Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - GENUINE PARTS CO | gpc-12312017xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - GENUINE PARTS CO | gpc-12312017xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - GENUINE PARTS CO | gpc-12312017xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - GENUINE PARTS CO | gpc-12312017xex311.htm |

| EX-23 - EXHIBIT 23 - GENUINE PARTS CO | gpcconsent2017-exx23.htm |

| EX-21 - EXHIBIT 21 - GENUINE PARTS CO | subsidiariesofthecompany20.htm |

| EX-10.31 - EXHIBIT 10.31 - GENUINE PARTS CO | notepurchaseagreement-ex10.htm |

| EX-10.30 - EXHIBIT 10.30 - GENUINE PARTS CO | syndicatedfacilityagreemen.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2017

Or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number: 1-5690

GENUINE PARTS COMPANY

(Exact name of registrant as specified in its charter)

Georgia | 58-0254510 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2999 Wildwood Parkway, Atlanta, Georgia | 30339 | |

(Address of principal executive offices) | (Zip Code) | |

678-934-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $1 par value per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $12,933,100,000 based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding at February 13, 2018 | |

Common Stock, $1 par value per share | 146,734,604 shares | |

Specifically identified portions of the Company’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on April 23, 2018 are incorporated by reference into Part III of this Form 10-K.

PART I.

ITEM 1. BUSINESS.

Genuine Parts Company, a Georgia corporation incorporated on May 7, 1928, is a service organization engaged in the distribution of automotive replacement parts, industrial parts and electrical materials and business products, each described in more detail below. In 2017, business was conducted from more than 3,100 locations throughout the United States, Canada, Mexico, Australia, New Zealand and Europe. In November 2017, the Company expanded its operations into France, the U.K., Germany and Poland. As of December 31, 2017, the Company employed approximately 48,000 persons.

As used in this report, the “Company” refers to Genuine Parts Company and its subsidiaries, except as otherwise indicated by the context; and the terms “automotive parts” and “industrial parts” refer to replacement parts in each respective category.

Financial Information about Segments. For financial information regarding segments as well as our geographic areas of operation, refer to Note 12 of Notes to Consolidated Financial Statements beginning on page F-1.

Available Information. The Company’s internet website can be found at www.genpt.com. The Company makes available, free of charge through its internet website, access to the Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other reports, and any amendments to these documents, as soon as reasonably practicable after such material is filed with or furnished to the Securities and Exchange Commission (“SEC”). Additionally, our corporate governance guidelines, codes of conduct and ethics, and charters of the Audit Committee and the Compensation, Nominating and Governance Committee of our Board of Directors, as well as information regarding our procedure for shareholders and other interested parties to communicate with our Board of Directors, are available on our website.

In Part III of this Form 10-K, we incorporate certain information by reference to our proxy statement for our 2018 annual meeting of shareholders. We expect to file that proxy statement with the SEC on or about February 27, 2018, and we will make it available online at the same time at http://www.proxydocs.com/gpc. Please refer to the proxy statement for the information incorporated by reference into Part III of this Form 10-K when it is available.

AUTOMOTIVE PARTS GROUP

The Automotive Parts Group, the largest division of the Company, distributes automotive parts and accessory items in the U.S., Canada, Mexico, Australasia, France, the U.K., Germany and Poland. The Automotive Parts Group offers complete inventory, cataloging, marketing, training and other programs to the automotive aftermarket in each of these regions to distinguish itself from the competition. The Company is the sole member of the National Automotive Parts Association (“NAPA”), a voluntary trade association formed in 1925 to provide nationwide distribution of automotive parts.

During 2017, the Company’s Automotive Parts Group included NAPA automotive parts distribution centers and automotive parts stores (“auto parts stores” or “NAPA AUTO PARTS stores”) owned and operated in the United States by the Company; NAPA and Traction automotive parts distribution centers and auto parts stores in the United States and Canada owned and operated by the Company and NAPA Canada/UAP Inc. (“NAPA Canada/UAP”), a wholly-owned subsidiary of the Company; auto parts stores and distribution centers in the United States operated by corporations in which the Company owned either a noncontrolling or controlling interest; auto parts stores in Canada operated by corporations in which NAPA Canada/UAP owns a 50% interest; Repco and other automotive parts distribution centers, branches and auto parts stores in Australia and New Zealand owned and operated by GPC Asia Pacific, a wholly-owned subsidiary of the Company; import automotive parts distribution centers in the United States owned by the Company and operated by its Altrom America division; import automotive parts distribution centers in Canada owned and operated by Altrom Canada Corporation (“Altrom Canada”), a wholly-owned subsidiary of the Company; distribution centers in the United States owned by Balkamp, Inc. (“Balkamp”), a wholly-owned subsidiary of the Company; distribution facilities in the United States owned by the Company and operated by its Rayloc division; automotive parts distribution centers and automotive parts stores in Mexico, owned and operated by Grupo Auto Todo, S.A. de C.V. (“Auto Todo”), a wholly-owned subsidiary of the Company; and an automotive parts distribution center and automotive parts stores in Mexico, owned and operated by Autopartes NAPA Mexico ("NAPA Mexico"), a wholly-owned subsidiary of the Company.

The Company's automotive parts network was expanded in 2017 via the acquisition of various store groups and automotive operations in the U.S., Australasia and Canada. In the United States, the Company acquired Standard Motor Parts in Baltimore, Maryland, which operates five locations, as well as Olympic Brake Supply in Seattle, Washington, which operates six locations, in January and February of 2017, respectively. Additionally, the Company added 14 new locations in the Tucson, Arizona market with the acquisition of Merle's Automotive Supply in May 2017, and 17 new locations with the addition of Monroe Motor Products in Rochester, New York, in November 2017. The Company also added four new locations

to its heavy vehicle parts operations with the June 2017 acquisition of Stone Truck Parts, headquartered in Raleigh, North Carolina.

The GPC Asia Pacific automotive business expanded its distribution network in Australia with the addition of three single-location businesses, including Welch Auto Parts in July 2017, Logan City Autobarn in August of 2017, subsequently re-branded as a NAPA Auto Super Store, and Sulco Tools and Equipment in September of 2017. Finally, the NAPA Canada/UAP business enhanced its auto parts and heavy vehicle distribution network with the addition of three new businesses. In April of 2017, NAPA Canada/UAP acquired Service de Freins Montreal Ltee ("Freno"), with four locations in Canada, and Belcher Parts and Attachments, with one location in Canada. In December of 2017, NAPA Canada/UAP also acquired Universal Supply Group, a 21 store operation in eastern Ontario serving the automotive, paint and body and heavy vehicle sectors. Collectively, the new store groups and automotive operations across the U.S., Australasia and Canada are expected to generate annual revenues of approximately $217 million.

Further, effective November 2, 2017, the Company acquired Alliance Automotive Group ("AAG") for approximately $2.0 billion, including the repayment of AAG's outstanding debt. The purchase was funded primarily through new debt agreements. AAG is the second largest parts distributor in Europe, with a focus on light vehicle and commercial vehicle replacement parts. Headquartered in London, England, AAG has annual revenues of approximately $1.7 billion and over 2,000 company-owned stores and affiliated outlets across France, the U.K., Germany and Poland.

The Company has a 15% interest in Mitchell Repair Information Corporation (“MRIC”), a subsidiary of Snap-on Incorporated. MRIC is a leading automotive diagnostic and repair information company that links North American subscribers to its services and information databases. MRIC’s core product, “Mitchell ON-DEMAND,” is a premier electronic repair information source in the automotive aftermarket.

The Company’s NAPA automotive parts distribution centers distribute replacement parts (other than body parts) for substantially all motor vehicle makes and models in service in the United States, including imported vehicles, trucks, SUVs, buses, motorcycles, recreational vehicles and farm vehicles. In addition, the Company distributes replacement parts for small engines, farm equipment and heavy duty equipment. The Company’s inventories also include accessory items for such vehicles and equipment, and supply items used by a wide variety of customers in the automotive aftermarket, such as repair shops, service stations, fleet operators, automobile and truck dealers, leasing companies, bus and truck lines, mass merchandisers, farms, industrial concerns and individuals who perform their own maintenance and parts installation. Although the Company’s domestic automotive operations purchase from approximately 100 different suppliers, approximately 48% of 2017 automotive parts inventories were purchased from 10 major suppliers. Since 1931, the Company has had return privileges with most of its suppliers, which have protected the Company from inventory obsolescence.

Distribution System. In 2017, the Company operated 57 domestic NAPA automotive parts distribution centers located in 41 states and approximately 1,100 domestic company-owned NAPA AUTO PARTS stores located in 45 states. The Company also operated domestically three TW Distribution heavy duty parts distribution centers which serve 20 company-owned and seven independently owned Traction Heavy Duty parts stores located in eight states. The Traction operations are discussed further below in Related Operations. At December 31, 2017, the Company had either a noncontrolling, controlling or other interest in 12 corporations, which operated approximately 200 auto parts stores in 14 states.

The Company’s domestic distribution centers serve approximately 4,800 independently owned NAPA AUTO PARTS stores located throughout the United States. NAPA AUTO PARTS stores, in turn, sell to a wide variety of customers in the automotive aftermarket. Collectively, sales to these independent automotive parts stores account for approximately 59% of the Company’s total U.S. Automotive sales and 22% of the Company’s total sales, with no automotive parts store or group of automotive parts stores with individual or common ownership accounting for more than 0.79% of the total U.S. auto sales and 0.29% of the total sales of the Company.

NAPA Canada/UAP, founded in 1926, is a leader in the distribution and marketing of replacement parts and accessories for automobiles and trucks and is also a significant supplier to the mining and forestry industries in Canada. NAPA Canada/UAP operates a network of nine NAPA automotive parts distribution centers, three heavy duty parts distribution centers and one fabrication/remanufacturing facility supplying 589 NAPA stores and 109 Traction wholesalers. The NAPA stores and Traction wholesalers in Canada include 176 company owned stores, 11 joint ventures and 21 progressive owners in which NAPA Canada/UAP owns a 50% interest and 490 independently owned stores. NAPA and Traction operations supply bannered installers and independent installers in all provinces of Canada, as well as networks of service stations and repair shops operating under the banners of national accounts. NAPA Canada/UAP is a licensee of the NAPA® name in Canada.

In Canada, Altrom Canada operates two import automotive parts distribution centers and 26 branches. In the United States, Altrom America operates two import automotive parts distribution centers and eight branches.

In Australia and New Zealand, GPC Asia Pacific, originally established in 1922, is a leading distributor of automotive replacement parts and accessories. GPC Asia Pacific operates 12 distribution centers, 482 auto parts stores, primarily under the Repco banner, and 78 branches associated with the Ashdown Ingram, Motospecs, McLeod and RDA Brakes operations. As

4

discussed earlier, GPC Asia Pacific expanded its footprint with the 2017 acquisitions of Welch Auto Parts, Logan City autoBarn and Sulco Tools and Equipment.

In Mexico, Auto Todo owns and operates 11 distribution centers, one auto parts store and one tire center. NAPA Mexico owns and operates one distribution center and serves 13 company-owned and 28 independently owned auto parts stores. Auto Todo and NAPA Mexico are licensees of the NAPA® name in Mexico.

Alliance Automotive Group, founded in 1989, is a leading European distributor of vehicle parts, tools, and workshop equipment with operations in four countries in Europe. In France, AAG operates 15 distribution centers and 1,014 stores, of which 220 are company-owned, under the banners GROUPAUTO France, Precisium Group, Partner's, and GEF Auto. In the U.K., AAG operates 25 distribution centers and 771 stores, of which 106 are company-owned, under the banners GROUPAUTO UK & Ireland and UAN. In Germany, AAG operates eight distribution centers and 37 company-owned stores under the banner Alliance Automotive Group Germany. In Poland, AAG operates 210 affiliated outlets under the banner GROUPAUTO Polska.

Products. Distribution centers in the U.S. have access to approximately 530,000 different parts and related supply items. Each item is cataloged and numbered for identification and accessibility. Significant inventories are carried to provide for fast and frequent deliveries to customers. Most orders are filled and shipped the same day they are received. The majority of sales are paid from statements with varied terms and conditions. The Company does not manufacture any of the products it distributes. The majority of products are distributed under the NAPA® name, a mark licensed to the Company by NAPA, which is important to the sales and marketing of these products. Traction sales also include products distributed under the HD Plus name, a proprietary line of automotive parts for the heavy duty truck market.

Related Operations. Balkamp, a wholly-owned subsidiary of the Company, distributes a wide variety of replacement parts and accessory items for passenger cars, heavy-duty vehicles, motorcycles and farm equipment. In addition, Balkamp distributes service items such as testing equipment, lubricating equipment, gauges, cleaning supplies, chemicals and supply items used by repair shops, fleets, farms and institutions. Balkamp packages many of the 42,000 products, which constitute the “Balkamp” line of products that are distributed through the NAPA system. These products are categorized into over 238 different product categories purchased from approximately 500 domestic suppliers and over 100 foreign manufacturers. Balkamp has two distribution centers located in Plainfield, Indiana, and West Jordan, Utah. In addition, Balkamp operates two redistribution centers that provide the NAPA system with over 1,300 SKUs of oils and chemicals. BALKAMP®, a federally registered trademark, is important to the sales and marketing promotions of the Balkamp organization.

The Company, through its Rayloc division, operates four facilities focused on providing cost effective, quality service in engineering, cataloging, global sourcing, and distribution. With over 10,000 part numbers, including brake pads, brake drums, chassis, and bearings, Rayloc delivers products through a nationwide distribution network of four transfer and shipping facilities. Products are distributed through the NAPA system under the NAPA® brand name. Rayloc® is a mark licensed to the Company by NAPA.

The Company’s Heavy Vehicle Parts Group operates as TW Distribution, with three heavy vehicle automotive parts distribution centers and 27 Traction Heavy Duty parts stores in the United States. Twenty of these stores are company-owned and seven are independently owned. This group, which expanded its U.S. footprint with the acquisition of Stone Truck Parts in 2017 (discussed earlier) distributes heavy vehicle parts through the NAPA system and direct to small and large fleet owners and operators.

Segment Data. In the year ended December 31, 2017, sales from the Automotive Parts Group were approximately 53% of the Company’s net sales, as compared to 53% in 2016 and 52% in 2015. For additional segment information, see Note 12 of Notes to Consolidated Financial Statements beginning on page F-1.

Service to NAPA AUTO PARTS Stores. The Company believes that the quality and the range of services provided to its automotive parts customers constitute a significant advantage for its automotive parts distribution system. Such services include fast and frequent delivery, parts cataloging (including the use of electronic NAPA AUTO PARTS catalogs) and stock adjustment through a continuing parts classification system which, as initiated by the Company from time to time, allows independent retailers (“jobbers”) to return certain merchandise on a scheduled basis. The Company offers its NAPA AUTO PARTS store customers various management aids, marketing aids and service on topics such as inventory control, cost analysis, accounting procedures, group insurance and retirement benefit plans, as well as marketing conferences and seminars, sales and advertising manuals and training programs. Point of sale/inventory management is available through TAMS® (Total Automotive Management Systems), a computer system designed and developed by the Company for the NAPA AUTO PARTS stores.

The Company has developed and refined an inventory classification system to determine optimum distribution center and auto parts store inventory levels for automotive parts stocking based on automotive registrations, usage rates, production statistics, technological advances and other similar factors. This system, which undergoes continuous analytical review, is an integral part of the Company’s inventory control procedures and comprises an important feature of the inventory management

5

services that the Company makes available to its NAPA AUTO PARTS store customers. Over the last 25 years, losses to the Company from obsolescence have been insignificant and the Company attributes this to the successful operation of its classification system, which involves product return privileges with most of its suppliers.

Competition. The automotive parts distribution business is highly competitive. The Company competes with automobile manufacturers (some of which sell replacement parts for vehicles built by other manufacturers as well as those that they build themselves), automobile dealers, warehouse clubs and large automotive parts retail chains. In addition, the Company competes with the distributing outlets of parts manufacturers, oil companies, mass merchandisers (including national retail chains), and with other parts distributors and retailers, including online retailers. The Automotive Parts Group competes primarily on product offering, service, brand recognition and price. Further information regarding competition in the industry is set forth in “Item 1A. Risk Factors — We Face Substantial Competition in the Industries in Which We Do Business.”

NAPA. The Company is the sole member of the National Automotive Parts Association, a voluntary association formed in 1925 to provide nationwide distribution of automotive parts. NAPA, which neither buys nor sells automotive parts, functions as a trade association whose sole member in 2017 owned and operated 57 distribution centers located throughout the United States. NAPA develops marketing concepts and programs that may be used by its members which, at December 31, 2017, includes only the Company. It is not involved in the chain of distribution.

Among the automotive products purchased by the Company from various manufacturers for distribution are certain lines designated, cataloged, advertised and promoted as “NAPA” lines. Generally, the Company is not required to purchase any specific quantity of parts so designated and it may, and does, purchase competitive lines from the same as well as other supply sources.

The Company uses the federally registered trademark NAPA® as part of the trade name of its distribution centers and parts stores. The Company funds NAPA’s national advertising program, which is designed to increase public recognition of the NAPA name and to promote NAPA product lines.

The Company is a party, together with the former members of NAPA, to a consent decree entered by the Federal District Court in Detroit, Michigan, on May 4, 1954. The consent decree enjoins certain practices under the federal antitrust laws, including the use of exclusive agreements with manufacturers of automotive parts, allocation or division of territories among the Company and former NAPA members, fixing of prices or terms of sale for such parts among such members, and agreements to adhere to any uniform policy in selecting parts customers or determining the number and location of, or arrangements with, auto parts customers.

INDUSTRIAL PARTS GROUP

The Industrial Parts Group is operated as Motion Industries, Inc. (“Motion”), a wholly-owned subsidiary of the Company headquartered in Birmingham, Alabama. Motion distributes industrial replacement parts and related supplies such as bearings, mechanical and electrical power transmission products, industrial automation, hose, hydraulic and pneumatic components, industrial and safety supplies and material handling products to MRO (maintenance, repair and operation) and OEM (original equipment manufacturer) customers throughout the United States, Canada and Mexico.

In Canada, industrial parts are distributed by Motion Industries (Canada), Inc. (“Motion Canada”). The Mexican market is served by Motion Mexico S de RL de CV (“Motion Mexico”).

In 2017, the Industrial Parts Group served more than 300,000 customers in all types of industries located throughout North America, including the food and beverage, forest products, primary metals, pulp and paper, mining, automotive, oil and gas, petrochemical and pharmaceutical industries; as well as strategically targeted specialty industries such as power generation, alternative energy, government, transportation, ports, and others. Motion services all manufacturing and processing industries with access to a database of 7.1 million parts. Additionally, Motion provides U.S. government agencies access to approximately 400,000 products and replacement parts through a Government Services Administration (GSA) schedule.

Effective April 3, 2017, the Company expanded its industrial operations beyond North America by making a 35% investment in Inenco Group ("Inenco") for approximately $72 million in cash. Inenco, headquartered in Sydney, Australia, is a leading distributor of industrial replacements parts and accessories in Australasia, with annual revenues of approximately $325 million and operating in 161 locations across Australia, New Zealand, and Asia. In accordance with the purchase agreement, the Company has an option to acquire the remaining 65% interest in Inenco at a later date, contingent upon Inenco meeting certain financial conditions. In 2017, the Company accounted for this investment under the equity method of accounting.

Effective August 1, 2017, Motion acquired Numatic Engineering ("Numatic"), a Los Angeles, California based distributor of automation products. Numatic complements Motion's growth strategy, which included the acquisition of Braas Company in 2016, of focusing on the area of industrial plant floor automation. Numatic is expected to generate approximately $18 million in annual revenues. Additionally, Motion acquired Apache Hose & Belting Company, Inc. ("Apache") on November 1, 2017. Apache, which operates seven locations across the United States, is based in Cedar Rapids, Iowa, and specializes in value-

6

added fabrication of belts, hoses and other industrial products. Apache is expected to generate approximately $100 million in annual revenues.

The Industrial Parts Group provides customers with supply chain efficiencies achieved through the Company’s On-Site Solutions offering. This service provides inventory management, asset repair and tracking, vendor managed inventory commonly referred to as VMI, as well as RFID asset management of the customer’s inventory. Motion’s Energy Services Team routinely performs in-plant surveys and assessments, helping customers reduce their energy consumption and finding opportunities for improved sustainability, ultimately helping customers operate more profitably. Motion also provides a wide range of services and repairs such as: gearbox and fluid power assembly repair, process pump assembly and repair, hydraulic drive shaft repair, electrical panel assembly and repair, hose and gasket manufacture and assembly, as well as many other value-added services. A highly developed supply chain with vendor partnerships and connectivity are enhanced by Motion’s leading e-business capabilities, such as MiSupplierConnect, which provides integration between the Company’s information technology network and suppliers’ systems, creating numerous benefits for both the supplier and customer. These services and supply chain efficiencies assist Motion in providing the cost savings that many of its customers require and expect.

Distribution System. In North America, the Industrial Parts Group operated 498 branches, 14 distribution centers and 43 service centers as of December 31, 2017. The distribution centers stock and distribute more than 275,000 different items purchased from more than 1,050 different suppliers. The service centers provide hydraulic, hose and mechanical repairs for customers. Approximately 45% of total industrial product purchases in 2017 were made from 10 major suppliers. Sales are generated from the Industrial Parts Group’s branches located in 49 states, Puerto Rico, nine provinces in Canada, and Mexico. Most branches have warehouse facilities that stock significant amounts of inventory representative of the products used by customers in the respective market area served.

Products. The Industrial Parts Group distributes a wide variety of parts and products to its customers, which are primarily industrial concerns. Products include such items as hoses, belts, bearings, pulleys, pumps, valves, chains, gears, sprockets, speed reducers, electric motors, and industrial supplies. In recent years, Motion expanded its offering to include systems and automation products in response to the increasing sophistication of motion control and process automation for full systems integration of plant equipment. Manufacturing trends and government policies have led to opportunities in the “green” and energy-efficient product markets, focusing on product offerings such as energy-efficient motors and drives, recyclable and environmentally friendly parts and supplies. The nature of this group’s business demands the maintenance of adequate inventories and the ability to promptly meet demanding delivery requirements. Virtually all of the products distributed are installed by the customer or used in plant and facility maintenance activities. Most orders are filled immediately from existing stock and deliveries are normally made within 24 hours of receipt of order. The majority of all sales are on open account. Motion has ongoing purchase agreements with existing customers that represent approximately 50% of the annual sales volume.

Supply Agreements. Non-exclusive distributor agreements are in effect with most of the Industrial Parts Group’s suppliers. The terms of these agreements vary; however, it has been the experience of the Industrial Parts Group that the custom of the trade is to treat such agreements as continuing until breached by one party or until terminated by mutual consent. Motion has return privileges with most of its suppliers, which helps protect the Company from inventory obsolescence.

Segment Data. In the year ended December 31, 2017, sales from the Company’s Industrial Parts Group approximated 30% of the Company’s net sales, as compared to 30% in 2016 and 2015. For additional segment information, see Note 12 of Notes to Consolidated Financial Statements beginning on page F-1.

Competition. The industrial parts distribution business is highly competitive. The Industrial Parts Group competes with other distributors specializing in the distribution of such items, general line distributors and others who provide similar services. To a lesser extent, the Industrial Parts Group competes with manufacturers that sell directly to the customer. The Industrial Parts Group competes primarily on the breadth of product offerings, service and price. Further information regarding competition in the industry is set forth in “Item 1A. Risk Factors — We Face Substantial Competition in the Industries in Which We Do Business.”

BUSINESS PRODUCTS GROUP

The Business Products Group (formerly referred to as our Office Products Group), operated through S.P. Richards Company (“S.P. Richards” or "SPR"), a wholly-owned subsidiary of the Company, is headquartered in Atlanta, Georgia. S.P. Richards is engaged in the wholesale distribution of a broad line of office and other business related products through a diverse customer base of resellers. These products are used in homes, businesses, schools, offices, and other institutions. Business products fall into the general categories of office furniture, technology products, general office, school supplies, cleaning, janitorial and breakroom supplies, safety and security items, healthcare products and disposable food service products.

The Business Products Group is represented in Canada through S.P. Richards Canada, a wholly-owned subsidiary of the Company headquartered near Toronto, Ontario. S.P. Richards Canada services office product resellers throughout Canada from locations in Vancouver, Toronto, Calgary, Edmonton and Winnipeg.

7

Distribution System. The Business Products Group distributes more than 98,000 items to over 9,700 resellers and distributors throughout the United States and Canada from a network of 55 distribution centers. This group’s network of strategically located distribution centers provides overnight delivery of the Company’s comprehensive product offering. Approximately 45% of the Company’s total office products purchases in 2017 were made from 10 major suppliers.

The Business Products Group sells to a wide variety of resellers. These resellers include independently owned office product dealers, national office product superstores and mass merchants, large contract stationers, mail order companies, Internet resellers, college bookstores, military base stores, office furniture dealers, value-add technology resellers, business machine dealers, janitorial and sanitation supply distributors, safety product resellers and food service distributors. Resellers are offered comprehensive marketing programs, which include print and electronic catalogs and flyers, digital content and email campaigns for reseller websites, and education and training resources. In addition, world-class market analytics programs are made available to qualified resellers.

Products. The Business Products Group distributes technology products and consumer electronics including storage media, printer supplies, iPad, iPhone and computer accessories, calculators, shredders, laminators, copiers, printers, fitness bracelets and digital cameras; office furniture including desks, credenzas, chairs, chair mats, office suites, panel systems, file, mobile and storage cabinets and computer workstations; general office supplies including desk accessories, business forms, accounting supplies, binders, filing supplies, report covers, writing instruments, envelopes, note pads, copy paper, mailroom and shipping supplies, drafting and audiovisual supplies; school and educational products including bulletin boards, teaching aids and art supplies; healthcare products including first aid supplies, gloves, exam room supplies and furnishings, cleaners and waste containers; janitorial and cleaning supplies; safety supplies; disposable food service products; and breakroom supplies including napkins, utensils, snacks and beverages. S.P. Richards has return privileges with most of its suppliers, which have protected the Company from inventory obsolescence.

While the Company’s inventory includes products from nearly 850 of the industry’s leading manufacturers worldwide, S.P. Richards also markets products under its nine proprietary brands. These brands include: Sparco™, an economical line of office supply basics; Compucessory®, a line of computer accessories; Lorell®, a line of office furniture; NatureSaver®, an offering of recycled products; Elite Image®, a line of new and remanufactured toner cartridges, premium papers and labels; Integra™, a line of writing instruments; Genuine Joe®, a line of cleaning and breakroom products; Business Source®, a line of basic office supplies available only to independent resellers; and Lighthouse, a brand of janitorial and cleaning products offered through the GCN business. The Company’s Impact and The Safety Zone businesses also offer an additional series of proprietary brands including ProGuard®, ProMax® and The Safety Zone that are product based and solution-specific oriented. Through the Company’s FurnitureAdvantage™ program, S.P. Richards provides resellers with an additional 16,000 furniture items made available to consumers in 7 to 10 business days.

Segment Data. In the year ended December 31, 2017, sales from the Company’s Business Products Group approximated 12% of the Company’s net sales, as compared to 13% in 2016 and 2015. For additional segment information, see Note 12 of Notes to Consolidated Financial Statements beginning on page F-1.

Competition. The business products distribution business is highly competitive. In the distribution of its product offering to resellers, S.P. Richards competes with many other wholesale distributors, as well as with certain manufacturers of office products. S.P. Richards competes primarily on product offerings, service, marketing programs, brand recognition and price. Further information regarding competition in the industry is set forth in “Item 1A. Risk Factors — We Face Substantial Competition in the Industries in Which We Do Business.”

ELECTRICAL/ELECTRONIC MATERIALS GROUP

The Electrical/Electronic Materials Group, operated as EIS, Inc. (“EIS”), a wholly-owned subsidiary of the Company, is headquartered in Atlanta, Georgia. EIS distributes materials to more than 20,000 electrical and electronic manufacturers, as well as to industrial assembly and specialty wire and cable markets in North America. With 38 branch locations and six fabrication facilities in the United States, Puerto Rico, the Dominican Republic, Mexico and Canada, EIS distributes over 100,000 items including wire, cable and connectivity solutions, insulating and conductive materials, assembly tools and test equipment. EIS' six fabrication facilities provide custom fabricated parts and specialty coated materials.

Effective April 5, 2017, EIS acquired Empire Wire and Supply ("Empire"), an innovative provider of custom cable assemblies and distributor of network, electrical, automation and safety products. Empire, based in Rochester Hills, Michigan, operates from three U.S. locations as well as one location in Canada, and is expected to generate approximately $65 million in annual revenues.

Effective January 1, 2018, EIS was combined with Motion Industries, the Industrial Parts Group, and will be identified as its Electrical Specialties Group. The combination of these two segments will provide strong economies of scale and greater operating efficiencies, which we intend to leverage. The opportunity to build synergies by sharing talent, physical resources, greater size and scale, and value-added expertise in each respective market channel is highly compelling, and the Company anticipates this combination will create value for both our customers and all our stakeholders.

8

Distribution System. The Electrical/Electronic Materials Group provides distribution services to OEMs, motor repair shops and a variety of industrial assembly markets, as well as specialty wire and cable users in market segments such as telecom and broadband, marine, industrial, smart building technology, factory automation and robotics. EIS actively utilizes its e-commerce Internet site to present its products to customers while allowing these on-line visitors to conveniently purchase from a large product assortment.

Electrical and electronic, industrial assembly, and wire and cable products are distributed from warehouse locations in major user markets throughout the United States, as well as in Mexico, Canada, Puerto Rico, and the Dominican Republic. EIS has return privileges with some of its suppliers, which have protected the Company from inventory obsolescence.

Products. The Electrical/Electronic Materials Group distributes a wide variety of products to customers from over 2,000 suppliers. These products include custom fabricated flexible materials that are used as components within a customer’s manufactured finished product in a variety of market segments. Among the products distributed and fabricated are such items as magnet wire, conductive materials, electrical wire and cable, cable assemblies, insulating and shielding materials, assembly tools, test equipment, adhesives and chemicals, pressure sensitive tapes, solder, anti-static products, thermal management products and coated films. To meet the prompt delivery demands of its customers, the Electrical/Electronic Materials Group maintains large inventories. The majority of sales are on open account. Approximately 50% of total Electrical/Electronic Materials Group purchases in 2017 were made from 10 major suppliers.

Integrated Supply. The Electrical/Electronic Materials Group’s integrated supply programs are a part of the marketing strategy, as a greater number of customers — especially national accounts — are given the opportunity to participate in this low-cost, high-service capability. EIS has developed AIMS (Advanced Inventory Management Solutions), a totally integrated, highly automated suite of solutions for inventory management. EIS’ integrated supply offering also includes AIMS Dispense, an electronic vending dispenser used to eliminate costly tool cribs, or in-house stores, at customer warehouse facilities.

Segment Data. In the year ended December 31, 2017, sales from the Company’s Electrical/Electronic Materials Group approximated 5% of the Company’s net sales, as compared to 4% in 2016 and 5% in 2015. For additional segment information, see Note 12 of Notes to Consolidated Financial Statements beginning on page F-1.

Competition. The electrical and electronics distribution business is highly competitive. The Electrical/Electronic Materials Group competes with other distributors specializing in the distribution of electrical and electronic products, general line distributors and, to a lesser extent, manufacturers that sell directly to customers. EIS competes primarily on factors of price, product offerings, service and engineered solutions. Further information regarding competition in the industry is set forth in “Item 1A. Risk Factors — We Face Substantial Competition in the Industries in Which We Do Business.”

ITEM 1A. RISK FACTORS.

FORWARD-LOOKING STATEMENTS

Some statements in this report, as well as in other materials we file with the SEC or otherwise release to the public and in materials that we make available on our website, constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Senior officers may also make verbal statements to analysts, investors, the media and others that are forward-looking. Forward-looking statements may relate, for example, to future operations, including the anticipated synergies and benefits of any acquisitions, as well as prospects, strategies, financial condition, economic performance (including growth and earnings), industry conditions and demand for our products and services. The Company cautions that its forward-looking statements involve risks and uncertainties, and while we believe that our expectations for the future are reasonable in view of currently available information, you are cautioned not to place undue reliance on our forward-looking statements. Actual results or events may differ materially from those indicated in our forward-looking statements as a result of various important factors. Such factors include, but are not limited to, those discussed below.

Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward-looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent Forms 10-Q, 8-K and other reports to the SEC.

Set forth below are the material risks and uncertainties that, if they were to occur, could materially and adversely affect our business or could cause our actual results to differ materially from the results contemplated by the forward-looking statements in this report and in the other public statements we make. Please be aware that these risks may change over time and other risks may prove to be important in the future. New risks may emerge at any time, and we cannot predict such risks or estimate the extent to which they may affect our business, financial condition, results of operations or the trading price of our securities.

We may not be able to successfully implement our business initiatives in each of our four business segments to grow our sales and earnings, which could adversely affect our business, financial condition, results of operations and cash flows.

9

We have implemented numerous initiatives in each of our four business segments to grow sales and earnings, including the introduction of new and expanded product lines, strategic acquisitions, geographic expansion (including through acquisitions), sales to new markets, enhanced customer marketing programs and a variety of gross margin and cost savings initiatives. If we are unable to implement these initiatives efficiently and effectively, or if these initiatives are unsuccessful, our business, financial condition, results of operations and cash flows could be adversely affected.

Successful implementation of these initiatives also depends on factors specific to the automotive parts industry and the other industries in which we operate and numerous other factors that may be beyond our control. In addition to the other risk factors contained in this “Item 1A. Risk Factors”, adverse changes in the following factors could undermine our business initiatives and have a material adverse effect on our business, financial condition, results of operations and cash flows:

• | the competitive environment in our end markets may force us to reduce prices below our desired pricing level or to increase promotional spending; |

• | our ability to anticipate changes in consumer preferences and to meet customers’ needs for our products in a timely manner; |

• | our ability to successfully enter new markets, including by successfully identifying and acquiring suitable acquisition targets in these new markets; |

• | our ability to effectively manage our costs; |

• | our ability to continue to grow through acquisitions and successfully integrate acquired businesses in our existing operations; |

• | our ability to identify and successfully implement appropriate technological, digital and e-commerce solutions; |

• | the occurrence of unusually severe weather events, which can disrupt our operations (forcing temporary closure of retail and distribution centers, prohibiting shipment of inventory and products) and negatively impact our results in the affected geographies; and |

• | the economy in general. |

Our business will be adversely affected if demand for our products slows.

Our business depends on customer demand for the products that we distribute. Demand for these products depends on many factors.

With respect to our automotive group, the primary factors are:

• | the number of miles vehicles are driven annually, as higher vehicle mileage increases the need for maintenance and repair; |

• | the number of vehicles in the automotive fleet, a function of new vehicle sales and vehicle scrappage rates, as a steady or growing total vehicle population supports the continued demand for maintenance and repair; |

• | the quality of the vehicles manufactured by the original vehicle manufacturers and the length of the warranty or maintenance offered on new vehicles; |

• | the number of vehicles in current service that are six years old and older, as these vehicles are typically no longer under the original vehicle manufacturers’ warranty and will need more maintenance and repair than newer vehicles; |

• | the addition of electric vehicles, hybrid vehicles, and autonomously driven vehicles and future legislation related thereto; |

• | gas prices, as increases in gas prices may deter consumers from using their vehicles; |

• | changes in travel patterns, which may cause consumers to rely more on other transportation; |

• | restrictions on access to diagnostic tools and repair information imposed by the original vehicle manufacturers or by governmental regulation, as consumers may be forced to have all diagnostic work, repairs and maintenance performed by the vehicle manufacturers’ dealer networks; and |

• | the economy generally, which in declining conditions may cause consumers to defer vehicle maintenance and repair and defer discretionary spending. |

With respect to our industrial parts group, the primary factors are:

• | the level of industrial production and manufacturing capacity utilization, as these indices reflect the need for industrial replacement parts; |

10

• | changes in manufacturing reflected in the level of the Institute for Supply Management’s Purchasing Managers Index, as an index reading of 50 or more implies an expanding manufacturing economy, while a reading below 50 implies a contracting manufacturing economy; |

• | the consolidation of certain of our manufacturing customers and the trend of manufacturing operations being moved overseas, which subsequently reduces demand for our products; |

• | changes in legislation or government regulations or policies which could impact international trade among our multi-national customer base and cause reduced demand for our products; and |

• | the economy in general, which in declining conditions may cause reduced demand for industrial output. |

With respect to our business products group, the primary factors are:

• | the increasing digitization of the workplace, as this negatively impacts the need for certain office products; |

• | the level of unemployment, especially as it relates to white collar and service jobs, as high unemployment reduces the need for office products; |

• | the level of office vacancy rates, as high vacancy rates reduces the need for office products; |

• | consolidation of customers and consolidation of the industry; and |

• | the economy in general, which in declining conditions may cause reduced demand for business products consumption. |

With respect to our electrical/electronic materials group, the primary factors are:

• | changes in manufacturing reflected in the level of the Institute for Supply Management’s Purchasing Managers Index, as an index reading of 50 or more implies an expanding manufacturing economy, while a reading below 50 implies a contracting manufacturing economy; and |

• | the economy in general, which in declining conditions may cause reduced demand for industrial output. |

Changes in legislation or government regulations or policies could have a significant impact on our results of operations.

Certain political developments, including the results of the presidential election in the U.S. and the decision of the United Kingdom to exit the European Union, have resulted in increased economic uncertainty for multi-national companies. These developments may result in economic and trade policy actions that could impact economic conditions in many countries and change the landscape of international trade. Our business is global, so changes to existing international trade agreements, blocking of foreign trade or imposition of tariffs on foreign goods could result in decreased revenues and/or increases in pricing, either of which could have an adverse impact on our business, results of operations, financial condition and cash flows in future periods. In addition, the Tax Cuts and Jobs Act (the "Act") was signed into law on December 22, 2017. The Act, which reduces the U.S. corporate tax rate to 21 percent from 35 percent for taxable years beginning after December 31, 2017, requires companies to pay a one-time transition tax on earnings of certain foreign subsidiaries that were previously tax deferred and creates new taxes on certain foreign sourced earnings. It resulted in the Company writing down our deferred tax assets in 2017 and recording a payable for the estimated transition tax on foreign sourced earnings. These amounts were provisional and could be adjusted in 2018 as calculations are finalized and the full effects of the Act are reflected on our business and financial results.

Uncertainty and/or deterioration in general macro-economic conditions, including unemployment, inflation or deflation, changes in tax policies, changes in energy costs, uncertain credit markets, or other economic conditions, could have a negative impact on our business, financial condition, results of operations and cash flows.

Our business and operating results have been and may in the future be adversely affected by uncertain global economic conditions, including domestic outputs, employment rates, inflation or deflation, changes in tax policies, instability in credit markets, declining consumer and business confidence, fluctuating commodity prices, interest rates, volatile exchange rates, and other challenges that could affect the global economy. Both our commercial and retail customers may experience deterioration of their financial resources, which could result in existing or potential customers delaying or canceling plans to purchase our products. Our vendors could experience similar conditions, which could impact their ability to fulfill their obligations to us. Future weakness in the global economy could adversely affect our business, results of operations, financial condition and cash flows in future periods.

We face substantial competition in the industries in which we do business.

The sale of automotive and industrial parts, business products and electrical materials is highly competitive and impacted by many factors, including name recognition, product availability, customer service, changing customer preferences, store location, and pricing pressures. Because we seek to offer competitive prices, if our competitors reduce their prices, we may be

11

forced to reduce our prices, which could result in a material decline in our revenues and earnings. Increased competition among distributors of automotive and industrial parts, office products and electronic materials, including increased availability among digital and e-commerce providers across the markets in which we do business, could cause a material adverse effect on our results of operations. The Company anticipates no decline in competition in any of its four business segments in the foreseeable future.

In particular, the market for replacement automotive parts is highly competitive and subjects us to a wide variety of competitors. We compete primarily with national and regional auto parts chains, independently owned regional and local automotive parts and accessories stores, automobile dealers that supply manufacturer replacement parts and accessories, mass merchandisers, internet providers and wholesale clubs that sell automotive products and regional and local full service automotive repair shops, both new and established.

Furthermore, both the automotive aftermarket and the office supply industries continue to experience consolidation. Consolidation among our competitors could further enhance their financial position, provide them with the ability to provide more competitive prices to customers for whom we compete, and allow them to achieve increased efficiencies in their consolidated operations that enable them to more effectively compete for customers. If we are unable to continue to develop successful competitive strategies or if our competitors develop more effective strategies, we could lose customers and our sales and profits may decline.

In addition, the loss of a major customer in the business products group could significantly impact its results of operations.

We depend on our relationships with our vendors, and a disruption of our vendor relationships or a disruption in our vendors’ operations could harm our business.

As a distributor of automotive parts, industrial parts, business products and electrical/electronic materials, our business depends on developing and maintaining close and productive relationships with our vendors. We depend on our vendors to sell us quality products at favorable prices. Many factors outside our control, including, without limitation, raw material shortages, inadequate manufacturing capacity, labor disputes, transportation disruptions, tax and legislative uncertainties or weather conditions, could adversely affect our vendors’ ability to deliver to us quality merchandise at favorable prices in a timely manner.

Furthermore, financial or operational difficulties with a particular vendor could cause that vendor to increase the cost of the products or decrease the quality of the products we purchase from it. Vendor consolidation could also limit the number of suppliers from which we may purchase products and could materially affect the prices we pay for these products. In addition, we would suffer an adverse impact if our vendors limit or cancel the return privileges that currently protect us from inventory obsolescence.

We recognize the growing demand for business-to-business and business-to-customer digital and e-commerce options and solutions, and we could lose business if we fail to provide the digital and e-commerce options and solutions our customers wish to use.

Our success in digital and e-commerce depends on our ability to accurately identify the products to make available through digital and e-commerce platforms across our business segments, and to establish and maintain such platforms to provide the highest level of data security to our customers on and through the platforms our customers wish to use (including mobile) with rapidly changing technology in a highly competitive environment.

If we experience a security breach, if our internal information systems fail to function properly or if we are unsuccessful in implementing, integrating or upgrading our information systems, our business operations could be materially affected.

We depend on information systems to process customer orders, manage inventory and accounts receivable collections, purchase products, manage accounts payable processes, ship products to customers on a timely basis, maintain cost effective operations, provide superior service to customers and accumulate financial results. Despite our implementation of security measures, our IT systems are vulnerable to damages from computer viruses, natural disasters, unauthorized physical or electronic access, power outages, computer system or network failures, cyber-attacks and other similar disruptions. Maintaining and operating these measures requires continuous investments, which the Company has made and will continue to make. A security breach could result in sensitive data being lost, manipulated or exposed to unauthorized persons or to the public.

A serious prolonged disruption of our information systems for any of the above reasons could materially impair fundamental business processes and increase expenses, decrease sales or otherwise reduce earnings. Furthermore, such a breach may harm our reputation and business prospects and subject us to legal claims if there is loss, disclosure or misappropriation of or access to our customers’ information. As threats related to cyber security breaches develop and grow, we may also find it necessary to make further investments to protect our data and infrastructure.

12

Because we are involved in litigation from time to time and are subject to numerous laws and governmental regulations, we could incur substantial judgments, fines, legal fees and other costs.

We are sometimes the subject of complaints or litigation from customers, employees or other third parties for various reasons. The damages sought against us in some of these litigation proceedings are substantial. Although we maintain liability insurance for some litigation claims, if one or more of the claims were to greatly exceed our insurance coverage limits or if our insurance policies do not cover a claim, this could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Additionally, we are subject to numerous federal, state and local laws and governmental regulations relating to taxes, environmental protection, product quality standards, building and zoning requirements, as well as employment law matters. If we fail to comply with existing or future laws or regulations, we may be subject to governmental or judicial fines or sanctions, while incurring substantial legal fees and costs. In addition, our capital expenses could increase due to remediation measures that may be required if we are found to be noncompliant with any existing or future laws or regulations.

We are dependent on key personnel and the loss of one or more of those key personnel could harm our business.

Our future success significantly depends on the continued services and performance of our key management personnel. We believe our management team’s depth and breadth of experience in our industry is integral to executing our business plan. We also will need to continue to attract, motivate and retain other key personnel. The loss of services of members of our senior management team or other key employees, the inability to attract additional qualified personnel as needed or failure to plan for the succession of senior management and key personnel could have a material adverse effect on our business.

Our increased debt levels could adversely affect our cash flow and prevent us from fulfilling our obligations.

We have an unsecured revolving credit facility and unsecured senior notes, which could have important consequences to our financial health. For example, our level of indebtedness could, among other things:

•make it more difficult to satisfy our financial obligations, including those relating to the senior unsecured notes and our credit facility;

•increase our vulnerability to adverse economic and industry conditions;

•limit our flexibility in planning for, or reacting to, changes and opportunities in our industry, which may place us at a competitive disadvantage;

•require us to dedicate a substantial portion of our cash flows to service the principal and interest on the debt, reducing the funds available for other business purposes, such as working capital, capital expenditures or other cash requirements;

•limit our ability to incur additional debt with acceptable terms; and

•expose us to fluctuations in interest rates.

In addition, the terms of our financing obligations include restrictions, such as affirmative, negative and financial covenants, conditions on borrowing and subsidiary guarantees. A failure to comply with these restrictions could result in a default under our financing obligations or could require us to obtain waivers from our lenders for failure to comply with these restrictions. The occurrence of a default that remains uncured or the inability to secure a necessary consent or waiver could have a material adverse effect on our business, financial condition, results of operations and cash flows.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2. PROPERTIES.

The Company’s corporate and Automotive Parts Group headquarters are located in two office buildings owned by the Company in Atlanta, Georgia.

The Company’s Automotive Parts Group currently operates 57 NAPA Distribution Centers in the United States distributed among eight geographic divisions. Approximately 90% of the distribution center properties are owned by the Company. At December 31, 2017, the Company operated approximately 1,100 NAPA AUTO PARTS stores located in 45 states, and the Company had either a noncontrolling, controlling or other interest in 200 additional auto parts stores in 14 states. Other than NAPA AUTO PARTS stores located within Company owned distribution centers, the majority of the automotive parts stores in which the Company has an ownership interest are operated in leased facilities. In addition, NAPA Canada/UAP operates 12 distribution centers, one fabrication/remanufacturing facility and approximately 188 automotive parts and Traction stores in Canada. In Mexico, Auto Todo operates 11 distribution centers, one automotive parts store, and one tire center, and NAPA Mexico operates one distribution center and 13 automotive parts stores. These operations in both Canada and Mexico

13

are conducted in leased facilities. GPC Asia Pacific operates throughout Australia and New Zealand with 12 distribution centers, 482 auto parts stores, primarily under the Repco banner, and 78 branches associated with the Ashdown Ingram, Motospecs, McLeod and RDA Brakes operations. These distribution center, store and branch operations are conducted in leased facilities. In 2017, the Company expanded its global distribution network to Europe through the Alliance Automotive Group acquisition described above. In France, the Company operates 15 distribution centers and 220 company-owned stores. In the U.K., the Company operates 25 distribution centers and 106 company-owned stores. In Germany, the Company operates eight distribution centers and 37 company-owned stores. Alliance Automotive Group serves affiliated outlets in Poland, but has no company-owned operations in that country. AAG's locations are operated in leased facilities, other than three distribution centers and the U.K. country office which are company-owned.

The Company’s Automotive Parts Group also operates four Balkamp distribution and redistribution centers, four Rayloc distribution facilities and four transfer and shipping facilities. Two of the Balkamp distribution centers and the four Rayloc distribution facilities are conducted in facilities owned by the Company. Altrom Canada operates two import automotive parts distribution centers and 26 branches, and Altrom America operates two import automotive parts distribution centers and eight branches. The Heavy Vehicle Parts Group operates three TW distribution centers, which serve 27 Traction stores of which 20 are company owned and located in the U.S. These operations are all conducted in leased facilities.

The Company’s Industrial Parts Group, operating through Motion and Motion Canada, operates 14 distribution centers, 43 service centers and 498 branches. Approximately 90% of these locations are operated in leased facilities and the remainder are Company owned.

The Company’s Business Products Group operates 49 facilities in the United States and six facilities in Canada distributed among the Group’s four geographic divisions. Approximately 75% of these facilities are operated in leased buildings and the remainder are Company owned.

The Company’s Electrical/Electronic Materials Group operates in 38 locations in the United States, one location in Puerto Rico, one location in the Dominican Republic, three locations in Mexico and one location in Canada. All of this Group’s 44 facilities are operated in leased buildings.

We believe that our facilities on the whole are in good condition, are adequately insured, are fully utilized and are suitable and adequate to conduct the business of our current operations.

For additional information regarding rental expense on leased properties, see Note 5 of Notes to Consolidated Financial Statements beginning on page F-1.

ITEM 3. LEGAL PROCEEDINGS.

The Company is subject to various legal and governmental proceedings, many involving routine litigation incidental to the businesses, including approximately 2,170 product liability lawsuits resulting from its national distribution of automotive parts and supplies. Many of these involve claims of personal injury allegedly resulting from the use of automotive parts distributed by the Company. While litigation of any type contains an element of uncertainty, the Company believes that its defense and ultimate resolution of pending and reasonably anticipated claims will continue to occur within the ordinary course of the Company’s business and that resolution of these claims will not have a material effect on the Company’s business, results of operations or financial condition.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

14

PART II.

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information Regarding Common Stock

The Company’s common stock is traded on the New York Stock Exchange under the ticker symbol “GPC”. The following table sets forth the high and low sales prices for the common stock per quarter as reported on the New York Stock Exchange and dividends per share of common stock paid during the last two fiscal years:

Sales Price of Common Shares | |||||||||||||||

2017 | 2016 | ||||||||||||||

High | Low | High | Low | ||||||||||||

Quarter | |||||||||||||||

First | $ | 100.90 | $ | 91.93 | $ | 99.59 | $ | 76.50 | |||||||

Second | 95.87 | 88.88 | 101.28 | 92.25 | |||||||||||

Third | 97.65 | 79.86 | 105.97 | 95.96 | |||||||||||

Fourth | 98.63 | 84.71 | 100.34 | 86.61 | |||||||||||

Dividends Declared per Share | |||||||

2017 | 2016 | ||||||

Quarter | |||||||

First | $ | 0.6750 | $ | 0.6575 | |||

Second | 0.6750 | 0.6575 | |||||

Third | 0.6750 | 0.6575 | |||||

Fourth | 0.6750 | 0.6575 | |||||

15

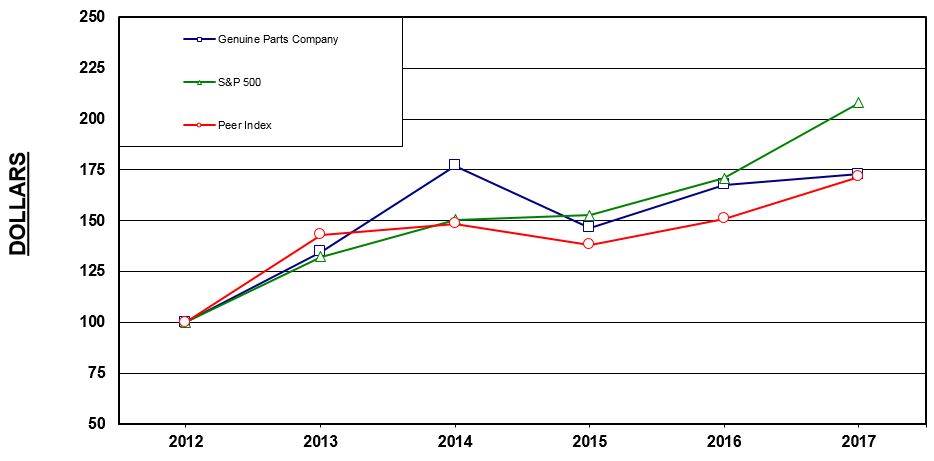

Stock Performance Graph

Set forth below is a line graph comparing the yearly dollar change in the cumulative total shareholder return on the Company’s Common Stock against the cumulative total shareholder return of the Standard and Poor’s 500 Stock Index and a peer group composite index structured by the Company as set forth below for the five year period that commenced December 31, 2012 and ended December 31, 2017. This graph assumes that $100 was invested on December 31, 2012 in Genuine Parts Company Common Stock, the S&P 500 Stock Index (the Company is a member of the S&P 500, and its cumulative total shareholder return went into calculating the S&P 500 results set forth in the graph) and the peer group composite index as set forth below and assumes reinvestment of all dividends.

Comparison of five year cumulative total shareholder return

Genuine Parts Company, S&P 500 Index and peer group composite index

Cumulative Total Shareholder Return $ at Fiscal Year End | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

Genuine Parts Company | 100.00 | 134.71 | 177.18 | 146.63 | 167.61 | 172.88 |

S&P 500 | 100.00 | 132.39 | 150.51 | 152.59 | 170.84 | 208.14 |

Peer Index | 100.00 | 143.10 | 148.58 | 138.13 | 151.01 | 171.56 |

In constructing the peer group composite index (“Peer Index”) for use in the stock performance graph above, the Company used the shareholder returns of various publicly held companies (weighted in accordance with each company’s stock market capitalization at December 31, 2012 and including reinvestment of dividends) that compete with the Company in three industry segments: automotive parts, industrial parts and business products (each group of companies included in the Peer Index as competing with the Company in a separate industry segment is hereinafter referred to as a “Peer Group”). Included in the automotive parts Peer Group are those companies making up the Dow Jones U.S. Auto Parts Index (the Company is a member of such industry group, and its individual shareholder return was included when calculating the Peer Index results set forth in the performance graph). Included in the industrial parts Peer Group are Applied Industrial Technologies, Inc. and Kaman Corporation and included in the business products Peer Group is Essendant. The Peer Index does not break out a separate electrical/electronic peer group due to the fact that there is currently no true market comparative to EIS. The electrical/electronic component of sales is redistributed to the Company’s other segments on a pro rata basis to calculate the final Peer Index.

16

In determining the Peer Index, each Peer Group was weighted to reflect the Company’s annual net sales in each industry segment. Each industry segment of the Company comprised the following percentages of the Company’s net sales for the fiscal years shown:

Industry Segment | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||||

Automotive Parts | 49 | % | 53 | % | 53 | % | 52 | % | 53 | % | 53 | % | |||||

Industrial Parts | 34 | % | 31 | % | 31 | % | 30 | % | 30 | % | 30 | % | |||||

Business Products | 13 | % | 12 | % | 11 | % | 13 | % | 13 | % | 12 | % | |||||

Electrical/Electronic Materials | 4 | % | 4 | % | 5 | % | 5 | % | 4 | % | 5 | % | |||||

Holders

As of December 31, 2017, there were 4,497 holders of record of the Company’s common stock. The number of holders of record does not include beneficial owners of the common stock whose shares are held in the names of various dealers, clearing agencies, banks, brokers and other fiduciaries.

Issuer Purchases of Equity Securities

The following table provides information about the purchases of shares of the Company’s common stock during the three month period ended December 31, 2017:

Period | Total Number of Shares Purchased(1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(2) | Maximum Number of Shares That May Yet be Purchased Under the Plans or Programs | ||||||||

October 1, 2017 through October 31, 2017 | — | — | — | 17,388,516 | ||||||||

November 1, 2017 through November 30, 2017 | 3,827 | $ | 90.31 | — | 17,388,516 | |||||||

December 1, 2017 through December 31, 2017 | 68,820 | $ | 94.13 | 17,313 | 17,371,203 | |||||||

Totals | 72,647 | $ | 93.93 | 17,313 | 17,371,203 | |||||||

(1) | Includes shares surrendered by employees to the Company to satisfy tax withholding obligations in connection with the vesting of shares of restricted stock, the exercise of stock options and/or tax withholding obligations. |

(2) | On November 17, 2008, and August 21, 2017, the Board of Directors announced that it had authorized the repurchase of 15 million shares and 15 million shares, respectively. The authorization for these repurchase plans continues until all such shares have been repurchased or the repurchase plan is terminated by action of the Board of Directors. Approximately 2.4 million shares authorized in the 2008 plan and 15.0 million shares authorized in 2017 remain available to be repurchased by the Company. There were no other plans announced as of December 31, 2017. |

17

ITEM 6. SELECTED FINANCIAL DATA.

The following table sets forth certain selected historical financial and operating data of the Company as of the dates and for the periods indicated. The following selected financial data are qualified by reference to, and should be read in conjunction with, the consolidated financial statements, related notes and other financial information beginning on page F-1, as well as in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this report.

Year Ended December 31, | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

(In thousands, except per share data) | |||||||||||||||||||

Net sales | $ | 16,308,801 | $ | 15,339,713 | $ | 15,280,044 | $ | 15,341,647 | $ | 14,077,843 | |||||||||

Cost of goods sold | 11,402,403 | 10,740,106 | 10,724,192 | 10,747,886 | 9,857,923 | ||||||||||||||

Operating and non-operating expenses, net | 3,897,130 | 3,525,267 | 3,432,171 | 3,476,022 | 3,175,616 | ||||||||||||||

Income before taxes | 1,009,268 | 1,074,340 | 1,123,681 | 1,117,739 | 1,044,304 | ||||||||||||||

Income taxes | 392,511 | 387,100 | 418,009 | 406,453 | 359,345 | ||||||||||||||

Net income | $ | 616,757 | $ | 687,240 | $ | 705,672 | $ | 711,286 | $ | 684,959 | |||||||||

Weighted average common shares outstanding during year — assuming dilution | 147,701 | 149,804 | 152,496 | 154,375 | 155,714 | ||||||||||||||

Per common share: | |||||||||||||||||||

Diluted net income | $ | 4.18 | $ | 4.59 | $ | 4.63 | $ | 4.61 | $ | 4.40 | |||||||||

Dividends declared | 2.70 | 2.63 | 2.46 | 2.30 | 2.15 | ||||||||||||||

December 31 closing stock price | 95.01 | 95.54 | 85.89 | 106.57 | 83.19 | ||||||||||||||

Total debt, less current maturities | 2,550,020 | 550,000 | 250,000 | 500,000 | 500,000 | ||||||||||||||

Total equity | 3,464,156 | 3,207,356 | 3,159,242 | 3,312,364 | 3,358,768 | ||||||||||||||

Total assets | $ | 12,412,381 | $ | 8,859,400 | $ | 8,144,771 | $ | 8,246,238 | $ | 7,680,297 | |||||||||