Attached files

| file | filename |

|---|---|

| 8-K - POLARIS INDUSTRIES INC. 8-K - Polaris Inc. | a51768402.htm |

Exhibit 99.l

Scott W. Wine, Chairman & CEO Raymond James Investor ConferenceMarch 6, 2018 POLARIS INDUSTRIES INC.

VIDEO: Levi Lavallee Super Bowl Jump 2 PII RJames 3/6/18

$5.4B20% POLARIS INDUSTRIES INC. – A GLOBAL CORPORATION 3 PII RJames 3/6/18 1954 Year Polaris was Founded ~11,000 Employees Worldwide 17 Manufacturing Locations 5 Research & Development Centers ~1,800 Dealers In North America ~1,400 Dealers Outside North America >370,000 Units Shipped Worldwide in 2017 >100 Countries – Polaris Products Sold AdjacentMarkets16% ORV/Snow9% Motorcycles7% excl. Victory Aftermarket362% 2017 Sales* by Segment *FY 2017 Sales results are adjusted; see Appendix for GAAP/Non-GAAP Reconciliation

N.A. POWERSPORTS CONSOLIDATED MARKET SHARE 4 CLEAR #1 IN N.A. POWERSPORTS Honda Harley Yamaha Kawasaki Can Am Other LEADER POWERSPORTSMARKET SHARE PII RJames 3/6/18

STRONG TRACK RECORD OF GROWTH 5 PII RJames 3/6/18 2017 Sales* 2009 Sales $1.6 BILLION Off-RoadVehicles/Snow Motorcycles $5.4 BILLION Off-RoadVehicles/Snow Aftermarket Global Adjacent Markets Motorcycles GLOBAL EXPANSION PLANT INVESTMENTS INDIAN MOTORCYCLES STRATEGIC ACQUISITIONS AFTERMARKET – TAP / PG&A ORGANIC GROWTH A MORE DIVERSE GROWTH COMPANY *Adjusted Results: See Q4/FY’17 Appendix for GAAP/Non-GAAP Reconciliation

$5.4 BILLION Off-Road Vehicles/Snowmobiles Aftermarket Global Adjacent Markets Motorcycles Platforms for Growth STRONG TRACK RECORD OF GROWTH 6 PII RJames 3/6/18 $3.6B $885M 2017 Sales* $5.4 BILLION $574M $397M Off-Road Vehicles/Snowmobiles Aftermarket Motorcycles Global Adjacent Markets *FY 2017 Sales results are adjusted; see Appendix for GAAP/Non-GAAP Reconciliation

PII RJames 3/6/18 7

8 2018 BUILDING A CUSTOMER-CENTRIC, HIGHLY EFFICIENT GROWTH COMPANY PII RJames 3/6/18

2018 FULL YEAR GUIDANCE BY SEGMENT 2018 GUIDANCE GROWTH 3% - 5% Adjusted* Sales Guidance $5.6 - $5.7 Billion EFFICIENCY 24% - 28% Adjusted* EPS Guidance $6.00 to $6.20 PII RJames 3/6/18 9 Aftermarket ORV/Snowmobiles Adjacent Markets Motorcycles low tomid-single digits % $3,572 $574 high-singledigits % mid-single digits % $397 high-single digits % $885 ($ in millions; PG&A sales included in each respective segment) *FY 2017 Sales results and 2018 Sales & EPS guidance are adjusted; see Appendix for GAAP/Non-GAAP Reconciliation

ORV / Snowmobile Segment Sales* 10 Remain Clear #1 in Market Share OFF-ROAD VEHICLES Drive InnovationActivate the CoreFlawless Delivery / ExecutionResolve Regulatory Issues Key Strategies $3.3B ORV PG&A Snow ORV PG&A Snow 9%$3.6B Reclassified(1) Guidance Up low tomid-single digits % ORV PG&A Snow * See GAAP/Non-GAAP Reconciliation in Appendix (1) 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments PII RJames 3/6/18 $ in billions; includes related PG&A Sales

VIDEO: RZR XP TURBO S 11 PII RJames 3/6/18 60 Sec. VideoNEED MP4/WMV FILEInsert picture of Turbo S

ORV / Snowmobile Segment Sales* 12 PII RJames 3/6/18 Remains One of Our Most Profitable Businesses SNOWMOBILES Win the CoreDrive InnovationCreate New Segments Key Strategies $3.3B ORV PG&A Snow ORV PG&A Snow 9%$3.6B Reclassified(1) Guidance Up low tomid-single digits % ORV PG&A Snow * See GAAP/Non-GAAP Reconciliation in Appendix (1) 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments $ in billions; includes related PG&A Sales

Motorcycle Segment Sales* 13 On-going Sales & Margin Expansion in 2018 MOTORCYCLES Drive Global AwarenessDeliver On-going InnovationMargin Improvement Key Strategies Reclassified(1) Guidance $699 18%(7% Excl. Victory) $574 Adjusted* Up high-singledigits % $ in millions; includes related PG&A Sales * See GAAP/Non-GAAP Reconciliation in Appendix (1) 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments PII RJames 3/6/18

GAM Segment Sales 14 PII RJames 3/6/18 Building on Strong Momentum GLOBAL ADJACENT MARKETS (GAM) Capitalize on Emerging TrendsExpand Products and ChannelsDrive Autonomous Capability Key Strategies Up mid-single digits % Guidance $ in millions; includes related PG&A Sales $342 16%$397

PII RJames 3/6/18 15 WEST GLAMIS Unforgettable ride and drive experiences nationwidehttps://adventures.polaris.com/

Core PG&A Sales 16 PG&A is Integral in Providing Industry-Leading Customer Experience CORE PARTS, GARMENTS & ACCESSORIES (PG&A) Up mid-single digits % 8%$784 Guidance $ in millions $727 Motorcycles Adjacent Markets (GAM) Snowmobiles 3%Apparel Build on Growth FoundationE-commerce AccelerationImproved New Product Readiness Key Strategies 2017 Sales by Segment 2017 Sales by Category PII RJames 3/6/18

Aftermarket Segment Sales 17 TAP Providing Access to the $10+ Billion Jeep & Truck Accessories Market AFTERMARKET Brand and Product LeadershipSales / Channel OptimizationSupply Chain Excellence Key Strategies Up high-single digits % Reclassified(1) Guidance $ in millions $192 (1) 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments Transamerican Auto Parts Other Aftermarket Brands Significantly$885 PII RJames 3/6/18

International Sales 18 Solid Execution in All Markets INTERNATIONAL Grow ORV / MotorcyclesMaximize SnowLeverage Local Manufacturing Key Strategies Up mid-single digits % Guidance $ in millions; includes related PG&A Sales $652 11%$725 PII RJames 3/6/18 2017 Sales by Business Opole, Poland

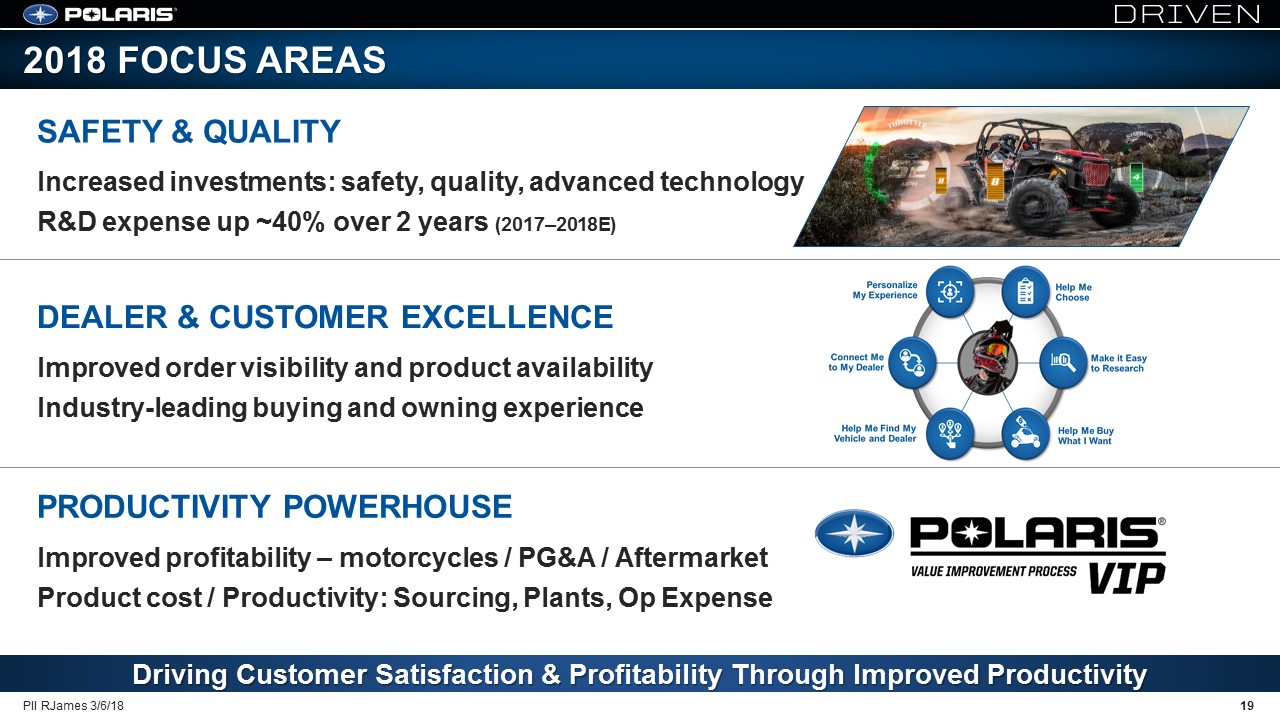

2018 FOCUS AREAS 19 PII RJames 3/6/18 Driving Customer Satisfaction & Profitability Through Improved Productivity SAFETY & QUALITYIncreased investments: safety, quality, advanced technologyR&D expense up ~40% over 2 years (2017–2018E) PRODUCTIVITY POWERHOUSEImproved profitability – motorcycles / PG&A / AftermarketProduct cost / Productivity: Sourcing, Plants, Op Expense DEALER & CUSTOMER EXCELLENCEImproved order visibility and product availabilityIndustry-leading buying and owning experience

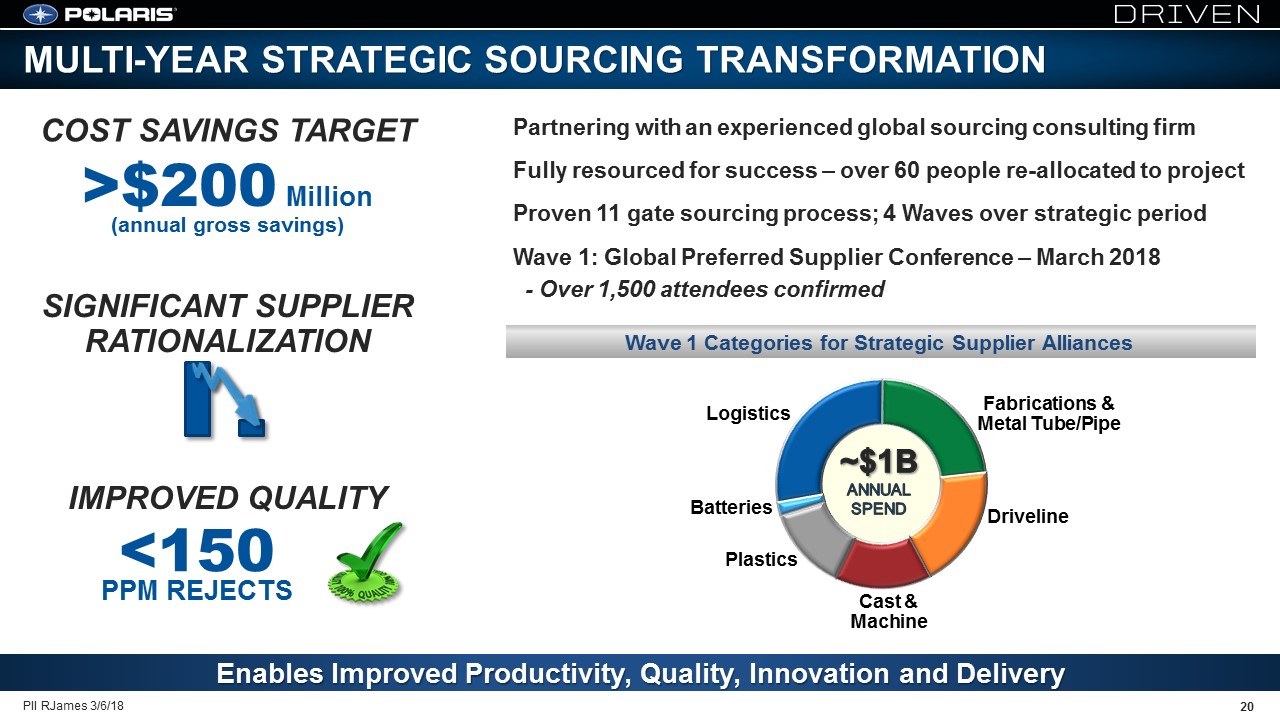

~$1BANNUALSPEND MULTI-YEAR STRATEGIC SOURCING TRANSFORMATION Partnering with an experienced global sourcing consulting firmFully resourced for success – over 60 people re-allocated to projectProven 11 gate sourcing process; 4 Waves over strategic periodWave 1: Global Preferred Supplier Conference – March 2018- Over 1,500 attendees confirmed PII RJames 3/6/18 20 Enables Improved Productivity, Quality, Innovation and Delivery SIGNIFICANT SUPPLIER RATIONALIZATION IMPROVED QUALITY <150PPM REJECTS COST SAVINGS TARGET >$200 Million(annual gross savings) Logistics Fabrications & Metal Tube/Pipe Driveline Cast & Machine Plastics Batteries Wave 1 Categories for Strategic Supplier Alliances

New product launches accelerating; 8 in past six monthsORV – Playing OffenseIndian – winning in the market and on the trackPG&A + TAP + Aftermarket = $1.7B – sizable foundation for growthInternational – leveraging momentumSafety, Quality, Dealer/Consumer Excellence Improved A Customer-centric Highly Efficient Growth Company 21 PII RJames 3/6/18 SUMMARY

SAFE HARBOR & NON-GAAP MEASURES 22 PII RJames 3/6/18 Except for historical information contained herein, the matters set forth in this presentation, including management’s expectations regarding 2018 future sales, shipments, net income, and net income per share, operational initiatives and impact of tax reform are forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those forward-looking statements. Potential risks and uncertainties include such factors as the Company’s ability to successfully implement its manufacturing operations expansion initiatives, product offerings, promotional activities and pricing strategies by competitors; economic conditions that impact consumer spending; acquisition integration costs; product recalls, warranty expenses; impact of changes in Polaris stock price on incentive compensation plan costs; foreign currency exchange rate fluctuations; environmental and product safety regulatory activity; effects of weather; commodity costs; uninsured product liability claims; uncertainty in the retail and wholesale credit markets; performance of affiliate partners; changes in tax policy and overall economic conditions, including inflation, consumer confidence and spending and relationships with dealers and suppliers. Investors are also directed to consider other risks and uncertainties discussed in documents filed by the Company with the Securities and Exchange Commission. The Company does not undertake any duty to any person to provide updates to its forward-looking statements. The data source for retail sales figures included in this presentation is registration information provided by Polaris dealers in North America and compiled by the Company or Company estimates. The Company must rely on information that its dealers supply concerning retail sales, and other retail sales data sources and this information is subject to revision.This presentation contains certain non-GAAP financial measures, consisting of “Adjusted” sales (total and organic), gross profit, operating expenses, net income and net income per diluted share as measures of our operating performance. Management believes these measures may be useful in performing meaningful comparisons of past and present operating results, to understand the performance of its ongoing operations and how management views the business. Reconciliations of Adjusted non-GAAP measures to reported GAAP measures are included on slides 4 and 5 in this presentation. These measures, however, should not be construed as an alternative to any other measure of performance determined in accordance with GAAP.

QUESTIONS? Raymond James Investor ConferenceMarch 6, 2018 POLARIS INDUSTRIES INC.

APPENDIX Raymond James Investor ConferenceMarch 6, 2018 POLARIS INDUSTRIES INC.

APPENDIX: NON-GAAP RECONCILIATIONS 25 PII RJames 3/6/18 Key Definitions: Throughout this presentation, the word “Adjusted” is used to refer to GAAP results excluding: TAP inventory step-up purchase accounting, TAP integration expenses, impacts associated with the Victory Motorcycles® wind down, restructuring and realignment costs, and impacts of the tax reform. Reconciliation of GAAP "Reported" Results to Non-GAAP "Adjusted" Results (In Thousands, except per share data; Unaudited) Adjustments: (1) Represents adjustments for the wind down of Victory Motorcycles, including wholegoods, accessories and apparel (2) Represents adjustments for TAP integration expenses (3) Represents adjustments for corporate restructuring and network realignment costs (4) Represents an adjustment for impacts of a charge in its income tax provision due to the remeasurement of its deferred income tax positions at the new corporate income tax rate of 23.8 percent (from 37.1 percent) (5) The Company used its estimated statutory tax rate of 37.1% for the non-GAAP adjustments, except for the non-deductible items and the tax reform related changes noted in Item 4 2016 Reclassified Results: 2016 sales and gross profit results for ORV/Snowmobiles, Motorcycles and Aftermarket are reclassified for the new Aftermarket reporting segment. Three months ended December 31, Three months ended December 31, Years ended December 31, Years ended December 31, 2017 2017 2016 2016 2017 2017 2016 2016 Sales $ 1,431,049 $ 1,217,789 $ 5,428,477 $ 4,516,629 Victory wind down (1) (2,364 ) — (1,857 ) — Restructuring & realignment (3) 1,048 — 1,048 — Adjusted sales 1,429,733 1,217,789 5,427,668 4,516,629 Gross profit 367,812 312,772 1,324,651 1,105,623 Victory wind down (1) 2,874 — 57,844 — TAP (2) — 8,803 12,950 8,803 Restructuring & realignment (3) 2,463 — 12,980 — Adjusted gross profit 373,149 321,575 1,408,425 1,114,426 Income before taxes 117,977 85,459 318,791 313,251 Victory wind down (1) 164 — 77,398 — TAP (2) 3,463 21,454 26,921 21,454 Restructuring & realignment (3) 11,598 — 22,116 — Adjusted income before taxes 133,202 106,913 445,226 334,705 Net income 31,475 62,581 $ 172,492 212,948 Victory wind down (1) (1,012 ) — 52,366 — TAP (2) 2,177 13,515 16,923 13,515 Restructuring & realignment (3) 7,291 — 13,902 — Tax reform (4) 55,398 — 55,398 — Adjusted net income (5) $ 95,329 $ 76,096 $ 311,081 $ 226,463 Diluted EPS $ 0.49 $ 0.97 $ 2.69 $ 3.27 Victory wind down (1) (0.02 ) — 0.82 — TAP (2) 0.03 0.21 0.26 0.21 Restructuring & realignment (3) 0.11 — 0.22 — Tax reform (4) 0.86 — 0.86 — Adjusted EPS (5) $ 1.47 $ 1.18 $ 4.85 $ 3.48

APPENDIX: NON-GAAP RECONCILIATIONS - SEGMENTS 26 PII RJames 3/6/18 Non-GAAP Reconciliation of Segment Results (In Thousands; Unaudited) Adjustments: (1) Represents adjustments for the wind down of Victory Motorcycles, including wholegoods, accessories and apparel (2) Represents adjustments for TAP integration expenses (3) Represents adjustments for corporate restructuring and network realignment costs (4) Represents adjustments for costs related to supply chain transformation. 2016 Reclassified Results: 2016 sales and gross profit results for ORV/Snowmobiles, Motorcycles and Aftermarket are reclassified for the new Aftermarket reporting segment. Three months ended December 31, Three months ended December 31, Years ended December 31, Years ended December 31, 2017 2017 2016 2016 2017 2017 2016 2016 SEGMENT SALES ORV/Snow segment sales $ 993,750 $ 880,905 $ 3,570,753 $ 3,283,890 Restructuring & realignment (3) 1,048 — 1,048 — Adjusted ORV/Snow segment sales 994,798 880,905 3,571,801 3,283,890 Motorcycles segment sales 102,723 104,331 576,068 699,171 Victory wind down (1) (2,364 ) — (1,857 ) — Adjusted Motorcycles segment sales 100,359 104,331 574,211 699,171 Global Adjacent Markets (GAM) segment sales 116,612 98,384 396,764 341,937 No adjustment — — — — Adjusted GAM segment sales 116,612 98,384 396,764 341,937 Aftermarket segment sales 217,964 134,169 884,892 191,631 No adjustment — — — — Adjusted Aftermarket sales 217,964 134,169 884,892 191,631 Total sales 1,431,049 1,217,789 5,428,477 4,516,629 Total adjustments (1,316 ) — (809 ) — Adjusted total sales $ 1,429,733 $ 1,217,789 $ 5,427,668 $ 4,516,629 Three months ended December 31, Years ended December 31, 2017 2016 2017 2016 SEGMENT GROSS PROFIT ORV/Snow segment gross profit 278,544 251,521 1,054,557 907,597 Restructuring & realignment (3) 1,048 — 1,048 — Adjusted ORV/Snow segment gross profit 279,592 251,521 1,055,605 907,597 Motorcycles segment gross profit 5,108 1,063 16,697 87,538 Victory wind down (1) 2,874 — 57,844 — Adjusted Motorcycles segment gross profit 7,982 1,063 74,541 87,538 Global Adjacent Markets (GAM) segment gross profit 29,623 28,986 94,920 95,149 Restructuring & realignment (3) 415 — 10,932 — Adjusted GAM segment gross profit 30,038 28,986 105,852 95,149 Aftermarket segment gross profit 60,777 28,017 225,498 46,289 TAP (2) — 8,803 12,950 8,803 Adjusted Aftermarket segment gross profit 60,777 36,820 238,448 55,092 Corporate segment gross profit (6,240 ) 3,185 (67,021 ) (30,950 ) Restructuring & realignment (4) 1,000 — 1,000 — Adjusted Corporate segment gross profit (5,240 ) 3,185 (66,021 ) (30,950 ) Total gross profit 367,812 312,772 1,324,651 1,105,623 Total adjustments 5,337 8,803 83,774 8,803 Adjusted total gross profit 373,149 321,575 1,408,425 1,114,426

APPENDIX: 2018 GUIDANCE DISCLOSURES 27 PII RJames 3/6/18 2018 guidance excludes the pre-tax effect of acquisition integration costs of approx. $10 million, supply chain transformation costs of approx. $10 million to $20 million and the remaining impacts associated with the Victory wind down which is estimated to be in the range of $5 million to $10 million. 2018 Adjusted sales guidance excludes any Victory wholegood, accessories and apparel sales and corresponding promotional costs as the Company is in the process of exiting the brand. The Company has not provided reconciliations of guidance for Adjusted diluted net income per share, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company is unable, without unreasonable efforts, to forecast certain items required to develop meaningful comparable GAAP financial measures. These items include costs associated with the Victory wind down that are difficult to predict in advance in order to include in a GAAP estimate.Product Quality Update: As previously disclosed, Polaris is working with regulators to resolve ongoing product issues. The Company expects to resolve, in the near term, a late reporting penalty with the CPSC related to previously announced recalls. An estimated amount for the pending penalty has been previously accrued for in Polaris’ prior year financial statements.