Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - CyrusOne Inc. | cone-20171231xex312.htm |

| EX-32.2 - EXHIBIT 32.2 - CyrusOne Inc. | cone-20171231xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - CyrusOne Inc. | cone-20171231xex321.htm |

| EX-31.1 - EXHIBIT 31.1 - CyrusOne Inc. | cone-20171231xex311.htm |

| EX-23.1 - EXHIBIT 23.1 - CyrusOne Inc. | cone-20171231xex231.htm |

| EX-21.1 - EXHIBIT 21.1 - CyrusOne Inc. | cone-20171231xex211.htm |

| EX-12.1 - EXHIBIT 12.1 - CyrusOne Inc. | cone-20171231xex121.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period ___________ to ____________

Commission File Number: 001-35789

CyrusOne Inc.

(Exact name of registrant as specified in its charter)

Maryland | 46-0691837 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2101 Cedar Springs Road, Suite 900, Dallas, TX 75201

(Address of Principal Executive Offices) (Zip Code)

(972) 350-0060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $.01 par value | NASDAQ | |

Securities registered pursuant to Section 12 (g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No ý

The aggregate market value of the voting Common Stock owned by non-affiliates on June 30, 2017, was $5.1 billion, computed by reference to the closing sale price of the Common Stock on the NASDAQ Global Select Market on such date.

There were 96,125,762 shares of Common Stock outstanding as of February 13, 2018.

Portions of the definitive proxy statement relating to the Company’s 2018 Annual Meeting of Shareholders are incorporated by reference into Part III of this report to the extent described herein.

EXPLANATORY NOTE

Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” “our Company” or “the Company” refer to CyrusOne Inc., a Maryland corporation, together with its consolidated subsidiaries, including CyrusOne LP, a Maryland limited partnership. Unless otherwise indicated or unless the context requires otherwise, all references to “our operating partnership” or “the operating partnership” refer to CyrusOne LP together with its consolidated subsidiaries.

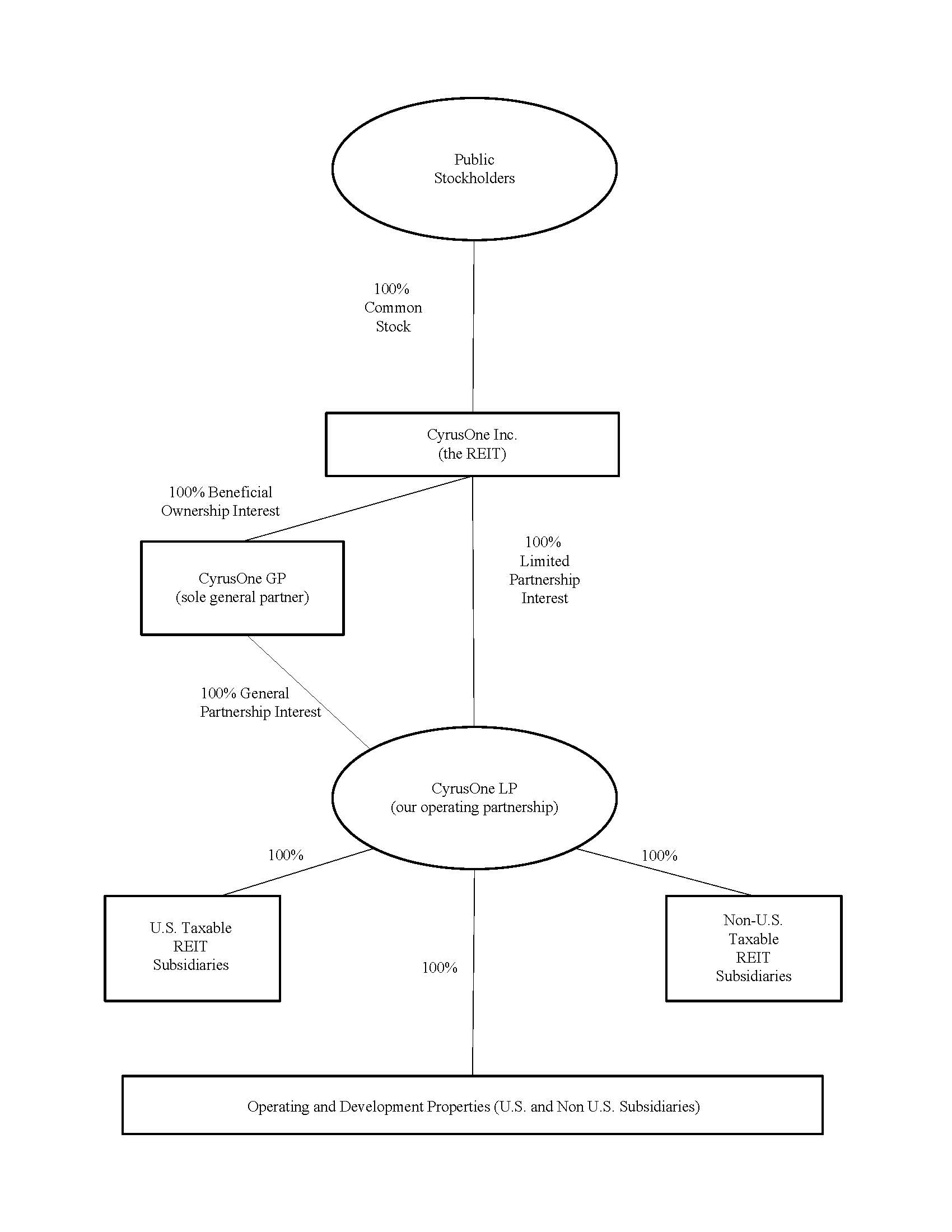

CyrusOne Inc. is a real estate investment trust (REIT) whose only material asset is its ownership of operating partnership units of CyrusOne LP. As a result, CyrusOne Inc. does not conduct business itself, other than acting as the sole beneficial owner and sole trustee of CyrusOne GP (the sole general partner of CyrusOne LP), a Maryland statutory trust, issuing public equity from time to time and guaranteeing certain debt of CyrusOne LP and certain of its subsidiaries. CyrusOne Inc. itself does not issue any indebtedness but guarantees the debt of CyrusOne LP and certain of its subsidiaries, as disclosed in this report. CyrusOne LP and its subsidiaries hold substantially all the assets of the Company. CyrusOne LP conducts the operations of the business, along with its subsidiaries, and is structured as a partnership with no publicly traded equity. Except for net proceeds from public equity issuances by CyrusOne Inc., which are generally contributed to CyrusOne LP in exchange for operating partnership units, CyrusOne LP generates the capital required for the Company's business through CyrusOne LP's operations and by CyrusOne LP's incurrence of indebtedness.

As of December 31, 2017, the total number of outstanding shares of common stock was approximately 96.1 million. CyrusOne Inc., directly or indirectly, owns all the operating partnership units of CyrusOne LP. As the direct or indirect owner of all the operating partnership units of CyrusOne LP and as sole beneficial owner and sole trustee of CyrusOne GP, which is the sole general partner of CyrusOne LP, CyrusOne Inc. has the full, exclusive and complete responsibility for the operating partnership's day-to-day management and control.

3

TABLE OF CONTENTS

PART I | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

PART III | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

PART IV | ||

ITEM 15. | ||

4

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this Annual Report on Form 10-K that are forward-looking statements within the meaning of the federal securities laws. In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, all of our statements regarding anticipated growth in our funds from operations and anticipated market conditions, demographics and results of operations are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

•loss of key customers;

•economic downturn, natural disaster or oversupply of data centers in the limited geographic areas that we serve;

•risks related to the development of our properties and our ability to successfully lease those properties;

•loss of access to key third-party service providers and suppliers;

•risks of loss of power or cooling which may interrupt our services to our customers;

•inability to identify and complete acquisitions and operate acquired properties, including the pending Zenium acquisition;

•our failure to obtain necessary outside financing on favorable terms, or at all;

•restrictions in the instruments governing our indebtedness;

•risks related to environmental matters;

•unknown or contingent liabilities related to our acquired properties;

•significant competition in our industry;

•loss of key personnel;

•risks associated with real estate assets and the industry;

• | failure to maintain our status as a REIT or to comply with the highly technical and complex REIT provisions of the Internal Revenue Code of 1986, as amended (the Code); |

•REIT distribution requirements could adversely affect our ability to execute our business plan;

•insufficient cash available for distribution to stockholders;

•future offerings of debt may adversely affect the market price of our common stock;

• | increases in market interest rates may drive potential investors to seek higher dividend yields and reduce demand for our common stock; |

•market price and volume of stock could be volatile;

•Our international activities are subject to special risks different from those faced by us in the United States;

•Any failure to comply with anti-corruption laws and regulations could have adverse effects on our business; and

•Legislative or other actions relating to taxes could have a negative effect on us.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section entitled “Risk Factors.”

5

PART I

ITEM 1. BUSINESS

The Company

We are a premier data center real estate investment trust (REIT) that owns, operates and develops enterprise-class, carrier-neutral, multi-tenant and single-tenant data center properties. Our data centers are generally purpose-built facilities with redundant power and cooling. Our data centers are carrier-neutral, enabling our customers to connect to a range of telecommunication carriers. We provide mission-critical data center facilities that protect and ensure the continued operation of information technology (IT) infrastructure for nearly 1,000 customers in 45 data centers and 2 recovery centers in 12 distinct markets (10 in the U.S., plus London and Singapore). We provide twenty-four hours-a-day, seven-days-a-week security monitoring with customizable security features.

Recent Developments

On February 27, 2017, the Company effected a full physical early settlement of the previously announced forward sale agreements (the Forward Sale Agreements) entered into with Goldman, Sachs & Co. on August 10, 2016 relating to, in the aggregate, approximately 4.4 million shares of the Company’s common stock. Upon settlement, the Company issued and sold all such shares to Goldman, Sachs & Co., in its capacity as forward purchaser, in exchange for net proceeds of approximately $210.8 million, in accordance with the provisions of the Forward Sales Agreements. Such proceeds were used to finance, in part, the acquisition of the Sentinel Properties (as defined below).

On February 28, 2017, CyrusOne closed its acquisition of two data centers located in Somerset, New Jersey and Raleigh-Durham, North Carolina (the Sentinel Properties) from Sentinel Data Centers. The Company paid aggregate cash consideration of approximately $492.3 million in connection therewith, including transaction related costs of $1.5 million. The transaction was financed by the Company with proceeds from settlement of its forward equity sale described above and borrowings under its Revolving Credit Facility (as defined in Note 10).

On March 17, 2017, CyrusOne LP and CyrusOne Finance Corp. completed their offering of $500.0 million aggregate principal amount of 5.000% senior notes due 2024 (the Original 2024 Notes) and $300.0 million aggregate principal amount of 5.375% senior notes due 2027 (the Original 2027 Notes) in a private offering. The Company received proceeds of $791.2 million, net of underwriting costs of $8.8 million.

The Company used the net proceeds from the offering (i) to finance its repurchase and redemption of all of its outstanding 6.375% Senior Notes due 2022 (the 2022 Notes), of which $474.8 million in aggregate principal amount was outstanding, (ii) for the repayment of borrowings outstanding under the operating partnership’s Revolving Credit Facility and (iii) for the payment of related premiums, fees, discounts and expenses.

On June 16, 2017, CyrusOne LP entered into an amendment to its senior Second Amended and Restated Credit Agreement (as defined in Note 10) that increased the total commitments thereunder by $450.0 million to $2.0 billion and provided additional flexibility to pursue various initiatives, including joint ventures and international expansion. The amendment increased the size of the term loan maturing in January 2022 from $300.0 million to $650.0 million and expanded the Revolving Credit Facility (as defined in Note 10) by $100.0 million to $1.1 billion. Proceeds from the $350.0 million term loan increase were used to pay down borrowings under the Revolving Credit Facility. The existing $250.0 million term loan maturing in September 2021 remained unchanged. The amendment refreshes the amount available under the accordion feature of the Second Amended and Restated Credit Agreement to enable CyrusOne LP to increase the total loan commitments under the Second Amended and Restated Credit Agreement to up to $2.3 billion from time to time.

On October 18, 2017, CyrusOne announced the formation of a new strategic partnership with the execution of a commercial agreement with GDS Holdings Limited (GDS), a leading developer and operator of high-performance, large-scale data centers in China. Under this new partnership, CyrusOne and GDS expect to work together to market and cross-sell data center space and related services in both the United States and China.

In addition, CyrusOne purchased newly issued unregistered ordinary shares equivalent to 8.0 million American depository shares (ADS) of GDS at a price per ordinary share equivalent to $12.45 per ADS, a 4% discount to the October 17, 2017 closing price, for a total investment of $100.0 million. Each ADS is equivalent to eight ordinary GDS shares. CyrusOne President and Chief Executive Officer Gary Wojtaszek will join the GDS Board of Directors.

On November 3, 2017, CyrusOne LP and CyrusOne Finance Corp. completed their offering of $200.0 million aggregate principal amount of 5.000% senior notes due 2024 (the Additional 2024 Notes) and $200.0 million aggregate principal amount of 5.375% senior notes due 2027 (the Additional 2027 Notes) in a private offering. The Additional 2024 Notes have terms substantially identical to the Original 2024 Notes and the Additional 2027 Notes have terms substantially identical to the Original 2027 Notes. The Original 2024 Notes and the Additional 2024 Notes form a single class of securities, and the Original 2027 Notes and the Additional 2027 Notes form a single class of securities. The Company received proceeds of $416.1 million, net of underwriting costs of $4.4 million. The Original 2024 Notes and

6

the Additional 2024 Notes are referred to as the 2024 Notes and the Original 2027 Notes, and the Additional 2027 Notes are referred to as the 2027 Notes. In January 2018, the 2024 Notes and the 2027 Notes were registered with the SEC.

During the third quarter of 2017, the Board authorized the Company to enter into sales agreements pursuant to which the Company may issue and sell from time to time shares of its common stock having an aggregate sales price of up to $500 million (the 2017 At The Market (ATM) Stock Offering Program). The 2017 ATM Stock Offering program replaces a prior ATM stock offering program. As of December 31, 2017, the Company had approximately $200.0 million in remaining capacity under the 2017 ATM Stock Offering program available for future offerings of stock. For the year ended December 31, 2017, the Company sold approximately 8.4 million shares of its common stock under the ATM stock offering programs, generating net proceeds of approximately $493.7 million, net of sales commissions of $6.3 million.

On December 21, 2017, CyrusOne announced the execution of a definitive agreement with Quantum Strategic Partners Ltd. (Quantum), a private investment fund managed by Soros Fund Management LLC and certain other sellers named therein, to purchase Zenium Data Centers (Zenium), a leading hyperscale data center provider in Europe with four properties in London and Frankfurt, the continent’s two largest data center markets. The purchase price is expected to be approximately $442.0 million, excluding transaction-related expenses. CyrusOne has also agreed to reimburse Zenium for capital expenditures between signing and closing. The transaction is expected to close in the first half of 2018, subject to the fulfillment of customary closing conditions including applicable regulatory approvals.

Our total stock issuance for the year ended December 31, 2017 was $706.0 million which included $210.8 million under the forward sales agreements, $493.7 million under the ATM stock offering program and $1.5 million related to the employee stock purchase plans and stock options exercised.

7

The following diagram depicts our ownership structure as of December 31, 2017:

8

Our Business

We provide mission-critical data center real estate assets designed and operated to protect and ensure the continued operation of IT infrastructure for our customers. Our goal is to be the preferred global data center provider to Fortune 1000 companies, including the largest enterprises and providers of cloud services. As of December 31, 2017, our customers included 197 of the Fortune 1000, or private, or foreign enterprises of equivalent size. These 197 Fortune 1000 customers, or private or foreign enterprises of equivalent size, provided 72% of our annualized rent as of December 31, 2017. Additionally, as of December 31, 2017, our top 10 customers represented 41% of our annualized rent.

Data centers are highly specialized and secure real estate assets that serve as centralized repositories of server, storage and network equipment. They are designed to provide the space, power, cooling and network connectivity necessary to efficiently operate mission-critical IT equipment. Telecommunications carriers typically provide network access into a data center through optical fiber. The demand for data center infrastructure is being driven by many factors, but most importantly by significant growth in data as well as an increased demand for outsourcing. The market for third-party data center facilities includes, among other companies, established “traditional” enterprises that are web-enabling their applications and business processes, as well as cloud-centric companies with sophisticated technology requirements.

We cultivate long-term strategic relationships with our customers and provide them with solutions for their data center facilities and IT infrastructure requirements. Our offerings provide flexibility, reliability and security delivered through a tailored, customer service focused platform that is designed to foster long-term relationships. Our customers include those who have not historically outsourced their data center needs and are open to solutions that address their current and future needs. Our facilities are designed and constructed in a manner to allow us to offer flexibility in density and power resiliency, and the opportunity for expansion as our customers' needs grow. The CyrusOne National IX Platform delivers interconnection across states and between metro-enabled sites within the CyrusOne footprint and beyond. The platform enables high-performance, low-cost data transfer and accessibility for customers by uniting our data centers.

Our Competitive Strengths

Our ability to attract and retain the world’s largest customers is attributed to the following competitive strengths, which distinguish us from other data center operators and will enable us to continue to grow our operations.

High Quality Customer Base. The high quality of our assets, combined with our reputation for serving the needs of large enterprises, has enabled us to focus on the Fortune 1000 to build a quality customer base. We currently have nearly 1,000 customers from a broad spectrum of industries and serve nine of the top ten cloud companies. Our revenue is generated by a stable enterprise customer base, as evidenced by the fact that as of December 31, 2017, 72% of our annualized rent comes from the Fortune 1000, private or foreign enterprises of equivalent size. We serve a diversity of industries, including information technology, financial services, energy, oil and gas, mining, medical and consumer goods and services.

As of December 31, 2017, Microsoft Corporation represented 18% of our revenue.

Strategically Located Portfolio. Our portfolio is located in several domestic and international markets possessing attractive characteristics for enterprise-focused data center operations. We have domestic properties in six of the largest metropolitan areas in the U.S. (Chicago, Dallas, Houston, New York, Phoenix and San Antonio) and six of the largest metropolitan areas for Fortune 500 headquarters (Chicago, Cincinnati, Dallas, Houston, San Antonio and New York). We believe cities with large populations or a large number of corporate headquarters are likely to produce incremental demand for IT infrastructure. In addition, being located close to our current and potential customers provides chief information officers (CIOs) with additional confidence when outsourcing their data center infrastructure to us.

Modern, High Quality, Flexible Facilities. Our portfolio includes highly efficient, reliable facilities with flexibility to customize customer solutions and accessibility to hundreds of connectivity providers. To optimize the delivery of power, our properties include modern engineering technologies designed to minimize unnecessary power usage and, in our newest facilities, we are able to provide power utilization efficiency ratios that we believe to be among the best in the multi-tenant data center industry. Fortune 1000 CIOs are dividing their application stacks into various groups as some applications require 100% availability, while others may require significant power to support complex computing, or robust connectivity. Our facility design enables us to deliver different power densities and resiliencies to the same customer footprint, allowing customers to tailor solutions to meet their application needs. In addition, the National IX Platform provides access to hundreds of telecommunication and Internet carriers.

Massively Modular® Construction Methods. Our Massively Modular® data center design principles allow us to efficiently stage construction on a large scale and deliver critical power and colocation square feet (CSF) in a timeframe that we believe is one of the best in the industry. We acquire or build a large powered shell capable of scaling with our customers’ power and colocation space needs. The powered shell can be acquired or constructed for a relatively inexpensive capital cost. Once the building shell is ready, we can build individual data center halls in portions of the building space to meet the needs of customers on a modular basis. This modular data center hall construction can

9

be completed in 12 to 16 weeks to meet our customers’ immediate needs. This short construction timeframe ensures a very high utilization of the assets and minimizes the time between our capital investment and the receipt of customer revenue, favorably impacting our return on investment while also translating into lower costs for our customers. Our design principles also allow us to add incremental equipment to increase power densities as our customers’ power needs increase, which provides our customers with a significant amount of flexibility to manage their IT demands. We believe this Massively Modular® approach allows us to respond to rapidly evolving customer needs, to commit capital toward the highest return projects and to develop state-of-the-art data center facilities.

Significant Leasing Capability. Our focus on the customer, our ability to scale with their needs, and our operational excellence provide us with embedded future growth from our customer base. During 2017, we signed new leases representing $105.5 million in annualized revenue, with previously existing customers accounting for approximately 80% of this amount. Since December 31, 2016, we have increased our CSF by approximately 1,187,000 square feet or 57%, while maintaining a high percentage of CSF utilized of 83% and 85% as of December 31, 2017 and 2016, respectively.

Significant, Attractive Expansion Opportunities. As of December 31, 2017, we had 1,534,000 net rentable square feet (NRSF) of powered shell available for future development and approximately 343 acres of land that are available for future data center facility development. The powered shell available for future development in locations that are part of our domestic portfolio consist of approximately 487,000 NRSF in the Southwest (Texas and Phoenix), 579,000 NRSF in the Northeast (Raleigh-Durham, Northern Virginia and New York Metro) and 468,000 NRSF in the Midwest (Chicago and Cincinnati). Our current development properties and available acreage were selected based on extensive site selection criteria and the collective industry knowledge and experience of our management team with a focus on markets with a strong presence of and high demand by Fortune 1000 companies and providers of cloud services. As a result, we believe that our development portfolio contains properties that are located in markets with attractive supply and demand conditions and that possess suitable physical characteristics to support data center infrastructure.

Differentiated Reputation for Service. We believe that the decision CIOs make to outsource their data center infrastructure has material implications for their businesses, and, as such, CIOs look to third-party data center providers that have a reputation for serving similar organizations and that are able to deliver a customized solution. We take a consultative approach to understanding the unique requirements of our customers, and our design principles allow us to deliver a customized data center solution to match their needs. We believe that this approach has helped fuel our growth. Our current customers are also often the source of new contracts, with referrals being an important source of new customers.

Experienced Management Team. Our management team is comprised of individuals drawing on diverse knowledge and skill sets acquired through extensive experiences in the real estate, REITs, telecommunications, technology and mission-critical infrastructure industries.

Balance Sheet Positioned to Fund Continued Growth. As of December 31, 2017, we had $1,243.4 million in available liquidity, including $1,091.5 million in borrowing capacity under our Revolving Credit Facility. The Second Amended and Restated Credit Agreement also includes an accordion feature that allows us to increase the aggregate commitment by up to $300 million. We believe that we are appropriately capitalized with sufficient financial flexibility and capacity to fund our anticipated growth.

Experienced Sales Force with Robust Partner Channel. We have an experienced sales force with a particular expertise in selling to large enterprises and providers of cloud services, which can require extensive consultation and drive long sales cycles as these enterprises make the initial outsourcing decision. As of December 31, 2017, we had 48 sales-related employees. We believe the depth, knowledge, and experience of our sales team differentiates us from other data center companies, and we are not as dependent on brokers to identify and acquire customers as some other companies in the industry. To complement our direct sales efforts, we have developed a robust network of partners, including value added resellers, systems integrators and hosting providers.

Business and Growth Strategies

Our objective is to grow our revenue and earnings and maximize stockholder returns and cash flow by continuing to expand our data center infrastructure outsourcing business.

Increasing Revenue from Existing Customers and Properties. We have historically generated a significant portion of our revenue growth from our existing customers. We will continue to target our existing customers because we believe that many have significant data center infrastructure needs that have not yet been outsourced, and many will require additional data center space and power to support their growth and their increasing reliance on technology infrastructure in their operations. To address new demand, as of December 31, 2017, we have approximately 1,098,000 NRSF currently available for lease. We also have approximately 645,000 NRSF under development, as well as 1,534,000 NRSF of additional powered shell space under roof available for development.

Attracting and Retaining New Customers. Increasingly, enterprises are beginning to recognize the complexities of managing data center infrastructure in the midst of rapid technological development and innovation. We believe that these complexities, brought about by the rapidly increasing levels of Internet traffic and data, cloud adoption, obsolete existing corporate data center infrastructure, increased power and cooling requirements and increased regulatory requirements, are all driving the need for companies to outsource their data center

10

facility requirements. Consequently, this will significantly increase the percentage of companies that use third-party data center colocation services over the next several years. We believe that our high quality assets and reputation for serving cloud providers and large enterprises have been, and will be, key differentiators for us in attracting customers that are outsourcing their data center infrastructure needs.

We acquire customers through a variety of channels. We have historically managed our sales process through a direct-to-the-customer model but are now also utilizing third-party leasing agents and indirect leasing channels to expand our universe of potential new customers. Over the past few years, we have developed a robust network of partners in our indirect leasing channels, including value added resellers, systems integrators and hosting providers. These channels, in combination with our marketing strategies, have enabled us to build both a strong brand and outreach program to new customers. Throughout the life cycle of a customer’s lease with us, we maintain a disciplined approach to monitoring their experience, with the goal of providing the highest level of customer service. This personal attention fosters a strong relationship and trust with our customers, which leads to future growth and leasing renewals.

Expanding into New Markets. Our expansion strategy focuses on acquiring and developing new data centers, both domestically and internationally, in markets where our customers are located and in markets with a strong presence of and high demand by Fortune 1000 customers and providers of cloud services. We conduct extensive analysis to ensure an identified market displays strong data center fundamentals, independent of the demand presented by any particular customer. In addition, we consider markets where our existing customers want us to be located. We regularly meet with our customers to understand their business strategies and potential data center needs. We believe that this approach, combined with our Massively Modular® construction design, reduces the risk associated with expansion into new markets because it provides strong visibility into our leasing opportunities and helps to ensure targeted returns on new developments. When considering a new market, we take a disciplined approach in evaluating potential business, property and site acquisitions, including a site’s geographic attributes, availability of telecommunications and connectivity providers, access to power, and expected costs for development.

Growing Interconnection Business. In April 2013, we launched the National IX Platform, delivering interconnection across states and between metro-enabled sites within the CyrusOne facility footprint and beyond. The platform enables high-performance, low-cost data transfer and accessibility for customers seeking to connect between CyrusOne facilities, from CyrusOne to their own private data center facility, or with one another via private peering, cross connects and/or public switching environments. Interconnection within a facility or on the National IX Platform allows our customers to share information and conduct commerce in a highly efficient manner not requiring a third-party intermediary, and at a fraction of the cost normally required to establish such a connection between two enterprises. The demand for interconnection creates additional rental and revenue growth opportunities for us, and we believe that customer interconnections increase our likelihood of customer retention by providing an environment not easily replicated by competitors. We act as a trusted neutral party that enterprises, carriers and content companies utilize to connect to each other. In 2014, we became the first colocation provider in North America to receive multi-site certification from the Open-IX Association, a non-profit industry group formed to promote better standards for data center interconnection and Internet Exchanges in North America.

Our Portfolio

As of December 31, 2017, our property portfolio included 45 data centers and 2 recovery centers in 12 distinct markets (10 in the U.S., plus London and Singapore) collectively providing approximately 5,717,000 net rentable square feet and powered by approximately 540 megawatts (MW) of available critical load capacity. Since December 31, 2016, the NRSF increased by 1,813,000. These increases were in San Antonio 248,000, Northern Virginia 519,000, New York Metro 213,000, Raleigh-Durham 167,000, Phoenix 373,000 and the remaining properties accounted for the balance. We own 33 of the buildings in which our data center facilities are located. We lease the remaining 14 buildings, which account for approximately 652,000 NRSF, or approximately 11% of our total operating NRSF. These leased buildings accounted for 18% of our total annualized rent as of December 31, 2017. We also had approximately 645,000 NRSF under development, as well as an aggregate of approximately 1,534,000 NRSF of additional powered shell space under roof available for development. In addition, we have approximately 343 acres of land that are available for future data center shell development. Along with our primary product offering, leasing of colocation space, certain of our customers are also interested in ancillary office and other space. We believe our existing operating portfolio and development pipeline will allow us to meet the evolving needs of our existing customers and continue to attract new customers. The following tables provide an overview of our operating and development properties as of December 31, 2017.

11

CyrusOne Inc.

Data Center Portfolio

As of December 31, 2017

(unaudited)

Operating Net Rentable Square Feet (NRSF)(a) | Powered Shell Available for Future Development (NRSF)(k) | Available Critical Load Capacity (MW)(l) | ||||||||||||||||||||

Stabilized Properties(b) | Metro Area | Annualized Rent(c) | Colocation Space (CSF)(d) | CSF Leased(e) | CSF Utilized(f) | Office & Other(g) | Office & Other Leased (h) | Supporting Infrastructure(i) | Total(j) | |||||||||||||

Dallas - Carrollton | Dallas | $ | 67,585,708 | 304,622 | 89 | % | 89 | % | 64,973 | 62 | % | 111,406 | 481,001 | 16,000 | 38 | |||||||

Houston - Houston West I | Houston | 42,497,450 | 112,133 | 96 | % | 97 | % | 11,343 | 99 | % | 37,244 | 160,720 | 3,000 | 28 | ||||||||

Cincinnati - 7th Street** | Cincinnati | 36,405,768 | 196,696 | 92 | % | 92 | % | 5,744 | 100 | % | 175,148 | 377,588 | 46,000 | 16 | ||||||||

Dallas - Lewisville* | Dallas | 36,257,388 | 114,054 | 94 | % | 94 | % | 11,374 | 95 | % | 54,122 | 179,550 | — | 21 | ||||||||

Northern Virginia - Sterling II | Northern Virginia | 30,309,953 | 158,998 | 100 | % | 100 | % | 8,651 | 100 | % | 55,306 | 222,955 | — | 30 | ||||||||

Somerset I | New York Metro | 28,531,926 | 96,918 | 88 | % | 88 | % | 26,613 | 85 | % | 88,991 | 212,522 | 2,000 | 11 | ||||||||

Chicago - Aurora I | Chicago | 27,652,512 | 113,032 | 96 | % | 96 | % | 34,008 | 100 | % | 223,478 | 370,518 | 27,000 | 71 | ||||||||

Totowa - Madison* | New York Metro | 25,970,252 | 51,290 | 89 | % | 89 | % | 22,477 | 100 | % | 58,964 | 132,731 | — | 6 | ||||||||

Cincinnati - North Cincinnati | Cincinnati | 25,398,959 | 65,303 | 97 | % | 97 | % | 44,886 | 75 | % | 52,950 | 163,139 | 65,000 | 14 | ||||||||

San Antonio III | San Antonio | 24,337,608 | 131,767 | 100 | % | 100 | % | 9,309 | 100 | % | 43,126 | 184,202 | — | 24 | ||||||||

Houston - Houston West II | Houston | 23,301,914 | 79,540 | 87 | % | 87 | % | 4,355 | 88 | % | 55,042 | 138,937 | 11,000 | 12 | ||||||||

Wappingers Falls I* | New York Metro | 22,968,754 | 37,000 | 86 | % | 86 | % | 20,167 | 97 | % | 15,077 | 72,244 | — | 3 | ||||||||

San Antonio I | San Antonio | 21,042,190 | 43,891 | 100 | % | 100 | % | 5,989 | 83 | % | 45,650 | 95,530 | 11,000 | 12 | ||||||||

Phoenix - Chandler II | Phoenix | 19,884,192 | 74,082 | 100 | % | 100 | % | 5,639 | 38 | % | 25,519 | 105,240 | — | 12 | ||||||||

Northern Virginia - Sterling I | Northern Virginia | 17,291,618 | 77,961 | 100 | % | 100 | % | 5,618 | 77 | % | 48,598 | 132,177 | — | 12 | ||||||||

Raleigh-Durham I | Raleigh-Durham | 17,078,401 | 75,664 | 88 | % | 88 | % | 9,507 | 100 | % | 82,119 | 167,290 | 246,000 | 12 | ||||||||

Houston - Galleria | Houston | 16,864,199 | 63,469 | 61 | % | 61 | % | 23,259 | 51 | % | 24,927 | 111,655 | — | 14 | ||||||||

Phoenix - Chandler I | Phoenix | 16,783,940 | 74,041 | 100 | % | 100 | % | 34,582 | 12 | % | 38,452 | 147,075 | 31,000 | 16 | ||||||||

Phoenix - Chandler III | Phoenix | 16,596,885 | 67,937 | 100 | % | 100 | % | 2,440 | — | % | 30,415 | 100,792 | — | 14 | ||||||||

Northern Virginia - Sterling III | Northern Virginia | 15,218,979 | 79,122 | 100 | % | 100 | % | 7,264 | 100 | % | 33,603 | 119,989 | — | 15 | ||||||||

Austin II | Austin | 13,666,086 | 43,772 | 95 | % | 95 | % | 1,821 | 100 | % | 22,433 | 68,026 | — | 5 | ||||||||

San Antonio II | San Antonio | 13,569,018 | 64,221 | 100 | % | 100 | % | 11,255 | 100 | % | 41,127 | 116,603 | — | 12 | ||||||||

Florence | Cincinnati | 13,361,160 | 52,698 | 99 | % | 99 | % | 46,848 | 87 | % | 40,374 | 139,920 | — | 9 | ||||||||

Phoenix - Chandler IV | Phoenix | 11,264,335 | 73,433 | 100 | % | 100 | % | 3,039 | 100 | % | 26,533 | 103,005 | — | 12 | ||||||||

Cincinnati - Hamilton* | Cincinnati | 9,073,368 | 46,565 | 76 | % | 76 | % | 1,077 | 100 | % | 35,336 | 82,978 | — | 10 | ||||||||

London - Great Bridgewater* | International | 5,680,892 | 10,000 | 94 | % | 94 | % | — | — | % | 514 | 10,514 | — | 1 | ||||||||

Northern Virginia - Sterling IV | Northern Virginia | 5,439,076 | 81,291 | 100 | % | 100 | % | 5,523 | 100 | % | 34,322 | 121,136 | — | 15 | ||||||||

Cincinnati - Mason | Cincinnati | 5,394,151 | 34,072 | 100 | % | 100 | % | 26,458 | 98 | % | 17,193 | 77,723 | — | 4 | ||||||||

Dallas - Midway* | Dallas | 5,356,920 | 8,390 | 100 | % | 100 | % | — | — | % | — | 8,390 | — | 1 | ||||||||

Phoenix - Chandler VI | Phoenix | 5,274,000 | 148,434 | 58 | % | 94 | % | 1,000 | 100 | % | 32,037 | 181,471 | 10,000 | 12 | ||||||||

Stamford - Riverbend* | New York Metro | 5,150,002 | 20,000 | 23 | % | 23 | % | — | — | % | 8,484 | 28,484 | — | 2 | ||||||||

Norwalk I* | New York Metro | 3,766,807 | 13,240 | 88 | % | 92 | % | 4,085 | 72 | % | 40,610 | 57,935 | 87,000 | 2 | ||||||||

Dallas - Marsh* | Dallas | 2,600,005 | 4,245 | 100 | % | 100 | % | — | — | % | — | 4,245 | — | 1 | ||||||||

Chicago - Lombard | Chicago | 2,274,283 | 13,516 | 61 | % | 61 | % | 4,115 | 100 | % | 12,230 | 29,861 | 29,000 | 3 | ||||||||

Stamford - Omega* | New York Metro | 1,233,557 | — | — | % | — | % | 18,552 | 84 | % | 3,796 | 22,348 | — | — | ||||||||

Totowa - Commerce* | New York Metro | 691,429 | — | — | % | — | % | 20,460 | 43 | % | 5,540 | 26,000 | — | — | ||||||||

Cincinnati - Blue Ash* | Cincinnati | 616,664 | 6,193 | 36 | % | 36 | % | 6,821 | 100 | % | 2,165 | 15,179 | — | 1 | ||||||||

South Bend - Crescent* | Chicago | 576,976 | 3,432 | 43 | % | 43 | % | — | — | % | 5,125 | 8,557 | 11,000 | 1 | ||||||||

Houston - Houston West III | Houston | 493,602 | — | — | % | — | % | 10,272 | 100 | % | 10,654 | 20,926 | 209,000 | — | ||||||||

Singapore - Inter Business Park* | International | 365,132 | 3,200 | 22 | % | 22 | % | — | — | % | — | 3,200 | — | 1 | ||||||||

South Bend - Monroe | Chicago | 119,741 | 6,350 | 23 | % | 23 | % | — | — | % | 6,478 | 12,828 | 4,000 | 1 | ||||||||

Cincinnati - Goldcoast | Cincinnati | 96,090 | 2,728 | — | % | — | % | 5,280 | — | % | 16,481 | 24,489 | 14,000 | 1 | ||||||||

Stabilized Properties - Total | $ | 638,041,890 | 2,653,300 | 91 | % | 93 | % | 524,804 | 77 | % | 1,661,569 | 4,839,673 | 822,000 | 470 | ||||||||

12

CyrusOne Inc. | ||||||||||||||||||||||

Data Center Portfolio | ||||||||||||||||||||||

As of December 31, 2017 | ||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||

Operating Net Rentable Square Feet (NRSF)(a) | Powered Shell Available for Future Development (NRSF)(k) | Available Critical Load Capacity (MW)(l) | ||||||||||||||||||||

Metro Area | Annualized Rent(c) | Colocation Space (CSF)(d) | CSF Leased(e) | CSF Utilized(f) | Office & Other(g) | Office & Other Leased (h) | Supporting Infrastructure(i) | Total(j) | ||||||||||||||

Stabilized Properties - Total | $ | 638,041,890 | 2,653,300 | 91 | % | 93 | % | 524,804 | 77 | % | 1,661,569 | 4,839,673 | 822,000 | 470 | ||||||||

Pre-Stabilized Properties(b) | ||||||||||||||||||||||

Austin III | Austin | 9,488,450 | 61,838 | 47 | % | 47 | % | 15,055 | 83 | % | 20,629 | 97,522 | 67,000 | 3 | ||||||||

Northern Virginia - Sterling V | Northern Virginia | 8,874,654 | 242,730 | 41 | % | 44 | % | 900 | — | % | 112,662 | 356,292 | 244,000 | 30 | ||||||||

Houston - Houston West III (DH #1) | Houston | 2,756,377 | 52,932 | 22 | % | 24 | % | — | — | % | 21,128 | 74,060 | — | 6 | ||||||||

Dallas - Carrollton (DH #6) | Dallas | 1,579,500 | 74,865 | 33 | % | 51 | % | — | — | % | 21,224 | 96,089 | — | 3 | ||||||||

Phoenix - Chandler V | Phoenix | 1,505,032 | 71,515 | 50 | % | 50 | % | 996 | 50 | % | 16,399 | 88,910 | 94,000 | 6 | ||||||||

Chicago - Aurora II (DH #1) | Chicago | 175,668 | 76,665 | 21 | % | 21 | % | 10,045 | — | % | 13,875 | 100,585 | 272,000 | 16 | ||||||||

San Antonio IV | San Antonio | — | 32,802 | — | % | — | % | 3,577 | — | % | 27,191 | 63,570 | 35,000 | 6 | ||||||||

All Properties - Total | $ | 662,421,571 | 3,266,647 | 80 | % | 83 | % | 555,377 | 75 | % | 1,894,677 | 5,716,701 | 1,534,000 | 540 | ||||||||

* | Indicates properties in which we hold a leasehold interest. |

** | The information provided for the Cincinnati - 7th Street property includes data for two facilities, one of which we lease and one of which we own. |

(a) | Represents the total square feet of a building under lease or available for lease based on engineers' drawings and estimates but does not include space held for development or space used by CyrusOne. |

(b) | Stabilized properties include data halls that have been in service for at least 24 months or are at least 85% utilized. Pre-stabilized properties include data halls that have been in service for less than 24 months and are less than 85% utilized. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2017, multiplied by 12. For the month of December 2017, customer reimbursements were $67.8 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2016 through December 31, 2017, customer reimbursements under leases with separately metered power constituted between 10.2% and 12.6% of annualized rent. |

(d) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

(e) | Percent leased is determined based on CSF being billed to customers under signed leases as of December 31, 2017 divided by total CSF. Leases signed but not commenced as of December 31, 2017 are not included. |

(f) | Utilization is calculated by dividing CSF under signed leases for colocation space (whether or not the lease has commenced billing) by total CSF. |

(g) | Represents the NRSF at an operating facility that is currently leased or readily available for lease as space other than CSF, which is typically office and other space. |

(h) | Percent leased is determined based on Office & Other space being billed to customers under signed leases as of December 31, 2017 divided by total Office & Other space. Leases signed but not commenced as of December 31, 2017 are not included. |

(i) | Represents infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(j) | Represents the NRSF at an operating facility that is currently leased or readily available for lease. This excludes existing vacant space held for development. |

(k) | Represents space that is under roof that could be developed in the future for operating NRSF, rounded to the nearest 1,000. |

(l) | Critical load capacity represents the aggregate power available for lease and exclusive use by customers expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. Does not sum to total due to rounding. |

13

CyrusOne Inc.

NRSF Under Development

As of December 31, 2017

(Dollars in millions)

(unaudited)

NRSF Under Development (a) | Under Development Costs(b) | ||||||||||||||||||

Facilities | Metropolitan Area | Estimated Completion Date | Colocation Space (CSF) | Office & Other | Supporting Infrastructure | Powered Shell(b) | Total | Critical Load MW Capacity(c) | Actual to Date(d) | Estimated Costs to Completion(e) | Total | ||||||||

Austin III | Austin | 1Q'18 | — | — | — | — | — | 3 | $ | 5 | $6-8 | $11-13 | |||||||

Somerset II | New York Metro | 1Q'18 | — | — | — | 210,000 | 210,000 | — | 15 | 9-10 | 24-25 | ||||||||

Northern Virginia - Sterling V | Northern Virginia | 1Q'18 | 33,000 | — | 8,000 | — | 41,000 | 3 | 5 | 17-19 | 22-24 | ||||||||

Phoenix - Chandler VI | Phoenix | 1Q'18 | — | — | — | — | — | 12 | 17 | 10-16 | 27-33 | ||||||||

Dallas - Carrollton | Dallas | 2Q'18 | 51,000 | — | 2,000 | — | 53,000 | 15 | 4 | 49-55 | 53-59 | ||||||||

Dallas - Allen | Dallas | 2Q'18 | 79,000 | 27,000 | 60,000 | 175,000 | 341,000 | 6 | 5 | 53-59 | 58-64 | ||||||||

Total | 163,000 | 27,000 | 70,000 | 385,000 | 645,000 | 39 | $ | 51 | $144-167 | $195-218 | |||||||||

(a) | Represents NRSF at a facility for which activities have commenced or are expected to commence in the next 2 quarters to prepare the space for its intended use. Estimates and timing are subject to change. |

(b) | Represents NRSF under construction that, upon completion, will be powered shell available for future development into operating NRSF. |

(c) | Critical load capacity represents the aggregate power available for lease and exclusive use by customers expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. |

(d) | Actual to date is the cash investment as of December 31, 2017. There may be accruals above this amount for work completed, for which cash has not yet been paid. |

(e) | Represents management’s estimate of the total costs required to complete the current NRSF under development. There may be an increase in costs if customers require greater power density. |

14

Customer Diversification

Our portfolio is currently leased to approximately 1,000 customers, many of which are leading global companies. The following table sets forth information regarding the 20 largest customers, including their affiliates, in our portfolio based on annualized rent as of December 31, 2017:

CyrusOne Inc.

Customer Diversification(a)

As of December 31, 2017

(unaudited)

Principal Customer Industry | Number of Locations | Annualized Rent(b) | Percentage of Portfolio Annualized Rent(c) | Weighted Average Remaining Lease Term in Months(d) | |||||

1 | Information Technology | 9 | $ | 118,237,061 | 17.8 | % | 93.0 | ||

2 | Information Technology | 9 | 26,994,022 | 4.1 | % | 46.9 | |||

3 | Information Technology | 4 | 25,234,226 | 3.8 | % | 86.7 | |||

4 | Financial Services | 1 | 19,754,228 | 3.0 | % | 159.0 | |||

5 | Telecommunication Services | 2 | 15,742,896 | 2.4 | % | 9.4 | |||

6 | Research and Consulting Services | 3 | 15,124,425 | 2.3 | % | 36.4 | |||

7 | Healthcare | 2 | 14,612,770 | 2.2 | % | 120.0 | |||

8 | Energy | 5 | 13,574,772 | 2.0 | % | 8.2 | |||

9 | Energy | 1 | 12,611,653 | 1.9 | % | 26.5 | |||

10 | Industrials | 4 | 11,224,802 | 1.7 | % | 20.4 | |||

11 | Telecommunication Services | 7 | 10,177,171 | 1.5 | % | 35.9 | |||

12 | Financial Services | 2 | 9,038,727 | 1.4 | % | 68.2 | |||

13 | Information Technology | 4 | 8,762,775 | 1.3 | % | 55.7 | |||

14 | Information Technology | 2 | 7,383,843 | 1.1 | % | 75.1 | |||

15 | Information Technology | 3 | 6,806,882 | 1.0 | % | 120.4 | |||

16 | Energy | 2 | 6,624,678 | 1.0 | % | 7.9 | |||

17 | Financial Services | 1 | 6,600,225 | 1.0 | % | 29.0 | |||

18 | Consumer Staples | 4 | 6,309,460 | 1.0 | % | 38.5 | |||

19 | Telecommunication Services | 5 | 5,885,604 | 0.9 | % | 16.1 | |||

20 | Consumer Staples | 2 | 5,216,417 | 0.8 | % | 51.5 | |||

$ | 345,916,637 | 52.2 | % | 70.6 | |||||

(a) | Customers and their affiliates are consolidated. |

(b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2017, multiplied by 12. For the month of December 2017, customer reimbursements were $67.8 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2016 through December 31, 2017, customer reimbursements under leases with separately metered power constituted between 10.2% and 12.6% of annualized rent. |

(c) | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of December 31, 2017, which was approximately $662.4 million. |

(d) | Weighted average based on customer’s percentage of total annualized rent expiring and is as of December 31, 2017, assuming that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised because such payments approximate the profitability margin of leasing that space to the customer, such that we do not consider early termination to be economically detrimental to us. |

15

Lease Distribution

The following table sets forth information relating to the distribution of customer leases in the properties in our portfolio, based on NRSF under lease as of December 31, 2017:

CyrusOne Inc.

Lease Distribution

As of December 31, 2017

(unaudited)

NRSF Under Lease(a) | Number of Customers(b) | Percentage of All Customers | Total Leased NRSF(c) | Percentage of Portfolio Leased NRSF | Annualized Rent(d) | Percentage of Annualized Rent | |||||||

0-999 | 685 | 70 | % | 148,208 | 3 | % | $ | 70,402,796 | 11 | % | |||

1,000-2,499 | 118 | 12 | % | 185,717 | 4 | % | 37,259,253 | 5 | % | ||||

2,500-4,999 | 67 | 7 | % | 234,626 | 5 | % | 45,074,048 | 7 | % | ||||

5,000-9,999 | 44 | 4 | % | 306,553 | 7 | % | 60,282,199 | 9 | % | ||||

10,000+ | 74 | 7 | % | 3,744,050 | 81 | % | 449,403,275 | 68 | % | ||||

Total | 988 | 100 | % | 4,619,154 | 100 | % | $ | 662,421,571 | 100 | % | |||

(a) | Represents all leases in our portfolio, including colocation, office and other leases. |

(b) | Represents the number of customers occupying data center, office and other space as of December 31, 2017. This may vary from total customer count as some customers may be under contract, but have yet to occupy space. |

(c) | Represents the total square feet at a facility under lease and that has commenced billing, excluding space held for development or space used by CyrusOne. A customer’s leased NRSF is estimated based on such customer’s direct CSF or office and light-industrial space plus management’s estimate of infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(d) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2017, multiplied by 12. For the month of December 2017, customer reimbursements were $67.8 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2016 through December 31, 2017, customer reimbursements under leases with separately metered power constituted between 10.2% and 12.6% of annualized rent. |

16

Lease Expiration

The following table sets forth a summary schedule of the customer lease expirations for leases in place as of December 31, 2017, plus available space, for each of the 10 full calendar years beginning January 1, 2018, at the properties in our portfolio.

CyrusOne Inc.

Lease Expirations

As of December 31, 2017

(unaudited)

Year(a) | Number of Leases Expiring(b) | Total Operating NRSF Expiring | Percentage of Total NRSF | Annualized Rent(c) | Percentage of Annualized Rent | Annualized Rent at Expiration(d) | Percentage of Annualized Rent at Expiration | |||||||||

Available | 1,097,547 | 18 | % | |||||||||||||

Month-to-Month | 555 | 56,214 | 1 | % | $ | 17,836,114 | 3 | % | $ | 18,047,234 | 2 | % | ||||

2018 | 2,249 | 554,759 | 10 | % | 133,521,351 | 20 | % | 136,908,269 | 18 | % | ||||||

2019 | 1,352 | 485,080 | 9 | % | 83,799,237 | 12 | % | 86,330,774 | 12 | % | ||||||

2020 | 1,314 | 483,807 | 9 | % | 64,655,451 | 10 | % | 67,967,365 | 9 | % | ||||||

2021 | 607 | 499,613 | 9 | % | 78,682,720 | 12 | % | 89,013,555 | 12 | % | ||||||

2022 | 222 | 538,570 | 9 | % | 45,783,999 | 7 | % | 62,049,815 | 8 | % | ||||||

2023 | 78 | 162,285 | 3 | % | 19,934,650 | 3 | % | 27,242,178 | 4 | % | ||||||

2024 | 39 | 223,937 | 4 | % | 30,482,675 | 5 | % | 39,275,747 | 5 | % | ||||||

2025 | 39 | 178,710 | 3 | % | 26,985,449 | 4 | % | 31,523,317 | 4 | % | ||||||

2026 | 26 | 577,649 | 10 | % | 74,754,446 | 11 | % | 81,745,331 | 11 | % | ||||||

2027 | 16 | 396,494 | 7 | % | 45,812,150 | 7 | % | 59,126,790 | 8 | % | ||||||

2028 - Thereafter | 14 | 462,036 | 8 | % | 40,173,329 | 6 | % | 49,029,966 | 7 | % | ||||||

Total | 6,511 | 5,716,701 | 100 | % | $ | 662,421,571 | 100 | % | $ | 748,260,341 | 100 | % | ||||

(a) | Leases that were auto-renewed prior to December 31, 2017 are shown in the calendar year in which their current auto-renewed term expires. Unless otherwise stated in the footnotes, the information set forth in the table assumes that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised. |

(b) | Number of leases represents each agreement with a customer. A lease agreement could include multiple spaces and a customer could have multiple leases. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2017, multiplied by 12. For the month of December 2017, customer reimbursements were $67.8 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2016 through December 31, 2017, customer reimbursements under leases with separately metered power constituted between 10.2% and 12.6% of annualized rent. |

(d) | Represents the final monthly contractual rent under existing customer leases that had commenced as of December 31, 2017, multiplied by 12. |

17

Regulation

General

Properties in our markets are subject to various laws, ordinances and regulations, including regulations relating to common areas. In addition to the regulations described below, we are subject to various federal, state and local regulations, such as state and local fire and life safety regulations. We believe that each of our properties has, or is expected to have when required, the necessary permits and approvals for us to operate our business.

Americans With Disabilities Act

Our properties must comply with Title III of the Americans with Disabilities Act of 1990, or the ADA, to the extent that such properties are “public accommodations” as defined by the ADA. The ADA may require removal of structural barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. We believe that our properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA could result in imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations is an ongoing one, and we will continue to assess our properties and to make alterations as appropriate in this respect.

Environmental Matters

We are subject to laws and regulations relating to the protection of the environment, the storage, management and disposal of hazardous materials, emissions to air and discharges to water, the cleanup of contaminated sites and health and safety matters. These include various regulations promulgated by the Environmental Protection Agency and other federal, state, and local regulatory agencies and legislative bodies relating to our operations, including those involving power generators, batteries, and fuel storage to support co-location infrastructure. While we believe that our operations are in substantial compliance with environmental, health, and human safety laws and regulations, as an owner or operator of property and in connection with the current and historical use of hazardous materials and other operations at its sites, we could incur significant costs, including fines, penalties and other sanctions, cleanup costs and third-party claims for property damages or personal injuries, as a result of violations of or liabilities under environmental laws and regulations. Fuel storage tanks are present at many of our properties, and if releases were to occur, we may be liable for the costs of cleaning up resulting contamination. Some of our sites also have a history of previous commercial operations, including past underground storage tanks.

Some of the properties may contain asbestos-containing building materials. Environmental laws require that asbestos-containing building materials be properly managed and maintained, and may impose fines and penalties on building owners or operators for failure to comply with these requirements.

Environmental consultants have conducted, as appropriate, Phase I or similar non-intrusive environmental site assessments on recently acquired properties and if appropriate, additional environmental inquiries and assessments on recently acquired properties. Nonetheless, we may acquire or develop sites in the future with unknown environmental conditions from historical operations. Although we are not aware of any sites at which we currently have material remedial obligations, the imposition of remedial obligations as a result of spill or the discovery of contaminants in the future could result in significant additional costs to us.

Our operations also require us to obtain permits and/or other governmental approvals and to develop response plans in connection with the use of our generators or other operations. These requirements could restrict our operations or delay the development of data centers in the future. In addition, from time to time, federal, state or local government regulators enact new or revise existing legislation or regulations that could affect us, either beneficially or adversely. As a result, we could incur significant costs in complying with environmental laws or regulations that are promulgated in the future.

Insurance

We carry comprehensive liability, fire, extended coverage, business interruption and rental loss insurance covering all of the properties in our portfolio under a blanket policy. In the opinion of our management, our policy specifications, limits and insurance carriers are appropriate given the relative risk of loss, the cost of coverage and industry practice. We cannot provide any assurance that the business interruption or property insurance we have will cover all losses that we may experience, that the insurance carrier will be solvent, that rates will remain commercially reasonable, that insurance carriers will not cancel our policies, or that the insurance carriers will pay all claims made by us. Certain circumstances, such as acts of war, are generally uninsurable under our policies. See also “Risk Factors-Risks Related to Our Business and Operations." Any losses to our properties that are not covered by insurance, or that exceed our policy coverage limits, could adversely affect our business, financial condition and results of operations.

18

Competition

We compete with numerous developers, owners and operators of technology-related real estate, many of which own properties similar to ours in the same markets in which our properties are located. If our competitors offer space at rental rates below current market rates or below the rental rates we currently charge our customers, or if our competitors offer space that tenants perceive to be superior to ours (based on factors such as available power, security considerations, location or connectivity), we may lose potential customers and we may be pressured to reduce our rental rates below those we currently charge in order to retain customers when our customers’ leases expire or incur costs to improve our properties. In addition, our customers have the option of building their own data center space which can also place pressure on our rental rates.

As a developer of data center space and provider of interconnection services, we also compete for the services of key third-party providers of services, including engineers and contractors with expertise in the development of data centers. There is competition for the services of specialized contractors and other third-party providers required for the development of data centers, increasing the cost of engaging such providers and the risk of delays in completing our development projects.

In addition, we face competition from real estate developers in our sector and in other industries for the acquisition of additional properties suitable for the development of data centers. Such competition may reduce the number of properties available for acquisition, increase the price of these properties and reduce the demand for data center space in the markets we seek to serve.

Employees

We employ approximately 416 persons. None of these employees are represented by a labor union.

Financial Information

For financial information related to our operations, please refer to the financial statements including the notes thereto, included in this Annual Report on Form 10-K.

How to Obtain Our SEC Filings

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (SEC). All reports we file with the SEC will be available free of charge via EDGAR through the SEC website at http://www.sec.gov. In addition, the public may read and copy materials we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Information about the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. We make available our reports on Forms 10-K, 10-Q, and 8-K (as well as all amendments to these reports), and other information, free of charge, at the "Investors" section of our website at http://www.cyrusone.com. The information found on, or otherwise accessible through, our website is not incorporated by reference into, nor does it form a part of, this report or any other document that we file with the SEC.

19

ITEM 1A. RISK FACTORS

You should carefully consider all the risks described below, as well as the other information contained in this document when evaluating your investment in our securities. Any of the following risks could materially and adversely affect our business, results of operations or financial condition. The risks and uncertainties described below are those that we currently believe may materially affect our Company. Additional risks and uncertainties of which we are unaware or that we currently deem immaterial also may become important factors that affect our Company. The occurrence of any of the following risks might cause you to lose all or a part of your investment. Some statements in this Form 10-K, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Operations

A small number of customers account for a significant portion of our revenue. The loss or significant reduction in business from one or more of our large customers could significantly harm our business, financial condition and results of operations, and impact the amount of cash available for distribution to our stockholders.

We currently depend, and expect to continue to depend, upon a relatively small number of customers for a significant percentage of our revenue. Our top 10 customers collectively accounted for approximately 41% of our total annualized rent as of December 31, 2017. We have one customer which accounted for approximately 18% of our total annualized rent as of December 31, 2017. As a result of this customer concentration, our business, financial condition and results of operations, including the amount of cash available for distribution to our stockholders, could be adversely affected if we lose one or more of our larger customers, if one or more of such customers significantly reduce their business with us or if we choose not to enforce, or to enforce less vigorously, any rights that we may have now or in the future against these significant customers because of our desire to maintain our relationship with them.

A significant percentage of our customer base is also concentrated in three industry sectors: information technology, financial services and energy sectors. Enterprises in the information technology, financial services and energy industries comprised approximately 42%, 19% and 11%, respectively, of our annualized rent as of December 31, 2017. A downturn in one of these industries could negatively impact the financial condition of one or more of our information technology, financial services or energy customers, including several of our larger customers. In addition, instability in financial markets and economies generally may adversely affect our customers’ ability to replace or renew maturing liabilities on a timely basis, access the capital markets to meet liquidity and capital expenditure requirements and may result in adverse effects on our customers’ financial condition and results of operations. As a result of these factors, customers could default on their obligations to us, delay the purchase of new services from us or decline to renew expiring leases, any of which could have an adverse effect on our business, financial condition and results of operations.

Additionally, if any customer becomes a debtor in a case under the U.S. Bankruptcy Code, applicable bankruptcy laws may limit our ability to terminate our contract with such customer solely because of the bankruptcy or recover any amounts owed to us under our agreements with such customer. In addition, applicable bankruptcy laws could allow the customer to reject and terminate its agreement with us, with limited ability for us to collect the full amount of our damages. Our business, including our revenue and cash available for distribution to our stockholders, could be adversely affected if any of our significant customers were to become bankrupt or insolvent.

A significant percentage of our customer leases expire each year or are on a month-to-month basis, and many of our leases contain early termination provisions. If leases with our customers are not renewed on the same or more favorable terms or are terminated early by our customers, our business, financial condition and results of operations could be substantially harmed.

Our customers may not renew their leases upon expiration. This risk is increased by the significant percentage of our customer leases that expire every year. As of December 31, 2017, leases representing 20%, 12% and 10% of the annualized rent for our portfolio will expire during 2018, 2019 and 2020, respectively, and an additional 3% of the 2017 annualized rent for our portfolio was from month-to-month leases. While historically we have retained a significant number of our customers, including those leasing from us on a month-to-month basis, upon expiration our customers may elect not to renew their leases or renew their leases at lower rates, for less space, for fewer services or for shorter terms. If we are unable to successfully renew or continue our customer leases on the same or more favorable terms or subsequently re-lease available data center space when such leases expire, our business, financial condition and results of operations could be adversely affected.

In addition, many of our leases contain early termination provisions that allow our customers to reduce the term of their leases subject to payment of an early termination charge that is often a specified portion of the remaining rent payable on such leases. The exercise by customers of early termination options could have an adverse effect on our business, financial condition and results of operations.

20

We generate a substantial portion of our revenue from a small number of metropolitan markets, which makes us more susceptible to regional economic downturns.

Our properties are located in 12 distinct markets (10 in the U.S., plus London and Singapore). Dallas, Cincinnati, Houston, New York Metro, Northern Virginia, Phoenix and San Antonio accounted for approximately 89% of our annualized rent as of December 31, 2017. As such, we are potentially susceptible to local economic conditions and the supply of, and demand for, data center space in these markets. If there is a downturn in the economy, a natural disaster or an oversupply of, or decrease in demand for, data centers in these markets, our business could be adversely affected to a greater extent than if we owned a real estate portfolio that was more diversified in terms of both geography and industry focus.

Even if we have additional space available for lease at any one of our data centers, our ability to meet existing customer requirements or lease this space to existing or new customers could be constrained by our ability to provide sufficient electrical power and cooling capacity.

Customers are increasing their deployment of high-density IT equipment in our data centers, which has increased the demand for power and cooling capacity. As current and future customers increase their power footprint in our facilities over time, we may be required to upgrade or add to our existing infrastructure or add additional infrastructure to meet customer requirements. Power and cooling systems are difficult and expensive to upgrade, and such changes may be required at a time or on a timeline during which we lack the financial or operational ability to make such changes. Our failure to timely upgrade or add additional infrastructure could result in a failure to meet the requirements of our existing customers, or limit our ability to increase occupancy rates or density within our existing facilities, whether for new or existing customers. Similarly, even when successful in implementing such changes, we may not be able to pass on any additional costs to our customers.

We do not own all of the buildings in which our data centers are located. Instead, we lease or sublease certain of our data center spaces and the ability to retain these leases or subleases could be a significant risk to our ongoing operations.

We do not own 14 buildings that account for approximately 652,000 NRSF, or approximately 11% of our total operating NRSF. These leased buildings accounted for 18% of our total annualized rent as of December 31, 2017. In addition, future companies that we acquire, particularly outside of the U. S., may lease facilities instead of owning them. Our business could be harmed if we are unable to renew the leases for these data centers on favorable terms or at all. Additionally, in several of our smaller facilities we sublease our space, and our rights under these subleases are dependent on our sublandlord retaining its rights under the prime lease. When the primary terms of our existing leases expire, we generally have the right to extend the terms of our leases for one or more renewal periods, subject to, in the case of several of our subleases, our sublandlord renewing its term under the prime lease. For four of these leases and subleases, the renewal rent will be determined based on the fair market value of rental rates for the property, and the then prevailing rental rates may be higher than the current rental rates under the applicable lease. The rent for the remaining leases and subleases will be based on a fixed percentage increase over the base rent during the year immediately prior to expiration. Several of our data centers are leased or subleased from other data center companies, which may increase our risk of non-renewal or renewal on less than favorable terms. If renewal rates are less favorable than those we currently have, we may be required to increase revenues within existing data centers to offset such increase in lease payments. Failure to increase revenues to sufficiently offset these projected higher costs would adversely impact our operating income. Upon the end of our renewal options, we would have to renegotiate our lease terms with the applicable landlords.