Attached files

| file | filename |

|---|---|

| EX-10.4 - EXHIBIT 10.4 - ANALOG DEVICES INC | q118exhibit104.htm |

| EX-32.2 - EXHIBIT 32.2 - ANALOG DEVICES INC | q118exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - ANALOG DEVICES INC | q118exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - ANALOG DEVICES INC | q118exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - ANALOG DEVICES INC | q118exhibit311.htm |

| EX-12.1 - EXHIBIT 12.1 - ANALOG DEVICES INC | q118exhibit121.htm |

| EX-10.7 - EXHIBIT 10.7 - ANALOG DEVICES INC | q118exhibit107.htm |

| EX-10.6 - EXHIBIT 10.6 - ANALOG DEVICES INC | q118exhibit106.htm |

| EX-10.5 - EXHIBIT 10.5 - ANALOG DEVICES INC | q118exhibit105.htm |

| EX-10.3 - EXHIBIT 10.3 - ANALOG DEVICES INC | q118exhibit103.htm |

| EX-10.2 - EXHIBIT 10.2 - ANALOG DEVICES INC | q118exhibit102.htm |

| EX-10.1 - EXHIBIT 10.1 - ANALOG DEVICES INC | q118exhibit101.htm |

| 10-Q - 10-Q - ANALOG DEVICES INC | adiq110-q232018.htm |

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

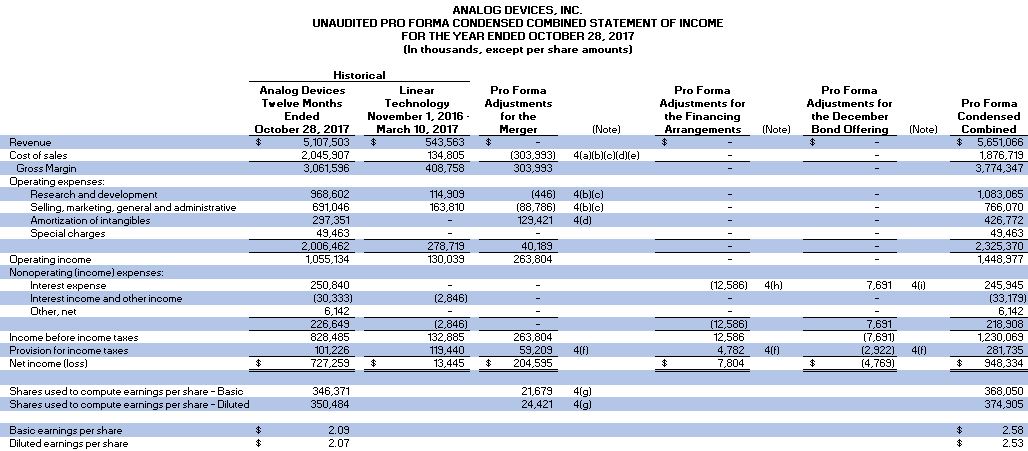

The following tables present unaudited pro forma condensed combined financial information about Analog Devices, Inc.’s (“Analog Devices”) consolidated statement of income, after giving effect to the merger (the “Merger”) with Linear Technology Corporation (“Linear”) which was consummated on March 10, 2017, certain related financing arrangements described in Note 1—Description of the Merger (the “Financing Arrangements”), and Analog Devices’ December 2016 bond offering (the “December Bond Offering”, and collectively with the Merger and the Financing Arrangements, the “Transactions”). The unaudited pro forma condensed combined financial information is derived from and should be read in conjunction with the historical consolidated financial statements and related notes of Analog Devices as of and for the year ended October 28, 2017 included in Analog Devices’ Annual Report on Form 10-K, filed with the SEC on November 22, 2017.

The unaudited pro forma condensed combined statement of income combines the historical audited consolidated statement of income of Analog Devices for the year ended October 28, 2017 with the historical unaudited consolidated income statement data of Linear for the period from October 30, 2016 through March 10, 2017 and gives effect to the Transactions as if they occurred on October 30, 2016. The historical financial information has been adjusted to give effect to pro forma adjustments that are (i) directly attributable to the Transactions, (ii) factually supportable, and (iii) expected to have a continuing impact on the combined entity’s consolidated results.

Unaudited condensed combined pro forma balance sheets as of October 28, 2017 and February 3, 2018 and an unaudited pro forma condensed combined statement of income for the three months ended February 3, 2018 have not been included, as the Transactions have been fully reflected in the periods ended and as of October 28, 2017 and February 3, 2018.

The unaudited pro forma condensed combined financial information presented is based on the assumptions and adjustments described in the accompanying notes, which should be read together with the unaudited pro forma condensed combined statement of income.

The Merger was accounted for as a business combination using the acquisition method of accounting under the provisions of Accounting Standards Codification (“ASC”) 805, Business Combinations (“ASC 805”), with Analog Devices representing the accounting acquirer. The following unaudited pro forma condensed combined financial information primarily gives effect to:

• | Application of the acquisition method of accounting in connection with the Merger; |

• | Adjustments to reflect the Financing Arrangements; |

• | Transaction costs incurred in connection with the Merger; and |

• | Adjustments to reflect the December Bond Offering. |

The unaudited pro forma condensed combined statement of income includes certain acquisition accounting and related financing adjustments, including items expected to have a continuing impact on the results of the combined company, such as increased amortization expense on acquired intangible assets. The unaudited pro forma condensed combined statement of income does not include the impact of any revenue, cost or other operating synergies that may result from the Merger or other adjustments that are not expected to have a continuing impact on the combined company.

The unaudited pro forma condensed combined financial information is presented for illustrative purposes only and does not purport to be indicative of the results or financial position that actually would have occurred or that may occur in the future had the Transactions been completed on the dates indicated, nor does it purport to be indicative of the future operating results or financial position of Analog Devices after the Transactions. Future results may vary significantly from the results reflected because of various factors, including those discussed in the section entitled “Risk Factors” of Analog Devices’ Annual Report on Form 10-K, filed with the SEC on November 22, 2017.

1

The unaudited pro forma condensed combined financial information has been compiled in a manner consistent with the accounting policies of Analog Devices.

2

See the accompanying notes to Unaudited Pro Forma Condensed Combined Financial Information.

3

Note 1 – Description of the Merger

On July 26, 2016, Linear, Analog Devices and Tahoe Acquisition Corp. (“Merger Sub”) entered into the merger agreement. The transaction closed on March 10, 2017, whereby Merger Sub merged with and into Linear, with Linear surviving the merger as a wholly owned subsidiary of Analog Devices.

Under the terms of the merger agreement, at the effective time (as defined therein), each outstanding share of common stock of Linear, including each restricted stock award and restricted stock unit award that became vested at the effective time, was automatically converted into the right to receive the following consideration: (b) $46.00 in cash, and (ii) 0.2321 shares of common stock of Analog Devices.

Each outstanding Linear restricted stock award and restricted stock unit award that was outstanding immediately prior to the effective time, and that did not become vested at the effective time, was converted into the right to receive the following:

• | For awards granted on or prior to July 22, 2016: Two adjusted awards with the same terms and conditions (including vesting) as were applicable to the corresponding Linear award immediately prior to the effective time as follows: (i) the right to receive an amount in cash equal to the product of (a) the number of shares of Linear common stock subject to such Linear restricted stock or restricted stock unit award immediately prior the effective time and (b) $46.00, and (ii) an Analog Devices restricted stock award or restricted stock unit award, as applicable, relating to the number of shares of Analog Devices common stock equal to the product (rounded to the nearest whole number of shares) of (a) the number of shares of Linear common stock subject to the Linear restricted stock award or restricted stock unit award immediately prior to the effective time and (b) the exchange ratio of 0.2321. |

• | For awards granted after July 22, 2016: An adjusted Analog Devices restricted stock award or restricted stock unit award, as applicable, relating to the number of shares of Analog Devices common stock equal to the product (rounded to the nearest whole number of shares) of (i) the number of shares of Linear common stock subject to such Linear restricted stock award or restricted stock unit award immediately prior to the effective time and (ii) 0.9947. |

Analog Devices funded the cash portion of the Merger with a combination of short and long-term debt and cash on hand. In connection with the financing of the Merger, Analog Devices entered into the following financing transactions:

The Financing Arrangements

• | On March 10, 2017, in connection with the Merger, Analog Devices entered into a 90-day bridge facility (the “Bridge Credit Agreement”) in the amount of $4.1 billion. This Bridge Credit Agreement replaced Analog Devices’ previous debt commitment letters, which included a 364-day bridge facility and a 90-day bridge facility. The 364-day bridge commitment was not drawn down and expired upon execution of the Bridge Credit Agreement. Within 90 days of closing, in the third quarter of fiscal 2017, all of the $4.1 billion of outstanding loans under the Bridge Credit Agreement were repaid using cash on hand; and |

• | On September 23, 2016, Analog Devices entered into a term loan agreement, which consisted of a 3-Year Term Loan Facility in the principal amount of $2.5 billion and a 5-Year Term Loan Facility in the principal amount of $2.5 billion, which were drawn down upon the closing of the Merger; and |

The December Bond Offering

• | On December 5, 2016, Analog Devices issued $400 million aggregate principal amount of 2.500% senior unsecured notes due December 5, 2021 (the “2021 Notes”), $550 million aggregate principal amount of 3.125% senior unsecured notes due December 5, 2023 (the “2023 Notes”), $900 million aggregate principal amount of 3.500% senior unsecured notes due December 5, 2026 (the “2026 Notes”) and $250 million |

4

aggregate principal amount of 4.500% senior unsecured notes due December 5, 2036 (the “2036 Notes” and together with the 2021 Notes, the 2023 Notes, and the 2026 Notes, the “Notes”) in a public offering.

Note 2 — Basis of Pro Forma Presentation

The accompanying unaudited pro forma condensed combined financial information was prepared in accordance with Article 11 of SEC Regulation S-X. The unaudited pro forma condensed combined statement of income was prepared using the historical audited consolidated statement of income of Analog Devices for the year ended October 28, 2017 and the historical unaudited consolidated income statement data of Linear for the period from October 30, 2016 through March 10, 2017.

Both Analog Devices’ historical audited financial statements and Linear’s historical unaudited financial data were prepared in accordance with U.S. GAAP and are presented in thousands of U.S. dollars. Linear’s historical unaudited financial data included within the unaudited pro forma condensed combined statement of income includes certain reclassifications that were made to conform Linear’s financial statement presentation to that of Analog Devices.

The acquisition of Linear by Analog Devices was accounted for as a business combination using the acquisition method of accounting under the provisions of ASC 805, with Analog Devices representing the accounting acquirer. The pro forma adjustments are based upon available information and certain assumptions, which management believes are reasonable under the circumstances and are described in the accompanying notes herein. Actual results may differ materially from the assumptions within the accompanying unaudited pro forma condensed combined statement of income and related footnotes herein. Under ASC 805, generally all assets acquired and liabilities assumed are recorded at their acquisition date fair value. The excess of merger consideration over the fair value of identified tangible and intangible assets acquired and liabilities assumed was recognized as goodwill.

The unaudited pro forma condensed combined statement of income includes certain acquisition accounting adjustments, including items expected to have a continuing impact on the results of the combined company, such as increased amortization expense on acquired intangible assets and compensation expense for ongoing share-based compensation arrangements replaced as a requirement of the Merger. The unaudited pro forma condensed combined statement of income does not include the impacts of any revenue, cost, or other operating synergies that may result from the Merger or any related restructuring costs that may be contemplated.

Note 3 –Merger Consideration

The merger consideration was approximately $15.8 billion based on the closing share price of Analog Devices’ common stock of $82.20 on March 10, 2017.

The following table summarizes the components of the merger consideration (in thousands of dollars):

Cash consideration* | $ | 11,092,047 |

Equity portion of purchase price** | 4,593,655 | |

Fair value of partially vested restricted stock and restricted stock units assumed*** | 70,954 | |

Total purchase consideration | $ | 15,756,656 |

* | The cash consideration was funded utilizing cash on hand, the net proceeds from the Financing Arrangements, and the December Bond Offering. This reflects the cash portion of the purchase price paid to Linear stockholders of approximately $11.1 billion, as well as $16.3 million for the cash-settled portion of consideration paid to holders of restricted stock and restricted stock awards which automatically vested at the effective time of the Merger pursuant to pre-existing change-of-control agreements. |

5

** | The fair value is based on the issuance of approximately 55.9 million shares of Analog Devices’ common stock with a per-share value of $82.20 (the closing share price of Analog Devices’ common stock on The Nasdaq Global Select Market on March 10, 2017). |

*** | In connection with the Merger, Analog Devices issued equity and cash awards to certain Linear employees in replacement of Linear equity awards that were canceled at closing. The amount represents the portion of the fair value of the replacement equity and cash awards associated with services rendered though March 10, 2017 and have been included as a component of the total estimated purchase consideration. |

Note 4 – Unaudited Pro Forma Condensed Combined Statement of Income Adjustments

The pro forma adjustments in the unaudited pro forma condensed combined statement of income are as follows:

Adjustments for the Merger:

(a) | Reflects additional depreciation expense for the estimated fair value adjustment of acquired property, plant and equipment on a straight-line basis as follows (in thousands), which will be depreciated over a weighted average useful life of approximately 9.6 years. |

Year Ended October 28, 2017 | ||

Cost of sales | $ | 10,752 |

Pro forma adjustment | $ | 10,752 |

(b) | Reflects an adjustment of $82.0 million for the year ended October 28, 2017, representing the elimination of the compensation, advisory, legal and accounting expenses incurred by both Analog Devices and Linear in connection with the Merger, which are not expected to have a continuing impact on results of operations (in thousands): |

Year Ended October 28, 2017 | ||

Cost of sales | $ | 2,200 |

Research and development | 5,500 | |

Selling, marketing, general and administrative | 74,261 | |

Pro forma adjustment | $ | 81,961 |

(c) | Reflects an adjustment to stock-based compensation expense of $8.9 million for the year ended October 28, 2017, representing the estimated difference between historical amounts recorded in the financial statements of both Analog Devices and Linear and the estimated fair value related to the unvested portion of the Linear equity awards converted into Analog Devices equity awards in connection with the Merger as follows (in thousands): |

6

Year Ended October 28, 2017 | ||

Cost of sales | $ | 567 |

Research and development | 5,054 | |

Selling, marketing, general and administrative | (14,525) | |

Pro forma adjustment | $ | (8,904) |

Included in the pro forma adjustment is the elimination of the one-time impact of accelerated vesting of certain Linear awards, which vested immediately prior to the Transactions and were recorded in Linear’s historical results. The replacement share-based awards vest over their respective service periods, which occur during the first five years in the post-combination period.

(d) | Reflects additional amortization expense for the estimated fair value adjustment of acquired intangible assets, recognized on a straight-line basis, of $176.5 million for the year ended October 28, 2017, as follows (in thousands): |

Year Ended October 28, 2017 | |||

Cost of sales | $ | 47,087 | |

Amortization of intangibles | 129,421 | ||

Pro forma adjustment | $ | 176,508 | |

Amortization expense was calculated using the fair value of acquired intangibles and their estimated useful lives as follows (in thousands):

Description | Weighted Average Useful Lives (in Years) | Estimated Fair Value | |

Customer relationship | 12 | $ | 4,034,300 |

Technology-based | 8 | 1,046,100 | |

Trade name | 7 | 72,200 | |

Total amortizable intangible assets | $ | 5,152,600 | |

(e) | Reflects an adjustment of $360.2 million to eliminate the one-time impact to cost of goods sold resulting from the fair value step-up of inventory reflected in the purchase price allocation at the date of the Merger, which was sold during the year ended October 28, 2017. The impact of the fair value adjustment to inventory sold in the post-acquisition period has been eliminated from the unaudited pro forma condensed combined statement of income as it not expected to have a continuing impact on results of operations. |

(f) | Reflects tax effects of the pro forma adjustments based on the estimated blended statutory tax rates in effect. |

(g) | Reflects the weighted average shares outstanding used to compute basic and diluted net income per share for the year ended October 28, 2017, which has been adjusted to give effect to the shares of Analog Device’s common stock issued upon closing of the Merger as if such issuances had occurred on October 30, 2016. Diluted net income per share also gives effect to the impact of potentially dilutive securities of |

7

Analog Devices that were issued to replace certain restricted stock awards and restricted stock unit awards of Linear at the close of the Merger.

Adjustments for the Financing Arrangements:

(h) | Reflects the following financing adjustments to interest expense resulting from the term loan facilities as if they had been issued on October 30, 2016: |

(i) | increase of $9.9 million to reflect the estimated interest expense associated with the term loan facilities as if they had been outstanding for the entire fiscal year ended October 28, 2017, net of historic interest expense previously recorded. Borrowings bear interest at a variable rate based on the one-month LIBOR plus an estimated margin of 1.125% per annum for the 3-Year Term Loan Facility, while the 5-Year Term Loan Facility bears interest at a variable rate based on the one-month LIBOR plus an estimated margin of 1.25% per annum; and |

(ii) | net decrease of $22.5 million to reflect the elimination of one-time costs incurred to establish the Financing Arrangements, partially offset by an increase in interest expense to reflect the amortization of debt issuance costs for the entire fiscal year ended October 28, 2017, net of historic amortization of debt issuance costs previously recorded. |

The financing adjustment to interest expense described in (i) and (ii) above includes a decrease to interest expense of $40.3 million to eliminate the non-recurring impact of interest expense and bridge fees related to the Bridge Credit Facility, which were incurred in the first three months of the year ended October 28, 2017. The Bridge Credit Facility was repaid within 90 days of the closing date and therefore will not have a continuing impact on the combined entity’s consolidated results. The permanent financing, as noted above, has been reflected in the unaudited pro forma condensed combined statement of income for the entire fiscal year ended October 28, 2017.

If LIBOR were to increase by 0.125%, interest expense on the term loan facilities would increase by $5.6 million for the year ended October 28, 2017.

Adjustments for the December Bond Offering:

(i) | Represents an adjustment to reflect the incremental interest expense for the December Bond Offering, as if it had occurred on October 30, 2016: |

(i) | increase of $7.3 million to reflect interest expense as if the December Bond Offering had been outstanding for the entire fiscal year ended October 28, 2017, net of historic interest expense previously recorded; and |

(ii) | increase of $0.4 million to reflect the amortization of estimated debt issuance costs associated with the December Bond Offering for the entire fiscal year ended October 28, 2017, net of historic amortization of debt issuance costs previously recorded. |

8