Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - TPG RE Finance Trust, Inc. | trtx-ex322_6.htm |

| EX-32.1 - EX-32.1 - TPG RE Finance Trust, Inc. | trtx-ex321_7.htm |

| EX-31.2 - EX-31.2 - TPG RE Finance Trust, Inc. | trtx-ex312_9.htm |

| EX-31.1 - EX-31.1 - TPG RE Finance Trust, Inc. | trtx-ex311_8.htm |

| EX-23.2 - EX-23.2 - TPG RE Finance Trust, Inc. | trtx-ex232_555.htm |

| EX-23.1 - EX-23.1 - TPG RE Finance Trust, Inc. | trtx-ex231_554.htm |

| EX-21.1 - EX-21.1 - TPG RE Finance Trust, Inc. | trtx-ex211_726.htm |

| EX-10.38 - EX-10.38 - TPG RE Finance Trust, Inc. | trtx-ex1038_556.htm |

| EX-10.37 - EX-10.37 - TPG RE Finance Trust, Inc. | trtx-ex1037_557.htm |

| EX-10.36 - EX-10.36 - TPG RE Finance Trust, Inc. | trtx-ex1036_558.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-38156

TPG RE Finance Trust, Inc.

(Exact name of Registrant as specified in its Charter)

|

Maryland |

36-4796967 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

888 Seventh Avenue, 35th Floor New York, New York |

10106 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 601-4700

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|||

|

Non-accelerated filer |

☒ |

|

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of June 30, 2017, the last business day of the Registrant’s most recently completed second fiscal quarter, the Registrant’s common stock was not listed on any exchange or over-the counter market. The Registrant’s common stock began trading on the New York Stock Exchange on July 20, 2017. On December 29, 2017, the last business day of the Registrant’s most recently completed fourth fiscal quarter, the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was $501.4 million based on the closing sales price of the Registrant’s common stock on such date as reported on the New York Stock Exchange. For purposes of this computation, all officers, directors and 10% beneficial owners of the Registrant’s common stock of which the Registrant is aware are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the Registrant.

As of February 23, 2018, there were 59,174,286 shares of the Registrant’s common stock, $0.001 par value per share, and 1,167,714 shares of the Registrant’s Class A common stock, $0.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this annual report on Form 10-K incorporates information by reference from the Registrant’s definitive proxy statement with respect to its 2018 annual meeting of stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of the Registrant’s fiscal year.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

2 |

|

|

Item 1A. |

12 |

|

|

Item 1B. |

58 |

|

|

Item 2. |

58 |

|

|

Item 3. |

58 |

|

|

Item 4. |

58 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

59 |

|

|

Item 6. |

63 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

64 |

|

Item 7A. |

89 |

|

|

Item 8. |

91 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

91 |

|

Item 9A. |

91 |

|

|

Item 9B. |

91 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

92 |

|

|

Item 11. |

92 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

92 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

92 |

|

Item 14. |

92 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

93 |

Certain Terms

Except where the context requires otherwise, the terms “Company,” “we,” “us,” and “our” refer to TPG RE Finance Trust, Inc., a Maryland corporation, and its subsidiaries; the term “Manager” refers to our external manager, TPG RE Finance Trust Management, L.P., a Delaware limited partnership; the term “TPG” refers to TPG Global, LLC, a Delaware limited liability company, and its affiliates; and the term “TPG Fund” refers to any partnership or other pooled investment vehicle, separate account, fund-of-one or any similar arrangement or investment program sponsored, advised or managed (including on a subadvisory basis) by TPG, whether currently in existence or subsequently established (in each case, including any related alternative investment vehicle, parallel or feeder investment vehicle, co-investment vehicle and any entity formed in connection therewith, including any entity formed for investments by TPG and its affiliates in any such vehicle, whether invested as a limited partner or through general partner investments).

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will occur or be achieved, and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this Form 10-K. Such risks and uncertainties include, but are not limited to, the following:

|

|

• |

the general political, economic and competitive conditions in the markets in which we invest; |

|

|

• |

the level and volatility of prevailing interest rates and credit spreads; |

|

|

• |

adverse changes in the real estate and real estate capital markets; |

|

|

• |

general volatility of the securities markets in which we participate; |

|

|

• |

changes in our business, investment strategies or target assets; |

|

|

• |

difficulty in obtaining financing or raising capital; |

|

|

• |

reductions in the yield on our investments and increases in the cost of our financing; |

|

|

• |

adverse legislative or regulatory developments, including with respect to tax laws; |

|

|

• |

acts of God such as hurricanes, earthquakes, wildfires and other natural disasters, acts of war and/or terrorism and other events that may cause unanticipated and uninsured performance declines and/or losses to us or the owners and operators of the real estate securing our investments; |

|

|

• |

deterioration in the performance of properties securing our investments that may cause deterioration in the performance of our investments and potentially principal losses to us; |

|

|

• |

defaults by borrowers in paying debt service on outstanding indebtedness; |

|

|

• |

the adequacy of collateral securing our investments and declines in the fair value of our investments; |

|

|

• |

adverse developments in the availability of desirable investment opportunities; |

|

|

• |

difficulty in successfully managing our growth, including integrating new assets into our existing systems; |

|

|

• |

the cost of operating our platform, including, but not limited to, the cost of operating a real estate investment platform and the cost of operating as a publicly traded company; |

|

|

• |

the availability of qualified personnel and our relationship with our Manager; |

|

|

• |

conflicts with TPG and its affiliates, including our Manager, the personnel of TPG providing services to us, including our officers, and certain funds managed by TPG; |

|

|

• |

our qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes and our exclusion from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and |

1

|

|

and Exchange Commission (the “SEC”), the Internal Revenue Service (the “IRS”), the New York Stock Exchange (the “NYSE) and other authorities that we are subject to, as well as their counterparts in any foreign jurisdictions where we might do business. |

There may be other factors that may cause our actual results to differ materially from the forward-looking statements contained in this Form 10-K, including factors disclosed in Item 1A – “Risk Factors” and in Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should evaluate all forward-looking statements made in this Form 10-K in the context of these risks and uncertainties.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this Form 10-K apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Form 10-K and in other filings we make with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Company and Organization

TPG RE Finance Trust, Inc. is a Maryland corporation that was incorporated on October 24, 2014 and which commenced operations on December 18, 2014. We are externally managed by TPG RE Finance Trust Management, L.P., an affiliate of TPG. Our principal executive offices are located at 888 Seventh Avenue, 35th Floor, New York, New York 10106. We are organized as a holding company and conduct our operations primarily through our various subsidiaries. As of December 31, 2017, the Company conducted substantially all of its operations through a Delaware limited liability company, TPG RE Finance Trust Holdco, LLC (“Holdco”), and the Company’s other wholly-owned subsidiaries.

We conduct our operations as a REIT for U.S. federal income tax purposes. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent that we annually distribute all of our net taxable income to stockholders and maintain our qualification as a REIT. We also operate our business in a manner that permits us to maintain an exclusion from registration under the Investment Company Act. We operate our business as one segment, which directly originates and acquires a diversified portfolio of commercial real estate-related assets consisting primarily of first mortgage loans and senior participation interests in first mortgage loans secured by institutional-quality properties in primary and select secondary markets in the United States, and commercial mortgage-backed securities (“CMBS”).

Manager

We are externally managed and advised by our Manager, which is responsible for administering our business activities, day-to-day operations, and providing us the services of our executive management team, investment team, and appropriate support personnel. TPG Real Estate, TPG’s real estate platform, includes TPG Real Estate Partners, TPG’s real estate equity investment platform, and us, currently TPG’s dedicated real estate debt investment platform. Collectively, TPG Real Estate managed more than $6.7 billion in assets at September 30, 2017, which included commercial real estate holdings in the United States consisting of approximately 1,000 properties comprising approximately 85.4 million square feet. TPG Real Estate’s teams work across TPG’s New York, San Francisco and London offices, and have 17 and 27 employees, respectively, between TPG’s real estate debt investment platform and TPG’s real estate equity platform.

Our chief executive officer, chief financial officer, and other executive officers are senior TPG Real Estate professionals. None of our executive officers, our Manager, or other personnel supplied to us by our Manager is obligated to dedicate any specific amount of time to our business. Our Manager is subject to the supervision and oversight of our board of directors and has only such functions and authority as our board of directors delegates to it. Pursuant to a management agreement between our Manager and us (our “Management Agreement”), our Manager is entitled to receive a base management fee, an incentive fee, and certain expense reimbursements.

2

See Note 10 to our consolidated financial statements in this Form 10-K for more detail on the terms of the Management Agreement.

Investment Strategy

The loans we target for origination and investment typically have the following characteristics:

|

|

• |

Unpaid principal balance greater than $50 million; |

|

|

• |

Stabilized as-is loan-to value (“LTV”) of less than 70% with respect to individual properties; |

|

|

• |

Floating rate loans tied to the one-month U.S. dollar-denominated London Interbank Offered Rate (“LIBOR”) and spreads of 300 to 500 basis points over LIBOR; |

|

|

• |

Secured by properties that are: (1) primarily in the office, mixed use, multifamily, industrial, retail and hospitality real estate sectors; (2) expected to reach stabilization within 24 months of the origination or acquisition date; and (3) located in primary and select secondary markets in the U.S. with multiple demand drivers, such as employment growth, medical infrastructure, universities, convention centers and attractive cultural and lifestyle amenities; and, |

|

|

• |

Well-capitalized sponsors with substantial experience in particular real estate sectors and geographic markets. |

We believe that our current investment strategy provides significant opportunities to our stockholders for attractive risk-adjusted returns over time. However, to capitalize on the investment opportunities at different points in the economic and real estate investment cycle, we may modify or expand our investment strategy. We believe that the flexibility of our strategy supported by our Manager’s significant commercial real estate experience and the extensive resources of TPG and TPG Real Estate will allow us to take advantage of changing market conditions to maximize risk-adjusted returns to our stockholders.

We invest primarily in commercial mortgage loans and other commercial real estate-related debt instruments, focusing on loans secured by properties primarily in the office, mixed use, multifamily, industrial, retail and hospitality real estate sectors in primary and select secondary markets in the U.S., including, but not limited to, the following:

|

|

• |

Commercial Mortgage Loans. We intend to continue to focus on directly originating and selectively acquiring first mortgage loans. These loans are secured by a first mortgage lien on a commercial property, may vary in duration, predominantly bear interest at a floating rate, may provide for regularly scheduled principal amortization and typically require a balloon payment of principal at maturity. These investments may encompass a whole commercial mortgage loan or may include a pari passu participation within a commercial mortgage loan. |

|

|

• |

Other Commercial Real Estate-Related Debt Instruments. Although we expect that originating and selectively acquiring commercial first mortgage loans will be our primary area of focus, we also expect to opportunistically originate and selectively acquire other commercial real estate-related debt instruments, subject to maintaining our qualification as a REIT for U.S. federal income tax purposes and exclusion or exemption from regulation under the Investment Company Act, including, but not limited to, subordinate mortgage interests, mezzanine loans, secured real estate securities, note financing, preferred equity and miscellaneous debt instruments. |

As market conditions evolve over time, we expect to adapt as appropriate. We believe our current investment strategy will produce significant opportunities to make investments with attractive risk-return profiles. However, to capitalize on the investment opportunities that may be present at various other points of an economic cycle, we may expand or change our investment strategy by targeting assets with debt characteristics, such as subordinate mortgage loans, mezzanine loans, preferred equity, real estate securities and note financings. We may also target assets with equity characteristics, including triple net lease properties and other forms of direct equity ownership of commercial real estate properties, subject to any duties to offer to other funds managed by TPG.

We believe that the diversification of our investment portfolio, our ability to actively manage those investments, and the flexibility of our strategy positions us to generate attractive returns for our stockholders in a variety of market conditions over the long term.

3

As of December 31, 2017, our portfolio consisted of 54 first mortgage loans (or interests therein) with an aggregate unpaid principal balance of $3.1 billion and four mezzanine loans with an aggregate unpaid principal balance of $75.4 million, and collectively having a weighted average credit spread of 4.8%, a weighted average all-in yield of 6.5%, a weighted average term to extended maturity (assuming all extension options are exercised by borrowers) of 3.6 years, and a weighted average LTV of 58.7%. As of December 31, 2017, 99.9% of the loan commitments in our portfolio consisted of floating rate loans, and 98.0% of the loan commitments in our portfolio consisted of first mortgage loans (or interests therein). We also had $529.0 million of unfunded loan commitments as of December 31, 2017, our funding of which is subject to satisfaction of borrower milestones. In addition, as of December 31, 2017, we held five CMBS investments, with an aggregate face amount of $85.7 million and a weighted average yield to final maturity of 3.1%.

Loan Portfolio

The following table details overall statistics for our loan portfolio as of December 31, 2017 (dollars in thousands):

|

|

|

|

|

|

|

Total Loan Exposure(1) |

|

|||||||||

|

|

|

Balance Sheet Portfolio |

|

|

Total Loan Portfolio |

|

|

Floating Rate Loans |

|

|

Fixed Rate Loans |

|

||||

|

Number of loans |

|

|

57 |

|

|

|

60 |

|

|

|

59 |

|

|

|

1 |

|

|

% of portfolio (by unpaid principal balance) |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

99.9 |

% |

|

|

0.1 |

% |

|

Total loan commitment |

|

$ |

3,727,156 |

|

|

$ |

3,862,656 |

|

|

$ |

3,860,016 |

|

|

$ |

2,640 |

|

|

Unpaid principal balance |

|

$ |

3,198,116 |

|

|

$ |

3,198,116 |

|

|

$ |

3,195,476 |

|

|

$ |

2,640 |

|

|

Unfunded loan commitments(2) |

|

$ |

529,040 |

|

|

$ |

529,040 |

|

|

$ |

529,040 |

|

|

$ |

— |

|

|

Carrying value |

|

$ |

3,175,672 |

|

|

$ |

3,175,672 |

|

|

$ |

3,173,236 |

|

|

$ |

2,436 |

|

|

Weighted average credit spread(3) |

|

|

4.8 |

% |

|

|

4.8 |

% |

|

|

4.8 |

% |

|

|

5.6 |

% |

|

Weighted average all-in yield(3) |

|

|

6.5 |

% |

|

|

6.5 |

% |

|

|

6.5 |

% |

|

|

7.9 |

% |

|

Weighted average term to extended maturity (in years)(4) |

|

|

3.6 |

|

|

|

3.6 |

|

|

|

3.6 |

|

|

|

2.7 |

|

|

Weighted average LTV(5) |

|

|

58.7 |

% |

|

|

58.7 |

% |

|

|

58.6 |

% |

|

|

84.2 |

% |

|

(1) |

In certain instances, we create structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third party. In either case, the senior mortgage loan (i.e., the non-consolidated senior interest) is not included on our balance sheet. When we create structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third party, we retain on our balance sheet a mezzanine loan. Total loan commitment encompasses the entire loan portfolio we originated, acquired and financed, including three non-consolidated senior interests totaling $135.5 million sold or co-originated and thus are not included in our balance sheet portfolio. See Item 7 - “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Investment Portfolio Financing—Non-Consolidated Senior Interests” in this Form 10-K for additional information. |

|

(2) |

Unfunded loan commitments may be funded over the term of each loan, subject in certain cases to an expiration date or a force-funding date, primarily to finance development, property improvements or lease-related expenditures by our borrowers, and in some instances to finance operating deficits during renovation and lease-up. |

|

(3) |

As of December 31, 2017, our floating rate loans were indexed to LIBOR. In addition to credit spread, all-in yield includes the amortization of deferred origination fees, purchase price premium and discount, loan origination costs and accrual of both extension and exit fees. Credit spread and all-in yield for the total portfolio assumes the applicable floating benchmark rate as of December 31, 2017 for weighted average calculations. |

|

(4) |

Extended maturity assumes all extension options are exercised by the borrower; provided, however, that our loans may be repaid prior to such date. As of December 31, 2017, based on the unpaid principal balance of our total loan exposure, 67.2% of our loans were subject to yield maintenance or other prepayment restrictions and 32.8% were open to repayment by the borrower without penalty. |

4

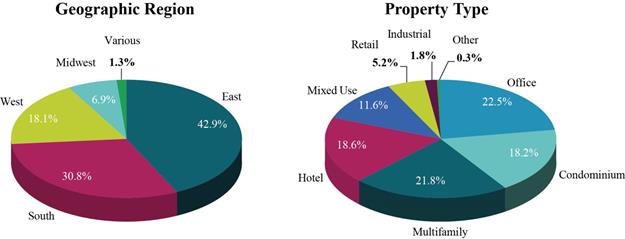

The following presents, by loan commitment, the geographic distribution and property types securing our loan portfolio as of December 31, 2017:

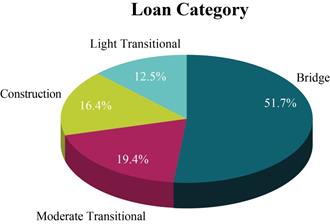

Our loan portfolio consists of Bridge, Construction, Moderate Transitional and Light Transitional mortgage loans. These mortgage loan categories are used by us to classify, define, and assess our loan investments. The following presents, by loan commitment, our loan portfolio by loan category as of December 31, 2017:

For the years ended December 31, 2017 and December 31, 2016, no loans were placed on non-accrual status, and we have sustained no losses or impairments to our loan portfolio.

5

We may invest in CMBS, or CMBS-related, assets as part of our investment strategy, primarily as a short-term cash management tool. Our current CMBS portfolio consists of five fixed rate securities whose underlying collateral is United States treasury bonds or first mortgage loans secured by multifamily or healthcare-related properties. The underlying real estate collateral is located across the United States, primarily in Texas, California, and Florida with no state representing more than 11% of an investment’s par value. At December 31, 2017, there were no floating rate securities in our CMBS Portfolio. The following table details overall statistics for our CMBS portfolio as of December 31, 2017 (dollars in thousands):

|

|

|

CMBS Portfolio |

|

|

|

Number of securities |

|

|

5 |

|

|

Fixed rate securities |

|

|

5 |

|

|

% of portfolio |

|

|

100 |

% |

|

Par value |

|

$ |

86,314 |

|

|

Face amount(1) |

|

$ |

85,661 |

|

|

Weighted average coupon(2) |

|

|

3.7 |

% |

|

Weighted average yield to final maturity(2) |

|

|

3.1 |

% |

|

Weighted average life (in years) |

|

|

2.4 |

|

|

Weighted average principal repayment window (in years) |

|

|

4.6 |

|

|

Final maturity (in years) |

|

|

16.3 |

|

|

Ratings range(3) |

|

Unrated to AAA |

|

|

|

(1) |

Amounts disclosed are before giving effect to unamortized purchase price premium and discount and unrealized gains or losses. |

|

(2) |

Weighted by market value as of December 31, 2017. |

|

(3) |

Ratings range includes one structured finance investment that is unrated. This three year structured finance investment is 100% collateralized by multifamily mortgage loans underwritten by the Federal Home Loan Mortgage Corporation (“FHLMC”), which loans are slated for near term securitization by FHLMC. Upon the contractual maturity of the structured finance investment, FHLMC is required to purchase all of the performing mortgage loans at par. Currently, all of the underlying mortgage loans are performing. The four other CMBS investments are rated AA+ through AAA. |

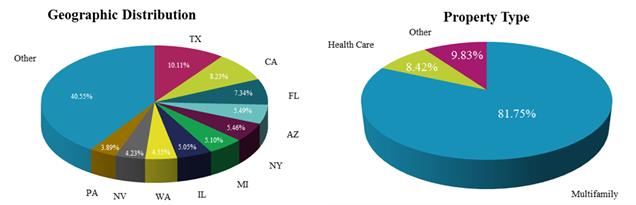

The following presents, by outstanding principal balance, the geographic distribution and property types securing our CMBS investments as of December 31, 2017:

For additional information regarding our investment portfolio as of December 31, 2017, see Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K.

6

In addition to raising capital through public offerings of our equity and debt securities, our financing strategy includes a combination of secured revolving repurchase facilities, a secured credit facility and asset-specific financing structures. To create structural, matched term financing, we have and may in certain instances, originate mezzanine loans in connection with the contemporaneous issuance of a first mortgage loan to a third-party lender or the non-recourse transfer of a first mortgage loan originated by us. In either case, the senior mortgage loan is not included on our balance sheet, and we refer to such senior loan interest as a “non-consolidated senior interest.” When we create structural leverage through the co-origination or non-recourse syndication of a senior loan interest to a third party, we retain on our balance sheet a mezzanine loan. Additionally, we may use other forms of leverage, including secured and unsecured warehouse facilities, issuances of non-recourse collateralized loan obligations (“CLO”), structured financing, derivative instruments, and public and private secured and unsecured debt issuances by us or our subsidiaries. We generally seek to match-fund and match-index our investments by minimizing the differences between the durations and indices of our investments and those of our liabilities, respectively, including in certain instances through the use of derivatives; however, under certain circumstances, we may determine not to do so or we may otherwise be unable to do so.

On February 14, 2018, we closed a $932.4 million CLO, creating additional matched-term, matched index funding for approximately 29% of our loan portfolio based on unpaid principal balance at December 31, 2017. For more information on the CLO, see Note 17 to our consolidated financial statements in this Form 10-K.

During the year ended December 31, 2017, we entered into a new secured revolving repurchase facility, increased the maximum facility size of four of our existing secured revolving repurchase facilities, entered into a new senior secured credit facility, and added three new asset-specific financings providing an aggregate of $1.4 billion of additional credit capacity. The following table details the principal balance amounts outstanding for our financing arrangements as of December 31, 2017 (dollars in thousands):

|

|

|

Portfolio Financing Outstanding Principal Balance |

|

|

|

|

|

December 31, 2017 |

|

|

|

Secured revolving repurchase facilities |

|

$ |

1,835,801 |

|

|

Senior secured credit facility |

|

|

- |

|

|

Asset-specific financings |

|

|

289,487 |

|

|

Total indebtedness(1) |

|

$ |

2,125,288 |

|

|

(1) |

Excludes deferred financing costs of $10.3 million at December 31, 2017. |

The amount of leverage we employ for particular assets will depend upon our Manager’s assessment of the credit, liquidity, price volatility, and other risks of those assets and the financing counterparties, the availability of particular types of financing at the time, and the financial covenants under our credit facilities. Our decision to use leverage to finance our assets will be at the discretion of our Manager and will not be subject to the approval of our stockholders. We currently expect that our leverage, measured as the ratio of debt to equity, will generally range from 3.0 to 3.5:1, subject to compliance with our financial covenants under our secured revolving repurchase facilities and other contractual obligations. We will endeavor to match the terms and indices of our assets and liabilities.

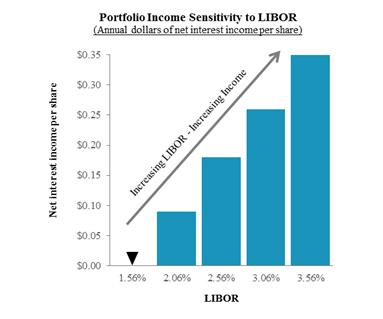

Floating Rate Portfolio

Our business model seeks to minimize our exposure to changing interest rates by match-indexing our assets using the same, or similar, benchmark indices, typically LIBOR, as well as durations. Accordingly, rising interest rates will generally increase our net interest income, while declining interest rates will generally decrease our net interest income. As of December 31, 2017, 99.9% of our loans by unpaid principal balance earned a floating rate of interest and were financed with liabilities that require interest payments based on floating rates, which resulted in approximately $1.1 billion of net floating rate exposure that is positively correlated to rising interest rates, subject to the impact of interest rate floors on certain of our floating rate loans. As of December 31, 2017, the remaining 0.1% of our loans by unpaid principal balance earned a fixed rate of interest, but were financed with liabilities that require interest payments based on floating rates, which results in a negative correlation to rising interest rates to the extent of our amount of fixed rate financing. Due to the short remaining term to maturity and the small percentage of our loan portfolio represented by fixed rate loans, we have elected not to employ interest rate derivatives (interest rate

7

swaps, caps, collars or swaptions) to limit our exposure to increases in interest rates on such liabilities, but we may do so in the future.

The following table shows how an increase in LIBOR would affect our net interest income per share per annum as of December 31, 2017:

Investment Guidelines

Our board of directors has approved the following investment guidelines:

|

|

• |

No investment will be made that would cause us to fail to maintain our qualification as a REIT under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”); |

|

|

• |

No investment will be made that would cause us or any of our subsidiaries to be required to be registered as an investment company under the Investment Company Act; |

|

|

• |

Our Manager will seek to invest our capital in our target assets; |

|

|

• |

Prior to the deployment of our capital into our target assets, our Manager may cause our capital to be invested in any short-term investments in money market funds, bank accounts, overnight repurchase agreements with primary Federal Reserve Bank dealers collateralized by direct U.S. government obligations and other instruments or investments determined by our Manager to be of high quality; |

|

|

• |

Not more than 25% of our Equity (as defined in our Management Agreement) may be invested in any individual investment without the approval of a majority of our independent directors (it being understood, however, that for purposes of the foregoing concentration limit, in the case of any investment that is comprised (whether through a structured investment vehicle or other arrangement) of securities, instruments or assets of multiple portfolio issuers, such investment for purposes of the foregoing limitation will be deemed to be multiple investments in such underlying securities, instruments and assets and not the particular vehicle, product or other arrangement in which they are aggregated); and |

|

|

• |

Any investment in excess of $300 million requires the approval of a majority of our independent directors. |

These investment guidelines may be amended, supplemented or waived pursuant to the approval of our board of directors (which must include a majority of our independent directors) from time to time, but without the approval of our stockholders.

8

We are engaged in a competitive business environment. We operate in a competitive market for the origination and acquisition of attractive investment opportunities. We compete with a variety of institutional investors, including other REITs, debt funds, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, financial institutions, private equity and hedge funds, governmental bodies and other entities and may compete with other TPG Funds. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. Several of our competitors, including other REITs, have recently raised, or are expected to raise, significant amounts of capital and may have investment objectives that overlap with our investment objectives, which may create additional competition for lending and other investment opportunities. Some of our competitors may have a lower cost of funds and access to funding sources that may not be available to us or are only available to us on substantially less attractive terms. Many of our competitors are not subject to the operating constraints associated with REIT tax compliance or maintenance of an exclusion or exemption from the Investment Company Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more lending relationships than we do. Competition may result in realizing fewer investments, higher prices, acceptance of greater risk, greater defaults, lower yields or a narrower spread of yields over our borrowing costs. In addition, competition for attractive investments could delay the investment of our capital.

In the face of this competition, we have access to our Manager’s professionals through TPG and TPG Real Estate, and their industry expertise, which may provide us with a competitive advantage in competing effectively for attractive investment opportunities and help us assess risks and determine appropriate pricing for certain potential investments. However, we may not be able to achieve our business goals or expectations due to the competitive risks that we face. For additional information concerning these competitive risks, see Item 1A - “Risk Factors—Risks Related to Our Lending and Investment Activities—We operate in a competitive market for the origination and acquisition of attractive investment opportunities and competition may limit our ability to originate or acquire attractive investments in our target assets, which could have a material adverse effect on us.”

Employees

We do not have any employees. We are externally managed and are advised by our Manager pursuant to our Management Agreement between our Manager and us. All of our executive officers and certain of our directors are employees of our Manager or its affiliates. We do not expect to have any employees.

Government Regulation

Our operations are subject, in certain instances, to supervision and regulation by U.S. and other governmental authorities, and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which among other things: (i) regulate credit-granting activities; (ii) establish maximum interest rates, finance charges and other charges; (iii) require disclosures to customers; (iv) govern secured transactions; and (v) set collection, foreclosure, repossession and claims-handling procedures and other trade practices. We are also required to comply with certain provisions of the Equal Credit Opportunity Act that are applicable to commercial loans. We intend to conduct our business so that neither we nor any of our subsidiaries are required to register as an investment company under the Investment Company Act.

In our judgment, existing statutes and regulations have not had a material adverse effect on our business. In recent years, legislators in the United States and in other countries have said that greater regulation of financial services firms is needed, particularly in areas such as risk management, leverage, and disclosure. While we expect that additional new regulations in these areas may be adopted and existing ones may change in the future, it is not possible at this time to forecast the exact nature of any future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon our future business, financial condition, or results of operations or prospects.

Taxation

We made an election to be taxed as a REIT for U.S. federal income tax purposes, commencing with our initial taxable year ended December 31, 2014. We generally must distribute annually at least 90% of our net taxable income, subject to certain adjustments and excluding any net capital gain, in order for U.S. federal income tax not to apply to our earnings that we distribute. To the extent that we satisfy this distribution requirement, but distribute less

9

than 100% of our net taxable income, we will be subject to U.S. federal income tax on our undistributed taxable income. In addition, we will be subject to a 4% nondeductible excise tax if the actual amount that we pay out to our stockholders in a calendar year is less than a minimum amount specified under U.S. federal tax laws. Our qualification as a REIT also depends on our ability to meet various other requirements imposed by the Internal Revenue Code, which relate to organizational structure, diversity of stock ownership, and certain restrictions with regard to the nature of our assets and the sources of our income. Even if we qualify as a REIT, we are subject to certain U.S. federal excise taxes and state and local taxes on our income and assets. If we fail to qualify as a REIT in any taxable year, we will be subject to U.S. federal income taxes at regular corporate rates, including any applicable alternative minimum tax, and will not be able to qualify as a REIT for the subsequent four years.

Furthermore, we have one or more taxable REIT subsidiaries, or TRSs, which pay federal, state, and local income tax on their net taxable income. See Item 1A – “Risk Factors – Risks Related to our REIT Status and Certain Other Tax Items” for additional tax status information.

Available Information

We maintain a website at www.tpgrefinance.com. We are providing the address to our website solely for the information of investors. The information on our website is not a part of, nor is it incorporated by reference into this report. Through our website, we make available, free of charge, our annual proxy statement, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish them to, the SEC. The SEC maintains a website that contains these reports at www.sec.gov. You may also read and copy any filed document at the SEC’s public reference room in Washington, D.C. at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about public reference rooms.

10

Risks Related to Our Lending and Investment Activities

Our success depends on the availability of attractive investment opportunities and our Manager’s ability to identify, structure, consummate, leverage, manage and realize returns on our investments.

Our operating results are dependent upon the availability of, as well as our Manager’s ability to identify, structure, consummate, leverage, manage and realize returns on, our loans and other investments. In general, the availability of attractive investment opportunities and, consequently, our operating results, will be affected by the level and volatility of interest rates, conditions in the financial markets, general economic conditions, the demand for investment opportunities in our target assets and the supply of capital for such investment opportunities. We cannot assure you that our Manager will be successful in identifying and consummating attractive investments or that such investments, once made, will perform as anticipated.

Our commercial mortgage loans and other commercial real estate-related debt instruments expose us to risks associated with real estate investments generally.

We seek to originate and selectively acquire commercial mortgage loans and other commercial real estate-related debt instruments. Any deterioration of real estate fundamentals generally, and in the United States in particular, could negatively impact our performance by making it more difficult for borrowers to satisfy their debt payment obligations, increasing the default risk applicable to borrowers and making it relatively more difficult for us to generate attractive risk-adjusted returns. Real estate investments will be subject to various risks, including:

|

|

• |

economic and market fluctuations; |

|

|

• |

political instability or changes, terrorism and acts of war; |

|

|

• |

changes in environmental, zoning and other laws; |

|

|

• |

casualty or condemnation losses; |

|

|

• |

regulatory limitations on rents; |

|

|

• |

decreases in property values; |

|

|

• |

changes in the appeal of properties to tenants; |

|

|

• |

changes in supply (resulting from the recent growth in commercial real estate debt funds or otherwise) and demand; |

|

|

• |

energy supply shortages; |

|

|

• |

various uninsured or uninsurable risks; |

|

|

• |

natural disasters; |

|

|

• |

changes in government regulations (such as rent control); |

|

|

• |

changes in the availability of debt financing and/or mortgage funds which may render the sale or refinancing of properties difficult or impracticable; |

|

|

• |

increased mortgage defaults; |

|

|

• |

increases in borrowing rates; and |

|

|

• |

negative developments in the economy and/or adverse changes in real estate values generally and other risk factors that are beyond our control. |

We cannot predict the degree to which economic conditions generally, and the conditions for commercial real estate debt investing in particular, will improve or decline. Any declines in the performance of the U.S. and global economies or in the real estate debt markets could have a material adverse effect on us.

11

Commercial real estate debt instruments that are secured or otherwise supported, directly or indirectly, by commercial property are subject to delinquency, foreclosure and loss, which could materially and adversely affect us.

Commercial real estate debt instruments, such as mortgage loans, that are secured or, in the case of certain assets (including participation interests, mezzanine loans and preferred equity), supported by commercial property are subject to risks of delinquency and foreclosure and risks of loss that are greater than similar risks associated with loans made on the security of single-family residential property. The ability of a borrower to pay the principal of and interest on a loan secured by an income-producing property typically is dependent primarily upon the successful operation of such property rather than upon the existence of independent income or assets of the borrower. If the net operating income of the property is reduced, the borrower’s ability to pay the principal of and interest on the loan in a timely manner, or at all, may be impaired and therefore could reduce our return from an affected property or investment, which could materially and adversely affect us. Net operating income of an income-producing property may be adversely affected by the risks particular to commercial real property described above, as well as, among other things:

|

|

• |

tenant mix and tenant bankruptcies; |

|

|

• |

success of tenant businesses; |

|

|

• |

property management decisions, including with respect to capital improvements, particularly in older building structures; |

|

|

• |

property location and condition, including, without limitation, any need to address environmental contamination at a property; |

|

|

• |

competition from comparable types of properties; |

|

|

• |

changes in global, national, regional or local economic conditions or changes in specific industry segments; |

|

|

• |

declines in regional or local real estate values or rental or occupancy rates; |

|

|

• |

increases in interest rates, real estate tax rates and other operating expenses; |

|

|

• |

changes to tax laws and rates to which real estate lenders and investors are subject; and |

|

|

• |

government regulations. |

In the event of any default under a mortgage loan held directly by us, we will bear a risk of loss to the extent of any deficiency between the value of the collateral and the principal of and accrued interest on the mortgage loan. In the event of the bankruptcy of a mortgage loan borrower, the mortgage loan to that borrower will be deemed to be secured only to the extent of the value of the underlying collateral at the time of bankruptcy (as determined by the bankruptcy court), and the lien securing the mortgage loan will be subject to the avoidance powers of the bankruptcy trustee or debtor-in-possession to the extent the lien is unenforceable under state law. Foreclosure of a mortgage loan can be an expensive and lengthy process that could have a substantial negative effect on any anticipated return on the foreclosed mortgage loan.

We originate and acquire transitional loans, which involves greater risk of loss than stabilized commercial mortgage loans.

We originate and acquire transitional loans secured by first lien mortgages on commercial real estate. These loans provide interim financing to borrowers seeking short-term capital for the acquisition or transition (for example, lease up and/or rehabilitation) of commercial real estate and generally have a maturity of three years or less. A borrower under a transitional loan has usually identified an asset that has been under-managed and/or is located in a recovering market. If the market in which the asset is located fails to recover according to the borrower’s projections, or if the borrower fails to improve the operating performance of the asset or the value of the asset, the borrower may not receive a sufficient return on the asset to satisfy the transitional loan, and we will bear the risk that we may not recover some or all of our investment.

In addition, borrowers usually use the proceeds of a conventional mortgage loan to repay a transitional loan. We may therefore be dependent on a borrower’s ability to obtain permanent financing to repay a transitional loan, which could depend on market conditions and other factors. In the event of any failure to repay under a transitional loan held by us, we will bear the risk of loss of principal and non-payment of interest and fees to the extent of any

12

deficiency between the value of the mortgage collateral and the principal amount and unpaid interest of the transitional loan.

There can be no assurances that the U.S. or global financial systems will remain stable, and the occurrence of another significant credit market disruption may negatively impact our ability to execute our investment strategy, which would materially and adversely affect us.

The U.S. and global financial markets experienced significant disruptions in the past, during which times global credit markets collapsed, borrowers defaulted on their loans at historically high levels, banks and other lending institutions suffered heavy losses and the value of real estate declined. During such periods, a significant number of borrowers became unable to pay principal and interest on outstanding loans as the value of their real estate declined. Although liquidity has returned to the market and property values have generally recovered to levels that exceed those observed prior to the global financial crisis, declining real estate values could in the future reduce the level of new mortgage and other real estate-related loan originations. Instability in the U.S. and global financial markets in the future could be caused by any number of factors beyond our control, including, without limitation, terrorist attacks or other acts of war and adverse changes in national or international economic, market and political conditions. Any future sustained period of increased payment delinquencies, foreclosures or losses could adversely affect both our net interest income from loans in our portfolio as well as our ability to originate and acquire loans, which would materially and adversely affect us.

The potential discontinuation of LIBOR may adversely affect the interest rate indices on our investments, the interest rate indices on the financing that we use to fund our investments, or both.

Our investments currently include loans primarily with floating interest rates. Our floating rate investments earn interest at rates that typically adjust from time to time based upon LIBOR. Additionally, the financing that we use to fund our investments typically bears interest at a rate equal to LIBOR plus a credit spread determined primarily by advance rate and property type.

LIBOR and other interest rates or other types of rates and indices which are deemed “benchmarks” are the subject of recent national, international and other regulatory guidance and proposals for reform. These reforms may cause these benchmarks to perform differently than in the past, to disappear entirely or to have other consequences which cannot be predicted. Any such consequences could have an adverse effect on the return on our investments, the cost of the financing that we use to fund our investments, or both.

Furthermore, Regulation (EU) 2016/1011 (the “Benchmark Regulation”) was published by the European Parliament and the Council of the European Union on June 8, 2016. If the methodology or other terms of LIBOR are changed in order to comply with the terms of the Benchmark Regulation, such changes could (among other things) have the effect of reducing or increasing the rate or level or affecting the volatility of the published rate or level of LIBOR. Any such changes could have an adverse impact on the return on our investments, the cost of the financing that we use to fund our investments, or both. In addition, the Benchmark Regulation stipulates that each administrator of a benchmark regulated thereunder must be licensed by the competent authority of the member state where such administrator is located. There is a risk that administrators of LIBOR will fail to obtain a necessary license, preventing them from continuing to provide LIBOR as a benchmark or causing them to cease to administer LIBOR altogether because of the additional costs of compliance with the Benchmark Regulation and other applicable regulations, and the risks associated therewith.

Central banks around the world, including the U.S. Federal Reserve, have commissioned working groups that include market participants (the “Alternative Rate Committees”) with the goal of finding suitable replacements for their currency’s LIBOR that are based on observable market transactions. The search for replacements accelerated after the Financial Stability Board reported that uncertainty surrounding the integrity of LIBOR represents a potentially serious systemic vulnerability and risk due to limited transactions in the underlying inter-bank lending market. In July 2017, the Chief Executive of the United Kingdom Financial Conduct Authority (the “FCA”), which regulates LIBOR, called for an orderly transition over a four to five year period from LIBOR to the reference rates selected by the Alternative Rate Committees. The FCA’s announcement stated that it expects that it would not be in a position to sustain LIBOR through its influence or legal compulsion powers after the end of 2021. The announcement indicates that the continuation of LIBOR on the current basis is not guaranteed. It is impossible to predict whether and to what extent banks will continue to provide LIBOR submissions to the administrator of LIBOR.

13

It is unclear at this time whether or not LIBOR will cease to exist or if new methods of calculating LIBOR will be established such that it continues to exist after 2021. If LIBOR ceases to exist, we may need to renegotiate the interest rate indices on our investments, the interest rate indices on the financing that we use to fund our investments, or both. Any such changes to the interest rate indices on our investments or the financing that we use to fund our investments could have an adverse effect on the return on our investments, the cost of the financing that we use to fund our investments, or both. Additionally, we may not be able to renegotiate the same indices on our investments and our financing that we used to fund our investments, which may result in a portfolio that is not match indexed.

Difficulty in redeploying the proceeds from repayments of our existing loans and other investments could materially and adversely affect us.

As of December 31, 2017, our portfolio, excluding CMBS investments, had a weighted average term to extended maturity (assuming all extension options have been exercised by borrowers) of 3.6 years. As our loans and other investments are repaid, we will attempt to redeploy the proceeds we receive into new loans and investments, and repay borrowings under our secured revolving repurchase facilities and other financing arrangements. It is possible that we will fail to identify reinvestment options that would provide a yield and/or a risk profile that is comparable to the asset that was repaid. If we fail to redeploy the proceeds we receive from repayment of a loan or other investment in equivalent or better alternatives, we could be materially and adversely affected.

If we are unable to successfully integrate new assets and manage our growth, our results of operations and financial condition may suffer.

We have in the past and may in the future significantly increase the size and/or change the mix of our portfolio of assets. We may be unable to successfully and efficiently integrate newly-acquired assets into our existing portfolio or otherwise effectively manage our assets or our growth effectively. In addition, increases in our portfolio of assets and/or changes in the mix of our assets may place significant demands on our Manager’s administrative, operational, asset management, financial and other resources. Any failure to manage increases in size effectively could adversely affect our results of operations and financial condition.

We operate in a competitive market for the origination and acquisition of attractive investment opportunities and competition may limit our ability to originate or acquire attractive investments in our target assets, which could have a material adverse effect on us.

We operate in a competitive market for the origination and acquisition of attractive investment opportunities. We compete with a variety of institutional investors, including other REITs, debt funds, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, financial institutions, private equity and hedge funds, governmental bodies and other entities and, may compete with TPG Funds. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. Several of our competitors, including other REITs, have recently raised, or are expected to raise, significant amounts of capital, and may have investment objectives that overlap with our investment objectives, which may create additional competition for lending and other investment opportunities. Some of our competitors may have a lower cost of funds and access to funding sources that may not be available to us or are only available to us on substantially less attractive terms. Many of our competitors are not subject to the operating constraints associated with REIT tax compliance or maintenance of an exclusion or exemption from the Investment Company Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more lending relationships than we do. Competition may result in realizing fewer investments, higher prices, acceptance of greater risk, greater defaults, lower yields or a narrower spread of yields over our borrowing costs. In addition, competition for attractive investments could delay the investment of our capital. Furthermore, changes in the financial regulatory regime following the 2016 U.S. Presidential election could decrease the current restrictions on banks and other financial institutions and allow them to compete with us for investment opportunities that were previously not available to, or otherwise pursued by, them. See “—Risks Related to Our Company—Changes in laws or regulations governing our operations, changes in the interpretation thereof or newly enacted laws or regulations and any failure by us to comply with these laws or regulations could materially and adversely affect us.”

14

As a result, competition may limit our ability to originate or acquire attractive investments in our target assets and could result in reduced returns. We can provide no assurance that we will be able to identify and originate or acquire attractive investments that are consistent with our investment strategy.

Interest rate fluctuations could significantly decrease our ability to generate income on our investments, which could materially and adversely affect us.

Our primary interest rate exposure relates to the yield on our investments and the financing cost of our debt, as well as any interest rate swaps that we may utilize for hedging purposes. Changes in interest rates affect our net interest income, which is the difference between the interest income we earn on our interest-earning investments and the interest expense we incur in financing these investments. Interest rate fluctuations resulting in our interest expense exceeding our interest income would result in operating losses for us. Changes in the level of interest rates also may affect our ability to originate or acquire investments and may impair the value of our investments and our ability to realize gains from the disposition of assets. Changes in interest rates may also affect borrower default rates.

Our operating results depend, in part, on differences between the income earned on our investments, net of credit losses, and our financing costs. For any period during which our investments are not match-funded, the income earned on such investments may respond more slowly to interest rate fluctuations than the cost of our borrowings. Consequently, changes in interest rates, particularly short-term interest rates, could materially and adversely affect us.

Prepayment rates may adversely affect our financial performance and cash flows and the value of certain of our investments.

Our business is currently focused on originating floating rate mortgage loans secured by commercial real estate assets. Generally, our mortgage loan borrowers may repay their loans prior to their stated maturities. In periods of declining interest rates and/or credit spreads, prepayment rates on loans generally increase. If general interest rates or credit spreads decline at the same time, the proceeds of such prepayments received during such periods may not be reinvested for some period of time or may be reinvested by us in comparable assets yielding less than the yields on the assets that were prepaid.

Because our mortgage loans are generally not originated or acquired at a premium to par value, prepayment rates do not materially affect the value of such loan assets. However, the value of certain other assets may be affected by prepayment rates. For example, if we acquire fixed rate CMBS or other fixed rate mortgage-related securities, or a pool of such mortgage securities in the future, we would anticipate that the underlying mortgages would prepay at a projected rate generating an expected yield. If we were to purchase such assets at a premium to par value, if borrowers prepay their loans faster than expected, the corresponding prepayments on any such mortgage-related securities would likely reduce the expected yield. Conversely, if we were to purchase such assets at a discount to par value, when borrowers prepay their loans slower than expected, the decrease in corresponding prepayments on the mortgage-related securities would likely reduce the expected yield. In addition, if we were to purchase such assets at a discount to par value, when borrowers prepay their loans faster than expected, the increase in corresponding prepayments on the mortgage-related securities would likely increase the expected yield.

Prepayment rates on floating rate and fixed rate loans may differ in different interest rate environments, and may be affected by a number of factors, including, but not limited to, the availability of mortgage credit, the relative economic vitality of the area in which the related properties are located, the servicing of the loans, possible changes in tax laws, other opportunities for investment, and other economic, social, geographic, demographic and legal factors, all of which are beyond our control, and structural factors such as call protection. Consequently, such prepayment rates cannot be predicted with certainty and no strategy can completely insulate us from prepayment risk.

15

Our investments may be concentrated and could be subject to risk of default.

We are not required to observe specific diversification criteria. Therefore, our investments may be concentrated in certain property types that are subject to higher risk of foreclosure, or secured by properties concentrated in a limited number of geographic locations. Although we attempt to mitigate our risk through various credit and structural protections, we cannot assure you that these efforts will be successful. To the extent that our portfolio is concentrated in any one region or type of asset, downturns relating generally to such region or type of asset may result in defaults on a number of our investments within a short time period, which may reduce our net income and, depending upon whether such loans are matched-term funded, may pressure our liquidity position. Such outcomes may adversely affect the market price of our common stock and, accordingly, have a material adverse effect on us. For more information on the concentration of our loan portfolio by geographic region and asset type, see Note 15 to our consolidated financial statements in this Form 10-K.

The illiquidity of certain of our investments may materially and adversely affect us.

The illiquidity of certain of our investments may make it difficult for us to sell such loans and other investments if the need or desire arises. In addition, certain of our loans and other investments may become less liquid after we originate or acquire them as a result of periods of delinquencies or defaults or turbulent market conditions, which may make it more difficult for us to dispose of such loans and other investments at advantageous times or in a timely manner. Moreover, we expect that many of our investments will not be registered under the relevant securities laws, resulting in prohibitions against their transfer, sale, pledge or their disposition except in transactions that are exempt from registration requirements or are otherwise in accordance with such laws. As a result, many of our loans and other investments are or will be illiquid, and if we are required to liquidate all or a portion of our portfolio quickly, for example as a result of margin calls, we may realize significantly less than the value at which we have previously recorded our investments. Further, we may face other restrictions on our ability to liquidate a loan or other investment to the extent that we or our Manager (and/or its affiliates) has or could be attributed as having material, non-public information regarding such business entity. As a result, our ability to vary our portfolio in response to changes in economic and other conditions may be relatively limited, which could materially and adversely affect us.

Most of the commercial mortgage loans that we originate or acquire are nonrecourse loans and the assets securing these loans may not be sufficient to protect us from a partial or complete loss if the borrower defaults on the loan, which could materially and adversely affect us.

Except for customary nonrecourse carve-outs for certain actions and environmental liability, most commercial mortgage loans are nonrecourse obligations of the sponsor and borrower, meaning that there is no recourse against the assets of the borrower or sponsor other than the underlying collateral. In the event of any default under a commercial mortgage loan held directly by us, we will bear a risk of loss to the extent of any deficiency between the value of the collateral and the principal of and accrued interest on the mortgage loan, which could materially and adversely affect us. Even if a commercial mortgage loan is recourse to the borrower (or if a nonrecourse carve-out to the borrower applies), in most cases, the borrower’s assets are limited primarily to its interest in the related mortgaged property. Further, although a commercial mortgage loan may provide for limited recourse to a principal or affiliate of the related borrower, there is no assurance that any recovery from such principal or affiliate will be made or that such principal’s or affiliate’s assets would be sufficient to pay any otherwise recoverable claim. In the event of the bankruptcy of a borrower, the loan to such borrower will be deemed to be secured only to the extent of the value of the underlying collateral at the time of bankruptcy (as determined by the bankruptcy court), and the lien securing the loan will be subject to the avoidance powers of the bankruptcy trustee or debtor-in-possession to the extent the lien is unenforceable under state law.

We may not have control over certain of our investments.

Our ability to manage our portfolio may be limited by the form in which our investments are made. In certain situations, we may:

|

|

• |

acquire loans or investments subject to rights of senior classes, servicers or collateral managers under intercreditor or servicing agreements or securitization documents; |

|

|

• |

pledge our investments as collateral for financing arrangements; |

|

|

• |

acquire only a minority and/or a non-controlling participation in an underlying loan or investment; |

16

|

|

• |

co-invest with others through partnerships, joint ventures or other entities, thereby acquiring non-controlling interests; or |

|

|

• |

rely on independent third-party management or servicing with respect to the management of an asset. |

Therefore, we may not be able to exercise control over all aspects of our loans and investments. Such financial assets may involve risks not present in investments where senior creditors, junior creditors, servicers or third party controlling investors are not involved. Our rights to control the process following a borrower default may be subject to the rights of senior or junior creditors or servicers whose interests may not be aligned with ours. A partner or co-venturer may have financial difficulties resulting in a negative impact on such asset, may have economic or business interests or goals that are inconsistent with ours, or may be in a position to take action contrary to our investment objectives. In addition, we may, in certain circumstances, be liable for the actions of our partners or co-venturers.

Future joint venture investments could be adversely affected by our lack of sole decision-making authority, our reliance on joint venture partners’ financial condition and liquidity and disputes between us and our joint venture partners.

We may in the future make investments through joint ventures. Such joint venture investments may involve risks not otherwise present when we originate or acquire investments without partners, including the following:

|

|

• |

we may not have exclusive control over the investment or the joint venture, which may prevent us from taking actions that are in our best interest; |

|

|

• |

joint venture agreements often restrict the transfer of a partner’s interest or may otherwise restrict our ability to sell the interest when we desire and/or on advantageous terms; |

|

|

• |

any future joint venture agreements may contain buy-sell provisions pursuant to which one partner may initiate procedures requiring the other partner to choose between buying the other partner’s interest or selling its interest to that partner; |

|

|

• |

we may not be in a position to exercise sole decision-making authority regarding the investment or joint venture, which could create the potential risk of creating impasses on decisions, such as with respect to acquisitions or dispositions; |

|

|

• |

a partner may, at any time, have economic or business interests or goals that are, or that may become, inconsistent with our business interests or goals; |

|

|

• |

a partner may be in a position to take action contrary to our instructions, requests, policies or objectives, including our policy with respect to maintaining our qualification as a REIT and our exclusion or exemption from registration under the Investment Company Act; |

|

|

• |

a partner may fail to fund its share of required capital contributions or may become bankrupt, which may mean that we and any other remaining partners generally would remain liable for the joint venture’s liabilities; |

|

|

• |

our relationships with our partners are contractual in nature and may be terminated or dissolved under the terms of the applicable joint venture agreements and, in such event, we may not continue to own or operate the interests or investments underlying such relationship or may need to purchase such interests or investments at a premium to the market price to continue ownership; |

|

|

• |

disputes between us and a partner may result in litigation or arbitration that could increase our expenses and prevent our Manager and our officers and directors from focusing their time and efforts on our business and could result in subjecting the investments owned by the joint venture to additional risk; or |

|

|

• |