Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Palo Alto Networks Inc | ex991q218earningsrelease.htm |

| EX-10.1 - EXHIBIT 10.1 - Palo Alto Networks Inc | ex101offerletterjcompeau.htm |

| 8-K - 8-K - Palo Alto Networks Inc | panw-8xkxq218earningsrelea.htm |

Impact of

2017 U.S. Tax Cuts and Jobs Act

Exhibit 99.2

This presentation contains forward-looking statements that involve risks and uncertainties, including statements regarding Palo Alto Networks’ expectations

regarding its expected effective tax rate, its expected weighted average non-GAAP effective tax rate, and the effects of such rates, as well as expectations

regarding its revenue and non-GAAP earnings per share, the related components of non-GAAP earnings per share, and weighted average basic and diluted

outstanding share count expectations for Palo Alto Networks’ fiscal third quarter and full fiscal year 2018.

There are a significant number of factors that could cause actual results to differ materially from statements made in this presentation, including: our limited

operating history; our ability to identify and effectively implement the necessary changes to address execution challenges; risks associated with managing our

rapid growth; organizational changes; the risks associated with new products and subscription and support offerings, including the discovery of software bugs;

our ability to attract and retain new customers; delays in the development or release of new subscription offerings, or the failure to timely develop and achieve

market acceptance of new products and subscriptions as well as existing products and subscription and support offerings; rapidly evolving technological

developments in the market for network security products and subscription and support offerings; length of sales cycles; and general market, political,

economic and business conditions. Further information on these and other factors that could affect the forward-looking statements we make in this presentation

can be found in the documents that we file with or furnish to the US Securities and Exchange Commission, including Palo Alto Networks’ most recent Quarterly

Report on Form 10-Q filed for the fiscal quarter ended October 31, 2017.

You should not rely on any forward-looking statements, and we assume no obligation, nor do we intend, to update them. All information in this presentation is

as of February 26, 2018. This presentation contains non-GAAP financial measures and key metrics relating to the company's past and expected future

performance. We have not reconciled diluted non-GAAP net income per share guidance to GAAP net income (loss) per diluted share because we do not

provide guidance on GAAP net income (loss) and would not be able to present the various reconciling cash and non-cash items between GAAP net income

(loss) and non-GAAP net income, including share-based compensation expense, without unreasonable effort. You can also find information regarding our use

of non-GAAP financial measures in our earnings release dated February 26, 2018.

Forward-looking statements and non-GAAP financial measures

2 | © 2018, Palo Alto Networks. All Rights Reserved.

U.S. Tax Cuts and Jobs Act (TCJA) impact on EPS

3 | © 2018, Palo Alto Networks. All Rights Reserved.

Q3 FY’18

Note: Q2 FY’18 non-GAAP EPS excluding the impact of the TCJA was $0.86. The lower effective tax rate (ETR) from 31% to 22% contributed an

$0.11 benefit to the reported non-GAAP EPS of $0.97. GAAP net loss was $0.38 per diluted share, which included a $0.07 benefit from the TCJA.

FY’18

$0.94 to $0.96 ~$0.11 22% $0.83 to $0.85

$3.84 to $3.91 ~$0.36 ~24% $3.48 to $3.55

Q2 FY’18 $0.97 $0.11 22% $0.86

Reported

Non-GAAP EPS

TCJA

benefit

Non-GAAP ETR

per TCJA

Note: As of February 26, 2018, we expect the TCJA to lower our non-GAAP ETR from 31% to 22% for both Q3 and Q4 of FY’18. For the full year

fiscal 2018, we expect a weighted average non-GAAP ETR of approximately 24%, which includes the prior tax rate of 31% for Q1 FY’18 and the

remainder of the year at the revised lower tax rate of 22%.

Non-GAAP EPS

excl. TCJA

Non-GAAP EPS

guidance range

TCJA

benefit

New non-GAAP

ETR per TCJA

Non-GAAP EPS

guide excl. TCJA

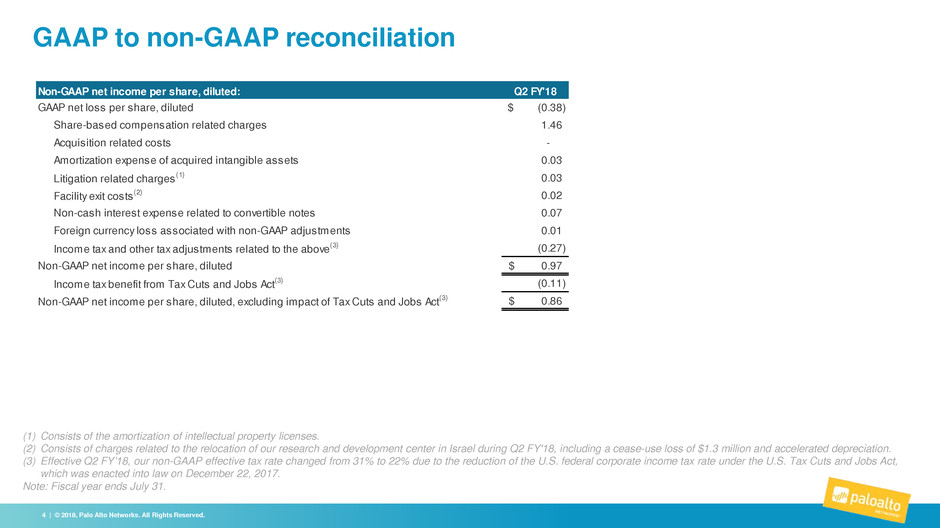

GAAP to non-GAAP reconciliation

4 | © 2018, Palo Alto Networks. All Rights Reserved.

(1) Consists of the amortization of intellectual property licenses.

(2) Consists of charges related to the relocation of our research and development center in Israel during Q2 FY'18, including a cease-use loss of $1.3 million and accelerated depreciation.

(3) Effective Q2 FY’18, our non-GAAP effective tax rate changed from 31% to 22% due to the reduction of the U.S. federal corporate income tax rate under the U.S. Tax Cuts and Jobs Act,

which was enacted into law on December 22, 2017.

Note: Fiscal year ends July 31.

Non-GAAP net income per share, diluted: Q2 FY'18

GAAP net loss per share, diluted (0.38)$

Share-based compensation related charges 1.46

Acquisition related costs -

Amortization expense of acquired intangible assets 0.03

Litigation related charges(1) 0.03

Facility exit costs(2) 0.02

Non-cash interest expense related to convertible notes 0.07

Foreign currency loss associated with non-GAAP adjustments 0.01

Income tax and other tax adjustments related to the above(3) (0.27)

Non-GAAP net income per share, diluted 0.97$

Income tax benefit from Tax Cuts and Jobs Act(3) (0.11)

Non-GAAP net income per share, diluted, excluding impact of Tax Cuts and Jobs Act(3) 0.86$