Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Altra Industrial Motion Corp. | aimc-ex991_6.htm |

| 8-K - 8-K - Altra Industrial Motion Corp. | aimc-8k_20180221.htm |

Fourth Quarter 2017 Results February 21, 2018 10:00 AM ET Dial In Number 877-407-8293 Domestic 201-689-8349 International Webcast at www.altramotion.com Replay Through March 7, 2018 877-660-6853 Domestic 201-612-7415 International Conference ID: # 13676208 Webcast Replay at www.altramotion.com Exhibit 99.2 Exhibit 99.2 Replay Through March 7, 2018 877-660-6853 Domestic 201-612-7415 International Conference ID: # 13676208 Webcast Replay at www.altramotion.com Fourth Quarter 2017 Results February 21, 2017 10:00 AM ET Dial In Number 877-407-8293 Domestic 201-689-8349 International Webcast at www.altramotion.com

Safe Harbor Statement Cautionary Statement Regarding Forward Looking Statements All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as "believes," "expects," "potential," "continues," "may," "should," "seeks," "predicts," "anticipates," "intends," "projects," "estimates," "plans," "could," "designed", "should be," and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, our expectation of the improvements in the industrial economy, the statements under “Business Outlook,” our expectations regarding economic conditions, our expectations regarding our tax rate and the Company’s guidance for full year 2018. In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with our debt leverage and operating covenants under our debt instruments, (19) risks associated with restrictions contained in our Convertible Notes and Credit Facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our ERP system, (23) risks associated with the Svendborg, Guardian and Stromag acquisitions and integration and other acquisitions, (24) risks associated with certain minimum purchase agreements we have with suppliers, (25) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (26) risks associated with interest rate swap contracts, (27) risks associated with our exposure to renewable energy markets, (28) risks related to regulations regarding conflict minerals, (29) risks related to restructuring and plant consolidations, and (30) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the U.S. Securities and Exchange Commission (SEC) or in materials incorporated therein by reference. Except as required by applicable law, Altra Industrial Motion Corp. does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise. 1 Safe Harbor Statement Cautionary Statement Regarding Forward Looking Statements All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as "believes," "expects," "potential," "continues," "may," "should," "seeks," "predicts," "anticipates," "intends," "projects," "estimates," "plans," "could," "designed", "should be," and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, our expectation of the improvements in the industrial economy, the statements under “Business Outlook,” our expectations regarding economic conditions, our expectations regarding our tax rate and the Company’s guidance for full year 2018. In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with our debt leverage and operating covenants under our debt instruments, (19) risks associated with restrictions contained in our Convertible Notes and Credit Facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our ERP system, (23) risks associated with the Svendborg, Guardian and Stromag acquisitions and integration and other acquisitions, (24) risks associated with certain minimum purchase agreements we have with suppliers, (25) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (26) risks associated with interest rate swap contracts, (27) risks associated with our exposure to renewable energy markets, (28) risks related to regulations regarding conflict minerals, (29) risks related to restructuring and plant consolidations, and (30) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the U.S. Securities and Exchange Commission (SEC) or in materials incorporated therein by reference. Except as required by applicable law, Altra Industrial Motion Corp. does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise.

Fourth Quarter 2017 Highlights Achieved a 29.4% increase in net sales to $223.3 million, 9.1% increase excluding Stromag Fourth-quarter net income was $12.4 million, or $0.43 per diluted share, compared with $1.7 million, or $0.06 per diluted share, in the fourth quarter of 2016 Non-GAAP net income in Q4 2017 was $13.8 million, or $0.47 per diluted share, compared with $10.6 million, or $0.41 per diluted share, in the prior year fourth quarter * Full year GAAP diluted EPS grew to $1.78 and non-GAAP diluted EPS grew to a record $2.05 * Cash flow from operations of $80.6 million led to free cash flow of $47.8 million for the year * 2 Fourth Quarter 2017 Highlights Achieved a 29.4% increase in net sales to $223.3 million, 9.1% increase excluding Stromag Fourth-quarter net income was $12.4 million, or $0.43 per diluted share, compared with $1.7 million, or $0.06 per diluted share, in the fourth quarter of 2016 Non-GAAP net income in Q4 2017 was $13.8 million, or $0.47 per diluted share, compared with $10.6 million, or $0.41 per diluted share, in the prior year fourth quarter * Full year GAAP diluted EPS grew to $1.78 and non-GAAP diluted EPS grew to a record $2.05 * Cash flow from operations of $80.6 million led to free cash flow of $47.8 million for the year *

End Market Review Sales to Distribution were up year over year Turf and Garden sales were up slightly compared to last year, which was a record year, and customers are optimistic about 2018 Ag market sales continue to be strong with double-digit year-over-year growth Material handling was off slightly in Q4 with strong demand in elevator and forklift markets, offset by weakness in cranes and hoists. Improvement is expected in 2018. Oil and gas sales were up year-over-year for the fourth consecutive quarter Renewable energy sales were down double digits as increasing price pressure affected Europe and India Conventional power generation sales were down significantly in the quarter and we expect slight declines in 2018 Metals sales were strong and we believe the recovery has started Mining sales continue to be strong as sales were up significantly in the quarter and we expect this to continue into 2018 3 End Market Review Sales to Distribution were up year over year Turf and Garden sales were up slightly compared to last year, which was a record year, and customers are optimistic about 2018 Ag market sales continue to be strong with double-digit year-over-year growth Material handling was off slightly in Q4 with strong demand in elevator and forklift markets, offset by weakness in cranes and hoists. Improvement is expected in 2018.Oil and gas sales were up year-over-year for the fourth consecutive quarter Renewable energy sales were down double digits as increasing price pressure affected Europe and India Conventional power generation sales were down significantly in the quarter and we expect slight declines in 2018 Metals sales were strong and we believe the recovery has started Mining sales continue to be strong as sales were up significantly in the quarter and we expect this to continue into 2018

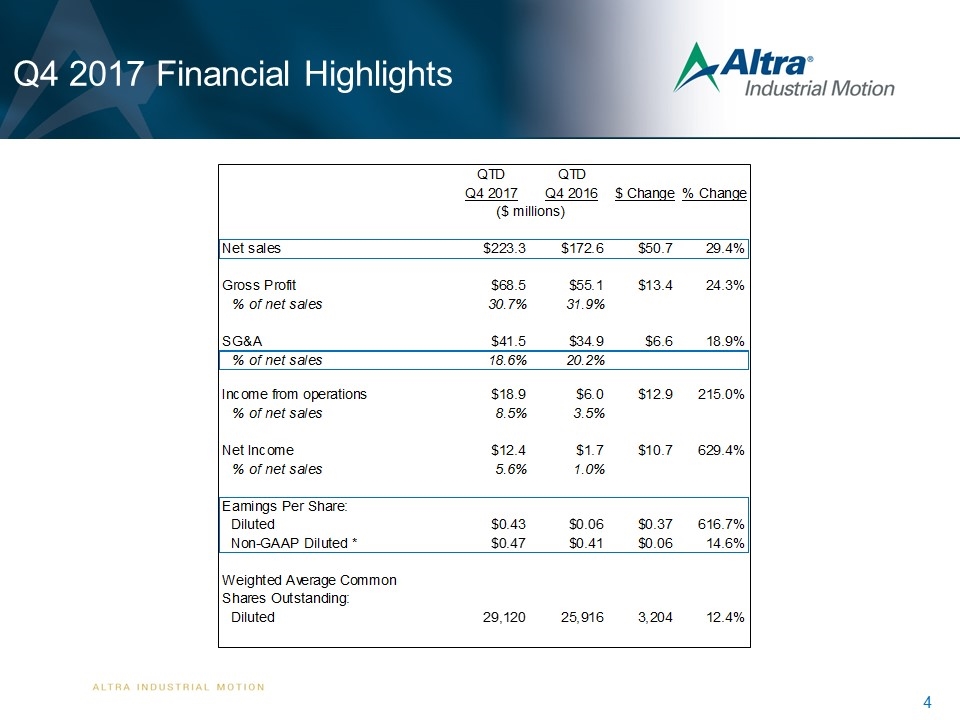

Q4 2017 Financial Highlights 4 Net Income (amounts in millions) Q1 2017 Q1 2016 Reported Net Income $10.3 $8.8 Restructuring and consolidation costs 1.9 1.6 Loss on extinguishment of convertible debt 1.8 - Amortization of inventory fair value adjustment 2.3 - Acquisition related expenses 1.0 - Tax impact of above adjustments (2.1) (1) (0.5) (2) Non-GAPP net income 15.3 9.9 Non-GAAP diluted earnings per share $0.53 $0.38 (1) tax impact is calculated by multiplying the estimated effective tax rate, 29.7% by the above (2) tax impact is calculated by multiplying the estimated effective tax rate, 29.9% by the above items Gross Profit (amounts in millions) Q1 2017 Q1 2016 Reported Gross Profit $66.2 $54.6 Amortization of inventory fair value adjustment 2.3 - Non-GAAP gross profit $68.5 $54.6 Non-GAAP gross profit as % of sales 31.8% 30.2% Q4 2017 Financial Highlights QTD QTD Q4 2017 Q4 2016 $ Change % Change ($ millions) Net sales $223.3 $172.6 $50.7 29.4% Gross Profit $68.5 $55.1 $13.4 24.3% % of net sales 30.7% 31.9% SG&A $41.5 $34.9 $6.6 18.9% % of net sales 18.6% 20.2% Income from operations $18.9 $6.0 $12.9 215.0% % of net sales 8.5% 3.5% Net Income $12.4 $1.7 $10.7 629.4% % of net sales 5.6% 1.0% Earnings Per Share:Diluted $0.43 $0.06 $0.37 616.7% Non-GAAP Diluted *$0.47 $0.41 $0.06 14.6% Weighted Average Common Shares Outstanding:Diluted 29,120 25,916 3,204 12.4% QTD QTD Q4 2017 Q4 2016 $ Change % Change ($ millions) Net sales $223.3 $172.6 $50.700000000000017 0.29374275782155285 Gross Profit $68.5 $55.1 $13.399999999999999 0.24319419237749543 % of net sales 0.30676220331392745 0.31923522595596759 SG&A $41.5 $34.9 $6.6000000000000014 0.1891117478510029 % of net sales 0.18584863412449618 0.2022016222479722 Income from operations $18.899999999999999 $6 $12.899999999999999 2.15 % of net sales 8.5% 3.5% Net Income $12.4 $1.7 $10.700000000000001 6.2941176470588243 % of net sales 5.6% .98493626882966388 Earnings Per Share: Diluted $0.43 $0.06 $0.37 6.166666666666667 Non-GAAP Diluted * $0.47 $0.41 $0.06 0.14634146341463414 Weighted Average Common Shares Outstanding: Diluted 29120 25916 3,204 0.12363018984411174 * See Appendix

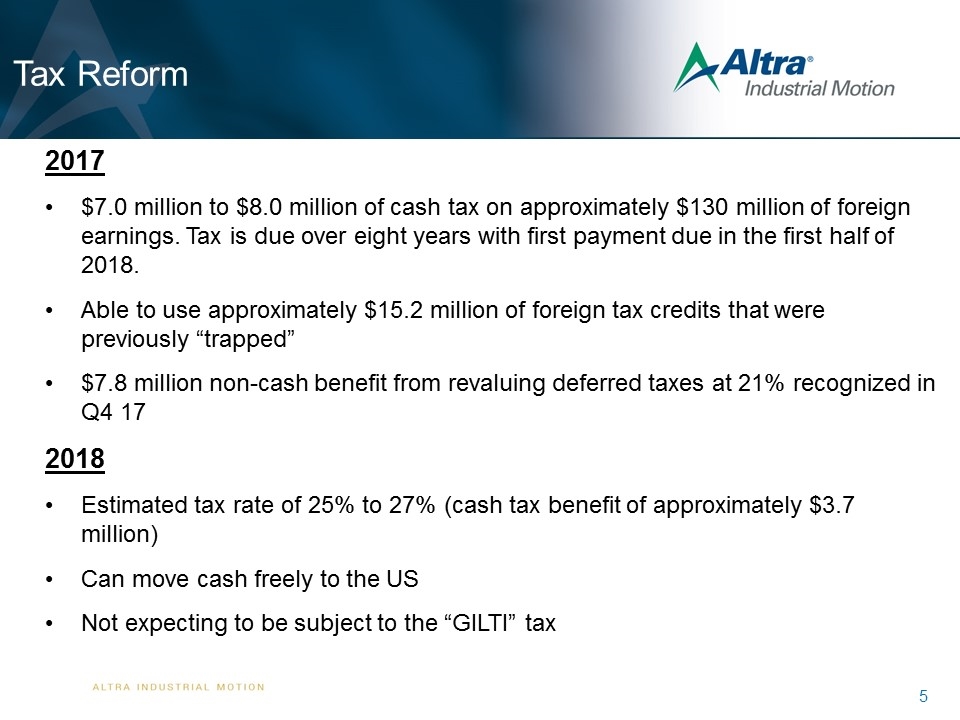

Tax Reform 5 Net Income (amounts in millions) Q1 2017 Q1 2016 Reported Net Income $10.3 $8.8 Restructuring and consolidation costs 1.9 1.6 Loss on extinguishment of convertible debt 1.8 - Amortization of inventory fair value adjustment 2.3 - Acquisition related expenses 1.0 - Tax impact of above adjustments (2.1) (1) (0.5) (2) Non-GAPP net income 15.3 9.9 Non-GAAP diluted earnings per share $0.53 $0.38 (1) tax impact is calculated by multiplying the estimated effective tax rate, 29.7% by the above (2) tax impact is calculated by multiplying the estimated effective tax rate, 29.9% by the above items Gross Profit (amounts in millions) Q1 2017 Q1 2016 Reported Gross Profit $66.2 $54.6 Amortization of inventory fair value adjustment 2.3 - Non-GAAP gross profit $68.5 $54.6 Non-GAAP gross profit as % of sales 31.8% 30.2% 2017 $7.0 million to $8.0 million of cash tax on approximately $130 million of foreign earnings. Tax is due over eight years with first payment due in the first half of 2018. Able to use approximately $15.2 million of foreign tax credits that were previously “trapped” $7.8 million non-cash benefit from revaluing deferred taxes at 21% recognized in Q4 17 2018 Estimated tax rate of 25% to 27% (cash tax benefit of approximately $3.7 million) Can move cash freely to the US Not expecting to be subject to the “GILTI” tax Tax Reform 2017 $7.0 million to $8.0 million of cash tax on approximately $130 million of foreign earnings. Tax is due over eight years with first payment due in the first half of 2018. Able to use approximately $15.2 million of foreign tax credits that were previously “trapped” $7.8 million non-cash benefit from revaluing deferred taxes at 21% recognized in Q417 2018 Estimated tax rate of 25% to 27% (cash tax benefit of approximately $3.7 million) Can move cash freely to the US Not expecting to be subject to the “GILTI” tax

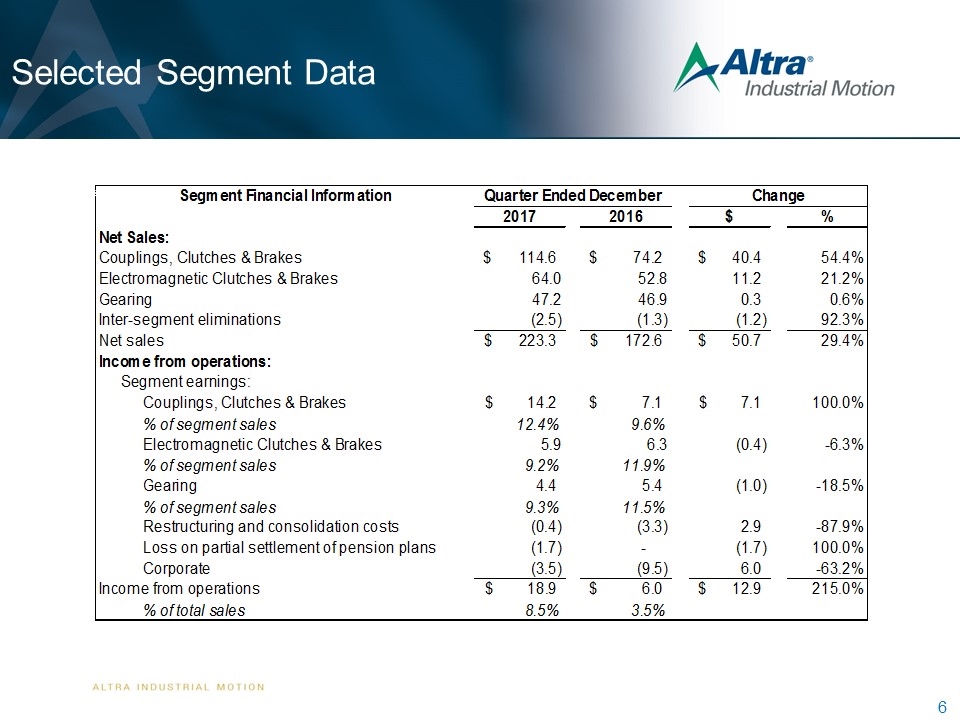

Selected Segment Data 6 Segment Financial Information Quarter Ended March 31, Variance 2017 2016 $ % Net Sales: Couplings , Clutches & Brakes $ 106.2 $ 75.6 $ 30.6 40.5% Electromagnetic Clutches & Brakes 63.9 57.3 6.5 11.4% Gearing 47.0 48.9 (1.9) -3.9% Inter-segment eliminations (1.7) (1.4) (0.3) 18.3% Net sales $215.4 $ 180.5 $ 35.0 19.4% Income from operations: Segment earnings: Couplings, Clutches & Brakes $ 8.3 $ 6.3 $ 2.1 32.6% % of segment sales 7.9% 8.3 % Electromagnetic Clutches & Brakes 7.6 6.5 1.1 17.5% % of segment sales 11.9% 11.3% Gearing 5.5 5.8 (0.2) -4.1% % of segment sales 11.7% 11.8% Restructuring (1.9) (1.6) (0.3) 22.2% Corporate Expenses (1.9) (2.0) Income from operations $ 17.7 $ 15.0 $ 2.7 17.9% % of total sales 8.2% 8.3% SelectedSegmentDataSegmentFinancialInformationQuarterEndedDecember31,Change20172016$%NetSales:Couplings,Clutches&Brakes$114.6$74.2$40.454.4%ElectromagneticClutches&Brakes64.052.811.221.2%Gearing47.246.90.30.6%Inter-segmenteliminations(2.5)(1.3)(1.2)92.3%Netsales$223.3$172.6$50.729.4%Incomefromoperations:Segmentearnings:Couplings,Clutches&Brakes$14.2$7.1$7.1100.0%%ofsegmentsales12.4%9.6%ElectromagneticClutches&Brakes5.96.3(0.4)-6.3%%ofsegmentsales9.2%11.9%Gearing4.45.4(1.0)-18.5%%ofsegmentsales9.3%11.5%Restructuringandconsolidationcosts(0.4)(3.3)2.9-87.9%Lossonpartialsettlementofpensionplans(1.7)-(1.7)100.0%Corporate(3.5)(9.5)6.0-63.2%Incomefromoperations$18.9$6.0$12.9215.0%%oftotalsales8.5%3.5%

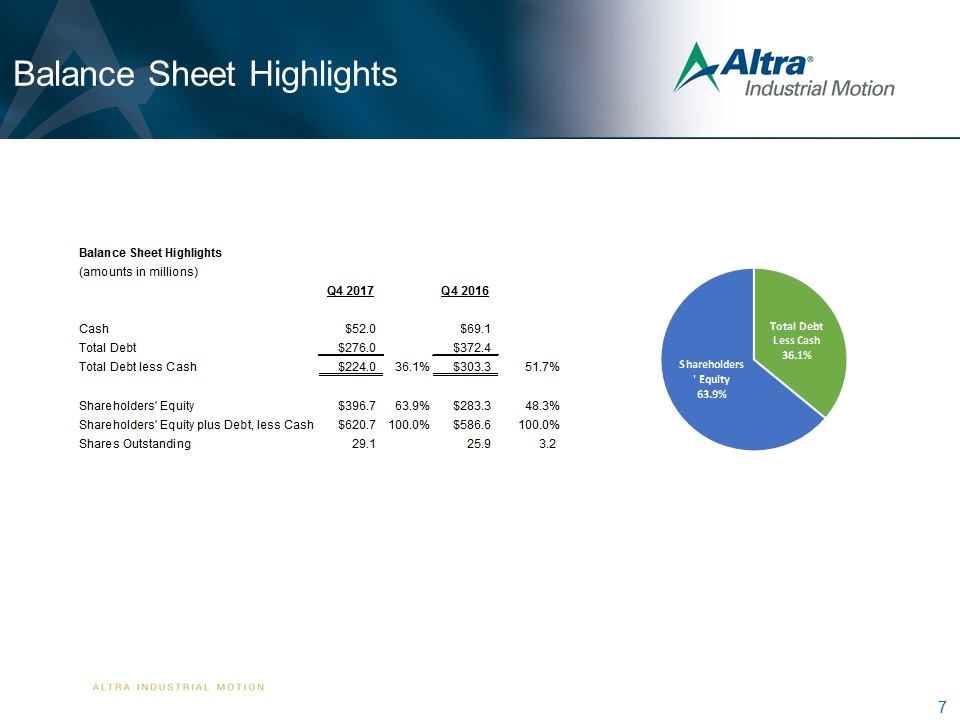

Balance Sheet Highlights 7 Balance Sheet HighlightsBalance Sheet Highlights (amounts in millions) Q4 2017 Q4 2016 Cash $52.0 $69.1 Total Debt $276.0 $372.4 Total Debt less Cash $224.0 36.1% $303.3 51.7% Shareholders' Equity $396.7 63.9% $283.3 48.3% Shareholders' Equity plus Debt, less Cash $620.7 100.0% $586.6 100.0% Shares Outstanding 29.1 25.9 3.2 Total Debt Less Cash 36.1% Shareholders' Equity 63.9% Balance Sheet Highlights (amounts in millions) Q4 2017 Q4 2016 Cash $52 $69.099999999999994 Total Debt $276 $372.4 Total Debt less Cash $224 0.3608828741743193 $303.29999999999995 0.51704739174906245 Shareholders' Equity $396.7 0.63911712582568059 $283.3 0.48295260825093772 Shareholders' Equity plus Debt, less Cash $620.70000000000005 100.0% $586.59999999999991 100.0% Shares Outstanding 29.1 25.9 3.2000000000000028 Total Debt Less Cash 0.3608828741743193 Shareholders' Equity 0.63911712582568059

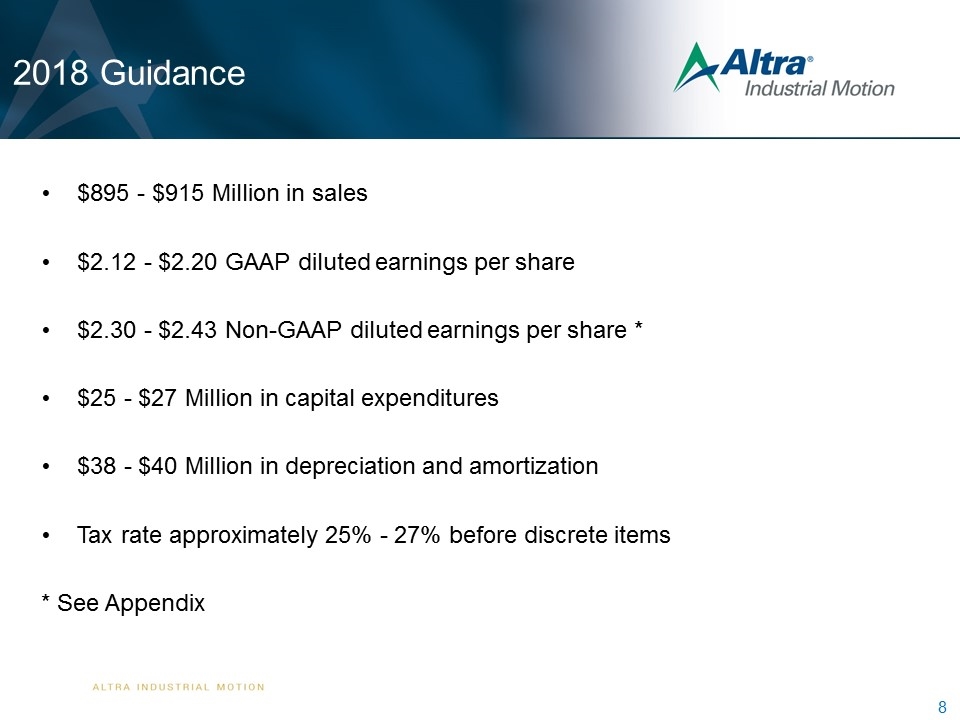

2018 Guidance $895 - $915 Million in sales $2.12 - $2.20 GAAP diluted earnings per share $2.30 - $2.43 Non-GAAP diluted earnings per share * $25 - $27 Million in capital expenditures $38 - $40 Million in depreciation and amortization Tax rate approximately 25% - 27% before discrete items * See Appendix 8 2018 Guidance $895 - $915 Million in sales $2.12 - $2.20 GAAP diluted earnings per share $2.30 - $2.43 Non-GAAP diluted earnings per share *$25 - $27 Million in capital expenditures $38 - $40 Million in depreciation and amortization Tax rate approximately 25% - 27% before discrete items * See Appendix

Summary Drove increased profitability in 2017 as a result of the initial success of our margin improvement initiatives Encouraged by the continuing improvement in the industrial economy and we expect that momentum to continue Well positioned for 2018 due to expected robust economic demand and a more efficient cost structure 9 Summary Drove increased profitability in 2017 as a result of the initial success of our margin improvement initiatives Encouraged by the continuing improvement in the industrial economy and we expect that momentum to continue Well positioned for 2018 due to expected robust economic demand and a more efficient cost structure

Discussion of Non-GAAP Measures * As used in this release and the accompanying slides posted on the Company's website, non-GAAP diluted earnings per share, non-GAAP income from operations and non-GAAP net income are each calculated using either net income or income from operations that excludes acquisition related costs, restructuring costs, and other income or charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP operating margin is calculated using income from operations that excludes charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP diluted earnings per share is calculated by dividing non-GAAP net income by GAAP weighted average shares outstanding (diluted). Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP operating working capital is calculated by deducting accounts payable from net trade receivables plus inventories. Altra believes that the presentation of non-GAAP net income, non-GAAP income from operations, non-GAAP operating margin, non-GAAP diluted earnings per share, non-GAAP free cash flow and non-GAAP operating working capital provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations. 10 Discussion of Non-GAAP Measures * As used in this release and the accompanying slides posted on the Company's website, non-GAAP diluted earnings per share, non-GAAP income from operations and non-GAAP net income are each calculated using either net income or income from operations that excludes acquisition related costs, restructuring costs, and other income or charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP operating margin is calculated using income from operations that excludes charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP diluted earnings per share is calculated by dividing non-GAAP net income by GAAP weighted average shares outstanding (diluted). Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP operating working capital is calculated by deducting accounts payable from net trade receivables plus inventories. Altra believes that the presentation of non-GAAP net income, non-GAAP income from operations, non-GAAP operating margin, non-GAAP diluted earnings per share, non-GAAP free cash flow and non-GAAP operating working capital provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations.

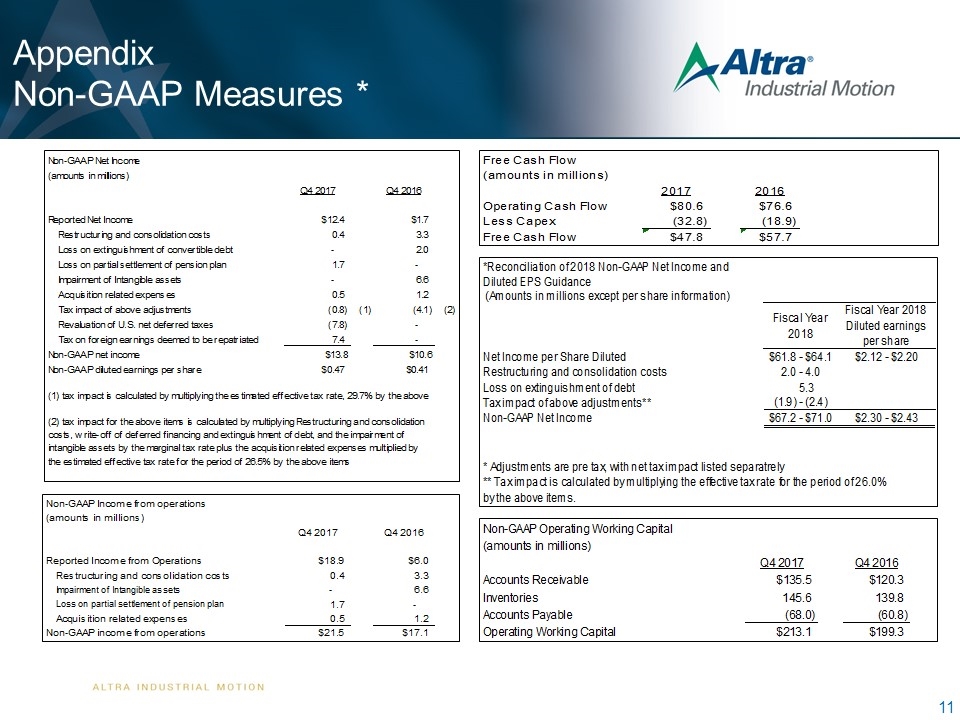

Appendix Non-GAAP Measures * 11 Non-GAAP Income from operations ( amounts in millions) Q1 2017 Q1 2016 Reported Income from Operations $17.7 $15.0 Restructuring and consolidation costs 1.9 1.6 Amortization of inventory fair value adjustment 2.3 - Acquisition related expenses 1.0 Non-GAAP income from operations $22.9 $16.5 Free Cash Flow (amounts in millions) Q1 2017 Q1 2016 Operating Cash Flow $3.0 $6.1 Less Capex (7.3) (5.7) Free Cash Flow ($4.3) $0.4 Non-GAAP Diluted EPS Guidance (amounts in millions) Projected Fiscal Year 2016 Net Income per share Diluted $1.7 - $1.80 Restructuring and consolidation costs 0.06 Acquisition related expenses 0.03 Amortization of inventory fair value adjustment 0.06 Loss on extinguishment of convertible debt 0.04 Tax impact of anove adjustments** (0.06) Non-GAAP Diluted EPS Guidance $1.83 - $ 1.93 ** Tax impact is calculated by multiplying the effect tax rate for the period of 31% Appendix Non-GAAP Measures * Non-GAAP Net Income (amounts in millions) Q4 2017 Q4 2016 Reported Net Income $12.4 $1.7 Restructuring and consolidation costs 0.4 3.3 Loss on extinguishment of convertible debt - 2.0 Loss on partial settlement of pension plan 1.7 - Impairment of Intangible assets - 6.6 Acquisition related expenses 0.5 1.2 Tax impact of above adjustments (0.8) (1) (4.1) (2) Revaluation of U.S. net deferred taxes (7.8) - Tax on foreign earnings deemed to be repatriated 7.4 - Non-GAAP net income $13.8 $10.6 Non-GAAP diluted earnings per share $0.47 $0.41 (1) tax impact is calculated by multiplying the estimated effective tax rate, 29.7% by the above items (2) tax impact for the above items is calculated by multiplying Restructuring and consolidation costs, write-off of deferred financing and extinguishment of debt, and the TB Woods impairment by the marginal tax rate plus the acquisition related expenses multiplied by the estimated effective tax rate for the period of 26.5% by the above items Non-GAAP Income from operations (amounts in millions) Q4 2017 Q4 2016 Reported Income from Operations $18.9 $6.0 Restructuring and consolidation costs 0.4 3.3 Impairment of Intangible assets - 6.6 Loss on partial settlement of pension plan 1.7 - Acquisition related expenses 0.5 1.2 Non-GAAP income from operations $21.5 $17.1 Free Cash Flow (amounts in millions) 2017 2016 Operating Cash Flow $80.6 $76.6 Less Capex (32.8) (18.9) Free Cash Flow $47.8 $57.7 *Reconciliation of 2018 Non-GAAP Net Income and Diluted EPS Guidance (Amounts in millions except per share information) Fiscal Year 2018 Fiscal Year 2018 Diluted earnings per share Net Income per Share Diluted $61.8 - $64.1 $2.12 - $2.20 Restructuring and consolidation costs 2.0 - 4.0 Loss on extinguishment of debt 5.3 Tax impact of above adjustments** (1.9) - (2.4) Non-GAAP Net Income $67.2 - $71.0 $2.30 - $2.43 * Adjustments are pre tax, with net tax impact listed separatrely ** Tax impact is calculated by multiplying the effective tax rate for the period of 26.0% by the above items. Non-GAAP Operating Working Capital (amounts in millions) Q4 2017 Q4 2016 Accounts Receivable $135.5 $120.3 Inventories 145.6 139.8 Accounts Payable (68.0) (60.8) Operating Working Capital $213.1 $199.3 Non-GAAP Income from operations (amounts in millions) Q4 2017 Q4 2016 Reported Income from Operations $18.899999999999999 $6 Restructuring and consolidation costs 0.4 3.3 Impairment of Intangible assets 0 6.6 Loss on partial settlement of pension plan 1.7 0 Acquisition related expenses 0.5 1.2 Non-GAAP income from operations $21.499999999999996 $17.100000000000001 Non-GAAP Operating Working Capital (amounts in millions) Q4 2017 Q4 2016 Accounts Receivable $135.5 $120.3 Inventories 145.6 139.80000000000001 Accounts Payable -68 -60.8 Operating Working Capital $213.10000000000002 $199.3 Free Cash Flow (amounts in millions) 2017 2016 Operating Cash Flow $80.599999999999994 $76.599999999999994 Less Capex -32.799999999999997 -18.899999999999999 Free Cash Flow $47.8 $57.699999999999996 *Reconciliation of 2018 Non-GAAP Net Income and Diluted EPS Guidance (Amounts in millions except per share information) Fiscal Year 2018 Fiscal Year 2018 Diluted earnings per share Net Income per Share Diluted $61.8 - $64.1 $2.12 - $2.20 Restructuring and consolidation costs 2.0 - 4.0 Loss on extinguishment of debt 5.3 Tax impact of above adjustments** (1.9) - (2.4) Non-GAAP Net Income $67.2 - $71.0 $2.30 - $2.43 * Adjustments are pre tax, with net tax impact listed separatrely ** Tax impact is calculated by multiplying the effective tax rate for the period of 26.0% by the above items.

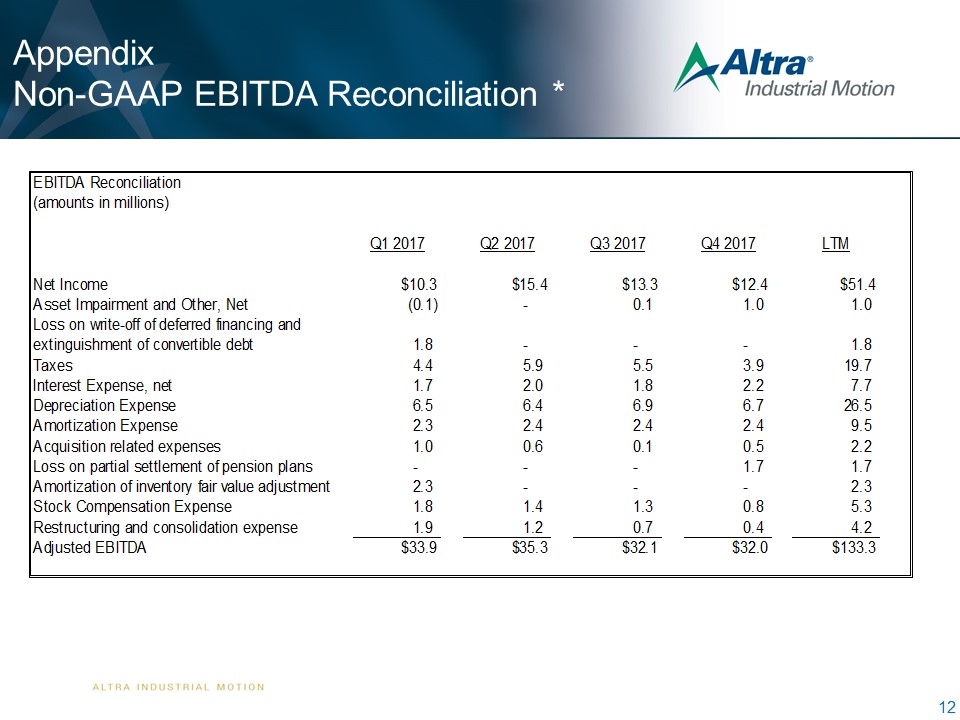

Appendix Non-GAAP EBITDA Reconciliation * 12 Appendix Non-GAAP EBITDA Reconciliation * EBITDA Reconciliation (amounts in millions) Q1 2017 Q2 2017 Q3 2017 Q4 2017 LTM Net Income $10.3 $15.4 $13.3 $12.4 $51.4 Asset Impairment and Other, Net (0.1) 0.1 1.0 1.0 Loss on write-off of deferred financing and extinguishment of convertible debt 1.8 1.8 Taxes 4.4 5.9 5.5 3.9 19.7 Interest Expense, net 1.7 2.0 1.8 2.2 7.7 Depreciation Expense 6.5 6.4 6.96.7 26.5 Amortization Expense 2.3 2.4 2.4 2.4 9.5 Acquisition related expenses 1.0 0.6 0.1 0.5 2.2 Loss on partial settlement of pension plans 1.7 1.7 Amortization of inventory fair value adjustment 2.3 2.3 Stock Compensation Expense 1.8 1.4 1.3 0.8 5.3 Restructuring and consolidation expense 1.9 1.2 0. 0.4 4.2 Adjusted EBITDA $33.9 $35.3 $32.1 $32.0 $133.3 EBITDA Reconciliation (amounts in millions) Q1 2017 Q2 2017 Q3 2017 Q4 2017 LTM Net Income $10.3 $15.399999999999999 $13.3 $12.4 $51.4 Asset Impairment and Other, Net -0.1 0 0.13600000000000001 1 1.036 Loss on write-off of deferred financing and extinguishment of convertible debt 1.8 0 0 0 1.8 Taxes 4.4000000000000004 5.9 5.5 3.9 19.7 Interest Expense, net 1.7 2 1.8 2.2000000000000002 7.7 Depreciation Expense 6.5 6.4 6.9 6.7000000000000011 26.5 Amortization Expense 2.2999999999999998 2.4000000000000004 2.3999999999999995 2.4000000000000004 9.5 Acquisition related expenses 1 0.6 0.1 0.5 2.2000000000000002 Loss on partial settlement of pension plans 0 0 0 1.7 1.7 Amortization of inventory fair value adjustment 2.2999999999999998 0 0 0 2.2999999999999998 Stock Compensation Expense 1.8 1.4000000000000001 1.2999999999999996 0.7999999999999996 5.3 Restructuring and consolidation expense 1.9 1.2 0.7 0.4 4.2 Adjusted EBITDA $33.9 $35.299999999999997 $32.136000000000003 $32 $133.33599999999998