Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST FINANCIAL BANCORP /OH/ | a8-kinvestorpresentation26.htm |

Investor Presentation

Fourth Quarter 2017

EXHIBIT 99.1

2

Certain statements contained in this presentation which are not statements of historical fact constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, certain plans, expectations, goals, projections and benefits

relating to the transaction between the Company and MainSource, which are subject to numerous assumptions, risks and uncertainties. Words such as

„„believes,‟‟ „„anticipates,‟‟ “likely,” “expected,” “estimated,” „„intends‟‟ and other similar expressions are intended to identify forward-looking statements but are not

the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to, statements we make about (i) our

future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our capital

structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward-looking statements.

As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in

circumstances that may cause actual results to differ materially from those set forth in the forward-looking statements. Forward-looking statements are not

historical facts but instead express only management‟s beliefs regarding future results or events, many of which, by their na ture, are inherently uncertain and

outside of the management‟s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes

indicated in these forward-looking statements. Important factors that could cause actual results to differ materially from those in our forward-looking statements

include the following, without limitation: (i) economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company‟s

business; (ii) the effect of and changes in policies and laws or regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act

and other legislation and regulation relating to the banking industry; (iii) management‟s ability to effectively execute its business plans; (iv) mergers and

acquisitions, including costs or difficulties related to the integration of acquired companies; (v) the Company‟s ability to comply with the terms of loss sharing

agreements with the FDIC; (vi) the effect of changes in accounting policies and practices; (vii) changes in consumer spending, borrowing and saving and

changes in unemployment; (viii) changes in customers‟ performance and creditworthiness; and (ix) the costs and effects of litigation and of unexpected or

adverse outcomes in such litigation. Additional factors that may cause our actual results to differ materially from those described in our forward-looking

statements can be found in the Form 10-K for the year ended December 31, 2016, as well as its other filings with the SEC, which are available on the SEC

website at www.sec.gov.

Statements concerning the potential merger of the Company and MainSource may also be forward-looking statements. Please refer to each of the Company‟s

and MainSource‟s Annual Report on Form 10-K for the year ended December 31, 2016, as well as their other filings with the SEC, for a more detailed discussion

of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements.

In addition to factors previously disclosed in reports filed by the Company and MainSource with the SEC, risks and uncertainties for the Company, MainSource

and the combined company include, but are not limited to: the possibility that any of the anticipated benefits of the proposed Merger will not be realized or will not

be realized within the expected time period; the risk that integration of MainSource's operations with those of the Company will be materially delayed or will be

more costly or difficult than expected; the inability to close the Merger in a timely manner; diversion of management's attention from ongoing business operations

and opportunities; the failure to satisfy other conditions to completion of the , including receipt of required regulatory and other approvals; the failure of the

proposed Merger to close for any other reason; the challenges of integrating and retaining key employees; the effect of the announcement of the Merger on the

Company‟s, MainSource‟s or the combined company's respective customer relationships and operating results; the possibility that the Merger may be more

expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions

and fluctuations. All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the

filing. Except as required by law, neither the Company nor MainSource assumes any obligation to update any forward-looking statement.

Forward Looking Statement Disclosure

3

About First Financial Bancorp

Financial Performance

MainSource Merger Update

Appendix

Presentation Contents

4

Company Overview

NASDAQ: FFBC

Overview

Founded: 1863

Headquarters: Cincinnati, Ohio

Banking Centers: 94

Assets: $8.9 billion

Loans: $6.0 billion

Deposits: $6.9 billion

Wealth Mgmt: $2.7 billion AUM

Lines of Business

Commercial / Private Banking

C&I, O-CRE, ABL, Equipment Finance,

Treasury, Wealth Management

Retail Banking

Consumer, Mortgage, Small Business

Investment Commercial Real Estate

Commercial Finance

Quick Service Restaurant,

Insurance Agency Finance

$ in millions except “per share” and where otherwise noted in the presentation

www.bankatfirst.com

$26.35 $26.15 $27.70 $27.45

$28.45

2.58% 2.60% 2.45% 2.48% 2.25%

4Q173Q172Q171Q174Q16

Share Price Dividend Yield

Central OH

Loans $1.1 billion

Loan Growth (Y-o-Y) 6.7%

Deposits $0.5 billion

Deposit Market Share #13 (0.8%)

Banking Centers 5

Fortune 500 Companies 4

5

Our Markets

Indianapolis

Loans $0.5 billion

Loan Growth (Y-o-Y) 16.6%

Deposits $0.5 billion

Deposit Market Share #13 (1.3%)

Banking Centers 7

Fortune 500 Companies 3

Community Markets

Loans $1.2 billion

Loan Growth (Y-o-Y) (5.1%)

Deposits $2.8 billion

Banking Centers 36

Greater Cincinnati

Loans $2.0 billion

Loan Growth (Y-o-Y) 1.8%

Deposits $2.6 billion

Deposit Market Share #6 (2.0%)

Banking Centers 46

Fortune 500 Companies 9

Proven Acquirer

Two FDIC-assisted acquisitions totaling $2.5 billion in assets & generating a $343 million pre-

tax bargain purchase gain (2009)

Two branch acquisitions of 38 offices in Indiana & Ohio (2011)

Three banks in Columbus, Ohio totaling $727 million in assets (2014)

Oak Street Funding, specialty lender focused on the insurance industry, $243 million in assets

(2015)

Pending merger with MainSource Financial Group – close/integration in 1H 2018

Effective Operator

109 consecutive quarters of profitability through 4Q 2017

Replaced the runoff of ~ $2 billion of high yield covered loans

Consolidated 78 banking centers in conjunction with efficiency efforts since 2009

Developed robust enterprise risk management & compliance programs, with board risk

committee since 2010

6

Through the Cycle

Product expansions (since 2009)

Specialty lending (~ $1.2 billion across Franchise, Oak Street, ABL, and Equipment Finance)

Mobile banking & other technology enhancements for clients

Re-entry into mortgage business (2010)

2017 originations of $229 million

Wealth infrastructure improvements

Investment model

Real estate management, tax & insurance outsourcing

Significant technology & infrastructure investments

Continued expansion of risk management & compliance

7

Investments in our Business

Mortgage Origination Platform

Talent & Finance ERP Platform

Enterprise Data Management

Commercial & Consumer CRM

Proven & sustainable business model

Well managed through the cycle

Conservative operating philosophy

Consistent profitability – 109 consecutive quarters

Robust capital management

Prudent steward of shareholders‟ capital

Strong asset quality

Well defined M&A strategy

Selective markets, products & asset diversification

Direct linkage between compensation and performance

Short/long term incentive plans, management stock ownership targets

8

Invest with First Financial

9

1 Includes dividend reinvestment

2 Peer group includes KBW regional bank index peers

3 Based on stock price as of 12/29/2017

4 Based on stock price as of 01/26/2018

Invest with First Financial

Total Shareholder Return1,2

117.5%

55.4%

-4.9%

7.8%

117.5%

50.5%

1.4% 3.9%

148.4%

66.1%

6.6% 7.3%

5 Year 3 Year 1 Year YTD 2018

FFBC KBW Peer Median KBW Peer Top Quartile

3 4 3 3

10

Strategic Priorities

Deliver long term top quartile shareholder returns

Successfully integrate MainSource merger – achieve operational, cultural, & financial

objectives

Deploy capital in an opportunistic & risk-appropriate manner

Invest in innovative solutions that enable our clients to bank with us on their terms

Promote leadership & development within our communities

Proactively develop leadership talent across the organization

Achieve best-in-class compliance & risk management programs

Remain vigilant in our credit philosophy & oversight

Focused growth efforts in metropolitan markets

Maintain process improvement & expense management discipline

11

About First Financial Bancorp

Financial Performance

MainSource Merger Update

Appendix

12

4Q 2017 Highlights – 109th Consecutive Quarter of Profitability

Total assets increased $135.2 million, to $8.9 billion, or 6.1% annualized, compared to the linked quarter.

EOP loans increased $36.1 million, or 2.4% annualized, compared to the linked quarter.

EOP deposits increased $169.0 million, or 10.0% annualized, compared to the linked quarter.

EOP investment securities increased $46.8 million, or 9.2% annualized, compared to the linked quarter.

Balance Sheet

Profitability

Asset Quality

Income Statement

Capital

Noninterest income = $18.4 million.

Noninterest expense = $82.9 million.

Efficiency ratio = 88.2%. Adjusted efficiency ratio = 58.0%2

Effective tax rate of (119.5)%. Adjusted effective tax rate of 30.2%2

Net interest income = $75.6 million, a $5.1 million increase compared to the linked quarter.

Net interest margin of 3.75% on a GAAP basis; 3.82% on a fully tax equivalent basis, a 25 bp increase from the

linked quarter.

Average earning assets grew 4.8% on an annualized basis.

Net income = $24.8 million or $0.40 per diluted share. Adjusted net income = $27.7 million or $0.45 per diluted share2

Return on average assets = 1.13%. Adjusted return on average assets = 1.26%2

Return on average shareholders‟ equity = 10.70%. Adjusted return on average shareholders‟ equity = 11.95%2

Return on average tangible common equity = 13.85%1. Adjusted return on average tangible common equity = 15.46%2

Provision expense = $(0.2) million. Net charge offs = $0.3 million. NCOs / Avg. Loans = 0.02% annualized.

Nonperforming Loans / Total Loans = 0.69%. Nonperforming Assets / Total Assets = 0.50%.

ALLL / Nonaccrual Loans = 224.32%. ALLL / Total Loans = 0.90%. Classified Assets / Total Assets = 0.98%.

Total capital ratio = 13.07%.

Tier 1 capital ratio = 10.63%.

Tangible common equity ratio = 8.30%.

Tangible book value per share = $11.62.

1) See Appendix for non-GAAP reconciliation

2) See Slide 4 for Adjusted Earnings detail.

13

Profitability

Net Income & EPS Return on Average Assets

Return on Tangible Common Equity

All dollars shown in millions, except per share data

$24.8 $24.8

$22.7

$24.4

$23.3

$0.40 $0.40

$0.37

$0.39 $0.38

4Q173Q172Q171Q174Q16

Net Income EPS - diluted

$8,732 $8,717 $8,583 $8,409 $8,360

1.13% 1.13%

1.06%

1.18%

1.11%

4Q173Q172Q171Q174Q16

Average Assets ROAA

$711 $698 $680 $661 $653

13.85% 14.10% 13.42%

14.98%

14.19%

4Q173Q172Q171Q174Q16

Average Tangible Equity ROATCE

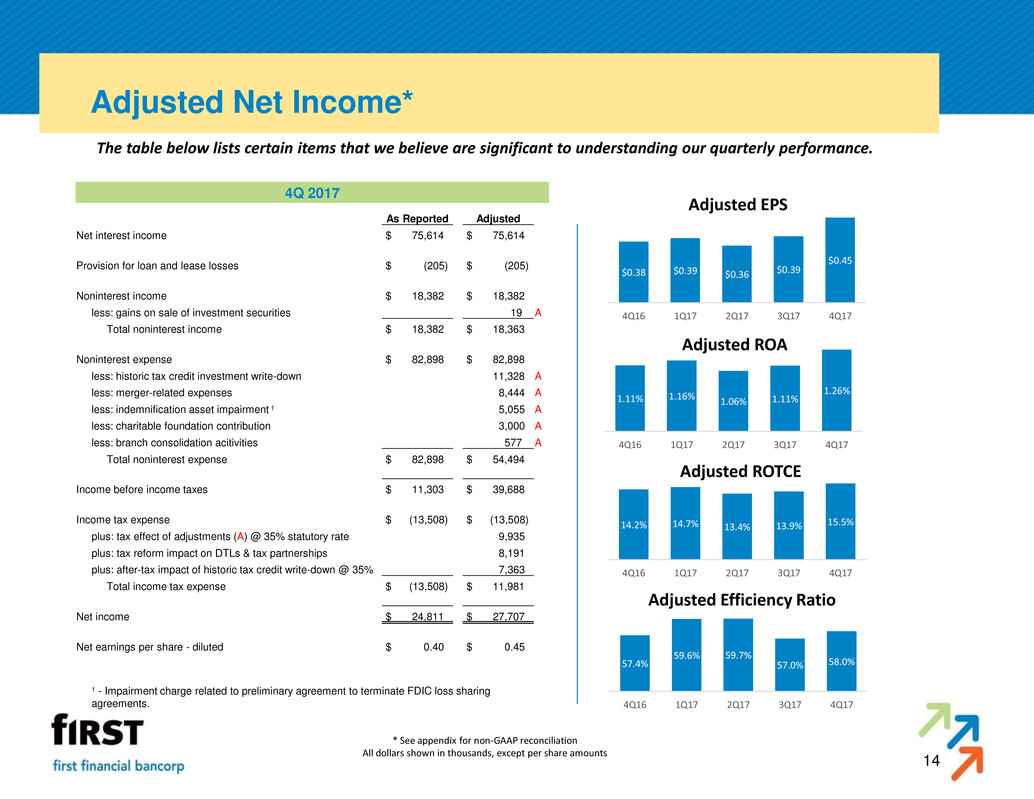

Adjusted Net Income*

* See appendix for non-GAAP reconciliation

All dollars shown in thousands, except per share amounts

The table below lists certain items that we believe are significant to understanding our quarterly performance.

4Q 2017

As Reported Adjusted

Net interest income $ 75,614 $ 75,614

Provision for loan and lease losses $ (205) $ (205)

Noninterest income $ 18,382 $ 18,382

less: gains on sale of investment securities 19 A

Total noninterest income $ 18,382 $ 18,363

Noninterest expense $ 82,898 $ 82,898

less: historic tax credit investment write-down 11,328 A

less: merger-related expenses 8,444 A

less: indemnification asset impairment 1 5,055 A

less: charitable foundation contribution 3,000 A

less: branch consolidation acitivities 577 A

Total noninterest expense $ 82,898 $ 54,494

Income before income taxes $ 11,303 $ 39,688

Income tax expense $ (13,508) $ (13,508)

plus: tax effect of adjustments (A) @ 35% statutory rate 9,935

plus: tax reform impact on DTLs & tax partnerships 8,191

plus: after-tax impact of historic tax credit write-down @ 35% 7,363

Total income tax expense $ (13,508) $ 11,981

Net income $ 24,811 $ 27,707

Net earnings per share - diluted $ 0.40 $ 0.45

1 - Impairment charge related to preliminary agreement to terminate FDIC loss sharing

agreements.

$0.45

$0.39 $0.36 $0.39 $0.38

4Q173Q172Q171Q174Q16

Adjusted EPS

1.26%

1.11% 1.06% 1.16% 1.11%

4Q173Q172Q171Q174Q16

Adjusted ROA

15.5% 13.9% 13.4% 14.7% 14.2%

4Q173Q172Q171Q174Q16

Adjusted ROTCE

58.0% 57.0%

59.7% 59.6%

57.4%

4Q173Q172Q171Q174Q16

Adjusted Efficiency Ratio

14

15

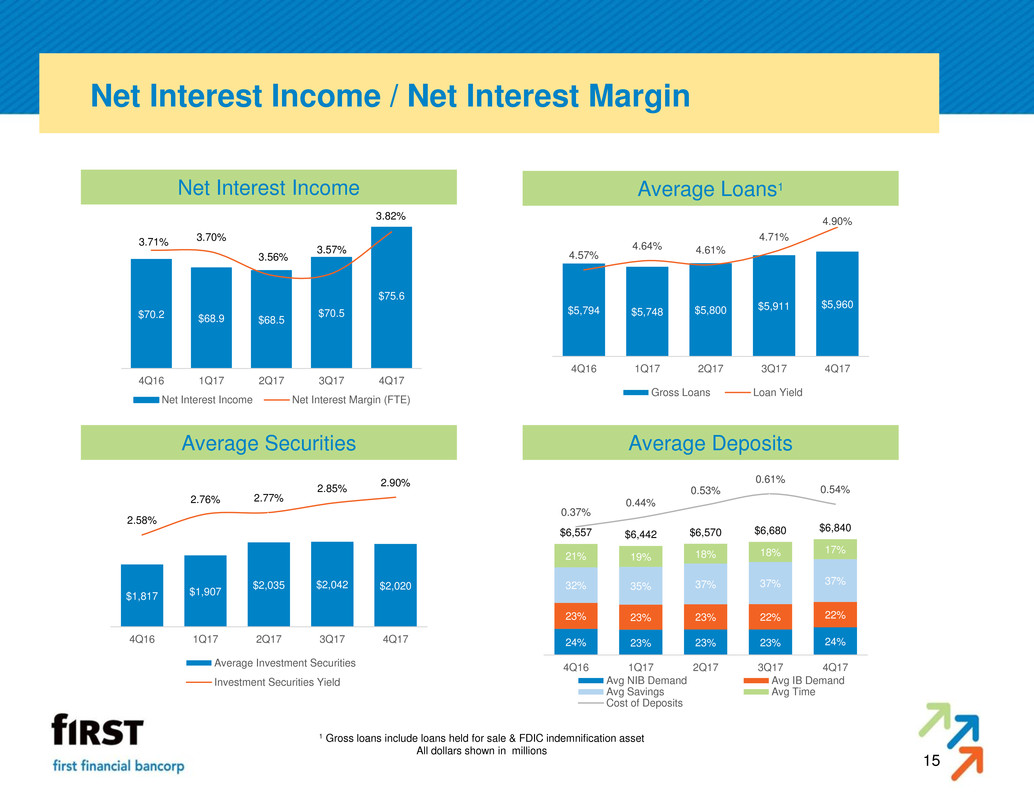

Net Interest Income / Net Interest Margin

1 Gross loans include loans held for sale & FDIC indemnification asset

All dollars shown in millions

Net Interest Income Average Loans1

Average Securities Average Deposits

$75.6

$70.5

$68.5 $68.9

$70.2

3.82%

3.57%

3.56%

3.70% 3.71%

4Q173Q172Q171Q174Q16

Net Interest Income Net Interest Margin (FTE)

$5,960 $5,911 $5,800 $5,748 $5,794

4.90%

4.71%

4.61% 4.64%

4.57%

4Q173Q172Q171Q174Q16

Gross Loans Loan Yield

$2,020 $2,042 $2,035

$1,907 $1,817

2.90%

2.85%

2.77% 2.76%

2.58%

4Q173Q172Q171Q174Q16

Average Investment Securities

Investment Securities Yield

24% 23% 23% 23% 24%

22% 22% 23% 23% 23%

37% 37% 37% 35% 32%

17% 18% 18% 19% 21%

$6,840 $6,680 $6,570 $6,442 $6,557

0.54%

0.61%

0.53%

0.44%

0.37%

4Q173Q172Q171Q174Q16

Avg NIB Demand Avg IB Demand

Avg Savings Avg Time

Cost of Deposits

16

Net Interest Margin

Net Interest Margin (FTE) 4Q17 NIM (FTE) Progression

3.58%

3.43% 3.41%

3.48% 3.48%

0.24%

0.14% 0.15%

0.22% 0.23%

3.82%

3.57% 3.56%

3.70% 3.71%

4Q173Q172Q171Q174Q16

Basic Margin (FTE) Loan Fees

3Q17 3.57%

Earning asset mix 0.05%

Interest recapture 0.02%

Interest recapture from loans previously

classified as nonaccrual

Loan fees 0.10% Predominately loan prepayment fees

Asset Drivers 0.17%

Deposit Cost 0.06%

Impact from deposit pricing strategies

implemented in 3Q17

Funding Mix 0.02%

Favorable mix shift toward lower cost

deposits

Liability Drivers 0.08%

4Q17 3.82%

17

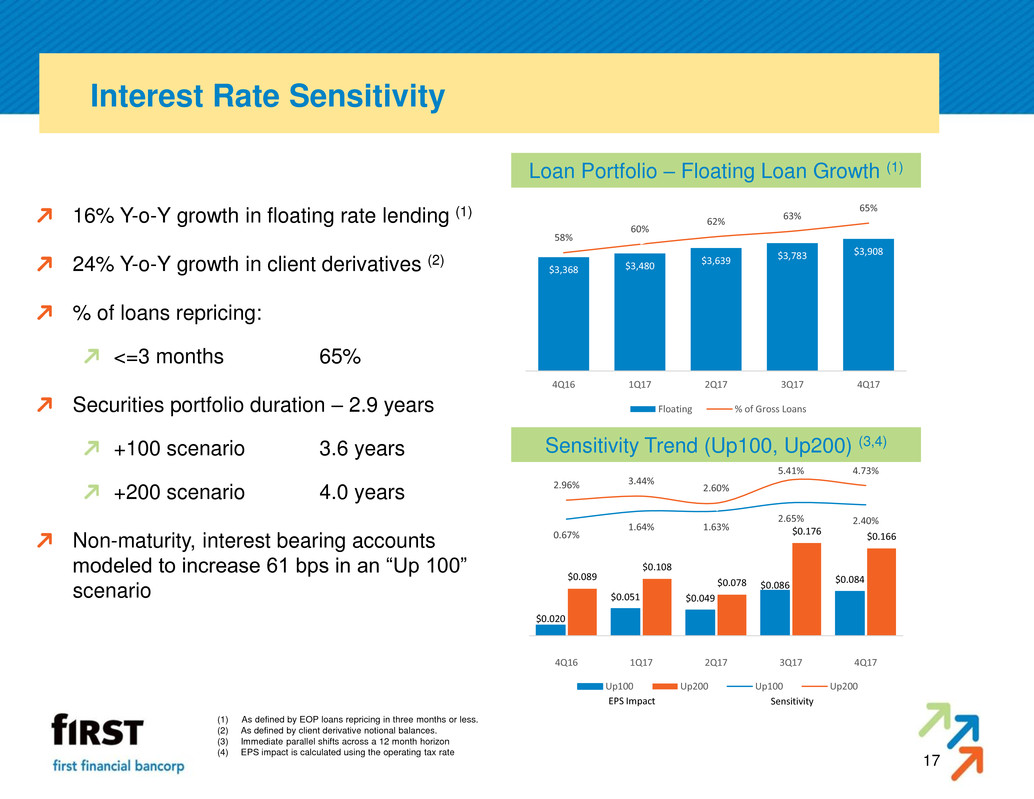

Interest Rate Sensitivity

Loan Portfolio – Floating Loan Growth (1)

Sensitivity Trend (Up100, Up200) (3,4)

16% Y-o-Y growth in floating rate lending (1)

24% Y-o-Y growth in client derivatives (2)

% of loans repricing:

<=3 months 65%

Securities portfolio duration – 2.9 years

+100 scenario 3.6 years

+200 scenario 4.0 years

Non-maturity, interest bearing accounts

modeled to increase 61 bps in an “Up 100”

scenario

(1) As defined by EOP loans repricing in three months or less.

(2) As defined by client derivative notional balances.

(3) Immediate parallel shifts across a 12 month horizon

(4) EPS impact is calculated using the operating tax rate

$3,368 $3,480

$3,639 $3,783

$3,908

58%

60%

62%

63%

65%

4Q16 1Q17 2Q17 3Q17 4Q17

Floating % of Gross Loans

$0.020

$0.051 $0.049

$0.086

$0.084 $0.089

$0.108

$0.078

$0.176

$0.166 0.67%

1.64% 1.63%

2.65% 2.40%

2.96% 3.44% 2.60%

5.41% 4.73%

4Q16 1Q17 2Q17 3Q17 4Q17

Up100 Up200 Up100 Up200

EPS Impact Sensitivity

18

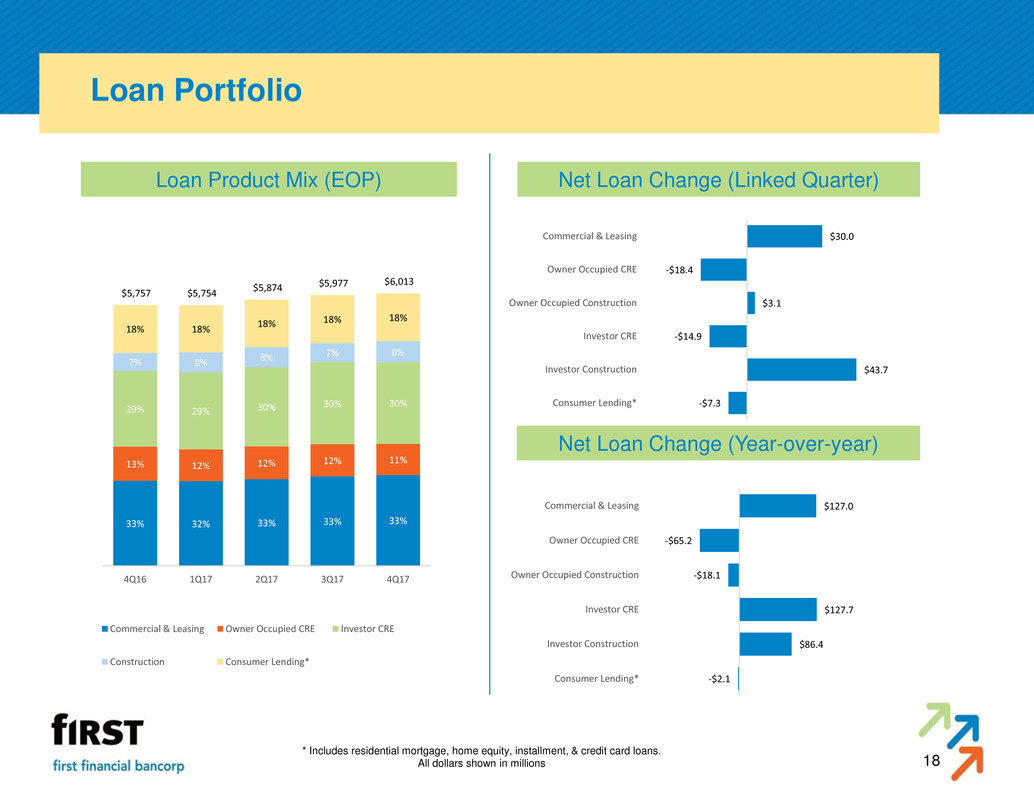

Loan Portfolio

Loan Product Mix (EOP) Net Loan Change (Linked Quarter)

* Includes residential mortgage, home equity, installment, & credit card loans.

All dollars shown in millions

Net Loan Change (Year-over-year)

33% 33% 33% 32% 33%

11% 12% 12% 12% 13%

30% 30% 30% 29% 29%

8% 7% 8%

8% 7%

18% 18% 18%

18% 18%

$6,013 $5,977 $5,874

$5,754 $5,757

4Q173Q172Q171Q174Q16

Commercial & Leasing Owner Occupied CRE Investor CRE

Construction Consumer Lending*

$30.0

-$18.4

$3.1

-$14.9

$43.7

-$7.3

Commercial & Leasing

Owner Occupied CRE

Owner Occupied Construction

Investor CRE

Investor Construction

Consumer Lending*

$127.0

-$65.2

-$18.1

$127.7

$86.4

-$2.1

Commercial & Leasing

Owner Occupied CRE

Owner Occupied Construction

Investor CRE

Investor Construction

Consumer Lending*

19

Loan Portfolio

Loan Portfolio By Geography 1

Average Loan Size & Rate 2

Nationwide Lending Platforms

1 Includes loans held for sale. Excludes purchase accounting loan marks.

2 Average loan balances in $000s, rate represents weighted average coupon & does not

include loan fees

3 Includes Oak Street, Franchise, shared national credits & other loans outside Ohio,

Indiana, & Kentucky.

$437

7%

$533

9%

$5,043

84%

Oak Street

Franchise

All Other Loans

$388 $412

$878

$1,060

$543

$117 $33

4.4% 4.3%

4.2%

5.2%

7.4%

4.0%

4.9%

C&I* OOCRE* ICRE* Franchise Oak Street Mortgage Home

EquityAverage Balance Weighted Average Rate

* Ex.Franchise & OSF

3

$2,818

47%

$1,451

24%

$209

3%

$1,558

26%

Ohio

Indiana

Kentucky

National Business 3

20

Loan Portfolio

C&I Loans By Industry 1 CRE Loans By Collateral 2

1 Industry types included in Other representing greater than 1% of total C&I loans include Agriculture, Retail Trade, Public Administration, Other

Services, Educational Services, Waste Management, Arts, and Transportation.

2 Collateral types included in Other representing greater than 1% of total CRE loans include Student Housing, Farmland, Manufacturing Facility,

Strip Center, Real Estate IUB Other, Recreation Facility, Vacant Land Held for Development, Church/Related, School/Education, and

Convenience Store.

Finance and

Insurance

24%

Accommodation and

Food Services

21%

Manufacturing

12%

Wholesale

Trade

8%

Real Estate and

Rental and Leasing

6%

Construction

4%

Professional,

Scientific, and

Technical Services

4%

Health Care and

Social Assistance

4%

Other

17%

Total C&I Loans: $1.9B

Retail

16%

Residential, Multi

Family 5+

15%

Office

13%

Hotel/Motel

7%

Restaurant

6%

Warehouse

5%

Industrial Facility

5%

Residential, 1-4

Family

4%

Medical Office

3%

Nursing/Assisted

Living

3%

All others

23%

Total CRE Loans: $3.0B

21

Investment Portfolio

Total EOP investments of $2.1 billion

Investment Portfolio / Total Assets = 23.1%

Effective yield = 2.90%

Portfolio duration = 2.9 years

Portfolio Composition Portfolio Quality

Agency, 56%

AAA, 20%

AA-, 4%

BBB, 3%

AA+, 3%

FRB/FHLB Stock, 3%

A+, 2%

AA, 2%

NR, 2%

BBB+, 2%

Other, 3%

Commercial MBS

20%

Asset-backed

Securities

18%

Agency CMOs

18%

Agency Pass-

through Securities

15%

Municipal

Securities

10% Non-Agency Pass-

through Securities

7%

Non-Agency CMOs

4%

Corporate

Securities

3%

Regulatory Stock

3% U.S. Government

Agency Debt

1%

Other

1%

U.S. Government

Debt

0%

22

Asset Quality

Nonperforming Assets / Total Assets Classified Assets / Total Assets

Allowance / Total Loans Net Charge Offs & Provision Expense

All dollars shown in millions

$87.3

$94.3

$98.4

$114.6

$125.2

0.98%

1.08% 1.13%

1.34%

1.48%

4Q173Q172Q171Q174Q16

Classified Assets Classified Assets / Total Assets

$44.4

$52.9

$62.7

$68.4

$54.3

0.50%

0.60%

0.72%

0.80%

0.64%

4Q173Q172Q171Q174Q16

NPAs NPAs / Total Assets

$54.0 $54.5 $54.9 $56.3 $58.0

0.90% 0.91% 0.93%

0.98% 1.01%

4Q173Q172Q171Q174Q16

Allowance for Loan Losses ALLL / Total Loans

$0.3

$3.3 $1.9 $2.0 $2.4

-$0.2

$3.0

$0.5 $0.4

$2.8

0.02%

0.22%

0.13% 0.14% 0.17%

4Q173Q172Q171Q174Q16

NCOs Provision Expense

23

Capital

Tier 1 Common Equity

Tangible Book Value Total Capital

Tangible Common Equity

All capital numbers are considered preliminary

All dollars shown in millions

$721.3

$705.2

$688.1

$669.7

$654.6

$11.62 $11.36

$11.07

$10.78

$10.56

4Q173Q172Q171Q174Q16

Tangible Book Value Tangible Book Value per Share

$721.3

$705.2

$688.1

$669.7

$654.6

8.30% 8.25% 8.09% 8.05% 7.96%

4Q173Q172Q171Q174Q16

Tangible Book Value Tangible Common Ratio

$929.1 $920.6 $905.2 $892.2 $881.2

13.07% 12.98% 13.05% 13.19% 13.10%

12.50%

4Q173Q172Q171Q174Q16

Total Capital Total Capital Ratio Target

$755.7

$746.7

$731.0 $716.7

$703.9

10.63% 10.53% 10.54% 10.59% 10.46%

10.50%

4Q173Q172Q171Q174Q16

Tier 1 Common Equity Tier 1 Common Ratio Target

Outlook

Taxes

Full year 2018 loan growth expected to be in the mid-single digits on a

percentage basis

1Q18 NIM (FTE) projected to be 3.70% – 3.75%

Includes lower FTE adjustment due to tax reform

1Q18 loan fees likely to approximate 2Q17 & 3Q17 levels

1Q18 interest income will reflect 2 fewer days vs. 4Q17

Asset sensitive balance sheet, realization dependent on loan & deposit competition

Noninterest expense base of approximately $51 million near-term,

excluding one time expenses

4Q17 noninterest expense includes approximately $4 million related to higher

incentive compensation and performance based 401(k) contribution

Noninterest

Expense

Net Interest Margin

Balance Sheet

Preliminary full year 2018 effective tax rate of approximately 21%

Will continue to refine as tax reform guidance becomes available

4Q17 adjusted earnings1 included $1.1 million net, after-tax benefit from historic

tax credit investment realized during the period

Credit

Stable credit outlook

Loan losses expected to revert to historical levels over time

1 See slide 4 for further detail.

24

25

About First Financial Bancorp

Financial Performance

MainSource Merger Update

Appendix

Complementary Midwest Footprint

1) All branches located in Northwest Indiana and within the Chicago MSA

Note: Deposit market share data shown pro forma as of 6/30/16

Source: SNL Financial

Deposit Concentration By State OH,

56%

IN, 41%

KY, 3%

FFBC Pro Forma

Dollars in Millions

Top 10 Pro Forma Markets

MSA Rank Branches Deposits

Cincinnati, OH 4 60 $2,884

Indianapolis, IN 13 18 789

Northwest IN ¹ 37 11 781

Louisvil le, KY 9 18 690

Columbus, IN 1 10 671

Dayton, OH 7 10 464

Columbus, OH 15 6 459

Greensburg, IN 1 5 345

Celina, OH 2 4 299

Bloomington, IN 3 3 290

Cincinnati, OH Indianapolis, IN

FFBC (102)

MSFG (101)

Columbus, IN

OH,

42%

IN, 49%

KY,

7%

IL, 1%

26

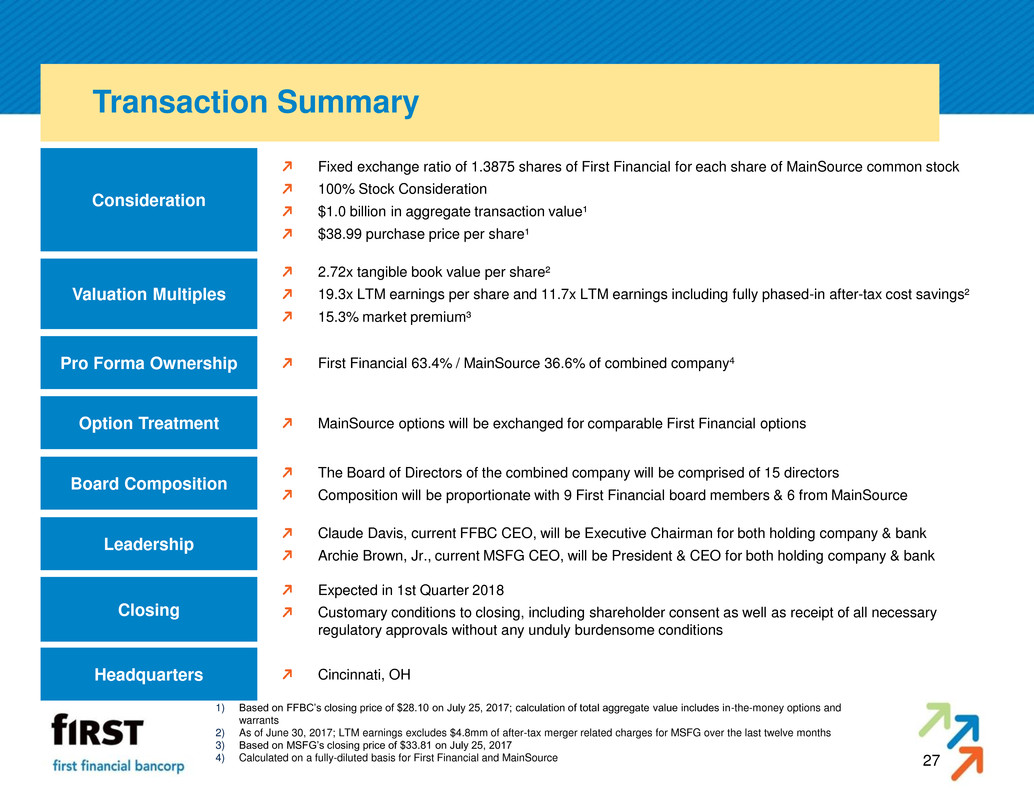

Transaction Summary

Fixed exchange ratio of 1.3875 shares of First Financial for each share of MainSource common stock

100% Stock Consideration

$1.0 billion in aggregate transaction value¹

$38.99 purchase price per share¹

MainSource options will be exchanged for comparable First Financial options

First Financial 63.4% / MainSource 36.6% of combined company4

The Board of Directors of the combined company will be comprised of 15 directors

Composition will be proportionate with 9 First Financial board members & 6 from MainSource

Claude Davis, current FFBC CEO, will be Executive Chairman for both holding company & bank

Archie Brown, Jr., current MSFG CEO, will be President & CEO for both holding company & bank

Expected in 1st Quarter 2018

Customary conditions to closing, including shareholder consent as well as receipt of all necessary

regulatory approvals without any unduly burdensome conditions

Consideration

Option Treatment

Pro Forma Ownership

Board Composition

Leadership

Closing

1) Based on FFBC‟s closing price of $28.10 on July 25, 2017; calculation of total aggregate value includes in-the-money options and

warrants

2) As of June 30, 2017; LTM earnings excludes $4.8mm of after-tax merger related charges for MSFG over the last twelve months

3) Based on MSFG‟s closing price of $33.81 on July 25, 2017

4) Calculated on a fully-diluted basis for First Financial and MainSource

Headquarters Cincinnati, OH

Valuation Multiples

2.72x tangible book value per share²

19.3x LTM earnings per share and 11.7x LTM earnings including fully phased-in after-tax cost savings²

15.3% market premium³

27

Financial Impact & Assumptions

Estimated $48 million; ~40% of MSFG‟s total noninterest expense base (~14.5% on a combined basis)5

~40% of cost saves from consolidation of 45 – 50 banking centers

~75% of cost saves realized in first year post-close, 100% thereafter

Gross credit mark on MSFG‟s loan portfolio of 1.00% or $31.9 million (net credit mark of 0.2%)

Including MSFG‟s mark on PCI loans the gross transaction credit mark is $37.1 million, or 1.16%

Cost Savings

One-Time Expenses

EPS Accretion

TBV Value Impact

Internal Rate of Return

6.4% in 2018 excl. transaction expenses, 11.1% in 2019 (first full year)

5.4% TBV dilution¹, earnback of 2.75 years using crossover method², 3.15 years using simple method³

18% IRR, above internal targets

Credit Mark

Total restructuring costs of ~$63 million5

1) See Appendix for non-GAAP reconciliation

2) Based on when pro forma tangible book value per share crosses over and begins to exceed projected standalone FFBC tangible book value

per share

3) Based on dilution to tangible book value per share at close divided by earnings per share accretion in 2019

4) All dollar amounts shown pre-tax except reduction in Fed dividend payments

5) Estimated cost savings and restructuring charges may be refined as the companies work through integration planning

$12 million combined annual interchange fee revenue loss due to Durbin

Phase in – 50% in 2019, 100% thereafter

$2 million additional annual expenses from heightened regulatory / compliance costs

Phase in – 50% in 2018, 100% thereafter

$500 thousand reduction in dividend payments on Federal Reserve Bank capital stock due to FAST Act

Phase in – 50% in 2018, 100% thereafter

$46.0 million CDI created (1.5% of core deposits), amortized over 9 years using sum of years digits

$5.1 million write-down on MSFG‟s TruPS, amortized through earnings over 16.3 years

$4.5 million write-down on MSFG‟s CDs & FHLB advances, amortized through earnings over 5.25 years

Regulatory

Adjustments4

Other Purchase

Accounting

Adjustments

28

14.1% 14.1%

15.8%

0.0%

4.0%

8.0%

12.0%

16.0%

20.0%

FFBC

LTM 6/30/17

MSFG

LTM 6/30/17

Pro Forma 2019

1.1 %

1.17%

1.30%

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

FFBC

LTM 6/30/17

MSFG

LTM 6/30/17

Pro Forma 2019

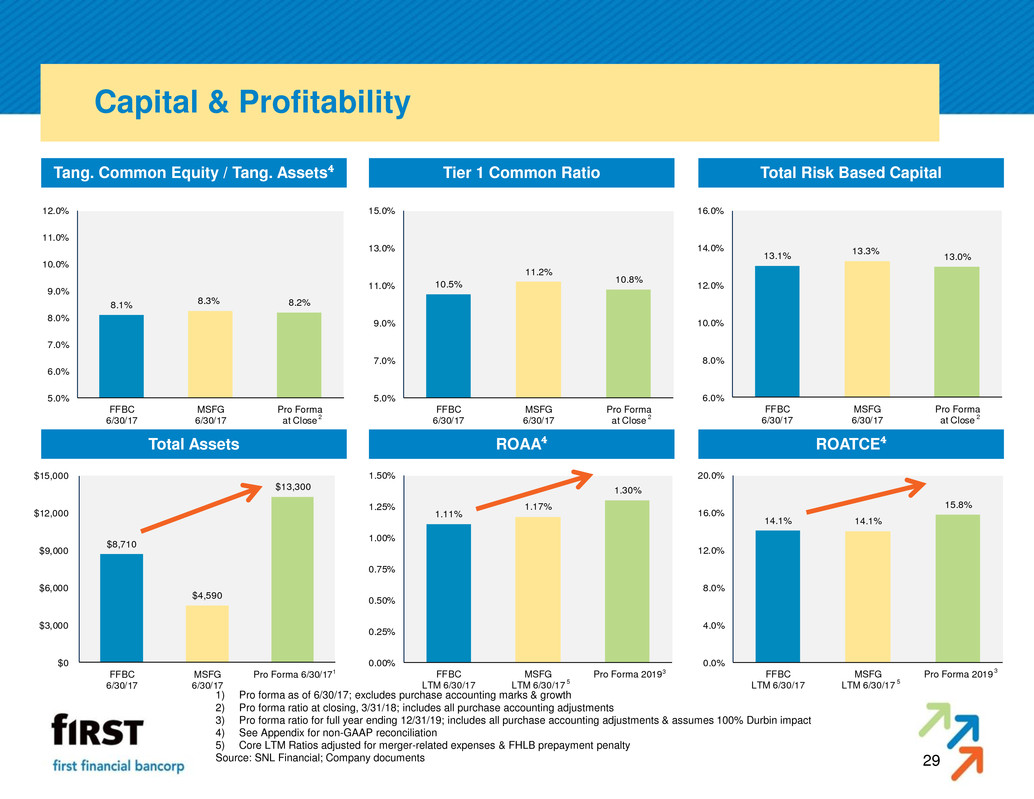

Capital & Profitability

Total Assets

Total Risk Based Capital

ROAA⁴ ROATCE⁴

Tang. Common Equity / Tang. Assets⁴

8.1% 8.3% 8.2%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

FFBC

6/3 /17

MSFG

6/30/17

Pro Forma

at Close

Tier 1 Common Ratio

10.5%

11.2%

10.8%

5.0%

7.

9.0%

11.0%

13.0%

15.0%

FFBC

6/30/17

MSFG

6/30/17

Pro Forma

at Close

1) Pro forma as of 6/30/17; excludes purchase accounting marks & growth

2) Pro forma ratio at closing, 3/31/18; includes all purchase accounting adjustments

3) Pro forma ratio for full year ending 12/31/19; includes all purchase accounting adjustments & assumes 100% Durbin impact

4) See Appendix for non-GAAP reconciliation

5) Core LTM Ratios adjusted for merger-related expenses & FHLB prepayment penalty

Source: SNL Financial; Company documents

13.1%

13.3%

13.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

FFBC

6/30 17

MSFG

6/30/17

Pro Forma

at Close

$8,710

$4,590

$13,300

$0

$3,000

$6,000

$9,000

$12,000

$15,000

FFBC

6/30/17

MSFG

6/30/17

Pro Forma 6/30/17

5 5

29

2

3 3 1

2 2

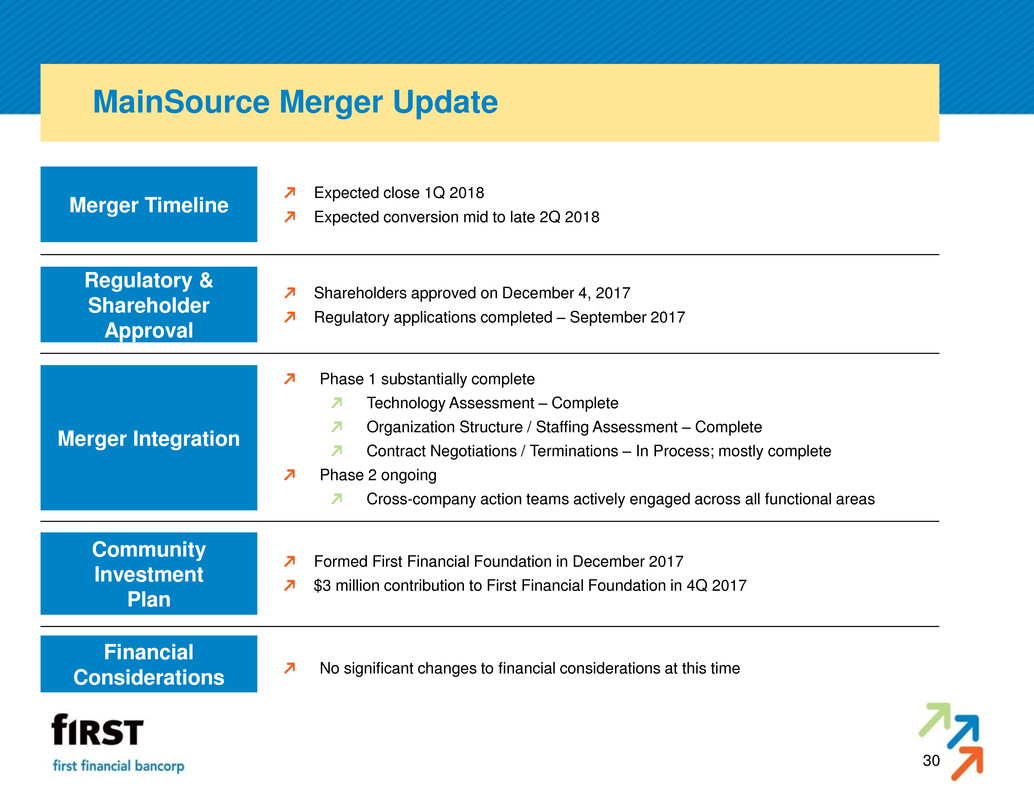

MainSource Merger Update

Regulatory &

Shareholder

Approval

Merger Integration

Financial

Considerations

Shareholders approved on December 4, 2017

Regulatory applications completed – September 2017

Phase 1 substantially complete

Technology Assessment – Complete

Organization Structure / Staffing Assessment – Complete

Contract Negotiations / Terminations – In Process; mostly complete

Phase 2 ongoing

Cross-company action teams actively engaged across all functional areas

Formed First Financial Foundation in December 2017

$3 million contribution to First Financial Foundation in 4Q 2017

Community

Investment

Plan

No significant changes to financial considerations at this time

Merger Timeline

Expected close 1Q 2018

Expected conversion mid to late 2Q 2018

30

Branch Divestiture

Letter of Agreement with United States Department of Justice to divest five

branch locations to resolve competitive concerns

Includes $125 million in loans, $160mm in deposits and all personal

property associated with the branches

4 MainSource Bank branch locations in Columbus, Indiana

529 Washington Street, Columbus, IN 47201

803 Washington Street, Columbus, IN 47201 (Drive-thru)

1901 25th Street, Columbus, IN 47201

2310 W Jonathan Moore Pike, Columbus, IN 47202

1 MainSource Bank branch location in Greensburg, Indiana

304 E 10th Street, Greensburg, IN 47240

Expected to consummate within 180 days following completion of the

merger

31

MSFG 4Q 2017 Highlights

Profitability

Net Interest Income

&

Net Interest Margin

Income Statement

Balance Sheet

Asset Quality

Capital

Net income = $16.6 million, or $14.4 million excluding non-operating items(1)

EPS = $0.64 per diluted share, or $0.55 per diluted share excluding non-operating items(1)

Return on average assets = 1.43%, or 1.24% excluding non-operating items(1)

Return on average shareholders’ equity = 12.5%, or 10.9% excluding non-operating items(1)

Return on average tangible common equity = 17.5%, or 15.2% excluding non-operating items(1)

Net interest income = $37.7 million, a $0.3 million increase compared to the linked quarter

Net interest margin of 3.78% on a fully tax equivalent basis

Purchase accounting marks added nineteen (19) basis points to the net interest margin

Noninterest income = $13.8 million

Noninterest expense = $31.7 million, or $31.3 million excluding non-operating expenses(1)

Efficiency ratio = 59.2%, or 58.5% excluding non-operating items(1)

Effective tax rate of 13.6%, 26.7% excluding the effect of tax reform

EOP loans increased $15 million on a linked quarter basis, or 2% annualized growth

Provision expense = $550K. Net charge offs = $550K. NCOs / Avg. Loans = 0.07% annualized

Nonperforming Assets (w/TDRs) / Total Assets = 0.45%

ALLL / Nonperforming Loans = 139.5%. ALLL / Total Loans = 0.74%

Total capital ratio = 13.6%

Tier 1 capital ratio = 12.9%

Tangible common equity ratio = 8.5%

Tangible book value per common share = $14.93

(1) Non-operating items include $0.3 million in merger-related expenses, net of tax and a $2.5 million income tax benefit due to tax reform. 32

33

About First Financial Bancorp

Financial Performance

MainSource Merger Update

Appendix

34

Appendix: Non-GAAP to GAAP Reconciliation

Net interest income and net interest margin - fully tax equivalent

Dec. 31, Sep. 30, June 30, Mar. 31, Dec. 31, Dec. 31, Dec. 31,

2017 2017 2017 2017 2016 2017 2016

Net interest income 75,614$ 70,479$ 68,520$ 68,932$ 70,166$ 283,545$ 272,671$

Tax equivalent adjustment 1,387 1,353 1,294 1,225 1,077 5,259 4,215

Net interest income - tax equivalent 77,001$ 71,832$ 69,814$ 70,157$ 71,243$ 288,804$ 276,886$

Average earning assets 8,005,100$ 7,989,969$ 7,855,564$ 7,695,717$ 7,630,148$ 7,887,718$ 7,524,233$

Net interest margin* 3.75 % 3.50 % 3.50 % 3.63 % 3.66 % 3.59 % 3.62 %

Net interest margin (fully tax equivalent)* 3.82 % 3.57 % 3.56 % 3.70 % 3.71 % 3.66 % 3.68 %

Three months ended YTD

* Margins are calculated using net interest income annualized divided by average earning assets.

The earnings press release and accompanying presentation include certain non-GAAP ratios, such as net interest income-tax equivalent. The tax

equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a

35% tax rate. Management believes that it is a standard practice in the banking industry to present net interest margin and net interest income on

a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer

comparisons. Management also uses these measures to make peer comparisons.

35

Appendix: Non-GAAP to GAAP Reconciliation

Additional non-GAAP ratios

Dec. 31, Sep. 30, June 30, Mar. 31, Dec. 31, Dec. 31, Dec. 31,

(Dollars in thousands, except per share data) 2017 2017 2017 2017 2016 2017 2016

Net income (a) 24,811$ 24,826$ 22,736$ 24,414$ 23,294$ 96,787$ 88,526$

Average total shareholders' equity 920,194 908,057 889,604 871,215 863,509 897,431 844,784

Less:

Goodw ill and other intangibles (209,379) (209,730) (210,045) (210,324) (210,625) (209,379) (210,625)

Average tangible equity (b) 710,815 698,327 679,559 660,891 652,884 688,052 634,159

Total shareholders' equity 930,664 914,954 898,117 880,065 865,224 930,664 865,224

Less:

Goodw ill and other intangibles (209,379) (209,730) (210,045) (210,324) (210,625) (209,379) (210,625)

Ending tangible equity (c) 721,285 705,224 688,072 669,741 654,599 721,285 654,599

Total assets 8,896,923 8,761,689 8,710,042 8,531,170 8,437,967 8,896,923 8,437,967

Less:

Goodw ill and other intangibles (209,379) (209,730) (210,045) (210,324) (210,625) (209,379) (210,625)

Ending tangible assets (d) 8,687,544 8,551,959 8,499,997 8,320,846 8,227,342 8,687,544 8,227,342

Risk-w eighted assets (e) 7,134,085 7,090,714 6,936,665 6,765,336 6,728,737 7,134,085 6,728,737

Total average assets 8,731,956 8,716,917 8,582,961 8,409,071 8,359,912 8,611,403 8,251,703

Less:

Goodw ill and other intangibles (209,379) (209,730) (210,045) (210,324) (210,625) (209,379) (210,625)

Average tangible assets (f) 8,522,577$ 8,507,187$ 8,372,916$ 8,198,747$ 8,149,287$ 8,402,024$ 8,041,078$

Ending shares outstanding (g) 62,069,087 62,061,465 62,141,071 62,134,285 61,979,552 62,069,087 61,979,552

Ratios

Return on average tangible shareholders' equity (a)/(b) 13.85% 14.10% 13.42% 14.98% 14.19% 14.07% 13.96%

Ending tangible equity as a percent of:

Ending tangible assets (c)/(d) 8.30% 8.25% 8.09% 8.05% 7.96% 8.30% 7.96%

Risk-w eighted assets (c)/(e) 10.11% 9.95% 9.92% 9.90% 9.73% 10.11% 9.73%

Average tangible equity as a percent of average tangible assets (b)/(f) 8.34% 8.21% 8.12% 8.06% 8.01% 8.19% 7.89%

Tangible book value per share (c)/(g) 11.62$ 11.36$ 11.07$ 10.78$ 10.56$ 11.62$ 10.56$

Three months ended YTD

The earnings press release and accompanying presentation include certain non-GAAP ratios. These ratios include: (1) Return on average tangible shareholders' equity; (2) Ending

tangible shareholders' equity as a percent of ending tangible assets; (3) Ending tangible shareholders' equity as a percent of risk-w eighted assets; (4) Average tangible shareholders'

equity as a percent of average tangible assets; and (5) Tangible book value per share. The Company considers these critical metrics w ith w hich to analyze banks. The ratios have

been included in the earnings press release to facilitate a better understanding of the Company's capital structure and f inancial condition.

36

Appendix: Non-GAAP to GAAP Reconciliation

Additional non-GAAP ratios

As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted

Net interest income (f) 75,614$ 75,614$ 70,479$ 70,479$ 68,520$ 68,520$ 68,932$ 68,932$ 70,166$ 70,166$

Provision for loan and lease losses (205) (205) 2,953 2,953 467 467 367 367 2,761 2,761

plus: provision expense adjustment 799

Noninterest income 18,382 18,382 22,942 22,942 17,454 17,454 17,364 17,364 16,946 16,946

less: gains from the redemption of off balance sheet securitizations 5,764

less: tax related adjustment to a limited partnership investment (119)

less: gains on sale of investment securities 19 275 838 516

Total noninterest income (g) 18,382 18,363 22,942 16,903 17,454 16,735 17,364 16,848 16,946 16,946

Noninterest expense 82,898 82,898 54,443 54,443 51,556 51,556 51,045 51,045 50,163 50,163

less: severance expense 3,818 533

less: charter conversion expenses 86

less: historic tax credit investment write-down 11,328

less: merger-related expenses 8,444 800

less: indemnification asset impairment 1 5,055

less: charitable foundation contribution 3,000

less: branch consolidation acitivities 577 154 (92)

Total noninterest expense (e) 82,898 54,494 54,443 49,825 51,556 50,869 51,045 51,137 50,163 50,077

Income before income taxes (i) 11,303 39,688 36,025 35,403 33,951 33,919 34,884 34,276 34,188 34,274

Income tax expense (13,508) (13,508) 11,199 11,199 11,215 11,215 10,470 10,470 10,894 10,894

plus: tax effect of adjustments 9,935 (178) (11) (213) 31

plus: tax reform impact on DTLs & tax partnerships 8,191

plus: after-tax impact of historic tax credit write-down @ 35% 7,363 -

Total income tax expense (h) (13,508) 11,981 11,199 11,021 11,215 11,204 10,470 10,257 10,894 10,925

Net income (a) 24,811$ 27,707$ 24,826$ 24,382$ 22,736$ 22,715$ 24,414$ 24,019$ 23,294$ 23,349$

Average diluted shares (b) 62,132 62,132 62,190 62,190 62,234 62,234 62,140 62,140 62,081 62,081

Average assets (c) 8,731,956 8,731,956 8,716,917 8,716,917 8,582,961 8,582,961 8,409,071 8,409,071 8,359,912 8,359,912

Average shareholders' equity 920,194 920,194 908,057 908,057 889,604 889,604 871,215 871,215 863,509 863,509

Less:

Goodwill and other intangibles (209,379) (209,379) (209,730) (209,730) (210,045) (210,045) (210,324) (210,324) (210,625) (210,625)

Average tangible equity (d) 710,815 710,815 698,327 698,327 679,559 679,559 660,891 660,891 652,884 652,884

1 - Impairment charge related to preliminary agreement to terminate FDIC loss sharing agreements.

Ratios

Net earnings per share - diluted (a)/(b) 0.40$ 0.45$ 0.40$ 0.39$ 0.37$ 0.37$ 0.39$ 0.40$ 0.38$ 0.39$

Return on average assets - (a)/(c) 1.13% 1.26% 1.13% 1.11% 1.06% 1.06% 1.18% 1.16% 1.11% 1.11%

Return on average tangible shareholders' equity - (a)/(d) 13.85% 15.46% 14.10% 13.85% 13.42% 13.41% 14.98% 14.74% 14.19% 14.23%

Efficiency ratio - (e)/((f)+(g)) 88.19% 57.99% 58.28% 57.02% 59.97% 59.67% 59.15% 59.61% 57.58% 57.49%

Effective tax rate - (h)/(i) -119.5% 30.2% 31.1% 31.1% 33.0% 33.0% 30.0% 29.9% 31.9% 31.9%

(Dollars in thousands, except per share data)

4Q164Q17 3Q17 2Q17 1Q17

37