Attached files

| file | filename |

|---|---|

| EX-2.1 - SALE AND PURCHASE AGREEMENT DATED DECEMBER 22, 2017 - SEABOARD CORP /DE/ | seb-20171231ex21256f5eb.htm |

| 10-K - INSTANCE DOCUMENT - SEABOARD CORP /DE/ | seb-20171231x10k.htm |

| EX-99.1 - AUDITED STATEMENTS OF BUTTERBALL, LLC DATED DECEMBER 31, 2017 - SEABOARD CORP /DE/ | seb-20171231ex991ad7354.htm |

| EX-32.2 - CERTIFICATION OF THE CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 906 - SEABOARD CORP /DE/ | seb-20171231ex3224cd0e1.htm |

| EX-32.1 - CERTIFICATION OF THE CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 906 - SEABOARD CORP /DE/ | seb-20171231ex3212f9602.htm |

| EX-31.2 - CERTIFICATION OF THE CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 302 - SEABOARD CORP /DE/ | seb-20171231ex312af00ec.htm |

| EX-31.1 - CERTIFICATION OF THE CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 - SEABOARD CORP /DE/ | seb-20171231ex311154ab4.htm |

| EX-21 - LIST OF SUBSIDIARIES - SEABOARD CORP /DE/ | seb-20171231ex2181e3a1e.htm |

Exhibit 13

2017 Annual Report

SEABOARD CORPORATION

Description of Business

Seaboard Corporation and its subsidiaries (“Seaboard”) are a diverse global agribusiness and transportation company. In the United States (“U.S.”), Seaboard is primarily engaged in pork production and processing and ocean transportation. Overseas, Seaboard is primarily engaged in commodity merchandising, grain processing, sugar production and electric power generation. Seaboard also has an interest in a turkey operation in the U.S.

This report, including information included or incorporated by reference in this report, contains certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Seaboard. Forward-looking statements generally may be identified as statements that are not historical in nature and statements preceded by, followed by or that include the words: “believes,” “expects,” “may,” “will,” “should,” “could,” “anticipates,” “estimates,” “intends,” or similar expressions. In more specific terms, forward-looking statements, include, without limitation: statements concerning the projection of revenues, income or loss, capital expenditures, capital structure or other financial items, including the impact of mark-to-market accounting on operating income; statements regarding the plans and objectives of management for future operations; statements of future economic performance; statements regarding the intent, belief or current expectations of Seaboard and its management with respect to: (i) Seaboard’s ability to obtain adequate financing and liquidity; (ii) the price of feed stocks and other materials used by Seaboard; (iii) the sales price or market conditions for pork, grains, sugar, turkey and other products and services; (iv) the recorded tax effects under certain circumstances and changes in tax laws; (v) the volume of business and working capital requirements associated with the competitive trading environment for the Commodity Trading and Milling segment; (vi) the charter hire rates and fuel prices for vessels; (vii) the fuel costs and spot market prices for electricity in the Dominican Republic; (viii) the effect of the fluctuation in foreign currency exchange rates; (ix) the profitability or sales volume of any of Seaboard’s segments; (x) the anticipated costs and completion timetables for Seaboard’s scheduled capital improvements, acquisitions and dispositions; (xi) the productive capacity of facilities that are planned or under construction, and the timing of the commencement of operations at such facilities; or (xii) other trends affecting Seaboard’s financial condition or results of operations, and statements of the assumptions underlying or relating to any of the foregoing statements.

This list of forward-looking statements is not exclusive. Seaboard undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changes in assumptions or otherwise. Forward-looking statements are not guarantees of future performance or results. They involve risks, uncertainties and assumptions. Actual results may differ materially from those contemplated by the forward-looking statements due to a variety of factors. The information contained in this report, including, without limitation, the information under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Letter to Stockholders” identifies important factors which could cause such differences.

2017 Annual Report 1

Letter to Stockholders is intentionally omitted from Exhibit 13 and will be included in the printed Annual Report.

2 2017 Annual Report

SEABOARD CORPORATION

Letter to Stockholders

Letter to Stockholders is intentionally omitted from Exhibit 13 and will be included in the printed Annual Report.

2017 Annual Report 3

SEABOARD CORPORATION

|

|

|

|

|

|

|

Corporate Office Seaboard Corporation Merriam, Kansas Pork Seaboard Foods LLC Pork Division Office Merriam, Kansas Processing Plants Guymon, Oklahoma Mexico Biodiesel Operations Guymon, Oklahoma St. Joseph, Missouri Daily’s Premium Meats, LLC* Missoula, Montana Salt Lake City, Utah St. Joseph, Missouri Seaboard Triumph Foods, LLC* Sioux City, Iowa Commodity Trading and Milling Commodity Trading Operations Atlanta, Georgia* Australia* Canada Chapel Hill, North Carolina Colombia Ecuador Greece Isle of Man Kenya Monaco Morocco* Peru* South Africa Africa Poultry Development Limited* Kenya and Zambia Bag Yaglari Sanayi ve Ticaret A.S.* Turkey Beira Grain Terminal, S.A. Mozambique Belarina Alimentos S.A. Brazil Bolux Group (Proprietary) Limited* Botswana Compania Industrial de Productos Agropecuarios S.A.* Colombia Fill-More Seeds Inc. Canada Flour Mills of Ghana Limited Ghana |

Gambia Milling Corporation Limited* Gambia National Milling Company of Guyana, Inc. Guyana Les Grands Moulins de Dakar Senegal Les Moulins d’Haiti S.E.M.* Haiti Lesotho Flour Mills Limited* Lesotho Life Flour Mill Limited* Nigeria Minoterie de Matadi, S.A.* Democratic Republic of Congo Minoterie du Congo S.A. Republic of Congo Moderna Alimentos, S.A.* Ecuador Molinos Champion, S.A.* Ecuador National Milling Corporation Limited Zambia Paramount Mills (Proprietary) Limited* South Africa Rafael del Castillo & Cia. S.A.* Colombia Societe Africaine de Developpement Industriel Alimentaire, S.P.R.L.* Democratic Republic of Congo Societe Les Grands Moulins d’Abidjan Ivory Coast Unga Holdings Limited* Kenya Marine Seaboard Marine Ltd. Marine Division Office Miami, Florida Port Operations Brooklyn, New York Houston, Texas Miami, Florida New Orleans, Louisiana Philadelphia, Pennsylvania Agencia Maritima del Istmo, S.A. Costa Rica Jacintoport International LLC Houston, Texas Kingston Wharves Limited* Jamaica Lafito Logistics Holding Ltd.* Bahamas & Haiti Representaciones Maritimas y Aereas, S.A. Guatemala |

Sea Cargo, S.A. Panama Seaboard de Colombia, S.A. Colombia Seaboard de Nicaragua, S.A. Nicaragua Seaboard Freight & Shipping Jamaica Limited Jamaica Seaboard Honduras, S. de R.L. de C.V. Honduras Seaboard Marine (Trinidad) Limited Trinidad Seaboard Marine of Haiti, S.A. Haiti SEADOM, S.A.S. Dominican Republic SeaMaritima, S.A. de C.V. Mexico Sugar Alconoa S.R.L. Argentina Ingenio y Refineria San Martin del Tabacal S.R.L. Argentina Power Transcontinental Capital Corp. (Bermuda) Ltd. Dominican Republic La Compania de Electricidad de San Pedro de Macoris* Dominican Republic Turkey Butterball, LLC* Division Office Garner, North Carolina Processing Plants Carthage, Missouri Huntsville, Arkansas Mt. Olive, North Carolina Ozark, Arkansas Further Processing Plants Jonesboro, Arkansas Raeford, North Carolina Other Mount Dora Farms de Honduras, S.R.L. Honduras Mount Dora Farms Inc. Houston, Texas |

*Represents a non-controlled, non-consolidated affiliate

4 2017 Annual Report

SEABOARD CORPORATION

Division Summaries

Seaboard’s Pork division is a vertically integrated pork producer and one of the largest producers and processors in the U.S. Seaboard is able to efficiently control pork production across the entire life cycle of a hog, beginning with research and development in nutrition and genetics and extending to the production of high quality meat products at Seaboard’s and its affiliates’ processing and further processing facilities.

This division’s hog processing plant is located in Guymon, Oklahoma. The plant is a double-shift operation that processes approximately 20,500 hogs per day and generally operates at capacity. Weekend shifts are added as market conditions dictate. Hogs processed at the plant are primarily Seaboard-raised hogs. The remaining hogs processed are raised by third parties and purchased under contract or occasionally in the open market. Seaboard produces and sells fresh and frozen pork products to further processors, food service operators, grocery stores, distributors and retail outlets throughout the U.S., Japan, Mexico, China and numerous other foreign markets.

Seaboard’s hog production facilities consist of genetic and commercial breeding, farrowing, nursery and finishing buildings located in the Central U.S. These facilities have a capacity to produce over five million hogs annually. Seaboard owns and operates seven centrally located feed mills to provide formulated feed to these hogs.

Seaboard produces biodiesel at facilities in Guymon, Oklahoma, and St. Joseph, Missouri. The biodiesel is produced from pork fat supplied by Seaboard’s Guymon pork processing plant and from other animal fat or vegetable oil supplied by non-Seaboard facilities. The biodiesel is sold to fuel blenders for distribution and in the retail markets.

Seaboard’s Pork division has agreements with Triumph Foods, LLC (“Triumph”), an independent pork processor, and Seaboard Triumph Foods, LLC (“STF”), a 50% non-consolidated, pork-processing affiliate, to market substantially all of the pork products produced at Triumph’s plant in St. Joseph, Missouri, and STF’s plant in Sioux City, Iowa. The agreements enhance the efficiency of Seaboard’s sales and marketing efforts and expand Seaboard’s geographic footprint. STF’s plant, which began operations in September 2017, is designed to process about three million market hogs annually when operating a single shift. Seaboard and Triumph each supply hogs to be processed at the STF plant. During 2017, the Pork division acquired hog inventory and related assets that provided additional sows to further increase its capacity to fulfill its hog supply commitment for processing at the STF plant, including its hog supply commitment for a second shift expansion. According to the trade publications Successful Farming and Informa Economics Seaboard was ranked number three in pork production (based on sows in production) and number four (based on daily processing capacity, including Triumph’s and STF’s capacities) in processing in the U.S. in 2017.

Seaboard’s Pork division also has a 50% noncontrolling interest in Daily’s Premium Meats, LLC (“Daily’s”). Daily’s produces and markets raw and pre-cooked bacon and ham primarily for the food service industry and, to a lesser extent, retail markets. Daily’s has three further processing plants located in Salt Lake City, Utah, Missoula, Montana, and St. Joseph, Missouri. Seaboard, Triumph and STF each supply raw product to Daily’s.

Commodity Trading and Milling Division

Seaboard’s Commodity Trading and Milling (“CT&M”) division is an integrated agricultural commodity trading, processing and logistics operation. This division sources, transports and markets approximately ten million metric tons per year of wheat, corn, soybeans, soybean meal and other commodities primarily to third-party customers and affiliated companies. These commodities are purchased worldwide, with primary destinations in Africa, South America, the Caribbean and Asia. This division integrates the delivery of commodities to its customers through the use of owned or chartered bulk vessels.

Seaboard’s CT&M division operates facilities in 28 countries. The commodity trading business has 13 offices in 12 countries, in addition to four non-consolidated affiliates in three other countries. The grain processing businesses operate facilities at 38 locations in 20 countries, with wheat flour mills in 16 countries, and include 6 consolidated and 18 non-consolidated affiliates primarily in Africa, South America, the Caribbean and Europe. Seaboard and its affiliates produce approximately five million metric tons of wheat flour, maize meal, manufactured feed and oilseed crush commodities per year in addition to other related grain-based products. In addition, on January 5, 2018, the CT&M division acquired five entities operating as Groupe Mimran (“Mimran”). Mimran operates three flour mills and an associated trading business located in Senegal, Ivory Coast and Monaco.

2017 Annual Report 5

SEABOARD CORPORATION

Division Summaries

Marine Division

Seaboard’s Marine division provides cargo shipping services between the U.S., the Caribbean and Central and South America. This division’s primary operations, located in Miami, include an off-port warehouse for cargo consolidation and temporary storage and a terminal at PortMiami. At the Port of Houston, Seaboard’s Marine division operates a cargo terminal facility that includes on-dock warehouse space for temporary storage of bagged grains, resins and other cargoes. Seaboard also makes scheduled vessel calls to Brooklyn, New Orleans, Philadelphia and various ports in the Caribbean and Central and South America.

This division’s fleet consists of chartered and, to a lesser extent, owned vessels, and includes dry, refrigerated and specialized containers and other cargo related equipment. Seaboard’s Marine division is the largest shipper in terms of cargo volume in PortMiami and provides extensive service between its domestic ports of call and multiple foreign destinations.

To maximize fleet utilization, Seaboard’s Marine division uses a network of offices and agents throughout the U.S., Canada, the Caribbean and Central and South America to sell freight at multiple points. Seaboard’s full service capabilities allow transport by truck or rail of import and export cargo to and from various U.S. ports. Seaboard’s frequent sailings and fixed-day schedules allow customers to coordinate manufacturing schedules and maintain inventories at cost-efficient levels.

Sugar Division

In Argentina, Seaboard’s Sugar division grows sugarcane, which it uses to produce refined sugar and alcohol. The sugar is primarily marketed locally, with some exports to the U.S. and other countries. Seaboard’s sugar processing plant, one of the largest in Argentina, has an annual capacity to produce approximately 250,000 metric tons of sugar and approximately 27 million gallons of alcohol per year. The mill is located in the Salta Province of Argentina, with administrative offices in Buenos Aires. Land owned by Seaboard in Argentina is planted primarily with sugarcane, which supplies the majority of the raw material processed. Depending on local market conditions, sugar and alcohol may also be purchased from third parties for resale. In addition, Seaboard’s Sugar division sells dehydrated alcohol to certain oil companies under the Argentine governmental bio-ethanol program, which requires alcohol to be blended with gasoline. This division also owns a 51 megawatt cogeneration power plant, which is fueled by the burning of sugarcane by-products, natural gas and other biomass when available.

Power Division

In the Dominican Republic, Seaboard’s Power division is an unregulated independent power producer generating electricity for the local power grid from an owned barge with a capacity to generate 108 megawatts. This division primarily sells power on the spot market and is not directly involved in the transmission or distribution of electricity, and its principal buyers are government-owned distribution companies.

Other Division

Seaboard has a 50% noncontrolling voting interest in Butterball, LLC (“Butterball”). Butterball is one of the largest vertically integrated producers, processors and marketers of branded and non-branded turkey products in the U.S. Butterball has four processing plants, two further processing plants and numerous live production and feed milling operations located in North Carolina, Arkansas, Missouri and Kansas. Butterball produces over one billion pounds of turkey each year. Butterball is a national supplier to retail stores, foodservice outlets and industrial entities, and also exports products to Mexico and numerous other foreign markets.

6 2017 Annual Report

SEABOARD CORPORATION

Summary of Selected Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ended December 31, |

|

|||||||||||||

|

(Millions of dollars except per share amounts) |

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

|||||

|

Net sales |

|

$ |

5,809 |

|

$ |

5,379 |

|

$ |

5,594 |

|

$ |

6,473 |

|

$ |

6,670 |

|

|

Operating income |

|

$ |

232 |

|

$ |

222 |

|

$ |

126 |

|

$ |

424 |

|

$ |

204 |

|

|

Net earnings attributable to Seaboard (a, c, d) |

|

$ |

247 |

|

$ |

312 |

|

$ |

171 |

|

$ |

367 |

|

$ |

212 |

|

|

Basic earnings per common share (a, c, d) |

|

$ |

211.01 |

|

$ |

266.50 |

|

$ |

146.44 |

|

$ |

311.44 |

|

$ |

177.53 |

|

|

Total assets |

|

$ |

5,161 |

|

$ |

4,755 |

|

$ |

4,431 |

|

$ |

3,692 |

|

$ |

3,431 |

|

|

Long-term debt, less current maturities |

|

$ |

482 |

|

$ |

499 |

|

$ |

518 |

|

$ |

— |

|

$ |

80 |

|

|

Stockholders’ equity |

|

$ |

3,408 |

|

$ |

3,175 |

|

$ |

2,882 |

|

$ |

2,735 |

|

$ |

2,493 |

|

|

Dividends declared per common share (b) |

|

$ |

6.00 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

(a) |

In 2017, Seaboard recorded $65 million of additional income tax expense, or $55.31 per common share, as a result of the December 22, 2017 enactment of the Tax Cuts and Job Act (the “2017 Tax Act”). The additional income tax expense includes a provisional $112 million of additional federal tax, payable over eight years, associated with the mandatory deemed repatriation of permanently invested foreign profits, offset by an estimated reduction in deferred taxes resulting from the rate decrease from 35% to 21%. See Note 6 to the consolidated financial statements for further information on the impacts of the 2017 Tax Act. |

|

(b) |

In 2017, Seaboard resumed declaring quarterly dividends and paid them in the amount of $1.50 per common share per quarter. In December 2012, Seaboard declared and paid a dividend of $12.00 per common share. The amount of the dividend represented a prepayment of the annual 2013, 2014, 2015 and 2016 dividends ($3.00 per common share per year). Basic and diluted earnings per common share are the same for all periods presented. |

|

(c) |

In the fourth quarter of 2015, Seaboard recorded interest income of $23 million, net of taxes ($31 million before taxes), or $19.49 per common share, for interest recognized on certain outstanding customer receivable balances in its Power segment. This interest income related to amounts determined to be collectible as of December 31, 2015, but previously had been considered uncollectable in prior years. This amount was fully collected by Seaboard in January 2016. |

|

(d) |

On September 27, 2014, Seaboard’s Pork segment sold to Triumph a 50% interest in Daily’s. Included in net earnings attributable to Seaboard for 2014 is a gain on sale of controlling interest in subsidiary of $40 million, net of taxes ($66 million gain before taxes), or $34.14 per common share. |

2017 Annual Report 7

SEABOARD CORPORATION

Company Performance Graph

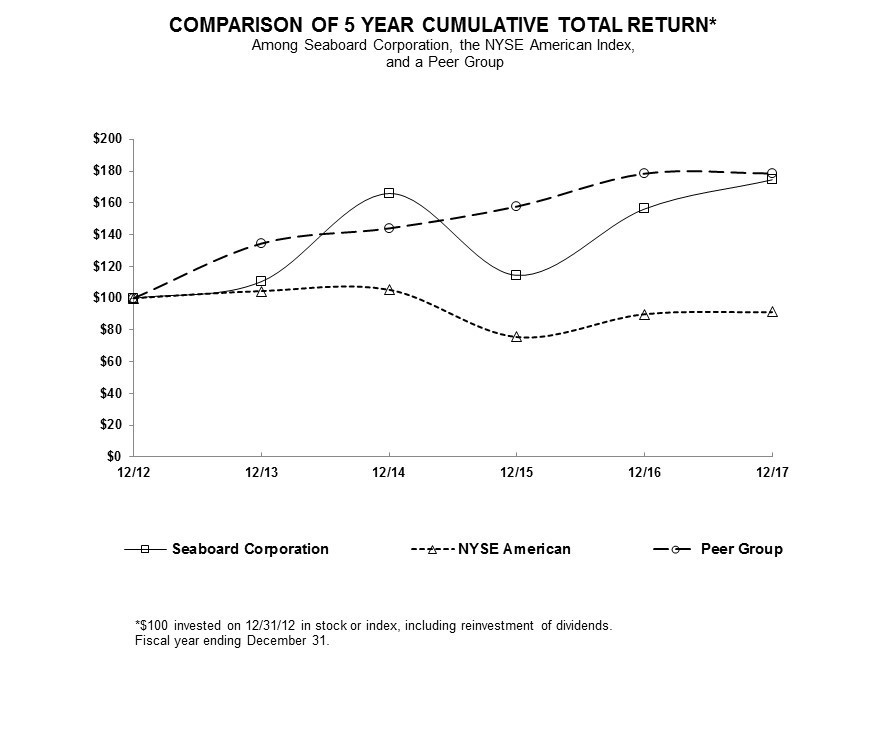

The Securities and Exchange Commission requires a five-year comparison of stock performance for Seaboard with that of an appropriate broad equity market index and similar industry index. Seaboard’s common stock is traded on the NYSE American and provides an appropriate comparison for Seaboard’s stock performance. In July 2017, the NYSE MKT exchange transitioned to the NYSE American exchange. Because there is no single industry index to compare stock performance, the companies comprising the Dow Jones Food and Marine Transportation Industry indices (the “Peer Group”) were chosen as the second comparison.

The following graph shows a five-year comparison of cumulative total return for Seaboard Corporation, the NYSE American Index and the companies comprising the Dow Jones U.S. Food Products and the Dow Jones U.S. Marine Transportation indices, weighted by market capitalization for the five fiscal years commencing December 31, 2012 and ending December 31, 2017. The information presented in the performance graph is historical in nature and is not intended to represent or guarantee future returns.

The comparison of cumulative total returns presented in the above graph was plotted using the following index values and common stock price values:

|

|

|

12/31/12 |

|

12/31/13 |

|

12/31/14 |

|

12/31/15 |

|

12/31/16 |

|

12/31/17 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seaboard Corporation |

|

$ |

100.00 |

|

$ |

110.48 |

|

$ |

165.93 |

|

$ |

114.42 |

|

$ |

156.21 |

|

$ |

174.58 |

|

|

NYSE American |

|

$ |

100.00 |

|

$ |

104.47 |

|

$ |

105.23 |

|

$ |

75.69 |

|

$ |

89.97 |

|

$ |

91.27 |

|

|

Peer Group |

|

$ |

100.00 |

|

$ |

134.50 |

|

$ |

144.07 |

|

$ |

157.86 |

|

$ |

178.61 |

|

$ |

178.77 |

|

8 2017 Annual Report

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(UNAUDITED) |

|

1st |

|

2nd |

|

3rd |

|

4th |

|

Total for |

|

|||||

|

(Millions of dollars except per share amounts) |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

the Year |

|

|||||

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,399 |

|

$ |

1,422 |

|

$ |

1,402 |

|

$ |

1,586 |

|

$ |

5,809 |

|

|

Operating income |

|

$ |

66 |

|

$ |

54 |

|

$ |

71 |

|

$ |

41 |

|

$ |

232 |

|

|

Net earnings attributable to Seaboard |

|

$ |

85 |

|

$ |

58 |

|

$ |

81 |

|

$ |

23 |

(a) |

$ |

247 |

|

|

Earnings per common share |

|

$ |

71.84 |

|

$ |

50.51 |

|

$ |

69.28 |

|

$ |

19.38 |

(a) |

$ |

211.01 |

|

|

Dividends declared per common share |

|

$ |

1.50 |

|

$ |

1.50 |

|

$ |

1.50 |

|

$ |

1.50 |

|

$ |

6.00 |

|

|

Closing market price range per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

$ |

4,204.00 |

|

$ |

4,319.80 |

|

$ |

4,550.00 |

|

$ |

4,654.08 |

|

|

|

|

|

Low |

|

$ |

3,632.45 |

|

$ |

3,695.00 |

|

$ |

3,815.00 |

|

$ |

4,107.05 |

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,319 |

|

$ |

1,357 |

|

$ |

1,330 |

|

$ |

1,373 |

|

$ |

5,379 |

|

|

Operating income |

|

$ |

36 |

|

$ |

76 |

|

$ |

42 |

|

$ |

68 |

|

$ |

222 |

|

|

Net earnings attributable to Seaboard |

|

$ |

54 |

|

$ |

80 |

|

$ |

75 |

|

$ |

103 |

|

$ |

312 |

|

|

Earnings per common share |

|

$ |

45.91 |

|

$ |

68.34 |

|

$ |

64.42 |

|

$ |

87.83 |

|

$ |

266.50 |

|

|

Dividends declared per common share (b) |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Closing market price range per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

|

$ |

3,054.00 |

|

$ |

3,125.00 |

|

$ |

3,440.00 |

|

$ |

4,444.14 |

|

|

|

|

|

Low |

|

$ |

2,483.00 |

|

$ |

2,726.50 |

|

$ |

2,782.92 |

|

$ |

3,201.95 |

|

|

|

|

|

(a) |

During the fourth quarter of 2017, Seaboard recorded $65 million of additional income tax expense, or $55.31 per common share, as a result of the December 22, 2017 enactment of the 2017 Tax Act. The additional income tax expense includes a provisional $112 million of additional federal tax, payable over eight years, associated with the mandatory deemed repatriation of permanently invested foreign profits, offset by an estimated reduction in deferred taxes resulting from the rate decrease from 35% to 21%. See Note 6 to the consolidated financial statements for further information on the impacts of the 2017 Tax Act. |

|

(b) |

No dividends were paid during 2016 as they were declared and prepaid in December 2012. |

2017 Annual Report 9

SEABOARD CORPORATION

Management’s Discussion & Analysis

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Seaboard is a diverse global agribusiness and transportation company with operations in several industries. Most of the sales and costs of Seaboard’s segments are significantly influenced by worldwide fluctuations in commodity prices and changes in foreign political and economic conditions. Accordingly, sales, operating income and cash flows can fluctuate significantly from year to year. As each segment operates in a distinct industry and a different geographical location, management evaluates their operations separately. Seaboard’s reporting segments are based on information used by Seaboard’s Chief Executive Officer in his capacity as chief operating decision maker to determine allocation of resources and assess performance.

Pork Segment

The Pork segment is primarily a United States (“U.S.”) business with some export sales to Japan, Mexico, China and numerous other foreign markets. Revenues from the sale of pork products are primarily generated from a single hog processing plant in Guymon, Oklahoma, which generally operates at daily double-shift processing capacity of approximately 20,500 hogs, and a ham boning and processing plant in Mexico. In 2017, Seaboard raised approximately 87% of the hogs processed at the Guymon plant, with the remaining hog requirements purchased primarily under contracts from independent producers. This segment is Seaboard’s most capital intensive segment, representing approximately 58% of Seaboard’s total fixed assets, in addition to 44% of total inventories.

Within the portfolio of Seaboard’s businesses, management believes profitability of the Pork segment is most susceptible to commodity price fluctuations. As a result, this segment’s operating income and cash flows can materially fluctuate from year to year, significantly affecting Seaboard’s consolidated operating income and cash flows. Sales prices are directly affected by both domestic and worldwide supply and demand for pork products and other proteins. Feed accounts for the largest input cost in raising hogs and is materially affected by price changes for corn and soybean meal. Market prices for hogs purchased from third parties for processing at the plant also represent a major cost factor. With the Guymon plant generally operating at capacity, Seaboard is continually looking for ways to enhance the plant’s operational efficiency, while also looking to increase margins by introducing new, higher value products.

The Pork segment also produces biodiesel, which is sold to third parties. Biodiesel is produced from pork fat from Seaboard’s pork processing plant and from other animal fat or vegetable oil purchased from third parties.

The Pork segment has a 50% noncontrolling interest in Seaboard Triumph Foods, LLC (“STF”), which operates a pork processing plant in Sioux City, Iowa, that began operations in September 2017. Seaboard has agreements with Triumph Foods, LLC (“Triumph”) and STF to market substantially all of the pork products produced at Triumph’s plant in St. Joseph, Missouri and STF’s pork processing plant. The STF plant is designed to process about three million market hogs annually when operating a single shift. Seaboard’s sales prices for its pork products are primarily based on a margin sharing arrangement that considers the average sales price and mix of products sold from the Seaboard, Triumph and STF hog processing plants. Seaboard and Triumph each agreed to provide a portion of the hogs to be processed at the STF plant. During 2017, the Pork segment acquired hog inventory and related assets to further increase its capacity to fulfill the hog supply commitment for single and double shift processing at the STF plant.

The Pork segment also has a 50% noncontrolling interest in Daily’s Premium Meats, LLC (“Daily’s”). Daily’s produces and markets raw and pre-cooked bacon and ham primarily for the food service industry and, to a lesser extent, retail markets. Daily’s has three further processing plants located in Salt Lake City, Utah, Missoula, Montana, and St. Joseph, Missouri.

Commodity Trading and Milling Segment

The Commodity Trading and Milling (“CT&M”) segment, which is managed under the name of Seaboard Overseas and Trading Group, primarily operates overseas and is an integrated agricultural commodity trading, processing and logistics operation with locations in Africa, South America, the Caribbean, Asia and Europe. These foreign operations can be significantly impacted by changes in local crop production, political instability and local government policies, as well as fluctuations in economic and industry conditions and foreign currency exchange rates. This segment’s sales are also significantly affected by fluctuating prices of various commodities, such as wheat, corn, soybeans and soybean meal. Although this segment owns three vessels, the majority of the trading business is transacted with chartered ships. Freight rates, influenced by available charter capacity for worldwide trade in bulk cargoes, and related fuel costs affect business volumes and margins. Consolidated and non-consolidated affiliates operate the grain processing businesses in foreign

10 2017 Annual Report

SEABOARD CORPORATION

Management’s Discussion & Analysis

countries that are in most cases lesser developed. Flour exports of various countries can exacerbate volatile market conditions that may have a significant impact on both the trading and milling businesses’ sales and operating income. This segment represents approximately 44% of Seaboard’s total inventories at December 31, 2017.

The majority of CT&M segment’s sales are derived from its commodity trading business in which agricultural commodities are sourced from multiple origins and delivered to third-party and affiliate customers in various international locations. The execution of these purchase and delivery transactions have long cycles of completion, which may extend for several months with a high degree of price volatility. As a result, these factors can significantly affect sales volumes, operating income, working capital and related cash flows from quarter to quarter. Profit margins are sometimes protected by using commodity derivatives and other risk management practices. Seaboard’s CT&M segment invested in several entities in recent years and continues to seek opportunities to expand its trading, milling and agro-processing business.

Marine Segment

The Marine segment provides cargo shipping services primarily between the U.S. and 28 countries in the Caribbean and Central and South America. Fluctuations in economic conditions and political instability in the regions or countries in which this segment operates may affect trade volumes and operating profits. In addition, cargo rates can fluctuate depending on local supply and demand for shipping services. The Marine segment time-charters the majority of its ocean cargo vessels and is therefore affected by fluctuations in charter hire rates as well as fuel costs. This segment continues to explore ways to increase volumes on existing routes while seeking opportunities to broaden its route structure in the regions it serves.

Sugar Segment

The Sugar segment operates a vertically integrated sugar and alcohol production facility in Argentina. This segment’s sales and operating income are significantly affected by local and worldwide sugar and alcohol prices. Domestic sugar production levels in Argentina affect the local price. Global sugar price fluctuations, to a lesser extent, have an impact in Argentina as well. Depending on local market conditions, this segment purchases sugar and alcohol from third parties for resale. The Sugar segment sells dehydrated alcohol to certain oil companies under an Argentine government bio-ethanol program, which mandates that alcohol be blended with gasoline. This segment also owns a 51 megawatt cogeneration power plant, which is fueled by the burning of sugarcane by-products, natural gas and other biomass when available. The functional currency of the Sugar segment is the Argentine peso. The currency exchange rate can have an impact on reported U.S. dollar sales, operating income and cash flows. Seaboard continues to explore various ways to improve and expand this segment, investing in efficiency improvements and production capacity increases.

Power Segment

The Power segment is an unregulated independent power producer in the Dominican Republic generating electricity for the local power grid from a system of diesel engines mounted on a barge. Seaboard sells power on the spot market primarily to government-owned distribution companies. This segment is subject to delays in obtaining timely collections from sales to these government-related entities. Supply of power in the Dominican Republic is determined by a government body and is subject to fluctuations based on governmental budgetary constraints. While fuel is this segment’s largest cost component and is subject to price fluctuations, higher fuel costs generally have been passed on to customers.

Turkey Segment

Seaboard has a 50% noncontrolling voting interest in Butterball, LLC (“Butterball”). Butterball is a vertically integrated producer, processor and marketer of branded and non-branded turkey products. Butterball has four processing plants, two further processing plants and numerous live production and feed milling operations located in North Carolina, Arkansas, Missouri and Kansas. During 2017, Butterball closed its Montgomery, Illinois, further processing plant, which was sold during the first quarter of 2018. Sales prices are directly affected by both domestic and worldwide supply and demand for turkey products and other proteins. Feed accounts for the largest input cost in raising turkeys and is materially affected by price changes for corn and soybean meal. As a result, commodity price fluctuations can significantly affect the profitability and cash flows of Butterball. The turkey business is seasonal only on the whole bird side, with the Thanksgiving and Christmas holidays driving the majority of those sales.

LIQUIDITY AND CAPITAL RESOURCES

Summary of Sources and Uses of Cash

Cash and short-term investments as of December 31, 2017 increased $338 million from December 31, 2016. The increase was primarily the result of net cash from operating activities of $245 million, repayments of affiliate notes receivable of $167 million and proceeds from short-term and long-term debt of $83 million. Partially offsetting the increase was cash

2017 Annual Report 11

SEABOARD CORPORATION

Management’s Discussion & Analysis

used for capital expenditures of $173 million. Cash from operating activities decreased $182 million from 2016 primarily as a result of lower net earnings including adjustments and working capital changes.

Cash and short-term investments as of December 31, 2016 increased $50 million from December 31, 2015. The increase was primarily the result of net cash from operating activities of $427 million, net proceeds from short-term investments of $53 million and proceeds from sale of fixed assets of $47 million. Partially offsetting the increase was cash used for acquisition of businesses of $219 million, capital expenditures of $158 million, investments in affiliates of $71 million and purchase of long-term investments of $31 million. Cash from operating activities increased $11 million for 2016 primarily as a result of higher net earnings, partially offset by working capital changes.

Capital Expenditures, Acquisitions and Other Investing Activities

During 2017, Seaboard invested $173 million in property, plant and equipment, of which $100 million was in the Pork segment, $15 million in the CT&M segment, $37 million in the Marine segment and $20 million in the Sugar segment. The Pork segment expenditures were primarily for improvements to existing facilities and related equipment and additional hog finishing barns. The Sugar segment expenditures were primarily related to a new bioethanol distillery. All other capital expenditures were primarily of a normal recurring nature and included replacements of machinery and equipment, and general facility modernizations and upgrades.

The total 2018 capital expenditures budget is $271 million. The Pork segment budgeted $115 million primarily for improvements to existing facilities and related equipment and additional hog finishing barns. The CT&M segment budgeted $48 million primarily for milling assets and other improvements to existing facilities and related equipment. The Marine segment budgeted $81 million primarily for additional cargo carrying and handling equipment and port improvements. The Sugar segment budgeted $26 million primarily for increasing the milling capacity and improving logistics infrastructure. The balance of $1 million is planned to be spent in all other businesses primarily for normal upgrades to existing operations. Management anticipates paying for these capital expenditures from a combination of available cash, the use of available short-term investments and Seaboard’s available borrowing capacity.

During 2016, Seaboard invested $158 million in property, plant and equipment, of which $69 million was in the Pork segment, $35 million in the CT&M segment, $19 million in the Marine segment and $34 million in the Sugar segment. The Pork segment expenditures were primarily for improvements to existing facilities and related equipment, additional hog finishing barns and the June 2016 purchase and improvement of a biodiesel plant in St. Joseph, Missouri, for $6 million that became operational in the third quarter. Of the CT&M segment expenditures, $29 million was for the construction of two dry bulk vessels, which were delivered and then sold and leased back by Seaboard at book value of $44 million during the first quarter of 2016. The Marine segment expenditures were primarily for purchases of cargo carrying and handling equipment. The Sugar segment expenditures were primarily for milling capacity increase and fermentation and distillery equipment upgrades. All other capital expenditures were primarily of a normal recurring nature and included replacements of machinery and equipment, and general facility modernizations and upgrades.

During 2015, Seaboard invested $139 million in property, plant and equipment, of which $40 million was in the Pork segment, $40 million in the CT&M segment and $43 million in the Marine segment. The Pork segment expenditures were primarily for improvements to existing facilities and related equipment and additional hog finishing barns. Of the CT&M segment expenditures, $30 million was for the construction of dry bulk vessels, two of which were delivered and then sold and leased back by Seaboard at book value of $44 million in 2015. The Marine segment expenditures were primarily for purchases of cargo carrying and handling equipment and $8 million for the purchase of a containerized cargo vessel. All other capital expenditures were of a normal recurring nature and primarily included replacements of machinery and equipment, and general facility modernizations and upgrades.

During 2017, 2016 and 2015, Seaboard contributed $73 million, $51 million and $26 million, respectively, to STF for construction of a pork processing plant in Sioux City, Iowa, which began operations in September 2017. In addition to capital contributions, Seaboard also agreed to provide a portion of the hogs to be processed at the plant, including a portion of those needed for a second shift expansion. During 2016, Seaboard acquired hog inventory and related assets through acquisitions of existing farm operations for a total investment of $219 million. These assets increased Seaboard’s hog production capacity to meet the majority of such hog supply commitment for single-shift processing at the new plant. During 2017, Seaboard acquired additional hog inventory and hog farms to further increase its capacity. See Note 12 to the consolidated financial statements for further discussion of the significant acquisitions.

Also during 2017, Seaboard’s CT&M segment acquired a pulse and grain elevator in Canada for total cash consideration of $14 million, and invested an additional $7 million in a grain trading and poultry business in Morocco, increasing its

12 2017 Annual Report

SEABOARD CORPORATION

Management’s Discussion & Analysis

ownership interest in this Moroccan business to 19.4%. See Note 12 to the consolidated financial statements for further information on the elevator purchase and Note 4 to the consolidated financial statements for further discussion of this investment.

On January 5, 2018, the CT&M segment completed the acquisition of Groupe Mimran (“Mimran”), including three flour mills in Senegal and Ivory Coast having a combined capacity of approximately 2,750 metric tons a day, and a trading business located in Monaco that is expected to increase Seaboard’s annual grain trading volume by approximately 900,000 tons. The purchase price was $375 million, plus an earn-out between zero and $48 million, using the exchange rate in effect at closing.

Seaboard purchased equity interests in two limited liability companies that operate refined coal processing plants, one in Oklahoma during 2015 and one in Nebraska during 2016. Production of refined coal generates federal income tax credits. Seaboard’s funding commitment for these companies varies depending on production and, based on current production estimates, is anticipated to total approximately $14 million per year until 2021, for a total estimate of approximately $52 million as of December 31, 2017. Seaboard invested $10 million, $14 million and $9 million during 2017, 2016 and 2015, respectively.

In 2016, Seaboard invested $7 million of cash and converted its $8 million note receivable to equity for a 36% noncontrolling interest in a holding company that owns a Caribbean start-up terminal operation. The investment is accounted for in the Marine segment using the equity method and reported on a three-month lag.

During 2016 and 2015, Seaboard invested an additional $14 million and $28 million, respectively, in equity and long-term advances in a flour production business in Brazil, of which Seaboard now holds a 98% controlling interest. See Note 4 to the consolidated financial statements for further discussion of this investment.

During 2015, the CT&M and Power segments invested in several businesses. Seaboard’s CT&M segment contributed $13 million in cash, a small amount of other assets, certain employees and rights to sell certain agricultural commodities that Seaboard had previously sold through its subsidiary, PS International, LLC, for a 40% noncontrolling interest in a commodity trading business in Atlanta, Georgia. Also, Seaboard invested $8 million in a flour milling business in Botswana for a 49% noncontrolling interest, $10 million for a 45% noncontrolling interest in a commodity trading and flour milling business in Uruguay, $10 million in an oilseed crushing business in the Republic of Turkey for a 25% noncontrolling interest, and $18 million for a 12% noncontrolling interest in a grain trading and poultry business in Morocco, which at the time was accounted for using the cost method. During 2015, the Power segment invested $10 million in a business operating a 300 megawatt electricity generating facility in the Dominican Republic, increasing Seaboard’s ownership interest to 29.9%. See Note 4 to the consolidated financial statements for further discussion.

Financing Activities, Debt and Related Covenants

The following table presents a summary of Seaboard’s available borrowing capacity as of December 31, 2017. At December 31, 2017, borrowings under the uncommitted lines of credit totaled $162 million, with $115 million of borrowings related to foreign subsidiaries. See Note 7 to the consolidated financial statements for further discussion.

|

|

|

|

|

|

|

|

|

Total amount |

|

|

|

(Millions of dollars) |

|

available |

|

|

|

Short-term uncommitted and committed lines |

|

$ |

477 |

|

|

Amounts drawn against lines |

|

|

(162) |

|

|

Letters of credit reducing borrowing availability |

|

|

(3) |

|

|

Available borrowing capacity at December 31, 2017 |

|

$ |

312 |

|

In 2017, Seaboard renewed its $100 million committed line of credit with Wells Fargo Bank, National Association (“Wells Fargo”) for another year until September 28, 2018. Interest is computed at LIBOR plus 0.50%, and Seaboard incurs an unused commitment fee of 0.09% per annum. This line of credit is secured by certain short-term investments and is subject to standard representations and covenants. There was no outstanding balance as of December 31, 2017.

At December 31, 2017, Seaboard had an unsecured term loan, which matures in 2022, with a balance of $484 million and $52 million of foreign subsidiary debt, primarily denominated in Argentine pesos. Seaboard was in compliance with all restrictive covenants related to these loans and facilities as of December 31, 2017. Seaboard has capacity under existing loan covenants to undertake additional debt financings of approximately $1,533 million at December 31, 2017. See Note 7 to the consolidated financial statements for further discussion of notes payable and long-term debt.

2017 Annual Report 13

SEABOARD CORPORATION

Management’s Discussion & Analysis

As of December 31, 2017, Seaboard had cash and short-term investments of $1,692 million and additional total working capital of $618 million. Accordingly, management believes Seaboard’s combination of internally generated cash, liquidity, capital resources and borrowing capabilities will be adequate for its existing operations and any currently known potential plans for expansion of existing operations or business segments for 2018. Management intends to continue seeking opportunities for expansion in the industries in which Seaboard operates, utilizing existing liquidity, available borrowing capacity and other financing alternatives.

As of December 31, 2017, $380 million of the $1,692 million of cash and short-term investments were held by Seaboard’s foreign subsidiaries. Historically, Seaboard has considered substantially all foreign profits as being permanently invested in its foreign operations, including all cash and short-term investments held by foreign subsidiaries. Seaboard intends to continue permanently reinvesting these funds outside the U.S. as current plans do not demonstrate a need to repatriate them to fund Seaboard’s U.S. operations and therefore, Seaboard has not recorded deferred taxes for state or foreign withholding taxes that would result upon repatriation to the U.S. However, with the December 22, 2017 enactment of the Tax Cuts and Job Act (the “2017 Tax Act”), Seaboard accrued a provisional $112 million of federal tax in its consolidated financial statements as of December 31, 2017 associated with the mandatory deemed repatriation of these balances. See Note 6 to the consolidated financial statements for further discussion on the tax reform.

No shares of common stock were repurchased by Seaboard in 2017, 2016 or 2015. In each of the four quarters of 2017, Seaboard declared and paid quarterly dividends of $1.50 per share of common stock. Seaboard’s Board of Directors intends that Seaboard will continue to pay quarterly dividends for the reasonably foreseeable future, with the amount of any dividends being dependent upon such factors as Seaboard’s financial condition, results of operations and current and anticipated cash needs, including capital requirements. There were no dividends paid in 2016 or 2015. See Note 11 to the consolidated financial statements for further discussion on stockholders’ equity.

Contractual Obligations and Off-Balance Sheet Arrangements

The following table provides a summary of Seaboard’s contractual obligations as of December 31, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments due by period |

|

|||||||||||||

|

|

|

|

|

|

Less than |

|

1-3 |

|

3-5 |

|

More than |

|

||||

|

(Millions of dollars) |

|

Total |

1 year |

|

years |

|

years |

|

5 years |

|

||||||

|

Vessel, time and voyage-charter commitments |

|

$ |

166 |

|

$ |

39 |

|

$ |

55 |

|

$ |

39 |

|

$ |

33 |

|

|

Contract grower agreements |

|

|

189 |

|

|

42 |

|

|

62 |

|

|

41 |

|

|

44 |

|

|

Other operating lease payments |

|

|

286 |

|

|

29 |

|

|

55 |

|

|

51 |

|

|

151 |

|

|

Total lease obligations |

|

|

641 |

|

|

110 |

|

|

172 |

|

|

131 |

|

|

228 |

|

|

Short-term notes payable |

|

|

162 |

|

|

162 |

|

|

— |

|

|

— |

|

|

— |

|

|

Long-term debt |

|

|

536 |

|

|

53 |

|

|

77 |

|

|

405 |

|

|

1 |

|

|

Interest payments (a) |

|

|

76 |

|

|

20 |

|

|

32 |

|

|

24 |

|

|

— |

|

|

Retirement benefit payments (b) |

|

|

90 |

|

|

6 |

|

|

20 |

|

|

23 |

|

|

41 |

|

|

Mandatory deemed repatriation tax (c) |

|

|

112 |

|

|

1 |

|

|

18 |

|

|

18 |

|

|

75 |

|

|

Investment in affiliates (d) |

|

|

54 |

|

|

16 |

|

|

28 |

|

|

10 |

|

|

— |

|

|

Other purchase commitments |

|

|

1,062 |

|

|

678 |

|

|

160 |

|

|

144 |

|

|

80 |

|

|

Total contractual cash obligations and commitments |

|

$ |

2,733 |

|

$ |

1,046 |

|

$ |

507 |

|

$ |

755 |

|

$ |

425 |

|

(a) Interest payments in the table above include cash payments for interest on variable rate long-term debt based on interest rates as of December 31, 2017.

(b) Retirement benefit payments in the table above represent expected benefit payments for various non-qualified pension plans and supplemental retirement arrangements as discussed in Note 9 to the consolidated financial statements, which are unfunded obligations that are deemed to be employer contributions. No contributions are planned at this time to the qualified pension plan.

(c) U.S. federal income tax on mandatory deemed repatriation is payable over eight years pursuant to the 2017 Tax Act.

14 2017 Annual Report

SEABOARD CORPORATION

Management’s Discussion & Analysis

(d) Investment in affiliates represents obligations made to equity method investments, primarily for expected funding commitments to two limited liability companies that operate refined coal processing plants.

Several of Seaboard’s segments have long-term contractual obligations, including non-cancelable operating lease agreements for facilities and equipment. The Marine and CT&M segments enter into contracts to time-charter vessels for use in operations. The Pork segment has contract grower agreements in place with farmers to raise a portion of Seaboard’s hogs to support its operations. The Pork segment has also entered into grain and feed ingredient purchase contracts to support the segment’s live hog operations, and has contracted for the purchase of additional hogs from third parties. The CT&M segment enters into commodity purchase contracts, primarily to support sales commitments. See Note 10 to the consolidated financial statements for further discussion on Seaboard’s contractual obligations and for a more detailed listing of other purchase commitments.

Non-current deferred income taxes and certain other long-term liabilities on the consolidated balance sheets are not included in the table above as management is unable to reliably estimate the timing of the payments for these items. In addition, deferred revenues and other deferred credits included in other long-term liabilities on the consolidated balance sheets have been excluded from the table above because they do not represent contractual obligations.

RESULTS OF OPERATIONS

Net sales for the years ended December 31, 2017, 2016 and 2015 were $5,809 million, $5,379 million and $5,594 million, respectively. The increase for 2017 compared to 2016 primarily reflected higher sales prices and volumes for certain commodities in the CT&M segment, higher overall prices for pork products sold, higher sales volume of market hogs and higher biodiesel revenue in the Pork segment, higher cargo volumes in the Marine segment and higher selling prices and volumes for alcohol in the Sugar segment. The decrease for 2016 compared to 2015 primarily reflected lower commodity prices and the mix of products sold for the CT&M segment, lower volumes of sugar sold in the Sugar segment, and lower cargo rates in the Marine segment, partially offset by higher sales volume of market hogs from 2016 acquisitions of live operations and higher biodiesel volumes from the acquisition of a second biodiesel plant in the Pork segment.

Operating income for the years ended December 31, 2017, 2016 and 2015 were $232 million, $222 million and $126 million, respectively. The increase for 2017 compared to 2016 primarily reflected higher margins from sugar in the Sugar segment and higher margins from meat prices in the Pork segment, partially offset by lower margins on biodiesel in the Pork segment, lower margins on commodities in the CT&M segment and lower cargo rates and higher fuel costs in the Marine segment. The increase for 2016 compared to 2015 primarily reflected lower feed costs for hogs internally grown in the Pork segment and higher margins on commodity trades to third parties in the CT&M segment, partially offset by higher production costs for sugar in the Sugar segment.

Pork Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars) |

|

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

Net sales |

|

|

|

$ |

1,609 |

|

$ |

1,443 |

|

$ |

1,332 |

|

|

Operating income |

|

|

|

$ |

188 |

|

$ |

175 |

|

$ |

116 |

|

|

Income (loss) from affiliates |

|

|

|

$ |

(10) |

|

$ |

11 |

|

$ |

11 |

|

Net sales for the Pork segment increased $166 million for the year ended December 31, 2017 compared to 2016. The increase was primarily the result of higher overall prices for pork products sold, higher sales volume of market hogs related to the August 2017 acquisition, higher biodiesel revenue and, to a lesser extent, a higher volume of pork products sold internationally.

Operating income for the Pork segment increased $13 million for the year ended December 31, 2017 compared to 2016. The increase was primarily the result of improved overall margins from higher meat prices and market hog sales, partially offset by lower biodiesel margins because the Federal blender’s credits were not renewed during 2017. In February 2018, Congress retroactively extended the Federal blender’s credits for 2017 which will cause Seaboard to recognize approximately $42 million of revenue in the first quarter of 2018. Management is unable to predict future market prices for pork products, the cost of feed or third-party hogs or the government’s intentions with the Federal blenders’ credits; however, management anticipates positive operating income for this segment in 2018.

Income from affiliates decreased $21 million for the year ended December 31, 2017 compared to 2016, primarily due to the start-up of STF operations, which began in September 2017, partially offset by earnings from its other non-consolidated affiliate, Daily’s.

2017 Annual Report 15

SEABOARD CORPORATION

Management’s Discussion & Analysis

Net sales for the Pork segment increased $111 million for the year ended December 31, 2016 compared to 2015. The increase was primarily the result of higher sales volume of market hogs related to 2016 acquisitions, higher prices for pork products sold and increased volume and sales prices for biodiesel resulting from increased output from the Guymon plant and the acquisition of a second biodiesel plant in St. Joseph, Missouri, during 2016. The increase was partially offset by lower volume of pork products sold.

Operating income for the Pork segment increased $59 million for the year ended December 31, 2016 compared to 2015. The increase was primarily the result of lower feed costs for hogs internally grown and improved overall margins from higher meat prices.

Income from affiliates for the Pork segment in 2016 and 2015 was solely from Seaboard’s 50% ownership interest in Daily’s, accounted for using the equity method.

Commodity Trading and Milling Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars) |

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

Net sales |

|

|

$ |

2,945 |

|

$ |

2,778 |

|

$ |

3,022 |

|

|

Operating income as reported |

|

|

$ |

25 |

|

$ |

38 |

|

$ |

2 |

|

|

Mark-to-market adjustments |

|

|

|

(4) |

|

|

— |

|

|

(5) |

|

|

Operating income (loss) excluding mark-to-market adjustments |

|

|

$ |

21 |

|

$ |

38 |

|

$ |

(3) |

|

|

Income (loss) from affiliates |

|

|

$ |

7 |

|

$ |

(10) |

|

$ |

(50) |

|

Net sales for the CT&M segment increased $167 million for the year ended December 31, 2017 compared to 2016. The increase primarily reflected higher sales prices for wheat sales to third parties and higher volumes of sales to affiliates and third parties, partially offset by lower corn and soybean meal sales prices and volumes to third parties.

Operating income for the CT&M segment decreased $13 million for the year ended December 31, 2017 compared to 2016. The decrease primarily reflected lower margins on commodities and higher selling, general and administrative expense, partially offset by higher gains of $4 million on mark-to-market derivative contracts as further discussed below. Excluding the effects of the mark-to-market adjustments for derivatives contracts, operating income decreased $17 million primarily due to a decrease in commodity prices in the pulse market.

Due to worldwide commodity price fluctuations, the uncertain political and economic conditions in the countries in which Seaboard operates, and the current volatility in the commodity markets, management is unable to predict future sales and operating results for this segment. However, management anticipates positive operating income for this segment in 2018, excluding the effects of marking to market derivative contracts.

Had Seaboard not applied mark-to-market accounting to its derivative instruments, operating income for this segment would have been lower by $4 million in 2017, remained the same in 2016 and been lower by $5 million in 2015. While management believes its commodity futures, options and foreign exchange contracts are primarily economic hedges of its firm purchase and sales contracts or anticipated sales contracts, Seaboard does not perform the extensive record-keeping required to account for these transactions as hedges for accounting purposes. Accordingly, while the changes in value of the derivative instruments were marked to market, the changes in value of the firm purchase or sales contracts were not. As products are delivered to customers, these existing mark-to-market adjustments should be primarily offset by realized margins or losses as revenue is recognized over time and therefore, these mark-to-market adjustments could reverse in fiscal 2018. Management believes eliminating these mark-to-market adjustments provides a more reasonable presentation to compare and evaluate period-to-period financial results for this segment.

Income from affiliates for the CT&M segment increased by $17 million for the year ended December 31, 2017 compared to 2016. The increase primarily reflected consolidation of an equity method investment that incurred $10 million of losses during 2016. See Note 4 to the consolidated financial statements for further discussion of this affiliate. Based on the uncertainty of local political and economic environments in the countries in which Seaboard’s affiliates operate, management cannot predict future results.

Net sales for the CT&M segment decreased $244 million for the year ended December 31, 2016 compared to 2015. The decrease primarily reflected lower sales prices, resulting from lower commodity prices and the mix of products sold, partially offset by higher volumes in corn and soybeans.

Operating income for the CT&M segment increased $36 million for the year ended December 31, 2016 compared to 2015. The increase primarily reflected higher margins on commodity trades to third parties and affiliates and fluctuations of $5

16 2017 Annual Report

SEABOARD CORPORATION

Management’s Discussion & Analysis

million of mark-to-market derivative contracts. Excluding the effects of mark-to-market adjustments for derivatives contracts, operating income increased $41 million.

Loss from affiliates for the CT&M segment decreased $40 million for the year ended December 31, 2016 compared to 2015. The decrease primarily reflected lower operating and currency losses recorded against the investment and lower reserves for notes receivable and advances from an affiliate in Brazil. Seaboard’s loss from this Brazilian affiliate totaled $60 million in 2015 compared to $10 million in 2016. This Brazilian affiliate was consolidated in the fourth quarter of 2016.

Marine Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars) |

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

Net sales |

|

|

$ |

956 |

|

$ |

916 |

|

$ |

940 |

|

|

Operating income |

|

|

$ |

21 |

|

$ |

33 |

|

$ |

19 |

|

|

Income (loss) from affiliate |

|

|

$ |

(7) |

|

$ |

1 |

|

$ |

2 |

|

Net sales for the Marine segment increased $40 million for the year ended December 31, 2017 compared to 2016. The increase was primarily the result of higher volumes in certain markets during 2017 compared to 2016, partially offset by lower cargo rates.

Operating income for the Marine segment decreased $12 million for the year ended December 31, 2017 compared to 2016. The decrease was primarily the result of lower cargo rates and higher fuel costs, partially offset by lower other voyage costs. Management cannot predict changes in future cargo volumes, cargo rates and fuel costs, or to what extent changes in economic conditions in markets served will affect net sales or operating income during 2018. However, management anticipates this segment will have positive operating income for 2018.

Income from affiliates decreased $8 million for the year ended December 31, 2017 compared to 2016 primarily due to an other-than-temporary impairment charge of $6 million related to Seaboard’s equity-method investment in a holding company that owns a start-up terminal operation. See Note 4 to the consolidated financial statements for further information on this affiliate.

Net sales for the Marine segment decreased $24 million for the year ended December 31, 2016 compared to 2015. The decrease was primarily the result of lower cargo rates in certain markets during 2016 compared to 2015, partially offset by higher volumes.

Operating income for the Marine segment increased $14 million for the year ended December 31, 2016 compared to 2015. The increase was primarily the result of lower voyage costs, principally fuel costs, on a per unit shipped basis, partially offset by lower cargo rates.

Sugar Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars) |

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

Net sales |

|

|

$ |

186 |

|

$ |

147 |

|

$ |

188 |

|

|

Operating income (loss) |

|

|

$ |

21 |

|

$ |

(12) |

|

$ |

2 |

|

|

Income from affiliates |

|

|

$ |

1 |

|

$ |

2 |

|

$ |

1 |

|

Net sales for the Sugar segment increased $39 million for the year ended December 31, 2017 compared to 2016. The increase primarily reflected higher volumes and selling prices of alcohol and higher selling prices for sugar, partially offset by lower volumes of sugar sold. Sugar and alcohol sales are denominated in Argentine pesos, and an increase in local sales prices in terms of U.S. dollars was partially offset by exchange rate changes as the Argentine peso continued to weaken against the U.S. dollar in 2017. Management cannot predict local sugar and alcohol prices for 2018, but management anticipates that the Argentine peso will continue to weaken against the U.S. dollar.

Operating income for the Sugar segment increased $33 million for the year ended December 31, 2017 compared to 2016. The increase primarily reflected higher margins from sugar, alcohol and cogeneration primarily related to increased selling prices, partially offset by higher selling, general and administrative costs. During 2016, labor strikes and inclement weather negatively impacted volumes and resulted in a $12 million inventory charge. Based on recent market conditions, management currently cannot predict if this segment will be profitable in 2018.

2017 Annual Report 17

SEABOARD CORPORATION

Management’s Discussion & Analysis

Net sales for the Sugar segment decreased $41 million for the year ended December 31, 2016 compared to 2015. The decrease primarily reflected lower volumes and lower selling prices of sugar sold. During the third and fourth quarters of 2016, labor strikes and inclement weather negatively impacted volumes and resulted in a $12 million inventory charge to cost of sales for fixed manufacturing costs associated with the revised production forecasts. Sugar and alcohol sales are denominated in Argentine pesos, and an increase in local sales prices in terms of U.S. dollars was principally offset by exchange rate changes as the Argentine peso continued to weaken against the U.S. dollar in 2016.

Operating income for the Sugar segment decreased $14 million for the year ended December 31, 2016 compared to 2015. The decrease primarily reflected lower sales prices, lower volumes and the $12 million inventory charge, partially offset by reduced selling, general and administrative expenses from decreased personnel-related costs.

Power Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars) |

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

Net sales |

|

|

$ |

97 |

|

$ |

79 |

|

$ |

97 |

|

|

Operating income |

|

|

$ |

9 |

|

$ |

7 |

|

$ |

7 |

|

|

Income from affiliate |

|

|

$ |

6 |

|

$ |

4 |

|

$ |

3 |

|

Net sales for the Power segment increased $18 million for the year ended December 31, 2017 compared to 2016. The increase primarily reflected higher spot market rates.

Operating income for the Power segment increased $2 million for the year ended December 31, 2017 compared to 2016 primarily due to higher spot market rates, partially offset by higher fuel costs. Management cannot predict future fuel costs or the extent that spot market rates will fluctuate compared to fuel costs; however, management anticipates positive operating income for this segment in 2018.

Net sales for the Power segment decreased $18 million for the year ended December 31, 2016 compared to 2015. The decrease primarily reflected lower spot market rates, which were attributable primarily to lower fuel costs, a component of pricing.

Operating income for the Power segment was flat for the year ended December 31, 2016 compared to 2015 primarily due to the lower spot market rates being offset by lower fuel costs per kilowatt hour generated and other lower production costs.

Turkey Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars) |

|

|

2017 |

|

2016 |

|

2015 |

|

|||

|

Income (loss) from affiliate |

|

|

$ |

(4) |

|

$ |

73 |

|

$ |

103 |

|

The Turkey segment, accounted for using the equity method, represents Seaboard’s investment in Butterball. The decrease in income from affiliate for 2017 compared to 2016 was primarily the result of lower prices for turkey products sold, pricing pressure from competing proteins and higher live growing costs. Also, the decrease included the 2017 closure of a further processing plant located in Montgomery, Illinois. Butterball’s closure and subsequent sale in 2018 of the plant, resulted in charges primarily related to impaired fixed assets and accrued severance. Seaboard’s proportionate share of these charges, recognized in income (loss) from affiliates, was $18 million, all of which was recorded in 2017. Management is unable to predict future market prices for turkey products or the cost of feed; however, management anticipates positive income for this segment in 2018.

The decrease in income from affiliate for 2016 compared to 2015 was primarily the result of lower volume and prices for turkey products sold.

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses for the year ended December 31, 2017 increased $42 million over 2016 to $317 million. The increase was primarily the result of increased personnel-related costs, including costs related to Seaboard’s deferred compensation program, which were offset by the effect of the mark-to-market on investments recorded in other investment income. As a percentage of revenues, SG&A was 5% for 2017 and 2016.

SG&A expenses for the year ended December 31, 2016 increased $5 million over 2015 to $275 million. The increase was primarily the result of increased costs related to Seaboard’s deferred compensation program, which were offset by the effect of the mark-to-market on investments recorded in other investment income. As a percentage of revenues, SG&A was 5% for 2016 and 2015.

18 2017 Annual Report

SEABOARD CORPORATION

Management’s Discussion & Analysis

Interest Expense

Interest expense totaled $29 million, $29 million and $18 million for the years ended December 31, 2017, 2016 and 2015, respectively. The increase in 2016 compared to 2015 primarily related to long-term debt issued in December 2015.

Interest Income

Interest income totaled $15 million, $15 million and $40 million for the years ended December 31, 2017, 2016 and 2015, respectively. The decrease for 2016 compared to 2015 primarily reflected lower interest recognized on customer receivable balances in the Power segment. In December 2015, the Power segment recognized $31 million of interest income related to aged receivable balances. See Note 13 to the consolidated financial statements for further discussion.

Interest Income from Affiliates

Interest income from affiliates totaled $22 million, $24 million and $29 million for the years ended December 31, 2017, 2016 and 2015, respectively, and primarily relates to a Butterball note receivable, which was repaid in December 2017. The decrease for 2016 compared to 2015 primarily reflected the modification of a Butterball note receivable. See Note 4 to the consolidated financial statements for further discussion of the modification.

Other Investment Income (Loss), Net