX-99.1 - Altra Industrial Motion Corp. | d545256dex991.htm |

| 8-K - 8-K - Altra Industrial Motion Corp. | d545256d8k.htm |

Exhibit 99.2 March 7, 2018 Altra Combination with Fortive A&S Creating a Global Leader in Power Transmission and Motion Control Exhibit 99.2

SEC Disclosure Rules ADDITIONAL INFORMATION This communication does not constitute an offer to buy, or a solicitation of an offer to sell, any securities of Fortive Corporation (“Fortive”), Stevens Holding Company, Inc. (“Newco”) or Altra Industrial Motion Corp. (“Altra”). In connection with the proposed transaction, Altra and Newco will file registration statements with the SEC registering shares of Altra common stock and Newco common stock in connection with the proposed transaction. Altra’s registration statement will also include a proxy statement and prospectus relating to the proposed transaction. Fortive shareholders are urged to read the prospectus that will be included in the registration statements and any other relevant documents when they become available, and Altra shareholders are urged to read the proxy statement and any other relevant documents when they become available, because they will contain important information about Altra, Newco and the proposed transaction. The proxy statement, prospectus and other documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. The proxy statement, prospectus and other documents (when they are available) can also be obtained free of charge from Fortive upon written request to Fortive Corporation, Investor Relations, 6920 Seaway Blvd., Everett, WA 98203, or by calling (425) 446-5000 or upon written request to Altra Industrial Motion Corp., Investor Relations, 300 Granite St., Suite 201, Braintree, MA 02184 or by calling (781) 917 0527. PARTICIPANTS IN THE SOLICITATION This communication is not a solicitation of a proxy from any security holder of Altra. However, Fortive, Altra and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of Altra in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Fortive may be found in its Annual Report on Form 10-K filed with the SEC on February 28, 2018 and its definitive proxy statement relating to its 2017 Annual Meeting filed with the SEC on April 17, 2017. Information about the directors and executive officers of Altra may be found in its Annual Report on Form 10-K filed with the SEC on February 23, 2018, and its definitive proxy statement relating to its 2017 Annual Meeting filed with the SEC on March 24, 2017.

Safe Harbor & Non-GAAP Financial Metrics Forward Looking Statements: This communication contains forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which reflect Altra’s current estimates, expectations and projections about Altra’s and the Fortive A&S business’s (“Fortive A&S”) future results, performance, prospects and opportunities. Such forward-looking statements may include, among other things, statements about the proposed acquisition of Fortive A&S, the benefits and synergies of the proposed transaction, future opportunities for Altra, Fortive A&S and the combined company, and any other statements regarding Altra’s, Fortive A&S’s or the combined company’s future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition and other expectations and estimates for future periods. Forward-looking statements include statements that are not historical facts and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “plan,” “may,” “should,” “will,” “would,” “project,” “forecast,” and similar expressions. These forward-looking statements are based upon information currently available to Altra and are subject to a number of risks, uncertainties, and other factors that could cause Altra’s, Fortive A&S’s or the combined company’s actual results, performance, prospects, or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Important factors that could cause Altra’s, Fortive A&S’s or the combined company’s actual results to differ materially from the results referred to in the forward-looking statements Altra makes in this communication include: the possibility that the conditions to the consummation of the transaction will not be satisfied; failure to obtain, delays in obtaining or adverse conditions related to obtaining shareholder or regulatory approvals; the ability to obtain the anticipated tax treatment of the transaction and related transactions; risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; the possibility that Altra may be unable to achieve expected synergies and operating efficiencies in connection with the transaction within the expected time-frames or at all and to successfully integrate Fortive A&S; expected or targeted future financial and operating performance and results; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintain relationships with employees, customers, clients or suppliers) being greater than expected following the transaction; failure to consummate or delay in consummating the transaction for other reasons; Altra’s ability to retain key executives and employees; slowdowns or downturns in economic conditions generally and in the market for advanced network and service assurance solutions specifically, Altra’s relationships with strategic partners, dependence upon broad-based acceptance of Altra’s network performance management solutions, the presence of competitors with greater financial resources than Altra and their strategic response to our products; the ability of Altra to successfully integrate the merged assets and the associated technology and achieve operational efficiencies; and the integration of Fortive A&S being more difficult, time-consuming or costly than expected. For a more detailed description of the risk factors associated with Altra, please refer to Altra’s Annual Report on Form 10-K for the fiscal year ended December, 31 2017 on file with the Securities and Exchange Commission. Altra assumes no obligation to update any forward-looking information contained in this communication or with respect to the announcements described herein.

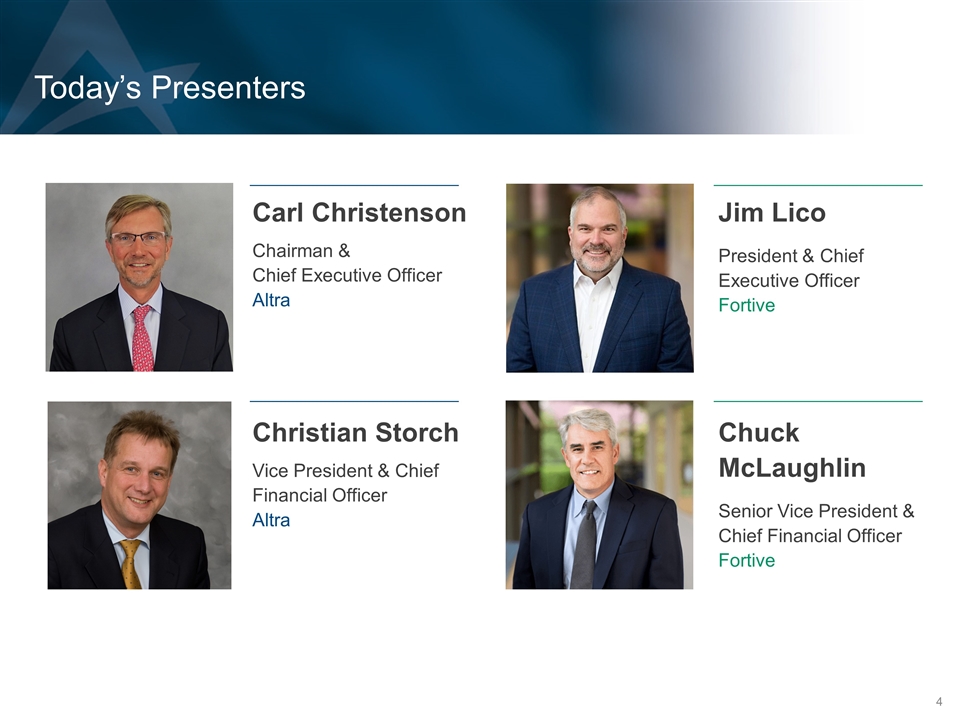

Today’s Presenters Carl Christenson Chairman & Chief Executive Officer Altra Christian Storch Vice President & Chief Financial Officer Altra Jim Lico President & Chief Executive Officer Fortive Chuck McLaughlin Senior Vice President & Chief Financial Officer Fortive

A Uniquely Compelling and Differentiated Industrial Combination ¹ Combined company 2017 revenues. Expands Presence Across the Technology Spectrum Into Highly Attractive Area From Electrical-Mechanical Capabilities to Precision Motion Control Expertise Increases Exposure to End Markets With Attractive Secular Trends Medical / Robotics / Factory Automation / Food & Beverage A World-Class Business System Leadership / Growth / Lean Manufacturing Attractive Financial Profile of the Combined Company Significant Scale / Strong Margins / Excellent Free Cash Flow Compelling Value Creation Through More Than $50mm of Estimated Synergies Cost and Revenue Synergies / Enhanced Strategic Flexibility Going Forward Global Leader in Power Transmission and Motion Control $1.8bn¹

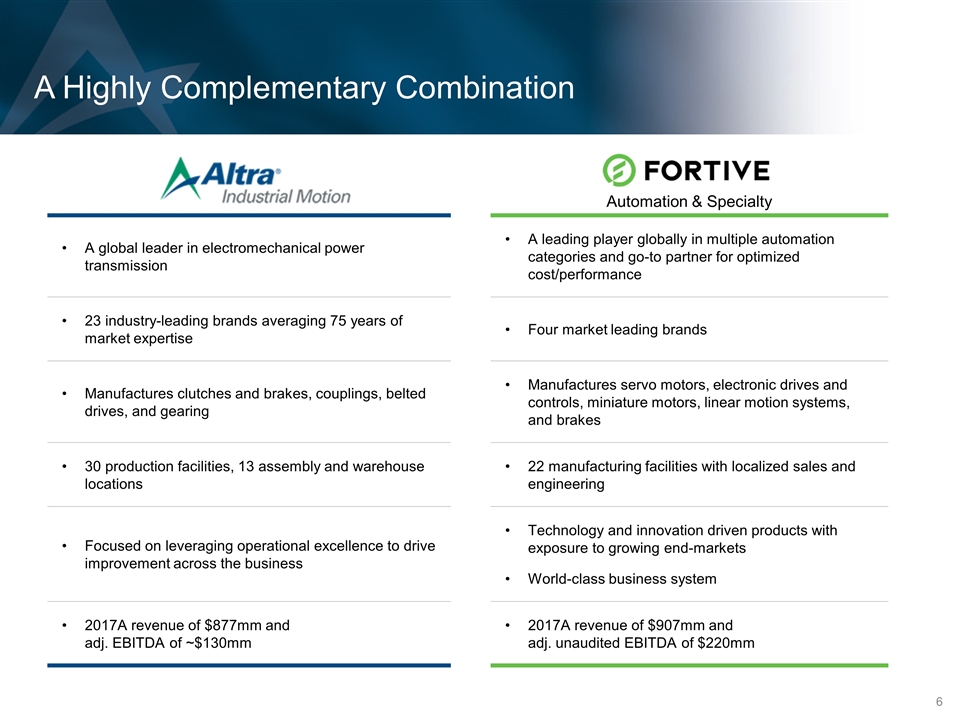

A Highly Complementary Combination Automation & Specialty A global leader in electromechanical power transmission A leading player globally in multiple automation categories and go-to partner for optimized cost/performance 23 industry-leading brands averaging 75 years of market expertise Four market leading brands Manufactures clutches and brakes, couplings, belted drives, and gearing Manufactures servo motors, electronic drives and controls, miniature motors, linear motion systems, and brakes 30 production facilities, 13 assembly and warehouse locations 22 manufacturing facilities with localized sales and engineering Focused on leveraging operational excellence to drive improvement across the business Technology and innovation driven products with exposure to growing end-markets World-class business system 2017A revenue of $877mm and adj. EBITDA of ~$130mm 2017A revenue of $907mm and adj. unaudited EBITDA of $220mm

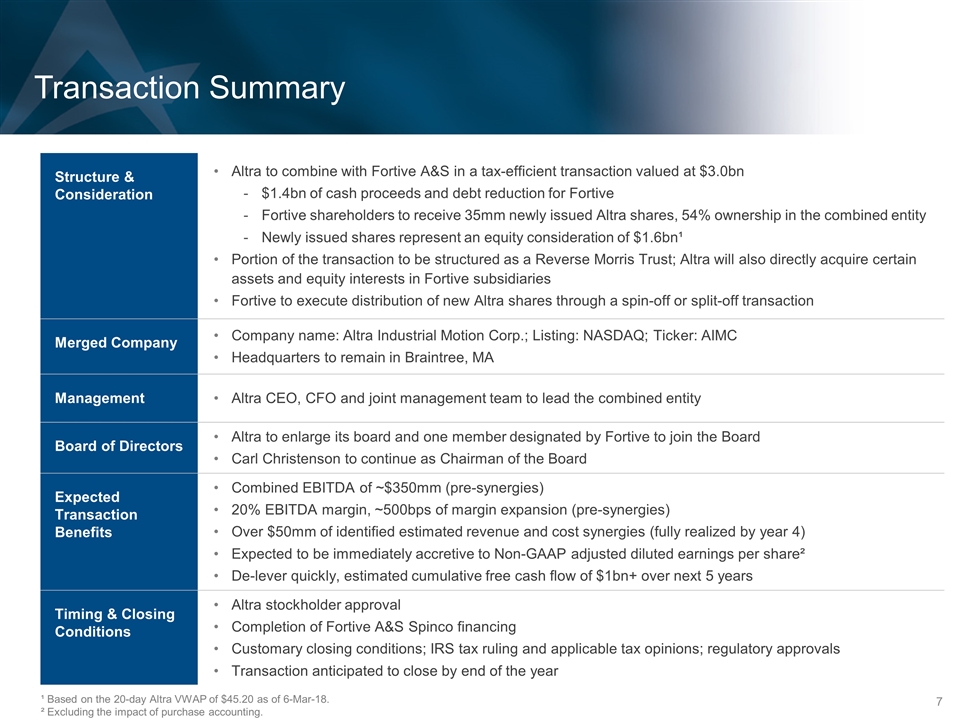

Transaction Summary Structure & Consideration Altra to combine with Fortive A&S in a tax-efficient transaction valued at $3.0bn $1.4bn of cash proceeds and debt reduction for Fortive Fortive shareholders to receive 35mm newly issued Altra shares, 54% ownership in the combined entity Newly issued shares represent an equity consideration of $1.6bn¹ Portion of the transaction to be structured as a Reverse Morris Trust; Altra will also directly acquire certain assets and equity interests in Fortive subsidiaries Fortive to execute distribution of new Altra shares through a spin-off or split-off transaction Merged Company Company name: Altra Industrial Motion Corp.; Listing: NASDAQ; Ticker: AIMC Headquarters to remain in Braintree, MA Management Altra CEO, CFO and joint management team to lead the combined entity Board of Directors Altra to enlarge its board and one member designated by Fortive to join the Board Carl Christenson to continue as Chairman of the Board Expected Transaction Benefits Combined EBITDA of ~$350mm (pre-synergies) 20% EBITDA margin, ~500bps of margin expansion (pre-synergies) Over $50mm of identified estimated revenue and cost synergies (fully realized by year 4) Expected to be immediately accretive to Non-GAAP adjusted diluted earnings per share² De-lever quickly, estimated cumulative free cash flow of $1bn+ over next 5 years Timing & Closing Conditions Altra stockholder approval Completion of Fortive A&S Spinco financing Customary closing conditions; IRS tax ruling and applicable tax opinions; regulatory approvals Transaction anticipated to close by end of the year ¹ Based on the 20-day Altra VWAP of $45.20 as of 6-Mar-18. ² Excluding the impact of purchase accounting.

Transaction Benefits for Fortive and its Shareholders Jim Lico President & Chief Executive Officer Fortive

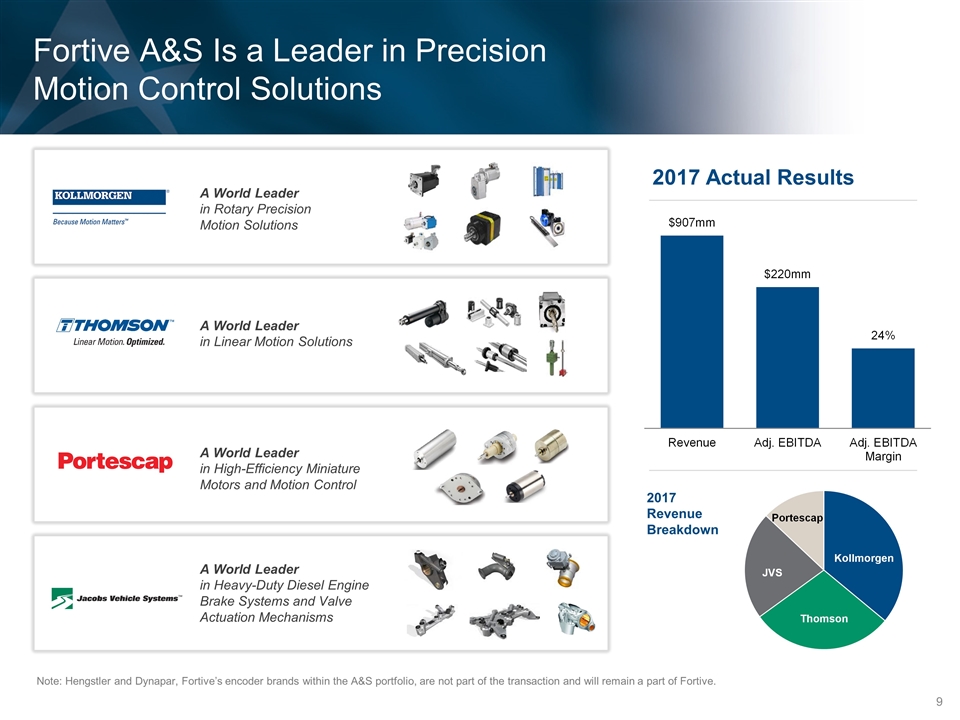

Fortive A&S Is a Leader in Precision Motion Control Solutions Note: Hengstler and Dynapar, Fortive’s encoder brands within the A&S portfolio, are not part of the transaction and will remain a part of Fortive. 2017 Actual Results A World Leader in Rotary Precision Motion Solutions 2017 Revenue Breakdown A World Leader in Linear Motion Solutions A World Leader in High-Efficiency Miniature Motors and Motion Control A World Leader in Heavy-Duty Diesel Engine Brake Systems and Valve Actuation Mechanisms

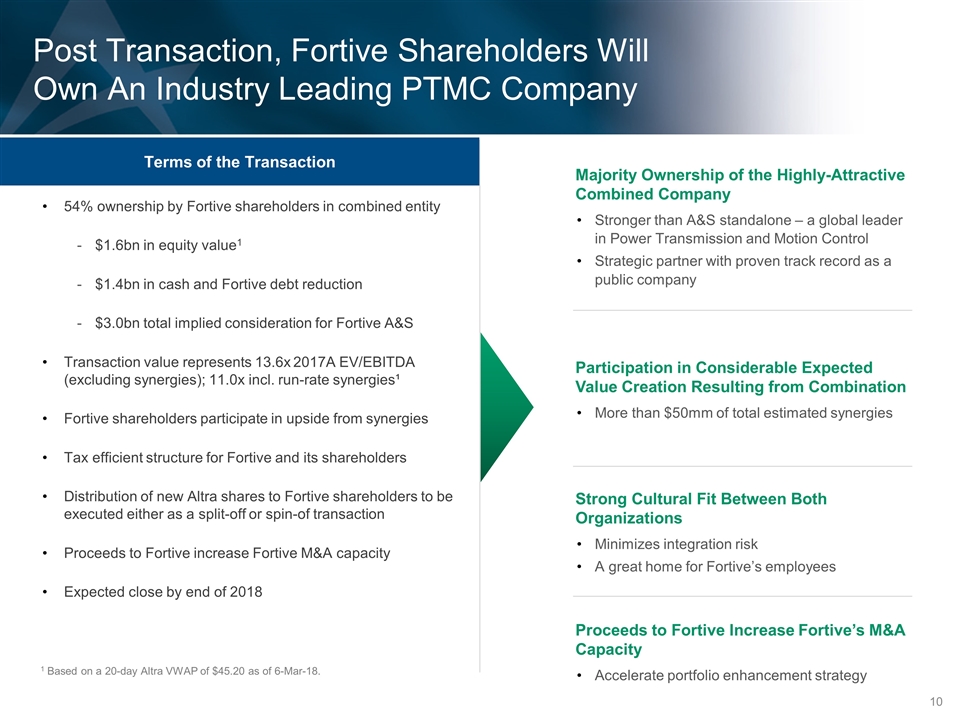

Majority Ownership of the Highly-Attractive Combined Company Stronger than A&S standalone – a global leader in Power Transmission and Motion Control Strategic partner with proven track record as a public company Post Transaction, Fortive Shareholders Will Own An Industry Leading PTMC Company 54% ownership by Fortive shareholders in combined entity $1.6bn in equity value1 $1.4bn in cash and Fortive debt reduction $3.0bn total implied consideration for Fortive A&S Transaction value represents 13.6x 2017A EV/EBITDA (excluding synergies); 11.0x incl. run-rate synergies¹ Fortive shareholders participate in upside from synergies Tax efficient structure for Fortive and its shareholders Distribution of new Altra shares to Fortive shareholders to be executed either as a split-off or spin-of transaction Proceeds to Fortive increase Fortive M&A capacity Expected close by end of 2018 1 Based on a 20-day Altra VWAP of $45.20 as of 6-Mar-18. Terms of the Transaction Participation in Considerable Expected Value Creation Resulting from Combination More than $50mm of total estimated synergies Strong Cultural Fit Between Both Organizations Minimizes integration risk A great home for Fortive’s employees Proceeds to Fortive Increase Fortive’s M&A Capacity Accelerate portfolio enhancement strategy

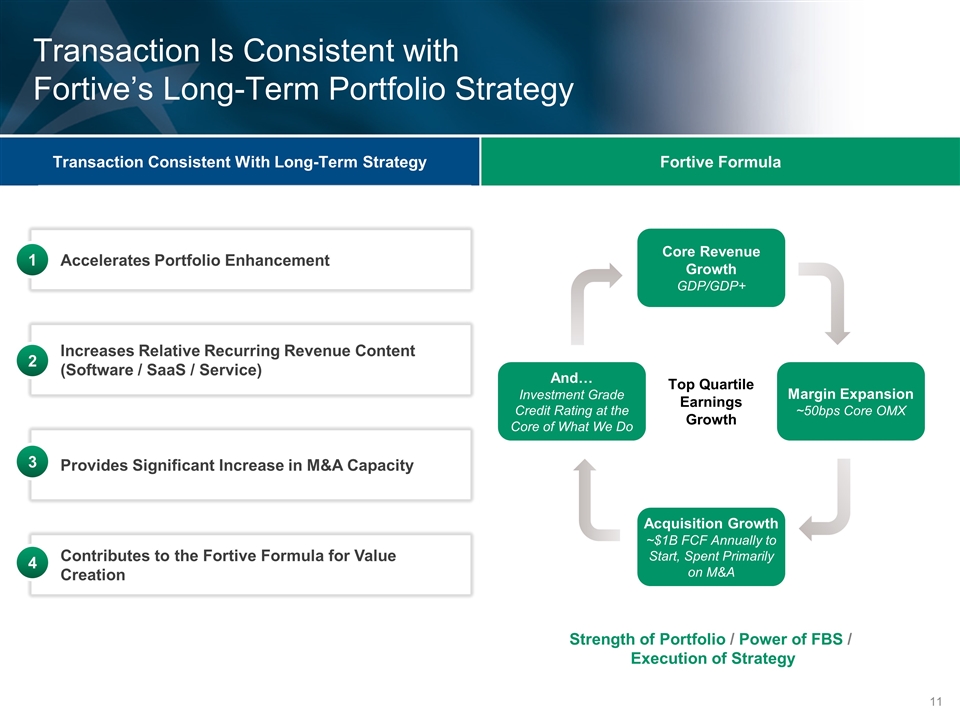

Accelerates Portfolio Enhancement Increases Relative Recurring Revenue Content (Software / SaaS / Service) Provides Significant Increase in M&A Capacity Contributes to the Fortive Formula for Value Creation Transaction Is Consistent with Fortive’s Long-Term Portfolio Strategy 1 2 3 4 And… Investment Grade Credit Rating at the Core of What We Do Margin Expansion ~50bps Core OMX Core Revenue Growth GDP/GDP+ Acquisition Growth ~$1B FCF Annually to Start, Spent Primarily on M&A Top Quartile Earnings Growth Strength of Portfolio / Power of FBS / Execution of Strategy Transaction Consistent With Long-Term Strategy Fortive Formula

Rationale for the Combination Carl Christenson Chairman & Chief Executive Officer Altra

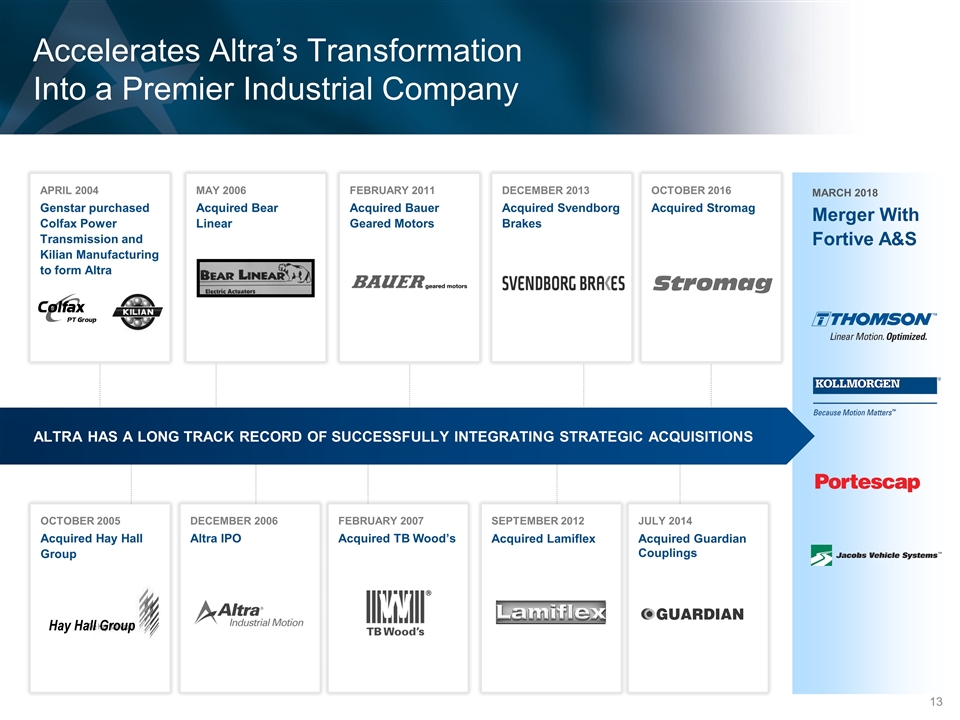

DECEMBER 2006 Altra IPO OCTOBER 2016 Acquired Stromag DECEMBER 2013 Acquired Svendborg Brakes FEBRUARY 2011 Acquired Bauer Geared Motors MAY 2006 Acquired Bear Linear APRIL 2004 Genstar purchased Colfax Power Transmission and Kilian Manufacturing to form Altra Accelerates Altra’s Transformation Into a Premier Industrial Company FEBRUARY 2007 Acquired TB Wood’s SEPTEMBER 2012 Acquired Lamiflex OCTOBER 2005 Acquired Hay Hall Group Hay Hall Group JULY 2014 Acquired Guardian Couplings ALTRA HAS A LONG TRACK RECORD OF SUCCESSFULLY INTEGRATING STRATEGIC ACQUISITIONS MARCH 2018 Merger With Fortive A&S

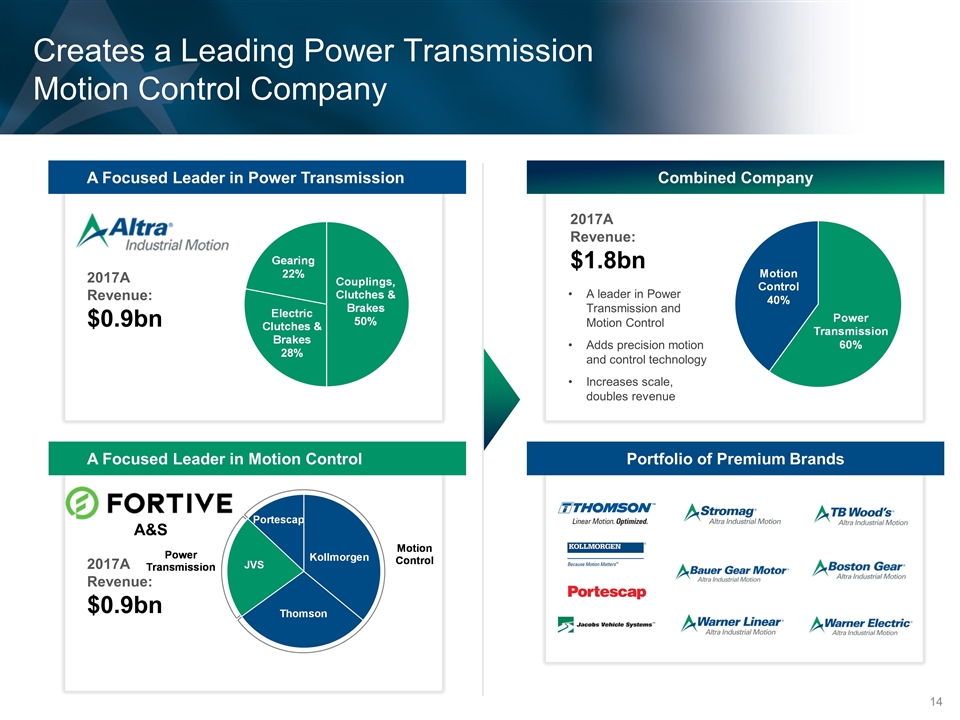

2017A Revenue: $0.9bn A&S Creates a Leading Power Transmission Motion Control Company A Focused Leader in Power Transmission 2017A Revenue: $0.9bn A Focused Leader in Motion Control Combined Company Portfolio of Premium Brands A leader in Power Transmission and Motion Control Adds precision motion and control technology Increases scale, doubles revenue 2017A Revenue: $1.8bn

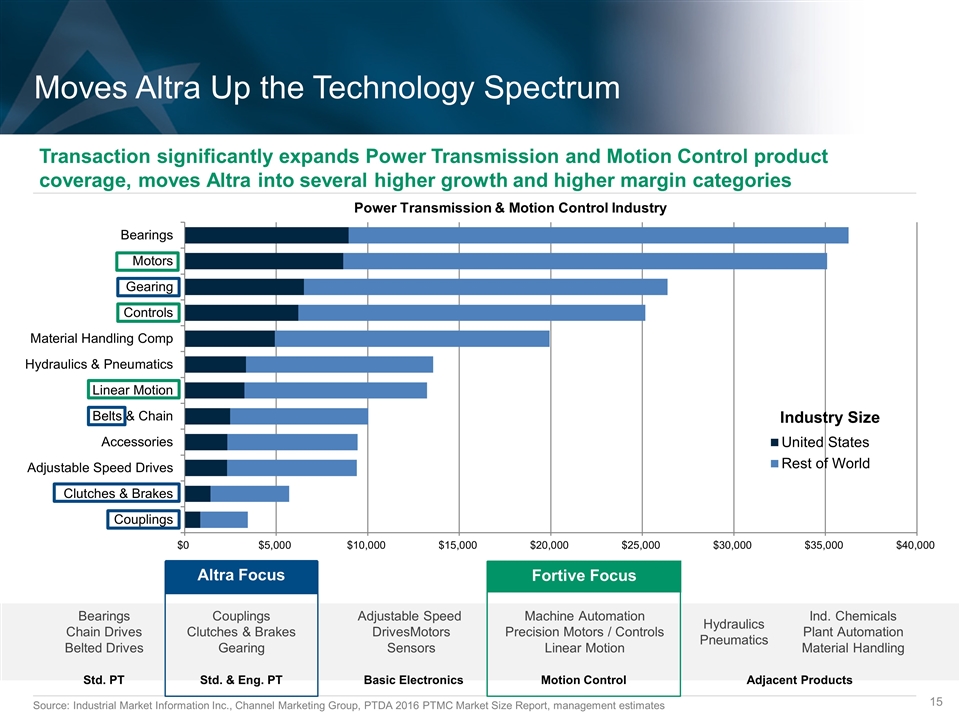

Altra Focus Moves Altra Up the Technology Spectrum Bearings Chain Drives Belted Drives Adjustable Speed DrivesMotors Sensors Hydraulics Pneumatics Ind. Chemicals Plant Automation Material Handling Std. PT Adjacent Products Source: Industrial Market Information Inc., Channel Marketing Group, PTDA 2016 PTMC Market Size Report, management estimates Power Transmission & Motion Control Industry Basic Electronics Couplings Clutches & Brakes Gearing Std. & Eng. PT Machine Automation Precision Motors / Controls Linear Motion Motion Control Industry Size Transaction significantly expands Power Transmission and Motion Control product coverage, moves Altra into several higher growth and higher margin categories Fortive Focus

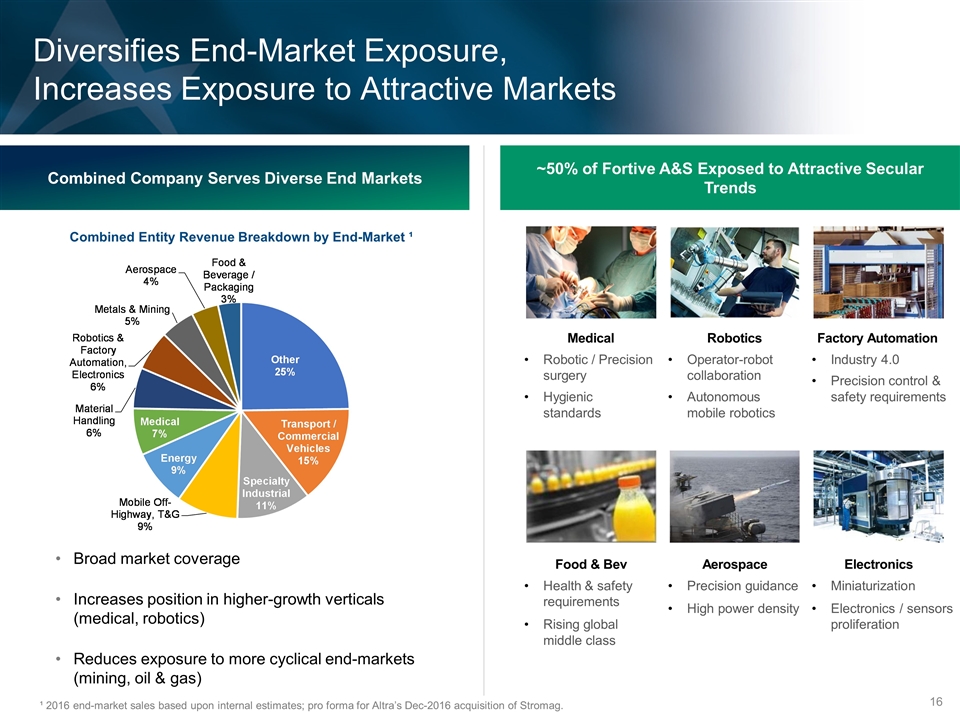

Diversifies End-Market Exposure, Increases Exposure to Attractive Markets Broad market coverage Increases position in higher-growth verticals (medical, robotics) Reduces exposure to more cyclical end-markets (mining, oil & gas) Robotic / Precision surgery Hygienic standards Operator-robot collaboration Autonomous mobile robotics Industry 4.0 Precision control & safety requirements Factory Automation Robotics Medical Health & safety requirements Rising global middle class Precision guidance High power density Miniaturization Electronics / sensors proliferation Electronics Aerospace Food & Bev Combined Company Serves Diverse End Markets ~50% of Fortive A&S Exposed to Attractive Secular Trends Combined Entity Revenue Breakdown by End-Market ¹ ¹ 2016 end-market sales based upon internal estimates; pro forma for Altra’s Dec-2016 acquisition of Stromag.

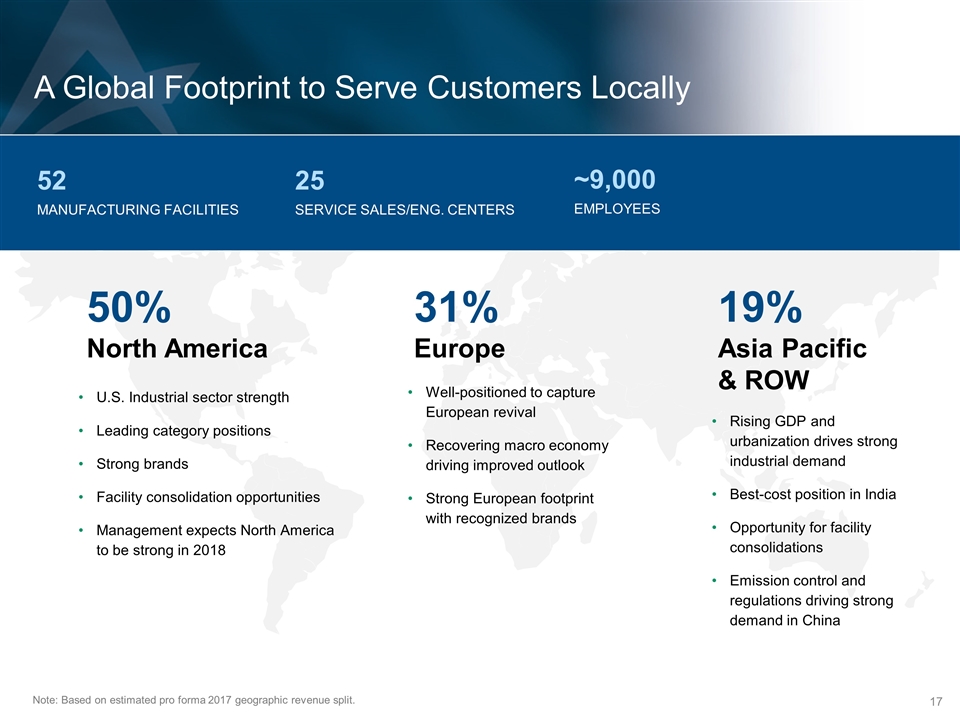

A Global Footprint to Serve Customers Locally 50% North America U.S. Industrial sector strength Leading category positions Strong brands Facility consolidation opportunities Management expects North America to be strong in 2018 31% Europe Well-positioned to capture European revival Recovering macro economy driving improved outlook Strong European footprint with recognized brands Note: Based on estimated pro forma 2017 geographic revenue split. 19% Asia Pacific & ROW Rising GDP and urbanization drives strong industrial demand Best-cost position in India Opportunity for facility consolidations Emission control and regulations driving strong demand in China 25 SERVICE SALES/ENG. CENTERS ~9,000 EMPLOYEES 52 MANUFACTURING FACILITIES

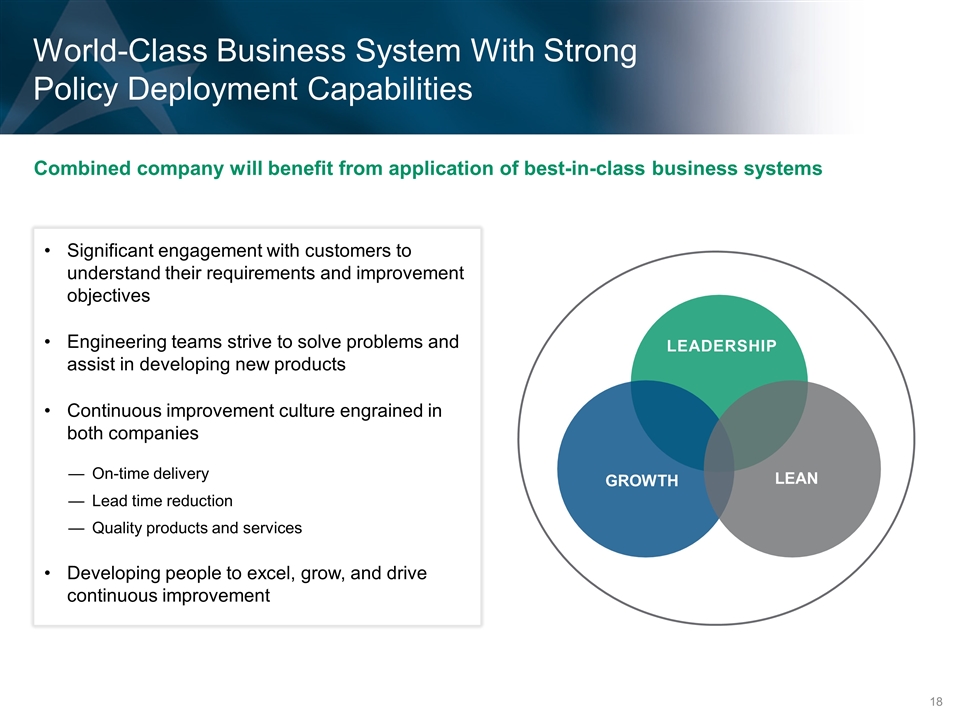

World-Class Business System With Strong Policy Deployment Capabilities LEADERSHIP GROWTH LEAN Combined company will benefit from application of best-in-class business systems Significant engagement with customers to understand their requirements and improvement objectives Engineering teams strive to solve problems and assist in developing new products Continuous improvement culture engrained in both companies On-time delivery Lead time reduction Quality products and services Developing people to excel, grow, and drive continuous improvement

Transaction Financials and Structure Christian Storch Vice President & Chief Financial Officer Altra

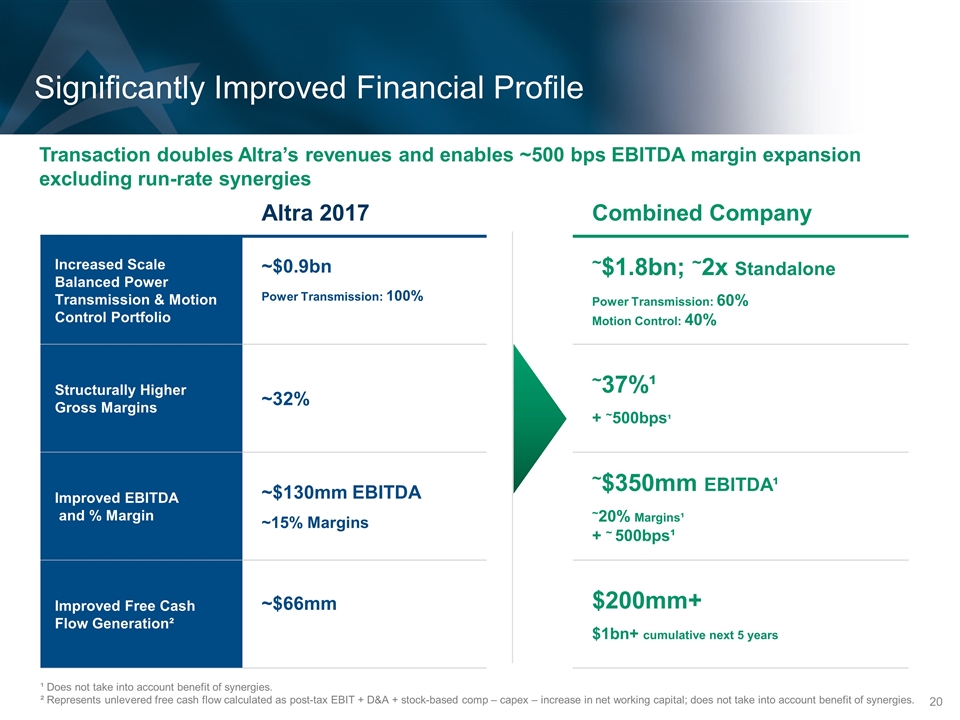

Significantly Improved Financial Profile ¹ Does not take into account benefit of synergies. ² Represents unlevered free cash flow calculated as post-tax EBIT + D&A + stock-based comp – capex – increase in net working capital; does not take into account benefit of synergies. Altra 2017 Combined Company Increased Scale Balanced Power Transmission & Motion Control Portfolio ~$0.9bn Power Transmission: 100% ~$1.8bn; ~2x Standalone Power Transmission: 60% Motion Control: 40% Structurally Higher Gross Margins ~32% ~37%¹ + ~500bps¹ Improved EBITDA and % Margin ~$130mm EBITDA ~15% Margins ~$350mm EBITDA¹ ~20% Margins¹ + ~ 500bps¹ Improved Free Cash Flow Generation² ~$66mm $200mm+ $1bn+ cumulative next 5 years Transaction doubles Altra’s revenues and enables ~500 bps EBITDA margin expansion excluding run-rate synergies

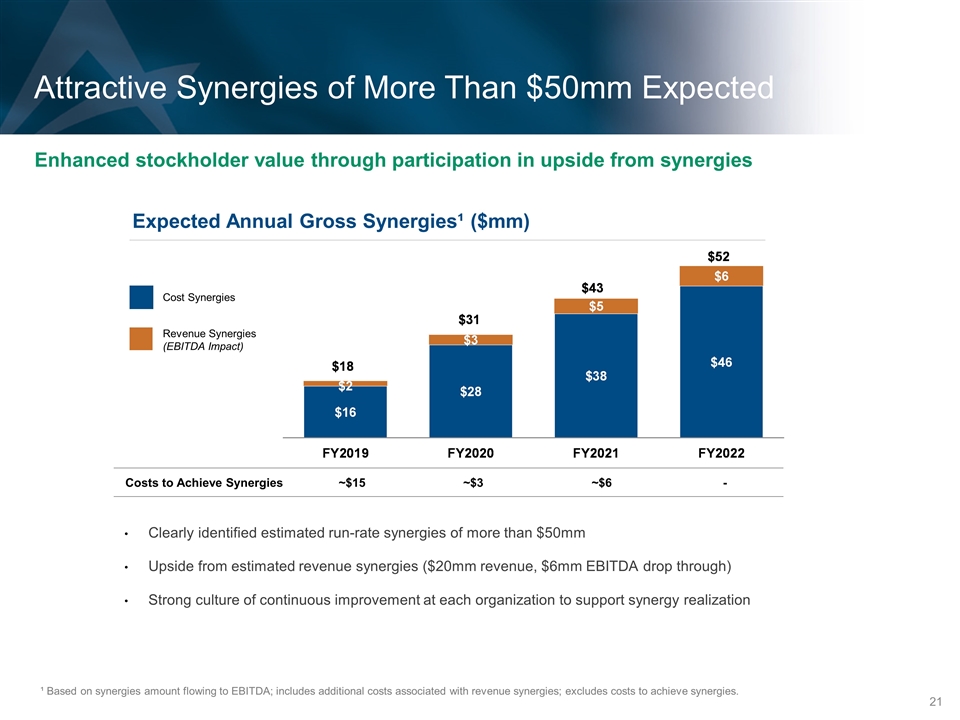

Attractive Synergies of More Than $50mm Expected Clearly identified estimated run-rate synergies of more than $50mm Upside from estimated revenue synergies ($20mm revenue, $6mm EBITDA drop through) Strong culture of continuous improvement at each organization to support synergy realization Cost Synergies Revenue Synergies (EBITDA Impact) ¹ Based on synergies amount flowing to EBITDA; includes additional costs associated with revenue synergies; excludes costs to achieve synergies. Costs to Achieve Synergies ~$15 ~$3 ~$6 - Expected Annual Gross Synergies¹ ($mm) Enhanced stockholder value through participation in upside from synergies

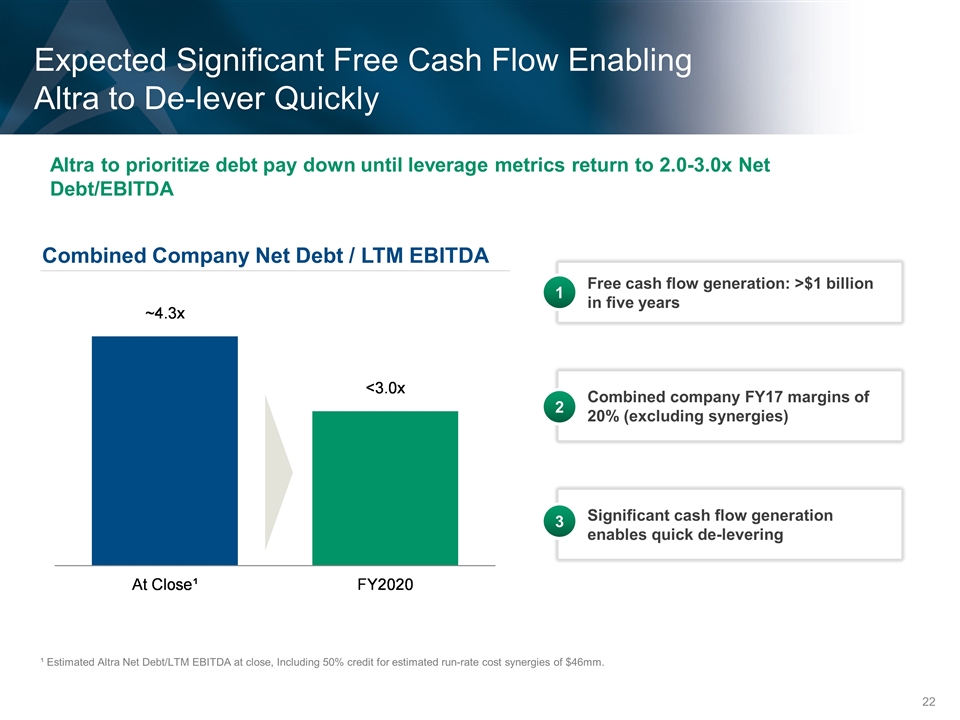

Expected Significant Free Cash Flow Enabling Altra to De-lever Quickly Combined Company Net Debt / LTM EBITDA ¹ Estimated Altra Net Debt/LTM EBITDA at close, Including 50% credit for estimated run-rate cost synergies of $46mm. Altra to prioritize debt pay down until leverage metrics return to 2.0-3.0x Net Debt/EBITDA Free cash flow generation: >$1 billion in five years 1 Combined company FY17 margins of 20% (excluding synergies) 2 Significant cash flow generation enables quick de-levering 3

Confidence in Ability to Integrate And Execute on Transaction Benefits Risk Mitigation Benefits Under Altra Ownership Combined business is stable and growing Lower cost structure will improve win rates Increased customer diversification and end-market exposure Cover customers across a broader technology spectrum Enhanced and complementary capabilities to better meet customer needs Altra to build on its significant operational expertise through FBS knowledge Similar cultures between both companies Strengthen customer relationships due to greater product offering Significant expertise successfully integrating acquisitions Fortive A&S employees now aligned in a pure play structure Altra end-markets continue to recover from trough (mining, oil & gas, farm, metals) Expanded professional growth and development opportunities

Summary of Transaction Benefits Creates a Leading Power Transmission and Motion Control Company Moves Altra up the Technology Spectrum Highly Complementary Product Offerings, Capabilities, and End-Markets Improved Financial Profile with Higher Revenue and Earnings Growth and Better Margins Clearly Identified Estimated Cost Synergies; Revenue Synergies Provide Long-Term Upside Expected to De-lever Quickly Based on Significant Free Cash Flow Generation Unique Opportunity to Drive Substantial Value Creation