Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - ERIE INDEMNITY CO | ex-3212312017.htm |

| EX-31.2 - EXHIBIT 31.2 - ERIE INDEMNITY CO | ex-31212312017.htm |

| EX-31.1 - EXHIBIT 31.1 - ERIE INDEMNITY CO | ex-31112312017.htm |

| EX-23 - EXHIBIT 23 - ERIE INDEMNITY CO | ex-2312312017.htm |

| EX-10.186 - EXHIBIT 10.186 - ERIE INDEMNITY CO | ex-1018612312017.htm |

| EX-10.185 - EXHIBIT 10.185 - ERIE INDEMNITY CO | ex-1018512312017.htm |

| EX-3.9 - EXHIBIT 3.9 - ERIE INDEMNITY CO | ex-3912312017.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 0-24000

ERIE INDEMNITY COMPANY | ||

(Exact name of registrant as specified in its charter)

Pennsylvania | 25-0466020 | |||

(State or other jurisdiction | (I.R.S. Employer | |||

of incorporation or organization) | Identification No.) | |||

100 Erie Insurance Place, Erie, Pennsylvania | 16530 | |||

(Address of principal executive offices) | (Zip code) | |||

(814) 870-2000 | ||

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Class A common stock, stated value $0.0292 per share, listed on the NASDAQ Stock Market, LLC | |||

(Title of each class) | (Name of each exchange on which registered) | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer X | Accelerated filer | Non-accelerated filer | |

Smaller reporting company | Emerging growth company | (Do not check if a smaller reporting company) | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

Aggregate market value of voting and non-voting common stock held by non-affiliates as of the last business day of the registrant's most recently completed second fiscal quarter: $3.1 billion of Class A non-voting common stock as of June 30, 2017. There is no active market for the Class B voting common stock. The Class B common stock is closely held by few shareholders.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date:

46,189,068 shares of Class A common stock and 2,542 shares of Class B common stock outstanding on February 16, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Part III of this Form 10-K (Items 10, 11, 12, 13, and 14) are incorporated by reference to the information statement on Schedule 14(C) to be filed with the Securities and Exchange Commission no later than 120 days after December 31, 2017.

INDEX

PART | ITEM NUMBER AND CAPTION | PAGE | |

2

PART I

ITEM 1. BUSINESS

General

Erie Indemnity Company ("Indemnity", "we", "us", "our") is a publicly held Pennsylvania business corporation that has since its incorporation in 1925 served as the attorney-in-fact for the subscribers (policyholders) at the Erie Insurance Exchange ("Exchange"). The Exchange, which also commenced business in 1925, is a Pennsylvania-domiciled reciprocal insurer that writes property and casualty insurance. The Exchange has wholly owned property and casualty subsidiaries including: Erie Insurance Company, Erie Insurance Company of New York, Erie Insurance Property and Casualty Company and Flagship City Insurance Company, and a wholly owned life insurance company, Erie Family Life Insurance Company ("EFL"). We function solely as the management company and all insurance operations are the responsibility of the Exchange and its subsidiaries. We operate our business as one segment.

Our primary function, as attorney-in-fact, is to perform certain services on behalf of the subscribers at the Exchange relating to policy issuance and renewals including the sales, underwriting, and issuance of policies. This is done in accordance with a subscriber's agreement (a limited power of attorney) executed individually by each subscriber (policyholder), which appoints us as their common attorney-in-fact to transact certain business on their behalf and to manage the affairs of the Exchange. Pursuant to the subscriber's agreement and for its services as attorney-in-fact, we earn a management fee calculated as a percentage, not to exceed 25%, of the direct and assumed premiums written by the Exchange. The management fee rate is set at least annually by our Board of Directors. The process of setting the management fee rate includes the evaluation of current year operating results compared to both prior year and industry estimated results for both Indemnity and the Exchange, and consideration of several factors for both entities including: their relative financial strength and capital position; projected revenue, expense and earnings for the subsequent year; future capital needs; as well as competitive position.

Services

The services we provide to the subscribers at the Exchange are related to the sales, underwriting and issuance of policies. The sales related services we provide include agent compensation and certain sales and advertising support services. Agent compensation includes scheduled commissions to agents based upon premiums written as well as additional commissions and bonuses to agents, which are earned by achieving targeted measures. Agent compensation comprised approximately 68% of our 2017 expenses. The underwriting services we provide include underwriting and policy processing and comprised approximately 10% of our 2017 expenses. The remaining services we provide include customer service and administrative support. We also provide information technology services that support all the functions listed above that comprised approximately 10% of our 2017 expenses.

By virtue of its legal structure as a reciprocal insurer, the Exchange does not have the ability to enter into contractual relationships and therefore, Indemnity also serves as the attorney-in-fact on behalf of the Exchange for all claims handling and investment management services, which include certain common overhead and service department functions in accordance with the subscriber's agreement. The Exchange's insurance subsidiaries also utilize Indemnity for these services, including life management services for EFL, in accordance with the service agreements between each of the subsidiaries and Indemnity. Claims handling services include cost incurred in the claims process, including the adjustment, investigation, defense, recording and payment functions, as well as an allocation of costs for departments that support these claims functions. Life management services include costs incurred in the management and processing of life insurance business. Investment management services are related to investment trading activity, accounting and all other functions attributable to the investment of funds, including an allocation of costs for departments that support the investment function. The amounts incurred for these services are the responsibility of the Exchange and its insurance subsidiaries as outlined in the subscriber's agreement and the services agreements, and are reimbursed to Indemnity as cost. State insurance regulations require that intercompany service agreements and any material amendments be approved in advance by the state insurance department. See Part II, Item 8. "Financial Statements and Supplementary Data - Note 13, Related Party, of Notes to Financial Statements" contained within this report.

Erie Insurance Exchange

Our primary purpose is to manage the affairs at the Exchange for the benefit of the subscribers (policyholders). The Exchange is our sole customer and our earnings are largely generated from management fees based on the direct and assumed premiums written by the Exchange. We have no direct competition in providing these services to the Exchange.

The Exchange generates revenue by insuring preferred and standard risks, with personal lines comprising 71% of the 2017 direct and assumed written premiums and commercial lines comprising the remaining 29%. The principal personal lines products are private passenger automobile and homeowners. The principal commercial lines products are commercial multi-

3

peril, commercial automobile and workers compensation. Historically, due to policy renewal and sales patterns, the Exchange's direct and assumed written premiums are greater in the second and third quarters than in the first and fourth quarters of the calendar year.

The Exchange is represented by independent agencies that serve as its sole distribution channel. In addition to their principal role as salespersons, the independent agents play a significant role as underwriting and service providers and are an integral part of the Exchange's success.

Our results of operations are tied to the growth and financial condition of the Exchange. If any events occurred that impaired the Exchange's ability to grow or sustain its financial condition, including but not limited to reduced financial strength ratings, disruption in the independent agency relationships, significant catastrophe losses, or products not meeting customer demands, the Exchange could find it more difficult to retain its existing business and attract new business. A decline in the business of

the Exchange almost certainly would have as a consequence a decline in the total premiums paid and a correspondingly adverse

effect on the amount of the management fees we receive. We also have an exposure to a concentration of credit risk related to the unsecured receivables due from the Exchange. See Part II, Item 8. "Financial Statements and Supplementary Data - Note 14, Concentrations of Credit Risk, of Notes to Financial Statements" contained within this report. See the risk factors related to our dependency on the growth and financial condition of the Exchange in Item 1A. "Risk Factors" contained within this report.

Competition

Our primary function is to provide management services to the Exchange as set forth in the subscriber's agreement executed by each subscriber (policyholder) at the Exchange. There are a limited number of companies that provide services under a reciprocal insurance exchange structure. We do not directly compete against other such companies, given we are appointed by the subscribers at the Exchange to provide these services.

The direct and assumed premiums written by the Exchange drive our management fee which is our primary source of revenue. The property and casualty insurance industry is highly competitive. Property and casualty insurers generally compete on the basis of customer service, price, consumer recognition, coverages offered, claims handling, financial stability and geographic coverage. Vigorous competition, particularly in the personal lines automobile and homeowners lines of business, is provided by large, well-capitalized national companies, some of which have broad distribution networks of employed or captive agents, by smaller regional insurers, and by large companies who market and sell personal lines products directly to consumers. In addition, because the insurance products of the Exchange are marketed exclusively through independent insurance agents, the Exchange faces competition within its appointed agencies based upon ease of doing business, product, price, and service relationships.

Market competition bears directly on the price charged for insurance products and services subject to regulatory limitations. Industry capital levels can also significantly affect prices charged for coverage. Growth is driven by a company's ability to provide insurance services and competitive prices while maintaining target profit margins. Growth is a product of a company's ability to retain existing customers and to attract new customers, as well as movement in the average premium per policy.

The Exchange's strategic focus includes employing an underwriting philosophy and product mix targeted to produce an underwriting profit on a long-term basis through careful risk selection and rational pricing, and consistently providing superior service to policyholders and agents. The Exchange's business model is designed to provide the advantages of localized marketing and claims servicing with the economies of scale and low cost of operations from centralized support services. The Exchange also carefully selects the independent agencies that represent it and seeks to be the lead insurer with its agents in order to enhance the agency relationship and the likelihood of receiving the most desirable underwriting opportunities from its agents.

See the risk factors related to our dependency on the growth and financial condition of the Exchange in Item 1A. "Risk Factors" contained within this report for further discussion on competition in the insurance industry.

Employees

We had almost 5,300 full-time employees at December 31, 2017, of which approximately 2,600, or 49%, provide claims related services exclusively for the Exchange. The Exchange reimburses us monthly for the cost of these services.

Government Regulation

Most states have enacted legislation that regulates insurance holding company systems, defined as two or more affiliated persons, one or more of which is an insurer. Indemnity and the Exchange, and its wholly owned subsidiaries, meet the definition of an insurance holding company system.

4

Each insurance company in the holding company system is required to register with the insurance supervisory authority of its state of domicile and furnish information regarding the operations of companies within the holding company system that may materially affect the operations, management, or financial condition of the insurers within the system. Pursuant to these laws, the respective insurance departments may examine us, as the management company, and the Exchange and its wholly owned subsidiaries at any time, and may require disclosure and/or prior approval of certain transactions with the insurers and us, as an insurance holding company.

All transactions within a holding company system affecting the member insurers of the holding company system must be fair and reasonable and any charges or fees for services performed must be reasonable. Approval by the applicable insurance commissioner is required prior to the consummation of transactions affecting the members within a holding company system.

Website Access

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are available free of charge on our website at www.erieinsurance.com as soon as reasonably practicable after such material is filed electronically with the Securities and Exchange Commission. Additionally, copies of our annual report on Form 10-K are available free of charge, upon written request, by contacting Investor Relations, Erie Indemnity Company,

100 Erie Insurance Place, Erie, PA 16530, or calling (800) 458-0811.

Our Code of Conduct and Code of Ethics for Senior Financial Officers are also available on our website and in printed form upon request, and our information statement on Schedule 14(C) is available free of charge on our website at www.erieinsurance.com.

ITEM 1A. RISK FACTORS

Our business involves various risks and uncertainties, including, but not limited to those discussed in this section. The risks and uncertainties described in the risk factors below, or any additional risk outside of those discussed below, could have a material adverse effect on our business, financial condition, operating results, cash flows, or liquidity if they were to develop into actual events. This information should be considered carefully together with the other information contained in this report and in other reports and materials we file periodically with the Securities and Exchange Commission.

If the management fee rate paid by the Exchange is reduced or if there is a significant decrease in the amount of direct and assumed premiums written by the Exchange, revenues and profitability could be materially adversely affected.

We are dependent upon management fees paid by the Exchange, which represent our principal source of revenue. Pursuant to the subscriber's agreements with the subscribers at the Exchange, we may retain up to 25% of all direct and assumed premiums written by the Exchange. Therefore, management fee revenue from the Exchange is calculated by multiplying the management fee rate by the direct and assumed premiums written by the Exchange. Accordingly, any reduction in direct and assumed premiums written by the Exchange and/or the management fee rate would have a negative effect on our revenues and net income.

The management fee rate is determined by our Board of Directors and may not exceed 25% of the direct and assumed premiums written by the Exchange. The Board of Directors sets the management fee rate each December for the following year. At their discretion, the rate can be changed at any time. The process of setting the management fee rate includes the evaluation of current year operating results compared to both prior year and industry estimated results for both Indemnity and the Exchange, and consideration of several factors for both entities including: their relative financial strength and capital position; projected revenue, expense and earnings for the subsequent year; future capital needs; as well as competitive position. The evaluation of these factors could result in a reduction to the management fee rate and our revenues and profitability could be materially adversely affected.

Serving as the attorney-in-fact in the reciprocal insurance exchange structure results in the Exchange being our sole customer. We have an interest in the growth of the Exchange as our earnings are largely generated from management fees based on the direct and assumed premiums written by the Exchange. If the Exchange's ability to grow or renew policies were adversely impacted, the premium revenue of the Exchange would be adversely affected which would reduce our management fee revenue. The circumstances or events that might impair the Exchange's ability to grow include, but are not limited to, the items discussed below.

5

Unfavorable changes in macroeconomic conditions, including declining consumer confidence, inflation, high unemployment, and the threat of recession, among others, may lead the Exchange's customers to modify coverage, not renew policies, or even cancel policies, which could adversely affect the premium revenue of the Exchange, and consequently our management fee.

The Exchange faces significant competition from other regional and national insurance companies. The property and casualty insurance industry is highly competitive on the basis of product, price and service. If the Exchange's competitors offer property and casualty products with more coverage or offer lower rates, and the Exchange is unable to implement product improvements quickly enough to keep pace, its ability to grow and renew its business may be adversely impacted. Likewise, an inability to match or exceed the service provided by competitors, which is increasingly relying on digital delivery and enhanced distribution technology, may impede the Exchange's ability to maintain and/or grow its customer base. In addition, due to the Exchange's premium concentration in the automobile and homeowners insurance markets, it may be more sensitive to trends that could affect auto and home insurance coverages and rates over time, for example changing vehicle usage, ownership and driving patterns such as ride sharing, advancements in vehicle or home technology or safety features such as accident and loss prevention technologies, the development of autonomous vehicles, or residential occupancy patterns, among other factors.

The Exchange markets and sells its insurance products through independent, non-exclusive insurance agencies. These agencies are not obligated to sell only the Exchange's insurance products, and generally also sell products of the Exchange's competitors. If agencies do not maintain their current levels of marketing efforts, bind the Exchange to unacceptable risks, place business with competing insurers, or the Exchange is unsuccessful in attracting or retaining agencies in its distribution system as well as maintaining its relationships with those agencies, the Exchange's ability to grow and renew its business may be adversely impacted. Additionally, consumer preferences may cause the insurance industry as a whole to migrate to a delivery system other than independent agencies.

The Exchange maintains a brand recognized for customer service. The perceived performance, actions, conduct and behaviors of employees, independent insurance agency representatives, and third-party service partners may result in reputational harm to the Exchange's brand. Specific incidents which may cause harm include but are not limited to disputes, long customer wait times, errors in processing a claim, failure to protect sensitive customer data, and negative or inaccurate social media communications. If third-party service providers fail to perform as anticipated, the Exchange may experience operational difficulties, increased costs and reputational damage. If an extreme catastrophic event were to occur in a heavily concentrated geographic area of subscribers/policyholders, an extraordinarily high number of claims could have the potential to strain claims processing and affect the Exchange's ability to satisfy its customers. Any reputational harm to the Exchange could have the potential to impair its ability to grow and renew its business.

We also have an interest in the financial condition of the Exchange based on serving as the attorney-in-fact in the reciprocal insurance exchange structure and the Exchange being our sole customer. Our earnings are largely generated from management fees based on the direct and assumed premiums written by the Exchange. If the Exchange were to fail to maintain acceptable financial strength ratings, its competitive position in the insurance industry would be adversely affected. If a rating downgrade led to customers not renewing or canceling policies, or impacted the Exchange's ability to attract new customers, the premium revenue of the Exchange would be adversely affected which would reduce our management fee revenue. The circumstances or events that might impair the Exchange's financial condition include, but are not limited to, the items discussed below.

Financial strength ratings are an important factor in establishing the competitive position of insurance companies such as the Exchange. Higher ratings generally indicate greater financial stability and a stronger ability to meet ongoing obligations to policyholders. The Exchange's A.M. Best rating is currently A+ ("Superior"). Rating agencies periodically review insurers' ratings and change their rating criteria; therefore, the Exchange's current rating may not be maintained in the future. A significant downgrade in this or other ratings would reduce the competitive position of the Exchange, making it more difficult to attract profitable business in the highly competitive property and casualty insurance market and potentially result in reduced sales of its products and lower premium revenue.

The performance of the Exchange's investment portfolio is subject to a variety of investment risks. The Exchange's investment portfolio is comprised principally of fixed income securities, equity securities and limited partnerships. The fixed income portfolio is subject to a number of risks including, but not limited to, interest rate risk, investment credit risk, sector/concentration risk and liquidity risk. The Exchange's common stock and preferred equity securities have exposure to price risk, the risk of potential loss in estimated fair value resulting from an adverse change in prices. Limited partnerships are significantly less liquid and generally involve higher degrees of price risk than publicly traded securities. Limited partnerships, like publicly traded securities, have exposure to market volatility; but unlike fixed income securities, cash flows and return expectations are less predictable. If any investments in the Exchange's investment portfolio were to suffer a substantial decrease in value, the Exchange's financial position could be materially adversely affected through increased unrealized losses

6

or impairments. A significant decrease in the Exchange's portfolio could also put it, or its subsidiaries, at risk of failing to satisfy regulatory or rating agency minimum capital requirements.

Property and casualty insurers are subject to extensive regulatory supervision in the states in which they do business. This regulatory oversight includes, by way of example, matters relating to licensing, examination, rate setting, market conduct, policy forms, limitations on the nature and amount of certain investments, claims practices, mandated participation in involuntary markets and guaranty funds, reserve adequacy, insurer solvency, restrictions on underwriting standards, accounting standards, and transactions between affiliates. Such regulation and supervision are primarily for the benefit and protection of policyholders. Changes in applicable insurance laws, regulations, or changes in the way regulators administer those laws or regulations could adversely change the Exchange's operating environment and increase its exposure to loss or put it at a competitive disadvantage, which could result in reduced sales of its products and lower premium revenue.

As insurance industry practices and legal, judicial, social and other environmental conditions change, unexpected and unintended issues related to claims and coverage may emerge. In some instances, these emerging issues may not become apparent for some time after the Exchange has issued the affected insurance policies. As a result, the full extent of liability under the Exchange's insurance policies may not be known for many years after the policies are issued. These issues may adversely affect the Exchange's business by either extending coverage beyond its underwriting intent or by increasing the number or size of claims.

The Exchange's insurance operations are exposed to claims arising out of catastrophes. Common natural catastrophic events include hurricanes, earthquakes, tornadoes, hail storms, and severe winter weather. The frequency and severity of these catastrophes is inherently unpredictable. Changing climate conditions have added to the unpredictability, frequency and severity of natural disasters and have created additional uncertainty as to future trends and exposures. A single catastrophic occurrence or aggregation of multiple smaller occurrences within its geographical region could adversely affect the financial condition of the Exchange. Terrorist attacks could also cause losses from insurance claims related to the property and casualty insurance operations. The Exchange could incur large net losses if terrorist attacks were to occur which could adversely affect its financial condition.

If the costs of providing services to the Exchange are not controlled, our profitability could be materially adversely affected.

Pursuant to the subscriber's agreements, we are appointed as attorney-in-fact to perform services for the subscribers at the Exchange relating to policy issuance and renewal, including certain sales, underwriting, and issuance services. The most significant costs we incur in providing these services are commissions, employee costs, and technology costs.

Commissions to independent agents are the largest component of our cost of operations. Commissions include scheduled commissions to agents based upon premiums written as well as additional commissions and bonuses to agents, which are earned by achieving certain targeted measures. Changes to commission rates or bonus programs may result in increased future costs and lower profitability.

The second largest component of our cost of operations are employee costs, including salaries, healthcare, pension, and other benefit costs. Regulatory developments, provider relationships, and demographic and economic factors that are beyond our control indicate that employee healthcare costs could continue to increase. Although we actively manage these cost increases, there can be no assurance that future cost increases will not occur and reduce our profitability. The defined benefit pension plan we offer to our employees is affected by variable factors such as the interest rate used to discount pension liabilities, asset performance and changes in retirement patterns, which are beyond our control and any related future costs increases would reduce our profitability.

Technological development is necessary to facilitate ease of doing business for employees, agents and customers. As we continue to develop technology initiatives in order to remain competitive, our profitability could be negatively impacted as we invest in system development projects.

We are subject to credit risk from the Exchange because the management fees from the Exchange are not paid immediately when premiums are written.

We recognize management fees due from the Exchange as income when the premiums are written because at that time we have performed substantially all of the services we are required to perform related to policy issuance and renewal. However, the management fees are not paid to us by the Exchange until the Exchange collects the premiums from subscribers/policyholders. As a result, we hold receivables for management fees on premiums that have been written and assumed by the Exchange but not yet collected. We also hold receivables from the Exchange for claims related and administrative costs for which we are

7

reimbursed at actual costs. These costs are settled monthly. The receivable from the Exchange totaled $418.3 million, or approximately 25% of our total assets at December 31, 2017.

Our ability to attract, develop, and retain talented executives, key managers, and employees is critical to our success.

Our success is largely dependent upon our ability to attract and retain executives and other key management. The loss of the services and leadership of certain key officers and the failure to attract and develop talented new executives and managers could prevent us from successfully communicating, implementing, and executing business strategies, and therefore have a material adverse effect on our financial condition and results of operations.

Our success also depends on our ability to attract, develop, and retain a talented employee base. The inability to staff all functions of our business with employees possessing the appropriate technical expertise could have an adverse effect on our business performance. Staffing appropriately skilled employees for the handling of claims and servicing of customers, rendering of disciplined underwriting, and effective sales and marketing are critical to the core functions of our business. In addition, skilled employees in the actuarial, finance, human resources, law, and information technology areas are also essential to support our core functions.

If we are unable to ensure system availability or effectively manage technology initiatives, we may experience adverse financial consequences and/or may be unable to compete effectively.

Our business is highly dependent upon the effectiveness of our technology and information systems which support key functions of our core business operations including processing applications and premium payments, providing customer support, performing actuarial and financial analysis, and maintaining key data. Additionally, the Exchange relies heavily on technology systems for processing claims. In order to support our business processes and strategic initiatives in a cost and resource efficient manner, we must maintain the effectiveness of existing technology systems and continue to both develop new, and enhance existing, technology systems. As we invest in the development of our systems, costs and completion times could exceed original estimates, and/or the project may not deliver the anticipated benefit, or perform as expected. If we do not effectively and efficiently manage and upgrade our technology systems, our ability to serve our customers and implement our strategic initiatives could be adversely impacted.

We utilize third-party vendors for certain technology and business process functions. If our third-party software vendors are subjected to intellectual property infringement claims, we may lose the ability to use their software until the dispute is resolved.

Additionally, we depend on a large amount of data to price policies appropriately, track exposures, perform financial analysis, report to regulatory bodies, and ultimately make business decisions. Should this data be inaccurate or insufficient, risk exposure may be underestimated and/or poor business decisions may be made. This may in turn lead to adverse operational or financial performance and adverse customer or investor confidence.

If we experience difficulties with technology, data and network security, including as a result of cyber attacks, third-party relationships or cloud-based relationships, our ability to conduct our business could be adversely impacted.

In the normal course of business we collect, use, store and where appropriate, disclose data concerning individuals and businesses. We also conduct business using third-party vendors who may provide software, data storage, cloud-based computing and other technology services. Like other companies, we have on occasion experienced, and will continue to experience, cyber threats to our data and systems. Cyber threats can create significant risks such as destruction of systems or data, denial of service, disruption of transaction execution, loss or exposure of customer data, theft or exposure of our intellectual property, theft of funds or disruption of other important business functions. The business we conduct with our third-party vendors may expose us to increased risk related to data security, service disruptions or effectiveness of our control system.

We employ a company-wide cybersecurity program of technical, administrative and physical controls intended to reduce the risk of cyber threats and protect our information. Our cybersecurity philosophy and approach align to the National Institute of Standards and Technology Cybersecurity Framework and its core elements, to identify, protect, detect, respond and recover from the various forms of cyber threats. Our practices include, but are not limited to, cybersecurity protocols and controls, system monitoring and detection, vendor risk management and ongoing privacy and cybersecurity training for employees and contractors concerning cyber risk. We periodically assess the effectiveness of our cybersecurity efforts including independent validation and verification, and security assessments conducted by independent third parties. The number, complexity and sophistication of cyber threats continues to increase over time. The controls we have implemented, and continue to develop, may not be sufficient to prevent events like unauthorized physical or electronic access, denial of service, cyber attacks, or other

8

security breaches to our computer systems or those of third parties with whom we do business. In some cases, such events may not be immediately detected.

In addition, we are subject to numerous federal and state data privacy laws relating to the privacy of the nonpublic personal information of our customers, employees and others. The misuse or mishandling of information sent to or received from a customer, employee or third party could result in legal liability, regulatory action and reputational damage. Third parties on whom we rely for certain business processing functions are also subject to these risks, and their failure to adhere to these laws and regulations could negatively impact us.

To date, we are not aware of any material cybersecurity breach with respect to our systems or data. Any cyber incident or other security breach could cause disruption in our business operations and may result in other negative consequences including remediation costs, loss of revenue, additional regulatory scrutiny, fines, litigation, monetary damages and reputational harm. While we maintain cyber liability insurance to mitigate the financial risk around cyber incidents, such insurance may not cover all costs associated with the consequences of information or systems being compromised. As a result, in the event of a material cybersecurity breach, our business, cash flows, financial condition or results of operations could be materially, adversely affected.

If events occurred causing interruption of our operations, facilities, systems or business functions, it could have a material adverse effect on our operations and financial results.

We have an established business continuity plan to ensure the continuation of core business operations in the event that normal business operations could not be performed due to a catastrophic event. While we continue to test and assess our business continuity plan to ensure it meets the needs of our core business operations and addresses multiple business interruption events, there is no assurance that core business operations could be performed upon the occurrence of such an event. Systems failures or outages could compromise our ability to perform our business functions in a timely manner, which could harm our ability to conduct business and hurt our relationships with our business partners and customers. Our business continuity is also dependent on third-party systems on which our information technology systems interface and rely. Our systems and those of our third-party vendors may become vulnerable to damage or disruption due to circumstances beyond our or their control, such as from catastrophic events, power anomalies or outages, natural disasters, network failures, and viruses. The failure of our information systems for any reason could result in a material adverse effect on our business, cash flows, financial condition, or results of operations.

The performance of our investment portfolio is subject to a variety of investment risks, which may in turn have a material adverse effect on our results of operations or financial condition.

Our investment portfolio is comprised principally of fixed income securities and limited partnerships. At December 31, 2017, our investment portfolio consisted of approximately 93% fixed income securities, 5% limited partnerships, and 2% equity securities.

All of our marketable securities are subject to market volatility. To the extent that future market volatility negatively impacts our investments, our financial condition will be negatively impacted. We review the investment portfolio on a continuous basis to evaluate positions that might have incurred other-than-temporary declines in value. Inherent in management's evaluation of a security are assumptions and estimates about the operations of the issuer and its future earnings potential. The primary factors considered in our review of investment valuation include the extent and duration to which fair value is less than cost, historical operating performance and financial condition of the issuer, short- and long-term prospects of the issuer and its industry, specific events that occurred affecting the issuer, including rating downgrades, and, depending on the type of security, our intent to sell or our ability and intent to retain the investment for a period of time sufficient to allow for a recovery in value. As the process for determining impairments is highly subjective, changes in our assessments may have a material effect on our operating results and financial condition. See also Item 7A. "Quantitative and Qualitative Disclosures about Market Risk".

If the fixed income, equity, or limited partnership portfolios were to suffer a substantial decrease in value, our financial position could be materially adversely affected through increased realized/unrealized losses or impairments.

The performance of the fixed income portfolio is subject to a number of risks including, but not limited to:

• | Interest rate risk - the risk of adverse changes in the value of fixed income securities as a result of increases in market interest rates. |

9

• | Investment credit risk - the risk that the value of certain investments may decrease due to the deterioration in financial condition of, or the liquidity available to, one or more issuers of those securities or, in the case of asset-backed securities, due to the deterioration of the loans or other assets that underlie the securities, which, in each case, also includes the risk of permanent loss. |

• | Sector/Concentration risk - the risk that the portfolio may be too heavily concentrated in the securities of one or more issuers, sectors, or industries. Events or developments that have a negative impact on any particular industry, group of related industries, or geographic region may have a greater adverse effect on our investment portfolio to the extent that the portfolio is concentrated within those issuers, sectors, or industries. |

• | Liquidity risk - the risk that we will not be able to convert investment securities into cash on favorable terms and on a timely basis, or that we will not be able to sell them at all, when desired. Disruptions in the financial markets or a lack of buyers for the specific securities that we are trying to sell, could prevent us from liquidating securities or cause a reduction in prices to levels that are not acceptable to us. |

General economic conditions and other factors beyond our control can adversely affect the value of our investments and the realization of net investment income, or result in realized investment losses. In addition, downward economic trends also may have an adverse effect on our investment results by negatively impacting the business conditions and impairing credit for the issuers of securities held in our respective investment portfolios. This could reduce fair values of investments and generate significant unrealized losses or impairment charges which may adversely affect our financial results.

In addition to the fixed income securities, a portion of our portfolio is invested in limited partnerships. At December 31, 2017, we had investments in limited partnerships of $45.1 million, or 3% of total assets. In addition, we are obligated to invest up to an additional $16.3 million in limited partnerships, including private equity, mezzanine debt, and real estate partnership investments. Limited partnerships are significantly less liquid and generally involve higher degrees of price risk, the risk of potential loss in estimated fair value resulting from an adverse change in prices, than publicly traded securities. Limited partnerships, like publicly traded securities, have exposure to market volatility; but unlike fixed income securities, cash flows and return expectations are less predictable. We have made no new limited partnership commitments since 2006, and the balance of limited partnership investments is expected to decline over time as additional distributions are received.

The primary basis for the valuation of limited partnership interests are financial statements prepared by the general partner. Because of the timing of the preparation and delivery of these financial statements, the use of the most recently available financial statements provided by the general partners result in a quarter delay in the inclusion of the limited partnership results in our Statements of Operations. Due to this delay, our financial statements at December 31, 2017 do not reflect market conditions experienced in the fourth quarter of 2017.

Our equity securities have exposure to price risk. We do not hedge our exposure to equity price risk inherent in our equity investments. Equity markets, sectors, industries, and individual securities may also be subject to some of the same risks that affect our fixed income portfolio, as discussed above.

Deteriorating capital and credit market conditions or a failure to accurately estimate capital needs may significantly affect our ability to meet liquidity needs and access capital.

Sufficient liquidity and capital levels are required to pay operating expenses, income taxes, and to provide the necessary resources to fund future growth opportunities, satisfy certain financial covenants, pay dividends on common stock, and repurchase common stock. Management estimates the appropriate level of capital necessary based upon current and projected results, which include a loading for potential risks. Failure to accurately estimate our capital needs may have a material adverse effect on our financial condition until additional sources of capital can be located. Further, a deteriorating financial condition may create a negative perception of us by third parties, including rating agencies, investors, agents, and customers which could impact our ability to access additional capital in the debt or equity markets.

Our primary sources of liquidity are management fee revenue and cash flows generated from our investment portfolio. In the event our current sources do not satisfy our liquidity needs, we have the ability to access our $100 million bank revolving line of credit, from which there were no borrowings as of December 31, 2017, or liquidate assets in our investment portfolio. Volatility in the financial markets could limit our ability to sell certain of our fixed income securities or, to a greater extent, our significantly less liquid limited partnership investments, or cause such investments to sell at deep discounts.

In the event these traditional sources of liquidity are not available, we may have to seek additional financing. Our access to funds will depend upon a number of factors including current market conditions, the availability of credit, market liquidity, and

10

credit ratings. In deteriorating market conditions, there can be no assurance that we will obtain additional financing, or, if available, that the cost of financing will not substantially increase and affect our overall profitability.

We are subject to applicable insurance laws, tax statutes, and regulations, as well as claims and legal proceedings, which, if determined unfavorably, could have a material adverse effect on our business, results of operations, or financial condition.

We face a significant risk of litigation and regulatory investigations and actions in the ordinary course of operating our businesses including the risk of class action lawsuits. Our pending legal and regulatory actions include proceedings specific to us and others generally applicable to business practices in the industries in which we operate. In our operations, we are, have been, or may become subject to class actions and individual suits alleging, among other things, issues relating to sales or underwriting practices, payment of contingent or other sales commissions, product design, product disclosure, policy issuance and administration, additional premium charges for premiums paid on a periodic basis, charging excessive or impermissible fees on products, recommending unsuitable products to customers, and breaching alleged fiduciary or other duties, including our obligations to indemnify directors and officers in connection with certain legal matters. We are also subject to litigation arising out of our general business activities such as contractual and employment relationships and claims regarding the infringement of the intellectual property of others. Plaintiffs in class action and other lawsuits against us may seek very large or indeterminate amounts, including punitive and treble damages, which may remain unknown for substantial periods of time. We are also subject to various regulatory inquiries, such as information requests, subpoenas, and books and record examinations from state and federal regulators and authorities. Changes in the way regulators administer those laws, tax statutes, or regulations could adversely impact our business, cash flows, results of operations, or financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

11

ITEM 2. PROPERTIES

Indemnity and the Exchange share a corporate home office complex in Erie, Pennsylvania, which comprises approximately 637,000 square feet. In November 2016, we began the construction of a new office building that will serve as part of our principal headquarters. The project is expected to span approximately three years and will add approximately 346,000 square feet to our existing home office complex. Additionally, we lease one office building and one warehouse facility from unaffiliated parties. We are charged rent for the related square footage we occupy.

Indemnity and the Exchange also operate 25 field offices in 12 states. Of these field offices, 17 provide both agency support and claims services and are referred to as branch offices, while seven provide only claims services and are referred to as claims offices, and one provides only agency support and is referred to as a sales office. We own three field offices and lease a portion of these buildings to the Exchange. The remaining field offices are leased from other parties as detailed below:

Number of | ||

Field office ownership: | field offices | |

Erie Indemnity Company | 3 | |

Erie Insurance Exchange | 3 | |

Erie Family Life Insurance Company | 1 | |

Unaffiliated parties (1) | 18 | |

25 | ||

(1) Lease commitments for these properties expire periodically through 2027. We

expect that most leases will be renewed or replaced upon expiration.

12

ITEM 3. LEGAL PROCEEDINGS

State Court Lawsuit Against Erie Indemnity Company

Erie Indemnity Company (“Indemnity”) was named as a defendant in a complaint filed on August 1, 2012 by alleged subscribers of the Erie Insurance Exchange (the “Exchange”) in the Court of Common Pleas Civil Division of Fayette County, Pennsylvania captioned Erie Insurance Exchange, an unincorporated association, by Joseph S. Sullivan and Anita Sullivan, Patricia R. Beltz, and Jenna L. DeBord, trustees ad litem v. Erie Indemnity Co. (the “Sullivan” lawsuit).

As subsequently amended, the complaint alleges that, beginning on September 1, 1997, Indemnity retained “Service Charges” (installment fees) and “Added Service Charges” (late fees and policy reinstatement charges) on policies written by Exchange and its insurance subsidiaries, which allegedly should have been paid to Exchange, in the amount of approximately $308 million. In addition to their claim for monetary relief on behalf of Exchange, Plaintiffs seek an accounting of all so-called intercompany transactions between Indemnity and Exchange from 1996 to date. Plaintiffs allege that Indemnity breached its contractual, fiduciary, and equitable duties by retaining Service Charges and Added Service Charges that should have been retained by Exchange. Plaintiffs bring these same claims under three separate derivative-type theories. First, Plaintiffs purport to bring suit as members of Exchange on behalf of Exchange. Second, Plaintiffs purport to bring suit as trustees ad litem on behalf of Exchange. Third, Plaintiffs purport to bring suit on behalf of Exchange pursuant to Rule 1506 of the Pennsylvania Rules of Civil Procedure, which allows shareholders to bring suit derivatively on behalf of a corporation or similar entity.

Indemnity filed a motion in the state court in November 2012 seeking dismissal of the lawsuit. On December 19, 2013, the court granted Indemnity’s motion in part, holding that the Pennsylvania Insurance Holding Company Act “provides the [Pennsylvania Insurance] Department with special competence to address the subject matter of plaintiff’s claims” and referring “all issues” in the Sullivan lawsuit to the Pennsylvania Insurance Department (the “Department”) for “its views and any determination.” The court stayed all further proceedings and reserved decision on all other grounds for dismissal raised by Indemnity. Plaintiffs sought reconsideration of the court’s order, and on January 13, 2014, the court entered a revised order affirming its prior order and clarifying that the Department “shall decide any and all issues within its jurisdiction.” On January 30, 2014, Plaintiffs asked the court to certify its order to permit an immediate appeal to the Superior Court of Pennsylvania and to stay any proceedings in the Department pending completion of any appeal. On February 18, 2014, the court issued an order denying Plaintiffs’ motion. On March 20, 2014, Plaintiffs filed a petition for review with the Superior Court, which was denied by the Superior Court on May 5, 2014.

The Sullivan matter was assigned to an Administrative Judge within the Department for determination. The parties agreed that an evidentiary hearing was not required, entered into a stipulated record, and submitted briefing to the Department. Oral argument was held before the Administrative Judge on January 6, 2015. On April 29, 2015, the Department issued a declaratory opinion and order: (1) finding that the transactions between Exchange and Indemnity in which Indemnity retained or received revenue from installment and other service charges from Exchange subscribers complied with applicable insurance laws and regulations and that Indemnity properly retained charges paid by Exchange policyholders for certain installment premium payment plans, dishonored payments, policy cancellations, and policy reinstatements; and (2) returning jurisdiction over the matter to the Fayette County Court of Common Pleas.

On May 26, 2015, Plaintiffs appealed the Department’s decision to the Pennsylvania Commonwealth Court. Oral argument was held before the Commonwealth Court en banc on December 9, 2015. On January 27, 2016, the Commonwealth Court issued an opinion vacating the Department’s ruling and directing the Department to return the case to the Court of Common Pleas, essentially holding that the primary jurisdiction referral of the trial court was improper at this time because the allegations of the complaint do not implicate the special competency of the Department.

On February 26, 2016, Indemnity filed a petition for allowance of appeal to the Pennsylvania Supreme Court seeking further review of the Commonwealth Court opinion. On March 14, 2016, Plaintiffs filed an answer opposing Indemnity’s petition for allowance of appeal; and, on March 28, 2016, Indemnity sought permission to file a reply brief in further support of its petition for allowance of appeal. On August 10, 2016, the Pennsylvania Supreme Court denied Indemnity’s petition for allowance of appeal; and the Sullivan lawsuit returned to the Court of Common Pleas of Fayette County.

On September 12, 2016, Plaintiffs filed a motion to stay the Sullivan lawsuit pending the outcome of the Federal Court Lawsuit they filed against Indemnity and former and current Directors of Indemnity on July 8, 2016. (See below.) Indemnity filed an opposition to Plaintiff’s motion to stay on September 19, 2016; and filed amended preliminary objections seeking dismissal of the Sullivan lawsuit on September 20, 2016. The motion to stay and the amended preliminary objections remain pending.

Indemnity believes that it continues to have meritorious legal and factual defenses to the Sullivan lawsuit and intends to vigorously defend against all allegations and requests for relief.

13

Federal Court Lawsuit Against Erie Indemnity Company and Directors

On February 6, 2013, a lawsuit was filed in the United States District Court for the Western District of Pennsylvania, captioned Erie Insurance Exchange, an unincorporated association, by members Patricia R. Beltz, Joseph S. Sullivan and Anita Sullivan, and Patricia R. Beltz, on behalf of herself and others similarly situate v. Richard L. Stover; J. Ralph Borneman, Jr.; Terrence W. Cavanaugh; Jonathan Hirt Hagen; Susan Hirt Hagen; Thomas B. Hagen; C. Scott Hartz; Claude C. Lilly, III; Lucian L. Morrison; Thomas W. Palmer; Martin P. Sheffield; Elizabeth H. Vorsheck; and Robert C. Wilburn (the “Beltz” lawsuit), by alleged policyholders of Exchange who are also the plaintiffs in the Sullivan lawsuit. The individuals named as defendants in the Beltz lawsuit were the then-current Directors of Indemnity.

As subsequently amended, the Beltz lawsuit asserts many of the same allegations and claims for monetary relief as in the Sullivan lawsuit. Plaintiffs purport to sue on behalf of all policyholders of Exchange, or, alternatively, on behalf of Exchange itself. Indemnity filed a motion to intervene as a Party Defendant in the Beltz lawsuit in July 2013, and the Directors filed a motion to dismiss the lawsuit in August 2013. On February 10, 2014, the court entered an order granting Indemnity’s motion to intervene and permitting Indemnity to join the Directors’ motion to dismiss; granting in part the Directors’ motion to dismiss; referring the matter to the Department to decide any and all issues within its jurisdiction; denying all other relief sought in the Directors’ motion as moot; and dismissing the case without prejudice. To avoid duplicative proceedings and expedite the Department’s review, the Parties stipulated that only the Sullivan action would proceed before the Department and any final and non-appealable determinations made by the Department in the Sullivan action will be applied to the Beltz action.

On March 7, 2014, Plaintiffs filed a notice of appeal to the United States Court of Appeals for the Third Circuit. Indemnity filed a motion to dismiss the appeal on March 26, 2014. On November 17, 2014, the Third Circuit deferred ruling on Indemnity’s motion to dismiss the appeal and instructed the parties to address that motion, as well as the merits of Plaintiffs’ appeal, in the parties’ briefing. Briefing was completed on April 2, 2015. In light of the Department’s April 29, 2015 decision in Sullivan, the Parties then jointly requested that the Beltz appeal be voluntarily dismissed as moot on June 5, 2015. The Third Circuit did not rule on the Parties’ request for dismissal and instead held oral argument as scheduled on June 8, 2015. On July 16, 2015, the Third Circuit issued an opinion and judgment dismissing the appeal. The Third Circuit found that it lacked appellate jurisdiction over the appeal, because the District Court’s February 10, 2014 order referring the matter to the Department was not a final, appealable order.

On July 8, 2016, the Beltz plaintiffs filed a new action labeled as a “Verified Derivative And Class Action Complaint” in the United States District Court for the Western District of Pennsylvania. The action is captioned Patricia R. Beltz, Joseph S. Sullivan, and Anita Sullivan, individually and on behalf of all others similarly situated, and derivatively on behalf of Nominal Defendant Erie Insurance Exchange v. Erie Indemnity Company; Kaj Ahlmann; John T. Baily; Samuel P. Black, III; J. Ralph Borneman, Jr.; Terrence W. Cavanaugh; Wilson C. Cooney; LuAnn Datesh; Patricia A. Goldman; Jonathan Hirt Hagen; Thomas B. Hagen; C. Scott Hartz; Samuel P. Katz; Gwendolyn King; Claude C. Lilly, III; Martin J. Lippert; George R. Lucore; Jeffrey A. Ludrof; Edmund J. Mehl; Henry N. Nassau; Thomas W. Palmer; Martin P. Sheffield; Seth E. Schofield; Richard L. Stover; Jan R. Van Gorder; Elizabeth A. Hirt Vorsheck; Harry H. Weil; and Robert C. Wilburn (the “Beltz II” lawsuit). The individual defendants are all present or former Directors of Indemnity (the “Directors”).

The allegations of the Beltz II lawsuit arise from the same fundamental, underlying claims as the Sullivan and prior Beltz litigation, i.e., that Indemnity improperly retained Service Charges and Added Service Charges. The Beltz II lawsuit alleges that the retention of the Service Charges and Added Service Charges was improper because, for among other reasons, that retention constituted a breach of the Subscriber’s Agreement and an Implied Covenant of Good Faith and Fair Dealing by Indemnity, breaches of fiduciary duty by Indemnity and the other defendants, conversion by Indemnity, and unjust enrichment by defendants Jonathan Hirt Hagen, Thomas B. Hagen, Elizabeth A. Hirt Vorsheck, and Samuel P. Black, III, at the expense of Exchange. The Beltz II lawsuit requests, among other things, that a judgment be entered against the Defendants certifying the action as a class action pursuant to Rule 23 of the Federal Rules of Civil Procedure; declaring Plaintiffs as representatives of the Class and Plaintiffs’ counsel as counsel for the Class; declaring the conduct alleged as unlawful, including, but not limited to, Defendants’ retention of the Service Charges and Added Service Charges; enjoining Defendants from continuing to retain the Service Charges and Added Service Charges; and awarding compensatory and punitive damages and interest.

On September 23, 2016, Indemnity filed a motion to dismiss the Beltz II lawsuit. On September 30, 2016, the Directors filed their own motions to dismiss the Beltz II lawsuit. On July 17, 2017, the Court granted Indemnity’s and the Directors’ motions to dismiss the Beltz II lawsuit, dismissing the case in its entirety. The Court ruled that “the Subscriber’s Agreement does not govern the separate and additional charges at issue in the Complaint” and, therefore, dismissed the breach of contract claim against Indemnity for failure to state a claim. The Court also ruled that the remaining claims, including the claims for breach of fiduciary duty against Indemnity and the Directors, are barred by the applicable statutes of limitation or fail to state legally cognizable claims. On August 14, 2017, Plaintiffs filed a notice of appeal to the United States Court of Appeals for the Third Circuit.

14

Indemnity believes it has meritorious legal and factual defenses and intends to vigorously defend against all allegations and requests for relief in the Beltz II lawsuit. The Directors have advised Indemnity that they intend to vigorously defend against the claims in the Beltz II lawsuit and have sought indemnification and advancement of expenses from the Company in connection with the Beltz II lawsuit.

Federal Court Lawsuit Against Erie Indemnity Company and Directors

On December 28, 2017 a lawsuit was filed in the United States District Court for the Western District of Pennsylvania captioned Lynda Ritz, individually and on behalf of all others similarly situated and derivatively on behalf of Nominal Defendant Erie Insurance Exchange v. Erie Indemnity Company, J. Ralph Borneman, Jr., Terrence W. Cavanaugh, Eugene C. Connell, LuAnn Datesh, Jonathan Hirt Hagen, Thomas B. Hagen, C. Scott Hartz, Brian A. Hudson, Sr., Claude C. Lilly, III, George R. Lucore, Thomas W. Palmer, Martin P. Sheffield, Richard L. Stover, Elizabeth A. Hirt Vorsheck, and Robert C. Wilburn, and Erie Insurance Exchange (Nominal Defendant) (the “Ritz” lawsuit). The individual named as Plaintiff is alleged to be a policyholder (subscriber) of the Erie Insurance Exchange (the “Exchange”). With the exception of Terrence W. Cavanaugh and Robert C. Wilburn, the individuals named as Defendants comprise the current Board of Directors of Indemnity. Messrs. Cavanaugh and Wilburn are former Directors of Indemnity (the “Directors”).

The Complaint alleges that since at least 2007, Erie Indemnity Company has taken “unwarranted and excessive” management fees as compensation for its services under the Subscriber’s Agreement. Count I of the Complaint purports to allege a claim for breach of alleged fiduciary duties against Indemnity and the Directors on behalf of Plaintiff and a putative class of subscribers. Count II purports to allege a claim for breach of alleged fiduciary duties against Indemnity and the Directors on behalf of Exchange. Count III purports to allege a claim for breach of contract and an alleged implied covenant of good faith and fair dealing against Indemnity on behalf of Plaintiff and a putative class. Count IV purports to allege a claim of unjust enrichment against several individually named Directors.

The Complaint seeks compensatory and punitive damages and requests the Court to enjoin Indemnity from continuing to retain excessive management fees; and order such other relief as may be appropriate.

Indemnity believes it has meritorious legal and factual defenses and intends to vigorously defend against all allegations and requests for relief in the Ritz lawsuit. The Directors have advised Indemnity that they intend to vigorously defend against the claims in the Ritz lawsuit and have sought indemnification and advancement of expenses from the Company in connection with the Ritz lawsuit.

For additional information on contingencies, see Part II, Item 8. "Financial Statements and Supplementary Data - Note 15, Commitment and Contingencies, of Notes to Financial Statements".

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

15

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock Market Prices and Dividends

Our Class A, non-voting common stock trades on The NASDAQ Stock MarketSM LLC under the symbol "ERIE". No established trading market exists for the Class B voting common stock. American Stock Transfer & Trust Company, LLC serves as our transfer agent and registrar. As of February 16, 2018, there were approximately 639 beneficial shareholders of record for the Class A non-voting common stock and 9 beneficial shareholders of record for the Class B voting common stock.

Historically, we have declared and paid cash dividends on a quarterly basis at the discretion of the Board of Directors. The payment and amount of future dividends on the common stock will be determined by the Board of Directors and will depend upon, among other things, our operating results, financial condition, cash requirements, and general business conditions at the time such payment is considered. The common stock high and low sales prices and cash dividends declared for each full quarter of the last two years were as follows:

2017 | 2016 | |||||||||||||||||||||||||||||||

Stock sales price | Cash dividend declared | Stock sales price | Cash dividend declared | |||||||||||||||||||||||||||||

Quarter ended | High | Low | Class A | Class B | High | Low | Class A | Class B | ||||||||||||||||||||||||

March 31 | $ | 124.73 | $ | 110.34 | $ | 0.7825 | $ | 117.375 | $ | 100.53 | $ | 89.92 | $ | 0.7300 | $ | 109.500 | ||||||||||||||||

June 30 | 126.46 | 114.06 | 0.7825 | 117.375 | 99.34 | 90.60 | 0.7300 | 109.500 | ||||||||||||||||||||||||

September 30 | 128.70 | 114.29 | 0.7825 | 117.375 | 103.69 | 96.68 | 0.7300 | 109.500 | ||||||||||||||||||||||||

December 31 | 124.10 | 116.09 | 0.8400 | 126.000 | 114.60 | 99.39 | 0.7825 | 117.375 | ||||||||||||||||||||||||

Total | $ | 3.1875 | $ | 478.125 | $ | 2.9725 | $ | 445.875 | ||||||||||||||||||||||||

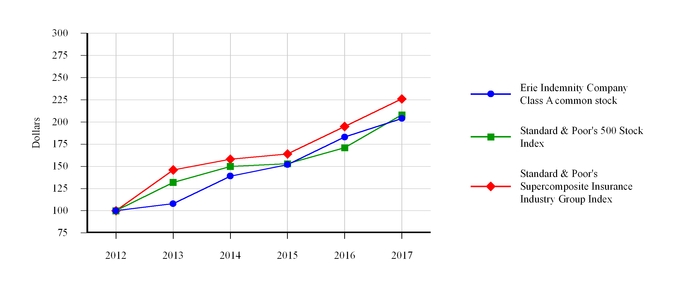

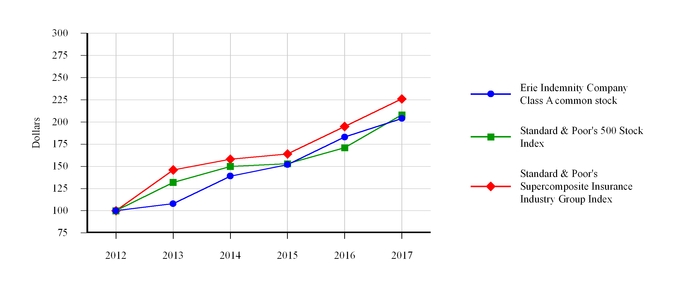

Stock Performance

The following graph depicts the cumulative total shareholder return, assuming reinvestment of dividends, for the periods indicated for our Class A common stock compared to the Standard & Poor's 500 Stock Index and the Standard & Poor's Supercomposite Insurance Industry Group Index. The Standard & Poor's Supercomposite Insurance Industry Group Index is made up of 56 constituent members represented by property and casualty insurers, insurance brokers, and life insurers, and is a capitalization weighted index.

2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||||||||||||

Erie Indemnity Company Class A common stock | $ | 100 | (1) | $ | 108 | $ | 139 | $ | 152 | $ | 183 | $ | 204 | |||||||||||

Standard & Poor's 500 Stock Index | 100 | (1) | 132 | 150 | 153 | 171 | 208 | |||||||||||||||||

Standard & Poor's Supercomposite Insurance Industry Group Index | 100 | (1) | 146 | 158 | 164 | 195 | 226 | |||||||||||||||||

(1) | Assumes $100 invested at the close of trading, including reinvestment of dividends, on the last trading day preceding the first day of the fifth preceding fiscal year, in our Class A common stock, the Standard & Poor's 500 Stock Index, and the Standard & Poor's Supercomposite Insurance Industry Group Index. |

16

Issuer Purchases of Equity Securities

We may purchase shares, from time-to-time, in the open market, through trading plans entered into with one or more brokerage firms pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, or through privately negotiated transactions. The purchase of shares is dependent upon prevailing market conditions and alternate uses of capital, and at times and in a manner that is deemed appropriate.

Our Board of Directors authorized a stock repurchase program effective January 1, 1999, allowing the repurchase of our outstanding Class A nonvoting common stock. Various approvals for continuation of this program have since been authorized, with the most recent occurring in October 2011 for $150 million, which was authorized with no time limitation. There were no repurchases of our Class A common stock under this program during the quarter ending December 31, 2017. We had approximately $17.8 million of repurchase authority remaining under this program, based upon trade date, at both December 31, 2017 and February 16, 2018.

See Part II, Item 8. "Financial Statements and Supplementary Data – Note 11, Capital Stock, of Notes to Financial Statements" contained within this report for discussion of additional shares purchased outside of this program.

ITEM 6. SELECTED FINANCIAL DATA

(in thousands, except per share data) | Years Ended December 31, | ||||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||

Operating Data: | |||||||||||||||||||||

Operating revenue | $ | 1,691,774 | $ | 1,596,631 | $ | 1,505,508 | $ | 1,407,119 | $ | 1,297,331 | |||||||||||

Operating expenses | 1,403,402 | 1,304,267 | 1,272,967 | 1,184,272 | 1,087,995 | ||||||||||||||||

Investment income | 28,561 | 27,828 | 33,708 | 28,417 | 37,278 | ||||||||||||||||

Interest expense, net | 1,238 | 101 | — | — | — | ||||||||||||||||

Income before income taxes | 315,695 | 320,091 | 266,249 | 251,264 | 246,614 | ||||||||||||||||

Net income | 196,999 | 210,366 | 174,678 | 167,505 | 162,611 | ||||||||||||||||

Per Share Data: | |||||||||||||||||||||

Net income per Class A share – diluted | $ | 3.76 | $ | 4.01 | $ | 3.33 | $ | 3.18 | $ | 3.08 | |||||||||||

Book value per share – Class A common and equivalent B shares | 16.40 | 15.62 | 14.72 | 13.45 | 13.96 | ||||||||||||||||

Dividends declared per Class A share | 3.1875 | 2.9725 | 2.773 | 2.586 | 2.4125 | ||||||||||||||||

Dividends declared per Class B share | 478.125 | 445.875 | 415.95 | 387.90 | 361.875 | ||||||||||||||||

Financial Position Data: | |||||||||||||||||||||

Investments | $ | 803,835 | $ | 771,450 | $ | 688,476 | $ | 702,387 | $ | 721,728 | |||||||||||

Receivables from Erie Insurance Exchange and affiliates | 418,328 | 378,540 | 348,055 | 335,220 | 300,442 | ||||||||||||||||

Long-term borrowings | 74,728 | 24,766 | — | — | — | ||||||||||||||||

Total assets | 1,665,859 | 1,548,955 | 1,407,296 | 1,319,198 | 1,213,042 | ||||||||||||||||

Total equity | 857,344 | 816,910 | 769,503 | 703,134 | 733,982 | ||||||||||||||||

17

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of financial condition and results of operations highlights significant factors influencing Erie Indemnity Company ("Indemnity", "we", "us", "our"). This discussion should be read in conjunction with the audited financial statements and related notes and all other items contained within this Annual Report on Form 10-K as these contain important information helpful in evaluating our financial condition and results of operations.

INDEX

Page Number | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

Statements contained herein that are not historical fact are forward-looking statements and, as such, are subject to risks and uncertainties that could cause actual events and results to differ, perhaps materially, from those discussed herein. Forward-looking statements relate to future trends, events or results and include, without limitation, statements and assumptions on which such statements are based that are related to our plans, strategies, objectives, expectations, intentions, and adequacy of resources. Examples of forward-looking statements are discussions relating to premium and investment income, expenses, operating results, and compliance with contractual and regulatory requirements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Among the risks and uncertainties, in addition to those set forth in our filings with the Securities and Exchange Commission, that could cause actual results and future events to differ from those set forth or contemplated in the forward-looking statements include the following:

• | dependence upon our relationship with the Exchange and the management fee under the agreement with the subscribers at the Exchange; |

• | dependence upon our relationship with the Exchange and the growth of the Exchange, including: |

◦ | general business and economic conditions; |

◦ | factors affecting insurance industry competition; |

◦ | dependence upon the independent agency system; and |

◦ | ability to maintain our reputation for customer service; |

• | dependence upon our relationship with the Exchange and the financial condition of the Exchange, including: |

◦ | the Exchange's ability to maintain acceptable financial strength ratings; |

◦ | factors affecting the quality and liquidity of the Exchange's investment portfolio; |

◦ | changes in government regulation of the insurance industry; |

◦ | emerging claims and coverage issues in the industry; and |

◦ | severe weather conditions or other catastrophic losses, including terrorism; |

• | costs of providing services to the Exchange under the subscriber's agreement; |

• | credit risk from the Exchange; |

• | ability to attract and retain talented management and employees; |

• | ability to ensure system availability and effectively manage technology initiatives; |

• | difficulties with technology or data security breaches, including cyber attacks; |

18

• | ability to maintain uninterrupted business operations; |

• | factors affecting the quality and liquidity of our investment portfolio; |

• | our ability to meet liquidity needs and access capital; and |

• | outcome of pending and potential litigation. |

A forward-looking statement speaks only as of the date on which it is made and reflects our analysis only as of that date. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changes in assumptions, or otherwise.

RECENT ACCOUNTING STANDARDS

See Part II, Item 8. "Financial Statements and Supplementary Data - Note 2, Significant Accounting Policies, of Notes to Financial Statements" contained within this report for a discussion of adopted as well as other recently issued accounting standards and the impact on our financial statements if known.

OPERATING OVERVIEW

Overview

We are a Pennsylvania business corporation that since 1925 has been the managing attorney-in-fact for the subscribers (policyholders) at the Erie Insurance Exchange ("Exchange"), a reciprocal insurer that writes property and casualty insurance. Our primary function is to perform policy issuance and renewal services on behalf of the subscribers at the Exchange. We operate our business as one segment.