Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BANC OF CALIFORNIA, INC. | d533544d8k.htm |

February 8, 2018 Franchise Overview & Strategy Update Investor Presentation Exhibit 99.1

Forward-looking Statements When used in this presentation and in documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other financial items of Banc of California Inc. and its affiliates (“BANC,” the “Company,” “we,” “us” or “our”). By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (i) a pending investigation by the SEC may result in adverse findings, reputational damage, the imposition of sanctions, increased costs and other negative consequences; (ii) management time and resources may be diverted to address the pending SEC investigation as well as any related litigation, litigation initiated by stockholders and other litigation; (iii) the costs and effects of litigation, including settlements and judgments; (iv) our performance may be adversely affected by the management transition resulting from the resignation of our former chief executive officer, notwithstanding the hiring of our new chief executive officer, and the resignation of our former interim chief financial officer, notwithstanding the hiring of our new chief financial officer; (v) risks that the Company’s merger and acquisition transactions may disrupt current plans and operations and lead to difficulties in customer and employee retention, risks that the costs, fees, expenses and charges related to these transactions could be significantly higher than anticipated and risks that the expected revenues, cost savings, synergies and other benefits of these transactions might not be realized to the extent anticipated, within the anticipated timetables, or at all; (vi) the disposition of our Banc Home Loans division during the first quarter of 2017 may adversely impact our revenues and profitability to the extent we are unable to replace its revenues or realize the expected cost savings of this transaction; (vii) risks that funds obtained from capital raising activities will not be utilized efficiently or effectively; (viii) a worsening of current economic conditions, as well as turmoil in the financial markets; (ix) the credit risks of lending activities, which may be affected by deterioration in real estate markets and the financial condition of borrowers, may lead to increased loan and lease delinquencies, losses and nonperforming assets in our loan and lease portfolio, and may result in our allowance for loan and lease losses not being adequate to cover actual losses and require us to materially increase our loan and lease loss reserves; (x) the quality and composition of our securities portfolio; (xi) changes in general economic conditions, either nationally or in our market areas, or changes in financial markets; (xii) continuation of or changes in the historically low short-term interest rate environment, changes in the levels of general interest rates, volatility in the interest rate environment, the relative differences between short- and long-term interest rates, deposit interest rates, our net interest margin and funding sources; (xiii) fluctuations in the demand for loans and leases, the number of unsold homes and other properties and fluctuations in commercial and residential real estate values in our market area; (xiv) our ability to maintain a strong core deposit base or other low cost funding sources necessary to fund our activities; (xv) results of examinations of us by regulatory authorities and the possibility that any such regulatory authority may, among other things, limit our business activities, require us to change our business mix, increase our allowance for loan and lease losses, write-down asset values or increase our capital levels, or affect our ability to borrow funds or maintain or increase deposits, any of which could adversely affect our liquidity and earnings; (xvi) legislative or regulatory changes that adversely affect our business, including, without limitation, changes in tax laws and policies and changes in regulatory capital or other rules, as well as additional regulatory burdens that result from our growth to over $10 billion in total assets; (xvii) our ability to control operating costs and expenses; (xviii) staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated charges; (xix) errors in estimates of the fair values of certain of our assets and liabilities, which may result in significant changes in valuation; (xx) the network and computer systems on which we depend could fail or experience a security breach; (xxi) our ability to attract and retain key members of our senior management team; (xxii) increased competitive pressures among financial services companies; (xxiii) changes in consumer spending, borrowing and saving habits; (xxiv) adverse changes in the securities markets; (xxv) earthquake, fire or other natural disasters affecting the condition of real estate collateral; (xxvi) the availability of resources to address changes in laws, rules or regulations or to respond to regulatory actions; (xxvii) inability of key third-party providers to perform their obligations to us; (xxiii) changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board or their application to our business or final audit adjustments, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; (xxix) share price volatility and reputational risks, related to, among other things, speculative trading and certain traders shorting our common shares and attempting to generate negative publicity about us; (xxx) war or terrorist activities; and (xxxi) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services and the other risks described from time to time in other documents that we file with or furnish to the SEC. You should not place undue reliance on forward-looking statements, and we undertake no obligation to update any such statements to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

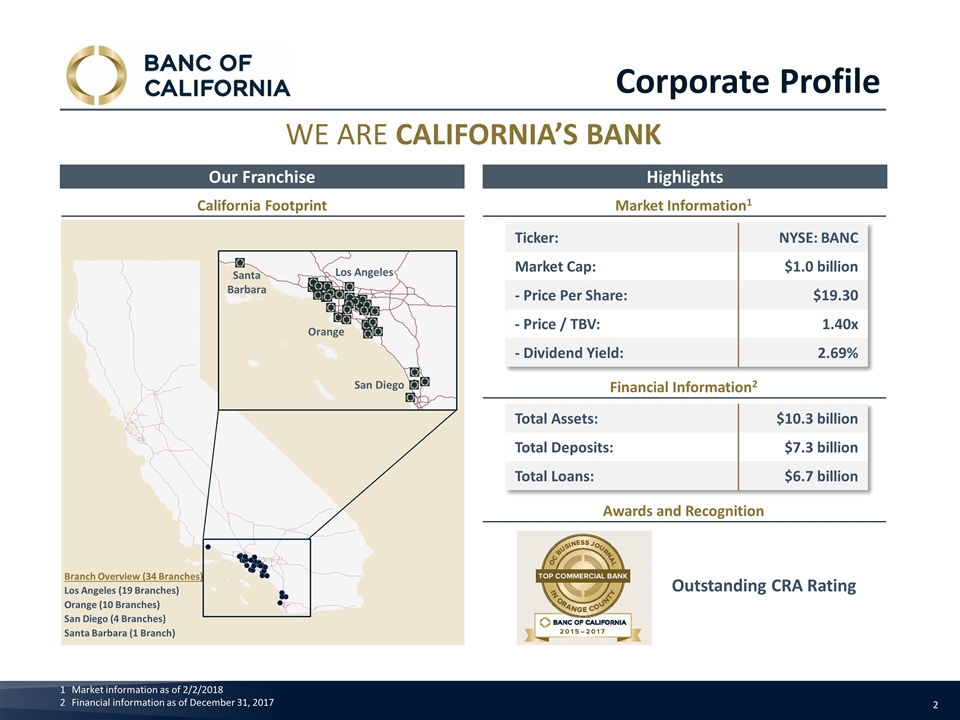

Market information as of 2/2/2018 Financial information as of December 31, 2017 Ticker: NYSE: BANC Market Cap: $1.0 billion - Price Per Share: $19.30 - Price / TBV: 1.40x - Dividend Yield: 2.69% Our Franchise WE ARE CALIFORNIA’S BANK Highlights California Footprint Market Information1 Branch Overview (34 Branches) Los Angeles (19 Branches) Orange (10 Branches) San Diego (4 Branches) Santa Barbara (1 Branch) Los Angeles San Diego Santa Barbara Orange Financial Information2 Total Assets: $10.3 billion Total Deposits: $7.3 billion Total Loans: $6.7 billion Corporate Profile Awards and Recognition Outstanding CRA Rating

Long-Term Vision California’s Bank: CA Focused Commercial Banking Franchise Diversified Loan Portfolio Maintain Strong and Stable Asset Quality Improved Core Deposit Base Team-Based Culture Employer of Choice Delivering Value for Stockholders Where We Go From Here and What We Plan to Create Moving Forward from Events of the Past and Emerging as a Transformed Commercial Banking Franchise Today: Starting with Strong Foundation, Experienced Leadership Team, and De-Risked Balance Sheet Foundational Items in Place: Brand, Market, Size, Strong Credit and Capital, and Leadership Opportunities to Improve: Wholesale Funding Levels High Higher Cost Deposit Base $10bln Regulatory Requirements: Increased Expenses Underinvested in Commercial Businesses (C&I, Private Banking, Treasury Management) CRE/MF Businesses with Limited Deposit Focus

Strong and Powerful Brand: Banc of California High Level of Brand Recognition, Closely Tied to California’s Business Owners and Entrepreneurs WE ARE CALIFORNIA’S BANK – Together We Win

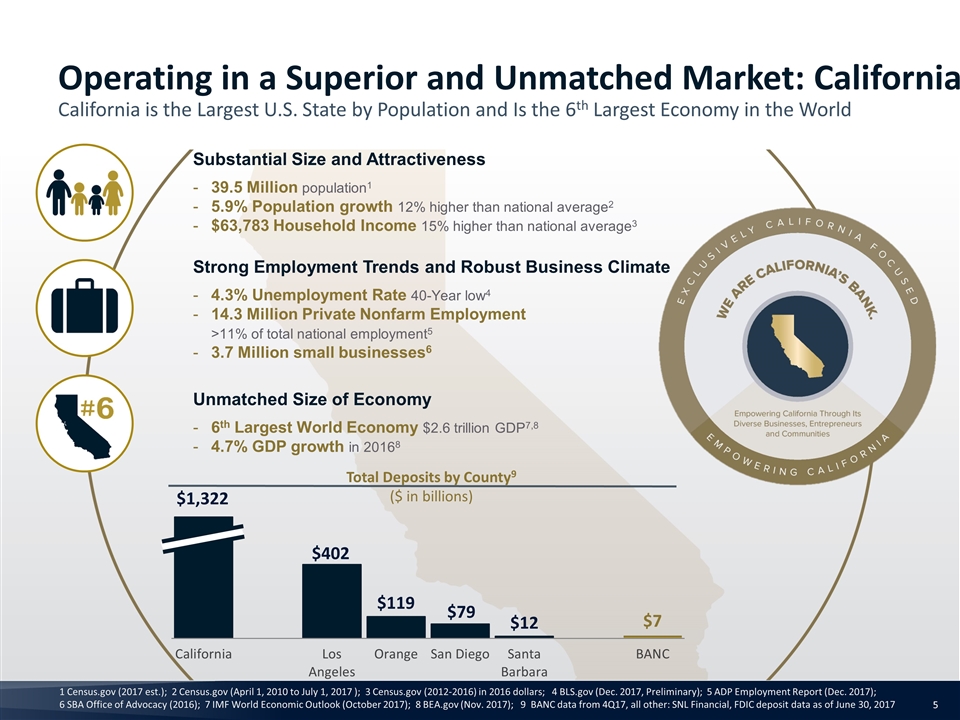

Substantial Size and Attractiveness 39.5 Million population1 5.9% Population growth 12% higher than national average2 $63,783 Household Income 15% higher than national average3 Strong Employment Trends and Robust Business Climate 4.3% Unemployment Rate 40-Year low4 14.3 Million Private Nonfarm Employment >11% of total national employment5 3.7 Million small businesses6 Unmatched Size of Economy 6th Largest World Economy $2.6 trillion GDP7,8 4.7% GDP growth in 20168 1 Census.gov (2017 est.); 2 Census.gov (April 1, 2010 to July 1, 2017 ); 3 Census.gov (2012-2016) in 2016 dollars; 4 BLS.gov (Dec. 2017, Preliminary); 5 ADP Employment Report (Dec. 2017); 6 SBA Office of Advocacy (2016); 7 IMF World Economic Outlook (October 2017); 8 BEA.gov (Nov. 2017); 9 BANC data from 4Q17, all other: SNL Financial, FDIC deposit data as of June 30, 2017 Total Deposits by County9 ($ in billions) $1,322 Operating in a Superior and Unmatched Market: California California is the Largest U.S. State by Population and Is the 6th Largest Economy in the World

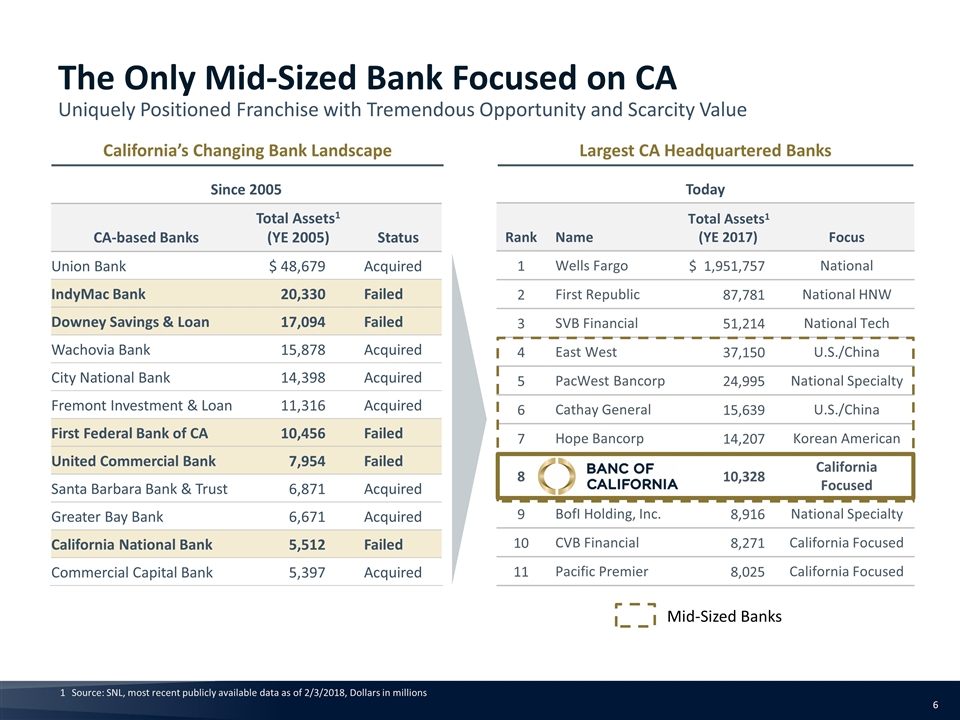

Source: SNL, most recent publicly available data as of 2/3/2018, Dollars in millions The Only Mid-Sized Bank Focused on CA Uniquely Positioned Franchise with Tremendous Opportunity and Scarcity Value Today Rank Name Total Assets1 (YE 2017) Focus 1 Wells Fargo $ 1,951,757 National 2 First Republic 87,781 National HNW 3 SVB Financial 51,214 National Tech 4 East West 37,150 U.S./China 5 PacWest Bancorp 24,995 National Specialty 6 Cathay General 15,639 U.S./China 7 Hope Bancorp 14,207 Korean American 8 10,328 California Focused 9 BofI Holding, Inc. 8,916 National Specialty 10 CVB Financial 8,271 California Focused 11 Pacific Premier 8,025 California Focused Mid-Sized Banks Since 2005 CA-based Banks Total Assets1 (YE 2005) Status Union Bank $ 48,679 Acquired IndyMac Bank 20,330 Failed Downey Savings & Loan 17,094 Failed Wachovia Bank 15,878 Acquired City National Bank 14,398 Acquired Fremont Investment & Loan 11,316 Acquired First Federal Bank of CA 10,456 Failed United Commercial Bank 7,954 Failed Santa Barbara Bank & Trust 6,871 Acquired Greater Bay Bank 6,671 Acquired California National Bank 5,512 Failed Commercial Capital Bank 5,397 Acquired Largest CA Headquartered Banks California’s Changing Bank Landscape

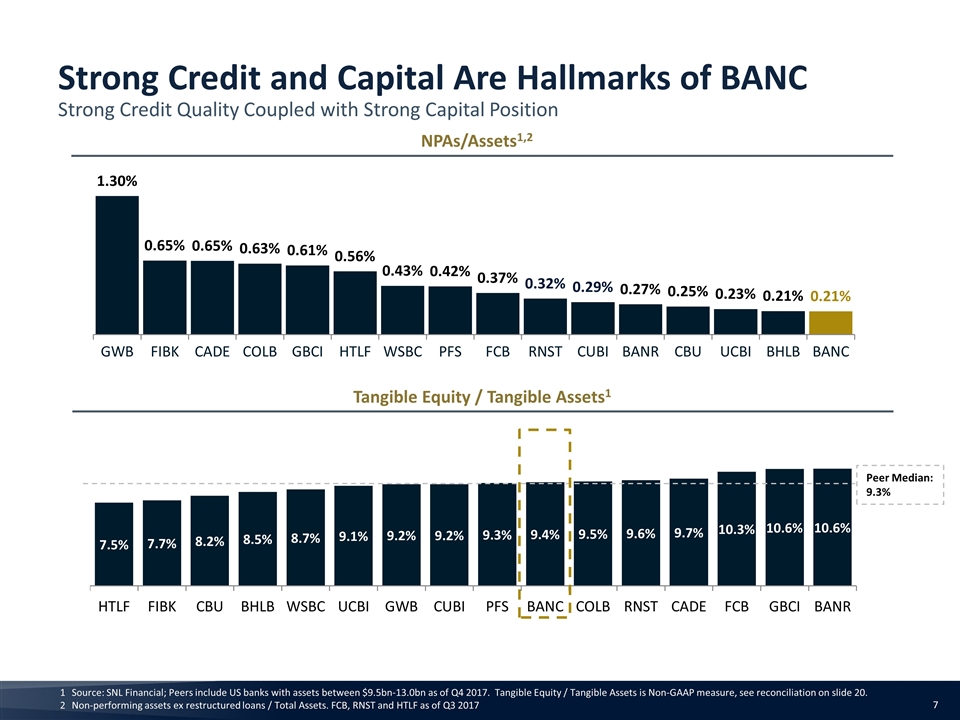

Strong Credit and Capital Are Hallmarks of BANC Strong Credit Quality Coupled with Strong Capital Position NPAs/Assets1,2 Tangible Equity / Tangible Assets1 Peer Median: 9.3% Source: SNL Financial; Peers include US banks with assets between $9.5bn-13.0bn as of Q4 2017. Tangible Equity / Tangible Assets is Non-GAAP measure, see reconciliation on slide 20. Non-performing assets ex restructured loans / Total Assets. FCB, RNST and HTLF as of Q3 2017

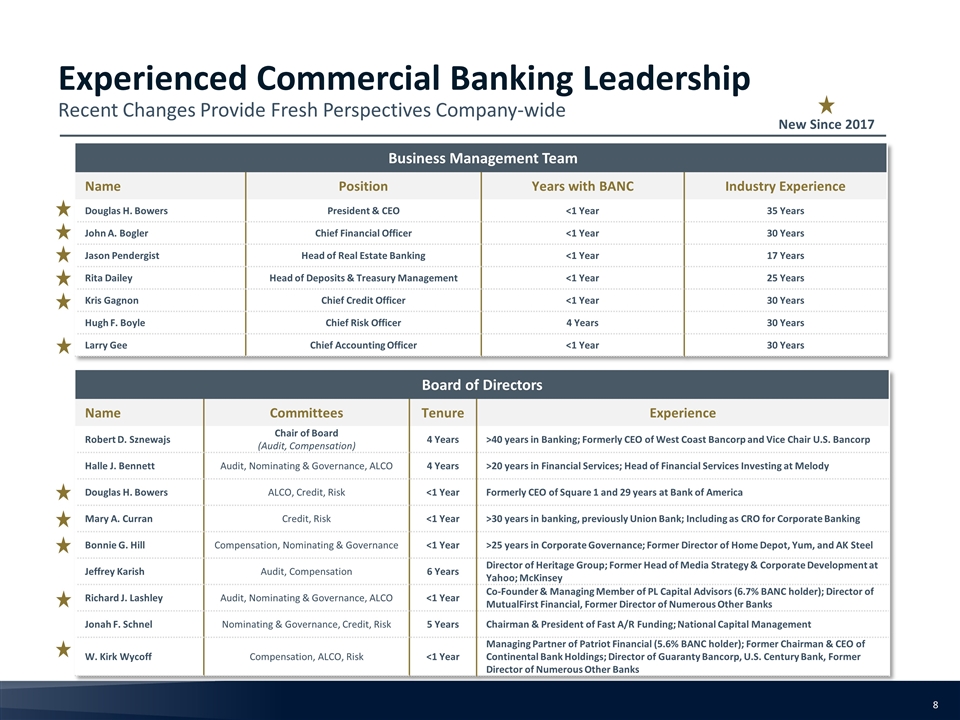

Business Management Team Name Position Years with BANC Industry Experience Douglas H. Bowers President & CEO <1 Year 35 Years John A. Bogler Chief Financial Officer <1 Year 30 Years Jason Pendergist Head of Real Estate Banking <1 Year 17 Years Rita Dailey Head of Deposits & Treasury Management <1 Year 25 Years Kris Gagnon Chief Credit Officer <1 Year 30 Years Hugh F. Boyle Chief Risk Officer 4 Years 30 Years Larry Gee Chief Accounting Officer <1 Year 30 Years Board of Directors Name Committees Tenure Experience Robert D. Sznewajs Chair of Board (Audit, Compensation) 4 Years >40 years in Banking; Formerly CEO of West Coast Bancorp and Vice Chair U.S. Bancorp Halle J. Bennett Audit, Nominating & Governance, ALCO 4 Years >20 years in Financial Services; Head of Financial Services Investing at Melody Douglas H. Bowers ALCO, Credit, Risk <1 Year Formerly CEO of Square 1 and 29 years at Bank of America Mary A. Curran Credit, Risk <1 Year >30 years in banking, previously Union Bank; Including as CRO for Corporate Banking Bonnie G. Hill Compensation, Nominating & Governance <1 Year >25 years in Corporate Governance; Former Director of Home Depot, Yum, and AK Steel Jeffrey Karish Audit, Compensation 6 Years Director of Heritage Group; Former Head of Media Strategy & Corporate Development at Yahoo; McKinsey Richard J. Lashley Audit, Nominating & Governance, ALCO <1 Year Co-Founder & Managing Member of PL Capital Advisors (6.7% BANC holder); Director of MutualFirst Financial, Former Director of Numerous Other Banks Jonah F. Schnel Nominating & Governance, Credit, Risk 5 Years Chairman & President of Fast A/R Funding; National Capital Management W. Kirk Wycoff Compensation, ALCO, Risk <1 Year Managing Partner of Patriot Financial (5.6% BANC holder); Former Chairman & CEO of Continental Bank Holdings; Director of Guaranty Bancorp, U.S. Century Bank, Former Director of Numerous Other Banks New Since 2017 Experienced Commercial Banking Leadership Recent Changes Provide Fresh Perspectives Company-wide

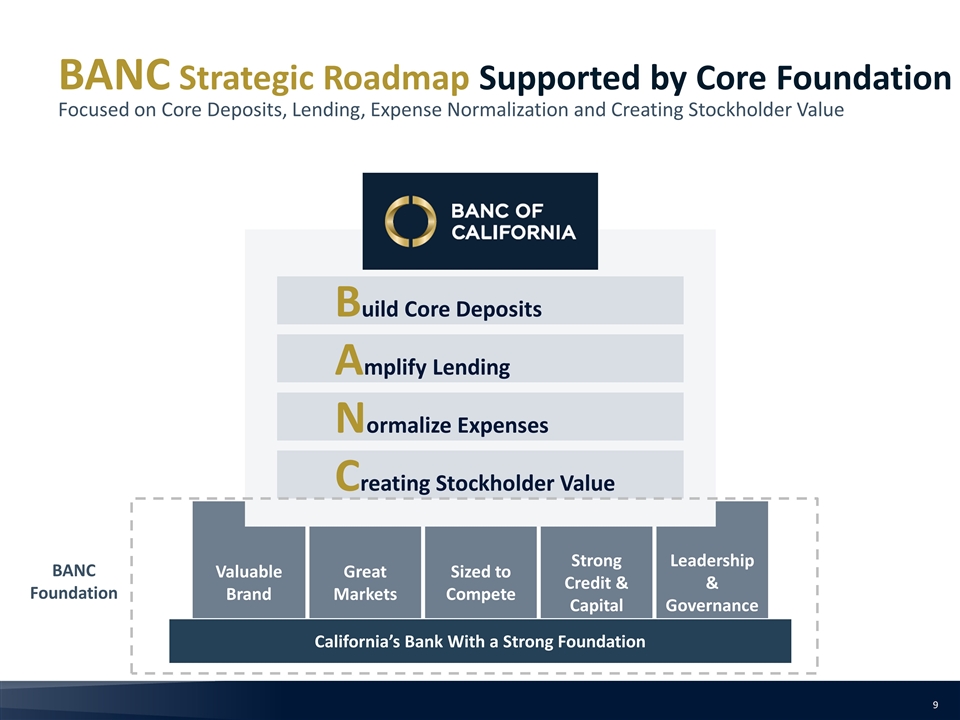

BANC Strategic Roadmap Supported by Core Foundation Focused on Core Deposits, Lending, Expense Normalization and Creating Stockholder Value Valuable Brand Great Markets Sized to Compete Strong Credit & Capital Leadership & Governance California’s Bank With a Strong Foundation Creating Stockholder Value Normalize Expenses Amplify Lending Build Core Deposits BANC Foundation

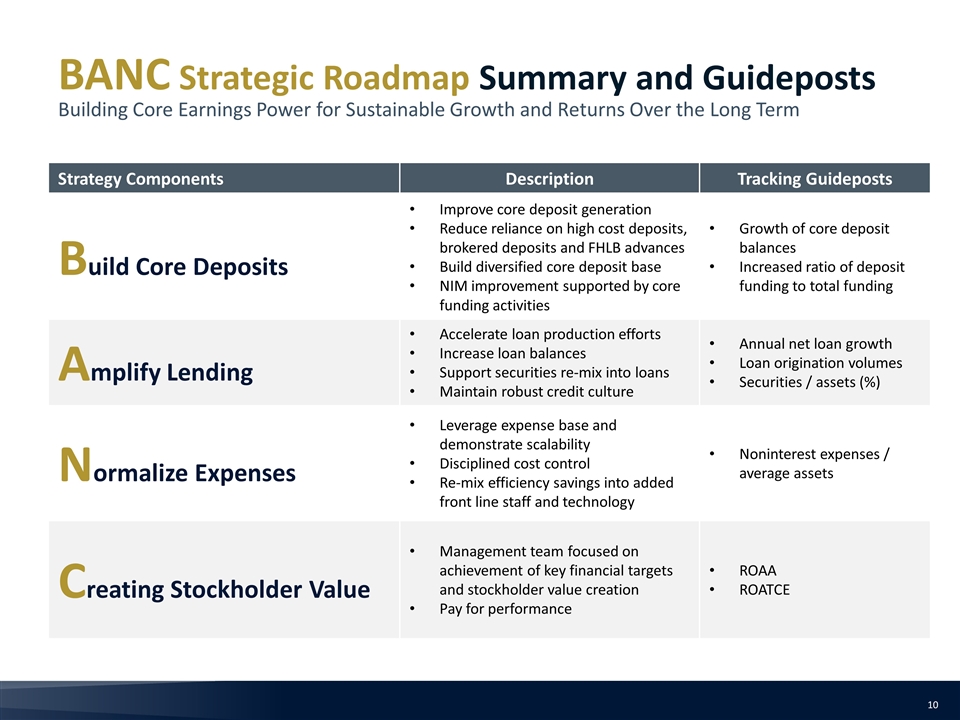

BANC Strategic Roadmap Summary and Guideposts Building Core Earnings Power for Sustainable Growth and Returns Over the Long Term Strategy Components Description Tracking Guideposts Build Core Deposits Improve core deposit generation Reduce reliance on high cost deposits, brokered deposits and FHLB advances Build diversified core deposit base NIM improvement supported by core funding activities Growth of core deposit balances Increased ratio of deposit funding to total funding Amplify Lending Accelerate loan production efforts Increase loan balances Support securities re-mix into loans Maintain robust credit culture Annual net loan growth Loan origination volumes Securities / assets (%) Normalize Expenses Leverage expense base and demonstrate scalability Disciplined cost control Re-mix efficiency savings into added front line staff and technology Noninterest expenses / average assets Creating Stockholder Value Management team focused on achievement of key financial targets and stockholder value creation Pay for performance ROAA ROATCE

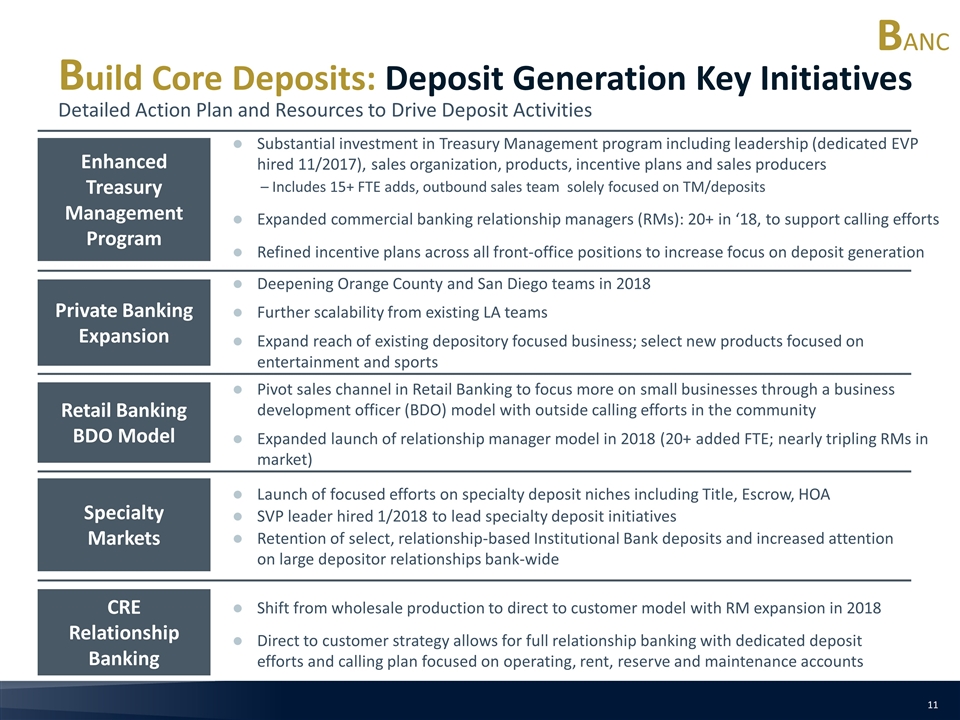

Enhanced Treasury Management Program CRE Relationship Banking Private Banking Expansion Substantial investment in Treasury Management program including leadership (dedicated EVP hired 11/2017), sales organization, products, incentive plans and sales producers – Includes 15+ FTE adds, outbound sales team solely focused on TM/deposits Expanded commercial banking relationship managers (RMs): 20+ in ‘18, to support calling efforts Refined incentive plans across all front-office positions to increase focus on deposit generation Shift from wholesale production to direct to customer model with RM expansion in 2018 Direct to customer strategy allows for full relationship banking with dedicated deposit efforts and calling plan focused on operating, rent, reserve and maintenance accounts Deepening Orange County and San Diego teams in 2018 Further scalability from existing LA teams Expand reach of existing depository focused business; select new products focused on entertainment and sports Retail Banking BDO Model Launch of focused efforts on specialty deposit niches including Title, Escrow, HOA SVP leader hired 1/2018 to lead specialty deposit initiatives Retention of select, relationship-based Institutional Bank deposits and increased attention on large depositor relationships bank-wide Build Core Deposits: Deposit Generation Key Initiatives Detailed Action Plan and Resources to Drive Deposit Activities Specialty Markets Pivot sales channel in Retail Banking to focus more on small businesses through a business development officer (BDO) model with outside calling efforts in the community Expanded launch of relationship manager model in 2018 (20+ added FTE; nearly tripling RMs in market) BANC

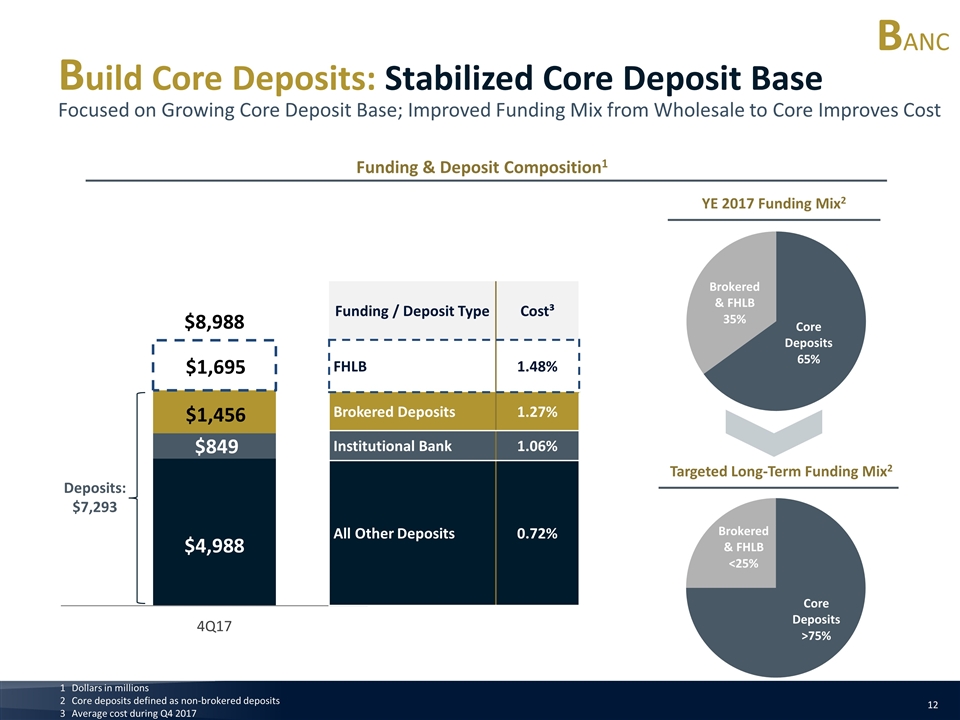

Build Core Deposits: Stabilized Core Deposit Base Focused on Growing Core Deposit Base; Improved Funding Mix from Wholesale to Core Improves Cost BANC Dollars in millions Core deposits defined as non-brokered deposits Average cost during Q4 2017 Funding & Deposit Composition1 Funding / Deposit Type Cost³ FHLB 1.48% Brokered Deposits 1.27% Institutional Bank 1.06% All Other Deposits 0.72% Deposits: $7,293 YE 2017 Funding Mix2 Targeted Long-Term Funding Mix2

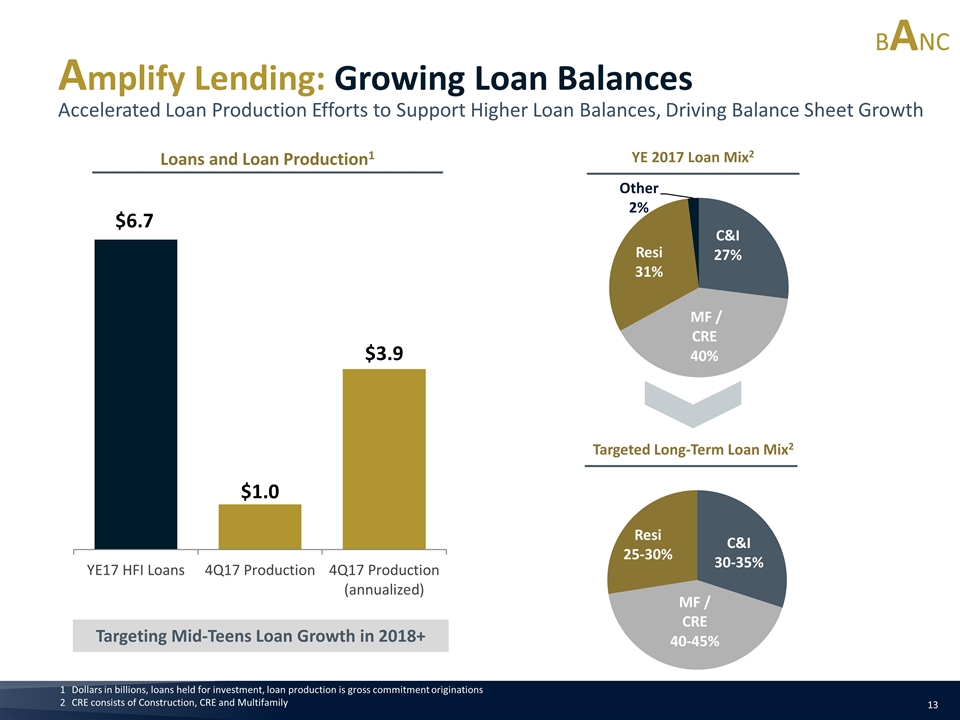

Amplify Lending: Growing Loan Balances Accelerated Loan Production Efforts to Support Higher Loan Balances, Driving Balance Sheet Growth Dollars in billions, loans held for investment, loan production is gross commitment originations CRE consists of Construction, CRE and Multifamily YE 2017 Loan Mix2 Targeted Long-Term Loan Mix2 BANC Targeting Mid-Teens Loan Growth in 2018+ Loans and Loan Production1

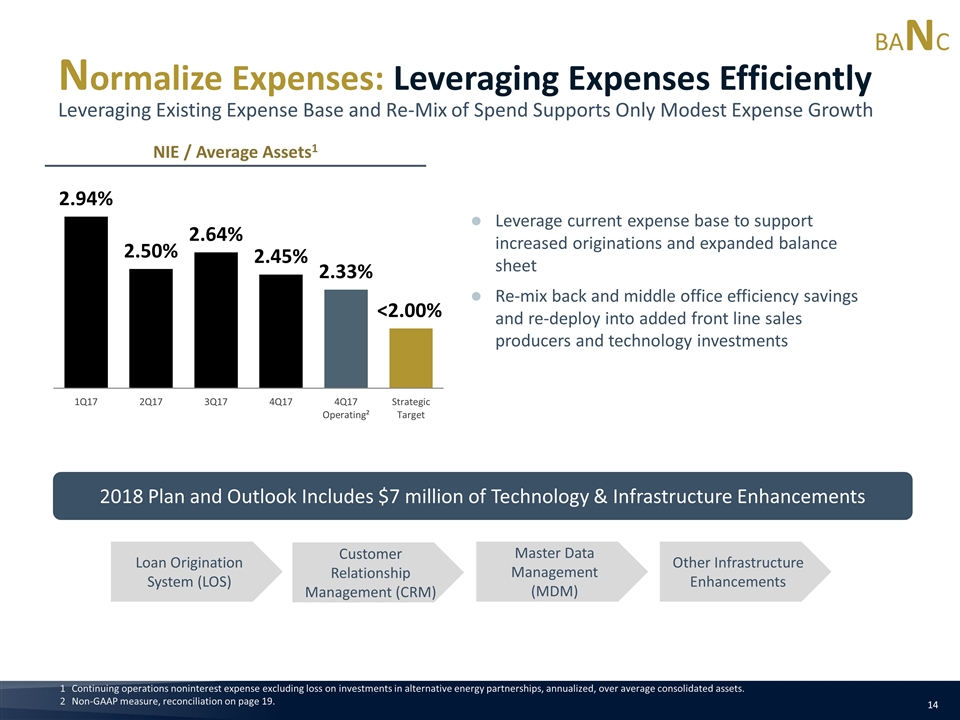

Leverage current expense base to support increased originations and expanded balance sheet Re-mix back and middle office efficiency savings and re-deploy into added front line sales producers and technology investments Loan Origination System (LOS) Normalize Expenses: Leveraging Expenses Efficiently Leveraging Existing Expense Base and Re-Mix of Spend Supports Only Modest Expense Growth NIE / Average Assets1 2018 Plan and Outlook Includes $7 million of Technology & Infrastructure Enhancements Customer Relationship Management (CRM) Master Data Management (MDM) Continuing operations noninterest expense excluding loss on investments in alternative energy partnerships, annualized, over average consolidated assets. Non-GAAP measure, reconciliation on page 19. Other Infrastructure Enhancements BANC

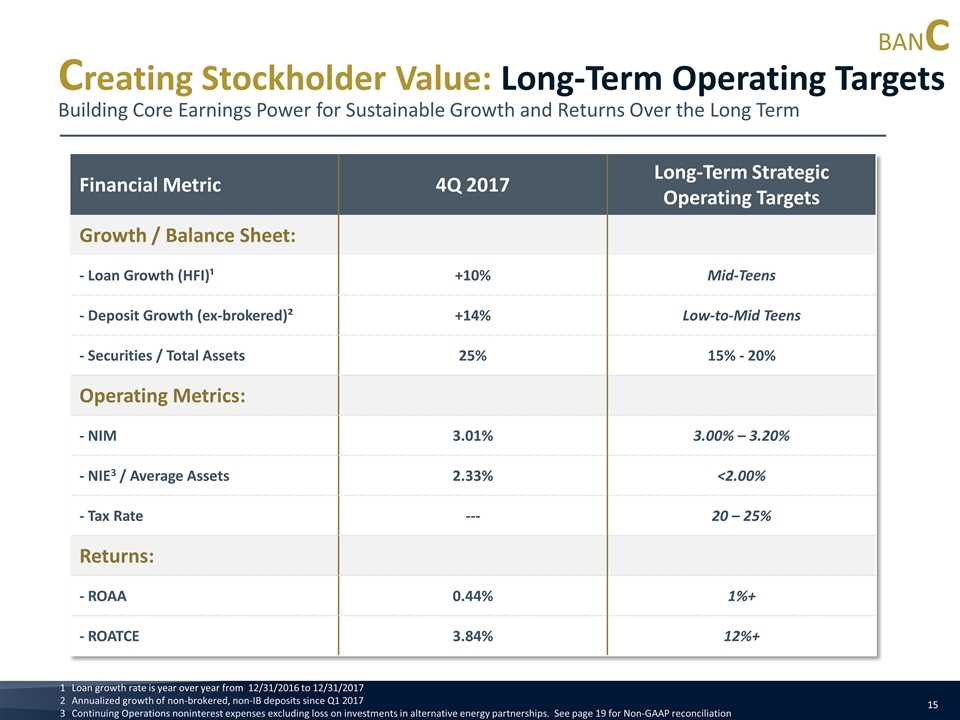

Financial Metric 4Q 2017 Long-Term Strategic Operating Targets Growth / Balance Sheet: - Loan Growth (HFI)¹ +10% Mid-Teens - Deposit Growth (ex-brokered)² +14% Low-to-Mid Teens - Securities / Total Assets 25% 15% - 20% Operating Metrics: - NIM 3.01% 3.00% – 3.20% - NIE3 / Average Assets 2.33% <2.00% - Tax Rate --- 20 – 25% Returns: - ROAA 0.44% 1%+ - ROATCE 3.84% 12%+ Loan growth rate is year over year from 12/31/2016 to 12/31/2017 Annualized growth of non-brokered, non-IB deposits since Q1 2017 Continuing Operations noninterest expenses excluding loss on investments in alternative energy partnerships. See page 19 for Non-GAAP reconciliation Creating Stockholder Value: Long-Term Operating Targets Building Core Earnings Power for Sustainable Growth and Returns Over the Long Term BANC

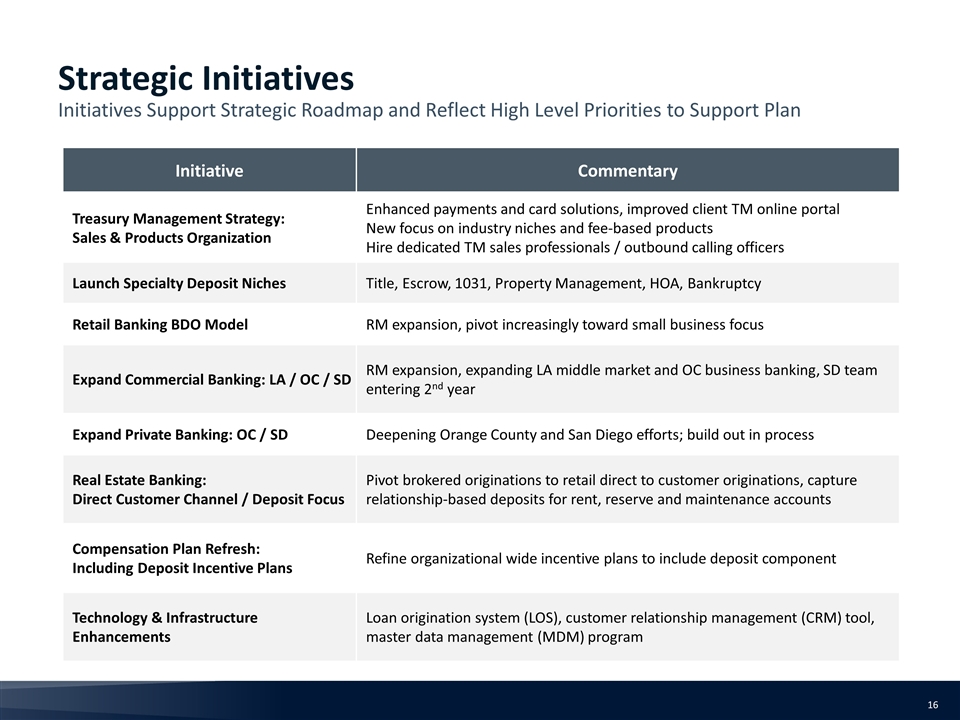

Strategic Initiatives Initiatives Support Strategic Roadmap and Reflect High Level Priorities to Support Plan Initiative Commentary Treasury Management Strategy: Sales & Products Organization Enhanced payments and card solutions, improved client TM online portal New focus on industry niches and fee-based products Hire dedicated TM sales professionals / outbound calling officers Launch Specialty Deposit Niches Title, Escrow, 1031, Property Management, HOA, Bankruptcy Retail Banking BDO Model RM expansion, pivot increasingly toward small business focus Expand Commercial Banking: LA / OC / SD RM expansion, expanding LA middle market and OC business banking, SD team entering 2nd year Expand Private Banking: OC / SD Deepening Orange County and San Diego efforts; build out in process Real Estate Banking: Direct Customer Channel / Deposit Focus Pivot brokered originations to retail direct to customer originations, capture relationship-based deposits for rent, reserve and maintenance accounts Compensation Plan Refresh: Including Deposit Incentive Plans Refine organizational wide incentive plans to include deposit component Technology & Infrastructure Enhancements Loan origination system (LOS), customer relationship management (CRM) tool, master data management (MDM) program

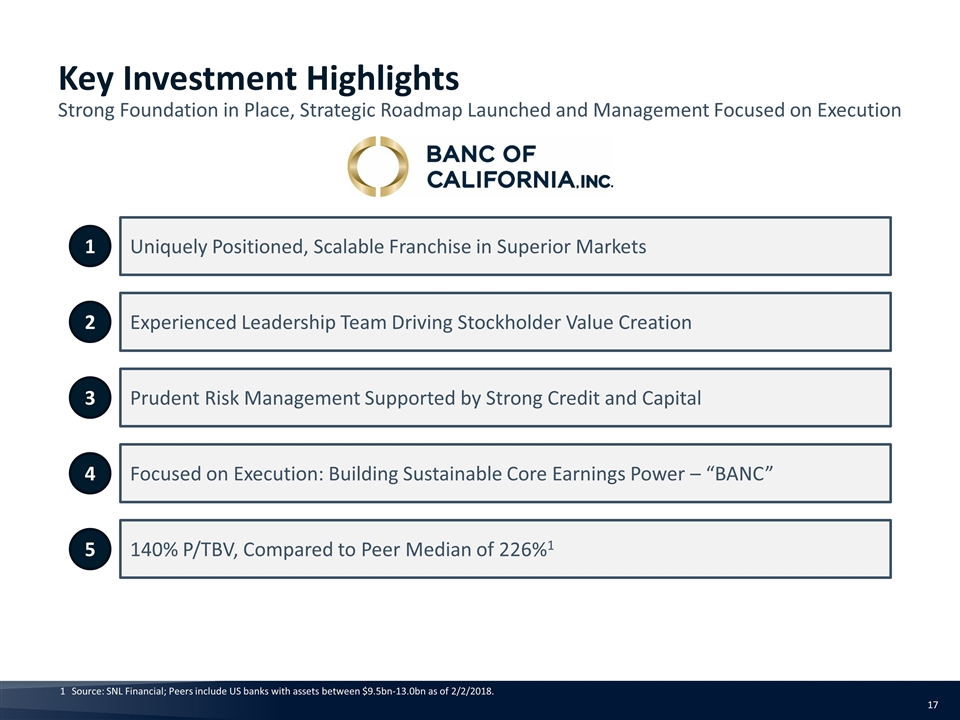

Key Investment Highlights Strong Foundation in Place, Strategic Roadmap Launched and Management Focused on Execution Source: SNL Financial; Peers include US banks with assets between $9.5bn-13.0bn as of 2/2/2018. Prudent Risk Management Supported by Strong Credit and Capital Uniquely Positioned, Scalable Franchise in Superior Markets Focused on Execution: Building Sustainable Core Earnings Power – “BANC” Experienced Leadership Team Driving Stockholder Value Creation 1 2 3 4 140% P/TBV, Compared to Peer Median of 226%1 5

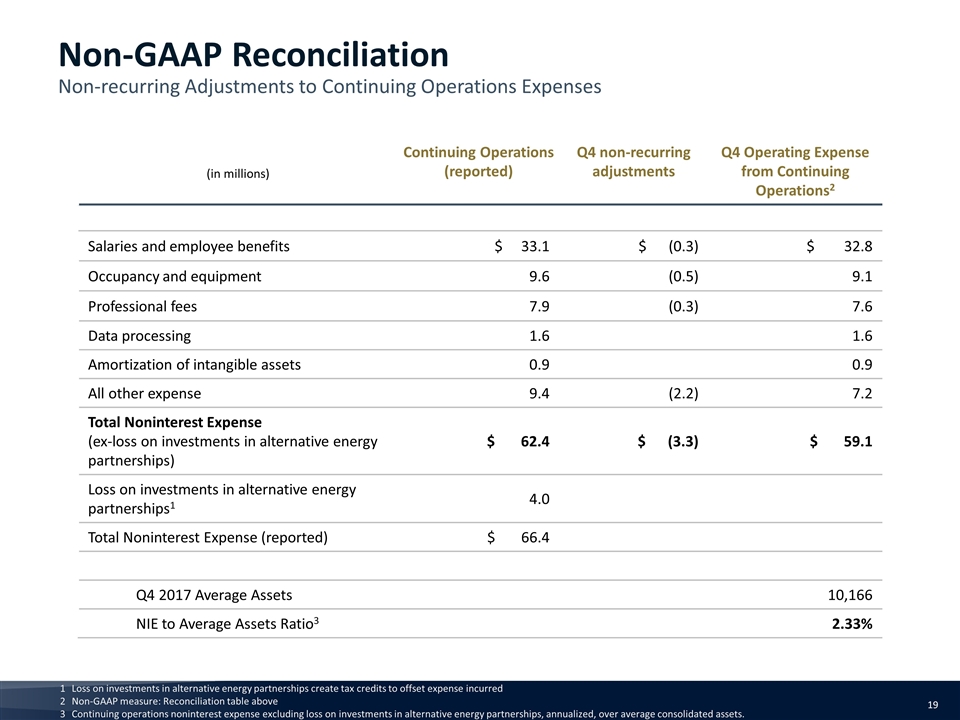

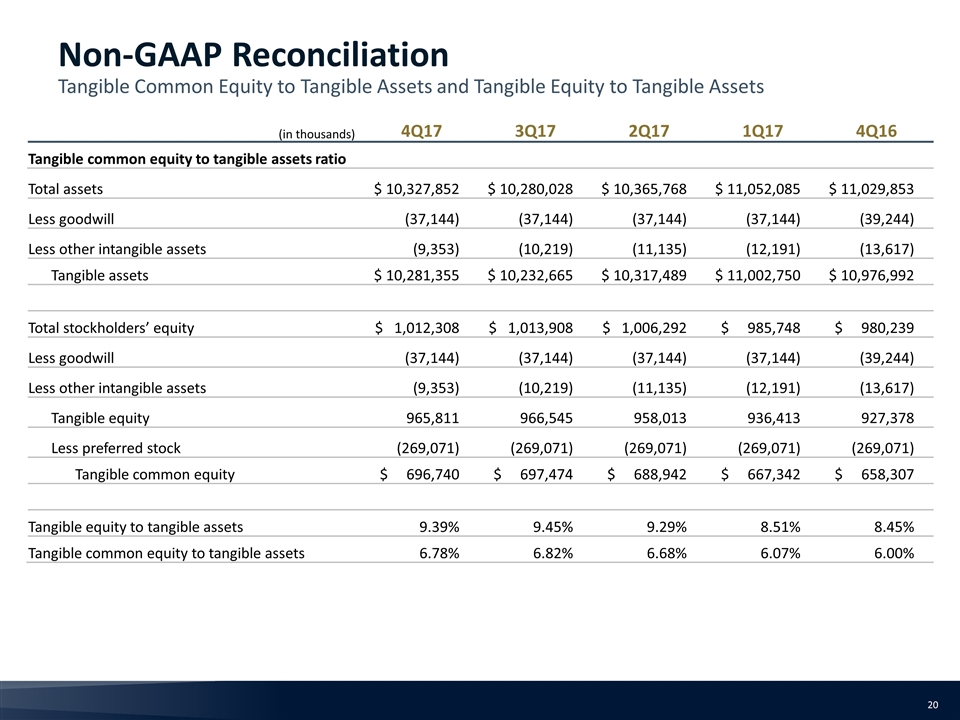

This presentation contains certain financial measures determined by methods other than in accordance with U.S. generally accepted accounting principles (GAAP). These measures include noninterest expense from continuing operations and operating expense from continuing operations, each excluding loss on investments in alternative energy partnerships and the latter also reflecting adjustments for non-recurring items. Management believes that these particular measures provide useful supplemental information in understanding our core operating performance. These measures should not be viewed as substitutes for measures determined in accordance with GAAP, nor are they necessarily comparable to non‐GAAP measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slide 19 of this presentation. Non-GAAP measures in this presentation also include tangible equity to tangible assets and tangible common equity to tangible assets. These particular measures are used by management in its analysis of the Company's capital strength and the performance of the Company’s businesses. Banking and financial institution regulators also exclude goodwill and other intangible assets from total stockholders' equity when assessing the capital adequacy of a financial institution. Management believes the presentation of these measures excluding the impact of these items provides useful supplemental information that is essential to a proper understanding of the capital and financial strength of the Company and the performance of its businesses. These measures should not be viewed as substitutes for results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slides 20 of this presentation. Non-GAAP Financial Information

Non-GAAP Reconciliation Non-recurring Adjustments to Continuing Operations Expenses (in millions) Continuing Operations (reported) Q4 non-recurring adjustments Q4 Operating Expense from Continuing Operations2 Salaries and employee benefits $ 33.1 $ (0.3) $ 32.8 Occupancy and equipment 9.6 (0.5) 9.1 Professional fees 7.9 (0.3) 7.6 Data processing 1.6 1.6 Amortization of intangible assets 0.9 0.9 All other expense 9.4 (2.2) 7.2 Total Noninterest Expense (ex-loss on investments in alternative energy partnerships) $ 62.4 $ (3.3) $ 59.1 Loss on investments in alternative energy partnerships1 4.0 Total Noninterest Expense (reported) $ 66.4 Q4 2017 Average Assets 10,166 NIE to Average Assets Ratio3 2.33% Loss on investments in alternative energy partnerships create tax credits to offset expense incurred Non-GAAP measure: Reconciliation table above Continuing operations noninterest expense excluding loss on investments in alternative energy partnerships, annualized, over average consolidated assets.

(in thousands) 4Q17 3Q17 2Q17 1Q17 4Q16 Tangible common equity to tangible assets ratio Total assets $ 10,327,852 $ 10,280,028 $ 10,365,768 $ 11,052,085 $ 11,029,853 Less goodwill (37,144) (37,144) (37,144) (37,144) (39,244) Less other intangible assets (9,353) (10,219) (11,135) (12,191) (13,617) Tangible assets $ 10,281,355 $ 10,232,665 $ 10,317,489 $ 11,002,750 $ 10,976,992 Total stockholders’ equity $ 1,012,308 $ 1,013,908 $ 1,006,292 $ 985,748 $ 980,239 Less goodwill (37,144) (37,144) (37,144) (37,144) (39,244) Less other intangible assets (9,353) (10,219) (11,135) (12,191) (13,617) Tangible equity 965,811 966,545 958,013 936,413 927,378 Less preferred stock (269,071) (269,071) (269,071) (269,071) (269,071) Tangible common equity $ 696,740 $ 697,474 $ 688,942 $ 667,342 $ 658,307 Tangible equity to tangible assets 9.39% 9.45% 9.29% 8.51% 8.45% Tangible common equity to tangible assets 6.78% 6.82% 6.68% 6.07% 6.00% Non-GAAP Reconciliation Tangible Common Equity to Tangible Assets and Tangible Equity to Tangible Assets