Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - DEAN FOODS CO | df-20171231x10kxexx23.htm |

| EX-32.2 - EXHIBIT 32.2 - DEAN FOODS CO | df-20171231x10kxex322.htm |

| EX-32.1 - EXHIBIT 32.1 - DEAN FOODS CO | df-20171231x10kxexx321.htm |

| EX-31.2 - EXHIBIT 31.2 - DEAN FOODS CO | df-20171231x10kxexx312.htm |

| EX-31.1 - EXHIBIT 31.1 - DEAN FOODS CO | df-20171231x10kxexx311.htm |

| EX-21 - EXHIBIT 21 - DEAN FOODS CO | df-20171231x10kxexx21.htm |

| EX-12 - EXHIBIT 12 - DEAN FOODS CO | df-20171213x10kxexx12.htm |

| EX-10.36 - EXHIBIT 10.36 - DEAN FOODS CO | df-20171231x10kxexx1036.htm |

| EX-10.35 - EXHIBIT 10.35 - DEAN FOODS CO | df-20171231x10kxexx1035.htm |

| EX-10.34 - EXHIBIT 10.34 - DEAN FOODS CO | df-20171231x10kxexx1034.htm |

| EX-10.33 - EXHIBIT 10.33 - DEAN FOODS CO | df-20171231x10kxexx1033.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-12755

Dean Foods Company

(Exact name of Registrant as specified in its charter)

Delaware | 75-2559681 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2711 North Haskell Avenue Suite 3400

Dallas, Texas 75204

(214) 303-3400

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $.01 par value | New York Stock Exchange | |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ | ||||

(Do not check if a smaller reporting company) | ||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant at June 30, 2017, based on the closing price for the registrant’s common stock on the New York Stock Exchange on June 30, 2017, was approximately $1.53 billion.

The number of shares of the registrant’s common stock outstanding as of February 21, 2018 was 91,166,009.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on or about May 9, 2018, which will be filed within 120 days of the registrant’s fiscal year end, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

Item | Page | |

PART I | ||

1 | ||

1A | ||

1B | ||

2 | ||

3 | ||

4 | ||

PART II | ||

5 | ||

6 | ||

7 | ||

7A | ||

8 | ||

9 | ||

9A | ||

PART III | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

PART IV | ||

15 | ||

16 | ||

Forward-Looking Statements

This Annual Report on Form 10-K (this “Form 10-K”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are predictions based on expectations and projections about future events, and are not statements of historical fact. Forward-looking statements include statements concerning business strategy, among other things, including anticipated trends and developments in and management plans for our business and the markets in which we operate. In some cases, you can identify these statements by forward-looking words, such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” "would," "can," “could,” “predict,” and “continue,” the negative or plural of these words and other comparable terminology. All forward-looking statements included in this Form 10-K are based upon information available to us as of the filing date of this Form 10-K, and we undertake no obligation to update any of these forward-looking statements for any reason. You should not place undue reliance on forward-looking statements. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include the matters discussed in the section entitled “Part I — Item 1A — Risk Factors” in this Form 10-K, and elsewhere in this Form 10-K. You should carefully consider the risks and uncertainties described in this Form 10-K.

PART I

Item 1. | Business |

We are a leading food and beverage company and the largest processor and direct-to-store distributor of fresh fluid milk and other dairy and dairy case products in the United States, with a vision to be the most admired and trusted provider of wholesome, great-tasting dairy products at every occasion.

We manufacture, market and distribute a wide variety of branded and private label dairy and dairy case products, including fluid milk, ice cream, cultured dairy products, creamers, ice cream mix and other dairy products to retailers, distributors, foodservice outlets, educational institutions and governmental entities across the United States. Our portfolio includes DairyPure®, the country's first and largest fresh, white milk national brand, and TruMoo®, the leading national flavored milk brand, along with well-known regional dairy brands such as Alta Dena ®, Berkeley Farms ®, Country Fresh ®, Dean’s ®, Friendly's ®, Garelick Farms ®, LAND O LAKES ® milk and cultured products (licensed brand), Lehigh Valley Dairy Farms ®, Mayfield ®, McArthur ®, Meadow Gold®, Oak Farms ®, PET ® (licensed brand), T.G. Lee ®, Tuscan ® and more. In all, we have more than 50 national, regional and local dairy brands, as well as private labels. With our acquisition of Uncle Matt's Organic, Inc., which was completed on June 22, 2017, we now sell and distribute organic juice, probiotic-infused juices, and fruit-infused waters under the Uncle Matt's Organic® brand. Additionally, we are party to the Organic Valley Fresh joint venture which distributes organic milk under the Organic Valley ® brand to retailers. Dean Foods also makes and distributes ice cream, cultured products, juices, teas and bottled water. Due to the perishable nature of our products, we deliver the majority of our products directly to our customers’ locations in refrigerated trucks or trailers that we own or lease. We believe that we have one of the most extensive refrigerated direct-to-store delivery ("DSD") systems in the United States. We sell our products primarily on a local or regional basis through our local and regional sales forces, and in some instances, with the assistance of national brokers. Some national customer relationships are coordinated by our centralized corporate sales department or national brokers.

Unless stated otherwise, any reference to income statement items in this Form 10-K refers to results from continuing operations. Each of the terms "we," "us," "our," "the Company," and "Dean Foods" refers collectively to Dean Foods Company and its wholly-owned subsidiaries unless the context indicates otherwise.

Our principal executive offices are located at 2711 North Haskell Avenue, Suite 3400, Dallas, Texas 75204. Our telephone number is (214) 303-3400. We maintain a web site at www.deanfoods.com. We were incorporated in Delaware in 1994.

1

Developments Since January 1, 2017

Management Changes — Effective January 1, 2017, Ralph Scozzafava, formerly Executive Vice President and Chief Operating Officer, was promoted to Chief Executive Officer and appointed to the Company’s Board of Directors. Gregg A. Tanner stepped down as Chief Executive Officer of the Company and resigned from his position as a member of the Company’s Board of Directors, effective January 1, 2017. Mr. Tanner continued to serve in an advisory capacity as an employee of the Company through the Annual Stockholders Meeting in May 2017.

Chris Bellairs, our former Executive Vice President and Chief Financial Officer, departed the Company effective September 1, 2017. Kimberly Warmbier, our former Executive Vice President, Human Resources, departed the Company effective December 1, 2017. Jose Motta, the Company's former Vice President of Total Rewards, was promoted to Senior Vice President, Human Resources following Ms. Warmbier's departure. Effective February 27, 2018, Jody L. Macedonio will join the Company as our Executive Vice President and Chief Financial Officer.

Organic Valley Fresh Joint Venture — In the third quarter of 2017, we commenced the operations of our previously announced 50/50 strategic joint venture with Cooperative Regions of Organic Producer Pools (“CROPP”), an independent farmer cooperative that distributes organic milk and other organic dairy products under the Organic Valley ® brand. The joint venture, called Organic Valley Fresh, combines our processing plants and refrigerated DSD system with CROPP's portfolio of recognized brands and products, marketing expertise, and access to an organic milk supply from America's largest cooperative of organic dairy farmers to bring the Organic Valley ® brand to retailers. See Note 3 to our Consolidated Financial Statements for additional information regarding our Organic Valley Fresh Joint Venture.

Uncle Matt's Organic Acquisition — On June 22, 2017, we completed the acquisition of Uncle Matt's Organic, Inc. ("Uncle Matt's") for an aggregate purchase price of $22.0 million. Uncle Matt's is a leading organic juice company offering a wide range of organic juices, including probiotic-infused juices and fruit-infused waters. See Note 2 to our Consolidated Financial Statements for additional information regarding the Uncle Matt's acquisition.

Investment in Good Karma — On May 4, 2017, we acquired a non-controlling interest in, and entered into a distribution agreement with, Good Karma Foods, Inc. (“Good Karma”), the leading producer of flax-based milk and yogurt products. This investment allows us to diversify our portfolio to include plant-based dairy alternatives and provides Good Karma the ability to more rapidly expand distribution across the U.S., as well as increase investments in brand building and product innovation. See Note 3 to our Consolidated Financial Statements for additional information regarding our investment in Good Karma.

Amendment to Senior Secured Revolving Credit Facility — On January 4, 2017, we amended the credit agreement (the "Credit Agreement") governing our senior secured revolving credit facility (the "Credit Facility") to, among other things, extend the maturity date of the Credit Facility to January 4, 2022, modify certain financial covenants and modify certain other terms. Please see "Part II — Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources" for additional information regarding the amendment.

Amendment to Receivables Securitization Facility — On January 4, 2017, we amended the credit agreement governing our receivables securitization facility to, among other things, extend the liquidity termination date to January 4, 2020, reduce the maximum size of the receivables securitization facility to $450 million, modify certain financial covenants to be consistent with the amended leverage ratio covenant under the Credit Agreement described above, and to modify certain other terms. Please see "Part II — Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources" for additional information regarding the amendment.

2

Overview

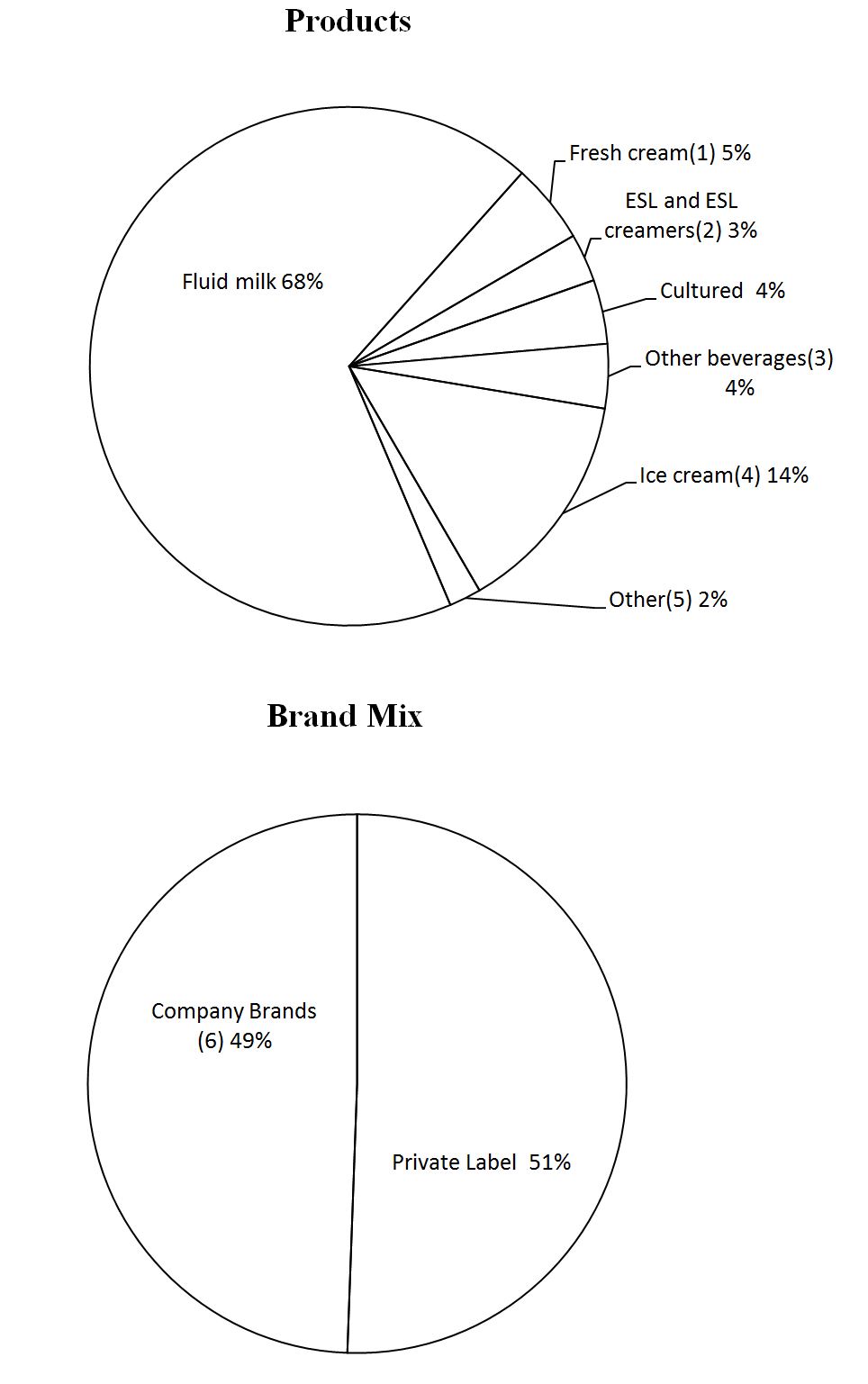

We manufacture, market and distribute a wide variety of branded and private label dairy and dairy case products, including fluid milk, ice cream, cultured dairy products, creamers, ice cream mix and other dairy products to retailers, distributors, foodservice outlets, educational institutions and governmental entities across the United States. Our consolidated net sales totaled $7.8 billion in 2017. The following charts depict our 2017 net sales by product and product sales mix between company branded versus private label.

(1) | Includes half-and-half and whipping cream. |

(2) | Includes creamers and other extended shelf-life fluids. |

(3) | Includes fruit juice, fruit flavored drinks, iced tea and water. |

(4) | Includes ice cream, ice cream mix and ice cream novelties. |

(5) | Includes items for resale such as cream, butter, cheese, eggs and milkshakes. |

(6) | Includes all national, regional and local brands. |

3

We sell our products under national, regional and local proprietary or licensed brands. Products not sold under these brands are sold under a variety of private labels. We sell our products primarily on a local or regional basis through our local and regional sales forces, although some national customer relationships are coordinated by a centralized corporate sales department. Our largest customer is Walmart Inc., including its subsidiaries such as Sam’s Club, which accounted for approximately 17.5% of our net sales for the year ended December 31, 2017.

Our brands include DairyPure®, the country's first and largest fresh, white milk national brand, and TruMoo®, the leading national flavored milk brand. As of December 31, 2017, our national, local and regional proprietary and licensed brands included the following:

Alta Dena® | Hygeia® | Over the Moon® |

Arctic Splash® | Jilbert™ | PET® (licensed brand) |

Barbers Dairy® | Knudsen® (licensed brand) | Pog® (licensed brand) |

Barbe’s® | LAND O LAKES® (licensed brand) | Price’s™ |

Berkeley Farms® | Land-O-Sun & design® | Purity™ |

Broughton™ | Lehigh Valley Dairy Farms® | ReadyLeaf® |

Brown Cow® | Louis Trauth Dairy Inc.® | Reiter™ |

Brown’s Dairy® | Mayfield® | Robinson™ |

Caribou® (licensed brand) | McArthur® | Schepps® |

Chug® | Meadow Brook® | Sonora™ |

Country Fresh™ | Meadow Gold® | Steve's® |

Country Love® | Mile High Ice Cream™ | Stroh’s® |

Creamland™ | Model Dairy® | Swiss Dairy™ |

DairyPure® | Morning Glory® | Swiss Premium™ |

Dean’s® | Nature’s Pride® | TruMoo® |

Fieldcrest® | Nurture® | T.G. Lee® |

Friendly's® | Nutty Buddy® | Turtle Tracks® |

Fruit Rush® | Oak Farms® | Tuscan® |

Gandy’s™ | Orchard Pure® | Uncle Matt's Organic® |

Garelick Farms® | Organic Valley® (licensed by joint venture) | Viva® |

We currently operate 65 manufacturing facilities in 31 states located largely based on customer needs and other market factors, with distribution capabilities across all 50 states. For more information about our facilities, see “Item 2. Properties.” Due to the perishable nature of our products, we deliver the majority of our products directly to our customers’ locations in refrigerated trucks or trailers that we own or lease. This form of delivery is called a “direct-to-store delivery” or “DSD” system. We believe that we have one of the most extensive refrigerated DSD systems in the United States.

The primary raw material used in our products is conventional raw milk (which contains both raw skim milk and butterfat) that we purchase primarily from farmers’ cooperatives, as well as from independent farmers. The federal government and certain state governments set minimum prices for raw skim milk and butterfat on a monthly basis. Another significant raw material we use is resin, which is a fossil fuel-based product used to make plastic bottles. The price of resin fluctuates based on changes in crude oil and natural gas prices. Other raw materials and commodities used by us include diesel fuel, used to operate our extensive DSD system, and juice concentrates and sweeteners used in our products. We generally increase or decrease the prices of our private label fluid dairy products on a monthly basis in correlation with fluctuations in the costs of raw materials, packaging supplies and delivery costs. We manage the pricing of our branded fluid milk products on a longer-term basis, balancing consumer demand with net price realization but, in some cases, we are subject to the terms of sales agreements with respect to the means and/or timing of price increases.

We have several competitors in each of our major product and geographic markets. Competition between dairy processors for shelf-space with retailers is based primarily on price, service, quality and the expected or historical sales performance of the product compared to its competitors’ products. In some cases we pay fees to customers for shelf-space. Competition for consumer sales is based on a variety of factors such as price, taste preference, quality and brand recognition. Dairy products also compete with many other beverages and nutritional products for consumer sales. Additionally, we face competitive pressures from vertically integrated retailers, discount supermarket chains, dairy cooperatives and other processors, and online and delivery grocery retailers.

4

The fluid milk category enjoys a number of attractive attributes. This category’s size and pervasiveness, plus the limited shelf life of the product, make it an important category for retailers and consumers, as well as a large long-term opportunity for the best positioned dairy processors. However, the dairy industry is not without some well documented challenges. It is a mature industry that has traditionally been characterized as highly competitive and subject to commodity volatility, with low profit margins. Additionally, according to the U.S. Department of Agriculture ("USDA"), consumption of fluid milk continues to decline.

For more information on factors that could impact our business, see “— Government Regulation — Milk Industry Regulation” and “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties — Conventional Raw Milk and Other Inputs.” See Note 19 to our Consolidated Financial Statements for segment, geographic and customer information.

Current Business Strategy

Dean Foods has evolved over the past 20 years through periods of rapid acquisition, consolidation, integration and the separation of our operations including the spin-off of The WhiteWave Foods Company ("WhiteWave") and sale of Morningstar Foods ("Morningstar") in 2013. Today, we are a leading food and beverage company and the largest processor and direct-to-store distributor of fresh fluid milk and other dairy and dairy case products in the United States.

Our vision is to be the most admired and trusted provider of wholesome, great-tasting dairy products at every occasion. Our strategy is to invest and grow our portfolio of brands while strengthening our operations and capabilities to achieve a more profitable core business. Our strategy is anchored by the following five pillars and is underscored by our commitments to safety, quality and service, and delivering sustainable profit growth and total shareholder return:

Build and Buy Strong Brands:

• | Build our existing brands with consumer-led innovation, marketing, and logistical excellence. |

• | Evaluate and consider strategic opportunities. |

• | Diversify our portfolio in adjacent categories. |

Win in Private Label:

• | Enhance our profitability by lowering our internal costs, partnering with our customers and driving standard practices across our business. |

• | Enhance our profitability by strategically targeting key customers and channels. |

Deliver Operational Excellence:

• | Reset our cost structure through the execution of our enterprise-wide cost productivity plan, including rescaling our supply chain, optimizing spend management and integrating our operating model. |

• | Consolidate our manufacturing and distribution network to better align with our current and projected volumes. |

Transform Go To Market:

• | Expand our reach and ability to meet evolving consumer needs. |

• | More profitably serve customers through new delivery and production capabilities. |

• | Drive efficiency through standardized business principles and customer collaboration. |

Enhance Future Capabilities:

• | Foster an engaged and aligned organization that has a consumer mindset. |

• | Improve processes, technology and infrastructure to enable cross-functional decision-making that creates opportunities to build our business. |

Corporate Responsibility

Within our business strategies, corporate responsibility remains an integral part of our efforts. As we work to strengthen our business, we are committed to do it in a way that is right for our employees, shareholders, consumers, customers, suppliers and the environment. We intend to realize savings by reducing waste and duplication while we continue to support programs that improve our local communities. We believe that our customers, consumers and suppliers value our efforts to operate in an ethical, environmentally sustainable, and socially responsible manner.

5

Seasonality

Our business is affected by seasonal changes in the demand for dairy products. Sales volumes are typically higher in the fourth quarter due to increased dairy consumption during seasonal holidays. Fluid milk volumes tend to decrease in the second and third quarters of the year primarily due to the reduction in dairy consumption associated with our school customers, partially offset by the increase in ice cream and ice cream mix consumption during the summer months. Because certain of our operating expenses are fixed, fluctuations in volumes and revenue from quarter to quarter may have a material effect on operating income for the respective quarters.

Intellectual Property

We are continually developing new technology and enhancing existing proprietary technology related to our dairy operations. Seven U.S. and eight international patents have been issued to us and five U.S. and two international patent applications are pending. Our U.S. patents are expected to expire at various dates between February 2019 and December 2035. If the pending U.S. patent applications are granted, those patents would be expected to expire at various dates between June 2035 and October 2037. Our international patents are expected to expire at various dates between February 2028 and March 2030. If the pending international patent applications are granted, those patents would be expected to expire in September 2037.

We primarily rely on a combination of trademarks, copyrights, trade secrets, confidentiality procedures and contractual provisions to protect our technology and other intellectual property rights. Despite these protections, it may be possible for unauthorized parties to copy, obtain or use certain portions of our proprietary technology or trademarks.

Research and Development

Our total research and development ("R&D") expense was $3.5 million, $3.0 million and $2.3 million for 2017, 2016 and 2015, respectively. Our R&D activities primarily consist of generating and testing new product concepts, new flavors of products and packaging.

Employees

As of December 31, 2017, we had approximately 16,000 employees. Approximately 37% of our employees participate in a multitude of collective bargaining agreements of varying duration and terms.

Government Regulation

Food-Related Regulations

As a manufacturer and distributor of food products, we are subject to a number of food-related regulations, including the Federal Food, Drug and Cosmetic Act and regulations promulgated thereunder by the U.S. Food and Drug Administration (“FDA”). This comprehensive regulatory framework governs the manufacture (including composition and ingredients), labeling, packaging and safety of food in the United States. The FDA:

• | regulates manufacturing practices for foods through its current good manufacturing practices regulations; |

• | specifies the standards of identity for certain foods, including many of the products we sell; and |

• | prescribes the format and content of certain information required to appear on food product labels. |

We are also subject to the Food Safety Modernization Act of 2011, which, among other things, mandates the FDA to adopt preventative controls to be implemented by food facilities in order to minimize or prevent hazards to food safety. In addition, the FDA enforces the Public Health Service Act and regulations issued thereunder, which authorizes regulatory activity necessary to prevent the introduction, transmission or spread of communicable diseases. These regulations require, for example, pasteurization of milk and milk products. We are subject to numerous other federal, state and local regulations involving such matters as the licensing and registration of manufacturing facilities, enforcement by government health agencies of standards for our products, inspection of our facilities and regulation of our trade practices in connection with the sale of food products.

We use quality control laboratories in our manufacturing facilities to test raw ingredients. In addition, all of our facilities have achieved Safety Quality Food ("SQF") Level 3 under the Global Food Safety Initiative. Product quality and freshness are essential to the successful distribution of our products. To monitor product quality at our facilities, we maintain quality control programs to test products during various processing stages. We believe our facilities and manufacturing practices are in material compliance with all government regulations applicable to our business.

6

Employee Safety Regulations

We are subject to certain safety regulations, including regulations issued pursuant to the U.S. Occupational Safety and Health Act. These regulations require us to comply with certain manufacturing safety standards to protect our employees from accidents. We believe that we are in material compliance with all employee safety regulations applicable to our business.

Environmental Regulations

We are subject to various state and federal environmental laws, regulations and directives, including the Food Quality Protection Act of 1996, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Federal Insecticide, Fungicide and Rodenticide Act and the Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended. Our plants use a number of chemicals that are considered to be “extremely” hazardous substances pursuant to applicable environmental laws due to their toxicity, including ammonia, which is used extensively in our operations as a refrigerant. Such chemicals must be handled in accordance with such environmental laws. Also, on occasion, certain of our facilities discharge biodegradable wastewater into municipal waste treatment facilities in excess of levels allowed under local regulations. As a result, certain of our facilities are required to pay wastewater surcharges or to construct wastewater pretreatment facilities. To date, such wastewater surcharges and construction costs have not had a material effect on our financial condition or results of operations.

We maintain above-ground and under-ground petroleum storage tanks at many of our facilities. We periodically inspect these tanks to determine whether they are in compliance with applicable regulations and, as a result of such inspections, we are required to make expenditures from time to time to ensure that these tanks remain in compliance. In addition, upon removal of the tanks, we are sometimes required to make expenditures to restore the site in accordance with applicable environmental laws. To date, such expenditures have not had a material effect on our financial condition or results of operations.

We believe that we are in material compliance with the environmental regulations applicable to our business. We do not expect the cost of our continued compliance to have a material impact on our capital expenditures, earnings, cash flows or competitive position in the foreseeable future. In addition, any asset retirement obligations are not material.

Milk Industry Regulation

The federal government establishes minimum prices that we must pay to producers in federally regulated areas for raw milk. Raw milk primarily contains raw skim milk in addition to a small percentage of butterfat. Raw milk delivered to our facilities is tested to determine the percentage of butterfat and other milk components, and we pay our suppliers for the raw milk based on the results of these tests.

The federal government’s minimum prices for Class I milk vary depending on the processor’s geographic location or sales area and the type of product manufactured. Federal minimum prices change monthly. Class I butterfat and raw skim milk prices (which are the minimum prices we are required to pay for raw milk that is processed into Class I products such as fluid milk) and Class II raw skim milk prices (which are the minimum prices we are required to pay for raw milk that is processed into Class II products such as cottage cheese, creams, creamers, ice cream and sour cream) for each month are announced by the federal government the immediately preceding month. Class II butterfat prices are announced either at the end of the month or the first week of the following month in which the price is effective. Some states have established their own rules for determining minimum prices for raw milk. In addition to the federal or state minimum prices, we also may pay producer premiums, procurement costs and other related charges that vary by location and supplier.

Labeling Regulations

We are subject to various labeling requirements with respect to our products at the federal, state and local levels. At the federal level, the FDA has authority to review product labeling, and the U.S. Federal Trade Commission (“FTC”) may review labeling and advertising materials, including online and television advertisements, to determine if advertising materials are misleading. Similarly, many states review dairy product labels to determine whether they comply with applicable state laws. We believe we are in material compliance with all labeling laws and regulations applicable to our business.

We are also subject to various state and local consumer protection laws.

7

Where You Can Get More Information

Our fiscal year ends on December 31. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission.

You may read and copy any reports, statements or other information that we file with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. You can request copies of these documents, upon payment of a duplicating fee, by writing to the Securities and Exchange Commission. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

We file our reports with the Securities and Exchange Commission electronically through the Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system. The Securities and Exchange Commission maintains an Internet site that contains reports, proxy and information statements and other information regarding companies that file electronically with the Securities and Exchange Commission through EDGAR. The address of this Internet site is http://www.sec.gov.

We also make available free of charge through our website at www.deanfoods.com our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating such information by reference into, this Form 10-K.

Our Code of Ethics is applicable to all of our employees and directors. Our Code of Ethics is available on our corporate website at www.deanfoods.com, together with the Corporate Governance Principles of our Board of Directors and the charters of the Audit, Compensation and Nominating/Corporate Governance Committees of our Board of Directors. Any waivers that we may grant to our executive officers or directors under the Code of Ethics, and any amendments to our Code of Ethics, will be posted on our corporate website. If you would like hard copies of any of these documents, or of any of our filings with the Securities and Exchange Commission, write or call us at:

Dean Foods Company

2711 North Haskell Avenue, Suite 3400

Dallas, Texas 75204

(214) 303-3400

Attention: Investor Relations

Item 1A. Risk Factors

Business, Competitive and Strategic Risks

The continuing shift from branded to private label products could continue to negatively impact our profit margin.

We are experiencing a continuing shift from branded to private label products. Retailers continue to aggressively price their private label milk to drive foot traffic, which has been increasing the price gap between branded and private label milk. We believe this negatively affects our branded product sales as customers trade down to private label products. This trend could be accelerated by the continued expansion of deep discount supermarket retailers, such as Aldi and Lidl, in the U.S. market. These factors have negatively impacted and could continue to impact our mix and margins, which could materially adversely affect our profitability.

Volume softness in the dairy category, combined with our volume losses, has had a negative impact on our sales and profits.

Industry-wide volume softness across dairy product categories, particularly within fluid milk, continued in 2017. Decreasing dairy category volume has increased the impact of declining margins on our business. Periods of declining volumes limit the cost and price increases that we can seek to recapture. We expect volume softness to continue in the future. In addition, in recent years, we have experienced volume losses and declines in historical volumes from some of our largest customers, which has negatively impacted our sales and profitability and which will continue to have a negative impact in the future if we are not able to reduce costs quickly enough to offset the lost volume and attract and retain a profitable customer and product mix.

8

Our results of operations and financial condition depend heavily on commodity prices and the availability of raw materials and other inputs. Our failure or inability to respond to high or fluctuating input prices could adversely affect our profitability.

Our results of operations and financial condition depend heavily on the cost and supply of raw materials and other inputs including conventional raw milk, butterfat, cream and other dairy commodities, many of which are determined by constantly changing market forces of supply and demand over which we have limited or no control. Cost increases in raw materials and other inputs could cause our profitability to decrease significantly compared to prior periods, as we may be unwilling or unable to increase our prices or unable to achieve cost savings to offset the increased cost of these raw materials and other inputs.

Although we generally pass through the cost of dairy commodities to our customers over time, we believe demand destruction can occur at certain price levels, and we may be unwilling or unable to pass through the cost of dairy commodities, which could materially and adversely affect our profitability. Dairy commodity prices can be affected by adverse weather conditions (including the impact of climate change) and natural disasters, such as floods, droughts, frost, fires, earthquakes and pestilence, which can lower crop and dairy yields and reduce supplies of these ingredients or increase their prices.

Our profitability also depends on the cost and supply of non-dairy raw materials and other inputs, such as sweeteners, petroleum-based products, diesel fuel, resin and other non-dairy food ingredients.

Our dairy and non-dairy raw materials are generally sourced from third parties, and we are not assured of continued supply, pricing or sufficient access to raw materials from any of these suppliers. Damage to our suppliers' manufacturing, transportation or distribution capabilities could impair our ability to make, transport, distribute or sell our products. Other events that adversely affect our suppliers and that are out of our control could also impair our ability to obtain the raw materials and other inputs that we need in the quantities and at the prices that we desire. Such events include adverse weather conditions (including climate change) or natural disasters, government action, or problems with our suppliers’ businesses, finances, labor relations, costs, production, insurance, reputation and international demand and supply characteristics.

If we are unable to obtain raw materials and other inputs for our products or offset any increased costs for such raw materials and inputs, our business could be negatively affected. While we may enter into forward purchase contracts and other purchase arrangements with suppliers and may purchase over-the-counter contracts with our qualified banking partners or exchange-traded commodity futures contracts for raw materials, these arrangements do not eliminate the risk of negative impacts on our business, financial condition and results of operations from commodity price changes.

We may not realize anticipated benefits from our enterprise-wide cost productivity plan, and we may not complete this plan within our projected time frames, either of which could materially adversely impact our business, financial condition, results of operations and cash flows.

We are executing an aggressive enterprise-wide cost productivity plan to significantly overhaul and reset our cost structure. We believe these cost savings measures are necessary to offset our volume deleverage and position our business for future success and growth. Our future success and earnings depend upon our ability to realize the benefit of our cost reduction activities and rationalization plans, particularly in an environment of increased competitive activity, volume pressures, and reduced profitability. Inflation, declining volumes and competitive pricing pressures have negated, and may continue to negate, some of the impact of our cost saving efforts. In addition, several factors could cause our cost productivity plan to adversely affect our business, financial condition, results of operations and cash flows. These include potential disruption of our operations and other aspects of our business and significant investments required to execute the plan. Employee morale and productivity could also suffer and result in unintended employee attrition. Our cost productivity plan will require substantial management time and attention and may divert management from other important work. In addition, certain of our cost reduction activities have led to increased costs in other aspects of our business such as increased conversion or distribution costs. For example, in connection with our plant closures, our cost of distribution on a per gallon basis has increased as we have changed distribution routes and transported product into areas previously serviced by now closed plants. If we fail to properly anticipate and mitigate the ancillary cost increases related to our plant closures or other cost savings, we may not realize the benefits of our cost productivity plan.

In addition, we must execute our plans within our projected timelines in order to meet our financial projections and to remain competitive in the marketplace. We could encounter delays in executing our plans, which could cause further disruption and additional unanticipated expense. If we are unable to realize the anticipated benefits from our cost productivity plan or complete them within the targeted time frame, we may be unable to meet our financial projections, or realize the necessary cost savings to offset the anticipated impact from our volume deleverage and cost inflation. In addition, we could be cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease. Depending on the extent of the decline in our financial results and our financial and cash flow projections, we may also incur tangible or intangible asset impairment charges in future periods.

9

Our volume, sales and profits have been, and may continue to be, negatively impacted by the outcome of competitive bidding.

Many of our retail customers have become increasingly price sensitive and investing in private label, which has intensified the competitive environment in which we operate. As a result, we have been subject to a number of competitive bidding situations, both formal and informal, which have materially reduced our sales volumes and profitability on sales to several customers. We expect this trend of competitive bidding to continue. In oder to win business in such a competitive environment, we may have to replace existing or lost volume with lower margin business, which could also negatively impact our profitability. Additionally, this competitive environment may result in us serving an increasing number of small format customers, which may raise the costs of production and distribution, and negatively impact the profitability of our business. If we are unable to structure our business to appropriately respond to the pricing demands of our customers, we may lose customers to other processors that are willing to sell product at a lower cost, which could negatively impact our volume, sales and profits.

Price concessions to retailers have negatively impacted, and could continue to negatively impact, our operating margins and profitability.

In the past, retailers have at times required price concessions that have negatively impacted our margins, and continued pressures to make such price concessions could negatively impact our profitability in the future. If we are not able to lower our cost structure adequately in response to customer pricing demands, and if we are not able to attract and retain a profitable customer mix and a profitable product mix, our profitability could continue to be adversely affected.

We may be adversely impacted by a changing customer and consumer landscape.

Many of our customers, such as supermarkets, warehouse clubs and food distributors, have consolidated. This consolidation may continue. These consolidations have produced large, more sophisticated customers with increased buying power and negotiating strength, who may seek lower prices or more favorable terms, and they have increased our dependence on key large-format retailers and discount supermarket retailers. In addition, some of these customers are vertically integrated and have re-dedicated key shelf-space that was formerly occupied by our branded products for their private label products. We are also facing downward pricing pressure from retailers, such as discount supermarket retailers, who sell their own private label products and proprietary brands. In addition to the competitive pressures from retail customers, we are facing increased competition from dairy cooperatives and other processors.

The highly competitive retail fluid milk and broader grocery industries are facing additional future uncertainties as a result of the rise of discount supermarket chains, online and delivery grocery offerings, meal kit services, and other mechanisms of food delivery. These developments may trigger significant changes in pricing competition, and the grocery industry, as well as consumer buying patterns, the effects and timing of which are currently unknown.

Higher levels of price competition and higher resistance to price increases have had a significant impact on our business. If we are unable to respond to these customer dynamics and potential future changes in the customer landscape, our business or financial results could be materially adversely affected.

Our ability to generate positive cash flow and profits will depend partly on our successful execution of our business strategy.

Our ability to generate positive cash flow and profits will depend partly on our successful execution of our business strategy. Our business strategy may require significant capital investment and management attention, which may result in the diversion of these resources from other business issues and opportunities. Additionally, the successful implementation of our current business strategy is subject to our ability to manage costs and expenses and implement our enterprise-wide cost productivity plan, our ability to develop new and innovative products, the success of continuing improvement initiatives, our ability to leverage processing and logistical efficiencies, our consumers’ demand for our brands and products, the effectiveness of our advertising and targeting of consumers and channels, the availability of favorable acquisition opportunities and our ability to attract and retain qualified management and other personnel. There can be no assurance that we will be able to successfully implement our business strategy. If we cannot successfully execute our business strategy, our business, financial condition and results of operations may be adversely impacted.

10

The success of our business strategy depends upon our ability to build our brands.

Building strong brands is a key component of our business strategy in order to expand sales and volumes and to respond to the changing customer landscape. With the launch of our national brands, DairyPure® and TruMoo®, we have expanded from a regional branding strategy to a national branding strategy. We have incurred, and may continue to incur in the future, significant expenditures for advertising and marketing campaigns in an effort to build brand awareness and preference over other private label products. We may not be successful in our efforts to expand our regional brand presence to a national brand presence, and we cannot guarantee that our advertising and marketing campaigns will result in customer or consumer acceptance of our brands. Further, the success of our national branding strategy requires us to drive operational changes in order to have a national brand footprint. If these efforts are unsuccessful or we incur substantial costs in connection with these efforts, our business, operating results and financial condition could be adversely affected.

The loss of, or a material reduction or change in the mix of sales volumes purchased by, any of our largest customers could negatively impact our sales and profits.

Walmart Inc. and its subsidiaries, including Sam’s Club, accounted for approximately 17.5% and 16.7% of our consolidated net sales in 2017 and 2016, respectively, and our top five customers, including Walmart, collectively accounted for approximately 32% and 31% of our consolidated net sales in 2017 and 2016, respectively. In connection with Walmart Inc.’s dairy processing plant in Indiana, we expect to lose approximately 60 million gallons of private label fluid milk volume beginning in the second half of 2018, which equates to approximately 100 to 110 million gallons annually. In addition, we expect marketplace volume and mix challenges to continue in 2018, including those associated with our largest customer.

We are also indirectly exposed to the financial and business risks of our largest customers because, if their business declines, they may correspondingly decrease the volumes purchased from us. The loss of, or further declines or changes in the mix of sales volumes purchased by, any of our largest customers could negatively impact our sales and profits, particularly due to our significant fixed costs and assets, which are difficult to rapidly reduce in response to significant volume declines.

The failure to successfully identify, consummate and integrate acquisitions into our existing operations could adversely affect our financial results.

We regularly evaluate acquisitions and other strategic opportunities as part of our business strategy. We face significant competition from numerous other bidders, many of which may have greater financial resources to allocate for acquisition opportunities. Accordingly, attractive acquisition opportunities may not be available to us or may be available only at higher cost or valuations. If we are unable to identify suitable acquisition candidates or successfully consummate the acquisitions and integrate the businesses we acquire, our business strategy may not succeed.

Additionally, the acquisitions that we complete may involve potential risks, including:

•diversion of management’s attention from other business concerns;

•inability to achieve anticipated benefits from these acquisitions in the timeframe we anticipate, or at all;

• | inherent risks in entering geographic locations, markets or lines of business in which we have limited prior experience; |

• | inability to integrate the new operations, technologies and products of the acquired companies successfully with our existing businesses; |

• | increased leverage and higher interest expense associated with borrowings that may be required to fund these acquisitions; |

• | potential disruption of our ongoing business; |

•potential loss of key employees and customers of the acquired companies;

•possible assumption of unknown liabilities; and

•potential disputes with the sellers.

Moreover, merger and acquisition activities are subject to antitrust and competition laws, which have impacted, and may continue to impact, our ability to pursue strategic transactions.

Any or all of these risks could materially adversely impact our business and financial results.

If we fail to anticipate and respond to changes in consumer preferences, demand for our products could decline.

Consumer tastes, preferences and consumption habits evolve over time and are difficult to predict. Demand for our products depends on our ability to identify and offer products that appeal to these shifting preferences. Factors that may affect consumer tastes and preferences include:

11

• | dietary trends and increased attention to nutritional values, such as the sugar, fat, protein or calorie content of different foods and beverages; |

• | concerns regarding the health effects of specific ingredients and nutrients, such as dairy, sugar and other sweeteners, vitamins and minerals; |

• | concerns regarding the public health consequences associated with obesity, particularly among young people; and |

• | increasing awareness of the environmental and social effects of product production. |

If we fail to anticipate and respond to these changes and trends, we may experience reduced consumer demand for our products, which in turn could adversely affect our sales volumes and our business could be negatively affected.

Our business operations could be disrupted and the liquidity and market price of our securities could decline if our information technology systems fail to perform adequately or experience a security breach.

We maintain a large database of confidential information and sensitive data in our information technology systems, including confidential employee, supplier and customer information, and accounting, financial and other data on which we rely for internal and external financial reporting and other purposes. In addition, the efficient operation of our business depends on our information technology systems. We rely on our information technology systems, including those of third parties, to effectively manage our business data, communications, supply chain, logistics, accounting and other business processes. If we do not allocate and effectively manage the resources necessary to build and sustain an appropriate technology environment, our business or financial results could be negatively impacted. In addition, our information technology systems and those of third parties are vulnerable to damage or interruption from circumstances beyond our control, including systems failures, viruses, security breaches or cyber incidents such as ransomware, intentional cyber attacks aimed at theft of sensitive data or inadvertent cyber-security compromises. A security breach of such information or failure of our information technology systems or those of third parties that we rely on could result in damage to our reputation, negatively impact our relations with our customers or employees, and expose us to liability and litigation. Moreover, a security breach or failure of our information systems could also result in the alteration, corruption or loss of the accounting, financial or other data on which we rely for internal and external financial reporting and other purposes and, depending on the severity of the security breach or systems failure, could prevent the audit of our financial statements or our internal control over financial reporting from being completed on a timely basis or at all, or could negatively impact the resulting audit opinions. Any such damage or interruption, or alteration, corruption or loss, could have a material adverse effect on our business or could cause our securities to become less liquid and the market price of our securities to decline.

We may incur liabilities or harm to our reputation, or be forced to recall products, as a result of real or perceived product quality or other product-related issues.

We sell products for human consumption, which involves a number of risks. Product contamination, spoilage, other adulteration, misbranding, mislabeling, or product tampering could require us to recall products. We also may be subject to liability if our products or operations violate applicable laws or regulations, including environmental, health and safety requirements, or in the event our products cause injury, illness or death. In addition, our product advertising could make us the target of claims relating to false or deceptive advertising under U.S. federal and state laws, including the consumer protection statutes of some states, or laws of other jurisdictions in which we operate. A significant product liability, consumer fraud or other legal judgment against us or a widespread product recall may negatively impact our sales, brands, reputation and profitability. Moreover, claims or liabilities of this sort might not be covered by insurance or by any rights of indemnity or contribution that we may have against others. Even if a product liability, consumer fraud or other claim is found to be without merit or is otherwise unsuccessful, the negative publicity surrounding such assertions regarding our products or processes could materially and adversely affect our reputation and brand image, particularly in categories that consumers believe as having strong health and wellness credentials. Further, the risks to our reputation and brand image are more susceptible on a national scale as a result of our expansion from a regional branded platform to a national branded platform. In addition, consumer preferences related to genetically modified foods, animal proteins, or the use of certain sweeteners could result in negative publicity and adversely affect our reputation. Any loss of consumer confidence in our product ingredients or in the safety and quality of our products would be difficult and costly to overcome and could have a material adverse effect on our business.

12

Disruption of our supply or distribution chains or transportation systems could adversely affect our business.

Our ability to make, move and sell our products is critical to our success. Damage or disruption to our manufacturing or distribution capabilities due to weather (including the impact of climate change), natural disaster, fire, environmental incident, terrorism (including eco-terrorism and bio-terrorism), pandemic, strikes, the financial or operational instability of key suppliers, distributors, warehousing and transportation providers, or other reasons could impair our ability to manufacture or distribute our products. If we are unable, or it is not financially feasible, to mitigate the likelihood or potential impact of such events, our business and results of operations could be negatively affected and additional resources could be required to restore our supply chain. In addition, we are subject to federal motor carrier regulations, such as the Federal Motor Carrier Safety Act, with which our extensive DSD system must comply. Failure to comply with such regulations could result in our inability to deliver product to our customers in a timely manner, which could adversely affect our reputation and our results.

Failure to maintain sufficient internal production capacity or to enter into co-packing agreements on terms that are beneficial for us may result in our inability to meet customer demand and/or increase our operating costs.

The success of our business depends, in part, on maintaining a strong production platform and we rely on internal production resources and third-party co-packers to fulfill our manufacturing needs. As part of our ongoing cost reduction efforts, we have closed or announced the closure of a number of our plants since late 2012. It is possible that we may need to increase our reliance on third parties to provide manufacturing and supply services, commonly referred to as “co-packing” agreements, for a number of our products. In particular, there is increasing consumer preference for certain sized extended shelf life (“ESL”) products in certain categories and, as a result of the Morningstar divestiture, we are contractually limited in our ability to manufacture ESL products. In such case, we must rely on our co-packers. A failure by our co-packers to comply with food safety, environmental, or other laws and regulations may disrupt our supply of products and cause damage to the reputation of our brand. If we need to enter into additional co-packing agreements in the future, we can provide no assurance that we would be able to find acceptable third-party providers or enter into agreements on satisfactory terms. Our inability to establish satisfactory co-packing arrangements could limit our ability to operate our business and could negatively affect our sales volumes and results of operations. If we cannot maintain sufficient production capacity, either internally or through third-party agreements, we may be unable to meet customer demand and/or our manufacturing costs may increase, which could negatively affect our business.

If we are unable to hire, retain and develop our leadership bench, or fail to develop and implement an adequate succession plan for current leadership positions, it could have a negative impact on our business.

Our continued and future success depends partly upon our ability to hire, retain and develop our leadership bench. Effective succession planning is also a key factor in our long-term success. Any unplanned turnover or failure to develop or implement an adequate succession plan to backfill key leadership positions could deplete our institutional knowledge base and erode our competitive advantage. Our failure to enable the effective transfer of knowledge or to facilitate smooth transitions with regard to key leadership positions, including the upcoming onboarding of Jody Macedonio as CFO, could adversely affect our long-term strategic planning and execution and negatively affect our business, financial condition and results of operations.

Our existing debt and other financial obligations may restrict our business operations and we may incur even more debt.

We have substantial debt and other financial obligations and significant unused borrowing capacity. We may incur additional debt in the future. In addition to our other financial obligations, on December 31, 2017, we had $918.9 million of long-term debt obligations, excluding unamortized discounts and debt issuance costs of $5.7 million. On February 21, 2018, we had the ability to borrow up to a combined additional $576.6 million of combined future borrowing capacity under our Credit Facility and receivables securitization facility, subject to compliance with certain conditions.

We have pledged substantially all of our assets, other than real property, to secure our Credit Facility. Our debt and related debt service obligations could:

• | require us to dedicate significant cash flow to the payment of principal and interest on our debt, which reduces the funds we have available for other purposes, including for funding working capital, capital expenditures, and acquisitions and for other general corporate purposes; |

• | limit our flexibility in planning for or reacting to changes in our business and market conditions; |

• | impose on us additional financial and operational restrictions, including restrictions on our ability to, among other things, incur additional indebtedness, create liens, guarantee obligations, undertake acquisitions or sales of assets, declare dividends and make other specified restricted payments, and make investments; and |

• | place us at a competitive disadvantage compared to businesses in our industry that have less debt or that are debt-free. |

13

To the extent that we incur additional indebtedness in the future, these limitations would likely have a greater impact on our business. Failure to make required payments on our debt or comply with the financial covenants or any other non-financial or restrictive covenants set forth in the agreements governing our debt could create a default and cause a downgrade to our credit rating. Upon a default, our lenders could accelerate the indebtedness, foreclose against their collateral or seek other remedies, which would jeopardize our ability to continue our current operations. In those circumstances, we may be required to amend the agreements governing our debt, refinance all or part of our existing debt, sell assets, incur additional indebtedness or raise equity. Our ability to make scheduled payments on our debt and other financial obligations and comply with financial covenants depends on our financial and operating performance, which in turn, is subject to various factors such as prevailing economic conditions and to financial, business and other factors, some of which are beyond our control. See “Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Current Debt Obligations” for more information.

The Tax Cuts and Jobs Act signed into law on December 22, 2017 could have a negative effect on our financial condition and results of operations.

Legislative or other actions relating to taxes could have a negative effect on the Company. The rules dealing with U.S. federal income taxation are constantly under review by persons involved in the legislative process and by the Internal Revenue Service ("IRS") and the U.S. Treasury Department. The Tax Cuts and Jobs Act (the “Tax Act”), which was signed into law in December 2017, made comprehensive changes to the U.S. tax code affecting tax years 2017 and thereafter. Among other things, the Tax Act reduces the U.S. federal corporate income tax rate from 35% to 21%, imposes a mandatory one-time transition tax on unrepatriated foreign earnings, enhances the acceleration of depreciation deductions on qualified property, changes the U.S. taxation of foreign earnings and eliminates certain business deductions. The legislation is unclear in certain respects and will require interpretations and implementing regulations by the IRS, as well as state tax authorities, and the legislation could be subject to potential amendments and technical corrections, any of which could lessen or increase certain adverse impacts of the legislation. It is also uncertain how credit rating agencies will treat the impacts of this legislation on their credit ratings and metrics. While there are benefits, there is substantial uncertainty regarding the details of the Tax Act. The intended and unintended consequences of the Tax Act on our business and on holders of our common stock is uncertain and could be adverse. For example, the tax reform legislation enacted a new provision that in general allows farmers a 20% deduction on all payments received on sales to cooperatives. This new deduction could increase our cost of raw milk purchased directly from farmers or make it more difficult to find direct farm sources of supply and could also indirectly impact our other commodity costs.

We cannot predict with certainty how the Tax Act or any other changes in the tax laws might affect the Company or its stockholders. The new legislation and any U.S. Treasury regulations, administrative interpretations or court decisions interpreting such legislation could significantly and negatively affect U.S. federal income tax consequences to the Company and its stockholders.

We may need additional financing in the future, and we may not be able to obtain that financing.

From time to time, we may need additional financing to support our business and pursue our growth strategy, including strategic acquisitions. Our ability to obtain additional financing, if and when required, will depend on investor demand, our operating performance, the condition of the capital markets, and other factors. We cannot assure you that additional financing will be available to us on favorable terms when required, or at all. If we are unable to obtain additional financing in the future, our business, financial condition, and operations could be materially adversely affected.

Risks Related to Our Common Stock

Our Board of Directors could change our dividend policy at any time.

In November 2013, our Board of Directors adopted a dividend policy under which we intend to pay quarterly cash dividends on our common stock. Under this policy, holders of our common stock will receive dividends when and as declared by our Board of Directors. Pursuant to this policy, we paid quarterly dividends of $0.09 per share ($0.36 per share annually) during 2017. However, we are not required to pay dividends and our stockholders do not have contractual or other legal rights to receive them. Any determination to pay cash dividends on our common stock in the future may be affected by business conditions, our views on potential future capital requirements, the terms of our debt instruments, legal risks, changes in federal income tax law and challenges to our business model. Furthermore, our Board of Directors may decide at any time, in its discretion, not to pay a dividend, to decrease the amount of dividends or to change or revoke the dividend policy entirely. If we do not pay dividends, for whatever reason, shares of our common stock could become less liquid and the market price of our common stock could decline.

14

Our stock price is volatile and may decline regardless of our operating performance, and you could lose a significant part of your investment.

The market price of our common stock has historically been volatile and in the future may be influenced by many factors, some of which are beyond our control, including those described in this section and the following:

• | changes in financial estimates by analysts or our inability to meet those financial estimates; |

• | strategic actions by us or our competitors, such as acquisitions, restructurings, significant contracts, acquisitions, joint marketing relationships, joint ventures or capital commitments; |

• | variations in our quarterly results of operations and those of our competitors; |

• | general economic and stock market conditions; |

• | changes in conditions or trends in our industry, geographies or customers; |

• | terrorist acts; |

• | activism by any large stockholder or group of stockholders; |

• | perceptions of the investment opportunity associated with our common stock relative to other investment alternatives; |

• | actual or anticipated growth rates relative to our competitors; and |

• | speculation by the investment community regarding our business. |

In addition, the stock markets, including the New York Stock Exchange, have experienced price and volume fluctuations that have affected and continue to affect the market prices of equity securities issued by many companies, including companies in our industry. In the past, some companies that have had volatile market prices for their securities have been subject to class action or derivative lawsuits or shareholder activism. The filing of a lawsuit against us or shareholder activism targeted toward us, regardless of the outcome, could have a negative effect on our business, financial condition and results of operations, as it could result in substantial legal costs and a diversion of management’s attention and resources.

These market and industry factors may materially reduce the market price of our common stock, regardless of our operating performance. This volatility may increase the risk that our stockholders will suffer a loss on their investment or be unable to sell or otherwise liquidate their holdings of our common stock.

Capital Markets and General Economic Risks

Future funding requirements, withdrawal liabilities and related charges associated with multiemployer plans in which we participate could have a material negative impact on our business.

In addition to our company-sponsored pension plans, we participate in certain multiemployer defined benefit pension plans that are administered jointly by labor unions representing certain of our employees and multiple employers like us that have employees participating in the plan. We make periodic contributions to these multiemployer pension plans in accordance with the provisions of negotiated collective bargaining agreements. Our required contributions to these plans could increase due to a number of factors, including the funded status of the plans and the level of our ongoing participation in these plans. Underfunding is not a direct obligation or liability of ours or any employer, but is likely to have important consequences. Our risk of such increased payments may be greater if any of the participating employers in these underfunded plans withdraws from the plan due to insolvency and is not able to contribute an amount sufficient to fund the unfunded liabilities associated with its participants in the plan. In the event that we decide to withdraw from participation in one of these multiemployer plans, we could be required to make additional lump-sum contributions to the relevant plan. These withdrawal liabilities may be significant and could materially adversely affect our business and our financial results.

Some of the plans in which we participate are reported to have significant underfunded liabilities, which could increase the amount of any potential withdrawal liability. This requires us to potentially make substantial withdrawal liability payments when we close a facility covered by one of these plans, which could hinder our ability to make otherwise appropriate management decisions to operate as efficiently as possible. In addition, under the Pension Protection Act of 2006 and the Multi-Employer Pension Reform Act of 2014, special funding rules apply to multiemployer pension plans that are classified as “endangered,” “seriously endangered,” “critical,” or "critical and declining" status. Some of the plans in which we participate are in critical or critical and declining status, and we have been required to make additional contributions and may be subject to additional contributions in the future. We are subject to substantial withdrawal liability with respect to a number of multiemployer pension plans in which we participate. Our greatest potential withdrawal liability is related to the Central States, Southeast and Southwest Areas Pension Fund, which is in “critical and declining” status and has been for a number of years based on that plan's annual

15

Form 5500 filings, meaning it was less than 65% funded. The plan is currently projected to become insolvent in 2025. It is unclear what will happen to this plan in the future, and the effects and consequences of the plan’s insolvency are currently unknown. Future funding requirements and related charges associated with multiemployer plans in which we participate could have a material negative impact on our results of operations, financial condition and cash flows.

The costs of providing employee benefits have escalated, and liabilities under certain plans may be triggered due to our actions or the actions of others, which may adversely affect our profitability and liquidity.

We sponsor various defined benefit and defined contribution retirement plans, as well as contribute to various multiemployer pension plans on behalf of our employees. Changes in interest rates or in the market value of plan assets could affect the funded status of our pension plans. This could cause volatility in our benefits costs and increase future funding requirements of our plans. Pension and post-retirement costs also may be significantly affected by changes in key actuarial assumptions including anticipated rates of return on plan assets and the discount rates used in determining the projected benefit obligation and annual periodic pension costs. Recent changes in federal laws require plan sponsors to eliminate, over defined time periods, the underfunded status of plans that are subject to the Employee Retirement Income Security Act rules and regulations. Certain of our defined benefit retirement plans are less than fully funded. Facility closings may trigger cash payments or previously unrecognized obligations under our defined benefit retirement plans, and the costs of such liabilities may be significant or may compromise our ability to close facilities or otherwise conduct cost reduction initiatives on time and within budget. A significant increase in future funding requirements could have a negative impact on our results of operations, financial condition and cash flows. In addition to potential changes in funding requirements, the costs of maintaining our pension plans are impacted by various factors including increases in healthcare costs and legislative changes.

Changes in our credit ratings may have a negative impact on our future financing costs or the availability of capital.

Some of our debt is rated by Standard & Poor’s, Moody’s Investors Service and Fitch Ratings, and there are a number of factors beyond our control with respect to these ratings. Our credit ratings are currently considered to be below “investment grade.” Although the interest rate on our existing credit facilities is not affected by changes in our credit ratings, such ratings or any further rating downgrades may impair our ability to raise additional capital in the future on terms that are acceptable to us, if at all, may cause the value of our securities to decline and may have other negative implications with respect to our business. Ratings reflect only the views of the ratings agency issuing the rating, are not recommendations to buy, sell or hold our securities and may be subject to revision or withdrawal at any time by the ratings agency issuing the rating. Each rating should be evaluated independently of any other rating.

Unfavorable economic conditions may adversely impact our business, financial condition and results of operations.