Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATIONS UNDER SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 - FASTENAL CO | fast1231201710-kexhibit32.htm |

| EX-31 - CERTIFICATIONS UNDER SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 - FASTENAL CO | fast1231201710-kexhibit31.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - FASTENAL CO | fast1231201710-kexhibit23.htm |

| EX-21 - SUBSIDIARIES OF FASTENAL COMPANY - FASTENAL CO | fast1231201710-kexhibit21.htm |

| EX-10.1 - BONUS PROGRAM FOR EXECUTIVE OFFICERS - FASTENAL CO | fast1231201710-kexhibit101.htm |

| 10-K - 10-K - FASTENAL CO | fast1231201710-k.htm |

2017 ANNUAL REPORT

9706257 | 2017 Annual Report | 2.18 KV | Printed in the USA

2017 ANNUAL REPORT

2017 ANNUAL REPORT 2017 ANNUAL REPORT

CO

UN

TR

IES

W

ITH I

N-MARKET LOCATION

S

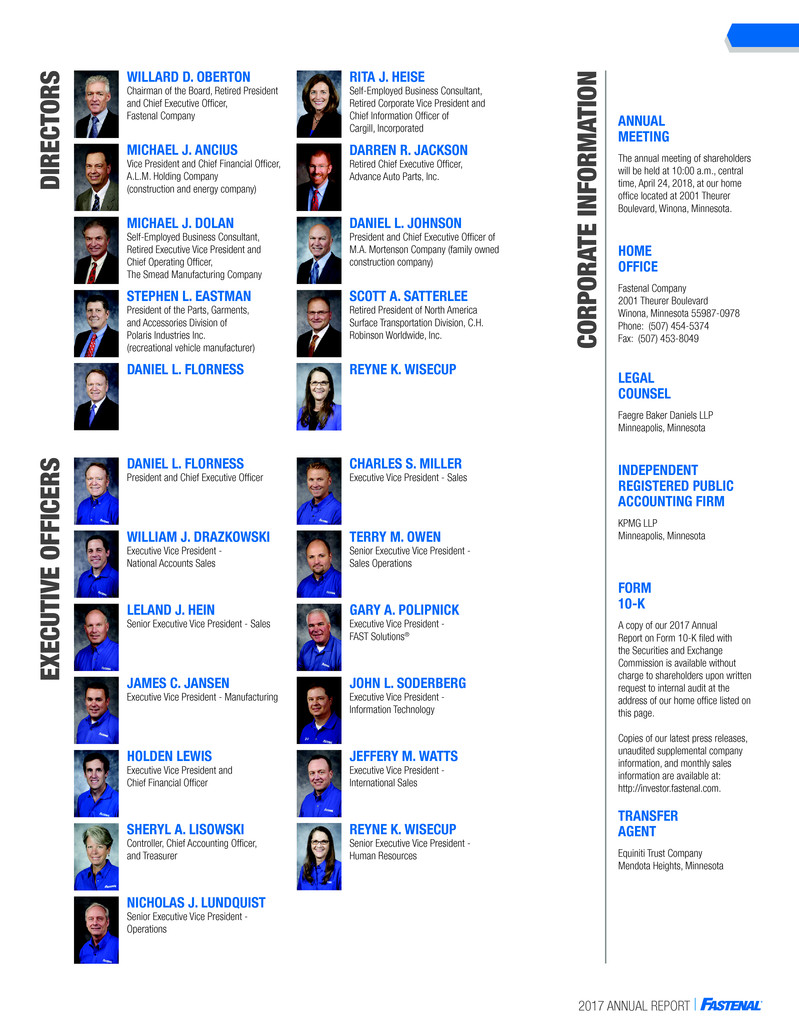

JAMES C. JANSEN

Executive Vice President - Manufacturing

HOLDEN LEWIS

Executive Vice President and

Chief Financial Officer

LELAND J. HEIN

Senior Executive Vice President - Sales

SHERYL A. LISOWSKI

Controller, Chief Accounting Officer,

and Treasurer

DANIEL L. FLORNESS

President and Chief Executive Officer

WILLIAM J. DRAZKOWSKI

Executive Vice President -

National Accounts Sales

EXECUTIVE OFFICER

S

ANNUAL

MEETING

The annual meeting of shareholders

will be held at 10:00 a.m., central

time, April 24, 2018, at our home

office located at 2001 Theurer

Boulevard, Winona, Minnesota.

HOME

OFFICE

Fastenal Company

2001 Theurer Boulevard

Winona, Minnesota 55987-0978

Phone: (507) 454-5374

Fax: (507) 453-8049

LEGAL

COUNSEL

INDEPENDENT

REGISTERED PUBLIC

ACCOUNTING FIRM

Faegre Baker Daniels LLP

Minneapolis, Minnesota

KPMG LLP

Minneapolis, Minnesota

FORM

10-K

TRANSFER

AGENT

A copy of our 2017 Annual

Report on Form 10-K filed with

the Securities and Exchange

Commission is available without

charge to shareholders upon written

request to internal audit at the

address of our home office listed on

this page.

Copies of our latest press releases,

unaudited supplemental company

information, and monthly sales

information are available at:

http://investor.fastenal.com.

Equiniti Trust Company

Mendota Heights, Minnesota

CORPOR

ATE INFORM

ATIO

N

$4.4 BILLIO

N

NET SALE

S

NET EARNING

S

$578.6 MILLIO

N

TABLE OF CONTENTS

1-3 Letter to Shareholders

4-5 10-Year Selected Financial

Data & Financial Highlights

6 Stock and Financial Data

MICHAEL J. DOLAN

Self-Employed Business Consultant,

Retired Executive Vice President and

Chief Operating Officer,

The Smead Manufacturing Company

SCOTT A. SATTERLEE

Retired President of North America

Surface Transportation Division, C.H.

Robinson Worldwide, Inc.

RITA J. HEISE

Self-Employed Business Consultant,

Retired Corporate Vice President and

Chief Information Officer of

Cargill, Incorporated

STEPHEN L. EASTMAN

President of the Parts, Garments,

and Accessories Division of

Polaris Industries Inc.

(recreational vehicle manufacturer)

DANIEL L. JOHNSON

President and Chief Executive Officer of

M.A. Mortenson Company (family owned

construction company)

REYNE K. WISECUP

DARREN R. JACKSON

Retired Chief Executive Officer,

Advance Auto Parts, Inc.

WILLARD D. OBERTON

Chairman of the Board, Retired President

and Chief Executive Officer,

Fastenal Company

MICHAEL J. ANCIUS

Vice President and Chief Financial Officer,

A.L.M. Holding Company

(construction and energy company)DIRECTOR

S

DANIEL L. FLORNESS

NO. OF FASTENAL SCHOOL OF

BUSINESS COURSE COMPLETIONS

655,261

BRANCHES

2,383

INVENTORY VALUE

$1.1 BILLION

NO. OF ORDERS PROCESSED

37,641,814

20,565

EMPLOYEES

127,000+

EMPLOYEE SAFETY

COACHING, TRAINING, &

INSPECTION EVENTS

GLANCE

FASTENAL

AT A

143 MILLIONMILES DELIVERED 834DELIVEREDMILLION POUNDS

50,000+

BIN STOCKS

ACTIVE

605

ONSITE

LOCATIONS 71,000

+

VENDING MACHINES INSTALLED

DAILY SALES

GROWTH TO

CUSTOMERS

WITH VENDING

13.2%

GARY A. POLIPNICK

Executive Vice President -

FAST Solutions®

REYNE K. WISECUP

Senior Executive Vice President -

Human Resources

JEFFERY M. WATTS

Executive Vice President -

International Sales

TERRY M. OWEN

Senior Executive Vice President -

Sales Operations

JOHN L. SODERBERG

Executive Vice President -

Information Technology

CHARLES S. MILLER

Executive Vice President - Sales

7 Stock Performance Highlights

8 A Deeper Level of Value

INSIDE

BACK

COVER

Directors

Executive Officers

Corporate Information

NICHOLAS J. LUNDQUIST

Senior Executive Vice President -

Operations

24

2017 ANNUAL REPORT

1

LETTER TO

SHAREHOLDERS

A Good Year for the Blue Team

Our 50th year was a good year for Fastenal, a year for our

customers and employees to experience improving success, a

year for our suppliers to participate in this success, and a year for

our shareholders to enjoy a return on their investment.

It was also a year to remind us about the nature of Fastenal.

We believe in people. We believe we can accomplish anything

if everyone in the organization pursues a common goal. And we

believe we can accomplish our goals faster if we unleash the vast

human potential within the organization.

We have a common goal; it’s Growth Through Customer Service.

We also have a means to unleash our potential; it’s called

challenging each other, providing great training, and operating

with a decentralized decision-making mindset.

What a difference a couple of years can make.

At the end of 2015, our customers were experiencing a weak

economy and we were struggling for growth. We closed out the

year with a daily sales contraction of about 2% during the fourth

quarter. In 2016, we worked extremely hard, but it often felt like

we were running in place.

We found our footing as we stepped into 2017. We also started to

‘Think Big,’ and we rekindled our belief in our ability to grow faster.

For the year, we grew our sales around 11% and grew our pre-tax

earnings around 11% – a return to double digits on both fronts. We

are proud of this accomplishment.

Here is a quick recap of 2017. In the first quarter we grew both

sales and pre-tax earnings around 6%, a welcome improvement.

Our momentum continued in the second quarter as we grew our

sales around 11% and our pre-tax earnings around 13%. We were

excited to create some leverage in the business. (For this purpose,

we define leverage as pre-tax earnings growing faster than sales.)

In the third quarter we grew both our sales and pre-tax earnings

around 12%. That was less satisfying than the second quarter. We

understand our growth drivers, and we understand that our primary

growth drivers carry a lower gross profit margin contribution. This

challenges our gross profit margins as our sales mix changes.

Our complementary challenge is simply to manage our operating

expenses as this sales mix change progresses.

These aren’t new comments, but they’re worth repeating. Our lack

of leverage in the third quarter did raise some concerns for us. We

believe we should be able to leverage 12% revenue growth. That

said, there are a couple of items worth noting about the quarter.

First, there was one less business day (63 days in 2017 versus

64 days in 2016). One less day means about $18 million less in

sales; however, certain expenses are linked to the month, not the

day, and they don’t drop when we lose a business day. Examples

include base payroll dollars, benefits, vehicle payments, insurance,

and occupancy. This hurts our gross profit percentage as freight

utilization suffers. It also hurts our operating expense percentage

as facility and people utilization suffers.

The second item centers on people costs and on our aggressive

ramp-up related to our Onsite rollout. Late in 2016, we modified

our branch manager compensation formula. This change, when

combined with an added element to reward for Onsite revenue

growth, added to our expense growth. We have also been

aggressively adding resources to vet and implement new Onsite

locations. We view this as a great long-term investment, but it did

create some added expenses in the near term. These two items

will also impact subsequent quarters.

This brings us to the fourth quarter, when we grew our sales about

15%. Given the relatively strong gross profit margin performance

in the fourth quarter of 2016, we did not expect to leverage our

pre-tax earnings; however, we did expect pre-tax earnings to grow

within two or three percentage points of sales growth. We fell just

shy of this and grew our pre-tax earnings about 11%. We moved a

bit too slowly on challenging our gross profit margins. As president

and CEO, that’s on me. With that said, I’m glad we continued to

invest in our future. This will serve us well in 2018.

You might have noticed the discussion above was focused on

sales growth and pre-tax earnings growth. The recent income

tax changes in the United States had a meaningful impact on our

fourth quarter net earnings – our tax expense dropped and our

net earnings grew faster. By focusing our discussion on pre-tax

results, we were able to provide you with a more ‘straightforward’

discussion. (We like straightforward.)

You may be wondering why a tax law signed in 2017 and effective

in 2018 would impact our net earnings in the fourth quarter of

2017. This relates to the tax liabilities we had previously recorded

on our financial statements for deferred taxes. To make a long

story short, these liabilities (which will come due in future years)

were recorded using the old income tax rates but will be paid using

the new income tax rates. The accounting rules stipulate that we

recognize this impact in the quarter the tax law is signed, hence

our recognition in the fourth quarter of 2017.

We also expect that the recent income tax changes will continue to

have a meaningful impact on our results. This impact is magnified

by the global mix of our business, which remains ‘U.S.-centric’

despite our continued international expansion. From an historical

perspective, we didn’t start to expand our global footprint until we

entered Canada in the mid-1990s. Because of this, our business

in the United States enjoyed a 30-year ‘head start’ and continues

to generate over 85% of our sales and profits. As a result, our

2017 ANNUAL REPORT

2

On November 6, 2017, 65 long-tenured Fastenal employees

traveled to Times Square to ring the Nasdaq opening bell. The event

was a celebration of two major milestones for our company in 2017:

50 years in business and 30 years on the Nasdaq Stock Market.

income tax expense is primarily driven by U.S. income tax rates,

which historically have been high relative to the rest of the world.

To put this in perspective, the average effective income tax rate of

the companies included in the S&P 500 has been around 27% in

recent years. By contrast, our rate has been closer to 37%.

Our customers have historically been limited by four things – the

vibrancy and size of their economy, the ability to fund growth, the

ability to develop their talent, and the ability to develop ideas to

serve their market. These four limitations impact Fastenal too. With a

stronger economy and lower tax burden, our task in 2018 will center

on the last two items – developing talent and generating ideas.

Year 51 is here for Fastenal. Let’s continue

to build our traditions, starting with a simple

approach - Think Big!

Fastenal began in November 1967, and as was mentioned

earlier, we celebrated 50 years in business during 2017. A lesser

known milestone also occurred: We celebrated 30 years as a

public company (since August 1987). Many have benefitted from

our decision to go public, including our employees, who have an

opportunity to take ownership in the company they’re working so

hard to grow.

Milestones are too often about celebrating the past. Our 2017

milestones gave us an opportunity to reflect on the enduring strength

of our culture and core beliefs. We believe in people, we believe in

decentralized decision-making, we promote from within, we provide

great business solutions for customers, and we believe in the future.

Speaking of the future, we believe we have the ability to grow

for years to come. We think this statement is important. We also

believe this can be profitable growth. Here are some thoughts on

our business.

First, we foster strong customer relationships by providing products

and services through multiple channels. These channels include

our traditional branch network, our Onsite network, our vending

network, our FMI (Fastenal Managed Inventory, or bin stock)

network, and our distribution network outside of North America.

Most of our customers buy from us through multiple channels. In

fact, if you add up customers with multiple-channel purchases,

it’s approximately 90% of our revenues. We have to perform at

a high level every day, but because our customer relationships

are so durable, the economy and our ability to expand business

relationships really drive our results. The 10% of our revenue that

is single-channel primarily includes smaller customers and ‘cash

customers’ (non-account retail sales). These customers tend to

buy from us through the traditional branch network. Fortunately,

our growth with these last two groups of customers continues to

experience growth as well.

Second, we believe we have a durable and vibrant business

model. Our durability derives from our frugality. This allows us to

be profitable where others aren’t and to try things others can’t.

We’re vibrant in that we learn from each other, and can identify

and replicate best practices quickly across the company.

Third, the market is really big. After 50 years in business, we believe

our market share is just a small sliver of the potential opportunity.

Some insight into several of our channels:

Let’s talk industrial vending. It helps us grow faster, it’s

profitable, and we continue to improve (although we still have a

lot of opportunity for improvement). We ended 2017 with about

86,000 vending devices deployed. Roughly 71,000 of these

devices primarily vend Fastenal-supplied products, and the

remaining 15,000 devices are primarily used to check out and

return customer-owned assets (tools, scanners, gauges, etc.)

We believe we are 12 to 18 months from having 100,000 total

devices deployed.*

Let’s talk Onsite. An Onsite business is a discrete business unit

serving a large customer location. We often describe it as a

‘branch’ within a customer’s facility, but it can also be a customer-

dedicated location within a lower-cost facility near the customer,

or a customer-dedicated location within an overflow space in the

back of an existing branch. Our Onsite model has become a bigger

growth driver in recent years. At the end of 2014, we had roughly

200 Onsite locations. Today, we have over 600, and we believe we

are 12 to 18 months from having 1,000 Onsite businesses.*

2017 ANNUAL REPORT

3

DANIEL L. FLORNESS

President and Chief Executive Officer

* We don’t have a crystal ball. This is neither a prediction nor a target; it’s our stated belief in the future.

We often speak about national accounts and government accounts.

These aren’t channels; they’re customer types. What makes

them different is we utilize a non-branch sales force to cultivate

and grow these relationships (although local branch and Onsite

personnel provide most of the delivery and stocking services). We

have a great sales team, and they are operating at a very high

level. These two customer groups represent just over 50% of our

revenue and contribute nearly 70% of our growth.

Our 50-year-old business evolves.

We have some core beliefs, and these beliefs typically manifest

in our strategy. We believe our marketplace can be under-served

by traditional distribution; therefore, we live by a Growth Through

Customer Service motto. We believe proximity to our customer is

a key ingredient to service; therefore, we operate a very frugal

business ethic to stretch our ability to operate smaller distribution

locations close to our customer. Finally, we know the needs of

our customers, the nature of our competitive landscape, and the

location of our marketplace change every day; therefore, we need

to evolve and understand our marketplace to provide success for

our customers, our employees, our suppliers, and our shareholders.

Here are two perspectives – one on our evolution over the last 15

years focused on time, the other on marketplace differences.

Time – In the five-year period from 2003 to 2007 we opened

around 1,000 branch locations and we closed/consolidated seven.

The number of Onsite businesses increased from around 75 to

130, and the number of deployed vending devices went from very

few to still very few.

In the five-year period from 2008 to 2012 we opened around

550 branch locations and we closed/consolidated around 65. The

number of Onsite businesses increased from around 130 to 160,

and the number of deployed vending devices went from very few

to around 21,000.

In the five-year period from 2013 to 2017 we opened approximately

175 branch locations; however, we closed/consolidated around

450. The number of Onsite businesses increased from around 160

to over 600, and the number of deployed vending devices went

from around 21,000 to around 86,000. This evolution positions us

to provide a greater service from an ever closer proximity.

Markets – We operate in individual marketplaces (cities) ranging

from large to small. We think of it as three distinct markets.

Large markets: In the United States, there are approximately

100 Major MSAs (defined as Metropolitan Statistical Areas with

a population over 500,000 people). The Large MSA markets

represent just over half of our revenues, just over half of our branch

locations, and just over half of our Onsite locations.

Smaller Markets: In the United States, we track approximately

170 Small MSAs (defined as Metropolitan Statistical Areas with a

population under 500,000 people). Our home office is located in one

of these Small MSAs, an area that includes La Crosse, Wisconsin

and Winona, Minnesota. The Small MSA markets represent just

over 15% of our revenues, around 15% of our branch locations,

and just over 15% of our Onsite locations.

Markets ignored by others: For lack of a better term, we refer to

the rest as our ‘Non-MSA’ markets (primarily smaller towns and

rural areas). The Non-MSA markets represent about a third of our

revenues, about a third of our branch locations, and about a third

of our Onsite locations.

I personally find this information really exciting because our

business model is successful in various channels (branch, Onsite,

vending, FMI, etc.), in various economies (United States, Canada,

Mexico, and overseas), and in a range of market sizes, from major

cities to small towns. It all adds up to a lot of great opportunities

for members of the Blue Team to be successful serving customers.

Finally, some thoughts on our obligations:

After two years in this role, I try to be honest about the quality

and type of leadership I provide. The Blue Team deserves great

leadership every day. If you flip to the inside back cover of this

report, you will see a group of talented, dedicated, and diverse

leaders. If you look deeper into the organization, you will see an

incredible depth of talent and potential – we are fortunate.

When thinking about my obligation to our team, several thoughts

come to mind: (1) to communicate, (2) to listen, and (3) to challenge

the team to Think Big!

When thinking about the obligations of every Fastenal employee to

each other, again several thoughts come to mind: (1) be willing to

learn and change, (2) be willing to help each other succeed, and

(3) be willing to challenge each other to Think Big!

And finally, a few overriding obligations for everyone at Fastenal:

(1) Create opportunities for your customers and for your employees

every day. (2) Think Big! This means - have a plan, stretch yourself,

and vet your business plan with those around you (your team, your

peers, your mentor or leader). (3) Make wise decisions.

Thank you for your belief in Fastenal, and thank you for being a

shareholder. We will endeavor to make wise decisions every day

as we embark on our next 50 years of Growth Through Customer

Service.

Sincerely,

2017 ANNUAL REPORT

4

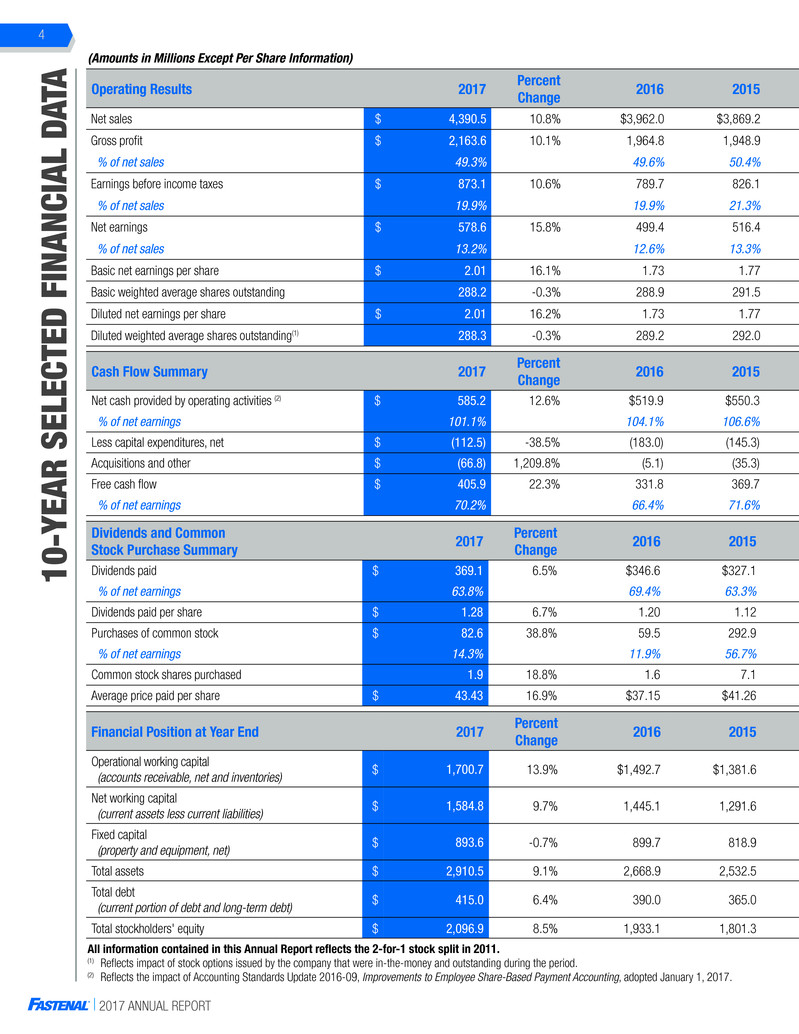

Operating Results 2017 Percent Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Net sales $ 4,390.5 10.8% $3,962.0 $3,869.2 $3,733.5 $3,326.1 $3,133.6 $2,766.9 $2,269.5 $1,930.3 $2,340.4

Gross profit $ 2,163.6 10.1% 1,964.8 1,948.9 1,897.4 1,719.4 1,614.5 1,434.2 1,174.8 983.4 1,236.1

% of net sales 49.3% 49.6% 50.4% 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8%

Earnings before income taxes $ 873.1 10.6% 789.7 826.1 787.4 713.5 674.2 575.1 430.6 297.5 451.2

% of net sales 19.9% 19.9% 21.3% 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3%

Net earnings $ 578.6 15.8% 499.4 516.4 494.2 448.6 420.5 357.9 265.4 184.4 279.7

% of net sales 13.2% 12.6% 13.3% 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0%

Basic net earnings per share $ 2.01 16.1% 1.73 1.77 1.67 1.51 1.42 1.21 0.90 0.62 0.94

Basic weighted average shares outstanding 288.2 -0.3% 288.9 291.5 296.5 296.8 296.1 295.1 294.9 296.7 297.7

Diluted net earnings per share $ 2.01 16.2% 1.73 1.77 1.66 1.51 1.42 1.21 0.90 0.62 0.94

Diluted weighted average shares outstanding(1) 288.3 -0.3% 289.2 292.0 297.3 297.7 297.2 295.9 294.9 296.7 297.7

Dividends and Common

Stock Purchase Summary 2017

Percent

Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Dividends paid $ 369.1 6.5% $346.6 $327.1 $296.6 $237.5 $367.3 $191.7 $182.8 $106.9 $117.5

% of net earnings 63.8% 69.4% 63.3% 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0%

Dividends paid per share $ 1.28 6.7% 1.20 1.12 1.00 0.80 1.24 0.65 0.62 0.36 0.395

Purchases of common stock $ 82.6 38.8% 59.5 292.9 52.9 9.1 - - - 41.1 26.0

% of net earnings 14.3% 11.9% 56.7% 10.7% 2.0% - - - 22.3% 9.3%

Common stock shares purchased 1.9 18.8% 1.6 7.1 1.2 0.2 - - - 2.2 1.2

Average price paid per share $ 43.43 16.9% $37.15 $41.26 $44.12 $45.40 - - - $18.69 $22.00

Financial Position at Year End 2017 Percent Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Operational working capital

(accounts receivable, net and inventories) $ 1,700.7 13.9% $1,492.7 $1,381.6 $1,331.3 $1,198.4 $1,087.5 $984.7 $827.5 $722.6 $809.2

Net working capital

(current assets less current liabilities) $ 1,584.8 9.7% 1,445.1 1,291.6 1,207.9 1,168.6 1,082.5 1,048.3 923.5 862.9 827.4

Fixed capital

(property and equipment, net) $ 893.6 -0.7% 899.7 818.9 763.9 654.9 516.4 435.6 363.4 335.0 324.2

Total assets $ 2,910.5 9.1% 2,668.9 2,532.5 2,359.1 2,075.8 1,815.8 1,684.9 1,468.3 1,327.4 1,304.1

Total debt

(current portion of debt and long-term debt) $ 415.0 6.4% 390.0 365.0 90.0 - - - - - -

Total stockholders' equity $ 2,096.9 8.5% 1,933.1 1,801.3 1,915.2 1,772.7 1,560.4 1,459.0 1,282.5 1,190.8 1,142.3

All information contained in this Annual Report reflects the 2-for-1 stock split in 2011.

(1) Reflects impact of stock options issued by the company that were in-the-money and outstanding during the period.

(2) Reflects the impact of Accounting Standards Update 2016-09, Improvements to Employee Share-Based Payment Accounting, adopted January 1, 2017.

(Amounts in Millions Except Per Share Information)

10-YEAR SELECTED FINANCIAL

DA

TA

Cash Flow Summary 2017 Percent Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Net cash provided by operating activities (2) $ 585.2 12.6% $519.9 $550.3 $501.5 $418.9 $406.4 $268.5 $240.4 $306.1 $259.9

% of net earnings 101.1% 104.1% 106.6% 101.5% 93.4% 96.6% 75.0% 90.6% 166.0% 92.9%

Less capital expenditures, net $ (112.5) -38.5% (183.0) (145.3) (183.7) (201.6) (133.9) (116.5) (69.1) (47.7) (86.9)

Acquisitions and other $ (66.8) 1,209.8% (5.1) (35.3) (5.6) (0.1) (0.1) 0.2 (10.3) (5.1) (0.1)

Free cash flow $ 405.9 22.3% 331.8 369.7 312.2 217.2 272.4 152.2 161.0 253.3 172.9

% of net earnings 70.2% 66.4% 71.6% 63.2% 48.4% 64.8% 42.5% 60.7% 137.4% 61.8%

2017 ANNUAL REPORT

5

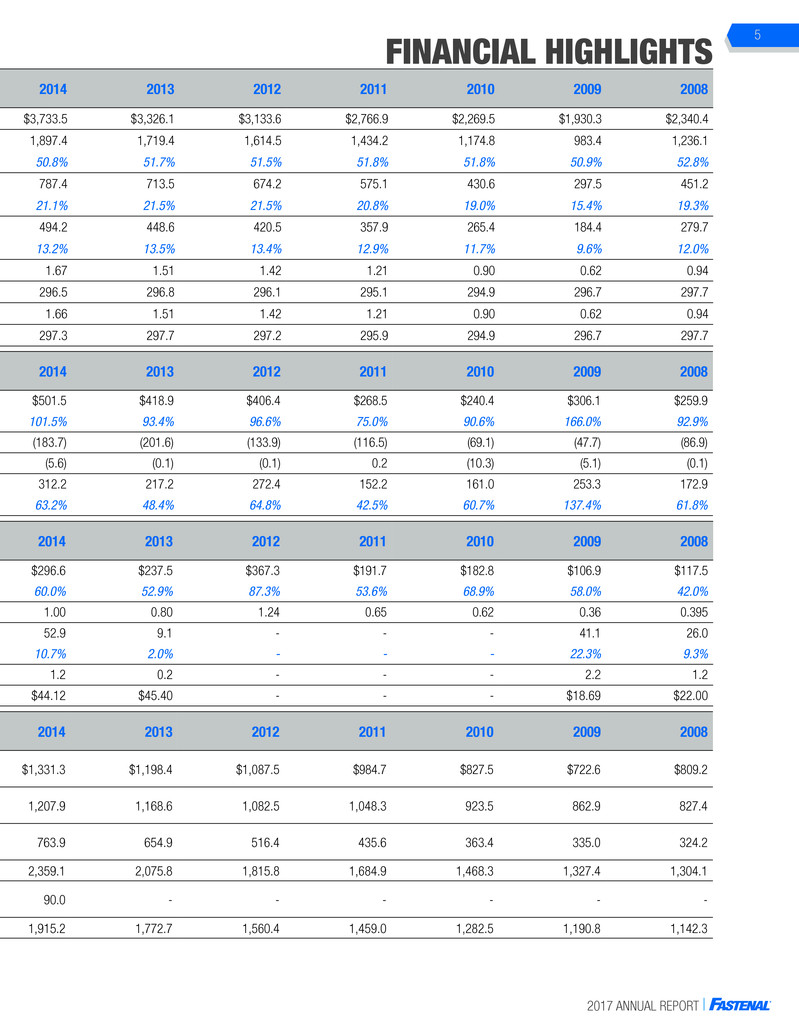

Operating Results 2017 Percent Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Net sales $ 4,390.5 10.8% $3,962.0 $3,869.2 $3,733.5 $3,326.1 $3,133.6 $2,766.9 $2,269.5 $1,930.3 $2,340.4

Gross profit $ 2,163.6 10.1% 1,964.8 1,948.9 1,897.4 1,719.4 1,614.5 1,434.2 1,174.8 983.4 1,236.1

% of net sales 49.3% 49.6% 50.4% 50.8% 51.7% 51.5% 51.8% 51.8% 50.9% 52.8%

Earnings before income taxes $ 873.1 10.6% 789.7 826.1 787.4 713.5 674.2 575.1 430.6 297.5 451.2

% of net sales 19.9% 19.9% 21.3% 21.1% 21.5% 21.5% 20.8% 19.0% 15.4% 19.3%

Net earnings $ 578.6 15.8% 499.4 516.4 494.2 448.6 420.5 357.9 265.4 184.4 279.7

% of net sales 13.2% 12.6% 13.3% 13.2% 13.5% 13.4% 12.9% 11.7% 9.6% 12.0%

Basic net earnings per share $ 2.01 16.1% 1.73 1.77 1.67 1.51 1.42 1.21 0.90 0.62 0.94

Basic weighted average shares outstanding 288.2 -0.3% 288.9 291.5 296.5 296.8 296.1 295.1 294.9 296.7 297.7

Diluted net earnings per share $ 2.01 16.2% 1.73 1.77 1.66 1.51 1.42 1.21 0.90 0.62 0.94

Diluted weighted average shares outstanding(1) 288.3 -0.3% 289.2 292.0 297.3 297.7 297.2 295.9 294.9 296.7 297.7

Dividends and Common

Stock Purchase Summary 2017

Percent

Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Dividends paid $ 369.1 6.5% $346.6 $327.1 $296.6 $237.5 $367.3 $191.7 $182.8 $106.9 $117.5

% of net earnings 63.8% 69.4% 63.3% 60.0% 52.9% 87.3% 53.6% 68.9% 58.0% 42.0%

Dividends paid per share $ 1.28 6.7% 1.20 1.12 1.00 0.80 1.24 0.65 0.62 0.36 0.395

Purchases of common stock $ 82.6 38.8% 59.5 292.9 52.9 9.1 - - - 41.1 26.0

% of net earnings 14.3% 11.9% 56.7% 10.7% 2.0% - - - 22.3% 9.3%

Common stock shares purchased 1.9 18.8% 1.6 7.1 1.2 0.2 - - - 2.2 1.2

Average price paid per share $ 43.43 16.9% $37.15 $41.26 $44.12 $45.40 - - - $18.69 $22.00

Financial Position at Year End 2017 Percent Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Operational working capital

(accounts receivable, net and inventories) $ 1,700.7 13.9% $1,492.7 $1,381.6 $1,331.3 $1,198.4 $1,087.5 $984.7 $827.5 $722.6 $809.2

Net working capital

(current assets less current liabilities) $ 1,584.8 9.7% 1,445.1 1,291.6 1,207.9 1,168.6 1,082.5 1,048.3 923.5 862.9 827.4

Fixed capital

(property and equipment, net) $ 893.6 -0.7% 899.7 818.9 763.9 654.9 516.4 435.6 363.4 335.0 324.2

Total assets $ 2,910.5 9.1% 2,668.9 2,532.5 2,359.1 2,075.8 1,815.8 1,684.9 1,468.3 1,327.4 1,304.1

Total debt

(current portion of debt and long-term debt) $ 415.0 6.4% 390.0 365.0 90.0 - - - - - -

Total stockholders' equity $ 2,096.9 8.5% 1,933.1 1,801.3 1,915.2 1,772.7 1,560.4 1,459.0 1,282.5 1,190.8 1,142.3

All information contained in this Annual Report reflects the 2-for-1 stock split in 2011.

(1) Reflects impact of stock options issued by the company that were in-the-money and outstanding during the period.

(2) Reflects the impact of Accounting Standards Update 2016-09, Improvements to Employee Share-Based Payment Accounting, adopted January 1, 2017.

FINANCIAL HIGHLIGHTS

Cash Flow Summary 2017 Percent Change 2016 2015 2014 2013 2012 2011 2010 2009 2008

Net cash provided by operating activities (2) $ 585.2 12.6% $519.9 $550.3 $501.5 $418.9 $406.4 $268.5 $240.4 $306.1 $259.9

% of net earnings 101.1% 104.1% 106.6% 101.5% 93.4% 96.6% 75.0% 90.6% 166.0% 92.9%

Less capital expenditures, net $ (112.5) -38.5% (183.0) (145.3) (183.7) (201.6) (133.9) (116.5) (69.1) (47.7) (86.9)

Acquisitions and other $ (66.8) 1,209.8% (5.1) (35.3) (5.6) (0.1) (0.1) 0.2 (10.3) (5.1) (0.1)

Free cash flow $ 405.9 22.3% 331.8 369.7 312.2 217.2 272.4 152.2 161.0 253.3 172.9

% of net earnings 70.2% 66.4% 71.6% 63.2% 48.4% 64.8% 42.5% 60.7% 137.4% 61.8%

2017 ANNUAL REPORT

6

2017 High Low 2016 High Low

First quarter $52.22 $46.17 First quarter $49.87 $36.53

Second quarter 51.76 42.10 Second quarter 48.93 42.70

Third quarter 45.73 39.97 Third quarter 45.36 39.92

Fourth quarter 55.14 44.51 Fourth quarter 49.17 38.16

As of January 19, 2018, there were approximately 1,100 record holders of our common stock, which includes nominees or broker

dealers holding stock on behalf of an estimated 220,000 beneficial owners.

In 2017 and 2016, we paid dividends per share totaling $1.28 and $1.20, respectively. On January 16, 2018, we announced a

quarterly dividend of $0.37 per share to be paid on February 27, 2018 to shareholders of record at the close of business on January

31, 2018. Our board of directors intends to continue paying quarterly dividends, provided that any future determination as to

payment of dividends will depend upon the financial condition and results of operations of the company and such other factors as

are deemed relevant by the board of directors.

We purchased 1,900,000 shares of our common stock in 2017 at an average price of $43.43 per share. In 2016, we purchased

1,600,000 shares of our common stock at an average price of $37.15 per share.

Common Stock Data

Our shares are traded on The Nasdaq Stock Market under the symbol ‘FAST.’ The following

table sets forth, by quarter, the high and low closing sale price of our shares on The Nasdaq

Stock Market for the last two years(1).

2017 Net Sales

Gross

Profit

Pre-tax

Earnings

Net

Earnings

Basic

Net Earnings

per Share (1)

Diluted

Net Earnings

per Share (1)

First quarter 1,047.7 518.0 210.9 134.2 0.46 0.46

Second quarter 1,121.5 558.5 235.4 148.9 0.52 0.52

Third quarter 1,132.8 555.9 226.0 143.1 0.50 0.50

Fourth quarter 1,088.5 531.2 200.8 152.4 (2) 0.53 (2) 0.53 (2)

Total 4,390.5 2,163.6 873.1 578.6 (3) 2.01 (3) 2.01 (3)

2016 Net Sales

Gross

Profit

Pre-tax

Earnings

Net

Earnings

Basic

Net Earnings

per Share (1)

Diluted

Net Earnings

per Share (1)

First quarter 986.7 491.5 199.9 126.2 0.44 0.44

Second quarter 1,014.3 501.6 207.8 131.5 0.46 0.45

Third quarter 1,013.1 499.8 201.2 126.9 0.44 0.44

Fourth quarter 947.9 471.9 180.8 114.8 0.40 0.40

Total 3,962.0 1,964.8 789.7 499.4 1.73 1.73

(1) The closing sale price was obtained from Shareholder.com, a division of Nasdaq OMX.

STOCK

AND

FINANCIAL

DATA

SELECTED Q

UA

RTER

LY FINANCIAL

DA

TA (UN

AUDITED

)

(Dollar Amounts in Millions

Except Share and

Per Share Information)

(1) Amounts may not foot due to rounding difference.

(2) Absent the impact of the Tax Act, our net earnings for the fourth quarter of 2017 would have been approximately $128.1, and our basic and diluted net earnings

per share would have each been $0.45.

(3) Absent the impact of the Tax Act, our net earnings for 2017 would have been approximately $554.2, and our basic and diluted net earnings per share would

have each been $1.92.

$

$

$

$

2017 ANNUAL REPORT

7

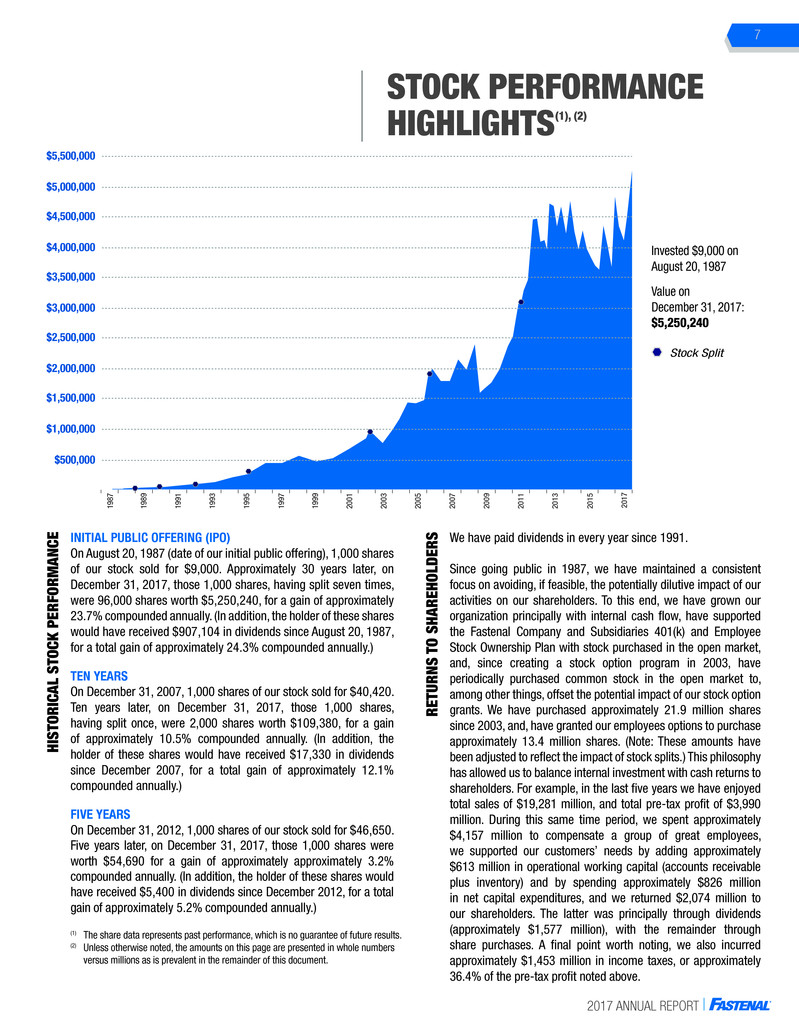

Invested $9,000 on

August 20, 1987

Value on

December 31, 2017:

$5,250,240

STOCK PERFORMANCE

HIGHLIGHTS(1), (2)

(1) The share data represents past performance, which is no guarantee of future results.

(2) Unless otherwise noted, the amounts on this page are presented in whole numbers

versus millions as is prevalent in the remainder of this document.

$1,000,000

$2,000,000

$3,000,000

$4,000,000

$5,000,000

$1,500,000

$500,000

$2,500,000

$3,500,000

$4,500,000

$5,500,000

198

7

198

9

199

1

199

3

199

5

199

7

199

9

200

1

200

3

200

5

200

7

200

9

201

1

201

3

201

5

201

7

Stock Split

INITIAL PUBLIC OFFERING (IPO)

On August 20, 1987 (date of our initial public offering), 1,000 shares

of our stock sold for $9,000. Approximately 30 years later, on

December 31, 2017, those 1,000 shares, having split seven times,

were 96,000 shares worth $5,250,240, for a gain of approximately

23.7% compounded annually. (In addition, the holder of these shares

would have received $907,104 in dividends since August 20, 1987,

for a total gain of approximately 24.3% compounded annually.)

TEN YEARS

On December 31, 2007, 1,000 shares of our stock sold for $40,420.

Ten years later, on December 31, 2017, those 1,000 shares,

having split once, were 2,000 shares worth $109,380, for a gain

of approximately 10.5% compounded annually. (In addition, the

holder of these shares would have received $17,330 in dividends

since December 2007, for a total gain of approximately 12.1%

compounded annually.)

FIVE YEARS

On December 31, 2012, 1,000 shares of our stock sold for $46,650.

Five years later, on December 31, 2017, those 1,000 shares were

worth $54,690 for a gain of approximately approximately 3.2%

compounded annually. (In addition, the holder of these shares would

have received $5,400 in dividends since December 2012, for a total

gain of approximately 5.2% compounded annually.)

HISTORICAL STOCK PERFORMANC

E

RETURNS

TO

SHAREHOLDER

S We have paid dividends in every year since 1991.

Since going public in 1987, we have maintained a consistent

focus on avoiding, if feasible, the potentially dilutive impact of our

activities on our shareholders. To this end, we have grown our

organization principally with internal cash flow, have supported

the Fastenal Company and Subsidiaries 401(k) and Employee

Stock Ownership Plan with stock purchased in the open market,

and, since creating a stock option program in 2003, have

periodically purchased common stock in the open market to,

among other things, offset the potential impact of our stock option

grants. We have purchased approximately 21.9 million shares

since 2003, and, have granted our employees options to purchase

approximately 13.4 million shares. (Note: These amounts have

been adjusted to reflect the impact of stock splits.) This philosophy

has allowed us to balance internal investment with cash returns to

shareholders. For example, in the last five years we have enjoyed

total sales of $19,281 million, and total pre-tax profit of $3,990

million. During this same time period, we spent approximately

$4,157 million to compensate a group of great employees,

we supported our customers’ needs by adding approximately

$613 million in operational working capital (accounts receivable

plus inventory) and by spending approximately $826 million

in net capital expenditures, and we returned $2,074 million to

our shareholders. The latter was principally through dividends

(approximately $1,577 million), with the remainder through

share purchases. A final point worth noting, we also incurred

approximately $1,453 million in income taxes, or approximately

36.4% of the pre-tax profit noted above.

QUALITY

PRODUCTION LINES

MAINTENANCE

MEETING

ROOM

PURCHASING

RECEIVING

ONSITE

ENGINEERING

2017 ANNUAL REPORT

8

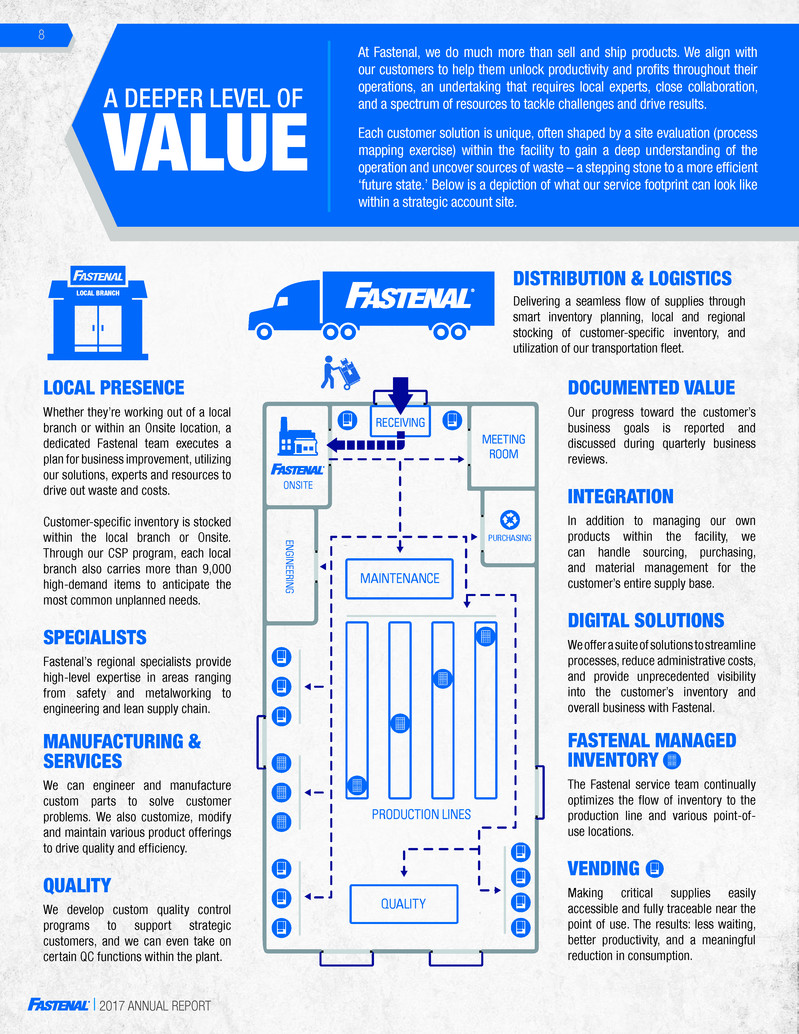

LOCAL PRESENCE

Whether they’re working out of a local

branch or within an Onsite location, a

dedicated Fastenal team executes a

plan for business improvement, utilizing

our solutions, experts and resources to

drive out waste and costs.

Customer-specific inventory is stocked

within the local branch or Onsite.

Through our CSP program, each local

branch also carries more than 9,000

high-demand items to anticipate the

most common unplanned needs.

SPECIALISTS

Fastenal’s regional specialists provide

high-level expertise in areas ranging

from safety and metalworking to

engineering and lean supply chain.

MANUFACTURING &

SERVICES

We can engineer and manufacture

custom parts to solve customer

problems. We also customize, modify

and maintain various product offerings

to drive quality and efficiency.

QUALITY

We develop custom quality control

programs to support strategic

customers, and we can even take on

certain QC functions within the plant.

DOCUMENTED VALUE

Our progress toward the customer’s

business goals is reported and

discussed during quarterly business

reviews.

INTEGRATION

In addition to managing our own

products within the facility, we

can handle sourcing, purchasing,

and material management for the

customer’s entire supply base.

DIGITAL SOLUTIONS

We offer a suite of solutions to streamline

processes, reduce administrative costs,

and provide unprecedented visibility

into the customer’s inventory and

overall business with Fastenal.

FASTENAL MANAGED

INVENTORY

The Fastenal service team continually

optimizes the flow of inventory to the

production line and various point-of-

use locations.

VENDING

Making critical supplies easily

accessible and fully traceable near the

point of use. The results: less waiting,

better productivity, and a meaningful

reduction in consumption.

Delivering a seamless flow of supplies through

smart inventory planning, local and regional

stocking of customer-specific inventory, and

utilization of our transportation fleet.

A DEEPER LEVEL OF

LOCAL BRANCH

DISTRIBUTION & LOGISTICS

VALUE

At Fastenal, we do much more than sell and ship products. We align with

our customers to help them unlock productivity and profits throughout their

operations, an undertaking that requires local experts, close collaboration,

and a spectrum of resources to tackle challenges and drive results.

Each customer solution is unique, often shaped by a site evaluation (process

mapping exercise) within the facility to gain a deep understanding of the

operation and uncover sources of waste – a stepping stone to a more efficient

‘future state.’ Below is a depiction of what our service footprint can look like

within a strategic account site.

2017 ANNUAL REPORT 2017 ANNUAL REPORT

CO

UN

TR

IES

W

ITH I

N-MARKET LOCATION

S

JAMES C. JANSEN

Executive Vice President - Manufacturing

HOLDEN LEWIS

Executive Vice President and

Chief Financial Officer

LELAND J. HEIN

Senior Executive Vice President - Sales

SHERYL A. LISOWSKI

Controller, Chief Accounting Officer,

and Treasurer

DANIEL L. FLORNESS

President and Chief Executive Officer

WILLIAM J. DRAZKOWSKI

Executive Vice President -

National Accounts Sales

EXECUTIVE OFFICER

S

ANNUAL

MEETING

The annual meeting of shareholders

will be held at 10:00 a.m., central

time, April 24, 2018, at our home

office located at 2001 Theurer

Boulevard, Winona, Minnesota.

HOME

OFFICE

Fastenal Company

2001 Theurer Boulevard

Winona, Minnesota 55987-0978

Phone: (507) 454-5374

Fax: (507) 453-8049

LEGAL

COUNSEL

INDEPENDENT

REGISTERED PUBLIC

ACCOUNTING FIRM

Faegre Baker Daniels LLP

Minneapolis, Minnesota

KPMG LLP

Minneapolis, Minnesota

FORM

10-K

TRANSFER

AGENT

A copy of our 2017 Annual

Report on Form 10-K filed with

the Securities and Exchange

Commission is available without

charge to shareholders upon written

request to internal audit at the

address of our home office listed on

this page.

Copies of our latest press releases,

unaudited supplemental company

information, and monthly sales

information are available at:

http://investor.fastenal.com.

Equiniti Trust Company

Mendota Heights, Minnesota

CORPOR

ATE INFORM

ATIO

N

$4.4 BILLIO

N

NET SALE

S

NET EARNING

S

$578.6 MILLIO

N

TABLE OF CONTENTS

1-3 Letter to Shareholders

4-5 10-Year Selected Financial

Data & Financial Highlights

6 Stock and Financial Data

MICHAEL J. DOLAN

Self-Employed Business Consultant,

Retired Executive Vice President and

Chief Operating Officer,

The Smead Manufacturing Company

SCOTT A. SATTERLEE

Retired President of North America

Surface Transportation Division, C.H.

Robinson Worldwide, Inc.

RITA J. HEISE

Self-Employed Business Consultant,

Retired Corporate Vice President and

Chief Information Officer of

Cargill, Incorporated

STEPHEN L. EASTMAN

President of the Parts, Garments,

and Accessories Division of

Polaris Industries Inc.

(recreational vehicle manufacturer)

DANIEL L. JOHNSON

President and Chief Executive Officer of

M.A. Mortenson Company (family owned

construction company)

REYNE K. WISECUP

DARREN R. JACKSON

Retired Chief Executive Officer,

Advance Auto Parts, Inc.

WILLARD D. OBERTON

Chairman of the Board, Retired President

and Chief Executive Officer,

Fastenal Company

MICHAEL J. ANCIUS

Vice President and Chief Financial Officer,

A.L.M. Holding Company

(construction and energy company)DIRECTOR

S

DANIEL L. FLORNESS

NO. OF FASTENAL SCHOOL OF

BUSINESS COURSE COMPLETIONS

655,261

BRANCHES

2,383

INVENTORY VALUE

$1.1 BILLION

NO. OF ORDERS PROCESSED

37,641,814

20,565

EMPLOYEES

127,000+

EMPLOYEE SAFETY

COACHING, TRAINING, &

INSPECTION EVENTS

GLANCE

FASTENAL

AT A

143 MILLIONMILES DELIVERED 834DELIVEREDMILLION POUNDS

50,000+

BIN STOCKS

ACTIVE

605

ONSITE

LOCATIONS 71,000

+

VENDING MACHINES INSTALLED

DAILY SALES

GROWTH TO

CUSTOMERS

WITH VENDING

13.2%

GARY A. POLIPNICK

Executive Vice President -

FAST Solutions®

REYNE K. WISECUP

Senior Executive Vice President -

Human Resources

JEFFERY M. WATTS

Executive Vice President -

International Sales

TERRY M. OWEN

Senior Executive Vice President -

Sales Operations

JOHN L. SODERBERG

Executive Vice President -

Information Technology

CHARLES S. MILLER

Executive Vice President - Sales

7 Stock Performance Highlights

8 A Deeper Level of Value

INSIDE

BACK

COVER

Directors

Executive Officers

Corporate Information

NICHOLAS J. LUNDQUIST

Senior Executive Vice President -

Operations

24

2017 ANNUAL REPORT

9706257 | 2017 Annual Report | 2.18 KV | Printed in the USA

2017 ANNUAL REPORT