Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INTERSECTIONS INC | form8k.htm |

Exhibit 99.1

Investor Overview February 2018

Forward-Looking Statements Statements in this presentation relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Those forward-looking statements involve known and unknown risks and uncertainties and are subject to change based on various factors and uncertainties that may cause actual results to differ materially from those expressed or implied by those statements, including the success of our strategic objectives; our ability to meet the targets disclosed by management with respect to costs and revenue, and that these targets do not represent historical performance, projected results or guidance; our ability to generate revenue from our partner sales strategy and business development pipeline with our distribution partners; the impact of shutting down and then divesting our Pet Health Monitoring segment; the timing and success of new product launches and other growth initiatives, including our Identity Guard® with Watson™ product; the continuing impact of the regulatory environment on our business; the continued dependence on a small number of financial institutions for a majority of our revenue and to service our U.S. financial institution customer base; our ability to execute our strategy and previously announced transformation plan; our incurring additional restructuring charges; our incurring additional charges for non-income business taxes or otherwise, or impairment costs or charges on goodwill and/or other assets; our ability to control costs; our failure to protect private data due to a security breach or other unauthorized access; our ability to maintain sufficient liquidity and produce sufficient cash flow to fund our business, growth strategy and debt service obligations; the impact of our recent senior management changes; and our needs for additional capital to grow our business, including our ability to maintain compliance with the covenants under our term loan or seek additional sources of debt and/or equity financing. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed under “Forward-Looking Statements,” “Item 1. Business—Government Regulation” and “Item 1A. Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and in its recent other filings with the U.S. Securities and Exchange Commission. The Company undertakes no obligation to revise or update any forward-looking statements unless required by applicable law. 2

Other Disclaimers 3 Securities DisclaimerThis presentation is for informational purposes only, and is neither an offer to sell nor a solicitation of an offer to buy any securities and shall not constitute an offer, solicitation, or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.Market and Industry DataThis presentation contains estimates and information concerning the Company’s industry that are based on industry publications, reports and peer company filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section of the Company’s public filings with the SEC.Non-GAAP Financial MeasuresThis presentation includes financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), as well as other financial measures referred to as non-GAAP financial measures. Consolidated adjusted EBITDA (loss) before share related compensation and non-cash impairment charges (“Adjusted EBITDA”) is presented in a manner consistent with the way management evaluates operating results and which management believes is useful to investors and others. Share related compensation includes non-cash share based compensation. An explanation regarding the Company’s use of non-GAAP financial measures and a reconciliation of non-GAAP financial measures used by the Company to GAAP measures is provided in the Appendix. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, net income (loss) and the other information prepared in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. Management strongly encourages stockholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.Trademarks and Trade NamesIdentity Guard® is a registered trademark of Intersections Inc. and its subsidiaries in the United States and other jurisdictions. For more information, please visit www.intersections.com. All other trademarks are the property of their respective owners.

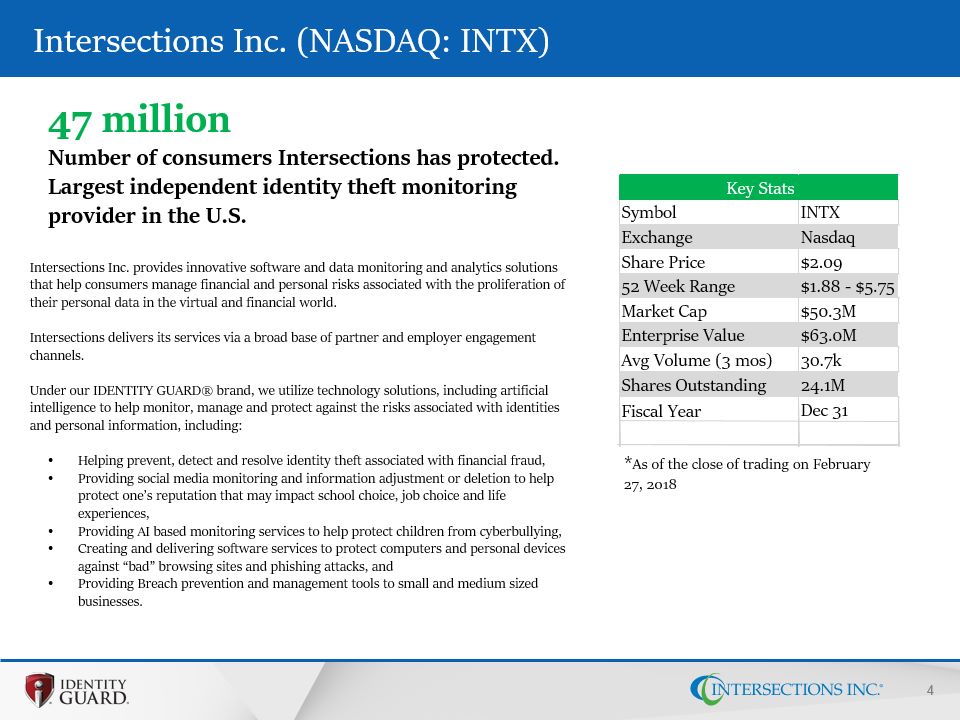

Intersections Inc. (NASDAQ: INTX) 47 million Number of consumers Intersections has protected.Largest independent identity theft monitoring provider in the U.S.Intersections Inc. provides innovative software and data monitoring and analytics solutions that help consumers manage financial and personal risks associated with the proliferation of their personal data in the virtual and financial world.Intersections delivers its services via a broad base of partner and employer engagement channels. Under our IDENTITY GUARD® brand, we utilize technology solutions, including artificial intelligence to help monitor, manage and protect against the risks associated with identities and personal information, including: Helping prevent, detect and resolve identity theft associated with financial fraud,Providing social media monitoring and information adjustment or deletion to help protect one’s reputation that may impact school choice, job choice and life experiences,Providing AI based monitoring services to help protect children from cyberbullying,Creating and delivering software services to protect computers and personal devices against “bad” browsing sites and phishing attacks, andProviding Breach prevention and management tools to small and medium sized businesses. Symbol INTX Exchange Nasdaq Share Price $2.09 52 Week Range $1.88 - $5.75 Market Cap $50.3M Enterprise Value $63.0M Avg Volume (3 mos) 30.7k Shares Outstanding 24.1M Fiscal Year Dec 31 Key Stats 4 *As of the close of trading on February 27, 2018

Our Brand Promise 5 THE REALITYAs people engage in today’s digital, interconnected world, and as our institutional world becomes more data driven, consumers’ personal data becomes pervasive in the virtual world, and is sought by criminals to perpetrate crimes.OUR PURPOSETo create advanced software solutions and help protect individuals, families and businesses from threats arising from the theft and misuse of personal data and to provide avenues to understand and manage other nonfinancial threats when discovered and analyzed.

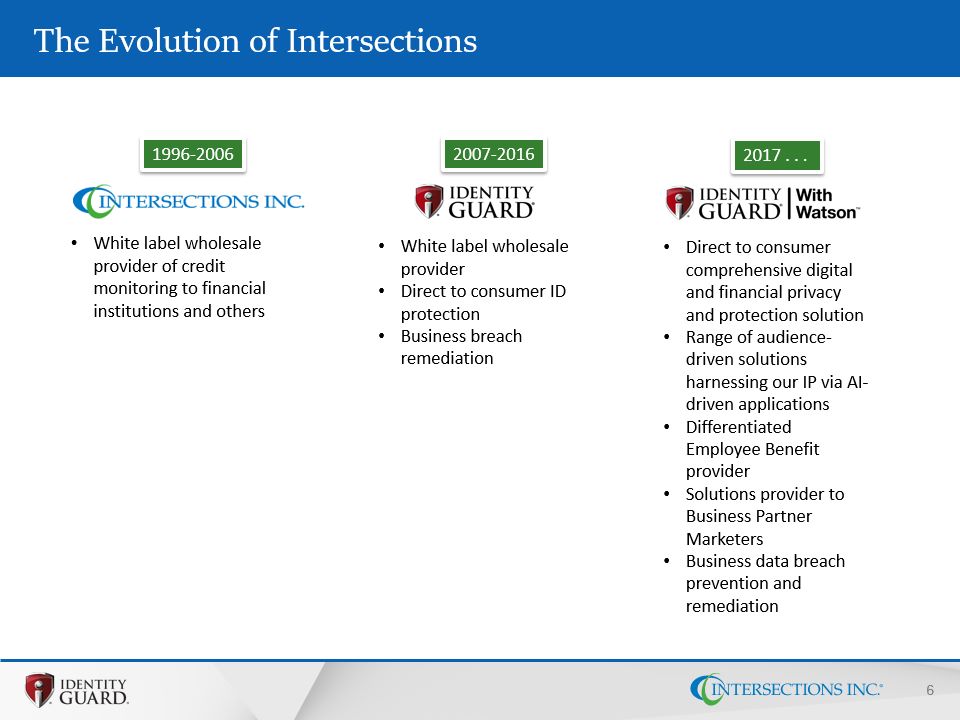

The Evolution of Intersections 6 White label wholesale provider of credit monitoring to financial institutions and others 1996-2006 2007-2016 White label wholesale providerDirect to consumer ID protectionBusiness breach remediation 2017 . . . Direct to consumer comprehensive digital and financial privacy and protection solutionRange of audience-driven solutions harnessing our IP via AI-driven applicationsDifferentiated Employee Benefit providerSolutions provider to Business Partner MarketersBusiness data breach prevention and remediation

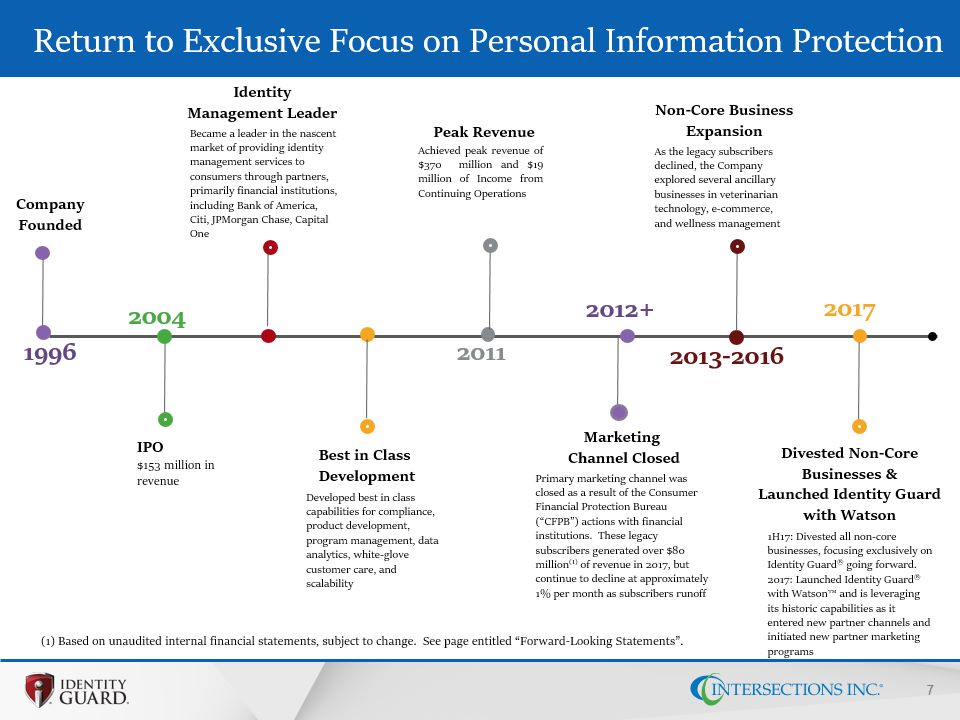

Return to Exclusive Focus on Personal Information Protection Company Founded Peak Revenue Achieved peak revenue of $370 million and $19 million of Income from Continuing Operations 2011 2012+ Marketing Channel Closed Primary marketing channel was closed as a result of the Consumer Financial Protection Bureau (“CFPB”) actions with financial institutions. These legacy subscribers generated over $80 million(1) of revenue in 2017, but continue to decline at approximately 1% per month as subscribers runoff 2013-2016 Non-Core Business Expansion As the legacy subscribers declined, the Company explored several ancillary businesses in veterinarian technology, e-commerce, and wellness management 2017 Divested Non-Core Businesses &Launched Identity Guard with Watson 1H17: Divested all non-core businesses, focusing exclusively on Identity Guard® going forward. 2017: Launched Identity Guard® with Watson™ and is leveraging its historic capabilities as it entered new partner channels and initiated new partner marketing programs Identity Management Leader 1996 IPO$153 million in revenue 2004 Became a leader in the nascent market of providing identity management services to consumers through partners, primarily financial institutions, including Bank of America, Citi, JPMorgan Chase, Capital One Developed best in class capabilities for compliance, product development, program management, data analytics, white-glove customer care, and scalability Best in Class Development 7 (1) Based on unaudited internal financial statements, subject to change. See page entitled “Forward-Looking Statements”.

The Market Opportunity A recent Javelin study(1) confirms Identity crimes continue to rise and continue to morph to different attack methods as businesses try new defensive options. The 2017 Equifax breach affected 145 million US consumers, exposed significant personal data that will remain static over a person’s lifetimeExposed social security numbers, driver’s license numbers, full names and dates of birth provide a broad base of data for criminals to mine and utilize.As criminals seek the easiest route to crime, small businesses are becoming a strong source for illicit harvesting of personal information.New technologies allow Identity Guard® to expand its products beyond financial fraud by monitoring and analyzing unstructured and natural language data. (1) 2017 Identity Fraud Study by Javelin Strategy & Research 8

The Market Opportunity Identity fraud affected a record number of victims in 2017. Fraud incidence greatly exceeded the previous year’s record level affecting 6.64% (16.7 million) of consumers in 2017(1)Intersections is leveraging its core competencies to deliver best-in-class service and user experience (1) 2017 Identity Fraud Study by Javelin Strategy & Research 9

Reinvented Capabilities, Business Model & Trajectory 10 FROM TO Building upon our foundational expertise in credit, financial services and data integration, we have built the capabilities and roadmap to lead and redefine what identity protection means in the 21st century Wholesaler of other’s financial data SaaS: IP creator of algorithms rooted in AI BUSINESS MODEL 7 primary data resources 71 data resources; 23 IBM Watson API’s; more to follow DEPTH OF DATA Physical delivery, web based Mobile-focus, web accessible SOLUTIONS PLATFORM Credit monitoring and alerts Financial, digital, social, personal protection and alerts CONSUMER PROMISE BREADTH OF DISTRIBUTION White label provider, some DTC DTC, Employee Benefit, Partners PRODUCT Primarily ID protection Comprehensive as well as multiple audience-driven solutions

The Secrets in the Sauce of Identity Guard 11 Identity Guard has 21 years of experience in providing monitoring and protection services to consumers.We have been the leading innovator in the marketplace -- first to release almost every enhancement over the past 20 years.Our systems demonstrated the fastest reporting capabilities vs. major competitors, confirmed via a study performed by an independent third-party.By incorporating IBM-Watson’s Artificial Intelligence capabilities into our solutions, we have greatly expanded the data and sources we can scan, monitor, understand and utilize.With AI capabilities, we have been able to create new products to diversify our services beyond identity theft.Our software development efforts have enhanced our ability to create services to help prevent identity fraud, not just detect it. IDG has a large portfolio of advanced tools and technologies Which can be selectively bundled to create unique solutions To meet market-specific needs For a diverse range of consumer and business market segments

SOCIAL & DIGITALSELF & FAMILY FINANCIAL WELL BEING Credit monitoringCredit reportsExpanded Public recordsBank/financial recordsGovernment ID monitoringExpanded Dark Web monitoringTax fraud EXCEEDINGcategory expectations Social reputation managerCyberbullying monitoringSafe browsing technologyAnti Phishing appJob & ReputationPersonalized real time scam alertsAlchemy news event detectionInternet of things PERSONAL SAFETY Geo-location aware alertsPolice reportsSex-Offender alerts SUPPORT & RESOLUTION $1M Theft InsuranceFastest alerts vs major competitorsVictim recovery specialistsU.S.-based call center PHYSICAL awareness/protection INDUSTRY LEADINGalerts/remediation DIGITALtools/alerts/information Identity Guard® Tool Kit Dynamic Artificial Intelligence technology for broadest data monitoring capability.Watson’s AlchemyData News API enables Identity Guard® to digest more than 250,000 news articles from 75,000 sources every day to identify news that could impact a consumer’s digital safety.Fastest mobile alert system for a broad range of events that impact the customer. Scans millions of news articles, blogs, and posts to warn of potential, emerging threats such as data breaches, software vulnerabilities, and dangerous online habits.Supported by trained U.S. based security experts.Proactively search the dark web, public records, credit files, thousands of news sources to detect identity risks. In the event of identity theft, a dedicated security expert is assigned to the case.Customers receive $1 million of insurance coverage for potential losses. 12

Strategic Objectives Utilize new data sources and new technologies to deliver better existing products and fantastic new products to meet financial and personal threats facing consumers and small businesses in the virtual world.Expand our channels to assure a diverse portfolio of marketing channels and buyer demographics and profiles.Expand our products and services beyond financial threat monitoring thereby diversifying our markets.Grow revenue through marketing channel expansion and new product and market creation.Hold G&A dollar costs steady, thereby reducing costs as a percentage of revenue, and grow earnings with increases in revenue. 13

Executing on Strategic Objectives Recent ProgressPartnered with IBM to create groundbreaking product capabilities allowing us to create new products for new markets - Identity Guard® with Watson™Company reduced its consolidated loss from continuing operations before income taxes in Q3 2017 and Q4 2017, and returned to adjusted EBITDA profitability in Q3 2017 and Q4 2017(1)Identity Guard® sequential quarterly revenue growth in last three quarters of 2017(1) Ongoing business revenue is expected to exceed runoff financial institutions revenue beginning in mid-2018Leading innovator of most enhancements to identity theft protection techniques over the past 20 years, having created or been the first to utilize one- and three-bureau daily monitoring, Identity theft insurance, public record monitoring, dark web monitoring, and now Artificial Intelligence based monitoring, including soon-to-be-released potential cyber-bullying alert capabilities.Successful entry into employee benefit channel during the fall 2017 selling season with new client programs acquired and launched in Q4 2017 and Q1 2018Launched Small Business Breach Readiness product with strong distribution partners and a recurring revenue service.Created and launching an AI based social media scanning service and a soon-to-be-released AI based Cyberbullying service to expand our markets beyond financial fraud prevention.Greatly expanded our business development efforts bringing in new partners, creating a strong foothold in the Employee Benefits space, and developing strong working relationships with the top employee benefit brokerage firms across the United States.Reinvigorated the Canadian business with a new marketing partner. 14 (1) Based on unaudited internal financial statements, subject to change. Please see Reconciliation of Non-GAAP Financial Information in Appendix.

Corporate Objectives-Revenue Drive Identity Guard® revenue growth through partner and employee benefit channelsFull effect of Identity Guard® with Watson™ is expected to support growth across Partner, Consumer and Employee Benefit channels in 2018Launch non-financial monitoring such as Social media and Cyberbullying servicesIdentity Guard® revenue to exceed run-off revenue on a run-rate basis by mid 2018Grow Identity Guard® and new products revenue 25-30% per year on average over next three yearsMaintain historic attrition rate of the run-off revenueThe Identity Guard® with Watson™, and partner and employee benefit channel growth is expected to provide the basis of accelerated revenue growth in 2019Target Objective: 27% to 30% Cumulative Total Revenue growth between 2017 ($160 million(1)) and 2020.The foregoing objectives are targets developed by management with respect to costs and revenue. They are qualified by and subject to the section of this presentation entitled "Forward Looking Statements". In addition, readers are cautioned that such target objectives do not represent historical performance, projected results or guidance and should not be relied upon or construed as such. 15 (1) Based on unaudited internal financial statements, subject to change. See page entitled “Forward-Looking Statements”.

Corporate Objectives-Costs Hold overall commission costs around 25% of Revenue.Maintain business models that minimize direct response marketing. Drive direct marketing costs from 7%(1) of revenue in 2017 to 1% of revenue in 2020.Hold overall Cost of Revenue in the 32-34% level, trending toward 32% as volume increases.Keep G&A flat in dollar terms at around $54-$55 million per annum. If target revenue is met, we expect G&A to decrease from 35%(1) of revenue in 2017 to 26%-27% of revenue in 2020.Target Objective: Increase Adjusted EBITDA from 2%(1) of Revenue in 2017 to 15%(2) of Revenue in 2020The foregoing objectives are targets developed by management with respect to costs and revenue. They are qualified by and subject to the section of this presentation entitled "Forward Looking Statements". In addition, readers are cautioned that such target objectives do not represent historical performance, projected results or guidance and should not be relied upon or construed as such. Based on unaudited internal financial statements, subject to change 16 Based on unaudited internal financial statements, subject to change. See page entitled “Forward-Looking Statements” and the “Reconciliation of Non-GAAP Financial Information” found in the Appendix.We are unable to present a quantitative reconciliation of this forward-looking non-GAAP financial measure to its most directly comparable forward-looking GAAP financial measure because management cannot reliably predict or estimate, without unreasonable effort, all of the necessary components of such GAAP measures. See pages entitled “Reconciliation of Non-GAAP Financial Measures” found in the Appendix for a discussion of items historically excluded from this non-GAAP measure. Such amounts may also be excluded in the future periods and could be significant.

Investment Summary Largest independent identity theft monitoring provider in the U.S.Generated approximately $160 million(1) of Revenue for the year ended December 31,2017, consolidated loss from continuing operations before income taxes of $(13.7) million(1) and Adjusted EBITDA profitability of approximately $3.2 million(1).Return to positive adjusted EBITDA in Q3 2017 and Q4 2017(1) Identity Guard® with Watson™ is a transformational identity theft protection productLong history of best in class capabilities for compliance, product development, program management, data analytics, white-glove customer care, recurring revenue growth and scalability INTX shares are trading significantly below peer group: Currently 0.3x TTM revenue, comparables acquired at ~3x revenue (LifeLock acquired by Symantec; CS Identity acquired by Experian) Currently 0.39x EV/revenue, average public comparables trading at 5.4x 17 (1) Based on unaudited internal financial statements, subject to change. See page entitled “Forward-Looking Statements” and the “Reconciliation of Non-GAAP Financial Information” found in the Appendix.

Appendix

Management Team Michael R. Stanfield, Executive Chairman and PresidentMichael R. Stanfield serves as Executive Chairman and President of the Company. He co-founded CreditComm, the predecessor to Intersections, in May 1996 and has been Chairman of the Board of Directors since that time and also served as our Chief Executive Officer from inception until January 2017. Mr. Stanfield joined Loeb Partners Corporation, an affiliate of Loeb Holding Corporation, in November 1993 and served as a Managing Director at the time of his resignation in August 1999. Mr. Stanfield has been involved in management information services and direct marketing through investments and management since 1982, and has served as a director of CCC Information Services Inc. and BWIA West Indies Airways. Prior to beginning his operational career, Mr. Stanfield was an investment banker with Loeb, Rhoades & Co. and Wertheim & Co. He holds a B.B.A. in Business Administration from Emory University and an M.B.A. from Columbia University.Melba M. Amissi, Chief Operating OfficerMs. Amissi, serves as Chief Operating Officer of the Company. Ms. Amissi joined the Company in 2001 and has served in a number of management positions over the years. Most recently, Ms. Amissi served as Senior Vice President, Chief Risk Officer since January 1, 2017, and prior to that became Senior Vice President, Chief of Staff since November 2014, after previously serving as Vice President of Legal and Business Affairs since 2007. In these roles, Ms. Amissi was responsible for effectively managing, directing, and implementing compliance and risk for marketing, technology, operations, customer care, information security, and human resources. Ms. Amissi received her business degree from Randolph Macon Woman’s College and she is a Certified Information Privacy Professional and IAPP Member since 2016. Ronald L. Barden, Chief Financial OfficerRon Barden serves as Intersections Chief Financial Officer. Prior to joining Intersections in September 2014, Mr. Barden served as Chief Financial Officer of three healthcare technology & services companies. He previously served on the Board of Directors of Heilig-Meyers Company as Managing Director of Reorganization and Senior Vice President and Controller. Prior to that, Mr. Barden spent ten years in public accounting at Deloitte & Touche and Ernst & Young. With more than 30 years of experience as a seasoned finance and operations executive, Mr. Barden’s extensive background includes board membership, investor relations, corporate finance and public company financial reporting. Mr. Barden holds a B.B.A. and M.B.A. the College of William and Mary and is a CPA. 19

Management Team Duane L. Berlin, Chief Legal Officer and General CounselDuane Berlin has served as Intersections’ Chief Legal Officer and General Counsel since October 2016. Mr. Berlin has practiced business law for more than three decades. His areas of expertise include securities law, mergers and acquisitions, commercial contracts, marketing and privacy law. Mr. Berlin is listed in the Martindale-Hubbell Bar Register of Preeminent Lawyers as an AV Preeminent attorney. Mr. Berlin has served as General Counsel for the Counsel of American Survey Research Organizations since 1998, a member of the International Association of Privacy Professionals since 2005, a Licensed U.S. Coast Guard Captain since 2007 and a member of the Board of Directors for The Roper Center for Public Opinion Research since 2011. Mr. Berlin received his bachelor's degree from Brandeis University and his Juris Doctorate, Cum Laude, from the University of Miami, where he served as an associate editor of the University of Miami Law Review and a member of the Society of the Wig and Robe. Mr. Berlin also completed studies at Harvard's John F. Kennedy School of Government. Mr. Berlin is a member of the bars of Virginia and Connecticut. Previously, Mr. Berlin served as managing principal of Lev & Berlin, P.C., and practiced law with Cummings & Lockwood.Barry Kessel, Chief Marketing OfficerBarry Kessel serves as Intersections Chief Marketing Officer. With 35 years’ experience in creative, strategy and executive leadership positions within both client and agency organizations, Mr. Kessel is a proven leader in the interconnected disciplines of brand, direct, digital, database and relationship marketing. Previously, Barry served as a senior executive within WPP, the world’s largest marketing communications firm, where he was CEO of Wunderman, DC, Wunderman’s chief client development officer -- responsible for the global P&G portfolio and the IBM relationship -- and president of Wunderman’s flagship New York office. Mr. Kessel has worked with a wide range of client organizations in both a global and local capacity, including IBM, AT&T, AARP, Kraft, UPS, Vanguard, Blackrock, Citibank, Dell, United Airlines, USPS, HP, Pfizer, P&G, Audi, Microsoft, Ritz-Carlton Hotels, and Samsung. He was previously responsible for global marketing communications at Time Inc. magazines. He is a frequent speaker and writer in marketing circles and the recipient of multiple Effie Awards from the American Marketing Association, as well as Echo Awards and the Henry Hoke Award from the Direct Marketing Association for effective use of new marketing channels. He is the coauthor of “Defining, Measuring and Managing Loyalty” and a guest lecturer at the University of Maryland Smith School of Business.Jerry Thompson, Chief Revenue OfficerJerry Thompson serves as Intersections Chief Revenue Officer since June 2015 when the start-up he co-founded, White Sky Inc. was acquired by the Company. Prior to White Sky Jerry was the President & CEO of the Vardi Group, a privately held consumer products company, which was acquired by an outside investment group. Prior to that he was Executive Vice President of Town & Country Corp where he ran all Field Operations and successfully grew revenue from $60 million to $435 million. Jerry started his career at Parker Brothers, where he rose to Senior Vice President of Sales for this manufacturer and marketer of board games, children’s toys and video games. 20

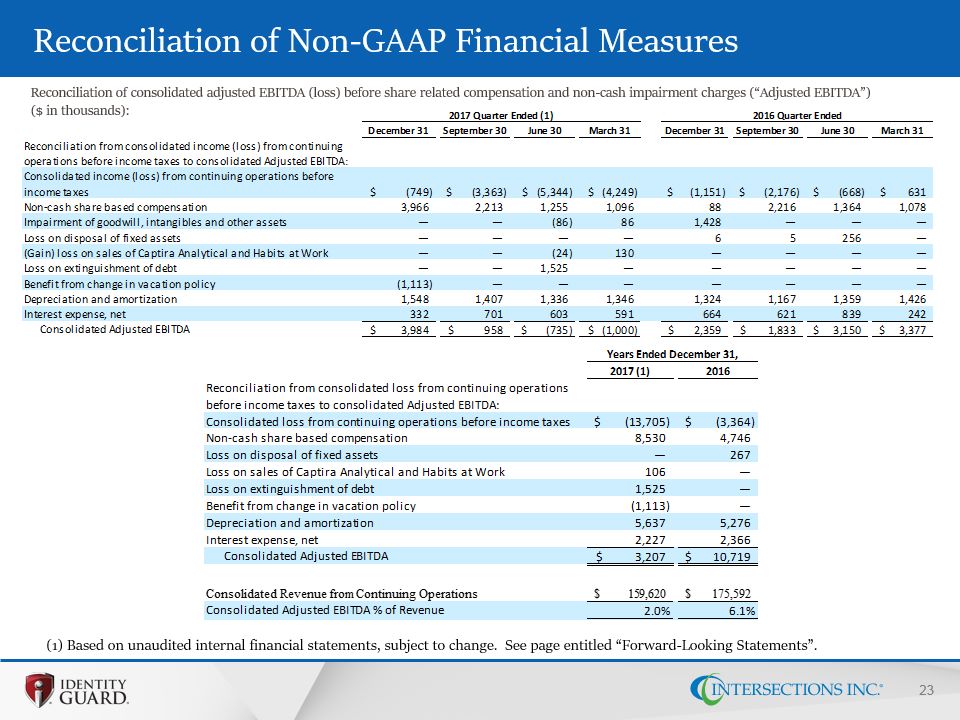

Reconciliation of Non-GAAP Financial Measures 21 The table below includes financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), as well as other financial measures referred to as non-GAAP financial measures. Consolidated adjusted EBITDA (loss) before share related compensation and non-cash impairment charges (“Adjusted EBITDA”) is presented in a manner consistent with the way management evaluates operating results and which management believes is useful to investors and others. Share related compensation includes non-cash share based compensation. An explanation regarding the Company’s use of non-GAAP financial measures and a reconciliation of non-GAAP financial measures used by the Company to GAAP measures is provided below. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, net income (loss) and the other information prepared in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. Management strongly encourages shareholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.Consolidated Adjusted EBITDA represents consolidated (loss) income from continuing operations before income taxes plus (minus): share related compensation; non-cash impairment of goodwill, intangibles and other assets; loss on disposal of fixed assets; (gain) loss on sale of Captira Analytical and Habits at Work; loss on extinguishment of debt; (benefit) from change in vacation policy; depreciation and amortization; and interest expense. We believe that the consolidated Adjusted EBITDA calculation provides useful information to investors because they are indicators of our operating performance, and we use these measures in communications with our board of directors, creditors, investors and others concerning our financial performance. Consolidated Adjusted EBITDA is commonly used as a basis for investors and analysts to evaluate and compare the periodic and future operating performance and value of companies within our industry. Our Board of Directors and management use consolidated Adjusted EBITDA to evaluate the operating performance of the Company. In addition, consolidated Adjusted EBITDA, as defined in our Credit Agreement with PEAK6 Investments, L.P., as amended, is used to measure covenant compliance.We provide this information to show the impact of share related compensation on our operating results, as it is excluded from our internal operating and budgeting plans and measurements of financial performance; however, we do consider the dilutive impact to our shareholders when awarding share related compensation and consider both the Black-Scholes value and GAAP value (to the extent applicable) in connection therewith, and value such awards accordingly.

Reconciliation of Non-GAAP Financial Measures, continued 22 We do not consider share related compensation charges when we evaluate the performance of our individual business groups or formulate our short and long-term operating plans. Due to its nature, individual managers generally are unable to project the impact of share related compensation and accordingly we do not hold them accountable for the impact of equity award grants. When we consider making share related compensation grants, we primarily take into account the need to attract and retain high quality employees, overall shareholder dilution and the Black-Scholes values of the equity grant to the recipient, rather than the potential accounting charges associated with such grants. For comparability purposes, we believe it is useful to provide a non-GAAP financial measure that excludes share related compensation in order to better understand the long-term performance of our core business and to compare our results to the results of our peer companies because of varying available valuation methodologies and the variety of award types that companies can use under GAAP. Furthermore, the value of share related compensation is determined using a complex formula that incorporates factors, such as market volatility, that are beyond our control. Accordingly, we believe that the presentation of consolidated Adjusted EBITDA when read in conjunction with our reported GAAP results can provide useful supplemental information to our management, to investors and to our lenders regarding financial and business trends relating to our financial condition and results of operations.Consolidated Adjusted EBITDA has limitations due to the fact it does not include all compensation related expenses. For example, if we only paid cash based compensation as opposed to a portion in share related compensation, the cash compensation expense included in our general and administrative expenses would be higher. We compensate for this limitation by providing information required by GAAP about outstanding share based awards in the footnotes to our financial statements in our SEC filings. We believe equity based compensation is an important element of our compensation program and all forms of share related awards are valued and included as appropriate in our operating results. The following tables reconcile consolidated (loss) income from continuing operations before income taxes to consolidated Adjusted EBITDA, as defined, for the previous eight quarters through December 31, 2017. The amounts shown for the year ending December 31, 2017 are based on internal, unaudited financial information and are subject to change. Please see page entitled “Forward-Looking Statements”.The information in the following tables is presented giving effect to the disposal of Voyce, with its historical financial results reflected as discontinued operations. We made adjustments to our historical financial results for certain costs and overhead allocations to either discontinued or continuing operations for the year ended December 31, 2016 and twelve months ended December 31, 2017; for additional information, please see "Note 2 — Basis of Presentation and Consolidation" in our most recent Form 10-Q. In managing our business, we analyze our performance quarterly on a consolidated income (loss) before income tax basis.In the second quarter of 2016, we ceased adding other expense (income) to consolidated loss before income taxes as part of our calculation of Adjusted EBITDA, to be consistent with the definition of Adjusted EBITDA in our Prior Credit Agreement. Prior periods have been recast to reflect the new presentation. For additional information, please see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” in our most recent Form 10-Q.

Reconciliation of Non-GAAP Financial Measures 23 Reconciliation of consolidated adjusted EBITDA (loss) before share related compensation and non-cash impairment charges (“Adjusted EBITDA”)($ in thousands): (1) Based on unaudited internal financial statements, subject to change. See page entitled “Forward-Looking Statements”.

Thank You! Corporate HeadquartersIntersections Inc.3901 Stonecroft BoulevardChantilly, VA 20151Toll-free: 800.695.7536www.intersections.com Investor RelationsRon Barden, CFO rbarden@intersections.com Tel: 703.488.6810