Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CVR ENERGY INC | cvi8-kq42017earningspresen.htm |

4th Quarter 2017 Earnings Report

February 22, 2018

This presentation should be reviewed in conjunction with CVR Energy, Inc.’s Fourth Quarter earnings conference

call held on February 22, 2018. The following information contains forward-looking statements based on

management’s current expectations and beliefs, as well as a number of assumptions concerning future events.

These statements are subject to risks, uncertainties, assumptions and other important factors. You are cautioned

not to put undue reliance on such forward-looking statements (including forecasts and projections regarding our

future performance) because actual results may vary materially from those expressed or implied as a result of

various factors, including, but not limited to (i) those set forth under “Risk Factors” in CVR Energy, Inc.’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Energy, Inc. makes with the

Securities and Exchange Commission, (ii) those set forth under “Risk Factors” in CVR Refining, LP’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Refining, LP makes with the

Securities and Exchange Commission, and (iii) those set forth under “Risk Factors” in the CVR Partners, LP

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and any other filings CVR Partners, LP makes

with the Securities and Exchange Commission. CVR Energy, Inc. assumes no obligation to, and expressly

disclaims any obligation to, update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except to the extent required by law.

All information in this earnings report is unaudited other than the consolidated statement of operations data for the

year ended December 31, 2016 and the balance sheet data as of December 31, 2014 through 2016.

Forward Looking Statements

2

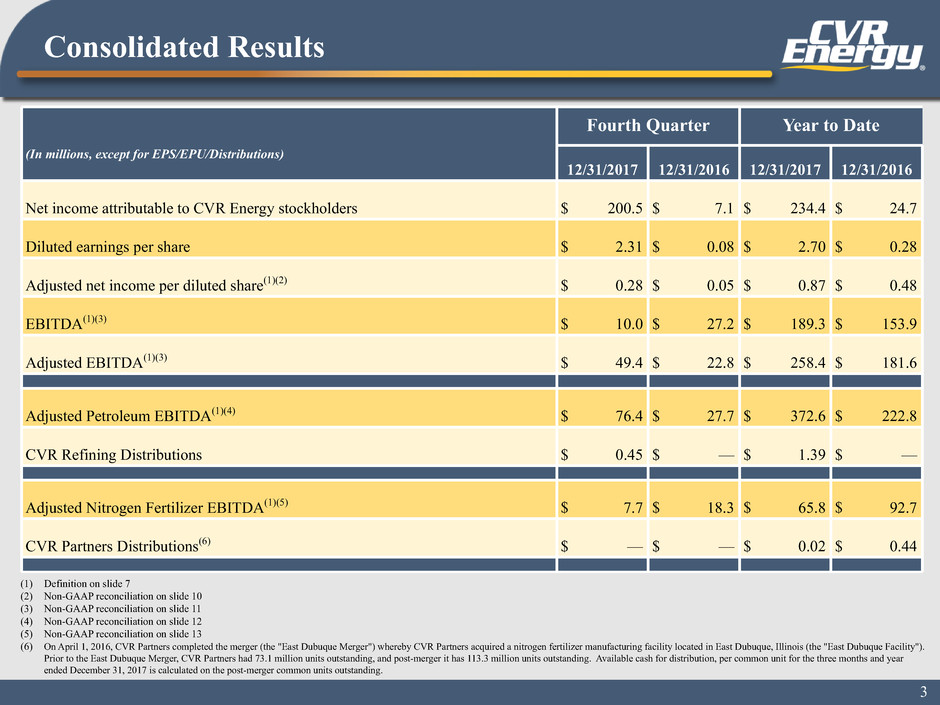

Consolidated Results

Fourth Quarter Year to Date

(In millions, except for EPS/EPU/Distributions)

12/31/2017 12/31/2016 12/31/2017 12/31/2016

Net income attributable to CVR Energy stockholders $ 200.5 $ 7.1 $ 234.4 $ 24.7

Diluted earnings per share $ 2.31 $ 0.08 $ 2.70 $ 0.28

Adjusted net income per diluted share(1)(2) $ 0.28 $ 0.05 $ 0.87 $ 0.48

EBITDA(1)(3) $ 10.0 $ 27.2 $ 189.3 $ 153.9

Adjusted EBITDA(1)(3) $ 49.4 $ 22.8 $ 258.4 $ 181.6

Adjusted Petroleum EBITDA(1)(4) $ 76.4 $ 27.7 $ 372.6 $ 222.8

CVR Refining Distributions $ 0.45 $ — $ 1.39 $ —

Adjusted Nitrogen Fertilizer EBITDA(1)(5) $ 7.7 $ 18.3 $ 65.8 $ 92.7

CVR Partners Distributions(6) $ — $ — $ 0.02 $ 0.44

(1) Definition on slide 7

(2) Non-GAAP reconciliation on slide 10

(3) Non-GAAP reconciliation on slide 11

(4) Non-GAAP reconciliation on slide 12

(5) Non-GAAP reconciliation on slide 13

(6) On April 1, 2016, CVR Partners completed the merger (the "East Dubuque Merger") whereby CVR Partners acquired a nitrogen fertilizer manufacturing facility located in East Dubuque, Illinois (the "East Dubuque Facility").

Prior to the East Dubuque Merger, CVR Partners had 73.1 million units outstanding, and post-merger it has 113.3 million units outstanding. Available cash for distribution, per common unit for the three months and year

ended December 31, 2017 is calculated on the post-merger common units outstanding.

3

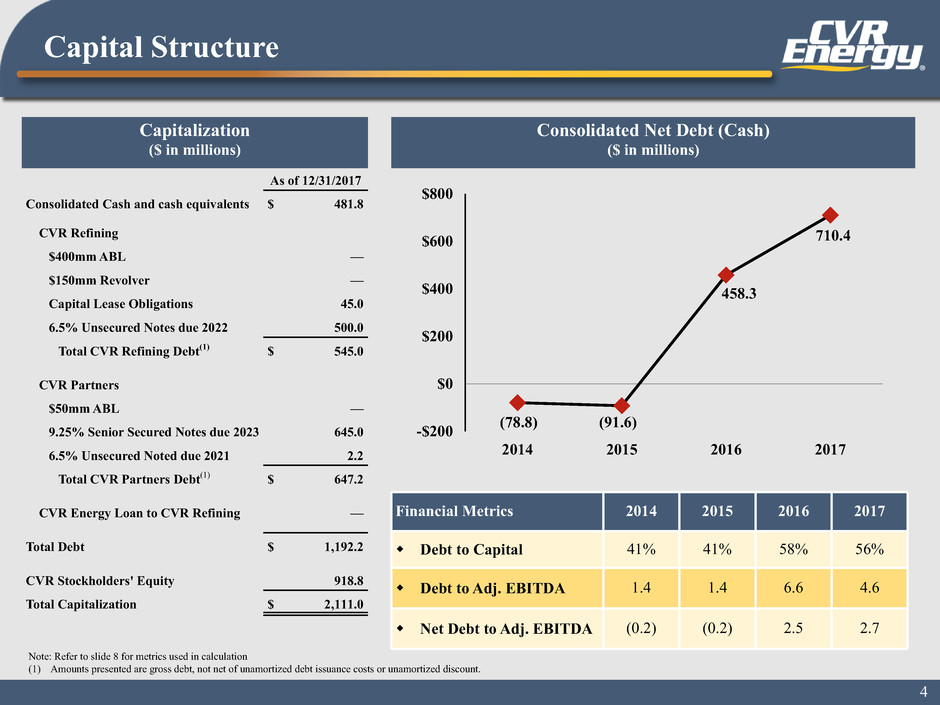

Capital Structure

$800

$600

$400

$200

$0

-$200

2014 2015 2016 2017

Note: Refer to slide 8 for metrics used in calculation

(1) Amounts presented are gross debt, not net of unamortized debt issuance costs or unamortized discount.

Financial Metrics 2014 2015 2016 2017

w Debt to Capital 41% 41% 58% 56%

w Debt to Adj. EBITDA 1.4 1.4 6.6 4.6

w Net Debt to Adj. EBITDA (0.2) (0.2) 2.5 2.7

As of 12/31/2017

Consolidated Cash and cash equivalents $ 481.8

CVR Refining

$400mm ABL —

$150mm Revolver —

Capital Lease Obligations 45.0

6.5% Unsecured Notes due 2022 500.0

Total CVR Refining Debt(1) $ 545.0

CVR Partners

$50mm ABL —

9.25% Senior Secured Notes due 2023 645.0

6.5% Unsecured Noted due 2021 2.2

Total CVR Partners Debt(1) $ 647.2

CVR Energy Loan to CVR Refining —

Total Debt $ 1,192.2

CVR Stockholders' Equity 918.8

Total Capitalization $ 2,111.0

Capitalization

($ in millions)

4

Consolidated Net Debt (Cash)

($ in millions)

(78.8) (91.6)

458.3

710.4

Appendix

Non-GAAP Financial Measures

To supplement the actual results in accordance with GAAP for the applicable periods, the Company also uses non-GAAP

financial measures as discussed below, which are reconciled to GAAP-based results. These non-GAAP financial measures

should not be considered an alternative for GAAP results. The adjustments are provided to enhance an overall understanding

of the Company’s financial performance for the applicable periods and are indicators management believes are relevant and

useful for planning and forecasting future periods.

6

Non-GAAP Financial Measures (cont'd)

Adjusted net income (loss) is not a recognized term under GAAP and should not be substituted for net income (loss) as a measure of our performance but rather should

be utilized as a supplemental measure of financial performance in evaluating our business. Management believes that adjusted net income (loss) provides relevant

and useful information that enables external users of our financial statements, such as industry analysts, investors, lenders and rating agencies, to better understand

and evaluate our ongoing operating results and allow for greater transparency in the review of our overall financial, operational and economic performance. Adjusted

net income (loss) per diluted share represents adjusted net income (loss) divided by weighted-average diluted shares outstanding. Adjusted net income represents net

income, as adjusted, that is attributable to CVR Energy stockholders.

EBITDA and Adjusted EBITDA. EBITDA represents net income attributable to CVR Energy stockholders before consolidated (i) interest expense and other financing

costs, net of interest income, (ii) income tax expense (benefit) and (iii) depreciation and amortization, less the portion of these adjustments attributable to non-controlling

interest. Adjusted EBITDA represents EBITDA adjusted for consolidated (i) FIFO impact (favorable) unfavorable, (ii) loss on extinguishment of debt, (iii) major

scheduled turnaround expenses (that many of our competitors capitalize and thereby exclude from their measures of EBITDA and Adjusted EBITDA),(iv) (gain) loss

on derivatives, net, (v) current period settlements on derivative contracts, (vi) flood insurance recovery, (vii) business interruption insurance recovery and (viii) expenses

associated with the East Dubuque Merger, less the portion of these adjustments attributable to non-controlling interest. EBITDA and Adjusted EBITDA are not

recognized terms under GAAP and should not be substituted for net income or cash flow from operations. Management believes that EBITDA and Adjusted EBITDA

enable investors to better understand and evaluate our ongoing operating results and allows for greater transparency in reviewing our overall financial, operational

and economic performance. EBITDA and Adjusted EBITDA presented by other companies may not be comparable to our presentation, since each company may define

these terms differently. Prior to 2016, EBITDA was also adjusted for share-based compensation expense in calculating Adjusted EBITDA. Beginning in 2016, share-

based compensation expense is no longer utilized as an adjustment to derive Adjusted EBITDA as no equity-settled awards remain outstanding for CVR Energy or

any of its subsidiaries, and CVR Partners and CVR Refining are responsible for reimbursing CVR Energy for their allocated portion of all outstanding awards.

Management believes, based on the nature, classification and cash settlement feature of the currently outstanding awards, that it is no longer necessary to adjust

EBITDA for share-based compensation expense to derive Adjusted EBITDA. EBITDA and Adjusted EBITDA represent EBITDA and Adjusted EBITDA that is attributable

to CVR Energy stockholders.

Petroleum and Nitrogen Fertilizer EBITDA and Adjusted EBITDA. EBITDA by operating segment represents net income (loss) before (i) interest expense and other

financing costs, net of interest income, (ii) income tax expense and (iii) depreciation and amortization. Adjusted EBITDA by operating segment represents EBITDA

by operating segment adjusted for, as applicable (i) FIFO impact (favorable) unfavorable; (ii) share-based compensation, non-cash; (iii) loss on extinguishment of

debt; (iv) major scheduled turnaround expenses (that many of our competitors capitalize and thereby exclude from their measure of EBITDA and adjusted EBITDA);

(v) (gain) loss on derivatives, net; (vi) current period settlements on derivative contracts; (vii) flood insurance recovery; (viii) expenses associated with the East

Dubuque Merger and (ix) business interruption insurance recovery. We present Adjusted EBITDA by operating segment because it is the starting point for CVR

Refining’s and CVR Partners' calculation of available cash for distribution. EBITDA and Adjusted EBITDA by operating segment are not recognized terms under

GAAP and should not be substituted for net income (loss) as a measure of performance. Management believes that EBITDA and Adjusted EBITDA by operating segment

enable investors to better understand CVR Refining’s and CVR Partners' ability to make distributions to their common unitholders, help investors evaluate our ongoing

operating results and allow for greater transparency in reviewing our overall financial, operational and economic performance. EBITDA and Adjusted EBITDA

presented by other companies may not be comparable to our presentation, since each company may define these terms differently.

7

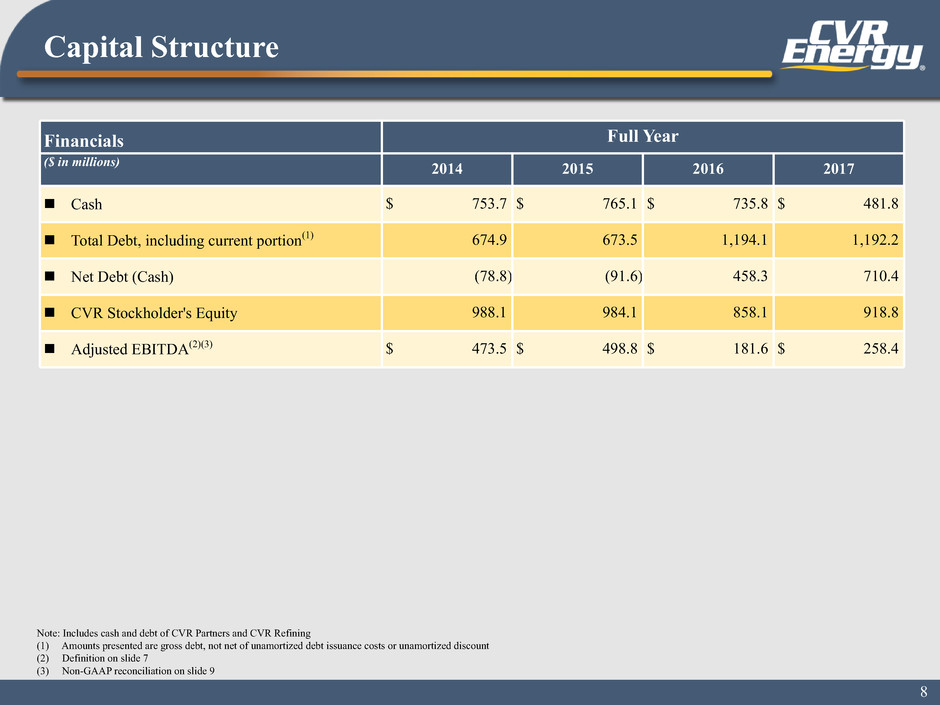

Capital Structure

Financials Full Year

($ in millions) 2014 2015 2016 2017

n Cash $ 753.7 $ 765.1 $ 735.8 $ 481.8

n Total Debt, including current portion(1) 674.9 673.5 1,194.1 1,192.2

n Net Debt (Cash) (78.8) (91.6) 458.3 710.4

n CVR Stockholder's Equity 988.1 984.1 858.1 918.8

n Adjusted EBITDA(2)(3) $ 473.5 $ 498.8 $ 181.6 $ 258.4

Note: Includes cash and debt of CVR Partners and CVR Refining

(1) Amounts presented are gross debt, not net of unamortized debt issuance costs or unamortized discount

(2) Definition on slide 7

(3) Non-GAAP reconciliation on slide 9

8

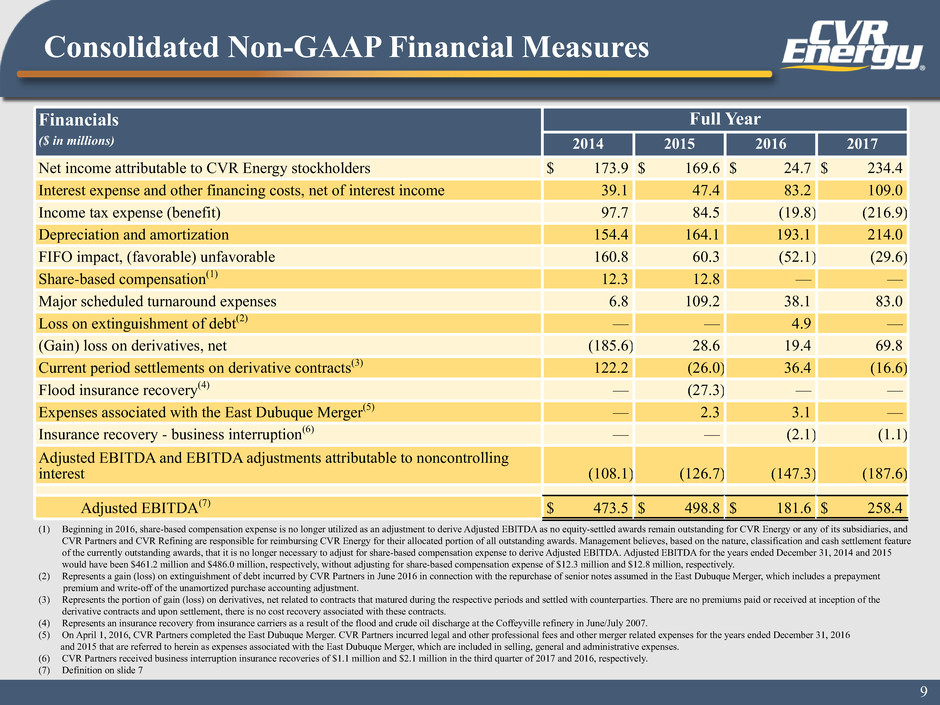

Consolidated Non-GAAP Financial Measures

Financials Full Year

($ in millions) 2014 2015 2016 2017

Net income attributable to CVR Energy stockholders $ 173.9 $ 169.6 $ 24.7 $ 234.4

Interest expense and other financing costs, net of interest income 39.1 47.4 83.2 109.0

Income tax expense (benefit) 97.7 84.5 (19.8) (216.9)

Depreciation and amortization 154.4 164.1 193.1 214.0

FIFO impact, (favorable) unfavorable 160.8 60.3 (52.1) (29.6)

Share-based compensation(1) 12.3 12.8 — —

Major scheduled turnaround expenses 6.8 109.2 38.1 83.0

Loss on extinguishment of debt(2) — — 4.9 —

(Gain) loss on derivatives, net (185.6) 28.6 19.4 69.8

Current period settlements on derivative contracts(3) 122.2 (26.0) 36.4 (16.6)

Flood insurance recovery(4) — (27.3) — —

Expenses associated with the East Dubuque Merger(5) — 2.3 3.1 —

Insurance recovery - business interruption(6) — — (2.1) (1.1)

Adjusted EBITDA and EBITDA adjustments attributable to noncontrolling

interest (108.1) (126.7) (147.3) (187.6)

Adjusted EBITDA(7) $ 473.5 $ 498.8 $ 181.6 $ 258.4

(1) Beginning in 2016, share-based compensation expense is no longer utilized as an adjustment to derive Adjusted EBITDA as no equity-settled awards remain outstanding for CVR Energy or any of its subsidiaries, and

CVR Partners and CVR Refining are responsible for reimbursing CVR Energy for their allocated portion of all outstanding awards. Management believes, based on the nature, classification and cash settlement feature

of the currently outstanding awards, that it is no longer necessary to adjust for share-based compensation expense to derive Adjusted EBITDA. Adjusted EBITDA for the years ended December 31, 2014 and 2015

would have been $461.2 million and $486.0 million, respectively, without adjusting for share-based compensation expense of $12.3 million and $12.8 million, respectively.

(2) Represents a gain (loss) on extinguishment of debt incurred by CVR Partners in June 2016 in connection with the repurchase of senior notes assumed in the East Dubuque Merger, which includes a prepayment

premium and write-off of the unamortized purchase accounting adjustment.

(3) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the

derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

(4) Represents an insurance recovery from insurance carriers as a result of the flood and crude oil discharge at the Coffeyville refinery in June/July 2007.

(5) On April 1, 2016, CVR Partners completed the East Dubuque Merger. CVR Partners incurred legal and other professional fees and other merger related expenses for the years ended December 31, 2016

and 2015 that are referred to herein as expenses associated with the East Dubuque Merger, which are included in selling, general and administrative expenses.

(6) CVR Partners received business interruption insurance recoveries of $1.1 million and $2.1 million in the third quarter of 2017 and 2016, respectively.

(7) Definition on slide 7

9

Consolidated Non-GAAP Financial Measures

Financials Fourth Quarter Year to Date

($ in millions, except per share data) 12/31/2017 12/31/2016 12/31/2017 12/31/2016

Income (loss) before income tax benefit $ (61.6) $ (28.1) $ — $ (10.9)

FIFO impact, favorable (30.4) (22.4) (29.6) (52.1)

Major scheduled turnaround expenses 43.0 — 83.0 38.1

Loss on derivatives, net 65.0 14.6 69.8 19.4

Current period settlement on derivative contracts(1) (17.7) 1.2 (16.6) 36.4

(Gain) loss on extinguishment of debt(2) — (0.2) — 4.9

Expenses associated with the East Dubuque Merger(3) — — — 3.1

Insurance recovery - business interruption(4) — — (1.1) (2.1)

Adjusted net income (loss) before income tax benefit and noncontrolling interest (1.7) (34.9) 105.5 36.8

Adjusted net income (loss) attributed to noncontrolling interest 7.5 15.5 (18.8) (4.1)

Income tax benefit, as adjusted 218.8 23.8 189.7 8.8

Net tax benefit related to the TCJA(5) (200.5) — (200.5) —

Adjusted net income(6) $ 24.1 $ 4.4 $ 75.9 $ 41.5

Adjusted net income per diluted share $ 0.28 $ 0.05 $ 0.87 $ 0.48

(1) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of

the derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

(2) Represents a gain (loss) on extinguishment of debt incurred by CVR Partners in June 2016 in connection with the repurchase of senior notes assumed in the East Dubuque Merger, which includes a

prepayment premium and write-off of the unamortized purchase accounting adjustment.

(3) On April 1, 2016, CVR Partners completed the East Dubuque Merger. CVR Partners incurred legal and other professional fees and other merger related expenses for the three months ended December 31,

2015 and the years ended December 31, 2016 and 2015 that are referred to herein as expenses associated with the East Dubuque Merger, which are included in selling, general and administrative expenses.

(4) CVR Partners received business interruption insurance recoveries of $1.1 million and $2.1 million in the third quarter of 2017 and 2016, respectively.

(5) Represents a one-time benefit related to the remeasurement of our net deferred tax liabilities as a result of the Tax Cuts and Jobs Act (“TCJA”) legislation being signed into law in December 2017 with the

reduction of the federal income tax rate from 35% to 21% beginning in 2018. Our net deferred tax liabilities at December 31, 2017 were remeasured to reflect the lower tax rate that will be in effect for the

years in which the deferred tax assets and liabilities will be realized. A benefit of approximately $200.5 million was recognized as a result of the remeasurement.

(6) Definition on slide 7

10

Consolidated Non-GAAP Financial Measures

Financials Fourth Quarter Year to Date

($ in millions) 12/31/2017 12/31/2016 12/31/2017 12/31/2016

Net income attributable to CVR Energy stockholders $ 200.5 $ 7.1 $ 234.4 $ 24.7

Interest expense and other financing costs, net of interest income 27.5 26.9 109.0 83.2

Income tax benefit (234.3) (22.1) (216.9) (19.8)

Depreciation and amortization 54.8 52.3 214.0 193.1

Adjustments attributable to noncontrolling interest (38.5) (37.0) (151.2) (127.3)

EBITDA(1) 10.0 27.2 189.3 153.9

FIFO impact, favorable (30.4) (22.4) (29.6) (52.1)

Major scheduled turnaround expenses 43.0 — 83.0 38.1

Loss on derivatives, net 65.0 14.6 69.8 19.4

Current period settlements on derivative contracts(2) (17.7) 1.2 (16.6) 36.4

(Gain) loss on extinguishment of debt(3) — (0.2) — 4.9

Expenses associated with the East Dubuque Merger(4) — — — 3.1

Insurance recovery - business interruption(5) — — (1.1) (2.1)

Adjustments attributable to noncontrolling interest (20.5) 2.4 (36.4) (20.0)

Adjusted EBITDA(1) $ 49.4 $ 22.8 $ 258.4 $ 181.6

(1) Definition on slide 7

(2) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception of the

derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

(3) Represents a gain (loss) on extinguishment of debt incurred by CVR Partners in June 2016 in connection with the repurchase of senior notes assumed in the East Dubuque Merger, which includes a prepayment

premium and write-off of the unamortized purchase accounting adjustment.

(4) On April 1, 2016, CVR Partners completed the East Dubuque Merger. CVR Partners incurred legal and other professional fees and other merger related expenses that are referred to herein as expenses associated with

the East Dubuque Merger, which are included in selling, general and administrative expenses.

(5) CVR Partners received business interruption insurance recoveries of $1.1 million and $2.1 million in the third quarter of 2017 and 2016, respectively.

11

Petroleum Non-GAAP Financial Measures

Financials Fourth Quarter Year to Date

($ in millions) 12/31/2017 12/31/2016 12/31/2017 12/31/2016

Petroleum net income (loss) $ (29.0) $ (10.7) $ 88.8 $ 15.3

Interest expense and other financing cost, net of interest income 11.9 11.6 46.7 43.3

Income tax expense — — — —

Depreciation and amortization 33.6 33.4 133.1 129.0

Petroleum EBITDA(1) 16.5 34.3 268.6 187.6

FIFO impact, favorable (30.4) (22.4) (29.6) (52.1)

Major scheduled turnaround expenses 43.0 — 80.4 31.5

Loss on derivatives, net 65.0 14.6 69.8 19.4

Current period settlements on derivative contracts(2) (17.7) 1.2 (16.6) 36.4

Adjusted Petroleum EBITDA(1) $ 76.4 $ 27.7 $ 372.6 $ 222.8

(1) Definition on slide 7

(2) Represents the portion of gain (loss) on derivatives, net related to contracts that matured during the respective periods and settled with counterparties. There are no premiums paid or received at inception

of the derivative contracts and upon settlement, there is no cost recovery associated with these contracts.

12

Fertilizer Non-GAAP Financial Measures

Financials Fourth Quarter Year to Date

($ in millions)

12/31/2017 12/31/2016 12/31/2017 12/31/2016

Nitrogen Fertilizer net loss $ (27.4) $ (14.5) $ (72.8) $ (26.9)

Interest expense and other financing costs, net 15.8 15.8 62.9 48.6

Income tax expense 0.2 — 0.2 0.3

Depreciation and amortization 19.1 17.2 74.0 58.2

Nitrogen Fertilizer EBITDA(1) 7.7 18.5 64.3 80.2

Major scheduled turnaround expenses — — 2.6 6.6

(Gain) loss on extinguishment of debt(2) — (0.2) — 4.9

Expenses associated with the East Dubuque Merger(3) — — — 3.1

Insurance recovery - business interruption(4) — — (1.1) (2.1)

Adjusted Nitrogen Fertilizer EBITDA(1) $ 7.7 $ 18.3 $ 65.8 $ 92.7

(1) Definition on slide 7

(2) Represents a gain (loss) on extinguishment of debt incurred by CVR Partners in June 2016 in connection with the repurchase of senior notes assumed in the East Dubuque Merger, which includes a

prepayment premium and write-off of the unamortized purchase accounting adjustment.

(3) On April 1, 2016, CVR Partners completed the East Dubuque Merger. CVR Partners incurred legal and other professional fees and other merger related expenses for the three months ended December 31,

2015 and the years ended December 31, 2016 and 2015 that are referred to herein as expenses associated with the East Dubuque Merger, which are included in selling, general and administrative expenses.

(4) CVR Partners received business interruption insurance recoveries of $1.1 million and $2.1 million in the third quarter of 2017 and 2016, respectively.

13