Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Travelport Worldwide LTD | tv483889_ex31-1.htm |

| EX-32 - EXHIBIT 32 - Travelport Worldwide LTD | tv483889_ex32.htm |

| EX-31.2 - EXHIBIT 31.2 - Travelport Worldwide LTD | tv483889_ex31-2.htm |

| EX-23 - EXHIBIT 23 - Travelport Worldwide LTD | tv483889_ex23.htm |

| EX-21 - EXHIBIT 21 - Travelport Worldwide LTD | tv483889_ex21.htm |

| EX-10.19 - EXHIBIT 10.19 - Travelport Worldwide LTD | tv483889_ex10-19.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-36640

Travelport Worldwide Limited

(Exact name of registrant as specified in its charter)

| Bermuda | 98-0505105 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Axis One, Axis Park

Langley, Berkshire, SL3 8AG, United Kingdom

(Address of principal executive offices, including zip code)

+44-1753-288-000

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Each Exchange on Which Registered | ||

| Common Shares, Par Value $0.0025 | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | ||||||||

| Emerging growth company ¨ | (Do not check if a smaller reporting company) | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2017, the aggregate market value of the Registrant’s common shares held by non-affiliates was $1,691,635,080 based on the closing pricing of its common shares on the New York Stock Exchange. Solely for the purpose of the foregoing calculation only, all directors and executive officers of the Registrant are assumed to be “affiliates” of the Registrant. As of February 16, 2018, there were 125,414,115 shares of the Registrant’s common shares, par value $0.0025 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be mailed to stockholders in connection with the Registrant’s annual stockholders’ meeting scheduled to be held on June 27, 2018 (the “Annual Proxy Statement”) are incorporated by reference into Part III hereof.

TABLE OF CONTENTS

The forward-looking statements contained herein involve risks and uncertainties. Many of the statements appear, in particular, in the sections entitled “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Forward-looking statements identify prospective information. Important factors could cause actual results to differ, possibly materially, from those in the forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “potential,” “should,” “will” and “would” or other similar words. You should read statements that contain these words carefully because they discuss our future priorities, goals, strategies, actions to improve business performance, market growth assumptions and expectations, new products, product pricing, changes to our business processes, future business opportunities, capital expenditures, financing needs, financial position and other information that is not historical information. References within this Annual Report on Form 10-K to “we,” “our,” “us” or “Travelport” refer to Travelport Worldwide Limited, a Bermuda company, and its consolidated subsidiaries.

The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results of continuing operations or those anticipated or predicted by these forward-looking statements:

| • | factors affecting the level of travel activity, particularly air travel volume, including security concerns, pandemics, general economic conditions, natural disasters and other disruptions; |

| • | our ability to obtain travel provider inventory from travel providers, such as airlines, hotels, car rental companies, cruise-lines and other travel providers; |

| • | our ability to maintain existing relationships with travel agencies and to enter into new relationships on acceptable financial and other terms; |

| • | our ability to develop and deliver products and services that are valuable to travel agencies and travel providers and generate new revenue streams; |

| • | the impact on travel provider capacity and inventory resulting from consolidation of the airline industry; |

| • | our ability to grow adjacencies, such as payment and mobile solutions; |

| • | general economic and business conditions in the markets in which we operate, including fluctuations in currencies, particularly in the U.S. dollar, and the economic conditions in the eurozone; |

| • | the impact on business conditions worldwide as a result of political decisions, including the United Kingdom’s (“U.K.”) decision to leave the European Union (“E.U.”); |

| • | pricing, regulatory and other trends in the travel industry; |

| • | the impact our outstanding indebtedness may have on the way we operate our business; |

| • | our ability to achieve expected cost savings from our efforts to improve operational and technological efficiency, including through our consolidation of multiple technology vendors and locations and the centralization of activities; and |

| • | maintenance and protection of our information technology (“IT”) and intellectual property. |

We caution you that the foregoing list of important factors may not contain all of the factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. The factors listed in the section captioned “Risk Factors” in this Annual report on Form 10-K, provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in the forward-looking statements. You should be aware that the occurrence of the events described in these risk factors and elsewhere in this report could have an adverse effect on our business, results of operations, financial position and cash flows.

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other forward-looking statements. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

| 1 |

Overview

Travelport is the technology company that makes the experience of buying and managing travel continually better. We operate a travel commerce platform providing distribution, technology, payment, mobile and other solutions for the global travel and tourism industry. We facilitate travel commerce by connecting the world’s leading travel providers, such as airlines, hotel chains and car rental companies, with online and offline travel buyers in a proprietary business-to-business (B2B) travel platform. Our travel buyers include travel agencies, including online travel agencies (“OTAs”), travel management companies (“TMCs”) and corporations. We have a focused strategy to enrich and broaden our content capabilities. We have a leadership position in airline merchandising with over 250 airlines fully implemented with high value-add merchandising capabilities out of a total airline roster of approximately 400 airlines. We lead in low cost carrier (“LCC”) content with approximately 125 LCCs connected to our Travel Commerce Platform. Additionally, we believe we are one of the largest third-party distributors of hotel room nights globally and complement this with a strong focus on car rental, rail, tour operators and cruise-lines. We have a strong focus on mobile commerce, providing a wide range of services that allows airlines, hotels, corporate TMCs and travel agencies to engage with their customers through digital services, including apps, corporate booking tools and mobile messaging. In addition, we leveraged our domain expertise in the travel industry to design a unique and pioneering B2B payment solution that addresses the need of travel agencies to efficiently and securely make payments to travel providers globally. Our leading B2B payments business experienced 29% annual growth in 2017. We also provide critical IT services to airlines such as shopping, ticketing, departure control, business intelligence and other solutions enabling them to focus on their core business competencies and reduce costs.

We operate at significant scale with approximately $83 billion of travel spending processed in 2017. With the rise of mobile and meta-search intermediaries, more than 2 trillion messages passed over our networks in 2017, with an average of over 7 billion air shopping requests per month. Our data center uses over 20,000 physical and virtual servers, with a current total storage capacity of approximately 16 petabytes.

We have a broad geographic footprint in the travel distribution industry. In 2017, we generated $2,341 million in Travel Commerce Platform revenue, of which 74% is international (with 24% from Asia Pacific, 32% from Europe, 5% from Latin America and Canada and 13% from the Middle East and Africa) and 26% is from the United States. Our geographically dispersed footprint helps insulate us from particular country or regional instability, allows for optimal IT efficiency and enhances our value proposition not only to travel providers, travel agencies and corporations, but also to end travelers. We are well positioned to capture higher value business from travel providers operating in non-domestic, or ‘away’ markets, in addition to serving their domestic, or ‘home’ markets, which results in higher per transaction revenue for both us and the travel providers we serve. We operate in approximately 180 countries and territories through our extensive global network of approximately 60 sales and marketing offices (“SMOs”) and a diverse workforce of over 4,000 full-time employees as of December 31, 2017.

As customer needs and technologies evolve, we continue to invest in our Travel Commerce Platform, developing new solutions to better serve the industry. We have led innovation in electronic distribution and merchandising of airline core and ancillary products and extensively diversified our offerings to address the high-volume and growing transaction processing requirements for the evolving needs of the travel industry through our Travel Commerce Platform. Comprised of Air and Beyond Air, our Travel Commerce Platform provides distribution and merchandising solutions for airline, hotel, car rental, rail, cruise-line and tour operators, B2B travel payment solutions, digital services, advertising and an array of additional platform services. We have acquired expertise in and are deploying machine learning, artificial intelligence and other leading-edge technology to support our customers. Our advanced search technology aggregates global travel content, filters it through sophisticated search algorithms and presents results via application programming interfaces (“APIs”) and in an online travel world via efficient workflow for travel agencies in the offline mobile travel world, enabling travel agencies to create and modify multi-content, modular and complex itineraries, issue travel documents, process millions of booking transactions and invoices and transfer secure, cost-effective and automated payments, all on a graphically rich, single user interface. We have invested in our infrastructure and conveyance mechanisms, including APIs and our point of sale (“POS”) interface, to make them easier to code to, lighter to use in terms of system processing for our customers and able to handle personalization. The significant growth of OTAs and the online channel, through meta-searches, the proliferation of mobile devices and consumerization has driven continued growth in the volume of searches and shopping transactions processed by our platform. Since 2015, we have seen a 4 times average increase in shopping requests coming onto our platform. We have effectively seen shopping requests double every 18 months, and we expect this trend to continue for the foreseeable future. Our focused strategy in search technology ensures we are positioned to manage the continued growth in the industry within our existing operating cost structure.

| 2 |

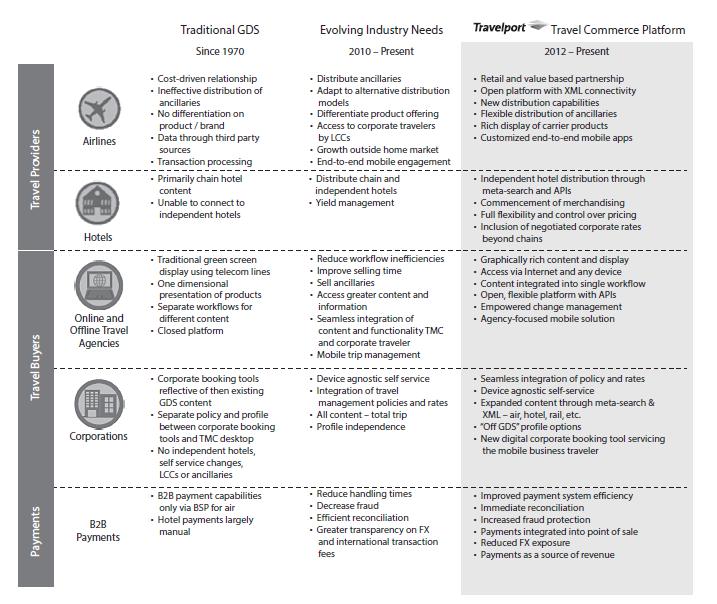

Our focus on enhancing our platform’s performance, including speed of search, is not just about price and speed, but also relevance and bookability of search results, including branded fares and ancillaries. By leveraging cloud, machine learning, mobile-enabled APIs and data and analytics, we can ensure insights are available and translated into personalized and smarter responses for the customer. For Air, we have transformed beyond the traditional global distribution system (“GDS”) concept, which had very limited ancillary sales capabilities, into an open platform with extensible markup language (“XML”) connectivity and a graphically rich, single user interface to enable marketing and sales of not only full air content, but also full ancillary content. We are a leader in the field of airline distribution being the first GDS supplier to acquire the International Air Transport Association’s (“IATA”) highest certification for its new distribution capability technology (“IATA NDC”). For Beyond Air, in addition to chain hotel content, we have added independent hotel inventory, previously rarely booked through the intermediary channel, to a global network of travel agencies through our meta-search technology, which combines search results from multiple sources and have given hotels the ability to display their full range of rates and packages in a one-stop booking portal. By investing in robotics and artificial intelligence, we help our customers engage in more “no touch” booking processes to address the changing needs of the traveler and drive business efficiencies automation. Our digital strategy and value propositions focus on improving the end-to-end customer experience through the provision of innovative digital travel solutions to all of our customers, including through Travelport Locomote’s corporate travel platform and our mobile travel solutions for airlines, hotels, TMCs, and travel agencies with Travelport Fusion and Travelport Trip Assist. Our Travel Commerce Platform creates synergies and network efficiencies that facilitate revenue growth across the travel value chain. The chart below demonstrates the ways in which our Travel Commerce Platform identified, addressed and redefined key elements of the travel value chain that are fully or partially unaddressed by traditional GDS providers:

Our Travel Commerce Platform Addresses the Evolving Needs of Our Industry

Our next generation Travel Commerce Platform focuses on the trends, inefficiencies and unmet needs of all components of the travel value, including innovative mobile engagement solutions and digital offerings.

| 3 |

We provide air distribution services to approximately 400 airlines globally, including approximately 125 LCCs. We distribute ancillaries for over 100 airlines. In addition, we secure content from numerous Beyond Air travel providers, including approximately 650,000 hotel properties (of which over 500,000 are independent hotel properties), over 38,000 car rental locations, approximately 50 cruise-line and tour operators and 14 major rail networks worldwide. We aggregate travel content across approximately 65,000 travel agency locations representing approximately 230,000 online and offline travel agency terminals worldwide, which in turn serve millions of end consumers globally. In 2017, we handled over 340 million segments sold by travel agencies and sold over 68 million hotel room nights and over 105 million car rental days. Our Travel Commerce Platform provides real-time search, pricing, booking, change, payment and integrated itinerary creation for travelers who use the services of online and offline travel agencies for both leisure and business travel. Our access to business travelers, merchandising capabilities and ability to process complex itineraries attracted and allowed for the full integration of several fast-growing LCCs, such as AirAsia, easyJet, IndiGo and Ryanair, into our Travel Commerce Platform.

Through eNett International (Jersey) Limited (“eNett”), our majority-owned subsidiary and an early adopter in automated payments, we redefined how travel agencies pay travel providers. When a consumer purchases an itinerary through a travel agency, the consumer pays using a variety of mechanisms, including cash, direct debit and credit card. Generally, the consumer makes one payment for the entire itinerary of flights, hotels and ground services, such as transfers. The travel agency then remits the individual payments to each travel provider. eNett’s core offering is a payment solution that automatically generates unique Mastercard numbers used to process payments globally. Before eNett, travel payments were primarily settled in cash and exposed payers to risks of fraud, delays and costly reconciliations. The Virtual Account Number (“VAN”) solution is integrated into all of our POS systems and exclusively utilizes the Mastercard network pursuant to a long-term agreement. eNett’s operations currently focus on Asia Pacific and Europe, and we believe the model is highly scalable. We have expanded beyond the core hospitality sector into air travel, including LCCs, with further opportunities for growth in other sectors of the travel industry.

Through our digital solutions, we also provide innovative mobile engagement solutions for airlines, hotels, TMCs and travel agencies. Travelport Digital’s solutions are used worldwide to improve the end-to-end mobile travel experience and increase the value of customer interactions via sophisticated apps and mobile services across smartphones, tablets and wearables. In addition to industry-leading travel apps, Travelport Digital provides advanced mobile services, including real-time mobile messaging, day-of-travel solutions and ancillary upsell opportunities. Travelport Digital’s solutions also enable airlines and travel companies to create new revenue opportunities through ancillary upsell and improved conversion rates as a result of high-end design and more personalized experiences via mobile. Through Travelport Locomote, we have significantly strengthened our offering to both corporates and TMCs from an end-to-end customer experience perspective. Travelport Locomote is a corporate travel platform that empowers travel managers to drive change and achieve efficiencies. Travelport Locomote creates seamless experiences and integrated solutions from approval management to cost savings to duty of care. Customers control the entire travel program, enabling greater insight into travel expenditure. The Travelport Locomote platform uses Travelport’s Universal Profile, Universal Record, travel policy engine and our Travelport Universal API, from which it obtains real time access to our content, which includes LCCs and network carriers, airline ancillary products, car rental companies and the broad range of hotel properties and rates that we distribute. The platform has been further developed to enable easy integration of third-party, complementary applications that an individual corporation might want to add to its travel and/or authorization processes, including expense management, corporate booking tools and other add-on services, all within the same corporate user experience, workflow and data management capabilities.

In addition to hospitality, payment solutions and digital services, we utilize the broad connections and extensive data managed by our Travel Commerce Platform to provide advertising solutions to over 3,000 advertisers that allow our travel providers to easily and cost-effectively promote upgrades, ancillary products or services, package deals and other offers. We also offer other platform services, including subscription services, processing services, business intelligence data services and marketing-oriented analytical tools, to travel agencies, travel providers and other travel data users.

We provide critical IT services to airlines, such as shopping, ticketing, departure control, business intelligence and other solutions, enabling them to focus on their core business competencies and reduce costs. We also host reservations, inventory management and other related critical systems for Delta Air Lines Inc. (“Delta”) and run the system infrastructure for the Delta platform in our Atlanta data center under a long-term agreement. We refer to these solutions and services as “Technology Services.” In addition, until April 2017, we owned 51% of IGT Solutions Private Ltd. (“IGTS”), a technology development services provider based in Gurgaon, India that was used for both internal and external software development. We divested our 51% interest in IGTS in April 2017.

We have a recurring, primarily transaction-based, revenue model. We do not take airline, hotel or other inventory risk, and we are not directly exposed to fuel price volatility or labor unions like our travel providers. Our recurring, transaction-based revenue model is primarily driven by discrete travel events such as Air or Beyond Air segments booked rather than the price of the booking, meaning we benefit from an increase in total global travel without being exposed to price changes. However, our results, like others in our industry, are dependent upon various levels of travel activity, particularly air travel, as well as our ability to obtain travel provider inventories, our ability to maintain existing relationships with travel agencies and our ability to deliver desired products and services.

Our ability to offer broad, high-quality and multi-product content on a single user interface encourages those booking travel to purchase additional products and services beyond the original Air or Beyond segment. For example, for every 100 air tickets sold in 2017, 46 hospitality segments were sold. The merchandising of additional products and services increases our revenue per transaction, and, consequently, we measure performance primarily on the basis of increases in both Reported Segments and RevPas (including Air and Beyond Air segments). Our recurring, transaction-based revenue model combined with high-quality content availability (which encourages incremental services booked with each transaction), our investment in our distribution and payment solutions technology and digital services and our multi-year contracts with travel providers and travel agents enabled us to grow our RevPas in each of the last 20 quarters on a year-over-year basis. We increased our RevPas from $5.19 in the first quarter of 2012 to $7.08 in the fourth quarter of 2017.

| 4 |

Company History

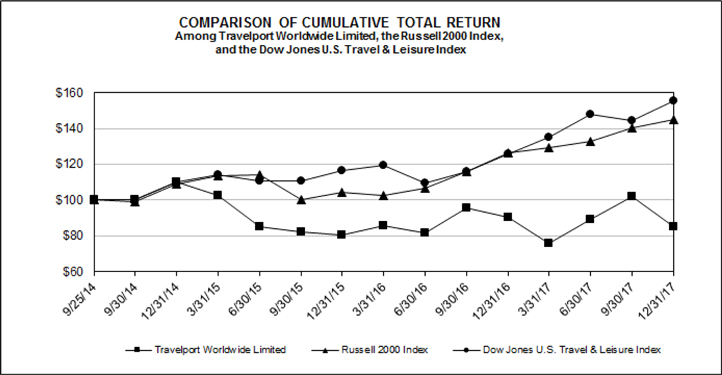

On September 30, 2014, we completed our initial public offering, and our common shares are traded on the New York Stock Exchange (“NYSE”) under the symbol “TVPT.”

We were incorporated in 2006 in Bermuda. Our principal executive offices are located at Axis One, Axis Park, Langley, Berkshire SL3 8AG, United Kingdom and our telephone number is +44-1753-288-000.

We continually explore, prepare for and evaluate possible transactions, including capital markets and debt transactions, acquisitions, divestitures, joint ventures and other arrangements, to ensure we have the most efficient and effective capital structure and/or to maximize the value of the enterprise. No assurance can be given with respect to the timing, likelihood or effect of any possible transactions.

Our Competitive Strengths

We believe that several aspects of our strategy fundamentally differentiate us from our competitors, including our focus on redefining travel distribution and commerce instead of investing in more capital and labor intensive airline and hospitality related IT solutions, our fast growing Beyond Air portfolio, including our automated B2B payments solution and digital services with large addressable markets, and our emphasis on a value-based partnership approach with travel providers that allows us to increase revenue and profitability per Reported Segment. The following attributes describe in further detail how we differentiate ourselves from our competitors.

Large and Structurally Growing Travel Market with Significant Exposure to Fast Growing Regions

The travel and tourism industry has shown continued strength as one of the world’s largest industries, contributing $7.6 trillion, or 10.2%, of the global GDP in 2016, according to The World Travel & Tourism Council (the “WTTC”). The industry is comprised of travel suppliers and buyers around the world, including airlines, hotels, car rental companies, rail carriers, cruise-lines, tour operators, online and offline travel agencies, travel management companies and corporate travel departments.

The travel and tourism industry is forecast to grow by 3.9% per annum over the next 10 years to reach $11.5 trillion contributing 11.4% of the global GDP by 2027, according to the WTTC. Global air passengers carried, one of the key underlying indicators for the wider travel and tourism industry, has been consistently growing from 1.7 billion passengers in 2000 to 3.7 billion in 2016 with a compound annual growth rate of 5.1%, according to the World Bank, demonstrating very low volatility and high resilience to unpredictable shocks from terrorist attacks, political instability health pandemics and natural disasters. IATA has forecasted air passenger demand to almost double over the next 20 years. Expected growth in air passenger demand is largely driven by increasing demand in the Asia Pacific, Latin America, Middle East and Africa regions, with total traffic expected to grow at compounded annual growth rates of 5.6%, 4.1%, 6.7% and 5.3%, respectively, from 2017 to 2036, according to Airbus.

Structural trends are largely driving, and are expected to continue to drive, growth in the travel and tourism industry. Emerging markets have contributed to a significant amount of the population growth around the globe and are forecasted to grow at a rate higher than developed nations through 2050, according to the Population Reference Bureau. Simultaneously, the middle class has expanded and increased consumption in emerging regions, with the gross national income per capita having grown at compound annual growth rates of between 5 – 9% from 2000 to 2016, according to the World Bank. These trends, combined with airlines increasing their capacity in away markets and growing business travel driven by globalization, support continued air market growth.

Coupled with these structural tailwinds, increased demand for digitalization and technological differentiation is driving change in the travel and tourism industry. Travel buyers demand faster, more relevant and more personalized travel content to help reach their target customers and drive higher revenue per seat, per room and per rental. Our use of enabling technologies, such as APIs, cloud computing, data and analytics, machine learning and robotics allows us to ensure insights are available and translated into relevant, personalized and smarter responses, enabling travel buyers to realize efficiency gains and the ability to differentiate. Additionally, in the past, the travel industry has not met the need for a secure and efficient payment solutions using traditional means of payments as a primary means to settle transactions, but there has been increasing demand and usage of digital solutions to eliminate the associated risks.

We are well positioned to benefit from these favorable trends and significant growth potential of the travel and tourism industry. Being a well-diversified global player, we have significant exposure to the fastest growing regions, including Asia Pacific, Middle East and Africa and Latin America and Canada, which, in 2017, contributed 24%, 13% and 5%, respectively, of our Travel Commerce Platform revenue. We have strategically invested over $1.2 billion in technology over the past 5 years to address the increasing importance of these market trends. These investments have enabled us to diversify further away from traditional GDS services to a leading global travel commerce platform, providing our customers with payment solutions and other digital and technology services, in addition to the traditional GDS offering.

Leading and Differentiated Travel Commerce Platform Addressing the Evolving Needs of the Travel Industry

Travel providers need flexible systems to distribute and merchandise their increasingly sophisticated core products and broadening offerings of ancillary products and services. We offer them a portfolio of industry-leading, value-add tools to increase revenue, lower costs and efficiently reach travel buyers globally in every channel. Our global reach allows travel providers to display and sell products in approximately 180 countries and territories and across approximately 65,000 travel agency locations representing approximately 230,000 online and offline travel agency terminals worldwide. Our Travel Commerce Platform enables travel providers to (i) extend their distribution by broadening their geographic reach to away markets and connects them with higher value business travelers, (ii) access higher yielding ticket prices from long-haul segments, room rates, complex itineraries and business travelers and (iii) encourage travelers to purchase ancillary services and/or upgrade or upsell travelers through our highly-differentiated merchandising capabilities.

| 5 |

Our Travelport Merchandising Suite, consisting of three distinct solutions—Travelport Aggregated Shopping, Travelport Ancillary Services and Travelport Rich Content and Branding— offers a range of sophisticated travel sales and marketing capabilities that allow airlines to promote their products and services to the right buyers, at the right time and in the right place. Travelport Aggregated Shopping allows travel agencies to efficiently and directly compare results from network carriers, who deliver data through the traditional industry standard, airline tariff publishing company (“ATPCO”), which regularly updates traditional GDSs, with those from LCCs and other carriers who use an API connection to deliver data directly and in real time to us. Travelport Ancillary Services allow travel agencies to sell airline ancillaries, such as checked baggage, premium seats and lounge passes, directly through their existing interface rather than needing to book separately on an airline’s website. Travelport Rich Content and Branding allows airlines to more effectively control how their flights and ancillaries are visually presented and described on travel agency screens, bringing the display more in line with the airlines’ own website. This is especially valuable to airlines given the increasing importance of ancillary revenue for profitability and allows travel agencies to sell more effectively. The benefits also are available to customers connected to our leading API solutions, including Travelport Universal API. This means that OTAs, corporate booking tool providers or other travel consultants, who are designing their own customized user interfaces, can still understand an airline’s full value proposition, including its branded fares and ancillaries, in the same way as a customer connected to Travelport’s POS solution, Travelport Smartpoint, would. Our ability to help travel providers and travel agencies increase their revenue reinforces the value proposition of our Travel Commerce Platform when compared to alternative distribution channels and is a key part of our strategy to shift the focus of our relationship with travel providers from priced-focused to value-focused.

Our leading access to global travel provider content helps attract more travel agencies, both online and offline, as well as corporations and self-serve travelers, onto our platform, which in turn drives greater value for the travel providers, increasing their addressable customer base. Our leading POS solutions, such as Travelport Smartpoint, along with Travelport Branded Fares and Ancillaries, provide travel agencies with greater choice and detailed information on key differences between the products and services offered by travel providers, allowing them to provide more valuable insights to their customers, higher levels of customer service and improved sales productivity. Travelport Smartpoint is Travelport’s innovative POS solution that allows travel consultants to more effectively advise their customers about the entire range of products, optional services and offers available from the travel providers Travelport distributes, with fully interactive, graphical screen displays and real time booking. Travelport Smartpoint provides upselling and cross-selling opportunities through the integration of Travelport’s Rich Content and Branding merchandising solution for airlines. In addition, Travelport Smartpoint mirrors for travel agents the experience of consumers booking hotels and car rentals online by allowing them to access enhanced features, including pictures, comparisons and maps, all within the same workflow. This allows travelers to be better informed of the products available to them, the options that might exist, the cost of enhanced products and the ancillary products available to buy, which allows them to tailor their journey to their specific requirements. Utilization of our leading Travelport Smartpoint POS simplifies highly complex, high volume operations, freeing up more time for travel agencies to focus on the selling process.

In addition, our Travel Commerce Platform reduces operating costs for travel agencies by offering a single point of access to broad global travel content and by integrating critical data for back office, accounting and corporate customer reporting. Furthermore, our Travel Commerce Platform gives travelers a quick and easy way to compare a multitude of available travel options and obtain the true cost of a desired itinerary, buy ancillaries directly after the core booking has been made and provides greater control over itineraries through an option to add features at later stages in the travel process.

Stable, Resilient and Recurring Transaction-based Business Model with High Revenue Visibility and Strong Cash Flow Generation

Our operations are primarily founded on a transaction-based business model that ties our revenue to travel providers’ transaction volumes rather than the price paid by a consumer for airfare, hotel rooms or other travel products and services booked through our systems. Travel related businesses with volume-based revenue models have generally shown strong visibility, predictability and resilience across economic cycles because travel providers have historically sought to maintain traveler volumes by reducing prices in an economic downturn.

In general, our business is characterized by multi-year travel provider and travel agency contracts. Our base distribution agreements with travel providers are open-ended or rollover unless specifically terminated. In 2017, we had 59 planned airline contract renewals, and we successfully renewed substantially all such contracts. We currently have 50 and 77 planned airline contract renewals in 2018 and 2019, respectively, including contracts that rollover on an annual basis. We also enter into contracts with travel buyers, such as travel agencies and corporate travel departments. A meaningful portion of our travel buyer agreements, representing approximately 15% of our revenue on average, are up for renewal in any given year. The length of our contracts, as well as the transaction-based and recurring nature of our revenue, provides high revenue visibility going forward.

We generate strong cash flows on a consistent basis, with net cash provided by operating activities of $318 million and $299 million for the years ended December 31, 2017 and 2016, respectively. Drivers of our cash flows benefit from relatively modest capital expenditure requirements and attractive working capital position. Furthermore, the diversity of our business provides us with multiple independent revenue streams from various markets and channels that lessen the impact of potential strategic and geographic shifts within the industry. These characteristics, combined with the contractual nature of our revenue and costs, our leading industry position and our long-standing customer relationships provide for a strong and predictable stream of cash flows.

Fast Growing Portfolio of Beyond Air Initiatives

Our Travel Commerce Platform provides us with a foundation to offer a fast growing portfolio of additional products and services, which in turn results in additional revenue. Our Beyond Air portfolio includes distribution and merchandising solutions for hotel, car rental, rail, cruise-line and tour operators, payment solutions, digital services, advertising and other platform services.

| 6 |

Independent hotels were largely unaddressed by the GDS industry; however, we integrate on one platform by combining the content from chain hotels captured by the traditional GDSs with independent hotel content our system accesses through our meta-search technology. In particular, our B2B solution, Travelport Rooms and More, is a single user interface that combines detailed product insights with meta-search functionality to deliver a fully-integrated hotel booking platform to travel agencies. Travelport Rooms and More captures highly fragmented content in one interface (including approximately 650,000 hotel properties) by combining content from large global OTAs with that from aggregators specializing in a particular geographic area. This streamlined and efficient interface also enables travel agencies to more easily upsell hotel content in a single, consistent and efficient workflow and user experience, as well as a new business travel booking app.

Travelport Hotelzon, a B2B hotel distribution technology provider, is part of our ongoing strategy to strengthen our hotel offering to both corporations and TMCs and make booking independent hotels easier for business travelers, including unmanaged travelers who do not use travel agencies. Many hotel bookings, especially for independent hotel properties, are still being booked direct by business travelers themselves. Through Travelport Hotelzon, we provide both corporations and Travelport-connected travel agencies with a best-in-class booking tool with extensive independent hotel content, complementing the extensive hotel chain content that has been in our system for many years. In turn, this also enables corporations to more easily track their employees while on business travel as part of their duty of care responsibilities. We have invested in Travelport Hotelzon’s technology and enhanced it with a user-friendly extranet that is uniquely positioned to capture independent hotels and privately negotiated corporate hotel rates that are provided to corporations.

We are an early adopter in automated B2B payments and are redefining payments from travel agencies to travel providers. We pioneered a new class of payments for the unmet needs of the travel industry that is focused on replacing cash and other payment methods with secure virtual pre-funded payment cards. eNett’s innovative, cost-efficient and secure travel payment solutions offer a strong value proposition to travel agencies and travel providers, including providing them with full flexibility, lower administrative cost due to significantly reduced time spent on reconciliation, rewards to travel agencies with incentive payments based on payment volumes and a lower spread for foreign currency payments. eNett exclusively utilizes Mastercard under a long-term arrangement, giving unparalleled access to the payment systems of virtually all the world’s travel providers who accept Mastercard as a form of payment. We believe the model is highly scalable as we expand beyond the core hospitality sector into air travel, including LCCs, as well as other sectors of the travel industry. We estimate that there is over $2 trillion of direct spending on travel annually, approximately $900 billion of which is booked through the indirect channel, and payment is made from travel agencies to travel providers.

Travelport Digital provides a mobile travel platform and digital product set that allows travel providers and travel agencies to engage with their customers through sophisticated, tailored mobile services, including apps, mobile web and intelligent mobile messaging. In response to increased demand for advanced mobile services at all stages of travel, Travelport has developed Travelport Fusion, a robust and rich mobile app solution for airlines of all sizes that can work across all host systems. Through Travelport Fusion, airlines can provide end-to-end trip engagement via mobile, allowing them to grow their revenues, streamline their operations and extend their digital engagement. For airlines that need highly customized mobile solutions adapted to their specific digital roadmap, Travelport Digital will continue to offer its unique and proven blend of market leading design, agile delivery and mobile customer engagement solutions. For travel agencies, we have developed Travelport Trip Assist, a mobile solution that brings the agency brand to the app store and a rich set of features directly into the end-traveler’s hands. This new mobile platform allows travel companies to better manage the travel experience through a powerful set of mobile tools available on iOS and Android, including a smart itinerary manager, a day of travel assistant, a push-notification engine, a real-time alert system and the ability to contact an agent from within the app. Through Travelport Locomote, we provide a corporate travel platform that empowers travel managers to drive change and achieve efficiencies. Travelport Locomote creates seamless experiences and integrated solutions from approval management to cost savings to duty of care. Customers control the entire travel program, enabling greater insight into travel expenditure.

In addition to hospitality, payment solutions and digital services, we utilize the broad connections and extensive data managed by our Travel Commerce Platform to provide advertising solutions to over 3,000 advertisers, which includes, among others, travel providers who use our advertising solutions to easily and cost-effectively promote upgrades, ancillary products or services, package deals and other offers and, as a result, more effectively merchandise their products and services to targeted customers. We give advertisers direct access to a captive professional audience across approximately 65,000 travel agency locations representing approximately 230,000 online and offline travel agency terminals worldwide, with a full-time focus on global travel bookings and cover all main domestic and international travel flows. In 2017, we generated over 9 billion advertising impressions. Our improved, graphically rich point of sale solutions provide increased capabilities and advertising space to display banner advertisements, add click through functionality and market ancillary products through our user interface.

| 7 |

Innovative, Flexible and Scalable Open Technology Platform Tailored to Meet Evolving Industry Needs

Through our industry-leading technology platform, we have been able to maintain our position at the forefront of innovation by meeting the global demands of our travel agents and travel providers for speed, flexibility and convergence. Our technology-enabled solutions offer rich content through multiple distribution channels, such as Travelport Smartpoint. To address unmet industry needs, we made significant strategic investments in innovative technology over the last five years, and we continue to invest in developing new technologies, platforms and ideas, all on an open and accessible platform that delivers expansive content, improved performance, empowered travel experience and intelligence. Our open connectivity approach allows for fully-flexible access to content and services across a range of delivery mechanisms, from the latest IATA NDC and XML protocols to more traditional industry sources such as ATPCO. Our open platform allows us to pull together content delivered from multiple sources into a cohesive display for the travel buyer, enabling search, comparison, reservation and payment across multiple providers. We deliver our content and functionality through state-of-the-art POS tools, mobile solutions for the traveler or via our own leading APIs, including Travelport Universal API, which enables the flexibility for travel agencies and intermediaries to design customized user interfaces. In 2017, a broad network of approximately 1,700 developers utilized our Travelport Universal API to create their own applications and increase the robustness of our systems. Our POS tools are device agnostic, allowing travel agents to access our platform via internet connection on a desktop or a variety of mobile devices, such as smartphones and tablets. Travel consultants connecting to the Travelport Universal API also can access the same rich product descriptions and graphics, branded fare and ancillary content available in Travelport Rich Content and Branding. In 2017, our systems processed over 6 billion travel related system messages per day and approximately 18 billion API calls per month with 99.977% core system uptime using over 20,000 physical and virtual servers and had total storage capacity of approximately 16 petabytes. In addition, we operate our own in-house data center.

In recognition of the advantages provided by our open platform, we were the first among our competitors to offer Delta Air Lines’ full range of seating products. In addition, starting in 2013, we offered Travelport Aggregated Shopping through XML connectivity to airline content, which has enabled and encouraged leading LCCs such as AirAsia, easyJet, IndiGo and Ryanair to join our fully integrated Travel Commerce Platform. In 2013, we launched our innovative Travelport Merchandising Suite to enhance user experience and focus on the sale of ancillary products and services, which are becoming increasingly important for airlines’ profitability. In the hospitality industry, we were the first GDS to our knowledge to offer a one-stop portal for hotel content distribution powered by “meta-search” technology.

Balanced Global Footprint with Diversified Customer Base and Longstanding Relationships

We have a broad geographic footprint in the travel distribution industry. In 2017, we generated $2,341 million in Travel Commerce Platform revenue, of which 74% is international (with 24% from Asia Pacific, 32% from Europe, 5% from Latin America and Canada and 13% from the Middle East and Africa), and 26% is from the United States. Our geographically dispersed footprint helps insulate us from particular country or regional instability, allows for optimal IT efficiency and enhances our value proposition to travel providers. We are well positioned to capture higher value business from travel providers operating in away markets, which results in higher per transaction revenue for both us and the travel providers we serve. This strategically diversified geographic footprint allows us to focus on higher value transactions in the international travel segment. Our balanced network positions us well to benefit from global industry growth, while lessening the impact of potential geographic shifts within the industry. Our footprint also positions us as the challenger to the industry leader for air segments processed in each geographic region and provides us opportunities to grow our share.

We also have highly diversified, strong, long-standing relationships with both our travel providers and travel buyers. None of our travel buyers or travel providers accounted for more than 10% of our revenue for the year ended December 31, 2017. Our top 15 travel providers (by 2017 revenue) have been with us for more than ten years on average.

Proven and Motivated Management Team with Strong Track Record and Deep Travel and Technology Industry Expertise

Our management team has extensive travel and technology industry experience and is committed to improving and maintaining operational excellence by utilizing their in-depth knowledge of these industries. Their dedication and excellence has been demonstrated by improving our key business metrics and our capital structure improvements. Our management team’s compensation structure directly incentivizes them to improve business performance and profitability, and more than half of the compensation opportunity for our executive officers is equity-based in order to properly align the interests of our executive officers and shareholders.

Our management team is supported by a skilled, diverse, motivated and global workforce, comprised of over 4,000 full-time employees as of December 31, 2017. By investing in training and skills development for our employees, we seek to develop leaders with broad knowledge of our business, the industry, technology and customer-specific needs. We also hire externally as needed to bring in new expertise. Our combination of deep industry and company experience combined with the fresh perspective and insight of new hires across our management team creates a solid foundation for driving our business to success, profitability and industry leadership.

| 8 |

Our Growth Strategies

We believe we are well positioned for future growth. Our balanced geographic footprint aligns us with anticipated industry growth across geographies, and we expect trends such as the increasing importance of ancillary revenue, the need of travel providers to personalize their offers to travelers, expansion by LCCs into the business travel industry, continued penetration by GDSs into hospitality distribution and growth of B2B travel advertising to further underpin our growth. We continue to make significant strategic investments in innovative technology, platforms and ideas, all on an open and accessible multi-source platform that delivers expansive content, improved performance, empowered travel experiences and intelligence and improved service. Our focused strategy in search technology, including speed of search and relevance and bookability of search results, ensures we are positioned to manage the continued growth in the industry, particularly through mobile customer engagement, while maintaining a low cost to serve. By leveraging cloud, machine learning, mobile-enabled APIs and data and analytics, we can ensure insights are available and translated into personalized and smarter responses for the customer. We continue to leverage our domain expertise and relationships with travel providers to grow eNett and Travelport Digital. We will continue to evaluate and pursue strategic acquisition opportunities that enhance our Travel Commerce Platform. Our strategic capital investments, current product portfolio and strategic positioning enable us to benefit from industry trends, and we intend to capitalize further on these industry trends by focusing on the following initiatives:

Driving Beyond Air Innovation and Growth

Our fast growing Beyond Air portfolio includes hospitality, payment solutions, digital services, advertising and other platform services. Given growth rates and the underpenetrated nature of these areas, we believe we can grow our Beyond Air portfolio at a multiple to overall travel industry growth by continuing to strategically invest in the development of state-of-the-art capabilities in order to achieve a leading industry position.

Hospitality: Through our leading meta-search capabilities, we are increasing our presence among independent hotels. In addition, we provide superior chain hotel content to OTAs relative to our competitors by providing direct XML connectivity. Our strategy to grow in hospitality distribution is also focused on delivering corporate access to aggregated hotel content, including both chain and independent hotels through a single point of sale. The Travelport Hotelzon solution also works well when a corporate hotel booking is not an ‘add on’ to an air booking, which is particularly the case for travel within Continental Europe, where many business trips actually take place in the traveler’s home country or to bordering countries, and trains and cars are often the preferred method of transport rather than flights. Through Travelport Hotelzon’s technology, privately negotiated rates for corporations can be added and accessed directly by the corporation and its employees.

Our strategy is to continue to build on our extensive car rental content offering for travel agencies. Our travel agencies have access to more choice of car content, as well as the ability to search and book content from smaller regional car rental companies.

Payments Solutions: Our strategy for eNett is to continue growing the scale of the business through further investment in operational capabilities, new products, sales and marketing and targeted geographic expansion. We plan to further capitalize on our early adopter advantage to address the travel industry’s previously unmet needs for a secure and efficient payment solution. Our Travel Commerce Platform allows us to leverage our extensive network of travel agencies to grow the penetration rate for eNett payments.

Digital Services: We have a strong focus on mobile commerce, providing a wide range of services that allows airlines, hotels, corporate TMCs and travel agencies to engage with their customers through digital services, including apps, corporate booking tools and mobile messaging. We develop robust and rich mobile app solutions for airlines of all sizes that can provide end-to-end trip engagement and a mobile solution for travel agencies that allows travel companies to better manage the end-user travel experience through a powerful set of mobile tools available on iOS and Android, including a smart itinerary manager, a day of travel assistant, a push-notification engine, a real-time alert system and the ability to contact an agent from within the app. We offer a corporate travel platform that empowers travel managers to drive change and achieve program efficiencies. It is more than an online booking tool and provides a range of app-powered workflows that consolidate the entire travel lifecycle.

Advertising: Our strategy is to focus on the B2B advertising opportunity by targeting travel agencies. Hotel advertising will remain our core offering, but other advertising categories (especially air) also represent areas for growth, which we believe we are well positioned to capitalize on through our Travel Commerce Platform.

Other Platform Services: Our strategy is to develop new insights into travel behaviors that will allow us to improve our other platform services including subscription services, processing services, business intelligence, data services and marketing-oriented analytical tools to travel agencies, travel providers and other travel data users.

| 9 |

Expand Platform Capabilities and Reach

We are well positioned in both the high-value, complex segment of air travel distribution, as well as the growing LCC segment, which is characterized by its larger number of business travelers, complex itineraries and international bookings. Our strategy to grow our platform focuses on providing state-of-the-art solutions to address the changing manner in which airlines, hotel chains and car rental companies are positioning and selling their products and services. Our Travel Commerce Platform provides us the foundation to offer a wide-ranging and expanding portfolio of differentiated products and services.

We intend to focus on the following strategies to drive growth across our Travel Commerce Platform:

Growth through Retailing, Personalization and Merchandising Capabilities: In order to address the growing importance for travel providers of flexible systems to distribute and merchandise their increasingly sophisticated core products and broadening offerings of ancillary products, we have heavily invested in our Travelport Merchandising Suite to more effectively market and sell products and services. The Travelport Merchandising Suite, which includes our Rich Content and Branding airline merchandising solutions, integrates XML content with traditional content in a graphically rich, single user interface and, together with our sourced travel content, including air, hotel and car rental options, is fully accessible to all customers and channels. These customers include our global network of offline travel agencies, as well as OTAs, corporate travelers who prefer to self-serve and use corporate booking tools and developers who are part of our developer community. The online channel is able to connect to this content and functionality via our leading APIs, including our Travelport Universal API.

Our Rich Content and Branding airline merchandising solutions allow for more flexible and effective distribution and merchandising of both core travel content and ancillary products and services, resulting in a higher value proposition for both network carriers and LCCs, while facilitating travel agencies to upsell more content efficiently. As of December 31, 2017, we have over 250 airlines utilizing our Rich Content and Branding solution with approximately 20 more contracted. We will continue to target additional airlines with this solution suite. In addition, increasing the sale of ancillaries through our platform not only results in additional transaction revenue, but also helps us attract new content from carriers. We intend to continuously invest in our retailing and ancillary merchandising capabilities and grow by partnering with both traditional carriers and LCCs.

Growth through Technologies that Enhance Performance: Artificial intelligence, machine learning and more sophisticated API-connected platforms are powering better speed, relevance and accuracy of search and automating services across all touchpoints of the traveler journey, allowing travel providers and buyers to connect with customers more efficiently. We continue to invest in these technologies to address the needs of travel buyers. Our continued investment in our search capabilities, data analytics, state of the art mobile interfaces, robotics and automation will drive greater customer conversion and business efficiency.

LCC Participation Growth: As LCCs continue to evolve and look for further growth opportunities, they seek to expand their offering to higher yield customers, mainly business travelers. Our access to business travelers, merchandising capabilities and ability to process complex itineraries have attracted and allowed for the full integration of several fast-growing LCCs such as AirAsia, easyJet, IndiGo and Ryanair into our Travel Commerce Platform. We view the expansion of LCCs into the business travel segment as a significant growth opportunity for us, and we will continue building our offering to win their business.

Targeted Geographic Expansion: Because the ability to increase away segments provides more revenue to airlines, away segments attract a premium to home segments, a dynamic that will benefit our performance as this trend continues. Furthermore, due to our balanced global footprint, we are well placed to benefit from global airline capacity shifts and increased LCC participation. We will continue to grow our international business and will focus on expanding into new emerging regions such as Africa, Latin America and Eastern Europe.

Business Travel Growth: Our strategy to grow in the business travel space is focused on investing in products that distribute travel technology solutions directly to corporations, allowing them to easily access and book travel content that incorporates their travel management policies directly through our platform. The demographic make-up of corporate travelers is changing rapidly, with many now preferring to self-serve and use their mobile devices rather than booking travel through more traditional methods. We intend to be at the forefront of these changes as we deploy our content and digital technology assets to address them. Our investments to support the growth and changes we are seeing in the business travel sector include Travelport Hotelzon, a B2B hotel distribution technology provider focused on corporates, which has made booking independent hotels and accessing privately negotiated corporate hotel rates more efficient for business travelers. Through Travelport Locomote, we are focused on empowering corporate travelers through an improved mobile user experience. The Travelport Locomote platform provides solutions for all corporate travel management needs, including travel authorization and policy compliance, flexibility to change bookings, and more efficient back-office reconciliation. We will continue to develop our offering in the business travel space, as well as strengthening our partnerships with TMCs and we will look at new opportunities to invest in products that distribute travel technology solutions directly to corporations.

| 10 |

Expanded Mobile Engagement: Travelers increasingly expect brands and businesses to meet their expectations of “connectedness”. This means to be present, active, useful and available at every stage of the travel journey. Through Travelport Digital, which we believe to be the world’s leading provider of innovative mobile apps development and digital services in the travel industry, we design, build and power the mobile experience for many of the world’s leading travel brands, including BCD Travel, easyJet, Etihad and Singapore Airlines. We will continue to invest in developing innovative mobile technologies that allow travel providers and travel agencies to engage with their customers through sophisticated, tailored mobile services, including apps, mobile web and intelligent mobile messaging.

Focus on Distribution Technology Leadership and Differentiated Products

Achieving growth in our Travel Commerce Platform is predicated on our continued investment in developing advanced technologies and differentiated products to maintain our competitive position. We intend to continue our strong commitment to product innovation and technological excellence to maintain our state-of-the-art product portfolio and preserve our early adopter advantage in several key growth areas, such as the sale of ancillaries, B2B travel payments solutions, digital services, hospitality merchandising and advertising. We plan to continue offering rich travel content and empowered selling experiences on an open platform with service oriented architecture and industry leading APIs, and plan to continue to focus on developing a diverse application set to consistently increase the value of our Travel Commerce Platform to our customers. We are exploring new adjacencies that will allow us to improve our products and data offerings to our customers and develop insights into travel behaviors. We have chosen not to focus our resources on more capital and labor intensive airline and hospitality related hosting solutions. Instead, we focus on distribution products, payment related solutions and digital services. Our ability to offer differentiated, high value products and services allows us to shift the focus of our dialogue with travel providers from price to value, leading to higher RevPas.

In February 2017, we named Tata Consultancy Services (“TCS”), part of the Tata Group and a leading global IT services, consulting and business solutions organization, as our primary technology partner. TCS was selected in recognition of its strengths in the global travel industry and its ability to work alongside us and provide scale in application engineering and assurance services. Through this appointment, we have rationalized the number of third-party IT development companies with whom we work. At the same time, we have consolidated our U.S. technology hubs into two centers in Atlanta and Denver. Our increased investment in technology forms an integral part of our overall growth plan and long-term strategy.

Travel Providers

Our relationships with travel providers extend to airlines, hotels, car rental companies, rail networks, cruise-line and tour operators. Travel providers are offered varying levels of services and functionality at which they can participate in our Travel Commerce Platform. These levels of functionality generally depend upon the travel provider’s preference as well as the type of communications and real-time access allowed with respect to the particular travel provider’s host reservations and other systems.

We provide air distribution services to approximately 400 airlines globally, including approximately 125 LCCs. We distribute ancillaries for over 100 airlines. We have relationships with approximately 310 hotel chains, representing approximately 145,000 hotel properties, which provide us with live availability and instant confirmation for bookings, in addition to approximately 15 hotel aggregators resulting in an aggregate of approximately 650,000 hotel properties bookable through Travelport Rooms and More. In addition, we serve over 38,000 car rental locations, approximately 50 cruise-lines and tour operators and 14 major rail networks worldwide.

The table below lists alphabetically our largest airline providers in the regions presented for the year ended December 31, 2017, based on revenue:

| Asia Pacific | Europe | Latin America and Canada |

Middle East and Africa |

United States | ||||||||

| Air India | Aeroflot Airlines | Aeromexico | Emirates Airlines | Alaska Airlines | ||||||||

| Jet Airways | Alitalia Airlines | Aerovias DAP | Ethiopian Airlines | American Airlines | ||||||||

| Qantas Airways | British Airways | Air Canada | Qatar Airways | Delta Air Lines | ||||||||

| Singapore Airlines | Lufthansa Airlines | LATAM Airlines | South African Airways | Hawaiian Airlines | ||||||||

| Thai Airways | TAP Portugal | WestJet | Turkish Airlines | United Airlines |

The majority of our agreements remain in effect each year, with exceptions usually linked to airline mergers or insolvencies. In 2017, we had 59 planned airline contract renewals, and we successfully renewed substantially all such contracts. We currently have 50 and 77 planned airline contract renewals in 2018 and 2019, respectively, including contracts which roll on an annual basis. Our top fifteen travel providers as measured by revenue for the year ended December 31, 2017, all of which are airlines, have been customers on average for more than ten years. For the year ended December 31, 2017, our top ten travel providers represented approximately 23% of revenue, and no single provider accounted for more than 10% of revenue.

| 11 |

We have entered into a number of specific-term agreements with airlines across the globe to secure all of the airline’s public content. These content agreements allow our travel agencies to have access to the full range of our airline providers’ public content, including the ability to book the last available seat, as well as other functionalities. We have secured full-content or distribution parity agreements with approximately 165 airlines, including LCCs. Revenue attributable to these agreements comprised 77% of Air revenue in the year ended December 31, 2017. Certain full-content agreements expire, or may be terminated, during 2018.

We have approximately 125 airlines that we classify as LCCs participating in our Travel Commerce Platform around the world, including AirAsia, easyJet, IndiGo and Ryanair. Revenue from LCCs accounted for less than 5% of our total Air revenue in 2017.

Our top hotel providers for the year ended December 31, 2017 were Hilton, Intercontinental Hotels Group and Marriott Hotels.

Our top car rental company providers by brand for the year ended December 31, 2017 were Advantage/EZ Group, Avis, Enterprise and Hertz. We provide electronic ticket distribution to 14 major international and national rail networks, including Amtrak (United States), Deutsche Bahn (Germany), Eurostar Group (United Kingdom/France) and Société Nationale des Chemins de Fer France (SNCF) (France).

Travel Agencies

As of December 31, 2017, approximately 65,000 travel agency locations representing approximately 230,000 online and offline travel agency terminals worldwide use us for travel information, booking and ticketing capabilities, travel purchases, workflow automation and management tools for travel information and travel agency operations. Access to our Travel Commerce Platform enables travel agencies to electronically search travel related data such as schedules, availability, services and prices offered by travel providers and to book travel for end customers.

Our Travel Commerce Platform also facilitates travel agencies’ internal business processes such as quality control, operations and financial information management. Increasingly, this includes the integration of products and services from independent parties that complement our core product and service offerings, including a wide array of mid- and back-office service providers. We also provide technical support, training and other assistance to travel agencies, including numerous customized access options, productivity tools, automation, training and customer support focusing on process automation, back-office efficiency, aggregation of content at the desktop and online booking solutions. In addition, we provide business intelligence and data solutions to our travel agencies.

Our relationships with travel agencies typically are non-exclusive, meaning they subscribe to and have the ability to use more than one GDS but may require a substantial portion to be booked through our Travel Commerce Platform. We pay travel agencies a commission for segments booked on our Travel Commerce Platform and, in order to encourage greater use of our Travel Commerce Platform, we may pay an increased commission based on negotiated segment volume thresholds. Travel agencies or other customers in some cases pay a fee for access to our Travel Commerce Platform or to access specific services or travel content. Our travel agencies comprise online, offline, corporate and leisure travel agencies. Our largest OTA customers, by revenue, in 2017 included Expedia, Inc. (“Expedia”), which includes Orbitz Worldwide, and Priceline. Our largest business travel agencies in 2017 included American Express Global Business Travel, Carlson Wagonlit Travel and Flight Centre Limited. Our largest leisure travel agencies in 2017 included Connexions Loyalty Travel Solutions and GTT Global/USA Gateway. For the year ended December 31, 2017, our top ten travel agencies represented approximately 22% of revenue, and no single travel agency customer accounted for more than 10% of revenue. Travel agency contracts representing approximately 27%, 11% and 62% of 2017 revenue are up for renewal in 2018, 2019 and beyond, respectively.

Competition

Travel Commerce Platform

The marketplace for travel distribution is large, multi-faceted and highly competitive. We compete with a number of travel distributors, including:

| • | traditional GDSs, such as Amadeus IT Group SA (“Amadeus”) and Sabre Corporation (“Sabre”); |

| • | local distribution systems that are primarily owned by airlines or governmental entities and operated predominately in their home countries, including TravelSky in China, Infini in Japan and Sirena Travel in Russia; |

| • | travel providers that use direct distribution, including through the use of travel provider websites and mobile applications; |

| • | corporate booking tools, including Concur Technologies, GetThere, Deem, KDS, eTravel and Egencia (although most corporate booking tools interface with a GDS to access the content and functionality offered by the GDS); and |

| • | other participants, including Kayak, TripAdvisor, Yahoo! and Google, which have launched business-to-consumer travel search tools (although bookings are often fulfilled through a GDS) that connect travelers with direct distribution channels and OTAs. |

| 12 |

While many of the products and services offered by non-GDSs offer some of the functionality and integration provided by our Travel Commerce Platform, we believe none of them offer the full functionality and integration we offer, including serving the end consumer who desires to explore all booking options. Among industry participants with a traditional GDS, we believe our Travel Commerce Platform differentiates us from our competitors. We believe that competition in the industry is based on the following criteria:

| • | the timeliness, reliability and scope of travel inventory and related content; |

| • | service, reliability and ease of use of the system; |

| • | the number and size of travel agencies and the fees charged by a GDS and incentives and loyalty payments made to travel agencies; |

| • | travel provider participation levels, inventory and the transaction fees charged to travel providers; |

| • | the range of products and services that deliver efficiencies that are available to travel providers and travel agencies; and |

| • | geographical reach, consistency of data and content, cross border capabilities and end traveler and corporation servicing. |

GDS Transacted Air Segments: According to our view of the GDS air market, which is based on all air-related transactions processed on GDS platforms as reported by Marketing Information Data Tapes (“MIDT”), our share for the years ended December 31, 2017 and 2016 amounted to 22% and 23%, respectively.

Payment Solutions

While we believe eNett redefined payments from travel agencies to travel providers, there are currently multiple ways to settle travel payments from travel agencies to travel providers. Traditional methods of settling travel payments include:

| • | cash and check; |

| • | consumer cards, corporate cards, lodge cards and bank-issued VANs; and |

| • | wire transfers and Electronic Funds Transfer (“EFT”). |

In addition to the traditional methods to settle travel payments, eNett’s principal competitor is WEX Inc.

| 13 |

Technology Services

The technology services sector of the travel industry is highly fragmented by service offering, including hosting solutions, such as internal reservation system services, as well as flight operations technology services and software development services. For example, sector participants include Amadeus, HP Enterprise Services, Sabre, SITA and Google, as well as airlines that provide the services and support for their own internal reservation system services and also host external airlines.

Sales and Marketing