Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-322.htm |

| EX-32.1 - EXHIBIT 32.1 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-321.htm |

| EX-31.2 - EXHIBIT 31.2 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-312.htm |

| EX-31.1 - EXHIBIT 31.1 - CHESAPEAKE UTILITIES CORP | cpk12302017ex-311.htm |

| EX-23.1 - EXHIBIT 23.1 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-231.htm |

| EX-21 - EXHIBIT 21 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-21.htm |

| EX-12 - EXHIBIT 12 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-12.htm |

| EX-4.13 - EXHIBIT 4.13 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-413.htm |

| EX-3.6 - EXHIBIT 3.6 - CHESAPEAKE UTILITIES CORP | cpk12312017ex-36.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

(Mark One)

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2017

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-11590

CHESAPEAKE UTILITIES CORPORATION | ||

(Exact name of registrant as specified in its charter) | ||

State of Delaware | 51-0064146 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

909 Silver Lake Boulevard, Dover, Delaware 19904

(Address of principal executive offices, including zip code)

302-734-6799

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock—par value per share $0.4867 | New York Stock Exchange, Inc. | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “accelerated filer,” “large accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company" | Smaller reporting company | ¨ | ||

Emerging growth company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of the common shares held by non-affiliates of Chesapeake Utilities Corporation as of June 30, 2017, the last business day of its most recently completed second fiscal quarter, based on the last trade price on that date, as reported by the New York Stock Exchange, was approximately $1.2 billion.

The number of shares of Chesapeake Utilities Corporation's common stock outstanding as of February 20, 2018 was 16,344,442.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2018 Annual Meeting of Stockholders are incorporated by reference in Part II and Part III, which Proxy Statement shall be filed with the Securities and Exchange Commission within 120 days after the end of registrant's fiscal year ended December 31, 2017.

CHESAPEAKE UTILITIES CORPORATION

FORM 10-K

YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

Page | |

GLOSSARY OF DEFINITIONS

AFUDC: Allowance for funds used during construction

Amendment: The Second Amendment to the Rights Agreement, which was executed on February 27, 2018, and which has the effect of terminating the Rights Agreement at 5:00 P.M., New York City time on that date.

ARM: ARM Energy Management, LLC, a natural gas supply and supply management company servicing commercial and industrial customers in Western Pennsylvania, which sold certain assets to PESCO in August 2017

ASC: Accounting Standards Codification

ASU: Accounting Standards Update

Aspire Energy: Aspire Energy of Ohio, LLC, a wholly-owned subsidiary of Chesapeake Utilities, into which Gatherco merged on April 1, 2015

AutoGas: Alliance AutoGas, a national consortium of companies providing an industry-leading complete program for fleets interested in shifting from gasoline to clean-burning propane, of which Sharp is a member

CDD: Cooling degree-day, which is the measure of the variation in weather based on the extent to which the daily average temperature (from 10:00 am to 10:00 am) is above 65 degrees Fahrenheit

Central Gas: Central Gas Company of Okeechobee, Incorporated, a propane distribution provider in Southeast Florida, which sold certain assets to Flo-gas in December 2017

CGC: Consumer Gas Cooperative, an Ohio natural gas cooperative

Chesapeake or Chesapeake Utilities: Chesapeake Utilities Corporation, its divisions and subsidiaries, as appropriate in the context of the disclosure

Chesapeake Pension Plan: A defined benefit pension plan sponsored by Chesapeake Utilities

Chesapeake Postretirement Plan: An unfunded postretirement health care and life insurance plan sponsored by Chesapeake Utilities

Chesapeake SERP: An unfunded supplemental executive retirement pension plan sponsored by Chesapeake Utilities

Chesapeake Service Company: Chesapeake Service Company, a wholly-owned subsidiary of Chesapeake Utilities and the parent company of Skipjack, CIC and ESRE

Chipola: Chipola Propane Gas Company, Inc., a propane distribution service provider in Northwest Florida, which sold certain assets to Flo-gas in August 2017

CHP: Combined heat and power plant

CIAC: Contributions from customers that are used to construct facilities

CIC: Chesapeake Investment Company, a wholly-owned subsidiary of Chesapeake Service Company, which is an investment company incorporated in Delaware

Columbia Gas: Columbia Gas Transmission, LLC, an unaffiliated interstate pipeline interconnected with Eastern Shore's pipeline

Columbia Gas of Ohio: An unaffiliated local distribution company based in Ohio

Company: Chesapeake Utilities Corporation, its divisions and subsidiaries, as appropriate in the context of the disclosure

CP: Certificate of Public Convenience and Necessity

Credit Agreement: The Credit Agreement dated October 8, 2015, among Chesapeake Utilities and the Lenders related to the Revolver

Degree-day: A degree-day is the measure of the variation in the weather based on the extent to which the average daily temperature (from 10:00 am to 10:00 am) falls above or below 65 degrees Fahrenheit

Delaware Division: Chesapeake Utilities' natural gas distribution operation serving customers in Delaware

Delmarva Peninsula: A peninsula on the east coast of the United States of America occupied by Delaware and portions of Maryland and Virginia

Delmarva Peninsula natural gas distribution: Chesapeake Utilities' natural gas distribution operations, which includes the Delaware Division, Chesapeake Utilities' Maryland division, and Sandpiper

Dodd-Frank Act: The Dodd-Frank Wall Street Reform and Consumer Protection Act

DNREC: Delaware Department of Natural Resources and Environmental Control

Dt(s): Dekatherm(s), which is a natural gas unit of measurement that includes a standard measure for heating value

Dts/d: Dekatherms per day

Eastern Shore: Eastern Shore Natural Gas Company, a wholly-owned interstate natural gas transmission subsidiary of Chesapeake Utilities

EGWIC: Eastern Gas & Water Investment Company, LLC, an affiliate of Eastern Shore Gas Company

Eight Flags: Eight Flags Energy, LLC, a subsidiary of Chesapeake OnSight Services, LLC, which owns and operates a CHP plant on Amelia Island, Florida, that supplies electricity to FPU and industrial steam to Rayonier

EPA: United States Environmental Protection Agency

ESG: Eastern Shore Gas Company and its affiliates

ESRE: Eastern Shore Real Estate, Inc., a wholly-owned subsidiary of Chesapeake Utilities that owns and leases office buildings in Delaware and Maryland to divisions and subsidiaries of Chesapeake Utilities

FASB: Financial Accounting Standards Board

FERC: Federal Energy Regulatory Commission, an independent agency of the United States government that regulates the interstate transmission of electricity, natural gas, and oil

FDEP: Florida Department of Environmental Protection

FDOT: Florida Department of Transportation

FGT: Florida Gas Transmission Company

Flo-gas: Flo-gas Corporation, a wholly-owned subsidiary of FPU

Florida Division: Chesapeake Utilities' natural gas distribution operation serving customers in Florida

Fort Meade: Fort Meade natural gas division of FPU

FPL: Florida Power & Light Company, an unaffiliated electric company that supplies electricity to FPU

FPU: Florida Public Utilities Company, a wholly-owned subsidiary of Chesapeake Utilities

FPU Medical Plan: A separate unfunded postretirement medical plan for FPU sponsored by Chesapeake Utilities

FPU Pension Plan: A separate defined benefit pension plan for FPU sponsored by Chesapeake Utilities

GAAP: Accounting principles generally accepted in the United States of America

Gatherco: Gatherco, Inc., a corporation that merged with and into Aspire Energy on April 1, 2015

GRIP: The Gas Reliability Infrastructure Program, a natural gas pipeline replacement program in Florida, pursuant to which we collect a surcharge from certain of our customers to recover capital and other program-related costs associated with the replacement of qualifying distribution mains and services

GSR: Gas Service Rates

Gulf Power: Gulf Power Company, an unaffiliated electric company which supplies electricity to FPU

Gulfstream: Gulfstream Natural Gas System, LLC, an unaffiliated pipeline network that supplies natural gas to FPU

HDD: Heating degree-day, which is a measure of the variation in weather based on the extent to which the daily average temperature (from 10:00 am to 10:00 am) is below 65 degrees Fahrenheit

ICE: Intercontinental Exchange is an electronic trading platform

IGC: Indiantown Gas Company, a division of FPU

IRS: Internal Revenue Service

JEA: The unaffiliated community-owned utility located in Jacksonville, Florida, formerly known as Jacksonville Electric Authority

Lenders: PNC, Bank of America, N.A., Citizens Bank N.A., Royal Bank of Canada, and Wells Fargo Bank, National Association, which are collectively the lenders that entered into the Credit Agreement with Chesapeake Utilities

MDE: Maryland Department of Environment

MetLife: MetLife Investment Advisors, an institutional debt investment management firm, with which we entered into the MetLife Shelf Agreement

MetLife Shelf Agreement: An agreement entered into by Chesapeake Utilities and MetLife pursuant to which Chesapeake Utilities may request that MetLife purchase, through March 2, 2020, up to $150.0 million of unsecured senior debt at a fixed interest rate and with a maturity date not to exceed 20 years from the date of issuance

MetLife Shelf Notes: Unsecured senior promissory notes issuable under the MetLife Shelf Agreement

MGP: Manufactured gas plant, which is a site where coal was previously used to manufacture gaseous fuel for industrial, commercial and residential use

MTM: Fair value (mark-to-market) accounting required for derivatives in accordance with ASC 815

MW: Megawatts, which is a unit of measurement for electric base load power or capacity

Non-Qualified Deferred Compensation Plan: A non-qualified, deferred compensation plan under which certain of our executives and members of the Board of Directors are able to defer payment of all or a part of certain specified types of compensation, including executive salaries, cash bonuses, executive performance shares and directors’ retainers

NYL: New York Life Investors LLC, an institutional debt investment management firm, with which we entered into the NYL Shelf Agreement

NYL Shelf Agreement: An agreement entered into by Chesapeake Utilities and NYL pursuant to which Chesapeake Utilities may request that NYL purchase, through March 2, 2020, up to $100.0 million of unsecured senior debt at a fixed interest rate and with a maturity date not to exceed 20 years from the date of issuance

NYL Shelf Notes: Unsecured senior promissory notes issuable under the NYL Shelf Agreement

NYSE: New York Stock Exchange

OPT Service: Off Peak ≤ 30 or ≤ 90 Firm Transportation Service, a tariff associated with Eastern Shore's firm transportation service that allows Eastern Shore to not schedule service for up to 30 or 90 days during the peak months of November through April each year

OTC: Over-the-counter

Peninsula Pipeline: Peninsula Pipeline Company, Inc., Chesapeake Utilities' wholly-owned Florida intrastate pipeline subsidiary

Peoples Gas: The Peoples Gas System division of Tampa Electric Company, an unaffiliated utility in Florida that has a joint pipeline with Peninsula Pipeline

PESCO: Peninsula Energy Services Company, Inc., Chesapeake Utilities' wholly-owned natural gas marketing subsidiary

PNC: PNC Bank, National Association, the administrative agent and primary lender for our Revolver

Proxy Statement: Chesapeake Utilities’ definitive Proxy Statement to be filed no later than March 31, 2018, in connection with our Annual Meeting to be held on or about May 9, 2018

Prudential: Prudential Investment Management Inc., an institutional investment management firm, with which we have entered into the Prudential Shelf Agreement

Prudential Shelf Agreement: An agreement entered into by Chesapeake Utilities and Prudential pursuant to which Chesapeake Utilities may request that Prudential purchase, through October 7, 2018, up to $150.0 million of Prudential Shelf Notes at a fixed interest rate and with a maturity date not to exceed 20 years from the date of issuance

Prudential Shelf Notes: Unsecured senior promissory notes issuable under the Prudential Shelf Agreement

PSC: Public Service Commission, which is the state agency that regulates the rates and/or services provided by Chesapeake Utilities' natural gas and electric distribution operations in Delaware, Maryland and Florida and Peninsula Pipeline in Florida

RAP: Remedial Action Plan, which is a plan that outlines the procedures taken or being considered in removing contaminants from a MGP formerly owned by Chesapeake Utilities or FPU

Rayonier: Rayonier Performance Fibers, LLC, the company that owns the property on which Eight Flags' CHP plant is located, and a customer of the steam generated by the CHP plant

Retirement Savings Plan: Chesapeake Utilities' qualified 401(k) retirement savings plan

Revolver: Our unsecured revolving credit facility with the Lenders

Rights Agreement: The Rights Agreement by and between the Company and BankBoston, N.A., dated August 20, 1999, as amended by that certain First Amendment to Rights Agreement by and between the Company and Computershare Trust Company N.A., as successor rights agent, dated September 12, 2008

Sandpiper: Sandpiper Energy, Inc., Chesapeake Utilities' wholly-owned subsidiary, which provides a tariff-based distribution service to customers in Worcester County, Maryland

Sanford Group: FPU and other responsible parties involved with the Sanford MGP site

SCO: Standard Choice Offer, a program offered by Columbia Gas of Ohio in which PESCO was selected as a natural gas supplier pursuant to a competitive auction to serve a pool of customers within Columbia Gas of Ohio's service territory from April 2016 through March 2017

SEC: Securities and Exchange Commission

Senior Notes: Our unsecured long-term debt issued primarily to insurance companies on various dates

Sharp: Sharp Energy, Inc., Chesapeake Utilities' wholly-owned propane distribution subsidiary

Sharpgas: Sharpgas, Inc., a subsidiary of Sharp

SICP: 2013 Stock and Incentive Compensation Plan

SIR: A system improvement rate adder designed to fund system expansion costs within the city limits of Ocean City, Maryland

Skipjack: Skipjack, Inc., a wholly-owned subsidiary of Chesapeake Service Company that owns and leases office buildings in Delaware and Maryland to affiliates of Chesapeake Utilities

S&P 500 Index: Standard & Poor’s 500 Index, a stock market index based on the market capitalization of 500 leading companies, which is intended to represent the overall composition of the economy

TCJA: Tax Cuts and Jobs Act of 2017, legislation passed by Congress and signed into law by the President on December 22, 2017, which among other things reduced the corporate income tax rate from 35 percent to 21 percent, effective January 1, 2018

TETLP: Texas Eastern Transmission, LP, an interstate pipeline interconnected with Eastern Shore's pipeline

Third Participation Agreement: An agreement signed by FPU and the Sanford Group, which provides for the funding of the final remedy approved by the EPA for the property owned by FPU in Sanford, Florida

Transco: Transcontinental Gas Pipe Line Company, LLC, an interstate pipeline interconnected with Eastern Shore's pipeline

Xeron: Xeron, Inc., an inactive subsidiary of Chesapeake Utilities, which previously engaged in propane and crude oil trading

PART I

References in this document to “Chesapeake,” “Chesapeake Utilities,” the “Company,” “we,” “us” and “our” mean Chesapeake Utilities Corporation, its divisions and/or its wholly-owned subsidiaries, as appropriate in the context of the disclosure.

Safe Harbor for Forward-Looking Statements

We make statements in this Annual Report on Form 10-K that do not directly or exclusively relate to historical facts. Such statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. One can typically identify forward-looking statements by the use of forward-looking words, such as “project,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “continue,” “potential,” “forecast” or other similar words, or future or conditional verbs such as “may,” “will,” “should,” “would” or “could.” These statements represent our intentions, plans, expectations, assumptions and beliefs about future financial performance, business strategy, projected plans and objectives of the Company. Forward-looking statements speak only as of the date they are made or as of the date indicated and we do not undertake any obligation to update forward-looking statements as a result of new information, future events or otherwise. These statements are subject to many risks and uncertainties. In addition to the risk factors described under Item 1A, Risk Factors, the following important factors, among others, could cause actual future results to differ materially from those expressed in the forward-looking statements:

• | state and federal legislative and regulatory initiatives (including deregulation) that affect cost and investment recovery, have an impact on rate structures, and affect the speed and the degree to which competition enters the electric and natural gas industries; |

• | the outcomes of regulatory, tax, environmental and legal matters, including whether pending matters are resolved within current estimates and whether the costs associated with such matters are adequately covered by insurance or recoverable in rates; |

• | the impact of significant changes to current tax regulations and rates; |

• | the timing of certification authorizations associated with new capital projects; |

• | the ability to construct facilities at or below estimated costs; |

• | changes in environmental and other laws and regulations to which we are subject and environmental conditions of property that we now, or may in the future, own or operate; |

• | possible increased federal, state and local regulation of the safety of our operations; |

• | general economic conditions, including any potential effects arising from terrorist attacks and any hostilities or other external factors over which we have no control; |

• | long-term global climate change, which could adversely affect customer demand or cause extreme weather conditions that disrupt the Company's operations; |

• | the weather and other natural phenomena, including the economic, operational and other effects of hurricanes, ice storms and other damaging weather events; |

• | customers' preferred energy sources; |

• | industrial, commercial and residential growth or contraction in our markets or service territories; |

• | the effect of competition on our businesses; |

• | the timing and extent of changes in commodity prices and interest rates; |

• | the ability to establish new, and maintain key, supply sources; |

• | the effect of spot, forward and future market prices on our various energy businesses; |

• | the extent of our success in connecting natural gas and electric supplies to transmission systems and in expanding natural gas and electric markets; |

• | the creditworthiness of counterparties with which we are engaged in transactions; |

• | the capital-intensive nature of our regulated energy businesses; |

• | the results of financing efforts, including our ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings and general economic conditions; |

• | the ability to successfully execute, manage and integrate merger, acquisition or divestiture plans; regulatory or other limitations imposed as a result of a merger; acquisition or divestiture, and the success of the business following a merger, acquisition or divestiture; |

• | the impact on our costs and funding obligations, under our pension and other post-retirement benefit plans, of potential downturns in the financial markets, lower discount rates, and costs associated with the Patient Protection and Affordable Care Act; |

• | the ability to continue to hire, train and retain appropriately qualified personnel; |

• | the effect of accounting pronouncements issued periodically by accounting standard-setting bodies; |

• | the timing and success of technological improvements; and |

• | risks related to cyber-attacks or cyber-terrorism that could disrupt our business operations or result in failure of information technology systems. |

Chesapeake Utilities Corporation 2017 Form 10-K Page 1

ITEM 1. BUSINESS.

CORPORATE OVERVIEW

Chesapeake Utilities Corporation is a Delaware corporation formed in 1947. We are a diversified energy company engaged, through our operating divisions and subsidiaries, in various energy and other businesses. We operate primarily on the Delmarva Peninsula and in Florida, Pennsylvania and Ohio and provide natural gas distribution, transmission, supply, gathering, processing and marketing; electric distribution and generation; propane distribution; steam generation; and other energy-related services.

OPERATING SEGMENTS

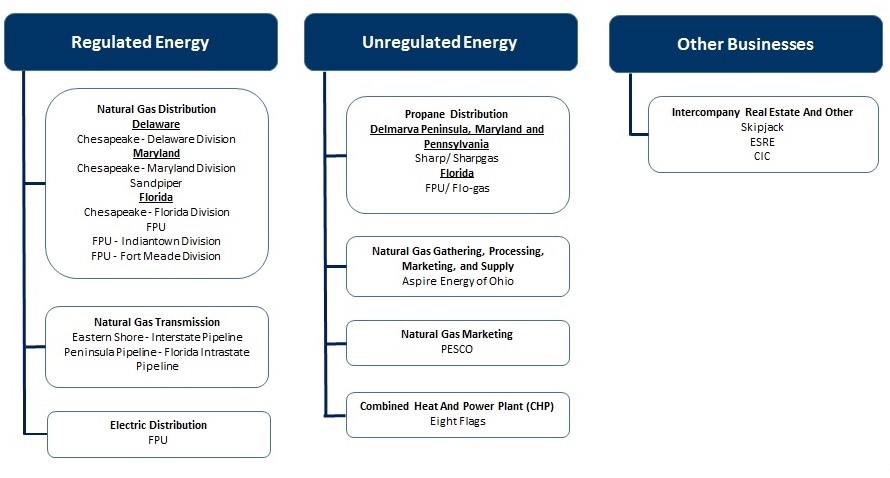

We operate within two reportable segments: Regulated Energy and Unregulated Energy. The remainder of our operations is presented as “Other businesses and eliminations."

The following chart shows our principal business structure by segment and other businesses:

The following table shows operating income for the year ended December 31, 2017, and total assets as of December 31, 2017, for our operating segments and other businesses and eliminations:

(dollars in thousands) | Operating Income | Total Assets | |||||

Regulated Energy | $ | 73,160 | $ | 1,121,673 | |||

Unregulated Energy | 12,477 | 261,541 | |||||

Other businesses and eliminations | 206 | 34,220 | |||||

Total | $ | 85,843 | $ | 1,417,434 | |||

Additional financial information by business segment is set forth in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, and Item 8, Financial Statements and Supplementary Data (see Note 5, Segment Information, in the consolidated financial statements).

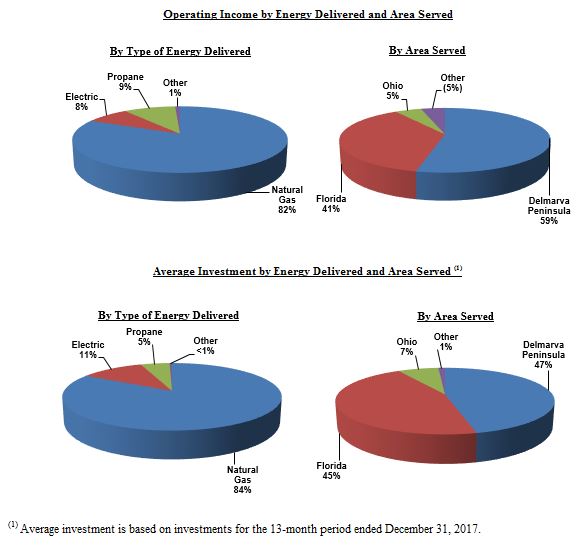

The following charts present operating income by type of energy delivered and areas served for the year ended December 31, 2017 and average investment by type of energy delivered and areas served as of December 31, 2017.

Chesapeake Utilities Corporation 2017 Form 10-K Page 2

REGULATED ENERGY

Regulated Energy is our largest segment and consists of: (i) our natural gas distribution operations in Delaware, Maryland and Florida; (ii) our electric distribution operations in Florida; and (iii) our natural gas transmission operations on the Delmarva Peninsula and in Florida. All operations in this segment are regulated, as to their rates and service, by the PSC having jurisdiction in each state in which we operate or by the FERC in the case of Eastern Shore. Our natural gas and electric distribution operations are local distribution utilities and generate revenues based on tariff rates approved by the PSC of each state in which we operate. The PSCs have also authorized our utilities to negotiate rates, based on approved methodologies, with customers that have competitive alternatives. Some of our customers in Maryland are, and will continue to be, served with propane through our underground propane distribution system under PSC-approved tariff rates until we complete the conversion of the system and these customers to natural gas. These customers are included in the Delmarva Peninsula natural gas distribution operation's results and customer statistics.

Eastern Shore generates revenues based upon the FERC-approved tariff rates. Eastern Shore is also authorized by the FERC to negotiate rates with its customers above or below the FERC-approved tariff rates. Peninsula Pipeline, our Florida intrastate pipeline subsidiary, is subject to regulation by the Florida PSC and has negotiated contracts with customers, including certain affiliates. Our rates are designed to provide the opportunity to generate revenues to recover all prudently incurred costs and provide a return on our rate base that is sufficient to pay interest on debt and a reasonable return for our stockholders. Each of our utilities has a rate base, which generally consists of the original cost of the utility's plant less related accumulated depreciation, working capital and certain other assets. In certain jurisdictions, the rate base may also include deferred income tax liabilities and other additions or deductions.

The natural gas commodity market for Chesapeake Utilities' Florida Division and FPU’s Indiantown division is deregulated. Accordingly, marketers, rather than a traditional utility, sell natural gas to end-use customers in those jurisdictions. For all of our other local distribution utilities, we have fuel cost recovery mechanisms authorized by the PSCs that allow us to periodically adjust fuel rates to reflect changes in the wholesale cost of natural gas and electricity and to ensure we recover all of the costs prudently incurred in purchasing natural gas and electricity for our customers.

Chesapeake Utilities Corporation 2017 Form 10-K Page 3

Operational Highlights

The following table presents operating revenues, volumes and the average number of customers by customer class for our natural gas and electric distribution operations for the year ended December 31, 2017:

Delmarva Natural Gas Distribution | Florida Natural Gas Distribution (2) | FPU Electric Distribution | ||||||||||||||||

Operating Revenues (in thousands) | ||||||||||||||||||

Residential | $ | 57,365 | 57 | % | $ | 38,703 | 38 | % | $ | 44,082 | 53 | % | ||||||

Commercial | 31,585 | 32 | % | 36,039 | 36 | % | 41,141 | 50 | % | |||||||||

Industrial | 7,619 | 8 | % | 28,182 | 28 | % | 3,561 | 4 | % | |||||||||

Other (1) | 3,504 | 3 | % | (1,495 | ) | (2 | )% | (5,918 | ) | (7 | )% | |||||||

Total Operating revenues | $ | 100,073 | 100 | % | $ | 101,429 | 100 | % | $ | 82,866 | 100 | % | ||||||

Volumes (in Dts for natural gas/MWHs for electric) | ||||||||||||||||||

Residential | 3,368,603 | 28 | % | 1,690,983 | 6 | % | 291,510 | 46 | % | |||||||||

Commercial | 3,274,975 | 28 | % | 7,019,970 | 26 | % | 304,235 | 48 | % | |||||||||

Industrial | 5,125,633 | 43 | % | 16,105,084 | 60 | % | 27,380 | 4 | % | |||||||||

Other | 95,415 | 1 | % | 1,875,761 | 8 | % | 7,511 | 2 | % | |||||||||

Total Volumes | 11,864,626 | 100 | % | 26,691,798 | 100 | % | 630,636 | 100 | % | |||||||||

Average Number of Customers (4) | ||||||||||||||||||

Residential | 68,699 | 91 | % | 70,206 | 90 | % | 24,574 | 77 | % | |||||||||

Commercial | 6,845 | 9 | % | 5,475 | 7 | % | 7,450 | 23 | % | |||||||||

Industrial | 147 | — | % | 2,157 | 3 | % | 2 | — | % | |||||||||

Other | 5 | — | % | 3 | — | % | — | — | % | |||||||||

Total Average Customers | 75,696 | 100 | % | 77,841 | 100 | % | 32,026 | 100 | % | |||||||||

(1) Operating Revenues from "Other" sources include unbilled revenue, under (over) recoveries of fuel cost, conservation revenue, other miscellaneous charges, fees for billing services provided to third parties, and adjustments for pass-through taxes.

(2) Florida natural gas distribution includes Chesapeake Utilities' Florida Division, FPU and FPU's Indiantown and Fort Meade divisions.

(3) Average number of customers is based on twelve-month average for the year ended December 31, 2017.

The following table presents operating revenues and design day capacity for Eastern Shore for the year ended December 31, 2017 and contracted firm transportation capacity at December 31, 2017:

Eastern Shore | |||||

Operating Revenues (in thousands) | |||||

Local distribution companies - affiliated (1) | $ | 18,350 | 32 | % | |

Local distribution companies - non-affiliated | 22,782 | 39 | % | ||

Commercial and industrial | 20,485 | 35 | % | ||

Other (2) | (3,847 | ) | (6 | )% | |

Total Operating Revenues | $ | 57,770 | 100 | % | |

Contracted firm transportation capacity (in Dts/d) | |||||

Local distribution companies - affiliated | 100,652 | 43 | % | ||

Local distribution companies - non-affiliated | 66,182 | 28 | % | ||

Commercial and industrial | 67,923 | 29 | % | ||

Total | 234,757 | 100 | % | ||

Design day capacity (in Dts/d) | 234,757 | 100 | % | ||

(1) Eastern Shore's service to our local distribution affiliates is based on FERC-approved rates and is an integral component of the cost associated with providing natural gas supplies for those affiliates. We eliminate operating revenues of Eastern Shore against the cost of sales of those affiliates in our consolidated financial information; however, our local distribution affiliates include this amount in their purchased fuel cost and recover it through fuel cost recovery mechanisms.

(2) Operating revenues from "Other" sources are from the rental of gas properties and reserve for rate case refund.

Peninsula Pipeline contracts with both affiliated and non-affiliated customers to provide firm transportation service. For the year ended December 31, 2017, operating revenues of Peninsula Pipeline were $7.2 million, of which $4.5 million was related to service to our affiliates, FPU and Eight Flags, under contracts which were previously approved by the Florida PSC. Peninsula Pipeline's operating revenues from FPU and Eight Flags are eliminated against the cost of sales in our consolidated financial information; FPU, however, includes this amount in its purchased fuel cost and recovers it through the fuel cost recovery mechanism.

Chesapeake Utilities Corporation 2017 Form 10-K Page 4

As of December 31, 2017, our investments in our regulated operations were as follows: $136.5 million for Delmarva Peninsula natural gas distribution; $316.0 million for Florida natural gas and electric distribution; and $250.1 million for natural gas transmission.

Weather

Revenues from our residential and commercial sales are affected by seasonal variations in weather conditions, which directly influence the volume of natural gas and electricity sold and delivered. Specifically, customer demand substantially increases during the winter months, when natural gas and electricity are used for heating. For electricity, customer demand also increases during the summer months, when electricity is used for cooling. We measure the relative impact of weather by using a degree-day methodology accepted by the utility industry. Degree-day data is used to estimate amounts of energy required to maintain comfortable indoor temperature levels based on each day’s average temperature. Normal heating and cooling degree-days are based on the most recent 10-year average.

Our Maryland division and Sandpiper's rates include a weather normalization adjustment for residential heating and smaller commercial heating customers. A weather normalization adjustment is a billing adjustment mechanism (or "decoupled" rate mechanism) that is designed to eliminate the effect of deviations from average seasonal temperatures on utility net revenues. Sandpiper received approval from the Maryland PSC to include in its rates a revenue normalization mechanism for residential heating and smaller commercial heating customers in 2016.

We do not currently have any weather or revenue normalization or “decoupled” rate mechanisms for our other local distribution utilities.

Regulatory Matters

The following table identifies the key regulatory agencies and highlights the most recent base rate proceeding information for each of our major utilities:

Chesapeake Utilities - Delaware Division | Chesapeake Utilities - Florida Division | FPU Natural Gas | FPU Electric | Chesapeake Utilities - Maryland Division | Eastern Shore | Sandpiper | |

Regulatory Agency: | Delaware PSC | Florida PSC | Florida PSC | Florida PSC | Maryland PSC | FERC | Maryland PSC |

Commission Structure: | 5 commissioners | 5 commissioners | 5 commissioners | 5 commissioners | 5 commissioners | 5 commissioners | 5 commissioners |

Part-Time | Full-Time | Full-Time | Full-Time | Full-Time | Full-Time | Full-Time | |

Gubernatorial Appointment | Gubernatorial Appointment | Gubernatorial Appointment | Gubernatorial Appointment | Gubernatorial Appointment | Presidential Appointment | Gubernatorial Appointment | |

Base Rate Proceeding: | |||||||

Delay in collection of rates subsequent to filing application | 60 days | 90 days | 90 days | 90 days | 180 days | Up to 180 days | 180 days |

Application date associated with the most recent permanent rates | 12/21/2015 | 07/14/2009 | 12/17/2008 | 07/03/2017 | 05/01/2006 | 1/27/2017 | 12/02/2015 |

Effective date of permanent rates | 01/01/2017 | 01/14/2010 | 01/14/2010(1) | 01/03/2018 | 12/01/2007 | 08/01/2017(2) | 12/01/2017 |

Annual rate increase approved(6) | $2,250,000 | $2,536,300 | $7,969,000 | $1,558,050 | $648,000 | $9,800,000(2) | N/A(7) |

Rate of return approved(6) | 9.75% (3) | 10.80%(3) | 10.85%(3) | 10.25%(3), (4) | 10.75%(3) | Not Stated(2) | Not Stated (5) |

(1) The effective date of the order approving the settlement agreement, which adjusted the rates originally approved on June 4, 2009.

(2) Eastern Shore filed an uncontested settlement agreement with the FERC in December 2017. FERC approved the settlement agreement by letter order on February 28, 2018. The order will be deemed final upon the expiration of the right to rehearing on March 30, 2018.

(3) Allowed after-tax return on equity.

(4) The terms of the settlement agreement for the FPU electric division limited proceeding with the Florida PSC prescribed an authorized return on equity range of 9.25 to 11.25 percent, with a mid-point of 10.25 percent. The FPU electric division cannot file for a base rate increase prior to December 2019, unless its allowed return on equity is below the authorized range and it experiences an unanticipated and unforeseen event that impacts the annual revenue requirement in excess of $800,000 within any contiguous four-month period.

(5) The terms of the agreement include revenue neutral rates for the first year, followed by a schedule of rate reductions in subsequent years based upon the projected rate of propane to natural gas conversions.

(6) The table reflects rate increases and rates of return approved prior to the enactment of the TCJA on December 22, 2017. See Item 8, Financial Statements and Supplementary Data (Note 18, Rates and Other Regulatory Activities and Note 11, Income Taxes in the consolidated financial statements) for further discussion on the impact of this legislation on our regulated businesses.

(7)The Maryland PSC approved a declining return on equity that will result in a decline in our rates.

In addition to the base rates approved by the PSCs, certain of our local distribution utilities have additional surcharge mechanisms that were separately approved by their respective PSC. The most notable surcharge mechanisms include Delaware’s surcharge to increase the

Chesapeake Utilities Corporation 2017 Form 10-K Page 5

availability of natural gas in portions of eastern Sussex County, Delaware; Maryland's surcharge designed to recover the costs associated with conversions to natural gas and to improve infrastructure in Worcester County, Maryland; and Florida’s GRIP surcharge designed to recover capital and other costs, inclusive of an appropriate return on investment, associated with accelerating the replacement of qualifying distribution mains.

TCJA

At the end of December 2017, the United States Congress passed and the President signed into law, the TCJA, which is effective beginning with the 2018 tax year. Among other things, the TCJA substantially reduces the corporate income tax rate to 21 percent, effective January 1, 2018. Each state PSC, with jurisdiction over the areas that we serve, has issued, or is in the process of issuing, requests for information or orders directing utilities to make filings estimating the impacts of the TCJA on their respective costs to serve and to propose how the tax law changes are to be reflected in rates. We will comply with these orders and will make any necessary changes, as directed by the applicable PSC. The FERC has not yet issued any procedural orders on this matter; however, the settlement agreement that we filed with the FERC in December 2017 outlined the procedures and proposed customer rates in the event of tax reform. We believe that the ultimate resolution of these matters will not have a material impact on our financial position, operating results or cash flows.

See Item 8, Financial Statements and Supplementary Data (Note 11, Income Taxes, and Note 18, Rates and Other Regulatory Activities, in the consolidated financial statements), for more information.

Competition

Our natural gas and electric distribution operations and our natural gas transmission operations compete with other forms of energy, including oil, propane and renewables. The principal competitive factors are price and, to a lesser extent, accessibility. Our natural gas distribution operations have several large industrial customers that are able to use fuel oil or propane as an alternative to natural gas. When oil or propane prices decline, these interruptible customers may convert to an alternative fuel source to satisfy their fuel requirements, and our sales volumes may decline. To address the uncertainty of alternative fuel prices, we use flexible pricing arrangements on both the supply and sales sides of our business to compete with alternative fuel price fluctuations.

Large industrial natural gas customers may be able to bypass our distribution and transmission systems and make direct connections with “upstream” interstate transmission pipelines when such connections are economically feasible. Certain large industrial electric customers may be capable of generating electricity for their own consumption. Although the risk of bypassing our systems is not considered significant, we may adjust services and rates for these customers to retain their business in certain situations.

Supplies, Transmission and Storage

We believe that the availability of supply and transmission of natural gas is adequate under existing arrangements to meet the needs of our customers.

Our Delaware, Maryland and Sandpiper divisions use their firm transportation resources to meet a significant percentage of their projected demand requirements. They purchase firm natural gas supplies to meet those projected requirements with purchases of base load, daily spot supplies and storage service. They have both firm and interruptible transportation service contracts with four interstate “open access” pipeline companies (Eastern Shore, Transco, Columbia Gas and TETLP) in order to meet customer demand. Their distribution system is directly interconnected with Eastern Shore’s pipeline, which is directly interconnected with the upstream pipelines of Transco, Columbia Gas and TETLP. The following table summarizes the firm transportation agreements for Delaware and Maryland divisions:

Maximum Daily Firm Transportation Capacity (Dts) | Contract Expiration Date | |||||

Division | Counterparty | |||||

Delaware | Eastern Shore | 72,029 | 2018 - 2028 | |||

Columbia Gas | 10,960 | 2019 - 2020 | ||||

Transco | 21,423 | 2018 - 2028 | ||||

TETLP | 34,100 | 2027 | ||||

Maryland | Eastern Shore | 26,673 | 2018 - 2027 | |||

Columbia Gas | 4,200 | 2018 - 2019 | ||||

Transco | 6,128 | 2018 | ||||

TETLP | 15,900 | 2027 | ||||

Chesapeake Utilities Corporation 2017 Form 10-K Page 6

The Delaware and Maryland divisions also have the capability to use propane-air and liquefied natural gas peak-shaving equipment to supplement or displace natural gas purchases.

Our Delaware and Maryland divisions contract with our natural gas marketing subsidiary, PESCO, through an asset management agreement, to optimize their transportation and storage capacity and secure an adequate supply of natural gas. Pursuant to the three-year asset management agreement, the asset manager pays our divisions a fee, which our divisions share with their customers.

Sandpiper is a party to a capacity, supply and operating agreement with EGWIC to purchase propane, with a contract ending in May 2019. Sandpiper's current annual commitment is estimated at approximately 2.7 million gallons. Sandpiper has the option to enter into either a fixed per-gallon price for some or all of the propane purchases or a market-based price utilizing one of two local propane pricing indices. Sandpiper also has 1,950 Dts of maximum daily firm transportation capacity available from Eastern Shore through contracts expiring on various dates between 2018 and 2027.

The following table summarizes the firm transportation agreements for our Florida Division and FPU:

Maximum Daily Firm Transportation Capacity (Dts) | Contract Expiration Date | |||||

Division | Counterparty | |||||

Florida Division | Gulfstream (1) | 10,000 | 2022 | |||

FPU | FGT | 41,909 - 73,317 | 2020 - 2041 | |||

Peninsula Pipeline | 25,000 - 32,000 | 2033 - 2038 | ||||

Peoples Gas System | 2,660 | 2024 - 2035 | ||||

Florida City Gas | 300 | 2032 | ||||

(1) Pursuant to a capacity release program approved by the Florida PSC, all of the capacity under this agreement has been released to various third parties, including PESCO. Under the terms of these capacity release agreements, Chesapeake Utilities is contingently liable to Gulfstream should any party, that acquired the capacity through release, fail to pay the capacity charge.

FPU uses gas marketers and producers to procure all of its gas supplies to meet projected requirements. FPU also uses Peoples Gas to provide wholesale gas sales service in areas far from FPU's interconnections with FGT.

Eastern Shore has three agreements with Transco for a total of 7,292 Dts/d of firm daily storage injection and withdrawal entitlements and total storage capacity of 288,003 Dts. These agreements expire on various dates between 2018 and 2023. Eastern Shore retains these firm storage services in order to provide swing transportation service and firm storage service to customers requesting such services.

During 2017, FPU purchased wholesale electricity primarily from three main suppliers: JEA, Gulf Power and Eight Flags. As of January 2018, FPU purchases its wholesale electricity primarily from Gulf Power, FPL and Eight Flags. The following table summarizes the supply contracts for FPU:

Counterparty | Contracted Amount (MW) | Contract Expiration Date |

Gulf Power | Full Requirement | 2019 |

FPL | Full Requirement | 2024 |

Eight Flags | 21 | 2036 |

Rayonier | 1.7 to 3.0 | 2036 |

WestRock Company | As-available | N/A |

The Gulf Power contract provides generation and transmission service to the Northwest Florida service territory. The FPL contract provides generation and transmission service to the Northeast Florida service territory. The electricity purchased from Eight Flags, Rayonier and WestRock Company serves a portion of FPU's electric distribution customers' base load in Northeast Florida.

UNREGULATED ENERGY

Our Unregulated Energy segment provides: (i) propane distribution; (ii) natural gas marketing; (iii) unregulated natural gas supply, gathering and processing; (iv) electricity and steam generation; and (v) other unregulated energy-related services to customers. Revenues generated from this segment are not subject to any federal, state or local pricing regulations. Our businesses in this segment typically complement our regulated energy businesses based on the products and services they sell.

Chesapeake Utilities Corporation 2017 Form 10-K Page 7

Propane Distribution

Our propane distribution operations sell propane to residential, commercial/industrial, and wholesale customers, including AutoGas customers, in Delmarva and southeastern Pennsylvania, through Sharp and Sharpgas, and in Florida through FPU and Flo-gas. Many of our propane distribution customers are “bulk delivery” customers. We make deliveries of propane to the bulk delivery customers as needed, based on the level of propane remaining in the tank located at the customer’s premises. We invoice and record revenues for our bulk delivery service customers at the time of delivery, rather than upon customers’ actual usage, since the customers typically own the propane gas in the tanks on their premises. We also have underground propane distribution systems serving various neighborhoods and communities. Such customers are billed monthly based on actual consumption, which is measured by meters installed on their premises. In Florida, we also offer metered propane distribution service to residential and commercial customers. We read the meters on such customers' tanks and bill customers monthly. As a member of AutoGas, Sharp and AutoGas install and support propane vehicle conversion systems for vehicle fleets. Sharp continues to convert fleets to bi-fuel propane-powered engines and provides onsite fueling infrastructure.

Propane Distribution - Operational Highlights

For the year ended December 31, 2017, operating revenues, volumes sold and average number of customers by customer class for our Delmarva Peninsula and Pennsylvania and Florida propane distribution operations were as follows:

Delmarva Peninsula and Pennsylvania | Florida | |||||||||||||

Operating Revenues (in thousands) | ||||||||||||||

Residential bulk | $ | 21,051 | 28 | % | $ | 6,123 | 28 | % | ||||||

Residential metered | 7,904 | 11 | % | 4,735 | 22 | % | ||||||||

Commercial bulk | 13,655 | 18 | % | 5,104 | 23 | % | ||||||||

Commercial metered | — | — | % | 2,119 | 10 | % | ||||||||

Wholesale | 24,667 | 33 | % | 920 | 4 | % | ||||||||

AutoGas | 2,318 | 3 | % | — | — | % | ||||||||

Other (1) | 5,033 | 7 | % | 2,946 | 13 | % | ||||||||

Total Operating Revenues | $ | 74,628 | 100 | % | $ | 21,947 | 100 | % | ||||||

Volumes (in thousands of gallons) | ||||||||||||||

Residential bulk | 8,718 | 17 | % | 1,433 | 23 | % | ||||||||

Residential metered | 3,352 | 6 | % | 893 | 14 | % | ||||||||

Commercial bulk | 9,032 | 18 | % | 2,371 | 37 | % | ||||||||

Commercial metered | — | — | % | 827 | 13 | % | ||||||||

Wholesale | 24,463 | 48 | % | 812 | 13 | % | ||||||||

AutoGas | 2,159 | 4 | % | — | — | % | ||||||||

Other | 3,500 | 7 | % | — | — | % | ||||||||

Total Volumes | 51,224 | 100 | % | 6,336 | 100 | % | ||||||||

Average Number of Customers (2) | ||||||||||||||

Residential bulk | 25,452 | 66 | % | 9,059 | 55 | % | ||||||||

Residential metered | 8,669 | 23 | % | 6,089 | 37 | % | ||||||||

Commercial bulk | 4,166 | 11 | % | 930 | 6 | % | ||||||||

Commercial metered | — | — | % | 278 | 2 | % | ||||||||

Wholesale | 35 | — | % | 8 | — | % | ||||||||

AutoGas | 74 | — | % | — | — | % | ||||||||

Total Average Customers | 38,396 | 100 | % | 16,364 | 100 | % | ||||||||

(1) Operating revenues from "Other" sources include revenues from energy-related merchandise; customer loyalty programs; delivery, service and appliance fees; and unbilled revenues.

(2)Average number of customer is based on twelve-month average for the year ended December 31, 2017.

Propane Distribution - Competition

We compete with several other propane distributors in our geographic markets, primarily on the basis of price and service. Our competitors generally include local outlets of national distributors and local independent distributors, whose proximity to customers entails lower costs to provide service. As an energy source, propane competes with home heating oil and electricity, which are typically more expensive (based on equivalent unit of heat value). Since natural gas has historically been less expensive than propane, propane is generally not utilized for home heating in geographic areas served by natural gas pipelines or distribution systems.

Chesapeake Utilities Corporation 2017 Form 10-K Page 8

Propane Distribution - Supplies, Transportation and Storage

We purchase propane for our propane distribution operations primarily from suppliers, including major oil companies, and independent producers of natural gas liquids. Although supplies of propane from these and other sources are generally readily available for purchase, extreme market conditions, such as significant fluctuations in weather, closing of refineries and disruption in supply chains, could result in a reduction in available supplies.

Propane is transported by trucks and railroad cars from refineries, natural gas processing plants or pipeline terminals to bulk propane storage facilities that we own in Delaware, Maryland, Pennsylvania, Virginia and Florida. These bulk storage facilities have an aggregate capacity of approximately 6.8 million gallons. We then deliver propane from these storage facilities by truck to tanks located on our customers’ premises.

Propane Distribution Weather

Revenues from our propane distribution sales activities are affected by seasonal variations in temperature and weather conditions. Weather conditions and their severity directly influence the volume of propane used by our metered customers or sold and delivered to our bulk customers, with demand increasing substantially during the winter months when propane is used for heating. Sustained warmer-than-normal temperatures will tend to reduce propane use, while sustained colder-than-normal temperatures will tend to increase consumption.

Propane and Crude Oil Wholesale Marketing

Prior to its wind down in the second quarter of 2017, Xeron traded in short-term natural gas liquids and crude oil forward and futures contracts on the InterContinentalExchange, Inc. Xeron settled its purchases and sales financially, without taking physical delivery of the propane or crude oil.

Natural Gas Marketing

We provide natural gas supply and supply management services through PESCO to residential, commercial, industrial and wholesale customers. PESCO operates primarily in the Southeast, Mid-Atlantic and Appalachian Basin regions. The following table summarizes PESCO's operating revenues by region in 2017:

Operating Revenues (in thousands) | % of Total | ||||||

Southeast | $ | 59,269 | 32 | % | |||

Mid-Atlantic | 87,241 | 47 | % | ||||

Appalachian Basin | 38,009 | 21 | % | ||||

$ | 184,519 | 100 | % | ||||

PESCO competes with regulated utilities and other unregulated third-party marketers to sell natural gas supplies directly to commercial and industrial customers through competitively-priced contracts. PESCO does not currently own or operate any natural gas transmission or distribution assets. The gas that PESCO sells is delivered to retail or wholesale customers through affiliated and non-affiliated local distribution company systems and transmission pipelines. PESCO bills its customers directly or through the billing services of the regulated utilities that deliver the gas. In August 2017, PESCO acquired certain natural gas marketing assets of ARM. The acquired assets complement PESCO’s current asset portfolio and expand our regional footprint and retail demand in a market where we have existing pipeline capacity and wholesale liquidity.

In 2017, PESCO entered into asset management agreements with our Delmarva Peninsula natural gas distribution operations to manage a portion of their natural gas transportation and storage capacity, which agreements were approved by the Delaware PSC with respect to our Delaware Division. The agreements were effective as of April 1, 2017, and each has a three-year term, expiring on March 31, 2020.

Unregulated Natural Gas Infrastructure Services

Aspire Energy is an unregulated natural gas infrastructure company that owns approximately 2,600 miles of pipeline systems in 40 counties throughout Ohio. The majority of Aspire Energy’s margin is derived from long-term supply agreements with Columbia Gas of Ohio and CGC, which together serve more than 20,000 end-use customers. Aspire Energy primarily sources gas from 300 conventional producers and also provides gathering and processing services so that it can maintain quality and reliability for its wholesale markets.

Chesapeake Utilities Corporation 2017 Form 10-K Page 9

For the twelve-month period ended December 31, 2017, Aspire Energy's operating revenues and deliveries by customer type were as follows:

Operating revenues | Deliveries | |||||

(in thousands) | (in Dts) | |||||

Supply to Columbia Gas of Ohio | $ | 11,827 | 2,264 | |||

Supply to CGC | 10,507 | 1,345 | ||||

Supply to Marketers - affiliated | 4,027 | 1,425 | ||||

Supply to Marketers - unaffiliated | 4,633 | 1,725 | ||||

Other (including natural gas gathering and processing) | 2,330 | 1,548 | ||||

Total | $ | 33,324 | 8,307 | |||

Eight Flags

Eight Flags provides electricity and steam generation services through its CHP plant located on Amelia Island, Florida. The construction of the CHP plant was completed in June 2016. The CHP plant, which consists of a natural-gas-fired turbine and associated electric generator, produces approximately 21 MW of base load power and includes a heat recovery steam generator capable of providing approximately 75,000 pounds per hour of residual steam. Eight Flags sells power generated from the CHP plant to FPU, pursuant to a 20-year power purchase agreement for distribution to its retail electric customers. Eight Flags also sells steam, pursuant to a separate 20-year contract, to the industrial customer that owns the property on which Eight Flags' CHP plant is located. During 2017, Eight Flags generated $15.0 million in operating revenues from the sale of electricity to FPU and $2.1 million from the sale of steam.

The CHP plant is powered by natural gas transported by FPU through its distribution system and by Peninsula Pipeline. For the year ended December 31, 2017, Eight Flags and other affiliates of Chesapeake Utilities generated $4.9 million in additional gross margin. This amount includes gross margin of $537,000 attributable to natural gas distribution and transportation services provided to the CHP plant by Chesapeake Utilities' regulated affiliates.

OTHER BUSINESSES AND ELIMINATIONS

Overview

Other businesses and eliminations consists primarily of other unregulated subsidiaries, including Skipjack and ESRE, that own real estate leased to affiliates, eliminations of inter-segment revenue and certain unallocated corporate costs which are not directly attributable to a specific business unit. Skipjack and ESRE own and lease office buildings in Delaware and Maryland to divisions and other subsidiaries of Chesapeake Utilities. See Item 8, Financial Statements and Supplementary Data (Note 5, Segment Information, in the consolidated financial statements) for more information.

ENVIRONMENTAL COMPLIANCE

We are subject to federal, state and local laws and regulations governing environmental quality and pollution control. These laws and regulations require us to remove or remediate the effect on the environment of the disposal or release of specified substances at current and former operating sites. We have participated in the investigation, assessment or remediation, and have exposures at seven former MGP sites.

For additional information on each site, refer to Item 8, Financial Statements and Supplementary Data (see Note 19, Environmental Commitments and Contingencies, in the consolidated financial statements).

EMPLOYEES

As of December 31, 2017, we had a total of 945 employees, 118 of whom are union employees represented by two labor unions: the International Brotherhood of Electrical Workers and Commercial Workers Union. The collective bargaining agreements with these labor unions expire in 2019.

EXECUTIVE OFFICERS

Set forth below are the names, ages, and positions of our executive officers with their recent business experience. The age of each officer is as of the filing date of this report.

Chesapeake Utilities Corporation 2017 Form 10-K Page 10

Name | Age | Position | ||

Michael P. McMasters | 59 | President (March 2010 - present) Chief Executive Officer (January 2011 - present) Director (March 2010 - present) Executive Vice President (September 2008 - February 2010) Chief Operating Officer (September 2008 - December 2010) Chief Financial Officer (January 1997 - September 2008) Mr. McMasters also previously served as Senior Vice President, Vice President, Treasurer, Director of Accounting and Rates and Controller. | ||

Beth W. Cooper | 51 | Senior Vice President (September 2008 - present) Chief Financial Officer (September 2008 - present) Assistant Secretary (March 2015-present) Corporate Secretary (June 2005 - March 2015) Vice President (June 2005 - September 2008) Treasurer (March 2003 - May 2012) Ms. Cooper also previously served as Assistant Vice President, Assistant Treasurer, Director of Internal Audit and Director of Strategic Planning. | ||

Elaine B. Bittner | 48 | Senior Vice President of Strategic Development (May 2013 - present) Chief Operating Officer - Sharp, Aspire Energy and PESCO (May 2014 - Present) Vice President of Strategic Development (June 2010 - May 2013) Vice President, Eastern Shore (May 2005 - June 2010) Ms. Bittner also previously served as Director of Eastern Shore, Director of Customer Services and Regulatory Affairs for Eastern Shore and Director of Environmental Affairs and Environmental Engineer. | ||

Stephen C. Thompson | 57 | Senior Vice President (September 2004 - present) President, Eastern Shore (January 1997 - present) President and Chief Operating Officer, Sandpiper (May 2014 - present) Vice President (May 1997 - September 2004) Mr. Thompson also previously served as Director of Gas Supply and Marketing for Eastern Shore, Superintendent of Eastern Shore and Regional Manager for Florida distribution operations. | ||

Jeffry M. Householder | 60 | President of Florida Public Utilities Company (June 2010 - present) Prior to joining Chesapeake Utilities, Mr. Householder operated a consulting practice that provided business development and regulatory services to utilities, propane retailers and industrial clients. | ||

James F. Moriarty | 60 | Senior Vice President (February 2017 - present) General Counsel & Corporate Secretary (March 2015 - present) Vice President (March 2015 - February 2017) Prior to joining Chesapeake Utilities, Mr. Moriarty was a Partner at Locke Lord LLP and Fulbright & Jaworski, LLP, both international law firms with offices in Washington, D.C. | ||

AVAILABLE INFORMATION AND CORPORATE GOVERNANCE DOCUMENTS

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports and amendments to these reports that we file with or furnish to the SEC are available free of charge at the SEC website http://www.sec.gov and at our website, www.chpk.com, as soon as reasonably practicable after we electronically file these reports with, or furnish these reports to the SEC. The content of this website is not part of this report.

In addition, the following documents are available free of charge on our website, www.chpk.com:

•Business Code of Ethics and Conduct applicable to all employees, officers and directors;

Chesapeake Utilities Corporation 2017 Form 10-K Page 11

•Code of Ethics for Financial Officers;

•Corporate Governance Guidelines;

• | Charters for the Audit Committee, Compensation Committee, Investment Committee, and Corporate Governance Committee of the Board of Directors; and |

•Corporate Governance Guidelines on Director Independence.

Any of these reports or documents may also be obtained by writing to: Corporate Secretary; c/o Chesapeake Utilities Corporation, 909 Silver Lake Boulevard, Dover, DE 19904.

CERTIFICATION TO THE NYSE

Our Chief Executive Officer certified to the NYSE on June 1, 2017 that, as of that date, he was unaware of any violation by Chesapeake Utilities of the NYSE’s corporate governance listing standards.

ITEM 1A. RISK FACTORS.

The following is a discussion of the primary factors that may affect the operations and/or financial performance of our regulated and unregulated energy businesses. Refer to the section entitled Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this report for an additional discussion of these and other related factors that affect our operations and/or financial performance.

FINANCIAL RISKS

Instability and volatility in the financial markets could negatively impact our ability to access capital at competitive rates, which could affect our ability to implement our strategic plan, undertake improvements and make other investments required for our future growth.

Our business strategy includes the continued pursuit of growth, both organically and through acquisitions. To the extent that we do not generate sufficient cash flow from operations, we may incur additional indebtedness to finance our growth. We rely on access to both short-term and long-term capital markets as a significant source of liquidity for capital requirements beyond the cash flows generated from our operations.

In addition, our ability to obtain adequate and cost-effective capital depends on our credit ratings, which are greatly affected by our financial performance and the liquidity of financial markets. A downgrade in our current credit ratings could adversely affect our access to capital markets, as well as our cost of capital. If we are not able to access capital at competitive rates, our ability to implement our strategic plan, undertake improvements and make other investments required for our future growth may be limited.

Our natural gas marketing subsidiary is exposed to market risks beyond our control, which could adversely affect our financial results and capital requirements.

Our natural gas marketing subsidiary is subject to market risks beyond our control, including market liquidity and commodity price volatility. Although we maintain a risk management policy, we may not be able to offset completely the price risk associated with volatile commodity prices, which could lead to volatility in earnings. Physical trading also has price risk on any net open positions at the end of each trading day, as well as volatility resulting from (i) intra-day fluctuations of natural gas prices, and (ii) daily price movements between the time natural gas is purchased or sold for future delivery and the time the related purchase or sale is economically hedged. The determination of our net open position at the end of any trading day requires us to make assumptions as to future circumstances, including the use of natural gas by our customers in relation to anticipated market positions. Because the price risk associated with any net open position at the end of such day may increase if the assumptions are not realized, we review these assumptions daily. Net open positions may increase volatility in our financial condition or results of operations if market prices move in a significantly favorable or unfavorable manner, because the changes in fair value of trading contracts are immediately recognized as profits or losses for financial accounting purposes. This volatility may occur, with a resulting increase or decrease in earnings or losses, even though the expected profit margin is essentially unchanged from the date the transactions were consummated.

Chesapeake Utilities Corporation 2017 Form 10-K Page 12

Our natural gas marketing subsidiary is exposed to the credit risk of its counterparties.

Our natural gas marketing subsidiary extends credit to counterparties and continually monitors and manages collections aggressively. There is risk that our subsidiary may not be able to collect amounts owed to it. If the counter-party to such a transaction fails to perform, and any underlying collateral is inadequate, we could experience financial losses, which would negatively impact our results of operations.

Our natural gas marketing subsidiary is dependent upon the availability of credit to successfully operate its business.

Our natural gas marketing subsidiary is dependent upon the availability of credit to buy natural gas for resale or to trade. If financial market conditions decline generally, or the financial condition of this subsidiary or of our Company declines, then the cost of credit could increase. If credit is not available, or if credit is more costly, our results of operations, cash flows and financial condition may be adversely affected.

Fluctuations in propane gas prices could negatively affect results or operations.

To compensate for fluctuations in propane gas prices, we adjust our propane selling prices to the extent allowed by the market. There can be no assurance, however, that we will be able to increase propane sales prices sufficiently to compensate fully for such fluctuations in the cost of propane gas to us. If we are unable to increase propane sales prices sufficiently to compensate fully for such fluctuations, our earnings could be negatively affected, which would adversely impact our results of operations.

If we fail to comply with our debt covenant obligations, we could experience adverse financial consequences that could affect our liquidity and ability to borrow funds.

Our long-term debt obligations, the Revolver and our committed short-term lines of credit contain financial covenants related to debt-to-capital ratios and interest-coverage ratios. Failure to comply with any of these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of outstanding debt obligations, a downgrade in our credit rating or the inability to borrow under certain credit agreements. Any such acceleration could cause a material adverse change in our financial condition.

An increase in interest rates may adversely affect our results of operations and cash flows.

An increase in interest rates, without the recovery of the higher cost of debt in the sales and/or transportation rates we charge our utility customers, could adversely affect future earnings. An increase in short-term interest rates could negatively affect our results of operations, which depend on short-term lines of credit to finance accounts receivable and storage gas inventories and to temporarily finance capital expenditures. Reference should be made to Item 7A, Quantitative and Qualitative Disclosures About Market Risk for additional information.

Current market conditions could adversely impact the return on plan assets for our pension plans, which may require significant additional funding.

Our pension plans are closed to new employees, and the future benefits are frozen. The costs of providing benefits and related funding requirements of these plans are subject to changes in the market value of the assets that fund the plans and the discount rates used to estimate the pension benefit obligations. The funded status of the plans and the related costs reflected in our financial statements are affected by various factors that are subject to an inherent degree of uncertainty, particularly in the current economic environment. Future losses of asset values and further declines in discount rates may necessitate accelerated funding of the plans in the future to meet minimum federal government requirements as well as higher pension expense to be recorded in future years. Adverse changes in the asset values and benefit obligations of our pension plans may require us to record higher pension expense and fund obligations earlier than originally planned, which would have an adverse impact on our cash flows from operations, decrease borrowing capacity and increase interest expense.

Changes in tax laws or regulations, including the recently adopted TCJA, may negatively affect our results of operations, net income, financial condition and cash flows.

We are subject to taxation by various taxing authorities at the federal, state and local levels. On December 22, 2017, President Trump signed into law the TCJA, which significantly changes how the U.S. taxes corporations. The TCJA requires complex computations to be performed that were not previously required in U.S. tax law, significant judgments to be made in interpretation of the provisions of the TCJA, significant estimates in calculations, and the preparation and analysis of information not previously relevant or regularly produced. The U.S. Treasury Department, the IRS, and other standard-setting bodies could issue guidance on how provisions of the TCJA will be applied or otherwise administered that may differ from our interpretations. As we complete our analysis of the TCJA, collect and prepare necessary data, and interpret any additional guidance, we may make adjustments to

Chesapeake Utilities Corporation 2017 Form 10-K Page 13

provisional amounts that we have recorded that may materially impact our provision for income taxes in the period in which adjustments are made.

In addition, beginning in 2018, we expect to incur lower income tax expense, which will generally decrease our regulated energy businesses' projected effective income tax rates. Over time, the TCJA will likely result in lower regulated rates due to lower income tax expense recoveries and the potential refund of deferred income tax regulatory liabilities. We have used our best judgment in attempting to quantify and reserve for these estimated obligations generated by the TCJA. However, a challenge by a taxing authority, our ability to utilize these tax benefits in a different fashion, or a deviation from other tax-related assumptions may cause actual financial results to deviate from previous estimates (see Note 11, Income Taxes, in the consolidated financial statements).

The TCJA is generally expected to result in lower operating cash flows from our regulated energy businesses as a result of the elimination of bonus depreciation and lower customer rates. As a result, we may need to access additional debt and equity capital to meet our financing needs, which we assume will be available.

Our stock price is subject to volatility.

The utility industry and the stock market as a whole have experienced more significant stock price and volume fluctuations that have affected stock prices in ways that may have been unrelated to operating performance. Our stock has experienced increased price and volume volatility as well. However, despite this increased volatility, we believe that our stock price should reflect expectations of future growth and profitability. We also believe our stock price should reflect expectations that our cash dividend will continue at current levels or grow, although future dividends are subject to declaration by our Board of Directors. We cannot predict the level of volatility in our stock price or volumes traded, which may fluctuate based upon our actual performance, including growth, profitability, and dividends paid, as well as for reasons unrelated to our operating performance or not under our control.

OPERATIONAL RISKS

We are dependent upon construction of new facilities to support future growth in earnings in our natural gas and electric distribution and natural gas transmission operations.

Construction of new facilities required to support future growth is subject to various regulatory and developmental risks, including but not limited to: (i) our ability to obtain timely certificate authorizations, necessary approvals and permits from regulatory agencies and on terms that are acceptable to us; (ii) potential changes in federal, state and local statutes and regulations, including environmental requirements, that prevent a project from proceeding or increase the anticipated cost of the project; (iii) inability to acquire rights-of-way or land rights on a timely basis on terms that are acceptable to us; (iv) lack of anticipated future growth in available natural gas and electricity supply; (v) insufficient customer throughput commitments; and (vi) lack of available and qualified third party contractors could impact timely construction of new facilities.

We operate in a competitive environment, and we may lose customers to competitors.

Natural Gas. Our natural gas transmission and distribution operations compete with interstate pipelines when our transmission and/or distribution customers are located close enough to a competing pipeline to make direct connections economically feasible. Our natural gas marketing operations compete with third-party suppliers to sell natural gas to commercial and industrial customers. Failure to retain and grow our natural gas customer base would have an adverse effect on our financial condition, cash flows and results of operations.

Electric. While there is active wholesale power sales competition in Florida, our retail electric business through FPU has remained substantially free from direct competition from other electric service providers. Generally, however, our retail electric business through FPU remains subject to competition from other energy sources. Changes in the competitive environment caused by legislation, regulation, market conditions, or initiatives of other electric power providers, particularly with respect to retail competition, could adversely affect our results of operations, cash flows and financial condition.

Propane. Our propane distribution operations compete with other propane distributors, primarily on the basis of service and price. Some of our competitors have significantly greater resources. Our ability to grow the propane distribution business is contingent upon capturing additional market share, expanding into new markets, and successfully utilizing pricing programs that retain and grow our customer base. Failure to retain and grow our customer base in our propane distribution operations would have an adverse effect on our results of operations, cash flows and financial condition.

Chesapeake Utilities Corporation 2017 Form 10-K Page 14

Fluctuations in weather may cause a significant variance in our earnings.