Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - 9 METERS BIOPHARMA, INC. | tv484364_ex99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - 9 METERS BIOPHARMA, INC. | tv484364_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - 9 METERS BIOPHARMA, INC. | tv484364_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - 9 METERS BIOPHARMA, INC. | tv484364_ex10-1.htm |

| EX-4.2 - EXHIBIT 4.2 - 9 METERS BIOPHARMA, INC. | tv484364_ex4-2.htm |

| EX-4.1 - EXHIBIT 4.1 - 9 METERS BIOPHARMA, INC. | tv484364_ex4-1.htm |

| EX-3.2 - EXHIBIT 3.2 - 9 METERS BIOPHARMA, INC. | tv484364_ex3-2.htm |

| EX-3.1 - EXHIBIT 3.1 - 9 METERS BIOPHARMA, INC. | tv484364_ex3-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

February 2, 2018

Date of Report (Date of earliest event reported)

| INNOVATE BIOPHARMACEUTICALS, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 001-37797 | 27-3948465 | ||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

8480 Honeycutt Road, Suite 120

Raleigh, North Carolina 27615

(Address of principal executive offices)

(919) 275-1933

(Registrant's telephone number, including area code)

Monster Digital, Inc.

2655 First Street, Suite 250

Simi Valley, California 93065

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets.

On January 29, 2018, Monster Digital, Inc. (the “Company”), completed its reverse recapitalization with Innovate Biopharmaceuticals, Inc., which changed its name in connection with the transaction to “IB Pharmaceuticals Inc.” (“Innovate”), in accordance with the terms of the Agreement and Plan of Merger and Reorganization, dated as of July 3, 2017, by and among the Company, Monster Merger Sub., Inc. (“Merger Sub”), and Innovate (the “Merger Agreement”), pursuant to which Merger Sub merged with and into Innovate, with Innovate surviving as a wholly owned subsidiary of the Company (the “Merger”).

Also, on January 29, 2018, in connection with and immediately prior to the effective time of the Merger (the “Effective Time”), the Company (i) effected a reverse stock split at a ratio of one new share for every ten shares of its common stock outstanding (the “Reverse Stock Split”), (ii) increased the number of authorized shares of the Company’s common stock from 100,000,000 to 350,000,000 and (iii) changed its name to “Innovate Biopharmaceuticals, Inc.” Following the completion of the Merger, the business conducted by the Company became primarily the business conducted by Innovate, which is a clinical stage biotechnology company focused on developing novel autoimmune/inflammation therapeutic drugs.

Under the terms of the Merger Agreement, the Company issued shares of its common stock to Innovate’s stockholders, at an exchange ratio of 0.37813802 of a share of common stock (post Reverse Stock Split), in exchange for each share of Innovate common stock outstanding as of the Effective Time. The Company also assumed all of the stock options issued and outstanding under the 2015 Stock Incentive Plan (the “Innovate Plan”), with such stock options henceforth representing the right to purchase a number of shares of the Company’s common stock equal to 0.37813802 multiplied by the number of shares of Innovate’s common stock previously represented by such stock options.

Immediately prior to the Merger, Innovate issued and sold an aggregate of approximately $18.1 million of shares of Innovate common stock, including the conversion of $9,229,819 in outstanding convertible debt, to certain current stockholders of Innovate and certain new investors. Additionally, Innovate issued five-year warrants to each cash purchaser of common stock with a price per exercise price of $3.1764 after giving effect the exchange ratio.

Immediately following the Effective Time, there were approximately 25.8 million shares of the Company’s common stock outstanding. Immediately following the Effective Time, the former Innovate security holders owned approximately 94% of the fully-diluted common stock of the Company, with the Company’s security holders immediately prior to the Merger owning approximately 6% of the fully-diluted common stock of the Company.

The Company’s shares of common stock, which were previously listed on The Nasdaq Capital Market and traded through the close of business on January 31, 2018 under the ticker symbol “MSDI,” commenced trading on The Nasdaq Capital Market, under the symbol “INNT” on February 1, 2018. The Company’s common stock has a new CUSIP number, 45782F105.

The descriptions of the Merger and Merger Agreement included herein are not complete and are subject to and qualified in their entirety by reference to the Merger Agreement, a copy of which was attached as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on July 6, 2017, and incorporated herein by reference.

On January 30, 2018, the Company issued a press release announcing the completion of the Merger. A copy of the press release is attached hereto as Exhibit 99.1.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On January 29, 2018, the Company entered into a Note Purchase Agreement (the “Note Purchase Agreement”) between the Company and Gustavia Capital Partners LLC (the “Lender”). The Note Purchase Agreement included customary representations and warranties of the Company and Lender and customary closing conditions.

The Company issued a senior promissory note (the “Note”) pursuant to the Note Purchase Agreement in the aggregate principal amount of $4,800,000, against receipt of a cash payment by the Lender to the Company equal to $3,000,000 (less certain expense deductions).

On September 30, 2018 (the “Maturity Date”), the Company shall pay the Lender an amount in cash equal to 105% of the outstanding principal amount of the Note plus accrued and unpaid interest and Later Charges (as defined in the Note). The Company may not prepay the Note, however, the Company may, at any time prior to the Maturity Date, redeem all of the Outstanding Amount (as defined in the Note) at a price equal to 105% of the Outstanding Amount.

The Note bears interest at per annum rate of interest equal to 12.5%, compounded quarterly, and is due and payable in arrears on each Interest Date (as defined in the Note), with the first Interest Date on March 30, 2018.

The Note contains customary affirmative and negative covenants, including among others, covenants limiting the ability of the Company and its subsidiaries to transfer or dispose of any assets, incur indebtedness, change the nature of its business, grant liens, make investments, make certain restricted payments, issue securities, and enter into transactions with affiliates, in each case subject to certain exceptions.

Upon an event of default, the Lender may require the Company to redeem all or a portion of the Note. The Company shall redeem at a cash price equal to 105% of the Outstanding Amount. The events of default under the Note Purchase Agreement include, among others, payment defaults, covenant defaults, a material adverse effect default, bankruptcy and insolvency defaults, a failure to consummate the Merger (as defined in the Note), cross-defaults to other material indebtedness, judgment defaults, and defaults related to inaccuracy of representations and warranties. A default interest rate will apply on all obligations during the existence of an event of default under the Note at a per annum rate of interest equal to 18.0%.

The foregoing description of the Note Purchase Agreement and Note is qualified in its entirety by reference to the full text of the Note Purchase Agreement and Note which the Company is filing with this Form 8-K.

| 2 |

Item 3.02. Unregistered Sales of Equity Securities.

Pursuant to the terms of the Merger Agreement and in connection with the Merger, the Company issued shares of its common stock to Innovate’s stockholders. The number of shares issued, the nature of the transaction and the nature and amount of consideration received by the Company are described in Item 2.01 of this Form 8-K, which is incorporated by reference into this Item 3.02. The shares of Company Common Stock issued in connection with the Merger were not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D and Rule 506 promulgated thereunder.

Item 3.03. Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 2.01 of this Current Report on Form 8-K is incorporated by reference herein.

On January 29, 2018, immediately prior to the Effective Time, the Company amended and restated its certificate of incorporation to (i) effect the Reverse Stock Split, (ii) increase the number of authorized shares of the Company’s common stock from 100,000,000 to 350,000,000 and (ii) change the Company’s name to “Innovate Biopharmaceuticals, Inc.” The amendment of the Company’s certificate of incorporation was approved by the Company’s stockholders at a special meeting of its stockholders on November 9, 2017.

The foregoing descriptions of the Company’s amended and restated certificate of incorporation are not complete and are subject to and qualified in their entirety by reference Company’s amended and restated certificate of incorporation, a copy of which is attached as Exhibit 3.1 hereto and is incorporated herein by reference.

| 3 |

Item 5.01. Changes in Control of Registrant.

The information set forth in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

In accordance with the Merger Agreement, on January 29, 2018, effective as of the Effective Time, David H. Clarke, Jonathan Clark, Robert B. Machinist, Christopher M. Miner and Steven Barre resigned from the Board and any respective committees of the Board to which they belonged. Also on January 29, 2018, the Board appointed, effective as of the Effective Time, Sandeep Laumas, M.D., Christopher Prior, Ph.D., Jay Madan, M.S., Roy Proujanksy, M.D., Lorin Johnson, Ph.D., Anthony Maida, Ph.D., M.A., M.B.A, and Anna Kazanchyan, M.D. as directors of the Company whose terms expire at the Registrant’s next annual meeting of stockholders.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Pursuant to the Merger Agreement, on January 29, 2018, effective as of the Effective Time, David H. Clarke, Jonathan Clark, Robert B. Machinist, Christopher M. Miner and Steven Barre resigned from the Board and any respective committees of the Board on which they served, which resignations were not the result of any disagreements with the Company relating to the Company’s operations, policies or practices.

Also, pursuant to the Merger Agreement, on January 29, 2018, effective as of the Effective Time, David H. Clarke, the Company’s Chief Executive Officer, Jonathan Clark, the Company’s Interim President, David Olert, the Company’s Vice President of Finance and Chief Financial Officer, and Stephen R. Brownsell, the Company’s Vice President, resigned as officers of the Company.

(c) Effective as of the Effective Time, the Board appointed Sandeep Laumas as the Company’s Executive Chairman, Christopher Prior as the Company’s Chief Executive Officer, and Jay Madan as the Company’s President. There are no family relationships among any of the Company’s directors and executive officers. The information set forth in Item 8.01 of this Current Report on Form 8-K regarding the biographical information, compensation arrangements and related party transaction information for the newly appointed executive officers of the Company is incorporated by reference to this Item 5.02(c). Each of the newly appointed executive officers of the Company entered into the Company’s standard form of indemnification agreement with the Company on January 29, 2018, the form of which is attached hereto as Exhibit 10.3 and incorporated herein by reference.

(d) The information set forth in Item 5.01 of this Current Report on Form 8-K with respect to the appointment of directors to the Company’s board of directors pursuant to and in accordance with the Merger Agreement is incorporated by reference into this Item 5.02(d). The information set forth in Item 8.01 of this Current Report on Form 8-K regarding the related party transaction information for the newly appointed directors of the Company is incorporated by reference to this Item 5.02(d). Each of Roy Proujansky, Lorin Johnson, Anthony Maida, and Anna Kazanchyan entered into the Company’s standard form of indemnification agreement with the Company on January 29, 2018, the form of which is attached hereto as Exhibit 10.3 and incorporated herein by reference.

Audit Committee

On January 29, 2018, Anthony Maida, Lorin Johnson and Anna Kazanchyan were appointed to the Audit Committee. Anthony Maida will serve as the chair of the Audit Committee.

| 4 |

Compensation Committee

On January 29, 2018, Anna Kazanchyan, Lorin Johnson and Anthony Maida were appointed to the compensation committee of the Board. Anna Kazanchyan will serve as chair of the compensation committee.

Nominating and Corporate Governance Committee

On January 29, 2018, Lorin Johnson, Anna Kazanchyan and Anthony Maida were appointed to the nominating and corporate governance committee of the Board. Lorin Johnson will serve as chair of the nominating and corporate governance committee.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

(a) To the extent required by Item 5.03 of Form 8-K, the information contained in Item 2.01 and Item 3.03 of this Current Report on Form 8-K is incorporated by reference herein.

Effective as of the Effective Time, the Board approved the amendment of the Company’s Bylaws to (i) amend Section 10 of Article I to eliminate the right of stockholders of the Company to act by written consent and (ii) conform to the name of the Company to “Innovate Biopharmaceuticals, Inc.” The foregoing description is qualified in its entirety by reference to the Bylaws, as amended, attached hereto as Exhibit 3.2 and incorporated herein by reference.

Item 8.01 Other Events.

In connection with the Merger and related transactions described in this Current Report on Form 8-K, the Company provides the following information related to Innovate set forth in this Item 8.01.

TABLE OF CONTENTS

Cautionary Statement Concerning Forward-Looking Statements

The information in Item 8.01 of this Current Report on Form 8-K, particularly in the sections entitled “Innovate Business,” and “Innovate Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the information incorporated herein by reference, include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations and beliefs and involve numerous risks and uncertainties that could cause actual results to differ materially from expectations. These forward-looking statements should not be relied upon as predictions of future events as we cannot assure you that the events or circumstances reflected in these statements will be achieved or will occur. When used in this report, the words “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “indicate,” “seek,” “should,” “would” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements contain these identifying words. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements.

If any of these risks or uncertainties materializes or any of these assumptions proves incorrect, our results could differ materially from the forward-looking statements in this report. All forward-looking statements in this report are current only as of the date of this report. We do not undertake any obligation to publicly update any forward-looking statement to reflect events or circumstances after the date on which any statement is made or to reflect the occurrence of unanticipated events.

The Company was incorporated in Delaware in November 2010 under the name “Monster Digital, Inc.” In January 2018, the Company merged its wholly-owned subsidiary, Monster Merger Sub, Inc., with and into IB Pharmaceuticals Inc. and changed the name of the Company to “Innovate Biopharmaceuticals, Inc.”

| 5 |

Overview

Innovate is a clinical-stage biopharmaceutical company developing novel therapies for autoimmune and inflammatory disorders. Innovate’s lead program, larazotide acetate (larazotide or INN-202), is entering Phase 3 registration trials and has the potential to be the first-to-market therapeutic for celiac disease, an unmet medical need, which effects an estimated 1% of the North American population or approximately 3 million individuals. Celiac patients have no treatment alternative other than a strict lifelong adherence to a gluten-free diet (GFD), which is difficult to maintain and can result in a lack in nutrients. Additionally, current FDA labeling standards allow up to 20 parts per million of gluten in GFD-labelled foods, which can be sufficient in many patients to cause celiac symptoms, including abdominal pain, cramping, bloating, gas, headaches, ataxia, ‘‘brain fog’’ and fatigue. Long-term sequelae of celiac disease include non-Hodgkin lymphoma, osteoporosis and anemia. Innovate’s second clinical program, INN-108, is in development for the treatment of mild-to-moderate ulcerative colitis (UC), an inflammatory bowel disease (IBD) with more than 1.25 million people affected in the major markets.

Innovate is led by an executive management team and board of directors that have held senior positions at leading pharmaceutical and biotechnology companies and that possess substantial experience across the spectrum of drug discovery, development and commercialization. Innovate’s CEO co-founded two successful biotechnology companies which were acquired by biotech and large pharmaceutical companies. Innovate’s medical and regulatory team conducted the Phase 2b trial for larazotide and have managed multiple other large scale clinical trials with successful New Drug Application (NDA) submissions and approvals. Members of Innovate’s board of directors have played key roles at Johnson & Johnson, Bristol-Myers Squibb, and AstraZeneca. One of Innovate’s directors was a co-founder of Salix Pharmaceuticals, the largest gastroenterology-focused company which was acquired for $16 billion in 2015.

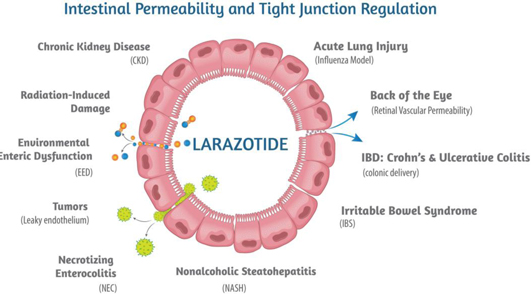

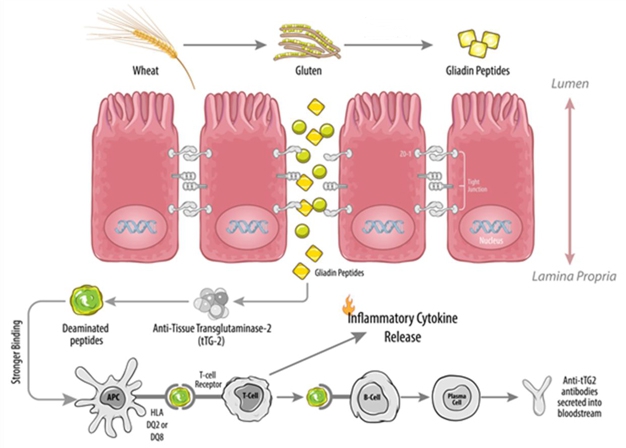

Figure 1: Larazotide’s mechanism of action is applicable to several other diseases.

| 6 |

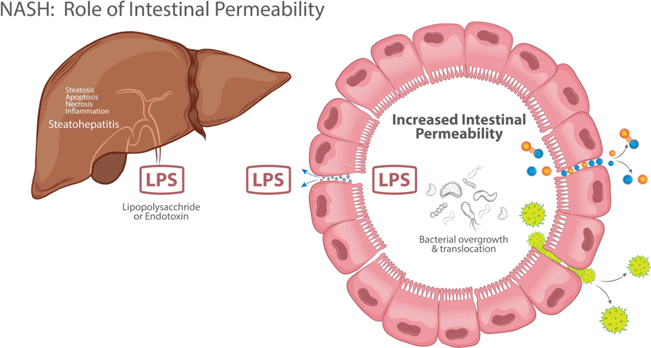

Larazotide is an 8-amino acid synthetic peptide orally administered as a capsule which has been tested in more than 500 celiac patients with proven safety and efficacy in clinical trials. The FDA has granted larazotide Fast Track Designation for celiac disease. Larazotide’s proven safety profile is due to its lack of systemic absorption into the blood circulation which allows it to act locally in the small bowel. Additionally, larazotide has a first-in-class mechanism of action (MoA) as a tight junction regulator. Pre-clinical studies showed larazotide causes a reduction in permeability across the epithelial barrier, making it the only drug known to Innovate which is in clinical trials with this MoA. Increased intestinal permeability is a MoA which underlies several other diseases, including Crohn’s disease, irritable bowel syndrome (IBS) and non-alcoholic steatohepatitis (NASH), among others (Figure 1). Innovate is engaging in academic collaborations to expand larazotide’s clinical indications with a shorter time to clinical proof-of-concept due to larazotide’s safety profile and exposure in more than 800 subjects.

With the release of the Phase 2b trial data in 342 patients as a late-breaker presentation at the 2014 Digestive Disease Week (DDW), larazotide became the first and the only drug for the treatment of celiac disease (published data) yet to meet its primary endpoint with statistical significance. The Phase 2b data showed clinically meaningful and statistically significant (p=0.022) reduction in abdominal and non-GI (headache) symptoms. After a successful End-of-Phase 2 meeting with the FDA, which confirmed the regulatory path forward to approval, Innovate is preparing to launch the Phase 3 registration program later this year with topline pivotal data expected by 2019.

For celiac patients, larazotide is being investigated as an adjunct to a GFD for patients who continue to experience symptoms despite following a GFD. As a result of the difficulty of maintaining a gluten-free lifestyle due to access to and cost of gluten-free foods, contamination from gluten and social pressures, more than half the celiac population experiences multiple, potentially debilitating symptoms per month. A recent study from the UK indicates that more than 70% of patients diagnosed with celiac disease consume gluten either intentionally or inadvertently (Hall et al. 2013). In academic studies and proprietary market research, there is a clear need for a therapeutic for this large and growing population.

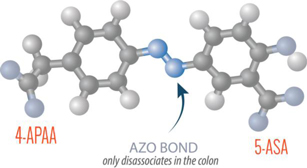

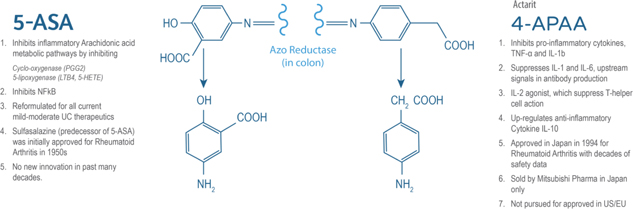

Innovate’s second drug candidate, INN-108, is in development for the treatment of mild-to-moderate UC. It is an oral tablet that uses an azo-bonded pro-drug approach linking mesalamine to 4-APAA (approved as Actarit in Japan in 1994 for the treatment of rheumatoid arthritis) and is entering a proof-of-concept Phase 2 trial in 2018, after having completed a successful Phase 1 trial demonstrating safety at currently approved doses of mesalamine. The azo-bond protects INN-108 (Figure 2) from the low pH in the stomach, allowing it to transit to the colon where the UC lesions are primarily located. In the colon, the azo bond is broken enzymatically, leading to mesalamine and 4-APAA releasing and having a synergistic anti-inflammatory effect. Although the majority of patients present with mild-to-moderate UC, which can progress to severe UC, the focus of drug development has been in moderate-to-severe UC with little innovation or drug development for mild-to-moderate UC. The mainstay of treatment for mild-to-moderate UC remains various oral reformulations of mesalamine or 5-ASA (5-amino salicylic acid) such as Shire’s Lialda (approved 2007) and Pentasa (approved 1993), Allergan’s Asacol HD (approved 2008) and Valeant/Salix’s Apriso (approved 2008).

Figure 2: 4-APAA is covalently bonded to 5-ASA via a high energy azo-bond which is only cleaved enzymatically in the colon.

| 7 |

Innovate also owns the global rights to INN-329, a proprietary formulation of secretin, a peptide hormone which is used to improve visualization in magnetic resonance cholangiopancreatography (MRCP) procedures. Secretin is a 27-amino acid long hormone which rapidly stimulates release of pancreatic secretions, thus improving visualization of the pancreatic ducts during imaging procedures. Secretin has also been tested in a variety of central nervous system conditions such as autism.

Innovate is based in Raleigh, North Carolina, was incorporated under the laws of North Carolina under the name ‘‘GI Therapeutics, Inc.’’ in 2012, and changed its name when it converted to a Delaware corporation in 2014.

Innovate’s Strategy

Innovate’s goal is to become a leading biopharmaceutical company by developing novel therapeutics that have the potential to transform current treatment paradigms for patients and to address unmet medical needs. Innovate is currently pursuing the development of oral drugs for autoimmune and inflammatory diseases that target established biological pathways. The critical components of Innovate’s strategy are as follows:

| • | Advance larazotide for celiac disease into Phase 3 clinical trials. Innovate’s immediate priority is to initiate the Phase 3 trials for larazotide for the treatment of celiac disease. Innovate had a successful End-of-Phase 2 meeting with the FDA in 2017. With the guidance and agreement reached with the FDA, Innovate plans to initiate its Phase 3 trials by mid-2018. |

| • | Accelerate Development of larazotide for NASH. The mechanism of action of larazotide to decrease intestinal permeability is one of the key recognized pathogenic factors in NASH. Innovate is initiating development of larazotide in combination with select NASH therapies in clinical trials with the potential for synergistic therapeutic benefit. |

| • | Further the Development of larazotide for Crohn’s Disease. The mechanism of action of larazotide to decrease intestinal permeability can have a beneficial therapeutic effect in IBD. In an IL-10 knockout animal model, larazotide showed promising data which can position it for a proof-of-concept study alone and in combinations with select immunological therapies. |

| • | Advance INN-108 for ulcerative colitis into a proof-of-concept Phase 2 trial. Innovate is currently developing the plans to initiate the proof of concept Phase 2 trials for INN-108 for the treatment of ulcerative colitis. INN-108 will be initially developed for mild-to-moderate ulcerative colitis in adults. |

| • | Seek Partnerships to Commercialize Late Stage Pipeline Drugs. With large addressable markets, such as celiac disease, Innovate plans to seek out partners with an established presence and history of successful commercialization. |

| • | Leverage and protect Innovate’s existing intellectual property portfolio and secure patents for additional indications. Innovate intends to continue to expand its intellectual property protection strategy, grounded in securing composition of matter patents and method of use patents for newer indications. Innovate plans to develop newer formulations for the product candidates for other indications and improved performance of existing indications. |

| • | In-license additional intellectual property and pipeline drugs to expand Innovate’s presence in the treatment of autoimmune and inflammatory diseases. In addition to broadening its current pipeline through indication expansion, Innovate plans to explore expansion of its product pipeline through strategic partnerships and product acquisitions, as it did in 2016 through its inlicensing of larazotide, Alba Therapeutics, Inc.’s celiac program. Future pipeline expansion decisions will be based on the unmet medical needs within the gastrointestinal disease area including, but not limited to, celiac disease and ulcerative colitis, the commercial opportunity, and the ability to rapidly develop and commercialize a product candidate. |

| • | Leverage the expertise of Innovate’s management team and network of scientific advisors and key opinion leaders. Innovate is led by a strong management team with deep experience in drug development, collaborations, operations, and corporate finance. Innovate’s team has been involved in a broad spectrum of R&D activities leading to successful outcomes, including FDA approvals and drug launches. Innovate will continue to leverage the collective experience and talent of its management team, network of leading scientific experts, and key opinion leaders (KOLs) to strategize and implement its development and eventually its commercialization strategy. |

| 8 |

| • | Out-license Innovate’s non-core assets/indications and establish research collaborations. Innovate continually reviews its internal research priorities and therapeutic focus areas and may decide to out-license non-core assets/indications that arise from current and future available data. Innovate may seek research collaborations that leverage the capabilities of its core assets in order to monetize and expand upon the breadth of opportunities that may be uniquely accessible through its drug candidates. |

| • | Outsource capital intensive operations. Innovate plans to continue to outsource capital intensive operations, including most clinical development and all manufacturing operations of its product candidates in order to facilitate the rapid development of its pipeline by using high quality specialist vendors and consultants in a capital efficient manner. |

| 9 |

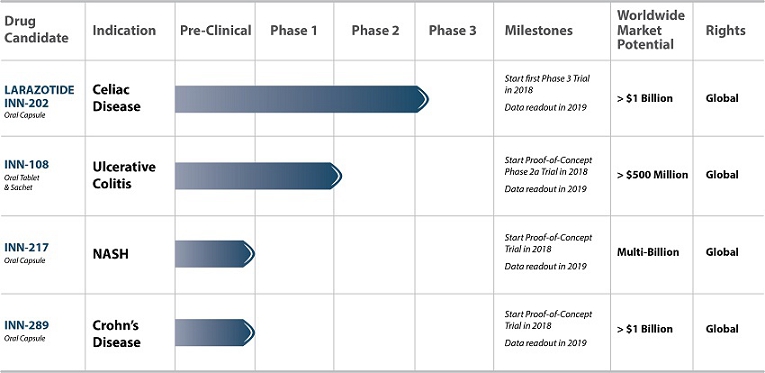

Innovate’s Drug Product Pipeline

Innovate’s current pipeline is focused on two clinical stage assets, one for celiac disease and one for ulcerative colitis. Innovate continues to leverage additional proof-of-concept work for larazotide to expand into additional indications, including irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD). The following table summarizes key information about Innovate’s pipeline of drug product candidates to date (Table 1):

Table 1: Innovate’s key pipeline products are clinical stage with an established safety profile, large markets for chronically dosed therapies, and key milestones during the next 24 months.

Larazotide (INN-202) for Celiac Disease

Larazotide has been developed for the treatment of celiac disease and has successfully completed a Phase 2b trial showing clinically meaningful and statistically significant reduction in abdominal and non-GI (headache) symptoms. Innovate is planning to launch the Phase 3 trials in mid-2018.

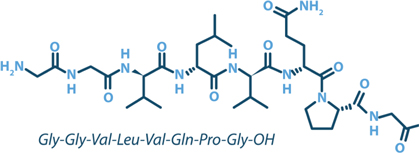

Larazotide is an orally administered, locally acting, non-systemic, synthetic 8-amino acid (Figure 3), first-in-class tight junction regulator being investigated as an adjunct to a gluten-free diet in celiac disease patients who still experience persistent GI symptoms despite being on a gluten-free diet. Larazotide’s established safety profile and the lack of absorption into the blood stream are advantages for a chronically dosed lifetime medication.

The larazotide drug product is an enteric coated (EC) drug product formulated as enteric-coated multiparticulate beads filled into hard gelatin capsules for oral delivery. The enteric coating is designed to allow the bead particles to bypass the stomach and release larazotide upon entry into the small intestine (duodenum). A mixed bead formulation is used to allow partial release of larazotide upon entry into the duodenum and to release the remaining larazotide approximately 30 minutes later. In clinical trials, larazotide has been dosed 15 minutes before meals allowing time for its effect in the small bowel before exposure to gluten.

| 10 |

Figure 3: Larazotide acetate is an 8-amino acid peptide formulated into a proprietary oral capsule

Larazotide’s Mechanism of Action

In research studies supportive of the mechanism of action, larazotide has been shown to stimulate recovery of mucosal barrier function via the regulation of tight junctions both in vitro and in vivo, including in the celiac disease mouse model (Gopalakrishnan, 2012; Gopalakrishnan, 2012). In doing so, it is proposed that larazotide reduces the signs and symptoms associated with celiac disease.

In several autoimmune diseases, this increased intestinal permeability or paracellular leakage allows increased exposure to a triggering antigen and a consequent inflammatory response, the characteristics of which are determined by the particular disease and the genetic makeup of the individual. A new paradigm for autoimmune disease is that there are three contributing factors to the development of disease:

| 1. | A genetically susceptible immune system that allows the host to react abnormally to an environmental antigen; |

| 2. | An environmental antigen that triggers the disease process; and |

| 3. | The ability of the environmental antigen to interact with the immune system. |

Larazotide inhibits tight junction opening triggered by both gluten and inflammatory cytokines, thus reducing uptake of gluten. Larazotide disrupts the intestinal permeability-inflammation loop, and reduces symptoms associated with celiac disease.

Larazotide’s Unique Dose Response

Previously published in vitro work has shown a wide linear dose response using Caco-2 cells, larazotide has been shown in numerous clinical trials to exhibit significant benefit at reducing symptoms but only at the lower doses while inhibition of this activity occurs at the higher doses. To explain this observation, Dr. Anthony Bliksager from North Carolina State University, evaluated the pharmacology of larazotide at the luminal surface of the small intestine in an ex vivo pig model. A section of the gut was ligated, placed in an Ussing chamber and changes in permeability measured by electrical resistance. The data confirmed full length larazotide is capable of fully restoring intestinal wall integrity to that of the non-ischemic control following an ischemic insult. Subsequently, it was discovered a specific aminopeptidase only located within the brush borders of the intestinal epithelium which cleaved larazotide into two fragments missing the either one or both N-terminus glycine (G) residues (GGVLVQPG). Both cleaved fragments, GVLVQPG and VLVQPG, are inactive in this ex vivo pig model. Moreover, when these two fragments are combined with the active full length larazotide, activity is abolished. These data confirm that local buildup of these inactive fragments derived from higher doses of larazotide compete and block function of larazotide after threshold concentration. The in vitro experiments using Caco-2 monolayers did not show the same pharmacology as they are missing the brush border and thus lack the aminopeptidase to degrade larazotide. These data also provide an explanation for the clinical observations of an optimal low dose of larazotide which avoids the reservoir of competing inactive fragments generated at high doses of larazotide.

| 11 |

Figure 4: An aminopeptidase in the brush border cleaves larazotide into two fragments, #1 and #2, which then act as inhibitors of larazotide

| 12 |

Figure 5: Illustrative effect of gluten ingestion, breakdown to gliadin which can cross a defective epithelial barrier in the small bowel thus activating the intestinal-inflammatory loop and causing symptoms and villous atrophy.

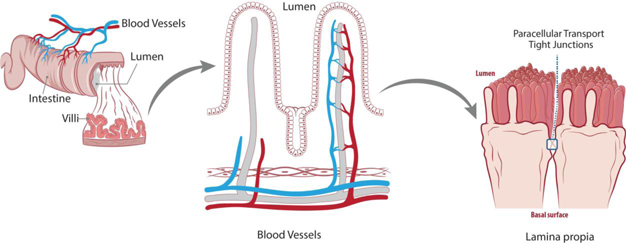

The Intestinal Barrier, Tight Junctions, and Intestinal Permeability

The intestine is the largest interface between a person and his or her environment, and an intact intestinal barrier is essential in maintaining overall health. An important function of the intestinal barrier is to regulate the trafficking of macromolecules between the environment and the host. Together with gut-associated lymphoid tissue (GALT) and the neuroendocrine network, the intestinal epithelial barrier controls the equilibrium between tolerance and immunity to non self-antigens. When the finely tuned trafficking of macromolecules is dysregulated, both intestinal and extra-intestinal autoimmune disorders can occur in genetically susceptible individuals (Figure 5).

Transcellular fluxes (through the cell membrane) allow nutrients and small molecules to enter the cell from the luminal side of the intestine and exit on the serosal side (internal milieu). Paracellular fluxes (between cells) in contrast are limited by size and charge constraints imposed by the tight junctions between epithelial cells. The paracellular pathway is the key regulator of intestinal permeability to larger more complex macromolecules that may be immunogenically significant.

Intestinal epithelial cells adhere to each other through junction complexes. The tight junction, also referred to as zonula occludens, represents the major barrier to diffusion within the paracellular space between intestinal cells. Multiple proteins that make up the tight junction have been identified including occludin, claudin family members, and junctional adhesion protein (JAM). These interact with cytosolic proteins (ZO-1, ZO-2, and ZO-3) that function as adaptors between the tight junction proteins and actin and myosin contractile elements within the cell. Acting together, they open and close the paracellular junctions between cells. It is now apparent that tight junctions are dynamic structures that are involved in developmental, physio logical, and pathological processes.

The role of tight junction dysfunction in the pathogenesis of autoimmune diseases is under active investigation. Many autoimmune populations have increased intestinal permeability and it is believed that this may play a fundamental role in the development of autoimmunity. In susceptible populations, the opening of tight junctions between intestinal epithelial cells may lead to exposure to oral antigens via paracellular transport and a consequent autoimmune response. A wide range of gastrointestinal and systemic inflammatory diseases are associated with abnormal intestinal permeability including celiac disease, type 1 diabetes, inflammatory bowel diseases (Crohn’s disease and ulcerative colitis), and ankylosing spondylitis.

| 13 |

Summary of Key Clinical Trials using Larazotide in Celiac Disease

Larazotide has been administered to humans in seven (7) clinical trials. These include three Phase 1 trials: (two trials in healthy subjects and a Phase 1b proof of concept (PoC) trial in subjects with celiac disease), two (2) Phase 2 gluten challenge studies in subjects with controlled celiac disease, and additionally two (2) Phase 2 trials in subjects with active celiac disease (Table 2). After demonstrating safety in the Phase 1 studies, larazotide was tested to explore which endpoint would be suitable for celiac disease. After looking at permeability changes in the gut, which turned out to be highly variable in a large trial setting, and then mucosal healing, which likely requires a longer-term study, symptom reduction showed the most consistent and reliable reduction both in a gluten challenge and a ‘‘real-life’’ trial. Importantly, after exposure in more than 800 subjects, the safety profile of larazotide remained similar to placebo due to its lack of absorption into the bloodstream — a critical advantage for a chronically dosed drug.

| Trial | Clinical Trial | No. of Subjects | ||

| -001 | Phase 1: Single Escalating Doses in Healthy Volunteers | 24 | ||

| -002 | Phase 1b: Multiple Dose POC in Celiac Patients – Gluten Challenge | 21 | ||

| -003 | Phase 1: Multiple Escalating Dose in Volunteers | 24 | ||

| -004 | Phase 2a: Multiple Dose POC in Celiac Patients Gluten Challenge 2 weeks | 86 | ||

| -006 | Phase 2b: Dose Ranging, in Celiac Patients Gluten Challenge, 6 weeks | 184 | ||

| -011 | Phase 2b: POC and Dose Ranging in Active Celiac Patients | 105 | ||

| -06B | Phase 2b: Similar to -006, in Celiac Patients | 42 | ||

| -012 | Phase 2b: Multiple dose in Celiac patients with Symptoms on a GFD | 342 |

Table 2: Significant drug exposure in more than 800 subjects in multiple clinical trials consistently showed a solid safety profile similar to placebo, which is a critical advantage for chronic lifetime administration.

Clinical Trial (‘006) Results Revealed Key Insight into Symptom Reduction as a Primary Endpoint

A Phase 2b study with a gluten challenge (CLIN1001-006) was conducted in 184 subjects with well-controlled celiac disease on a GFD. Subjects were randomized to one of four treatment groups, (placebo, 1 mg, 4 mg, or 8 mg larazotide) and asked to take treatment 15 minutes prior to each meal (TID). Nine hundred (900) mg of gluten was taken with each meal. Subjects remained on their GFD throughout the duration of the trial. The trial results revealed key insight into how to move the program forward by focusing on reduction of symptoms. The 1-mg dose prevented the development of gluten-induced symptoms as measured by GSRS (a patient-reported outcome (PRO) devised and validated by AstraZeneca), and all drug treatment groups had lower anti-transglutaminase antibody levels than the placebo group. Results of pre-specified secondary endpoints suggest that larazotide reduced antigen exposure as manifested by reduced production of anti-tTG levels and immune reactivity towards gluten and gluten-related gastrointestinal symptoms in subjects with celiac disease undergoing a gluten challenge.

| 14 |

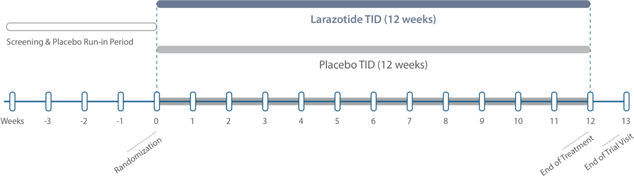

Figure 6: Trial design for Phase 2b and Phase 3 is the same with a screening period followed by 12 weeks of randomization, larazotide acetate vs. placebo.

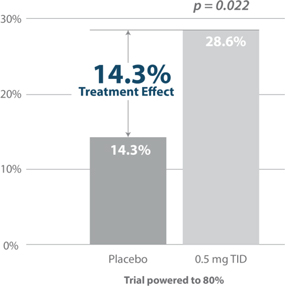

Figure 7: Responder Rate Analysis: Larazotide is the only celiac drug to meet its primary endpoint with statistical significance and a clinically meaningful improvement in the copyrighted CeD PRO (celiac disease patient reported outcome), an FDA-agreed upon primary endpoint for Phase 3 (shown above).

Source: Gastroenterology 2015; 148:1311–1319; p. 1315

Clinical Trial (‘012) Met the Primary Endpoint with Statistical Significance (CeD-GSRS/CeD PRO)

The purpose of the ‘012 study was to assess the efficacy (reduction and relief of signs and symptoms of celiac disease) of 3 different doses of larazotide (0.5 mg, 1 mg, and 2 mg TID) versus placebo for the treatment of celiac disease in adults as an adjunct to a GFD. Larazotide or placebo which was administered TID, 15 minutes prior to each meal. After a screening period, subjects were asked to continue following their current GFD diets into a placebo-run in phase for 4 weeks after which they were randomized to drug versus placebo. Subjects maintained an electronic diary capturing: daily symptoms celiac disease patient reported outcome (CeD-PRO), weekly symptoms (CeD-GSRS), bowel moments (BSFS), and a self-reported daily general well-being assessment (Figure 6).

The primary endpoint of average on-treatment CeD GSRS score throughout the treatment period was met at the 0.5 mg TID dose. In addition, a number of pre-specified secondary and exploratory endpoints, such as symptomatic days and symptom-free days, collectively demonstrated that a dose of 0.5 mg TID was superior to placebo and higher doses of larazotide. No difference was observed between the two higher dose levels (1 and 2 mg TID) or placebo, suggesting a narrow dose range around the 0.5mg dose which seems to correlate with pre-clinical data.

| 15 |

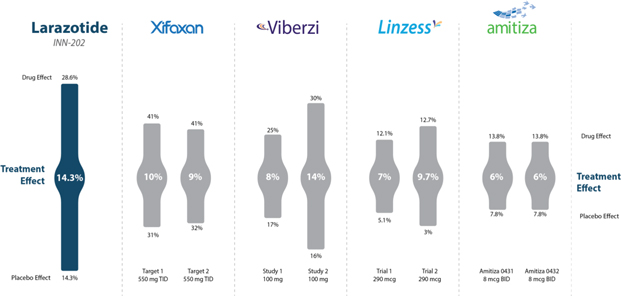

Figure 8: Treatment effect of larazotide acetate from the Phase 2b trial (‘012) compared to approved IBS/CIC drugs with varying treatment effects mostly in the mid to high single digit range.

Source: Gastroenterology 2015; 148:1311–1319; p. 1315 and FDA Drug Labels

The CeD PRO, a copyrighted PRO created specifically for celiac disease and wholly owned by Innovate, showed a statically significant (p=0.022) result with a treatment effect of 14.3% (drug responder rate minus placebo responder rate). Although, there are no celiac drugs approved as a comparator, the treatment effect was greater than several other GI dugs approved for irritable bowel syndrome (IBS) and chronic idiopathic constipation (CIC) which use a similar clinical trial design and have GI/abdominal symptoms similar to celiac disease (Figure 8).

Clinical Path Forward to Phase 3 Trials

After a successful End-of-Phase 2 meeting with the FDA, agreements were reached on the key aspects of the Phase 3 trials. The FDA agreed on using the previously validated CeD PRO as the primary endpoint with two doses of larazotide which bracket the range of efficacy in previous trials. Two Phase 3 trials with a size of about 450 patients each would allow for more than a 90% power to replicate the Phase 2b trial results. Most other criteria such as inclusion, exclusion, site selection/coordination will remain the same as the ‘012 Phase 2b trial. One of the leading causes of Phase 3 trial failure is toxicity which appears when drugs are tested in larger populations and in the case of larazotide, we believe this risk is diminished due to larazotide’s lack of systemic absorption into the blood circulation.

| 16 |

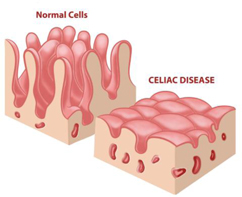

About Celiac Disease

Celiac disease is a genetic autoimmune disease triggered by the ingestion of gluten-containing foods such as wheat, barley, and rye. Individuals with celiac disease have increased intestinal permeability, commonly referred to as a ‘‘leaky’’ gut. This allows macromolecules that normally remain on the luminal side of the intestine to pass through to the serosal side through tight junctions via paracellular diffusion (Figure 9). In the case of celiac disease, this permeability may allow gluten break-down products, the triggering antigens of celiac disease, to reach gut-associated lymphoid tissue (GALT), initiating an inflammatory response. Celiac disease is characterized by chronic inflammation of the small intestinal mucosa that may result in diverse symptoms, malabsorption, atrophy of intestinal villi, and a variety of clinical manifestations.

Figure 9: The epithelial barrier separates the intestinal content from the immune system (lamina propria) and the vasculature.

| 17 |

Figure 10: Intestinal villi atrophy in celiac patients, a characteristic finding upon biopsy of the duodenum.

Large Population — Unmet Need (no drug approved); Serious Long-Term Sequelae

Celiac disease affects an estimated 1% of the Western population (Dubé, 2005). Currently, there are no therapeutics available to treat celiac disease, and the current management of celiac disease is a life-long adherence to a gluten-free diet. Changes in dietary habits are difficult to maintain, and foods labeled as gluten-free may still contain small amounts of gluten (up to 20 ppm per FDA labeling standards). Dietary compliance is imperfect in a large fraction of patients (Rostom, 2006) and difficult to adhere to on an ongoing basis (Green, 2007). In a recent survey conducted in the United Kingdom non-adherence to the gluten-free diet was found to be as high as 70% (Hall, 2013).

There are serious long-term consequences to exposure to gluten in patients with celiac disease, including the risk of developing osteoporosis, stomach, esophageal, or colon cancer, and T-cell lymphoma (Green 2003, Green 2007). The continuous GI symptoms often result in significant morbidity with a substantial reduction in quality of life. In addition, not all patients respond to a gluten-free diet. Patients with known celiac disease may continue to have or re-develop symptoms despite being on a gluten-free diet (Rostom 2006). This suggests a need for a therapeutic agent for the treatment of celiac disease (Green, 2007; Hall, 2013).

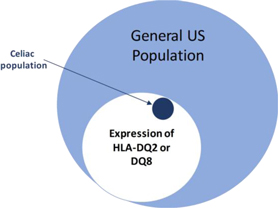

Celiac disease represents a unique model of an autoimmune disorder in that the following elements are known:

| 1. | The triggering environmental factor is glutenin or gliadin, the proline, glutamine and glycine rich glycoprotein fractions of gluten; |

| 2. | There is a close genetic association with HLA haplotypes DQ2 and/or DQ8; and |

| 3. | A highly specific humoral autoimmune response occurs. |

| 18 |

Genetics of Celiac Disease

The high incidence of celiac disease in first degree relatives of celiac patients (10 − 15%) and high concordance rate in monozygotic twins (80%) suggest a strong genetic component. Gliadin deamidation by tissue transglutaminase (tTG) enhances the recognition of gliadin peptides by human leukocyte antigen (HLA) DQ2 and DQ8 T cells in genetically predisposed subjects, which in turn may initiate the cascade of autoimmune reactions responsible for mucosal destruction. This interaction implies that gliadin and/or its breakdown peptides in some way cross the intestinal epithelial barrier and reach the lamina propria of the intestinal mucosa where they are recognized by antigen-presenting cells. The enhanced paracellular permeability of individuals with celiac disease would allow passage of macromolecules through the paracellular spaces with resulting autoimmune inflammation. There is a strong genetic predisposition to celiac disease, with major risk associated with HLA DQ2 (approximately 95% of celiac disease patients) and HLA-DQ8 (approximately 5% of celiac disease patients). The prevalence of celiac disease in the U.S. is estimated to be approximately 1%; however approximately 30% of the general U.S. population is HLA DQ2 positive (Figure 11), indicating that additional factors are involved in the development of celiac disease.

Figure 11: Distribution of HLA-DQ2/DQ8 in the general US population and in celiac disease.

Source: J. Clin. Invest. 2007 Jan 2;117(1):41.

In celiac disease, an inflammatory reaction occurs in the intestine that is characterized by infiltration of immune cells in the lamina propria and epithelial compartments with chronic inflammatory cells and progressive architectural changes to the mucosa. Both adaptive and innate branches of the immune system are involved. The adaptive response is mediated by gluten-reactive CD4+ T cells in the lamina propria that recognize gluten-derived peptides when presented by the HLA class II molecules DQ2 or DQ8. The CD4+ T cells then produce pro-inflammatory cytokines such as interferon gamma. This results in an inflammatory cascade with the release of cytokines, anti-tTG antibodies, T cells, and other tissue-damaging mediators leading to villous injury and crypt hyperplasia in the intestine. Anti-human tissue transglutaminase (anti-tTG) antibodies are also produced, which form the basis of serological diagnosis of celiac disease.

Anti-tTG Antibodies: Highly Sensitive and Specific Blood-based ELISA Diagnostic Test

The current approach for diagnosis of celiac disease, is to use anti-tissue transglutaminase-2 (tTG-2) antibody tests as an initial screen with definitive diagnosis from biopsy of the small intestine mucosa. The diagnosis of celiac disease is confirmed by demonstration of characteristic histologic changes in the small intestinal mucosa, which are scored based on criteria initially put forth by Marsh and later modified. In 2012, the European Society of Pediatric Gastroenterology, Hepatology, and Nutrition (ESPGHAN) Guidelines allowed symptomatic children with serum anti-tTG antibody levels ≥10 times upper limit of normal (ULN) to avoid duodenal biopsies after positive HLA test and serum anti-endomysial antibodies (EMAs). It’s likely with further improvement in diagnostic testing, the guidelines will expand to include adults in the EU and eventually in the US as well, making it easier to quickly and cost effectively screen the broader population.

| 19 |

The need for multiple clinical and laboratory findings to diagnose celiac disease makes monitoring disease progression difficult. International guidelines give standardized definitions and criteria for the diagnosis of celiac disease, however there are not clear standards for follow-up and monitoring of treatment. This is particularly true for celiac patients diagnosed as adults, who respond differently and less completely to a GFD than do celiac patients diagnosed as children. It is not clear who should perform follow-up of patients with celiac disease and at what frequency but the American College of Gastroenterology suggests that an annual follow-up seems reasonable. Recommendations for monitoring disease progression include assessing symptoms and dietary compliance, and repeating serology tests. Markers of celiac disease progression and improvement that are both validated and provide a timely assessment of disease activity are lacking.

Role of Tissue Transglutaminase in Celiac Disease

Anti-tTG-2 antibodies are produced in the small-intestinal mucosa (Picarelli et al. 1996), where they can bind tTG-2 present in the basement membrane and around blood vessels and form deposits characteristic of the disease. tTG-2 has been implicated in a variety of human disorders including several neurodegenerative conditions and cancer. Transglutaminases (TGs) were first discovered in the 1950s and are a family of enzymes which catalyze Ca2+-dependent post-translational modification of proteins. Of the seven isoforms discovered so far all share the same basic four-domain tertiary structure, with minor variations, although their catalytic mechanism is conserved, resembling that of the cysteine proteases. tTGs cause transamidation, esterification, and hydrolysis; all of which lead to post-translational modifications in the target proteins. Characteristically, tTG’s mediate selective protein cross-linking by forming covalent isopeptide linkages between two target proteins. The resulting cross-linked products in many cases have high molecular masses and are unusually resistant to proteolytic degradation and mechanical strain. As in the case of the gliadin fragments in celiac disease, they are able to pass thru the leaky paracellular pathway from the lumen to the lamina propria, where the immune cells reside and are then activated.

Gliadin fragments, in addition to being rich in proline, also have high glutamine content, which makes them suitable substrates for tTG-2, which targets glutamine residues. For augmented DQ2/8 binding, the conversion of glutamine residues to glutamic acid is catalyzed by tTG-2 as a deamidation reaction. After deamidation, the gliadin peptides become highly negatively charged in key anchor positions, thereby increasing their affinity to the HLA molecules. CD4+ T cells recognize the deamidated gliadin peptides bound to the HLA DQ2 or DQ8 molecules by their T cell receptors, thus activating intestinal inflammation leading to villous atrophy.

Gluten and Food Labeling

Gluten is a complex molecule contained in several grains such as wheat, rye and barley. Gluten can be subdivided into two major protein subgroups according to their solubility in alcohol and aqueous solutions. These subclasses consist of gliadins, soluble in 40 − 70% ethanol and glutenins which are large, polymeric molecules insoluble in both alcohol and aqueous solutions. The gliadins and glutenins can be further subdivided into groups according to their molecular weight. Glutenins can be subdivided into low and high molecular weight proteins, while the gliadin protein family contains α-, β-, γ- and ω- types. Both glutenins and gliadins are characterized by a high amount of prolines (20%) and glutamines (40%) that protect them from complete degradation in the gastrointestinal tract and make them difficult to digest. Currently 31 nine-amino acid peptide sequences in the prolamins of wheat and related species have been defined as being celiac toxic or celiac ‘‘epitopes.’’ These epitopes are located in the repetitive domains of the prolamins, which are proline and glutamine-rich, and the high levels of proline make the peptide resistant to proteolysis. In addition, the prolamin-reactive T cells also recognize these epitopes to a greater extent when specific glutamine residues in their sequences have been deamidated to glutamic acid by tTG-2. The immunodominant sequence after wheat challenge corresponds to a well-characterized 33 residue peptide from α-gliadin, ‘‘33-mer,’’ that is resistant to gastrointestinal digestion (with pepsin and trypsin) and was initially identified as the major celiac toxic peptide in the gliadins.

| 20 |

The FDA finalized a standard definition of ‘‘gluten-free’’ in August 2013. As of August 5, 2014, all manufacturers of FDA-regulated packaged food making a gluten-free claim must comply with the guidelines outlined by the FDA (www.fda.gov/gluten-freelabeling). A ‘‘gluten free’’ claim still allows up to 20 ppm of gluten which leads to more than 100mg/day up to 500 mg/day of gluten exposure. Due to presence of gluten in foods, beer/liquor, cosmetics and household products, exposure is virtually impossible to completely avoid, and with cross-contamination, celiac patients cannot avoid exposure to gluten therefore, making symptoms more frequent than expected.

|

CNS |

Endocrine | Oncology/Heme | Skin | Other | ||||

| Headaches | Type 1 Diabetes |

Enteropathy associated T-cell lymphoma (EATL) |

Dermatitis herpetiformis | Rheumatoid arthritis (RA) | ||||

| Gluten ataxia |

Autoimmune thyroid |

Anemia | Alopecia areata |

Reduced bone density | ||||

| Peripheral neuropathies | Addison’s disease | Vitiligo | Sjogren’s syndrome |

Non-GI Manifestations of Celiac Disease and Co-Morbidities

Table 3: Diseases associated with celiac disease

Headache, Gluten Ataxia: Nervous System Manifestation of Celiac Disease

The association between celiac disease and neurologic disorders has been supported by numerous studies over the past 40 years. While peripheral neuropathy and ataxia have been the most frequently reported neurologic extra-intestinal manifestations of celiac disease a growing body of literature has established headache as a common presentation of celiac disease as well. The exact prevalence of headache among patients ranges from about 30% to 6% (Lebwohl, 2016).

Dermatitis herpetiformis: Skin Manifestation of Celiac Disease

Dermatitis herpetiformis (DH) is an inflammatory cutaneous disease characterized by intensely pruritic polymorphic lesions with a chronic-relapsing course, first described by Duhring in 1884. DH’s only treatment is a strict lifelong GFD, for achieving and maintaining a permanent control. It appears in around 25% patients with CD, at any age of life, mainly in adults and is a very characteristic clinical presenting symptom.

| 21 |

Figure 12: LPS (Lipopolysaccharide) or Endotoxin produced by bacteria in the “leaky gut” has been implicated in the pathogenesis of NASH. Larazotide can prevent LPS translocation to the liver via the portal circulation.

Non-alcoholic steatohepatitis (NASH)

NASH is a growing disorder (up to 25%) in the general population though its incidence is elevated 6-fold in celiac patients. It has been suggested several times that NASH is associated with increased gut permeability caused by disruption of intercellular tight junctions in the intestine allowing lipopolysaccharide (LPS) from bacteria to pass into the portal circulation to the liver. Explosive growth in the market for NASH therapeutics is expected according to Global Data across the seven major markets of the U.S., France, Germany, Italy, Spain, the UK, and Japan, with such market set to grow to around $25.3 billion by 2026. Larazotide can be used in combination with the multitude of NASH drugs in clinical trials as a safe drug with a different and potentially synergistic therapeutic effect.

Enteropathy-associated T-cell lymphoma (EATL): High Mortality Rate and Unmet Need

Cancer associated with celiac disease occurs in about 2% − 3% of the celiac population, with the most common representing approximately 2⁄3 of the cases, being Enteropathy-associated T-cell lymphoma (EATL). EATL effects approximately 1% of the celiac population. EATL is an intestinal tumor of intraepithelial T lymphocytes found throughout the small intestines and increased in number in celiac disease. Intestinal intraepithelial α-β T-cells, in various stages of transformation, are thought to be the normal-cell counterpart for EATL. Currently there are no standardized treatment regimens and surgery and/or radiation maybe indicated depending on tumor bulk and spread followed by anthracycline-containing chemotherapy such as CHOP is often used. Relapses after CHOP or CHOP-like chemotherapy occur 1 − 60 months from diagnosis in ∼80% of responsive patients, with a mortality of 85% due to progressive disease or complications.

Refractory Celiac Disease

Refractory celiac disease is clinically defined as the persistence of pathologic changes in the intestine consistent with celiac disease despite a strict gluten-free diet for more than 12 months. These pathologic changes include increased intraepithelial lymphocytes, villous atrophy, and crypt hyperplasia. Cases of refractory celiac disease are commonly divided into two types:

| 22 |

| • | Type I refractory celiac disease — These lesions typically show no atypia in the intraepithelial lymphocytes, normal surface T cell receptor, CD3 and CD8 expression by intraepithelial T lymphocytes and a polyclonal pattern on T cell receptor gene rearrangement studies. |

| • | Type II refractory celiac disease — These lesions also have no atypia in the intraepithelial lymphocytes, but demonstrate a loss of surface T cell receptor, CD3, or CD8 expression and may have a monoclonal T cell receptor gene rearrangement. |

The clinical significance of refractory celiac disease type is incompletely understood. While type I refractory celiac disease is unlikely to progress to EATL, type II may be a precursor lesion to EATL. Imaging with computed tomography, positron emission tomography, and video capsule endoscopy may help to identify cases of refractory celiac disease that have progressed to EATL.

Type I Diabetes Mellitus

Celiac disease is overrepresented in type 1 diabetes (T1DM), which shares a mutual genetic predisposition with celiac disease; both diseases are associated with the HLA class II genes (HLA-DQB1) on chromosome 6p21 (Smyth et al. 2008). The incidence of celiac disease is increased by 8 to 10-fold in the T1DM population versus the overall population incidence. In fact, T1DM patients with the HLADQ2/8 haplotype are also positive for anti-tTG antibodies, an established highly sensitive test for celiac disease.

The association of Human Leukocyte Antigens (HLA) with type 1 diabetes was first reported in the 1970s. Classical HLA molecules are cell-surface proteins that bind and present peptide antigens for recognition by the T cell receptor (TCR). The shape of the peptide binding groove and charges within it determine the type of peptides which bind to a given HLA and the combination then activates the TCR and in celiac disease leads to the intestinal-inflammatory loop causing villous atrophy and in T1DM causing destruction of the insulin secreting pancreatic β - cells.

In addition to the genetic link, several studies over the past two decades have implicated a leaky or damaged intestinal barrier leading to passage of toxins and/or viruses as a potential causative factor in T1DM. (Vaarala, 2008). Increased intestinal permeability, also common to celiac disease, and reports of gliadin activated lymphocytes trafficking to the pancreas lead to a link amongst autoimmunity, intestinal permeability, intestinal inflammation and potential role of gliadin. A growing body of evidence also suggests the beneficial effects of a GFD (for patients with concomitant celiac disease) may actually protect against the long-term complications of T1DM. such as retinopathy, nephropathy and others. Heretofore, until larazotide, no drug, to Innovate’s knowledge, with an MoA to decrease intestinal permeability has advanced into clinical trials and with its established safety profile as an oral capsule, a targeted exploratory clinical study could help further elucidate the role of intestinal permeability as a therapeutic modality for T1DM as well.

Non-Celiac Gluten Sensitivity: Large Growing Patient population with Celiac Symptoms

Non-celiac gluten sensitivity (NCGS) is a syndrome diagnosed in patients with symptoms that respond to removal of gluten from the diet, after celiac disease and wheat allergy have been excluded. NCGS patients lack the villous atrophy of the small intestine, yet biopsies show reduced numbers of T-regulatory cells, which may indicate that the innate immune system is involved. Anti-tTG antibodies are not elevated in NCGS as in celiac disease which is another key difference between the two diseases. Anti-gliadin antibodies (AGA) may be an indicator of NCGS as up to 50% of such patients presenting to gastroenterologists have detectable circulating levels, primarily of IgG AGA.

The ‘‘classical’’ presentation of NCGS is a combination of GI symptoms including abdominal pain, bloating, bowel habit abnormalities (either diarrhea or constipation), and extra-intestinal symptoms such as ‘‘brain fog,’’ depression, headache, fatigue, and leg or arm numbness. NCGS has been described in the literature since the 1980s and is distinct from celiac disease, however, both share symptomatic relief from a GFD, implying benefit from preventing gluten from passing through the epithelial barrier is beneficial.

| 23 |

Other Indications using Larazotide’s Mechanism of Action

Larazotide for Crohn’s Disease: IL-10 Knockout Mouse Model

The effect of larazotide on disease attenuation in an IL-10 knockout mouse study was studied (Arrieta, 2009). Larazotide was placed in the drinking water of the mice at a low dose (0.1 mg/ml) or high dose (1.0 mg/ml) during the period from 4 to 17 weeks of age. Results were compared to wild type mice, IL-10 knockout mice with no treatment, and IL-10 knockout mice treated with probiotics. Intestinal and colonic permeability was significantly reduced in the high dose larazotide treatment group, but not in the untreated IL-10 knockout group. Larazotide treatment caused a reduction in all tissue markers of colonic inflammation (IFNγ and TNFα) and in histological inflammation.

Larazotide for Environmental Enteric Dysfunction (EED): Positive in vitro Data; Potential for PriorityReview Voucher

Environmental enteric dysfunction (EED) is a rare pediatric tropical disease in the US and Europe, however, more than 165 million children in developing countries in Africa and Asia suffer from it. As per section 524 of the Federal Food, Drug, and Cosmetic Act (FD&C) Act, EED would likely fall under ‘‘Current List of Tropical Disease’’ number ‘S,’ thus making a drug approved for EED in the US eligible for a Priority Review Voucher (PRV). PRVs save time to approval for a drug and can be sold to a large pharma company. The most recent PRV sold by BioMarin Pharmaceuticals Inc. yielded them $125 million.

The histological presentation of EED is very similar to celiac disease with villous atrophy and chronic inflammation of the small bowel and the pathogenesis of EED is linked to increased intestinal permeability. We have tested Larazotide against some of the pathogens commonly found in EED (unpublished) and found positive in vitro results which will need to be confirmed in animal models before starting a clinical trial in EED.

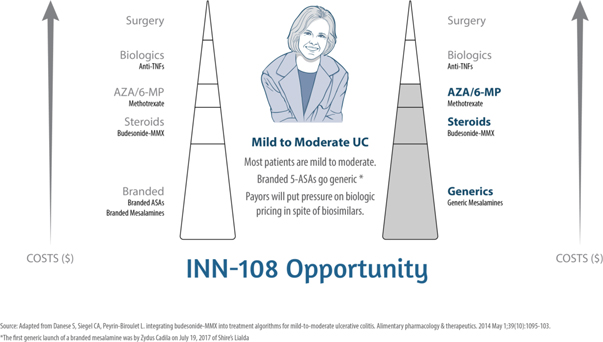

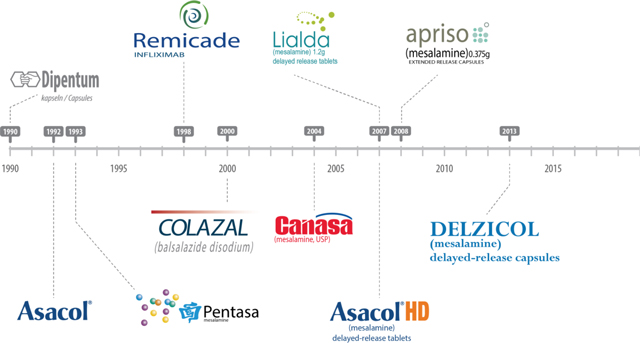

INN-108: Mild-to-Moderate Ulcerative Colitis

INN-108 is in development for mild-to-moderate ulcerative colitis (UC) and is expected to enter a proof-of-concept Phase 2 trial in the second half of 2018 after a successful Phase 1 trial demonstrating safety at currently approved doses of mesalamine. UC is an inflammatory bowel disorder (IBD) that affects more than 1.25 million people in the major markets and is characterized by inflammation and ulcers in the colon and rectum. UC is a chronic disease that can be debilitating and sometimes lead to life-threatening complications. While poorly understood, a multitude of environmental factors and genetic vulnerabilities are thought to lead to the dysregulation of the immune response via a defective epithelial barrier. Although the majority of patients present with mild-to-moderate UC which can progress to severe UC, the focus of drug development has been in moderate-to-severe UC with little innovation or drug development for mild-to-moderate UC. The mainstay of treatment for mild-to-moderate UC remain various oral reformulations of mesalamine or 5-ASA (5-amino salicylic acid) such as Shire’s Lialda (approved 2007) and Pentasa (approved 1993), Allergan’s Asacol HD (approved 2008) and Valeant/Salix’s Apriso (approved 2008).

| 24 |

INN-108 uses an azo-bonded pro-drug approach linking mesalamine to 4-APAA. Mitsubishi Pharma developed 4-APAA as Actarit in Japan which was approved in 1994 for rheumatoid arthritis. IBD drugs were all originally approved for rheumatoid arthritis (RA), from the oldest 5-ASA, sulfasalazine, to the latest biologics, Humira and Enbrel. 4-APAA has more than two decades of safety data as a standalone drug and has an MoA which is differentiated from mesalamine though the ultimate effect for both is anti-inflammatory (Figure 13). Taken orally as a tablet, the azo-bond protects INN-108 from the low pH in the stomach, thus allowing it to transit to the colon where the UC lesions are located. In the colon, the azo bond is broken enzymatically leading to the release of mesalamine and 4-APAA which have a synergistic anti-inflammatory effect. With the addition of 4-APAA, which is not approved in the U.S. or EU, to the already approved mesalamine, the synergistic effect could lead to superior clinical efficacy over the currently approved oral mesalamines.

Figure 13: 4-APAA is covalently bonded to 5-ASA via a high energy azo-bond which is only cleaved enzymatically in the colon. The anti-inflammatory effect of each of 5-ASA and 4-APAA via different pathways which could lead to a potential synergistic anti-inflammatory effect as seen in animal studies.

| 25 |

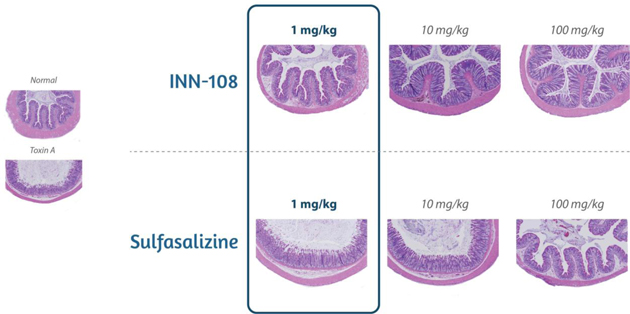

INN-108: UC Animal Model Data Shows Synergy between 4-APAA and Mesalamine

The effects of chronic treatment with INN-108 on Clostridium diffıcile toxin A — induced colitis of the colon is shown in Figure 14. Orally administered INN-108 was significantly more potent than sulfasalazine or 4-APAA alone (McVey, 2005).

Figure 14: A rat UC model using toxin A induced-colitis as the insult leads to sloughing of the colonic epithelium with increasing doses. Using sulfasalazine vs. INN-108 to protect against the toxin A injury showed INN-108 was significantly more potent that sulfasalazine.

Source: McVey DC et al. Digestive Diseases and Sciences. 2005 Mar 1;50(3):565-73.

INN-108 Clinical Development Pathway

After completing a Phase 1 study with 24 subjects, safety was established with dosing of mesalamine and 4-APAA at 2 grams each for a total of 4 grams TID. The typical dose of the various approved mesalamine formulations range from 1.5g to 2.4g per day, thus INN-108’s mesalamine content is within the established approved dose range. The addition of 4-APAA is thought to improve the efficacy above mesalamine, which would allow INN-108 to be used either after or instead of current mesalamines. In a Phase 2 trial, Innovate plans to compare INN-108 to mesalamine seeking to demonstrate a greater clinical effect than mesalamine alone.

Source: McVey DC et al. Digestive Diseases and Sciences. 2005 Mar 1;50(3):565-73.

Ulcerative Colitis: Lack of Innovation in New Drug Development for Past Several Decades

Conventional therapies broadly inhibit mechanisms involved in the inflammatory process and are commonly used to effectively treat patients experiencing a mild-to-moderate form of the disease. For mild-to-moderate UC, oral mesalamine has an established efficacy and safety profile. However, gastroenterologists cite the need for new therapies for mild-to-moderate UC.

Patients who do not respond to mesalamine are eventually transitioned to biologics. The primary targets for biologics have been to control the immune response and inflammatory cascade, by inhibiting or downregulating molecules such as TNF-α, NF-κB, IL-1β and IFN1-γ. We believe INN-108 bridges the gap between mesalamine and biologics by its mechanism of action of both inhibiting the inflammatory process as well as down-regulating the cytokines.

| 26 |

Branded mesalamine formulations didn’t face any generics and have been a profit generator until July 2017, when Zydus Cadila launched the first generic of Shire’s Lialda. Within weeks generic Lialda grabbed about 40% unit market share as per IMS. This rapid generic penetration would be expected over time for the remaining mesalamines as well. Thus, if INN-108 shows improved efficacy over mesalamine, it could convert branded mesalamines, some generics as well as steroids/AZA/6-MP and early use of biologics. INN-108 could offer a more cost effective and more efficacious profile than mesalamines and avoid or delay the need for high-cost biologics (Figure 15).

Figure 15: INN-108’s market opportunity improved over mesalamine without the side effects from Steroids/AZA/6-MP

About Ulcerative Colitis

UC is a chronic intermittent relapsing inflammatory disorder of the large intestine and rectum. While poorly understood, a multitude of environmental factors and genetic vulnerabilities are thought to lead to the dysregulation of the immune response via a defective epithelial barrier. As a result, chronic inflammation and ulceration of the colon occurs. UC is specific to the colon and affects only the mucosal lining of the colon. Common symptoms of UC include diarrhea, bloody stools, and abdominal pain. The majority of patients are intermittent in their disease course, in that they experience a relapse among periods of remission. However, some patients experience only a single episode of the disease prior to maintaining remission whereas other patients are chronically symptomatic and may require a proctocolectomy to treat their condition.

History of Drug Development in Mild-to-Moderate Ulcerative Colitis

The original compound used in UC was sulfasalazine (Azulfidine), a conjugate of 5-ASA linked to sulfapyridine by an azo bond, which is split into the two molecules by bacterial azoreductases in the colon. The 5-ASA component or mesalamine is the active therapeutic moiety of sulfasalazine, with sulfapyridine thought to have little if any therapeutic effect. Sulfapyridine, however, is the cause of most of the significant adverse side effects of sulfasalazine.

| 27 |

This led to the development of other 5-ASA preparations utilizing azo chemistry to deliver high concentrations of mesalamine or 5-ASA to the colon by preventing early absorption of the drug in the small intestine. Such preparations include olsalazine (Dipentum), consisting of two molecules of 5-ASA bonded together by an azo bond, and balsalazide (Colazal), consisting of 5-ASA azo bonded to an inert carrier (4-aminobenzoyl-β-alanine). The efficacy of these newer oral forms of 5-ASA is comparable to that of sulfasalazine, but they are better tolerated. However, some side effects persist which prevent wider use. In each of these preparations, the only active moiety is mesalamine or 5-ASA, an anti-inflammatory agent.

INN-329

INN-329 is a proprietary formulation of secretin, a peptide hormone which is used to improve visualization in a magnetic resonance MRCP procedures. Secretin is a 27-amino acid long hormone which rapidly stimulates release of pancreatic secretions, thus improving visualization of the pancreatic ducts during imaging procedures. Secretin has also been tested in a variety of central nervous system conditions such as autism, though currently approved only for pancreatic function testing and imaging with endoscopic retrograde cholangiopancreatography (ERCP). The currently marketed synthetic secretin, approved by the FDA in 2004, is not approved by the FDA or the EMEA for Secretin-MRCP (S-MRCP) procedures. Innovate acquired the assets of secretin from Repligen Corporation in December 2014.

MRCP has been used for more than 20 years as a non-invasive tool for imaging pancreatic ducts. With the addition of secretin, pancreatic secretions are increased leading to significantly improved visualization of the pancreatic ducts for detection of abnormalities, including pancreatic cancer. The gold standard for pancreatic duct imaging had been ERCP, an expensive and invasive procedure with complications such as pancreatitis (3 − 5%), bleeding (1 − 2%), perforation (1%), infection (1 − 2%) and death (1/250). More than a half-million ERCP procedures are performed annually in the US and as the role of ERCP diminishes for screening, it will further the need for approval of secretin for S-MRCP. Innovate expects to repeat a Phase 3 trial with a partner, if and when secured, as per previous discussion with the FDA to look at improvement in visualization of the pancreatic duct via MRCP with and without secretin.

Innovate’s Intellectual Property

Innovate strives to protect the proprietary technology that it believes is important to its business, including its product candidates and its processes. Innovate seeks patent protection in the United States and internationally for its products, their methods of use, and processes of manufacture and any other technology to which Innovate has rights, as appropriate. Additionally, Innovate has licensed the rights to intellectual property related to certain of its product candidates, including patents and patent applications that cover the products or their methods of use or processes of manufacture. The terms of the licenses are described below under the heading ‘‘Licensing Agreements.’’ The patent families related to the intellectual property covered by the licenses include 29 U.S. patents and 107 foreign patents with expirations dates ranging from 2018 to 2035. Innovate also relies on trade secrets that may be important to the development of its business.