Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF CENTURION ZD CPA LIMITED (AS SUCCESSOR TO DOMINIC K.F. CHAN & CO) - Consumer Capital Group, Inc. | fs12017a1ex23-1_consumer.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Consumer Capital Group, Inc. | fs12017a1ex21-1_consumer.htm |

| EX-1.1 - FORM OF UNDERWRITING AGREEMENT - Consumer Capital Group, Inc. | fs12017a1ex1-1_consumer.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

AMENDMENT

NO.1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________

CONSUMER CAPITAL GROUP INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

6199 |

|

27-1636887 |

|

(State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

136-82

39th Ave,

4th

Floor, Unit B

Flushing, New York, 11354

(718) 395-8150

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________

VCorp Services, LLC

1013 Centre Road

Suite 403-B

Wilmington, DE 19805

(888) 528-2677

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________

Copies to:

|

William S. Rosenstadt, Esq. |

|

Louis

Taubman, Esq. |

__________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

Large accelerated filer ¨ |

|

Accelerated filer ¨ |

Non-accelerated filer ¨ |

|

Smaller reporting company x |

|

|

Emerging growth company ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Class of Securities to be Registered |

|

Amount to be Registered |

|

Proposed Price |

|

Proposed Aggregate Offering Price |

|

Amount of Registration Fee |

||||

|

Common Stock, par value $0.0001 per share |

|

[•] |

|

$ |

[•] |

|

$ |

40,000,000 |

|

$ |

4,636 |

|

|

Common Stock underlying Representative’s Warrants(2) |

|

[•] |

|

$ |

[•] |

|

$ |

2,600,000 |

|

$ |

301.34 |

|

|

Total |

|

[•] |

|

$ |

[•] |

|

$ |

42,600,000 |

|

$ |

4,937.34 |

(3) |

____________

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended, which represents the sale of shares at the maximum aggregate price per share.

(2) We have agreed to issue, on the closing date of this offering, warrants to Boustead Securities LLC (the “Underwriter”) to purchase up to 6.5% of the aggregate number of common stock sold by the Registrant (the “Underwriter’s Warrants”). The Underwriter’s Warrants will be exercisable at any time, and from time to time, in whole or in part, commencing from the effective date of the offering and expiring five years from the effective date of the offering. The Underwriter expects to deliver the shares against payment in New York, New York, on or about [•], 2018. Assuming an offering price of $[•] per share, on the closing date the underwriters would receive [•] Underwriters Warrants. The exercise price of the Underwriters Warrants is equal to 100% of the price of the common stock offered hereby. Assuming at an exercise price of $[•] per share, we would receive, in the aggregate, $[•] upon exercise of the Underwriter’s Warrants.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION ON February [•], 2018 |

CONSUMER CAPITAL GROUP INC.

[•] Shares of Common Stock

Consumer Capital Group Inc. is offering [•] shares of our common stock. Prior to this offering, our stock has been listed on the OTCQB Venture Market (“OTCQB”) under the symbol “CCGN”. We expect the offering price of our common stock to be $[•] per share. We have applied to list our common stock on the Nasdaq Capital Market under the symbol “CCGN”. We cannot assure you that our application will be approved.

|

|

|

Per Common Share |

|

Total |

||

|

Assumed public offering price |

|

$ |

[•] |

|

$ |

40,000,000 |

|

Discounts and commissions to Underwriters(1) |

|

$ |

[•] |

|

$ |

2,600,000 |

|

Proceeds to us, before expenses |

|

$ |

[•] |

|

$ |

[•] |

____________

(1) See “Underwriting” on page 61 of this prospectus for a description of our arrangements with the underwriters.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 8 TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN SHARES OF OUR COMMON STOCK. NEITHER THE SECURITIES AND EXCHANGE COMMITTEE NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

|

|

The date of this prospectus is , 2018

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY |

|

1 |

|

RISK FACTORS |

|

8 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

24 |

|

USE OF PROCEEDS |

|

25 |

|

DIVIDEND POLICY |

|

26 |

|

CAPITALIZATION |

|

27 |

|

DILUTION |

|

29 |

|

DESCRIPTION OF BUSINESS |

|

30 |

|

DESCRIPTION OF PROPERTY |

|

45 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND |

|

46 |

|

UNDERWRITING |

|

61 |

|

DIRECTORS AND EXECUTIVE OFFICERS |

|

66 |

|

EXECUTIVE COMPENSATION |

|

69 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

70 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

71 |

|

LEGAL PROCEEDINGS |

|

73 |

|

DESCRIPTION OF SECURITIES |

|

74 |

|

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS |

|

75 |

|

LEGAL MATTERS |

|

76 |

|

EXPERTS |

|

76 |

|

WHERE YOU CAN FIND MORE INFORMATION |

|

76 |

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS |

|

F-1 |

Neither we nor the Underwriter have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

i

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements, before making an investment decision.

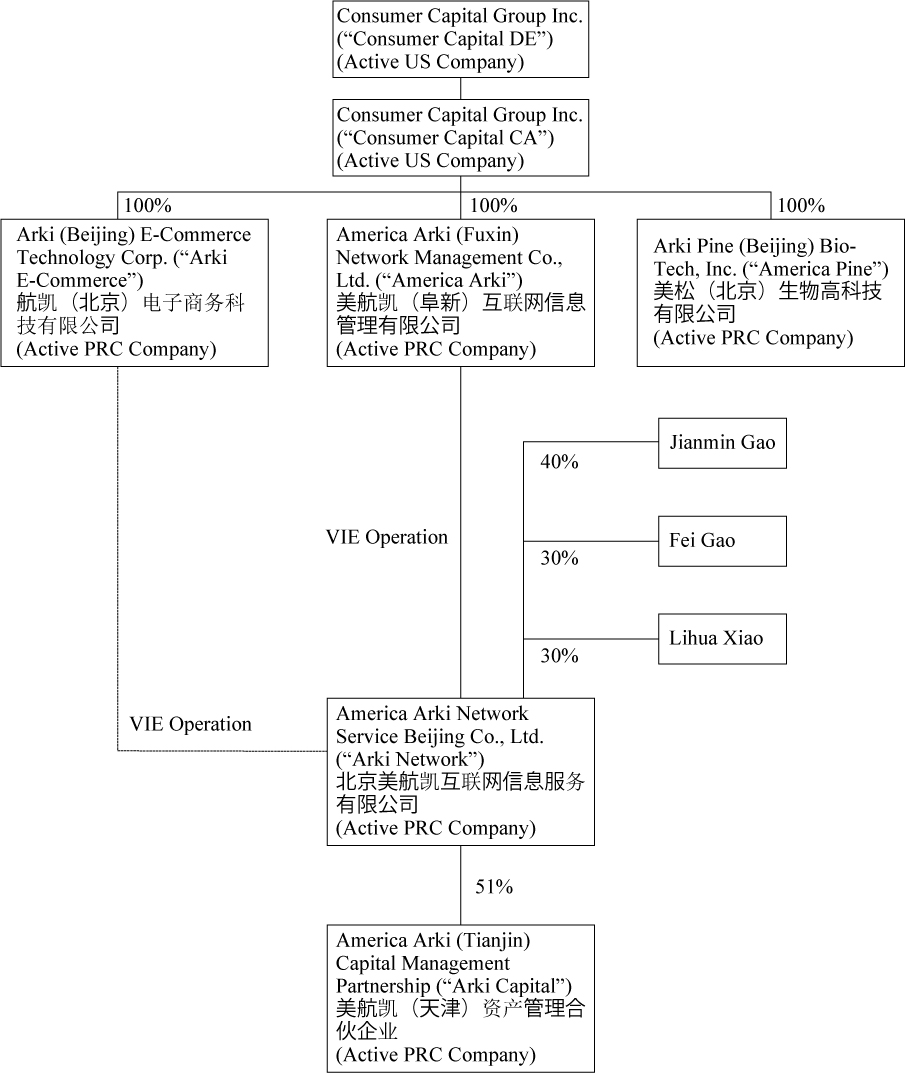

In this prospectus, unless otherwise noted or as the context otherwise requires, “Consumer Capital”, the “Company,” “CCGN” “we,” “us,” and “our” refers to the combined business of i) Consumer Capital Group, Inc. (“Consumer Capital DE”), a corporation formed under the laws of Delaware, ii) Consumer Capital Group, Inc. (“Consumer Capital CA”), a corporation formed under the laws of California, iii) Arki (Beijing) E-Commerce Technology Corp. (“Arki E-Commerce”), a wholly-owned subsidiary of Consumer Capital and a wholly foreign-owned enterprise (“WFOE”) formed under the laws of the People’s Republic of China (the “PRC”), iv) America Pine (Beijing) Bio-Tech Inc. (“America Pine”), a wholly-owned subsidiary of Consumer Capital and a WFOE formed under the laws of the PRC, v) America Arki (Fuxin) Network Management Co. Ltd. (“America Arki”), a wholly-owned subsidiary of Consumer Capital and a WFOE formed under the laws of the PRC, vi) America Arki Network Service Beijing Co., Ltd. (“Arki Network”), a variable interest entity (“VIE”) and a limited liability company formed under the laws of the PRC controlled by Jianmin Gao and Fei Gao, and vii) America Arki (Tianjin) Capital Management Partnership (“Arki Capital”), a 51%-owned subsidiary of Arki Network and a limited partnership formed under the laws of the PRC.

For the sake of clarity, this prospectus follows English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Chief Executive Officer will be presented as “Jianmin Gao,” even though, in Chinese, Mr. Gao’s name is presented as “Gao Jianmin.”

We have relied on statistics provided by a variety of publicly-available sources regarding China’s expectations of growth. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus. We have sought to provide current information in this prospectus and believe that the statistics provided in this prospectus remain up-to-date and reliable, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus.

Overview

We strive to become a one-stop shop that focuses on lending service for micro, small-to-medium sized enterprises (“SMEs”) in China. We are primarily engaged in the business of microfinancing services. We operate our direct microfinancing business through our subsidiary, Arki E-Commerce, and our VIE, Arki Network. With the increased difficulty of obtaining sufficient financing through traditional channels by SMEs, we offer SMEs alternative financing means through risk-controlled private lending to meet their capital needs and develop their business. We offer advisory and risk assessment services to both lenders and borrowers to help increase the efficiency of loan origination by financial institutions. It is our belief that the growth of SMEs will become an important factor of China’s economic growth in the next decade. We believe that our expertise in streamlining microfinancing process will place our company in a unique position in the marketplace.

On December 31, 2015, we issued 1,357,300 shares of common stock pursuant to a Regulation S offering for an aggregate offering price of $3,382,500. Also on July 28, 2016, we issued an aggregate of 825,180 shares of the common stock pursuant to another Regulation S offering for an aggregate proceeds of $1,790,640. From these offerings, we raised approximately $5.3 million, approximately $1.5 million were contributed to Consumer Capital DE for working capital needs and approximately $3.7 million were contributed to America Arki Network Service Beijing Co., Ltd. for its microfinancing business.

Our Business

Microfinancing

Currently, we engage in microfinancing business through our subsidiary, Arki E-Commerce and VIE, Arki Network, to provide direct loans to SMEs and sole proprietors based in Liaoning Province. Through Arki Network’s collaboration with China UnionPay Merchant Service (Liaoning) Co. Ltd (“UnionPay Liaoning”), Arki E-Commerce provides private loans for borrowers and Arki Network and UnionPay act as intermediary to facilitate the loan transactions

1

for a 5% service fee. Arki E-Commerce’s practice of microfinancing has been limited to certain businesses and sole proprietors pre-screened and recommended by UnionPay Liaoning based on historical sales volume generated through credit card transactions using UnionPay’s system.

UnionPay Liaoning are incentivized to recommend as many borrowers to us as possible as the additional service fee becomes another source of revenue for their operation. Arki E-Commerce’s practice of microfinancing has been limited to certain businesses and sole proprietors pre-screened by UnionPay Liaoning based on historical sales volume generated through credit card transactions using UnionPay’s system. Once a business owner submits his/her loan application to us, along with a recommendation letter provided by UnionPay Liaoning, Arki Network’s loan servicing team conducts additional due diligence on the quality of the borrowers. The loan servicing team first makes sure that the business is duly incorporated and in good standing with the State Administration for Industry and Commerce. The servicing team will then check business’s credit history based on public records provided by the National Enterprise Credit Information Publicity System. The servicing team will also check business’s history with local tax authority to ensure that it does not have any outstanding tax liability. Lastly, the servicing team will conduct phone or in-person interview with the applicant to verify all necessary information. In certain instance, the servicing team may conduct arbitrary on-site visit to the business to assess the validity of the business. Upon completion of the background check by Arki Network’s servicing team, Arki E-Commerce provides short-term loans in the form of original issue discount (“OID Loans”) to qualified borrowers with pre-set interest rate, terms and conditions. While Arki E-Commerce collects the interest generated through these loans, Arki Network generates revenue through a one-time 3% service fee while UnionPay Liaoning collects an additional 2% service fee based on the loan amount, due upon issuance of the OID Loans. As of the date of this prospectus, because we are a relatively new entry to the this market, with the exception of three companies for which we granted loan amount of RMB 1,000,000 each in December 2016, we only provide loans to business with annual revenue of at least RMB 2,000,000 (approximately US$285,714) with the following terms in order to lower default risk by the borrowers:

• Principal loan amount: RMB 300,000

• Term: 3-6 months

• Security interest is not required

• Interest: 1% per month (in the form of original issue discount)

• Principal amount to be paid in equal monthly tranches with the first payment due at the end of the 1st month

We granted the three larger loans outside of our general practice due our interest in diversifying our loan portfolio and testing out markets’ demand for such products. While we do not expect to issue these larger loans again in the near future, we may do so on a case by case basis.

Once the loan application is approved by Arki Network, Arki E-Commerce provides funding for the loan to Arki Network, which in turn transfer the funding, net of its service fee, to UnionPay Liaoning, which will wire the money after deducing its service fee to borrower’s bank account stored in its system, the same account borrower uses for receivables from the credit card transactions. Once payments are due from the borrower, the borrower will send each tranche of repayment directly to Arki Network through Unionpay’s payment processing system and Arki Network will transfer the repayment back to Arki E-Commerce. Neither UnionPay nor Arki Network charges any service fee to process the repayments.

Because there are many SMEs throughout China, we believe that our microfinancing model offers substantial market potential and intend to devote additional resources to apply the business model in other regions throughout China.

Wealth Management

Arki Network through its 51%-owned subsidiary, America Arki (Tianjin) Capital Management Partnership (“Capital”), engages wealth management business. Arki Capital operates its business on its financial advisory platform “Bangnitou”, which translates to “Help You Invest” in English and attracts capital from investors to invest in fixed income opportunities such as inter-bank loans, currency exchange products and other equity investment opportunities to help investor obtain return on their investment. Still at its development stage, Bangnitou will have a number of financial products that aims to generate annual return ranging from 8-12%. The

2

platform will allow retail investors to invest in products for as little as RMB 100 (or approximately US$15). Once each product reaches its maximum subscription or the end of its offering period, the investments are held for a period of time before being redeemable by the investors, along with the return. As of September 30, 2017, Arki has received funds of RMB 38,560,000 (approximately $5,795,568), which were presented as cash as an asset and loan payable as a liability on our consolidated balance sheet. The funds mostly carry a two year term without interest. Upon redemption date, the investors may demand back the funding or stay on as a limited partner. As of the date of this prospectus, Arki Capital has not made any investment and therefore has not generated any revenue. The funds may be redeemed back by the investors starting in September 2018. Investors may also stay on as a limited partner.

We expect Arki Capital to derive substantially all of its revenues from the return generated by the performance of the underlying investment products. It would keep all return in excess of the return that is marketed to the retail investors for the product.

As of September 30, 2017, Consumer Capital DE had a total asset of $4,110,943, a total liability of $2,677,085, and a total equity of $1,433,859; and that for the fiscal year ended 2016, Consumer Capital DE had a net loss of $58,571 and a total revenue of $0, that for the nine months ended September 30, 2017, Consumer Capital DE had a net loss of $2,831,812 and a total revenues of $0, and that for the three months ended in September 30, 2017, Consumer Capital DE had a net loss of $2,553,605 and a total revenues of $0. As of September 30, 2017, Consumer Capital DE had 3 employees.

As of September 30, 2017, Consumer Capital CA had a total asset of $0, a total liability of $0, and a total equity of $0; and that for the fiscal year ended 2016, Consumer Capital CA had a net loss of $0 and a total revenue of $0, that for the nine months ended in September 30, 2017, Consumer Capital CA had a net loss of $0 and a total revenues of $0, and that for the three months ended in September 30, 2017, Consumer Capital CA had a net loss of $0 and a total revenues of $0. As of September 30, 2017, Consumer Capital CA had 0 employees.

As of September 30, 2017, Arki E-Commerce had a total asset of $4,540,320, a total liability of $4,308,267, and a total equity of $232,053; and that for the fiscal year ended 2016, Arki E-Commerce had a net loss of $215,201 and a total revenue of $0, that for the nine months ended in September 30, 2017, Arki E-Commerce had a net profit of $186,382 and a total revenues of $255,901, and that for the three months ended in September 30, 2017, Arki E-Commerce had a net loss of $118,107 and a total revenues of $158,152. As of September 30, 2017, Arki E-Commerce had 3 employees.

As of September 30, 2017, American Pine had a total asset of $433,759, a total liability of $267,340, and a total equity of $166,418; and that for the fiscal year ended 2016, American Pine had a net loss of $793 and a total revenue of $0, that for the nine months ended in September 30, 2017, American Pine had a net loss of $0 and a total revenues of $0, and that for the three months ended in September 30, 2017, American Pine had a net loss of $0 and a total revenues of $0. As of September 30, 2017, American Pine had 0 employees.

As of September 30, 2017, American Arki had a total asset of $384,045, a total liability of $553,287, and a total equity of $(169,242); and that for the fiscal year ended 2016, American Arki had a net loss of $724 and a total revenue of $0, that for the nine months ended in September 30, 2017, American Arki had a net loss of $2 and a total revenues of $2, and that for the three months ended in September 30, 2017, American Arki had a net loss of $2 and a total revenues of $0. As of September 30, 2017, American Arki had 0 employees.

As of September 30, 2017, Arki Network had a total asset of $1,594,644, a total liability of $3,209,237, and a total equity of $(1,614,593); and that for the fiscal year ended 2016, Arki Network had a net loss of $248,124 and a total revenue of $213,821, that for the nine months ended in September 30, 2017, Arki Network had a net loss of $198,637 and a total revenues of $0, and that for the three months ended in September 30, 2017, Arki Network had a net loss of $50,405 and a total revenues of $0. As of September 30, 2017, Arki Network had 4 employees.

As of September 30, 2017, Arki Capital had a total asset of $4,654,962, a total liability of $6,156,857, and a total equity of $(1,501,895); and that for the fiscal year ended 2016, Arki Capital had a net loss of $223,042 and a total revenue of $0, that for the nine months ended in September 30, 2017, Arki Capital had a net loss of $1,090,211 and a total revenues of $0, and that for the three months ended in September 30, 2017, Arki Capital had a net loss of $69,036 and a total revenues of $0. As of September 30, 2017, Arki Capital had 5 employees.

3

Ceased Businesses

On December 23, 2014, we entered into a share exchange agreement with Shanghai Zhonghui Financial Information Services Corp. (“Shanghai Zhonghui”), a PRC peer-to-peer lending company (the “Zhonghui Agreement”), pursuant to which we agreed to acquire 51% of the capital stock of Shanghai Zhonghui (the “Acquisition”). Pursuant to the term of the share exchange agreement, we agreed to issue 5,000,000 shares of common stock to certain individuals affiliated with Shanghai Zhonghui (the “Zhonghui Affiliates”), valued at $1.00 per share for a total of $5,000,000 or approximately 31,000,000 RMB, to exchange 51% of the capital stock of Shanghai Zhonghui. As incentive for the closing of the Acquisition, we also agreed to issue to the Affiliates 5,000,000 additional shares of our common stock. Through the acquisition, we engaged in peer-to-peer lending. On December 28, 2016, upon approval by the majority shareholder and Board of Directors of the Company and Arki Network, Arki Network entered into certain business sale agreement with Yanbian YaoTian Gas Group Co., Ltd, a company organized under the laws of the PRC whereby Arki Network sold all of its interest in Shanghai Zhonghui for no consideration. In connection with the sale, Zhonghui Affiliates agreed to cancel 5,000,000 shares of our common stock obtained from the transaction. We have since ceased our peer-to-peer lending business.

On November 29, 2010, our wholly-owned subsidiary CCG California received approval from the Beijing Fangshan District Business Council in the PRC to acquire the controlling interest of Beitun Trading Co. Ltd. (“Beitun Trading”), a PRC trading and distribution company. Beitun Trading had a registered capital of RMB500,000 (approximately $80,250), of which RMB255,000 (approximately $40,928) was contributed by CCG and RMB245,000 (approximately $39,323) was contributed by Wei Guo. Effectively, CCG had control of 51% of Beitun Trading, and Wei Guo owned 49% of Beitun Trading. Through Beitun Trading, we engaged in the wholesale distribution of various food and meat products. On April 1, 2014, we entered into an agreement to sell our 51% interest in Beitun Trading to Zhang Yifan in exchange for cash payment of RMB 255,000 ($41,030). We have since ceased our distribution business.

Our Industry

According to a working paper published by Hong Kong University of Science and Technology, despite their on-going contributions to China’s economic development, SMEs face significant barriers in accessing credit from state-owned commercial banks. In 2013, only 23.2 percent of bank loans were extended to SMEs. Access to working capital loans is even more restricted: only 4.7 percent of short-term loans went to SMEs. Given these structural constraints on private sector borrowing from state banks, China’s SMEs have depended on non-banking sources of credit since the earliest years of economic reform. In surveys of private businesses conducted during the mid-1990s and mid-2000s, over two-thirds of the respondents indicated that they had relied on some form of informal finance. More recent research indicates that reliance on non-banking financing mechanisms has not abated. A World Bank survey of 2,700 private companies in 2011 to 2013 found that only 25 percent had bank credit and 90 percent drew on internal financing. Within that period, a 2012 survey of SMEs in fifteen provinces conducted by China’s Central University of Finance and Economics (CUFE) found that 57.5 percent had participated in informal credit markets. The bi-annual national surveys private enterprises administered by the All-China Federation of Industry and Commerce consistently find that ‘accessing bank credit’ is among the top self-reported challenges facing the private sector. As such, SMEs in China continue to rely heavily on non-banking financial intermediaries. (Source: Financing Small and Medium Enterprises in China: Recent Trends and Prospects beyond Shadow Banking, Kellee S. Tsai, HKUST IEMS Working Paper No. 2015-24, May 2015)

In China, the reliance on these non-banking financial intermediaries represents a market response to a combination of policy restrictions and related political priorities. At the most basic level, financial repression allows SOEs to receive subsidised credit, while inhibiting the ability of banks to price loans for higher risk SMEs. As such, since the earliest years of reform, various types of informal financial intermediaries and non-banking financial intermediaries have emerged to fill the SME funding gap. Some lend directly to private businesses, while others guarantee loans from commercial banks. Meanwhile, artificial suppression of deposit rates has driven savers to seek higher returns from other investment opportunities. Banks thus turned to off-balance sheet products to generate earnings from alternative sectors. The recent rise of on-line P2P lending and crowd funding platforms bypasses the banking system altogether by brokering between SMEs and private lenders/investors. This imbalance between supply and demand for capital among SMEs therefore presents business opportunities for us.

4

Business Strategy

We plan to implement two primary strategies to expand our market presence within the industry: (i) increase Arki E-Commerce’s lending capacity through the cash generated from operations and capital raised from this offering; and (ii) expand the Company’s geographic coverage for both microfinancing and wealth management business to major metropolitan areas such as Beijing, Shanghai, Guangzhou through the establishment of sales force. We believe that we can experience significant growth in these areas because there is a large number of established SMEs and sole proprietors in need of capital resources but lack the ability to finance either due to their limited size of business or local banks’ preferences to finance bigger and more established companies. In addition, we believe that our wealth management business will be able to provide potential investors a more attractive return comparing to traditional investment products.

Competitive Strengths

Although we operate in a highly-competitive industry, we believe that the following factors provide us with the competitive advantage in the marketplace that could differentiate us from our potential competitors:

• Strong Relationships with Local Financial Institutions. We have developed strong relationships with local financial institutions. For our microfinancing business, we only provide financing to clients that have been pre-screened by the credit card processing companies such as UnionPay, who and Arki Network would then charge a service fee based on the loan amount. The additional stream of revenue incentivizes UnionPay to promote our services and provide us with potential lending opportunities. It is through leveraging this relationship with large financial institutions such as UnionPay that we believe we are able to provide a unique value-added service to our clients and will be able to grow our client base.

• Experienced and committed leadership. Our CEO, Mr. Jianmin Gao, has had extensive experience in the banking industry prior to founding our company. Mr. Gao’s experience has provided our company with the skills and expertise that are essential in approaching and selecting appropriate banks, dealing with bank personnel, identifying and evaluating appropriate financial products and services, structuring tailored financial solutions and bargaining with banks on behalf of our clients. In addition, Mr. Gao also has extensive experience working with SMEs. We believe the experience and resources that Mr. Gao can offer will help our company become a more active player in the industry.

• Substantial potential client base. Our microfinancing clients are provided by the Liaoning provincial branch of UnionPay. Almost all businesses of various sizes use UnionPay as their primary credit card payment processor within China. Our collaboration with UnionPay therefore places us in a unique position, as UnionPay’s large portfolio of users could provide us with lending opportunities on a mass scale. As our business grows, we believe the existing clients will also continue to be a referral source of our business.

Our Challenges and Risks

We recommend that you consider carefully the risks discussed below and under the heading “Risk Factors” beginning on page 8 of this prospectus before purchasing our common stock. If any of these risks occur, our business, prospects, financial condition, liquidity, results of operations and ability to make distributions to our shareholders could be materially and adversely affected. In that case, the trading price of our common stock could decline and you could lose some or all of your investment. These risks include, among others, the following:

Limited Operating History.

• Our significant business lines have a limited operating history, which makes it difficult to evaluate our future prospects and results of operations.

PRC Legal Challenges.

• Under PRC laws and regulations, we are permitted to use the proceeds from this offering to fund our PRC subsidiaries only through loans or capital contributions, subject to applicable government registration and approval requirements. We currently anticipate financing our subsidiaries by means of capital contributions. These capital contributions must be filed with the Ministry of Commerce of China, or MOFCOM, or its

5

local counterpart. While the cost for completing such filings and registration is minimal, time and efforts to be used to navigate PRC regulations of loans to, and direct investments in, PRC entities by offshore holding companies may delay or prevent us from using proceeds from this offering and/or future financing activities to make loans or additional capital contributions to our PRC operating subsidiaries.

• Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

• Since our operations and assets are located in the PRC, shareholders may find it difficult to enforce a U.S. judgment against the assets of our company, our directors and executive officers.

• If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, this offering and our reputation and could result in a loss of your investment in our ordinary shares, especially if such matter cannot be addressed and resolved favorably.

Competition.

• We face considerable competition from established financing companies in the PRC.

The employment and retain of professional staff.

• Our business will suffer if we cannot employ or retain staff possessing industry and financial knowledge and experience.

Our ability to maintain and enhance our brand recognition and to conduct our sales and marketing activities cost-effectively.

• As we have a limited operating history, our focus will be on maintaining and enhancing our brand recognition in a cost-effective manner. We may not be able to compete effectively with our more established competitors and this may in turn impede our growth and profitability.

Information technology infrastructure

• We are heavily reliant on information technology and our business will suffer from any unexpected network interruptions or network failures.

See “Risk Factors” and “Special Note Regarding Forward-Looking Statements” for a discussion of these and other risks and uncertainties associated with our business and investing in our ordinary shares.

6

OFFERING SUMMARY

|

Shares Offered: |

|

[•] shares of common stock |

|

|

|

|

|

Shares Outstanding Prior to the Completion of the Offering: |

|

|

|

|

|

|

|

Shares to be Outstanding After the Offering: |

|

|

|

|

|

|

|

Proposed Offering Price per Share: |

|

$[•] |

|

|

|

|

|

Trading Symbol: |

|

CCGN |

|

|

|

|

|

Transfer Agent: |

|

Pacific Stock Transfer Co. |

|

|

|

|

|

Use of Proceeds |

|

We expect that we will receive net proceeds of approximately $[•] from this offering, assuming an initial public offering price of $[•] per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We plan to use the net proceeds we will receive from this offering for general corporate purposes, including without limitation, investment in product development, sales and marketing activities, technology infrastructure, team development, capital expenditures, improvement of corporate facilities and other general and administrative matters. We may also use a portion of these proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or investments. See “Use of Proceeds” for more information. See the “Use of Proceeds” section beginning on page 25. |

|

|

|

|

|

Risk Factors |

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on Page 8. |

|

|

|

|

|

Dividend Policy: |

|

We have no present plans to declare dividends and plan to retain our earnings to continue to grow our business. |

Corporate information

Our principal executive office is located at 136-82, 39th Ave, 4th Floor, Unit B, Flushing, NY 11354 and our telephone number is (718) 395-8150. Our website address is http://www.ccgusa.com. The information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus or the registration statement of which it forms a part.

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Cautionary Note Regarding Forward Looking Statements” below for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

We have a limited operating history in a new and evolving market, which makes it difficult to evaluate our future prospects.

The market for China’s microfinancing service is relatively new and may not develop as expected. The regulatory framework for this market is also evolving and may remain uncertain for the foreseeable future. Potential borrowers and lenders may not be familiar with this market and may have difficulty distinguishing our services from those of our competitors. Convincing potential new borrowers and lenders of the value of our services is critical to increasing the volume of loan transactions facilitated by our company and to the success of our business.

We started engaging in the microfinancing business in 2016 and wealth management business in 2015. As a result, our current core business has a limited operating history. As our business develops or in response to competition, we may continue to introduce new products and services or make adjustments to our existing offerings and business model. In connection with the introduction of new products or in response to general economic conditions, we may impose more stringent borrower qualifications to ensure the quality of loans facilitated by our companies, which may negatively affect the growth of our business. Any significant change to our business model may not achieve expected results and may have a material and adverse impact on our financial conditions and results of operations. It is therefore difficult to effectively assess our future prospects. The risks and challenges we encounter or may encounter in this developing and rapidly evolving market may have impacts on our business and prospects. These risks and challenges include our ability to, among other things:

• navigate an evolving regulatory environment;

• expand the base of borrowers and lenders;

• broaden our loan product offerings;

• enhance our risk management capabilities;

• improve our operational efficiency;

• cultivate a vibrant consumer finance ecosystem;

• maintain the security of our IT infrastructure and the confidentiality of the information provided and utilized across our platform;

• attract, retain and motivate talented employees; and

• defend ourselves against litigation, regulatory, intellectual property, privacy or other claims.

If we fail to educate potential borrowers and lenders about the value of our services, if the market for our services does not develop as we expect, or if we fail to address the needs of our target market, or other risks and challenges, our business and results of operations will be harmed.

If we are unable to maintain or increase the volume of loan transactions or if we are unable to retain existing borrowers or lenders or attract new borrowers or lenders, our business and results of operations will be adversely affected.

To maintain the high growth momentum of our business, we must continuously increase the volume of loan transactions by retaining current participants and attracting more clients. We intend to continue to dedicate significant resources to our client acquisition efforts, including establishing new acquisition channels, particularly

8

as we continue to grow our service portfolio and introduce new loan products. The overall transaction volume may be affected by several factors, including our brand recognition and reputation, the interest rates offered to borrowers relative to market rates, the effectiveness of our risk control, the repayment rate of borrowers, the efficiency of our service, the macroeconomic environment and other factors. In connection with the introduction of new products or in response to general economic conditions, we may also impose more stringent borrower qualifications to ensure the quality of loans facilitated by our company, which may negatively affect the growth of loan volume. If any of our current client acquisition channels become less effective, if we are unable to continue to use any of these channels or if we are not successful in using new channels, we may not be able to attract new borrowers and lenders in a cost-effective manner or convert potential borrowers and lenders into active borrowers and lenders, and may even lose our existing borrowers and lenders to our competitors. If we are unable to attract qualified borrowers and sufficient lender commitments or if borrowers and lenders do not continue to participate at the current rates, we might be unable to increase our loan transaction volume and revenues as we expect, and our business and results of operations may be adversely affected.

If our loan products do not achieve sufficient market acceptance, our financial results and competitive position will be harmed.

We incur expenses and consume resources upfront to develop and market new loan products. Our existing or new loan products could fail to attain sufficient market acceptance for many reasons, including but not limited to:

• our failure to predict market demand accurately and supply loan products that meet this demand in a timely fashion;

• borrowers and lenders using our services may not like, find useful or agree with any changes;

• our failure to properly price new loan products;

• defects, errors or failures on our service;

• negative publicity about our loan products or our service’s performance or effectiveness;

• views taken by regulatory authorities that the new products or service changes do not comply with PRC laws, rules or regulations applicable to us; and

• the introduction or anticipated introduction of competing products by our competitors.

We cannot rule out the possibility that there may be a mismatch between the investor’s expected timing of exit and the maturity date of the loans to which the automated investing tool allocates the investor’s funds. Investors using our automated investing tool typically invest for a shorter period than the terms of the underlying loans. If we are unable to find another investor to take over the remainder of the loans from the original investor that uses our automated investing tool at the time of his expected exit, then the original investor will have to remain invested in the loans and his expectation of liquidity would not be satisfied. If such mismatches occur in a widespread manner, investor acceptance of or satisfaction with our automatic investing tool would be adversely impacted.

If our new loan products do not achieve adequate acceptance in the market, our competitive position, results of operations and financial condition could be harmed.

If we do not compete effectively, our results of operations could be harmed.

The private lending industry in China is intensely competitive and evolving. We compete with many firms with lending capability. We also compete with financial products and companies that attract borrowers, lenders or both. With respect to borrowers, we primarily compete with traditional financial institutions, such as consumer finance business units in commercial banks, credit card issuers and other consumer finance companies. With respect to lenders, we primarily compete with other investment products and asset classes, such as equities, bonds, investment trust products, bank savings accounts, real estate and alternative asset classes.

Our competitors operate with different business models, have different cost structures or participate selectively in different market segments. They may ultimately prove more successful or more adaptable to new regulatory, technological and other developments. Some of our current and potential competitors have significantly more financial, technical, marketing and other resources than we do and may be able to devote greater resources to the development,

9

promotion, sale and support of their services. Our competitors may also have longer operating histories, more extensive borrower or lender bases, greater brand recognition and brand loyalty and broader partner relationships than us. Additionally, a current or potential competitor may acquire one or more of our existing competitors or form a strategic alliance with one or more of our competitors. Our competitors may be better at developing new products, offering more attractive investment returns or lower fees, responding faster to new technologies and undertaking more extensive and effective marketing campaigns. In response to competition and in order to grow or maintain the volume of loan transactions facilitated through our services, we may have to offer higher investment return to lenders or charge lower transaction fees, which could materially and adversely affect our business and results of operations. If we are unable to compete with such companies and meet the need for innovation in our industry, the demand for our services could stagnate or substantially decline, we could experience reduced revenues or our services could fail to achieve or maintain more widespread market acceptance, any of which could harm our business and results of operations.

Our inability to collect loans could adversely affect our results of operations.

We diversify our loan portfolio by only providing small loans to SMEs recommended by UnionPay Liaoning, which provide such potential borrowers based on borrowers past sales volume using their credit card processing system. There are inherent risks associated with our lending activities, including credit risk, which is the risk that borrowers may not repay the outstanding loans balances in our direct loan business or that we may not recover the full amount of the payment we made to the lender in our guarantee business. While we hedge such default risk by keeping the loan amount at a relative low amount comparing to borrowers’ sale, the borrowers generally have fewer financial resources in terms of capital or borrowing capacity than larger entities and may have fewer financial resources to weather a downturn in the economy. Such borrowers may expose us to greater credit risks than lenders lending to larger, better-capitalized state-owned businesses with longer operating histories. Conditions such as inflation, economic downturn, local policy change, adjustment of industrial structure and other factors beyond our control may increase our credit risk more than such events would affect larger lenders. Such systematic adverse changes in the local economy may have a negative impact on the ability of borrowers to repay their loans and our results of operations and financial condition may be adversely affected.

If we fail to promote and maintain our brand in an effective and cost-efficient way, our business and results of operations may be harmed.

The continued development and success of our business relies on the recognition of our brands. We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing borrowers and lenders to our services. Successful promotion of our brand and our ability to attract qualified borrowers and sufficient lenders depend largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. Our efforts to build our brand have caused us to incur significant expenses, and it is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

Our reputation may be harmed if information supplied by borrowers is inaccurate, misleading or incomplete, including if the borrowers use the loan proceeds for purposes other than as originally provided.

Borrowers supply a variety of information that is included in the loan listings on our services. We do not verify all the information we receive from borrowers, and such information may be inaccurate or incomplete. For example, we often do not verify a borrower’s home ownership status or intended use of loan proceeds, and the borrower may use loan proceeds for other purposes with increased risk than as originally provided. Moreover, lenders do not, and will not, have access to detailed financial information about borrowers. If lenders issue loans through our service based on information supplied by borrowers that is inaccurate, misleading or incomplete, those lenders may not receive their expected returns and our reputation may be harmed. Moreover, inaccurate, misleading or incomplete borrower information could also potentially subject us to liability as an intermediary under the PRC Contract Law.

10

Misconduct, errors and failure to function by our employees and third-party service providers could harm our business and reputation.

We are exposed to many types of operational risks, including the risk of misconduct and errors by our employees and third-party service providers. Our business depends on our employees and third-party service providers to interact with potential borrowers and lenders, process large numbers of transactions and support the loan collection process, all of which involve the use and disclosure of personal information. We could be materially adversely affected if transactions were redirected, misappropriated or otherwise improperly executed, if personal information was disclosed to unintended recipients or if an operational breakdown or failure in the processing of transactions occurred, whether as a result of human error, purposeful sabotage or fraudulent manipulation of our operations or systems. In addition, the manner in which we store and use certain personal information and interact with borrowers and lenders through our services is governed by various PRC laws. It is not always possible to identify and deter misconduct or errors by employees or third-party service providers, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses. If any of our employees or third-party service providers take, convert or misuse funds, documents or data or fail to follow protocol when interacting with borrowers and lenders, we could be liable for damages and subject to regulatory actions and penalties.

Furthermore, as we rely on certain third-party service providers, such as third-party payment services and custody and settlement service providers, to conduct our business, if these third-party service providers failed to function properly, we cannot assure you that we would be able to find an alternative in a timely and cost-efficient manner or at all. Any of these occurrences could result in our diminished ability to operate our business, potential liability to borrowers and lenders, inability to attract borrowers and lenders, reputational damage, regulatory intervention and financial harm, which could negatively impact our business, financial condition and results of operations. borrowers from participating in our services, which may adversely affect our business.

A severe or prolonged downturn in the Chinese or global economy could materially and adversely affect our business and financial condition.

Any prolonged slowdown in the Chinese or global economy may have a negative impact on our business, results of operations and financial condition. In particular, general economic factors and conditions in China or worldwide, including the general interest rate environment and unemployment rates, may affect borrower willingness to seek loans and lenders’ ability and desire to invest in loans. Economic conditions in China are sensitive to global economic conditions. The global financial markets have experienced significant disruptions since 2008 and the United States, Europe and other economies have experienced periods of recession. The recovery from the lows of 2008 and 2009 has been uneven and there are new challenges, including the escalation of the European sovereign debt crisis from 2011 and the slowdown of China’s economic growth since 2012 which may continue. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies, including the United States and China. There have also been concerns over unrest in Ukraine, the Middle East and Africa, which have resulted in volatility in financial and other markets. There have also been concerns about the economic effect of the tensions in the relationship between China and surrounding Asian countries. If present Chinese and global economic uncertainties persist, many of our lenders may delay or reduce their investment in the loans facilitated through our service. Adverse economic conditions could also reduce the number of qualified borrowers seeking loans on our service, as well as their ability to make payments. Should any of these situations occur, the amount of loans facilitated through our service and our net revenues will decline, and our business and financial conditions will be negatively impacted. Additionally, continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

Our ability to protect the confidential information of our borrowers and lenders may be adversely affected by cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions.

Our service collects, stores and processes certain personal and other sensitive data from our borrowers and lenders, which makes it an attractive target and potentially vulnerable to cyber attacks, computer viruses, physical or electronic break-ins or similar disruptions. While we have taken steps to protect the confidential information that we have access to, our security measures could be breached. Because techniques used to sabotage or obtain unauthorized access to systems change frequently and generally are not recognized until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Any accidental or willful security breaches or other unauthorized access to our service could cause confidential borrower and investor information to be stolen and

11

used for criminal purposes. Security breaches or unauthorized access to confidential information could also expose us to liability related to the loss of the information, time-consuming and expensive litigation and negative publicity. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our technology infrastructure are exposed and exploited, our relationships with borrowers and lenders could be severely damaged, we could incur significant liability and our business and operations could be adversely affected.

If we fail to develop and maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud.

Our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. However, in connection with the audits of our consolidated financial statements as of and for the two years ended December 31, 2014 and 2015, we identified “material weaknesses,” and other control deficiencies including significant deficiencies in our internal control over financial reporting. We also have a history of not filing our periodic reports in a timely manner. As defined in the standards established by the Public Company Accounting Oversight Board of the United States, or PCAOB, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

One material weakness that has been identified related to our lack of sufficient financial reporting and accounting personnel with appropriate knowledge of U.S. GAAP and SEC reporting requirements to properly address complex U.S. GAAP accounting issues and to prepare and review our consolidated financial statements and related disclosures to fulfill U.S. GAAP and SEC financial reporting requirements. The other material weakness that has been identified related to our lack of comprehensive accounting policies and procedures manual in accordance with U.S. GAAP.

We have implemented a number of measures to address the material weaknesses that have been identified in connection with the audits of our consolidated financial statements as of and for the two years ended December 31, 2016 and 2015. However, there is no assurance that we will not have any material weakness in the future. Failure to discover and address any control deficiencies could result in inaccuracies in our financial statements and impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. Moreover, ineffective internal control over financial reporting could significantly hinder our ability to prevent fraud. Ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the stock exchange on which we list, regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results.

If we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common shares.

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over financial reporting. In connection with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover “material weaknesses” in our internal controls as defined in standards established by the Public Company Accounting Oversight Board, or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. The PCAOB defines “significant deficiency” as a deficiency that results in more than a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected. We determined that our disclosure controls and procedures over financial reporting are not effective and were not effective as of December 31, 2016 and 2015.

The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that we will implement and maintain adequate controls over our financial process and reporting in the future or that the measures we will take will remediate any material weaknesses that we may identify in the future.

12

Our operations depend on the performance of the internet infrastructure and fixed telecommunications networks in China.

Almost all access to the internet in China is maintained through state-owned telecommunication operators under the administrative control and regulatory supervision of the Ministry of Industry and Information Technology, or the MIIT. We primarily rely on a limited number of telecommunication service providers to provide us with data communications capacity through local telecommunications lines and internet data centers to host our servers. We have limited access to alternative networks or services in the event of disruptions, failures or other problems with China’s internet infrastructure or the fixed telecommunications networks provided by telecommunication service providers. With the expansion of our business, we may be required to upgrade our technology and infrastructure to keep up with the increasing traffic on our service. We cannot assure you that the internet infrastructure and the fixed telecommunications networks in China will be able to support the demands associated with the continued growth in internet usage.

In addition, we have no control over the costs of the services provided by telecommunication service providers. If the prices we pay for telecommunications and internet services rise significantly, our results of operations may be adversely affected. Furthermore, if internet access fees or other charges to internet users increase, our user traffic may decline and our business may be harmed.

Our service and internal systems rely on software that is highly technical, and if it contains undetected errors, our business could be adversely affected.

Our service and internal systems rely on software that is highly technical and complex. In addition, our service and internal systems depend on the ability of such software to store, retrieve, process and manage immense amounts of data. The software on which we rely has contained, and may now or in the future contain, undetected errors or bugs. Some errors may only be discovered after the code has been released for external or internal use. Errors or other design defects within the software on which we rely may result in a negative experience for borrowers and lenders using our service, delay introductions of new features or enhancements, result in errors or compromise our ability to protect borrower or investor data or our intellectual property. Any errors, bugs or defects discovered in the software on which we rely could result in harm to our reputation, loss of borrowers or lenders or liability for damages, any of which could adversely affect our business, results of operations and financial conditions.

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how or other intellectual property rights held by third parties. We may be from time to time in the future subject to legal proceedings and claims relating to the intellectual property rights of others. In addition, there may be third-party trademarks, patents, copyrights, know-how or other intellectual property rights that are infringed by our products, services or other aspects of our business without our awareness. Holders of such intellectual property rights may seek to enforce such intellectual property rights against us in China, the United States or other jurisdictions. If any third-party infringement claims are brought against us, we may be forced to divert management’s time and other resources from our business and operations to defend against these claims, regardless of their merits.

Additionally, the application and interpretation of China’s intellectual property right laws and the procedures and standards for granting trademarks, patents, copyrights, know-how or other intellectual property rights in China are still evolving and are uncertain, and we cannot assure you that PRC courts or regulatory authorities would agree with our analysis. If we were found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and results of operations may be materially and adversely affected.

Our business depends on the continued efforts of our senior management. If one or more of our key executives were unable or unwilling to continue in their present positions, our business may be severely disrupted.

Our business operations depend on the continued services of our senior management, particularly the executive officers named in this prospectus. While we have provided different incentives to our management, we cannot assure you that we can continue to retain their services. We currently do not carry a “key man” life insurance on the officers.

13

Therefore, if one or more of our key executives were unable or unwilling to continue in their present positions, we may incur substantial cost or may not be able to replace them at all. Consequently, our future growth may be constrained, our business may be severely disrupted and our financial condition and results of operations may be materially and adversely affected. If that’s the case, we may incur additional expenses to recruit, train and retain qualified personnel. In addition, although we have entered into confidentiality and non-competition agreements with our management, there is no assurance that any member of our management team will not join our competitors or form a competing business. If any dispute arises between our current or former officers and us, we may have to incur substantial costs and expenses in order to enforce such agreements in China or we may be unable to enforce them at all.

Competition for employees is intense, and we may not be able to attract and retain the qualified and skilled employees needed to support our business.

We believe our success depends on the efforts and talent of our employees, including risk management, software engineering, financial and marketing personnel. Our future success depends on our continued ability to attract, develop, motivate and retain qualified and skilled employees. Competition for highly skilled technical, risk management and financial personnel is extremely intense. We may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. Some of the companies with which we compete for experienced employees have greater resources than we have and may be able to offer more attractive terms of employment.

In addition, we invest significant time and expenses in training our employees, which increases their value to competitors who may seek to recruit them. If we fail to retain our employees, we could incur significant expenses in hiring and training their replacements, and the quality of our services and our ability to serve borrowers and lenders could diminish, resulting in a material adverse effect to our business.

Increases in labor costs in the PRC may adversely affect our business and results of operations.

The economy in China has experienced increases in inflation and labor costs in recent years. As a result, average wages in the PRC are expected to continue to increase. In addition, we are required by PRC laws and regulations to pay various statutory employee benefits, including pension, housing fund, medical insurance, work-related injury insurance, unemployment insurance and maternity insurance to designated government agencies for the benefit of our employees. The relevant government agencies may examine whether an employer has made adequate payments to the statutory employee benefits, and those employers who fail to make adequate payments may be subject to late payment fees, fines and/or other penalties. We expect that our labor costs, including wages and employee benefits, will continue to increase. Unless we are able to control our labor costs or pass on these increased labor costs to our users by increasing the fees of our services, our financial condition and results of operations may be adversely affected.

We do not have any business insurance coverage.

Insurance companies in China currently do not offer as extensive an array of insurance products as insurance companies in more developed economies. Currently, we do not have any business liability or disruption insurance to cover our operations. We have determined that the costs of insuring for these risks and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Any uninsured business disruptions may result in our incurring substantial costs and the diversion of resources, which could have an adverse effect on our results of operations and financial condition.

We face risks related to natural disasters, health epidemics and other outbreaks, which could significantly disrupt our operations.

We are vulnerable to natural disasters and other calamities. Fire, floods, typhoons, earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks or similar events may give rise to server interruptions, breakdowns, system failures, technology service failures or internet failures, which could cause the loss or corruption of data or malfunctions of software or hardware as well as adversely affect our ability to provide products and services on our service.

Our business could also be adversely affected by the effects of Zika virus, Ebola virus disease, H1N1 flu, H7N9 flu, avian flu, Severe Acute Respiratory Syndrome, or SARS, or other epidemics. Our business operations could

14

be disrupted if any of our employees is suspected of having Zika virus, Ebola virus disease, H1N1 flu, H7N9 flu, avian flu, SARS or other epidemic, since it could require our employees to be quarantined and/or our offices to be disinfected. In addition, our results of operations could be adversely affected to the extent that any of these epidemics harms the Chinese economy in general.

Risks Related to Our Corporate Structure

If the PRC government deems that the contractual arrangements in relation to Arki Network, our consolidated variable interest entity, do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations.

Foreign ownership of internet-based businesses, such as distribution of online information, is subject to restrictions under current PRC laws and regulations. For example, foreign investors are not allowed to own more than 50% of the equity interests in a value-added telecommunication service provider (except e-commerce) and any such foreign investor must have experience in providing value-added telecommunications services overseas and maintain a good track record in accordance with the Guidance Catalog of Industries for Foreign Investment promulgated in 2007, as amended in 2011 and in 2015, respectively, and other applicable laws and regulations.

It is uncertain whether any new PRC laws, rules or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. In particular, in January 2015, the Ministry of Commerce, or MOC, published a discussion draft of the proposed Foreign Investment Law for public review and comments. Among other things, the draft Foreign Investment Law expands the definition of foreign investment and introduces the principle of “actual control” in determining whether a company is considered a foreign-invested enterprise, or an FIE. Under the draft Foreign Investment Law, variable interest entities would also be deemed as FIEs, if they are ultimately “controlled” by foreign investors, and be subject to restrictions on foreign investments. However, the draft law has not taken a position on what actions will be taken with respect to the existing companies with the “variable interest entity” structure, whether or not these companies are controlled by Chinese parties. It is uncertain when the draft would be signed into law and whether the final version would have any substantial changes from the draft. Substantial uncertainties exist with respect to the enactment timetable, interpretation and implementation of draft PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations” below. If the ownership structure, contractual arrangements and business of our company, Arki Network are found to be in violation of any existing or future PRC laws or regulations, or we fail to obtain or maintain any of the required permits or approvals, the relevant governmental authorities would have broad discretion in dealing with such violation, including levying fines, confiscating our income or the income of Arki Network, revoking the business licenses or operating licenses of Arki Network, shutting down our servers or blocking our online service, discontinuing or placing restrictions or onerous conditions on our operations, requiring us to undergo a costly and disruptive restructuring, restricting or prohibiting our use of proceeds from our initial public offering to finance our business and operations in China, and taking other regulatory or enforcement actions that could be harmful to our business. Any of these actions could cause significant disruption to our business operations and severely damage our reputation, which would in turn materially and adversely affect our business, financial condition and results of operations. If any of these occurrences results in our inability to direct the activities of Arki Network, and/or our failure to receive economic benefits from Arki Network, we may not be able to consolidate its results into our consolidated financial statements in accordance with U.S. GAAP.

Any failure by Arki Network, our consolidated variable interest entity, or its shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business.