Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsrelease.htm |

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw123117earnings8-k.htm |

1

Earnings Conference Call – Fourth Quarter 2017

January 31, 2018

John Wiehoff, Chairman & CEO

Andrew Clarke, CFO

Tim Gagnon, Vice President

2

Safe Harbor Statement

Except for the historical information contained herein, the matters set forth in

this presentation and the accompanying earnings release are forward-looking

statements that represent our expectations, beliefs, intentions or strategies

concerning future events. These forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to differ materially

from our historical experience or our present expectations, including, but not

limited to such factors as changes in economic conditions, including uncertain

consumer demand; changes in market demand and pressures on the pricing for

our services; competition and growth rates within the third party logistics

industry; freight levels and increasing costs and availability of truck capacity or

alternative means of transporting freight, and changes in relationships with

existing truck, rail, ocean and air carriers; changes in our customer base due to

possible consolidation among our customers; our ability to integrate the

operations of acquired companies with our historic operations successfully; risks

associated with litigation and insurance coverage; risks associated with

operations outside of the U.S.; risks associated with the potential impacts of

changes in government regulations; risks associated with the produce industry,

including food safety and contamination issues; fuel prices and availability;

changes to our share repurchase activity; risk of unexpected or unanticipated

events or opportunities that might require additional capital expenditures; the

impact of war on the economy; and other risks and uncertainties detailed in our

Annual and Quarterly Reports.

2

3

Results Q4 2017

Three Months Ended December 31

in thousands, except per share amounts and headcount

▪ Total revenues increased as a result of increased pricing, volume, and fuel costs in most of our transportation

services in the fourth quarter of 2017 when compared to the fourth quarter of 2016.

▪ Realized one-time tax reduction of approximately $31.8 million in the fourth quarter primarily due to a domestic

manufacturing deduction and revaluation of deferred net tax liabilities.

▪ Headcount increased in the fourth quarter when compared to last year's fourth quarter as a result of the Milgram

acquisition and other talent investments across the business.

3

Twelve Months Ended December 31

2017 2016 % Change 2017 2016 % Change

Total Revenues $3,959,786 $3,414,975 16.0% $14,869,380 $13,144,413 13.1%

Total Net Revenues $631,849 $561,516 12.5% $2,368,050 $2,277,528 4.0%

Net Revenue Margin % 16.0% 16.4% (40 bps) 15.9% 17.3% (140 bps)

Income from Operations $210,876 $193,565 8.9% $775,119 $837,531 (7.5%)

Operating Margin % 33.4% 34.5% (110 bps) 32.7% 36.8% (410 bps)

Net Income $152,556 $122,303 24.7% $504,893 $513,384 (1.7%)

Earnings Per Share (Diluted) $1.08 $0.86 25.6% $3.57 $3.59 (0.6%)

Weighted Average Shares

Outstanding (Diluted) 140,724 142,164 (1.0%) 141,382 142,991 (1.1%)

Depreciation and Amortization $23,637 $21,953 7.7% $92,977 $74,669 24.5%

Total Assets $4,235,834 $3,687,758 14.9% $4,235,834 $3,687,758 14.9%

Average Headcount 15,036 14,074 6.8% 14,687 13,670 7.4%

Ending Headcount 15,074 14,125 6.7% 15,074 14,125 6.7%

‹#›

Summarized Income Statement

▪ Personnel expenses increased as a result of headcount additions and an increase

in variable compensation in the fourth quarter of 2017 when compared to the

fourth quarter of 2016.

▪ SG&A expenses increased as a result of higher warehousing, occupancy,

equipment rental and depreciation offset by lower claims expenses in the fourth

quarter of 2017 when compared to the fourth quarter of 2016.

▪ The effective tax rate was 21.1 percent in the fourth quarter. We expect the 2018

effective tax rate to be 24 – 25 percent.

in thousands

4

Three Months Ended December 31 Twelve Months Ended December 31

2017 2016 % Change 2017 2016 % Change

Total Revenues $3,959,786 $3,414,975 16.0% $14,869,380 $13,144,413 13.1%

Total Net Revenues $631,849 $561,516 12.5% $2,368,050 $2,277,528 4.0%

Personnel Expenses $311,599 $260,305 19.7% $1,179,527 $1,064,936 10.8%

Selling, General, and Admin $109,374 $107,646 1.6% $413,404 $375,061 10.2%

Total Operating Expenses $420,973 $367,951 14.4% $1,592,931 $1,439,997 10.6%

Income from Operations $210,876 $193,565 8.9% $775,119 $837,531 (7.5%)

% of Net Revenue 33.4% 34.5% (110 bps) 32.7% 36.8% (410 bps)

Net Income $152,556 $122,303 24.7% $504,893 $513,384 (1.7%)

‹#›

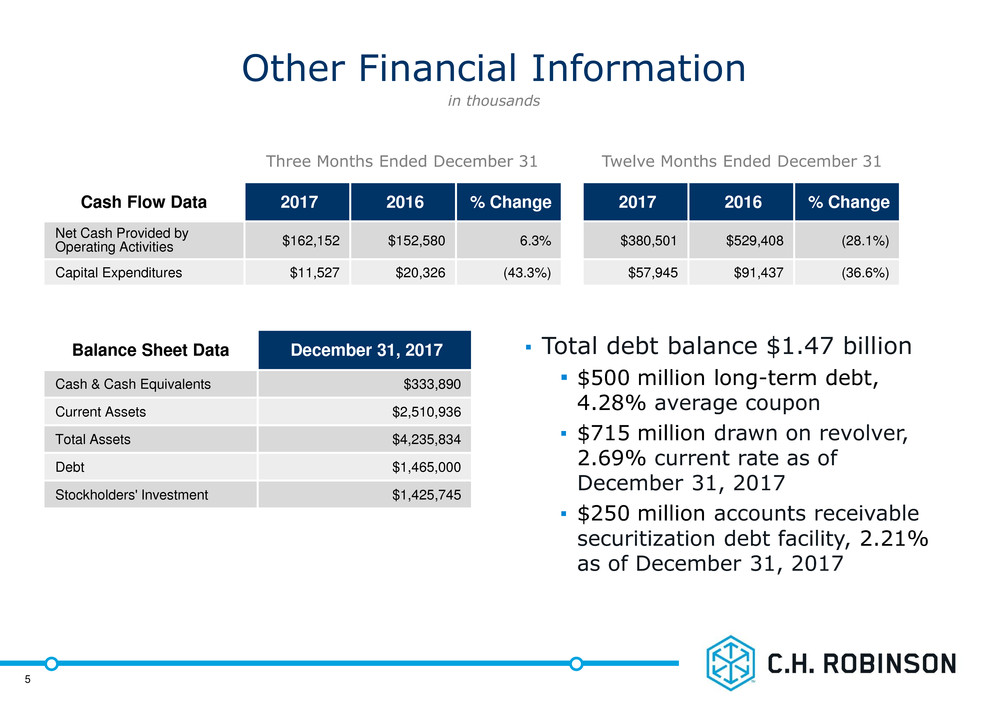

Other Financial Information

▪ Total debt balance $1.47 billion

▪ $500 million long-term debt,

4.28% average coupon

▪ $715 million drawn on revolver,

2.69% current rate as of

December 31, 2017

▪ $250 million accounts receivable

securitization debt facility, 2.21%

as of December 31, 2017

in thousands

5

Three Months Ended December 31 Twelve Months Ended December 31

Cash Flow Data 2017 2016 % Change 2017 2016 % Change

Net Cash Provided by

Operating Activities $162,152 $152,580 6.3% $380,501 $529,408 (28.1%)

Capital Expenditures $11,527 $20,326 (43.3%) $57,945 $91,437 (36.6%)

Balance Sheet Data December 31, 2017

Cash & Cash Equivalents $333,890

Current Assets $2,510,936

Total Assets $4,235,834

Debt $1,465,000

Stockholders' Investment $1,425,745

‹#›

Capital Distribution

▪ Capital returned to shareholders during the quarter

▪ $65.5 million cash dividends

▪ $52.8 million in cash for share repurchase activity

▪ 672,401 shares repurchased in the fourth quarter

▪ Average price of $78.53 for the shares repurchased in the fourth quarter

▪ Target is to return approximately 90% of net income to shareholders annually.

(a) 2012 Net Income is adjusted to excluded transaction related gains and expenses. A reconciliation of adjusted

results appears in Appendix A. 2012 Dividends exclude the fifth dividend payment made during the year.

(b) Includes a $500 million accelerated share repurchase.

in thousands

6

2012 (a) 2013 2014 2015 2016 2017

Net Income $447,007 $415,904 $449,711 $509,699 $513,384 $504,893

Capital Distribution

Cash Dividends Paid $219,313 $220,257 $215,008 $235,615 $245,430 $258,222

Share Repurchases $255,849 $807,449 $176,645 $241,231 $209,603 $203,542

Subtotal $475,162 $1,027,706 $391,653 $476,846 $455,033 $461,764

Percent of Net Income

Cash Dividends Paid 49.1 % 53.0 % 47.8 % 46.2 % 47.8 % 51.1 %

Share Repurchases 57.2 % 194.1 % 39.3 % 47.3 % 40.8 % 40.3 %

Subtotal 106.3 % 247.1 % 87.1 % 93.6 % 88.6 % 91.5 %

(b)

‹#›

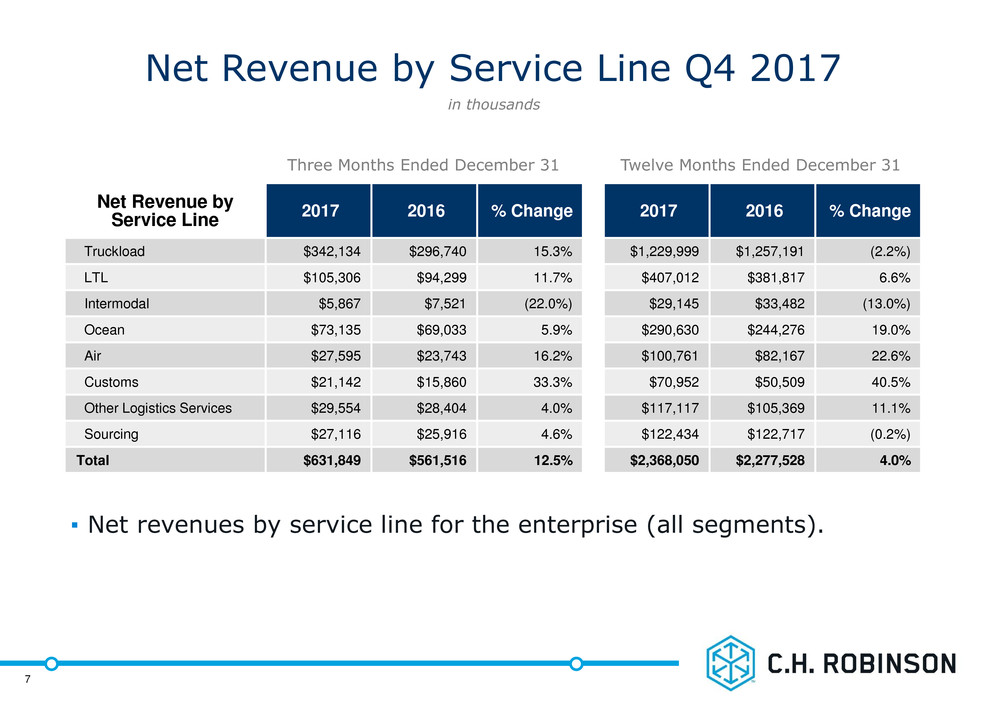

Three Months Ended December 31 Twelve Months Ended December 31

Net Revenue by Service Line Q4 2017

▪ Net revenues by service line for the enterprise (all segments).

in thousands

7

Net Revenue by

Service Line

2017 2016 % Change 2017 2016 % Change

Truckload $342,134 $296,740 15.3% $1,229,999 $1,257,191 (2.2%)

LTL $105,306 $94,299 11.7% $407,012 $381,817 6.6%

Intermodal $5,867 $7,521 (22.0%) $29,145 $33,482 (13.0%)

Ocean $73,135 $69,033 5.9% $290,630 $244,276 19.0%

Air $27,595 $23,743 16.2% $100,761 $82,167 22.6%

Customs $21,142 $15,860 33.3% $70,952 $50,509 40.5%

Other Logistics Services $29,554 $28,404 4.0% $117,117 $105,369 11.1%

Sourcing $27,116 $25,916 4.6% $122,434 $122,717 (0.2%)

Total $631,849 $561,516 12.5% $2,368,050 $2,277,528 4.0%

‹#›

Transportation Results Q4 2017(1)

in thousands

(1) Includes results across all segments.

8

▪ Transportation net revenue margin decline in the fourth quarter of 2017 when

compared to the fourth quarter of 2016 was primarily the result of lower net

revenue margins in Global Forwarding.

Three Months Ended December 31 Twelve Months Ended December 31

Transportation 2017 2016 % Change 2017 2016 % Change

Total Revenues $3,647,167 $3,110,978 17.2% $13,502,906 $11,704,745 15.4%

Total Net Revenues $604,733 $535,600 12.9% $2,245,616 $2,154,811 4.2%

Net Revenue Margin % 16.6% 17.2% (60 bps) 16.6% 18.4% (180 bps)

Transportation Net

Revenue Margin %

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Q1 18.2% 22.6% 17.4% 17.2% 16.9% 16.3% 15.3% 16.8% 19.7% 17.3%

Q2 15.4% 20.6% 15.8% 16.2% 14.9% 15.4% 16.0% 17.5% 19.3% 16.2%

Q3 15.9% 19.8% 16.6% 16.4% 15.6% 15.0% 16.2% 18.4% 17.6% 16.4%

Q4 19.0% 18.3% 17.6% 16.3% 15.8% 15.1% 15.9% 19.0% 17.2% 16.6%

Total 17.0% 20.2% 16.8% 16.5% 15.8% 15.4% 15.9% 17.9% 18.4% 16.6%

‹#›

T

R

ANSPORTA

T

ION

N

E

T

R

E

VE

N

U

E

MAR

G

I

N

▪ North America Truckload cost and price change chart

represents truckload shipments from all North America

segments. Transportation net revenue margin represents

total Transportation results from all segments.

(1) Cost and price change exclude the estimated impact of fuel.

North America Truckload Cost and Price Change(1)

9

Transportation Net Revenue Margin

YoY Price Change

YoY Cost Change

North America

Truckload Q4 YTD

Volume (1.5%) 4.5%

Price 15.0% 4.5%

Cost 14.5% 6.5%

Net Revenue

Margin

‹#›

North American Surface Transportation (“NAST”) Results Q4 2017

▪ Net revenues increased primarily as a result of increased pricing in the truckload

service line and 10 percent volume growth in the less than truckload service line

when compared to the fourth quarter of 2016.

▪ NAST operating expenses increased 14.2 percent in the fourth quarter of 2017

when compared to the fourth quarter of 2016. This increase was primarily due

to increased personnel expenses.

▪ NAST headcount increased 1.0 percent when compared to the fourth quarter of

2016 and was down 120 employees sequentially from the third quarter of 2017.

in thousands, except headcount

10

(1) Does not include intersegment revenues.

Three Months Ended December 31 Twelve Months Ended December 31

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $2,618,587 $2,281,435 14.8% $9,728,810 $8,737,716 11.3%

Total Net Revenues $415,315 $363,281 14.3% $1,525,064 $1,524,355 0.0%

Net Revenue Margin % 15.9% 15.9% 0 bps 15.7% 17.4% (170 bps)

Income from Operations $180,557 $157,631 14.5% $628,110 $674,436 (6.9%)

Operating Margin % 43.5% 43.4% 10 bps 41.2% 44.2% (300 bps)

Depreciation and Amortization $6,126 $5,575 9.9% $23,230 $22,126 5.0%

Total Assets $2,277,252 $2,088,611 9.0% $2,277,252 $2,088,611 9.0%

Average Headcount 6,878 6,809 1.0% 6,907 6,773 2.0%

‹#›

NAST Results by Service Line Q4 2017

Truckload, Less Than Truckload, and Intermodal

▪ Net revenues increase in the fourth quarter was a result of improved pricing when

compared to the fourth quarter of 2016.

▪ Net revenues increase in the fourth quarter was a result of 10 percent volume

growth.

▪ Net revenues decreased in the fourth quarter as a result of lower intermodal

margins partially offset by an increase in volume.

in thousands

TL

LTL

IMDL

11 (1) Represents price and cost YoY change for North America shipments across all segments.

(2) Pricing and cost measures exclude the estimated impact of the change in fuel prices.

Three Months Ended December 31 Twelve Months Ended December 31

Net Revenues 2017 2016 % Change 2017 2016 % Change

Truckload $304,525 $261,065 16.6% $1,088,790 $1,108,287 (1.8%)

LTL $100,529 $90,629 10.9% $388,816 $366,137 6.2%

Intermodal $4,679 $7,138 (34.4%) $26,732 $31,308 (14.6%)

Other $5,582 $4,449 25.5% $20,726 $18,623 11.3%

Total $415,315 $363,281 14.3% $1,525,064 $1,524,355 0.0%

Truckload(1) Quarter YTD

Pricing(2) 15.0% 4.5%

Cost(2) 14.5% 6.5%

Volume (3%) 4.5%

Net Revenue

Margin

LTL(1) Quarter YTD

Pricing(2)

Volume 10.0% 8.0%

Net Revenue

Margin

Intermodal(1) Quarter YTD

Pricing(2)

Volume 7.0% 12.0%

Net Revenue

Margin

‹#›

Global Forwarding Results Q4 2017

▪ Net revenues increase in the fourth quarter was the result of growth across all

service lines.

▪ Global Forwarding operating expenses increased 24.1 percent when compared

to the fourth quarter of 2016.

▪ The acquisition of Milgram added approximately 5 percentage points to net

revenue and 7.5 percentage points to average headcount when compared to

the fourth quarter of 2016.

in thousands, except headcount

12

(1) Does not include intersegment revenues.

Three Months Ended December 31 Twelve Months Ended December 31

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $591,245 $475,971 24.2% $2,140,987 $1,574,686 36.0%

Total Net Revenues $127,869 $114,079 12.1% $485,280 $397,537 22.1%

Net Revenue Margin % 21.6% 24.0% (240 bps) 22.7% 25.2% (250 bps)

Income from Operations $16,836 $24,631 (31.6%) $91,842 $80,931 13.5%

Operating Margin % 13.2% 21.6% (840 bps) 18.9% 20.4% (150 bps)

Depreciation and Amortization $8,734 $7,868 11.0% $33,308 $23,099 44.2%

Total Assets $821,182 $703,741 16.7% $821,182 $703,741 16.7%

Average Headcount 4,683 3,934 19.0% 4,310 3,673 17.3%

‹#›

Three Months Ended December 31 Twelve Months Ended December 31

Global Forwarding Results by Service Line Q4 2017

Ocean, Air, and Customs

▪ Achieved organic volume growth in each of the global forwarding services in

the fourth quarter of 2017 when compared to the fourth quarter of 2016.

▪ Milgram & Company acquisition added approximately 3 percentage points to

ocean net revenues, 2 percentage points to air net revenues and 22

percentage points to customs net revenues.

in thousands

13

Net Revenues 2017 2016 % Change 2017 2016 % Change

Ocean $73,069 $69,270 5.5% $290,837 $244,177 19.1%

Air $25,668 $21,997 16.7% $94,518 $76,139 24.1%

Customs $21,145 $15,859 33.3% $70,949 $50,497 40.5%

Other $7,987 $6,953 14.9% $28,976 $26,724 8.4%

Total $127,869 $114,079 12.1% $485,280 $397,537 22.1%

Ocean Quarter YTD

Pricing

Volume

Net Revenue

Margin

Air Quarter YTD

Pricing

Volume

Net Revenue

Margin

‹#›

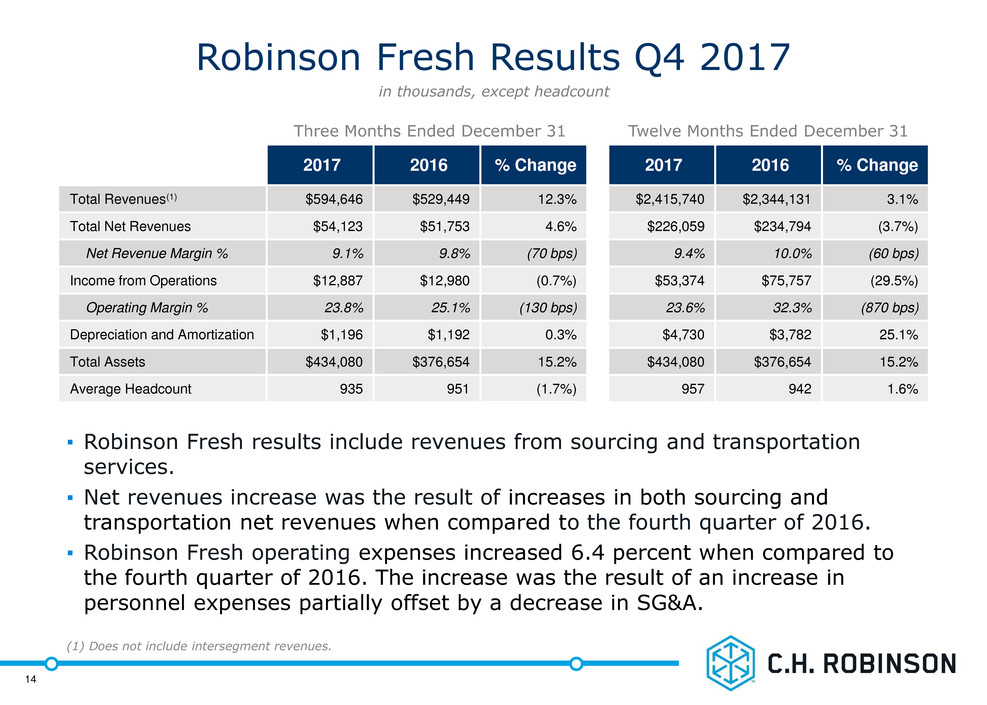

▪ Robinson Fresh results include revenues from sourcing and transportation

services.

▪ Net revenues increase was the result of increases in both sourcing and

transportation net revenues when compared to the fourth quarter of 2016.

▪ Robinson Fresh operating expenses increased 6.4 percent when compared to

the fourth quarter of 2016. The increase was the result of an increase in

personnel expenses partially offset by a decrease in SG&A.

in thousands, except headcount

Robinson Fresh Results Q4 2017

14

(1) Does not include intersegment revenues.

Three Months Ended December 31 Twelve Months Ended December 31

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $594,646 $529,449 12.3% $2,415,740 $2,344,131 3.1%

Total Net Revenues $54,123 $51,753 4.6% $226,059 $234,794 (3.7%)

Net Revenue Margin % 9.1% 9.8% (70 bps) 9.4% 10.0% (60 bps)

Income from Operations $12,887 $12,980 (0.7%) $53,374 $75,757 (29.5%)

Operating Margin % 23.8% 25.1% (130 bps) 23.6% 32.3% (870 bps)

Depreciation and Amortization $1,196 $1,192 0.3% $4,730 $3,782 25.1%

Total Assets $434,080 $376,654 15.2% $434,080 $376,654 15.2%

Average Headcount 935 951 (1.7%) 957 942 1.6%

‹#›

Robinson Fresh Results Q4 2017

Sourcing

▪ Sourcing total revenues increase was the result of higher sourcing commodity

pricing and case volume increase of 1 percent compared to the fourth quarter of

2016.

▪ Sourcing net revenues increased when compared to last year's fourth quarter due

to higher net revenue per case.

in thousands

15

(1) Does not include intersegment revenues.

Three Months Ended December 31 Twelve Months Ended December 31

Sourcing 2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $312,619 $303,997 2.8% $1,366,474 $1,439,668 (5.1%)

Net Revenues $27,116 $25,916 4.6% $122,434 $122,717 (0.2%)

Net Revenue Margin % 8.7% 8.5% 20 bps 9.0% 8.5% 50 bps

‹#›

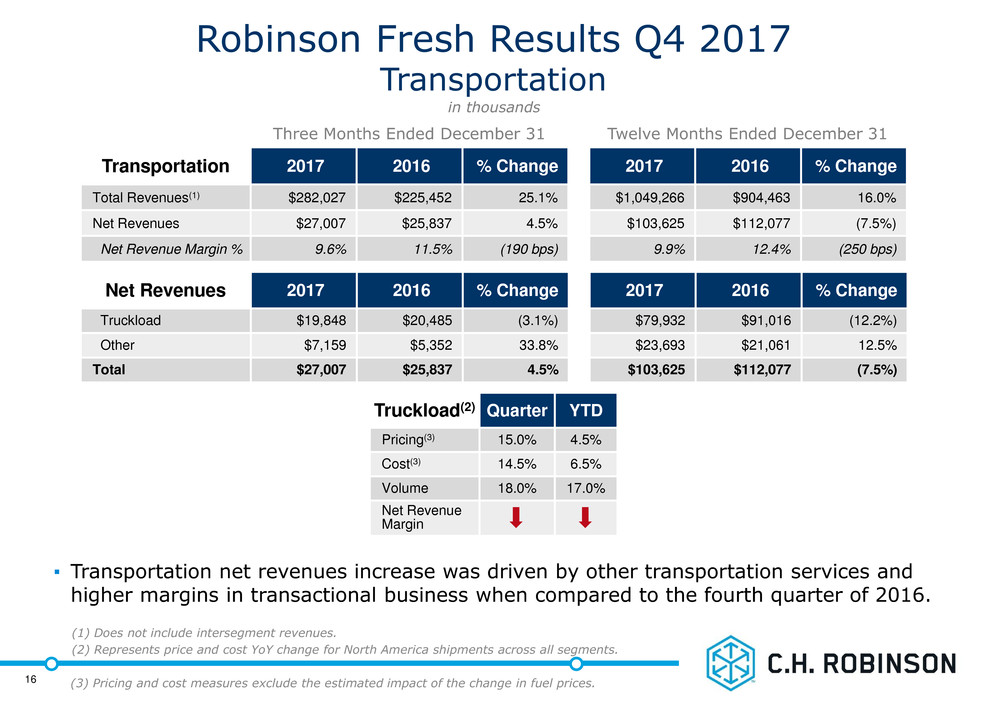

Robinson Fresh Results Q4 2017

Transportation

▪ Transportation net revenues increase was driven by other transportation services and

higher margins in transactional business when compared to the fourth quarter of 2016.

in thousands

16

(1) Does not include intersegment revenues.

(2) Represents price and cost YoY change for North America shipments across all segments.

(3) Pricing and cost measures exclude the estimated impact of the change in fuel prices.

Three Months Ended December 31 Twelve Months Ended December 31

Transportation 2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $282,027 $225,452 25.1% $1,049,266 $904,463 16.0%

Net Revenues $27,007 $25,837 4.5% $103,625 $112,077 (7.5%)

Net Revenue Margin % 9.6% 11.5% (190 bps) 9.9% 12.4% (250 bps)

Net Revenues 2017 2016 % Change 2017 2016 % Change

Truckload $19,848 $20,485 (3.1%) $79,932 $91,016 (12.2%)

Other $7,159 $5,352 33.8% $23,693 $21,061 12.5%

Total $27,007 $25,837 4.5% $103,625 $112,077 (7.5%)

Truckload(2) Quarter YTD

Pricing(3) 15.0% 4.5%

Cost(3) 14.5% 6.5%

Volume 18.0% 17.0%

Net Revenue

Margin

‹#›

▪ Results represent business from Managed Services, Other Surface

Transportation outside of North America, and other miscellaneous

operations.

▪ Headcount includes personnel from shared services, Managed Services,

Other Surface Transportation, and other miscellaneous operations.

All Other and Corporate Results Q4 2017

in thousands, except headcount

17

(1) Does not include intersegment revenues.

Three Months Ended December 31 Twelve Months Ended December 31

2017 2016 % Change 2017 2016 % Change

Total Revenues(1) $155,308 $128,120 21.2% $583,843 $487,880 19.7%

Total Net Revenues $34,542 $32,403 6.6% $131,647 $120,842 8.9%

Income from Operations $596 ($1,677) NM $1,793 $6,407 NM

Depreciation and Amortization $7,581 $7,318 3.6% $31,709 $25,662 23.6%

Total Assets $703,320 $518,752 35.6% $703,320 $518,752 35.6%

Average Headcount 2,540 2,380 6.7% 2,513 2,282 10.1%

‹#›

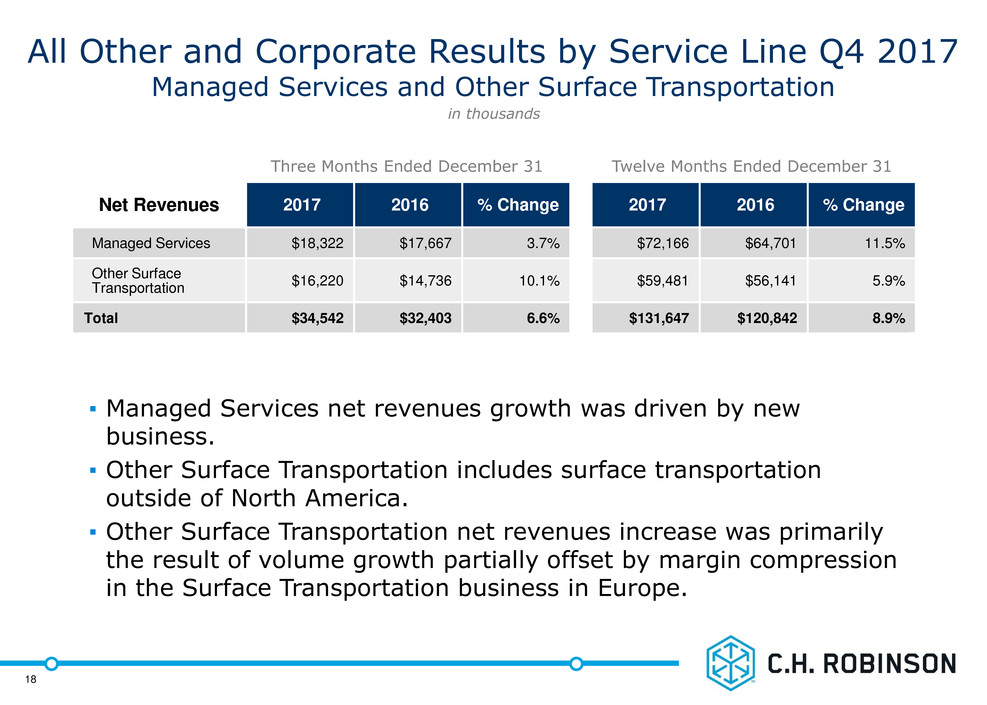

All Other and Corporate Results by Service Line Q4 2017

Managed Services and Other Surface Transportation

▪ Managed Services net revenues growth was driven by new

business.

▪ Other Surface Transportation includes surface transportation

outside of North America.

▪ Other Surface Transportation net revenues increase was primarily

the result of volume growth partially offset by margin compression

in the Surface Transportation business in Europe.

in thousands

18

Three Months Ended December 31 Twelve Months Ended December 31

Net Revenues 2017 2016 % Change 2017 2016 % Change

Managed Services $18,322 $17,667 3.7% $72,166 $64,701 11.5%

Other Surface

Transportation

$16,220 $14,736 10.1% $59,481 $56,141 5.9%

Total $34,542 $32,403 6.6% $131,647 $120,842 8.9%

‹#›

Final Comments

▪ January to date total company net revenue per day has

increased approximately 5 percent when compared to

January 2017.

▪ Truckload volume has decreased approximately 7 percent on

a year-over-year basis in January.

▪ 2018 outlook

▪ Capacity and price volatility will likely continue in 2018

▪ Tax reform will be a positive factor in our business

▪ We will win globally through people, process and

technology

19

‹#›

Appendix A: 2012 Summarized Adjusted Income Statement

To assist investors in understanding our financial performance, we supplement the financial results that are generated in accordance with the accounting principles

generally accepted in the United States, or GAAP, with non-GAAP financial measures, including non-GAAP operating expenses, non-GAAP income from operations,

non-GAAP net income and non-GAAP diluted net income per share. We believe that these non-GAAP measures provide meaningful insight into our operating

performance excluding certain event-specific charges, and provide an alternative perspective of our results of operations. We use non-GAAP measures to assess our

operating performance for the quarter. Management believes that these non-GAAP financial measures reflect an additional way of analyzing aspects of our ongoing

operations that, when viewed with our GAAP results, provides a more complete understanding of the factors and trends affecting our business.

1) The adjustment to personnel consists of $33 million of incremental vesting expense of our equity awards triggered by the gain on the divestiture

of T-Chek. The balance consists of transaction related bonuses.

2) The adjustments to other operating expenses reflect fees paid to third parties for:

a) Investment banking fees related to the acquisition of Phoenix

b) External legal and accounting fees related to the acquisitions of Apreo and Phoenix and the divestiture of T-Chek.

3) The adjustment to investment and other income reflects the gain from the divestiture of T-Chek.

4) The adjustment to diluted weighted average shares outstanding relates to the shares of C.H. Robinson stock issued as consideration paid to the

sellers in the acquisition of Phoenix.

5) The adjustment to diluted weighted average shares outstanding relates to the additional vesting of performance-based restricted stock as a result

of the gain on sale recognized from the divestiture of T-Chek.

in thousands, except per share amounts

20

2012 Actual Non-Recurring Acquisition Impacts

Non-Recurring

Divestiture Impacts Adjusted

Total Net Revenues $1,717,571 $1,717,571

Personnel Expenses(1) 766,006 (385 ) (34,207 ) 731,414

Other Operating Expenses(2) 276,245 (10,225 ) (379 ) 265,641

Total Operating Expenses 1,042,251 (10,610 ) (34,586 ) 997,055

Income from Operations 675,320 10,610 34,586 720,516

Investment & Other Income(3) 283,142 (281,551 ) 1,591

Income before Taxes 958,462 10,610 (246,965 ) 722,107

Provision for Income Taxes 364,658 2,745 (92,303 ) 275,100

Net Income $593,804 $7,865 ($154,662) $447,007

Net Income Per Share (Diluted) $3.67 $2.76

Weighted Average Shares (Diluted) 161,946 185 (4) 92 (5) 161,669

21