Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kennedy-Wilson Holdings, Inc. | a8kq4earningsrelease201712.htm |

Kennedy-Wilson Holdings, Inc.

Supplemental Financial Information

Fourth Quarter and Full Year December 31, 2017

TABLE OF CONTENTS

Supplemental Financial Information (unaudited) | ||

Components of Value | ||

Components of Value Summary | ||

All Property Investment Summary by Ownership | ||

Multifamily Investment Detail | ||

Commercial Investment Detail | ||

Unstabilized and Development Detail | ||

Other Portfolio and Financial Information | ||

Appendix | ||

Cover

The property depicted on the cover of this earnings release and supplemental financial information is 90 East, an office property in

Issaquah, Washington.

Certain terms used in this release are defined below under the caption "Common Definitions". Certain information included in this release constitutes non-GAAP financial measures. For a definition of the non-GAAP financial measures used in this release, see "Common Definitions" below, and for a reconciliation of those measures to their most comparable GAAP measure, see the tables set forth in the Company's supplemental financial information included in this release and also available at www.kennedywilson.com.

| ||

Contact: Daven Bhavsar, CFA | ||

Director of Investor Relations | ||

(310) 887-3431 | ||

dbhavsar@kennedywilson.com | 151 S. El Camino Drive | |

www.kennedywilson.com | Beverly Hills, CA 90212 | |

KENNEDY WILSON REPORTS 4Q AND FULL YEAR 2017 RESULTS

Company posts record quarterly and annual EPS, Adjusted EBITDA, and Adjusted Net Income

BEVERLY HILLS, Calif. (February 22, 2018) - Kennedy-Wilson Holdings, Inc. (NYSE: KW) today reported the following results for the fourth quarter and full year of 2017:

4Q | Full Year | |||||||||||||

(Amounts in millions, except per share data) | 2017 | 2016 | 2017 | 2016 | ||||||||||

GAAP Results | ||||||||||||||

GAAP Net Income to Common Shareholders | $ | 99.2 | $ | 14.4 | $ | 100.5 | $ | 2.8 | ||||||

Per Diluted Share | 0.69 | 0.13 | 0.83 | 0.01 | ||||||||||

Non-GAAP Results | ||||||||||||||

Adjusted EBITDA | $ | 200.6 | $ | 116.9 | $ | 455.7 | $ | 349.9 | ||||||

Adjusted Net Income | 113.9 | 64.7 | 242.5 | 191.3 | ||||||||||

*GAAP Net Income to Common Shareholders includes a one-time tax benefit of $44.8 million, or $0.32 per share for 4Q-2017 and $0.38 per share for FY-2017, recorded in 4Q-2017. This one-time tax benefit is excluded from Adjusted EBITDA and Adjusted Net Income.

"Q4 capped off a year of outstanding financial results including record levels of GAAP EPS, Adjusted Net Income and Adjusted EBITDA. While successfully executing our core business plan, we also completed the acquisition of Kennedy Wilson Europe that we expect will grow our recurring cash flows by $100 million per year and enhance our flexibility to execute on all compelling real estate opportunities," said William McMorrow, chairman and CEO of Kennedy Wilson. "Entering 2018, Kennedy Wilson is well positioned to grow our existing portfolio, our development pipeline and our investment management platforms globally.”

4Q & Full Year Highlights

• | KWE Acquisition: On October 20, 2017, Kennedy Wilson successfully completed the acquisition of Kennedy Wilson Europe Real Estate Plc ("KWE"). KWE, which was previously 24% owned by KW, became a wholly-owned subsidiary of the Company as a result of the transaction. |

• | In-place Estimated Annual NOI Growth: The Company's estimated annual NOI from its stabilized portfolio grew by 72% to $439 million from $254 million on December 31, 2016, an increase of $185 million. |

• | Development and Unstabilized NOI: The Company expects to add approximately $35 million in estimated annual NOI by the end of 2019 as it completes development initiatives and the stabilization of certain assets. |

3

• | Capex Investment: During 2017, the Company invested $186 million into value-add and development capex initiatives globally, with significant capex projects taking place across approximately 20% of its global property portfolio. |

•Strong Same Property Performance Across Multifamily: The 4Q and FY change in same property results are as follows:

4Q - 2017 vs 4Q - 2016 | FY - 2017 vs FY - 2016 | |||||||||

Occupancy | Revenue | NOI | Occupancy | Revenue | NOI | |||||

Multifamily - Market Rate | 0.1% | 6.0% | 8.6% | —% | 5.9% | 6.9% | ||||

Multifamily - Affordable | (1.4)% | 3.7% | 4.3% | (0.8)% | 4.1% | 6.0% | ||||

Commercial | (0.6)% | 2.9% | —% | (0.4)% | (0.2)% | (1.9)% | ||||

Hotel | NA | 5.7% | 9.8% | NA | 9.3% | 25.0% | ||||

Weighted Average | 5.0% | 3.6% | 4.1% | 3.0% | ||||||

*Please see additional footnotes at the end of the earnings release

• | Capital Recycling: In November 2017, the Company sold Summer House, a wholly-owned 615-unit apartment community built in 1966 in Alameda, CA, for $231 million, representing the nation's largest single-asset multifamily transaction in 2017. The Company recorded a gain on sale of $105 million. On a 1031 tax deferred basis, the Company then invested the sale proceeds into two multifamily assets in greater Portland, Oregon and one multifamily asset in Issaquah, Washington built on average in 2009 for a combined purchase price of $246 million. |

• | Gains: The Company's pro-rata share of total gains in 4Q-2017 was $153 million, an increase of $62 million from 4Q-2016, and $265 million in FY-2017, an increase of $81 million from 2016: |

◦ | Realized Gains: The Company had realized gains on sale of real estate of $145 million, an increase of $76 million in 4Q-2017 (vs. 4Q-2016). For FY-2017, the Company had realized gains on sale of real estate of $256 million, an increase of $131 million (vs. FY-2016). |

◦ | Acquisition-related and Fair Value Gains: The Company had acquisition-related and fair value gains of $8 million, a decrease of $14 million in 4Q-2017 (vs 4Q-2016). For FY-2017, the Company had acquisition-related and fair value gains of $8 million, a decrease of $51 million (vs FY-2016). |

Impact of Tax Reform

• | In 4Q-2017, the Company recorded a one-time $44.8 million tax benefit associated with the remeasurement of deferred tax assets and liabilities as a result of the US Tax Cuts and Jobs Act of 2017. |

$3.2 Billion in Investment Activity

• | Investment Transactions: The Company, together with its equity partners, completed the following: |

4

($ in millions) | Gross | Kennedy Wilson's Share | |||||||||||||||||||

4Q - 2017 | Aggregate Purchase/Sale Price | Income Producing | Non-income Producing | Total | NOI | KW Cap Rate on Stabilized(1) | KW Cap Rate on All | ||||||||||||||

Acquisitions(2) | $386.0 | $330.9 | $2.5 | $333.4 | $ | 14.6 | 4.7% | 4.4% | |||||||||||||

Dispositions(3) | 615.6 | 396.9 | 15.5 | 412.4 | 21.2 | 5.3% | 5.1% | ||||||||||||||

Total Transactions | $1,001.6 | $ | 745.8 | ||||||||||||||||||

FY - 2017 | |||||||||||||||||||||

Acquisitions(2) | $1,287.4 | $739.8 | $23.2 | $763.0 | $ | 41.2 | 5.7% | 5.4% | |||||||||||||

Dispositions(3) | 1,880.1 | 661.2 | 152.3 | 813.5 | 35.5 | 5.4% | 4.4% | ||||||||||||||

Total Transactions | $3,167.5 | $1,576.5 | |||||||||||||||||||

* Excludes the acquisition of KWE by KW. Please see additional footnotes at the end of the earnings release.

Investment Management and Real Estate Services Business

This segment earns fees primarily from its investment management business along with its real estate services activities.

• | Fund V: To date, Kennedy Wilson Real Estate Fund V has made 21 separate investments and acquired more than $1 billion in value-add office, multifamily, retail and hospitality investments across the Western U.S. |

• | Adjusted Fees: For the quarter, adjusted fees were lower by $8.4 million compared to 4Q-2016 due to the reduction in KWE management fees and the sale of the Company's loan servicing platform in Spain. The Company is also exploring strategic alternatives for its research and technology division. |

Balance Sheet and Liquidity

• | KWE Acquisition Consideration: On October 20, 2017, the Company purchased the remaining 76% of KWE shares it did not previously own for $1.4 billion, which represented a discount of approximately $260 million to the original value of the shares when issued. As part of the acquisition consideration, the Company issued 37.2 million shares of common stock valued at $722.2 million. Due to KWE's previous consolidation by KW, the carrying value of the remaining 76% non-controlling interest in KWE was $1.1 billion, which included the cumulative effects of depreciation and foreign currency losses. As a result of paying a premium above carrying value, Kennedy-Wilson Holdings, Inc. shareholders' equity only increased by $322.4 million. |

• | Senior Notes Redemption: On December 1, 2017, the Company redeemed at par all $55 million in aggregate principal amount of its 7.75% Senior Notes due 2042. |

• | Share Repurchase Program: From September 30, 2017 through February 21, 2018, the Company has repurchased and retired 2.1 million shares for an average purchase price of $17.96 per share. |

• | Corporate Credit Facility: In October, the Company closed a $700 million unsecured credit facility comprised of a $500 million revolving line of credit and a $200 million term loan facility that has an initial maturity date of March 31, 2021 with a one-year extension (subject to certain conditions precedent). Concurrent with the closing of this new facility, the Company refinanced its previous $475 million corporate unsecured revolving credit facility and terminated KWE's previous £225 million revolving credit facility. As of December 31, 2017, the Company had $100 million drawn on its revolving line of credit along with the $200 million term loan facility. |

5

• | Debt Profile: As of December 31, 2017, Kennedy Wilson had a weighted average interest rate of 3.8%, a weighted average remaining maturity of 6.4 years, and approximately 69% of total debt (at share) is fixed with another 11% hedged against long term increases in rates. The Company has less than 12% of its share of debt maturing before 2021. |

• | Liquidity: As of December 31, 2017, the Company had $751 million of liquidity, including cash of $351 million and $400 million of undrawn capacity on its revolving line of credit. |

Foreign Currency Fluctuations and Hedging

For 4Q-2017 and FY-2017, changes in foreign currency rates increased consolidated revenue by 5% and 3%, respectively and Adjusted EBITDA by 3% and 2%, respectively, compared to foreign currency rates as of December 31, 2016. During the quarter and year, the net (decrease) increase in Kennedy Wilson's shareholder's equity related to fluctuations in foreign currency and related hedges (in the GBP, EUR and JPY) was $(12.2) million and $14.5 million, respectively.

6

Footnote for same property results table

(1) Please see definition of "Same Property" in the common definitions section below.

Footnotes for investment transactions table

(1) KW Cap rate includes only stabilized income-producing properties. Please see "common definitions" for a definition of cap rate.

(2) The three months ended and year ended December 31, 2017 includes $76.3 million and $76.3 million of acquisitions by KWE, respectively.

(3) The three months ended and year ended December 31, 2017 includes $152.2 million and $271.9 million of dispositions by KWE, respectively.

Conference Call and Webcast Details

Kennedy Wilson will hold a live conference call and webcast to discuss results at 7:00 a.m. PT/ 10:00 a.m. ET on Friday, February 23. The direct dial-in number for the conference call is (844) 340-4761 for U.S. callers and (412) 717-9616 for international callers.

A replay of the call will be available for one week beginning two hours after the live call and can be accessed by (877) 344-7529 for U.S. callers and (412) 317-0088 for international callers. The passcode for the replay is 10116432.

The webcast will be available at: https://services.choruscall.com/links/kw180223DaxhpXtw.html. A replay of the webcast will be available one hour after the original webcast on the Company’s investor relations web site for three months.

About Kennedy Wilson

Kennedy Wilson (NYSE:KW) is a leading global real estate investment company. We own, operate, and invest in real estate both on our own and through our investment management platform. We focus on multifamily and office properties located in the Western U.S., UK, and Ireland. For further information on Kennedy Wilson, please visit www.kennedywilson.com.

7

Forward-Looking Statements

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are necessarily estimates reflecting the judgment of our senior management based on our current estimates, expectations, forecasts and projections and include comments that express our current opinions about trends and factors that may impact future operating results. Disclosures that use words such as "believe," "anticipate," "estimate," "intend," "may," "could," "plan," "expect," "project" or the negative of these, as well as similar expressions, are intended to identify forward-looking statements. These statements are not guarantees of future performance, rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievement, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. For example, our estimated recurring cash flows from our acquisition of KWE is a forward-looking statement that represents our current expectations and is subject to many uncertainties that can result in actual recurring cash flows being significantly less than our current estimate. The risks and uncertainties relating to our forward-looking statements may include the factors and the risks and uncertainties described elsewhere in this report and other filings with the Securities and Exchange Commission (the "SEC"), including the Item 1A. "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2016, as amended by our subsequent filings with the SEC. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed in our filings with the SEC. Except as required under the federal securities laws and the rules and regulations of the SEC, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

Common Definitions

· “KWH,” "KW," “Kennedy Wilson,” the "Company," "we," "our," or "us" refers to Kennedy-Wilson Holdings, Inc. and its wholly-owned subsidiaries. The consolidated financial statements of the Company include the results of the Company's consolidated subsidiaries.

· “KWE” refers to Kennedy Wilson Europe Real Estate plc, which was a London Stock Exchange-listed company that we externally managed through a wholly-owned subsidiary. On October 20, 2017 we acquired KWE, which is now a wholly-owned subsidiary. Prior to the acquisition, we owned approximately 24% and in accordance with U.S. GAAP, the results of KWE were consolidated in our financial statements due to our role as asset manager.

· | "Acquisition-related gains" consist of non-cash gains recognized by the Company or its consolidated subsidiaries upon a GAAP -required fair value measurement due to a business combination. These gains are typically recognized when a loan is converted into consolidated real estate owned and the fair value of the underlying real estate at the time of conversion exceeds the basis in the previously held loan. These gains also arise when there is a change of control of an investment. The gain amount is based upon the fair value of the Company’s or its consolidated subsidiaries' equity in the investment in excess of the carrying amount of the equity immediately preceding the change of control. |

· “Adjusted EBITDA” represents net income before interest expense, our share of interest expense included in income from investments in unconsolidated investments, depreciation and amortization, our share of depreciation and amortization included in income from unconsolidated investments, loss on early extinguishment of corporate debt and income taxes, share-based compensation expense for the Company and EBITDA attributable to noncontrolling interests.

Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com. Our management uses Adjusted EBITDA to analyze our

8

business because it adjusts net income for items we believe do not accurately reflect the nature of our business going forward or that relate to non-cash compensation expense or noncontrolling interests. Such items may vary for different companies for reasons unrelated to overall operating performance. Additionally, we believe Adjusted EBITDA is useful to investors to assist them in getting a more accurate picture of our results from operations. However, Adjusted EBITDA is not a recognized measurement under GAAP and when analyzing our operating performance, readers should use Adjusted EBITDA in addition to, and not as an alternative for, net income as determined in accordance with GAAP. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, Adjusted EBITDA is not intended to be a measure of free cash flow for our management’s discretionary use, as it does not remove all non-cash items (such as acquisition-related gains) or consider certain cash requirements such as tax and debt service payments. The amount shown for Adjusted EBITDA also differs from the amount calculated under similarly titled definitions in our debt instruments, which are further adjusted to reflect certain other cash and non-cash charges and are used to determine compliance with financial covenants and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

· “Adjusted fees’’ refers to Kennedy Wilson’s gross investment management, property services and research fees adjusted to include fees eliminated in consolidation and Kennedy Wilson’s share of fees in unconsolidated service businesses. Our management uses Adjusted fees to analyze our investment management and real estate services business because the measure removes required eliminations under GAAP for properties in which the Company provides services but also has an ownership interest. These eliminations understate the economic value of the investment management, property services and research fees and makes the Company comparable to other real estate companies that provide investment management and real estate services but do not have an ownership interest in the properties they manage. Our management believes that adjusting GAAP fees to reflect these amounts eliminated in consolidation presents a more holistic measure of the scope of our investment management and real estate services business.

· “Adjusted Net Income” represents net income before depreciation and amortization, our share of depreciation and amortization included in income from unconsolidated investments, share-based compensation, the tax impact of the recently enacted tax reform and net income attributable to noncontrolling interests, before depreciation and amortization. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· “Cap rate” represents the net operating income of an investment for the year preceding its acquisition or disposition, as applicable, divided by the purchase or sale price, as applicable. Cap rates set forth in this presentation only includes data from income-producing properties. We calculate cap rates based on information that is supplied to us during the acquisition diligence process. This information is often not audited or reviewed by independent accountants and may be presented in a manner that is different from similar information included in our financial statements prepared in accordance with GAAP. In addition, cap rates represent historical performance and are not a guarantee of future NOI. Properties for which a cap rate is provided may not continue to perform at that cap rate.

· "Consolidated investment account" refers to the sum of Kennedy Wilson’s equity in: cash held by consolidated investments, consolidated real estate and acquired in-place leases gross of accumulated depreciation and amortization, net hedge asset or liability, unconsolidated investments, consolidated loans, and net other assets.

· "Equity partners" refers to non-wholly-owned subsidiaries that we consolidate in our financial statements under U.S. GAAP and third party equity providers.

· "Estimated annual NOI" is a property-level non-GAAP measure representing the estimated annual net operating income from each property as of the date shown, inclusive of rent abatements (if applicable). The calculation excludes depreciation and amortization expense, and does not capture the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures, tenant improvements, and leasing commissions necessary to maintain the operating performance of our properties. Any of the enumerated items above could have a material effect on the performance of our properties. Also, where specifically noted, for properties purchased in 2017, the NOI represents estimated Year 1 NOI from our original underwriting. Estimated year 1 NOI for properties purchased in 2017 may not be indicative of the actual results for those properties. Estimated annual NOI is not an indicator of the actual annual net operating income that the Company will or

9

expects to realize in any period. Please also see the definition of "Net operating income" below. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors.

· | "Gross Asset Value” refers to the gross carrying value of assets, before debt, depreciation and amortization, and net of noncontrolling interests. |

· "Investment account” refers to the consolidated investment account presented after noncontrolling interest on invested assets gross of accumulated depreciation and amortization.

· | "Investment Management and Real Estate Services Assets under Management" ("IMRES AUM") generally refers to the properties and other assets with respect to which we provide (or participate in) oversight, investment management services and other advice, and which generally consist of real estate properties or loans, and investments in joint ventures. Our IMRES AUM is principally intended to reflect the extent of our presence in the real estate market, not the basis for determining our management fees. Our IMRES AUM consists of the total estimated fair value of the real estate properties and other real estate related assets either owned by third parties, wholly owned by us or held by joint ventures and other entities in which our sponsored funds or investment vehicles and client accounts have invested. Committed (but unfunded) capital from investors in our sponsored funds is not included in our IMRES AUM. The estimated value of development properties is included at estimated completion cost. |

· | "KW Cap Rate” represents the Cap Rate (as defined above) weighted by the Company’s ownership interest in the underlying investments. Cap rates set forth in this presentation includes data only from income-producing properties. We calculate cap rates based on information that is supplied to us during the acquisition diligence process. This information is often not audited or reviewed by independent accountants and may be presented in a manner that is different from similar information included in our financial statements prepared in accordance with GAAP. In addition, cap rates represent historical performance and are not a guarantee of future NOI. Properties for which a cap rate is provided may not continue to perform at that cap rate. |

· "Net operating income" or "NOI” is a non-GAAP measure representing the income produced by a property calculated by deducting operating expenses from operating revenues. Our management uses net operating income to assess and compare the performance of our properties and to estimate their fair value. Net operating income does not include the effects of depreciation or amortization or gains or losses from the sale of properties because the effects of those items do not necessarily represent the actual change in the value of our properties resulting from our value-add initiatives or changing market conditions. Our management believes that net operating income reflects the core revenues and costs of operating our properties and is better suited to evaluate trends in occupancy and lease rates.

· "Noncontrolling interests" represents the portion of equity ownership in a consolidated subsidiary not attributable to Kennedy Wilson.

· "Pro-Rata" represents Kennedy Wilson's share calculated by using our proportionate economic ownership of each asset in our portfolio, including our approximate 24% ownership in KWE prior to our acquisition of KWE. Please also refer to the pro-rata financial data in our supplemental financial information.

· "Property net operating income" or "Property NOI" is a non-GAAP measure calculated by deducting the Company's Pro-Rata share of rental and hotel operating expenses from the Company's Pro-Rata rental and hotel revenues.

· “Same property” refers to properties in which Kennedy Wilson has an ownership interest during the entire span of both periods being compared. The same property information presented throughout this report is shown on a

10

cash basis and excludes non-recurring expenses. This analysis excludes properties that are either under development or undergoing lease up as part of our asset management strategy.

Note about Non-GAAP and certain other financial information included in this presentation

In addition to the results reported in accordance with U.S. generally accepted accounting principles ("GAAP") included within this presentation, Kennedy Wilson has provided certain information, which includes non-GAAP financial measures (including Adjusted EBITDA, Adjusted Net Income, and Adjusted Fees, as defined above). Such information is reconciled to its closest GAAP measure in accordance with the rules of the SEC, and such reconciliations are included within this presentation. These measures may contain cash and non-cash acquisition-related gains and expenses and gains and losses from the sale of real-estate related investments. Consolidated non-GAAP measures discussed throughout this report contain income or losses attributable to non-controlling interests. Management believes that these non-GAAP financial measures are useful to both management and Kennedy Wilson's shareholders in their analysis of the business and operating performance of the Company. Management also uses this information for operational planning and decision-making purposes. Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measures. Additionally, non-GAAP financial measures as presented by Kennedy Wilson may not be comparable to similarly titled measures reported by other companies. Annualized figures used throughout this release and supplemental financial information, including annualized net operating income, are not an indicator of the actual net operating income that the Company will or expects to realize in any period.

KW-IR

Tables Follow

11

Kennedy-Wilson Holdings, Inc.

Consolidated Balance Sheets

(Unaudited)

(Dollars in millions)

December 31, | ||||||||

2017 | 2016 | |||||||

Assets | ||||||||

Cash and cash equivalents | $ | 351.3 | $ | 885.7 | ||||

Accounts receivable | 62.7 | 44.0 | ||||||

Real estate and acquired in place lease values (net of accumulated depreciation and amortization of $552.2 and $374.3) | 6,443.7 | 5,814.2 | ||||||

Loan purchases and originations | 84.7 | 87.7 | ||||||

Unconsolidated investments | 486.4 | 555.6 | ||||||

Other assets | 296.0 | 269.4 | ||||||

Total assets | $ | 7,724.8 | $ | 7,656.6 | ||||

Liabilities | ||||||||

Accounts payable | $ | 19.5 | $ | 11.2 | ||||

Accrued expenses and other liabilities | 465.9 | 412.1 | ||||||

Mortgage debt | 3,156.6 | 2,770.4 | ||||||

KW unsecured debt | 1,179.4 | 934.1 | ||||||

KWE unsecured bonds | 1,325.9 | 1,185.7 | ||||||

Total liabilities | 6,147.3 | 5,313.5 | ||||||

Equity | ||||||||

Common Stock | — | — | ||||||

Additional paid-in capital | 1,883.3 | 1,231.4 | ||||||

Accumulated deficit | (90.6 | ) | (112.2 | ) | ||||

Accumulated other comprehensive loss | (427.1 | ) | (71.2 | ) | ||||

Total Kennedy-Wilson Holdings, Inc. shareholders’ equity | 1,365.6 | 1,048.0 | ||||||

Noncontrolling interests | 211.9 | 1,295.1 | ||||||

Total equity | 1,577.5 | 2,343.1 | ||||||

Total liabilities and equity | $ | 7,724.8 | $ | 7,656.6 | ||||

12

Kennedy-Wilson Holdings, Inc.

Consolidated Statements of Operations

(Unaudited)

(Dollars in millions, except per share data)

For the Three Months Ended | For the Year Ended | |||||||||||||||

December 31, | December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Revenue | ||||||||||||||||

Rental | $ | 131.1 | $ | 122.8 | $ | 504.7 | $ | 485.9 | ||||||||

Hotel | 31.7 | 28.9 | 127.5 | 116.2 | ||||||||||||

Sale of real estate | 8.1 | 12.6 | 111.5 | 29.3 | ||||||||||||

Investment management, property services, and research fees | 10.4 | 12.7 | 51.7 | 59.4 | ||||||||||||

Loan purchases, loan originations, and other | 0.2 | 3.4 | 15.2 | 12.6 | ||||||||||||

Total revenue | 181.5 | 180.4 | 810.6 | 703.4 | ||||||||||||

Operating expenses | ||||||||||||||||

Rental operating | 40.7 | 37.0 | 151.2 | 135.4 | ||||||||||||

Hotel operating | 27.0 | 24.4 | 100.3 | 96.3 | ||||||||||||

Cost of real estate sold | 6.5 | 9.0 | 80.2 | 22.1 | ||||||||||||

Commission and marketing | 1.3 | 2.0 | 7.2 | 8.0 | ||||||||||||

Compensation and related | 63.7 | 58.1 | 177.2 | 186.5 | ||||||||||||

General and administrative | 11.5 | 12.9 | 42.2 | 45.4 | ||||||||||||

Depreciation and amortization | 55.3 | 50.9 | 212.5 | 198.2 | ||||||||||||

Total operating expenses | 206.0 | 194.3 | 770.8 | 691.9 | ||||||||||||

Income from unconsolidated investments | 20.2 | 67.3 | 69.0 | 126.6 | ||||||||||||

Operating (loss) income | (4.3 | ) | 53.4 | 108.8 | 138.1 | |||||||||||

Non-operating income (expense) | ||||||||||||||||

Gain on sale of real estate | 149.7 | 54.7 | 226.7 | 130.7 | ||||||||||||

Acquisition-related gains | — | — | — | 16.2 | ||||||||||||

Acquisition-related expenses | (2.1 | ) | (0.1 | ) | (4.4 | ) | (9.5 | ) | ||||||||

Interest expense | (58.8 | ) | (49.9 | ) | (217.7 | ) | (191.6 | ) | ||||||||

Other income (loss) | 3.7 | (1.0 | ) | 8.3 | 6.6 | |||||||||||

Income before benefit from (provision for) income taxes | 88.2 | 57.1 | 121.7 | 90.5 | ||||||||||||

Benefit from (provision for) income taxes | 17.2 | (11.9 | ) | 16.3 | (14.0 | ) | ||||||||||

Net income | 105.4 | 45.2 | 138.0 | 76.5 | ||||||||||||

Net (income) attributable to the noncontrolling interests | (6.2 | ) | (29.6 | ) | (37.5 | ) | (70.9 | ) | ||||||||

Preferred dividends and accretion of preferred stock issuance costs | — | (1.2 | ) | — | (2.8 | ) | ||||||||||

Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | $ | 99.2 | $ | 14.4 | $ | 100.5 | $ | 2.8 | ||||||||

Basic and diluted earnings per share (1) | ||||||||||||||||

Income per basic and diluted | $ | 0.69 | $ | 0.13 | $ | 0.83 | $ | 0.01 | ||||||||

Weighted average shares outstanding for basic and diluted | 140,490,974 | 109,479,528 | 119,147,192 | 109,094,530 | ||||||||||||

Dividends declared per common share | $ | 0.19 | $ | 0.14 | $ | 0.70 | $ | 0.56 | ||||||||

(1) Includes impact of the Company allocating income and dividends per basic and diluted share to participating securities.

13

Kennedy-Wilson Holdings, Inc.

Adjusted EBITDA

(Unaudited)

(Dollars in millions)

The table below reconciles Adjusted EBITDA to net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders, using Kennedy Wilson’s pro-rata share amounts for each adjustment item.

Three Months Ended | Year Ended | |||||||||||||||

December 31, | December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | $ | 99.2 | $ | 14.4 | $ | 100.5 | $ | 2.8 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back (Kennedy Wilson's Share)(1) | ||||||||||||||||

Interest expense | 59.5 | 38.5 | 189.2 | 146.7 | ||||||||||||

Depreciation and amortization | 50.5 | 31.8 | 148.4 | 120.6 | ||||||||||||

(Benefit from) provision for income taxes | (17.6 | ) | 13.7 | (20.8 | ) | 11.9 | ||||||||||

Share-based compensation | 9.0 | 17.3 | 38.4 | 65.1 | ||||||||||||

Preferred stock dividends and accretion of issuance costs | — | 1.2 | — | 2.8 | ||||||||||||

Adjusted EBITDA | $ | 200.6 | $ | 116.9 | $ | 455.7 | $ | 349.9 | ||||||||

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

The table below provides a detailed reconciliation of Adjusted EBITDA to net income.

Three Months Ended | Year Ended | |||||||||||||||

December 31, | December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net income | $ | 105.4 | $ | 45.2 | $ | 138.0 | $ | 76.5 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back: | ||||||||||||||||

Interest expense | 58.8 | 49.9 | 217.7 | 191.6 | ||||||||||||

Kennedy Wilson's share of interest expense included in unconsolidated investments | 6.0 | 4.4 | 23.0 | 23.0 | ||||||||||||

Depreciation and amortization | 55.3 | 50.9 | 212.5 | 198.2 | ||||||||||||

Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments | 3.2 | 4.8 | 16.2 | 20.8 | ||||||||||||

(Benefit from) provision for income taxes | (17.2 | ) | 11.9 | (16.3 | ) | 14.0 | ||||||||||

Share-based compensation | 9.0 | 17.3 | 38.4 | 65.1 | ||||||||||||

EBITDA attributable to noncontrolling interests (1) | (19.9 | ) | (67.5 | ) | (173.8 | ) | (239.3 | ) | ||||||||

Adjusted EBITDA | $ | 200.6 | $ | 116.9 | $ | 455.7 | $ | 349.9 | ||||||||

(1) EBITDA attributable to noncontrolling interests includes $7.9 million and $23.9 million of depreciation and amortization, $5.3 million and $15.8 million of interest, and $0.4 million and $(1.8) million of taxes, for the three months ended December 31, 2017 and 2016, respectively. EBITDA attributable to noncontrolling interests includes $80.4 million and $98.4 million of depreciation and amortization, $51.4 million and $67.9 million of interest, and $4.6 million and $2.1 million of taxes, for the year ended December 31, 2017 and 2016, respectively.

14

Kennedy-Wilson Holdings, Inc.

Adjusted Net Income

(Unaudited)

(Dollars in millions, except per share data)

The table below reconciles Adjusted Net Income to net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders, using Kennedy Wilson’s pro-rata share amounts for each adjustment item.

Three Months Ended | Year Ended | |||||||||||||||

December 31, | December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders | $ | 99.2 | $ | 14.4 | $ | 100.5 | $ | 2.8 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back (Kennedy Wilson's Share)(1): | ||||||||||||||||

Depreciation and amortization | 50.5 | 31.8 | 148.4 | 120.6 | ||||||||||||

Share-based compensation | 9.0 | 17.3 | 38.4 | 65.1 | ||||||||||||

Preferred stock dividends and accretion of issuance costs | — | 1.2 | — | 2.8 | ||||||||||||

One-time tax remeasurement | (44.8 | ) | — | (44.8 | ) | — | ||||||||||

Adjusted Net Income | $ | 113.9 | $ | 64.7 | $ | 242.5 | $ | 191.3 | ||||||||

Weighted average shares outstanding for diluted | 140,490,974 | 109,479,528 | 119,147,192 | 109,094,530 | ||||||||||||

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

The table below provides a detailed reconciliation of Adjusted Net Income to net income.

Three Months Ended | Year Ended | |||||||||||||||

December 31, | December 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net income | $ | 105.4 | $ | 45.2 | $ | 138.0 | $ | 76.5 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back: | ||||||||||||||||

Depreciation and amortization | 55.3 | 50.9 | 212.5 | 198.2 | ||||||||||||

Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments | 3.2 | 4.8 | 16.2 | 20.8 | ||||||||||||

Share-based compensation | 9.0 | 17.3 | 38.4 | 65.1 | ||||||||||||

Net income attributable to the noncontrolling interests, before depreciation and amortization(1) | (14.2 | ) | (53.5 | ) | (117.8 | ) | (169.3 | ) | ||||||||

One-time tax remeasurement | (44.8 | ) | — | (44.8 | ) | — | ||||||||||

Adjusted Net Income | $ | 113.9 | $ | 64.7 | $ | 242.5 | $ | 191.3 | ||||||||

Weighted average shares outstanding for diluted | 140,490,974 | 109,479,528 | 119,147,192 | 109,094,530 | ||||||||||||

(1) Includes $7.9 million and $23.9 million of depreciation and amortization for the three months ended December 31, 2017 and 2016, respectively, and $80.4 million and $98.4 million for the year ended December 31, 2017 and 2016, respectively.

15

Kennedy-Wilson Holdings, Inc.

Pro Forma Adjusted EBITDA

(Unaudited)

(Dollars in millions)

The tables below show Pro Forma Adjusted EBITDA at KWH’s ownership amount, including a reconciliation to net income calculated in accordance with GAAP:

Three Months Ended December 31, 2017 | |||||||||||

KWH As Reported | Pro Forma Adjustments(1) | Pro Forma(1) | |||||||||

(Dollars in millions) | |||||||||||

Net income (loss) attributable to KWH common shareholders | $ | 99.2 | $ | (0.7 | ) | $ | 98.5 | ||||

Non-GAAP adjustments: | |||||||||||

Interest expense | 59.5 | 3.1 | 62.6 | ||||||||

Depreciation and amortization | 50.5 | 4.5 | 55.0 | ||||||||

(Benefit from) provision for income taxes | (17.6 | ) | 0.3 | (17.3 | ) | ||||||

Share-based compensation | 9.0 | — | 9.0 | ||||||||

Adjusted EBITDA | $ | 200.6 | $ | 7.2 | $ | 207.8 | |||||

(1) Pro forma adjustments include assumption of 100% ownership of KWE as of October 1, 2017 and additional provision for income taxes relating to KWH’s increased ownership in KWE.

Year Ended December 31, 2017 | |||||||||||

KWH As Reported | Pro Forma Adjustments(1) | Pro Forma(1) | |||||||||

(Dollars in millions) | |||||||||||

Net income attributable to KWH common shareholders | $ | 100.5 | $ | 5.5 | $ | 106.0 | |||||

Non-GAAP adjustments: | |||||||||||

Interest expense | 189.2 | 50.3 | 239.5 | ||||||||

Depreciation and amortization | 148.4 | 67.5 | 215.9 | ||||||||

(Benefit from) provision for income taxes | (20.8 | ) | 3.8 | (17.0 | ) | ||||||

Share-based compensation | 38.4 | — | 38.4 | ||||||||

Adjusted EBITDA | $ | 455.7 | $ | 127.1 | $ | 582.8 | |||||

(1) Pro forma adjustments include assumption of 100% ownership of KWE as of January 1, 2017, additional provision for income taxes relating to KWH’s increased ownership in KWE and additional interest expense on the Company’s line of credit based on it having a $350 million outstanding balance for the year ended December 31, 2017.

16

Kennedy-Wilson Holdings, Inc.

Pro Forma Adjusted Net Income

(Unaudited)

(Dollars in millions, except per share data)

The tables below show Pro Forma Adjusted Net Income at KWH’s ownership amount, including a reconciliation to net income calculated in accordance with GAAP:

Three Months Ended December 31, 2017 | |||||||||||

KWH As Reported | Pro Forma Adjustments(1) | Pro Forma(1) | |||||||||

(Dollars in millions) | |||||||||||

Net income (loss) attributable to KWH common shareholders | $ | 99.2 | $ | (0.7 | ) | $ | 98.5 | ||||

Non-GAAP adjustments: | |||||||||||

Depreciation and amortization | 50.5 | 4.5 | 55.0 | ||||||||

Share-based compensation | 9.0 | — | 9.0 | ||||||||

Tax Reform Adjustment | (44.8 | ) | — | (44.8 | ) | ||||||

Adjusted Net Income | $ | 113.9 | $ | 3.8 | $ | 117.7 | |||||

Weighted average shares outstanding for diluted | 140,490,974 | 11,281,812 | 151,772,786 | ||||||||

(1) Pro forma adjustments include assumption of 100% ownership of KWE as of October 1, 2017 and additional provision for income taxes relating to KWH’s increased ownership in KWE.

Year Ended December 31, 2017 | |||||||||||

KWH As Reported | Pro Forma Adjustments(1) | Pro Forma Consolidated(1) | |||||||||

(Dollars in millions) | |||||||||||

Net income attributable to KWH common shareholders | $ | 100.5 | $ | 5.5 | $ | 106.0 | |||||

Non-GAAP adjustments: | |||||||||||

Depreciation and amortization | 148.4 | 67.5 | 215.9 | ||||||||

Share-based compensation | 38.4 | — | 38.4 | ||||||||

Tax Reform Adjustment | (44.8 | ) | — | (44.8 | ) | ||||||

Adjusted Net Income | $ | 242.5 | $ | 73.0 | $ | 315.5 | |||||

Weighted average shares outstanding for diluted | 119,147,192 | 32,599,375 | 151,746,567 | ||||||||

(1) Pro forma adjustments include assumption of 100% ownership of KWE as of January 1, 2017, additional provision for income taxes relating to KWH’s increased ownership in KWE and additional interest expense on the Company’s line of credit based on it having a $350 million outstanding balance for the year ended December 31, 2017.

17

Supplemental Financial Information | ||

18

Kennedy-Wilson Holdings, Inc.

Capitalization Summary

(Unaudited)

(Dollars in millions, except per share data)

December 31, 2017 | December 31, 2016 | |||||||

Market Data | ||||||||

Common stock price per share | $ | 17.35 | $ | 20.50 | ||||

Common stock shares outstanding | 151,561,284 | 115,740,906 | ||||||

Equity Market Capitalization | $ | 2,629.6 | $ | 2,372.7 | ||||

Kennedy Wilson's Share of Debt | ||||||||

Kennedy Wilson's share of property debt | 3,534.0 | 2,272.1 | ||||||

Senior notes payable | 900.0 | 955.0 | ||||||

Kennedy Wilson Europe bonds | 1,335.2 | 287.1 | ||||||

Credit facility | 300.0 | — | ||||||

Total Kennedy Wilson's share of debt | 6,069.2 | 3,514.2 | ||||||

Total Capitalization | 8,698.8 | 5,886.9 | ||||||

Less: Kennedy Wilson's share of cash | (345.7 | ) | (499.1 | ) | ||||

Total Enterprise Value | $ | 8,353.1 | $ | 5,387.8 | ||||

19

Kennedy-Wilson Holdings, Inc.

Components of Value Summary - as of December 31, 2017

(Unaudited, Dollars in millions)

Below are key valuation metrics provided to assist in the calculation of a sum-of-the-parts valuation of the Company as of December 31, 2017. Please note that excluded below is the potential value of the Company's future promoted interest as well as the value of the Company's team and brand. A sum of the parts can be calculated by adding together KW’s share of the value of its investments (#1-#6), the value of KW’s services business (#7-#9) and subtracting KW’s net liabilities (#10-#11).

Kennedy Wilson's Share | ||||||||||||||

Investments | Description | Occupancy | Est. Annual NOI(1)(2) | Common Valuation Approach | Page # | |||||||||

Income-producing Assets | ||||||||||||||

1 | Multifamily | 23,865 units | 93.8% | $ | 172.1 | Cap rate | ||||||||

2 | Commercial | 17.1 million sq. ft. of office, retail and industrial | 94.2% | 240.8 | Cap rate | |||||||||

3 | Hotels | 974 Hotel Rooms | N/A | 25.9 | Cap rate | |||||||||

Total | $ | 438.8 | ||||||||||||

Unstabilized, Development, and Non-income Producing Assets | KW Gross Asset Value | |||||||||||||

4 | Unstabilized - Multifamily and Commercial(3) | 581 multifamily units 1.0 million commercial sq.ft. | 45.6% | $ | 370.0 | Detail on Page 27; gross asset value multiple | ||||||||

5 | Development - Multifamily, Commercial, and Hotel(3) | 2,715 multifamily units 0.7 million commercial sq. ft. One five-star resort | N/A | 335.8 | Detail on Page 27; gross asset value multiple | |||||||||

6 | Loans, residential, and other(3) | 25 investments, 13 unresolved loans | N/A | 290.1 | Gross asset value multiple | |||||||||

Total | $ | 995.9 | ||||||||||||

Investment Management and Real Estate Services | Annual Adj. Fees | Annual Adj. EBITDA | ||||||||||||

7 | Investment management | Management and promote fees (excluding fees for management of KWE) | $ | 29.3 | $ | 18.6 | Adj. EBITDA or Adj. Fees Multiple | |||||||

8 | Property services | Fees and commissions | 28.9 | 5.7 | Adj. EBITDA or Adj. Fees Multiple | |||||||||

9 | Meyers Research | Subscription revenue and consulting fees | 12.4 | (4.6 | ) | Adj. Fees Multiple | ||||||||

Total | $ | 70.6 | $ | 19.7 | ||||||||||

Net Debt | Total | |||||||||||||

10 | KW Share of Debt | Secured and Unsecured Debt | $ | 6,069.2 | Face Value | |||||||||

11 | KW Share of Cash | Cash | (345.7 | ) | Book Value | |||||||||

Total Net Debt | $ | 5,723.5 | ||||||||||||

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other

20

items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors.

(2) Based on weighted-average ownership figures held by KW.

(3) See additional detail related to Unstabilized, Development, and Non-income Producing Assets, as of December 31, 2017. KW Share of Debt below is included in the Net Debt amounts within the Components of Value Summary above.

KW Gross Asset Value | KW Share of Debt | Investment Account | ||||||||||

Unstabilized - Multifamily and Commercial | $ | 370.0 | $ | 94.1 | $ | 275.9 | ||||||

Development - Multifamily, Commercial, and Hotel | 335.8 | 72.4 | 263.4 | |||||||||

Loans, residential, and other | 290.1 | 5.7 | 284.4 | |||||||||

Unstabilized, Development, and Non-income Producing Assets | $ | 995.9 | $ | 172.2 | $ | 823.7 | ||||||

21

Kennedy-Wilson Holdings, Inc.

Incoming-producing Portfolio - 2017

(Unaudited, Dollars in millions)

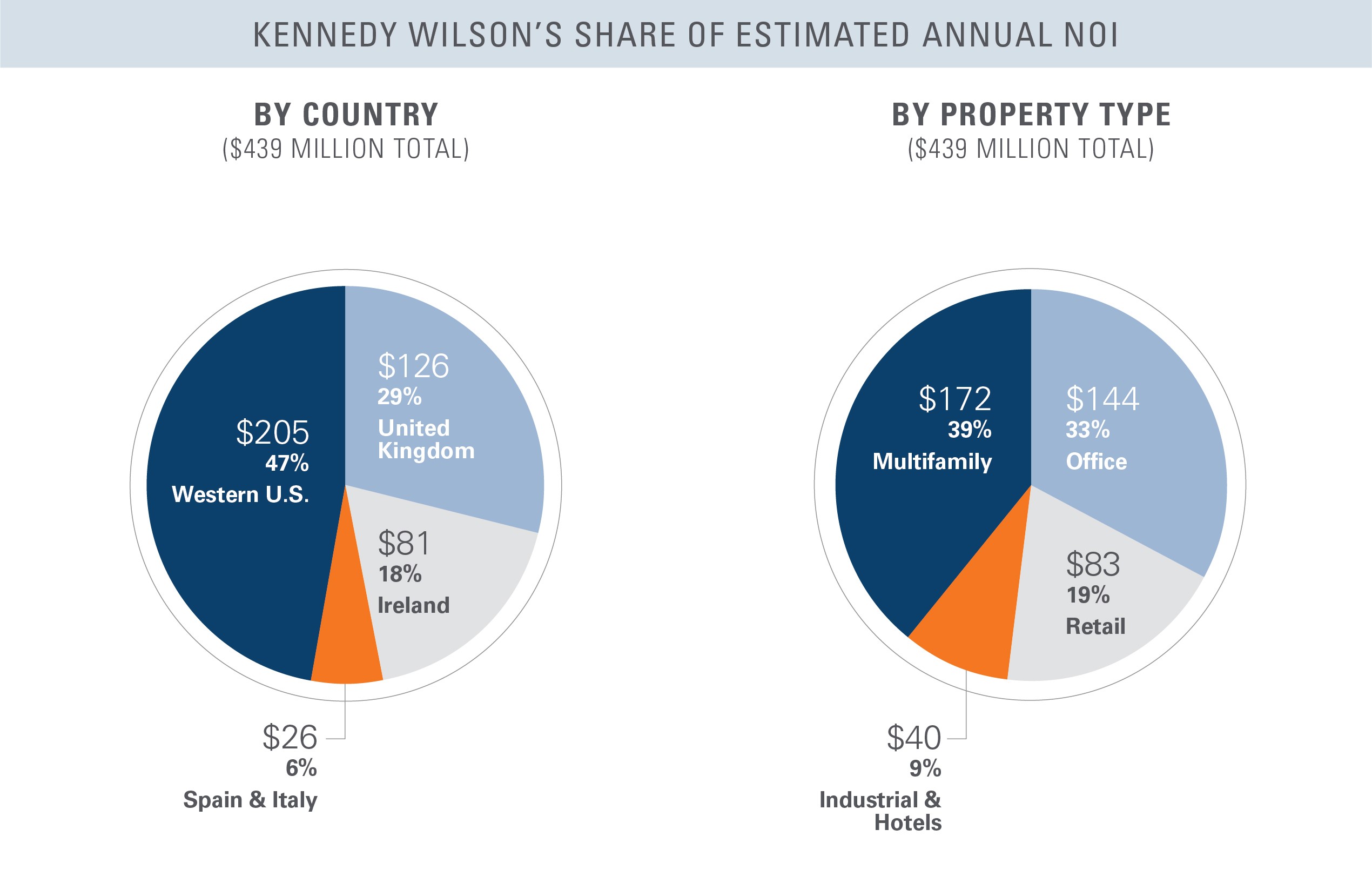

The pie charts below reflect Kennedy Wilson's Pro-rata share of Estimated Annual NOI (in income-producing properties) by country and property type, as of December 31, 2017, of which 82% is derived from wholly-owned assets.

The following summarizes Kennedy Wilson's pro-rata share of estimated annual NOI from its income-producing portfolio by property type and geography.

Pacific Northwest | Southern California | Northern California | Mountain States | U.K. | Ireland | Italy | Spain | Total | |||||||||||||||||||

Multifamily - Market Rate | $ | 61.8 | $ | 22.5 | $ | 29.4 | $ | 18.8 | $ | — | $ | 19.4 | $ | — | $ | — | $ | 151.9 | |||||||||

Multifamily - Affordable | 14.3 | 1.7 | 2.2 | 2.0 | — | — | — | — | 20.2 | ||||||||||||||||||

Office | 14.9 | 20.3 | 0.8 | 0.5 | 61.4 | 31.2 | 14.4 | — | 143.5 | ||||||||||||||||||

Retail | 0.9 | 2.1 | 0.9 | 7.7 | 47.8 | 11.7 | — | 11.7 | 82.8 | ||||||||||||||||||

Industrial | — | — | — | — | 14.5 | — | — | — | 14.5 | ||||||||||||||||||

Hotels | — | — | 3.2 | 1.0 | 2.6 | 19.1 | — | — | 25.9 | ||||||||||||||||||

Total Estimated Annual NOI | $ | 91.9 | $ | 46.6 | $ | 36.5 | $ | 30.0 | $ | 126.3 | $ | 81.4 | $ | 14.4 | $ | 11.7 | $ | 438.8 | |||||||||

22

Kennedy-Wilson Holdings, Inc.

All-Property Investment Summary by Ownership

(Unaudited, Dollars in millions)

The following summarizes Kennedy Wilson's income-producing multifamily and commercial portfolio by ownership category. Excluded below are commercial - unstabilized, development, loans, and residential and other investments.

Total Portfolio | ||||||||||||

December 31, 2017 | December 31, 2016 | |||||||||||

KW Ownership Category | Multifamily Units | Commercial Rentable Sq. Ft. | Hotel Rooms | KW Share of Est. Annual NOI(1) | Ownership(2) | NOI Growth | Multifamily Units | Commercial Rentable Sq. Ft. | Hotel Rooms | KW Share of Est. Annual NOI(1) | Ownership(2) | |

~100% Owned | 9,841 | 12.3 | 611 | $362.0 | 99.5% | 157.8 | % | 8,787 | 1.8 | 265 | $140.4 | 98.4% |

~50% owned | 9,452 | 0.9 | 363 | 60.1 | 48.2% | 16.5 | % | 8,799 | 1.1 | 363 | 51.6 | 47.3% |

Minority-owned | 4,572 | 3.9 | N/A | 16.7 | 14.5% | (73.2 | )% | 8,056 | 13.3 | 344 | 62.4 | 19.8% |

Total | 23,865 | 17.1 | 974 | $438.8 | 72.6% | 72.5 | % | 25,642 | 16.2 | 972 | $254.4 | 44.9% |

(1) | Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. |

(2) | Weighted average ownership figures based on the Company’s share of NOI and are presented on a pre-promote basis. |

23

Kennedy-Wilson Holdings, Inc.

Multifamily Investment Summary

(Unaudited)

(Dollars in millions, except average rents per unit)

Multifamily | # of Assets | # of Units | Occupancy(1) | Average Monthly Rents Per Unit(4)(5) | Kennedy Wilson's Share of Estimated Annual NOI(2)(3) | |||||||||||

Pacific Northwest | 47 | 11,454 | 94.5 | % | $ | 1,460 | $ | 76.1 | ||||||||

Southern California | 9 | 2,968 | 93.0 | 1,830 | 24.2 | |||||||||||

Northern California | 10 | 3,669 | 92.4 | 1,778 | 31.6 | |||||||||||

Mountain States | 15 | 4,426 | 93.3 | 1,118 | 20.8 | |||||||||||

Total Western US | 81 | 22,517 | 94.0 | % | 1,508 | 152.7 | ||||||||||

Ireland(3) | 6 | 1,300 | 95.8 | 1,747 | 19.4 | |||||||||||

Japan(3) | 1 | 48 | 91.7 | 607 | — | |||||||||||

Total Stabilized | 88 | 23,865 | 93.8 | % | $ | 1,526 | $ | 172.1 | ||||||||

Unstabilized/Development(a) | 14 | 3,296 | See page 27 for more information | |||||||||||||

Total Multifamily | 102 | 27,161 | ||||||||||||||

(a) Represents properties that are either under development or undergoing lease up as part of our asset management strategy. Refer to the "Unstabilized and Development Detail" page for further discussion.

(1) As of December 31, 2017.

(2) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. Amounts are based on weighted-average ownership figures held by KW.

(3) Estimated foreign exchange rates are €0.83 = $1 USD, £0.74 = $1 USD, and ¥113 = $1 USD, related to NOI.

(4) Average rents is defined as the total potential monthly rental revenue (actual rent for occupied units plus market rent for vacant units) divided by the number of units, and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(5) Average rents for the market rate portfolio based on Kennedy Wilson's share of units. Average rents for the affordable portfolio are $780, $837, $815, and $727 for Pacific Northwest, Southern California, Northern California, and Mountain States, respectively.

24

Kennedy-Wilson Holdings, Inc.

Commercial Investment Summary

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq ft)

# of Assets | Rentable Sq. Ft. | Occupancy(1) | Average Annual Rent per sq ft(3) | Kennedy Wilson's Share of Estimated Annual NOI(2) | ||||||||||||

Pacific Northwest | 6 | 1.6 | 96.0 | % | $ | 22.1 | $ | 15.8 | ||||||||

Southern California(4) | 8 | 1.2 | 92.5 | 41.2 | 22.4 | |||||||||||

Northern California | 2 | 0.2 | 86.4 | 13.7 | 1.7 | |||||||||||

Mountain States | 13 | 1.7 | 92.0 | 11.6 | 8.2 | |||||||||||

Total Western US | 29 | 4.7 | 93.2 | % | 24.1 | 48.1 | ||||||||||

United Kingdom(5) | 141 | 9.3 | 93.5 | 17.5 | 123.6 | |||||||||||

Ireland(5) | 15 | 1.2 | 99.1 | 39.3 | 43.0 | |||||||||||

Spain(5) | 15 | 0.8 | 92.0 | 16.7 | 11.7 | |||||||||||

Italy(5) | 9 | 1.1 | 100.0 | 15.6 | 14.4 | |||||||||||

Total Stabilized | 209 | 17.1 | 94.2 | % | $ | 20.4 | $ | 240.8 | ||||||||

Unstabilized/Development Total(a) | 18 | 1.7 | See page 27 for more information | |||||||||||||

Total Commercial | 227 | 18.8 | ||||||||||||||

(a) Represents properties that are either under development or undergoing lease up as part of our asset management strategy. Refer to the "Unstabilized and Development Detail" page for further discussion.

(1) As of December 31, 2017.

(2) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. Amounts are based on weighted-average ownership figures held by KW.

(3) Average Rent per RSF represent contractual rents as in-place as-of December 31, 2017, and are weighted-averages based on the Company's ownership percentage in the underlying properties.

(4) The information presented in this row for Southern California commercial assets includes our corporate headquarters wholly owned by KW comprising 58,000 sq. ft., $35 million of debt, 100% occupancy, $3.0 million in annual NOI and investment account balance of $34.1 million as of December 31, 2017.

(5) Estimated foreign exchange rates are €0.83 = $1 USD and £0.74 = $1 USD, related to NOI.

25

Kennedy-Wilson Holdings, Inc.

Hotel, Loans, Residential and Other Investment Summary

(Unaudited)

(Dollars in millions, except ADR)

Hotel | # of Assets | Hotel Rooms | Average Daily Rate(3) | Kennedy Wilson's Share of Estimated Annual NOI(1) | |||||||||

Northern California | 1 | 170 | $ | 518.7 | $ | 3.2 | |||||||

Mountain States | 1 | 193 | 105.1 | 1.0 | |||||||||

Total Western US | 2 | 363 | 298.8 | 4.2 | |||||||||

United Kingdom(2) | 1 | 211 | 192.6 | 2.6 | |||||||||

Ireland(2) | 2 | 400 | 278.6 | 19.1 | |||||||||

Total Hotel | 5 | 974 | $ | 267.5 | $ | 25.9 | |||||||

Development(a) | 1 | 150 | See page 27 for more information | ||||||||||

Pro Forma Total | 6 | 1,124 | |||||||||||

(a) Refer to the Unstabilized and Development page for further discussion.

(1) Please see “common definitions” for a definition of estimated annual NOI and a description of its limitations. The Company does not provide a reconciliation for estimated annual NOI to its most directly comparable forward-looking GAAP financial measure, because it is unable to provide a meaningful or accurate estimation of each of the component reconciling items, and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact estimated annual NOI, including, for example, gains on sales of depreciable real estate and other items that have not yet occurred and are out of the Company’s control. For the same reasons, the Company is unable to meaningfully address the probable significance of the unavailable information and believes that providing a reconciliation for estimated annual NOI would imply a degree of precision as to its forward-looking net operating income that would be confusing or misleading to investors. Amounts are based on weighted-average ownership figures held by KW.

(2) Estimated foreign exchange rates are €0.83 = $1 USD and £0.74 = $1 USD, related to NOI.

(3) Average Daily Rate data is based on the most recent 12 months.

Residential, Loans and Other | # of Investments | Residential Units/Lots | Total Acres | # of Unresolved Loans | KW Gross Asset Value | ||||||||||

Southern California | 8 | 217 | 758 | 1 | $ | 67.4 | |||||||||

Northern California | 2 | 4 | 4 | — | 7.8 | ||||||||||

Hawaii | 6 | 249 | 3,243 | 1 | 107.8 | ||||||||||

Total Western US | 16 | 470 | 4,005 | 2 | 183.0 | ||||||||||

United Kingdom(1) | 1 | — | — | 6 | 51.8 | ||||||||||

Ireland(1) | 1 | — | — | 5 | 25.5 | ||||||||||

Total Residential and Loans | 18 | 470 | 4,005 | 13 | $ | 260.3 | |||||||||

Other Investments | 7 | — | — | — | $ | 29.8 | |||||||||

Total Residential, Loans and Other | 25 | 470 | 4,005 | 13 | $ | 290.1 | |||||||||

(1) Estimated foreign exchange rates are €0.83 = $1 USD and £0.74 = $1 USD, related to Gross Asset Value.

26

Kennedy-Wilson Holdings, Inc.

Unstabilized and Development Detail

(Unaudited, Dollars in millions)

Unstabilized Assets

This section includes the Company's unstabilized assets that are undergoing lease-up. There is no certainty that these assets will reach stabilization in the time periods shown. All dollar amounts are Kennedy Wilson's share.

KW Share | |||||||||||||||||||||||||

Location | Type | # of Assets | Commercial Sq. Ft. | MF Units | Est. Stabilization Date | Current NOI(a) | Est. Incremental NOI | Est. Stabilized NOI | KW Est. Costs to Complete(2) | KW Gross Asset Value | |||||||||||||||

Ireland(3) | Multifamily | 2 | — | 287 | 2018-2021 | $ | 2.8 | $ | 2.3 | $ | 5.1 | $ | 6.3 | $ | 76.8 | ||||||||||

United Kingdom(3) | Multifamily | 1 | — | 294 | 2018 | 1.7 | 4.9 | 6.6 | — | 113.3 | |||||||||||||||

Ireland(3) | Office | 3 | 198,000 | — | 2019 | 3.0 | 2.0 | 5.0 | 1.3 | 96.6 | |||||||||||||||

United Kingdom(3) | Office | 3 | 114,000 | — | 2018-2019 | (0.1 | ) | 1.8 | 1.7 | 0.1 | 11.6 | ||||||||||||||

Mountain States | Retail | 4 | 533,000 | — | 2019-2020 | 2.2 | 2.5 | 4.7 | 7.2 | 52.2 | |||||||||||||||

Southern California | Retail | 1 | 16,000 | — | 2019 | 0.1 | 0.5 | 0.6 | 0.6 | 9.8 | |||||||||||||||

United Kingdom(3) | Industrial | 1 | 188,000 | — | 2019 | (0.3 | ) | 1.5 | 1.2 | — | 9.7 | ||||||||||||||

Total | 15 | 1,049,000 | 581 | $ | 9.4 | $ | 15.5 | $ | 24.9 | $ | 15.5 | $ | 370.0 | ||||||||||||

(a) Current NOI is excluded from Estimated Annual NOI. The Company currently expects to add $24.9 million in Estimated Annual NOI from the stabilization of these assets.

Development Projects

This section includes the developments or redevelopment projects that the Company is undergoing or considering, and excludes residential investments. The scope of these projects may change. There is no certainty that the Company will develop or redevelop any or all of these potential projects. All dollar amounts are Kennedy Wilson's share.

If Completed | Current | |||||||||||||||||||||||||||||

Location | Type | Investment | Status | Est. Completion Date(1) | Est. Stabilization Date | Commercial Sq. Ft. | MF Units / Hotel Rooms | KW Share Total Capitalization | KW Gross Asset Value | KW Share Current Debt | KW Est. Costs to Complete(2) | KW Est. Cash to Complete | KW Share Est. Stabilized NOI | |||||||||||||||||

Ireland(3) | Mixed-Use | Capital Dock(4) | Under Construction | 2018 | 2020 | 240,000 | 190 | $ | 129.1 | $ | 79.4 | $ | 29.0 | $ | 49.7 | 18.1 | (5) | $ | 10.1 | |||||||||||

WA and NV | Multifamily - Affordable | Vintage Housing Holdings | 3 Under Construction | 2018-2019 | 2018-2019 | — | 711 | 70.9 | 38.1 | 31.2 | 32.8 | — | (6) | 2.5 | ||||||||||||||||

Spain(3) | Retail | Puerta del Sol | In Planning | 2019 | 2019 | 37,000 | — | 68.9 | 64.1 | — | 4.8 | 4.8 | 3.8 | |||||||||||||||||

Nor Cal | Multifamily | Santa Rosa | In Design | 2019 | 2019 | — | 120 | 24.8 | 1.2 | — | 23.6 | 9.6 | 1.8 | |||||||||||||||||

WA and NV | Multifamily - Affordable | Vintage Housing Holdings | 5 In Design | 2019-2020 | 2020-2021 | — | 1,435 | 157.6 | 15.4 | 3.6 | 142.2 | — | (6) | 5.8 | ||||||||||||||||

Ireland(3) | Multifamily | Clancy Quay - Phase 3 | In Planning | 2020 | 2021 | 6,000 | 259 | 52.7 | 7.4 | — | 45.3 | 22.6 | (7) | 3.1 | ||||||||||||||||

Ireland(3) | Office | Hanover Quay | In Planning | 2020 | 2021 | 61,000 | — | 35.4 | 6.5 | — | 28.9 | 14.5 | (7) | 2.4 | ||||||||||||||||

Ireland(3) | Office | Kildare | In Design | 2020 | 2021 | 65,000 | — | 56.1 | 10.2 | — | 45.9 | 23.0 | (7) | 3.5 | ||||||||||||||||

Nor Cal | Office | 400 California | Under Construction | 2020 | 2022 | 247,000 | — | TBD | 16.5 | — | TBD | TBD | NA | |||||||||||||||||

Hawaii | Hotel | Kona Village Resort | In Design | 2021 | 2024 | — | 150 | TBD | 57.4 | — | TBD | TBD | NA | |||||||||||||||||

Total | 656,000 | 2,865 | $ | 595.5 | $ | 296.2 | $ | 63.8 | $ | 373.2 | $ | 92.6 | $ | 33.0 | ||||||||||||||||

Note: The table above excludes two development projects, 200 Capital Dock and Leisureplex, with KW Gross Asset Value of $21.3 million and $18.3 million, respectively.

(1) The actual completion date for projects is subject to several factors, many of which are not within our control. Accordingly, the projects identified may not be completed when expected, or at all.

27

(2) | Figures shown in this column are an estimate of KW's remaining costs to develop to completion or to complete the entitlement process, as applicable, as of December 31, 2017. Total remaining costs may be financed with third-party cash contributions, proceeds from projected sales, and/or debt financing. These figures are budgeted costs and are subject to change. There is no guarantee that the Company will be able to secure the project-level debt financing that is assumed in the figures above. If the Company is unable to secure such financing, the amount of capital that the Company will have to invest to complete the projects above may significantly increase. |

(3) Estimated foreign exchange rates are €0.83 = $1 USD and £0.74 = $1 USD, related to NOI.

(4) In December 2017, Indeed, one of the world's largest talent recruiting companies, signed the largest Dublin lease of this cycle to fully occupy the office space at Capital Dock.

(5) Will be partially financed with the proceeds from the forward-funding sale agreement of 200 Capital Dock, which was executed with JPMorgan during 2Q-2017. We still have cash available under the project's $150.1 million construction loan.

(6) We anticipate these development projects to be financed with tax-exempt bonds and tax-credit equity.

(7) We anticipate being able to secure construction financing at a 50% leverage of KW Estimated Costs to Complete. These figures are budgeted costs and are subject to change.

28

Kennedy-Wilson Holdings, Inc.

Debt and Liquidity Schedule

(Unaudited, Dollars in millions)

Maturity | Consolidated Secured(1) | Kennedy Wilson Europe Unsecured Bonds(1) | Unconsolidated Secured | KW Unsecured Debt | KW Share | ||||||||||||||

2018 | $ | 67.6 | $ | — | $ | 276.8 | $ | — | $ | 144.8 | |||||||||

2019 | 356.3 | — | 232.1 | — | 354.7 | ||||||||||||||

2020 | 164.6 | — | 191.5 | — | 212.7 | ||||||||||||||

2021 | 159.6 | — | 70.3 | 300.0 | (2) | 458.4 | |||||||||||||

2022 | 434.8 | 675.7 | 187.0 | — | 1,131.7 | ||||||||||||||

2023 | 451.7 | — | 232.3 | — | 470.3 | ||||||||||||||

2024 | 208.1 | — | 190.0 | 900.0 | (3) | 1,115.3 | |||||||||||||

2025 | 650.9 | 659.5 | 6.3 | — | 1,179.1 | ||||||||||||||

2026 | 396.0 | — | 170.2 | — | 437.2 | ||||||||||||||

2027 | 249.2 | — | 146.6 | — | 318.0 | ||||||||||||||

Thereafter | 39.6 | — | 474.2 | — | 247.0 | ||||||||||||||

Total | $ | 3,178.4 | $ | 1,335.2 | $ | 2,177.3 | $ | 1,200.0 | $ | 6,069.2 | |||||||||

Cash (a) | (233.1 | ) | (61.9 | ) | (76.3 | ) | (56.3 | ) | (345.7 | ) | |||||||||

Net Debt | $ | 2,945.3 | $ | 1,273.3 | $ | 2,101.0 | $ | 1,143.7 | $ | 5,723.5 | |||||||||

(1) Excludes $29.3 million of unamortized loan fees and unamortized net discount of $1.9 million, as of December 31, 2017.

(2) Represents balance outstanding on line of credit and term loan.

(3) Represents principal balance of senior notes.

Weighted average interest rate (KW Share): 3.8% per annum

Weighted average remaining maturity in years (KW Share): 6.4 years

29

Kennedy-Wilson Holdings, Inc.

Debt and Liquidity Schedule (continued)

(Unaudited, Dollars in millions)

Kennedy Wilson has exposure to fixed and floating rate debt through its corporate debt along with debt encumbering its consolidated properties and its joint venture investments. The table below details Kennedy Wilson's share of consolidated and unconsolidated debt by interest rate type.

KW Share of Debt | |||||||||||||||

(Dollars in millions) | Fixed Rate Debt | Floating with Interest Rate Caps | Floating without Interest Rate Caps | Total KW Share of Debt | |||||||||||

Secured Investment Level Debt | $ | 1,965.2 | $ | 638.0 | $ | 930.8 | $ | 3,534.0 | |||||||

Kennedy Wilson Europe Unsecured Bonds | 1,335.2 | — | — | 1,335.2 | |||||||||||

KW Unsecured Debt | 900.0 | — | 300.0 | 1,200.0 | |||||||||||

Total | $ | 4,200.4 | $ | 638.0 | $ | 1,230.8 | $ | 6,069.2 | |||||||

% of Total Debt | 69 | % | 11 | % | 20 | % | 100 | % | |||||||

KW Share of Secured Investment Debt | ||||||||||||||||||||||

(Dollars in millions) | Multifamily | Commercial | Hotels | Residential, Loans and Other | Total | % of KW Share | ||||||||||||||||

Pacific Northwest | $ | 868.9 | $ | 100.5 | $ | — | $ | — | $ | 969.4 | 27 | % | ||||||||||

Southern California | 274.5 | 194.2 | — | 3.0 | 471.7 | 13 | % | |||||||||||||||

Northern California | 356.2 | 14.0 | 19.5 | — | 389.7 | 11 | % | |||||||||||||||

Mountain States | 221.1 | 110.3 | 7.4 | — | 338.8 | 10 | % | |||||||||||||||

Hawaii | — | — | — | 2.7 | 2.7 | — | % | |||||||||||||||

Total Western US | $ | 1,720.7 | $ | 419.0 | $ | 26.9 | $ | 5.7 | $ | 2,172.3 | 61 | % | ||||||||||

United Kingdom | $ | — | $ | 604.0 | $ | — | $ | — | $ | 604.0 | 17 | % | ||||||||||

Ireland | 179.3 | 396.3 | 86.4 | — | 662.0 | 19 | % | |||||||||||||||

Spain | — | 95.5 | — | — | 95.5 | 3 | % | |||||||||||||||

Italy | — | — | — | — | — | — | % | |||||||||||||||

Total Europe | $ | 179.3 | $ | 1,095.8 | $ | 86.4 | $ | — | $ | 1,361.5 | 39 | % | ||||||||||

Japan | $ | 0.2 | $ | — | $ | — | $ | — | $ | 0.2 | — | % | ||||||||||

Total | $ | 1,900.2 | $ | 1,514.8 | $ | 113.3 | $ | 5.7 | $ | 3,534.0 | 100 | % | ||||||||||

% of Total Debt | 54 | % | 43 | % | 3 | % | — | % | 100 | % | ||||||||||||

30

Kennedy-Wilson Holdings, Inc.

Investment Management and Real Estate Services Platform

(Unaudited, Dollars in millions)

Kennedy Wilson's investment management and real estate services platform offers a comprehensive line of real estate services for the full lifecycle of real estate ownership. Kennedy Wilson has approximately $16 billion in IMRES AUM(1) and 53.1 million square feet under management as of December 31, 2017.

Below are other key statistics related to our platform:

Adjusted Fees | ||||||||||||||||

4Q | Full Year | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Investment management, property services and research fees | $ | 10.4 | $ | 12.7 | $ | 51.7 | $ | 59.4 | ||||||||

Non-GAAP adjustments: | ||||||||||||||||

Add back: | ||||||||||||||||

Fees eliminated in consolidation(1) | 3.8 | 6.6 | 26.3 | 36.9 | ||||||||||||

KW share of fees in unconsolidated service businesses(2) | — | 3.3 | 8.6 | 12.6 | ||||||||||||

Adjusted Fees | $ | 14.2 | $ | 22.6 | $ | 86.6 | $ | 108.9 | ||||||||

(1) The three months ended December 31, 2017 and 2016 includes $1.8 million and $4.6 million, respectively, and the year ended December 31, 2017 and 2016 includes $17.3 million and $23.1 million, respectively, of fees recognized in net (income) loss attributable to noncontrolling interests relating to portion of fees paid by noncontrolling interest holders in KWE and equity partner investments.

(2) Included in income from unconsolidated investments relating to the Company's investment in a servicing platform in Spain. This investment was sold in 4Q-2017.

Adjusted Fees - Detail | ||||||||||||||||

4Q | Full Year | |||||||||||||||

Fee Description | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Investment Management - Base(1) | $ | 6.4 | $ | 9.0 | $ | 35.7 | $ | 41.1 | ||||||||

Investment Management - Performance | 0.2 | 2.4 | 8.7 | 19.8 | ||||||||||||

Investment Management - Acquisition / Disposition | 0.3 | — | 0.9 | 0.3 | ||||||||||||

Property Services | 3.8 | 8.3 | 28.9 | 36.3 | ||||||||||||

Research | 3.5 | 2.9 | 12.4 | 11.4 | ||||||||||||

Total Adjusted Fees | $ | 14.2 | $ | 22.6 | $ | 86.6 | $ | 108.9 | ||||||||

(1) The three months ended December 31, 2017 and 2016 includes $1.1 million and $4.9 million, respectively, and the year ended December 31, 2017 and 2016 includes $16.0 million and $22.2 million, respectively, of management fees related to KWE. With the KWE Acquisition, we own 100% of KWE and will no longer earn fees from it.

Investment Management and Real Estate Services | |||||||

Investment Management | Property Services | Research | Total | ||||

YTD 2017 Adjusted Fees(1) | $45.3 million | $28.9 million | $12.4 million | $86.6 million | |||

YTD 2017 Adjusted EBITDA(1)(2) | $29.0 million | $5.7 million | $(4.6) million | $30.1 million | |||

Description | $5.0 billion in total Invested Capital(3) | ||||||

(1) As defined in "Common Definitions" section of the earnings release.

(2) See reconciliation of Adjusted EBITDA in Adjusted EBITDA by Segment section.

(3) Represents total investment level equity on which we earn fee income, of which $3.1 billion relates to Kennedy Wilson. Figures as of December 31, 2017.

31

Kennedy-Wilson Holdings, Inc.

Multifamily Same Property Analysis

(Unaudited)

(Dollars in millions)

Same Property Analysis By Region - Kennedy Wilson's Pro-Rata Share

The Same Property analysis below reflects Kennedy Wilson's ownership in each underlying property and is shown to provide greater clarity of the impact of the Same Property(1)(2) changes to Kennedy Wilson.

Three Months Ended December 31, | Same Property Units | Average % Leased | Total Revenues | Net Operating Income | ||||||||||||||||||||||||||||||

2017 vs. 2016 | 2017 | 2017 | 2016 | % Change | 2017 | 2016 | % Change | 2017 | 2016 | % Change | ||||||||||||||||||||||||

Market Rate Portfolio | ||||||||||||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 5,249 | 93.6 | % | 92.5 | % | 1.2 | % | $ | 15.2 | $ | 13.9 | 8.8 | % | $ | 9.8 | $ | 8.9 | 10.1 | % | |||||||||||||||

Northern California | 2,993 | 92.5 | 92.6 | (0.1 | ) | 11.3 | 11.0 | 2.0 | 7.4 | 7.1 | 4.1 | |||||||||||||||||||||||

Southern California | 2,500 | 94.2 | 95.0 | (0.8 | ) | 8.8 | 8.4 | 5.3 | 5.7 | 5.2 | 11.3 | |||||||||||||||||||||||

Mountain States | 1,992 | 94.2 | 94.6 | (0.3 | ) | 5.6 | 5.2 | 7.8 | 3.7 | 3.4 | 9.0 | |||||||||||||||||||||||

Western US | 12,734 | 93.6 | % | 93.4 | % | 0.2 | % | $ | 40.9 | $ | 38.5 | 6.0 | % | $ | 26.6 | $ | 24.6 | 8.5 | % | |||||||||||||||

Ireland | 1,134 | 97.2 | 98.0 | (0.8 | ) | 5.1 | 4.8 | 6.8 | 4.0 | 3.6 | 9.7 | |||||||||||||||||||||||

Total | 13,868 | 93.9 | % | 93.8 | % | 0.1 | % | $ | 46.0 | $ | 43.3 | 6.0 | % | $ | 30.6 | $ | 28.2 | 8.6 | % | |||||||||||||||

Affordable Portfolio | ||||||||||||||||||||||||||||||||||

Region: | ||||||||||||||||||||||||||||||||||

Pacific Northwest | 4,099 | 96.6 | % | 97.2 | % | (0.6 | )% | $ | 5.2 | $ | 4.9 | 4.8 | % | $ | 3.4 | $ | 3.3 | 5.5 | % | |||||||||||||||

Northern California | 492 | 87.7 | 94.7 | (7.3 | ) | 0.6 | 0.6 | 2.1 | 0.4 | 0.4 | 6.6 | |||||||||||||||||||||||

Southern California | 468 | 87.4 | 92.1 | (5.0 | ) | 0.6 | 0.6 | (6.3 | ) | 0.3 | 0.4 | (15.8 | ) | |||||||||||||||||||||

Mountain States | 714 | 96.2 | 95.8 | 0.4 | 0.8 | 0.7 | 5.6 | 0.5 | 0.5 | 11.2 | ||||||||||||||||||||||||

Western U.S. | 5,773 | 95.1 | % | 96.4 | % | (1.4 | )% | $ | 7.2 | $ | 6.8 | 3.7 | % | $ | 4.6 | $ | 4.6 | 4.3 | % | |||||||||||||||

Note: Percentage changes are based on whole numbers while revenues and net operating income are shown in millions.

(1) As defined in "Common definitions" section of the earnings release.

(2) Ownership in investments originally held by KWE reflects the Company’s 100% ownership as of December 31, 2017.

32

Kennedy-Wilson Holdings, Inc.

Multifamily Same Property Analysis (continued)

(Unaudited)

(Dollars in millions)

Year Ended December 31, | Same Property Units | Average % Leased | Total Revenues | Net Operating Income | ||||||||||||||||||||||||||||||

2017 vs. 2016 | 2017 | 2017 | 2016 | % Change | 2017 | 2016 | % Change | 2017 | 2016 | % Change | ||||||||||||||||||||||||

Market Rate Portfolio | ||||||||||||||||||||||||||||||||||