Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Daseke, Inc. | a18-5227_7ex99d3.htm |

| EX-99.2 - EX-99.2 - Daseke, Inc. | a18-5227_7ex99d2.htm |

| EX-23.1 - EX-23.1 - Daseke, Inc. | a18-5227_7ex23d1.htm |

| 8-K/A - 8-K/A - Daseke, Inc. | a18-5227_78ka.htm |

Tennessee Steel Haulers, Inc. and Related Companies

COMBINED FINANCIAL STATEMENTS

DECEMBER 31, 2016

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Table of Contents

|

Independent Auditors’ Report |

1 |

|

|

|

|

COMBINED FINANCIAL STATEMENTS |

|

|

Combined Balance Sheet as of December 31, 2016 |

3 |

|

|

|

|

Combined Statement of Income for the Year Ended December 31, 2016 |

4 |

|

|

|

|

Combined Statement of Changes in Stockholders’ Equity for the Year Ended December 31, 2016 |

5 |

|

|

|

|

Combined Statement of Cash Flows for the Year Ended December 31, 2016 |

6 |

|

|

|

|

Notes to Combined Financial Statements |

7-17 |

INDEPENDENT AUDITORS’ REPORT

To the Board of Directors

Tennessee Steel Haulers, Inc. and Related Companies

Nashville, Tennessee

We have audited the accompanying combined financial statements of Tennessee Steel Haulers, Inc. and its subsidiary, and Alabama Carriers, Inc. and Fleet Movers, Inc. (collectively, the “Company”), which comprise the combined balance sheet as of December 31, 2016, and the related combined statements of income, stockholders’ equity, and cash flows for the year then ended, and the related notes to the combined financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these combined financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these combined financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the combined financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the combined financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the combined financial statements whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the combined financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the combined financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the combined financial statements referred to above present fairly, in all material respects, the financial position of Tennessee Steel Haulers, Inc. and related companies as of December 31, 2016, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

|

CARR, RIGGS & INGRAM, LLC |

|

|

|

|

|

Nashville, Tennessee |

|

|

February 16, 2018 |

|

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Combined Balance Sheet

The accompanying footnotes are an integral part of these combined financial statements.

![]()

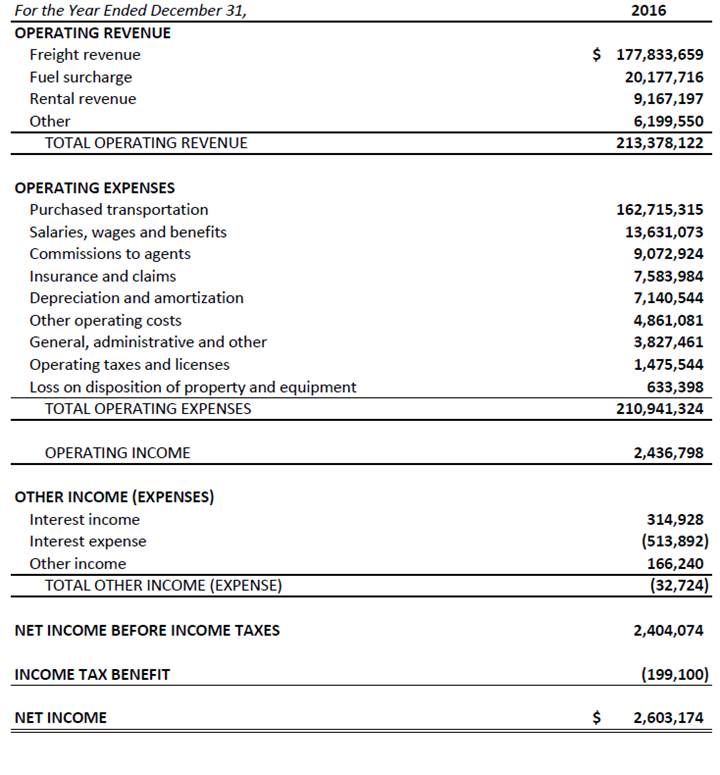

Tennessee Steel Haulers, Inc. and Related Companies

Combined Statement of Income

The accompanying footnotes are an integral part of these combined financial statements.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Combined Statement of Changes in Stockholders’ Equity

The accompanying footnotes are an integral part of these combined financial statements.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Combined Statement of Cash Flows

The accompanying footnotes are an integral part of these combined financial statements.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 1: ORGANIZATION

Operations

The combined financial statements include the accounts of Tennessee Steel Haulers, Inc. and its subsidiary (TSH International Services, Inc.); and Alabama Carriers, Inc., and Fleet Movers, Inc. The “Company”, refers to collectively Tennessee Steel Haulers, Inc. and the related companies noted above. The Company is an international flatbed carrier, based in the Southeast United States, which provides shipment of freight to customers located throughout North America.

TSH International Services, Inc. is 99% owned by Tennessee Steel Haulers, Inc. The principal business of TSH International Services, Inc. is to provide administrative services for freight sold to customers throughout Mexico.

Basis of Presentation

The Company’s combined financial statements have been prepared in conformity with U.S. accounting principles generally accepted in the United States of America (U.S. GAAP). Tennessee Steel Haulers, Inc., TSH International Services, Inc., Alabama Carriers, Inc. and Fleet Movers, Inc. are under common management and all transactions and accounts between them have been eliminated.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies of the Company are presented to assist in understanding the Company’s combined financial statements. The combined financial statements and notes are representations of the Company’s management, who is responsible for their integrity and objectivity.

Cash and Cash Equivalents

The Company considers all highly-liquid investments with original maturities of three months or less to be cash equivalents. The Company generally maintains cash and cash equivalents on deposit at banks in excess of federally insured amounts. The Company has not experienced any losses in such accounts and management believes the Company is not exposed to any significant credit risk related to cash and cash equivalents.

Accounts Receivable

Trade accounts receivable are stated at the amount management expects to collect from outstanding balances. Management provides for probable uncollectible amounts through a charge to earnings and a credit to a valuation allowance based on its assessment of the current status of individual accounts. Balances that are still outstanding after management has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to trade accounts receivable.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Cash Value of Life Insurance

Cash value of life insurance consists of the cash surrender value of life insurance policies on certain key employees of the Company. Cash surrender value on life insurance policies was $516,945 as of December 31, 2016 and is included in other assets.

Revenue Recognition

The Company recognizes revenue upon delivery of freight to the customer. Transportation and delivery expenses associated with shipments are recorded as the related revenue is recognized. Freight revenue is generally exempt from sales taxes.

Property and Equipment

Property and equipment is recorded at cost. Major property additions and improvements are capitalized, while maintenance and repairs that do not extend the useful life of an asset are expensed as incurred. The Company’s automobiles, furniture, fixtures and equipment are depreciated using the straight-line method over the estimated useful lives of the assets. Leasehold improvements are amortized using the straight-line method over the term of the lease, and all expected renewal options, or the useful life of the improvement, whichever is shorter. The estimated useful lives are as follows:

|

Buildings |

39 years |

|

Revenue equipment |

2-8 years |

|

Furniture, fixtures and equipment |

2-10 years |

|

Leasehold improvements |

15 years |

Lease Purchase Program and Rental Revenues

The Company leases revenue equipment to independent contractors (owner-operators) who have the opportunity to purchase the equipment at the conclusion of a lease. Management has elected to account for these leases as operating leases as the collection of minimum lease payments associated with the leases is not predictable. The Company recognizes revenue on the rental of the equipment over the term of the lease on a straight-line basis. As of December 31, 2016, revenue equipment with a cost of approximately $28,500,000 and accumulated depreciation of approximately $12,100,000 were under lease to owner-operators.

The Company also provides revenue equipment to owner-operators on a month-to-month rental basis. Revenue for these rentals are recognized upon the receipt of payment.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

During the year ended December 31, 2016, the Company recognized revenue of $9,167,197 from lease purchase and rental programs to owner-operators. As the collection of future minimum lease payments is not predictable, a schedule of future minimum lease payments has not been presented.

Impairment of Long-Lived Assets

The Company reviews the carrying value of property and equipment for impairment whenever events or circumstances indicate the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which property is used, and the effects of obsolescence, demand, competition, and other economic factors. Based on this assessment, there was no impairment recognized during the year ended December 31, 2016.

Concentration of Credit Risk

The Company has a concentrated credit risk for accounts receivable in that as of December 31, 2016, approximately 11% of outstanding trade receivable was due from one customer. For the year-ended December, 31, 2016, one customer accounted for approximately 15% of operating revenue.

Variable Interest Entities

The Company has not applied the variable interest entity (VIE) guidance in ASC 810, Consolidation, to assess certain lessor entities under common control for consolidation, as it has met the criteria and applies an accounting alternative described in Accounting Standards Update No. (ASU) [ASU 2014-07] Consolidation (Topic 810) Applying Variable Interest Entities Guidance to Common Control Leasing Arrangements. See Note 11.

Income Taxes

The Company, with the consent of its stockholders, elected to be taxed under the provisions of Subchapter S of the Internal Revenue Code. Accordingly, the Company is not subject to federal or certain state corporation income taxes.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

The Company accounts for income taxes in accordance with the Financial Accounting Standards Board (FASB) Accounting Standards Codification (AS) No. 740, Income Taxes. This statement clarifies the criteria that the Company’s tax position must satisfy for some or all of the benefits of that position to be recognized in a company’s financial statements. ASC 740 prescribes a recognition threshold of more-likely-than-not, and a measurement attribute for all tax positions taken or expected to be taken on a tax return, in order for those tax positions to be recognized in the combined financial statements. The Company’s policy is to account for interest and penalties related to uncertain tax positions as income tax expense in the accompanying combined statement of income. The Company has evaluated its uncertain tax positions and has determined that, as of December 31, 2016, there are no positions that meet the criteria for recognition as an uncertain tax position. During the year ended December 31, 2016, the Company did not record any interest and penalties related to uncertain tax contingencies. With few exceptions, the Company’s state income tax returns are open to audit under the statute of limitations for the years ending December 31, 2014 and thereafter.

Use of Estimates

The preparation of combined financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the combined financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements

FASB issued [ASU 2016-02], Leases (Topic 842), the new standard on lease accounting. Under the new ASU, lessees will recognize lease assets and liabilities on their balance sheet for all leases with terms of more than 12 months. The new lessee accounting model retains two types of leases and is consistent with the lessee accounting model under existing accounting principles generally accepted in the United States of America. One type of lease (finance leases) will be accounted for in substantially the same manner as capital leases are accounted for today. The other type of lease (operating leases) will be accounted for (both in the income statement and statement of cash flows) in a manner consistent with today’s operating leases. Lessor accounting under the new standard is fundamentally consistent with existing U.S. GAAP.

Lessees and lessors would be required to provide additional qualitative and quantitative disclosures to help financial statement users assess the amount, timing and uncertainty of cash flows arising from leases. These disclosures are intended to supplement the amounts recorded in the financial statements so that users can understand more about the nature of an organization’s leasing activities.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

For non-public entities, the final leases standard will be effective for fiscal years beginning after December 15, 2019, and interim periods thereafter. Early application is permitted. Management has not early adopted, nor evaluated the impact on future accounting periods.

FASB issued ASC Subtopic 205-40, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. Subtopic 205-40 provides guidance to an organization’s management, with principles and definitions that are intended to reduce diversity in the timing and content of disclosures that are commonly provided by organizations today in the financial statement footnotes.

The final standard is effective for fiscal years ending after December 15, 2016, and interim periods thereafter. Management adopted the standard in the current year with no material impact to the combined financial statements.

FASB issued ASC Topic 805, Accounting for Identifiable Intangible Assets in a Business Combination. Topic 805 allows a private company that elects this accounting alternative to no longer recognize or otherwise consider the fair value of intangible assets as a result of any in-scope transactions separately from goodwill: (1) customer-related intangible assets unless they are capable of being sold or licensed independently from the other assets of the business, and (2) noncompetition agreements.

For non-public entities, the final standard will be effective for fiscal years beginning after December 15, 2016, and interim periods thereafter. Early application is permitted. Management has not early adopted, nor evaluated the impact on future accounting periods.

FASB issued ASU 2014-09, Revenue from Contracts with Customer (Topic 606). The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In August 2015, the FASB issued updated guidance with ASU 2015-14 and deferred the effective date of ASU 2014-09 by one year. The guidance in ASU 2014-09 is effective for annual periods beginning after December 15, 2018, and interim periods within those annual periods.

In March 2016, the FASB issued an ASU that further clarifies guidance under ASU 2014-09 with respect to principal versus agent considerations in revenue from contracts with customers. In the second quarter of 2016, the FASB issued two ASUs that provide additional guidance when identifying performance obligations and licenses as well as allowing for certain narrow scope improvements and practical expedients. In May 2017, the FASB issued an ASU that provides guidance on the identification of the customer in a service concession arrangement. The guidance permits two methods of adoption: retrospectively to each prior reporting period presented (full retrospective), or retrospectively with the cumulative effect of initially applying the guidance recognized at the date of initial application (modified retrospective).

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

The Company plans to adopt this new guidance in the first quarter of 2019 and anticipates applying the modified retrospective method, which may result in a cumulative-effect adjustment to opening retained earnings with an insignificant change to revenue on a go-forward basis.

NOTE 3: PROPERTY AND EQUIPMENT

Property and equipment, summarized by categories, consisted of the following as of December 31, 2016:

Depreciation expense incurred during the year ended December 31, 2016 was $7,140,544.

NOTE 4: PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets consist of the following as of December 31, 2016:

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 5: ACCRUED EXPENSES

Accrued expenses consist of the following as of December 31, 2016:

NOTE 6: LINES OF CREDIT

The Company has three revolving bank lines of credit which provide for short-term borrowings of up to $7,650,000. The lines of credit expired and were renewed in September 2017 through September 2018. At December 31, 2016, the Company had an outstanding balance of $3,001,417. Borrowings under the lines: bear interest computed at various rates between 3.00% and 4.25%; are collateralized by trade receivables and the personal guarantee of a minority owner; and require the Company to maintain certain financial and non-financial covenants. As of December 31, 2016, the Company was in compliance with the covenants.

NOTE 7: COMMON STOCK AND TREASURY STOCK

Common stock consists of the following as of December 31, 2016:

Treasury stock of $2,000,000 consists of 1,000 shares of Fleet Movers, Inc. stock at cost.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 8: LONG-TERM DEBT

Long-term debt at December 31, 2016 consists of 21 installment notes for the purchase of revenue equipment. The revenue equipment notes are paid in monthly installments, which aggregate approximately $502,000 per month, including interest, with fixed and variable interest rates ranging from 2.76 percent to 5.94 percent at December 31, 2016 and maturity dates from April 2017 through October 2020. The notes are secured by the revenue equipment purchased. At December 31, 2016, long term debt totaled $10,826,435. The debt is collateralized by certain equipment and the personal guarantee of a minority owner.

At December 31, 2016, maturities of the Company’s installment notes are as follows:

NOTE 9: NOTES RECEIVABLE

The Company had a note receivable from Southern Carriers, Inc., an unrelated entity, totaling $1,099,785 at December 31, 2016. The note bears interest at 4.00% annually with monthly payments of $8,000 for 35 months and the remaining principal and interest due in September 2019. Interest income related to this note totaled $43,383 for the year ended December 31, 2016. The note is subordinate to other outstanding debt held by Southern Carriers, Inc. The note is secured by an assessment of a deed of trust covering certain parcels of land and buildings owned by Southern Carriers, Inc.

The Company had a note receivable from IFT, Inc., an unrelated entity, totaling $360,488 at December 31, 2016. The note bears interest at 4.25% and requires monthly payments of approximately $8,000 until June 2020. Interest income related to this note totaled $15,969 for the year ended December 31, 2016. The note is subordinate to other outstanding debt held by IFT, Inc. The note is secured by a personal guarantee of a shareholder of IFT, Inc.

NOTE 10: COMMITMENTS AND CONTINGENCIES

The Company is obligated under certain non-cancelable operating leases with a related party (see Note 11 for further detail) and an unrelated party expiring through April 2021. Total rent expense on all non-cancelable leases was $484,953 for the year ended December 31, 2016.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 10: COMMITMENTS AND CONTINGENCIES (CONTINUED)

Future minimum annual lease commitments subsequent to December 31, 2016 are as follows:

Litigation

From time to time, claims and suits arise in the ordinary course of the Company’s business. In certain of these actions, plaintiffs request punitive or other damages against the Company that may not be covered by insurance. The Company does not believe that it is a party to any proceeding that, in management’s opinion, would have a material adverse effect on the Company’s business, financial condition or results of operations.

Guarantees

The Company guaranteed approximately $2,200,000 of Sydney Properties, LLC mortgage debt obligations at December 31, 2016, which matures in May 2021. Management believes that the maximum exposure as a result of outstanding advances and the debt guarantees would be reduced to zero as management estimates that the fair market value of Sydney Properties, LLC assets is approximately $4,000,000, primarily buildings and land.

NOTE 11: RELATED PARTY TRANSACTIONS

The Company has engaged in several transactions with parties related by common ownership, including Sydney Properties, LLC.

The Company leases certain buildings from Sydney Properties, LLC pursuant to various operating leases. See Note 10. During 2016, the Company incurred rent expense pursuant to these operating leases of approximately $362,000. During 2016, the Company also made advances to Sydney Properties, LLC, which bear interest at 5.25%, with repayment requirements through April 2021. Amounts due from Sydney Properties, LLC totaled $956,609 at December 31, 2016.

In 2016, the Company made unsecured advances to its stockholders, which are noninterest bearing and payable on demand. Amounts due from stockholders totaled $208,241 at December 31, 2016.

The Company made various advances to related parties under common ownership totaling $85,558 at December 31, 2016. The advances do not bear interest and are due on demand.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 11: RELATED PARTY TRANSACTIONS (CONTINUED)

During the year-ended December 31, 2016, the Company had various lines of insurance covered either directly or indirectly through TennRe, Inc. (TR), a reciprocal insurance company, affiliated through common ownership. These lines of insurance required deductibles, ranging from $1,000 to $10,000, per claim. The Company paid approximately $920,000 of insurance premiums (directly and indirectly) to TR for the year ended December 31, 2016. Additionally, the Company provides administrative services to TR. Revenue from these services totaled $120,000 for the year ended December 31, 2016.

NOTE 12: INCOME TAX

The benefit for income taxes is as follows:

Deferred state income taxes reflect the net tax effects of temporary differences between amounts reported for financial reporting and income tax purposes. The major components of the deferred state income taxes are depreciation and cash basis accounting for income tax purposes. The Company had total deferred state tax liabilities of approximately $75,000 at December 31, 2016.

Effective January 1, 2012, the Company, with the consent of its stockholders, elected under the Internal Revenue Code to be taxed as an S Corporation. The Company was required to pay a built-in-gains tax in future periods for assets disposed of during the five-year period beginning January 1, 2012 and ending on December 31, 2016 based on the Company’s taxable income. Management had recorded a liability that included built-in-gains tax of $274,100 in prior periods. During 2016, the time period the Company was subject to the built-in-gains tax expired. As a result, during the year-ended December 31, 2016, the Company recognized a deferred tax benefit of $199,100.

NOTE 13: EMPLOYEE BENEFIT PLAN

The Company sponsors an employee benefit plan with a 401(k) feature covering substantially all employees. The Company may make discretionary matching contributions to each participant’s account. The Company made contributions of $186,693 to the plan for the year ended December 31, 2016.

![]()

Tennessee Steel Haulers, Inc. and Related Companies

Notes to the Combined Financial Statements

NOTE 14: SUBSEQUENT EVENTS

Subsequent events have been evaluated through the date of the independent auditors’ report which is the date the combined financial statements were available to be issued.

Sale of Company

On December 1, 2017, the Company was sold to Daseke, Inc. Daseke, Inc. acquired substantially all of the assets of Tennessee Steel Haulers, Inc. and subsidiary, Alabama Carriers, Inc., and Fleet Movers, Inc. except for certain notes receivable balances, shareholder accounts receivable balances, life insurance policies, and certain real estate.