Attached files

| file | filename |

|---|---|

| EX-4.(I) - EXHIBIT 4.(I) - WEYERHAEUSER CO | wy-123117xex4imacmillanblo.htm |

| EX-32 - EXHIBIT 32 - WEYERHAEUSER CO | wy-123117xex32.htm |

| EX-31 - EXHIBIT 31 - WEYERHAEUSER CO | wy-123117xex31.htm |

| EX-23 - EXHIBIT 23 - WEYERHAEUSER CO | wy-123117xex23.htm |

| EX-21 - EXHIBIT 21 - WEYERHAEUSER CO | wy-123117xex21.htm |

| EX-12 - EXHIBIT 12 - WEYERHAEUSER CO | wy-123117xex12.htm |

| EX-10.(Z) - EXHIBIT 10.(Z) - WEYERHAEUSER CO | wy-123117xex10zdirectorrsu.htm |

| EX-10.(I) - EXHIBIT 10.(I) - WEYERHAEUSER CO | wy-123117xex10iltincentive.htm |

| EX-4.(J) - EXHIBIT 4.(J) - WEYERHAEUSER CO | wy-123117xex4jmacmillanblo.htm |

| EX-4.(H) - EXHIBIT 4.(H) - WEYERHAEUSER CO | wy-123117xex4hwillamette83.htm |

| EX-4.(G) - EXHIBIT 4.(G) - WEYERHAEUSER CO | wy-123117xex4gwillamette93.htm |

| EX-4.(F) - EXHIBIT 4.(F) - WEYERHAEUSER CO | wy-123117xex4fwillamette83.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 1-4825

WEYERHAEUSER COMPANY

A WASHINGTON CORPORATION

91-0470860

(IRS EMPLOYER IDENTIFICATION NO.)

220 OCCIDENTAL AVENUE SOUTH, SEATTLE, WASHINGTON 98104-7800 TELEPHONE (206) 539-3000

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

TITLE OF EACH CLASS | NAME OF EACH EXCHANGE ON WHICH REGISTERED: | |

Common Shares ($1.25 par value) | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o

Smaller reporting company o Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

As of June 30, 2017, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $25.0 billion based on the closing sale price as reported on the New York Stock Exchange Composite Price Transactions.

As of February 5, 2018, 756,097,841 shares of the registrant’s common stock ($1.25 par value) were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Notice of 2018 Annual Meeting of Shareholders and Proxy Statement for the company’s Annual Meeting of Shareholders to be held May 18, 2018, are incorporated by reference into Part II and III.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K

TABLE OF CONTENTS

PART I | PAGE | |

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | MINE SAFETY DISCLOSURES — NOT APPLICABLE | |

PART II | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | OTHER INFORMATION — NOT APPLICABLE | |

PART III | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

PART IV | ||

ITEM 15. | ||

ITEM 15. | ||

OUR BUSINESS

We are one of the world's largest private owners of timberlands. We own or control 12.4 million acres of timberlands, primarily in the U.S., and manage an additional 14.0 million acres of timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards. Our objective is to maximize the long-term value of timberlands we own. We analyze each timberland acre comprehensively to understand its highest-value use. We realize this value in many ways, particularly through harvesting the trees, but also by selling properties when we can create incremental value. In addition, we focus on opportunities to realize value for oil and natural gas production, construction aggregates and mineral extraction, wind power, communication tower leases and transportation rights of way that exist in our ownership.

We are also one of the largest manufacturers of wood products in North America. We provide high-quality wood products, including softwood lumber, engineered wood products, structural panels, medium density fiberboard and other specialty products. These products are primarily supplied to the residential, multi-family, industrial, light commercial and repair and remodel markets. Our manufacturing operations are located in the United States and Canada and span across 35 facility locations.

Our company is a real estate investment trust (REIT).

We are committed to operate as a sustainable company and are listed on the North American and Dow Jones World Sustainability Indices. In our operations, we focus on increasing energy and resource efficiency, reducing greenhouse gas emissions, reducing water consumption, conserving natural resources, and offering products that meet our customers' needs with superior sustainability attributes. We operate with world class safety results, understand and address the needs of the communities in which we operate, and communicate transparently.

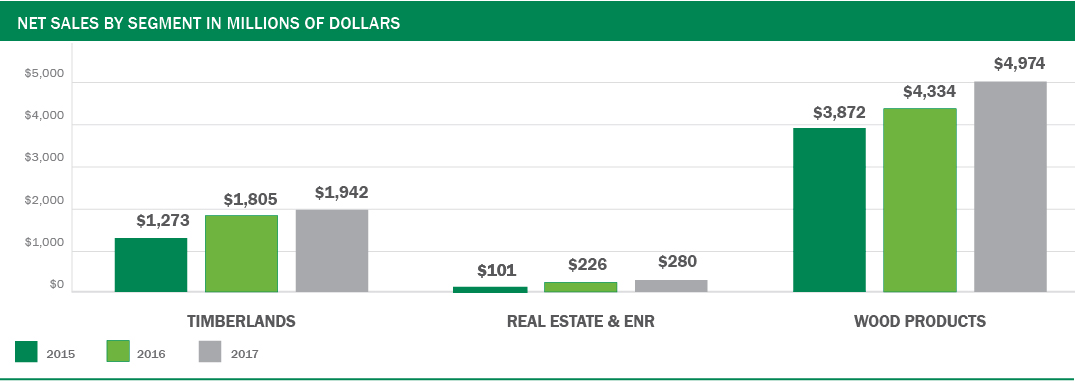

In 2017, we generated $7.2 billion in net sales from continuing operations and employed approximately 9,300 people who serve customers worldwide.

This portion of our Annual Report on Form 10-K provides detailed information about who we are, what we do and where we are headed. Unless otherwise specified, current information reported in this Form 10-K is as of or for the fiscal year ended December 31, 2017.

We break out financial information such as revenues, earnings and assets by the business segments that form our company. We also discuss the development of our company and the geographic areas where we do business.

Throughout this Form 10-K, unless specified otherwise, references to “we,” “our,” “us” and “the company” refer to the consolidated company.

WE CAN TELL YOU MORE |

AVAILABLE INFORMATION

We meet the information-reporting requirements of the Securities Exchange Act of 1934 by filing periodic reports, proxy statements and other information with the Securities and Exchange Commission (SEC). These reports and statements — information about our company’s business, financial results and other matters — are available at:

• | the SEC website — www.sec.gov; |

• | the SEC’s Public Conference Room, 100 F St. N.E., Washington, D.C., 20549, (800) SEC-0330; and |

• | our website (without charge) — www.weyerhaeuser.com. |

When we file the information electronically with the SEC, it also is posted to our website.

WHO WE ARE |

Weyerhaeuser Timber Company was incorporated in the state of Washington in January 1900, when Frederick Weyerhaeuser and 15 partners bought 900,000 acres of timberland. Today, we are working to be the world's premier timber, land, and forest products company for our shareholders, customers and employees.

REAL ESTATE INVESTMENT TRUST (REIT) ELECTION

Starting with our 2010 fiscal year, we elected to be taxed as a REIT. REIT income can be distributed to shareholders without first paying corporate level tax, substantially eliminating the double taxation on income. We expect to derive most of our REIT income from investments in timberlands, including the sale of standing timber through pay-as-cut sales contracts and lump sum timber deeds. We continue to be required to pay federal corporate income taxes on earnings of our Taxable REIT Subsidiary (TRS), which includes our Wood Products segment and a portion of our Timberlands and Real Estate, Energy and Natural Resources (Real Estate & ENR) segments.

MERGER WITH PLUM CREEK

On February 19, 2016, pursuant to the Agreement and Plan of Merger dated November 6, 2015, Plum Creek Timber Company, Inc. (Plum Creek) merged with and into Weyerhaeuser. Plum Creek was a REIT that primarily owned and managed timberlands in the United States. Plum Creek also produced wood products, developed opportunities for mineral and other natural resource extraction, and sold real estate properties. The merger combined two industry leaders. The breadth and diversity of our combined timberlands, real estate, energy and natural resources assets, and wood products operations position Weyerhaeuser to capitalize on the improving housing market and to continue to capture value across the combined portfolio. See Note 4: Merger with Plum Creek in the Notes to Consolidated Financial Statements for further information about the merger.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 1

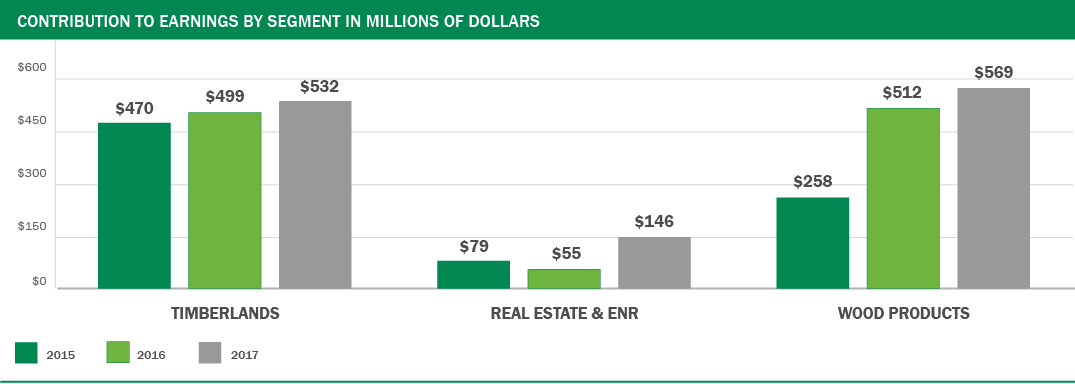

OUR BUSINESS SEGMENTS

In the Consolidated Results section of Management’s Discussion and Analysis of Financial Condition and Results of Operations, you will find our overall performance results for our business segments, which are as follows:

• | Timberlands; |

• | Real Estate, Energy and Natural Resources (Real Estate & ENR); and |

• | Wood Products. |

Detailed financial information about our business segments and our geographic locations is provided in Note 2: Business Segments and Note 21: Geographic Areas in the Notes to Consolidated Financial Statements, as well as in this section and in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

EFFECT OF MARKET CONDITIONS

The health of the U.S. housing market strongly affects the performance of all our business segments. Wood Products primarily sells into the new residential building and repair and remodel markets. Demand for logs from our Timberlands segment is affected by the production of wood-based building products as well as export demand. Real Estate is affected by local real estate market conditions, such as the level of supply or demand for properties sharing the same or similar characteristics as our timberlands. Energy and Natural Resources is affected by underlying demand for commodities, including oil and gas.

COMPETITION IN OUR MARKETS

We operate in highly competitive domestic and foreign markets, with numerous companies selling similar products. Many of our products also face competition from substitutes for wood products. We compete in our markets primarily through product quality, service levels and price. We are relentlessly focused on operational excellence, producing quality products customers want and are willing to pay for, at the lowest possible cost.

Our business segments’ competitive strategies are as follows:

• | Timberlands — Extract maximum timber value from each acre we own or manage. |

• | Real Estate & ENR — Deliver premiums to timber value by identifying and monetizing higher and better use lands and capturing the full value of surface and subsurface assets. |

• | Wood Products — Manufacture high-quality lumber, structural panels and engineered wood products, as well as deliver complementary building products for residential, multi-family, industrial and light commercial applications at competitive costs. |

SALES OUTSIDE THE U.S.

In 2017, $1,028 million — 14 percent — of our total consolidated sales from continuing operations were to customers outside the U.S. Our sales outside the U.S. are generally denominated in U.S. dollars. The table below shows sales outside the U.S. for the last three years.

DOLLAR AMOUNTS IN MILLIONS | |||||||||

2017 | 2016 (1) | 2015 (1) | |||||||

Exports from the U.S. | $ | 545 | $ | 515 | $ | 497 | |||

Canadian export and domestic sales | 443 | 342 | 317 | ||||||

Other foreign sales | 40 | 58 | 69 | ||||||

Total | $ | 1,028 | $ | 915 | $ | 883 | |||

Percent of total sales | 14 | % | 14 | % | 17 | % | |||

(1) Excludes sales from Discontinued Operations. Refer to Note 3: Discontinued Operations and Other Divestitures in the Notes to Consolidated Financial Statements for further information. | |||||||||

OUR EMPLOYEES

We have approximately 9,300 employees. Of these employees, approximately 2,500 are members of unions covered by multi-year collective-bargaining agreements. More information about these agreements is provided in Note 9: Pension and Other Postretirement Benefit Plans in the Notes to Consolidated Financial Statements.

WHAT WE DO |

This section provides information about how we:

• | grow and harvest trees; |

• | maximize the value of every acre we own; and |

• | manufacture and sell wood products. |

For each of our business segments, we provide details about what we do, where we do it, how much we sell and where we are headed.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 2

TIMBERLANDS

Our Timberlands segment manages 12.4 million acres of private commercial timberlands in the U.S. We own 11.5 million of those acres and have long-term leases on the remaining acres. In addition, we have renewable, long-term licenses on 14.0 million acres of Canadian timberlands. The tables presented in this section include data from this segment's business units as of the end of 2017.

WHAT WE DO

Forestry Management

Our Timberlands segment:

• | plants seedlings to reforest harvested areas using the most effective regeneration method for the site and species (natural regeneration is employed and managed in parts of Canada and the northern U.S.); |

• | manages our timberlands as the planted trees grow to maturity; |

• | harvests trees to be converted into lumber, wood products, pellets, pulp and paper; |

• | strives to sustain and maximize the timber supply from our timberlands while keeping the health of our environment a key priority; and |

• | offers recreational access to the public. |

Our goal is to maximize returns by selling logs and stumpage to internal and external customers. We leverage our expertise in forestry and use intensive silviculture to improve forest productivity and returns while managing our forests on a sustainable basis to meet customer needs and public expectations.

Competitive factors within each of our market areas generally include price, species, grade, quality, proximity to wood consuming facilities and the ability to consistently meet customer requirements. We compete in the marketplace through our ability to provide customers with a consistent and reliable supply of high-quality logs at scale volumes and competitive price. Our customers also value our status as a Sustainable Forestry Initiative® certified supplier.

Sustainable Forestry Practices

We manage our forests intensively to maximize the value of each acre and produce a sustainable supply of wood fiber for our customers. At the same time, we are careful to protect biological diversity, water quality and other ecosystem services. Our working forests also provide unique environmental, cultural, historical and recreational value. We work hard to protect these and other qualities, while still managing our forests to produce financially mature timber. We follow regulatory requirements, voluntary standards and certify one hundred percent of our North American timberlands under the Sustainable Forestry Initiative® (SFI) Forest Management Standard.

Canadian Forestry Operations

In Canada, we manage timberlands under long-term licenses that provide the primary source of the raw material for our manufacturing facilities in various provinces. When we harvest trees, we pay the provinces at stumpage rates set by the government. We transfer logs to our manufacturing facilities at cost, and do not generate any significant profit in the Timberlands segment from the harvest of timber from the licensed acres in Canada.

Timberlands Products

PRODUCTS | HOW THEY’RE USED | |

Delivered logs: • Grade logs • Fiber logs | Grade logs are made into lumber, plywood, veneer and other products used in residential homes, commercial structures, furniture, industrial and decorative applications. Fiber logs are sold to pulp, paper, and oriented strand board mills to make products used for printing, writing, packaging, homebuilding and consumer products, as well as into renewable energy and pellet manufacturing. | |

Timber | Standing timber is sold to third parties. | |

Recreational leases | Timberlands are leased to the public for recreational purposes. | |

Other products | Seed and seedlings grown in the U.S. and plywood produced at our mill in Uruguay (1). | |

(1) Our Uruguayan operations were divested on September 1, 2017. Refer to Note 3: Discontinued Operations and Other Divestitures in the Notes to Consolidated Financial Statements for further information on this divestiture. | ||

HOW WE MEASURE OUR PRODUCT

We use multiple units of measure when transacting business including:

• | Thousand board feet (MBF) — used in the West to measure the expected lumber recovery from a tree or log. |

• | Green tons (GT) — used in the South to measure weight; factors used for conversion to product volume can vary by species, size, location and season. |

We report Timberland volumes in ton equivalents. Prior to 2016, we reported Timberlands volumes information in cubic meters. Volumes for periods prior to 2016 have been converted from cubic meters to tons using conversion factors as follows:

• | West: 1.056 m3 = 1 ton |

• | South: 0.818 m3 = 1 ton |

• | Uruguay: 0.907 m3 = 1 ton |

• | Canada: 1.244 m3 = 1 ton |

WHERE WE DO IT

We manage sustainable timberlands in twenty states. This includes owned or leased acres in the following locations:

• | 2.93 million acres in the western U.S. (Oregon and Washington); |

• | 6.95 million acres in the southern U.S. (Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, Texas and Virginia); and |

• | 2.48 million acres in the northern U.S. (Maine, Michigan, Montana, New Hampshire, Vermont, West Virginia and Wisconsin). |

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 3

In Canada, we manage timberlands under long-term licenses that provide raw material for our manufacturing facilities. These licenses are in Alberta, British Columbia, Ontario (license is managed by partnership) and Saskatchewan (license is managed by partnership).

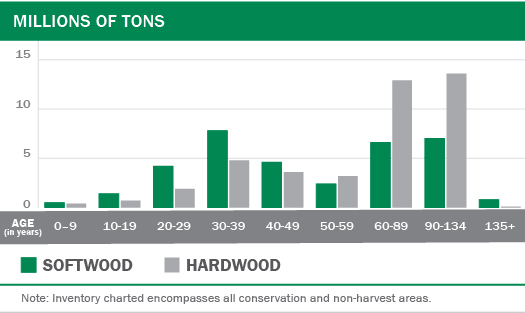

Our total timber inventory — including timber on owned and leased land— is approximately 635 million tons. The amount of timber inventory does not translate into an amount of lumber or panel products because the quantity of end products varies according to the species, size and quality of the timber; and will change through time as these variables adjust.

We maintain our timber inventory in an integrated resource inventory system and geographic information system (“GIS”). The resource inventory component of the system is proprietary and is largely based on internally developed methods, including growth and yield models developed by our research and development organization. The GIS component is based on GIS software that is viewed as the standard in our industry.

Timber inventory data collection and verification techniques include the use of industry standard field sampling procedures as well as proprietary remote sensing technologies in some geographies. The data is collected and maintained at the timber stand level.

We also own and operate nurseries and seed orchards in Alabama, Arkansas, Georgia, Louisiana, Mississippi, Oregon, South Carolina, and Washington.

Summary of 2017 Standing Timber Inventory

GEOGRAPHIC AREA | MILLIONS OF TONS AT DECEMBER 31, 2017 | |

TOTAL INVENTORY(1) | ||

U.S.: | ||

West | ||

Douglas fir/Cedar | 164 | |

Whitewood | 34 | |

Hardwood | 15 | |

Total West | 213 | |

South | ||

Southern yellow pine | 263 | |

Hardwood | 83 | |

Total South | 346 | |

North | ||

Conifer | 35 | |

Hardwood | 41 | |

Total North | 76 | |

Total Company | 635 | |

(1) Inventory encompasses all conservation and non-harvest areas. | ||

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 4

Summary of 2017 Timberland Locations

GEOGRAPHIC AREA | THOUSANDS OF ACRES AT DECEMBER 31, 2017 | |||||

FEE OWNERSHIP | LONG-TERM LEASES | TOTAL ACRES(1) | ||||

U.S.: | ||||||

West | ||||||

Oregon | 1,593 | — | 1,593 | |||

Washington | 1,333 | — | 1,333 | |||

Total West | 2,926 | — | 2,926 | |||

South | ||||||

Alabama | 390 | 232 | 622 | |||

Arkansas | 1,214 | 18 | 1,232 | |||

Florida | 227 | 84 | 311 | |||

Georgia | 623 | 55 | 678 | |||

Louisiana | 1,027 | 351 | 1,378 | |||

Mississippi | 1,154 | 76 | 1,230 | |||

North Carolina | 564 | 1 | 565 | |||

Oklahoma | 495 | — | 495 | |||

South Carolina | 281 | — | 281 | |||

Texas | 30 | 2 | 32 | |||

Virginia | 124 | — | 124 | |||

Total South | 6,129 | 819 | 6,948 | |||

North | ||||||

Maine | 839 | — | 839 | |||

Michigan | 558 | — | 558 | |||

Montana | 713 | — | 713 | |||

New Hampshire | 24 | — | 24 | |||

Vermont | 86 | — | 86 | |||

West Virginia | 258 | — | 258 | |||

Wisconsin | 4 | — | 4 | |||

Total North | 2,482 | — | 2,482 | |||

Total Company | 11,537 | 819 | 12,356 | |||

(1) Acres include all conservation and non-harvest areas. | ||||||

We provide a year-round flow of logs to internal and external customers. We sell grade and fiber logs to manufacturers that produce a diverse range of products. We also sell standing timber to third parties and lease land for recreational purposes. Our timberlands are generally well located to take advantage of road, logging and transportation systems for efficient delivery of logs to customers.

Western United States

Our Western timberlands are well situated to serve the wood product and pulp markets in Oregon and Washington. Additionally, our location on the West Coast provides access to higher-value export markets for Douglas fir and whitewood logs to Japan, China and Korea. Our largest export market is Japan where Douglas fir is the preferred species for higher-valued post and beam homebuilding. The size and quality of our Western Timberlands, coupled with their proximity to several deep-water port facilities, competitively positions us to meet the needs of Pacific Rim log markets.

Our holdings are composed primarily of Douglas fir, a species highly valued for its structural strength, stiffness and visual appearance. Most of our lands are located on the west side of the Cascade Mountain Range with soil and rainfall conditions considered favorable for growing this species. Approximately 80 percent of our lands are in established Douglas fir plantations. Our remaining holdings include a mix of whitewood and hardwood.

Our management systems and supply chain expertise provide us a competitive operating advantage in a number of areas including research and forestry, harvesting, marketing, and logistics. Additionally, our scale, diversity of timberlands ownership and infrastructure in the West Coast allow us to consistently and reliably supply logs to our customers year round.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 5

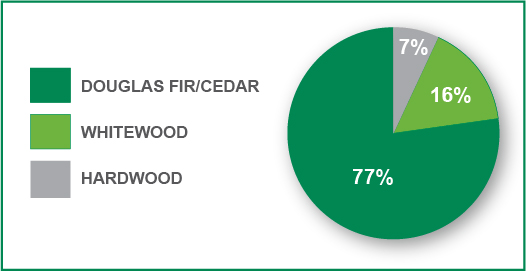

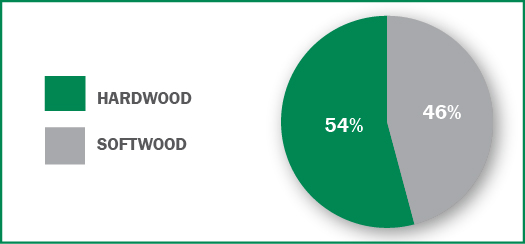

2017 Western U.S. Inventory by Species

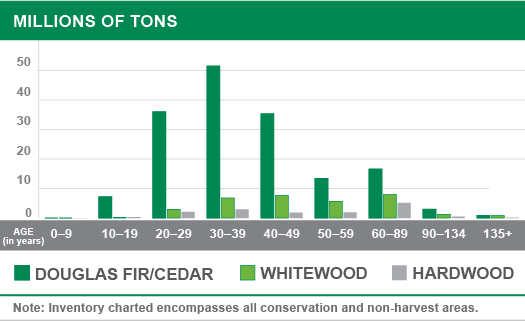

2017 Western U.S. Inventory by Age / Species

The average age of timber harvested from our Western timberlands in 2017 was 50 years. In accordance with our sustainable forestry practices, we harvest approximately 2 percent of our Western acreage each year.

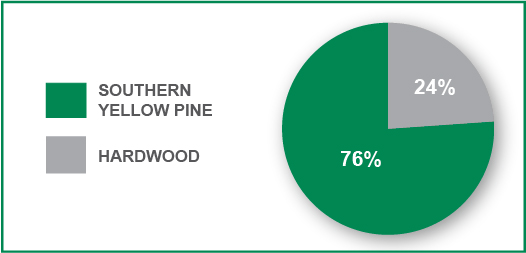

Southern United States

Our Southern acres, covering 11 states, are well situated to serve domestic wood products and pulp markets, including our own mills. Additionally, our coastal locations position us to serve a developing Asian log export market. Our holdings are comprised of 76 percent Southern yellow pine and 24 percent hardwoods.

We intensively manage our timber plantations using:

• | forestry research and planning systems to optimize log production, |

• | customized silviculture prescriptions increasing productivity across our acreage and |

• | innovative planting and harvesting techniques on varying Southern terrain. |

Operationally, we focus on efficiently harvesting and hauling logs from our ownership and capitalizing on our scale and supply chain expertise to consistently and reliably serve customers through seasonal events.

We lease more than 95 percent of our owned Southern acreage for recreational purposes.

2017 Southern U.S. Inventory by Species

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 6

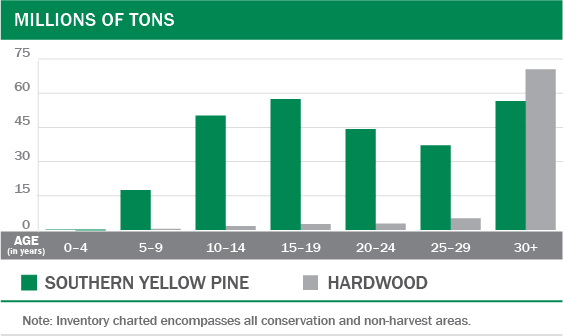

2017 Southern U.S. Inventory by Age / Species

The average age of timber harvested from our Southern timberlands in 2017 was 30 years. In accordance with our sustainable forestry practices, we harvest approximately 3 percent of our acreage each year in the South.

Northern United States

We are one of the largest private owners of northern hardwood timberlands. Our Northern acres contain a diverse mix of temperate broadleaf hardwoods and mixed conifer species across timberlands located in seven states. Species include American beech, balsam fir, birch, cedar, cherry, Douglas fir, hemlock, maple, oak, poplar, red pine, spruce, Western larch and white pine. We grow over 50 species and market over 600 product grades to a diverse mix of customers.

Our large-diameter cherry saw logs and veneer logs serve domestic and export furniture markets. Our hard maple and other appearance woods support furniture and high-value decorative applications. In addition to high value hardwood saw logs, our mix includes hardwood fiber logs for pulp and OSB applications. Hardwood pulpwood is a significant market in the Northern region and we have long term supply agreements, primarily at market rates, for nearly 86 percent of our production.

We also grow softwood logs that supply our Montana medium density fiberboard (MDF), lumber and plywood mills and other customers. Our competitive advantages include a merchandising program to capture the value of the premium hardwood logs and steep slope harvest mechanizing systems.

Regeneration is predominantly natural, augmented by planting where appropriate.

2017 Northern U.S. Inventory by Species

2017 Northern U.S. Inventory by Age / Species

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 7

The average age of timber harvested from our Northern timberlands in 2017 was 66 years. Timber harvested in the North is sold predominantly as delivered logs to domestic mills, including our manufacturing facilities located in Montana and West Virginia. In accordance with our sustainable forestry practices, we harvest approximately 1 percent of our acreage each year in the North.

Canada — Licensed Timberlands

We manage timberlands in Canada under long-term licenses from the provincial governments to secure volume for our manufacturing facilities in various provinces. The provincial governments regulate the volume of timber that may be harvested each year through Annual Allowable Cuts (AAC), which are updated every 10 years. As of December 31, 2017, our AAC by province was:

• | Alberta — 3,107 thousand tons, |

• | British Columbia — 627 thousand tons, |

• | Ontario — 254 thousand tons and |

• | Saskatchewan — 632 thousand tons. |

When the volume is harvested, we pay the province at stumpage rates set by the government. The harvested logs are transferred to our manufacturing facilities at cost (stumpage plus harvest, haul and overhead costs less any margin on selling logs to third parties). Any profit from harvesting the log through to converting to finished products is recognized at the respective mill in our Wood Products segment.

A small amount of harvested volumes are sold to unaffiliated customers.

GEOGRAPHIC AREA | THOUSANDS OF ACRES AT DECEMBER 31, 2017 | |

TOTAL ACRES UNDER LICENSE ARRANGEMENTS | ||

Province: | ||

Alberta | 5,398 | |

British Columbia | 1,012 | |

Ontario(1) | 2,574 | |

Saskatchewan(1) | 4,987 | |

Total Canada | 13,971 | |

(1) License is managed by partnership. | ||

HOW MUCH WE HARVEST

Our fee harvest volumes are managed sustainably across all regions to ensure the preservation of long-term economic value of the timber and to capture maximum value from the markets. This is accomplished by ensuring annual harvest schedules target financially mature timber and reforestation activities align with the growing of timber through its life cycle to financial maturity.

Five-Year Summary of Timberlands Fee Harvest Volumes

FEE HARVEST VOLUMES IN THOUSANDS | ||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | ||||||

Fee harvest volume – tons: | ||||||||||

West | 10,083 | 11,083 | 10,563 | 10,580 | 8,435 | |||||

South | 27,149 | 26,343 | 14,113 | 14,276 | 14,177 | |||||

North | 2,205 | 2,044 | — | — | — | |||||

Uruguay(1) | 822 | 1,119 | 980 | 1,091 | 902 | |||||

Other(2) | 1,384 | 701 | — | — | — | |||||

Total | 41,643 | 41,290 | 25,656 | 25,947 | 23,514 | |||||

(1) Our Uruguayan operations were divested on September 1, 2017. Refer to Note 3: Discontinued Operations and Other Divestitures in the Notes to Consolidated Financial Statements for further information on this divestiture. (2) Other includes volumes managed for the Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see Note 8: Related Parties in Notes to Consolidated Financial Statements. | ||||||||||

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 8

Five-Year Summary of Timberlands Fee Harvest Volumes - Percentage of Grade and Fiber

PERCENTAGE OF GRADE AND FIBER | |||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||

West | Grade | 89 | % | 87 | % | 87 | % | 89 | % | 90 | % |

Fiber | 11 | % | 13 | % | 13 | % | 11 | % | 10 | % | |

South | Grade | 52 | % | 52 | % | 59 | % | 59 | % | 57 | % |

Fiber | 48 | % | 48 | % | 41 | % | 41 | % | 43 | % | |

North | Grade | 49 | % | 47 | % | — | — | — | |||

Fiber | 51 | % | 53 | % | — | — | — | ||||

Uruguay (1) | Grade | 69 | % | 66 | % | 65 | % | 63 | % | 60 | % |

Fiber | 31 | % | 34 | % | 35 | % | 37 | % | 40 | % | |

Other (2) | Grade | 47 | % | 45 | % | — | — | — | |||

Fiber | 53 | % | 55 | % | — | — | — | ||||

Total | Grade | 63 | % | 64 | % | 73 | % | 73 | % | 69 | % |

Fiber | 37 | % | 36 | % | 27 | % | 27 | % | 31 | % | |

(1) Our Uruguayan operations were divested on September 1, 2017. Refer to Note 3: Discontinued Operations and Other Divestitures in the Notes to Consolidated Financial Statements for further information on this divestiture. (2) Other includes volumes managed for the Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see Note 8: Related Parties in Notes to Consolidated Financial Statements. | |||||||||||

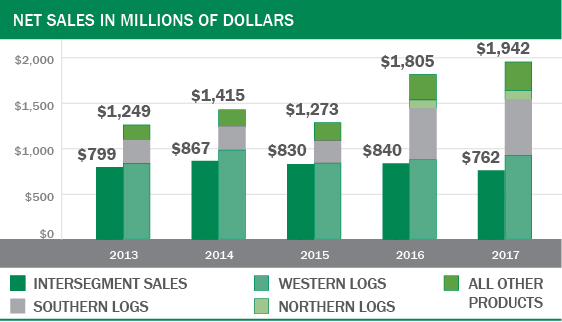

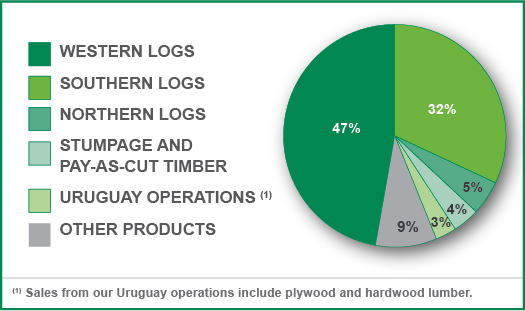

HOW MUCH WE SELL

Our net sales to unaffiliated customers over the last two years were:

• | $1.9 billion in 2017 — up 8 percent from 2016; and |

• | $1.8 billion in 2016. |

Effective December 31, 2017, we terminated the agreements under which we had managed the Twin Creeks timberlands. Refer to Note 8: Related Parties in Notes to Consolidated Financial Statements for further detail.

Our intersegment sales over the last two years were:

• | $762 million in 2017 — a decrease of 9 percent from 2016; and |

• | $840 million in 2016. |

The decrease in intersegment sales is primarily due to a decrease in chip and pulp log intersegment sales, which were previously sold to our Cellulose Fibers business segment. Refer to Note 3: Discontinued Operations and Other Divestitures in Notes to Consolidated Financial Statements for further detail regarding this divestiture.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 9

Five-Year Summary of Net Sales for Timberlands

NET SALES IN MILLIONS OF DOLLARS | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

To unaffiliated customers: | |||||||||||||||

Delivered Logs: | |||||||||||||||

West | $ | 915 | $ | 865 | $ | 830 | $ | 972 | $ | 828 | |||||

South | 616 | 566 | 241 | 257 | 256 | ||||||||||

North | 95 | 91 | — | — | — | ||||||||||

Other(1) | 59 | 38 | 24 | 22 | 19 | ||||||||||

Total | 1,685 | 1,560 | 1,095 | 1,251 | 1,103 | ||||||||||

Stumpage and pay-as-cut timber | 73 | 85 | 37 | 18 | 9 | ||||||||||

Uruguay operations(2) | 63 | 79 | 87 | 88 | 76 | ||||||||||

Recreational lease revenue | 59 | 44 | 25 | 22 | 21 | ||||||||||

Other products(3) | 62 | 37 | 29 | 36 | 40 | ||||||||||

Subtotal sales to unaffiliated customers | 1,942 | 1,805 | 1,273 | 1,415 | 1,249 | ||||||||||

Intersegment sales: | |||||||||||||||

United States | 520 | 590 | 559 | 576 | 518 | ||||||||||

Canada | 242 | 250 | 271 | 291 | 281 | ||||||||||

Subtotal intersegment sales | 762 | 840 | 830 | 867 | 799 | ||||||||||

Total | $ | 2,704 | $ | 2,645 | $ | 2,103 | $ | 2,282 | $ | 2,048 | |||||

(1) Other delivered logs include sales to unaffiliated customers in Canada and sales from timberlands managed for the Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see Note 8: Related Parties in Notes to Consolidated Financial Statements. | |||||||||||||||

(2) Sales from our Uruguay operations include plywood and hardwood lumber. Our Uruguayan operations were divested on September 1, 2017. Refer to Note 3: Discontinued Operations and Other Divestitures in the Notes to Consolidated Financial Statements for further information on this divestiture. | |||||||||||||||

(3) Other products sales include sales of seeds and seedlings from our nursery operations, chips, and sales from our operations in Brazil (operations sold in 2014). | |||||||||||||||

Five-Year Trend for Total Net Sales in Timberlands

Percentage of 2017 Sales Dollars to Unaffiliated Customers

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 10

Log Sales Volume

Logs sold to unaffiliated customers in 2017 increased 1.8 million tons — 7 percent — from 2016.

• | Sales volume in the South increased 1.9 million tons — 12 percent — primarily due to the addition of volumes harvested from acquired Plum Creek Timberlands. |

• | Sales to "Other" unaffiliated customers increased 0.5 million tons — 55 percent — primarily due to increased chips sales in Canada, which we previously sold to our former Cellulose Fibers segment and were intersegment sales during 2016. |

We sell three grades of logs — domestic grade, domestic fiber and export. Factors that may affect log sales in each of these categories include:

• | domestic grade log sales — lumber usage, primarily for housing starts and repair and remodel activity, the needs of our own mills and the availability of logs from both outside markets and our own timberlands; |

• | domestic fiber log sales — demand for chips by pulp, containerboard mills, pellet mills and OSB mills; and |

• | export log sales — the level of housing starts in Japan and construction in China. |

Our sales volume includes logs purchased in the open market and all our domestic and export logs that are sold to unaffiliated customers or transferred at market prices to our internal mills.

Five-Year Summary of Log Sales Volume to Unaffiliated Customers

SALES VOLUME IN THOUSANDS | ||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | ||||||

Logs – tons: | ||||||||||

West | 8,202 | 8,713 | 8,212 | 8,504 | 7,300 | |||||

South | 17,895 | 15,967 | 6,480 | 6,941 | 7,198 | |||||

North | 1,574 | 1,500 | — | — | — | |||||

Uruguay (1) | 291 | 470 | 714 | 667 | 394 | |||||

Other (2) | 1,458 | 943 | 551 | 474 | 410 | |||||

Total | 29,420 | 27,593 | 15,957 | 16,586 | 15,302 | |||||

(1) Our Uruguayan operations were divested on September 1, 2017. Refer to Note 3: Discontinued Operations and Other Divestitures in the Notes to Consolidated Financial Statements for further information on this divestiture. | ||||||||||

(2) Other includes our Canadian operations and managed Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see Note 8: Related Parties in Notes to Consolidated Financial Statements. | ||||||||||

Log Prices

The majority of our log sales to unaffiliated customers involve sales to domestic sawmills and the export market. Log prices in the following tables are on a delivered (mill) basis:

Five-Year Summary of Published Domestic Log Prices (#2 Sawlog Bark On — $/MBF)

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 11

Five-Year Summary of Export Log Prices (#2 Sawlog Bark On — $/MBF)

Log prices are affected by the supply of and demand for grade and fiber logs. Export log prices are particularly affected by the Japanese housing market and Chinese demand.

WHERE WE’RE HEADED

Our competitive strategies include:

• | continuing to capitalize on our scale of operations, silviculture expertise and sustainability practices; |

• | optimizing cash flow through operational excellence initiatives including merchandising for value, harvest and transportation efficiencies, and flexing harvest to capture seasonal and short-term opportunities; |

• | sustaining our export and domestic market access, infrastructure and strong customer relationships; |

• | increasing our recreational lease revenue stream; and |

• | continuing to maximize the value of our timberlands portfolio by managing the acres with the ultimate best use in mind. |

REAL ESTATE, ENERGY AND NATURAL RESOURCES

Our Real Estate & ENR segment maximizes the value of our timberland ownership through application of our asset value optimization (AVO) process and captures the full value of surface and subsurface assets, such as oil, natural gas, minerals and wind resources.

WHAT WE DO

Real Estate

Properties that exhibit higher value than commercial timberlands are monetized within our Real Estate business. We analyze existing U.S. timberland holdings using a process we call AVO. We start with understanding the value of a parcel operating as commercial timberlands and then assess the specific real estate attributes of the parcel and its corresponding market. The assessment includes demographics, infrastructure and proximity to amenities and recreation to determine the potential to yield a premium value to commercial timberland. Attributes can evolve over time, and accordingly, the assignment of value and opportunity can change.

These properties are acres we expect to sell, and/or entitle to support development, for recreational, conservation, commercial or residential purposes over time. Development, outside of entitlement activities, is typically performed by third parties. Some of our real estate activities are conducted through our taxable REIT subsidiary.

Occasionally we sell a small amount of timberlands acreage in areas where we choose to reduce our market presence, or we can capture a price that exceeds the value derivable from holding and operating as commercial timberlands. These transactions will vary based on factors including the locations and physical characteristics of the timberlands.

The timing of real estate sales is a function of many factors, including the general state of the economy, demand in local real estate markets, the ability of buyers to obtain financing, the number of competing properties listed for sale, the seasonal nature of sales (particularly in the Northern states), the plans of adjacent landowners, our expectation of future price appreciation, the timing of the harvesting activities, and the availability of government and not-for-profit funding. In any period, the average sales price per acre will vary based on the location and physical characteristics of parcels sold.

The AVO review of our legacy Weyerhaeuser Southern timberlands was completed in fourth quarter 2016. The AVO review of our legacy Weyerhaeuser Western timberlands was completed in second quarter 2017. We will continually revisit our AVO assessment of all of our U.S. timberland acres, including legacy Plum Creek acres for which AVO assessment was completed prior to the merger.

Energy and Natural Resources

We focus on maximizing potential opportunities for oil, natural gas, construction materials, industrial minerals, coal, renewable energy and rights of way easements on our timberlands portfolio and retained mineral interests.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 12

As the owner of mineral rights and interests, we typically do not invest in operations but instead enter into contracts with operators granting them the rights to explore and sell natural resources produced from our property in exchange for rents and royalties. Our primary sources of revenue are:

• | rentals and royalties from the exploration, extraction, generation and sale of minerals, oil and natural gas, coal and wind energy production; |

• | rental payments from communication, energy and transportation rights of way; and |

• | the occasional sale of mineral assets. |

We generally reserve mineral rights when selling timberlands acreage. Some Energy and Natural Resources activities are conducted through our taxable REIT subsidiary.

Real Estate Development Joint Venture

Our share of equity earnings from WestRock-Charleston Land Partners, LLC (WR-CLP) is included in the net contribution to earnings of our Real Estate & ENR segment. WR-CLP develops and sells its acreage of high value rural lands and development-quality lands near Charleston, South Carolina. Refer to Note 8: Related Parties in Notes to Consolidated Financial Statements for further information.

Real Estate, Energy and Natural Resources Sources of Revenue

SOURCES | ACTIVITIES | ||

Real Estate | Select timberland tracts are sold for recreational, conservation, commercial or residential purposes. | ||

Energy and Natural Resources | • Rights are sold to explore and extract construction aggregates (rock, sand and gravel), coal, industrial materials and oil and natural gas for sale into energy markets. • Ground leases and easements are granted to wind and solar developers to generate renewable electricity from our timberlands. • Rights are granted to access and utilize timberland acreage for communications, pipeline, powerline and transportation rights of way. | ||

WHERE WE DO IT

Our Real Estate business identifies opportunities to realize premium value for our U.S. timberland acreage.

Our significant Energy and Natural Resources revenue sources are located in Oregon, South Carolina and Georgia (construction material royalties); the Gulf South (oil and natural gas royalties); and West Virginia (coal reserves).

HOW MUCH WE SELL

Our net sales to unaffiliated buyers over the last two years were:

• | $280 million in 2017 — up 24 percent from 2016; and |

• | $226 million in 2016. |

Five-Year Summary of Net Sales for Real Estate, Energy and Natural Resources

NET SALES IN MILLIONS OF DOLLARS | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

Net Sales: | |||||||||||||||

Real Estate | $ | 208 | $ | 172 | $ | 75 | $ | 72 | $ | 84 | |||||

Energy and Natural Resources | 72 | 54 | 26 | 32 | 31 | ||||||||||

Total | $ | 280 | $ | 226 | $ | 101 | $ | 104 | $ | 115 | |||||

Five-Year Summary of Real Estate Sales Statistics

REAL ESTATE SALES STATISTICS | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

Acres sold | 97,235 | 82,687 | 27,390 | 24,583 | 25,781 | ||||||||||

Average price per acre | $ | 2,079 | $ | 2,072 | $ | 2,490 | $ | 2,428 | $ | 2,462 | |||||

WHERE WE’RE HEADED

Our competitive strategies include:

• | continuing to apply the AVO process to identify opportunities to capture a premium to timber value; |

• | maintaining a flexible, low-cost execution model by continuing to leverage strategic relationships with outside real estate brokers; |

• | capturing the full value of our oil and natural gas, aggregates and industrial minerals, and wind renewable energy resources; and |

• | delivering the most value from every acre. |

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 13

WOOD PRODUCTS

We are a large manufacturer of wood products in North America and distributor of wood products, primarily in North America.

WHAT WE DO

Our wood products segment:

• | provides high-quality softwood lumber, engineered wood products, structural panels, medium density fiberboard (MDF) and other specialty products to the residential, multi-family, industrial, light commercial and repair and remodel markets; |

• | distributes our products as well as complementary building products that we purchase from other manufacturers; and |

• | exports our softwood lumber, oriented strand board (OSB) and engineered wood products, primarily to Asia. |

Wood Products

PRODUCTS | HOW THEY’RE USED |

Structural lumber | Structural framing for new residential, repair and remodel, treated applications, industrial and commercial structures |

Engineered wood products • Solid section • I-joists | Floor and roof joists, and headers and beams for residential, multi-family and commercial structures |

Structural panels • OSB • Softwood plywood | Structural sheathing, subflooring and stair tread for residential, multi-family and commercial structures |

Medium density fiberboard (MDF) | Furniture and cabinet components, architectural moldings, doors, store fixtures, core material for hardwood plywood, face material for softwood plywood, commercial wall paneling and substrate for laminate flooring |

Other products | Wood chips and other byproducts |

Complementary building products | Complementary building products such as cedar, decking, siding, insulation and rebar sold in our distribution facilities |

WHERE WE DO IT

We operate manufacturing facilities in the United States and Canada. We distribute through a combination of Weyerhaeuser distribution centers and third-party distributors. Information about the locations, capacities and actual production of our manufacturing facilities is included below.

Summary of Wood Products Capacities and Principal Manufacturing Locations as of December 31, 2017

CAPACITIES IN MILLIONS | |||||

PRODUCTION CAPACITY | NUMBER OF FACILITIES | FACILITY LOCATION | |||

Structural lumber – board feet | 4,985 | 19 | Alabama, Arkansas, Louisiana (2), Mississippi (3), Montana, North Carolina (3), Oklahoma, Oregon (2), Washington (2), Alberta (2), British Columbia | ||

Engineered solid section – cubic feet(1) | 43 | 6 | Alabama, Louisiana, Oregon, West Virginia, British Columbia, Ontario | ||

Oriented strand board – square feet (3/8”) | 3,035 | 6 | Louisiana, Michigan, North Carolina, West Virginia, Alberta, Saskatchewan | ||

Softwood plywood – square feet (3/8”) | 610 | 3 | Arkansas, Louisiana, Montana | ||

Medium density fiberboard – square feet (3/4") | 265 | 1 | Montana | ||

(1) This represents total press capacity. Three facilities also produce I-Joist to meet market demand. In 2017, approximately 26 percent of the total press production was converted into 213 lineal feet of I-Joist. | |||||

Production capacities listed represent annual production volume under normal operating conditions and producing a normal product mix for each individual facility.

We also own or lease 18 distribution centers in the U.S. where our products and complementary building products are sold.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 14

Five-Year Summary of Wood Products Production

PRODUCTION IN MILLIONS | ||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | ||||||

Structural lumber – board feet | 4,509 | 4,516 | 4,252 | 4,152 | 4,084 | |||||

Engineered solid section – cubic feet(1) | 25.1 | 22.8 | 20.9 | 20.4 | 18.0 | |||||

Engineered I-joists – lineal feet(1) | 213 | 184 | 185 | 182 | 168 | |||||

Oriented strand board – square feet (3/8”) | 2,995 | 2,910 | 2,847 | 2,749 | 2,723 | |||||

Softwood plywood – square feet (3/8”)(2) | 370 | 396 | 248 | 252 | 241 | |||||

Medium density fiberboard – square feet (3/4") | 232 | 209 | — | — | — | |||||

(1) Weyerhaeuser engineered solid section facilities also may produce engineered I-joist. (2) All Weyerhaeuser plywood facilities also produce veneer. | ||||||||||

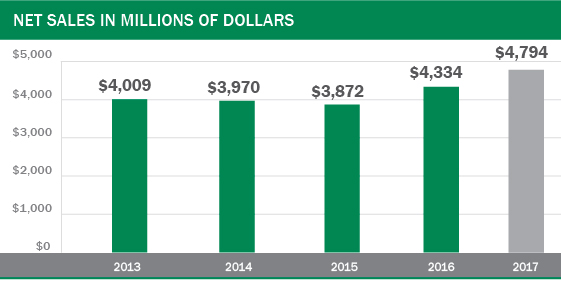

HOW MUCH WE SELL

Revenues of our Wood Products segment come from sales to wood products dealers, do-it-yourself retailers, builders and industrial users. Wood Products net sales were $5.0 billion in 2017 and $4.3 billion in 2016.

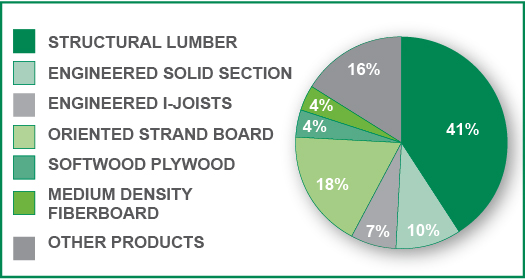

Five-Year Summary of Net Sales for Wood Products

NET SALES IN MILLIONS OF DOLLARS | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

Structural lumber | $ | 2,058 | $ | 1,839 | $ | 1,741 | $ | 1,901 | $ | 1,873 | |||||

Engineered solid section | 500 | 450 | 428 | 402 | 353 | ||||||||||

Engineered I-joists | 336 | 290 | 284 | 277 | 247 | ||||||||||

Oriented strand board | 904 | 707 | 595 | 610 | 809 | ||||||||||

Softwood plywood | 176 | 174 | 129 | 143 | 144 | ||||||||||

Medium density fiberboard | 183 | 158 | — | — | — | ||||||||||

Other products produced (1) | 276 | 201 | 189 | 176 | 171 | ||||||||||

Complementary building products | 541 | 515 | 506 | 461 | 412 | ||||||||||

Total | $ | 4,974 | $ | 4,334 | $ | 3,872 | $ | 3,970 | $ | 4,009 | |||||

(1) Includes wood chips and other byproducts. | |||||||||||||||

Five-Year Trend for Total Net Sales in Wood Products

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 15

Percentage of 2017 Net Sales Dollars in Wood Products

Wood Products Volume

Five-Year Summary of Sales Volume for Wood Products

SALES VOLUME(1) IN MILLIONS | ||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | ||||||

Structural lumber – board feet | 4,658 | 4,723 | 4,588 | 4,463 | 4,436 | |||||

Engineered solid section – cubic feet | 25.1 | 23.3 | 21.3 | 20.0 | 18.2 | |||||

Engineered I-joists – lineal feet | 220 | 195 | 188 | 184 | 177 | |||||

Oriented strand board – square feet (3/8”) | 2,971 | 2,934 | 2,972 | 2,788 | 2,772 | |||||

Softwood Plywood – square feet (3/8”) | 453 | 481 | 381 | 395 | 402 | |||||

Medium density fiberboard – square feet (3/4") | 222 | 206 | — | — | — | |||||

(1) Sales volume includes sales of internally produced products and complementary building products sold primarily through our distribution centers. | ||||||||||

Wood Products Prices

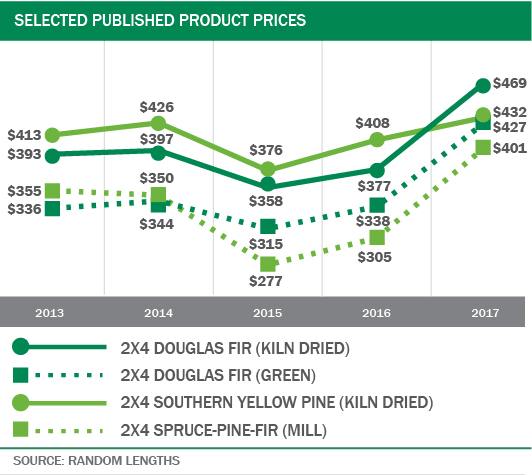

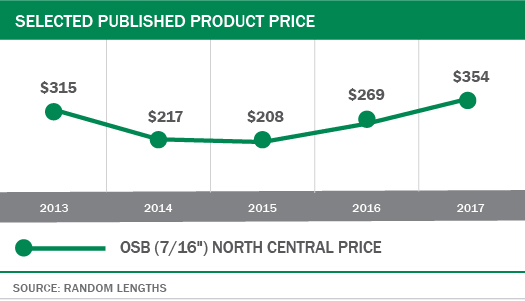

Prices for commodity wood products — Structural lumber, OSB and Plywood — increased in 2017 from 2016.

In general, the following factors influence sales realizations for wood products:

• | Demand for wood products used in residential and multi-family construction and the repair and remodel of existing homes affects prices. Residential and multi-family construction is influenced by factors such as population growth and other demographics, the level of employment, consumer confidence, consumer income, availability of financing and interest rate levels, and the supply and pricing of existing homes on the market. Repair and remodel activity is affected by the size and age of existing housing inventory and access to home equity financing and other credit. |

• | The availability of supply of commodity building products such as structural lumber, OSB and plywood affects prices. A number of factors can influence supply, including changes in production capacity and utilization rates, weather, raw material supply and availability of transportation. |

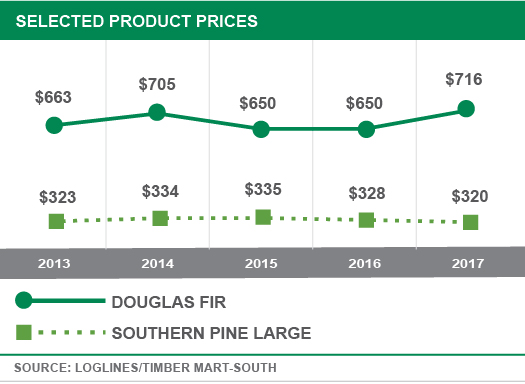

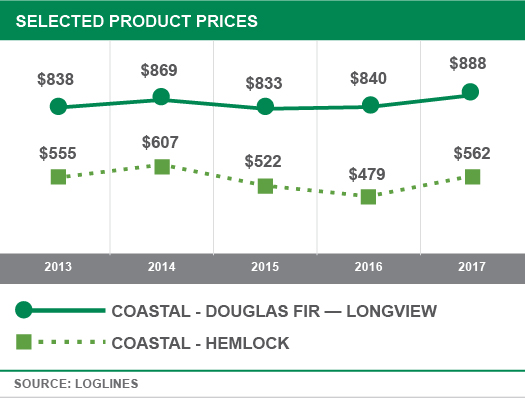

Demand for wood products continued to improve in 2017. The following graphs reflect product price trends for the past five years.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 16

Five-Year Summary of Published Lumber Prices — $/MBF

Five-Year Summary of Published Oriented Strand Board Price — $/MSF

WHERE WE’RE HEADED

Our competitive strategies include:

• | Industry leading controllable manufacturing costs through operational excellence and disciplined capital execution; |

• | strong alignment with fiber supply; |

• | leverage our brand and reputation as the preferred provider of quality building products; and |

• | pursue disciplined, profitable sales growth in target markets. |

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 17

EXECUTIVE OFFICERS OF THE REGISTRANT |

Adrian M. Blocker, 61, has been senior vice president, Wood Products since January 2015. Previously, he served as senior vice president, Lumber, from August 2013 to December 2014. He joined the company in May 2013 as vice president, Lumber. Prior to joining the company, he served as CEO of the Wood Products Council. He has held numerous leadership positions in the industry focused on forest management, fiber procurement, consumer packaging, strategic planning, business development and manufacturing, including at West Fraser, International Paper and Champion International.

Russell S. Hagen, 52, has been senior vice president and chief financial officer since February 2016. Previously, he served as senior vice president, Business Development, at Plum Creek from December 2011 to February 2016. Prior to this he was vice president, Real Estate Development, overseeing the development activities of the company's real estate, oil and gas, construction materials and bioenergy businesses. Mr. Hagen began his career in 1988 with Coopers and Lybrand, where he was a certified public accountant and led the audits of public clients in technology, banking and natural resource industries. He joined Plum Creek in 1993 as Manager of Internal Audit and held director-level positions in accounting, financial operations, risk management and information technology.

Kristy T. Harlan, 44, has been senior vice president, general counsel and corporate secretary since January 2017. She leads the company's Law department, with responsibility for global legal, compliance, real estate services and land title functions. Before joining the company, she was a partner at K&L Gates LLP since 2007. Previously, she worked as an attorney at Preston Gates & Ellis LLP and Akin Gump Strauss Hauer & Feld.

Devin W. Stockfish, 44, has been senior vice president, Timberlands, since January 2018. Previously, he has served as senior vice president, general counsel and corporate secretary, and vice president, Western Timberlands. He joined the company in March 2013 as corporate secretary and assistant general counsel. Before joining the company, he was vice president & associate general counsel at Univar Inc. where he focused on mergers and acquisitions, corporate governance and securities law. Previously, he was an attorney in the law department at Starbucks Corporation and practiced corporate law at K&L Gates LLP. Before he began practicing law, Mr. Stockfish was an engineer with the Boeing Company.

James A. Kilberg, 61, has been senior vice president, Real Estate, Energy and Natural Resources, since April 2016. In this position, he oversees the company's real estate development, land asset management, conservation, mitigation banking, recreational lease management, oil and gas, construction materials, heavy minerals, wind and water. Prior to joining the company, he served as Plum Creek's senior vice president, Real Estate, Energy and Natural Resources, from 2006 until February 2016, and as Plum Creek’s vice president, Land Management, from 2001 until 2006. Prior to joining Plum Creek, Mr. Kilberg held several executive positions in real estate, asset management and development. He currently serves on the board of the Georgia Chamber of Commerce and the Alliance Theater, as well as the Corporate Council of the Land Trust Alliance.

Denise M. Merle, 54, has been senior vice president, Human Resources and Information Technology, since February 2016. Prior to her current role, she was senior vice president, Human Resources and Investor Relations, since August 2014; and senior vice president, Human Resources, since February 2014. She was director, Finance and Human Resources, for the Lumber business since 2013. Prior to that, she was director, Compliance & Enterprise Planning, from 2009 to 2013, and director, Internal Audit, from 2004 to 2009. She has also held various roles in the company's paper and packaging businesses, including finance, capital planning and analysis, and business development. She is a licensed CPA in the state of Washington. She serves on the Board of Advisors of the Seattle University business school.

Doyle R. Simons, 54, has been president and chief executive officer since August 2013 and a director of the company since June 2012. He was appointed chief executive officer-elect and an executive officer of the company in June 2013. Prior to joining the company, he served as chairman and chief executive officer of Temple-Inland, Inc., from 2008 until February 2012 when it was acquired by International Paper Company. He held various management positions with Temple-Inland, including executive vice president from 2005 through 2007 and chief administrative officer from 2003 to 2005. Prior to joining Temple-Inland in 1992, he practiced real estate and banking law with Hutcheson and Grundy, L.L.P. He also serves on the Board of Fiserv, Inc.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 18

NATURAL RESOURCE AND ENVIRONMENTAL MATTERS |

We are subject to a multitude of laws and regulations in the operation of our businesses. We also participate in voluntary certification of our timberlands to ensure that we sustain their overall quality, including the protection of wildlife and water quality. Changes in law and regulation, or certification standards, can significantly affect our business.

REGULATIONS AFFECTING FORESTRY PRACTICES

In the United States, regulations established by federal, state and local government agencies to protect water quality, wetlands and other wildlife habitat could affect future harvests and forest management practices on our timberlands. Forest practice laws and regulations that affect present or future harvest and forest management activities in certain states include:

• | limits on the size of clearcuts, |

• | requirements that some timber be left unharvested to protect water quality and fish and wildlife habitat, |

• | regulations regarding construction and maintenance of forest roads, |

• | rules requiring reforestation following timber harvest and |

• | various related permit programs. |

Each state in which we own timberlands has developed best management practices to reduce the effects of forest practices on water quality and aquatic habitats. Additional and more stringent regulations may be adopted by various state and local governments to achieve water-quality standards under the federal Clean Water Act, protect fish and wildlife habitats, human health, or achieve other public policy objectives.

In Canada, our forest operations are carried out on public timberlands under forest licenses with the provinces. All forest operations are subject to:

• | forest practices and environmental regulations and |

• | license requirements established by contract between us and the relevant province designed to: |

- protect environmental values and

- encourage other stewardship values.

In Canada, 21 member companies of the Forest Products Association of Canada (FPAC), including Weyerhaeuser’s Canadian subsidiary, announced in May 2010 the signing of a Canadian Boreal Forest Agreement (CBFA) with nine environmental organizations. The CBFA applies to approximately 72 million hectares of public forests licensed to FPAC members and, when fully implemented, was expected to lead to the conservation of significant areas of Canada’s boreal forest and protection of boreal species at risk, in particular, woodland caribou. While the CBFA mandate came to an end in 2017, CBFA signatories continue to work on management plans with provincial governments, and seek the participation of aboriginal and local communities in advancing the goals of the CBFA.

ENDANGERED SPECIES PROTECTIONS

In the United States, a number of fish and wildlife species that inhabit geographic areas near or within our timberlands have been listed as threatened or endangered under the federal Endangered Species Act (ESA) or similar state laws, such as:

• | the northern spotted owl, the marbled murrelet, a number of salmon species, bull trout and steelhead trout in the Pacific Northwest; |

• | several freshwater mussel and sturgeon species; and |

• | the red-cockaded woodpecker, gopher tortoise, gopher frog, dusky gopher frog, American burying beetle and Northern long-eared bat in the South or Southeast. |

Additional species or populations may be listed as threatened or endangered as a result of pending or future citizen petitions or petitions initiated by federal or state agencies. In addition, significant citizen litigation seeks to compel the federal agencies to designate "critical habitat" for ESA-listed species, and many cases have resulted in settlements under which designations will be implemented over time. Such designations may adversely affect some management activities and options. Restrictions on timber harvests can result from:

• | federal and state requirements to protect habitat for threatened and endangered species; |

• | regulatory actions by federal or state agencies to protect these species and their habitat; and |

• | citizen suits under the ESA. |

Such actions could increase our operating costs and affect timber supply and prices in general. To date, we do not believe that these measures have had, and we do not believe that in 2018 they will have, a significant effect on our harvesting operations. We anticipate that likely future actions will not disproportionately affect Weyerhaeuser as compared with comparable operations of U.S. competitors.

In Canada:

• | The federal Species at Risk Act (SARA) requires protective measures for species identified as being at risk and for critical habitat, pursuant to SARA, Environment Canada continues to identify and assess species deemed to be at risk and their critical habitat. |

• | In October 2012, the Canadian Minister of the Environment released a strategy for the recovery of the boreal population of woodland caribou under the SARA. The population and distribution objectives for boreal caribou across Canada are to (1) maintain the current status of existing, self-sustaining local caribou populations and (2) stabilize and achieve self-sustaining status for non-self-sustaining local caribou populations. Critical habitat for boreal caribou is identified for all boreal caribou ranges, except for northern Saskatchewan’s Boreal Shield range (SK1) where additional information is required for that population. Species assessment and recovery plans are developed in consultation with aboriginal communities and stakeholders. |

• | In 2017, the Provinces were required to update the federal government on any progress associated with their draft caribou range plans. These draft plans will be further evaluated in 2018, and any additional information on potential impacts to forest harvest operations will be released. |

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 19

The identification and protection of habitat and the implementation of range plans and land use action plans may, over time, result in additional restrictions on timber harvests and other forest management practices that could increase operating costs for operators of timberlands in Canada. To date, we do not believe that these Canadian measures have had, and we do not believe that in 2018 they will have, a significant effect on our harvesting operations. We anticipate that likely future measures will not disproportionately affect Weyerhaeuser as compared with similar operations of Canadian competitors.

FOREST CERTIFICATION STANDARDS

We operate in North America under the Sustainable Forestry Initiative (SFI®). This is a certification standard designed to supplement government regulatory programs with voluntary landowner initiatives to further protect certain public resources and values. SFI® is an independent standard, overseen by a governing board consisting of:

• | conservation organizations, |

• | academia, |

• | the forest industry and |

• | large and small forest landowners. |

Ongoing compliance with SFI® may result in some increases in our operating costs and curtailment of our timber harvests in some areas. There also is competition from other private certification systems, primarily the Forest Stewardship Council (FSC), coupled with efforts by supporters to further those systems by persuading customers of forest products to require products certified to their preferred system. Certain features of the FSC system could impose additional operating costs on timberland management. Because of the considerable variation in FSC standards, and variability in how those standards are interpreted and applied, if sufficient marketplace demand develops for products made from raw materials sourced from other than SFI-certified forests, we could incur substantial additional costs for operations and be required to reduce harvest levels.

WHAT THESE REGULATIONS AND CERTIFICATION PROGRAMS MEAN TO US

The regulatory and non-regulatory forest management programs described above have:

• | increased our operating costs; |

• | resulted in changes in the value of timber and logs from our timberlands; |

• | contributed to increases in the prices paid for wood products and wood chips during periods of high demand; |

• | sometimes made it more difficult for us to respond to rapid changes in markets, extreme weather or other unexpected circumstances; and |

• | potentially encouraged further reductions in the use of, or substitution of other products for, lumber, oriented strand board, engineered wood products and plywood. |

We believe that these kinds of programs have not had, and in 2018 will not have, a significant effect on our total harvest of timber in the United States or Canada. However, these kinds of programs may have such an effect in the future. We expect we will not be disproportionately affected by these programs as compared with typical owners of comparable timberlands. We also expect that these programs will not significantly disrupt our planned operations over large areas or for extended periods.

CANADIAN ABORIGINAL RIGHTS

Many of the Canadian timberlands are subject to the constitutionally protected treaty or common-law rights of aboriginal peoples of Canada. Most of British Columbia (B.C.) is not covered by treaties, and as a result the claims of B.C.’s aboriginal peoples relating to forest resources have been largely unresolved. On June 26, 2014 the Supreme Court of Canada ruled that the Tsilhqot’in Nation holds aboriginal title to approximately 1,900 square kilometers in B.C. This was the first time that the court has declared title to exist based on historical occupation by aboriginal peoples. Many aboriginal groups continue to be engaged in treaty discussions with the governments of B.C., other provinces and Canada.

Final or interim resolution of claims brought by aboriginal groups can be expected to result in:

• | additional restrictions on the sale or harvest of timber, |

• | potential increase in operating costs and |

• | impact to timber supply and prices in Canada. |

We believe that such claims will not have a significant effect on our total harvest of timber or production of forest products in 2018, although they may have such an effect in the future. In 2008, FPAC, of which we are a member, signed a Memorandum of Understanding with the Assembly of First Nations, under which the parties agree to work together to strengthen Canada’s forest sector through economic-development initiatives and business investments, strong environmental stewardship and the creation of skill-development opportunities particularly targeted to aboriginal youth.

POLLUTION-CONTROL REGULATIONS

Our operations are subject to various laws and regulations, including:

• | federal, |

• | state, |

• | provincial and |

• | local pollution controls. |

These laws and regulations, as well as market demands, impose controls with regard to:

• | air, water and land; |

• | solid and hazardous waste management; |

• | waste disposal; |

• | remediation of contaminated sites; and |

• | the chemical content of some of our products. |

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 20

Compliance with these laws, regulations and demands usually involves capital expenditures as well as additional operating costs. We cannot easily quantify the future amounts of capital expenditures we might have to make to comply with these laws, regulations and demands or the effects on our operating costs because in some instances compliance standards have not been developed or have not become final or definitive. In addition, it is difficult to isolate the environmental component of most manufacturing capital projects.

Our capital projects typically are designed to:

• | enhance safety, |

• | extend the life of a facility, |

• | increase capacity, |

• | increase efficiency, |

• | facilitate raw material changes and handling requirements, |

• | increase the economic value of assets or products, and |

• | comply with regulatory standards. |

ENVIRONMENTAL CLEANUP

We are involved in the environmental investigation or remediation of numerous sites. Of these sites:

• | we may have the sole obligation to remediate, |

• | we may share that obligation with one or more parties, |

• | several parties may have joint and several obligations to remediate or |

• | we may have been named as a potentially responsible party for sites designated as U.S. Superfund sites. |

Our liability with respect to these various sites ranges from insignificant to substantial. The amount of liability depends on:

• | the quantity, toxicity and nature of materials at the site; and |

• | the number and economic viability of the other responsible parties. |

We spent approximately $15 million in 2017 and expect to spend approximately $14 million in 2018 on environmental remediation of these sites.

It is our policy to accrue for environmental-remediation costs when we:

• | determine it is probable that such an obligation exists and |

• | can reasonably estimate the amount of the obligation. |

We currently believe it is reasonably possible that our costs to remediate all the identified sites may exceed our current accruals of $48 million. Based on currently available information and analysis, remediation costs for all identified sites may exceed our existing reserves by up to $150 million. This estimate of the upper end of the range of reasonably possible additional costs is much less certain than the estimates we currently are using to determine how much to accrue. The estimate of the upper range also uses assumptions less favorable to us among the range of reasonably possible outcomes.

REGULATION OF AIR EMISSIONS IN THE U.S.

The United States Environmental Protection Agency (EPA) has promulgated regulations for air emissions from:

• | wood products facilities and |

• | industrial boilers. |

These regulations cover:

• | hazardous air pollutants that require use of maximum achievable control technology (MACT); and |

• | controls for pollutants that contribute to smog, haze and more recently, greenhouse gases. |

Between 2011 and 2015, the EPA issued three related portions of new MACT standards for industrial boilers and process heaters. In July 2016, a court decision was issued that remains unsettled at this time, but which will cause certain of the emissions standards to be re-issued. Some of these re-issued emissions standards will be applicable to a small number of our wood products mills. Because the court decision remains unsettled and because we do not know how or when the EPA will implement the final court decision, we cannot predict whether or when the emission standard revisions may have a material impact on regulatory compliance costs at our mills. We do not expect any material expenditures in 2017 to comply with MACT standards.

The EPA must still promulgate supplemental MACT standards for plywood, lumber and composite wood products facilities. The EPA is expected to collect information for these future rulemakings in 2017.

We cannot currently quantify the amount of capital we will need in the future to comply with new regulations being developed by the EPA because final rules have not been promulgated.

In 2010, the EPA issued a final greenhouse gas rule limiting the growth of emissions from new projects meeting certain thresholds. On June 23, 2014, the US Supreme Court issued a decision that removed potential applicability of the underlying 2010 regulations based solely on greenhouse gas emissions and limited application of the rule’s technology requirements to larger emission sources as a result of new emissions from non-greenhouse gas pollutants. As a result of this Supreme Court ruling, EPA is expected to issue new regulations to set thresholds for when the greenhouse gas technology requirements apply if the non-greenhouse gas emissions trigger the rule in the first instance. The impact of the Supreme Court ruling is to end the potential applicability of the technology requirements for our smaller manufacturing operations and limit the applicability for our other operations.

In 2015, the EPA issued an extensive regulatory program for new and existing electric utility generating units to scale back emissions of greenhouse gas carbon dioxide (CO2) arising from fossil fuel use to generate electricity. EPA also proposed additional regulations related to how states and federal agencies may implement the requirements finalized in 2015. This regulatory program potentially will have indirect impacts on our operations, such as from rising purchased electricity prices or from mandated energy demand reductions that could apply to our mills and other facilities that we operate. We are evaluating the regulations and additional proposals but are not able to predict whether the regulations, when complete and implemented, will have a material impact on our operations.

WEYERHAEUSER COMPANY > 2017 ANNUAL REPORT AND FORM 10-K 21

We use significant biomass for energy production at our mills. EPA is currently working on rules regarding regulation of biomass emissions.

The impact of these greenhouse gas and biomass rules, as well as recent court decisions, on our operations remains uncertain.

To address concerns about greenhouse gases as a pollutant, we:

• | closely monitor legislative, regulatory and scientific developments pertaining to climate change; |

• | adopted in 2006, as part of the company's sustainability program, a goal of reducing greenhouse gas emissions by 40 percent by 2020 compared with our emissions in 2000, assuming a comparable portfolio and regulations; |

• | determined to achieve this goal by increasing energy efficiency and using more greenhouse gas-neutral, biomass fuels instead of fossil fuels; and |

• | reduced greenhouse gas emissions by approximately 25 percent considering changes in the asset portfolio according to 2014 data, compared to our 2000 baseline. |

Additional factors that could affect greenhouse gas emissions in the future include:

• | policy proposals by federal or state governments regarding regulation of greenhouse gas emissions, |