Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STANDARD DIVERSIFIED INC. | tv484869_8k.htm |

Exhibit 99.1

February 2018 • Investor Presentation S TANDARD D IVERSIFIED O PPORTUNITIES I NC . Standard Diversified Opportunities Inc. owns and operates subsidiaries in a variety of industries, including other tobacco products, outdoor advertising and insurance.

This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Certain statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward - looking statements within the meaning of the federal securities laws and as such are based upon the current beliefs of Standard Diversified Opportunities Inc . (“we,” ”us,” “our,” “SDOI,” or the “Company”) as to the outcome and timing of future events . There can be no assurance that the expectations, conclusions or beliefs expressed in any forward - looking statements will in fact occur . Examples of forward looking statements in this presentation include, but are not limited to, statements regarding : (i) the earnings impact of our investments ; (ii) improvements in our new business production ; (iii) future M&A activity ; (iv) global brand recognition ; (v) the leveraging of internal resources across divisions ; (vi) our ability to stay in front of improvements in technology ; (vii) growth drivers and expected levels of our organic growth ; (viii) our management team ; (ix) our balance sheet ; and (x) our return to shareholders . Forward - looking statements are generally identifiable by use of forward - looking terminology such as “may,” “will,” “should,” “potential,” “intend” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “hypothetical,” “continue,” “future” or other similar words or expressions . All forward - looking statements included in this presentation are based upon information available to the Company on the date hereof and the Company is under no duty to update any of the forward - looking statements after the date of this presentation to conform these statements to actual results . The forward - looking statements involve a number of significant risks and uncertainties . Factors that could have a material adverse effect on the Company’s operations and future prospects are set forth in the prospectus included in the Company’s Registration Statement on Form S - 4 (Commission File No . 333 - 215802 ), as well as the Company’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2016 and Quarterly Reports on Form 10 - Q for each of the three months ended March 31 , 2017 , June 30 , 2017 , and September 30 , 2017 including the sections entitled “Risk Factors” contained therein . The factors set forth in the Risk Factors section and otherwise described in the Company’s filings with SEC could cause the Company’s actual results to differ significantly from those contained in any forward - looking statement contained in this presentation . The Company does not guarantee that the assumptions underlying such forward - looking statements are free from errors . Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the Company’s business, financial condition, liquidity, cash flows and results could differ materially from those expressed in any forward - looking statement . While forward - looking statements reflect our good faith beliefs, they are not guarantees of future performance . Any forward - looking statement speaks only as of the date on which it is made . New risks and uncertainties arise over time, and it is not possible for us to predict the occurrence of those matters or the manner in which they may affect us . We disclaim any obligation to publicly update or revise any forward - looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes . Use caution in relying on past forward - looking statements, which were based on results and trends at the time they were made, to anticipate future results or trends . 2 S AFE H ARBOR

3 Selected Financial Information a s of September 30, 2017 Cash and cash equivalents $20.5 Million Total Assets $304.4 Million Ticker SDOIA Shares Outstanding 16,569,223* Market Cap $188.7 Million** Standard Diversified Opportunities Inc. (“SDOI” or the “Company”) • A publicly - listed, diversified holding company • Permanent capital vehicle with experienced management, focused on investing in quality operating businesses run by high - caliber executive teams • Create and maximize long - term value for shareholders • Public platform in which to pursue opportunistic M&A * Includes Class A and Class B shares of common stock outstanding as of October 31 , 2017 and 181 , 825 shares of Class A common stock sold on January 12 , 2018 ** Calculation is based on the closing price of shares of Class A common stock as of January 31 , 2018 A T A G LANCE

4 All ownership percentages are 100% unless otherwise noted Non - Standard General Shareholders (~ 11.0% ownership - includes directors/officers ownership) Standard General Entity Shareholders (~ 89.0% ownership) Maidstone Insurance Company (New York State domiciled insurance company) AIM Insurance Agency Interboro Management S TANDARD D IVERSIFIED O PPORTUNITIES I NC . OTCQB: SDOIA Pillar General Inc. Interboro Holdings, Inc. Turning Point Brands, Inc. NYSE: TPB (~51.2% ownership) Standard Outdoor Southeast II LLC Standard Outdoor LLC Standard Outdoor Southeast I LLC Standard Outdoor Southwest LLC O RGANIZATIONAL S TRUCTURE

5 Value to the Company Value to the SDOI Investor Established operating business in the expanding Other Tobacco Products market with a strong executive management team Current size and scale facilitates substantial growth The Company owns approximately 51% of Turning Point Brands, Inc. a NYSE - listed company (TPB) The Company’s stock provides an alternative opportunity to participate in TPB’s growth Free cash flow generating business model Uncorrelated risk profile in the out - of - home advertising space P ILLAR G ENERAL Maidstone Insurance Co, a P&C carrier licensed in 24 states that carries brand recognition in the New York market Potential for long - term capital growth with a focus on BOTH underwriting and active asset investing I NVESTMENT T HESIS

6 • Develop a platform to facilitate long - term value creation • Focus on acquisitions of sustainable cash flow generating businesses with top - quality management teams • Drive growth across the portfolio with appropriate capital allocation Sustainable Cash Flow Generating Businesses with Strong Management Teams Permanent Capital Platform Long - Term Value Creation L ONG T ERM V IEW

7 Objective Offer solutions to companies with management teams that : ▪ Have successfully implemented their business plan ▪ Want to continue building upon their historical profits and growth ▪ Have identifiable, untapped business potential ▪ Seek the flexibility and liquidity of public markets Acquisition Target Size & Industry $40 - $400 million Enterprise Value Industry agnostic, with a focus on: ▪ Situations with "social issues" ▪ Distressed opportunities ▪ Legacy holdings of PE/Asset Managers ▪ Generational businesses U NIQUE V ALUE P ROPOSITION

8 2013 2016 2018 2017 2017 2015 Management exits operating businesses and company converts to a publicly - traded shell In February, Greg Baxter named Chairman and Ian Estus nominated to Board of Directors; largest shareholder proposes the contribution and exchange of a controlling interest in Turning Point Brands In January, Company closes on acquisition of Maidstone Insurance Company, along with a significant acquisition of billboard assets In June, Company closes on the TPB acquisition and emerges from shell company status In July, Company closes on acquisition of billboard assets from Metro Outdoor Advertising Greg Baxter nominated to Board of Directors C ORPORATE T IMELINE

9 Ian Estus, President and Chief Executive Officer Mr . Estus has served as a director on the Board of the Company since August 2016 and as President and Chief Executive Officer since June 2017 , and has over 19 years of investment and asset management experience . Prior to joining the Board, Mr . Estus was the Managing Director of Investments of HC 2 Holdings, Inc . (NYSE : HCHC), a diversified holding company with investments in various industries including manufacturing, marine services, insurance, utilities, telecommunications and life sciences . Mr . Estus received a B . S . in Business Administration with a Concentration in Accounting from the State University of New York at Buffalo . Greg Baxter, Executive Chairman of the Board Mr . Baxter has served as a director on the Board of the Company since October 2015 and Executive Chairman since June 2017 , and has over 40 years of financial and operational experience . Mr . Baxter has also served as a director of Turning Point Brands (NYSE : TPB and its predecessor), since April 2006 . Mr . Baxter has held senior level positions at Diaz & Altschul Capital Management, SG Cowen, and Rothschild Inc . Mr . Baxter holds a Bachelor of Arts from the University of Victoria in Canada and a Master of Business Administration from the Ivey Business School in London . Brad Tobin, General Counsel and Secretary Mr . Tobin joined the Company as the General Counsel in January 2018 with over 10 years of legal and operational experience . Immediately prior to joining the Company, Mr . Tobin served as the General Counsel and Senior Vice President of General Wireless Operations Inc . dba RadioShack where he steered operations and the legal team through two bankruptcies . Preceding this role, Mr . Tobin served on the distressed debt team at Silver Point Capital, LP . Mr . Tobin holds a Juris Doctor from St . John’s University, School of Law in New York and a B . S . in Economics from the University of Wisconsin - Madison . L EADERSHIP T EAM

O PERATING B USINESSES

11 P ILLAR G ENERAL The Company owns approximately 51 % of the outstanding common stock of TPB Pillar General is a wholly - owned subsidiary of the Company Standard Outdoor is a wholly - owned subsidiary of the Company Turning Point Brands, Inc. is a leading U.S. provider of Other Tobacco Products Through its three focus brands – Stoker’s® in Smokeless Products , Zig - Zag® in Smoking Products and the VaporBeast ® distribution engine in NewGen Products – TPB generates solid cash flow which it uses to finance acquisitions, increase brand support and strengthen its capital structure TPB does not sell cigarettes Standard Outdoor is a full - service outdoor advertising company. Through its wholly - owned subsidiaries, Standard Outdoor recently closed on acquisitions of billboard assets located near Austin, TX and in Northern Alabama Pillar General is our insurance holding company, which recently acquired Maidstone Insurance, a New York domiciled seller of auto and personal lines of property and casualty insurance. S UBSIDIARIES : A G ROWTH P LATFORM

Turning Point Brands 12 • $ 424 . 1 million market capitalization as of 1 / 31 / 2018 • $ 212 . 2 million of revenue ( 9 months ended 9 / 30 / 2017 ) • $ 45 . 3 million of Adjusted EBITDA* ( 9 months ended 9 / 30 / 2017 ) T URNING P OINT B RANDS * This is a non - GAAP figure. Reconciliation to the most comparable GAAP measure, as well as related disclosure, can be found in the Appendix

13 Turning Point Brands, Inc . (NYSE : TPB) is a leading provider of ‘Other Tobacco Products’ in the United States with some of the most widely recognized names in the industry A T A G LANCE

14 $52.4 $26.9 $50.6 $9.1 FY 2016 FY 2015 $206.2 $197.3 Net Sales Net Income Adjusted EBITDA* $45.3 $ 16.7** $39.0 $ 9.8*** $ 212.2 $ 152.4 9 Mos 2017 9 Mos 2016 +39% +16% * This is a non - GAAP figure. Reconciliation to the most comparable GAAP measure, as well as related disclosure, can be found in t he Appendix ** Includes after - tax charge of $3.8 million on extinguishment of debt and $0.6MM loss on variable interest entity Vapor Shark *** Includes after - tax charge of $2.8MM on extinguishment of debt ($ in millions) $58.8 $ 33.8 LTM $ 266.0 F INANCIAL P ERFORMANCE

$0.00 $5.00 $10.00 $15.00 $20.00 $25.00 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 15 IPO $10.00 May 11, 2016 $ 22.00 January 31, 2018 P OST - IPO M ARKET P ERFORMANCE

16 • Improved capital structure and fl exibility • Innovative management team • Strong market position with organic growth opportunities • Integration potential for acquired operations • Attractive landscape for accretive acquisitions Recent Acquisitions “Plug and Play” Strong Regional Brands • Wind River smokeless brand purchase increased TPB chew market share • Accretive to earnings • Opportunity to expand beyond 25% of U.S. Market “Bolt - on Infrastructure” NewGen Sales Engine • VaporBeast acquisition strengthened TPB sales and distribution infrastructure, with 4,500+ non - traditional retailers and direct consumers • Vapor Shark provides proprietary products, market insight and integration synergies P OSITIONED FOR FUTURE GROWTH

S TANDARD O UTDOOR 17 A wholly - owned subsidiary of the Company Standard Outdoor is committed to expansion in the out - of - home advertising space through acquisition and organic growth in local markets across the country

18 • With technological advances driving demand, the out - of - home advertising space continues to expand • The Company believes there is an attractive opportunity in this industry, which consists of three large nationwide players, a few medium - sized regional companies and hundreds of independent sign owners Austin Market Opportunity • In July 2017 , Standard Outdoor purchased ten billboard faces ( 5 structures) and the related ground leases and advertising contracts in the Austin, Texas market • In January 2018 , Standard Outdoor purchased over 150 faces ( 83 billboard structures) and the related ground leases and advertising contracts located in the Birmingham and Huntsville, Alabama markets Birmingham Huntsville A T A G LANCE

19 Market Approach • Acquire high - quality outdoor advertising assets with upside potential from strategic sales efforts • Aggressively pursue growth through “tuck - in” acquisitions, new site development and digital conversion • Establish regional operation hubs for managing assets • Focus on markets dominated by local ad sales and establish relationships through direct market participation in these communities G ROWTH S TRATEGY

P ILLAR G ENERAL 20 • Pillar General is SDOI’s insurance holding company subsidiary • On January 2 , 2018 , the Company acquired Interboro Holdings, Inc . , the parent of Maidstone Insurance Company, an automobile and personal property and casualty insurance company P ILLAR G ENERAL • Maidstone is licensed to write automobile and/or personal property and casualty insurance in 24 states Licensed States A T A G LANCE

21 Market Approach ▪ Focus on four primary lines of business : homeowners, automobile, workers compensation and general liability ▪ Utilize local independent agents that control substantial small to mid - sized insurance markets ▪ Develop niche residential and commercial programs to target small - sized policyholders Unique Strategy ▪ Accumulate “safe” risk on both sides of the balance sheet – risk that can be underwritten with a margin of safety and has the potential to generate long - term capital appreciation ▪ Generate higher asset returns, supported by the leveraged and stable balance sheet of an insurance company, resulting in a lower cost of capital P ILLAR G ENERAL G ROWTH S TRATEGY

APPENDIX

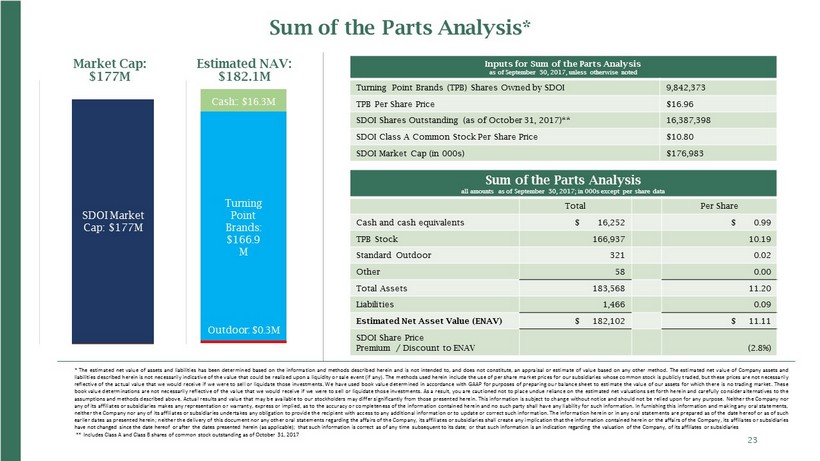

23 2 Inputs for Sum of the Parts Analysis as of September 30, 2017, unless otherwise noted Turning Point Brands (TPB) Shares Owned by SDOI 9,842,373 TPB Per Share Price $16.96 SDOI Shares Outstanding (as of October 31, 2017)** 16,387,398 SDOI Class A Common Stock Per Share Price $10.80 SDOI Market Cap (in 000s) $176,983 Sum of the Parts Analysis all amounts as of September 30, 2017; in 000s except per share data Total Per Share Cash and cash equivalents $ 16,252 $ 0.99 TPB Stock 166,937 10.19 Standard Outdoor 321 0.02 Other 58 0.00 Total Assets 183,568 11.20 Liabilities 1,466 0.09 Estimated Net Asset Value (ENAV) $ 182,102 $ 11.11 SDOI Share Price Premium / Discount to ENAV (2.8%) Outdoor: $0.3M Turning Point Brands: $166.9 M Cash:: $16.3M * The estimated net value of assets and liabilities has been determined based on the information and methods described herein and is not intended to, and does not constitute, an appraisal or estimate of value based on any other method . The estimated net value of Company assets and liabilities described herein is not necessarily indicative of the value that could be realized upon a liquidity or sale event (if any) . The methods used herein include the use of per share market prices for our subsidiaries whose common stock is publicly traded, but these prices are not necessarily reflective of the actual value that we would receive if we were to sell or liquidate those investments . We have used book value determined in accordance with GAAP for purposes of preparing our balance sheet to estimate the value of our assets for which there is no trading market . These book value determinations are not necessarily reflective of the value that we would receive if we were to sell or liquidate those investments . As a result, you are cautioned not to place undue reliance on the estimated net valuations set forth herein and carefully consider alternatives to the assumptions and methods described above . Actual results and value that may be available to our stockholders may differ significantly from those presented herein . This information is subject to change without notice and should not be relied upon for any purpose . Neither the Company nor any of its affiliates or subsidiaries makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information . In furnishing this information and making any oral statements, neither the Company nor any of its affiliates or subsidiaries undertakes any obligation to provide the recipient with access to any additional information or to update or correct such information . The information herein or in any oral statements are prepared as of the date hereof or as of such earlier dates as presented herein ; neither the delivery of this document nor any other oral statements regarding the affairs of the Company, its affiliates or subsidiaries shall create any implication that the information contained herein or the affairs of the Company, its affiliates or subsidiaries have not changed since the date hereof or after the dates presented herein (as applicable) ; that such information is correct as of any time subsequent to its date ; or that such information is an indication regarding the valuation of the Company, of its affiliates or subsidiaries ** Includes Class A and Class B shares of common stock outstanding as of October 31, 2017 SDOI Market Cap: $177M Sum of the Parts Analysis* Market Cap: $177M Estimated NAV: $182.1M

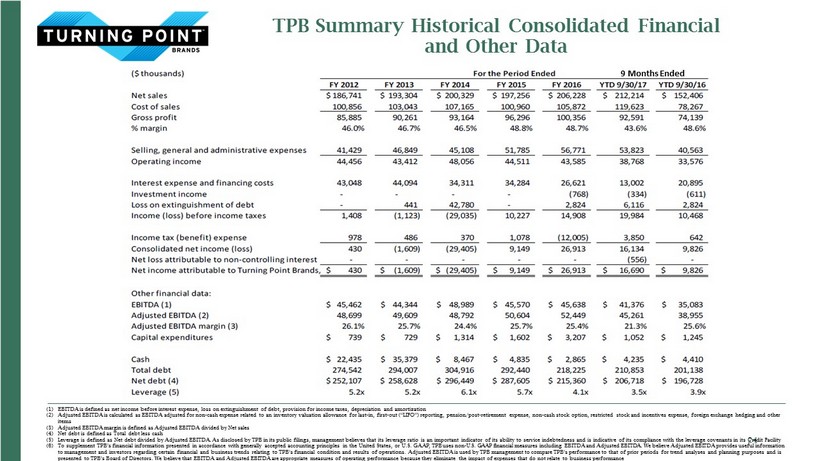

TPB Summary Historical Consolidated Financial and Other Data 24 (1) EBITDA is defined as net income before interest expense, loss on extinguishment of debt, provision for income taxes, depreci ation and amortization (2) Adjusted EBITDA is calculated as EBITDA adjusted for non - cash expense related to an inventory valuation allowance for last - i n, first - out (‘‘LIFO’’) reporting, pension/post - retirement expense, non - cash stock option, restricted stock and incentives expen se, foreign exchange hedging and other items (3) Adjusted EBITDA margin is defined as Adjusted EBITDA divided by Net sales (4) Net debt is defined as Total debt less cash (5) Leverage is defined as Net debt divided by Adjusted EBITDA. As disclosed by TPB in its public filings, management believes th at its leverage ratio is an important indicator of its ability to service indebtedness and is indicative of its compliance with the leverage covenants in its Credit Facility (6) To supplement TPB’s financial information presented in accordance with generally accepted accounting principles in the United St ates, or U.S. GAAP, TPB uses non - U.S. GAAP financial measures including EBITDA and Adjusted EBITDA. We believe Adjusted EBITDA p rovides useful information to management and investors regarding certain financial and business trends relating to TPB’s financial condition and results of operations. Adjusted EBITDA is used by TPB management to compare TPB’s performance to that of prior periods for trend analyse s and planning purposes and is presented to TPB’s Board of Directors. We believe that EBITDA and Adjusted EBITDA are appropriate measures of operating perfo rma nce because they eliminate the impact of expenses that do not relate to business performance 9 Months Ended

TPB Adjusted EBITDA Reconciliation Tables 25 (1) Represents expense related to an inventory valuation allowance for last - in, first - out ("LIFO") reporting (2) Represents our pension and postretirement expense (3) Represents non - cash stock option, restricted stock and incentive expenses (4) Represents non - cash gain and loss stemming from our foreign exchange hedging activities ( 5 ) Represents non - recurring compensation expenses incurred in connection with our IPO ( 6 ) Other items : (a) Year ended December 31 , 2016 : fees incurred for the study of strategic initiatives and product launch costs of our new product lines . (b) Year ended December 31 , 2015 : an expense related to a one - time relocation of finished product for improved logistical services from three third - party distribution warehouses to a new third - party distribution warehouse, fees for the study of strategic initiatives and product launch costs of our new product lines, including our vaporizers within the NewGen segment . (c) Year ended December 31 , 2013 : an expense related to the settlement of a contractual dispute regarding Gordian Group, LLC's alleged right to remuneration under the terms of a 2009 engagement letter, legal expenses and a reimbursement from our insurance company relating to the Langston Complaint (as described below) that was paid in 2013 , and an expense relating to product launch costs of our new product lines, including our e - cigarettes and cartomizers within our NewGen segment . (d) Year ended December 31 , 2012 : the receipt of approximately $ 1 . 2 million that had been reserved in relation to promissory notes held by Mr . Thomas F . Helms, Jr . and an expense related to the settlement of a shareholder litigation concerning the use of corporate assets to extend the loans to Mr . Helms, among other things (the "Langston Complaint") 9 Months Ended

C ONTACT I NFORMATION Investor Relations: The Equity Group Inc. Adam Prior Senior Vice President APrior@equityny.com 212 - 836 - 9606