Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - QUAKER CHEMICAL CORP | tv487390_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - QUAKER CHEMICAL CORP | tv487390_ex99-1.htm |

Exhibit 99.2

1 Fourth Quarter 2017 Results Investor Conference Call March 1, 2018 Quaker Chemical Corporation

Risks and Uncertainties Statement Regulation G The attached charts include C ompany information that does not conform to generally accepted accounting principles ( “GAAP”). Management believes that an analysis of this data is meaningful to investors because it provides insight with respect to ongoing operating results of the Company and allows investors to better evaluate the financial results of the Company. These measures should not be viewed as an alternative to GAAP measures of performance. Furthermore, these measures may not be consis tent with similar measures provided by other companies. This data should be read in conjunction with the Company’s fourth quarter and full year earnings news release dated February 28, 2018, which has been furnished to the Securities and Exchange Commission (“SEC”) on Form 8-K and the Company’s Form 10-K for the year ended December 31, 2017, which has been filed with the SEC. Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in such statements. A major risk is that demand for the Company's products and services is largely derived from the demand for its customers' products, which subjects the Company to uncertainties related to downturns in a customer's business and unanticipated customer production shutdowns. Other major risks and uncertainties include, but are not limited to, significant increases in raw material costs, customer financial stability, worldwide economic and political condi tions, foreign currency fluctuations, significant changes in applicable tax rates and regulations, future terrorist attacks and other acts of violence. Other factors, including those related to the previously announced pending Houghton combination (“the Combination”), could also adversely affect us including, but not limited to: the risk that a required regulatory approval will not be obtained or is subject to conditions that are not anticipated or acceptable to us; the potential that regulatory authorities may require that we make divestitures in connection with the Combination of a greater amount than we anticipated, which would result in a smaller than anticipated combined business; the risk that a closing condition to the Combination may not be satisfied in a timely manner; risks associated with the financing of the Combination; the occurrence of any event, change or other circumstance that could give rise to the termination of the share purchase agreement; potential adverse effects on Quaker Chemical’s business, properties or operations caused by the implementation of the Combination; Quaker Chemical’s ability to promptly, efficiently and effectively integrate the operations of Houghton and Quaker Chemical; risks related to each company’s distraction from ongoing business operations due to the Combination; and, the outcome of any legal proceedings that may be instituted against the companies related to the Combination. Therefore, we caution you not to place undue reliance on our forward-looking statements. For more information regarding these risks and uncertainties as well as certain additional risks that we face, you should refer to the Risk Factors detailed in Item 1A of our Form 10-K for the year ended December 31, 2017 as well as the proxy statement the Company filed on July 31, 2017 and in our quarterly and other reports filed from time to time with the SEC. We do not intend to, and we disclaim any duty or obligation to, update or revise any forward- looking statements to reflect new information or future events or for any other reason. This discussion is provided as permitted by the Private Securities Litigation Reform Act of 1995.

Speakers Michael F. Barry Chairman of the Board, Chief Executive Officer & President Mary Dean Hall Vice President, Chief Financial Officer & Treasurer Robert T. Traub Vice President, General Counsel & Corporate Secretary Chart #1

Fourth Quarter 2017 Headlines ▪ 10% growth in net sales for both the fourth quarter and full year driven by strong volumes ▪ U.S. tax reform charges of $22.2 million and Houghton combination - related expenses decrease net income in the fourth quarter and full year to a net loss of $9.8 million, or $0.73 per diluted share, and net income of $20.3 million, or $1.52 per diluted share, respectively ▪ Fourth quarter non - GAAP earnings per diluted share of $1.27 increases full year non - GAAP earnings per diluted share to $5.01, a 9% increase year - over - year ▪ 15% increase in fourth quarter adjusted EBITDA of $29.6 million drives an 8% increase in full year adjusted EBITDA to $115.2 million Chart #2

Chairman Comments Fourth Quarter 2017 ▪ Fourth Quarter 2017 x Net sales of $211.1 million increase 10% driven by organic volume growth of 5% on continued market share gains and increased production in some end markets x Strong volumes drove higher gross profit despite a lower gross margin primarily due to higher raw material costs and changes in the mix of products sold x Operating income benefited from continued discipline in managing SG&A and drove a 15% increase in adjusted EBITDA of $29.6 million ▪ 2018 Outlook x For Quaker’s current business, continue to expect volume growth, leverage of SG&A and gradual increases in gross margin throughout 2018 x Currently expect to close the Houghton combination during the first half of 2018 x Newly combined company will approximately double the current company’s annual sales and adjusted EBITDA, not including estimated synergies, which are expected to meet or exceed $45 million once fully achieved by the third year Chart #3 Overall, we remain confident in our future and expect 2018 to be another good year for both the current Quaker business and the combined new company post - closing

▪ Net sales increases of 10% in both Q4’17 and FY’17 driven by volume growth of 6% and 7%, respectively, and to a lesser extent increases from changes in selling price and product mix and the positive impact from FX in each period ▪ Gross profit increased $4.2 million in Q4’17 and $11.4 million in FY’17 despite lower gross margins of 35.1% compared to 36.5% quarter - over - quarter and 35.5% compared to 37.5% year - over - year, primarily due to higher raw material costs and changes in the mix of products sold ▪ Houghton combination - related expenses totaled $7.7 million or $0.43 per diluted share in Q4’17 and $30.8 million or $1.90 per diluted share in FY’17 ▪ Operating income in both Q4’17 and FY’17 benefited from continued discipline in managing SG&A costs, leveraging the Company’s significant sales growth ▪ Record quarter and full year adjusted EBITDA of $29.6 million and $115.2 million, up 15% and 8% period - over - period, respectively ▪ Effective tax rate of 163.0% in Q4’17 and 68.7% in FY’17 driven by $22.2 million of tax expense incurred as a result of U.S. Tax Reform and certain non - deductible combination - related expenses; ETR would be approximately 29% in Q4’17 and 27% in FY’17 without these impacts ▪ Non - GAAP EPS of $1.27 in Q4’17 up 1% from Q4’16 and FY’17 non - GAAP EPS of $5.01 up 9% compared to $4.60 in the prior year ▪ Q4’17 net operating cash flow of $24.0 million results in full year net operating cash flow of $64.8 million compared to $73.8 million in the prior year, primarily due to outflows of $25.9 million for Houghton combination - related expenses in the current year Financial Highlights Fourth Quarter and Full Year 2017 Chart #4

Chart #5 Financial Snapshot ($ Millions unless otherwise noted) Q4 2017 Q4 2016 YTD 2017 YTD 2016 Net Sales 211.1 191.2 820.1 746.7 Gross Profit 74.0 69.8 291.5 280.1 Gross Margin 35.1% 36.5% 35.5% 37.5% SG&A 50.1 48.9 198.8 193.7 Restructuring and Related Activities - (0.4) - (0.4) Combination-Related Expenses 6.9 0.4 29.9 1.5 Operating Income 17.1 21.0 62.7 85.4 Operating Margin 8.1% 11.0% 7.7% 11.4% Net (Loss) Income Attributable to Quaker Chemical Corporation (9.8) 17.4 20.3 61.4 GAAP (Loss) Earnings Per Diluted Share (0.73) 1.31 1.52 4.63 Non-GAAP Earnings Per Diluted Share 1.27 1.26 5.01 4.60 Adjusted EBITDA 29.6 25.6 115.2 106.6 Adjusted EBITDA Margin 14.0% 13.4% 14.1% 14.3% Net Cash (Debt) 23.1 22.3 23.1 22.3 Net Operating Cash Flow 24.0 20.8 64.8 73.8 Effective Tax Rate 163.0% 17.3% 68.7% 27.6%

Chart #6 Strong organic volumes continue to drive top line growth Product Volume by Quarter and Year in Thousands of Kilograms 115,000 135,000 155,000 175,000 195,000 215,000 235,000 255,000 275,000 25,000 30,000 35,000 40,000 45,000 50,000 55,000 60,000 65,000 70,000 75,000 Full Year Volume Quarter Volume Quarter Volume Full Year Volume

28.1% 35.0% 35.6% 32.7% 33.8% 35.9% 35.8% 37.7% 37.5% 35.5% 20.0% 25.0% 30.0% 35.0% 40.0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Gross Margin Percentage 36.5% 36.4% 35.7% 35.1% 35.1% 20.0% 25.0% 30.0% 35.0% 40.0% Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Gross Margin Percentage Chart #7 Expect gross margins to increase throughout 2018 from the current 35% levels to 36%, heading towards our 37% target Gross Margin Percentage Trends

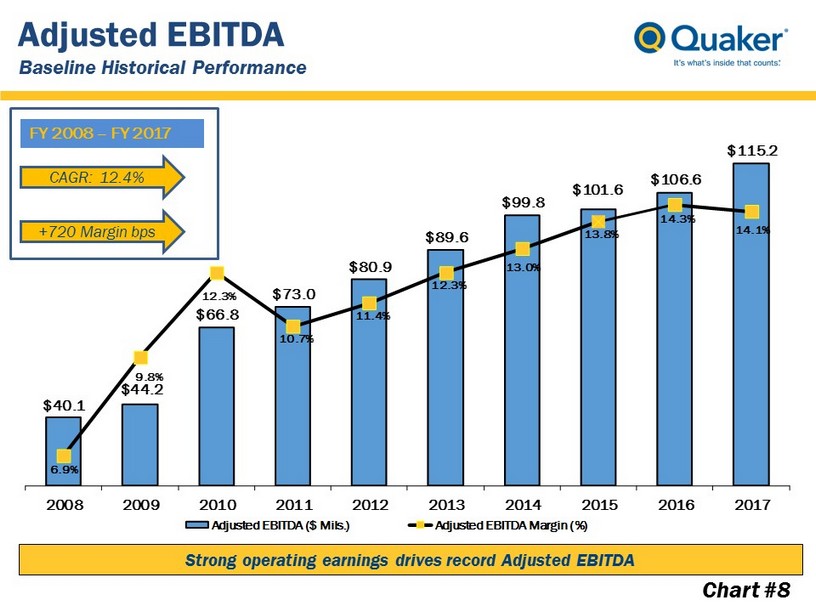

FY 2008 – FY 2017 CAGR: 12.4% +720 Margin bps Adjusted EBITDA Baseline Historical Performance $40.1 $44.2 $66.8 $73.0 $80.9 $89.6 $99.8 $101.6 $106.6 $115.2 6.9% 9.8% 12.3% 10.7% 11.4% 12.3% 13.0% 13.8% 14.3% 14.1% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Adjusted EBITDA ($ Mils.) Adjusted EBITDA Margin (%) Strong operating earnings drives record Adjusted EBITDA Chart #8

-$120 -$80 -$40 $0 $40 $80 $120 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 $ Millions Cash ST/LT Debt Net Cash (Debt) Chart #9 Continued solid cash flow generation and strong balance sheet Balance Sheet Cash and Debt

APPENDIX

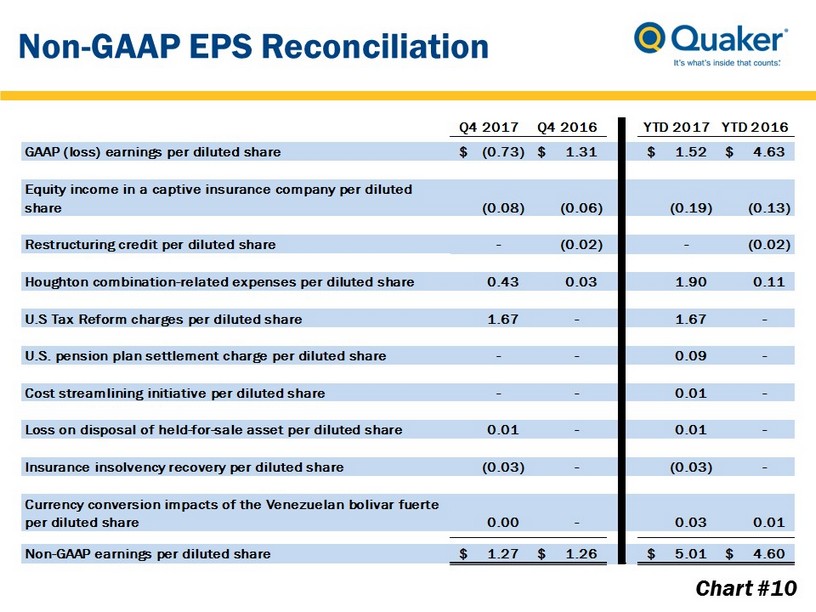

Chart #10 Non - GAAP EPS Reconciliation Q4 2017 Q4 2016 YTD 2017 YTD 2016 GAAP (loss) earnings per diluted share (0.73)$ 1.31$ 1.52$ 4.63$ Equity income in a captive insurance company per diluted share (0.08) (0.06) (0.19) (0.13) Restructuring credit per diluted share - (0.02) - (0.02) Houghton combination-related expenses per diluted share 0.43 0.03 1.90 0.11 U.S Tax Reform charges per diluted share 1.67 - 1.67 - U.S. pension plan settlement charge per diluted share - - 0.09 - Cost streamlining initiative per diluted share - - 0.01 - Loss on disposal of held-for-sale asset per diluted share 0.01 - 0.01 - Insurance insolvency recovery per diluted share (0.03) - (0.03) - Currency conversion impacts of the Venezuelan bolivar fuerte per diluted share 0.00 - 0.03 0.01 Non-GAAP earnings per diluted share 1.27$ 1.26$ 5.01$ 4.60$

Chart #11 Adjusted EBITDA Reconciliation ($ Thousands unless otherwise noted) Q4 2017 Q4 2016 YTD 2017 YTD 2016 Net (loss) income attributable to Quaker Chemical Corporation (9,762)$ 17,434$ 20,278$ 61,403$ Depreciation and amortization 5,012 4,778 19,966 19,566 Interest expense 1,664 663 3,892 2,889 Taxes on income before equity in net income of associated companies 27,424 3,562 41,653 23,226 Equity income in a captive insurance company (1,120) (736) (2,547) (1,688) Restructuring credit - (439) - (439) Houghton combination-related expenses 6,850 374 29,938 1,531 U.S. pension plan settlement charge - - 1,860 - Cost streamlining initiative - - 286 - Loss on disposal of held-for-sale asset 125 - 125 - Insurance insolvency recovery (600) - (600) - Currency conversion impacts of the Venezuelan bolivar fuerte 13 - 388 88 Adjusted EBITDA 29,606$ 25,636$ 115,239$ 106,576$ Adjusted EBITDA Margin (%) 14.0% 13.4% 14.1% 14.3%

Chart #12 Adjusted EBITDA Reconciliation ($ Thousands unless otherwise noted) 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Net income 9,833$ 16,058$ 32,120$ 45,892$ 47,405$ 56,339$ 56,492$ 51,180$ 61,403$ 20,278$ Depreciation 10,879 9,525 9,867 11,455 12,252 12,339 12,306 12,395 12,557 12,598 Amortization 1,177 1,078 988 2,338 3,106 3,445 4,325 6,811 7,009 7,368 Interest expense 5,509 5,533 5,225 4,666 4,283 2,922 2,371 2,585 2,889 3,892 Taxes on income before equity in net income of associated companies 4,977 7,065 12,616 14,256 15,575 20,489 23,539 17,785 23,226 41,653 Equity loss (income) from a captive insurance company 1,299 162 (313) (2,323) (1,812) (5,451) (2,412) (2,078) (1,688) (2,547) Non-cash gain from the purchase of an equity affiliate - - - (2,718) - - - - - - Equity affiliate out of period charge - - 564 - - - - - - - Restructuring expense (credit) 2,916 2,289 - - - - - 6,790 (439) - Executive transition costs 3,505 2,443 1,317 - 609 - - - - - Houghton combination-related expenses - - - - - - - - 1,531 29,938 Verkol transaction-related expenses - - - - - - - 2,813 - - U.K. pension plan amendment - - - - - - 902 - - - Customer bankruptcy costs - - - - 1,254 - 825 328 - - U.S. pension plan settlement charge - - - - - - - - - 1,860 Cost streamlining initiatives - - - - - 1,419 1,166 173 - 286 Loss on disposal of held-for-sale asset - - - - - - - - - 125 Insurance insolvency recovery - - - - - - - - - (600) Non-income tax contingency charge - - 4,132 - - 796 - - - - Change in acquisition-related earnout liability - - - (595) (1,737) (497) - - - - Mineral oil excise tax refund - - - - - (2,540) - - - - Currency conversion impacts of the Venezuelan bolivar fuerte - - 322 - - 357 321 2,806 88 388 Adjusted EBITDA 40,095$ 44,153$ 66,838$ 72,971$ 80,935$ 89,618$ 99,835$ 101,588$ 106,576$ 115,239$ Adjusted EBITDA Margin (%) 6.9% 9.8% 12.3% 10.7% 11.4% 12.3% 13.0% 13.8% 14.3% 14.1%