Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Worldpay, Inc. | d662978d8k.htm |

| EX-99.1 - EX-99.1 - Worldpay, Inc. | d662978dex991.htm |

WORLDPAY, INC. 4Q17 & FY2017 Financial Results February 28, 2018 Exhibit 99.2 © 2018 Worldpay, Inc. All rights reserved.

No Offer or Solicitation This presentation is provided for informational purposes only and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities of Worldpay, Inc. (“Worldpay” or the “Company”) or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Neither the contents of Worldpay’s website, nor the contents of any other website accessible from hyperlinks on such websites, is incorporated herein or forms part of this document. Forward-Looking Statements This presentation contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward-looking statements including any statements regarding guidance and statements of a general economic or industry specific nature. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, guidance, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “will,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. The forward-looking statements contained in this presentation are based on assumptions that we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you review and consider information presented herein, you should understand that these statements are not guarantees of future performance or results. They depend upon future events and are subject to risks, uncertainties (many of which are beyond our control) and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual future performance or results and cause them to differ materially from those anticipated in the forward-looking statements. Certain of these factors and other risks are discussed in the Company's filings with the U.S. Securities and Exchange Commission (the “SEC”) and include, but are not limited to: (i) our ability to adapt to developments and change in our industry; (ii) competition; (iii) unauthorized disclosure of data or security breaches; (iv) systems failures or interruptions; (v) our ability to expand our market share or enter new markets; (vi) our ability to successfully integrate the businesses of our predecessor companies; (vii) our ability to identify and complete acquisitions, joint ventures and partnerships; (viii) failure to comply with applicable requirements of Visa, MasterCard or other payment networks or changes in those requirements; (ix) our ability to pass along fee increases; (x) termination of sponsorship or clearing services; (xi) loss of clients or referral partners; (xii) reductions in overall consumer, business and government spending; (xiii) fraud by merchants or others; (xiv) changes in foreign currency exchange rates; (xv) a decline in the use of credit, debit or prepaid cards; (xvi) consolidation in the banking and retail industries; (xvii) geopolitical, regulatory, tax and business risks associated with our international operations; (xviii) the effects of governmental regulation or changes in laws; (xix) outcomes of future litigation or investigations; and (xx) our dual-listings with the NYSE and LSE. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements. More information on potential factors that could affect the Company’s financial results and performance is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic reports filed with the SEC, including the Company’s most recently filed Annual Report on Form 10-K and its subsequent filings with the SEC. Any forward-looking statement made by us in this presentation speaks only as of the date of this presentation. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Disclaimer

Presenters Charles Drucker Executive Chairman & Co-Chief Executive Officer Philip Jansen Co-Chief Executive Officer Stephanie Ferris Chief Financial Officer

STRATEGIC OVERVIEW Charles Drucker Executive Chairman and Co-CEO

Leader in global integrated omnicommerce High-single-digit revenue growth, with upside from revenue synergies Heritage Vantiv delivered strong 4Q17 results, including double-digit merchant net revenue organic growth Heritage Worldpay global eCommerce continued to exceed expectations in 4Q17, with strong topline growth The new Worldpay © 2018 Worldpay, Inc. All rights reserved.

POWERFUL LEADER IN global integrated OMNICOMMERCE Leader in large, expanding global payments market Well-positioned in large and deep global payments industry Market expansion driven by adoption of electronic payments at a rapid pace around the world Investing in high-growth segments Global e-commerce Integrated payments High-growth verticals Geographic expansion Differentiated competitive advantages Unmatched global scale Broad and diverse distribution Leading technology capabilities Compelling financial profile High-growth, recurring revenue stream Superior operating leverage Highly cash generative

MULTIPLE OPPORTUNITIES FOR GROWTH Philip Jansen Co-CEO

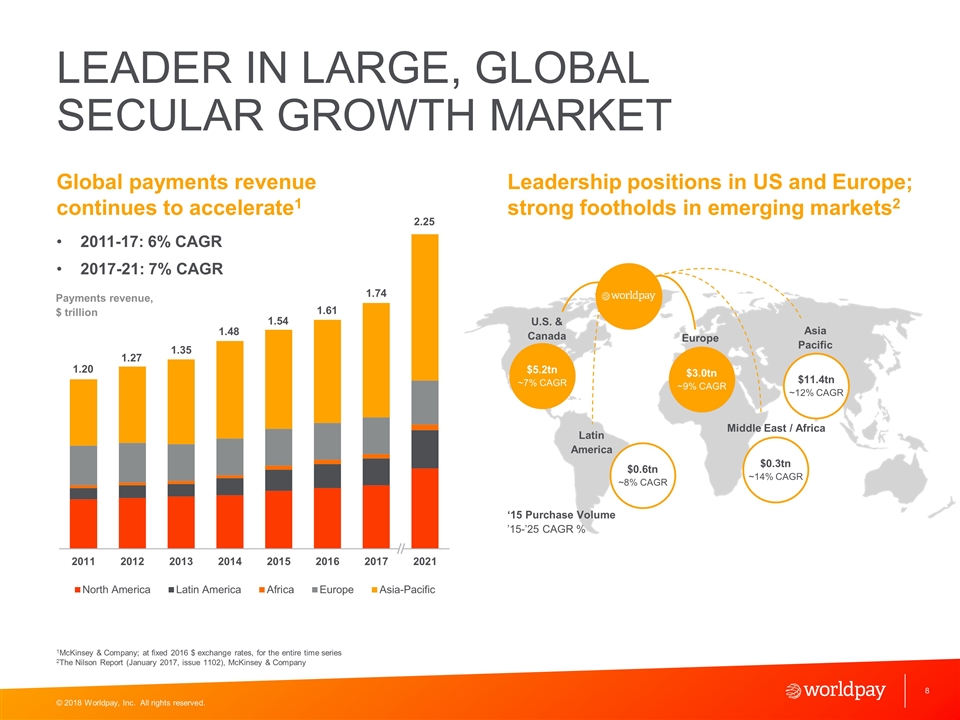

LEADER IN LARGE, GLOBAL SECULAR GROWTH MARKET Global payments revenue continues to accelerate1 2011-17: 6% CAGR 2017-21: 7% CAGR Leadership positions in US and Europe; strong footholds in emerging markets2 1McKinsey & Company; at fixed 2016 $ exchange rates, for the entire time series 2The Nilson Report (January 2017, issue 1102), McKinsey & Company 2.25 1.74 1.61 1.54 1.48 1.35 1.27 1.20 $5.2tn ~7% CAGR U.S. & Canada $11.4tn ~12% CAGR Europe Asia Pacific Latin America Middle East / Africa $3.0tn ~9% CAGR $0.3tn ~14% CAGR $0.6tn ~8% CAGR ‘15 Purchase Volume ’15-’25 CAGR % Payments revenue, $ trillion

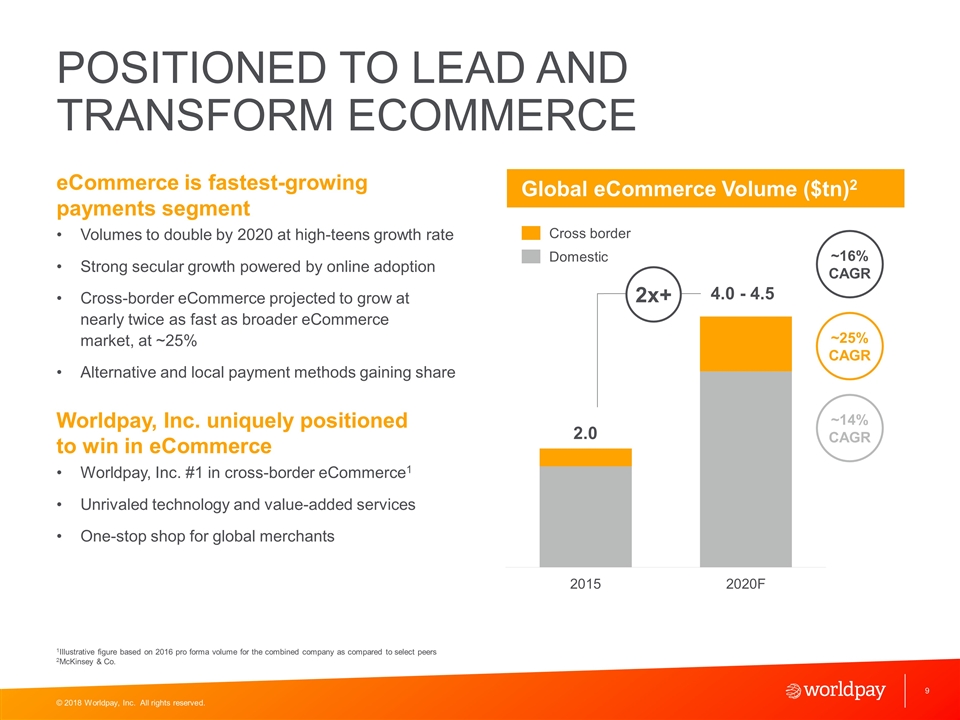

eCommerce is fastest-growing payments segment Volumes to double by 2020 at high-teens growth rate Strong secular growth powered by online adoption Cross-border eCommerce projected to grow at nearly twice as fast as broader eCommerce market, at ~25% Alternative and local payment methods gaining share Worldpay, Inc. uniquely positioned to win in eCommerce Worldpay, Inc. #1 in cross-border eCommerce1 Unrivaled technology and value-added services One-stop shop for global merchants POSITIONED TO LEAD AND TRANSFORM ECOMMERCE 1Illustrative figure based on 2016 pro forma volume for the combined company as compared to select peers 2McKinsey & Co. Global eCommerce Volume ($tn)2 ~25% CAGR ~14% CAGR ~16% CAGR 2x+ 4.0 - 4.5

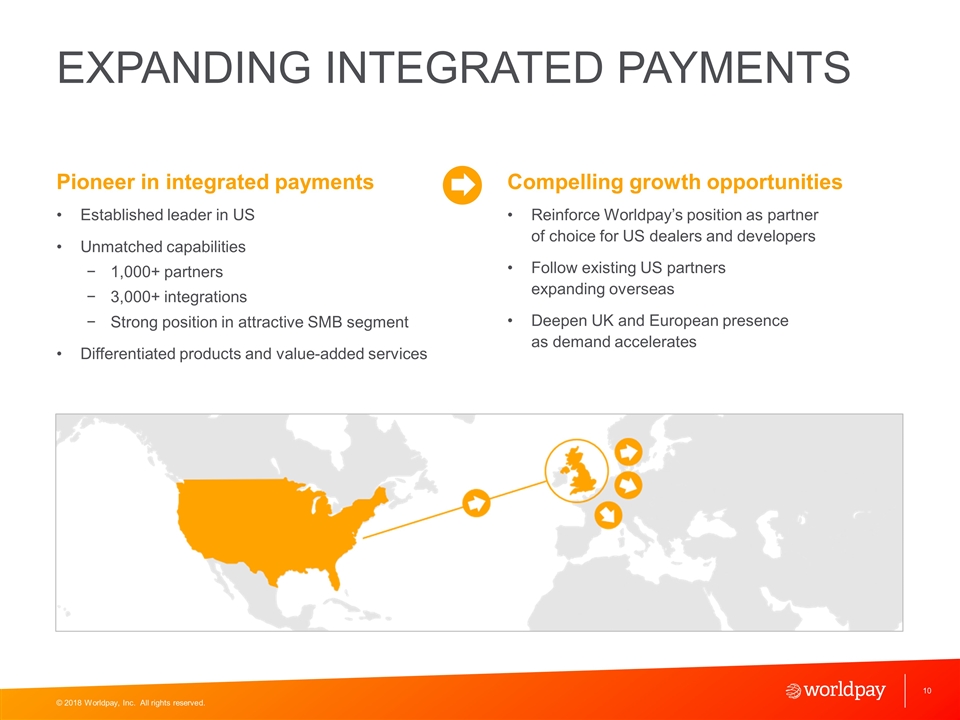

Pioneer in integrated payments Established leader in US Unmatched capabilities 1,000+ partners 3,000+ integrations Strong position in attractive SMB segment Differentiated products and value-added services Compelling growth opportunities Reinforce Worldpay’s position as partner of choice for US dealers and developers Follow existing US partners expanding overseas Deepen UK and European presence as demand accelerates EXPANDING INTEGRATED PAYMENTS

Differentiated expertise Track record of delivering expert solutions tailored to vertical-specific needs Opportunities to expand further Deepen presence in high-growth verticals INVESTING TO SERVE HIGH-GROWTH VERTICAL MARKETS Grocery & Drug Retail Digital Gaming & Entertainment Travel Healthcare B2B

DIFFERENTIATED COMPETITIVE ADVANTAGES Unmatched global scale Broad and diverse distribution Leading technology capabilities #1 global acquirer 42 billion annual transactions; $1.6 trillion payment volume Capabilities spanning 300+ payment methods, 146 countries, and 126 currencies Global distribution reach Strong presence and partners in all major channels, including direct and indirect Faster speed to market for new products Ability to innovate at scale Seamless integrated technology Agile, scalable, flexible Comprehensive, differentiated solution set Global footprint

FINANCIAL OVERVIEW Stephanie Ferris Chief Financial Officer

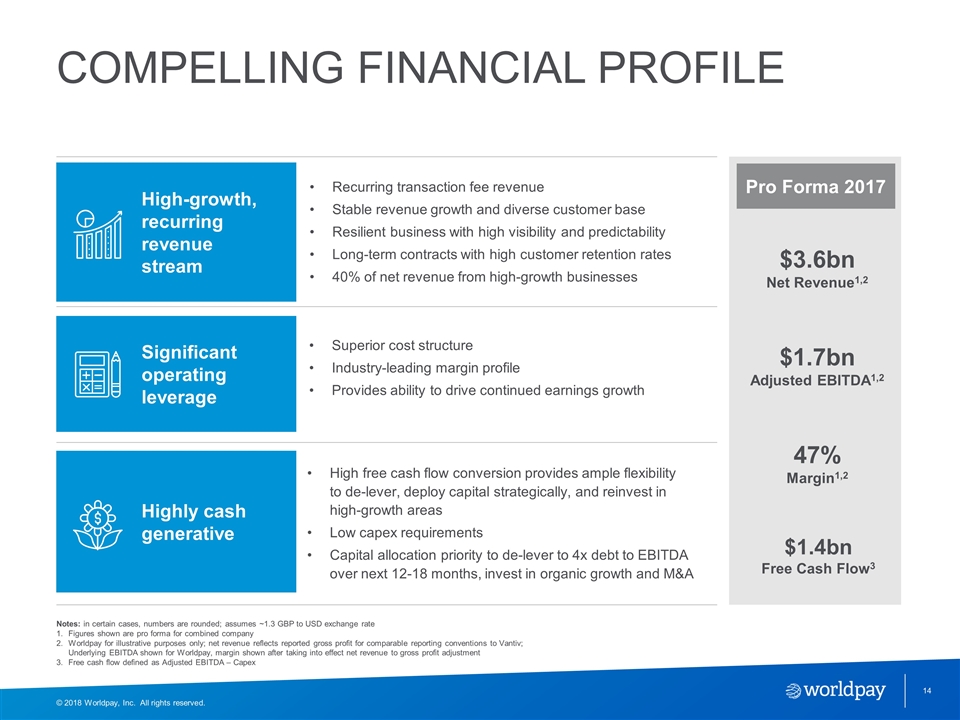

COMPELLING FINANCIAL PROFILE Pro Forma 2017 $3.6bn Net Revenue1,2 $1.7bn Adjusted EBITDA1,2 $1.4bn Free Cash Flow3 47% Margin1,2 Notes: in certain cases, numbers are rounded; assumes ~1.3 GBP to USD exchange rate Figures shown are pro forma for combined company Worldpay for illustrative purposes only; net revenue reflects reported gross profit for comparable reporting conventions to Vantiv; Underlying EBITDA shown for Worldpay, margin shown after taking into effect net revenue to gross profit adjustment Free cash flow defined as Adjusted EBITDA – Capex Significant operating leverage Superior cost structure Industry-leading margin profile Provides ability to drive continued earnings growth Highly cash generative High free cash flow conversion provides ample flexibility to de-lever, deploy capital strategically, and reinvest in high-growth areas Low capex requirements Capital allocation priority to de-lever to 4x debt to EBITDA over next 12-18 months, invest in organic growth and M&A High-growth, recurring revenue stream Recurring transaction fee revenue Stable revenue growth and diverse customer base Resilient business with high visibility and predictability Long-term contracts with high customer retention rates 40% of net revenue from high-growth businesses

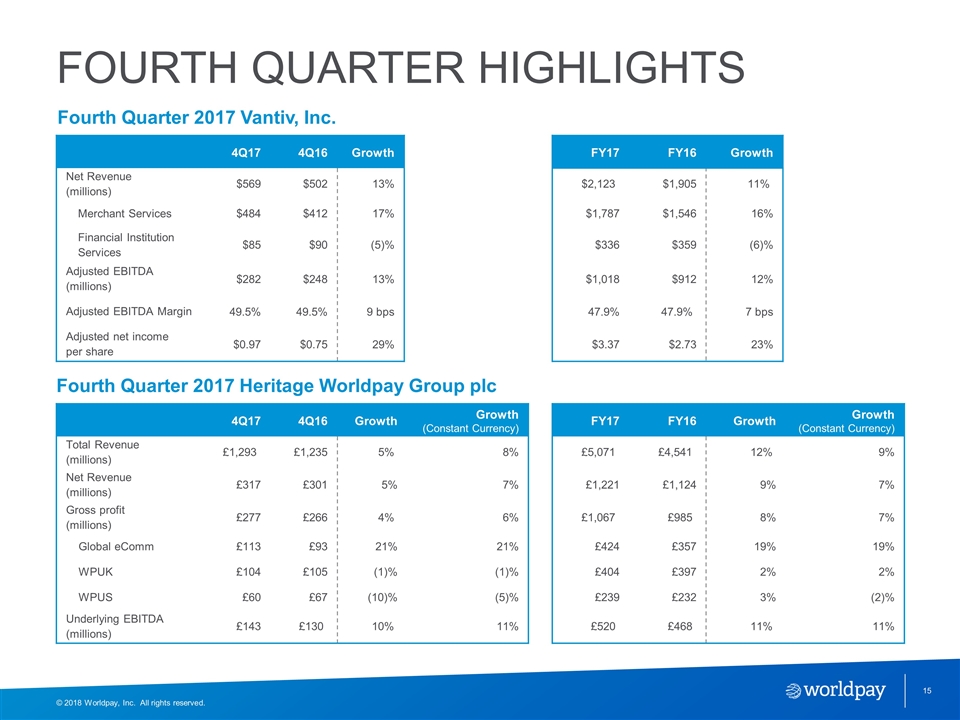

FOURTH QUARTER HIGHLIGHTS Fourth Quarter 2017 Vantiv, Inc. 4Q17 4Q16 Growth FY17 FY16 Growth Net Revenue (millions) $569 $502 13% $2,123 $1,905 11% Merchant Services $484 $412 17% $1,787 $1,546 16% Financial Institution Services $85 $90 (5)% $336 $359 (6)% Adjusted EBITDA (millions) $282 $248 13% $1,018 $912 12% Adjusted EBITDA Margin 49.5% 49.5% 9 bps 47.9% 47.9% 7 bps Adjusted net income per share $0.97 $0.75 29% $3.37 $2.73 23% Fourth Quarter 2017 Heritage Worldpay Group plc 4Q17 4Q16 Growth Growth (Constant Currency) FY17 FY16 Growth Growth (Constant Currency) Total Revenue (millions) £1,293 £1,235 5% 8% £5,071 £4,541 12% 9% Net Revenue (millions) £317 £301 5% 7% £1,221 £1,124 9% 7% Gross profit (millions) £277 £266 4% 6% £1,067 £985 8% 7% Global eComm £113 £93 21% 21% £424 £357 19% 19% WPUK £104 £105 (1)% (1)% £404 £397 2% 2% WPUS £60 £67 (10)% (5)% £239 £232 3% (2)% Underlying EBITDA (millions) £143 £130 10% 11% £520 £468 11% 11%

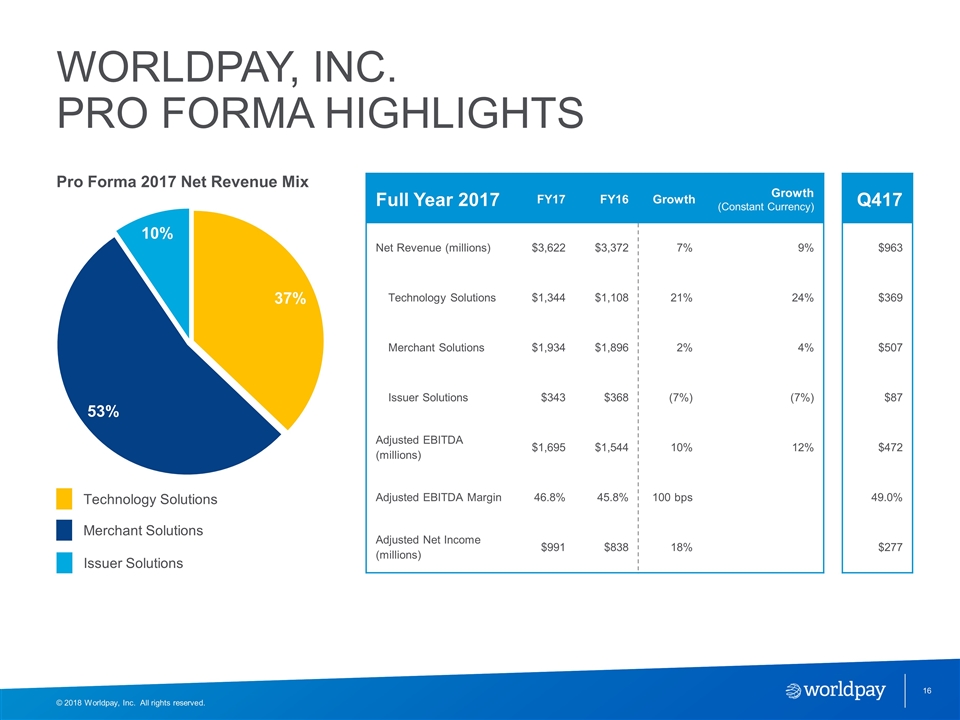

WORLDPAY, INC. PRO FORMA HIGHLIGHTS © 2018 Worldpay, Inc. All rights reserved. Pro Forma 2017 Net Revenue Mix Technology Solutions Merchant Solutions Issuer Solutions Full Year 2017 FY17 FY16 Growth Growth (Constant Currency) Net Revenue (millions) $3,622 $3,372 7% 9% Technology Solutions $1,344 $1,108 21% 24% Merchant Solutions $1,934 $1,896 2% 4% Issuer Solutions $343 $368 (7%) (7%) Adjusted EBITDA (millions) $1,695 $1,544 10% 12% Adjusted EBITDA Margin 46.8% 45.8% 100 bps Adjusted Net Income (millions) $991 $838 18% Q417 $963 $369 $507 $87 $472 49.0% $277

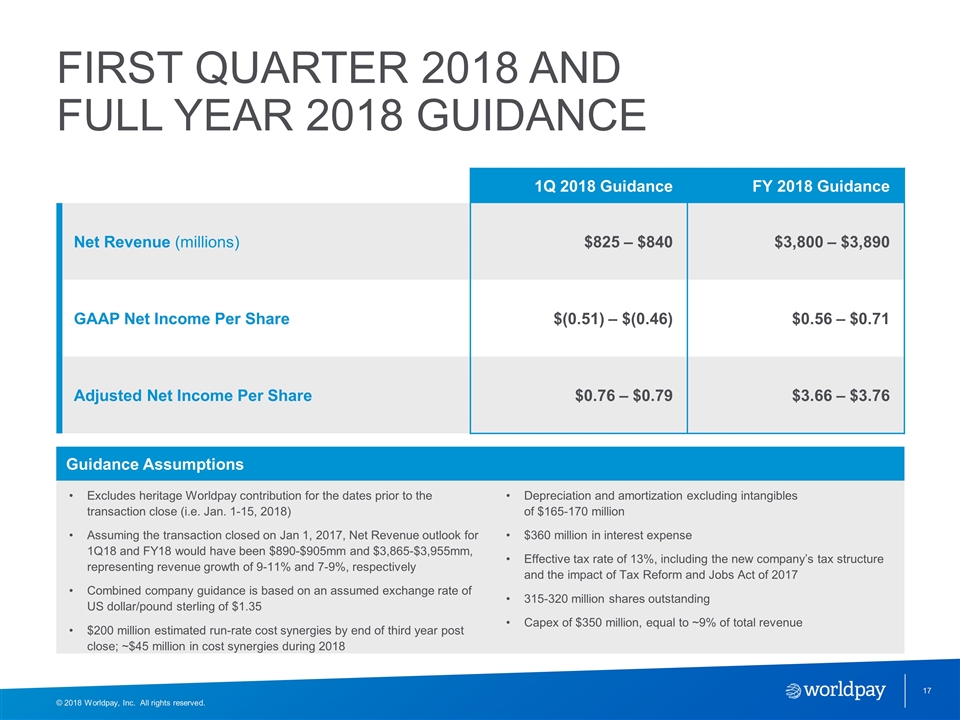

Excludes heritage Worldpay contribution for the dates prior to the transaction close (i.e. Jan. 1-15, 2018) Assuming the transaction closed on Jan 1, 2017, Net Revenue outlook for 1Q18 and FY18 would have been $890-$905mm and $3,865-$3,955mm, representing revenue growth of 9-11% and 7-9%, respectively Combined company guidance is based on an assumed exchange rate of US dollar/pound sterling of $1.35 $200 million estimated run-rate cost synergies by end of third year post close; ~$45 million in cost synergies during 2018 FIRST QUARTER 2018 AND FULL YEAR 2018 GUIDANCE 1Q 2018 Guidance FY 2018 Guidance Net Revenue (millions) $825 – $840 $3,800 – $3,890 GAAP Net Income Per Share $(0.51) – $(0.46) $0.56 – $0.71 Adjusted Net Income Per Share $0.76 – $0.79 $3.66 – $3.76 Guidance Assumptions Depreciation and amortization excluding intangibles of $165-170 million $360 million in interest expense Effective tax rate of 13%, including the new company’s tax structure and the impact of Tax Reform and Jobs Act of 2017 315-320 million shares outstanding Capex of $350 million, equal to ~9% of total revenue

Integration update Charles Drucker Executive Chairman and Co-CEO

Following an established, disciplined integration approach Top priority: Bring forward strengths of both companies to customers and partners Consolidation of global functions underway Anticipate majority of US consolidation over next three years Confident to achieve cost synergies of at least $200 million by year three Encouraging client reaction STRONG PERFORMANCE OUT OF THE GATE © 2018 Worldpay, Inc. All rights reserved.

Combination already delivering solid results Leader in the secular high-growth global payments industry Investing to further extended our lead in eCommerce, Integrated Payments, and attractive high-growth verticals Differentiated technology, distribution, and scale Integration advancing per plan Engaging with clients to realize product and distribution benefits THE leader in global INTEGRATED omnicommerce © 2018 Worldpay, Inc. All rights reserved.

Q&A

Appendix

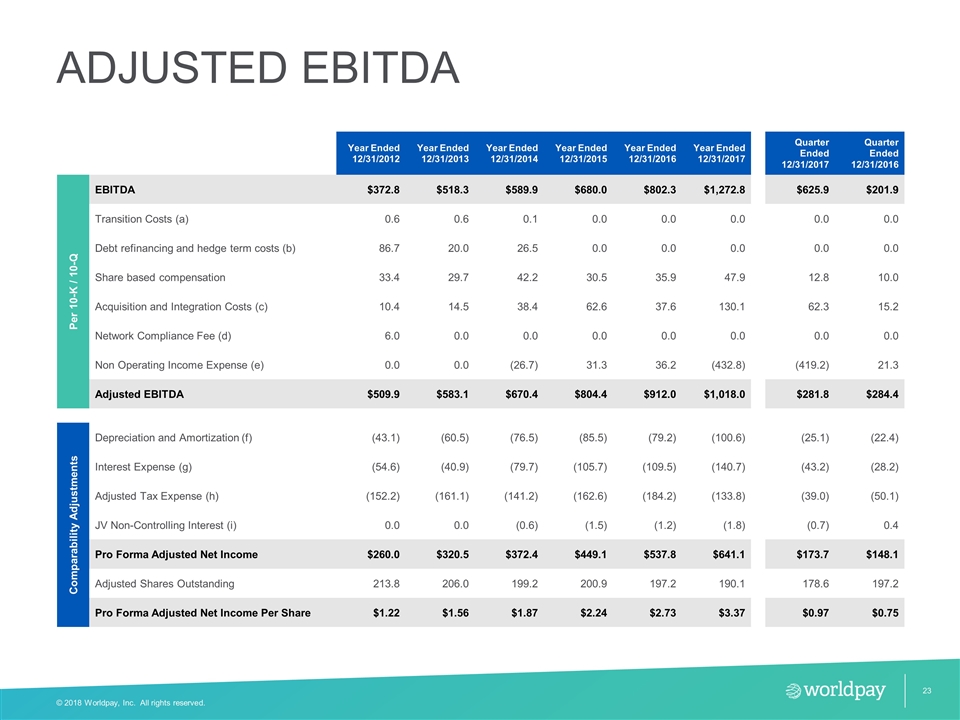

ADJUSTED EBITDA Year Ended 12/31/2012 Year Ended 12/31/2013 Year Ended 12/31/2014 Year Ended 12/31/2015 Year Ended 12/31/2016 Year Ended 12/31/2017 Quarter Ended 12/31/2017 Quarter Ended 12/31/2016 Per 10-K / 10-Q EBITDA $372.8 $518.3 $589.9 $680.0 $802.3 $1,272.8 $625.9 $201.9 Transition Costs (a) 0.6 0.6 0.1 0.0 0.0 0.0 0.0 0.0 Debt refinancing and hedge term costs (b) 86.7 20.0 26.5 0.0 0.0 0.0 0.0 0.0 Share based compensation 33.4 29.7 42.2 30.5 35.9 47.9 12.8 10.0 Acquisition and Integration Costs (c) 10.4 14.5 38.4 62.6 37.6 130.1 62.3 15.2 Network Compliance Fee (d) 6.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non Operating Income Expense (e) 0.0 0.0 (26.7) 31.3 36.2 (432.8) (419.2) 21.3 Adjusted EBITDA $509.9 $583.1 $670.4 $804.4 $912.0 $1,018.0 $281.8 $284.4 Comparability Adjustments Depreciation and Amortization (f) (43.1) (60.5) (76.5) (85.5) (79.2) (100.6) (25.1) (22.4) Interest Expense (g) (54.6) (40.9) (79.7) (105.7) (109.5) (140.7) (43.2) (28.2) Adjusted Tax Expense (h) (152.2) (161.1) (141.2) (162.6) (184.2) (133.8) (39.0) (50.1) JV Non-Controlling Interest (i) 0.0 0.0 (0.6) (1.5) (1.2) (1.8) (0.7) 0.4 Pro Forma Adjusted Net Income $260.0 $320.5 $372.4 $449.1 $537.8 $641.1 $173.7 $148.1 Adjusted Shares Outstanding 213.8 206.0 199.2 200.9 197.2 190.1 178.6 197.2 Pro Forma Adjusted Net Income Per Share $1.22 $1.56 $1.87 $2.24 $2.73 $3.37 $0.97 $0.75

Transition costs include costs associated with our separation transaction from Fifth Third Bank, including costs incurred for our human resources, finance, marketing and legal functions and severance costs; consulting fees related to non-recurring transition projects; expenses related to various strategic and separation initiatives; depreciation and amortization charged to us by Fifth Third Bank under our transition services agreement; and compensation costs related to payouts of a one-time signing bonus to former Fifth Third Bank employees transferred to us as part of our transition deferred compensation plan. Primarily includes non-operating expenses incurred with the refinancing of our debt in May 2011, March 2012, May 2013, June 2014, and October 2016 as well costs associated with the early termination of our interest rate swaps in March 2012. Represents acquisition and integration costs incurred in connection with our acquisitions, charges related to employee termination benefits and other transition activities. Included in Transition, acquisition and integration costs for the three months and year ended December 31, 2017, is a charge of $3.5 million and $41.5 million, respectively, to G&A related to a settlement agreement stemming from legacy litigation of an acquired company. Mastercard assessed a change of control compliance fee to the company of $6.0 million as a result of our IPO. Non-operating income for the three months and year ended December 31, 2017, primarily consists of a gain of approximately $418.9 million relating to the impact to the tax receivable agreement (“TRA”) liability as a result of the Tax Cuts and Jobs Act (“Tax Reform”) being enacted on December 22, 2017, and an unrealized gain of approximately $8.7 million for the three months and $33.1 million for the year ended, respectively, relating to the change in fair value of a deal contingent forward entered into in connection with the Worldpay Group plc acquisition, partially offset by the change in fair value of a TRA entered into as part of the acquisition of Mercury (“Mercury TRA”). Nonoperating expense for the three months and year ended December 31, 2016, relates to the change in fair value of Mercury TRA as well as expenses relating to the refinancing of our senior secured credit facilities in October 2016. For periods prior to 2012, amounts represent depreciation expense associated with the company’s property and equipment, assuming that the company’s property and equipment at December 31, 2011 was in place on January 1, 2009. For periods subsequent to 2011, amounts represent the company’s depreciation and amortization expense adjusted to exclude amortization of intangible assets acquired through business combinations and customer portfolio and related asset acquisitions. The twelve months ended December 31, 2014 also includes the write-down of a trade name of $34.3 million. For periods prior to 2012, amounts represent interest expense associated with the company’s level of debt, assuming the level of debt and applicable terms at December 31, 2011 was outstanding on January 1, 2009. Represents adjustments to income tax expense to reflect an effective tax rate of 34.0% for 2017, 36% for 2016 and 2015, 36.5% for 2014 and 38.5% for all other periods presented, assuming the conversion of the Class B units of Vantiv Holding into shares of Class A common stock, including the tax effect of the adjustments described above. Represents the non-controlling interest, net of pro forma income tax expense, associated with a consolidated joint venture formed in May 2014. Vantiv’s Non-GAAP Reconciliation