Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Veritex Holdings, Inc. | fy17earningspressrelease.htm |

| 8-K - 8-K - Veritex Holdings, Inc. | a8-kxearningsreleasefy17.htm |

V E R I T E X

Earnings Presentation

Fourth Quarter 2017

Revised as of February 26, 2018

2

Safe Harbor Statement

NO OFFER OR SOLICITATION

This communication does not constitute an offer to sell, a solicitation of an offer to sell, the solicitation or an offer to buy any securities or a solicitation of any vote or approval. There will be no sale of

securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirement of Section 10 of the Securities Act of 1933, as amended.

NON-GAAP FINANCIAL MEASURES

Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP financial measures used in managing its

business may provide meaningful information to investors about underlying trends in its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Veritex’s reported

results prepared in accordance with and management uses these non-GAAP measures to measure the Company’s performance and believes that these non-GAAP measures provide a greater understanding of

ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the impact of unusual items or

events that may obscure trends in the Company’s underlying performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP. The following

are the non-GAAP measures used in this presentation:

• core net interest income adjusts net interest income as determined in accordance with GAAP to exclude income recognized on acquired loans

• core noninterest expense adjusts noninterest expense as determined in accordance with GAAP to exclude merger and acquisition costs

• core income tax expense adjusts income tax expense as determined in accordance with GAAP to exclude the tax impact of the adjustments to core net interest income and core noninterest expense, the re-measurement of

our deferred tax asset as a result of the Tax Act and the tax impact of other M&A discrete items

• core net income adjusts net income as determined in accordance with GAAP to exclude the impact of income recognized on acquired loans, merger and acquisition costs and the tax impact of the adjustments to core net

interest income and core noninterest expense, exclude the re-measurement of our deferred tax asset as a result of the Tax Act and exclude the tax impact of other M&A discrete items

• Core diluted earnings per share (EPS) divides (i) core net income by (ii) weighted average diluted shares of common stock outstanding for the applicable period

• Core efficiency ratio is determined by dividing core noninterest expense by the sum of core net interest income and noninterest income

• Tangible common equity is defined as total stockholders’ equity less goodwill and other intangible assets

• Tangible assets is defined as total assets less goodwill and other intangible assets

• Tangible common equity to tangible assets is a ratio that is determined by dividing tangible common equity by tangible assets

• Tangible book value per common share is determined by dividing tangible common equity by common shares outstanding

Please see Reconciliation of Non-GAAP Financial Measures at the end of this presentation for a reconciliation to the nearest GAAP financial measure.

FORWARD LOOKING STATEMENTS

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding the

Company’s future financial performance, business and growth strategy, projected plans and objectives, and related transactions, integration of the acquired businesses, ability to recognize anticipated

operational efficiencies, and other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations

may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions, current expectations, estimates and projections about the Company and its

subsidiaries, any of which may change over time and some of which may be beyond the Company’s control. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,”

“anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and

not historical facts, although not all forward-looking statements include the foregoing. Further, certain factors that could affect our future results and cause actual results to differ materially from those

expressed in the forward-looking statements include, but are not limited to whether the Company can: successfully implement its growth strategy, including identifying acquisition targets and consummating

suitable acquisitions; continue to sustain internal growth rate; provide competitive products and services that appeal to its customers and target market; difficult market conditions and unfavorable economic

trends in the United States generally, and particularly in the market areas in which the Company operates and in which its loans are concentrated, including the effects of declines in housing markets; an

increase in unemployment levels and slowdowns in economic growth; the Company's level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other

costs; changes in market interest rates may increase funding costs and reduce earning asset yields thus reducing margin; the impact of changes in interest rates and the credit quality and strength of underlying

collateral and the effect of such changes on the market value of the Company's investment securities portfolio; the credit risk associated with the substantial amount of commercial real estate, construction

and land development, and commercial loans in our loan portfolio; the extensive federal and state regulation, supervision and examination governing almost every aspect of the Company's operations including

changes in regulations affecting financial institutions, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations being issued in accordance with this statute and

potential expenses associated with complying with such regulations; the Company's ability to comply with applicable capital and liquidity requirements, including our ability to generate liquidity internally or

raise capital on favorable terms, including continued access to the debt and equity capital markets; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of

governments, agencies, and similar organizations; and, the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes as well as effects from geopolitical instability and

manmade disasters including terrorist attacks; and achieve its performance goals. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Special

Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Veritex’s Annual Report on Form 10-K filed with the SEC on March 10, 2017 and any updates to those risk factors set forth in

Veritex’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions

prove to be incorrect, actual results may differ materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking

statement speaks only as of the date on which it is made, and Veritex does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information,

future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, Veritex cannot assess the

impact of each factor on Veritex’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All

forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in

connection with any subsequent written or oral forward-looking statements that Veritex or persons acting on Veritex’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for

illustrative purpose only, are not forecasts and may not reflect actual results.

3

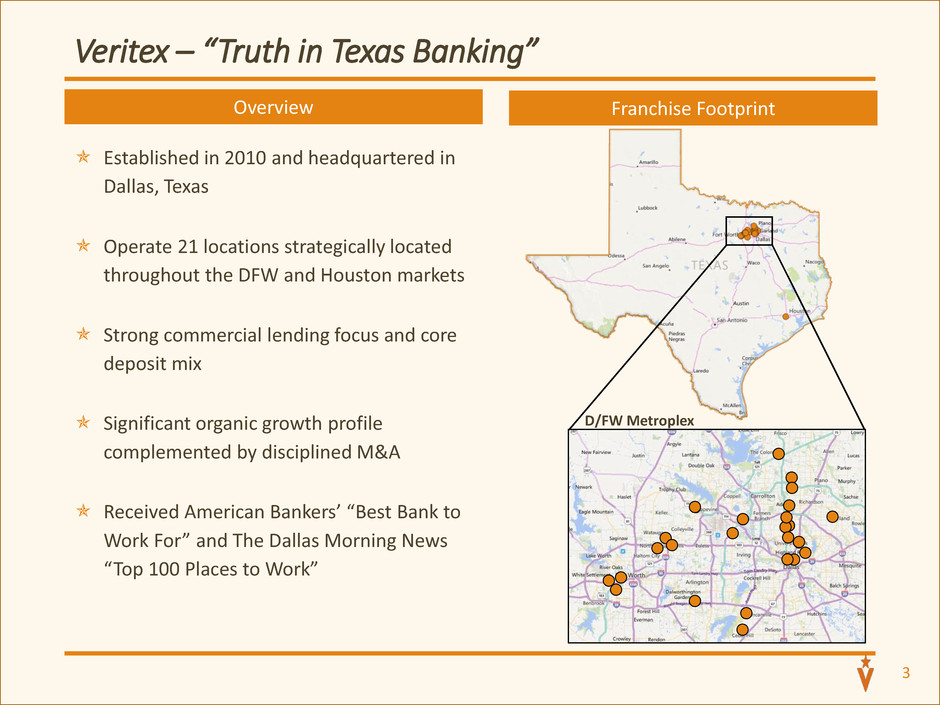

Established in 2010 and headquartered in

Dallas, Texas

Operate 21 locations strategically located

throughout the DFW and Houston markets

Strong commercial lending focus and core

deposit mix

Significant organic growth profile

complemented by disciplined M&A

Received American Bankers’ “Best Bank to

Work For” and The Dallas Morning News

“Top 100 Places to Work”

Overview

Veritex – “Truth in Texas Banking”

NASDAQ Bank

52.7%

VBTX

43.0%

S&P 500

14.5%

VBTX

54.4%

NASDAQ Bank

51.7%

S&P 500

14.3%

Franchise Footprint

D/FW Metroplex

Completed public offering of common stock, raising $56.7 million to

fund the acquisition of Liberty and support continued growth

Purchased our headquarters office building in Dallas

CAPITAL STEWARDSHIP

4

Continued to achieve meaningful cost savings from our recent

acquisitions and consolidated our back office functions into a North

Dallas operations center

Closed two redundant branches in our Dallas market and two non-

core branches in Austin

OPERATIONAL

EXCELLENCE

Closed Sovereign (over $1.1 billion in assets) and Liberty (over $460

million in assets) acquisitions, solidifying presence in the DFW

Metroplex and entering the Houston market

2017 organic loan growth was $203.0 million or 20.5% compared to

December 31, 2016 excluding acquired loans of $1.1 billion

STRATEGIC GROWTH

Received The Dallas Morning News “Top 100 Places to Work” for the

third consecutive year and American Bankers’ “Best Bank to Work

For” for the fourth consecutive year

CULTURE

2017 Accomplishments

Spartan

day 1 loans

$750.9

Liberty day

1 loans

$313,034,

920

Total

purchased

loans

$1063.9

5

Fourth Quarter Highlights

Spartan

day 1 loans

$750.9

Liberty day

1 loans

$313,034,

920

Total

purchased

loans

$1063.9

Net income of $3.3 million, or $0.14 diluted EPS and core net income of $5.4 million, or $0.23 core diluted

EPS

Increase in net interest margin to 4.24%, compared to 3.78% in 3Q17 and 3.44% in 4Q16. Core net interest

margin increased to 3.75%, compared to 3.66% in 3Q17 and 3.42% in 4Q16

Maintained efficiency ratio of 53.60%, or core efficiency ratio of 55.86%, with investments in our growth

initiatives and infrastructure

Core results exclude $3.0 million of PAA, but include $1.4 million of provision on acquired loan renewals

Q4 results include only one month of earnings related to Liberty acquisition

Achieved company all-time high in quarterly new loan commitments with annualized organic loan growth

of 13.8% over 3Q17

Closed acquisition of Liberty Bancshares, Inc. in December, adding over $460 million in total assets

Sold two non-core Austin branches (closed January 1, 2018), exiting the Austin market and centering our

focus on DFW and Houston

Continued success attracting talented bankers including an experienced commercial lender in Houston

Significant progress towards enhancing the funding and liquidity profile from our recent acquisitions while

maintaining strong asset sensitivity

Strong capital levels with 11.12% TCE / TA as of 12/31/17

After more than doubling assets in 2017, we enter 2018 poised to further

leverage our strong capital position through accretive growth across our franchise

Fourth Quarter Financial Highlights

(1) As used in this presentation, core net interest margin, core noninterest expense, core net income available to common, core diluted EPS, core efficiency ratio, tangible common equity to tangible assets and

tangible book value per common share are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slides 15 and 16 of this presentation.

6

For the quarter ended

Dec 31,

2017

Sept 30,

2017

Dec 31,

2016

Linked

Q Δ

YoY

Q Δ

Selected balance sheet

Total loans $ 2,259,831 $ 1,907,509 $ 991,897 18.5 % 127.8 %

Total deposits 2,342,912 1,985,658 1,119,630 18.0 109.3

Total assets 2,945,583 2,494,861 1,408,507 18.1 109.1

Selected profitability

Net interest income $

25,750 $

19,129 $

10,520 34.6 % 144.8 %

Net interest margin 4.24 % 3.78 % 3.44 % 46bps 80bps

Core net interest margin(1) 3.75 3.66 3.42 9bps 33bps

Noninterest expense $ 15,035 $ 12,522 $ 7,084 20.1 % 112.2 %

Core noninterest expense(1) 14,017 11,131 6,805 25.9 106.0

Net income available to common 3,257 5,140 3,190 -36.6 2.1

Core net income available to common(1) 5,447 5,630 3,332 -3.3 63.5

Reported diluted EPS 0.14 0.25 0.27 -44.0 -48.1

Core diluted EPS(1) 0.23 0.28 0.29 -17.9 -20.7

Reported efficiency ratio 53.60 % 59.33 % 57.39 % -9.7 -6.6

Core efficiency ratio(1) 55.86 54.38 55.40 -2.7 0.8

Tangible common equity to tangible assets(1) 11.12 12.76 15.23 -12.9 -27.0

Tangible book value per common share(1) $ 12.75 $ 13.23 $ 13.82 -3.6 -7.7

Successful Growth of a Diversified Loan Portfolio

Total Loans(1)

$298

$398

$495

$603

$821

$992

$2,260

2011 2012 2013 2014 2015 2016 2017

Ending Balances

$ in millions

Fourth quarter yield on loans(1) was 5.51% including

58 basis points of purchase discount accretion

relating to acquired loans

For the period ended Dec 31, 2017, loan balances increased $352.3 million over September 30, 2017

Legacy Veritex loan portfolio grew $39.7 million, 3.4% over prior quarter end or 13.8% annualized

Acquired Liberty loans at quarter end represented $312.6 million of the increase

7 (1) Excludes mortgage loans held for sale of $0.8 million and includes Austin branches held for sale loans of $26.3 million

Payoffs, Pay-downs and New Commitments

8

$885 $928 $927 $992 $1,021

$1,122

$1,908

$2,260

$143

$125 $131

$164 $158

$225 $163

$276

2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4

Quarter-end Loan Balances

versus New Commitments

QTR End Balances New Commitments

Dollars in millions

$56

$67

$107

$82

$106

$73

$104

$172

Total Payoffs / Pay-downs

Payoffs and Pay Downs

2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4

Credit Quality Metrics

Credit Quality – Nonperforming Loans and Net Charge-Offs

Reconciliation of provision for loan loss quarter ending December 31, 2017

Dollars in thousands

Provision

Expense Comments

Charge-off $ 240 Larger commercial and four consumer/small business loans

Specific reserve 629 Energy production missed targets reducing collateral value

General reserve- growth excluding 2017 acquisitions 300 Reserve on legacy loan growth

General reserve- acquired loan renewals 1,360 Reflects $110 million of purchased loan renewals

Total provision for loan losses $ 2,529

9

0.33%

0.21%

0.23%

0.02%

0.07% 0.08% 0.08%

0.01%

0.18%

0.03%

0.62%

0.01%

Nonperforming loans to total loans Net charge-offs to average loans

2012 2013 2014 2015 2016 2017

Core Funded Deposit Mix

Total Funding Sources

.

$365

$448

$574 $639

$868

$1,120

$2,343

2011 2012 2013 2014 2015 2016 2017

Ending Balances

$ in millions

Fourth quarter average rates:

• Interest-bearing deposits 0.93%

• Total cost of funds 0.68%

Total Deposits (1)

For the period ended December 31, 2017, deposit balances increased $357.3 million over Sept 30, 2017.

The Liberty acquisition contributed $396.6 million to the growth. Deposits, excluding deposits acquired in

the quarter, declined $39.3 million for the quarter, primarily due to reduction in high cost time deposits.

10 (1) Includes Austin branches held for sale deposits of $64.2 million

Core Net Interest Income and Margin Growth

$10,397 $10,459 $11,198 $12,241

$18,492

$22,795

3.65%

3.42%

3.19%

3.49%

3.66%

3.75%

3Q16 4Q16 1Q2017 2Q2017 3Q2017 4Q2017

Quarterly Net Interest Trend

Core Net interest income Core Net interest margin

(1)

72%

20%

8%

1Q2017

76%

14%

10%

2Q2017

82%

9%

9%

3Q2017

80%

12%

8%

4Q2016

Interest-bearing deposits

in other banks

Investment Securities Loans

Average

Loans 4.76% 4.76% 4.83% 4.85% 4.93%

Deposits 0.81 0.78 0.80 0.86 0.93

Quarterly Average Earning Asset Mix

(1)Excludes 2 bps, 2 bps, 5 bps, 15 bps, and 58 bps of income recognized on acquired loans for 4Q2016, 1Q2017, 2Q2017, 3Q2017, and 4Q2017, respectively. See Reconciliation of Non-GAAP Financial Measures for a

reconciliation of core net interest income and core net interest margin.

(1)

11

84%

6%

10%

4Q2017

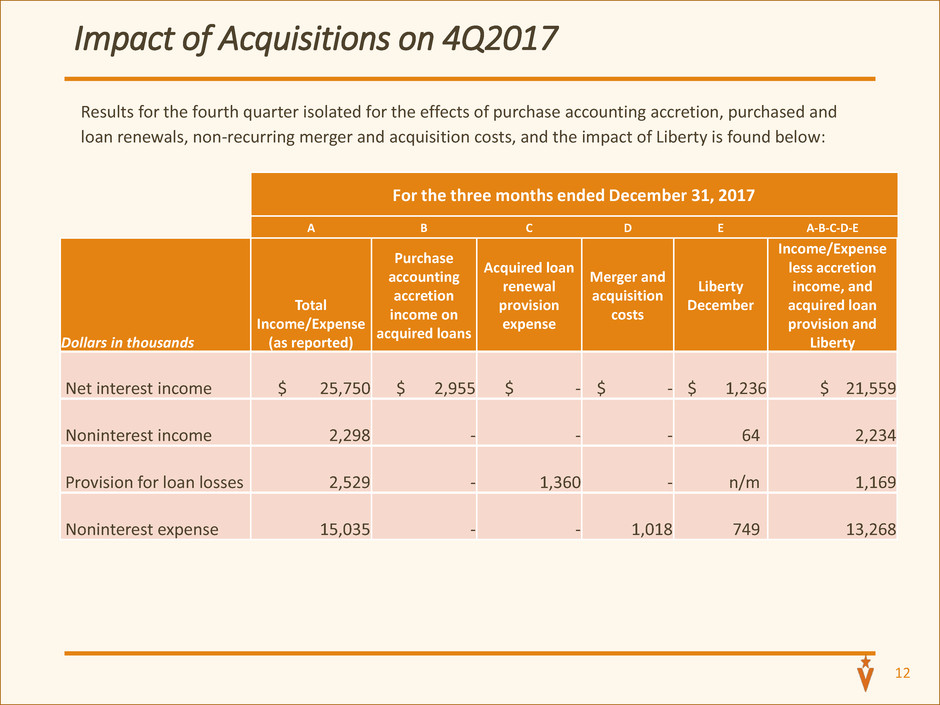

Impact of Acquisitions on 4Q2017

12

Results for the fourth quarter isolated for the effects of purchase accounting accretion, purchased and

loan renewals, non-recurring merger and acquisition costs, and the impact of Liberty is found below:

For the three months ended December 31, 2017

A B C D E A-B-C-D-E

Dollars in thousands

Total

Income/Expense

(as reported)

Purchase

accounting

accretion

income on

acquired loans

Acquired loan

renewal

provision

expense

Merger and

acquisition

costs

Liberty

December

Income/Expense

less accretion

income, and

acquired loan

provision and

Liberty

Net interest income $ 25,750 $ 2,955 $ - $ - $ 1,236 $ 21,559

Noninterest income 2,298 - - -

64

2,234

Provision for loan losses 2,529 - 1,360 - n/m

1,169

Noninterest expense 15,035 - -

1,018

749

13,268

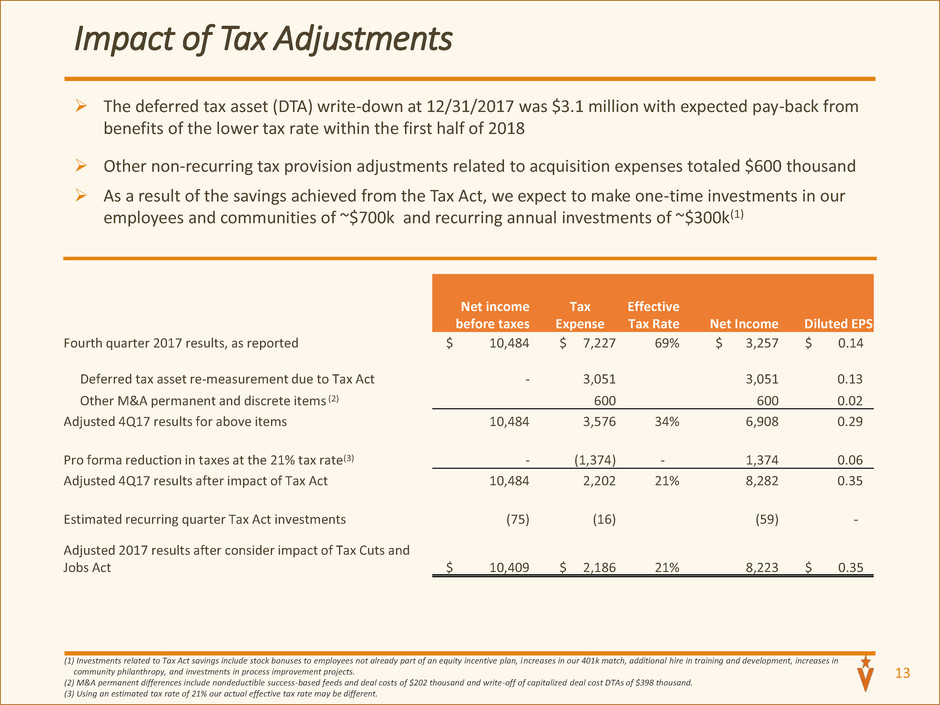

Impact of Tax Adjustments

(1) Investments related to Tax Act savings include stock bonuses to employees not already part of an equity incentive plan, increases in our 401k match, additional hire in training and development, increases in

community philanthropy, and investments in process improvement projects.

(2) M&A permanent differences include nondeductible success-based feeds and deal costs of $202 thousand and write-off of capitalized deal cost DTAs of $398 thousand.

(3) Using an estimated tax rate of 21% our actual effective tax rate may be different.

13

The deferred tax asset (DTA) write-down at 12/31/2017 was $3.1 million with expected pay-back from

benefits of the lower tax rate within the first half of 2018

Other non-recurring tax provision adjustments related to acquisition expenses totaled $600 thousand

As a result of the savings achieved from the Tax Act, we expect to make one-time investments in our

employees and communities of ~$700k and recurring annual investments of ~$300k(1)

Net income

before taxes

Tax

Expense

Effective

Tax Rate Net Income Diluted EPS

Fourth quarter 2017 results, as reported $ 10,484 $ 7,227 69% $ 3,257 $ 0.14

Deferred tax asset re-measurement due to Tax Act - 3,051 3,051 0.13

Other M&A permanent and discrete items (2) 600 600 0.02

Adjusted 4Q17 results for above items 10,484 3,576 34% 6,908 0.29

Pro forma reduction in taxes at the 21% tax rate(3) - (1,374) - 1,374 0.06

Adjusted 4Q17 results after impact of Tax Act 10,484 2,202 21% 8,282 0.35

Estimated recurring quarter Tax Act investments (75) (16) (59) -

Adjusted 2017 results after consider impact of Tax Cuts and

Jobs Act $ 10,409 $ 2,186 21% 8,223 $ 0.35

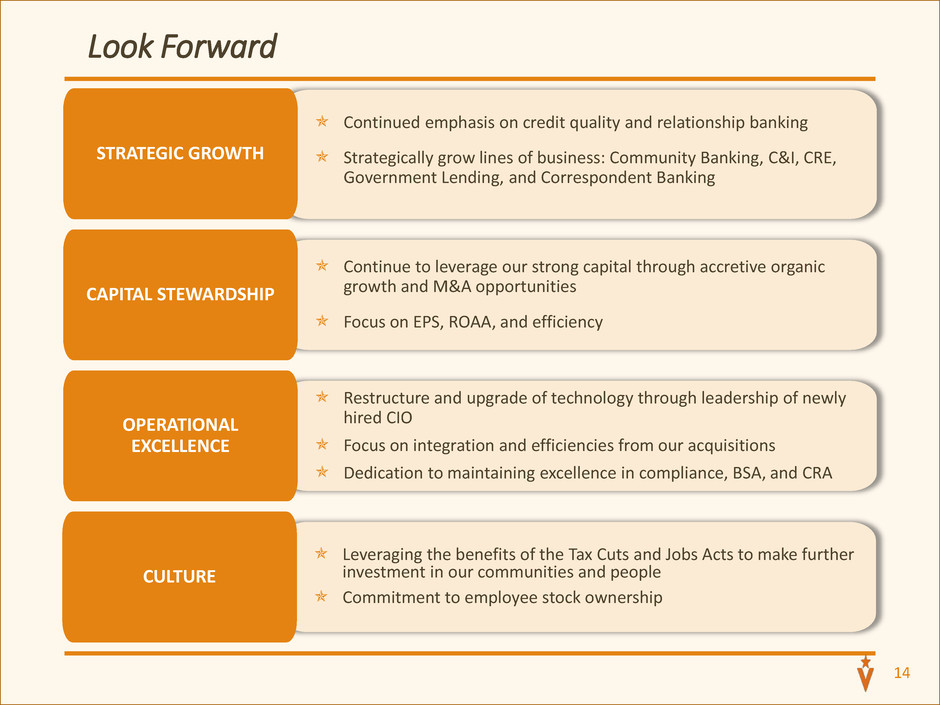

Continue to leverage our strong capital through accretive organic

growth and M&A opportunities

Focus on EPS, ROAA, and efficiency

CAPITAL STEWARDSHIP

14

Restructure and upgrade of technology through leadership of newly

hired CIO

Focus on integration and efficiencies from our acquisitions

Dedication to maintaining excellence in compliance, BSA, and CRA

OPERATIONAL

EXCELLENCE

Continued emphasis on credit quality and relationship banking

Strategically grow lines of business: Community Banking, C&I, CRE,

Government Lending, and Correspondent Banking

STRATEGIC GROWTH

Leveraging the benefits of the Tax Cuts and Jobs Acts to make further

investment in our communities and people

Commitment to employee stock ownership

CULTURE

Look Forward

15

Reconciliation of Non-GAAP Financial Measures

The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance. The

Company has included in this presentation information related to these non-GAAP financial measures for the applicable periods presented.

Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the table below.

(Dollars in Thousands, Except Per Share)

.

As of or For the Quarter Ended

December 31, 2017 September 30, 2017 June 30, 2017 March 31, 2017 December 31, 2016

Net interest income (as reported) $ 25,750 $ 19,129 $ 12,376 $ 11,253 $ 10,520

Adjustment: Income recognized on acquired loans (2,955) (637) (135) (55) (61)

Core net interest income 22,795 18,492 12,241 11,198 10,459

Provision for loan losses (as reported) 2,529 752 943 890 440

Noninterest income (as reported) 2,298 1,977 1,766 1,535 1,824

Noninterest expense (as reported) 15,035 12,522 7,782 7,450 7,084

Adjustment: Merger and acquisition costs (1,018) (1,391) (193) (89) (279)

Core noninterest expense 14,017 11,131 7,589 7,361 6,805

Core net income from operations 8,547 8,586 5,475 4,482 5,038

Income tax expense (as reported) 7,227 2,650 1,802 1,350 1,630

Adjustment: Tax impact of adjustments (678) 264 20 12 76

Deferred tax asset re-measurement due to Tax Act (3,051) - - - -

Other M&A discrete tax items (398) - - - -

Core income tax expense 3,100 2,914 1,822 1,362 1,706

Core net income 5,447 5,672 3,653 3,120 3,332

Core net income available to common stockholders $ 5,447 $ 5,630 $ 3,653 $ 3,120 $ 3,332

Weighted average diluted shares outstanding 23,524 20,392 15,637 15,632 11,653

Earnings Per Share

Diluted earnings per share (as reported) $ 0.14 $ 0.25 $ 0.23 $ 0.20 $ 0.27

Core diluted earnings per share 0.23 0.28 0.23 0.20 0.29

Efficiency Ratio

Efficiency Ratio (as reported) 53.60% 61.52% 58.96% 62.62% 59.51%

Core Efficiency Ratio 55.86% 56.45% 58.09% 62.15% 57.46%

Net Interest Margin

Net interest margin (as reported) 4.24% 3.78% 3.53% 3.21% 3.44%

Core net interest margin 3.75% 3.66% 3.49% 3.19% 3.42%

16

Reconciliation of Non-GAAP Financial Measures

The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance

including tangible book value per common share and tangible common equity to tangible assets. The Company has included in this presentation

information related to these non-GAAP financial measures for the applicable periods presented. Reconciliation of these non-GAAP financial measures

to the most directly comparable GAAP financial measures are presented in the table below.

(Dollars in Thousands, Except Per Share)

For the Three Months Ended

December 31, September 30, June 30, March 31, December 31.

2017 2017 2017 2017 2016

Tangible Common Equity

Total stockholders’ equity $ 488,929 $ 445,929 $ 247,602 $ 242,725 $ 239,088

Adjustments:

Goodwill (159,452) (135,832) (26,865) (26,865) (26,865)

Intangible assets (22,165) (10,531) (2,171) (2,161) (2,181)

Total tangible common equity $ 307,312 $ 299,566 $ 218,566 $ 213,699 $ 210,042

Tangible Assets

Total assets $ 2,945,583 $ 2,494,861 $ 1,508,589 $ 1,522,015 $ 1,408,507

Adjustments:

Goodwill (159,452) (135,832) (26,865) (26,865) (26,865)

Intangible assets (22,165) (10,531) (2,171) (2,161) (2,181)

Total tangible assets $ 2,763,966 $ 2,348,498 $ 1,479,553 $ 1,492,989 $ 1,379,461

Tangible Common Equity to Tangible Assets 11.12% 12.76% 14.77% 14.31% 15.23%

Common shares outstanding 24,110 22,644 15,233 15,229 15,195

Book value per common share $ 20.28 $ 19.69 $ 16.25 $ 15.94 $ 15.73

Tangible book value per common share 12.75 13.23 14.35 14.03 13.82

17