Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Zendesk, Inc. | zen_8-kxq4x2017.htm |

| EX-99.4 - EXHIBIT 99.4 - Zendesk, Inc. | zenasc606investordeck261.htm |

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | zendeskq42017highlightsf.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq4x2017xex991.htm |

| EX-3.1 - EXHIBIT 3.1 - Zendesk, Inc. | zendesk-amendedandrestated.htm |

Zendesk Shareholder Letter Q4 2017 - 1

Shareholder Letter

Q4 2017

February 6, 2018

Exhibit 99.2

Zendesk Shareholder Letter Q4 2017 - 2

Mikkel

Svane

CEO

Elena

Gomez

CFO

Marc

Cabi

Strategy & IR

Q4 2017 Revenue

Q4 Y/Y Revenue Growth

Paid Customer Accounts

INTRODUCTION

In 2017, we made great progress towards our goal of being a $1 billion

revenue company in 2020. Through disciplined execution, we expanded

our product line, increased our market penetration, and rapidly grew our

business. We also delivered on our important strategic goals for the year:

moving upmarket by landing larger deals with mid-market and enterprise

companies, and becoming a multiproduct company with new revenue

opportunities. With this performance, we delivered strong revenue growth,

our highest-ever annual net cash from operating activities, and—for the first

time in Zendesk’s history—positive full-year free cash flow.

As we move into 2018, we are focused on further maturing our omnichannel

offering and accelerating our push upmarket. We enter 2018 with a strong

team enhanced by two new board members and a new head of worldwide

sales, and a very high level of optimism about the sales opportunities our

teams are pursuing to begin the year. Based on our results and momentum,

we have gained additional confidence in our plan to reach our $1 billion 2020

revenue goal.

$123.4M

39%

119,000

Zendesk Shareholder Letter Q4 2017 - 3

Fourth quarter and full fiscal year 2017 financial summary

(in thousands, except per share data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

GAAP Results 2017 2016 2017 2016

Revenue $ 123,426 $ 88,623 $ 430,492 $ 311,999

Gross profit 88,468 63,041 303,070 218,099

Gross margin 71.7% 71.1% 70.4% 69.9%

Operating loss $ (28,523) $ (25,130) $ (114,643) $ (104,326)

Operating margin -23.1% -28.4% -26.6% -33.4%

Net loss $ (26,649) $ (24,548) $ (110,638) $ (103,799)

Net loss per share (0.26) (0.26) (1.11) (1.11)

Non-GAAP Results

Non-GAAP gross profit $ 91,998 $ 66,273 $ 317,623 $ 230,710

Non-GAAP gross margin 74.5% 74.8% 73.8% 73.9%

Non-GAAP operating loss $ (2,411) $ (4,394) $ (17,108) $ (21,076)

Non-GAAP operating margin -2.0% -5.0% -4.0% -6.8%

Non-GAAP net loss $ (537) $ (3,812) $ (13,103) $ (20,549)

Non-GAAP net loss per share (0.01) (0.04) (0.13) (0.22)

Our fourth quarter and full-year results highlight our upmarket progress. We

added many new large businesses as customers, while expanding with many

more existing enterprise customers during the quarter. We saw a significant

increase in our metric tracking the percentage of Zendesk Support MRR

coming from customers with 100 or more Support agents—ending 2017 at

38% compared to 34% a year earlier. Additionally, our portfolio of customer

success stories expanded in both number and variety throughout 2017,

showcasing our move into new use cases and our traction in key industry

segments.

For the fourth quarter of 2017, we achieved revenue of $123.4 million, with

an annual growth rate of 39%. For the full year, we ended 2017 with $430.5

million in revenue, with an annual growth rate of 38%. Looking forward to

2018, we project revenue to be in the range of $555 million to $565 million.

Our operating results continue to keep us on track to deliver both year-over-

year GAAP and non-GAAP operating margin improvement, and increased

net cash from operating activities and free cash flow, consistent with the

goals that we established in prior years.

Zendesk Shareholder Letter Q4 2017 - 4

2017 REVIEW

One of Zendesk’s biggest strengths has always been the broad appeal

of our products across industries and organizations of every size. In 2017,

our prevalence grew to a point where we saw Zendesk increasingly at the

center of customer experiences worldwide. For example, over the four days

between Black Friday and Cyber Monday last November, our chat widget

reached more than 400 million visitors collectively across our customers’

individual websites.

Throughout 2017, we saw solid improvement in growth opportunities and

operating fundamentals. Our mission to expand beyond customer service

to address customer journeys and relationships more broadly was a key

investment theme that generated positive results.

On the product front, we focused on creating a more unified customer

experience and simplifying the buying experience across our product family.

As part of that process, we launched Chat Enterprise in August and Talk

Enterprise in September, and brought greater consistency in feature set and

scalability across all our products. Zendesk Support, Chat, Talk, and Guide

can now be used together across a variety of use cases and degrees of

complexity to deliver improved customer experiences.

119,000

Paid customer

accounts

1.25 BILLION

Support tickets solved

in 2017

150,000

Public apps installed

to date

640

Public apps on the

App Marketplace

20,000

Customers with active

web widgets

10,000

Apps using a

mobile SDK

2,000

Employees worldwide

2017

by the num

bers

Zendesk Shareholder Letter Q4 2017 - 5

2018 PRIORITIES

As we move into 2018, our key priorities will revolve around two major

themes: accelerating our upmarket business through larger deals and

greater penetration with enterprise customers, and empowering our

customers to provide the best omnichannel customer experiences possible.

In addition, our product development efforts are focused on delivering

innovation through new products and enhancements to existing products,

including harnessing more data and machine learning opportunities.

Focus on the Enterprise

No longer the obsession of small, nimble startups alone, digital

transformation initiatives are changing even the largest businesses. At

the same time, enterprises are recognizing the critical importance of the

customer experiences they deliver. We believe these trends and others are

creating new opportunities for us to both attract more enterprise customers

and build deeper relationships with our existing large customers.

Enterprise

During the second half of 2017, we observed acceleration in the primary

metric we use to measure our upmarket progress (percentage of Support

MRR from customers with 100 or more Support agents). We benefited

from a growing level of productivity from the salespeople who joined

Zendesk in the past year. In addition, we saw a strong general uptick in

new opportunities worldwide, closing 2017 with a solid set of opportunities

for new and expanded business across a growing family of products. Our

increasing number of customer references across certain industries has

contributed to our ability to repeat successes in those industries.

We believe our progress in 2017 was further underscored by several industry

analyst recognitions in the year. Gartner scored Zendesk the highest for

its business to consumer (B2C) use case in its December 2017 Critical

Capabilities for the CRM Customer Engagement Center report.* Earlier,

we improved our position in Gartner’s May 2017 Magic Quadrant for the

CRM Customer Engagement Center* (in which Zendesk is in the Leaders

quadrant). We also improved our position in The Forrester Wave™: Customer

Service Solutions For Midsize Teams, Q2 2017 (in which Zendesk is a Strong

Performer).

*Gartner does not endorse any vendor, product or service depicted in its research

publications, and does not advise technology users to select only those vendors

with the highest ratings or other designation. Gartner research publications consist

of the opinions of Gartner’s research organization and should not be construed as

statements of fact. Gartner disclaims all warranties, expressed or implied, with respect

to this research, including any warranties of merchantability or fitness for a particular

purpose.

Zendesk Shareholder Letter Q4 2017 - 6

Mike joins Hilarie Koplow-McAdams, who was appointed to the board in

September. Hilarie brings deep global enterprise software sales expertise to

Zendesk, having formerly held executive leadership positions at New Relic,

Salesforce, Intuit, and Oracle. Mike and Hilarie will be key product and sales

resources for us as we move upmarket toward our $1 billion revenue goal.

In addition, we announced the appointment of Norman Gennaro as senior

vice president of worldwide sales in December. Norman brings more than

25 years of business and technology experience leading and growing

global teams of sales professionals. Most recently, he helped to build the

mid-market segment for North America into a multibillion-dollar business

for Amazon Web Services, and prior to that, he spent 16 years in enterprise

sales with Oracle. Norman will partner with Jeff Titterton, who joined us as

senior vice president of marketing earlier in 2017.

Our new sales and marketing leadership is building experienced teams that

can meet the demands of our growing global business. These two teams are

working in concert on our many go-to-market activities worldwide, including

customer and prospect events. Our new 2018 events strategy includes

more than ten major Zendesk-produced events in our most significant

regions around the globe. These events are designed to help generate and

accelerate our pipeline of new and expansion business with their focus on

Zendesk products and customer experience best practices.

In 2018, we plan to expand our investments globally to build a broader

partner and channel ecosystem to support our upmarket activities.

While we continue to pride ourselves on our products’ ease of use and

implementation, we also recognize that our largest enterprise customers

frequently require the expertise of systems integrators and partners. Our

regional partnerships demonstrated the potential value and impact of

such alliances, and we expect to expand the number and scope of these

partnerships over this year.

Our largest customers value our ability to scale with them to serve their

growing demands. To that end, Zendesk continues to make reliability and

scalability top priorities. Our customers view Zendesk as a critical piece

of their businesses and rely on Zendesk products to achieve successful

outcomes. In 2017, we began to migrate our data center investments to cloud

infrastructure to enable greater reliability, flexibility, and scale. In early 2018,

we will finalize our transition plans to cloud infrastructure and develop a plan

for customer migration, which is likely to take several quarters.

Mike Frandsen, Board Member

Our product family enables large companies to transform their customer

experiences. In 2018, we are focused on building out even more

sophisticated product capabilities that our largest customers will expect as

they adapt to these new trends.

To help guide our teams as we continue to move upmarket, we put an

emphasis in the second half of 2017 on filling key roles with leaders

who have experience working with larger companies. Two of these key

additions were for our board of directors—most recently, the appointment

of Mike Frandsen in November. Mike brings more than three decades of

valuable enterprise product development experience with companies like

DemandTec and PeopleSoft. He is currently executive director of products

at Workday.

Zendesk Shareholder Letter Q4 2017 - 7

Focus on Omnichannel

The rise of new communication channels and ubiquitous access to

information has made customer journeys increasingly complex. Customers

have individual channel preferences, and they want to be recognized

across any and all channels they choose. As more power and control shifts

from companies to consumers, organizations are recognizing the critical

importance of their customer experiences and are searching for solutions to

improve their customer interactions.

We believe that we are well positioned to help companies deliver the

omnichannel experiences their customers expect today. The Zendesk

product family is purpose-built to unify disparate channels and departments

and to simplify the process of providing great customer service, whether that

is through self-service, a phone call, live chat, messaging, or a simple email.

In 2017, we put an emphasis on rolling out features that would bring the

rest of our products in-line with the scope and scalability of our Support

product, including launching Enterprise versions of Chat and Talk. All

of that foundational work last year paved the way for our 2018 focus on

omnichannel, and our product organization is now well positioned for a

unified omnichannel offering.

Throughout 2018, we will continue to implement new features for our core

products, including an Enterprise version of Guide in the first half of this year.

This and other ongoing improvements to all our products ensure that we are

always delivering the best capabilities to our customers through a robust

omnichannel solution that can scale to meet the needs of even our largest

customers.

Zendesk Shareholder Letter Q4 2017 - 8

Focus on Innovation

While we added many new products to our

family in 2017, our development efforts in 2018

are focused both on continuing new product

development and delivering enhancements for

our existing products.

An example of this strategy is Answer Bot,

our first machine learning product to directly

monetize our data assets. A paid add-on to our

Guide product, Answer Bot continues to gain

traction within our customer base, and we have

rolled out new features to enhance the customer

experience. In January, we launched Answer

Bot for Web Forms, allowing it to work in more

customer touchpoints and handle more requests.

Answer Bot increases self-service efficiency by

responding to customers’ questions with relevant

knowledge base articles. In addition, Answer Bot

is now available in both Spanish and Portuguese.

We expect to add additional channels and

languages this year.

Meanwhile, we are continuing our development

of two new products—currently in early access

programs—that we believe will deliver greater

innovation for our customers and expand our

market opportunities in the longer term. The

Outbound technology we acquired last year has

been folded into our development efforts for

Zendesk Connect, a product that we believe will

open more opportunities for us to address the

customer experience beyond traditional customer

service. Connect will initially offer new customer

segmentation opportunities and customer activity

history for our Support customers as well as

power proactive campaigns across web, email,

and mobile channels.

Zendesk Explore also continues to progress. This

new customer analytics product will supplement

our current Insights and Benchmark capabilities—

both of which we plan to expand while Explore is

in development. Explore’s modern architecture

will give our customers better decision-making

power by combining Zendesk data with external

data sources for a broader, more integrated

picture of the entire customer data set.

Answer Bot

The good kind of

know-it-all

Zendesk Shareholder Letter Q4 2017 - 9

CUSTOMERS

Increasingly, companies are turning to Zendesk

when seeking a flexible solution for digital

transformation projects centered on improving

the customer experience. Large enterprises—and

even more traditional mid-sized companies—

often are challenged by legacy processes,

infrastructure, and systems that don’t provide

enough agility for large-scale change. With our

ease of integration and quick deployment times,

we are seeing many such companies start down

the path to digital transformation using Zendesk.

Among the customers to join us or expand with us

recently include:

amaysim - an Australian provider of mobile,

broadband, and energy services as well as

devices

Chime - an online bank focused on automatic

savings

Circles.Life - a digital telecommunications

operator in Singapore

Conrad Electronic SE - a European online retailer

of electronic products

Etsy - an online retail marketplace for sellers of

creative goods

FINALCAD - mobile apps and predictive

analytics for construction

GoFundMe - a social fundraising platform with

50 million donors

JD Sports Fashion - a U.K. retailer of branded

trainer and sports fashion

Nexway - solutions for online sales and digital

distribution

ProctorU - online proctoring and identity

management solutions

Rappi - a Mexico City-based ecommerce

company active in Mexico, Brazil, and Colombia

Ryanair - a leading European airline serving 33

countries in Europe, Africa, and the Middle East

Soothe - a global, on-demand massage service

available in 50 cities

Stride Health - a service to connect individual

workers with health insurance plans

Tile - devices and technologies to help locate

missing things

UncommonGoods - an online retailer of unique

gifts by independent makers

Zendesk Shareholder Letter Q4 2017 - 10

OPERATING METRICS

A key metric we use to gauge our penetration within larger

organizations is represented by the percentage of Support

MRR generated by customers with 100 or more Support

agents. That percentage grew to 38% at the end of the fourth

quarter of 2017, compared to 37% at the end of the third

quarter of 2017 and 34% at the end of the fourth quarter of

2016. While we expect this metric to grow gradually, we see

these increases in the second half of 2017 as evidence of

improving upmarket momentum.

As a proxy of our success with upmarket opportunities, we

measure our number of contracts signed with an annual value

of $50,000 or greater. In the fourth quarter of 2017, the number

of these contracts we closed was over 25% greater than in

the fourth quarter of 2016. However, we saw a decrease in the

average size of these transactions as compared to the same

period last year.

Our dollar-based net expansion rate, which we use to quantify

our annual expansion within existing customers, increased

by one percentage point to end the fourth quarter at 119%,

compared to 118% at the end of the third quarter of 2017. Our

dollar-based net expansion rate was 115% at the end of the

fourth quarter of 2016. Consistent with expectations in prior

quarters, we expect our dollar-based net expansion rate to

remain in the 110% - 120% range over the next several quarters.

% of total quarter-ending Support MRR

from paid customer accounts with 100+ Support agents

38%100+ Agents

Q4 2017

Zendesk Shareholder Letter Q4 2017 - 11

CORPORATE SOCIAL RESPONSIBILITY (CSR)

Our commitment to social responsibility is unwavering as we enter 2018.

One of our 2017 projects involved seeking evidence of what we believed

to be true: that CSR activity and employee volunteering have a positive

downstream impact on a business’s customer experience and satisfaction.

To that end, our CSR team commissioned a study from Drexel University to

help substantiate whether and how CSR activities influence how customer-

facing employees at Zendesk interact with customers and how those

interactions affect customer satisfaction. The main takeaways from the

research include:

• Customer support agents who volunteered at least once every two months

were more than three times more likely to be rated among the top third in

the company for empathy.

• CSR can drive customer satisfaction by stimulating helping behaviors

among Zendesk’s customer support agents. Helping behaviors are

important because the more an advocate seeks help from others at the

company, the higher their CSAT scores.

The Zendesk Neighbor Foundation issued $2.1 million in grants in 2017 to

its nonprofit partners across the globe. Meanwhile, Zendesk employees

invested more than 9,500 engagement hours in their communities around

the world. Zendesk’s CSR team also sponsored 28 pro bono customer

accounts for a total of $596,000 worth of donated product.

Zendesk Shareholder Letter Q4 2017 - 12

FINANCIAL MEASURES AND CASH FLOW

We made solid progress on operating fundamentals in 2017. Our strong

revenue growth and continued focus on improving operating margins

have been a key focus of management. In 2017, we achieved GAAP and

non-GAAP operating margin expansion based on continued improvements

across all our cost categories, despite the impact on our gross margin

incurred by our recent decision to move our infrastructure operations to

cloud infrastructure from our current co-located data centers. Our focus in

2018 and beyond is to continue to deliver high revenue growth and further

scale our business as measured by expanding GAAP and non-GAAP

operating margins.

Our revenue growth and improvements in margins also helped drive positive

results in net cash from operating activities and results for free cash flow. In

2017, we achieved positive net cash from operating activties and free cash

flow in each quarter and for the year.

Fourth Quarter Results

Our fourth quarter and full-year 2017 results below are based on the revenue

recognition standard ASC 605. Our guidance for 2018 will be based on the

new revenue recognition standard ASC 606, as discussed further in that

section.

Revenue was $123.4 million for the fourth quarter of 2017, up 39% year-over-

year compared to $88.6 million in the fourth quarter of 2016. GAAP gross

margin increased quarter over quarter to 71.7% in the fourth quarter of 2017,

from 70.1% in the third quarter of 2017. GAAP gross margin in the fourth

quarter of 2016 was 71.1%. Non-GAAP gross margin increased quarter over

quarter to 74.5% in the fourth quarter of 2017 compared to 73.5% in the third

quarter of 2017. Non-GAAP gross margin in the fourth quarter of 2016 was

74.8%. Both GAAP and non-GAAP gross margin continues to be impacted by

our dual infrastructure deployments.

GAAP operating loss for the fourth quarter of 2017 was $28.5 million

compared to GAAP operating loss for the third quarter of 2017 of $28.4

million. GAAP operating loss for the fourth quarter of 2016 was $25.1 million.

Non-GAAP operating loss for the fourth quarter of 2017 was $2.4 million,

compared to non-GAAP operating loss for the third quarter of 2017 of $3.3

million. Non-GAAP operating loss for the fourth quarter of 2016 was

$4.4 million.

GAAP operating margin improvement is attributed to overall sales force

productivity gains and G&A operational scaling. GAAP operating margin for

the fourth quarter of 2017 improved to -23.1% from -25.2% in the third quarter

of 2017. GAAP operating margin was -28.4% in the fourth quarter of 2016.

Non-GAAP operating margin improved to -2.0% in the fourth quarter of 2017

from -2.9% in the third quarter of 2017. Non-GAAP operating margin was

-5.0% in the fourth quarter of 2016.

GAAP net loss for the fourth quarter of 2017 was $26.6 million or $0.26 per

share compared to GAAP net loss of $27.7 million or $0.28 per share for the

third quarter of 2017. GAAP net loss was $24.5 million or $0.26 per share for

the fourth quarter of 2016.

Non-GAAP net loss for the fourth quarter of 2017 was $0.5 million or $0.01

per share compared to non-GAAP net loss of $2.5 million or $0.02 per share

for the third quarter of 2017. Non-GAAP net loss was $3.8 million or $0.04

per share for the fourth quarter of 2016. Weighted average shares used to

compute both GAAP and non-GAAP net loss per share for the fourth quarter

of 2017 was 102.0 million.

Non-GAAP results for the fourth quarter of 2017 exclude $24.7 million in

share-based compensation and related expenses (including $2.0 million

of employer tax related to employee stock transactions and $0.4 million

of amortization of share-based compensation capitalized in internal-use

software), $0.7 million of amortization of purchased intangibles, and

$0.7 million of acquisition-related expenses. Non-GAAP results for the

third quarter of 2017 exclude $23.7 million in share-based compensation

and related expenses (including $0.7 million of employer tax related to

Zendesk Shareholder Letter Q4 2017 - 13

Full-Year 2017 Results

Revenue was $430.5 million for the full year of

2017, up 38% year-over-year compared to $312.0

million for 2016. GAAP gross margin increased

to 70.4% in 2017 compared to 69.9% in 2016.

Non-GAAP gross margin decreased slightly to

73.8% in 2017 compared to 73.9% in 2016. As

mentioned above, our gross margins in 2017

were negatively impacted by the migration of our

infrastructure operations to cloud infrastructure

from our current co-located data centers.

GAAP operating loss for 2017 was $114.6 million

compared to GAAP operating loss for 2016 of

$104.3 million. Non-GAAP operating loss for

2017 was $17.1 million, compared to non-GAAP

operating loss for 2016 of $21.1 million.

GAAP operating margin in 2017 improved to

-26.6% from -33.4% in 2016. Non-GAAP operating

margin improved to -4.0% in 2017 from -6.8% in

2016.

GAAP net loss in 2017 was $110.6 million or $1.11

per share compared to GAAP net loss of $103.8

million or $1.11 per share for 2016. Non-GAAP

net loss in 2017 was $13.1 million or $0.13 per

share compared to non-GAAP net loss of $20.5

million or $0.22 per share in 2016. Weighted

average shares used to compute both GAAP and

non-GAAP net loss per share for 2017 was 99.9

million.

Non-GAAP results for 2017 exclude $91.6 million

in share-based compensation and related

expenses (including $4.8 million of employer

tax related to employee stock transactions

and $1.8 million of amortization of share-

based compensation capitalized in internal-

use software), $3.7 million of amortization

of purchased intangibles, and $2.2 million

of acquisition-related expenses. Non-GAAP

results for 2016 exclude $79.5 million in share-

based compensation and related expenses

(including $3.9 million of employer tax related

to employee stock transactions and $1.8 million

of amortization of share-based compensation

capitalized in internal-use software), and $3.8

million of amortization of purchased intangibles.

For the full year of 2017, net cash from operating

activities was $42.1 million, and we achieved

positive free cash flow of $18.2 million.

employee stock transactions and $0.5 million

of amortization of share-based compensation

capitalized in internal-use software), $1.0 million

of amortization of purchased intangibles, and

$0.5 million in acquisition-related expenses.

Non-GAAP results for the fourth quarter of

2016 exclude $19.8 million in share-based

compensation and related expenses (including

$1.8 million of employer tax related to

employee stock transactions and $0.6 million

of amortization of share-based compensation

capitalized in internal-use software), and $0.9

million of amortization of purchased intangibles.

During the fourth quarter of 2017, net cash from

operating activities was $17.4 million, and we

achieved positive free cash flow of $12.0 million.

We ended the fourth quarter of 2017 with $109.4

million of cash and equivalents, and we had an

additional $137.6 million of short-term marketable

securities and $97.4 million of long-term

marketable securities.

Zendesk Shareholder Letter Q4 2017 - 14

GUIDANCE

Our guidance for 2018 is based on the new revenue recognition standard

ASC 606. The new standard has a minimal impact on our revenue

recognition, however the requirement to defer sales commissions under

the new standard results in a benefit to our operating margins. The new

standard does not impact net cash from operating activities or free cash flow.

For comparability, we have provided restated historical financial statements

under the new standard for the full year of 2016 and the full year and

quarters of 2017 on our investor relations website.

For the first quarter of 2018, we expect revenue to range between $125.0

and $127.0 million and we expect our GAAP operating loss to range between

$33.0 and $35.0 million. We expect our non-GAAP operating loss for the

first quarter of 2018 to range between $3.0 and $5.0 million. Our GAAP

operating loss for the first quarter of 2018 is estimated to include share-

based compensation and related expenses of approximately $28.7 million,

amortization of purchased intangibles of approximately $0.7 million, and

acquisition-related expenses of $0.6 million.

For the full year of 2018, we expect revenue to range between $555.0

and $565.0 million, representing growth between 29% and 31% year-over-

year. We expect our GAAP operating loss for the full year of 2018 to range

between $113.0 and $118.0 million, and we expect our non-GAAP operating

income to range between $0.0 (breakeven) and $5.0 million. Our GAAP

operating loss for the full year of 2018 is estimated to include share-based

compensation and related expenses of approximately $112.8 million,

amortization of purchased intangibles of approximately $2.7 million, and

acquisition-related expenses of $2.5 million.

Our full-year guidance reflects our confidence in maintaining a high growth

rate in 2018. We note, however, that several factors affect our revenue

recognition primarily in the first half of the year, as evidenced by our first

quarter 2018 guidance. The first half of the year tends to be more heavily

weighted toward our transactional business, whereas we see more

enterprise deals close in the second half of the year. Our first quarter

revenue guidance reflects this seasonal trend.

As part of our infrastructure migration, we will continue to incur expenses for

both Amazon Web Services and our co-located data centers while we host

customers in both environments during the transition period. We expect to

incur up to approximately 100 basis points of additional depreciation and

related costs in each period while the migration continues. We expect to

finalize our migration plan in the first quarter and will disclose information

about the schedule of expense recognition on our first quarter earnings call.

We expect net cash from operating activities to be positive for the full year of

2018, and for the first time, we are introducing annual guidance on free cash

flow. For the full year of 2018, we expect free cash flow between $25 million

and $30 million, representing a year over year growth of 51% at the midpoint.

This target regarding free cash flow includes cash used for purchases of

property and equipment and internal-use software development costs. We

have not reconciled free cash flow guidance to net cash from operating

activities for this future period because we do not provide guidance on the

reconciling items between net cash from operating activities and free cash

flow, as a result of the uncertainty regarding, and the potential variability

of, these items. The actual amount of such reconciling items will have a

significant impact on our free cash flow and, accordingly, a reconciliation

of net cash from operating activities to free cash flow for the period is not

available without unreasonable effort.

Finally, we estimate we will have approximately 103.8 million weighted

average shares outstanding for the first quarter of 2018 and 106.2 million

weighted average shares outstanding for the full year of 2018, each based

only on current shares outstanding and anticipated activity associated with

equity incentive plans.

Zendesk Shareholder Letter Q4 2017 - 15

Condensed consolidated

statements of operations

(In thousands, except per

share data; unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2017 2016 2017 2016

Revenue $123,426 $88,623 $430,492 $311,999

Cost of revenue 34,958 25,582 127,422 93,900

Gross profit 88,468 63,041 303,070 218,099

Operating expenses:

Research and development 30,779 24,383 115,291 91,067

Sales and marketing 64,035 47,566 220,742 166,987

General and administrative 22,177 16,222 81,680 64,371

Total operating expenses 116,991 88,171 417,713 322,425

Operating loss (28,523) (25,130) (114,643) (104,326)

Other income, net 1,142 775 2,487 1,520

Loss before provision for (benefit from) income taxes (27,381) (24,355) (112,156) (102,806)

Provision for (benefit from) income taxes (732) 193 (1,518) 993

Net loss $(26,649) $(24,548) $(110,638) $(103,799)

Net loss per share, basic and diluted $(0.26) $(0.26) $(1.11) $(1.11)

Weighted-average shares used to compute net loss per share,

basic and diluted 102,044 95,793 99,918 93,161

Zendesk Shareholder Letter Q4 2017 - 16

Condensed consolidated

balance sheets

(In thousands, except par

value; unaudited)

December 31,

2017

December 31,

2016

Assets

Current assets:

Cash and cash equivalents $109,370 $93,677

Marketable securities 137,576 131,190

Accounts receivable, net of allowance for

doubtful accounts of $1,252 and $1,269 as of

December 31, 2017 and December 31, 2016,

respectively

57,096 37,343

Prepaid expenses and other

current assets 24,165 17,608

Total current assets 328,207 279,818

Marketable securities, noncurrent 97,447 75,168

Property and equipment, net 59,157 62,731

Goodwill and intangible assets, net 67,034 53,296

Other assets 8,359 4,272

Total assets $560,204 $475,285

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $5,307 $4,555

Accrued liabilities 21,876 19,106

Accrued compensation and

related benefits 29,017 20,281

Deferred revenue 174,524 123,276

Total current liabilities 230,724 167,218

Deferred revenue, noncurrent 1,213 1,257

Other liabilities 6,626 7,382

Total liabilities 238,563 175,857

Stockholders’ equity:

Preferred stock, par value $0.01 per share — —

Common stock, par value $0.01 per share 1,031 971

Additional paid-in capital 753,568 624,026

Accumulated other comprehensive loss (2,372) (5,197)

Accumulated deficit (430,586) (319,720)

Treasury stock, at cost — (652)

Total stockholders’ equity 321,641 299,428

Total liabilities and stockholders’ equity $560,204 $475,285

Zendesk Shareholder Letter Q4 2017 - 17

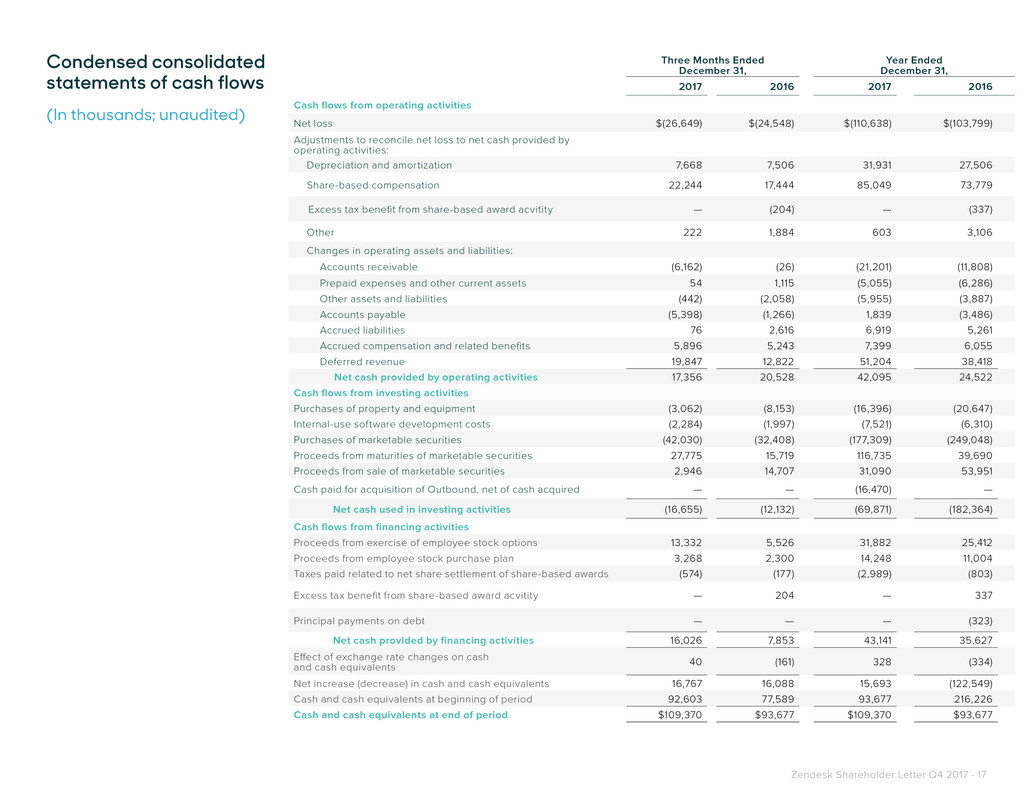

Condensed consolidated

statements of cash flows

(In thousands; unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2017 2016 2017 2016

Cash flows from operating activities

Net loss $(26,649) $(24,548) $(110,638) $(103,799)

Adjustments to reconcile net loss to net cash provided by

operating activities:

Depreciation and amortization 7,668 7,506 31,931 27,506

Share-based compensation 22,244 17,444 85,049 73,779

Excess tax benefit from share-based award acvitity — (204) — (337)

Other 222 1,884 603 3,106

Changes in operating assets and liabilities:

Accounts receivable (6,162) (26) (21,201) (11,808)

Prepaid expenses and other current assets 54 1,115 (5,055) (6,286)

Other assets and liabilities (442) (2,058) (5,955) (3,887)

Accounts payable (5,398) (1,266) 1,839 (3,486)

Accrued liabilities 76 2,616 6,919 5,261

Accrued compensation and related benefits 5,896 5,243 7,399 6,055

Deferred revenue 19,847 12,822 51,204 38,418

Net cash provided by operating activities 17,356 20,528 42,095 24,522

Cash flows from investing activities

Purchases of property and equipment (3,062) (8,153) (16,396) (20,647)

Internal-use software development costs (2,284) (1,997) (7,521) (6,310)

Purchases of marketable securities (42,030) (32,408) (177,309) (249,048)

Proceeds from maturities of marketable securities 27,775 15,719 116,735 39,690

Proceeds from sale of marketable securities 2,946 14,707 31,090 53,951

Cash paid for acquisition of Outbound, net of cash acquired — — (16,470) —

Net cash used in investing activities (16,655) (12,132) (69,871) (182,364)

Cash flows from financing activities

Proceeds from exercise of employee stock options 13,332 5,526 31,882 25,412

Proceeds from employee stock purchase plan 3,268 2,300 14,248 11,004

Taxes paid related to net share settlement of share-based awards (574) (177) (2,989) (803)

Excess tax benefit from share-based award acvitity — 204 — 337

Principal payments on debt — — — (323)

Net cash provided by financing activities 16,026 7,853 43,141 35,627

Effect of exchange rate changes on cash

and cash equivalents 40 (161) 328 (334)

Net increase (decrease) in cash and cash equivalents 16,767 16,088 15,693 (122,549)

Cash and cash equivalents at beginning of period 92,603 77,589 93,677 216,226

Cash and cash equivalents at end of period $109,370 $93,677 $109,370 $93,677

Zendesk Shareholder Letter Q4 2017 - 18

Non-GAAP results

(In thousands, except per

share data)

The following table shows

Zendesk’s GAAP results

reconciled to non-GAAP

results included in this letter.

Three Months Ended

December 31,

Year Ended

December 31,

2017 2016 2017 2016

Reconciliation of gross profit and gross margin

GAAP gross profit $88,468 $63,041 $303,070 $218,099

Plus: Share-based compensation 2,372 1,691 9,040 7,045

Plus: Employer tax related to employee stock transactions 129 106 530 383

Plus: Amortization of purchased intangibles 612 837 3,209 3,362

Plus: Amortization of share-based compensation

capitalized in internal-use software 417 598 1,774 1,821

Non-GAAP gross profit $91,998 $66,273 $317,623 $230,710

GAAP gross margin 72% 71% 70% 70%

Non-GAAP adjustments 3% 4% 4% 4%

Non-GAAP gross margin 75% 75% 74% 74%

Reconciliation of operating expenses

GAAP research and development $30,779 $24,383 $115,291 $91,067

Less: Share-based compensation (7,697) (6,535) (29,970) (27,083)

Less: Employer tax related to employee stock transactions (816) (756) (1,971) (1,559)

Less: Acquisition-related expenses (406) — (843) —

Non-GAAP research and development $21,860 $17,092 $82,507 $62,425

GAAP research and development as percentage of revenue 25% 28% 27% 29%

Non-GAAP research and development as percentage of revenue 18% 19% 19% 20%

GAAP sales and marketing $64,035 $47,566 $220,742 $166,987

Less: Share-based compensation (6,414) (5,263) (24,776) (23,043)

Less: Employer tax related to employee stock transactions (356) (768) (1,164) (1,342)

Less: Amortization of purchased intangibles (135) (104) (495) (418)

Less: Acquisition-related expenses (281) — (750) —

Non-GAAP sales and marketing $56,849 $41,431 $193,557 $142,184

GAAP sales and marketing as percentage of revenue 52% 54% 51% 54%

Non-GAAP sales and marketing as percentage of revenue 46% 47% 45% 46%

Zendesk Shareholder Letter Q4 2017 - 19

(continued...)

Non-GAAP results

(In thousands, except per

share data)

The following table shows

Zendesk’s GAAP results

reconciled to non-GAAP

results included in this letter.

Three Months Ended

December 31,

Year Ended

December 31,

2017 2016 2017 2016

GAAP general and administrative $22,177 $16,222 $81,680 $64,371

Less: Share-based compensation (5,761) (3,955) (21,263) (16,608)

Less: Employer tax related to employee stock transactions (671) (123) (1,184) (586)

Less: Acquisition-related expenses (45) — (566) —

Non-GAAP general and administrative $15,700 $12,144 $58,667 $47,177

GAAP general and administrative as percentage of revenue 18% 18% 19% 21%

Non-GAAP general and administrative as percentage of revenue 13% 14% 14% 15%

Reconciliation of operating loss and operating margin

GAAP operating loss $(28,523) $(25,130) $(114,643) $(104,326)

Plus: Share-based compensation 22,244 17,444 85,049 73,779

Plus: Employer tax related to employee stock transactions 1,972 1,753 4,849 3,870

Plus: Amortization of purchased intangibles 747 941 3,704 3,780

Plus: Acquistion-related expenses 732 — 2,159 —

Plus: Amortization of share-based compensation capitalized in

internal-use software 417 598 1,774 1,821

Non-GAAP operating loss $(2,411) $(4,394) $(17,108) $(21,076)

GAAP operating margin (23)% (28)% (27)% (33)%

Non-GAAP adjustment 21% 23% 23% 26%

Non-GAAP operating margin (2)% (5)% (4)% (7)%

Reconciliation of net loss

GAAP net loss

$(26,649) $(24,548) $(110,638)

$(103,799)

Plus: Share-based compensation 22,244 17,444 85,049 73,779

Plus: Employer tax related to employee stock transactions 1,972 1,753 4,849 3,870

Plus: Amortization of purchased intangibles 747 941 3,704 3,780

Plus: Acquistion-related expenses 732 — 2,159 —

Plus: Amortization of share-based compensation capitalized in

internal-use software 417 598 1,774 1,821

Non-GAAP net loss $(537) $(3,812) $(13,103) $(20,549)

Zendesk Shareholder Letter Q4 2017 - 20

Three Months Ended

December 31,

Year Ended

December 31,

2017 2016 2017 2016

Reconciliation of net loss per share, basic and diluted

GAAP net loss per share, basic and diluted $(0.26) $(0.26) $(1.11) $(1.11)

Non-GAAP adjustments to net loss 0.25 0.22 0.98 0.89

Non-GAAP net loss per share, basic and diluted $(0.01) $(0.04) $(0.13) $(0.22)

Weighted-average shares used to compute

net loss per share, basic and diluted 102,044 95,793 99,918 93,161

Computation of free cash flow

Net cash provided by operating activities $17,356 $20,528 $42,095 $24,522

Less: purchases of property and equipment (3,062) (8,153) (16,396) (20,647)

Less: internal-use software development costs (2,284) (1,997) (7,521) (6,310)

Free cash flow $12,010 $10,378 $18,178 $(2,435)

(continued...)

Non-GAAP results

(In thousands, except per

share data)

The following table shows

Zendesk’s GAAP results

reconciled to non-GAAP

results included

in this letter.

Zendesk Shareholder Letter Q4 2017 - 21

About Zendesk

Zendesk builds software for better customer relationships. It empowers organizations to im-

prove customer engagement and better understand their customers. Approximately 119,000

paid customer accounts in over 160 countries and territories use Zendesk products. Based

in San Francisco, Zendesk has operations in the United States, Europe, Asia, Australia, and

South America. Learn more at www.zendesk.com.

Forward-Looking Statements

This press release contains forward-looking statements, including, among other things,

statements regarding Zendesk’s future financial performance, its continued investment to

grow its business, and progress towards its long-term financial objectives. The words such as

“may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases

that denote future expectation or intent regarding Zendesk’s financial results, operations, and

other matters are intended to identify forward-looking statements. You should not rely upon

forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to

known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual

results, performance, or achievements to differ materially, including (i) adverse changes in

general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang-

ing market dynamics and customer preferences or achieve increased market acceptance of

its products; (iii) Zendesk’s expectation that the future growth rate of its revenues will decline,

and that, as its costs increase, Zendesk may not be able to generate sufficient revenues to

achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes it difficult

to evaluate its prospects and future operating results; (v) the market in which Zendesk oper-

ates is intensely competitive, and Zendesk may not compete effectively; (vi) the development

of the market for software as a service business software applications; (vii) Zendesk’s ability

to introduce and market new products and to support its products on a shared services

platform; (viii) Zendesk’s ability to integrate acquired businesses and technologies success-

fully or achieve the expected benefits of such acquisitions; (ix) Zendesk’s ability to effectively

manage its growth and organizational change; (x) breaches in Zendesk’s security measures

or unauthorized access to its customers’ data; (xi) service interruptions or performance prob-

lems associated with Zendesk’s technology and infrastructure; (xii) real or perceived errors,

failures, or bugs in its products; (xiii) Zendesk’s substantial reliance on its customers renewing

their subscriptions and purchasing additional subscriptions; and (xiv) Zendesk’s ability to

effectively expand its sales capabilities.

The forward-looking statements contained in this press release are also subject to additional

risks, uncertainties, and factors, including those more fully described in Zendesk’s filings

with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q

for the quarter ended September 30, 2017. Further information on potential risks that could

affect actual results will be included in the subsequent periodic and current reports and other

filings that Zendesk makes with the Securities and Exchange Commission from time to time,

including its Annual Report on Form 10-K for the year ended December 31, 2017.

Forward-looking statements represent Zendesk’s management’s beliefs and assumptions

only as of the date such statements are made. Zendesk undertakes no obligation to update

any forward-looking statements made in this press release to reflect events or circumstances

after the date of this press release or to reflect new information or the occurrence of unantici-

pated events, except as required by law.

About Non-GAAP Financial Measures

To provide investors and others with additional information regarding Zendesk’s results, the

following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross

margin, non-GAAP operating expenses, non-GAAP operating loss and operating margin,

non-GAAP net loss, non-GAAP net loss per share, basic and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-GAAP

financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation Capitalized

in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain

employees. It is principally aimed at aligning their interests with those of its stockholders

and at long-term retention, rather than to address operational performance for any particular

period. As a result, share-based compensation expenses vary for reasons that are generally

unrelated to financial and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of

employer taxes related to its employee stock transactions as an expense that is dependent

on its stock price, employee exercise and other award disposition activity, and other factors

that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock

transactions vary for reasons that are generally unrelated to financial and operational perfor-

mance in any particular period.

Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible

assets, including the amortization of the cost associated with an acquired entity’s developed

technology, as items arising from pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for impairment regularly, amortization

of the cost of purchased intangibles is an expense that is not typically affected by operations

during any particular period.

Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transac-

tion costs, integration costs, restructuring costs, and acquisition-related retention payments,

including amortization of acquisition-related retention payments capitalized in internal-use

software, as events that are not necessarily reflective of operational performance during

a period. In particular, Zendesk believes the consideration of measures that exclude such

expenses can assist in the comparison of operational performance in different periods which

may or may not include such expenses.

Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from

operating activities, less purchases of property and equipment and internal-use software

development costs. Zendesk uses free cash flow, among other measures, to evaluate the

ability of its operations to generate cash that is available for purposes other than capital

expenditures and capitalized software development costs. Zendesk believes that informa-

tion regarding free cash flow provides investors with an important perspective on the cash

available to fund ongoing operations.

Zendesk has not reconciled free cash flow guidance to net cash from operating activities for

the year ending December 31, 2018 because Zendesk does not provide guidance on the

reconciling items between net cash from operating activities and free cash flow, as a result

of the uncertainty regarding, and the potential variability of, these items. The actual amount

of such reconciling items will have a significant impact on Zendesk’s free cash flow and,

accordingly, a reconciliation of net cash from operating activities to free cash flow for the year

ending December 31, 2018 is not available without unreasonable effort.

Zendesk’s disclosures regarding its expectations for its non-GAAP operating margin include

adjustments to its expectations for its GAAP operating margin that exclude the expected

share-based compensation and related expenses, amortization of purchased intangibles,

and acquisition-related expenses excluded from its expectations for non-GAAP operating

loss as compared to its expectation for GAAP operating loss for the same period.

Zendesk Shareholder Letter Q4 2017 - 22

Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to

GAAP operating margin for future periods beyond the current fiscal year because Zendesk

does not provide guidance on the reconciling items between GAAP operating margin and

non-GAAP operating margin for such periods, as a result of the uncertainty regarding, and

the potential variability of, these items. The actual amount of such reconciling items will have

a significant impact on Zendesk’s non-GAAP operating margin and, accordingly, a reconcili-

ation of GAAP operating margin to non-GAAP operating margin guidance for such periods is

not available without unreasonable effort.

Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include

adjustments to its expectations for its GAAP gross margin that exclude share-based com-

pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased

intangibles related to developed technology. The share-based compensation and related

expenses excluded due to such adjustments are primarily comprised of the share-based

compensation and related expenses for employees associated with Zendesk’s platform

infrastructure and customer experience organization.

Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP

gross margin for future periods because Zendesk does not provide guidance on the rec-

onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the

uncertainty regarding, and the potential variability of, these items. The actual amount of such

reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and,

accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for

the period is not available without unreasonable effort.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. Zendesk’s management does not itself, nor does

it suggest that investors should, consider such non-GAAP financial measures in isolation

from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk

presents such non-GAAP financial measures in reporting its financial results to provide inves-

tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these

non-GAAP financial measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational decision-making.

This allows investors and others to better understand and evaluate Zendesk’s operating

results and future prospects in the same manner as management.

Zendesk’s management believes it is useful for itself and investors to review, as applicable,

both GAAP information that may include items such as share-based compensation and relat-

ed expenses, amortization of purchased intangibles, and acquisition-related expenses, and

the non-GAAP measures that exclude such information in order to assess the performance

of Zendesk’s business and for planning and forecasting in subsequent periods. When Ze-

ndesk uses such a non-GAAP financial measure with respect to historical periods, it provides

a reconciliation of the non-GAAP financial measure to the most closely comparable GAAP fi-

nancial measure. When Zendesk uses such a non-GAAP financial measure in a forward-look-

ing manner for future periods, and a reconciliation is not determinable without unreasonable

effort, Zendesk provides the reconciling information that is determinable without unreason-

able effort and identifies the information that would need to be added or subtracted from the

non-GAAP measure to arrive at the most directly comparable GAAP measure. Investors are

encouraged to review the related GAAP financial measures and the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP financial measure as

detailed above.

About Operating Metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure per-

formance, identify trends, formulate business plans, and make strategic decisions. These

include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its

other products, dollar-based net expansion rate, monthly recurring revenue represented by

its churned customers, and the percentage of its monthly recurring revenue from Support

originating from customers with 100 or more agents on Support.

Zendesk defines the number of paid customer accounts at the end of any particular period

as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free

trials, or other free services, (ii) the number of accounts using Chat, exclusive of free trials

or other free services, and (iii) the number of accounts on all of its other products, exclusive

of free trials and other free services, each as of the end of the period and as identified by

a unique account identifier. Use of Support, Chat, and Zendesk’s other products requires

separate subscriptions and each of these accounts are treated as a separate paid custom-

er account. Existing customers may also expand their utilization of Zendesk’s products by

adding new accounts and a single consolidated organization or customer may have multiple

accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or

work processes. Each of these accounts is also treated as a separate paid customer account.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase

revenue across its existing customer base through expansion of authorized agents asso-

ciated with a paid customer account, upgrades in subscription plans, and the purchase of

additional products as offset by churn, contraction in authorized agents associated with a

paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net

expansion rate is based upon monthly recurring revenue for a set of paid customer accounts

on its products. Monthly recurring revenue for a paid customer account is a legal and con-

tractual determination made by assessing the contractual terms of each paid customer ac-

count, as of the date of determination, as to the revenue Zendesk expects to generate in the

next monthly period for that paid customer account, assuming no changes to the subscrip-

tion and without taking into account any one-time discounts or any platform usage above

the subscription base, if any, that may be applicable to such subscription. Monthly recurring

revenue is not determined by reference to historical revenue, deferred revenue, or any other

GAAP financial measure over any period. It is forward-looking and contractually derived as of

the date of determination.

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue

net of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue

as the aggregate monthly recurring revenue across its products for customers with paid

customer accounts on Support or Chat as of the date one year prior to the date of calcula-

tion. Zendesk defines the retained revenue net of contraction and churn as the aggregate

monthly recurring revenue across its products for the same customer base included in the

measure of base revenue at the end of the annual period being measured. The dollar-based

net expansion rate is also adjusted to eliminate the effect of certain activities that Zendesk

identifies involving the transfer of agents between paid customer accounts, consolidation of

customer accounts, or the split of a single paid customer account into multiple paid customer

accounts. In addition, the dollar-based net expansion rate is adjusted to include paid cus-

tomer accounts in the customer base used to determine retained revenue net of contraction

and churn that share common corporate information with customers in the customer base

that are used to determine the base revenue. Giving effect to this consolidation results in

Zendesk’s dollar-based net expansion rate being calculated across approximately 92,800

customers, as compared to the approximately 118,900 total paid customer accounts as of

December 31, 2017.

Zendesk Shareholder Letter Q4 2017 - 23

To the extent that Zendesk can determine that the underlying customers do not share com-

mon corporate information, Zendesk does not aggregate paid customer accounts associated

with reseller and other similar channel arrangements for the purposes of determining its

dollar-based net expansion rate. While not material, Zendesk believes the failure to account

for these activities would otherwise skew the dollar-based net expansion metrics associated

with customers that maintain multiple paid customer accounts across its products and paid

customer accounts associated with reseller and other similar channel arrangements.

Zendesk does not currently incorporate operating metrics associated with its analytics prod-

uct or its Outbound product into its measurement of dollar-based net expansion rate.

For a more detailed description of how Zendesk calculates its dollar-based net expansion

rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange Com-

mission.

Zendesk calculates its monthly recurring revenue represented by its churned customers on

an annualized basis by dividing base revenue associated with paid customer accounts on

Support that churn, either by termination of the subscription or failure to renew, during the

annual period being measured, by Zendesk’s base revenue. Zendesk’s monthly recurring

revenue represented by its churned customers excludes expansion or contraction associ-

ated with paid customer accounts on Support and the effect of upgrades or downgrades

in subscription plan. The monthly recurring revenue represented by its churned customers

is adjusted to exclude paid customer accounts that churned from the customer base used

that share common corporate information with customer accounts that did not churn from

the customer base during the annual period being measured. While not material, Zendesk

believes the failure to make this adjustment could otherwise skew the monthly recurring rev-

enue represented by its churned customers as a result of customers that maintain multiple

paid customer accounts on Support.

Zendesk’s percentage of monthly recurring revenue from Support that is generated by cus-

tomers with 100 or more agents on Support is determined by dividing the monthly recurring

revenue from Support for paid customer accounts with 100 or more agents on Support as of

the measurement date by the monthly recurring revenue from Support for all paid customer

accounts on Support as of the measurement date. Zendesk determines the customers with

100 or more agents on Support as of the measurement date based on the number of activat-

ed agents on Support at the measurement date and includes adjustments to aggregate paid

customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly recurring

revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with products other

than Support into its measurement of monthly recurring revenue represented by its churned

customers or the percentage of monthly recurring revenue from Support that is generated by

customers with 100 or more agents on Support.

December 31,

2016

March 31,

2017

June 30,

2017

September 30,

2017

December 31,

2017

Paid customer accounts on

Zendesk Support (approx.) 50,800 54,900 57,800 61,200 64,100

+ Paid customer accounts on

Zendesk Chat (approx.) 41,300 44,000 45,300 46,600 47,000

+ Paid customer accounts on

other Zendesk products (approx.) 2,200 2,900 4,300 6,100 7,800

= Approximate number of

paid customer accounts 94,300 101,800 107,400 113,900 118,900

Source: Zendesk, Inc.

Contact:

Investor Contact

Marc Cabi, +1 415-852-3877

ir@zendesk.com

Media Contact

Tian Lee, +1 415-231-0847

press@zendesk.com

Customer Metrics

Geographic Information

United States

EMEA

Other

Q4’17

53.2%

28.9%

17.9%

FY’17

53.3%

28.6%

18.1%

Revenue by geography: