Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - GULFSLOPE ENERGY, INC. | gspe-8k_021218.htm |

Exhibit 99.1

Leading the Gulf of Mexico Recovery Investor Presentation February 2018 OTCQB: GSPE

2 This presentation may contain forward - looking statements about the business, financial condition and prospects of the Company. Forwar d - looking statements can be identified by the use of forward - looking terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” or “anticipates,” or the negative thereof, or other variations th ereon, or comparable terminology, or by discussions of strategy or objectives. Forward - looking statements relate to anticipated or expecte d events, activities, and trends. Because forward - looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Forward - looking statements in this presentation include, without limitation, the Company’s e xpectations of oil and oil equivalents, barrels of oil and gas resources, prospects leased , dollar amounts of value creation, undiscovered resources, drilling success rates, resource information, superior economics, consistent value growth and other performance results. The SEC permits oil and gas companies, in their filings with the SEC to disclose only proved, probable and possible reserves, i.e . Items 1201 through 1208 of Regulation S - K (“SEC Oil and Gas Industry Disclosures” ). The estimates of recoverable resources used in this presentation do not comply with the SEC Oil and Gas Industry Disclosures, nor should it be assumed that any recoverable resources will be classified as proved, probable or p oss ible reserves consistent with the SEC Oil and Gas Industry Disclosures. Recoverable resources estimates are undiscovered, highly speculativ e r esources estimated where geological and geophysical data suggest the potential for discovery of petroleum but where the level of proof is insufficient for a classification as reserves or contingent resources. In addition, recoverable resources have a great amount of uncertainty as to their existence, absolute amount, and economic feasibility . Although the Company believes that the expectations reflected in forward - looking statements are reasonable, there can be no assurances that such expectations will prove to be accurate. Potential and existing shareholders are cautioned that such forward - looking statements involve risks and uncertainties. The forward - looking statements contained in this presentation speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertakin g t o report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, condi tio ns or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticip ate d by some of the statements made in this presentation. Please carefully review our filings with the SEC as we have identified many risk fa cto rs that impact our business plan. U.S. investors are urged to consider closely the disclosures in our Forms 10 - K, 10 - Q, 8 - K and other filings with the SEC, which can be electronically accessed from our website at www.GulfSlope.com or the SEC's website at http://www.sec.gov / . Abbreviations : MM Million $ United States dollar B B illion RTM Reverse time migration BOE Barrel of oil equivalent GSPE GulfSlope Energy, Inc . EUR Estimated ultimate recovery SEC Securities and Exchange Commission Mcf Million cubic feet DHI Direct hydrocarbon i ndicator NPV 10 Net Present Value discounted at 10 % IRR Internal rate of return F&D Costs Full cycle finding and development c osts Pg Likelihood of encountering recoverable hydrocarbons Forward Looking Statement

3 World Class Opportunity • Delek Group, Ltd. secured as partner for drilling portfolio • Anticipate a minimum of two wells to be drilled in 2018 • High specification jackup rig contracted for initial drilling 2018 Drilling Program Underway • Nine well portfolio ready - to - drill with almost 1 billion BOE of gross unrisked recoverable resources • Represents $9.2+ billion of net present value Significant Oil and Natural Gas Exposure • GulfSlope executive team credited for originally discovering this play • Industry has developed 1.8+ billion BOE from multiple discoveries • Strategic advantage from proprietary reprocessed seismic Proven Play • Prospects offer 60%+ IRRs in current pricing environment • Gulf of Mexico has among the lowest breakeven costs in the industry • Significant existing infrastructure with multiple points of sale Superior Economics • Executive leadership with GoM exploration and operations experience • Proven track record of applying best technologies to find oil and gas • Specialized technical team with extensive local knowledge in GoM Experienced Team Resource figures are based on Company estimates and reflect gross unrisked recoverable resources for 100% working interest . NPV10 and IRR assume NYMEX strip pricing as of January 12, 2018, and reflect unrisked recoverable resources for 100% working interest, net of royalties and net profits interest.

4 Partnership Overview Summary of Farmout Terms • Minimum commitment by Delek to drill two exploratory wells in Phase 1 ‒ Partnership has selected Canoe Shallow and Tau prospects to be drilled ‒ Delek has the option to participate in multiple additional two - well phases • Delek paying 90% of exploration costs to earn 75% working interest ‒ GulfSlope to retain 20% working interest and will receive $1.1 million cash per prospect drilled ‒ GulfSlope will be operator and will fund 8% of exploratory costs ‒ Delek has option to become operator upon commercial discovery • Delek will have the right to purchase up to 5% of GulfSlope’s common stock after each phase, up to a total of 20% of GulfSlope’s common stock after four phases • GulfSlope and Delek are pursuing additional GOM opportunities Delek Group, Ltd . • Leading international independent exploration and production company ‒ Publicly traded on Tel Aviv Exchange (Symbol: DLEKG) ‒ Delek’s market capitalization is approximately $1.7 billion (1 ) • Offshore - focus with particular emphasis on applying latest technology to exploration • Leveraging success in Eastern Mediterranean Sea (Leviathan and Tamar Fields) and North Sea to become global operator GulfSlope has partnered with Delek Group Ltd. for the drilling of its prospect portfolio (1) In USD as of February 12, 2018.

5 0 5 10 15 20 25 30 35 Canoe (2) Canoe Tau Months Drilling Development Regulatory/POD Production • 18MMBOE prospect with $162MM NPV 10 » 3.0MMBOE with $37MM NPV 10 net to GulfSlope • $4.6MM dry hole cost – 5,500ft drilling depth » $370k dry hole cost net to GulfSlope • Direct hydrocarbon indicators present • Immediately offset by analogue production • Can be drilled with standard jack - up rig • Target spud date mid - 2018 • Current Status: Regulatory / POE • 300+ MMBOE prospect with $3+B NPV 10 » 51MMBOE with $593MM NPV 10 net to GulfSlope • $ 38.7MM dry hole cost – 26,000ft drilling depth » $3.1MM dry hole cost net to GulfSlope • Analogue – prolific Mahogany and Conger fields • High spec jack - up required for drilling • 1st production in less than 36 months • Anticipate drilling immediately after Canoe • Current Status: Regulatory / POE C ANOE T AU 2018 Drilling Program Estimated Timeline (1) Regulatory/POE Exploratory (1) Assumes rig availability. (2) Reflects alternative development scenario which could decrease time to first production . Appraisal GulfSlope anticipates drilling a minimum of two wells in 2018

6 Corporate Overview Executive Team and Board John Seitz Chairman & CEO Ron Bain President & COO John Malanga CFO Robert Meize VP - Operations Charles Hughes VP - Land Clint Moore VP and CAE Rich Langdon Board Member Paul Morris Board Member Snapshot Established 2013 Focus Area Offshore Gulf of Mexico Subsalt Targets Primarily Shelf Miocene Suprasalt Target Pleistocene Seismic 2.2 MM Acres (440 Blocks) Lease Blocks 12 Portfolio 9 Exploration Prospects Area of Operation GulfSlope Deep Water Shelf Capitalization (as of 9 - 30 - 17) Ticker (OTCQB) GSPE Enterprise Value $86 million Stock Price (as of 2 - 12 - 18) $0.087 Avg. Daily Volume (2) 750,000 Diluted Shares Out. (1) 873 million Invested Capital $42 million Equity Value $76 million Employee Ownership 33% (1) Includes approximately 780 million common shares outstanding plus convertible securities, options and warrants using the Tr easury Method of Accounting. (2) Trailing 30 trading days.

7 Alaska – Alpine Field Discovery Algeria – Ourhoud, Hassi Berkine Discoveries Proven Track Record Background Management Response Discovery Opportunity • Mega - majors had lost interest in Alaska exploration • Anadarko identified prospect with seismic anomaly support below the primary objective • Partnered with ARCO to drill • 500+ million BOE to date with drilling ongoing • Largest Alaskan oilfield discovered in over 25 years • Extended the life of the Alaskan pipeline Background Management Response Discovery Opportunity • Shell and Total unsuccessful drilling program in late 1980s • No interest from major oil companies due to seismic imaging challenges • Petroleum laws revised to encourage investment • Breakthrough technologies in Sahara Desert seismic data acquisition and processing • Shot and utilized new seismic technology • Found JV partners to complete drilling program • 3+ billion BOE • Largest Algerian oilfields discovered in over 30 years Background Management Response Discovery Opportunity • Reduction in total exploration drilling by majors • Majors planned to sell assets • 1 st Regional merged 3D seismic data became available • Became first independent to explore with merged seismic data • Applied advanced seismic reprocessing • 110 million BOE and was the largest gas discovery in the UK Southern Gas Basin in 25 years • 1 st production in 2017 (represents 5 % of UK gas production) Background Management Response Discovery Opportunity • Pre - 1990 subsalt imaging was poor • Industry believed massive salt was basement • Giant subsalt exploration potential first identified by 1986 penetration of reservoir below salt in SMI 200 well • Utilized newest seismic processing available to de - risk exploration drilling of new play type (subsalt) • 150+ million BOE • Ignited world - wide exploration of subsalt plays North Sea – Cygnus and Bacchus Discoveries Gulf of Mexico Source: Company data and public company filings John Seitz and Ron Bain have consistently demonstrated their ability to utilize the latest proven technology to discover large oil and gas fields, credited with over 3.7 billion BOE worldwide

8 2018 Goals Milestones Achieved GulfSlope has Reached an Inflection Point Complete build out of operational capabilities Increase investor awareness through active investor relations program Drill a minimum of two exploratory wells Up - list onto a national exchange Pursue additional strategic opportunities including the acquisition of additional leases and producing properties Strategy • Acquired 2.2MM acres of seismic data • Re - processed 800,000 acres to RTM • Completed $10MM round of funding • Acquired 2 blocks (2 prospects ) in Federal OCS Lease Sale 235 • Re - processed 300,000 acres to RTM • Finalized drill - ready portfolio • Completed farmout of 20% working interest in five subsalt prospects • Acquired 22 blocks (17 prospects) in Federal OCS Lease Sale 231 • Raised over $18MM through farmout agreement, vendor investment, and PIPE 2016 2014 2015 2013 • Added 7 th prospect to drill - ready portfolio • Added shallow suprasalt prospects • Optimized cost structure Rigorous risk reduction with technical focus and proven portfolio approach • Apply cutting edge technologies to producing basins with overlooked potential • Capitalize on recent advancements in subsalt seismic imaging • Deploy specialized technical team for Gulf of Mexico exploration Apply proven portfolio approach to create value • Target high potential subsalt reservoirs balanced with shallow depth program • Diversify drilling risk through multi - well program and partnering • Continue to optimize portfolio through leasing and acquisitions/farm - ins 2017 • Farmed out drill - ready portfolio to Delek • Acquired one block in OCS Lease Sale 249 • Initiated build out of operations capability GulfSlope is focused on its growth strategy with particular emphasis on achieving its 2018 goals

9 Why the Gulf of Mexico? • Historical lows for drilling and development costs • Significant strategic opportunities for technology - centric acquirors • Royalty rates for new leases reduced to 12.5% from 18.75% • Consistent and predictable approach from regulatory bodies • Probability of success steadily improving – The industry has significantly reduced the risk of conventional exploration through extensive seismic and geologic analysis – GulfSlope deploys the same technology, skill sets, and best practices as major oil companies – Portfolio diversification further reduces the risk of making a high value discovery 24% 40% 61% 1990s Shelf-Miocene Play Current Deepwater by E&P Industry Rose & Associates Risking of GSPE Drill-Ready Program (1) Success rates have improved with technology and experience (1) Rose & Associates LLP, a global leader in risk assessment for oil and gas exploration programs, analyzed five of GulfSlo pe’ s prospects . Opportunity to invest near the bottom of the cycle

10 • Seismic Processing – Advanced algorithms maximize accuracy – Processing is now faster and less expensive – Reverse Time Migration and other technologies utilized by GulfSlope and industry provide the most accurate view of subsalt prospects • Seismic Capture – 1990s: 2D and isolated 3D seismic – Today: 3D data now standard x Maximize chance of discoveries x Improve resource estimates x Enable a small team to successfully compete Technology Evolution 1980s 1990s 2000 2005 2015 Kirchhoff Migration Wave Equation Migration Reverse Time Migration Scalable Processing Parallel Processing Computing Cost Imaging Capability Beam Migration Multi - core Processors Technology has Reduced Entry Costs Large E&P companies no longer have exclusive access to the most advanced seismic processing technologies

11 Today: RTM Reprocessed Circa 2005: WEM Processing Base of salt now clear Additional salt body appears Potential targets now defined Previous generations of seismic interpretation were insufficient to reduce exploration risk below salt Unclear interpretation of geology below salt Recent advances in seismic processing provide clear images of prospects below salt, where previous interpretations failed, as proven by multi - billions of BOE discovered in deepwater GoM, Brazil , and Angola Seismic Processing Improvements Seismic data courtesy of TGS Why this opportunity still exists today

12 Focused on Proven Petroleum System Conger Field 250+ MMBOE Cardamom Field 140+ MMBOE Enchilada Field 35 MMBOE Mahogany Field 60+ MMBOE Hickory Field 75+ MMBOE Tanzanite Field 30 MMBOE Selectron Tanker Graviton Photon Pomeron Tachyon Tau Katmai Discovery Quark Canoe Tornado Discovery Megalodon Discovery EW 910 Field Discovery Recent Activity Legacy Discoveries Louisiana TX 400+ MMBOE discovered below salt in the GulfSlope Area of Interest

13 Prospects Canoe Shallow Selectron Shallow Graviton Photon Pomeron Quark Tachyon Tanker Tau Total / W. Avg. EUR (MMBOE) 18 9 190 88 32 156 112 89 301 996 Drill Depth 5,500’ 5,000’ 25,000’ 19,000’ 15,000’ 23,000 19,000’ 25,000’ 26,000’ Water Depth 320’ 315’ 325’ 405’ 325’ 430’ 415’ 325’ 280’ Percentage Oil 51% 100% 27% 59% 19% 59% 59% 75% 75% 58% Exploration Well DHC ($MM) $4.6 $4.6 $ 36 $24 $19 $26 $25 $36 $ 39 $215 Prospect DHI DHI 3 - / 4 - way DHI DHI Submarine Fan DHI 3 - way 3 - way Risk (Pg) 80% 80% 39% 81% 62% 44% 72% 52% 44% 53% F&D Costs ($/BOE) $5.28 $4.35 $3.06 $4.08 $5.00 $2.21 $3.61 $3.96 $3.35 $3.35 NPV10 ($MM) $162 $140 $960 $920 $139 $1,758 $1,177 $923 $3,046 $9,224 IRR 87% 98% 40% 67% 31% 95% 69% 60% 59% 63% Drilling Portfolio Resource figures are based on Company estimates and reflect gross unrisked recoverable resources for 100% working interest . DHC based on current rates for jackup drilling rigs. NPV10 and IRR assume NYMEX strip pricing as of January 12, 2018 (Assumes average annual oil price per barrel for 2019 - 2022 of $58, $54, $53, and $53, respectively . Assumes average annual gas price per mcf for 2019 - 2022 of $2.82, $2.98, $3.00, and $3.03, respectively). Reflect unrisked recoverable resources for 100% working interest, net of royalties and net profits int ere st. GulfSlope has advanced nine high potential prospects to drill - ready status that could hold almost 1 billion BOE of gross recoverable resources representing more than $9.2 billion of net present value

14 Canoe Shallow Prospect Vermillion Area, South Addition 378 • GSPE 20 % WI (75% Delek, 5% TXSO) • 81.25% NRI 8/8 ths • GSPE 8% of exploratory well’s costs, 20% of costs thereafter upon commercial discovery Objectives / Traps • Shallow S, C and T sands • L arge , simple fault traps • Estimated 51% oil • Subsalt opportunities to be tested later Analogue (VR 379 immediately adjacent) • Targets: S, C and T sands • Initially drilled: 1999 • Current operator: Ankor • Cumulative production: 8.2 mmboe • Peak production rate: 5,600 boepd Drill Plan • Water depth: 300 – 320 ft. • Planned total depth: 5,500 ft. • $370k net GSPE cost for exploratory well • Jack - up drilling rig • 2.7 miles to facility at VR379 EUR NPV 10 (1) Success % Status Gross 20 MMBOE $162MM 80% Drill Ready Net (2) 3 MMBOE $37 MM GulfSlope Selectron GulfSlope Nucleon Canoe (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest. Drilled first, highest probability of success among current prospects, small GSPE cost for exploration well

15 Canoe Shallow Prospect (cont.) Canoe

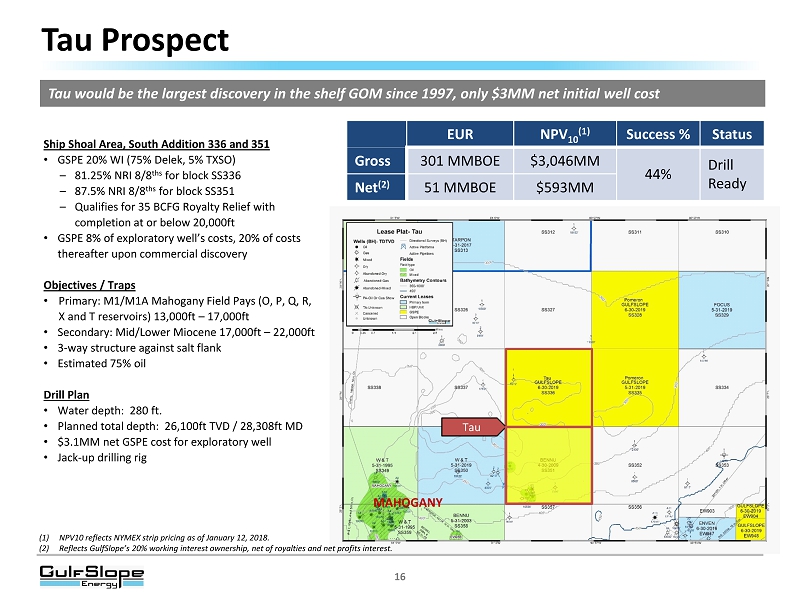

16 Tau Prospect Ship Shoal Area , South Addition 336 and 351 • GSPE 20 % WI (75% Delek, 5% TXSO) – 81.25% NRI 8/8 ths for block SS336 – 87.5% NRI 8/8 ths for block SS351 – Qualifies for 35 BCFG Royalty Relief with completion at or below 20,000ft • GSPE 8% of exploratory well’s costs, 20% of costs thereafter upon commercial discovery Objectives / Traps • Primary: M1/M1A Mahogany Field Pays (O, P, Q, R, X and T reservoirs) 13,000ft – 17,000ft • Secondary : Mid/Lower Miocene 17,000ft – 22,000ft • 3 - way structure against salt flank • Estimated 75% oil Drill Plan • Water depth: 280 ft. • Planned total depth: 26,100ft TVD / 28,308ft MD • $3.1MM net GSPE cost for exploratory well • Jack - up drilling rig Tau would be the largest discovery in the shelf GOM since 1997, only $3MM net initial well cost EUR NPV 10 (1) Success % Status Gross 301 MMBOE $3,046MM 44% Drill Ready Net (2) 51 MMBOE $593 MM MAHOGANY Tau (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.

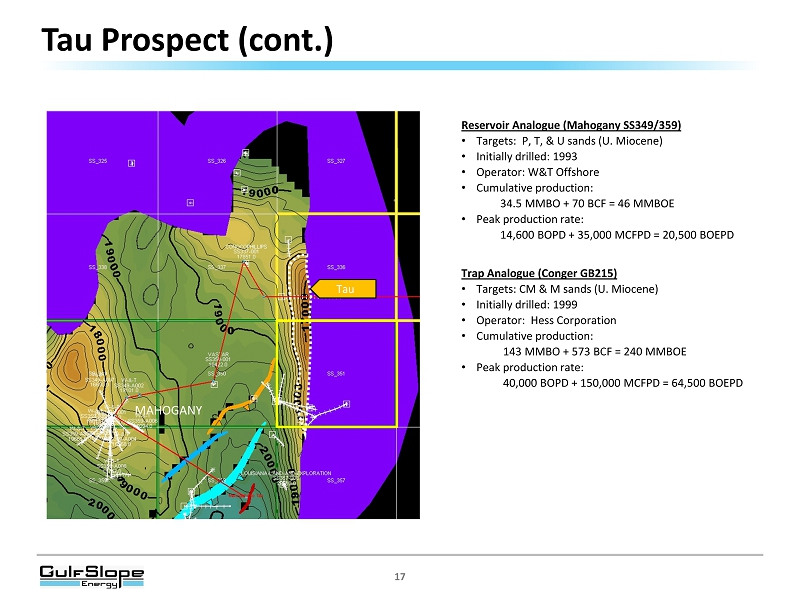

17 Tau Prospect (cont.) Tau MAHOGANY Reservoir Analogue (Mahogany SS349/359) • Targets: P, T, & U sands (U. Miocene) • Initially drilled: 1993 • Operator: W&T Offshore • Cumulative production: 34.5 MMBO + 70 BCF = 46 MMBOE • Peak production rate: 14,600 BOPD + 35,000 MCFPD = 20,500 BOEPD Trap Analogue (Conger GB215) • Targets: CM & M sands (U. Miocene) • Initially drilled: 1999 • Operator: Hess Corporation • Cumulative production: 143 MMBO + 573 BCF = 240 MMBOE • Peak production rate: 40,000 BOPD + 150,000 MCFPD = 64,500 BOEPD

18 Value Proposition $162 $3,208 $4,131 $5,091 $6,011 $7,188 $8,946 $9,085 $9,225 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 Canoe Shallow Tau Tanker Graviton Photon Tachyon Quark Pomeron Selectron Shallow $ Millions Prospect Net Present Value @ 10% Cumulative NPV @ 10% NPV @ 10% Potential for more than $9 billion in net present value for ready to drill prospects Phase 1 Resource figures are based on Company estimates and reflect gross unrisked recoverable resources for 100% working interest . NPV10 assumes NYMEX strip pricing as of January 12, 2018, and reflect unrisked recoverable resources for 100% working interest, net of royalties and net profits interest.

19 OTCQB: GSPE GulfSlope Energy John H. Malanga 281.918.4103 john.malanga@gulfslope.com www.GulfSlope.com MZ Group Derek Gradwell 512.270.6990 dgradwell@mzgroup.us

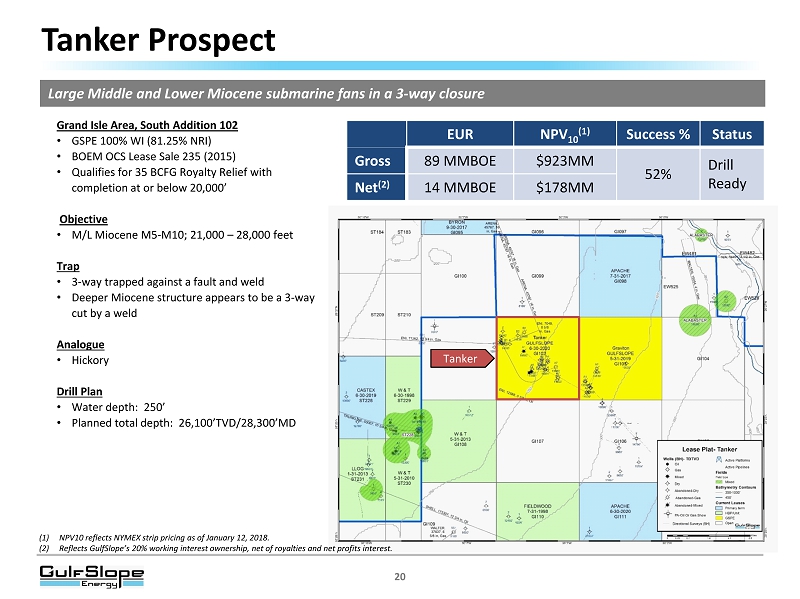

20 Tanker Prospect Grand Isle Area, South Addition 102 • GSPE 100% WI (81.25% NRI) • BOEM OCS Lease Sale 235 (2015) • Qualifies for 35 BCFG Royalty Relief with completion at or below 20,000’ Objective • M/L Miocene M5 - M10; 21,000 – 28,000 feet Trap • 3 - way trapped against a fault and weld • Deeper Miocene structure appears to be a 3 - way cut by a weld Analogue • Hickory Drill Plan • Water depth: 250’ • Planned total depth: 26,100’TVD/28,300’MD EUR NPV 10 (1) Success % Status Gross 89 MMBOE $923MM 52% Drill Ready Net (2) 14 MMBOE $178 MM Large Middle and Lower Miocene submarine fans in a 3 - way closure Tanker (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.

21 Graviton Graviton Prospect Grand Isle Area, South Addition 103 • GSPE 100% WI (81.25% NRI) • BOEM OCS Lease Sale 231 (2014) • Qualifies for 35 BCFG Royalty Relief with completion at or below 20,000ft Primary Objectives • Upper Miocene pays at Hickory (M3) 16,000ft • Deeper sands in GI 106 #1 (M4 – M8) 20,000ft Secondary Objectives • Lower Miocene (M10 - 11) Blue Level 26,000ft as seen in Statoil GC 36 Trap • 3 - way closure • Estimated 27% oil Analogue • Reservoir and trap: Hickory (GI 110,116) Drill Plan • Water depth: 300ft • Planned total depth: 26,200ft TV/28,263ft MD • 7 miles WSW ST229 fixed platform “A” • 8 miles SW Hickory fixed platform “A ” EUR NPV 10 (1) Success % Status Gross 190 MMBOE $960MM 39% Drill Ready Net (2) 31 MMBOE $189 MM Large Upper and Mid - Miocene submarine channel - fans in a 3 - way closure (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.

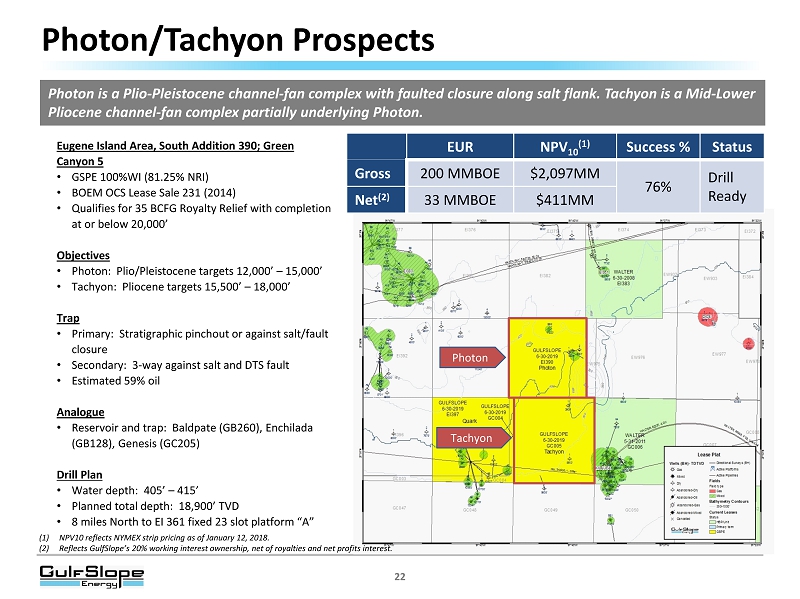

22 Tachyon Photon Photon/Tachyon Prospects Eugene Island Area, South Addition 390; Green Canyon 5 • GSPE 100%WI (81.25% NRI) • BOEM OCS Lease Sale 231 (2014) • Qualifies for 35 BCFG Royalty Relief with completion at or below 20,000’ Objectives • Photon: Plio/Pleistocene targets 12,000’ – 15,000’ • Tachyon: Pliocene targets 15,500’ – 18,000’ Trap • Primary: Stratigraphic pinchout or against salt/fault closure • Secondary: 3 - way against salt and DTS fault • Estimated 59% oil Analogue • Reservoir and trap: Baldpate (GB260), Enchilada (GB128), Genesis (GC205) Drill Plan • Water depth: 405’ – 415’ • Planned total depth: 18,900’ TVD • 8 miles North to EI 361 fixed 23 slot platform “A” EUR NPV 10 (1) Success % Status Gross 200 MMBOE $2,097MM 76% Drill Ready Net (2) 33 MMBOE $411 MM Photon is a Plio - Pleistocene channel - fan complex with faulted closure along salt flank. Tachyon is a Mid - Lower Pliocene channel - fan complex partially underlying Photon. (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.

23 Quark Prospect Eugene Island Block 390, 397 and Green Canyon 4, 5 • GulfSlope 100% WI (81.25% NRI) • BOEM OCS Lease Sale 231 (2014) • Qualifies for 35 BCFG Royalty Relief with completion at or below 20,000’ Objectives • Pliocene targets: 17,000’ – 22,000’ Trap • Fault and Stratigraphic • Estimated 59% oil Analogue • Reservoir and trap: Auger, Mars Well Plan • Water depth 430’ • Planned total depth: 23,000’ TVD • 8 miles north to EI 361 fixed 23 slot platform “A ” EUR NPV 10 (1) Success % Status Gross 156 MMBOE $1,758MM 44% Drill Ready Net (2) 25 MMBOE $343 MM Lower Pliocene submarine fan complex supported by seismic amplitude anomalies Quark (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.

24 Pomeron Prospect Ship Shoal Area, South Addition 328 and 335 • GSPE 100% WI (81.25% NRI) • BOEM OCS Lease Sale 231 (2014) • Qualifies for 35 BCFG Royalty Relief with completion at or below 20,000ft Objectives • DHI Supported • Lower Pliocene: PL5 - A @ 13,500ft PL5 - B @ 14,000ft Trap • 3 - Way against salt and fault • Estimated 19% oil Analogue • Trap: Baldpate(GB 260) • Reservoir: Diana/Hoover (EB 945), Holstein (GC 644/645) Drill Plan • Water depth: 300ft • Planned total depth: 15,400ft TV/ 16,600ft MD • 8 miles to facility at SS 351 EUR NPV 10 (1) Success % Status Gross 32 MMBOE $139MM 62% Drill Ready Net (2) 5.2 MMBOE $27 MM DHI - supported Lower Pliocene fan - channel complex on a 3 - way closure along a salt flank Pomeron (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.

25 Selectron Shallow Prospect Vermillion Area, South Addition 375 • 100% WI (81.25% NRI) • BOEM OCS Lease Sale 231 (2014) Suprasalt Objectives • Pleistocene (DHI - supported) • “S” Series sand @ 3100 - 3900’ normal pressure • “C” Series sand @ 4200 - 4500’ Trap • Simple fault traps • Estimated 100% oil Analogue • VR375, VR 376 and VR 380 fields Drill Plan • Water depth: 300 - 315’ • Planned total depth: 5,100’ (straight hole) • 1.5 miles to fixed platform “A” (VR 376) • 2.6 miles to fixed platform “A” (VR 380) • 4.2 miles to fixed platform (VR 379) Subsalt Opportunity • Miocene objective • EUR: 90 mmboe (primarily oil) EUR NPV 10 (1) Success % Status Gross 9.4 MMBOE $140MM 80% Drill Ready Net (2) 1.4 MMBOE $31 MM Upper Pleistocene delta sands in set of simple fault traps with multiple DHI - supported targets Selectron VR 380 FIELD 17mmbo + 174 bcfg 1981 - 2014 4000 – 10,000’ Pleistocene Ownership VR 376 Rooster to 9000’ >9000’ BHP 66.7%, COP 33.3% (1) NPV10 reflects NYMEX strip pricing as of January 12, 2018. (2) Reflects GulfSlope’s 20% working interest ownership, net of royalties and net profits interest.